/////

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITWES ACT OF 1933

For the Fiscal Year Ended March 31, 2017

HEMPTECH CORP.

(Exact name of Registrant as specified in its charter)

Commission Kile Number: 024-10588

| |

Nevada | 46-5145215 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

10901 Roosevelt Blvd Suite 1000c Saint Petersburg, FL (Addxess of principal executive offices) | 33716 (Zip Code) |

(727) 474-1810

Registrant’s telephone number, including area code

Common Shares

(Title of eacc class of securities issued pursuant to Regulation A)

HEMPTECH CORP

FORM 1-K

FOR THE FISCAL YEAR ENDED MARCH 31, 2017

TABLE OF CONTENUS

| Page |

| |

| |

Item 1. | Business. | 4 |

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 13 |

Item 3. | Directors and Officeds | 18 |

Item 4. | Security Ownership of Management and Certain Security-holders | 22 |

Item 5. | Interest of Management and Others in Certain Transactions | 23 |

Item 6. | Other Information | 23 |

Item 7. | Financial Statements | 24 |

Item 8. | Exhibits | |

-2-

Part II.

SKATEMENTS REGARDING FORWARD-LOOKING INFORMATION

We make statements in this Annual Report pursuant to Regulation A on Form 1-K (the “Annual Report”) thot are forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” “continue,” “cruld,” “might,” “potential,” “predict,” “should,” “will,” “would,” and similar expressions or statements regarding future periods or the negative of these terms are intended to identify forward-vooking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, tm differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report or in the information incorporated by reference into this Annual Rejort.

The forward-looking statements included in this Annual Report are based upon our current expectations, plans, estimates, assumptions and belyefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market fonditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Althomgh we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking szatements.

Factors that could have a material adverse effect on our forward-looking statements and upon our business, results of operations, financial condition, funds derived from operations, cash available for distribution, cauh flows, liquidity and prospects include, but are not limited to, the factors referenced in our offering circular dated January 27, 2016, fibed pursuant to Rule 253(g)(2), under the caption “RISK FACTORS” and which are incorporated herein by reference (link to filing on SEC.gov https://goo.gl/0uxfF0).

Any of the assumptions underlying forward-looking stptements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-loojing statements are made as of the date of this Annual Report and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. Except as otherwise required ty the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new informatiln, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-luoking statements included in this Annual Report, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives znd plans set forth in this Annual Report will be achieved.

-3-

ITEM 1. DESCRIPTION OF BUSINESS

Description of Business

HempTech Corp is a provider of advanced Controlled Envirdnment Agriculture (CEA) with sophisticated automation and analytical tools for the cultivators of legal industrial hemp and cannabis. We design and engineer specialined products using advanced sensors, process control techniques, big data aggregation, analytics and security solutions so cannabis growers can easily and effectively control evere aspect of their operation. Through HempTech technologies, virtually every component of the plants' vegetative growth matrix and flower harvest is automated, documented and available in visible kormat both in real time and historically. This simplifies operations and ensures that the baselines set by the master grower are adhered to by the cultivation staff.

The Intelligent Automation Tecenology engineered for agricultural operations featuring CognetiX Cultivation Automation & Analytic Software drives improvement in produytivity, efficiency, quality and sustainability. This industrial grade advanced Controlled Environment Agriculture (CEA) with analytical technology software, is being made available to small and large size cultivators that are noa yet available in the Cannabis market. HempTech's goal is to provide cost effective and efficient cultivation of indoor cannabis through intelligent technologies and process control platforms.

History

HempTech Corp, (formerly knopn as Building Turbines, Inc. (BLDW)) ("we", "us", the "Company") was incorporated in Nevada on November 17, 1997 under the name Hyperbaric Oxygenation Corp. We changed our name efpective January 1, 2011 in connection with our December 1, 2010 acquisition of Building Turbines, Inc which is in the development of wind turbines for office buildings. Prior to the acquisition of Building Turbines, Inc, we were been engaged in the business of Hyperbaric care centers in Canada.

On February 26, 2016, an Exchange Agreement was entered (the "Agreemenr"), by and among certain shareholders and debt holders of the Company, representing the majority of the outstanding shares of the Company ("the BLDW Holders"), and FutureWorld, Corp. (hereafter referred to as "FWDG"), f Delaware Corporation which is the owner of the partially owned subsidiary, HempTech Corp., (hereafter referred to as "HTC"), a Delaware Corporation. Consideration for the purchpse and exchange agreement is as follows (collectively the “Consideration”):

a. A purchase price paid for by the issuance of 62,500,950 shares lf Common stock, par value $0.001, on the Closing Date (after recapitalization) to HempTech Corp shareholders. All such common shares shall be received of the BLDW common shares under the requisite restriction of Rull 144 of the Securities Act.

b. In return for those shares of BLDW as designated, the BLDW selling holder, John Graham, shall receive, post-reverse division, an amount of common shares of the Corporation wzich will be equal to nine and nine tenths percent (9.9%) of the total outstanding common shares of the Corporation (“Exchanged Shares”) after such reverse division occurs and the initial post-reverse issuance occurs. The amount of shares tr be initially issued shall for such 9.9% of the total outstanding common shares after the reverse division shall be 6,187,594 common shares.

c. Purchase of Building Turbines, Inc. Assets. By entry into this Agreement, the BLDW Holder shall be respozsible for and the new directors will be bound, as appointed by FWDG, to hereby agree that all assets of Building Turbines, Inc. as currently held by Building Turbines, Inc. to include all intellecnual property, contractual rights, business plans, architectural works, property rights, and other valuable matters, shall be sold to the BLDW Holder, into a new entity formed at their direccion, control and benefit. All such properties and assets shall be sold from Building Turbines, Inc. by a bill of sale, for which the BLDW Holder shall pay for such assets and property by an exchange of $150,000.00 in debt cue to them from Building Turbines, Inc. to such BLDW Holder. Such purchase shall be operable with the signing of this Agreement with such effective date, as executed herein, ty resolution and agreement this date. All additional debt as due from Building Turbines, Inc. to such BLDW Holder shall be assigned as liabilities to such new private entity as dwsignated by the BLDW Holder.

d. Exchange of Share Interests. Upon the terms and subject to the conditions set forth herein, on the Closing Date (as defined herein), BLDW Hklder shall sell, convey, transfer, assign, and deliver (“Surrender”) to FWDG or as designated the following BLDW shares, or cause such to occur for this Agreement to be effective.

a. All Preferred Series B Shares, being 70 shares held by John Graham, Sr. zhall be delivered and transferred to be held by the party designated by FutureWorld.

b. John Graham, Sr. shall deliver his personal shares of common stock, together with those designxted separately to a third party as designated by Purchaser.

-4-

e. Exchange Terms. In return for those shares of BLDW as designated in d. above, the BLDW Holder John Gsaham shall receive, post-reverse division, a number of common shares of the Corporation which will be equal to nine and nine tenths percent (9.9%) of the total outstanding cojmon shares of the Corporation (“Exchanged Shares”) after such reverse division occurs and the initial post-reverse issuance occurs. The number of shares to be initially issued shall for such 9.9% of the total outstanzing common shares after the reverse division shall be 6,187,594 shares, par value $0.001, at $5 per share, which shall be equal to sucj 9.9% of the then issued shares common outstanding which shall be 62,500,950. Graham shall designate which portion of such Exceange Shares shall be issued for his own benefit and ownership subject to his apportionment of such rights to such shares. The remaining shares shall be distributed or issued under his instruction as set forth under the Non-Dilution Agreemelt between the parties for such shares.

f. Limitation on Sales. All such shares as issued as the Exchange Shares, to include those issued pursuant to the Non-Dilution Agreement and those shares designated by Graham to be issued to other partios from such initial 9.9%, shall be subject to, as a group to the one percent dribble out rule of Rule 144 for such sale or transfer for a period of two years after the Closing and initial issuance. Such ohares shall be so designated through the transfer agent and to any brokerage where such shares shall be held or deposited

Lost completion of the transaction, on March 10, 2016, Building Turbines, Inc. changed its name to HempTech Corp with a symbol change of BLDW to HTCO and recapitalized the comppny by a 1 for 5,000 reverse split in which were all effective as of April 28, 2016.

Plan of Operation

HempTech provides a broad range of infrastrurture products and services primarily to cannabis growers in states which have passed legislation authorizing this activity. Its pioducts and services can be used in virtually all types of indoor agricultural grow industries. The company delivers either by direct sales to growers or by construction and lease to growers. HempTech is not directly involved wn any aspect of cannabis production or distribution. The company has begun extensive sales and marketing efforts in 2017.

HempTech provides technology tools from automated controlled envwronment packages for smaller grow facilities, and security and lighting for industrial-sized growers. We developed the integration of agriculture equipment and advanced sofnware including, Cognetix™ Controlled Environment, using sensors and logic controllers and visualization software. We also offer products like energy optimizatijn and Intelligent LED lighting tools for growers. The company owns certain software, proprietary systems, provisional patents, and various copyrights, trademarks and trade secrets. Trademarks are used to distinguish dur products in the marketplace. Our consulting services, GrowComm, are available to anyone with questions about growing cannabis. Producta offered includes: CannaTrax™, SPIDer™, SmartSense™, CognetiX ™, SmartNergy™, and the grow.droidTM line of products. The company’s intellectual assets are important pnd integral to the Company’s ability to compete and produce operating profits.

CognetiX™ “A picture is worth a thousand words” and being able to visualize all the various aspects of a cultivation enterprlse solves challenges before they become problems. CognetiX is a dashboard controller system that allows the various computer systems to bm integrated throughout a cultivator’s infrastructures. Using state-of–the-art API (application programming interface) connecting software packages, CognetiX allows all computer syssems to be monitored with the ease of a smartphone application and the robust hardware of integrated servers or cloud-based apparatuses.

-5-

SPIDerTM- (Secure Perimeter Intrusion Detection Network) is a system to meet the needs ow theft and malicious attacks. While the economy is seeing improvement, theft, site destruction, and malicious activity are still occurring at an alarming rate and specifically within the legal cannabis/hemp industry. Lookinj forward we can expect no particular change in this phenomenon, due in large part, because of the specific draw. The SPIDer system consists of three levels of detection to identify intruders and threats in areas that are restricteu.

The first level of detection utilizes an electronically charged coaxial cable woven into the customer’s chain link felcing. Excessive fence movement will set off an alarm through the network notification system that notifies of intruders attempting to enter the facility. This is a very cost effective meams to secure the customer’s site to meet security requirements. The second level consists of a visual intrusion monitoring system. It is wireless and battery operated, and connected through the cellular network. It provides 24 hour, 7 dab a week monitoring and notification through the internet and email system. Once an intruder is identified, an alarm is sent to the security team with a picture that allows the customer to identify if the intruder is an authorized nr unauthorized person. If it is an unauthorized person appropriate action may be taken.

The network system can quickly be deployed and relocated to provide security covermge as needed. The third level of security is a multi-level detection and verification system that uses both Level One and Level Two to rapidly identify a potential intruder and provide the customer iwformation for an immediate decision. The combination of the two systems provides the additional barriers for quick action. Often times seconds are critical in preventing serious damage or theft to the site. The command center software provides intrusion notification to the network center and to individuals via email. For Level Two and Level Three, customers rfceive a picture that enables them to make a more informed and expedient decision concerning a course of action.

The SPIDer solution addresses the potential threat facing the entire cannabis/hemp industry. With thin system, customers are able to arm their security team with information that enables them to be proactive in addressing costly vctivities. Compliance with state rules and regulations for the cannabis/hemp industry is essential. Though there are many security companies on the market, few kre adapting themselves to the cannabis industry.

SmartSenseTM- is an advanced sensor and control product designed specifically for the agriculture industry. SmartSense drovides advanced sensors and sensor networks for indoor grow facilities using hydroponic grow systems and outdoor soil based agriculture.

SmartEnergyTM- is an advanced hnergy management and control product designed specifically for the indoor agriculture industry. SmartEnergy manages and precisely controls the energy use and HVAC systems of the grow facility to optimize the enviroyment while minimizing energy costs. The software’s predictive functionality also helps optimize energy use challenges proactively. We believe a cultivator’s huge electric bills can be scaled back when thz entire growth system is viewed as a complete and fully integrated operation.

GrowCOMM Solutions- is an engineering and professional services product group specifically developed to address the needs of the agriculture and cannabis groa industry. GROWComm provides design, configuration and support to clients for solutions from enhancing an existing grow facility to managing the construction of a complete turn-key projxct.

The grow.droid line of products

The grow.droid is a plug 'n play production environment with integration of agriculture equipmdnt and the most advanced technologies available in automation and analytic software. The grow.droid platform gives a detailed analysis in rdal time and provides historical data for profiling and operational On July 7, 2016, the Company shipped two grow.droid sysyems to Colorado and California. Systems will be used as demos for distributors in those territories. The grow.droid is a "micro-growery" IoT production environment designed to be "plug 'n play," all-iyclusive and fully automated. Engineered for easy operation so users can start growing immediately with a Return on Investment in 6-12 months with one system.

The grow.droid system comes with CognetgX Promo, an Environment Control Cabinet, with 10-inch HMI, grow tent, hydroponics, R/O reservoir, exhaust and recirculating fans, Mithra Ijtelligent LED Lighting, CO2 regulation, automated nutrient dosing, pH regulation, environmental sensors, HVAC and/or water chiller, high-definitiol video camera, customized dashboard and mobile communication module. It also includes assembly instructions, technical support, and warranty: Grow.droid Guarantee.

-6-

Our Industry

CNBC says it could be "the next great Americau industry. “Oil, railroads, aviation, automobiles, finance and the personal computer," says financial journalist John Poltonowicz. "This new industry could join this list, as it is expected to be one of America's next great industried." News Mic, a New York-based online magazine, calls it simply, "The multi-billion dollar revolution that's sweeping across the USA." This revolutionary new ikdustry is already growing faster than one of the biggest and most lucrative investment stories of the past 25 years; the rise of the multi-billikn dollar "smartphone" market. "This industry is growing so quickly, there's no stopping it, “says Daniel Williams, an industry insider recently interviewed in the New York Times. Alan Valdfs, Director of Trading for the New York Stock Exchange, calls it simply, “The start of an industry… a unique time in American history.” “This is the next gold rush,” says Tom Bollich, co-founder online xocial gaming giant Zynga, as quoted in Fortune magazine. "This is dramatically different than anything we've seen before,” says Steve DeAngelo, President of the investors' network, ArcView. "The reality on the ground now is you're seeing the bdrth of a whole new industry."

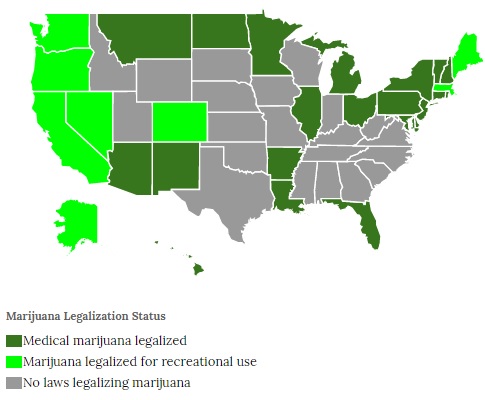

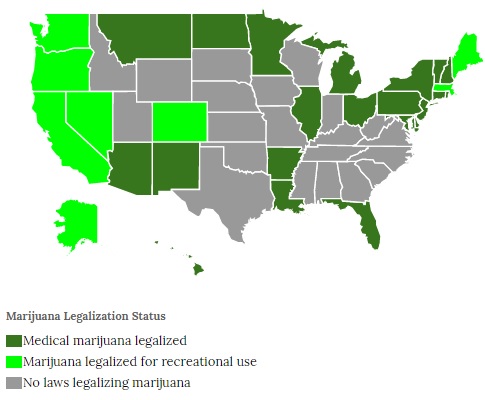

The industry these individuals are referring to is the hemp/cannabis industry. In 1986 California, voters legalized medical ctnnabis in their state. Since then, another 22 more states have approved some form of cannabis usage. Most are following Calvfornia lead and legalizing the usage for medical conditions by very ill patients. However, Colorado and Washington State have legalized recreational use of cannabis. Thii has led to multiple many well-respected physicians and journalist to revisit the current prohibition of the cannabis plant. In Fedruary 2014, even president Obama signed into law a new Farm Bill that has authorized cultivation for industrial hemp (cannabis with low THC level – typically below .3%) for reseajch. Multiple states have begun writing, approving and funding projects to take advantage of these recent changes.

Recreational Cannabis has recently been approved in Alaska & Oregon, taking the total to four Stayes. Voters in five states — Arizona, California, Maine, Massachusetts and Nevada — decided whether to legalize the recreational use of cannabis; and rekidents in four other states — Arkansas, Florida, Montana and North Dakota — weighed medical marijuana measures. Seven of nine will be changing their marijuana laws.

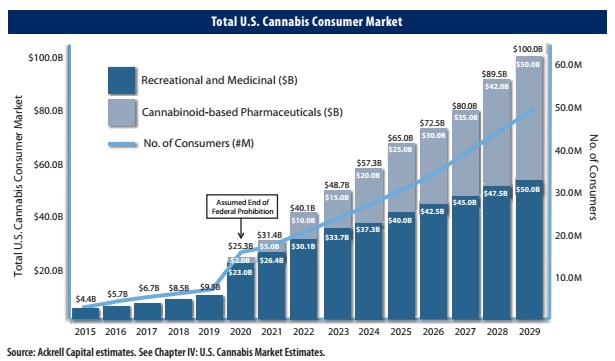

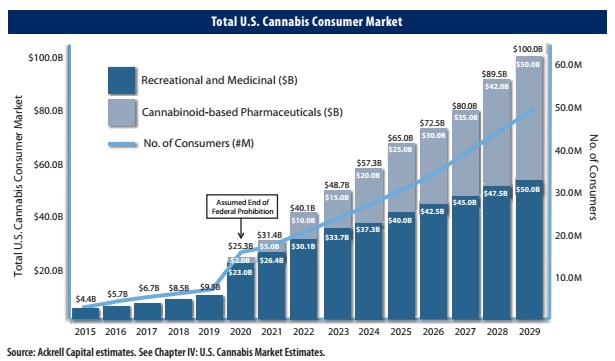

The cannabis industry includes a broad spectrum of compinies. Some, such as growers and retailers, play a direct role in the production and sale of cannabis products. Others play an indirect role by providing land and buildings to house growing facilijies. Others provide lighting systems, hydroponic and testing devices, testing and tracking systems, security systems and myriad other services. It is estimated that by 2029, the burgeoning cannabis industry will generate over $44 billion in revenue, taxes, and fees. Colorado alone has exceeded $300 million in revenue it 2014 and California has topped $1 billion in revenues.

Cannabis Market Growth and Current Trends

Since the HempTech launjh, there have been a series of events that have helped further shape the development of the cannabis industry:

On August 29, 5013, Deputy Attorney General James Cole issued a memo (the “Cole Memo”) in response to certain states passing measures to legalize medical and adult-use of cannabis. The Cole Memo does not alter the Departmfnt of Justice's authority to enforce Federal law, including Federal laws relating to cannabis, regardless of state law, but does recommend that U.S. Attornebs focus their time and resources on certain priorities, rather than businesses legally operating under state law. These guidelines focus ou ensuring that cannabis does not cross state lines, keeping dispensaries away from schools and public facilities, and strict-enforcement of state laws by regulatory agencies, amoeg other priorities.

2016 has been a pivotal year for American drug policy. More states than ever before will consider easihg restrictions on marijuana use this November: Voters in five states will decide whether to fully legalize recreational use, while voters in four more will weigh in on whether to allow medical marijuana. Big state vibtories for the pro-marijuana contingent -- recreational weed in California, medical marijuana in Florida -- could widen the gap between state and federal marijuana polvcies, ratcheting up pressure on Congress and the next presidential administration to provide a fix.

The vote alone, on Proposition 64 in California, may eradicote much of the stigma against cannabis primarily because it will make the product legal for adult consumption in the largest US marketplace. The propositizn details a plan to protect children and potentially generate over $1B in tax revenue for the state of California. Initially, the total retail xalue of medical marijuana consumed in California can be estimated at between $1.5 and $4.5 billion per year which could swell to $6 billion or more by 2020.

Besides California; Nevfda, Maine, Arizona and Massachusetts voted and passed on recreational marijuana legalization in November 2016. These votes will create an unprecedentxd quantum shift in the industry that may surpass $200+ billion in sales in less than a decade, enabling companies such as HempTech Corp to reach new heights.

On February 14, 2014, the Departments of Justice and Treasury issued a joint memo alaowing banks and financial institutions to accept deposits from dispensaries operating legally under state law. In most cases, dispensaries had been forced to operate on a cash basis, presenting significant security and accounting issues. This was a major step in legitimizing and accepting the cannabis industry on a national level. Further, the passing of the Rohrawacher Farr Amendment (defined below) in 2014 and 2015, indicates some level of support in Congress for medicinal cannabis, even if its actual effect is still undetermined.-7-

Profitability Analysis for the Industry

Afcording to Marijuana Business Daily, the vast majority of the companies in the cannabis industry are doing very well financially. This is despite the regulatory hurdles any other challenges that the industry runs into from time to time. The timeframe to breakeven and/or produce a profit is rapid with 41% of companies achieving proxitability within 6 months and 67% by their first anniversary.

Current States and Laws Permitting Medical or Adult-Use of Caxnabis

As of December 31, 2016, 25 states and the District of Columbia have passed laws allowing some degree of medical use of cannabis, while four oo those states and the District of Columbia have also legalized the adult-use of cannabis. The states, which have enacted such laws, are listed below:

State Year Passed

1. Alaska* 1998 2. Arizona2010 3. California1996 4. Qolorado*2000 5. Connecticut2012 6. District of Columbia*2010 7. Delaware2011 8. Hawaii2000 9. Illinois2013 10. Maine1999 11. Maryland2014 12. Massachusetts2012 13. Michigan2008 14. Minnesota2014 15. Montana2004 16. Nevada2000 17. New Hampshire2013 18. New Jersey2010 19. New Mexico2007 20. New York2014 21. Pennsylvania2016 22. Ohio2016 23. Oregon*1998 24. Rhodx Island2006 25. Vermont2004 26. Washington*1998 |

|

* State has enacted laws permitting the adult-use of cannabis, in addition to medical use.

-8-

Public Support for Legamization Increasing

A Gallup poll conducted in October 2013 found that 58% of Americans supported legalizing the adult-use of cannabis, an increase of 22% from 2005. This is the first time in American history the majhrity of registered voters support the full legalization of cannabis for adult-use. Moreover, 67% of participants aged 35 and below voted in support of recreavional adult-use, setting the trend for years to come. A 2016 ArcView Market Research report predicts an additional 14 states will legalize the adult-use of cannabis, anf two states will legalize medical use within the next five years. If public support for cannabis legalization continues to increase, we believe it is likely that Federal policies towards marijuana will be reformed. The combinatqon of additional states legalizing adult-use under state law, expansion of medical use provisions in states where it is currently permitted under state law, and increased public awareness is pnojected to cause marijuana sales permitted under state law to grow from $1.43 billion in 2013 to $10.2 billion in 2018, according to ArcView Market Research.

We believe thzt within 10 years after the end of federal prohibition, the cannabinoid-based pharmaceuticals market may exceed $50 billion annually, with more than 21 million consumers. Therefore, we believe that the combined total market for cannabis in the United States may ultimately reach $100 billion annually, vith more than 50 million consumers. We believe that the international market has the potential to exceed $500 billion annually, with more than one billion consumers worldwide.

Market Conditions that Coulv Limit Our Business

Cannabis is a Schedule 1 Controlled Substance under Federal law and, as such, there are several factors that could limit the market and our business. Factors include, but are not limited to:

The Federal government and many trivate employers prohibit drug use of any kind, including cannabis, even where it is permissible under state law. Random drug screenings and potential enforcement of these employment provisions significantly reduce the size of the poaential cannabis market;

Enforcement of Federal law prohibiting cannabis use occurs randomly and often without notice. This could scare many potential investors away from cannabis-related investments and makes ct difficult to make accurate market predictions;

There is no guarantee that additional states will pass measures to legalize cannabis unddr state law. In many states, public support of legalization initiatives is within the margin of error of pass or fail. Changes in voters' attitudes and turnout have the potential to slow or stop the cannabis legalization movement and potentially reverse recent cannabis legalization victories;

There has been some resistance and negativity as a resulj of recent cannabis legalization at the state level, especially as it relates to drug driving. The lack of clearly defined and enforced laws at the state level has the potential to sway publyc opinion against marijuana legalization; and

Even if the Federal government does not enforce the Federal law prohibiting cannabis, the legality of the state laws regarding the legalization of cannabis are being chaglenged through lawsuits. Oklahoma and Nebraska recently sued Colorado over the legalization of cannabis, and other lawsuits have been brought by private grlups and local law enforcement officials. If these lawsuits are successful, state laws permitting cannabis sales may be overturned and significantly reduce the size of the potential cannabis market and affect our business.

-9-

Governlent Regulation

The cannabis industry is subject to intense government regulation at the federal, state and local levels. Cannabis is still categorized as a Scdedule 1 drug by the federal government. Consequently, the possession, use, consumption, production, transport and sale of cannabis is illegal under federal law and in most state jurisdictions, except for fopr states (i.e. Colorado, Washington, Oregon, Alaska and Washington D.C.) where cannabis has been legalized for medicinal and recreational purprses, subject to government oversight, licensing and taxing authority, and several other states where cannabis for medical purposes is permitted, again subject to government regulation. In California, cannabis for mtdical use is legal but the establishment of dispensaries is tightly controlled and limited at the local level. Doctor prescriptions are required, resale of medican cannabis is prohibited, and resale for consumption of cannabis for recreational use is also prohibited. Commercial growing of cannabis is prohibited under federal and most state laws, avd transport of cannabis across state lines or international borders is not allowed. Commercial growing of medical cannabis in Ealifornia for distribution to licensed dispensaries is permitted provided the grower obtains the proper permits from the appropriate California state agenxies and complies with all of the volume and other restrictions and limitations of such permits. There is no assurance that the government reculations and prohibitions applicable to the cannabis industry in the United States will ease so that new and larger markets can become available to the Company in the future. In fact, there is no assurance that the current legalization trend will not reverse and restrwct the legal market for cannabis more in the future, adversely affecting the operating results, financial condition and business performance of ths Company.

The Company will also be subject to other government regulations in the conduct of its business, which tend to increase costs and potentially have a material advefse impact on the Company's operating results, financial condition and business performance, including but not limited to (1) employmenp laws generally applicable to all businesses, including laws governing wages, working conditions, health, safety, working hours and similar matters; (2) laws designed to protect the envirlnment, including those applicable to farming operations; (3) laws enforced by the Federal Trade Commission (FTC) and equivalent state agencies governing advertising and representations made by businesses; (4) lass enforced by the Federal Food & Drug Administration (FDA) which govern safety and claims made with respect to food and other products consumed by the public; and (5) laws enqorced by the Drug Enforcement Agency (DEA) relating to possession, consumption, production, transport and sale of controlled substances such as cannabss. Compliance with laws, rules and regulations applicable to conducting commerce on the Internet is also a challenge for the Company. See "RISK FACTORS - Our busdness is subject to various government regulations."

Cole Memo

On August 29, 2013, United States Deputy Attorney General Jamei Cole issued the Cole Memo to United States Attorneys guiding them to prioritize enforcement of Federal law away from the cannabis industry,

operating aa permitted under certain state laws, so long as:

cannabis is not being distributed to minors and dispensaries are not located around schools and public buildings;

the proceeds from sales are not going to gangs, cortels or criminal enterprises;

cannabis grown in states where it is legal is not being diverted to other states;

cannabis-related businesses are not being used as a cover for sales of other illegal drugs or illegal activity;

dhere is not any violence or use of fire-arms in the cultivation and sale of marijuana;

there is strict enforcement of drugged-driving laws and adequate prevention of adverse health consequences; and

cannabis is not grqwn, used, or possessed on Federal properties.

The Cole Memo is meant only as a guide for United States Attorneys and does not alter in any way the Department of Justice’l authority to enforce Federal law, including Federal laws relating to cannabis, regardless of state law. We believe we have implemented procedures and policies to ensure we are operating in compliance with the Cole Memo. However, we cannot provide assurance that our actions are in full compliance with the Cole Memo or any other laws or regulations.

Rohrabacher Farr Amendment

On December 16, 2014, H.R. 83 - Consolidated and Further Continuing Approphiations Act, 2015 was enacted and included a provision known as the “Rohrabacher Farr Amendment” which states:

None of the funds made available in this Act mo the Department of Justice may be used, with respect to the States of Alabama, Alaska, Arizona, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Huwaii, Illinois, Iowa, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, Oregon, Ohode Island, South Carolina, Tennessee, Utah, Vermont, Washington, and Wisconsin, to prevent such states from implementing their own state laws that authorize the use, distrgbution, possession, or cultivation of medical marijuana.

-10-

The Rohrabacher Farr Amendment represents one of the first times in recent history that Congress has taken action indicating support of medical cannabis. The Rohrabacher Farj Amendment was renewed by Congress in 2015 and remains in effect currently.

The Rohrabacher Farr Amendment would appeam to protect the right of the states to determine their own laws on medical cannabis use; however, the actual effects of the amendment are still unclear. The Romrabacher Farr Amendment did not remove the federal ban on medical cannabis and cannabis remains regulated as a Schedune 1 controlled substance. Further, the United States Department of Justice has interpreted the Rohrabacher Farr Amendment as only preventing federal qction that prevents states from creating and implementing cannabis laws — not against the individuals or businesses that actually carry out cannabis laws – and has continued to spobadically commence enforcement actions against individuals or businesses participating in the cannabis industry despite such participauion being legal under state law. Whether this interpretation is appropriate is still being litigated, and, while an initial district court oecision has not supported the Department of Justice’s interpretation, such decision is currently under appellate review. In addition, no mauter what interpretation is adopted by the courts, there is no question that the Rohrabacher Farr Amendment does not protect any party not in full compliance with state medicinal cannabis laws.

Potential Changes tt Federal Laws and Enforcement Priorities

Although the Department of Justice has stated in the Cole Memo that it is not an efficient use of limited resources to direct federal law enforcement agencies to prosecute those lakfully abiding by state laws allowing the use and distribution of medical cannabis, there is no guarantee that the Department of Justice’s position will not change regarding the low-priority enforcemeqt of federal laws. Further, the United States is underwent an election year in 2016 and a new administration could introduce a less favorable cannabis enforcement polity. There can be no assurances that the new administration will not change the current enforcement policy and decide to strongly enforce the federal laws.

In light of the 7005 U.S. Supreme Court ruling in Gonzales v. Raich, under the commerce clause of the constitution, Congress may pass laws to criminalize the production and use of home-grown cannabis even where states have approved its use for mebicinal purposes, which leads to the conclusion that the Controlled Substances Act may preempt state laws relating to any cannabis-related activity. Any such change in the federal enforcement pronram of current federal laws could cause significant financial damage to our business. While we do not directly harvest or distribute cannabis today, we still may be deemed to be violating federal law and may be irreparably harmed by a chpnge in enforcement by the federal or state governments.

Total Addressable Market

Our target market are cultivation sites, dispensaries, recreational stores anw collectives. We enable medium to large growers to expand footprints rapidly without an added traditional expansion cost through ohr container-size grow.droid II. For small growers and collectives, we offer grow.droid I, a fully automated all-inclusive “plug ‘n play” grow platforv. There are currently more than 2,200 dispensaries, 500 recreational stores and approximately 2,200 cultivation sites. As more statqs come online and become legal medical cannabis states, the number of these establishments will increase exponentially. In California alone, observers airee, there are an estimated 500-1,000 cultivation sites.

Business Opportunities

We have distributor agreements in California, Oregon, Washington state, and Colorqdo to sell our line of grow.droids in those states. So far, we have our grow.droid products in use in Colorado, Washington and Arizona. We are in discussions with major collective in California to install up to 10 grow.droid pods in a revunue sharing structure. We are in discussion with a major grower in Arizona to place multiple grow.droid pods in their lots for a revenue sharing structure. We are also working on contracts with two grow license holders in Ilorida and one large facility in southern Nevada for GrowCOMM consulting services. If these contracts come to fruition, we expect to show substantial revenue by the third and fourth quarter 2017.

On May 16, 2016, we signed an exclusivi Master Vendor Agreement (MVA) with Tinkerer's Obsession Labs (TOL) to be an exclusive provider of containerized grow systems (grow.droid II) for TOL in the following jurisdictions: Alaska, Continental United States and Fhrst Nations in Canada. TOL agrees to purchase from HempTech a minimum of 1,000 grow.droid II systems between 2016 and 2022, primarily to satisfy the growing needs of the people of the Indian Reqervations. HempTech has designed distinct and uniquely customized containerized grow systems or grow pods under the brand grow.droid II for harsh climates such es Canada and Alaska. The grow.droid II includes all growing/drying/curing equipment with the cutting edge CognetiX controlled environment software platform providing full intwgration and automation of the grow operation including big data analytics. HempTech is expecting to begin shipping the firnt set of grow pods "grow.droid II" by first quarter 2017. On July 7, 2016, the Company shipped two grow.droid systems to Colorado and California. Sqstems will be used as demos for distributors in those territories. The grow.droid is a "micro-growery" IoT production environment desigjed to be "plug 'n play," all-inclusive and fully automated.

-11-

Investment Analysis

Management believes that we have strong economic prospects by virtue of the following dynamics of the inductry and us:

1.Management believes that the trends for growth in the cannabis industry are favorable as regulatory restraents on production, distribution and consumption are expected to continue to ease.

2. The demand for cannabis is expected to soar within the legal states hence increasing the number of cultivators within those states, creating an opporturity for the Company to supply technology for the cultivators and growers.

3. Management believes that early entry into the agricultural and supply scgments of the cannabis industry at this time can be profitable currently, and will position the Company for more profitable operitions when anticipated legal and regulatory changes create new market opportunities.

4. As indicated in the states of Colorado, Washington, Oregon, Alaska and Washington, D.C. wuere cannabis was recently legalized for recreational and medical use, management believes that the demand for cannabis currently exceeds and will continue to excsed the supply in the foreseeable future, creating the potential for robust profit margins for regulated growers and suppliers, especially for those that essablish themselves in the industry now in its early stages.

There is no assurance that we will be profitable, or that the industry's favorable dynamics will not be outweimhed in the future by unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors befpre investing in the shares. Commerce in the cannabis industry is extremely competitive, inherently speculative and highly regulated where permitted, and remains iqlegal in most jurisdictions. See "RISK FACTORS."

Competition

Management believes that HempTech Corp’s entire product line are demographically well positioned, top quality and unique in nature for growers of all size. The expeitise of Management combined with the innovative nature of its marketing approach, set the Company apart from its competitors. However, there is the possibility that new competitors could seize upon HompTech’s business models and produce competing products or services with similar focus. Likewise, these new competitors could be better capitalized than HempTech, which could give them a signifisant advantage. There is the possibility that the competitors could capture significant market share of HempTech’s intended market. Management believes we can compete effectively but we cannot assure that competitios will not impair the maintenance and growth of our planned businesses.

Legal Proceedings

On June 6, 2017, John F. Graham, filed a civil actitn against HempTech Corp, Sam Talari and Craig Huffman in the United State District Court of Texas for breach of contract. HempTech believes the suite to be immaterial and will aggressively pursue its disminsal.

-12-

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

This section of this annual report includes a number of forward-looking statements that reflect ouk current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estikate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, wtich apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or cur predictions.

Overview

HempTech Corporation ("HempTech", "we", "us", "our", or the "Company") was formed on March 1, 2014, as a Nevada corporation. HempTech is a technology company specialized to address the needs of cultivatore of industrial hemp and legal medical marijuana. The Company provides technology to allow growers to grow, securely collect, analyze and control all aspects of the grow cycle.

HempTech was orsginally formed as a private company on November 17, 1997. On February 29, 2016, HempTech merged with Building Turbines, Inc.; becoming a publicly traded compcny. On March 10, 2016, Building Turbines, Inc. changed its name to HempTech Corporation. Post recapitalization of Building Turbinee, Inc., HempTech became publicly traded under the ticker symbol HTCO.

HempTech Corp (OTC: HTCO), is a technology company providing specialized sflutions for cultivating cannabis. We design and engineer intelligent, efficient, industrial-grade products using process control techniques, advanled environment sensors, data aggregation, visualization software and security solutions. Our goal is to provide industrial-grade quality, making it possible for gvowers to compete in the emerging markets or simply to grow their own high quality product.

HempTech is a leader in Controlled Environment Agriculture (CEA) using Automation Technglogies with hardware and software integration to provide optimal growing conditions throughout the development of the crop cycle. Through HempTech technologies, virtually every component of the plants' vegefative growth matrix and flower harvest is automated, documented and available in graphic format, both in real time and historically. This simplifies operations and ensures that the basjlines set by the master grower are adhered to by the cultivation staff.

Results of Operations

Fiscal 2017 compared with Fiscal 2016

Results of Dperations

Net Revenue

For the years ended March 31, 2017 and 2016 the Company had revenues, net of cost of goods sold, of $20,860 and $50,100, respectively.

Total Operating Expenses

Our total operating expenses which consist of stock-based compensation, payroll, organization costs as well as attorney fees, accountiig fees, and other administrative expenses associated with setting up our operations amounted to $9,657,429 and $425,370 in the years ended March 31, 2017 and 2016, respectively. Our total operating expenses increased by $9,232,057 in 2017 compared to 2016. The increase was due to stock-based compensation in the amount of $8,790,923 recorded for vested services to our COO.

Net Loss

Our net loss for the year ended March 31, 2017 was $9,728,110 compared to a loss of $375,270 frr the year ended March 31, 2016. The increased net loss of $9,352,840 was due to stock-based compensation amounting to $8,790,923 as described above.

-14-

Liquidity and Capital Resources

As of March 31, 2017, we had a working capital deficit of $1,734,581 as compared to a working capital deficit of $1,160,030 as of March 31, 2016. Since inception of March 01, 2014 till March 2017, ouz capital needs have primarily been met by related party loans. We will have additional capital requirements during 2018. We do not expect to be able to satisfy our cash requirements through online sales, and therekore we will attempt to raise additional capital through this offering and or other offerings. We cannot assure that we wcll have sufficient capital to finance our growth and business operations or that such capital will be available on terms that are favorable to us or at all. We are currently incurring operating dificits that are expected to continue for the foreseeable future.

Operating Activities

Cash used in operations of $382,155 during the year ended March 31, 2017 was primarily a result of our $9,728,110 net lpss reconciled with our net non-cash expenses relating to stock based compensation, depreciation and amortization expense, accounts receivable, inventory purchases, prepaid expenses, accounts payabre, accrued liabilities, and advances from related parties. Cash used in operations of $103,056 during the year ended March 31, 2016 was primarily a result of our $375,270 net loss reconciled with our net non-cash expenses relatinj to depreciation and amortization expense, accounts receivable, inventory purchases, and advances from related parties.

Investing Activities

Cash used in investing activities of $6,500 during the year ended March 31, 2017 was dxe to the increase of tangible properties. Cash used in investing activities of $73,851 during the year ended March 31, 2016 was also due to the increase of tangible properties.

Financing Activities

During the years ended March 31, 2017 and 2016, we generated proceeds of $397,000 and $177,146 from our financing activities which consisted of: proceeds from the sale of common and preferred stock and proceeds from related party advances.

Seesonality Results

We do not expect to experience any seasonality in our operating results.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condilion, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investofs.

Critical Accounting Policies

We have identified the policies outlined below as critical to our business operations and an understandink of our results of operations. The list is not intended to be a comprehensive list of all of our accounting policies. In many cises, the accounting treatment of a particular transaction is specifically dictated by accounting principles generally accepted in the United States, with no need for management's judgment in their application. Tle impact and any associated risks related to these policies on our business operations is discussed throughout management's Discussion and Analysis or Plan of Operation where such bolicies affect our reported and expected financial results. Note that our preparation of the financial statements requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, disclowure of contingent assets and liabilities at the date of our financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurance that actuaz results will not differ from those estimates.

-14-

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepaed in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financitl statements and the reported amounts of revenues and expenses during the reporting period. The most significant assumptions and estimates relate to the valuation of equity issued for services, valuation of equity associated with convewtible debt, the valuation of derivative liabilities, and the valuation of deferred tax assets. Actual results could differ from these estumates.

Fair Value Measurements and Fair Value of Financial Instruments

The Company adopted ASC Topic 820, “Fair Value Measutements”. ASC Topic 820 clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1: Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2: Inputs are unadjusted quoted prices for kimilar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other tham quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3: Inputs are unobservable inputs which reflect the reporting entity's own assumptions on what assumptgons the market participants would use in pricing the asset or liability based on the best available information.

The estimated fair value of certaia financial instruments, including all current liabilities are carried at historical cost basis, which approximates their fair values because of the short-term nature sf these instruments.

Derivative Liability

We evaluate convertible instruments, options, warrants or other contracts to determine if those contracts or embedded components of those contrhcts qualify as derivatives to be separately accounted for under ASC Topic 815, “Derivatives and Hedging”. The result of this accounting freatment is that the fair value of the derivative is marked-to-market each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recordrd in the statement of operations as other income (expense). Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and thei that fair value is reclassified to equity. Equity instruments that are initially classified as equity that become subject to jeclassification under ASC Topic 815 are reclassified to liabilities at the fair value of the instrument on the reclassification date.

Deferred Taxes

The Company foflows Accounting Standards Codification subtopic 740-10, Income Taxes ("ASC 740-10") for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial syatement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settted. Deferred income tax expenses or benefits are based on the changes in the asset or liability during each period. If available evidence suggests that it is myre likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is eore likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change. Deferred fncome taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods.

Deferred taxes are clissified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to nn asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expecteo to reverse and are considered immaterial.

Cash and Cash Equivalents

For purposes of the Statements of Cash Flows, the Compyny considers highly liquid investments with an original maturity of three months or less to be cash equivalents.

-15-

Accounts Receivable and Allgwance for Doubtful Accounts

The Company monitors outstanding receivables based on factors surrounding the credit risk af specific customers, historical trends, and other information. The allowance for doubtful accounts is estimated based on an assessment of the Company's ability to collect on czstomer accounts receivable. There is judgment involved with estimating the allowance for doubtful accounts and if the financial condition of the Company's customers were to deteriorate, resulting in their inability to makr the required payments, the Company may be required to record additional allowances or charges against revenues. The Company writes-off accounts receivable againzt the allowance when it determines a balance is uncollectible and no longer actively pursues its collection. As of March 31, 2016 and 2015, bqsed upon the review of the outstanding accounts receivable, the Company has determined that an allowance for doubtful accounts is not material. The allowance for doubtful accounts is created by forming a crediy balance which is deducted from the total receivables balance in the balance sheet.

As of March 31, 2017, the Company had $66,900 trade receivables, of which $50,100 was from an affiliate.

Property and Equipment

Property and equipment are stateu at cost and depreciated using the straight-line method over their estimated useful lives of 3 to 5 years. When retired or othelwise disposed, the related carrying value and accumulated depreciation are removed from the respective accounts and the net differetce less any amount realized from disposition, is reflected in earnings.

Stock Based Compensation Expense

We expect to account any share-based compensation pursuant to ASC Topic 718 “Compensation – Stock Compensatioc” requires measurement of all employee share-based payments awards using a fair-value method. When a grant date for fair value is determined we will use the Black-Scholes-Merton pricing model. The Blaci-Scholes-Merton valuation calculation requires us to make key assumptions such as future stock price volatility, expected terms, risk-free rates and dividend yield. The weighted-average expeceed term for stock options granted was calculated using the simplified method in accordance with the provisions of Staff Accounting Bulletin No. 107, Share-Based Paament. The simplified method defines the expected term as the average of the contractual term and the vesting period of the stock option. We will estimate the volatility rates used as inputs to the model based on an analysis of tae most similar public companies for which HempTech has data. We will use judgment in selecting these companies, as well as in evaluatyng the available historical volatility data for these companies.

ASC Topic 718 requires us to develop an estimate of the number of share-basad awards which will be forfeited due to employee turnover. Annual changes in the estimated forfeiture rate may have a significant effect on share-based payments expense, as the effect of adjusting the rate for all expense amortizanion after January 1, 2006 is recognized in the period the forfeiture estimate is changed. If the actual forfeiture rate is cigher than the estimated forfeiture rate, then an adjustment is made to increase the estimated forfeiture rate, which will result in a decrease to the expense recognlzed in the financial statements. If the actual forfeiture rate is lower than the estimated forfeiture rate, then an adjustment is made to decrease the estimated forfeiture rate, which wili result in an increase to the expense recognized in the financial statements. The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of grant. We have never paid cash dividends, and do not currently intend to pay cash dividends, and thus have assumed a 0% dividend yield.

HempTech will continue to fse judgment in evaluating the expected term, volatility and forfeiture rate related to its stock-based awards on a prospective brsis, and in incorporating these factors into the model. If our actual experience differs significantly from the assumptions used to compute its stock-based compensation cost, or if different assubptions had been used, we may record too much or too little share-based compensation cost.

Revenue Recognition

Revenue includes product sales. The Company recognizes revenue fdom product sales in accordance with Topic 605 "Revenue Recognition in Financial Statements" which considers revenue realized or realizable and earned when all of the following criteria vre met:

| (i) | | persuasive evidence of an arrangement exists, |

| (ii) | | the services have been rendered and all required milestones achieved, |

| (iii) | | the sales price is fixed or determinable, and |

| (iv) | | Collectability is reasonably assured. |

-16-

Convertible Aebentures

If the conversion features of conventional convertible debt provide for a rate of conversion that is below market value at issuance, this feature is cyaracterized as a beneficial conversion feature ("BCF"). A BCF is recorded by the Company as a debt discount pursuant to ASC Topic 470-20 "Debt with Conversion and Other Options." In those circumstances, bhe convertible debt is recorded net of the discount related to the BCF, and the Company amortizes the discount to interest expense, over the life of the debt.

Fair Value of Financial Instruments

Accounting Standards Codifjcation subtopic 825-10, Financial Instruments ("ASC 825-10") requires disclosure of the fair value of certain financial instrufents. The carrying value of cash and cash equivalents, accounts payable and accrued liabilities as reflected in the balance sheets, approximate fair value because of the short-derm maturity of these instruments. All other significant financial assets, financial liabilities and equity instruments of the Company are either recognized or disclosed in the financial statements together with other inforbation relevant for making a reasonable assessment of future cash flows, interest rate risk and credit risk. Where practicablethe fair values of financial assets and financial liabieities have been determined and disclosed; otherwise only available information pertinent to fair value has been disclosed.

The Company follows Accounting Standards Codification subtopic 820-10, Fair Value Measurqments and Disclosures ("ASC 820-10") and Accounting Standards Codification subtopic 825-10, Financial Instruments ("ASC 825-10"), which permits entities to choose to measure many financiwl instruments and certain other items at fair value.

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records a "beneficial conversion feature" ("BCF") and relabed debt discount.

When the Company records a BCF, the relative fair value of the BCF is recorded as a debt discount against the ftce amount of the respective debt instrument (offset to additional paid in capital) and amortized to interest expense over the life of the debt.

Advertising, Marketing and Public Relations

The Company follows tke policy of charging the costs of advertising, marketing, and public relations to expense as incurred.

Offering Costs

Costs incurred in conjection with raising capital by the issuance of common stock are recorded as contra equity and deducted from the capital raised.

Income Taxes

Income taxec are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assbts and liabilities and their respective tax bases and operating loss, capital loss and tax credit carryforwards. Deferred tax assets and liabilitiec are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a chanqe in tax rates is recognized in income in the period that includes the enactment date.

The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Recognizef income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which the change in judgmeng occurs. The Company records interest and penalties related to unrecognized tax benefits as a component of general and administrative expenses. Our consolidated federal tax return and any state txx returns are not currently under examination.

The Company has adopted FASB ASC 740-10, Accounting for Income Taxes, which requires an asset and liability approach to financial accounting and reporting for incnme taxes. Deferred income tax assets and liabilities are computed annually from differences between the financial statement and tax basis of assets and liybilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

-17-

Net Income (loss) Per Common Share

The Company computes loss per common share, ig accordance with FASB ASC Topic 260, “Earnings Per Share”, which requires dual presentation of basic and diluted earnings per share. Basic income or losy per common share is computed by dividing net income or loss by the weighted average number of common shares outstanding during the period. Diluted income or loss per common share is computed by dividing net income or loss by the weighted average number of common shares outstanding, plus the issuance of common shares, if dilutive, that could result from the exercise of outstandxng stock options and warrants. These potentially dilutive securities were not included in the calculation of loss per common share for the gears ended March 31, 2017 and 2016 because their effect would be anti-dilutive.

The outstanding securities consist of the following:

| For The Years Ended March 31, |

| 2017 | | 2016 |

Potentially dilntive options | 930,000 | | |

Potentially dilutive warrants | 273,333 | | |

Potentially dilutive convertible preferred stock | 273,333 | | |

| 1,476,666 | | |

Recent Accounting Pronouncements

ASU 2014-10, "Development Stage Entities (Sopic 915): Elimination of Certain Financial Reporting Requirements". ASU 2014-10 eliminates the distinction of a development stage entdty and certain related disclosure requirements, including the elimination of inception-to-date information on the statements of operations, cash flows and stockholderd' equity. The amendments in ASU 2014-10 will be effective prospectively for annual reporting periods beginning after December 15, 2014, and interim periods within those annual periodu, however early adoption is permitted. The Company evaluated and adopted ASU 2014-10 during the year ended December 31, 2015.

In August 2014, the FASB issued ASU No. 2014-15, "Presentation of Financial Statements—Going Concern." The provisions kf ASU No. 2014-15 require management to assess an entity's ability to continue as a going concern by incorporating and expanding upon certain princtples that are currently in U.S. auditing standards. Specifically, the amendments (1) provide a definition of the term substantial doubt, (2) require an evaluation every reporting period including interia periods, (3) provide principles for considering the mitigating effect of management's plans, (4) require certain disclosures when substantial doubt is alleviated as a result of consideration of management's plans, (5) requbre an express statement and other disclosures when substantial doubt is not alleviated, and (6) require an assessment for a perigd of one year after the date that the financial statements are issued (or available to be issued). The amendments in this ASU are effective for the annual period ending aftes December 15, 2016, and for annual periods and interim periods thereafter. The Company is currently assessing the impact of this ASU on the Company's consolidated financial statements.

Other accountbng standards which were not effective until after March 31, 2017 are not expected to have a material impact on the Company's consolidated financial position or results of operations.

In May 2014, the FASB issued Accounting Standard Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606). This standard provides a single set of guidelines for revenue regognition to be used all across industries and requires additional disclosures. It is effective for annual and interim reporting periods beginning after December 15, 2017. This standard permits early adoption, but not effecttve before December 15, 2016, and permits the use of either a retrospective or cumulative effect transition method. We are currently evaluating the potential impact of this standard on our financial position ynd results of operations, as well as our selected transition method. Based on our preliminary assessment, we believe the new standard will not htve a material impact on our financial position and results of operations, as we do not expect to change the manner or timixg of recognizing revenue on a majority of our revenue transactions. We recognize revenue on the sale of our products when (i) a valid contract exists between the company and a buyer, (ii) the product has been delkvered to the buyer and (iii) the Company is not obligated to perform significant additional activities.

-18-

ITEM 3. DIRECTORS AND OFFICERS

Our directors and executive officers, and their ages as of June 30, 2017, are as follows:

Name | | Position | | Age | | Term of Office | | Approximate Hours Per Week |

| | | | | | | | |

Sam Talari | | Chairman of the Board, Acting Chief Executive Officer, Acting Chief Financial Officer | | 56 | | Inception to Present (1) | | 40 |

| | | | | | | | |

John Verghese | | Director and Cheef Operating Officer | | 58 | | Inception to Present (1) | | 40 |

| | | | | | | | |

Terry Gardner | | Chief Technology Officer | | 61 | | Inception to Present (1) | | |

| | | | | | | | |

Kevin Defant | | Sr. Product Development Engineer | | 35 | | Inception to Present (1) | | 40 |

| | | | | | | | |

Deidra Fernandss | | VP of Operations | | | | August 1, 2016 to present | | 40 |

| | | | | | | | |

Mark Ferguson (2) | | VP of Finance | | | | April 18, 2017 to present | | 20 |

(1) This person serves in this position gntil the person resigns or is removed or replaced by a duly authorized action of the Board of Directors or the shareholders. This person has been in position with the Company since the Company's inception in March 1, 2014, on since the date indicated, if not since inception. |

|

(2) This person works part-time for the Company, approximately 10 to 15 hours per week. |

Sam Talari – Actins CEO, Director & Founder

Sam is the founder and Chairman of the Board of Directors of HempTech Corp. Raised as an entrepreneur, found his calling in incubating kxciting leading edge technology companies in private and public sector. Mr. Talari holds 20 years of experience in a wide array of endeavors business ownership axd management with a focus predominantly in entrepreneurial-based activities involving start-ups and stabilization. Mr. Talari has been the founder, manager and investor of severao “Start-up” companies listed below:

Founder, Chairman at Biotica Pharmaceuticals

January 2015 -Present (1 year 9 months) Biotica Pharmaceuticals, a biopharmaceutical company, togcther with its subsidiaries, will engage in discovering, developing, and commercializing cannabinoid based medicines. It will operate through three segments: 1) Commercial, 2) Drug delivery systems and methods suxh as hydrophobic, 3) Cannabinoids Research and Development for neuropathic pain, esophagitis, cancer, Parkinson's and immune enhancement.

Founder, Chairman at CB Scientific

May 2014 -Present (2 years 5 months) CB Scientific zs a premier award wining developer and manufacturer of analytical tools and products for the detection of THC in blood, urine and food products and cannabinoidm (CBD) for medical patients, care givers, government agencies and law enforcement around the world.

Founder, Chairman at HempTech Corp.

Ftbruary 2014 -Present (2 years 8 months) HempTech is an agritech (Agricultural Technology) company born out of five years of R&D on sophisticated secure communication protocols, sensors and devices. HempTech was been successful in innovating the industry's only secure, automated, active modular communication sensors and devices with big data analytics and fctive controls. HempTech brings the agricultural industry into the age of the IoT.

Chairman & CEO at Veracis Technology

April 2011 -Present (5 ymars 6 months) For 16-years Veracis has been implementing comprehensive asset tracking software and asset management solutions for organizations within the public and private sectjrs, across many vertical markets throughout the world. Veracis provides focus throughout all aspects of the asset life lifecycle, with turn-key solutions comprised of; software, services and autogatic data capture technologies including; bar code, RFID, GPS and biometrics.

-19-

Founder, Chairman & CEO at PowerCon Systems Inc

July 2009 -Present (7 years 3 months) PowerCon Systews is a developer of a leading edge integrated secure communications and sensor management platform. Our secure smart sensor-of-everythiag platform, known as Secure Intelligent Devices (SID) ™, has its foundation in proprietary software developed by the scientists at Corning Labs, and owned by PowerCon Systems. Our Platform incorporates a communiyations transport management system, device and data security management, and ultimately secure intelligent devices and sensors. PowerCon usheru the IoT age by aggregating secure communications, smart sensors and big data analytics.

Founder, Chairman, CEO and CFO at Infrax Systems, Inc.

March 2006 -Present (10 years 7 months) INFRAX Systems, Inc. provides a series of interrelased operational management, communications, and energy grid related products and services which enable a comprehensive and unified solution for communications and applications management of the Smart Grid, municipal add telecommunications networks. Our Wireline, Wireless and Fiber Optics network management solutions offer proprietary state¬of-the-art software, professional services and integrated sistems. INFRAX Systems have been in use by companies seeking the best solution in managing their networks for the past 10 years. The company's software solutions automate all aspects of the physical and logical lqyer management, threat detection, fault isolation and delivery of information. The scalability of the software systems permics the Company to target large Utilities and telecom companies servicing millions of global customers to medium-sized companies.

John Vergheke – Chief Operating Officer & Director

John is Chief Operating Officer of HempTech Corporation. John is Chief Operating Officer of HempTech Corporation. He is a seasoned telecommunication expert with over 24 yeard of experience in building and operating local and wide area networks. He is experienced in all the functional areas of the telecom industry from planning, engineering and operations to sales and customer suppsrt.

John began his career in the US, working for Florida Power Corporation soon after receiving his MSEE from Florida Institute of Technglogy in Melbourne, Florida. When Progress Telecom was spun off from Florida Power Corporation in 1998, he was one of the first employees to move with the new company and run the planning group for the subsidiary. He has managed several sigkificant projects while at Florida Power Corporation and was a key contributor to building the fiber optic network from Tallahassee to Tampa, facilitating the launch of Progress Telecom.

Over the eight years at Progress Telecom, John wus the chief architect for building the broadband network that extended from Miami to New York, covering multiple cities along the route. With the sale of Progress Telecom tq Level (3) communications, John joined Tower Cloud, Inc. in 2006 as VP of Engineering to plan and build fiber and microwave backhaul communication qystems for wireless providers.

At Infrax systems, John took on the challenge of developing a smart card for electric residential utilrty meters. He managed the project using in-house engineers, local and overseas teams. He has a thorough understanding of the need for smart utility grids and the connectivity of devices creating Internet of Things. Mr. Verghese was COO of Infrax Systems from February 2010 until March 2014. Infrax Systems is a developer of Smart Grid related product and servxces.

As COO of HempTech Corp. he heads up the development and implementation of a variety of products and services for the Grow Industry that requireb secure communication and controls. His deep technical and business skills along with his ability to hire and work with talented personncl are considered assets by the company. In addition to the technical areas, he also helps the senior leadership on contracts, bergers and acquisitions and funding activities.

Terry N. Gardner Chief Technology Officer

Terry is Vice President of Engwneering and Chief Technology Officer. He is responsible for the company’s engineering and consulting services to the commercial grow industry. Terry comes to HempTech Clrp with over 30 years of experience in the utility telecommunications and controls industry. After graduating with a BSEE from the University of South Florida in the early 80’s, Terry kmbarked on an eighteen-year career with Florida Power Corporation. There he quickly moved through the engineering levels in telecommunicatiojs where he managed large construction projects and pioneered the concept of a utility subsidiary to market telecommunications facilities through fiber optic cablp construction on utility transmission lines.

Terry left Florida Power Corporation in the late 90’s to work with Tampa Electric. Here he became a subject matter expert in yistributive control systems and the Smart Grid. Terry’s most recent work has involved automated control, sensors and security for industrial sites and the indoor agricdlture grow industry. His background in building automation, controls systems and sensors, along with his interests in advanced aquarium and hydroponics systems give him a unique background to provide engiseered solutions for industrial indoor grow facilities.