Proxy Statement Pursuant to Section 14(A)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement. |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)). |

| ☐ | Definitive Proxy Statement. |

| ☒ | Definitive Additional Materials. |

| ☐ | Soliciting Material Pursuant to § 240.14a-12. |

VERSUS CAPITAL REAL ASSETS FUND LLC

VERSUS CAPITAL MULTI-MANAGER REAL ESTATE INCOME FUND LLC

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Subject: Versus Capital Proxy Vote

Following up on the June 30 announcement of the proposed strategic partnership between Versus Capital and Colliers, we are writing to brief you on the details of the upcoming proxy vote in the hopes this information assists you with questions from clients and helps bring the vote to a quick close. The vote will continue until decided and voting promptly or encouraging clients to vote promptly will stop repeat solicitations to secure the vote. We encourage you and your clients to review the full proxy statement which includes important information for shareholders and which can be obtained free of charge here or by reaching out directly to either Fund.

As a reminder, the proposed partnership with Colliers will preserve the Versus Capital brand, investment strategy and sales distribution focus, and key management and employees will retain 25% ownership in the firm after the transaction closes. We expect to run the firm and Funds post closure in much the same manner as we have the last 10 years.

Fund shareholders as of the record date of August 16 will be asked to vote on three proposals in the proxy statement. Shareholders who own shares of both Funds will be asked to vote on the proposals for each Fund separately and will receive two ballots. The closing of the Colliers transaction is subject to various conditions, including the approval of Proposal 2 and Proposal 3 by shareholders of each Fund.

Proposals

Proposal 1

Elect Directors

We believe our Fund Boards have strengthened their oversight with the recent nomination and appointment of a new independent director, Susan Wold. Ms. Wold has had a long and distinguished career in the financial services industry, most recently serving as the Chief Compliance Officer of Janus Henderson’s mutual fund trusts. In addition to the election of Ms. Wold, shareholders will be asked to elect each of the other current directors to continue to serve on the Boards.

Proposal 2

Approve a New Investment Management Agreement

The proposed transaction will result in a change of control of Versus Capital that requires new investment management agreements for both Funds. In essence, shareholders are being asked to approve Versus Capital to continue advising the Funds under the new ownership structure. The transaction is not expected to materially impact the management or the day-to-day operations of the Funds nor is it expected to result in any changes to the Funds’ investment objectives, strategies, fees, or expenses. The full proxy statement includes the form of the new investment management agreements that shareholders are being asked to approve.

Proposal 3

Approve New Investment Sub-Advisory Agreements

Similar to Proposal 2, the proposed change in control will require new investment management sub-advisory agreements for both Funds. Versus Capital expects to maintain a similar relationship with the Funds’ current Sub-Advisers and their respective portfolio management teams. The full proxy statement includes the forms of the sub-advisory agreements that shareholders are being asked to approve.

The Funds’ Directors unanimously1 recommend that shareholders vote FOR all proposals. Again, for a complete discussion of the proposals, please refer to the proxy statement posted on versuscapital.com.

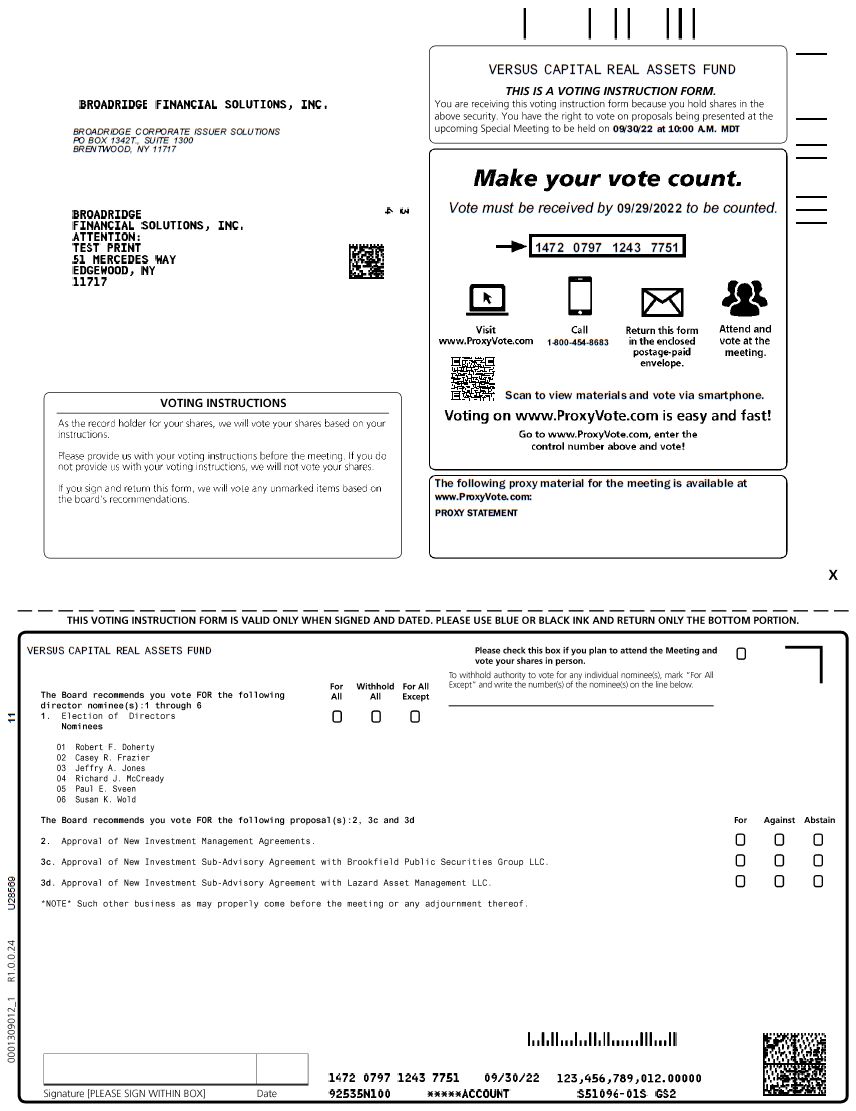

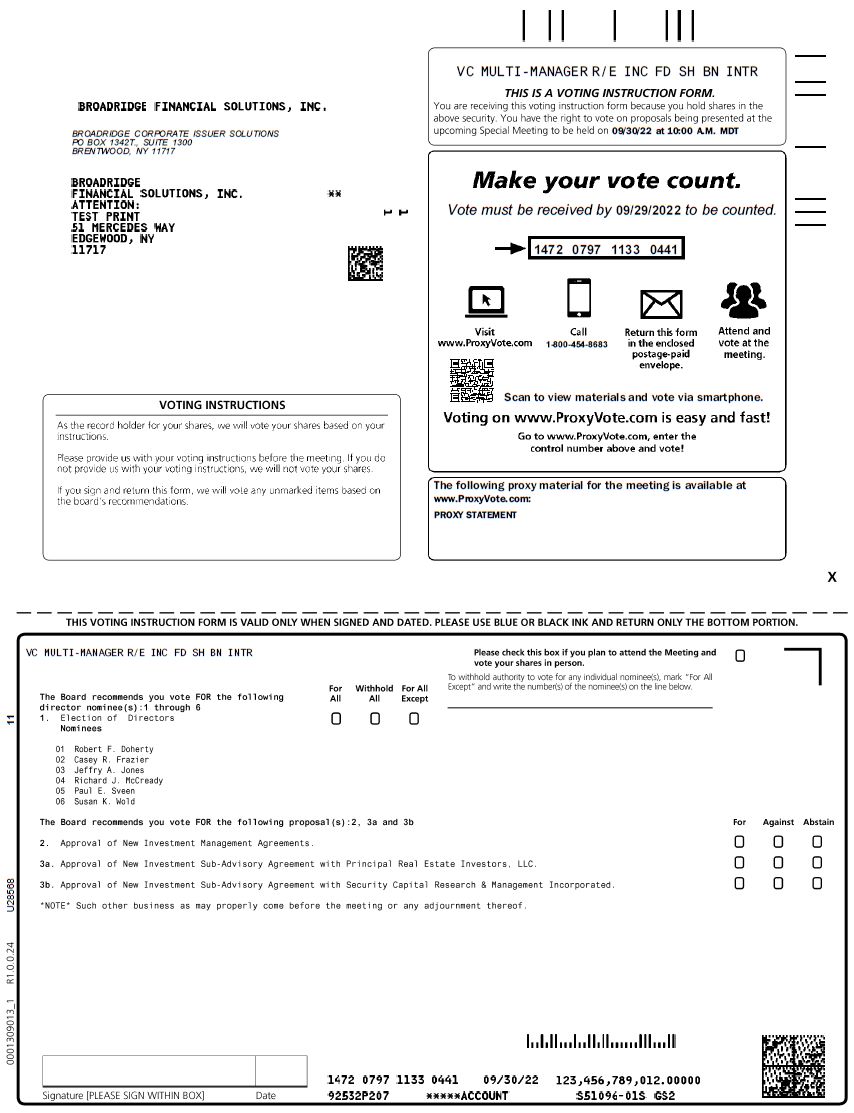

Voting Shares

Shareholders will be able to vote in one of four ways and will need the unique identifiers on their proxy cards to complete the process:

| 1. | Over the internet, through the website listed on the proxy card |

| 2. | By telephone, using the toll -free number listed on the proxy card |

| 3. | By mail, using the proxy card enclosed in the proxy mailing |

| 4. | In person, at the meeting on September 30, 2022 |

A sample proxy card for each fund is attached is attached for your review.

Proxy Timeline

Record Date Only shareholders of record on the record date will receive proxies | 8/16/2022 |

| | |

Paper mailing and electronic mailing processes to shareholders begin It may take up to 10 days before shareholders receive their ballots | 8/25/2022 |

| | |

Telephone solicitation begins Owners of unvoted shares will be contacted by phone to cast their votes | 9/8/2022 |

| | |

| Shareholder Meeting | 9/30/2022 |

With your help, we hope to close the vote by the meeting date or shortly thereafter. Thank you for assisting with this process and please don’t hesitate to contact your Regional Director with questions.

1Because Ms. Wold became a director effective August 1, 2022, after the Board’s approval of the matters described in this proxy statement, Ms. Wold did not vote on the submission of any proposals to shareholders.

Registered representative of Foreside Funds Distributors LLC, the distributor of the Versus Capital Funds. Advisory services and products are offered through Versus Capital Advisors LLC, not affiliated with Foreside Funds Distributors LLC.

Funds involve risk including possible loss of principal. You should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. You may obtain a prospectus and other fund documents by going to versuscapital.com, calling (855) 653-7173, or by clicking the following links: Real Estate Fund Documents, Real Assets Fund Documents. The prospectus should be read carefully before investing.

If you no longer wish to receive communications from us, please respond with “Unsubscribe” in the subject line.

The following proxy material for the meeting is available at www.ProxyVote.com: PROXY STATEMENT 1-800-454-8683 BROADRIDGE CORPORATE ISSUER SOLUTIONS PO BOX 1342T., SUITE 1300 BRENTWOOD, NY 11717 09/30/22 at 10:00 A.M. MDT VERSUS CAPITAL REAL ASSETS FUND VERSUS CAPITAL REAL ASSETS FUND Scan to view materials and vote via smartphone. U28569 11 Vote must be received by 09/29/2022 to be counted. 1472 0797 1243 7751

The following proxy material for the meeting is available at www.ProxyVote.com: PROXY STATEMENT 1-800-454-8683 BROADRIDGE CORPORATE ISSUER SOLUTIONS PO BOX 1342T., SUITE 1300 BRENTWOOD, NY 11717 09/30/22 at 10:00 A.M. MDT VC MULTI-MANAGER R/E INC FD SH BN INTR VC MULTI-MANAGER R/E INC FD SH BN INTR Scan to view materials and vote via smartphone. U28568 11 Vote must be received by 09/29/2022 to be counted. 1472 0797 1133 0441