As filed with the Securities and Exchange Commission on February 10, 2021

Registration No. 333-251850

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HUALE ACOUSTICS LIMITED

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands | | 5731 | | Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification No.) |

13th Floor, Building B1, Wisdom Plaza,

Qiaoxiang Road, Nanshan District

Shenzhen, Guangdong Province, China 518000

Telephone: (86) 13502862928

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Copies to:

Henry F. Schlueter, Esq.

Celia Velletri, Esq.

Schlueter & Associates, P.C.

5290 DTC Parkway, Suite 150

Greenwood Village, CO 80111

Tel: 303-292-3883

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: From time to time after effectiveness of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company [X]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | | Amount to be Registered | | | Proposed

Maximum

Offering Price Per Share | | | Proposed Maximum Aggregate Offering

Price(1) | | | Amount of Registration Fee | |

| Ordinary Shares, par value $0.0001 per share(2)(3) | | | 9,125,000 | | | $ | 0.02 | | | $ | 182,500 | | | $ | 19.91 | (4) |

| | | | | | | | | | | | | | | | | |

| Total | | | 9,125,000 | | | $ | 0.02 | | | $ | 182,500 | | | $ | 19.91 | (4) |

| (1) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. The registrant’s securities are not trading on any exchange or in any market, and our Ordinary Shares have a negative book value. The registration fee has been calculated based on an offering price of $0.02 per share, or $182,500. The price of $0.02 is a fixed price at which the Selling Shareholders may sell their shares until our Ordinary Shares are quoted on the OTCQB or a higher market at which time the shares may be sold at prevailing market prices or at privately negotiated prices. |

| | |

| (2) | In accordance with Rule 416(a), the Registrant is also registering an indeterminate number of additional Ordinary Shares that shall be issuable pursuant to Rule 416 to prevent dilution resulting from share splits, share dividends or similar transactions. |

| | |

| (3) | Reflects the resale by Selling Shareholders included herein of their Ordinary Shares. |

| | |

| (4) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the Selling Shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

DATED FEBRUARY 10, 2021

PRELIMINARY PROSPECTUS

HUALE ACOUSTICS LIMITED

February 10, 2021

This prospectus relates to the resale from time to time by the Selling Shareholders identified in this prospectus under the caption “Selling Shareholders” of up to 9,125,000 of our $0.0001 par value Ordinary Shares.

For the details about the Selling Shareholders, please see “Principal and Selling Shareholders – Selling Shareholders.” The Selling Shareholders may sell some or all of their Shares from time to time at a fixed price of $0.02 per Share until our Shares are quoted on the OTCQB or a higher market and thereafter in the principal market on which our Ordinary Shares are traded at the prevailing market price, in negotiated transactions or through any other means described in the section titled “Plan of Distribution.” The Selling Shareholders may be deemed underwriters within the meaning of the Securities Act of 1933, as amended, of the Ordinary Shares that they are offering. We will pay the expenses of registering these Shares. We will not receive proceeds from the sale of our Shares by the Selling Shareholders that are covered by this prospectus.

The Shares are being registered to permit the Selling Shareholders, or their respective pledgees, donees, transferees or other successors-in-interest, to sell the Shares from time to time in the public market. We do not know when or in what amount the Selling Shareholders may offer the securities for sale. The Selling Shareholders may sell some, all or none of the securities offered by this prospectus.

There is no market for the Ordinary Shares and there can be no assurance that a market for the Shares will develop. However, management intends to seek to have the Ordinary Shares admitted to quotation on the OTCQB subsequent to the SEC declaring the registration statement of which this prospectus is a part effective. However, there can be no assurance that our Ordinary Shares will be approved for trading on the OTCQB or any other trading exchange.

We are an emerging growth company, as defined in the U.S. Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in the Ordinary Shares involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Selling Shareholders may sell their Ordinary Shares described in this prospectus in a number of different ways, at prevailing market prices or privately negotiated prices and there is no termination date of the Selling Shareholders’ offering.

The date of this prospectus is ______________, 2021

TABLE OF CONTENTS

We have not authorized any person to provide you with information different from that contained in this prospectus or any related free-writing prospectus that we authorize to be distributed to you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of the securities offered hereby.

For investors outside of the United States: We have not done anything that would permit this Offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the Offering and the distribution of this prospectus outside of the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

COMMONLY USED DEFINED TERMS

| | ● | “Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended. |

| | | |

| | ● | “Hong Kong” or “H.K.” refers to Hong Kong Special Administrative Region of the People’s Republic of China. |

| | | |

| | ● | “Offering” refers to the resale of the Ordinary Shares offered by the Selling Shareholders included herein. |

| | | |

| | ● | “Ordinary Shares” or “Shares” refers to the Company’s Ordinary Shares, par value $0.0001 per share. |

| | | |

| | ● | “PRC” and “China” refer to the People’s Republic of China. |

| | | |

| | ● | “Securities and Exchange Commission,” “SEC,” “Commission” or similar terms refer to the United States Securities and Exchange Commission. |

| | | |

| | ● | “Securities Act” refers to the U.S. Securities Act of 1933, as amended. |

| | | |

| | ● | “Selling Shareholders” refers to our pre-existing shareholders who are selling their Ordinary Shares pursuant to the Registration Statement on Form F-1. |

| | | |

| | ● | “United States,” “U.S.,” “USA” and “US” refer to the United States of America. |

| | | |

| | ● | “$,” “U.S. $,” “U.S. dollars,” “dollars,” “US$” and “USD” refer to United States dollars. |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. A forward-looking statement is a projection about a future event or result, and whether the statement comes true is subject to many risks and uncertainties. These statements often can be identified by the use of terms such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “approximate” or “continue,” or the negative thereof. The actual results, performance, achievements or activities of the Company, either express or implied, will likely differ from projected results or activities of the Company as described in this prospectus, and such differences could be material. You should review carefully all information included in this prospectus.

You should rely only on the forward-looking statements that reflect management’s view as of the date of this prospectus. We undertake no obligation to publicly revise or update these forward-looking statements to reflect subsequent events or circumstances. You should also carefully review the risk factors described in other documents we file from time to time with the Securities and Exchange Commission (the “SEC”). We are hereby identifying important factors that could cause actual results to differ materially from those contained in any forward-looking statements made by us or on our behalf. Factors that might cause such a difference include, but are not limited to, those discussed in the section entitled “Risk Factors.”

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our Ordinary Shares, you should carefully read the entire prospectus, including our financial statements and the related notes included elsewhere in this prospectus. You should also consider, among other things, the matters described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case appearing elsewhere in this prospectus. Unless otherwise stated, all references to “us,” “our,” “we,” the “Company,” the “group” and similar designations refer to Huale Acoustics Limited, a Cayman Islands exempted company with limited liability,

History of the Company

The Company was originally incorporated in Nevada under the name “Illumitry Corp.” on October 17, 2014. It currently maintains its principal executive offices at Floor 13, Building B1, Wisdom Plaza, Qiaoxiang Road, Nanshan District, Shenzhen, Guangdong Province, China 518000. The Company was formed to commence operations in the field of embroidery on fabric in Armenia.

The Company filed a registration statement on Form S-1 with the SEC on March 18, 2015, which was declared effective on October 6, 2015. In October 2017, subsequent to a change of control, the Company’s name was changed to Huale Acoustics Corporation and management of the Company abandoned its business plan and determined to seek a possible business combination. The business purpose of the Company changed to seeking the acquisition of, or merger with, an existing company.

As a result, the Company became a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act) with nominal assets and no business operations, and it sought to identify, evaluate and investigate various companies with the intent that, if such investigation warranted, a reverse merger transaction could be negotiated and completed pursuant to which the Company would acquire a target company with an operating business with the intent of continuing the acquired company’s business as a publicly held entity.

Effective May 7, 2019, the Company changed its domicile from Nevada to the Cayman Islands by merging into its wholly owned Cayman Islands subsidiary, Huale Acoustics Limited (the “Redomicile Merger”). As a result of the Redomicile Merger, the Company’s name was changed to Huale Acoustics Limited.

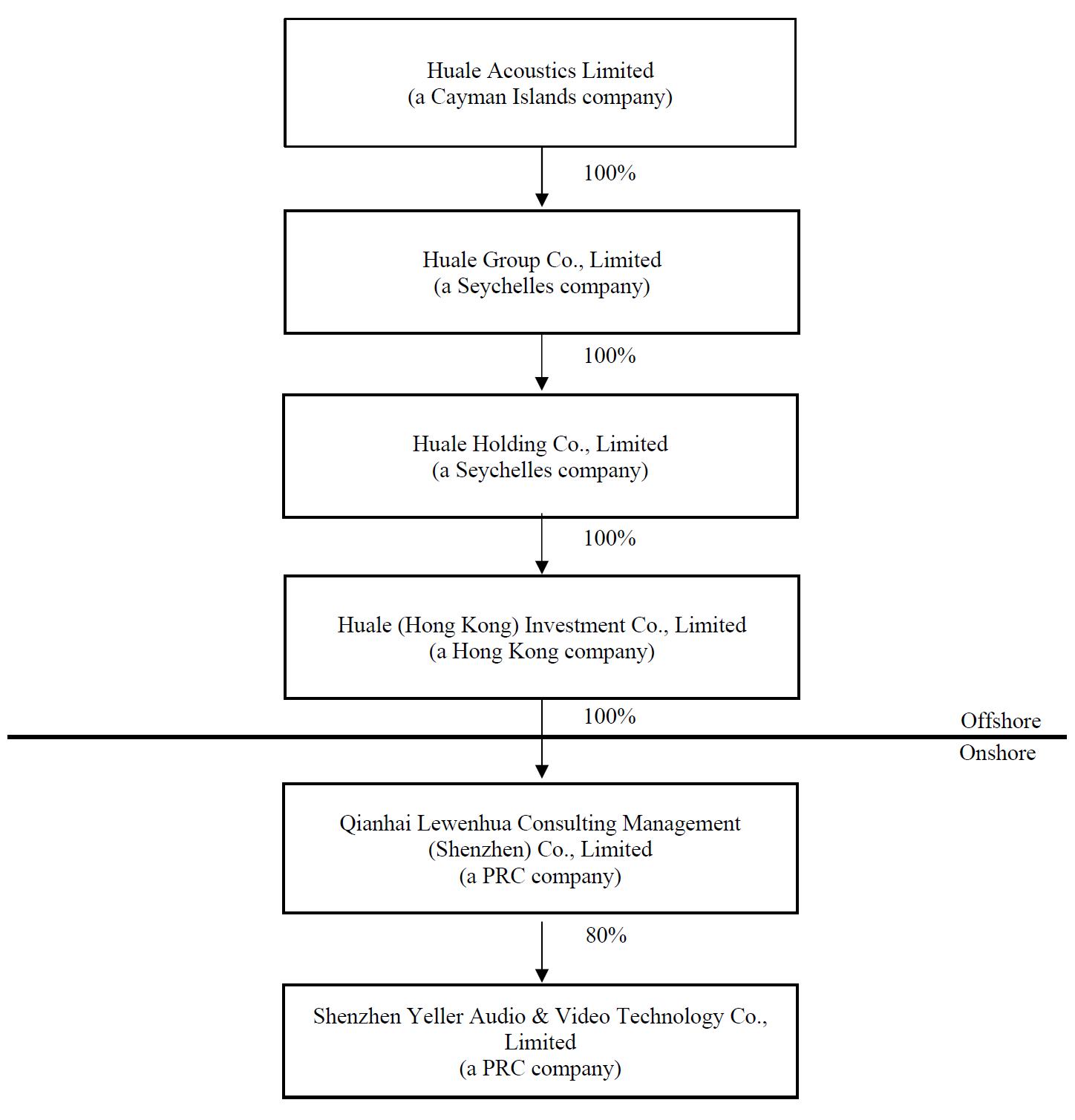

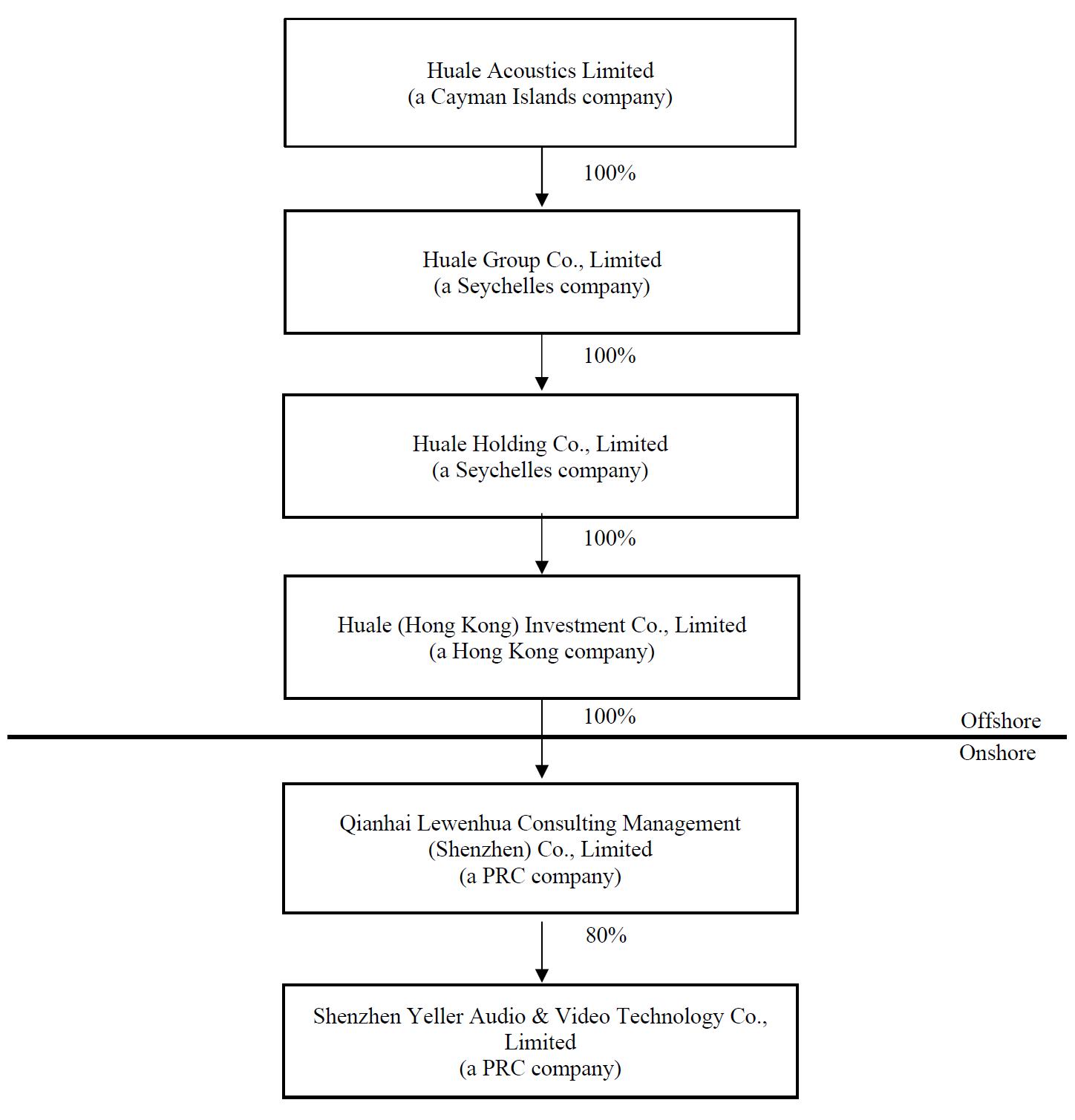

On April 28, 2020 (the “Closing Date”), the Company closed on a share exchange (the “Share Exchange”) with Huale Group Co., Limited, (“HGL”), a Seychelles company limited by shares, and HGL’s shareholders (the “HGL Shareholders”). As a result, HGL is now a wholly owned subsidiary of the Company. Under the Share Exchange Agreement, the HGL Shareholders exchanged all of the shares that they held in HGL for 32,625,000 Ordinary Shares of the Company.

As a result of the Share Exchange, management of the Company believes that the Company is no longer a shell company. The Company’s operations now consist of the operations of HGL and its subsidiaries. When we refer in this prospectus to business and financial information for periods prior to the consummation of the Share Exchange, we are referring to the business and financial information of HGL and its subsidiaries unless the context suggests otherwise; when we use phrases such as “we,” “our,” “company” and “us,” we are referring to the Company and all of its subsidiaries, as a combined entity.

On November 23, 2020, the Company closed on the sale of 4,856,775 Ordinary Shares, at a purchase price of $0.02 per Share, pursuant to a private securities offering (the “2020 Private Offering”) conducted under Regulation S promulgated under the Securities Act. In accordance with Regulation S, the Shares were offered and sold solely outside the United States to investors who are not U.S. persons, as defined in Regulation S.

Neither the Shares issued pursuant to the Redomicile Merger, the Shares issued to the HGL Shareholders in connection with the Share Exchange nor the Shares issued in the 2020 Private Offering were registered under the Securities Act. The purpose of the registration statement of which this prospectus is a part is to register for resale a portion of the Shares issued pursuant to the Redomicile Merger and the Share Exchange, as well as the Shares issued in the 2020 Private Offering.

Business of the Company

Through its indirect subsidiary, Shenzhen Yeller Audio & Video Technology Co., Limited (“Shenzhen Yeller”), the Company is engaged in the business of providing integrated audio and video equipment, smart home technology and cultural media to customers in China.

Through its professional design and installation team, Shenzhen Yeller displays and sells high-quality smart home and audio and video products to its customers in a one-stop manner, so that users can achieve a set of smart home solutions and high-quality audio and video experience within the shortest time and at a lower cost. Through its professional team, it integrates automatic control technology, computer technology and Internet of Things technology to combine the functions of household appliance control, environmental monitoring, information management and video entertainment so as to provide customers with a more comfortable, safe, energy-saving and high-quality family life experience.

Shenzhen Yeller is focused on creating customer value, satisfaction and loyalty. Through complementary acquisitions or investments with existing businesses, the company intends to further expand its product range and business scope to meet customers’ full program purchase system needs, increase market share and create sustainable profitability and investment value for the company. The company also intends to expand its business by establishing new regional service centers in key cities across China. The company intends to establish branches in several regions where China’s economy is prosperous, including Beijing, Shanghai, Guangzhou, Xiamen, Chengdu, Hangzhou, Ganzhou and other places. Management expects that these areas will bring considerable sales performance and returns to the company.

The company strives to be a one-stop, full-house, smart, audio and video system solution provider, providing personalized services to meet the needs of both the upper class and the middle class populations in China.

Risk Factors

Investing in our Ordinary Shares involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page 7 of this prospectus before making a decision to purchase Ordinary Shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our Ordinary Shares would likely decline, and you may lose all or part of your investment.

Our Securities

Our authorized capital is $50,000, consisting of 500,000,000 Shares, $0.0001 par value per Share. Holders of our Ordinary Shares are entitled to one vote for each whole Share on all matters to be voted upon by shareholders, including the election of directors. Holders of our Ordinary Shares do not have cumulative voting rights in the election of directors. All of our Ordinary Shares are equal to each other with respect to dividend rights. Holders of our Ordinary Shares are entitled to receive dividends if and when declared by our Board of Directors out of funds legally available therefor under Cayman Islands law. In the event of our liquidation, the liquidator may, after having discharged the debts, if any, of the Company, divide among the shareholders on a pari passu basis, in specie or in kind, the whole or any part of the assets of the Company (whether they shall consist of property of the same kind or not) and may for such purpose set such value as he deems fair upon any property to be divided as aforesaid. Holders of our Ordinary Shares have no preemptive rights to purchase any additional unissued Ordinary Shares. The Board of Directors has the ability to determine the rights, preferences and restrictions of preferred shares at their discretion.

As of November 30, 2020, there were 41,106,775 of our Ordinary Shares issued and outstanding. All Shares were fully paid. We do not have any options to purchase Shares or any preferred shares outstanding. (For a more complete description of our Ordinary Shares, see “Description of Share Capital,” below.)

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of certain exemptions from specified disclosure and other requirements that are otherwise generally applicable to public companies. These exemptions include:

| | ● | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| | | |

| | ● | not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002; |

| | | |

| | ● | reduced disclosure obligations regarding executive compensation; and |

| | | |

| | ● | not being required to hold a nonbinding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (i) the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; (ii) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; (iii) the issuance, in any three-year period, by the Company of more than $1.0 billion in non-convertible debt securities; or (iv) the last day of the fiscal year ending after the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement.

We are also considered a “foreign private issuer” and will report under the Exchange Act as a non-U.S. company with foreign private issuer status. This means that, even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| | ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| | | |

| | ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| | | |

| | ● | the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from our competitors that are public companies, or other public companies in which you have made an investment.

Notes on Prospectus Presentation

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. Certain market data and other statistical information contained in this prospectus is based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of the audio and video equipment, smart home and cultural media sales industries. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

Accordingly, actual events or circumstances may differ materially from events and circumstances that are assumed in this information and you are cautioned not to give undue weight to such data.

Securities Being Offered by Selling Shareholders

The Selling Shareholders are offering up to 9,125,000 Ordinary Shares. The Selling Shareholders may sell their Ordinary Shares at a fixed price of $0.02 per share until our Shares are quoted on the OTCQB or a higher market and thereafter in the principal market on which our Ordinary Shares are traded at the prevailing market price, in negotiated transactions or through any other means described in the section titled “Plan of Distribution.” We will not receive any proceeds from the sales by the Selling Shareholders.

Transfer Agent

The transfer agent and registrar for the Ordinary Shares of the Company is Action Stock Transfer, 2469 E. Fort Union Blvd, Suite 214, Salt Lake City, UT 84121; telephone: (801) 274-1088, and Facsimile: (801) 274-1099.

RISK FACTORS

Investing in our Ordinary Shares involves a high degree of risk. You should carefully consider the following risks and all other information contained in this prospectus, including our and Huale Group Co., Limited’s consolidated financial statements, Shenzhen Yeller’s financial statements and the related notes, before making an investment decision regarding our securities. The risks and uncertainties described below are those significant risk factors, currently known and specific to us that we believe are relevant to an investment in our securities. If any of these risks materialize, our business, financial condition or results of operations could suffer, the price of our Ordinary Shares could decline and you could lose part or all of your investment.

Risks Related to the Company

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

The Company is in the process of developing its business and has a limited operating history. You should consider our future prospects in light of the risks and uncertainties experienced by early stage companies. Some of these risks and uncertainties relate to our ability to:

| | ● | offer products of sufficient quality to attract and retain a larger customer base; |

| | ● | attract additional customers and increase spending per customer; |

| | ● | increase awareness of our products and continue to develop customer loyalty; |

| | ● | respond to competitive market conditions; |

| | ● | respond to changes in our regulatory environment; |

| | ● | maintain effective control of our costs and expenses; |

| | ● | raise sufficient capital to sustain and expand our business; and |

| | ● | attract, retain and motivate qualified personnel. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

We envision a period of rapid growth that may impose a significant burden on our administrative and operational resources, which, if not effectively managed, could impair our growth.

Our strategy envisions a period of rapid growth that may impose a significant burden on our administrative and operational resources. The growth of our business will require significant investments of capital and management’s close attention. Our ability to effectively manage our growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract, train, manage and retain qualified management, IT, sales and marketing and other personnel; we may be unable to do so. In addition, our failure to successfully manage our growth could result in our sales not increasing commensurately with capital investments. If we are unable to successfully manage our growth, we may be unable to achieve our goals.

We may not be able to raise the additional capital necessary to execute our business strategy, which could result in the curtailment of our operations.

We will need to raise additional funds to fully fund our existing operations and for development and expansion of our business. We have no current arrangements with respect to sources of additional financing and the needed additional financing may not be available on commercially reasonable terms, on a timely basis or at all. The inability to obtain additional financing when needed would have a negative effect on us, including possibly requiring us to curtail our operations. If any future financing involves the sale of equity securities, the Shares held by our shareholders could be substantially diluted. If we borrow money or issue debt securities, the Company will be subject to the risks associated with indebtedness, including the risk that interest rates may fluctuate and the possibility that it may not be able to pay principal and interest on the indebtedness when due. Insufficient funds would prevent us from implementing our business plan and would require us to delay, scale back or eliminate certain of our operations.

We will be required to hire and retain skilled managerial personnel, IT and sales and marketing personnel.

Our continued success depends in large part on our ability to attract, train, motivate and retain qualified management, IT and sales and marketing personnel. Any failure to attract and retain the required managerial, sales and technical personnel that are integral to our business may have a negative impact on our operations, which would have a negative impact on revenues. There can be no assurance that we will be able to attract and retain skilled persons and the loss of skilled management, sales or technical personnel would adversely affect us.

We are dependent upon our and Shenzhen Yeller’s officers and management for direction and the loss of any of these persons could adversely affect our operations and results.

We are dependent upon our and Shenzhen Yeller’s officers for implementation of our proposed strategy and execution of our business plan. The loss of any of our, or Shenzhen Yeller’s, officers could have a material adverse effect upon our results of operations and financial position. Neither the Company nor Shenzhen Yeller maintains “key person” life insurance for any of our officers. The loss of any of our, or Shenzhen Yeller’s, officers could delay or prevent the achievement of our business objectives.

We currently have only one operating subsidiary.

We are a holding company with a total of five subsidiaries; however, at the current time only one of those subsidiaries, Shenzhen Yeller, is conducting operations. Therefore, we are totally dependent on Shenzhen Yeller for our revenue. A decline in sales revenue of Shenzhen Yeller could have a material adverse effect on our earnings, cash flows and financial position.

We may be sued or become a party to litigation, which could require significant management time and attention and result in significant legal expenses and may result in an unfavorable outcome, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may be subject to a number of lawsuits from time to time arising in the ordinary course of our business. The expense of defending ourselves against such litigation may be significant. The amount of time to resolve these lawsuits is unpredictable and defending ourselves may divert management’s attention from the day-to-day operations of our business, which could adversely affect our business, results of operations and cash flows. In addition, an unfavorable outcome in such litigation could have a material adverse effect on our business, results of operations and cash flows.

We have identified material weaknesses in our internal control over financial reporting. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, stockholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our Shares.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could cause us to fail to meet our reporting obligations. Ineffective internal control could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our Shares.

We have identified material weaknesses in our internal control over financial reporting in the Company and in its subsidiaries. As defined in Regulation 12b-2 under the Exchange Act, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented, or detected on a timely basis. Specifically, we determined that we had the following material weaknesses in our internal control over financial reporting: (i) we have limited controls over information processing; (ii) we have inadequate segregation of duties; (iii) we do not have a formal audit committee with a financial expert; and (iv) we do not have sufficient formal written policies and procedures for accounting and financial reporting with respect to the requirements and application of both generally accepted accounting principles in the United States of America, or GAAP, and SEC guidelines.

The Company utilizes a third-party independent contractor for the preparation of our financial statements; however, this practice does not fully address any material weakness or other deficiencies that we may have in our internal control over financial reporting. Although the financial statements and footnotes are reviewed by our management, we do not have a formal policy to review significant accounting transactions and the accounting treatment of such transactions. The third-party independent contractor is not involved in the day-to-day operations of the Company and may not be provided information from management on a timely basis to allow for adequate reporting/consideration of certain transactions.

Even if we develop effective internal controls over financial reporting, such controls may become inadequate due to changes in conditions, or the degree of compliance with such policies or procedures may deteriorate, which could result in the discovery of additional material weaknesses and deficiencies. In any event, the process of determining whether our existing internal control over financial reporting is compliant with Section 404 of the Sarbanes-Oxley Act (“Section 404”) and is sufficiently effective requires the investment of substantial time and resources by our senior management. As a result, this process may divert internal resources and take a significant amount of time and effort to complete. In addition, we cannot predict the outcome of this process and whether we will need to implement remedial actions in order to establish effective controls over financial reporting. The determination of whether or not our internal controls are sufficient, and any remedial actions required, could result in us incurring additional costs that we did not anticipate, including the hiring of additional outside consultants. We may also fail to timely complete our evaluation, testing and any remediation required to comply with Section 404.

We are required, pursuant to Section 404, to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. However, for as long as we are a “smaller reporting company,” our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404. While we could be a smaller reporting company for an indefinite amount of time, and thus relieved of the above-mentioned attestation requirement, an independent assessment of the effectiveness of our internal control over financial reporting could detect problems that our management’s assessment might not. Such undetected material weaknesses in our internal control over financial reporting could lead to financial statement restatements and require us to incur the expense of remediation.

Our independent auditors have issued audit opinions for the Company, HGL and Shenzhen Yeller, which include a statement describing their going concern status. Their financial status creates a doubt whether HGL and Shenzhen Yeller, and therefore the Company, will continue as going concerns.

Our auditors have issued going concern opinions regarding the Company, HGL and Shenzhen Yeller. This means there is substantial doubt as to whether they can continue as ongoing businesses for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty regarding their ability to continue in business. As such, since Shenzhen Yeller is currently our only operating subsidiary, we may have to cease operations and investors could lose part or all of their investment in our company.

To the extent that our independent registered public accounting firm’s audit documentation related to their audit reports for the Company are, or will be, located in China, the PCAOB may not be able to inspect such audit documentation and, as a result, you may be deprived of the benefits of such inspection.

Our independent registered public accounting firm issued audit opinions on the financial statements included in this prospectus and will issue audit reports related to the Company in the future. As the auditor of a company filing reports with the SEC and as a firm registered with the PCAOB, our auditor is required by the laws of the United States to undergo regular inspections by the PCAOB. However, to the extent that our auditor’s work papers are or become located in China, such work papers will not be subject to inspection by the PCAOB because the PCAOB is currently unable to conduct inspections without the approval of the Chinese authorities. Inspections of certain other firms that the PCAOB has conducted outside of China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The inability of the PCAOB to conduct inspections of our auditors’ work papers in China would make it more difficult to evaluate the effectiveness of our auditor’s audit procedures or quality control procedures as compared to auditors outside of China that are subject to PCAOB inspections. Investors may consequently lose confidence in our reported financial information and procedures and the quality of our financial statements. As a result, our investors may be deprived of the benefits of the PCAOB’s oversight of our auditors through such inspections.

We are an emerging growth company and may take advantage of certain reduced reporting requirements.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and we may take advantage of certain exemptions from various requirements applicable to other public companies that are not emerging growth companies including, most significantly, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 for so long as we are an emerging growth company. As a result, if we elect not to comply with such auditor attestation requirements, our investors may not have access to certain information they may deem important.

The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the extended transition period. As a result of this election, our future financial statements may not be comparable to other public companies’ that comply with the public company effective dates for these new or revised accounting standards.

Risks Related to the Business of Shenzhen Yeller

Our business depends on the market recognition of our brand. If we are not able to maintain our reputation and enhance our brand recognition, our business and operating results may be materially and adversely affected.

Our track record in providing quality products and services will determine whether Shenzhen Yeller becomes recognized as a leading brand in the industry. We believe that market recognition of our brand is a key factor to ensuring our future success. As we continue to grow in size and increase the number of our stores as well as broaden the scope of our services, however, it may become increasingly difficult to maintain the quality and consistency of the products and services we offer, which may negatively impact our brand and the popularity of our products and services offered thereunder.

Our brand value will also be affected by customer perceptions. Those perceptions are affected by a number of factors; some of them are based on first-hand observation of our product and service quality while others may be based on indirect information from media or other sources. Incidents and any negative publicity related thereto, even if factually incorrect, may lead to significant deterioration of our brand image and reputation, and consequently negatively affect customers’ interest in our services and products, as well as potential franchisees’ interest in being associated with our brand. Particularly in the age of digital media and social network, impacts of negative publicity associated with any single incident could be easily amplified and potentially cause impacts that go beyond our estimation or control.

If we are unable to maintain our reputation, enhance our brand recognition or increase positive awareness of our products and services, it may be difficult to maintain and grow our customer base or attract more business partners to become our affiliates, and our business and growth prospects may be materially and adversely affected.

If we fail to maintain and increase our customer base, our revenues may decline and we may not be able to reach profitability.

The success of our business depends largely on the number of customers. Therefore, our ability to continue to attract new customers and to retain existing customers is critical to our continued success and growth. Our ability to attract new customers is affected by several factors, including our ability to expand our geographic reach, manage our growth while maintaining consistent and high service quality, effectively market and precisely target our services to a broader base of prospective customers and respond effectively to competition. If we are unable to continue to attract a sufficient number of new customers or to retain existing customers, our revenues may decline or we may not be able to reach profitability, either of which could have a material adverse effect on our business, financial condition and results of operations.

Our business relies on our ability to recruit, train and retain dedicated and qualified management and sales personnel.

Our sales staff is critical to the quality of our services and our reputation. We seek to recruit, train and retain qualified and dedicated salespeople. However, the type of products we sell requires our salespeople to have a certain interest in and understanding of audio, video and smart home technology. We may not be able to recruit, train and retain sufficient qualified salespeople to keep pace with our growth while maintaining consistent service quality in the different markets we serve. A shortage of qualified salespeople or a deterioration in the quality of our salespeople’s services, whether actual or perceived, or a significant increase in the average compensation paid by our competitors to their salespeople would have a material adverse effect on our business, financial condition and results of operations.

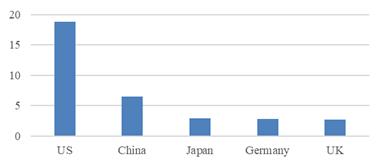

Competition

The high-end audio, video and smart home market in China is rapidly evolving and competition in this industry may be expected to increase. As more competitors enter the market, we will have to compete based on brand image, range and quality of products offered and service quality. New competitors may enter the market and one or more of our competitors may offer products and services that may adversely affect our ability to sell our products and services to new customers. Competitors continually introduce new products and services that may compete directly with our products and services, or that may make our products and services uncompetitive or obsolete. Larger competitors may have superior abilities to compete for distributorships and sales staff, reducing our ability to deliver quality products and services to our customers. Some of our competitors may have greater financial or other resources than we do. We cannot assure you that we will be able to compete successfully against existing or potential competitors, and if we fail to gain or maintain, or if we lose market share, our business, financial condition and results of operations may be materially and adversely affected.

Our success depends on the continuing efforts of our senior management team and other key personnel and our business may be harmed if we lose their services.

Our success depends in part on the continued application of services, efforts and motivation of our senior management team and key personnel. If one or more of our senior management members or key personnel are unable to continue in their present positions, we may not be able to find replacements successfully, and our business may be disrupted. We will need to continue to hire additional personnel as our business grows. A shortage in the supply of personnel with the requisite skills could negatively impact our ability to manage our business and expand our operations. There is competition for experienced personnel in the technology sales industry and key personnel could leave us to join our competitors. Losing the services of our experienced personnel may be disruptive to and cause uncertainty for our business, which may have a material adverse effect on our business, financial condition and results of operations.

We could incur additional liabilities or our reputation could be damaged if we do not protect customer data or if our information systems are breached.

We are dependent on information technology networks and systems to process, transmit and store electronic information and to communicate between our locations around China and with our customers. Security breaches of this infrastructure could lead to shutdowns or disruptions of our systems and potential unauthorized disclosure of confidential information. We are also required at times to manage, utilize and store sensitive or confidential customer or employee data. As a result, we are subject to laws and regulations designed to protect this information. If any person, including any of our employees, mismanages or misappropriates such data, we could be subject to monetary damages, fines and/or criminal prosecution. Unauthorized disclosure of sensitive or confidential customer or employee data, whether through systems failure, employee negligence, fraud or misappropriation could damage our reputation, disrupt our operations or result in remedial or other costs, fines or lawsuits and cause us to lose customers.

Legal requirements relating to the collection, storage, handling, and transfer of personal data continue to evolve. China’s Cybersecurity Law (“CSL”), which came into effect in June 2017, regulates how organizations should protect digital information and outlines measures to safeguard Internet systems, products and services against cyberattacks. The CSL was supplemented in May 2018 with the Personal Information Security Specification, which was amended and strengthened in February 2019. Although these amendments attempt to ease the compliance burden placed on businesses, the laws could impose significant limitations, require changes to our business or restrict our use or storage of personal information, which may increase our compliance expenses and make our business more costly or less efficient to conduct.

Our business is sensitive to general economic conditions.

Our business may be negatively affected by a downturn in general economic conditions and rising labor and material costs in China. Furthermore, a serious and/or prolonged economic downturn combined with a negative or uncertain political climate could adversely affect our customers’ financial condition and the amount they are able to spend for our products and services. These conditions may reduce the demand for our products and services or depress the pricing of those products and services and have an adverse impact on our results of operations. Changes in global economic conditions may also shift demand to products and services for which we do not have competitive advantages, and this could negatively affect the amount of business that we are able to obtain. Such economic, political and customer spending conditions are influenced by a wide range of factors that are beyond our control and that we have no comparative advantage in forecasting. If we are unable to successfully anticipate these changing conditions, we may be unable to effectively plan for and respond to those changes, and our business could be adversely affected.

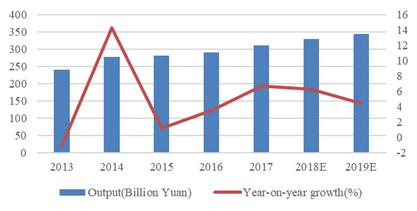

Since the products and services we offer are discretionary, our business success depends in part upon continued growth of disposable income in China. In challenging economic environments, our customers may reduce or defer their spending on new audio, video and smart home products in order to focus on other priorities. If growth in demand for our products declines or fails to increase, or if we cannot convince our customers or potential customers to embrace new audio, video and smart home technologies, our results of operations could be adversely affected.

Our business operations may be adversely affected by the outbreak of coronavirus COVID-19 or future epidemics or pandemics.

An outbreak of respiratory illness caused by a novel coronavirus (“COVID-19”) first emerged in Wuhan city, Hubei province, China in late 2019 and continued to expand within the PRC and globally. The new strain of coronavirus is considered highly contagious and poses a serious public health threat. With the aim of containing the COVID-19 outbreak, the PRC government imposed extreme measures across the PRC including, but not limited to, the complete lockdown of Wuhan city on January 23, 2020, partial lockdown measures across various cities in the PRC, the extended shutdown of business operations and mandatory quarantine requirements on infected individuals and anyone deemed potentially infected. On January 30, 2020, the World Health Organization (“WHO”) declared the outbreak of COVID-19 a Public Health Emergency of International Concern and on March 11, 2020, WHO declared COVID-19 a global pandemic.

The COVID-19 pandemic significantly disrupted China’s economy in the first quarter of 2020. Despite the PRC government’s efforts to revive China’s economy, China’s economy experienced a significant slowdown since the outbreak and will continue to face new difficulties and challenges due to the spread of the pandemic, increasing risk of imported cases and heightened volatility and uncertainties in the global economy, and there remains uncertainty as to how soon or whether economic activities in China will rebound to the level prior to the COVID-19 pandemic.

Our business has been and may continue to be adversely impacted. Our sole operating subsidiary is located in China, as are its employees and customers. A slowdown in the Chinese economy could be expected to result in a reduction in disposable income of our potential customers, which could have a negative effect on our sales due to the discretionary nature of the products we sell. In addition, the global nature of the pandemic could negatively affect our suppliers and lockdown measures and travel restrictions have impeded Shenzhen Yeller’s ability to work towards expanding its sales network. Shenzhen Yeller’s total sales decreased by approximately 16.2% from RMB 1,144,908.29 (approximately US$167,102) during the six months ended June 30, 2019 to RMB 959,181.41 (approximately US$136,394) for the six months ended June 30, 2020 and management estimates that, due to the outbreak, Shenzhen Yeller’s sales for the year ending December 31, 2020 could be approximately 10% to 20% lower than the year ended December 31, 2019.

The potential downturn brought by and the duration of the COVID-19 outbreak is difficult to assess or predict and the full impact of the virus on our operations will depend on many factors beyond our control. A slowdown in the Chinese economy and/or negative business sentiment could potentially have a significant negative impact on our revenues due to the discretionary nature of our products. A major resurgence of the epidemic in China could be expected to significantly reduce the demand for our products and services. In addition, our business operations could be disrupted again if any of our employees is suspected of contracting COVID-19, since our employees could be quarantined and/or our facilities be shut down for disinfection. The extent to which the COVID-19 outbreak impacts our business, results of operations and financial condition remains uncertain. Our business, results of operations, financial condition and prospects could be materially adversely affected to the extent that COVID-19 persists in China or harms the Chinese and global economy in general.

We may also experience negative effects from future public health crises beyond our control. These events are impossible to forecast, their negative effects may be difficult to mitigate and they could adversely affect our business, financial condition and results of operations.

Risks Related to the People’s Republic of China

The Chinese government may exert substantial influence over the manner in which we conduct our business operations in China.

The Chinese government has exercised, and continues to exercise, substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to conduct our business in China may be harmed by changes in its laws and regulations, including those relating to regulation of the sales industry, taxation, import and export tariffs, environmental regulations, land use rights, property ownership and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future could have a significant effect on us and our business.

China’s economic policies could affect our business.

Substantially all of our assets are located in China and substantially all of our revenue is derived from our operations in China. Accordingly, our results of operations and prospects are subject, to a significant extent, to economic, political and legal developments in China.

While China’s economy has experienced significant growth over the past decades, growth has been irregular, both geographically and among various sectors of the economy, and the rate of growth has been slowing since 2012. Any adverse changes in economic conditions in China, in the policies of the Chinese government or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, lead to reduction in demand for our products and services and adversely affect our competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of China but may also have a negative effect on us. For example, our operating results and financial condition may be adversely affected by government control over capital investments or changes in tax regulations.

The economy of China has been transitioning from a planned economy to a more market-oriented economy. In recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises; however, a substantial portion of productive assets in China are still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

Fluctuation of the RMB may affect our financial condition by affecting the volume of cross-border money flow.

The value of the RMB fluctuates and is subject to changes in the PRC’s political and economic conditions. Since July 2005, the conversion of RMB into foreign currencies, including USD, has been based on rates set by the People’s Bank of China which are set based upon the interbank foreign exchange market rates and current exchange rates of a basket of currencies on the world financial markets.

We may face obstacles from the communist system in the PRC.

Foreign companies conducting operations in the PRC face significant political, economic and legal risks. The communist regime in the PRC, including a stifling bureaucracy, may hinder Western investment.

We may have difficulty establishing adequate management, legal and financial controls in the PRC.

The PRC historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

The PRC legal system embodies uncertainties, which could limit law enforcement availability.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, decided legal cases have little precedence. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past several decades has significantly enhanced the protections afforded to various forms of foreign investment in China. Our PRC operating subsidiary and affiliate is subject to PRC laws and regulations. However, these laws and regulations change frequently, and the interpretation and enforcement involve uncertainties. For instance, we may have to resort to administrative and court proceedings to enforce the legal protection that we are entitled to by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting statutory and contractual terms, it may be difficult to evaluate the outcome of administrative court proceedings and the level of law enforcement that we would receive in more developed legal systems. Such uncertainties, including the inability to enforce our contracts, could affect our business and operation. In addition, confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the PRC legal system, particularly with regard to our business, including the promulgation of new laws. This may include changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the availability of law enforcement, including our ability to enforce our agreements.

Failure to make adequate contributions to various employee benefit plans as required by PRC regulations may subject us to penalties.

Companies operating in China are required to participate in various government sponsored employee benefit plans, including certain social insurance, housing funds and other welfare-oriented payment obligations, and contribute to the plans in amounts equal to certain percentages of salaries, including bonuses and allowances, of employees up to a maximum amount specified by the local government from time to time at locations where they operate their businesses. The requirement of employee benefit plans has not been implemented consistently by the local governments in China given the different levels of economic development in different locations. Our failure in making contributions to various employee benefit plans and in complying with applicable PRC labor-related laws may subject us to late payment penalties. We may be required to make up the contributions for these plans as well as to pay late fees and fines. If we are subject to late fees or fines in relation to the underpaid employee benefits, our financial condition and results of operations may be adversely affected.

We may rely on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiary to make payments to us could have a material and adverse effect on our ability to conduct our business.

We are a Cayman Islands holding company and we rely principally on dividends and other distributions on equity from our PRC subsidiary for our cash requirements, including for services of any debt we may incur. Our PRC subsidiary’s ability to distribute dividends is based upon its distributable earnings. Current PRC regulations permit our PRC subsidiary to pay dividends to its respective shareholders only out of its accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiary is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Our PRC subsidiary as a foreign invested enterprise, or FIE, is also required to further set aside a portion of its after-tax profit to fund an employee welfare fund, although the amount to be set aside, if any, is determined at its discretion. These reserves are not distributable as cash dividends. If our PRC subsidiary incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us. Any limitation on the ability of our PRC subsidiary to distribute dividends or other payments to its shareholders could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends or otherwise fund and conduct our business.

Changes to PRC tax laws may subject us to greater taxes.

We base our tax position upon the anticipated nature and conduct of our business and upon our understanding of the tax laws of the various administrative regions and countries in which we have assets or conduct activities. However, our tax position is subject to review and possible challenge by taxing authorities and to possible changes in law, which may have retroactive effect. We cannot determine in advance the extent to which some jurisdictions may require us to pay taxes or make payments in lieu of taxes.

Chinese regulations relating to overseas investment by Chinese residents may restrict our overseas and cross-border investment activities and adversely affect the implementation of our strategy as well as our business and prospects.

On July 4, 2014, the State Administration of Foreign Exchange of China, or SAFE, issued the Circular on the Administration of Foreign Exchange Issues Related to Overseas Investment, Financing and Roundtrip Investment by Domestic Residents through Offshore Special Purpose Vehicles, or the SAFE Circular 37, which replaced the former circular commonly known as “SAFE Circular 75” promulgated on October 21, 2005. The SAFE Circular 37 requires Chinese residents to register with the competent local SAFE branch in connection with their direct establishment or indirect control of an offshore special purpose vehicle, for the purpose of overseas investment and financing, with such Chinese residents’ legally owned assets or equity interests in domestic enterprises or offshore assets or interests. The SAFE Circular 37 further requires amendment to the registration in the event of any significant changes with respect to the special purpose vehicle, such as any change of basic information (including change of the Chinese residents, name and operation term), increase or decrease of capital contribution by Chinese individuals, share transfer or exchange, merger, division or other material event. In the event that a Chinese shareholder holding interests in a special purpose vehicle fails to fulfill the required SAFE registration, the Chinese subsidiaries of that special purpose vehicle may be prohibited from making profit distributions to the offshore parent and from carrying out subsequent cross-border foreign exchange activities, and the special purpose vehicle may be restricted in its ability to contribute additional capital into its Chinese subsidiary. Moreover, failure to comply with the various SAFE registration requirements described above could result in liability under Chinese law for evasion of foreign exchange controls.

The failure of our Chinese beneficial owners to comply with the registration procedures set forth in the SAFE Circular 37 may subject such beneficial owners and our Chinese subsidiaries to fines and legal sanctions. Such failure may also result in restrictions on our Chinese subsidiaries’ ability to distribute profits to us or our ability to inject capital into our Chinese subsidiaries or otherwise materially adversely affect our business, financial condition and results of operations.

Risks Related to the Company’s Shares

There is currently no trading market for our Shares.

There currently is no trading market for our Shares. Our outstanding Shares cannot be offered, sold, pledged or otherwise transferred unless subsequently registered pursuant to, or exempt from registration under, the Securities Act and any other applicable federal or state securities laws or regulations in the United States. These restrictions will limit the ability of our shareholders to liquidate their investment.

The registration statement of which this prospectus is a part registered a portion of our outstanding Shares for resale in the United States. We intend to seek to identify a market maker to apply for our Shares to be admitted to quotation on the OTCQB. We cannot assure you that we will be able to identify a market maker that will file such application or that, if the Shares are admitted to quotation, a public market will ever develop. There is no guarantee that our Shares will ever be quoted on the OTCQB or any exchange. Furthermore, you will likely not be able to sell your securities if a regular trading market for our securities does not develop and we cannot predict the extent, if any, to which investor interest will lead to the development of a viable trading market in our Shares. We expect the initial market for our Shares to be limited, if a market develops at all. Even if a limited trading market does develop, there is a risk that the absence of potential buyers will prevent any potential sellers from selling their Shares.

The offering price of our Ordinary Shares was determined based on the offering price in the 2020 Private Offering and should not be used as an indicator of the future market price of the securities.

Since our Shares are not listed or quoted on any exchange or quotation system, the offering price of $0.02 per share for the Ordinary Shares was determined based on the offering price in the 2020 Private Offering. The offering price bears no relationship to the book value, assets or earnings of the Company or any other recognized criterion of value. The offering price should not be regarded as an indicator of the future market price of the securities.

Enforcement actions by FINRA will make it difficult for investors to dispose of their Ordinary Shares as long as they remain an OTC security.

In order to be able to publicly trade a security, such security is required to have a trading symbol. Trading symbols for OTC securities are assigned by FINRA following a submission by a market maker of a Form 211. In the past, the review of such submissions by FINRA was a routine matter that would typically be completed within weeks. Recently, FINRA reviews have often taken well in excess of six months, with many securities being subject to indefinite delays. As a result of the enhanced regulatory scrutiny and long review process, many market makers are now declining to submit Forms 211.

In addition, and in response to increased scrutiny and recent regulatory actions by FINRA, many brokers have started to refuse deposits of OTC securities, whether restricted or free trading and regardless of the price at which these securities are traded, even after they obtained a trading symbol. As a result, investors may find it increasingly difficult to dispose of their Ordinary Shares.

We may not be able to achieve secondary trading of our Shares in certain states because our Ordinary Shares are not nationally traded, which could subject our shareholders to significant restrictions and costs.

Our Ordinary Shares are not eligible for trading on The NASDAQ Capital Market or on a national securities exchange. Therefore, our Ordinary Shares are subject to the securities laws of the various states and jurisdictions of the United States in addition to federal securities law. While we may register our Ordinary Shares or qualify for exemptions for our Ordinary Shares in one or more states, if we fail to do so the investors in those states where we have not taken such steps may not be allowed to purchase our Shares or those who presently hold our Shares may not be able to resell their Shares without substantial effort and expense. These restrictions and potential costs could be significant burdens on our shareholders.

It is likely that there will be significant volatility in the trading price of our Shares.

In the event that a public market for our Ordinary Shares is created or maintained in the future, market prices for the Shares will be influenced by many factors and will be subject to significant fluctuations in response to variations in operating results of Shenzhen Yeller and other factors. Our stock price will also be affected by the trading price of the stock of our competitors, investor perceptions of Shenzhen Yeller, interest rates, general economic conditions and those specific to our industry, developments with regard to Shenzhen Yeller’s operations and activities, our future financial condition and changes in our management.

Risks relating to low priced stocks.

The Company’s Ordinary Shares are not quoted and traded on the OTC Markets, and the price at which the Shares will trade in the future cannot currently be estimated. There can be no assurance that trading will be commenced or sustained, although management intends to take such actions as are necessary to initiate trading on the OTC Markets. The trading price of the Shares will most likely be below $5.00. If our Shares trade below $5.00 per Share, trading in the Shares may be subject to the requirements of certain rules promulgated under the Exchange Act, which require additional disclosure by broker-dealers in connection with any trades involving a stock defined as a penny stock (generally, any non-Nasdaq equity security that has a market price of less than $5.00 per share, subject to certain exceptions) and a two business day “cooling off period” before broker-dealers can effect transactions in penny stocks. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. These, and the other burdens imposed upon broker-dealers by the penny stock requirements, could discourage broker-dealers from effecting transactions in our Shares, which could severely limit the market liquidity of our Shares and the ability of holders of our Shares to sell them.

We do not intend to pay dividends.

We have not paid any cash dividends on any of our securities since inception and we do not anticipate paying any cash dividends on any of our securities in the foreseeable future.

Future sales of our securities, or the perception in the markets that these sales may occur, could depress our stock price.

As of the date of this prospectus, we have issued and outstanding 41,106,775 Ordinary Shares. Although only 9,125,000 of those Shares have been registered for resale under the registration statement of which this prospectus is a part, the remaining 31,981,775 Shares also may be sold in the future if registered under the Securities Act or if the shareholder qualifies for an exemption from registration under Rule 144 or Rule 701 under the Securities Act, or other applicable exemption. The market price of our capital stock could drop significantly if the holders of these restricted Shares sell them or are perceived by the market as intending to sell them. These factors also could make it more difficult for us to raise capital or make acquisitions through the issuance of additional Ordinary Shares or other equity securities.

The ability of the Board of Directors of the Company to issue preferred shares and any anti-takeover provisions we adopt may depress the value of our Ordinary Shares.