As filed with the Securities and Exchange Commission on November 13, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

-----------------------------------

FORM 20-F

[X] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended _________________

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _______________

For the transition period from ____________ to ____________

Commission File No. ____ - _______

-----------------------------------

PENINSULA ENERGY LIMITED

(Exact name of Registrant as specified in its charter)

-----------------------------------

| N/A | AUSTRALIA |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Unit 17, Level 2, 100 Railway Road

Subiaco, WA, 6008 Australia

(Address of principal executive offices)

David Coyne

Chief Financial Officer

+61 8 9380 9920 (telephone)

+61 8 9381 5064 (facsimile)

Unit 17, Level 2, 100 Railway Road

Subiaco, WA, 6008 Australia

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered or to be registered: |

| American Depository Shares each representing Ordinary | NYSE MKT LLC |

| Shares, no par value | |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of November 13, 2015: 173,996,544 ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes [ ] No [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months.

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP [ ]

International Financial Reporting Standards as issued by the International Accounting Standards Board [X]

Other [ ]

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[ ] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes [ ] No [ ]

2

TABLE OF CONTENTS

i

ii

INTRODUCTION

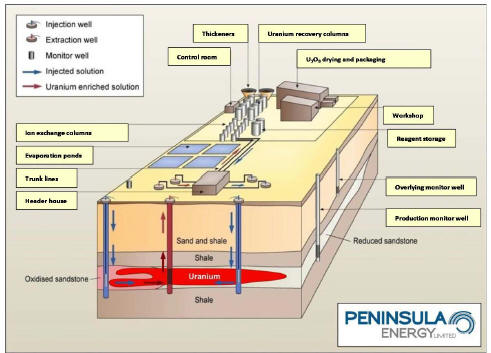

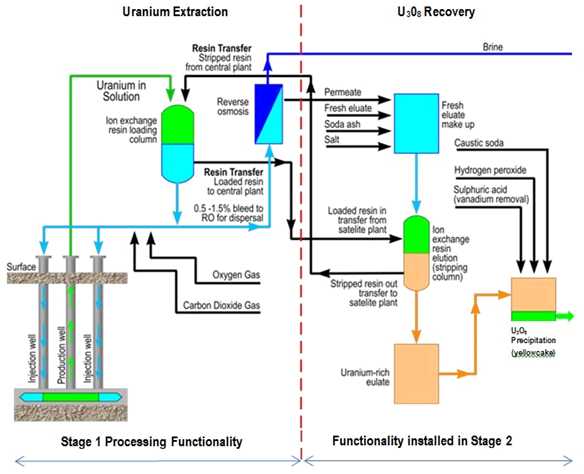

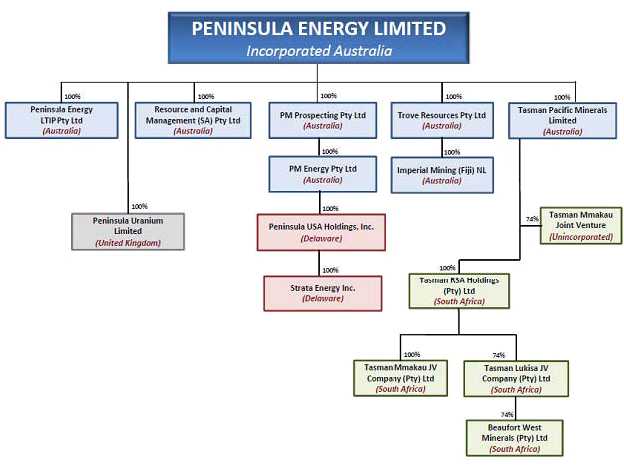

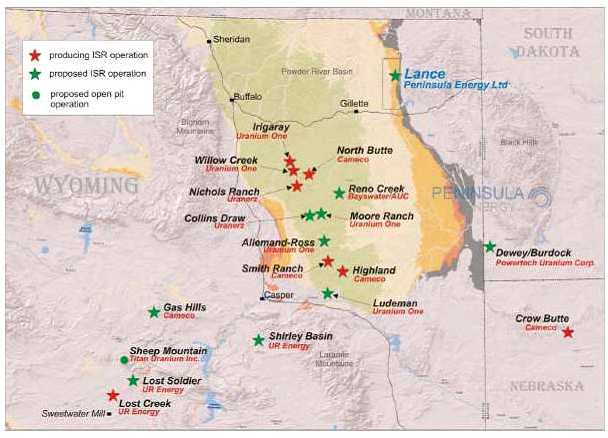

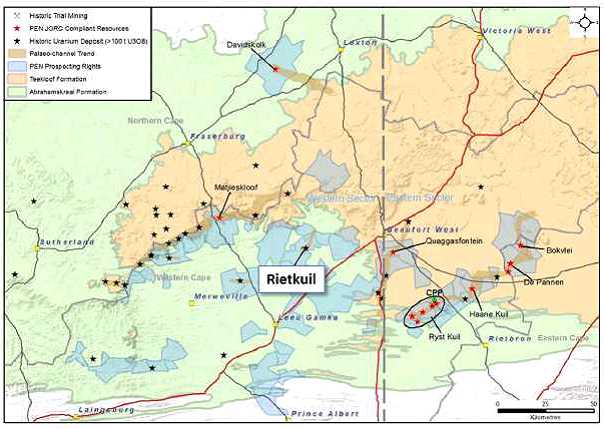

We are an exploration-stage uranium company with our primary assets being the Lance Projects in Wyoming, USA and the Karoo Projects in South Africa. We are currently completing construction and commissioning of our flagship project, the Lance Projects, located in Wyoming, USA. We are in the exploration stage at our Karoo Projects in South Africa where we have confirmed significant uranium mineralization and are working towards preparing a feasibility study. We intend for the Karoo Projects to be our second uranium project providing us with potential optionality for greater exposure to uranium prices in the future.

Our head office and registered office is located at Unit 17, Level 2, 100 Railway Road, Subiaco, Western Australia 6008. Our telephone number is +(61) 9 380 9920 and facsimile number is +(61) 8 9381 5064.

On September 24, 2015, our shareholders voted to approve a reverse stock split (consolidation) of our issued and outstanding ordinary shares on the basis of one new ordinary share for every 40 shares held, which took effect on October 1, 2015. All references in this registration statement on Form 20-F to the number of ordinary shares, stock options, the market price of our ordinary shares and financial information are presented on that basis, unless otherwise indicated.

Our ordinary shares are publicly traded on the ASX under the symbol “PEN”.

We are filing this registration statement on Form 20-F in anticipation of the listing of our American Depositary Shares, or ADSs, each representing of our ordinary shares, on the NYSE MKT LLC, or NYSE MKT, under the symbol “ ”. The Bank of New York Mellon, acting as depositary, will register and deliver our ADSs.

We also maintain a web site at www.pel.net.au. The information contained on our website or available through our website is not incorporated by reference into and should not be considered a part of this registration statement on Form 20-F, and the reference to our website in this registration statement on Form 20-F is an inactive textual reference only.

ABOUT THIS REGISTRATION STATEMENT

All references in this registration statement on Form 20-F to:

“the Company”, “Peninsula”, “we”, “us”, or “our” refer to Peninsula Energy Limited and the subsidiaries through which we conduct our business, unless otherwise indicated;

“ADR” means the American depositary receipts evidencing the ADSs;

“ADS” means the American depositary shares;

“ASX” means the Australian Securities Exchange;

“ISR” means in-situ mining recovery method;

“Strata Energy” means Strata Energy, Inc., our wholly-owned subsidiary; and

“U3O8” means uranium concentrate.

Unless otherwise indicated, all references to “$” or “A$” are to Australian dollars, and all references to “US$” are to United States dollars. Our reporting and functional currency is the Australian dollar. This registration statement on Form 20-F contains references to U.S. dollars where the underlying transaction or event was denominated in U.S. dollars. See “Exchange Rate Information”. Our financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, or IFRS, which differs in certain material respects from U.S. generally accepted accounting principles. See “Presentation of Financial Information”. This registration statement on Form 20-F contains forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements”. This registration statement on Form 20-F also includes statistical data, market data and other industry data and forecasts, which we obtained from market research, publicly available information and independent industry publications and reports that we believe to be reliable sources. See “Industry and Market Data”.

2

CAUTIONARY NOTE TO UNITED STATES INVESTORS

As a public company in Australia, we report estimates of “measured,” “indicated” and “inferred” mineral resources, which are terms that are recognized and required by the 2012 Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia, or JORC, and also the ASX. These definitions differ from the definitions in Industry Guide 7, or Industry Guide 7, under the U.S. Securities Act of 1933, as amended, or the Securities Act.

In particular, Industry Guide 7 applies different standards in order to classify mineralization as a reserve. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

Consequently, the terms “measured,” “indicated” and “inferred” mineral resources” are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned that public disclosure by us of such mineral resources in Australia in accordance with ASX listing rules do not form a part of this registration statement on Form 20-F.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this registration statement on Form 20-F may be deemed to be “forward-looking statements” within the meaning of applicable securities laws. Such forward-looking statements concern our anticipated results and progress of our operations in future periods, planned exploration and, if warranted, development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “expect”, “estimate”, “may”, “will”, “could”, “leading”, “intend”, “contemplate”, “shall” and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements. Forward-looking statements in this registration statement on Form 20-F include, but are not limited to, statements with respect to:

risks related to our limited operating history;

risks related to our ability to achieve commercial production at our Lance Projects and Karoo Projects;

risks related to our ability to access capital and the financial markets;

risks related to our ability to manage growth;

risks related to our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities;

risks related to foreign exchange rates;

risks related to acquisitions or other material transactions we may enter into;

risks related to the probability that our properties contain reserves;

risks related to higher than expected construction and operating costs at our Lance Projects;

risks related to the in-situ mining recovery process;

risks related to our dependence on key management employees;

risks related to our ability to attract and hire new personnel;

risks related to the competitive nature of the uranium industry;

risks related to the fluctuation of uranium prices;

risks related to the volatility of uranium prices;

risks related to the public acceptance of nuclear power;

risks related to the limited market and customers for U3O8;

risks related to the prices of competing sources of energy;

risks related to licensing and environmental laws and regulations;

risks related to our ability to acquire necessary mining licenses, permits or access rights;

risks related to environmental liabilities and reclamation costs;

risks related to the application of anti-corruption laws;

risks related to deregulation of the electrical industry;

risks related to the economic, cultural, regulatory and political environment in the countries and jurisdictions where we do business;

risks related to litigation including our Source Material and By-product License;

risks related to defects in title to our mineral properties;

3

risks related to indigenous rights and title claims;

risks related to insurance;

risks related to potential conflicts of interest of our directors;

risks related to stock price and trading volume volatility;

risks relating to the development of an active trading market for the ADSs;

risks related to ADR holders not having shareholder rights;

risks related to ADR holders not receiving distributions;

risks related to effecting service of process in the United States or enforcing judgments obtained in the United States;

risks related to having a significant shareholder;

risks related to liquidity;

risks related to currency fluctuations;

risks related to our status as a foreign private issuer;

risks related to our status as an emerging growth company;

risks related to internal financial controls;

risks related to becoming publicly traded in the United States;

risks related to not being considered a shareholder;

risks related to having an ADR depository;

risks related to potentially being considered a “passive foreign investment company” under U.S. federal income tax laws;

risks related to our lack of dividends;

risks related to analyst coverage;

risks related to potential limitations on the transfer of ADRs;

risks related to Australian takeover laws;

risks related to Australian corporate law;

risks related to securities regulations; and

risks related to our securities.

All forward-looking statements reflect our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions, forecasts, projections or other forward-looking statements will not occur. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the securities laws of the United States and Australia, we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward-looking statements contained in this registration statement on Form 20-F by the foregoing cautionary statements.

4

INDUSTRY AND MARKET DATA

This registration statement on Form 20-F includes information with respect to market and industry conditions and market share from third-party sources or based upon estimates using such sources when available. We believe that such information and estimates are reasonable and reliable. We also believe the information extracted from publications of third-party sources has been accurately reproduced. However, we have not independently verified any of the data from third-party sources. Similarly, our internal research is based upon our understanding of industry conditions, and such information has not been verified by any independent sources.

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise indicated, the consolidated financial statements and related notes included in this registration statement on Form 20-F have been prepared in accordance with IFRS and interpretations issued by the International Accounting Standards Board, or IASB, which differ in certain significant respects from Generally Accepted Accounting Principles in the United States, or U.S. GAAP, and thus may not be comparable to financial statements of United States companies. As the SEC has adopted rules to accept financial statements prepared in accordance with IFRS as issued by the IASB without reconciliation to U.S. GAAP from foreign private issuers such as us, we will not be providing a description of the principal differences between U.S. GAAP and IFRS.

Our fiscal year ends on June 30. We designate our fiscal year by the year in which that fiscal year ends; e.g. fiscal 2015 refers to our fiscal year ended June 30, 2015.

5

EXCHANGE RATE INFORMATION

We are an Australian company that is headquartered in the Commonwealth of Australia. All of our revenues and losses are denominated in Australian dollars. The conversion of Australian dollars into U.S. dollars in this registration statement on Form 20-F is based on the rate published by the Reserve Bank of Australia on the date indicated.

The table below sets forth for the periods identified the number of U.S. dollars per Australian dollar as published by the Reserve Bank of Australia. We make no representation that any Australian dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Australian dollars, as the case may be, at any particular rate, the rates stated below, or at all.

| Fiscal Year Ended | | High (US$) | | | Low (US$) | |

| June 30, 2011 | | 1.0939 | | | 0.8366 | |

| June 30, 2012 | | 1.1055 | | | 0.9500 | |

| June 30, 2013 | | 1.0593 | | | 0.9202 | |

| June 30, 2014 | | 0.9672 | | | 0.8716 | |

| June 30, 2015 | | 0.9458 | | | 0.7590 | |

| | | | | | | |

| Quarter Ended | | | | | | |

| September 30, 2013 | | 0.9496 | | | 0.8909 | |

| December 31, 2013 | | 0.9672 | | | 0.8836 | |

| March 31, 2014 | | 0.9270 | | | 0.8716 | |

| June 30, 2014 | | 0.9439 | | | 0.9219 | |

| September 30, 2014 | | 0.9458 | | | 0.8693 | |

| December 31, 2014 | | 0.8883 | | | 0.8112 | |

| March 31, 2015 | | 0.8244 | | | 0.7604 | |

| June 30, 2015 | | 0.8122 | | | 0.7590 | |

| September 30, 2015 | | 0.7713 | | | 0.6924 | |

| | | | | | | |

| Month Ended | | | | | | |

| May 2015 | | 0.8122 | | | 0.7663 | |

| June 2015 | | 0.7799 | | | 0.7649 | |

| July 2015 | | 0.7713 | | | 0.7289 | |

| August 2015 | | 0.7397 | | | 0.7114 | |

| September 2015 | | 0.7209 | | | 0.6924 | |

| October 2015 | | 0.7332 | | | 0.7038 | |

On November 13, 2015, the exchange rate published by the Reserve Bank of Australia for the conversion of Australian dollars into U.S. dollars was $1.00 = US$0.7135.

6

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

The following table lists the current members of our board of directors and our executive officers. The address for our directors and officers is c/o Peninsula Energy Limited, Unit 17, Level 2, 100 Railway Road, Subiaco, Western Australia 6008.

| Name | | Position |

| John Simpson | | Chief Executive Officer and Managing Director |

| Richard Lockwood | | Non-Executive Chairman |

| Warwick Grigor | | Non-Executive Director |

| Neil Warburton | | Non-Executive Director |

| John Harrison | | Non-Executive Director |

| Evgenij Iorich | | Non-Executive Director |

| Harrison Barker | | Non-Executive Director |

| David Coyne | | Chief Financial Officer |

| Jonathan Whyte | | Corporate Secretary |

For further details, see “Directors, Senior Management and Employees.”

B. Advisers

Our principal Australian legal advisers are Clayton Utz, located at 250 St. Georges Terrace, Perth Western Australia, 6000. Our principal United States legal advisors are Dorsey & Whitney LLP, located at 161 Bay Street, Brookfield Place, Suite 4310, Toronto, Ontario M5J 2S1.

C. Auditors

BDO Audit (WA) Pty Ltd. served as our principal independent registered public accounting firm for the fiscal year ended June 30, 2015. The address of BDO Audit (WA) Pty Ltd. is 38 Station Street, Subiaco, Western Australia 6008. Somes Cooke served as our principal independent registered public accounting firm for the fiscal years ended June 30, 2014 and June 30, 2013.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following tables summarize consolidated financial data as at and for the fiscal years ended June 30, 2014 and June 30, 2015 prepared in accordance with International Financial Reporting Standards. The consolidated financial information in the tables below as at June 30, 2014 and 2015 and for the fiscal years then ended have been derived from our audited consolidated financial statements and related notes included in this registration statement on Form 20-F that have been audited by BDO Audit (WA) Pty Ltd.

The summary consolidated financial data below should be read in conjunction with our consolidated financial statements beginning on page F-1 of this registration statement on Form 20-F and with the information appearing in the section of this registration statement on Form 20-F entitled “Operating and Financial Review and Prospects”. Our historical results do not necessarily indicate results expected for any future period.

In the current year, with a change in auditors to an accounting firm that is registered with the Public Company Accounting Oversight Board, and subsequent review of the accounting treatment of certain transactions and events in 2013 and 2014, it was determined that certain prior period transactions and events were not treated in compliance with certain accounting standards. This has resulted in a restatement of certain items in the consolidated financial statements for the fiscal year ended June 30, 2014 as described in more detail within note 1 of the audited consolidated financial statements included in this registration statement on Form 20-F.

Unless otherwise indicated, all references to “$” are to Australian dollars, and all references to “US$” are to United States dollars.

7

Summary Financial Information

(In whole dollars except for per share amounts)

| | Fiscal Year Ended June 30, | |

| | 2014 | | | 2015 | |

Consolidated Operating Data | | | | | | |

Interest and Other Revenue | $ | 183,900 | | $ | 232,844 | |

General and administrative | | (4,987,068 | ) | | (4,742,692 | ) |

Foreign exchange gain/(loss) | | (48,107 | ) | | 1,731,067 | |

Other income (expense) | | (1,667,051 | ) | | (2,566,434 | ) |

Operating loss | | (6,518,326 | ) | | (5,345,215 | ) |

Net loss attributable to the company | | (6,518,326 | ) | | (5,345,215 | ) |

Net loss per basic and diluted ordinary share (cents per ordinary share) | | (0.21 | ) | | (0.11 | ) |

| | As of June 30, | |

| | 2014 | | | 2015 | |

Consolidated Balance Sheet Data | | | | | | |

Cash and cash equivalents | $ | 7,027,753 | | $ | 32,644,734 | |

Restricted cash and marketable securities | | 10,123,626 | | | - | |

Working capital (deficit) | | (3,760,030 | ) | | 32,361,092 | |

Net property and equipment | | 11,443,355 | | | 17,169,113 | |

Total assets | | 121,292,279 | | | 185,245,498 | |

Total liabilities | | 25,572,426 | | | 6,194,390 | |

Deficit accumulated during the exploration stage | | (52,945,208 | ) | | (58,125,104 | ) |

Total shareholders’ equity (deficit) | $ | 94,069,366 | | $ | 177,296,919 | |

B. Capitalization and Indebtedness

The following table sets forth our capitalization as of September 30, 2015. You should read this information together with our financial statements and the related notes and with “Item 5. Operating and Financial Review and Prospects” appearing elsewhere in this registration statement on Form 20-F.

| | | Actual | | | Actual | |

| | | ($) | | | (US$)(1) | |

| | | | | | | |

| Cash and cash equivalents | $ | 14,951,361 | | $ | 10,480,904 | |

| | | | | | | |

| Equity: | | | | | | |

| Contributed equity | | 206,302,874 | | | 144,618,315 | |

| Reserves | | 41,988,193 | | | 29,433,723 | |

| Accumulated losses | | (58,149,171 | ) | | (40,762,569 | ) |

| Non-controlling interest | | 1,685,990 | | | 1,181,879 | |

| | | | | | | |

| Total equity | | 191,827,886 | | | 134,471,348 | |

| | | | | | | |

| Total capitalization | $ | 191,827,886 | | $ | 134,471,348 | |

(1) The amounts have been translated into U.S. dollars from Australian dollars based upon the exchange rate as published by the Reserve Bank of Australia as of September 30, 2015. These translations are merely for the convenience of the reader and should not be construed as representations that the Australian dollar amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks described below, together with all of the other information in this registration statement on Form 20-F. The risks and uncertainties below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we believe to be immaterial may also adversely affect our business. If any of the following risks occur, our business, financial condition and results of operations could be seriously harmed and you could lose all or part of your investment. Further, if we fail to meet the expectations of the public market in any given period, the market price of our ADSs could decline. We operate in a highly competitive environment that involves significant risks and uncertainties, some of which are outside of our control. If any of these risks actually occurs, our business and financial condition could suffer and the price of our ADSs could decline.

8

Financial Risks

Our future performance is difficult to evaluate because we have a limited operating history.

We were incorporated in 1993 and we began to implement our current business strategy in the uranium industry in the beginning of 2005. We have not realized any revenues to date from the sale of uranium. Our operating cash flow needs have been financed primarily through issuances of our ordinary shares and not through cash flows derived from our operations. As a result, we have little historical financial and operating information available to help you evaluate our performance.

We are an exploration company in the process of commissioning our first project and there is no guarantee that any of our properties will result in the commercial production of mineral deposits.

We are engaged in the business of acquiring and exploring mineral properties with the intention of locating economic deposits of minerals. Our property interests are in the exploration stage only. Accordingly, it is unlikely that we will realize profits in the short term, and there is no assurance that we will realize profits in the medium to long term. Any profitability in the future from our business will be dependent upon development of an economic deposit of minerals and further exploration and development of other economic deposits of minerals, each of which is subject to numerous risk factors. Further, there can be no assurance, even when an economic deposit of minerals is located, that any of our property interests can be commercially mined. The exploration and development of mineral deposits involve a high degree of financial risk over a significant period of time which a combination of careful evaluation, experience and knowledge of management may not eliminate. While discovery of additional ore-bearing structures may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish reserves by drilling and to construct mining and processing facilities at a particular site. It is impossible to ensure that our current exploration programs will result in profitable commercial mining operations. The profitability of our operations will be, in part, directly related to the cost and success of its exploration and development programs which may be affected by a number of factors. Additional expenditures are required to establish reserves which are sufficient to commercially mine and to construct, complete and install mining and processing facilities in those properties that are actually mined and developed.

We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to execute our business plan or pursue investments that we may rely on for future growth.

We rely on access to long-term capital markets as a source of liquidity for capital and operating requirements. Our existing cash reserves are sufficient to complete construction of the Stage 1 central processing plant and to enable the commencement of production, however, we may require access to additional liquidity to enable the ramp of production to rates planned for Stage 1 of the Lance Projects. Depending on our ability to generate income from our operations and our ability to repay or refinance our debt obligations, we may require further financing for current and future exploration and development. The source of future funds available to us is through the sale of uranium when operations commence, sale of additional equity capital or borrowing of funds. There is no assurance that we will be successful in commencing commercial production, that our sales projections will be realized or that additional funding will be available to us on satisfactory terms, or at all.

In order to finance our future production plans and working capital needs, we may have to raise funds through the issuance of additional equity or debt securities. Depending on the type and the terms of any financing we pursue, shareholders’ rights and the value of their investment in our ordinary shares or our ADSs could be reduced. Any additional equity financing will dilute shareholdings, and new or additional debt financing, if available, may involve restrictions on financing and operating activities. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of shareholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results. If the issuance of new securities results in diminished rights to holders of our ordinary shares or our ADSs, the market price of our ADSs could be negatively impacted.

If we are unable to obtain additional financing, as needed, at competitive rates, our ability to implement our business plan and strategy may be affected, and we may be required to reduce the scope of our operations and scale back our exploration, development and production programs as the case may be. There is, however, no guarantee that we will be able to secure any additional funding or be able to secure funding which will provide us with sufficient funds to meet our objectives, which may adversely affect our business and financial position.

Certain market disruptions may increase our cost of borrowing or affect our ability to access one or more financial markets. Such market disruptions could result from:

9

adverse economic conditions;

adverse general capital market conditions;

poor performance and health of the uranium industry in general;

bankruptcy or financial distress of unrelated uranium companies or marketers;

significant decrease in the demand for uranium;

adverse regulatory actions that affect our exploration and construction plans or the use of uranium generally; and

terrorist attacks on our potential customers.

Our ability to manage growth will have an impact on our business, financial condition and results of operations.

Future growth may place strains on our financial, technical, operational and administrative resources and cause us to rely more on project partners and independent contractors, potentially adversely affecting our financial position and results of operations. Our ability to grow will depend on a number of factors, including:

our ability to obtain leases or options on properties;

our ability to identify and acquire new exploratory prospects;

our ability to develop existing prospects;

our ability to continue to retain and attract skilled personnel;

our ability to maintain or enter into new relationships with project partners and independent contractors;

the results of our exploration programs;

the market price for uranium;

our access to capital; and

our ability to enter into term contracts or other offtake agreements.

We may not be successful in upgrading our technical, operational and administrative resources or increasing our internal resources sufficiently to provide certain of the services currently provided by third parties, and we may not be able to maintain or enter into new relationships with project partners and independent contractors on financially attractive terms, if at all. Our inability to achieve or manage growth may materially and adversely affect our business, results of operations and financial condition.

Our long-term success will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities.

Our long-term success, including the recoverability of the carrying values of our assets and our ability to acquire additional uranium projects and continue with exploration, development and commissioning and mining activities on our existing uranium projects, will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our operations by establishing ore bodies that contain commercially recoverable uranium and to develop these into profitable mining activities. The economic viability of our future mining activities has many risks and uncertainties including, but not limited to:

- a significant, prolonged decrease in the market price of uranium;

- difficulty in marketing and/or selling U3O8;

- significantly higher than expected capital costs to construct the mine and/or processing plant;

- significantly higher than expected extraction costs;

- significantly lower than expected uranium extraction;

- significant delays, reductions or stoppages of uranium extraction activities; and

- the introduction of significantly more stringent regulatory laws and regulations.

Our future mining activities may change as a result of any one or more of these risks and uncertainties and there is no assurance that any ore body that we extract mineralized materials from will result in achieving and maintaining profitability and developing positive cash flow.

Fluctuations in currency exchange rates may adversely affect our financial position and results of operations.

Fluctuations in currency exchange rates, particularly operating costs denominated in currencies other than Australian dollars, may significantly impact our financial position and results of operations. A major portion of our operating expenses and any uranium sales revenue are and will be incurred in U.S. dollars; however, we report in Australian dollars. In addition, the devaluation of the Australian dollar against the U.S. dollar could materially affect our results of operations and our financial condition.

We may enter into acquisitions or other material transactions at any time.

We are regularly engaged in a review of opportunities to acquire properties, to partner with other companies on projects or to acquire or merge with companies. We currently, and generally at any time, have such opportunities in various stages of active review, including, for example, our engagement of consultants and advisors to analyze particular opportunities, technical, financial and other confidential information, submission of indications of interest and participation in discussions or negotiations for acquisitions. Any such acquisition could be material to us. We could issue ordinary shares or ADSs or incur additional indebtedness to fund our acquisitions. Issuances of equity securities may dilute existing shareholders. In addition, any such acquisition or other transaction may have other transaction specific risks associated with it, including risks related to the completion of the transaction, the project or the jurisdictions in which the project is located or could subject us to unforeseen liabilities or other risks. We could enter into one or more acquisitions or other transactions at any time.

10

Risks Related to our Business Operational Risks

Because the probability of an individual prospect ever having reserves is not known, our properties may not contain any reserves, and any funds spent on exploration and development may be lost.

We have no reserves as defined by Industry Guide 7. There can be no assurance about the quantity and grade of mineralization until reserves are actually mined. Because the probability of an individual prospect ever having reserves is uncertain, our properties may not contain any reserves and, any funds spent on development and exploration may be lost. Until reserves are actually mined and processed, the quantity of reserves and grades must be considered as estimates only. We do not know with certainty that economically recoverable uranium exists on any of our properties. In addition, the quantity of reserves may vary depending on commodity prices. Any material change in the quantity of reserves, grade or stripping ratio may affect the economic viability of our properties. Further, our lack of established reserves means that we are uncertain as to our ability to generate revenue from our operations. We will continue to attempt to acquire the surface and mineral rights on lands that we think are geologically favorable or where we have historical information in our possession that indicates uranium mineralization might be present.

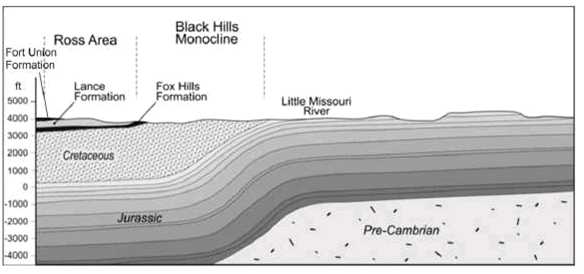

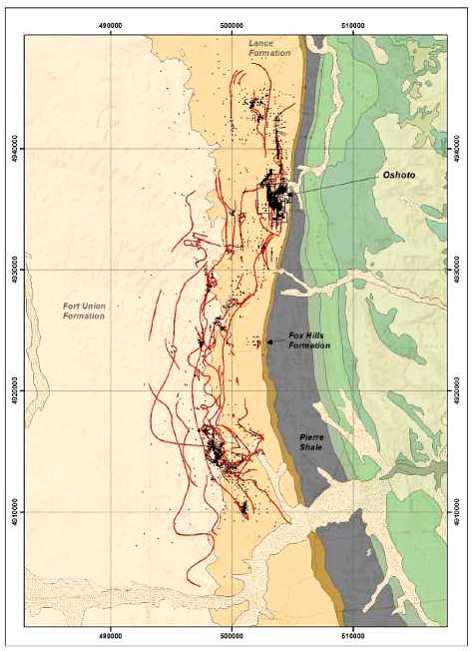

For the Lance Projects, the uranium mineralization is located in host sandstones that have demonstrated positive uranium recovery from test-work. Furthermore, geological modelling of the extensive down-hole geophysical data has accurately defined the impermeable shale and mudstone horizons that form the confining horizons to the mineralized sandstones. However, there can be no guarantee that the aggregate uranium mineralization will necessarily be commercially extracted in the aggregate quantities we have planned.

In general, the exploration and, if warranted, development of mineral deposits involves significant financial and other risks over an extended period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. Major expenditures are required to establish reserves by drilling and to construct mining and processing facilities at a site. Our uranium properties are all at the exploration stage and it is impossible to ensure that the current or proposed exploration programs on properties in which we have an interest will result in the delineation of mineral reserves or in profitable commercial operations. Our operations are subject to the hazards and risks normally encountered in the exploration and development of uranium, including unusual and unexpected geology formations, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. The nature of these risks is such that liabilities could exceed any applicable insurance policy limits or could be excluded from coverage. There are also risks against which we cannot insure or against which we may elect not to insure. The potential costs which could be associated with any liabilities not covered by insurance, or in excess of insurance coverage, or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our future earnings and competitive position and, potentially our financial viability.

We face risks related to exploration and mine construction, if warranted, on our properties.

Our level of profitability, if any, in future years will depend to a great degree on uranium prices and whether any of our exploration stage properties can be brought into production. The exploration and development of mineral deposits involves significant risks. It is impossible to ensure that the current and future exploration programs and/or feasibility studies on our existing properties will establish reserves. Whether a uranium ore body will be commercially viable depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; uranium prices, which cannot be predicted and which have been highly volatile in the past; mining, processing and transportation costs; perceived levels of political risk and the willingness of lenders and investors to provide project financing; labor costs and possible labor strikes; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us receiving an adequate return on invested capital.

We are subject to the risks normally encountered in the mining industry, such as:

the discovery of unusual or unexpected geological formations;

accidental fires, floods, earthquakes, volcanic eruptions, and other natural disasters;

11

unplanned power outages and water shortages;

controlling water and other similar mining hazards;

operating labor disruptions and labor disputes;

the ability to obtain suitable or adequate machinery, equipment, or labor;

our liability for pollution or other hazards; and

other known and unknown risks involved in the conduct of exploration, the operation of mines and the market for uranium.

In addition, our operations may also be affected by the success of the wellfield operation and extraction of uranium from the targeted host rock at the Lance Projects. A potential problem is unknown or changing geochemical conditions resulting in uranium recovery rates from the mineralized zones being significantly different from previous bench-scale tests. Another risk is reduced hydraulic conductivity in the formation due to chemical precipitation or lower hydraulic conductivities than estimated, high flare and/or recovery of significant amounts of groundwater, the need for additional injection wells to increase uranium recovery rates, variability in the uranium concentration in the host rock and discontinuity of the mineralized zone confining layers. If any such risks were to materialize it may negatively affect our results of operations and our financial condition.

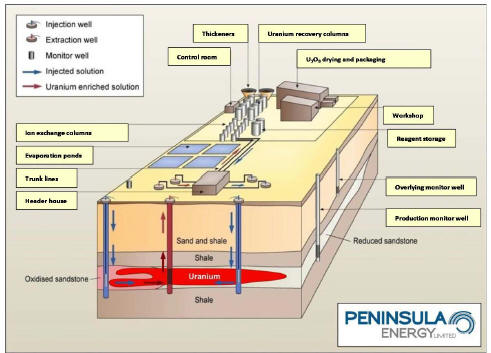

We intend to extract uranium from one of our properties using the in-situ recovery mining process which may not be successful.

We intend to extract uranium from one of our properties using in-situ recovery mining, which is suitable for extraction of certain types of uranium deposits.

Our in-situ recovery operations may be affected by various factors, including, failure to achieve predicted grades in exploration and mining; operational and technical difficulties encountered in mining; difficulties in constructing, commissioning, and operating plant and equipment; mechanical failure or plant breakdown; unanticipated metallurgical problems which may affect extraction costs; adverse weather conditions; industrial and environmental accidents; industrial disputes; and unexpected shortages or increases in the costs of consumables, spare parts, plant and equipment.

While we have conducted numerous bench tests during 2009 through 2013 to support our decision to develop the Lance Projects, no assurances can be given that we will achieve our commercial targets or that our predicted production rates will be realized.

We are dependent upon key management employees.

The responsibility of overseeing the day-to-day operations and the strategic management of our business depends substantially on our senior management and our key personnel, in particular the Strata Energy management team at the Lance Projects in Wyoming. Loss of such personnel may have an adverse effect on our performance. The success of our operations will depend upon numerous factors, many of which are beyond our control, including our ability to attract and retain additional key personnel in sales, marketing, technical support and finance. We currently depend upon on a relatively small number of key persons to seek out and form strategic alliances and find and retain additional employees. Certain areas in which we operate are highly competitive regions and competition for qualified personnel is intense. We may be unable to hire suitable field personnel for our technical team or there may be periods of time where a particular position remains vacant while a suitable replacement is identified and appointed. We may not be successful in attracting and retaining the personnel required to grow and operate our business profitably.

Our growth will require new personnel, which we will be required to recruit, hire, train and retain.

While members of our management team possess significant experience and have previously carried out or been exposed to exploration and production activities both within and outside the uranium industry, we have limited operating history with respect to uranium projects. Our ability to achieve our objectives depends on the ability of our directors, officers and management to implement current plans and respond to any unforeseen circumstances that require changes to those plans.

The execution of our plan to continue exploration and expansion of our extraction operations will continue to place demands on us and our management. Our ability to recruit and assimilate new personnel will be critical to our performance. We will be required to recruit additional personnel and to train, motivate and manage employees without assurance of success.

Industry Risks

The uranium industry is highly competitive and we cannot guarantee that we will achieve commercial production from our exploration and development efforts.

The uranium industry is highly competitive. Our activities are directed towards the search, exploration and development of uranium deposits. There is no certainty that the expenditures to be made by us will result in the production or discoveries of commercial quantities of uranium deposits. There is aggressive competition within the mining industry for the discovery and acquisition of properties considered to have commercial potential. We will compete with other interests, many of which have greater financial resources than we will have, for the opportunity to participate in promising projects. Such competition may have better access to potential uranium resources, more developed infrastructure, more available capital, have better access to necessary financing, and more knowledgeable and available employees than us. We may encounter competition in acquiring uranium properties, hiring mining professionals, obtaining mining resources, such as manpower, drill rigs, and other mining equipment. Such competitors could outbid us for potential projects or produce minerals at lower costs. Increased competition could also affect our ability to attract necessary capital funding or acquire suitable producing properties or prospects for uranium exploration in the future. Significant capital investment is required to achieve commercial production from successful exploration and development efforts.

12

Our future uranium production will also compete with the sale of uranium inventory held by the United States Department of Energy. In addition, there are numerous entities in the market that compete with us for properties and are attempting to become licensed to operate ISR and/or underground mining facilities. If we are unable to successfully compete for properties, capital, customers or employees or with alternative uranium sources, it could have a materially adverse effect on our results of operations.

Our future profitability will be dependent on uranium prices.

Unlike other commodities, uranium does not trade on an open market. Contracts are negotiated privately by buyers and sellers. Changes in the price of uranium can have a significant impact on the economic performance of our projects.

The marketability of uranium and acceptance of uranium mining is subject to numerous factors beyond our control. Since our revenues are expected to be derived from the sale of uranium, our net earnings, if any, can be affected by the long-term and short-term market price of U3O8. The price of uranium may experience volatile and significant price movements over short periods of time. The price of uranium has been and will continue to be affected by numerous factors beyond our control. Factors known to affect the market and the price of uranium include:

demand for nuclear power;

political and economic conditions in uranium mining, producing and consuming countries;

production costs incurred by uranium mining companies;

uranium supply from secondary sources;

interest rates, inflation and currency exchange fluctuations;

government regulations;

availability of financing for nuclear plants, reprocessing of spent fuel and the re-enrichment of depleted uranium tails or waste;

sales of excess civilian and military inventories (including from the dismantling of nuclear weapons) by governments and industry participants;

production levels and costs of production in certain geographical areas such as Russia, Africa, and Australia; and

changes in public acceptance of nuclear power generation as a result of any future accidents or terrorism at nuclear facilities.

Although the New York Mercantile Exchange provides financially-settled uranium futures contracts where the size of each contract is 250 pounds of uranium as U3O8, uranium is not traded on any open market or organized commodity exchange such as the London Metal Exchange. Typically, buyers and sellers negotiate contracts privately and usually directly among themselves. Uranium prices, both spot prices and long-term prices, are reported on a weekly basis by two independent market consulting firms, TradeTech and Ux Consulting, or UxC. The prices reported by these two independent consulting firms are based on information that they obtain from buyers and sellers.

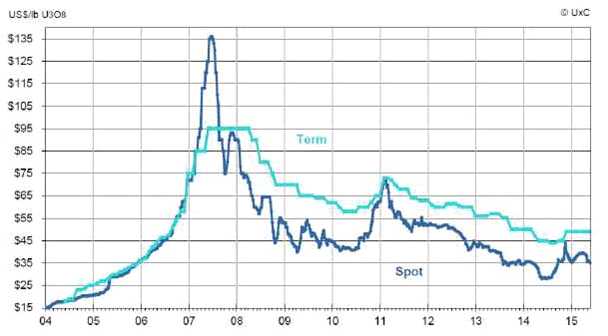

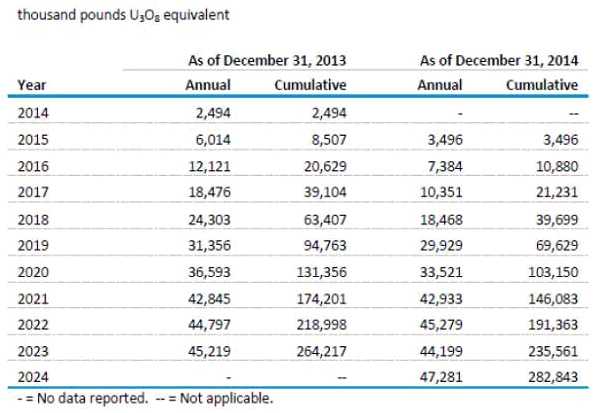

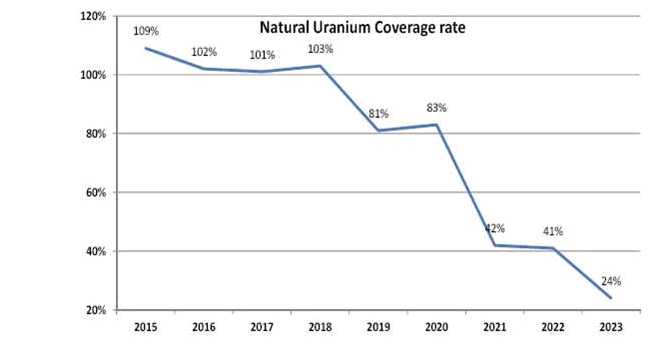

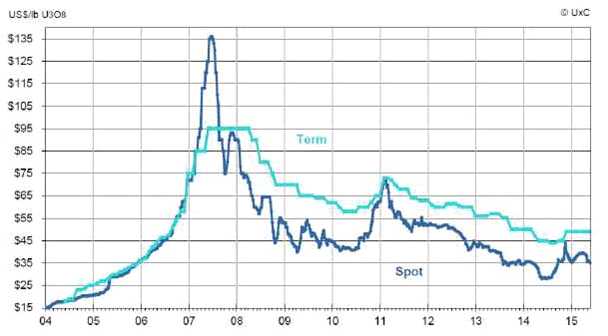

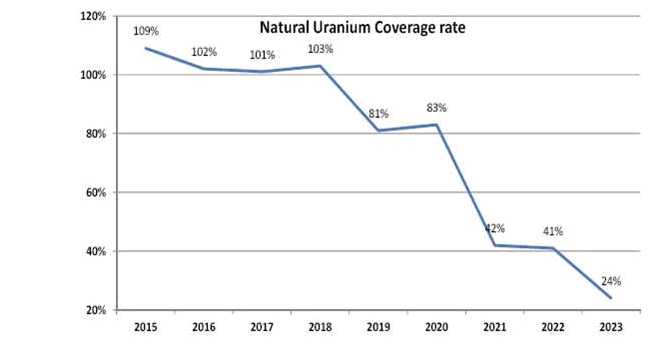

Spot prices represent prices for a one-off delivery, usually made within 6 to 12 months from the date of contract. Term prices represent the base price in long-term contracts that usually reflect multiple deliveries over periods of between 5 and 10 years. According to the U.S. Energy Information Administration and the European Union EurAtom Supply Agency, the bulk of U3O8delivered to respective nuclear power generating utilities each year in the U.S. and European Union is made under long-term contracts.

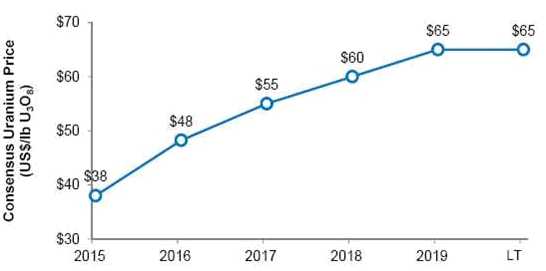

Spot prices for U3O8 were at $20.75 per pound U3O8 in December 2004, and then increased to $36.25 per pound in December 2005 and $72.00 per pound in December 2006. During 2007 the spot price reached a high of $136.00 per pound. The spot price of U3O8 was $90.00 per pound in December 2007. The spot price declined during 2008, reaching a low of $45.00 per pound in October. In 2009, the spot price of U3O8 had a high of $52.00 and a low of $42.00. In 2010, the spot price had a high of $62.50 and a low of $40.75. In 2011, the spot price had a high of $73.00 and a low of $49.00. In 2012, the spot price had a high of $52.00 and a low of $42.00. In 2013, the spot price reached a high of $44.00 and a low of $34.50. In 2014, the spot price had a high of $40.00 and a low of $28.25. The spot price at the end of October 2015 was $36.50.

Term prices for U3O8 were at $25.00 per pound U3O8 in December 2004, and then increased to $36.25per pound in December 2005 and $75.00 per pound in December 2006. During 2007 the term price reached a high of $95.00 per pound. The term price of U3O8 was $95.00 per pound in December 2007. The term price declined during 2008, reaching a low of $70.00 per pound in October. In 2009, the term price of U3O8 had a high of $70.00 and a low of $62.00. In 2010, the term price had a high of $65.00 and a low of $58.00. In 2011, the term price had a high of $73.00 and a low of $63.00. In 2012, the term price had a high of $61.50 and a low of $56.00. In 2013, the term price reached a high of $57.00 and a low of $50.00. In 2014, the term price had a high of $50.00 and a low of $44.00. The term price at the end of October 2015 was $44.00.

13

Other than for uranium already committed under contract at agreed prices, no assurance can be given on the accuracy of future prices used in the derivation of our ability to generate positive cash flow from our planned future operations.

Uranium prices are subject to volatility and there can be no assurance that our marketing strategy will protect us against uranium price volatility.

Our marketing strategy is to sell the majority of our uranium production under long-term contracts that we negotiate directly with nuclear power generating utilities. The entering into of long-term contracts is intended to protect us from the fluctuations of the price of uranium, deliver predictable revenue and minimize the effect of declines in uranium prices on results of operations for a period of time. These long-term contracts are typically entered into at a fixed base price subject to periodic price escalation over the term of the contract. Although such activities may protect us against low uranium prices, there is no guarantee that we will be able to sell all of our production under long-term contracts. Long-term contracts may also limit the price that can be realized in the future on uranium production that is committed to be delivered under long-term contracts as we may not have uranium available to sell during times where the market price of uranium exceeds the uranium price in long-term contracts that we have entered into, including the four long-term contracts that we have already entered. See “Information on the Company – Business Overview – Delivery Commitments”.

Public acceptance of nuclear energy is uncertain and can affect the level of regulation, the demand for uranium and uranium prices.

Maintaining the demand for uranium at current levels and achieving any growth in demand in the future will depend on society’s acceptance of nuclear technology as a means of generating electricity.

Although the safety record of nuclear reactors has generally been very good, there have been accidents and other unforeseen problems in the former USSR, the United States, Japan and in other countries. The consequences of a major incident can be severe and include loss of life, property damage and environmental damage. An accident or other significant event at a nuclear plant could result in increased regulation, less public support for nuclear energy, lower demand for uranium and lower uranium prices. This could have a material and adverse effect on our own earnings, cash flows, financial condition, results of operations or prospects.

On March 11, 2011, a significant earthquake struck the northeast coast of Japan, producing a tsunami and causing massive damage and destruction along the Pacific coastline of Japan. This included damage to the Fukushima-Daiichi nuclear power plant, located in the town of Okuma, about 130 miles north of Tokyo. The plant suffered a series of power and equipment failures affecting the cooling water systems and released radioactive material into the environment. The incident at the Fukushima-Daiichi nuclear power plant has called into question public confidence in nuclear energy in Japan and elsewhere around the world. This had an immediate and sustained negative impact on uranium prices and the share price of companies involved in the uranium industry.

Prior to the events of March 11, 2011, Japan had 55 nuclear reactors, which represented 10.3% of global nuclear generating capacity. Japan subsequently ceased operations of all nuclear reactors in 2013 to enable review of safety systems at all reactor sites. As of November 9, 2015, Japan has restarted operations at two of the reactors following a demonstration that these reactors are able to meet new safety standards that were developed by Japan’s newly established Nuclear Regulatory Authority. Additional nuclear reactors in Japan may be restarted but will be dependent on the ability of each individual reactor to meet the new safety standards.

Germany has decided to revert to its previous phase out policy, shutting down eight of its reactors and plans to shut down the remaining nine reactors by 2022.

Lack of public acceptance of nuclear technology would have an adverse effect on the demand for nuclear power and potentially increase the regulation of the nuclear power industry. We may be impacted by changes in regulation and public perception of the safety of nuclear power plants, which could adversely affect the construction of new plants, the re-licensing of existing plants, the demand for uranium and the future prospects for nuclear generation. These events could have a material adverse effect on our own earnings, cash flows, financial condition, results of operations or prospects.

The only significant market for uranium is nuclear power plants world-wide, and there are a limited number of customers.

Our main business relates to the production and sale of U3O8. We rely heavily on a small number of customers to purchase a significant portion of our U3O8. We are dependent on a limited number of electric utilities that buy uranium for nuclear power plants. Because of the limited market for uranium, a reduction in purchases of newly produced uranium by electric utilities for any reason (such as plant closings) would adversely affect the viability of our business. We have in place an existing contract for the delivery of approximately 1.0million pounds of U3O8with a weighted average price ranging between $73.00 and $75.00 per pound for deliveries made between 2016 and 2020. The current spot price as of October 2015 for U3O8is approximately $36.50 per pound and the current term price for U3O8is approximately $44.00 per pound, the loss of this contract would have an adverse effect on the business.

14

The price of alternative energy sources affects the demand for and price of uranium.

Nuclear energy competes with other sources of energy, including oil, natural gas, coal and hydro-electricity. These other energy sources are to some extent interchangeable with nuclear energy, particularly over the longer term. The attractiveness of uranium as an alternative fuel to generate electricity may be dependent on the relative prices of oil, gas, coal and hydro-electricity and the possibility of developing other low-cost sources of energy. If the prices of alternative energy sources decrease or new low-cost alternative energy sources are developed, the demand for uranium could decrease, which may result in a decrease in the price of uranium.

Regulatory Risks

Proposed rule changes by the United States Environmental Protection Agency could adversely affect the feasibility of conducting our planned operations and our financial performance.

In January 2015, the United States Environmental Protection Agency, or US EPA, issued proposed revisions to regulations promulgated in 40 Code of Federal Regulations, or CFR, Part 192 under the Uranium Mill Tailings Radiation Control Act of 1978. The proposed rule would revise the US EPA’s regulations for in-situ recovery that produce uranium by injecting and extracting a solution that dissolves the uranium from the porous minerals in which it is found. In-situ uranium production represents an increasing share of uranium production and poses special groundwater protection challenges compared with conventional uranium production because, according to the US EPA, it solubilizes and mobilizes uranium and other constituents and changes the geochemistry within the aquifer containing the uranium deposit. If geochemistry and groundwater conditions are not restored after in-situ operations cease or the restoration is not stable over time, the groundwater in aquifers surrounding the wellfield may become contaminated with uranium and other constituents. Part 192.53 of the proposed rule would require in-situ uranium mine operators to implement a groundwater monitoring program that will: (i) establish pre-mining water quality; (ii) monitor during mine unit operations to detect groundwater impacts; (iii) monitor the progress of groundwater restoration after the mine unit is no longer operating; (iv) monitor aquifer conditions after restoration and during the stabilization process; and (v) provide for long-term monitoring of groundwater conditions (the US EPA has proposed 30 years) after stabilization. In addition, the rules would require mine operators to maintain the necessary facilities to resume restoration activities during the entire long-term monitoring period should groundwater conditions deteriorate. The effect of this proposed rule change, if implemented, would significantly increase annual compliance costs and our closure costs incurred by us.

The passage of the proposed rule change would adversely affect the feasibility of conducting our planned operations and our financial performance. We, along with other uranium in-situ mining companies in the United States, have made submissions to the US EPA strenuously arguing that the proposed rule should not be implemented; however, there can be no assurance that our submissions will be successful in preventing the proposed rule change from being passed. See “Business Overview – Environmental Regulation –Proposed Rule Change to UMTRCA”.

Our operations are subject to licensing and environmental regulation and risks in the United States and South Africa.

Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Compliance with environmental quality requirements and reclamation laws imposed by federal, state and local governmental authorities may require significant capital outlays, materially affect the economics of a given property, cause material changes or delays in our intended activities, and expose us to litigation. These authorities may require us to prepare and present data pertaining to the effect or impact that any proposed exploration for or production of minerals may have upon the environment. The requirements imposed by any such authorities may be costly, time consuming, and may delay operations. Future legislation and regulations designed to protect the environment, as well as future interpretations of existing laws and regulations, may require substantial increases in equipment and operating costs and delays, interruptions, or a termination of operations. We cannot accurately predict or estimate the impact of any such future laws or regulations, or future interpretations of existing laws and regulations, on our operations. Historic mining activities have occurred on certain of our properties. If such historic activities have resulted in releases or threatened releases of regulated substances to the environment, potential for liability may exist under federal or state remediation statutes.

While exploration and mining for uranium is currently permitted in the United States and South Africa there can be no guarantee that it will continue to be permitted in the future.

The uranium industry is subject not only to the worker health and safety, license and environmental risks associated with all mining businesses, but also to additional risks uniquely associated with uranium mining and processing. The possibility of more stringent regulations exists in the areas of worker health and safety, the disposition of wastes, the decommissioning and reclamation of exploration and in-situ recovery mining sites, and other environmental matters, each of which could have a material adverse effect on the costs or the viability of a particular project. We cannot predict what environmental legislation, regulation or policy will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. The recent trend in environmental legislation and regulation, generally, is toward stricter standards and this trend is likely to continue in the future. This recent trend includes, without limitation, laws and regulations relating to air and water quality, mine reclamation, waste handling and disposal, the protection of certain species and the preservation of certain lands. These regulations may require the acquisition of permits or other authorizations for certain activities. These laws and regulations may also limit or prohibit activities on certain lands. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or stricter interpretation of existing laws, may necessitate significant capital outlays, may materially affect our results of operations and business, or may cause material changes or delays in our intended activities.

15

Our operations may require additional analysis in the future including environmental and social impact and other related studies. Certain activities require the submission and approval of environmental impact assessments. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers, and employees. There can be no assurance that we will be able to obtain or maintain all necessary permits that may be required to continue operations or exploration of properties or, if feasible, to commence construction and operation of mining facilities at such properties at economically justifiable costs.

We are subject to complex federal, state, local and other laws, controls and regulations that could adversely affect the cost, manner and feasibility of conducting our planned operations.

Our operations require licenses and permits from various governmental authorities. We believe we hold or are in the process of obtaining all necessary licenses and permits to carry on the activities which we are currently conducting under applicable laws and regulations. However, such licenses and permits are subject to changes in regulations and in various operating circumstances. There can be no guarantee that we will be able to obtain all necessary licenses and permits that may be required to maintain our exploration and mining activities including constructing mines and commencing operations of any of our properties.

We believe that we hold the necessary licenses and permits to construct our processing facilities and produce up to 3.0 million pounds U3O8per annum from the Lance Projects. As we progressively deplete wellfields over time, we may require license and permit amendments to expand the area that we can extract uranium from and maintain rates of production. In addition, when we proceed to production on any property, we must obtain and comply with permits and licenses which contain specific conditions concerning operating procedures, water use, the discharge of various materials into or on land, air or water, waste disposal, spills, environmental studies, abandonment and restoration plans and financial assurances. There can be no assurance that all necessary authorizations, licenses, permits and consents will be granted to us, or that authorizations, licenses, permits and consents already granted will not be withdrawn or made subject to limitations.

Our business is also subject to various federal, state and local laws governing prospecting and development, taxes, labor standards and occupational health, mine safety, toxic substances, environmental protection and other matters. Exploration and development are also subject to various federal, state and local laws and regulations relating to the protection of the environment. These laws impose high standards on the mining industry to monitor the discharge of waste water and report the results of such monitoring to regulatory authorities, to reduce or eliminate certain effects on or into land, water or air, to progressively rehabilitate mine properties, to manage hazardous wastes and materials and to reduce the risk of worker accidents. A violation of these laws may result in the imposition of substantial fines and other penalties. There can be no assurance that we will be able to meet all the regulatory requirements in a timely manner or without significant expense or that the regulatory requirements will not change to prohibit us from proceeding with certain exploration and development.

Members of the United States Congress have repeatedly introduced bills which would supplant or alter the provisions of the United States Mining Law of 1872, as amended. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Although it is impossible to predict at this point what any legislated royalties might be, enactment could adversely affect the potential for development of such mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our financial performance.

Restoration and reclamation costs for environmental liabilities may exceed the provisions we have made.

Environmental regulators are demanding more and more financial assurances so that the parties involved, and not the government, bear the cost of decommissioning and reclaiming sites. Natural resource companies are required to close their operations and rehabilitate the lands in accordance with a variety of environmental laws and regulations. Estimates of the total ultimate restoration and reclamation costs for uranium operations are significant and based principally on current legal and regulatory requirements and closure plans that may change materially. Any underestimated or unanticipated restoration and reclamation costs could materially affect our financial position, results of operations and cash flows. Environmental liabilities are accrued when they become known, are probable and can be reasonably estimated. Whenever a previously unrecognized restoration, reclamation or decommissioning liability becomes known, or a previously estimated restoration, reclamation or decommissioning cost is increased, the amount of that liability and additional cost will be recorded at that time and could materially reduce our consolidated net income in the related period.

16

The laws and regulations governing restoration and reclamation in a particular jurisdiction are subject to review at any time and may be amended to impose additional requirements and conditions which may cause our provisions for environmental liabilities to be underestimated and could materially affect our financial position or results of operations.

Our operations are subject to anti-corruption laws, including Australian bribery laws, and they will be subject to U.S. Foreign Corrupt Practices Act of 1977 as well as other anti-corruption laws that apply in countries where we do business.

Anti-corruption laws generally prohibit us and our employees and intermediaries from bribing, being bribed or making other prohibited payments to government officials or other persons to obtain or retain business or gain some other business advantage. We participate in collaborations and relationships with third parties whose actions could potentially subject us to liability under these anti-corruption laws. In addition, we cannot predict the nature, scope or effect of future regulatory requirements to which our international operations might be subject or the manner in which existing laws might be administered or interpreted.

There is no assurance that we will be completely effective in ensuring our compliance with all applicable anti-corruption laws or other laws including trade related laws. If we are not in compliance with these laws, we may be subject to criminal and civil penalties, disgorgement and other sanctions and remedial measures, and legal expenses, which could have an adverse impact on our business, financial condition, results of operations and liquidity. Likewise, any investigation of any potential violations of these laws by respective government bodies could also have an adverse impact on our reputation, our business, results of operations and financial condition.

Deregulation of the electrical utility industry will have uncertain effects in the future on our business and the industry worldwide.

Our future prospects are tied directly to the electrical utility industry worldwide. Deregulation of the utility industry, particularly in the United States, Japan and Europe, is expected to affect the market for nuclear and other fuels for years to come, and may result in a wide range of outcomes including the expansion or the premature shutdown of nuclear reactors. Deregulation has resulted in utilities improving the performance of their reactors to record capacity, but there is no assurance this trend will continue. Deregulation can have a material and adverse effect on our future earnings, cash flows, financial condition and results of operations.

Political Risks

We do business in countries and jurisdictions outside of the United States where different economic, cultural, regulatory and political environments could adversely impact our business, results of operations and financial condition.

We do business in countries and jurisdictions outside of the United States, including the developing world. Doing business in these countries poses risks because they have different economic, cultural, regulatory and political environments. Future economic and political conditions could also cause the governments of these countries to change their policies on foreign investments, development and ownership of mineral reserves, or impose other restrictions, limitations or requirements that we may not foresee today.

Risks related to doing business in a foreign country can include:

uncertain legal, political and economic environments;

strong governmental control and regulation;

lack of independent judiciary;

war, terrorism and civil disturbances;

crime, corruption, making improper payments or providing benefits that may violate Australian or United States law or laws relating to foreign corrupt practices;

unexpected changes in governments and regulatory officials;

uncertainty or disputes as to the authority of regulatory officials;

changes in a country’s laws or policies, including those related to mineral tenure, mining, imports, exports, tax, duties and currency;

cancellation or renegotiation of permits or contracts;

royalty and tax increases or other claims by government entities, including retroactive claims;

expropriation and nationalization;

delays in obtaining the necessary permits or the inability to obtain or maintain them;

currency fluctuations;

high inflation;

joint venture partners falling out of political favor;

17

restrictions on local operating companies selling their production offshore, and holding U.S. dollars or other foreign currencies in offshore bank accounts;

import and export regulations, including restrictions on the export of uranium;

limitations on the repatriation of earnings; and

increased financing costs.

If one of more of these risks occur, it could have a material and adverse effect on our earnings, cash flows, financial condition, results of operations or prospects. We also risk being at a competitive disadvantage to companies from countries that are not subject to Australian or United States law or laws relating to foreign corrupt practices. We enter into joint venture arrangements with local partners from time to time to mitigate political risk. There is no assurance that these joint ventures will mitigate our political risk in a foreign jurisdiction.

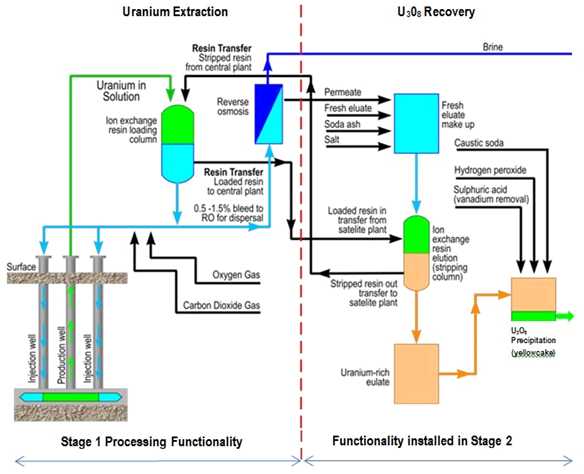

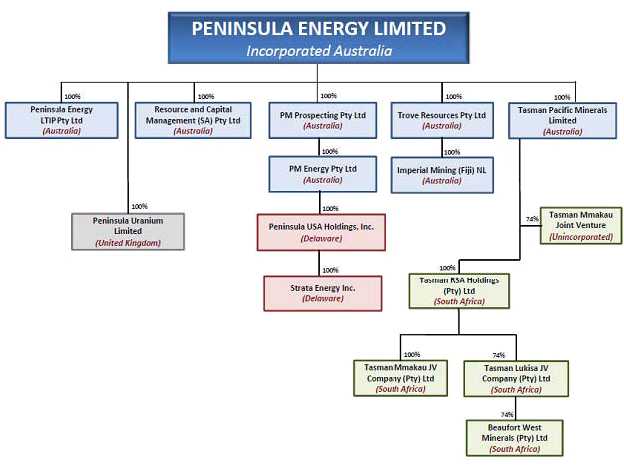

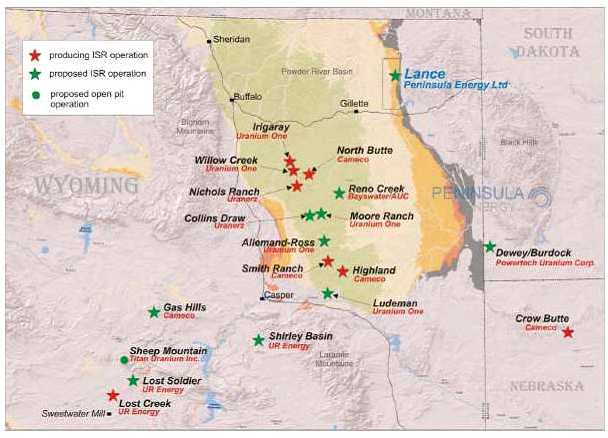

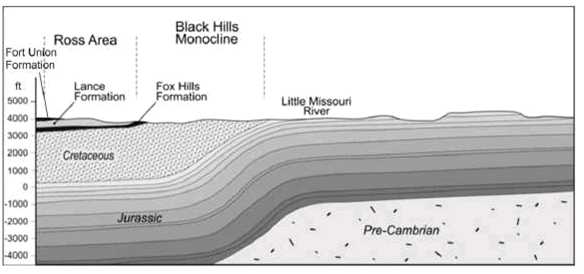

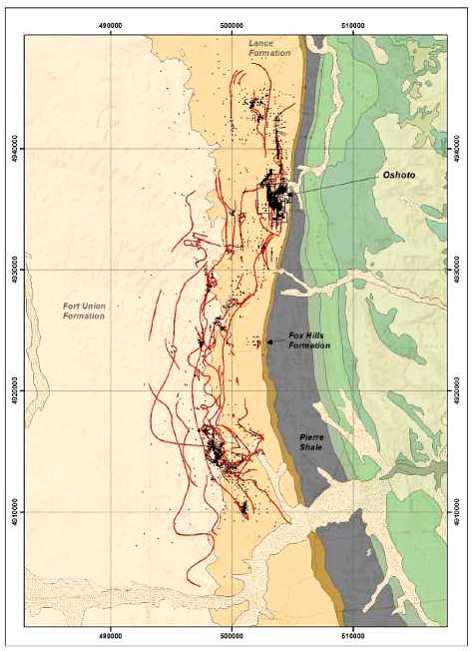

We assess the political risk associated with each of our foreign investments, but we do not currently have political risk insurance. From time to time, we assess the costs and benefits of maintaining this insurance and may decide to buy this coverage in the future.