decrease and we may not be able to grow our store base as planned, which could have a material adverse effect on our business, financial condition and results of operations.

Our success depends on our executive officers, our merchant team and other key personnel. If we lose key personnel or are unable to hire additional qualified personnel, it could have a material adverse effect on our business, financial condition and results of operations.

Our future success depends to a significant degree on the skills, experience and efforts of our executive officers, our merchant team and other key personnel. The unexpected loss of services of any of our executive officers, particularly Mark Butler, our co-founder, Chairman, President and Chief Executive Officer, or senior members of our merchant team could materially adversely affect our business and operations. Competition for skilled and experienced management in the retail industry is intense, and our future success will also depend on our ability to attract and retain qualified personnel, including our merchant team, which is responsible for purchasing and negotiating the terms of our merchandise. Failure to attract and retain new qualified personnel could have a material adverse effect on our business, financial condition and results of operations.

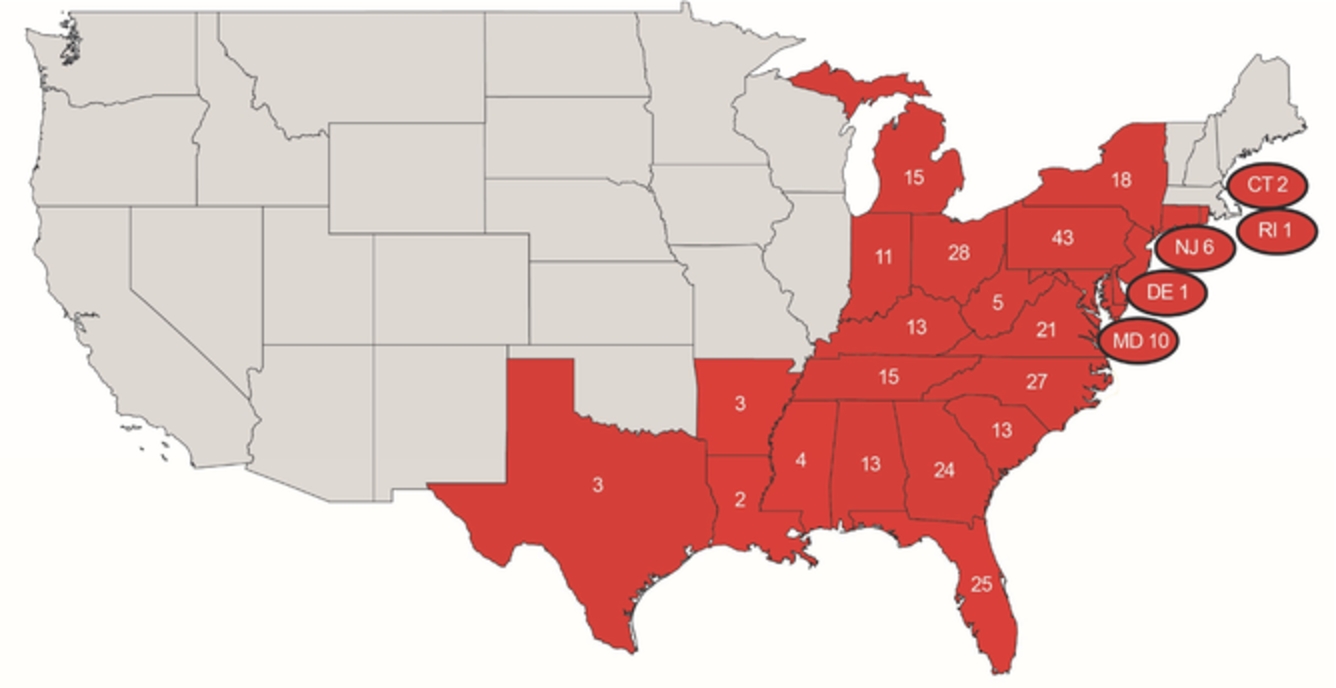

Our new store growth is dependent on our ability to successfully expand our distribution network capacity, and failure to achieve or sustain these plans could affect our performance adversely.

We maintain distribution centers in York, PA and Commerce, GA and are building a third in Lancaster, TX to support our existing stores and our growth objectives. We continuously assess ways to maximize the productivity and efficiency of our existing distribution facilities and evaluate opportunities for additional distribution centers. Delays in opening our Lancaster, TX distribution center or any future new distribution centers could adversely affect our future operations by slowing store growth, which could, in turn, reduce sales growth. In addition, any distribution-related construction or expansion projects entail risks which could cause delays and cost overruns, such as shortages of materials, shortages of skilled labor or work stoppages, unforeseen construction, scheduling, engineering, environmental or geological problems, weather interference, fires or other casualty losses and unanticipated cost increases. The completion date and ultimate cost of future projects, including our Lancaster, TX distribution center, could differ significantly from initial expectations due to construction-related or other reasons. We cannot guarantee that any project will be completed on time or within established budgets.

The failure to timely acquire, develop, and open, the loss of, or disruption or interruption in the operations of, our centralized distribution centers could materially adversely affect our business and operations.

With few exceptions, inventory is shipped directly from suppliers to our distribution centers in York, PA, and Commerce, GA, where the inventory is then processed, sorted and shipped to our stores. We depend in large part on the orderly operation of this receiving and distribution process, which depends, in turn, on adherence to shipping schedules and effective management of our distribution centers. Increases in transportation costs (including increases in fuel costs), supplier-side delays, reductions in the capacity of carriers, changes in shipping companies, labor strikes or shortages in the transportation industry and unexpected delivery interruptions also have the potential to derail our orderly distribution process. We also may not anticipate changing demands on our distribution system or timely develop and open any necessary additional facilities. In addition, events beyond our control, such as disruptions in operations due to fire or other catastrophic events or labor disagreements, may result in delays in the delivery of merchandise to our stores. While we maintain business interruption insurance, in the event our distribution centers are shut down for any reason, such insurance may not be sufficient, and any related insurance proceeds may not be timely paid to us. In addition, our new store locations receiving shipments may be further away from our distribution centers, which may increase transportation costs and may create transportation scheduling strains. Any repeated, intermittent, or long-term disruption in the operations of our distribution centers would hinder our ability to provide merchandise to our stores and could have a material adverse effect on our business, financial condition and results of operations.

Factors such as inflation, cost increases and energy prices could have a material adverse effect on our business, financial condition and results of operations.

Future increases in costs, such as the cost of merchandise, shipping rates, freight costs and store occupancy costs, may reduce our profitability, given our pricing model. These cost increases may be the result of inflationary pressures, geopolitical factors or public policies, which could further reduce our sales or profitability. Increases in other operating costs, including changes in energy prices, wage rates and lease and utility costs, may increase our cost of