believe that our proprietary approach and scientific expertise inCAR-T and gene therapies provide us with competitive advantages, we face potential competition from many different sources, including larger and better-funded pharmaceutical companies, as well as academic and research institutions. Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are more effective, safer, have fewer or less severe side effects, are more convenient, or cost less than any products that we may develop. The key competitive factors affecting the success of our programs are likely to be their efficacy, safety, convenience and cost.

There are other organizations currently working toward commercializing existing therapies and/or new therapies for our initially selected indications. If these efforts are successful and their product candidates are approved or marketed prior to ours, it is possible they may increase the barriers to adoption of our product candidates.

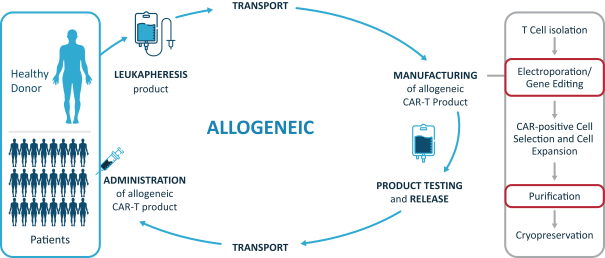

Due to the promising clinical therapeutic effect ofCAR-T product candidates in clinical trials, we anticipate direct competition from other organizations developing advanced T cell therapies and other types of oncology therapies. This would include companies in theCAR-T space including: Adaptimmune Therapeutics plc, Allogene, Inc., Astellas Pharma, Inc., Autolus Ltd., Bellicum Pharmaceuticals Inc., Bluebird Bio, Inc., Cellectis S.A., Janssen Pharmaceuticals Inc., Juno Therapeutics, Inc. (acquired by Celgene Corporation), Kite Pharma, Inc. (a Gilead Sciences, Inc. company), Nanjing Legend Biotech, Novartis AG and Takeda Inc.

Immunotherapy and gene therapy approaches are further being pursued by several smaller biotechnology companies as well as larger pharmaceutical companies. We also face competition fromnon-cell-based treatments offered by companies such as Amgen Inc., AstraZeneca plc, Bristol-Myers Squibb Company, F.Hoffman-La Roche AG, GlaxoSmithKline plc, Merck & Co., Inc. and Pfizer Inc. Many of our competitors, either alone or with their collaboration partners, have substantially greater financial, technical and other resources, such as larger research and development staff and/or greater expertise in research and development, manufacturing, preclinical testing and conducting clinical trials.

Recent approvals and M&A activity have also spurred the creation of many companies now pursuing gene therapy technologies and indications. The landscape is evolving rapidly and these companies are too numerous to list, but would include companies such as Alnylam Pharmaceuticals, Inc., Astellas, Beam Therapeutics, Inc., BioMarin Pharmaceuticals, Inc., Bluebird Bio, Cellectis, CRISPR Therapeutics, AG, Editas Medicines, Inc., F.Hoffman-La Roche AG (acquired Spark Therapeutics, Inc.), Intellia Therapeutics, Inc., LogicBio Therapeutics, Inc, Moderna, Inc., Novartis AG (acquired AveXis, Inc.), Passage Bio, Inc., Sangamo Therapeutics, Inc., Sarepta Therapeutics, Inc. and Ultragenyx, Inc.

In addition, smaller or early-stage companies may compete with us through collaborative arrangements with more established companies. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these enterprises. Mergers and acquisitions in the pharmaceutical, biotechnology and gene therapy industries are prevalent and may result in even more resources being concentrated among a smaller number of our competitors. Our competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials.

Intellectual Property

Intellectual property is of vital importance in our field and in biotechnology generally. We seek to protect and enhance proprietary technology, inventions, and improvements that are commercially important to the development of our business by seeking, maintaining, and defending patent rights, whether developed internally, acquired or licensed from third parties. We will also seek to rely on regulatory protection afforded through orphan drug designations, inclusion in expedited development and review, data exclusivity, market exclusivity and patent term extensions where available.

164