As filed with the U.S. Securities and Exchange Commission on July 19, 2024

Registration No. 333-279141

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 2 TO

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

GD Culture Group Limited

(Exact name of registrant as specified in its charter)

| Nevada | | 47-3709051 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

22F - 810 Seventh Avenue,

New York, NY 10019

+1-347-2590292

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Vcorp Services, LLC

701 S Carson St Suite #200,

Carson City, NV 89701

(Name, address including zip code, and telephone number, including area code, of agent for service)

Copies to:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

+1-212-588-0022 – telephone

+1-212-826-9307 – facsimile

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JULY 19, 2024 |

GD Culture Group Limited

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer, from time to time, in one or more offerings, common stock, preferred stock, debt securities, warrants to purchase our common stock, preferred stock or debt securities, debt securities consisting of debentures, notes or other evidence of indebtedness, units consisting of a combination of the foregoing securities, or any combination of these securities, which we collectively refer to as the “securities”. The aggregate offering price of the securities that we may offer and sell under this prospectus will not exceed $100,000,000.

We may offer and sell any combination of the securities described in this prospectus in different series, at times, in amounts, at prices and on terms to be determined at, or prior to, the time of each offering. This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We will provide the specific terms of these securities in supplements to this prospectus. The prospectus supplements will also describe the specific manner in which these securities will be offered and may also supplement, update or amend information contained in this prospectus. This prospectus may not be used to consummate a sale of securities unless accompanied by the applicable prospectus supplement. You should read this prospectus and any applicable prospectus supplement before you invest.

We may offer and sell the securities from time to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters, to other purchasers, through agents, or through a combination of these methods. If any underwriters are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and any applicable commissions or discounts will be set forth in a prospectus supplement. The offering price of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement. See “Plan of Distribution” elsewhere in this prospectus for a more complete description of the ways in which the securities may be sold.

As of July 18, 2024, the aggregate market value of our common stock held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3 was 13,406,685.6, which is based on 9,576,204 shares of our common stock outstanding held by non-affiliates and a price of $1.40 per share, the closing price of our common stock on July 5, 2024 which is the highest closing sale price of our common stock on the Nasdaq Capital Market within the sixty (60) days prior to the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell the securities described in this prospectus in a public primary offering with an aggregate market value exceeding more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our outstanding common stock held by non-affiliates remains below $75 million.

The applicable prospectus supplement will contain information, where applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the prospectus supplement. We may experience price volatility in our stock. See related risk factors in the “Risk Factors” section of this prospectus and as set forth in our most recent annual report on Form 10-K.

Unless otherwise specified in an applicable prospectus supplement, our warrants, debt securities, rights and units will not be listed on any securities or stock exchange or on any automated dealer quotation system.

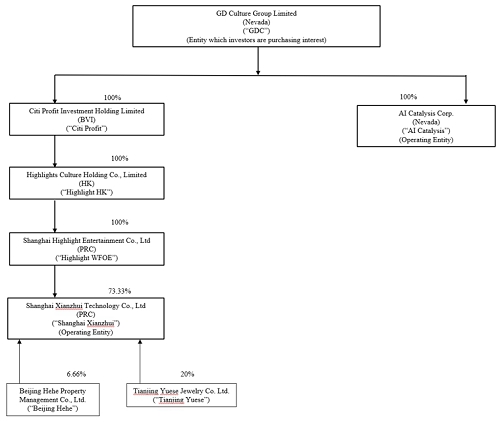

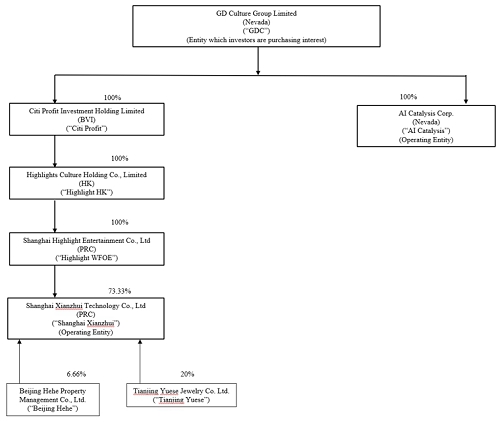

The Company is a Nevada company that conducts its operations and operates its business in both United States and China by itself and through its subsidiaries, AI Catalysis Corp. and Shanghai Xianzhui Technology Co., Ltd. Investors are cautioned that you are not buying shares of a China-based operating company but instead are buying shares of a Nevada company with operations conducted by our subsidiaries based in China and that this structure involves unique risks to investors.

Furthermore, Chinese regulatory authorities could change the rules and regulations regarding foreign ownership in the industry in which the Company operates, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such securities to significantly decline or become worthless. Investors in our common stock should be aware that they do not directly hold equity interests in the operating subsidiaries in Nevada and China, but rather are purchasing equity in GD Culture Group Limited, our Nevada company, which directly and indirectly owns 100% and 73.33% equity interests in the operating subsidiaries in Nevada and China, respectively. See “Risk Factors — Risks Related to Doing Business in China” on page 24.

The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties. See “Risk Factors — Risks Related to Doing Business in China — Uncertainties in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protection available to you and us” on page 27 and “Given the Chinese government’s significant oversight and discretion over the conduct of the business of Shanghai Xianzhui, the Chinese government may intervene or influence its operations at any time, which could result in a material change in the operations of Shanghai Xianzhui and/or the value of our common stock” on page 27.

We are subject to certain legal and operational risks associated with our operations in China, including those changes in the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or United States regulations may materially and adversely affect our business, financial condition and results of operations. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks could result in a material change in our operations and/or the value of our ordinary shares or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our ordinary shares to significantly decline or be worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

On December 28, 2021, the CAC, the National Development and Reform Commission (“NDRC”), and several other administrations jointly issued the revised Measures for Cybersecurity Review, or the Revised Review Measures, which became effective and has replaced the existing Measures for Cybersecurity Review on February 15, 2022. According to the Revised Review Measures, if an “online platform operator” that is in possession of personal data of more than one million users intends to list in a foreign country, it must apply for a cybersecurity review. Based on a set of Q&A published on the official website of the State Cipher Code Administration in connection with the issuance of the Revised Review Measures, an official of the said administration indicated that an online platform operator should apply for a cybersecurity review prior to the submission of its listing application with non-PRC securities regulators. Given the recency of the issuance of the Revised Review Measures and their pending effectiveness, there is a general lack of guidance and substantial uncertainties exist with respect to their interpretation and implementation. For example, it is unclear whether the requirement of cybersecurity review applies to follow-on offerings by an “online platform operator” that is in possession of personal data of more than one million users where the offshore holding company of such operator is already listed overseas. Furthermore, the CAC released the draft of the Regulations on Network Data Security Management in November 2021 for public consultation, which among other things, stipulates that a data processor listed overseas must conduct an annual data security review by itself or by engaging a data security service provider and submit the annual data security review report for a given year to the municipal cybersecurity department before January 31 of the following year. If the draft Regulations on Network Data Security Management are enacted in the current form, we, as an overseas listed company, will be required to carry out an annual data security review and comply with the relevant reporting obligations.

As advised by Junjin Law Firm, we will not be subject to cybersecurity review with the CAC, given that: (i) Shanghai Xianzhui does not possess and does not anticipate that it will possess a large amount of personal information in our business operations and (ii) data processed in Shanghai Xianzhui’s business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. In addition, for the same reasons, we are not subject to network data security review by the CAC if the Draft Regulations on the Network Data Security Administration are enacted as proposed. However, the definition of “network platform operator” is unclear and it is also unclear on how it will be interpreted and implemented by the relevant PRC governmental authorities. See “Risk Factors — Risks Related to Doing Business in China — Shanghai Xianzhui may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. Shanghai Xianzhui may be required to suspend its business, be liable for improper use or appropriation of personal information provided by our customers or face other penalties.”

On February 17, 2023, the China Securities Regulatory Commission, or the CSRC, announced the Circular on the Administrative Arrangements for Filing of Securities Offering and Listing by Domestic Companies, or the Circular, and released a set of new regulations which consists of the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, and five supporting guidelines. On the same date, the CSRC also released the Notice on the Arrangements for the Filing Management of Overseas Listing of Domestic Companies, or the Notice. The Trial Measures came into effect on March 31, 2023. The Trial Measures refine the regulatory system by subjecting both direct and indirect overseas offering and listing activities to the CSRC filing-based administration. Requirements for filing entities, time points and procedures are specified. A PRC domestic company that seeks to offer and list securities in overseas markets shall fulfill the filing procedure with the CSRC per the requirements of the Trial Measures. Where a PRC domestic company seeks to indirectly offer and list securities in overseas markets, the issuer shall designate a major domestic operating entity, which shall, as the domestic responsible entity, file with the CSRC. The Trial Measures also lay out requirements for the reporting of material events. Breaches of the Trial Measures, such as offering and listing securities overseas without fulfilling the filing procedures, shall bear legal liabilities, including a fine between RMB 1.0 million (approximately $150,000) and RMB 10.0 million (approximately $1.5 million), and the Trial Measures increase the cost for offenders by enforcing accountability with administrative penalties and incorporating the compliance status of relevant market participants into the Securities Market Integrity Archives.

According to the Circular, since the date of effectiveness of the Trial Measures on March 31, 2023, PRC domestic enterprises falling within the scope of filing that have been listed overseas or met the following circumstances are “existing enterprises”: before the effectiveness of the Trial Measures on March 31, 2023, the application for indirect overseas issuance and listing has been approved by the overseas regulators or overseas stock exchanges (such as the registration statement has become effective on the U.S. market), it is not required to perform issuance and listing supervision procedures of the overseas regulators or overseas stock exchanges, and the overseas issuance and listing will be completed by September 30, 2023. Existing enterprises are not required to file with the CSRC immediately, and filings with the CSRC should be made as required if they involve refinancings and other filing matters. PRC domestic enterprises that have submitted valid applications for overseas issuance and listing but have not been approved by overseas regulatory authorities or overseas stock exchanges at the date of effectiveness of the Trial Measures on March 31, 2023 can reasonably arrange the timing of filing applications with the CSRC and shall complete the filing with the CSRC before the overseas issuance and listing.

In addition, an overseas-listed company must also submit the filing with respect to its follow-on offerings, issuance of convertible corporate bonds and exchangeable bonds, and other equivalent offering activities, within the time frame specified by the Trial Measures.

As advised by Junjin Law Firm, because the Company is not a company registered and formed in the territory of China, its continued listing on Nasdaq and future offerings are not “direct overseas offering and listing of domestic enterprises” as defined under the Trial Measures. Furthermore, according to Article 2 of the Trial Measures, the “indirect overseas offering and listing of domestic enterprises” refers to the overseas offering and listing of enterprises whose main business activities are in China, in the name of enterprises registered overseas, which offering and listing are based on the equity, assets, income or other similar rights and interests of the domestic enterprises. According to Article 15 of the Trial Measures, if the issuer meets both of the following conditions, the overseas offerings and listings shall be determined as an “indirect overseas offering and listing of domestic enterprises”: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by domestic enterprises; and; (ii) its major operational activities are carried out in China or its main places of business are located in China, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in China.

The Company does not meet both the requirements under Article 15 of the Trial Measures and therefore its continued listing on Nasdaq and future offerings are not an “Indirect overseas offering and listing of domestic enterprises”, considering that (i) the operating income and total profit of the Company’s subsidiaries that were established in China for the year ended December 31, 2023 do not account for more than 50% of the operating income and total profit in our consolidated financial statements for the same period, (ii) our main business is not conducted within China, and (iii) the majority of our senior management personnel are not Chinese citizens or reside in China on a regular basis. Therefore, as advised by Junjin Law Firm, we are not required to complete the record filing requirement under the Trial Measures. However, if we inadvertently conclude that such filing procedures are not required, or applicable laws, regulations, or interpretations change such that we are required to complete the filing procedures in the future, we may be subject to investigations by the regulators, fines or penalties, ordered to suspend our relevant operations and rectify any non-compliance, prohibited from engaging in relevant business or conducting any offering, and these risks could result in a material adverse change in our operations and/or the value of our common stock, and could significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless. See “Risk Factors — Risks Related to Doing Business in China”.

As of the date of this prospectus, as confirmed by our PRC counsel, Junjin Law Firm, our PRC operating subsidiaries have received all requisite permissions or approvals to operate the business and no such permissions or approvals have been denied. As further confirmed by our PRC counsel, Junjin Law Firm, except for the business license mentioned in “Prospectus Summary – Governmental Regulations in the PRC – Regulations on Business License” on page 14 of this prospectus, our PRC operating subsidiaries are not required to obtain any other permissions or approvals from any Chinese authorities to operate the business. As further confirmed by our PRC counsel, Junjin Law Firm, no relevant PRC laws or regulations in effect require that we obtain permission from any PRC authorities to issue securities to foreign investors, and we have not received any inquiry, notice, warning, sanction, or any regulatory objection from the CSRC, the CAC, or any other PRC authorities that have jurisdiction over our operations. See “Prospectus Summary – Governmental Regulations in the PRC – Regulations on Mergers & Acquisitions and Overseas Listings” on page 18 of this prospectus and “– Regulations on Cybersecurity Review” on page 20 of this prospectus. However, applicable laws and regulations may be tightened, and new laws or regulations may be introduced to impose additional government approval, license, and permit requirements. If (i) we or our subsidiaries do not receive or maintain all such required permissions or approvals to operate our business, (ii) we or our subsidiaries inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future, we may face sanctions, including fines and penalties, by the CAC, CSRC, or other PRC regulatory agencies, our PRC subsidiaries’ ability to pay dividends outside of the PRC could be limited, our operations could be adversely affected, directly or indirectly, we could be required to restructure our operations to comply with such regulations or potentially cease operations in the PRC entirely, our ability to offer, or continue to offer, securities to investors could be significantly limited or completely hindered and the value of our securities might significantly decline or be worthless.

In addition, since 2021, the Chinese government has strengthened its anti-monopoly supervision, mainly in three aspects: (1) establishing the National Anti-Monopoly Bureau; (2) revising and promulgating anti-monopoly laws and regulations, including: the Anti-Monopoly Law (draft Amendment published on October 23, 2021 for public opinions), the anti-monopoly guidelines for various industries, and the detailed Rules for the Implementation of the Fair Competition Review System; and (3) expanding the anti-monopoly law enforcement targeting Internet companies and large enterprises. As of the date of this prospectus, the Chinese government’s recent statements and regulatory actions related to anti-monopoly concerns have not impacted our ability to conduct business, accept foreign investments, or list on a U.S. or other foreign exchange because neither the Company nor its PRC subsidiaries engages in monopolistic behaviors that are subject to these statements or regulatory actions.

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCAA, if the Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect an issuer’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. Furthermore, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”) with the China Securities Regulatory Commission and the Ministry of Finance of China. The SOP, together with two protocol agreements governing inspections and investigations (together, the “SOP Agreement”), establishes a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed.

Our previous auditor, Enrome LLP, with their headquarter at 143 Cecil St, #19-03/04 GB Building, Singapore 069542, has been inspected by the PCAOB on a regular basis in the audit period. Our current auditor, HTL International, LLC, with their headquarter at 12 Greenway Plaza Suite 1100, Houston, Texas 77046, has been inspected by the PCAOB on a regular basis as well. If it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate. Moreover, if trading in our securities is prohibited under the HFCAA in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, an exchange may determine to delist our securities. See “Risk Factors — Risks Related to Doing Business in China — The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. Although the audit report included in the annual report was issued by U.S. auditors who are currently inspected by the PCAOB, if it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors would be deprived of the benefits of such inspection and our common stock may be delisted or prohibited from trading” on page 33.

GDC may rely on dividends to be paid by our subsidiaries in Nevada and in the PRC, to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses.

Under the Nevada Revised Statutes and the Articles of Incorporation and Bylaws of each of GDC and AI Catalysis (a direct subsidiary of GDC), dividends may be declared by the Board of Directors at any regular or special meeting. No distribution may be made if, after giving it effect: (a) such company would not be able to pay its debts as they become due in the usual course of business; or (b) such company’s total assets would be less than the sum of its total liabilities plus the amount that would be needed, if such company were to be dissolved immediately after the time of the distribution, to satisfy the preferential rights upon such dissolution of holders of shares of any class or series of the capital stock of such company having preferential rights superior to those receiving the distribution.

Under the laws of the British Virgin Islands, our BVI subsidiary and a direct subsidiary of GDC, Citi Profit, may pay a dividend to GDC out of profit, provided that in no circumstances may a dividend be paid if this would result in Citi Profit being unable to pay our debts due in the ordinary course of business.

Under the laws of Hong Kong, our Hong Kong subsidiary and a direct subsidiary of Citi Profit, Highlight HK, is permitted, to provide funding to Citi Profit through dividends distribution out of its profits. Under the current practices of the Hong Kong Inland Revenue Department, no tax is payable in Hong Kong in respect of dividends paid to Citi Profit as a British Virgin Islands company.

Under PRC laws and regulations, our PRC subsidiaries, Highlight WFOE (a direct subsidiary of Citi Profit), and Shanghai Xianzhui (a direct subsidiary of Highlight WFOE), may pay dividends only out of its accumulated profits as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiaries are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. In addition, a wholly foreign-owned enterprise is required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund a certain statutory reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital. Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to examination by the banks designated by the State Administration of Foreign Exchange, or SAFE.

In addition, we expect that revenue, if any, to be generated by our PRC operating subsidiary, Shanghai Xianzhui, will be in Renminbi, which is not freely convertible into other currencies. As a result, any restriction on currency exchange may limit the ability of our PRC operating subsidiary to use its Renminbi revenues to pay dividends to us. To the extent cash or assets in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash or assets. Shortages in the availability of foreign currency may temporarily delay the ability of our PRC subsidiaries to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. In view of the foregoing, to the extent cash in our business is held in China or by a PRC entity, such cash may not be available to fund operations or for other use outside of the PRC. The PRC government may continue to strengthen its capital controls, and more restrictions and substantial vetting process may be put forward by SAFE for cross-border transactions falling under both the current account and the capital account. In addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax rate of up to 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless otherwise exempted or reduced according to treaties or arrangements between the PRC central government and governments of other countries or regions where the non-PRC resident enterprises are incorporated. Any limitation on the ability of our PRC subsidiaries to pay dividends or make other kinds of payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

Under PRC law, Highlight WFOE and Shanghai Xianzhui may be funded through capital contributions by its immediate parent company or loans, subject to satisfaction of applicable government registration and approval requirements. Before providing loans to our PRC subsidiaries, we will be required to make filings about details of the loans with the SAFE in accordance with relevant PRC laws and regulations.

Highlight HK is permitted under the laws of Hong Kong to provide funding to Shanghai Xianzhui through capital contributions or to other companies within our corporate structure through loans without restrictions on the amount of the funds and such funding is not subject to government registration or filing requirements under the laws of Hong Kong.

Citi Profit is permitted under the laws of the British Virgin Islands to provide funding to Highlight WFOE through capital contributions or to other companies within our corporate structure through loans without restrictions on the amount of the funds and such funding is not subject to government registration or filing requirements under the laws of the British Virgin Islands.

GDC is permitted under the laws of Nevada to provide funding to Citi Profit through capital contributions or to other companies within our corporate structure through loans without restrictions on the amount of the funds and such funding is not subject to government registration or filing requirements under the laws of the Nevada.

AI Catalysis is permitted under the laws of Nevada to provide funding to other companies within our corporate structure through loans without restrictions on the amount of the funds and such funding is not subject to government registration or filing requirements under the laws of the Nevada.

GDC presently does not maintain any cash management policies which dictate how funds are transferred, however, GDC continues to conduct regular review and management of all its subsidiaries’ cash transfers and reports to board of directors.

Prior to September 28, 2022, Makesi IoT Technology (Shanghai) Co., Ltd., a then indirect subsidiary of the Company (“Makesi WFOE”), had a series of contractual arrangement with Sichuan Wuge Network Games Co., Ltd. (“Wuge”) and its shareholders that established a variable interest entity (the “VIE”) structure. For accounting purposes, Makesi WFOE was the primary beneficiary of Wuge. Accordingly, under accounting principles generally accepted in the United States of America (“U.S. GAAP”), the Company treated Wuge as the consolidated affiliated entity and has consolidated Wuge’s financial statements prior to September 28, 2022. Wuge focused its business on research, development and application of Internet of Things (IoT) and electronic tokens Wuge digital door signs. On September 28, 2022, Makesi WFOE entered into a termination agreement with Wuge and the shareholders of Wuge to terminate the VIE Agreements and to cancel the shares previously issued to the shareholders of Wuge, based on the average closing price of $0.237 per share of the Company during the 30 trading days immediately prior to the date of the termination agreement. As a result of such termination, the Company no longer treats Wuge as a consolidated affiliated entity or consolidates the financial results and balance sheet of Wuge in the Company’s consolidated financial statements under U.S. GAAP.

Prior to June 26, 2023, Makesi WFOE had a series of contractual arrangement with Shanghai Yuanma Food and Beverage Management Co., Ltd. (“Yuan Ma”) and its shareholders that established a VIE structure. For accounting purposes, Makesi WFOE was the primary beneficiary of Yuan Ma. Accordingly, under U.S. GAAP, the Company treated Yuan Ma as the consolidated affiliated entity and has consolidated Yuan Ma’s financial results in the Company’s consolidated financial statements prior to June 26, 2023. On June 26, 2023, the Company entered into a share purchase agreement with a buyer unaffiliated with the Company. Pursuant to the agreement, the Company agreed to sell and the buyer agreed to purchase all the issued and outstanding equity interest in TMSR Holdings Limited (“TMSR HK”), which owned 100% equity interest in Makesi WFOE. The purchase price for the transaction contemplated by the Agreement was $100,000. The sale of TMSR HK did not have any material impact on the Company’s consolidated financial statements.

Prior to September 26, 2023, Highlight WFOE had a series of contractual arrangement with Highlight Media and its shareholders that established a VIE structure. For accounting purposes, Highlight WFOE was the primary beneficiary of Highlight Media. Accordingly, under U.S. GAAP, the Company treated Highlight Media as the consolidated affiliated entity and has consolidated Highlight Media’s financial results in the Company’s financial statements prior to September 26, 2023. Highlight Media was an integrated marketing service agency, focusing on enterprise brand management, crisis public relations, intelligent public opinion monitoring, media PR, financial and economic we-media operation, digital face application, large-scale exhibition services and other businesses. On September 26, 2023, Highlight WFOE entered into a termination agreement with Highlight Media and the shareholders of Highlight Media to terminate the VIE Agreements and sold the interest in the VIE Agreements for a purchase price of $100,000. As a result of such termination, the Company no longer treats Highlight Media as a consolidated affiliated entity or consolidates the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under U.S. GAAP.

As of December 31, 2023 and as of the date of this prospectus, we do not have a VIE structure.

During the three months ended March 31, 2024, there was no transfer of assets between GDC and its subsidiaries. No amounts owed under any previous VIE agreements were settled. There were no cash transfers to or from the VIEs. GDC did not make any dividends or distributions to U.S. investors.

During the fiscal years ended December 31, 2023, GDC transferred a total of $2,100,000 to its subsidiary AI Catalysis Corp as capital contribution. No subsidiary made any dividends or distributions to GDC. No amounts owed under any VIE agreements were settled. There were no cash transfers to or from the VIEs. GDC did not make any dividends or distributions to U.S. investors.

During the fiscal years ended December 31, 2022, there was no transfer of assets between GDC and its subsidiaries. No earnings or other amount owed under any VIE agreements was settled. There were no cash transfers to or from the VIEs. GDC did not make any dividends or distributions to U.S. investors.

As of the date of this prospectus, we have no intention of distributing any earnings as dividends to our investors or to settle amounts owned under the previous VIE agreements. If our subsidiary incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

See “Prospectus Summary – Asset Transfer between our Company and our Subsidiaries.” See also “Risk Factors — Risks Related to Our Corporate Structure — We may rely on dividends paid by our subsidiaries for our cash needs. Any limitation on the ability of our subsidiaries to make dividend payments to us, or any tax implications of making dividend payments to us, could limit our ability to pay our parent company expenses or pay dividends to holders of our common stock” on page 22 of this prospectus, and “Risk Factors — Risks Related to Doing Business in China — “PRC regulation of loans to, and direct investments in, PRC entities by offshore holding companies may delay or prevent us from using proceeds from future financing activities to make loans or additional capital contributions to our PRC operating subsidiary” on page 24 of this prospectus. See also the “Item 1. Business — Summary of Financial Position and Cash Flows of GD Culture Group Limited, its subsidiaries and the VIEs” and the consolidated financial statements contained in our latest annual report on Form 10-K and incorporated herein by reference.

This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement. The information contained or incorporated in this prospectus or in any prospectus supplement is accurate only as of the date of this prospectus, or such prospectus supplement, as applicable, regardless of the time of delivery of this prospectus or any sale of our securities.

Investing in our securities being offered pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the ‘‘Risk Factors’’ section of this prospectus, and risk factors set forth in our most recent annual report on Form 10-K, in other reports incorporated herein by reference, and in the applicable prospectus supplement before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized any person to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we have filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings up to an aggregate offering price of $100,000,000.

Each time we sell securities, we will provide a supplement to this prospectus that contains specific information about the securities being offered and the specific terms of that offering. The supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the prospectus supplement.

We may offer and sell securities to, or through, underwriting syndicates or dealers, through agents or directly to purchasers.

The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering.

In connection with any offering of securities (unless otherwise specified in a prospectus supplement), the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the securities offered at a higher level than that which might exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution.”

Please carefully read both this prospectus and any prospectus supplement together with the documents incorporated herein by reference under “Incorporation of Documents by Reference” and the additional information described below under “Where You Can Get More Information.”

You should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We have not authorized anyone to provide you with different information. The distribution or possession of this prospectus in or from certain jurisdictions may be restricted by law. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is accurate only as of the date of this prospectus and any information incorporated by reference is accurate as of the date of the applicable document incorporated by reference, regardless of the time of delivery of this prospectus or of any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| | ● | “AI Catalysis” are to AI Catalysis Corp., a Nevada company, which is wholly owned by GDC; |

| | ● | “Citi Profit” are to Citi Profit Investment Holding Limited, a British Virgin Islands company, which is wholly owned by GDC; |

| | ● | “GDC” and the “Company” are to GD Culture Group Limited (formerly known as JM Global Holding Company, TMSR Holding Company Limited and Code Chain New Continent Limited), a Nevada Corporation; |

| | ● | “Highlight HK” are to Highlights Culture Holding Co., Limited, a Hong Kong SAR company, which is wholly owned by Citi Profit; |

| | ● | “Highlight WFOE” are to Shanghai Highlight Entertainment Co., Ltd., a PRC company, which is wholly owned by Highlight HK; |

| | ● | “PRC” or “China” are to the People’s Republic of China, including Hong Kong SAR and Macau, but excluding, for the purpose of this prospectus, Taiwan; |

| | ● | “RMB” or “Renminbi” are to the legal currency of China; and |

| | ● | “Shanghai Xianzhui” are to Shanghai Xianzhui Technology Co., Ltd., a joint venture, of which Highlight Entertainment Co. Ltd. owns 73.3333% of the total equity interest; |

| | ● | “we”, “our”, “us” are to the Company and its subsidiaries; |

| | ● | “$”, “US$” or “U.S. Dollars” are to the legal currency of the United States. |

Unless otherwise indicated, all references to common stock, warrants to purchase common stock, share data, per share data, and related information have been retroactively adjusted, where applicable, in this prospectus to reflect a 1-to-30 reverse stock split of our common stock which became effective on November 9, 2022 as if they had occurred at the beginning of the earlier period presented.

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, the applicable prospectus supplement or amendment and the information incorporated by reference in this prospectus contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), which represent our expectations or beliefs concerning future events. Forward-looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, and/or which include words such as “believes,” “plans,” “intends,” “anticipates,” “estimates,” “expects,” “may,” “will” or similar expressions. In addition, any statements concerning future financial performance, ongoing strategies or prospects, and possible future actions, which may be provided by our management, are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties, and assumptions about our Company, economic and market factors, and the industry in which we do business, among other things. These statements are not guarantees of future performance, and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. Factors that could cause our actual performance, future results and actions to differ materially from any forward-looking statements include, but are not limited to, those discussed under the heading “Risk Factors” in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. The forward-looking statements in this prospectus, the applicable prospectus supplement or any amendments thereto and the information incorporated by reference in this prospectus represent our views as of the date such statements are made. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date such statements are made.

PROSPECTUS SUMMARY

Business Overview

GD Culture Group Limited (formerly known as JM Global Holding Company, TMSR Holding Company Limited, and Code Chain New Continent Limited) is a Nevada company that conducts its operations and operates its business in both United States and China by itself and through its subsidiaries, AI Catalysis Corp., a Nevada corporation, and Shanghai Xianzhui Technology Co., Ltd., a company incorporated in China. The majority of the Company’s operation is in the United States. GDC focuses its business on three segments mainly through the Company and two subsidiaries, AI Catalysis and Shanghai Xianzhui: 1) AI-driven digital human creation and customization; 2) Live streaming and e-commerce and 3) Live streaming interactive game. The company has relentlessly been focusing on serving its customers and creating value for them through the continual innovation and optimization of its products and services.

For AI-driven digital human creation and customization sector, the Company uses AI algorithms and software to generate realistic 3D or 2D digital human models. AI algorithms and machine learning models are used to simulate human characteristics, such as facial expressions, body movements, and even speech patterns. These models can be customized to create and personalize lifelike digital representations of humans. Customization may involve adjusting facial features, body proportions, skin textures, hair styles, clothing, and more. Once created and customized, digital humans find applications in a wide range of industries, including gaming, entertainment, advertising, education, and more. Depending on the specific industry and the application scenario, the Company helps the customers to define the objectives to achieve with digital humans, choose the technology for character customization, then create unique aviators and deploy in the chosen platform.

For live streaming and e-commerce sector, the Company applies digital human technology in live streaming e-commerce businesses. Livestream usage is taking off globally. The integration of cutting-edge AI digital human technologies and live streaming platforms will transform the way businesses, sellers and consumers engage in online commerce. Digital anchors can offer long-duration intelligent live broadcasting. It also supports customized avatars that perfectly adapt to different live streaming scenarios. The company has introduced online e-commerce businesses on TikTok under different accounts.

For live streaming interactive game sector, the Company has launched a live-streamed game called “Trible Light.” This game is owned by the company, and we independently operate it. Currently, the game is being livestreamed on TikTok (TikTok account: almplify001). In addition to “Trible Light,” we have also introduced other licensed games on the same TikTok account, providing a diverse gaming experience for the players.

We aim to generate revenue from: 1) Service revenue and advertising revenue from digital human creation and customization; 2) Products’ sales revenue from social live streaming e-commerce business; and 3) Virtual paid gifts revenue from live streaming interactive gaming.

Our principal executive office is located at 810 Seventh Avenue, 22nd Floor, New York, NY 10019, and our telephone number is: +1-347-2590292.

Corporate History and Structure

Investors are cautioned that you are buying shares of GDC a Nevada company with operations conducted itself and through its subsidiaries in Nevada and in China and that this structure involves unique risks to investors.

The following is an organizational chart setting forth our corporate structure as of the date of this prospectus.

GDC, formerly known as Code Chain New Continent Limited, TMSR Holding Company Limited and JM Global Holding Company, was a blank check company incorporated in Delaware on April 10, 2015. The Company was formed for the purpose of acquiring, through a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, exchangeable share transaction or other similar business transaction, one or more operating businesses or assets. Effective as of February 6, 2018, the Company consummated a business combination, changed its corporate name from “JM Global Holding Company” to “TMSR Holding Company Limited” and the Company’s common stock traded on the Nasdaq Capital Market under the ticker symbol “TMSR”. On June 20, 2018, the Company consummated the reincorporation. As a result, the Company changed its state of incorporation from Delaware to Nevada and implemented a 2-for-1 forward stock split of the Company’s common stock. Effective as of May 18, 2020, the Company changed its corporate name from “TMSR Holding Company Limited” to “Code Chain New Continent Limited”, and the Company’s common stock traded on the Nasdaq Capital Market under the ticker symbol “CCNC”. On November 9, 2022, the Company effected a one-for-thirty (30) reverse stock split. Effective as of January 10, 2023, the Company changed its corporate name from “Code Chain New Continent Limited” to “GD Culture Group Limited” and the Company’s common stock started trading on the Nasdaq Capital Market under the ticker symbol “GDC”. This is the entity which investors will be purchasing their interest in.

Citi Profit is a company formed under the laws of the British Virgin Islands in August 2019 and is wholly owned by GDC. It is a holding company with no material operations of its own.

Highlight HK is a company formed under the laws of Hong Kong SAR in November 2022 and is wholly owned by Citi Profit. It is a holding company with no material operations of its own.

Highlight WFOE or Shanghai Highlight is a company formed under the laws of the PRC in January 2023 and is wholly owned by Highlight HK. It is a holding company with no material operations of its own.

Shanghai Xianzhui is a company formed under the laws of the PRC in August 2023 for social media marketing purposes. It is a joint venture, of which Highlight WFOE owns 73.3333% of the total equity interest. This is an operating subsidiary of the Company.

AI Catalysis is a company formed under the laws of Neveda in May 2023, and is a wholly-owned subsidiary of GDC. It is an operating company focusing on AI-driven digital human creation and customization, live streaming and e-commerce, and live streaming interactive game. This is an operating subsidiary of the Company.

Prior to September 28, 2022, Makesi IoT Technology (Shanghai) Co., Ltd., a then indirect subsidiary of the Company (“Makesi WFOE”), had a series of contractual arrangement with Sichuan Wuge Network Games Co., Ltd. (“Wuge”) and its shareholders that established a variable interest entity (the “VIE”) structure. For accounting purposes, Makesi WFOE was the primary beneficiary of Wuge. Accordingly, under accounting principles generally accepted in the United States of America (“U.S. GAAP”), the Company treated Wuge as the consolidated affiliated entity and has consolidated Wuge’s financial statements prior to September 28, 2022. Wuge focused its business on research, development and application of Internet of Things (IoT) and electronic tokens Wuge digital door signs. On September 28, 2022, Makesi WFOE entered into a termination agreement with Wuge and the shareholders of Wuge to terminate the VIE Agreements and to cancel the shares previously issued to the shareholders of Wuge, based on the average closing price of $0.237 per share of the Company during the 30 trading days immediately prior to the date of the termination agreement. As a result of such termination, the Company no longer treats Wuge as a consolidated affiliated entity or consolidates the financial results and balance sheet of Wuge in the Company’s consolidated financial statements under U.S. GAAP.

Prior to June 26, 2023, Makesi WFOE had a series of contractual arrangement with Shanghai Yuanma Food and Beverage Management Co., Ltd. (“Yuan Ma”) and its shareholders that established a VIE structure. For accounting purposes, Makesi WFOE was the primary beneficiary of Yuan Ma. Accordingly, under U.S. GAAP, the Company treated Yuan Ma as the consolidated affiliated entity and has consolidated Yuan Ma’s financial results in the Company’s consolidated financial statements prior to June 26, 2023. On June 26, 2023, the Company entered into a share purchase agreement with a buyer unaffiliated with the Company. Pursuant to the agreement, the Company agreed to sell and the buyer agreed to purchase all the issued and outstanding equity interest in TMSR Holdings Limited (“TMSR HK”), which owned 100% equity interest in Makesi WFOE. The purchase price for the transaction contemplated by the Agreement was $100,000. The sale of TMSR HK did not have any material impact on the Company’s consolidated financial statements.

Prior to September 26, 2023, Highlight WFOE had a series of contractual arrangement with Highlight Media and its shareholders that established a VIE structure. For accounting purposes, Highlight WFOE was the primary beneficiary of Highlight Media. Accordingly, under U.S. GAAP, the Company treated Highlight Media as the consolidated affiliated entity and has consolidated Highlight Media’s financial results in the Company’s financial statements prior to September 26, 2023. Highlight Media was an integrated marketing service agency, focusing on enterprise brand management, crisis public relations, intelligent public opinion monitoring, media PR, financial and economic we-media operation, digital face application, large-scale exhibition services and other businesses. On September 26, 2023, Highlight WFOE entered into a termination agreement with Highlight Media and the shareholders of Highlight Media to terminate the VIE Agreements and sold the interest in the VIE Agreements for a purchase price of $100,000. As a result of such termination, the Company no longer treats Highlight Media as a consolidated affiliated entity or consolidates the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under U.S. GAAP.

Reverse Stock Split

On November 4, 2022, the Company filed a Certificate of Amendment to the Articles of Incorporation (the “Certificate of Amendment”) with the Nevada Secretary of State to effect a reverse stock split of the outstanding shares of common stock, par value $0.0001 per shares, of the Company at a ratio of one-for-thirty (30), which became effective at 12:01 a.m. on November 9, 2022. Upon effectiveness of the reverse stock split, every thirty (30) outstanding shares of common stock were combined into and automatically become one share of common stock. The Company’s warrants (OTC Pink: CCNCW) was adjusted so that each warrant is to purchase one-half of one shares of common stock at a price of $86.40 per half share ($172.50 per whole share). The warrants expired on February 5, 2023.

Unless otherwise indicated, all references to common stock, warrants to purchase common stock, share data, per share data, and related information have been retroactively adjusted, where applicable, in this prospectus to reflect the reverse stock split of our common stock as if they had occurred at the beginning of the earlier period presented.

Name Change

Effective as of January 10, 2023, the Company changed its corporate name from “Code Chain New Continent Limited” to “GD Culture Group Limited” pursuant to a Certificate of Amendment to the Company’s Articles of Incorporation. In connection with the name change, effective as of the opening of trading on January 10, 2023, the Company’s common stock is trading on the Nasdaq Capital Market under the ticker symbol “GDC”.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic did not have a material impact on our business or results of operation during the three months ended March 31, 2024 fiscal years ended December 31, 2023 and 2022. However, the extent to which the COVID-19 pandemic may negatively impact the general economy and our business is highly uncertain and cannot be accurately predicted. These uncertainties may impede our ability to conduct our operations and could materially and adversely affect our business, financial condition and results of operations, and as a result could adversely affect our stock price and create more volatility.

Recent Regulatory Developments

On December 28, 2021, the CAC, the National Development and Reform Commission (“NDRC”), and several other administrations jointly issued the revised Measures for Cybersecurity Review, or the Revised Review Measures, which became effective and has replaced the existing Measures for Cybersecurity Review on February 15, 2022. According to the Revised Review Measures, if an “online platform operator” that is in possession of personal data of more than one million users intends to list in a foreign country, it must apply for a cybersecurity review. Based on a set of Q&A published on the official website of the State Cipher Code Administration in connection with the issuance of the Revised Review Measures, an official of the said administration indicated that an online platform operator should apply for a cybersecurity review prior to the submission of its listing application with non-PRC securities regulators. Given the recency of the issuance of the Revised Review Measures and their pending effectiveness, there is a general lack of guidance and substantial uncertainties exist with respect to their interpretation and implementation. For example, it is unclear whether the requirement of cybersecurity review applies to follow-on offerings by an “online platform operator” that is in possession of personal data of more than one million users where the offshore holding company of such operator is already listed overseas. Furthermore, the CAC released the draft of the Regulations on Network Data Security Management in November 2021 for public consultation, which among other things, stipulates that a data processor listed overseas must conduct an annual data security review by itself or by engaging a data security service provider and submit the annual data security review report for a given year to the municipal cybersecurity department before January 31 of the following year. If the draft Regulations on Network Data Security Management are enacted in the current form, we, as an overseas listed company, will be required to carry out an annual data security review and comply with the relevant reporting obligations.

As advised by Junjin Law Firm, we will not be subject to cybersecurity review with the CAC, given that: (i) Shanghai Xianzhui does not possess and does not anticipate that it will possess a large amount of personal information in our business operations and (ii) data processed in Shanghai Xianzhui’s business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. In addition, for the same reasons, we are not subject to network data security review by the CAC if the Draft Regulations on the Network Data Security Administration are enacted as proposed. However, the definition of “network platform operator” is unclear and it is also unclear on how it will be interpreted and implemented by the relevant PRC governmental authorities. See “Risk factors — Risk Factors Related to Doing Business in China — Shanghai Xianzhui may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. Shanghai Xianzhui may be required to suspend its business, be liable for improper use or appropriation of personal information provided by our customers or face other penalties.”

On July 6, 2021, the relevant PRC governmental authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. As these opinions were recently issued, official guidance and related implementation rules have not been issued yet and the interpretation of these opinions remains unclear at this stage. As of the date of this prospectus, we have not received any inquiry, notice, warning, or sanctions regarding listing abroad or offshore offering from the CSRC, the CAC, or any other PRC governmental authorities. See “Risk Factors — Risk Factors Related to Doing Business in China — The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if Shanghai Xianzhui or GDC were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our common stock may significantly decline or become worthless, which would materially affect the interest of the investors.”

On February 17, 2023, the China Securities Regulatory Commission, or the CSRC, announced the Circular on the Administrative Arrangements for Filing of Securities Offering and Listing by Domestic Companies, or the Circular, and released a set of new regulations which consists of the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, and five supporting guidelines. On the same date, the CSRC also released the Notice on the Arrangements for the Filing Management of Overseas Listing of Domestic Companies, or the Notice. The Trial Measures came into effect on March 31, 2023. The Trial Measures refine the regulatory system by subjecting both direct and indirect overseas offering and listing activities to the CSRC filing-based administration. Requirements for filing entities, time points and procedures are specified. A PRC domestic company that seeks to offer and list securities in overseas markets shall fulfill the filing procedure with the CSRC per the requirements of the Trial Measures. Where a PRC domestic company seeks to indirectly offer and list securities in overseas markets, the issuer shall designate a major domestic operating entity, which shall, as the domestic responsible entity, file with the CSRC. The Trial Measures also lay out requirements for the reporting of material events. Breaches of the Trial Measures, such as offering and listing securities overseas without fulfilling the filing procedures, shall bear legal liabilities, including a fine between RMB 1.0 million (approximately $150,000) and RMB 10.0 million (approximately $1.5 million), and the Trial Measures increase the cost for offenders by enforcing accountability with administrative penalties and incorporating the compliance status of relevant market participants into the Securities Market Integrity Archives.

According to the Circular, since the date of effectiveness of the Trial Measures on March 31, 2023, PRC domestic enterprises falling within the scope of filing that have been listed overseas or met the following circumstances are “existing enterprises”: before the effectiveness of the Trial Measures on March 31, 2023, the application for indirect overseas issuance and listing has been approved by the overseas regulators or overseas stock exchanges (such as the registration statement has become effective on the U.S. market), it is not required to perform issuance and listing supervision procedures of the overseas regulators or overseas stock exchanges, and the overseas issuance and listing will be completed by September 30, 2023. Existing enterprises are not required to file with the CSRC immediately, and filings with the CSRC should be made as required if they involve refinancings and other filing matters. PRC domestic enterprises that have submitted valid applications for overseas issuance and listing but have not been approved by overseas regulatory authorities or overseas stock exchanges at the date of effectiveness of the Trial Measures on March 31, 2023 can reasonably arrange the timing of filing applications with the CSRC and shall complete the filing with the CSRC before the overseas issuance and listing.

In addition, an overseas-listed company must also submit the filing with respect to its follow-on offerings, issuance of convertible corporate bonds and exchangeable bonds, and other equivalent offering activities, within the time frame specified by the Trial Measures.

As advised by Junjin Law Firm, because the Company is not a company registered and formed in the territory of China, its continued listing on Nasdaq and future offerings are not “direct overseas offering and listing of domestic enterprises” as defined under the Trial Measures. Furthermore, according to Article 2 of the Trial Measures, the “indirect overseas offering and listing of domestic enterprises” refers to the overseas offering and listing of enterprises whose main business activities are in China, in the name of enterprises registered overseas, which offering and listing are based on the equity, assets, income or other similar rights and interests of the domestic enterprises. According to Article 15 of the Trial Measures, if the issuer meets both of the following conditions, the overseas offerings and listings shall be determined as an “indirect overseas offering and listing of domestic enterprises”: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by domestic enterprises; and; (ii) its major operational activities are carried out in China or its main places of business are located in China, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in China.

The Company does not meet both the requirements under Article 15 of the Trial Measures and therefore its continued listing on Nasdaq and future offerings are not an “Indirect overseas offering and listing of domestic enterprises”, considering that (i) the operating income and total profit of the Company’s subsidiaries that were established in China for the year ended December 31, 2023 do not account for more than 50% of the operating income and total profit in our consolidated financial statements for the same period, (ii) our main business is not conducted within China, and (iii) the majority of our senior management personnel are not Chinese citizens or reside in China on a regular basis. Therefore, as advised by Junjin Law Firm, we are not required to complete the record filing requirement under the Trial Measures. However, if we inadvertently conclude that such filing procedures are not required, or applicable laws, regulations, or interpretations change such that we are required to complete the filing procedures in the future, we may be subject to investigations by the regulators, fines or penalties, ordered to suspend our relevant operations and rectify any non-compliance, prohibited from engaging in relevant business or conducting any offering, and these risks could result in a material adverse change in our operations and/or the value of our common stock, and could significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless.

Implication of the Holding Foreign Company Accountable Act