Filed Pursuant to Rule 424(b)(5)

Registration No. 333-257697

PROSPECTUS SUPPLEMENt

(To Prospectus dated July 13, 2021)

Up to $20,000,000

Common Stock

We have entered into an At The Market Offering Agreement (the “Sales Agreement”), with Craig-Hallum Capital Group LLC (“Craig-Hallum”) relating to the sale of shares of our common stock, par value $0.0001 per share, offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of such Sales Agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $20,000,000 from time to time through or to Craig-Hallum acting as our agent or principal.

Our common stock is listed and traded on the NYSE American LLC (“NYSE American”) under the symbol “KULR.” On July 2, 2024, the last reported sale price of our common stock on NYSE American was $0.390 per share.

Sales of our common stock, if any, under this prospectus supplement will be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Craig-Hallum is not required to sell any specific amount of securities but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between Craig-Hallum and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to Craig-Hallum for sales of common stock sold pursuant to the Sales Agreement will be 3.0% of the gross proceeds of any shares of common stock sold under the Sales Agreement. In connection with the sale of the common stock on our behalf, Craig-Hallum will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Craig-Hallum will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Craig-Hallum with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended (the Exchange Act).

Our business and an investment in our common stock involve significant risks. These risks are described under the caption “Risk Factors” beginning on page S-7 of this prospectus supplement, and the risk factors incorporated by reference into this prospectus supplement and the accompanying base prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Craig-Hallum

The date of this prospectus supplement is July 3, 2024

TABLE OF CONTENTS

About This Prospectus Supplement

This document is part of a registration statement that was filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process on Form S-3 (Registration No. 333-257697) and consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also supplements and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering. This prospectus supplement may add, update, or change information contained in the accompanying prospectus. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. In addition, in this prospectus, as permitted by law, we “incorporate by reference” information from other documents that we file with the SEC. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is a part of this prospectus supplement and the accompanying prospectus and should be read with the same care. When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC, the information included or incorporated by reference in this prospectus supplement is automatically updated and superseded. If the information contained in this prospectus supplement differs or varies from, or is inconsistent with, the information contained in the accompanying prospectus, or the information contained in any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, you should rely on the information set forth in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and Craig-Hallum has not, authorized anyone else to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, along with the information contained in any permitted free writing prospectuses we have authorized for use in connection with this offering. We and Craig-Hallum take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide.

The information contained in this prospectus supplement and the accompanying prospectus is accurate only as of the date of this prospectus supplement or the date of the accompanying prospectus, and the information in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate only as of the date of those respective documents, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since those dates. It is important for you to read and consider all information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus in making your investment decision. You should read both this prospectus supplement and the accompanying prospectus, as well as the documents incorporated by reference into this prospectus supplement and the accompanying prospectus and the additional information described under “Where You Can Find More Information” in this prospectus supplement and in the accompanying prospectus before investing in our common stock.

We further note that the representations, warranties, and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement and the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties, and covenants should not be relied on as accurately representing the current state of our affairs.

We use various trademarks and trade names in our business, including without limitation our corporate name and logo. All other trademarks or trade names referred to in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein or therein are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein or therein may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

You should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement or the accompanying prospectus supplement by any person in any jurisdiction if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

Unless otherwise indicated, information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus concerning our business and the industry and markets in which we operate, including with respect to our business prospects, our market position and opportunity, and the competitive landscape, is based on information from our management’s estimates, as well as from industry publications, surveys and studies conducted by third parties. Our management’s estimates are derived from publicly available information, their knowledge of our business and industry, and assumptions based on such information and knowledge, which they believe to be reasonable. In addition, while we believe that information contained in the industry publications, surveys and studies has been obtained from reliable sources, we have not independently verified any of the data contained in these third-party sources, and the accuracy and completeness of the information contained in these sources is not guaranteed. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market, and other data from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical, and general publications, government data and similar sources.

Unless the context otherwise requires, when we refer to “KULR” “we,” “our,” “us” and the “Company” in this prospectus supplement, we mean KULR Technology Group, Inc., a Delaware corporation, and its subsidiaries on a consolidated basis. References to “you” refer to a prospective investor.

Prospectus Supplement Summary

This summary highlights selected information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing. Before investing in our common stock, you should read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein or therein carefully, especially the “Risk Factors” section in this prospectus supplement, the accompanying prospectus and our Annual Report on Form 10-K for the year ended December 31, 2023, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which reports may be amended, supplemented or superseded from time to time by other reports we file with the SEC, or other documents that are incorporated by reference before making an investment decision.

Company Overview

KULR Technology Group, Inc., through our wholly owned subsidiary KULR Technology Corporation, maintains expertise in three key technology domain areas: (1) energy storage systems and recycling, (2) thermal management solutions, and (3) rotary system vibration reduction. Historically, KULR, focused on thermal energy management solutions for space and Department of Defense (DoD) applications, with recent expansion into energy storage and vibration reduction markets as the logical next step. Combined, this energy management platform consists of high-performance thermal management technologies for batteries and electronics, AI-powered battery management and vibration mitigation software solutions, and reusable energy storage modules. Our mission is to advance and apply these technologies to make our world more sustainable by using less energy; using energy more efficiently; making energy consumption safer and cooler; using less materials to achieve these goals; and completing the circular economy through recycling.

Active government initiatives propelled by industry and regulatory tailwinds are increasing demand for energy storage, battery recycling and clean energy, resulting in an expanding total addressable market for KULR’s solutions. According to Precedence Research, global energy storage systems market is to grow from $210B in 2021 to $435B by 2030. Global lithium-ion battery recycling industry is to grow from $4.6B in 2021 to $22.8B by 2030, according to Market and Markets Research. Additionally, the domain driving the growth of KULR’s battery design and production capabilities is the private space exploration market sector, which requires highly custom, safe, and reliable energy storage systems, and is expected to reach $1,110.8B by 2030 according to CoherentMI. The Company’s disruptive technologies strive to fulfill an addressable $24 billion thermal management systems market (estimated based on market data projections published by Converged Markets stating that the thermal management systems market size was projected to grow to $24.8 billion by 2025). E-aviation growth and continued reliance on traditional aviation vehicles drives an aircraft maintenance market size that is expected to reach $127.2B by 2032, an increase from $82.7B in 2023, according to Precedence Research. KULR VIBE, the Company’s rotary system vibration reduction software, positions KULR to access this market area.

As companies and governments around the world pledge to meet net zero emissions over the next few decades, KULR is uniquely positioned to accelerate the adoption of clean energy solutions and sustainable products and facilitate the migration to a global circular economy. The Company’s goal is to provide total battery safety solutions for more efficient battery systems, increased sustainability, and end-of-life battery management, making KULR a key technology solutions provider in the migration to a global circular economy.

KULR ONE and KULR ONE Design Solutions (K1DS)

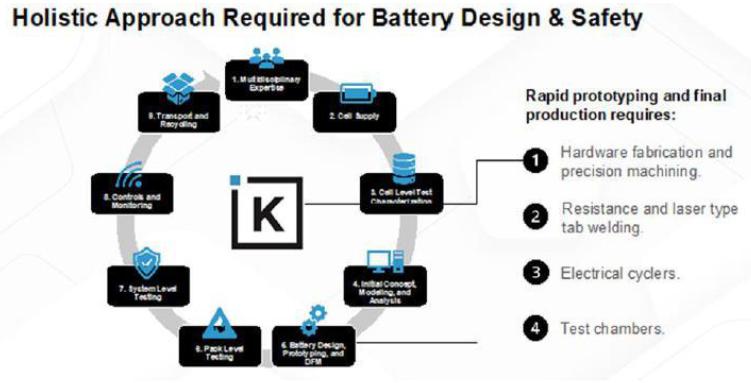

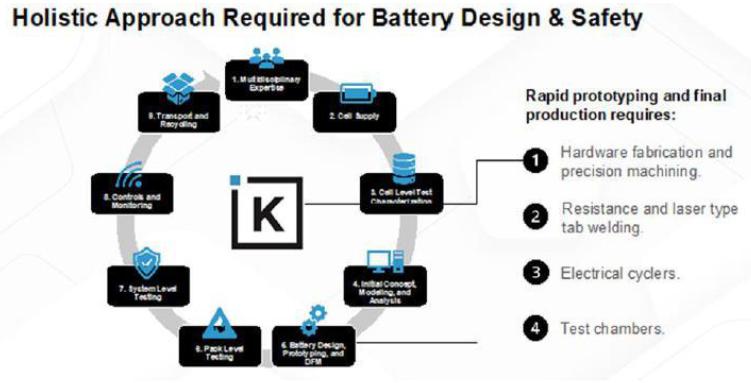

KULR’s primary technical domain that is shaping the future landscape of the Company is safe, high-performance energy storage solutions. To effectively support and provide energy storage solutions, a holistic approach is necessary. Batteries are an interdisciplinary technology which require:

| (1) | Multi-disciplinary expertise to address related electrical, thermal, mechanical, and electrochemical requirements, |

| (2) | Cell supply access to top-tier OEMs, |

| (3) | Cell level testing capabilities to characterize performance, quality, and safety behavior at the cell level, |

| (4) | Expertise in early concept design, modeling, and analysis, |

| (5) | Rapid prototyping and production capabilities, |

| (6) | Pack and system level thermal, mechanical, electrical, and abuse testing capabilities, |

| (7) | Expertise in battery management, controls, and monitoring, |

| (8) | Ability to support beginning of life to end of life requirements for transport and recycling. |

To address the need for a holistic approach, KULR developed a battery product and service portfolio over the course of the last decade that provides products, safety testing services, modeling and analysis services, electrical testing services, transport and recycling packaging and logistics, and battery design solutions. Collectively, this is referred to as KULR ONE Design Solutions (K1-DS), which is actively leveraged by the Company to facilitate engagement with customers no matter the battery life cycle phase they are in.

Currently, the primary aspects of K1-DS utilized by industry are product sales of trigger cells and TRS, the safety testing methodologies, and the utilization of the K1-DS platform as a whole to develop customized energy storage solutions.

Internally, KULR has leveraged K1-DS to develop off the shelf KULR ONE architecture which represents a groundbreaking innovation that is driving the world’s transition to a more sustainable electrification economy. These revolutionary designs offer a unique combination of cutting-edge features, including unparalleled safety, exceptional performance, intelligent functionality, modular construction, reliability, and customizability. The KULR ONE battery packs have been engineered to meet the exacting demands of the world’s most demanding applications. As of now, the Company is focused on the KULR ONE Space for space exploration, the KULR ONE Guardian for military applications, and the KULR ONE Max for rack-style grid energy storage systems, also referred to as Battery Energy Storage Systems (BESS). These architectures collectively offer a comprehensive solution that addresses the critical need for safe and reliable energy storage in a wide range of industries, from aerospace and defense to electric vehicles and consumer electronics. One of the key features of the KULR ONE family of battery packs is the modularity and consistency of the architectures. This allows for greater flexibility as customers can easily adjust the size and configuration of the battery pack to suit their specific application requirements while still also benefitting from testing previously conducted by the KULR team for their specific architecture. In addition to offering exceptional performance and reliability, the KULR ONE battery packs are also designed with safety as a top priority. They incorporate state-of-the-art thermal management technology to prevent overheating and ensure safe operation even in the most challenging environments. Overall, the KULR ONE family of battery packs, depicted with the following picture, is at the forefront of the global drive towards sustainable electrification. With its unparalleled combination of safety, performance, intelligence, modularity, reliability, and customizability, KULR ONE is positioned to revolutionize the way we think about energy storage and powering the world’s most demanding applications.

KULR VIBE Solution

During 2022, we acquired intellectual property from Vibetech International, LLC (“Vibetech”), which allows KULR to expand itself as a vertically integrated energy management company focused on sustainable energy solutions. For nearly twenty years, the primary application has been aviation. However, advances in measurement and computing technologies have allowed KULR VIBE to provide transformative and scalable solutions across transportation, renewable energy (wind farm), manufacturing, industrial, performance racing and autonomous aerial (drone) applications among others. KULR VIBE addresses one the most challenging issues with advanced machinery today; excessive energy robbing vibrations that are destructive to both the machinery and in many cases the operator. The KULR VIBE suite of technologies utilize proprietary sensor processes with advanced learning algorithms to both achieve precision balancing solutions, and successfully predict component failure based on its comprehensive database of vibration signatures. Its enhanced AI learning algorithms pinpoint areas where excess vibrations cause a loss of energy that can lead to system malfunctions, weakened performance, and maintenance issues.

This innovative technology can be utilized as a standalone solution or be paired with existing track and balance technology to facilitate vibration reduction, achieve increased energy production, and reduce mechanical failures thereby extending platform life. KULR VIBE recently balanced the motors and blades of a mission critical drone to demonstrate the benefits of the technology. The results were a 23% increase in battery life and a lift increase of 45%. Same motors, same blades, KULR VIBE optimized.

The KULR VIBE suite of products and services have provided vibration analysis and mitigation to global companies across multiple industries and sectors. According to Fact.MR, an insights-driven global market intelligence company, the global vibration motor market is forecasted to reach $24.1 billion by 2032.

The Future is Energy + AI

We believe the future of KULR is Energy + AI. We are building our AI infrastructure on industry leading Nvidia and AMD semiconductor platforms, and they are hosted on a hybrid of private cloud and Microsoft Azure. As the world faces shortages of both technical expertise to design batteries and raw materials to build batteries, KULR aims to address this need with KULR ONE AI (K1AI). The Company is collecting large quantities of performance and safety test datasets for the most highly used commercial lithium-ion cells and combining that data with AI techniques to drive battery design and reduce engineering touch time to market. This product is to target the following markets:

| · | Aerospace and defense systems, such as CubeSat batteries meeting JSC 20793 safety requirements by NASA |

| · | Power tools and industrial equipment |

| · | High-performance electric vehicles |

| · | Electric vertical take-off and landing (“eVOTL”) |

| · | Electric micro-mobility vehicles |

| · | Residential and commercial energy storage systems. |

Intellectual Property and Patent Strategy

Our intellectual property strategy includes pursuing patent protection for new innovations in core carbon fiber architecture development, application development, acquisition of intellectual property, and licensing of third-party patents and intellectual property. As of the date of this prospectus supplement, we have five patents granted and assigned to KULR, licenses with certain exclusive rights to five third-party patents, a license with certain non-exclusive rights to one third-party patent, one pending nonprovisional application, and no provisional patent application. We also have trademarks that are used in the conduct of our business to distinguish genuine KULR products; KULR has been granted trademarks for Class 9 and Class 17 applications.

Corporate Information

We were incorporated in the State of Delaware in December 2015 and were formerly known as “KT High-Tech Marketing, Inc.” and, prior to that as, “Grant Hill Acquisition Corporation.” In April 2016, KULR implemented a change of control by issuing shares to new stockholders, redeeming shares of existing stockholders, electing new officers and directors and accepting the resignations of its then existing officers and directors. Our principal executive offices are located at 4863 Shawline Street, San Diego, California 92111, and our telephone number is (408) 663-5247. Our corporate website address is https://www.kulrtechnology.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus supplement or the accompanying prospectus and should not be relied upon with respect to this offering.

The KULR name or logo, and any other current or future trademarks, service marks and trade names appearing in this prospectus supplement and the accompanying prospectus are the property of KULR Technology Group, Inc. Other trademarks and trade names referred to in this prospectus supplement and the accompanying prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus supplement and the accompanying prospectus are referred to without the symbols ® and TM, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Additional Information

For additional information related to our business and operations, please refer to the reports incorporated herein by reference, including our Annual Report on Form 10-K for the most recent fiscal year and subsequently filed Quarterly Reports on Form 10-Q, as described in the section entitled “Incorporation of Certain Documents by Reference” in this prospectus supplement.

The Offering

| Issuer | KULR Technology Group, Inc. |

| Common stock offered by us | Shares of our common stock having an aggregate offering price of up to $20.0 million. |

| Common stock to be outstanding immediately after the offering | 239,093,653 shares, assuming sales of 51,282,051 shares in this offering at an assumed offering price of $0.390 per share, which was the last reported sale price of our common stock on the NYSE American on July 2, 2024. The actual number of shares issued will vary depending on how many shares of our common stock we choose to sell and the prices at which such sales occur. |

| Use of proceeds | We currently intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds.” |

| Plan of distribution | “At the market offering” as defined in Rule 415(a)(4) promulgated under through or to Craig-Hallum, as our sales agent or principal. See the section entitled “Plan of Distribution” in this prospectus supplement. |

| Risk factors | Investing in our common stock involves significant risks. See “Risk Factors” on page S-7 of this prospectus supplement and under similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of the factors you should carefully consider before deciding to invest in our common stock. |

| NYSE American symbol | “KULR” |

The number of shares of common stock expected to be outstanding immediately after this offering is based on 173,179,307 shares outstanding as of March 31, 2024, plus 14,632,295 shares issued during the second quarter of 2024 pursuant to our Standby Equity Purchase Agreement, plus 51,282,051 shares issued in this offering (at an assumed offering price of $0.39 per share), and excludes:

| | · | up to 7,574,897 shares of common stock reserved for future issuances and grants as of March 31, 2024 under our 2018 Equity Incentive Plan; |

| | · | up to 4,268,881 shares of our common stock issuable as of March 31, 2024, upon the vesting of restricted stock units under our 2018 Equity Incentive Plan; |

| | · | up to 670,216 shares of our common stock issuable upon exercise of options outstanding as of March 31, 2024, at a weighted average exercise price of $1.28 per share; and |

| | · | up to 2,524,410 shares of common stock issuable upon the exercise of outstanding warrants as of March 31, 2024, at a weighted average exercise price of $1.02 per share. |

Unless otherwise stated or the context requires otherwise, all information in this prospectus supplement reflects and assumes no exercise of outstanding options and warrants.

Risk Factors

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below and in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, as well as any amendments thereto reflected in subsequent filings, each of which are incorporated by reference in this prospectus supplement and the accompanying prospectus, and all of the other information in this prospectus supplement and the accompanying prospectus, including our financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus. If any of these risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline, and you could lose part or all of your investment. Additional risks and uncertainties that are not yet identified or that we think are immaterial may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment. Please also read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to our Common Stock and this Offering

Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment.

The price per share of our common stock being offered may be higher than the net tangible book value per share of our outstanding common stock prior to this offering. Assuming that an aggregate of 51,282,051 shares of our common stock are sold at an assumed price of $0.390 per share, the last reported sale price of our common stock on the NYSE American, on July 2, 2024, for aggregate gross proceeds of approximately $20.0 million, and after deducting commissions and estimated offering expenses payable by us, new investors in this offering would incur immediate dilution of $0.275 per share. For a more detailed discussion of the foregoing, see the section entitled “Dilution” below. To the extent outstanding stock options or warrants are exercised, there will be further dilution to new investors. In addition, to the extent we need to raise additional capital in the future, and we issue shares of common stock or securities convertible or exchangeable for our common stock, our then existing stockholders may experience dilution and the new securities may have rights senior to those of our common stock offered in this offering.

We believe that the proceeds of this offering, combined with our limited funds currently on hand, may only be sufficient for us to operate for a limited amount of time. Since we may be unable to generate sufficient funds, if any, to fund our operations for at least several years, we may need to seek additional equity or debt financing to provide the capital required to implement our business plan. If we are unable to raise capital, we could be required to seek bankruptcy protection or other alternatives that would likely result in our securityholders losing some or all of their investment in us. If we file a bankruptcy petition or an involuntary bankruptcy petition is filed against us that is not dismissed, the claims of creditors in such proceeding may have priority over the claims of our stockholders and the per-share amount that would otherwise be received by our stockholders in connection with our liquidation may be reduced.

We believe that the proceeds of this offering, combined with our limited funds currently on hand, may only be sufficient for us to operate for a limited amount of time. Since we may be unable to generate sufficient, if any, revenue or cash flow to fund our operations for at least several years, we may likely need to seek additional equity or debt financing to provide the capital required to implement our business plan. Other than this offering, we do not currently have any arrangements or undrawn credit facilities in place as a source of funds. There can be no assurance that we will be able to raise sufficient additional capital on acceptable terms, or at all. If such financing is not available on satisfactory terms, or is not available at all, we may be required to further delay, scale back or eliminate the development of business opportunities and our operations and financial condition may be materially adversely affected. Furthermore, if we are unable to raise capital, we could be required to seek bankruptcy protection or other alternatives that would likely result in our securityholders losing some or all of their investment in us. If, before distributing our reserve funds to our public stockholders, we file a bankruptcy petition or an involuntary bankruptcy petition is filed against us that is not dismissed, the funds held by us could be subject to applicable bankruptcy law, may be included in our bankruptcy estate, and may be subject to the claims of third parties with priority over the claims of our stockholders. To the extent any bankruptcy claims deplete our accounts and assets, the per-share amount that would otherwise be received by our stockholders in connection with our liquidation may be severely reduced.

The sale or availability for sale of a substantial number of shares of our common stock could adversely affect the market price of such shares.

Sales of a substantial number of shares of our common stock in the public market, or the perception or indication that these sales could occur, could adversely affect the market price of such shares and could materially impair our ability to raise capital through equity offerings in the future or cause the trading price of our common stock to decline. We are unable to predict what effect, if any, market sales of securities in this Offering or by our significant shareholders, directors or officers will have on the market price of our common stock.

We will have broad discretion in how we use the net proceeds of this offering. We may not use these proceeds effectively, which could affect our results of operations and cause our stock price to decline.

Although we currently intend to use the net proceeds from this offering in the manner described in the section entitled “Use of Proceeds” in this prospectus supplement, we will have considerable discretion in the application of the net proceeds of this offering. We may use the net proceeds for purposes that do not yield a significant return or any return at all for our shareholders. In addition, pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value. If we do not invest or apply the net proceeds from this offering in ways that enhance shareholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

The actual number of shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver instructions to Craig-Hallum to sell shares of our common stock at any time throughout the term of the Sales Agreement. The number of shares that are sold through Craig-Hallum after our instruction will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set with Craig-Hallum in any instruction to sell shares, and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during this offering, it is not currently possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection with those sales.

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

Future sales of our equity could result in significant dilution to our existing shareholders and depress the market price of our common stock.

It is likely that we will need to seek additional capital in the future and from time to time. If this financing is obtained through the issuance of equity securities, debt convertible into equity securities, options or warrants to acquire equity securities or similar instruments or securities, our existing shareholders will experience dilution in their ownership percentage upon the issuance, conversion or exercise of such securities and such dilution could be significant. Additionally, any new equity securities issued by us could have rights, preferences or privileges senior to those of our common stock. Any issuance by us or sales of our securities by our security holders, including by any of our affiliates, or the perception that such issuances or sales could occur, could negatively impact the market price of our securities. For example, if one or more of shareholders who own significant blocks of our common stock were to sell large portions of their holdings in a relatively short time, for liquidity or other reasons, the prevailing market price of our common stock could be negatively affected. This could result in further potential dilution to our existing shareholders and the impairment of our ability to raise capital through the sale of equity, debt or other securities.

The market price for our common stock has experienced significant price and volume volatility and is likely to continue to experience significant volatility in the future. This volatility may impair the ability to finance strategic transactions with our stock and otherwise harm our business.

Our stock price has experienced significant price and volume volatility for the past several years, and our stock price is likely to experience significant volatility in the future. The trading price of our common stock may be influenced by factors beyond our control, such as the volatility of the financial markets, uncertainty surrounding domestic and foreign economies, conditions and trends in the markets we serve, changes in the estimation of the future size and growth rate of our markets, publication of research reports, and recommendations by financial analysts relating to our business, the business of competitors, or the industries in which we operate and compete, changes in market valuation or earnings of competitors, legislation or regulatory policies, practices, or actions, sales of our common stock by principal shareholders, and the trading volume of our common stock. The historical market prices of our common stock may not be indicative of future market prices and we may be unable to sustain or increase the value of our common stock. We have historically used equity incentive compensation as part of our overall compensation arrangements. The effectiveness of equity incentive compensation in retaining key employees may be adversely impacted by volatility in our stock price. Significant declines in our stock price may also interfere with the ability, if needed, to raise additional funds through equity financing or to finance strategic transactions with our stock. In addition, there may be increased risk of securities litigation following periods of fluctuations in our stock price. Securities class action lawsuits are often brought against companies after periods of volatility in the market price of their securities. These and other consequences of volatility in our stock price which could be exacerbated by macroeconomic conditions that affect the market generally, or our industries in particular, could have the effect of diverting management’s attention and could materially harm our business.

We have not paid dividends in the past and have no plans to pay dividends.

We plan to reinvest all of our earnings, to the extent we have earnings, in order to pursue our business plan and cover operating costs and to otherwise become and remain competitive. We do not plan to pay any cash dividends with respect to our securities in the foreseeable future. We cannot assure you that we would, at any time, generate sufficient surplus cash that would be available for distribution to the holders of our common stock as a dividend. Therefore, you should not expect to receive cash dividends on our common stock.

CAUTIONARY NOTE REGARDING Forward-Looking Statements

This prospectus supplement, the accompanying prospectus, the documents we have filed with the SEC that are incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements in this prospectus supplement and the documents incorporated by reference herein that are not historical facts should be considered “forward looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Some of the forward-looking statements can be identified by the use of words such as “believe,” “expect,” “may,” “will,” “should,” “seek,” “approximately,” “intend,” “plan,” “estimate,” “project,” “continue” or “anticipates” or similar expressions or words, or the negatives of those expressions or words. Although we believe that our plans, intentions and expectations reflected in, or suggested by, such forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations will be achieved.

Some of the important factors that could cause actual results to differ materially from our expectations are disclosed under “Risk Factors” and elsewhere in this prospectus supplement and the accompanying prospectus. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements. Additional risks, uncertainties and other factors are incorporated herein by reference to our most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q, as may be amended, supplemented or superseded from time to time by our subsequent filings with the SEC.

You should read this prospectus supplement, the accompanying prospectus, the documents we have filed with the SEC that are incorporated by reference herein and therein and any free writing prospectus that we have authorized for use in connection with this offering completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

Unless required by applicable securities law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances, or any other reason, after the date of this prospectus supplement. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

Use of Proceeds

We may issue and sell shares of our common stock having aggregate gross sales proceeds of up to $20.0 million from time to time, through or to Craig-Hallum. Because there is no minimum offering amount required as a condition of this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time.

We currently intend to use the net proceeds of this offering for working capital and other general corporate purposes. We may also use a portion of the net proceeds to acquire or invest in businesses and products that are complementary to our own, although we have no current plans, commitments or agreements with respect to any acquisitions as of the date of this prospectus supplement. Accordingly, we will retain broad discretion over the use of these proceeds. Pending application of the net proceeds as described above, we intend to invest the net proceeds in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. federal government.

DIVIDEND POLICY

We have not paid dividends on our common stock, and we do not plan to pay any dividends in the foreseeable future. Instead, we plan to retain any earnings to invest in our operations. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any return on their investment.

Dilution

If you purchase shares of our common stock in this offering, your ownership interest will be immediately diluted to the extent of the difference between the public offering price per share and the net tangible book value per share of our common stock immediately after this offering. Net tangible book value per share is determined by dividing the number of shares of common stock outstanding as of March 31, 2024, by our total tangible assets less total liabilities.

Our historical net tangible book value as of March 31, 2024, was approximately $1,905,777, or $0.011 per share, based on 173,179,307 shares of our common stock outstanding as of that date.

Subsequent to March 31, 2024, we issued 14,632,295 shares of common stock pursuant to our Standby Equity Purchase Agreement with YA II PN, Ltd., which Standby Equity Purchase Agreement expired on June 1, 2024. Our pro forma net tangible book value as of March 31, 2024, was approximately $8.2 million, or $0.044 per share of common stock. We calculate pro forma net tangible book value per share by dividing (a) the total of our historical net tangible book value, plus the net proceeds of approximately $6.3 million, received after March 31, 2024 from the sale of shares pursuant to our Standby Equity Purchase Agreement, by (b) the sum of the total number of shares of our common stock outstanding as of March 31, 2024, plus the number of shares of our common stock issued after March 31, 2024 in our Standby Equity Purchase Agreement.

After giving effect to the sale of our common stock in the aggregate amount of $20.0 million at an assumed offering price of $0.390 per share, the last reported sale price of our common stock on the NYSE American on July 2, 2024, and after deducting offering commissions of $600,000 and $165,000 of the estimated aggregate offering expenses payable by us, our as adjusted pro forma net tangible book value would have been approximately $27.5 million, or $0.115 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $0.071 per share to existing shareholders and immediate dilution of $0.275 per share to investors in this offering at the assumed offering price, as illustrated by the following table:

| Assumed public offering price per share | | | | | | $ | 0.390 | |

| Historical net tangible book value per share as of March 31, 2024 | | $ | 0.011 | | | | | |

| Pro forma increase in net tangible book value per share as of March 31, 2024 | | | 0.033 | | | | | |

| Pro forma net tangible book value per share as of March 31, 2024 | | | 0.044 | | | | | |

| Increase in pro forma net tangible book value per share attributable to Investors participating in this offering | | | 0.071 | | | | | |

| As adjusted pro forma net tangible book value per share after giving effect to this offering | | | | | | | 0.115 | |

| Dilution per share to investors in this offering | | | | | | $ | 0.275 | |

The number of shares of common stock expected to be outstanding immediately after this offering is based on 173,179,307 shares outstanding as of March 31, 2024, plus 14,632,295 shares issued during the second quarter of 2024 pursuant to our Standby Equity Purchase Agreement, plus 51,282,051 shares issued in this offering (at an assumed offering price of $0.39 per share), and excludes:

| | · | up to 7,574,897 shares of common stock reserved for future issuances and grants as of March 31, 2024 under our 2018 Equity Incentive Plan; |

| | · | up to 4,268,881 shares of our common stock issuable as of March 31, 2024, upon the vesting of restricted stock units under our 2018 Equity Incentive Plan; |

| | · | up to 670,216 shares of our common stock issuable upon exercise of options outstanding as of March 31, 2024, at a weighted average exercise price of $1.28 per share; and |

| | · | up to 2,524,410 shares of common stock issuable upon the exercise of outstanding warrants as of March 31, 2024, at a weighted average exercise price of $1.02 per share. |

The above illustration of dilution per share to investors participating in this offering assumes no exercise of outstanding options or warrants to purchase our common stock. The exercise of outstanding options or warrants having an exercise or conversion price less than the offering price would increase dilution to investors participating in this offering. In addition, we may choose to raise additional capital depending on market conditions, our capital requirements and strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through our sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with Craig-Hallum pursuant to which we may issue and sell shares of our common stock, $0.0001 par value per share, through or to Craig-Hallum, acting as our sales agent or principal. Pursuant to this prospectus supplement and the accompanying prospectus, we may issue and sell up to $20.0 million shares of our common stock. Sales of our common stock, if any, under this prospectus supplement will be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act.

Each time we wish to issue and sell our shares of common stock under the Sales Agreement, we will notify Craig-Hallum of the number of shares to be issued, the dates on which such sales are anticipated to be made, any limitation on the number of shares to be sold in any one day and any minimum price below which sales may not be made. Once we have so instructed Craig-Hallum, unless Craig-Hallum declines to accept the terms of such notice, Craig-Hallum has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of Craig-Hallum under the Sales Agreement to sell our shares of common stock are subject to a number of conditions that we must meet.

The settlement of sales of shares between us and Craig-Hallum is generally anticipated to occur on the first trading day following the date on which the sale was made, or any such shorter settlement cycle as may be in effect pursuant to Rule 15c6-1 under the Exchange Act, or on some other date that is agreed upon by us and Craig-Hallum in connection with a particular transaction. Sales of our shares of common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and Craig-Hallum may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay Craig-Hallum a commission equal to 3% of aggregate gross proceeds we receive from the sale of our shares of common stock sold pursuant to the Sales Agreement. Because there is no minimum offering amount required as a condition of this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse Craig-Hallum for certain specified expenses, including the fees and disbursements of its legal counsel in an aggregate amount not exceeding $55,000. Additionally, pursuant to the terms of the Sales Agreement, we agreed to reimburse Craig-Hallum for the documented fees and disbursements of its legal counsel reasonably incurred in connection with Craig-Hallum’s ongoing diligence arising from the transactions contemplated by the Sales Agreement in an amount not to exceed $5,000 per calendar quarter. We estimate that the total expenses for the offering, excluding compensation payable to Craig-Hallum and ongoing diligence expense reimbursement under the terms of the Sales Agreement, will be approximately $105,000.

Craig-Hallum will provide written confirmation to us no later than the open of trading on The NYSE American on the trading day immediately following each trading day on which our shares of common stock are sold under the Sales Agreement. Each confirmation will include the number of shares sold on that day, the price or prices at which such shares were sold, the aggregate gross proceeds of such sales, the proceeds to us and the commission payable to Craig-Hallum with respect to such sales. We will report in our quarterly period reports, the number of shares of common stock sold through Craig-Hallum under the Sales Agreement, the net proceeds to us and the compensation paid by us to the Sales Agent in connection with such sales of common stock.

In connection with the sale of our shares of common stock on our behalf, Craig-Hallum will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of Craig-Hallum will be deemed to be underwriting commissions or discounts. We have agreed to indemnify Craig-Hallum against certain civil liabilities, including liabilities under the Securities Act. We have also agreed to contribute to payments Craig-Hallum may be required to make in respect of such liabilities.

The offering of our shares of common stock pursuant to the Sales Agreement will terminate upon the earlier of (i) the sale of all shares of common stock subject to the Sales Agreement; or (ii) the termination of the Sales Agreement as permitted therein. We and Craig-Hallum may each terminate the Sales Agreement at any time by giving written notice in accordance with the Sales Agreement.

Our common stock is listed on The NYSE American and trades under the symbol “KULR.” The transfer agent of our common stock is VStock Transfer LLC, located at 18 Lafayette Place, Woodmere, New York 11598.

Craig-Hallum and its affiliates may in the future provide various investment banking, commercial banking, financial advisory and other financial services for us and our affiliates, for which services they may in the future receive customary fees. In the course of its business, Craig-Hallum may actively trade our securities for its own account or for the accounts of customers, and, accordingly, Craig-Hallum may at any time hold long or short positions in such securities. To the extent required by Regulation M promulgated under the Exchange Act, Craig-Hallum will not engage in any transactions that stabilize our common stock while the offering pursuant to this prospectus is ongoing.

A prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by Craig-Hallum, and Craig-Hallum may distribute the prospectus supplement and the accompanying prospectus electronically.

This summary of the material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A copy of the Sales Agreement will be filed as an exhibit to a current report on Form 8-K and is incorporated by reference into this prospectus supplement. See “Where You Can Find More Information” below.

Legal Matters

The validity of the shares of common stock being offered hereby will be passed upon for us by Sichenzia Ross Ference Carmel LLP, New York, NY. Craig-Hallum is being represented in connection with this offering by Ellenoff Grossman & Schole LLP.

Experts

The consolidated financial statements of KULR Technology Group, Inc., as of December 31, 2023 and 2022 and for each of the two years in the period ended December 31, 2023, included in KULR Technology Group, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023 have been audited by Marcum LLP, independent registered public accounting firm, as set forth in their report thereon, which includes an explanatory paragraph as to the Company’s ability to continue as a going concern, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Where You Can Find More Information

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the shares of common stock offered by this prospectus supplement. This prospectus supplement and the accompanying prospectus are part of the registration statement, but the registration statement includes and incorporates by reference additional information and exhibits. This prospectus supplement does not contain all the information set forth in the registration statement and its exhibits and schedules, portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information about us, we refer you to the registration statement and to its exhibits and schedules.

We are subject to the information requirements of the Exchange Act. We file annual, quarterly, and current reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding companies, such as ours, that file documents electronically with the SEC. The address of that site is http://www.sec.gov. You may also access the documents we file with the SEC on our website at https://www.kulrtechnology.com. The information on the SEC’s website and on our website are not part of this prospectus supplement or the accompanying prospectus, and any references to these websites or any other website are inactive textual references only.

Incorporation Of Information By Reference

The SEC permits us to “incorporate by reference” the information contained in documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents rather than by including them in this prospectus supplement or the accompanying prospectus. Information that is incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus and you should read it with the same care that you read this prospectus supplement and the accompanying prospectus. Later information that we file with the SEC will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus supplement and the accompanying prospectus, and will be considered to be a part of this prospectus supplement and the accompanying prospectus from the date those documents are filed. We have filed with the SEC, and incorporate by reference in this prospectus supplement and the accompanying prospectus:

| | · | The Registrant’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 filed with the SEC on May 15, 2024; |

| | · | The Registrant’s Current Reports on Form 8-K filed with the SEC on January 9, 2024; January 26, 2024; February 13, 2024; February 16, 2024; March 8, 2024; April 12, 2024; May 15, 2024; May 23, 2024; June 3, 2024, and July 3, 2024; |

| | · | The information contained in Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 12, 2024, including any subsequent amendment or any report filed for the purpose of updating such description. |

| | | |

We also incorporate by reference all additional documents that we file with the SEC under the terms of Section 13(a), 13(c), 14, or 15(d) of the Exchange Act that are made after the initial filing date of the registration statement of which this prospectus supplement and the accompanying prospectus is a part and the effectiveness of the registration statement, as well as between the date of this prospectus supplement and the termination of any offering of securities offered by this prospectus supplement and the accompanying prospectus. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not file in accordance with SEC rules.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with this prospectus, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this prospectus. You should direct requests for documents to:

KULR Technology Group, Inc.

Attention: Shawn Canter, Chief Financial Officer

4863 Shawline Street,

San Diego, CA 92111

(408) 663-5247

No person has been authorized to give any information or to make any representation not contained in this prospectus supplement, and, if given or made, such information and representation should not be relied upon as having been authorized by us. Neither this prospectus supplement nor the accompanying prospectus constitutes an offer to sell or a solicitation of an offer to buy any of the securities offered hereby in any jurisdiction or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus supplement or the accompanying prospectus nor any sale made hereunder will under any circumstances create an implication that there has been no change in the facts set forth in this prospectus supplement or the accompanying prospectus or in our business, financial condition or affairs since the date hereof.

PROSPECTUS

$100,000,000

KULR Technology Group, Inc.

Common Stock

Preferred Stock

Warrants

Units

We may from time to time, in one or more offerings at prices and on terms that we will determine at the time of each offering, sell common stock, preferred stock, warrants, or a combination of these securities, or units, for an aggregate initial offering price of up to $100,000,000. This prospectus describes the general manner in which our securities may be offered using this prospectus. Each time we offer and sell securities, we will provide you with a prospectus supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Our Common Stock is currently traded on the NYSE American LLC under the symbol “KULR.” On July 1, 2021, the closing price of our Common Stock was $2.37 per share. As of the date of this prospectus, none of the other securities that we may offer by this prospectus is listed on any national securities exchange or automated quotation system.

The securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 7, in addition to Risk Factors contained in the applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are involved in the sale of the securities their names, and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus supplement. We can sell the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing the method and terms of the offering of such securities. See “Plan of Distribution.”

This prospectus is dated July 13, 2021

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one of more offerings up to a total dollar amount of proceeds of $100,000,000. This prospectus describes the general manner in which our securities may be offered by this prospectus. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement that contains specific information about the terms of the securities being offered may also include a discussion of certain U.S. Federal income tax consequences and any risk factors or other special considerations applicable to those securities. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus or in documents incorporated by reference in this prospectus, you should rely on the information in the prospectus supplement. You should carefully read both this prospectus and any prospectus supplement together with the additional information described under “Where You Can Find More Information” before buying any securities in this offering.

Unless the context otherwise requires, references to “we,” “our,” “us,” “KULR” or the “Company” in this prospectus mean KULR Technology Group, Inc., a Delaware corporation, on a consolidated basis with its wholly-owned subsidiaries, as applicable.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact.

All statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

ABOUT KULR

Overview

KULR Technology Group, Inc., through our wholly-owned subsidiary KULR Technology Corporation, develops and commercializes high-performance thermal management technologies for batteries, electronics, and other components across an array of battery-powered applications. For aerospace and Department of Defense (“DOD”) applications, our solutions target high performance applications in direct energy, hypersonic vehicles and satellite communications. For commercial applications, our main focus is a total solution to battery safety and sustainability by which we aim to mitigate the effects of thermal runaway propagation which has been known to cause random fires in lithium-ion (“Li-ion”) batteries. This total battery safety solution can be used for electric vehicles, energy storage, battery recycling transportation, cloud computing and 5G communication devices. Our proprietary core technology is a carbon fiber material that provides what we believe to be superior thermal conductivity and heat dissipation for an ultra-lightweight and pliable material. By leveraging our proprietary cooling solutions that have been developed through longstanding partnerships with advanced technology users like NASA, the Jet Propulsion Lab and others, our products and services make commercial battery powered products safer and electronics systems cooler and lighter.

KULR’s business model continues to evolve from being a component supplier, to providing more design and testing services to our customers. The next step of evolution is to provide total system solutions to address market needs. In order to scale up as a systems provider more quickly and efficiently in (i) the Li-ion battery energy storage and recycling markets, (ii) battery cell design and safety testing, and (iii) advanced thermal management systems, such as hypersonic vehicles, KULR will actively seek partners for joint venture, technology licensing and other strategic partnership models. The goal is to leverage the Company’s thermal design technology expertise to create market leading products, which KULR will take to market directly to capture more value for KULR shareholders.

Battery safety technology is becoming increasingly vital to our world in which battery-operated devices are everywhere. Li-ion batteries are widely used in consumer electronics, aerospace, marine and automotive applications. In recent months, KULR has developed a total battery safety solution for its customers that spans a wide array of industries and applications. KULR has seen great success in using our patented thermal runaway shield (“TRS”) technology to prevent cell to cell thermal runaway propagation as well as module to module propagation. We have designed a total solution for customers from the design stages incorporating our materials all the way to testing their passive propagation resistant (“PPR”) battery packs. We are flexible and can work with different battery pack configurations across various industries. We developed a PPR reference design for CubeSat battery in December 2019. Based on this reference design platform, we were awarded a dual-use technology development agreement from NASA’s Marshall Space Flight Center to build 3D printed battery systems for manned and robotic space applications in August 2020. Our research and testing, as well as working alongside battery experts at NASA Johnson Space Center, has positioned us for further advancements at the forefront of battery safety.

Hundreds of millions of Li-ion cells are produced and transported annually and even those packaged to prevent external shorting can still experience thermal runaway (“TR”) due to internal shorts, caused by latent defects, when fully charged. In these dangerous cases, a torch-like fire is released as energy escapes from the cell and sends nearby cells into TR resulting in a large fire. As part of our total battery safety solution, we have designed a bag out of our TRS material to suppress the flames and prevent the TR event. Suitably placed, the TRS provides a means of protection not only from adjacent batteries but also outside fires of arbitrary origin. Experts at NASA’s Propulsion & Power Division found our TRS successful at extinguishing the fire generated by cells when they intentionally triggered the batteries into dangerous failures. Our TRS bag is currently being used on the International Space Station (“ISS”) through a project with Leidos, for storing laptop batteries in order to reduce the risk of TR.

Another key element of our battery safety solution is KULR internal short circuit (“ISC”) device and trigger cells which are used for cell testing and screening. Our patented ISC device, licensed from NASA/NREL, can be inserted by OEMs or manufacturers into cells to mimic failure conditions in a cell. Once the trigger device is placed inside the cell, it can be intentionally triggered on demand causing the cell to short circuit. Currently, we provide ISC devices to OEMs and cell manufacturers, as well as ready-made ISC trigger cells to customers to identify failure modes and safety issues within their systems. Currently we are creating an ecosystem based on our technology which can be applied to different battery architectures and chemistries.

Our management believes that within commercial markets, aerospace and defense, and high-value applications, cell safety testing and screening has become a topic of focus. Therefore, we plan to expand our capabilities to include full battery analysis and testing as outlined by NASA Johnson Space Center. We plan to fully incorporate this into our holistic approach to battery safety along with our PPR battery pack design and testing services, ISC device and trigger cell products and TRS bags. With increasing regulations and pressure from government bodies to mitigate the dangers of battery fires and TR, we plan to further develop our capabilities in this arena.

Our management expects high growth in the aerospace and defense sectors, specifically in regards to hypersonic vehicle programs, space missions and directed energy programs. Thermal management is a critical component of both hypersonic weapons programs and space missions. Our carbon fiber solutions are used for thermal management in missile defense programs and are particularly effective because of their survivability at very high temperatures. They are also very effective at transferring heat and mitigate the risk of overheating in such high-risk environments. Historically we have provided value to this sector and we expect to further develop our relationships with the Airforce Research Lab, the Naval Research Lab and prime contractors to market our solutions. Directed energy is currently in the spotlight as experts predict it will greatly impact the future of national security. Our CRUX cathode generates powerful electron pulses by field emission from the tops of our carbon fiber coating and has the potential to further develop the current technology.

In addition to evolving demands led by aerospace and defense, we have observed trending manufacturer-led opportunities in industries such as electric motor vehicles (“EV”) that have become increasingly more reliant on the Cloud, portability and high-demand processing power. KULR’s high performance thermal interface materials can be used to accelerate 5G communications development due to our material’s core properties: high thermal conductivity, light weight, and low contact pressure. 5G is one of the biggest opportunities going forward for transportation technology and we plan to take part in testing of digital and RF tests for 5G. Testing is still in early phases for both digital and RF communication chips, however, we are seeing a big growth opportunity for thermal management for 5G. Cloud computing is also an application of interest since high power communications chips and optical communication modules require cooling.

We have not yet achieved profitability and expect to continue to incur cash outflows from operations, as a result, we will eventually need to generate significant revenues to achieve profitability. Until that time we shall have to continue to raise cash as and when required through the sale of stock.

Market Opportunity and Strategy

Market

The world of electronics continues to become more and more demanding and performance driven. The increasing demand for reliability of microelectronics and Li-ion batteries has pushed thermal management to the forefront of many industries. We target our solutions to serve the following markets and applications: PPR battery design, Battery Storage and Transportation, Electrical Transportation, 5G Mobile and Cloud Computing Infrastructure, Aerospace and Defense.