UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2024 |

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number: 001-41951

AMERICAN HEALTHCARE REIT, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 47-2887436 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

18191 Von Karman Avenue, Suite 300 Irvine, California | | 92612 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (949) 270-9200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | AHR | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the shares of voting Common Stock held by non-affiliates of the registrant, computed by reference to the closing sales price as of the last business day of the registrant’s most recently completed second fiscal quarter, was $942,277,000. Further, while there was no established market for the registrant’s Class T and Class I common stock, as of the last business day of the registrant’s most recently completed second fiscal quarter the aggregate market value of shares of Class T common stock and shares of Class I common stock held by non-affiliates of the registrant was $606,540,000 and $1,458,259,000, respectively, assuming a market value as of that date of $31.40 per share, which was the last estimated per share net asset value established by the registrant’s board of directors.

As of February 19, 2025, American Healthcare REIT, Inc. had 157,565,295 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2025 annual meeting of stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

AMERICAN HEALTHCARE REIT, INC.

(A Maryland Corporation)

TABLE OF CONTENTS

PART I

Item 1. Business.

The use of the words “we,” “us” or “our” refers to American Healthcare REIT, Inc. and its subsidiaries, including American Healthcare REIT Holdings, LP, except where otherwise noted.

Company

American Healthcare REIT, Inc., a Maryland corporation, is a self-managed real estate investment trust, or REIT, that acquires, owns and operates a diversified portfolio of clinical healthcare real estate properties, focusing primarily on senior housing, skilled nursing facilities, or SNFs, outpatient medical, or OM, buildings and other healthcare-related facilities. We have built a fully-integrated management platform, with approximately 114 employees, that operates clinical healthcare properties throughout the United States, the United Kingdom and the Isle of Man. We own and operate our integrated senior health campuses and senior housing operating properties, or SHOP, utilizing the structure permitted by the REIT Investment Diversification and Empowerment Act of 2007, which is commonly referred to as a “RIDEA” structure. We have also originated and acquired secured loans and may acquire other real estate-related investments in the future on an infrequent and opportunistic basis. We generally seek investments that produce current income; however, we have selectively developed, and may continue to selectively develop, healthcare real estate properties. We have elected to be taxed as a REIT for U.S. federal income tax purposes. We believe that we have been organized and operated, and we intend to continue to operate, in conformity with the requirements for qualification and taxation as a REIT under the Code.

Operating Partnership

We conduct substantially all of our operations through American Healthcare REIT Holdings, LP, or our operating partnership, and we are the sole general partner of our operating partnership. As of December 31, 2023, we owned 95.0% of the operating partnership units, or OP units, in our operating partnership, and the remaining 5.0% OP units were owned by the following limited partners: (i) AHI Group Holdings, LLC, which is owned and controlled by Jeffrey T. Hanson, the non-executive Chairman of our board of directors, or our board, Danny Prosky, our Chief Executive Officer, President and director, and Mathieu B. Streiff, one of our non-executive directors; (ii) Platform Healthcare Investor T-II, LLC; (iii) Flaherty Trust; and (iv) a wholly owned subsidiary of Griffin Capital Company, LLC, or Griffin Capital. On August 19, 2024 and October 18, 2024, Platform Healthcare Investor T-II, LLC and Flaherty Trust, respectively, redeemed all of their OP units in exchange for 1,216,571 shares and 211,306 shares, respectively, of our Common Stock on a one-for-one basis and, as a result, are no longer limited partners of our operating partnership. On December 6, 2024, Griffin Capital redeemed a portion of its OP units in exchange 69,882 shares of our Common Stock on a one-for-one basis. As of December 31, 2024, we owned 98.7% of the OP units in our operating partnership, and the remaining 1.3% of the OP units were owned by the remaining limited partners. See Note 12, Redeemable Noncontrolling Interests, and Note 13, Equity — Noncontrolling Interests in Total Equity, to the Consolidated Financial Statements that are a part of this Annual Report on Form 10-K, for a further discussion of the ownership in our operating partnership.

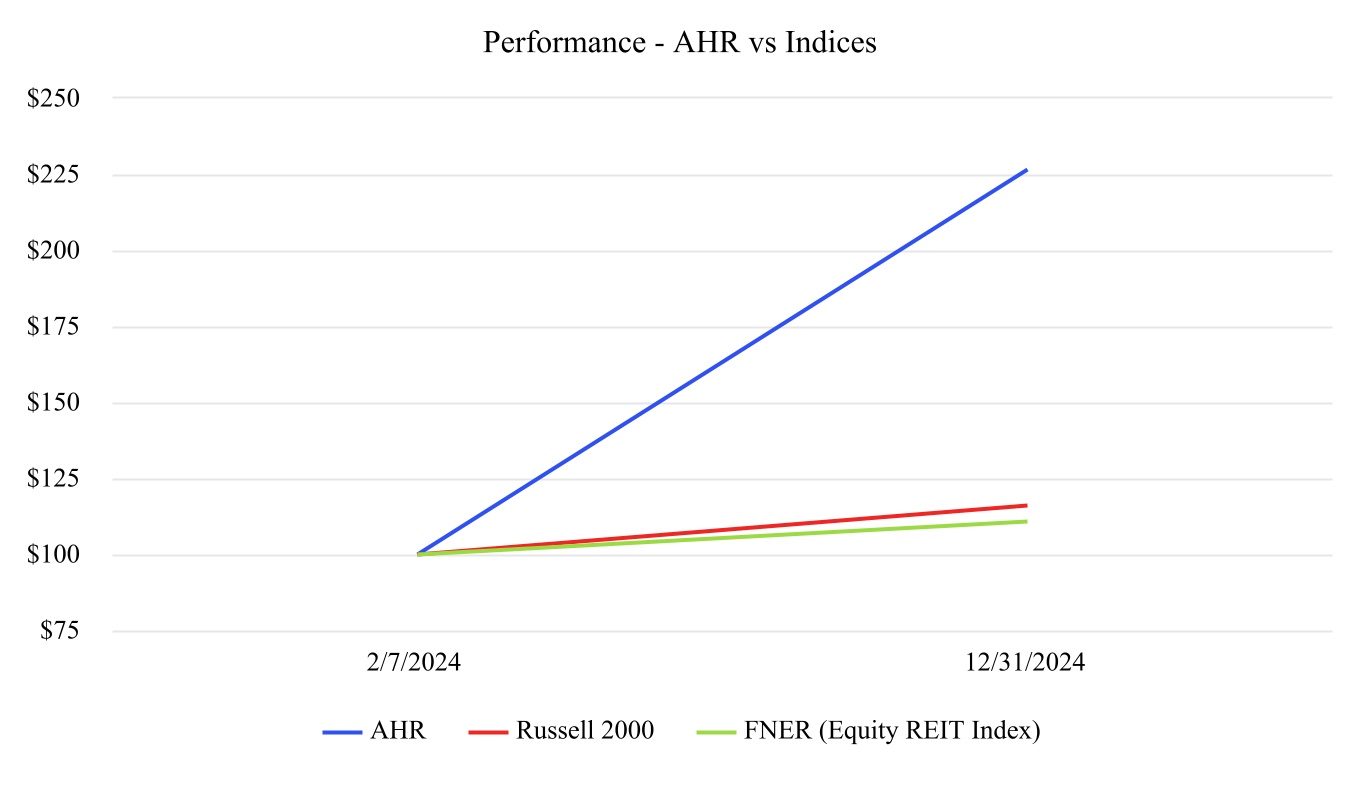

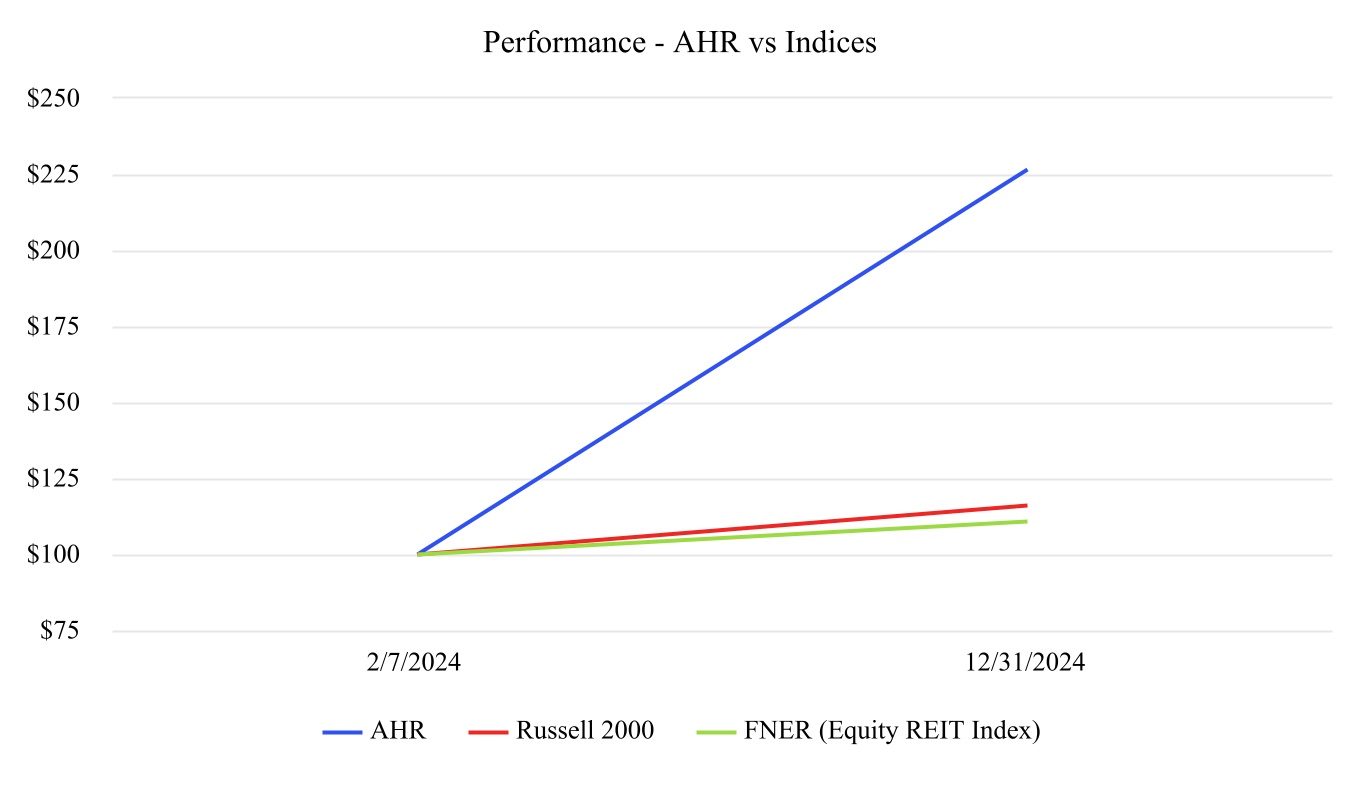

Public Offerings and Listing

On February 9, 2024, pursuant to a Registration Statement filed with the United States Securities and Exchange Commission, or SEC, on Form S-11 (File No. 333-267464), as amended, we closed our underwritten public offering, or the February 2024 Offering, through which we issued 64,400,000 shares of Common Stock, for a total of $772,800,000 in gross offering proceeds. Such amounts include the exercise in full of the underwriters’ overallotment option to purchase up to an additional 8,400,000 shares of Common Stock. We listed these shares of Common Stock on the New York Stock Exchange, or NYSE, under the trading symbol “AHR” and began trading on February 7, 2024.

Following the closing of the February 2024 Offering and until August 5, 2024, we presented our Common Stock, Class T common stock and Class I common stock, as separate classes of common stock within our consolidated balance sheets and consolidated statements of equity. Any references to Common Stock in this Annual Report on Form 10-K refer to our NYSE-listed shares of common stock, whereas Class T common stock and Class I common stock refer to our historical non-listed shares of common stock. This applies to all historical periods presented herein. On August 5, 2024, 180 days after the listing of our Common Stock on the NYSE, each share of our Class T common stock and Class I common stock automatically converted into one share of our listed Common Stock.

On September 20, 2024, we closed our follow-on underwritten public offering, or the September 2024 Offering, under a prospectus supplement and related prospectus filed with the SEC pursuant to our effective shelf Registration Statement on Form S-3 (File No. 333-281488). Through the September 2024 Offering, we issued 20,010,000 shares of Common Stock, for a total of $471,236,000 in gross offering proceeds. Such amounts include the exercise in full of the underwriters’ overallotment option to purchase up to an additional 2,610,000 shares of Common Stock. These shares are also listed on the NYSE under the trading symbol “AHR” and began trading on September 19, 2024.

On November 18, 2024, we entered into a sales agreement and established an at-the-market equity offering program, or ATM Offering, under a prospectus supplement and related prospectus filed with the SEC pursuant to our effective shelf Registration Statement on Form S-3 (File No. 333-281488), pursuant to which we may, from time to time, offer and sell shares of Common Stock having an aggregate gross sales price of up to $500,000,000. Shares sold through the ATM Offering may be offered and sold in amounts to be determined by us from time to time, and are sold in negotiated transactions at market prices prevailing at the time of sale in accordance with Rule 415 under the Securities Act of 1933, as amended. During the year ended December 31, 2024, we sold an aggregate of 4,285,531 shares of Common Stock under the ATM Offering for gross proceeds of $120,220,000 at an average gross price of $28.05 per share. As of December 31, 2024, the remaining amount available under the ATM Offering for future sales of Common Stock was $379,780,000.

See Note 13, Equity — Common Stock, to the Consolidated Financial Statements that are a part of this Annual Report on Form 10-K, for a further discussion of our public offerings.

Key Developments

•On February 9, 2024, we completed the February 2024 Offering through which we issued 64,400,000 shares of common stock, $0.01 par value per share, for a total of $772,800,000 in gross offering proceeds. These shares are listed on the NYSE under the trading symbol “AHR” and began trading on February 7, 2024.

•On February 14, 2024, we, through our operating partnership, entered into an amendment, or the 2024 Credit Agreement, to our existing credit agreement, to increase the aggregate maximum borrowing capacity from $1,050,000,000 to up to $1,150,000,000 and extend the maturity date of the senior unsecured revolving credit facility portion of the 2024 Credit Agreement from January 19, 2026 to February 14, 2028.

•On September 20, 2024, we completed the September 2024 Offering through which we issued 20,010,000 shares of common stock, $0.01 par value per share, for a total of $471,236,000 in gross offering proceeds.

•On September 20, 2024, using the net proceeds from the September 2024 Offering, we exercised our option to purchase the 24.0% minority membership interest in Trilogy REIT Holdings, LLC that was owned by our joint venture partner for a total all-cash purchase price of $258,001,000. As a result of such purchase and as of December 31, 2024, we own 100% of Trilogy REIT Holdings and indirectly own 100% of Trilogy Investors, LLC, or Trilogy, the entities through which we indirectly own and/or operate our integrated senior health campuses.

•On November 18, 2024, we entered into a sales agreement and established the ATM Offering through which we may, from time to time, offer and sell shares of our Common Stock, $0.01 par value per share, having an aggregate gross sales price of up to $500,000,000. During the year ended December 31, 2024, we sold an aggregate of 4,285,531 shares of Common Stock under the ATM Offering for gross proceeds of $120,220,000 at an average gross price of $28.05 per share.

•During 2024, we paid off our variable-rate mortgage loans payable and paid down on our variable-rate lines of credit using the net proceeds received from the February 2024 Offering, the September 2024 Offering and the ATM Offering.

•During 2024, we expanded our integrated senior health campuses segment by $82,361,000 primarily through the acquisition, development and expansion of campuses. In addition, we acquired $138,839,000 of senior housing facilities during 2024, which are included in our SHOP segment.

•During 2024, we disposed of properties within each of our segments for an aggregate contract sales price of $155,545,000.

•As of February 25, 2025, we owned and/or operated 313 buildings and integrated senior health campuses, or approximately 19,090,000 square feet of gross leasable area, or GLA, for an aggregate contract purchase price of $4,519,012,000. In addition, as of February 25, 2025, we also owned a real estate-related debt investment purchased for $60,429,000.

Our principal executive offices are located at 18191 Von Karman Avenue, Suite 300, Irvine, California 92612, and our telephone number is (949) 270-9200. We maintain a website at www.AmericanHealthcareREIT.com, at which there is additional information about us. The contents of that site are not incorporated by reference in, or otherwise a part of, this filing. We make our periodic and current reports and all amendments to those reports available at www.AmericanHealthcareREIT.com as soon as reasonably practicable after such materials are electronically filed with the SEC. They also are available for printing by any stockholder upon request. In addition, copies of our filings with the SEC may be obtained from the SEC’s website, https://www.SEC.gov. Access to these filings is free of charge.

Business Objectives and Growth Strategies

Our business objectives are to grow our earnings and cash flows, maintain financial flexibility, increase the value of our portfolio, make regular cash distributions to our stockholders and generate attractive risk-adjusted returns through the following growth strategies:

•external growth through disciplined and targeted acquisitions to expand our diversified portfolio;

•continue to selectively develop and expand integrated senior health campuses with experienced development partners;

•continue to generate strong organic growth in our long-term care portfolio comprised of integrated senior health campuses and SHOP, as a result of historically low levels of new supply and ever increasing demand from an aging population; and

•actively position our balance sheet for growth.

Investment Strategy

We have acquired, and may continue to acquire, properties either directly or jointly with third parties and may also consider disposing of non-core properties from time to time. We also have originated and acquired, and may continue to acquire, secured loans and other real estate-related investments on an infrequent and opportunistic basis.

We generally seek investments that produce current income; however, we have selectively developed, are currently developing (through Trilogy), and may continue to selectively develop, real estate properties. Our portfolio may include properties in various stages of development other than those producing current income. These stages include unimproved land both with and without entitlements and permits, property to be redeveloped and repositioned, newly constructed properties and properties in lease-up or other stabilization stages, all of which have limited or no relevant operating histories and current income. We make such investment determinations based upon a variety of factors, including the anticipated risk-adjusted returns for such properties when compared with other available properties, the appropriate diversification of our portfolio and our objectives of realizing both current income and capital appreciation.

We seek to grow our earnings and cash flows, maintain financial flexibility, increase the value of our portfolio, make regular cash distributions and generate attractive risk-adjusted returns for our stockholders through the business objectives and growth strategies discussed above. In order to achieve these objectives, we may invest using a number of investment structures, which may include direct acquisitions, joint ventures, leveraged investments, issuing securities for property and direct and indirect investments in real estate. In order to maintain our exemption from regulation as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act, we may be required to limit our investments in certain types of real estate-related investments. See “Investment Company Act Considerations” below for a further discussion.

For each of our investments, regardless of property type, we seek to invest in properties with the following attributes:

•Quality. We seek to acquire properties that are suitable for their intended use with a quality of construction that is capable of sustaining the property’s long-term investment potential, assuming funding of budgeted maintenance, repairs and capital improvements.

•Location. We seek to acquire properties that are located in established or otherwise appropriate markets, with access and visibility suitable to meet the needs of their occupants.

•Market; Supply and Demand. We focus on local or regional markets that have potential for stable and growing property level cash flows in the long term. These determinations are based in part on an evaluation of local and regional economic, demographic and regulatory factors affecting the property. For instance, we favor markets that indicate a growing population and employment base and markets that exhibit potential limitations on additions to supply, such as barriers to new construction. Barriers to new construction include lack of available

land, stringent zoning restrictions and states where certificates of need are required. Conversely, we generally seek to limit our investments in areas that have limited potential for growth.

•Strong Local Health Systems and Operating Partners. We seek to invest in properties that are associated with strong health systems and operators, provide exceptional care, have dominant market share and/or are critical to the healthcare delivery system in the communities that they serve.

•Predictable Capital Needs. We seek to acquire properties where the future expected capital needs can be reasonably projected in a manner that would enable us to meet our objectives.

•Cash Flows. We seek to acquire properties where the current and projected cash flows, including the potential for appreciation in value, would enable us to maximize long-term stockholder value. We evaluate cash flows as well as expected growth and the potential for appreciation.

We are not limited as to the geographic areas where we may acquire properties. We are not specifically limited in the number or size of properties we may acquire or on the percentage of our assets that we may invest in a single property or investment. The number and mix of properties and real estate-related investments we will acquire will depend upon real estate and market conditions and other circumstances existing at the time we are acquiring our properties and making our investments and the amount of debt financing available.

Real Estate Investments

We generally seek investments that produce current income. We expect our real estate investments to include:

•integrated senior health campuses;

•senior housing;

•OM buildings;

•SNFs; and

•healthcare-related facilities operated utilizing a RIDEA structure.

Our real estate investments may also include:

•long-term acute care facilities;

•surgery centers;

•memory care facilities;

•specialty medical and diagnostic service facilities;

•hospitals;

•laboratories and research facilities; and

•pharmaceutical and medical supply manufacturing facilities.

We generally seek to acquire real estate of the types described above that will best enable us to meet our investment objectives, taking into account, among other things, the diversification of our portfolio at the time, relevant real estate and financial factors, location, income-producing capacity and the prospects for long-term appreciation of a particular property. As a result, we may acquire properties other than the types described above. In addition, we may acquire properties that vary from the parameters described above for a particular property type.

Our real estate investments generally take the form of holding fee title or long-term leasehold interests. Our investments may be made either directly through our operating partnership or indirectly through investments in joint ventures, limited liability companies, general partnerships or other co-ownership arrangements with the developers of the properties or other persons. See “Joint Ventures” below for a further discussion.

We have exercised, and may continue to exercise, our purchase options to acquire properties that we currently lease. In addition, we have participated in sale-leaseback transactions, in which we purchase real estate investments and lease them back to the sellers of such properties. We seek to structure any such sale-leaseback transaction such that the lease will be characterized as a “true lease” and we will be treated as the owner of the property for U.S. federal income tax purposes.

Our obligation to close a transaction involving the purchase of real estate is generally conditioned upon the delivery and verification of certain documents, including, where appropriate: (i) plans and specifications; (ii) environmental reports (generally a minimum of a Phase I investigation); (iii) building condition reports; (iv) surveys; (v) evidence of marketable title subject to such liens and encumbrances; (vi) audited financial statements covering recent operations of real properties having operating histories unless such statements are not required to be filed with the SEC and delivered to stockholders; (vii) title insurance policies; and (viii) the availability of property and liability insurance policies.

In determining whether to purchase a particular real estate investment, we may obtain an option on such property, including land suitable for development. The amount paid for an option is normally surrendered if the real estate is not purchased and is normally credited against the purchase price if the real estate is purchased. We also may enter into arrangements with the seller or developer of a real estate investment whereby the seller or developer agrees that if, during a stated period, the real estate investment does not generate specified cash flows, the seller or developer will pay us cash in an amount necessary to reach the specified cash flows level, subject in some cases to negotiated dollar limitations.

We have obtained, and we intend to continue to obtain, adequate insurance coverage for all real estate investments in which we invest.

We have acquired, and we intend to continue to acquire, leased properties with long-term leases and we generally do not intend to operate any healthcare-related facilities directly. As a REIT, we are prohibited from operating healthcare-related facilities directly; however, we have leased, and may continue to lease, healthcare-related facilities that we acquire to wholly- owned taxable REIT subsidiaries, or TRS, utilizing a RIDEA structure permitted by the Code. In such an event, our TRS will engage a third party in the business of operating healthcare-related facilities to manage the property. Through our TRS, we bear operational risks and liabilities associated with the operation of such healthcare-related facilities unlike our triple-net leased properties. Such operational risks and liabilities might include, but are not limited to, resident quality of care claims and governmental reimbursement matters.

Development and Construction Activities

On an opportunistic basis, we have selectively developed, are currently developing (through Trilogy), and may continue to selectively develop, real estate assets within our integrated senior health campuses segment and other segments of our portfolio when market conditions warrant, which may be funded through capital that we, and in certain circumstances, our joint venture partners, provide. In doing so, we may be able to reduce overall purchase costs by developing property versus purchasing an existing property. We retain and will continue to retain independent contractors to perform the actual construction work on tenant improvements, as well as property development.

Terms of Leases

The terms and conditions of any lease we enter into with our tenants may vary substantially. However, we expect that a majority of our tenant leases will require the tenant to pay or reimburse us for some or all of the operating expenses of the building based on the tenant’s proportionate share of rentable space within the building. Operating expenses typically include, but are not limited to, real estate and other taxes, utilities, insurance and building repairs, and other building operation and management costs. For our multi-tenanted properties, we generally expect to be responsible for the replacement of certain capital improvements affecting a property, including structural components of a property such as the roof of a building and other capital improvements such as parking facilities. We expect that many of our tenant leases will have terms of five or more years, some of which may have renewal options.

Substantially all of our leases with residents at our SHOP and integrated senior health campuses are for a term of one year or less, which creates the opportunity for operators to adjust rents to reflect current market conditions.

Joint Ventures

We have entered into, and we may continue to enter into, joint ventures, general partnerships and other arrangements with one or more institutions or individuals, including real estate developers, operators, owners, investors and others, for the purpose of acquiring real estate. Such joint ventures may be leveraged with debt financing or unleveraged. We have entered into, and may continue to enter into, joint ventures to further diversify our investments or to access investments which meet our investment criteria that would otherwise be unavailable to us. In determining whether to invest in a particular joint venture, we will evaluate the real estate that such joint venture owns or is being formed to own under the same criteria described elsewhere in this Annual Report on Form 10-K for the selection of our other properties. However, we will not participate in tenant-in-common syndications or transactions.

Real Estate-Related Investments

In addition to our acquisition of properties, we have invested on an infrequent and opportunistic basis, and may continue to invest, in real estate-related investments, including loans and securities investments.

Investments in Real Estate Mortgages

We have invested, and we may continue to invest, in first and second mortgage loans, mezzanine loans and bridge loans. However, we will not make or invest in any loans that are subordinate to any mortgage or equity interest of any of our directors or affiliates. We also may invest in participations in mortgage loans. Second mortgage loans are secured by second deeds of trust on real property that is already subject to prior mortgage indebtedness. A mezzanine loan is a loan made in respect of certain real property but is secured by a lien on the ownership interests of the entity that, directly or indirectly, owns the real property. A bridge loan is short-term financing for an individual or business, until the next stage of financing can be obtained. Mortgage participation investments are investments in partial interests of mortgages of the type described above that are made and administered by third-party mortgage lenders. We may also make seller financing loans in connection with the disposition of our properties. In evaluating prospective loan investments, we consider factors, including, but not limited to: (i) the ratio of the investment amount to the underlying property’s value; (ii) current and projected cash flows of the property; (iii) the degree of liquidity of the investment; (iv) the quality, experience and creditworthiness of the borrower; and (v) in the case of mezzanine loans, the ability to acquire the underlying real property.

Our criteria for making or investing in loans are substantially the same as those involved in our investment in properties. We do not intend to make loans to other persons, to underwrite securities of other issuers or to engage in the purchase and sale of any types of investments other than those relating to real estate. We generally will not make or invest in mortgage loans on any one property if the aggregate amount of all mortgage loans outstanding on the property, including our loan, would exceed an amount equal to 85.0% of the appraised value of the property, as determined by an appraiser, unless we find substantial justification due to other underwriting criteria; however, our policy generally will be that the aggregate amount of all mortgage loans outstanding on the property, including our loan, would not exceed 75.0% of the appraised value of the property. We may find such justification in connection with the purchase of loans in cases in which we believe there is a high probability of our foreclosure upon the property in order to acquire the underlying assets and in which the cost of the loan investment does not exceed the fair market value of the underlying property. We will not invest in or make loans unless an appraisal has been obtained concerning the underlying property, except for those loans insured or guaranteed by a government or government agency or in connection with seller financing loans. In the event the transaction is with any of our directors or their respective affiliates, the appraisal will be obtained from a certified independent appraiser to support its determination of fair market value. In addition, we will seek to obtain a customary lender’s title insurance policy or commitment as to the priority of the mortgage or condition of the title. Because the factors considered, including the specific weight we place on each factor, will vary for each prospective loan investment, we do not, and are not able to, assign a specific weight or level of importance to any particular factor.

We will evaluate all potential loan investments to determine if the security for the loan and the loan-to-value ratio meets our investment criteria and objectives. Most loans that we will consider for investment would provide for monthly payments of interest, and some may also provide for principal amortization, although many loans of the nature that we will consider provide for payments of interest only and a payment of principal in full at the end of the loan term. We will not originate loans with negative amortization provisions.

We are not limited as to the amount of our assets that may be invested in mezzanine loans, bridge loans and second mortgage loans. However, we recognize that these types of loans are riskier than first deeds of trust or first priority mortgages on income-producing, fee-simple properties, and we expect to minimize the amount of these types of loans in our portfolio. We will evaluate the fact that these types of loans are riskier in determining the rate of interest on the loans. We do not have any policy that limits the amount that we may invest in any single loan or the amount we may invest in loans to any one borrower. We have not established a portfolio turnover policy with respect to loans we invest in or originate.

Financing Policies

We have used, and intend to continue to use, unsecured and secured debt as a means of providing additional funds for the acquisition of properties and real estate-related investments. When interest rates are high or financing is otherwise unavailable on a timely basis, we may purchase certain assets for cash with the intention of obtaining debt financing at a later time. We have also used, and may continue to use, derivative financial instruments such as fixed interest rate swaps and caps to add stability to interest expense and to manage our exposure to interest rate movements.

We seek to obtain financing on the most favorable terms available to us and refinance assets during the term of a loan only in limited circumstances, such as when a decline in interest rates makes it beneficial to prepay an existing loan, when an existing loan matures or if an attractive investment becomes available and the proceeds from the refinancing can be used to purchase such investment. The benefits of refinancing may include increased cash flows resulting from reduced debt service requirements, an increase in distributions from proceeds of the refinancing and an increase in diversification and assets owned if all or a portion of the refinancing proceeds are reinvested.

Dispositions

We have disposed, and may continue to dispose, of assets. We will determine whether a particular property or real estate-related investment should be sold or otherwise disposed of after consideration of the relevant factors, including prevailing economic conditions, with a view toward maximizing our investment objectives. We intend to hold each property or real estate-related investment we acquire for an extended period. However, circumstances might arise which could result in a shortened holding period for certain investments. A property or real estate-related investment may be sold before the end of the expected holding period if: (i) diversification benefits exist associated with disposing of the investment and rebalancing our investment portfolio; (ii) an opportunity arises to pursue a more attractive investment; (iii) the value of the investment might decline; (iv) with respect to properties, a major tenant involuntarily liquidates or is in default under its lease; (v) the investment was acquired as part of a portfolio acquisition and does not meet our general acquisition criteria; (vi) an opportunity exists to enhance overall investment returns by raising capital through sale of the investment; or (vii) the sale of the investment is in our best interest and the best interests of our stockholders.

The determination of whether a particular property or real estate-related investment should be sold or otherwise disposed of will be made after consideration of the relevant factors, including prevailing economic conditions, with a view toward maximizing our investment objectives.

Tax Status and Distribution Policy

We have elected to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2016. We believe that we have been organized and operated, and we intend to continue to operate, in conformity with the requirements for qualification and taxation as a REIT under the Code. Our qualification as a REIT, and maintenance of such qualification, will depend on our ability to meet, on a continuing basis, various complex requirements under the Code relating to, among other things, the sources of our gross income, the composition and values of our assets, our distribution levels and the concentration of ownership of our stock.

As a REIT, we generally are not subject to U.S. federal income tax on the REIT taxable income that we currently distribute to our stockholders. Under the Code, REITs are subject to numerous organizational and operational requirements, including a requirement that they distribute annually at least 90.0% of their REIT taxable income to their stockholders. If we fail to qualify as a REIT in any calendar year and do not qualify for certain statutory relief provisions, our REIT taxable income would be subject to U.S. federal income tax at the regular corporate rate, and we would likely be precluded from qualifying for treatment as a REIT until the fifth calendar year following the year in which we fail to qualify. Accordingly, our failure to qualify as a REIT could have a material adverse effect on us. Even if we qualify as a REIT, we may still be subject to certain U.S. federal, state and local taxes on our income and assets and to U.S. federal income and excise taxes on our undistributed REIT taxable income. In addition, subject to maintaining our qualification as a REIT, a portion of our business has been, and is likely to continue to be, conducted through, and a portion of our income may be earned in, one or more TRSs that are themselves subject to regular corporate income taxation.

We cannot predict if we will generate sufficient cash flows to continue to pay cash distributions to our stockholders on an ongoing basis or at all. The amount of any cash distributions is determined by our board and depends on the amount of distributable funds, current and projected cash requirements, tax considerations, any limitations imposed by the terms of indebtedness we may incur, as well as other factors. If our investments produce sufficient cash flows, we expect to continue paying distributions to our stockholders as determined at the discretion of our board. Because our cash available for distribution in any year may be less than 90.0% of our annual taxable income, excluding net capital gains, for the year, we may be required to borrow money, use proceeds from the issuance of securities (in subsequent offerings, if any) or sell assets to pay out enough of our taxable income to satisfy the distribution requirement. These methods of obtaining funds could affect future distributions by increasing operating costs. We did not establish any limit on the amount of net proceeds from the initial offering or borrowings that may be used to fund distributions, except that, in accordance with our organizational documents and Maryland law, we may not make distributions that would: (i) cause us to be unable to pay our debts as they become due in the usual course of business; or (ii) cause our total assets to be less than the sum of our total liabilities plus senior liquidation preferences.

To the extent that any distributions to our stockholders are paid out of our current or accumulated earnings and profits, such distributions are taxable as ordinary income. To the extent that any of our distributions exceed our current and accumulated earnings and profits, such amounts constitute a return of capital to our stockholders for U.S. federal income tax purposes and thereafter will constitute capital gain. Any portion of distributions to our stockholders paid from net offering proceeds or borrowings will be treated in the same manner.

Our board shall authorize distributions, if any, on a quarterly basis. The amount of distributions we pay to our stockholders is determined by our board and is dependent on a number of factors, including funds available for the payment of distributions, our financial condition, capital expenditure requirements, annual distribution requirements needed to maintain our status as a REIT under the Code and restrictions imposed by our organizational documents and Maryland Law.

See Part II, Item 5, Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities — Distributions, for a further discussion of distributions approved by our board.

Competition

We compete with many other entities engaged in real estate investment activities for acquisitions and dispositions of integrated senior health campuses, OM buildings, senior housing, SNFs, and other healthcare-related facilities. Our ability to successfully compete is impacted by economic trends, availability of acceptable investment opportunities, our ability to negotiate beneficial investment terms, availability and cost of capital, construction and development costs and applicable laws and regulations.

Income from our investments is dependent on the ability of our tenants and operators to compete with other healthcare operators. These operators compete on a local and regional basis for patients and residents, and the operators’ ability to successfully attract and retain patients and residents depends on key factors such as the number of properties in the local market, the quality of the affiliated health system, proximity to hospital campuses, the price and range of services available, the scope and quality of care, reputation, age and appearance of each property, demographic trends and the cost of care in each locality. For additional information on the risks associated with our business, please see Item 1A, Risk Factors.

Government Regulations

Our properties are subject to various federal, state and local regulatory requirements, and changes in these laws and regulations, or their interpretation by agencies, occur frequently. Further, our tenants and our healthcare facility operators, including our TRS entities that own and operate our properties under a RIDEA structure, are typically subject to extensive and complex federal, state and local healthcare laws and regulations relating to quality of care, government reimbursement, fraud and abuse practices and similar laws governing the operation of healthcare facilities, and we expect the healthcare industry, in general, will continue to face increased regulation and pressure in the areas of healthcare management, fraud and provision of services, among others. If we fail to comply with these various requirements, we may incur governmental fines or private damage awards. We believe, based in part on third-party due diligence reports which are generally obtained at the time we acquire the properties, that all of our properties comply in all material respects with current regulations. For additional information on the risks associated with our healthcare industry, please see Item 1A, Risk Factors.

Privacy and Security Laws and Regulations

There are various federal and state privacy laws and regulations that provide for consumer protection of personal health information, particularly electronic security and privacy. Compliance with such laws and regulations may require us to, among other things, conduct additional risk analysis, modify our risk management plan, implement new policies and procedures and conduct additional training. We are generally dependent on our tenants and management companies to fulfill our compliance obligations, and we have in certain circumstances developed a program to periodically monitor compliance with such obligations. However, there can be no assurance we would not be required to alter one or more of our systems and data security procedures to be in compliance with these laws. If we fail to adequately protect health information, we could be subject to civil or criminal liability and adverse publicity, which could harm our business and impact our ability to attract new tenants and residents. We may be required to notify individuals, as well as government agencies and the media, if we experience a data breach. See Item 1C, Cybersecurity, below for a further discussion.

Healthcare Licensure and Certification

Generally, certain properties in our portfolio are subject to licensure, may require a certificate of need, or CON, or other certification through regulatory agencies in order to operate and participate in Medicare and Medicaid programs. Requirements pertaining to such licensure and certification relate to the quality of care provided by the operator, qualifications of the operator’s staff and continuing compliance with applicable laws and regulations. In addition, CON laws and regulations may place restrictions on certain activities such as the addition of beds/units at our facilities and changes in ownership. Failure to

obtain a license, CON or other certification, or revocation, suspension or restriction of such required license, CON or other certification, could adversely impact our properties’ operations and their ability to generate revenue from services provided. State CON laws are not uniform throughout the United States and are subject to change. We cannot predict the impact of state CON laws on our facilities or the operations of our tenants.

Compliance with the Americans with Disabilities Act

Under the Americans with Disabilities Act of 1990, as amended, or the ADA, all public accommodations must meet federal requirements for access and use by disabled persons. Additional federal, state and local laws also may require modifications to our properties or restrict our ability to renovate our properties. We cannot predict the cost of compliance with the ADA or other legislation. We may incur substantial costs to comply with the ADA or any other legislation.

Government Environmental Regulation and Private Litigation

Environmental laws and regulations hold us liable for the costs of removal or remediation of certain hazardous or toxic substances which may be on our properties. These laws could impose liability without regard to whether we are responsible for the presence or release of the hazardous materials. Government investigations and remediation actions may have substantial costs, and the presence of hazardous substances on a property could result in personal injury or similar claims by private plaintiffs. Various laws also impose liability on a person who arranges for the disposal or treatment of hazardous or toxic substances, and such person often must incur the cost of removal or remediation of hazardous substances at the disposal or treatment facility. These laws often impose liability whether or not the person arranging for the disposal ever owned or operated the disposal facility. As the owner of our properties, we may be deemed to have arranged for the disposal or treatment of hazardous or toxic substances.

Geographic Concentration

For a discussion of our geographic information, see Item 2, Properties — Geographic Diversification/Concentration Table, as well as Note 18, Segment Reporting, and Note 19, Concentration of Credit Risk, to the Consolidated Financial Statements that are a part of this Annual Report on Form 10-K.

Corporate Responsibility

We are committed to ethical business practices and dedicated to establishing a corporate responsibility program that benefits our residents, tenants, operators, employees, communities, and investors. We believe integrating corporate responsibility principles into our operations and across our portfolio of senior housing properties, skilled nursing facilities, and OM buildings will deliver a lasting and positive impact in the communities in which we operate by providing and facilitating high-quality care and outcomes. To achieve this, we have developed, and intend to update as applicable, a comprehensive corporate responsibility strategy and related policies, which are briefly summarized below and will be posted on the Investor Relations section of our website, www.AmericanHealthcareREIT.com, and will contain more detailed information once available. Information contained on, or accessible through, our website is not incorporated by reference into and does not constitute a part of this Annual Report on Form 10-K.

Our board’s Nominating and Corporate Governance Committee has been delegated the authority to provide oversight and guidance to our board regarding environmental, social and corporate governance trends and best practices in connection with our corporate responsibility to society and the environment. In particular, the Nominating and Corporate Governance Committee shall, as it deems appropriate, recommend changes to our company’s corporate responsibility practices as necessary to comply with existing legal requirements or emerging trends and best practices. The Nominating and Corporate Governance Committee also shall periodically receive reports from management regarding our corporate responsibility strategy, initiatives and policies.

Corporate Governance

We are committed to conducting business with the highest degree of ethics and integrity to protect the long-term interests of our stakeholders. We believe that our approach to corporate governance supports transparency, accountability, oversight and risk minimization across our business. We adhere to all applicable laws and regulations and maintain a Code of Business Conduct and Ethics, Corporate Governance Guidelines and other policies, each available on the Investor Relations section of our website, www.AmericanHealthcareREIT.com, that reflect our values and promote a culture of integrity, while our board provides oversight for the integration of corporate responsibility practices across the organization. In addition, we established a Corporate Responsibility Committee that is composed of a cross-functional team across our organization that includes representatives from our Legal, Accounting and Finance, Human Resources, Investor Relations and Asset Management departments. The Corporate Responsibility Committee is responsible for providing oversight and guidance of our corporate responsibility strategy and program and for monitoring compliance with legal requirements and regulations. Our Chief

Operating Officer serves as the chairman of the Corporate Responsibility Committee and reports to the Nominating and Corporate Governance Committee of our board.

Environmental Responsibility

Our environmental responsibility program is designed to comply with state and national environmental regulations and manage our operations in a way that promotes energy efficiency, effective waste and water management and sustainable procurement. Across our portfolio at our senior housing and OM buildings, we are implementing energy efficiency measures, including LED lighting upgrades, smart thermostats, sensors to monitor building temperature and energy audits to identify areas for continued improvement. We additionally seek to minimize waste and water consumption across all of our properties, including through: smart irrigation controls for water consumption, improved water and waste management policies and practices in our offices and properties, and employee training on environmentally responsible practices into their daily work. Our corporate headquarters is also LEED Gold certified and incorporates energy efficient systems, utilizes sustainable materials, promotes practices that increase water efficiency and reduce waste, and prioritizes the human health experience.

Social Responsibility

Our Portfolio

Our top priority is to deliver the best resident experience by partnering with operators that provide the highest quality care across our senior housing properties, skilled nursing facilities and OM buildings. As part of our commitment to deliver exceptional quality care to our residents, we prioritize partnerships with operators that share our values and implement practices that focus on quality care and contribute to better health outcomes and a positive living environment.

Our People

As of December 31, 2024, we had approximately 114 employees, including 71 in Accounting and Finance, 15 in Asset Management, eight in Investments, four in Information Technology and four in Legal. We recognize that our employees are a reflection of our values and our greatest asset, and we are dedicated to implementing programs that support our employees and provide the right tools to build a safe and healthy workplace. We also believe that one of the keys to our success is our ability to benefit from a wide range of opinions and experiences. As of December 31, 2024, 72.8% of our employees were minorities and 57.0% were female. We have several programs to support our employees’ professional development and to create a sense of belonging, including new hire mentorship programs, employee investment programs, employee satisfaction surveys, employee engagement events, and trainings related to health and safety and professional development.

Moreover, we have implemented a number of programs to foster not only their professional growth, but also their growth as global citizens. All of our employees are provided with a comprehensive benefits and wellness package, which may include high-quality medical, dental, and vision insurance, life insurance, 401(k) matching, long-term incentive plans, educational grants, fitness programs, employee stock purchase plan, and other benefits. We provide our employees, consultants and executive officers with competitive compensation and, where applicable, opportunities for equity ownership through our Second Amended and Restated 2015 Incentive Plan, or the AHR Incentive Plan, and Employee Stock Purchase Plan. See Note 13, Equity — Equity Compensation Plans, to the Consolidated Financial Statements that are part of this Annual Report on Form 10-K, for a further discussion.

Our Communities

We also recognize the importance of engaging with our local communities and have partnerships with local organizations and charities to support initiatives such as affordable housing projects, community clean-up events, and educational programs. We aim to foster positive relationships and contribute to the well-being of the communities in which we operate. Every year, we donate to charitable causes nominated by employees such as Save the Children, J3 Foundation, Skid Row Ministry and Alzheimer’s Association.

Our corporate responsibility program will continue to evolve with the aim of building a more resilient future and creating long-term value for our residents, tenants, operators, employees, communities, and investors. For additional information and updates to our corporate responsibility strategy and policies, please refer to the Investor Relations section of our website, www.AmericanHealthcareREIT.com.

Investment Company Act Considerations

We conduct, and intend to continue to conduct, our operations, and the operations of our operating partnership and any other subsidiaries, so that no such entity meets the definition of an “investment company” under Section 3(a)(1) of the Investment Company Act. We primarily engage in the business of investing in real estate assets; however, our portfolio does include, to a much lesser extent, other real estate-related investments. We have also acquired, and may continue to acquire, real

estate assets through investments in joint venture entities, including joint venture entities in which we may not own a controlling interest. We anticipate that our assets generally will be held in our wholly and majority-owned subsidiaries, each formed to hold a particular asset. We monitor our operations and our assets on an ongoing basis in order to ensure that neither we, nor any of our subsidiaries, meet the definition of “investment company” under Section 3(a)(1) of the Investment Company Act. Among other things, we monitor the proportion of our portfolio that is placed in investments in securities.

Information About Industry Segments

We segregate our operations into reporting segments in order to assess the performance of our business in the same way that management reviews our performance and makes operating decisions. As of December 31, 2024, we operated through four reportable business segments: integrated senior health campuses, OM, SHOP and triple-net leased properties.

Integrated Senior Health Campuses

Integrated senior health campuses are a valuable component of our portfolio because of their ability to provide a continuum of care as residents require increasing levels of care. As of December 31, 2024, we owned and/or operated 126 integrated senior health campuses. These facilities allow residents to “age-in-place” by providing independent living, assisted living, memory care, skilled nursing and certain ancillary services, all within a single campus setting. Integrated senior health campuses predominantly focus on need-driven segments of senior care (i.e., assisted living, memory care and skilled nursing) and charge market rents in lieu of entry fees, as is commonly the case with continuing care retirement communities. Predominantly all of our integrated senior health campuses are operated utilizing a RIDEA structure, allowing us to participate in the upside from any improved operational performance while bearing the risk of any decline in operating performance.

Outpatient Medical

We value the stable and reliable cash flows our OM buildings provide our company, which we believe are particularly valuable during market disruptions and recessionary periods. As of December 31, 2024, we owned 84 OM buildings that we lease to third parties. These properties are similar to commercial office buildings, but typically require specialized infrastructure to accommodate physicians’ offices and examination rooms, as well as some ancillary uses, including pharmacies, hospital ancillary service space and outpatient services, such as diagnostic centers, rehabilitation clinics and outpatient-surgery operating rooms. Our OM buildings are typically multi-tenant properties leased to healthcare providers (hospitals and physician practices) under leases that generally provide for recovery of certain operating expenses and certain capital expenditures and have initial terms of five to 10 years with fixed annual rent escalations (historically ranging from 2% to 3% per year).

Senior Housing Operating Properties

We believe our SHOP segment has the potential for demand growth from an aging U.S. population. As of December 31, 2024, we owned and operated 84 senior housing and skilled nursing facilities in our SHOP segment. Such facilities cater to different segments of the elderly population based upon their personal needs and include independent living, assisted living, memory care or skilled nursing services. Residents of assisted living facilities typically require limited medical care but need assistance with eating, bathing, dressing and/or medication management. Services provided by operators at these facilities are primarily paid for by the residents directly or through private insurance and are therefore less reliant on government reimbursement programs, such as Medicaid and Medicare. The facilities in our SHOP segment are operated utilizing RIDEA structures, allowing us to participate in the upside from any improved operational performance while bearing the risk of any decline in operating performance.

Triple-Net Leased Properties

Our triple-net leased properties segment includes senior housing, skilled nursing facilities and hospitals. We lease such properties to tenants under triple-net or absolute-net leases that obligate the tenants to pay all property-related expenses, including maintenance, utilities, repairs, taxes, insurance and capital expenditures.

As of December 31, 2024, we owned seven SNFs within our triple-net leased properties segment that we lease to third parties. SNF residents are generally higher acuity and need assistance with eating, bathing, dressing and/or medication management and also require available 24-hour nursing care. SNFs offer restorative, rehabilitative and custodial nursing care for people who cannot live independently but do not require the more extensive and sophisticated treatment available at hospitals. Skilled nursing services provided by our tenants in SNFs are paid for either by private sources or through the Medicare and Medicaid programs. Each SNF is leased to a single tenant under a triple-net lease, with an initial term typically ranging from 12 to 15 years, fixed annual rent escalations (historically ranging from 2% to 3% per year) and requiring minimum lease coverage ratios. We commonly structure SNFs under a master lease with multiple facilities in order to diversify our master tenant’s sources of rent and mitigate risk. We typically focus on SNF investments in states that require a CON in order to develop new SNFs, which we believe reduces the risk of over-supply.

As of December 31, 2024, we owned 11 senior housing facilities within our triple-net leased properties segment that we lease to third parties. Each facility is leased to a single tenant under a triple-net lease structure with an initial term typically ranging from approximately 12 to 15 years, fixed annual rent escalations (historically ranging from 2% to 3% per year) and requiring minimum lease coverage ratios. Such assets are commonly leased under a single master lease covering multiple facilities in order to diversify a master tenant’s sources of rent and mitigate risk.

As of December 31, 2024, we have one wholly-owned hospital and one hospital in which we own an approximately 90.6% interest within our triple-net leased properties segment. Services provided by operators and tenants in our hospitals are paid for by private sources, third-party payors (e.g., insurance and health maintenance organizations) or through the Medicare and Medicaid programs. Our hospital properties include acute care, long-term acute care, specialty and rehabilitation services that are leased to single tenants or operators under triple-net lease structures with an initial term ranging from 21 to 29 years and fixed annual rent escalations (historically ranging from 2% to 6% per year).

For a further discussion of our segment reporting for the years ended December 31, 2024, 2023 and 2022, see Item 2, Properties, Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Note 18, Segment Reporting, to the Consolidated Financial Statements that are a part of this Annual Report on Form 10-K.

Item 1A. Risk Factors

Investing in our common stock involves risks. Our stockholders should carefully consider the risk factors below, together with all of the other information included in this Annual Report on Form 10-K, including our Consolidated Financial Statements and the notes thereto included herein. If any of these risks were to occur, our business, financial condition, liquidity, results of operations and prospects and our ability to service our debt and make distributions to our stockholders at a particular rate, or at all, could be materially and adversely affected (which we refer to collectively as “materially and adversely affecting us” or having “a material adverse effect on us” and comparable phrases).

Risk Factor Summary

Below is a summary of the principal factors that make an investment in our common stock speculative or risky. This summary should be read in conjunction with the full risk factors contained below.

Risks Related to Our Business and Financial Results

•The financial deterioration, insolvency or bankruptcy of one or more of our major tenants, operators, borrowers or other obligors could have a material adverse effect on us.

•We are dependent on tenants for our revenue, and lease defaults or terminations could reduce our ability to make distributions to our stockholders.

•We have experienced net losses in the past and we may experience additional losses in the future.

•Our prior performance may not be an accurate predictor of our ability to achieve our business objectives or of our future results.

•Our success is dependent on the performance and continued contributions of certain of our key personnel, and, in the event they are no longer employed by us, we could be materially and adversely affected.

•All of our integrated senior health campuses are managed by Trilogy Management Services, LLC, or the Trilogy Manager, and account for a significant portion of our revenues and operating income. Adverse developments in the Trilogy Manager’s business or financial strength could have a material adverse effect on us.

Risks Related to Investments in Real Estate

•Changing market conditions could lead our real estate investments to decrease in value or may cause us to sell our properties at a loss in the future.

•Most of our costs, such as operating and general and administrative expenses, interest expense and real estate acquisition and construction costs, are subject to inflation and may not be recoverable.

•Our high concentrations of properties in particular geographic areas magnify the effects of negative conditions affecting those geographic areas.

•Our real estate investments may be concentrated in senior housing, SNFs, OM buildings or other healthcare-related facilities, making us more vulnerable to negative factors affecting these classes than if our investments were diversified beyond the healthcare industry.

•Our business, tenants, residents and operators may face litigation and experience rising liability and insurance costs, which may materially and adversely affect us.

Risks Related to Real Estate-Related Investments

•Unfavorable real estate market conditions and delays in liquidating defaulted mortgage loan investments may negatively impact mortgage loans in which we have invested and may invest, which could result in losses to us.

•We expect a portion of our real estate-related investments to be illiquid, and we may not be able to adjust our portfolio in a timely manner in response to changes in economic and other conditions.

Risks Related to the Healthcare Industry

•The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of licensure or failure to obtain licensure could result in the inability of our tenants to make rent payments to us or adversely affect our operators’ ability to operate facilities held in RIDEA structures.

•Reimbursement rates from third-party payors, including Medicare and Medicaid, that do not rise as quickly, or at all, compared to the rate of inflation, could adversely affect our tenants’ operations and ability to make rental payments to us or our profitability from operating facilities held in RIDEA structures.

•If seniors delay moving to senior housing facilities until they require greater care or forgo moving to senior housing facilities altogether, such action could have a material adverse effect on us.

•We, our tenants and our operators for our senior housing facilities and SNFs may be subject to various government reviews, audits and investigations that could materially and adversely affect us, including an obligation to refund amounts previously paid to us, potential criminal charges, the imposition of fines and/or the loss of the right to participate in Medicare and Medicaid programs.

Risks Related to Joint Ventures

•When we serve as a managing member, general partner or controlling party with respect to investments or joint ventures, we may be subject to risks and liabilities that we would not otherwise face.

Risks Related to Debt Financing

•We may incur additional indebtedness in the future, which could materially and adversely affect us.

•Lenders may require us to enter into restrictive covenants that could adversely affect our business.

Risks Related to Our Corporate Structure and Organization

•Our charter imposes a limit on the percentage of shares of our common stock or capital stock that any person may own, and such limit may discourage a takeover or business combination that may have benefited our stockholders.

Risks Related to Taxes and Our REIT Status

•Failure to maintain our qualification as a REIT for U.S. federal income tax purposes would subject us to U.S. federal income tax on our REIT taxable income at the regular corporate rate, which would substantially increase our income tax expenses and reduce our distributions to our stockholders.

•We may be subject to adverse legislative or regulatory tax changes that could increase our tax liability or reduce our operating flexibility.

Risks Related to Our Common Stock

•The market price and trading volume of shares of our common stock may be volatile.

•Our ability to pay dividends in the future may be limited by agreements relating to our indebtedness and other factors.

•Future offerings of debt securities, which would be senior to our common stock, or equity securities, which would dilute our existing stockholders and may be senior to our common stock, may adversely affect our stockholders.

•We may be unable to raise additional capital on favorable terms, or at all, needed to grow our business.

Risks Related to Our Business and Financial Results

The financial deterioration, insolvency or bankruptcy of one or more of our major tenants, operators, borrowers or other obligors could have a material adverse effect on us.

A downturn in any of our tenants’, operators’, borrowers’ or other obligors’ businesses could ultimately lead to voluntary or involuntary bankruptcy or similar insolvency proceedings, including but not limited to assignment for the benefit of creditors, reorganization, liquidation or winding-up. Bankruptcy and insolvency laws afford certain rights to a defaulting tenant, operator or borrower that has filed for bankruptcy or reorganization that may render certain of our remedies unenforceable or, at the least, delay our ability to pursue such remedies and realize any related recoveries. A debtor has the right to assume, or to assume and assign to a third party, or to reject its executory contracts and unexpired leases in a bankruptcy proceeding. If a debtor were to reject its leases with us, obligations under such rejected leases would cease. The claim against the rejecting debtor would be an unsecured claim, which would be limited by the statutory cap set forth in the U.S. Bankruptcy Code, and there may be insufficient assets to satisfy all unsecured claims, even ones limited by the statutory cap. This statutory cap may be substantially less than the remaining rent actually owed under the lease. In addition, a debtor may also assert in bankruptcy

proceedings that leases should be re-characterized as financing agreements, which could result in our being deemed a lender instead of a landlord. A lender’s rights and remedies, as compared to a landlord’s, generally are materially less favorable, and our rights as a lender may be subordinated to other creditors’ rights.

Furthermore, the automatic stay provisions of the U.S. Bankruptcy Code would preclude us from enforcing our remedies unless we first obtain relief from the court having jurisdiction over the bankruptcy case. This would effectively limit or delay our ability to collect unpaid rent or interest payments, and we may ultimately not receive any payment at all. In addition, we would likely be required to fund certain expenses and obligations to preserve the value of our properties, avoid the imposition of liens on our properties or transition our properties to a new tenant or operator. Additionally, we lease many of our properties to healthcare providers who provide long-term custodial care to the elderly. Evicting operators for failure to pay rent while the property is occupied typically involves specific procedural or regulatory requirements and may not be successful. Even if eviction is possible, we may determine not to do so due to reputational or other risks. Bankruptcy or insolvency proceedings typically also result in increased costs to the operator, significant management distraction and performance declines. If we are unable to transition affected properties, they would likely experience prolonged operational disruption, leading to lower occupancy rates and further depressed revenues. Publicity about the operator’s financial troubles and bankruptcy or insolvency proceedings may also negatively impact their and our reputations, decreasing customer demand and revenues. Any or all of these risks could have a material adverse effect on us.

We are dependent on tenants for our revenue, and lease defaults or terminations could reduce our ability to make distributions to our stockholders.

The successful performance of our real estate investments is materially dependent on the financial stability of our tenants. Lease payment defaults by tenants would cause us to lose the revenue associated with such leases and could reduce our ability to make distributions to our stockholders. If a property is subject to a mortgage, a default by a significant tenant on its lease payments to us may result in a foreclosure on the property if we are unable to find an alternative source of revenue to meet our mortgage payments. In the event of a tenant default, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment and re-leasing our property. Further, we cannot assure our stockholders that we will be able to re-lease the property for the rent previously received, if at all, or that lease terminations will not cause us to sell the property at a loss.

We have experienced net losses in the past and we may experience additional losses in the future.

Historically, we have experienced net losses (calculated in accordance with GAAP), and we may not be profitable or realize growth in the value of our investments. Many of our losses can be attributed to depreciation and amortization, interest expense, general and administrative expenses, as well as acquisition expenses incurred in connection with purchasing properties or making other investments. For a further discussion of our operational history and the factors affecting our net losses, see Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and our Consolidated Financial Statements and the notes thereto that are a part of this Annual Report on Form 10-K.

Our prior performance may not be an accurate predictor of our ability to achieve our business objectives or of our future results.

Our stockholders should not rely on our past performance to predict our future results. Our stockholders should review our prospects in light of the risks, uncertainties and difficulties frequently encountered by companies that have a limited operating history, many of which may be beyond our control. For example, due to challenging economic conditions in the past, distributions to stockholders were reduced. Therefore, to be successful in this market, we must, among other things:

•successfully manage our assets;

•attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations; and

•respond to competition both for investment opportunities and potential investors’ investment in us.

We cannot guarantee that we will succeed in achieving these goals, and our failure to do so could materially and adversely affect us and the market price of our common stock could be highly volatile and decline significantly and our stockholders could lose all or a portion of their investment.

Our success is dependent on the performance and continued contributions of certain of our key personnel, and, in the event they are no longer employed by us, we could be materially and adversely affected.

Our success depends, to a significant degree, upon the continued contributions of our executives and key officers. In particular, Danny Prosky would be difficult to replace. Mr. Prosky currently serves as our Chief Executive Officer and one of our directors. In the event that Mr. Prosky or one of our other executives or key executive officers are no longer employed by

us, for any reason, it could have a material adverse effect on us, and we may not be able to attract and hire equally capable individuals to replace them. If we were to lose the benefit of the experience, efforts and abilities of one or more of our executives or other key officers, we could be materially and adversely affected.

Our financial results and our ability to make distributions to our stockholders are subject to international, national and local market conditions we cannot control or predict.

We are subject to the risks of an international or national economic slowdown or downturn and other changes in international, national and local market conditions. The following factors may have affected, and may continue to affect, income from our properties, our ability to acquire and develop properties, and our overall financial results and ability to make distributions to our stockholders:

•poor economic times may result in defaults by tenants of our properties due to bankruptcy, lack of liquidity or operational failures. We may provide rent concessions, tenant improvement expenditures or reduced rental rates to maintain or increase occupancy levels;

•fluctuations as a result of supply and demand imbalances and reduced occupancies and rental rates may cause the properties that we own to decrease in value. Consequently, we may not be able to recover the carrying amount of our properties, which may require us to recognize an impairment charge or record a loss on sale in our financial results;