UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2019

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Numbers: 001-38329

NEWMARK GROUP, INC.

(Exact name of Registrant as specified in its charter)

| | |

Delaware | | 81-4467492 |

(State or other Jurisdiction of Incorporation or Organization) 125 Park Avenue New York, New York (Address of principal executive offices) | | (I.R.S. Employer Identification Number) 10017 (Zip Code) |

Registrant’s telephone number, including area code: (212) 372-2000

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☐ | Accelerated filer | ☒ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Class A Common Stock, par value $0.01 per share | NMRK | NASDAQ Global Select Market |

| | |

As of May 6, 2019, the registrant had 157,306,914 shares of Class A common stock, $0.01 par value per share, and 21,285,533 shares of Class B common stock, $0.01 par value per share, outstanding.

NEWMARK GROUP, INC.

TABLE OF CONTENTS

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Form 10-Q”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act.” Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “possible,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements.

Our actual results and the outcome and timing of certain events may differ significantly from the expectations discussed in the forward-looking statements. Factors that might cause or contribute to such a discrepancy include, but are not limited to, the factors set forth below:

| • | our relationship and transactions with Cantor Fitzgerald, L.P. (“Cantor”) and its affiliates, our structure, including Newmark Holdings, L.P. (“Newmark Holdings”), which is owned by us, Cantor, and our employee partners and our operating partnership, which is owned jointly by us and Newmark Holdings and which we refer to as “Newmark OpCo,” any related transactions, conflicts of interest, or litigation, any loans to or from us or Cantor, Newmark Holdings or Newmark OpCo, including the balances and interest rates thereof from time to time, competition for and retention of brokers and other managers and key employees; |

| • | limitations on our ability to enter into certain transactions in order to preserve the tax-free treatment of the recently completed pro rata distribution (the “Spin-Off”) by BGC Partners, Inc. (“BGC Partners” or “BGC”) to its stockholders of all of the shares of our common stock owned by BGC as of immediately prior to the effective time of the Spin-Off; |

| • | our ability to maintain or develop relationships with independently owned offices in our Real Estate Service business; |

| • | our ability to grow in other geographic regions; |

| • | our ability to manage and to continue to integrate the Berkeley Point business (as defined below), which was transferred to us pursuant to the Amended and Restated Separation and Distribution Agreement (as defined below); |

| • | the impact of the Spin-Off and related transactions on our business and on our financial results on current or future periods, including with respect to any assumed liabilities or indemnification obligations with respect to such transactions, the integration of any completed acquisitions and the use of proceeds of any completed dispositions; |

| • | market conditions, including trading volume and volatility, potential deterioration of equity and debt capital markets for commercial real estate and related services, impact of significant changes in interest rates and our ability to access the capital markets; |

| • | pricing, commissions and fees, and market position with respect to any of our products and services and those of our competitors; |

| • | the effect of industry concentration and reorganization, reduction of customers and consolidation; |

| • | liquidity, regulatory requirements and the impact of credit market events; |

| • | risks associated with the integration of acquired businesses with our business; |

| • | risks related to changes in our relationships with the Government Sponsored Enterprises (“GSEs”) and Housing and Urban Development (“HUD”), changes in prevailing interest rates and the risk of loss in connection with loan defaults; |

| • | risks related to changes in the future of the GSEs, including changes in the terms of applicable conservatorships and changes in their origination capabilities; |

3

| • | economic or geopolitical conditions or uncertainties, the actions of governments or central banks, including uncertainty regarding the nature, timing and consequences of the United Kingdom (“U.K.”)’s exit from the European Union (“EU”) following the referendum, withdrawal process, proposed transition period and related rulings, including potential reduction in investment in the U.K., and the pursuit of trade, border control or other related policies by the U.S. and/or other countries, political and labor unrest in France, the impact of U.S. government shutdowns, and the impact of terrorist acts, acts of war or other violence or political unrest, as well as natural disasters or weather-related or similar events, including hurricanes as well as power failures, communication and transportation disruptions, and other interruptions of utilities or other essential services; |

| • | the effect on our business, our clients, the markets in which we operate, and the economy in general of recent changes in the U.S. and foreign tax and other laws, including changes in tax rates, repatriation rules, and deductibility of interest, potential policy and regulatory changes in Mexico, sequestrations, uncertainties regarding the debt ceiling and the federal budget, and other potential political policies and impasses; |

| • | the effect on our business of changes in interest rates, worldwide governmental debt issuances, austerity programs, increases or decreases in deficits, and other changes to monetary policy, and potential political impasses or regulatory requirements, including increased capital requirements for banks and other institutions or changes in legislation, regulations and priorities; |

| • | extensive regulation of our business and clients, changes in regulations relating to commercial real estate and other industries, and risks relating to compliance matters, including regulatory examinations, inspections, investigations and enforcement actions, and any resulting costs, increased financial and capital requirements, enhanced oversight, fines, penalties, sanctions, and changes to or restrictions or limitations on specific activities, operations, compensatory arrangements, and growth opportunities, including acquisitions, hiring, and new businesses, products, or services, as well as risks related to our taking actions to ensure that we and Newmark Holdings are not deemed investment companies under the Investment Company Act of 1940 (the “Investment Company Act”); |

| • | factors related to specific transactions or series of transactions as well as counterparty failure; |

| • | costs and expenses of developing, maintaining and protecting our intellectual property, as well as employment and other litigation and their related costs, including related to acquisitions and other matters, including judgments or settlements paid and the impact thereof on our financial results and cash flow in any given period; |

| • | our ability to maintain continued access to credit and availability of financing necessary to support our ongoing business needs, including to refinance our indebtedness, and the risks associated with the resulting leverage, as well as fluctuations in interest rates; |

| • | certain other financial risks, including the possibility of future losses, indemnification obligations, assumed liabilities, reduced cash flows from operations, increased leverage and the need for short- or long-term borrowings, including from Cantor, the ability of us to refinance our indebtedness, or other sources of cash relating to acquisitions, dispositions, or other matters, potential liquidity and other risks relating to our ability to maintain continued access to credit and availability of financing necessary to support our ongoing business needs on terms acceptable to us, if at all, and risks associated with the resulting leverage, including potentially causing a reduction in our credit ratings and the associated outlooks and increased borrowing costs, including as a result of the Berkeley Point Acquisition (defined below), as well as interest rate and foreign currency exchange rate fluctuations; |

| • | risks associated with the temporary or longer-term investment of our available cash, including in Newmark OpCo, including defaults or impairments on our investments, stock loans or cash management vehicles and collectability of loan balances owed to us by partners, employees, Newmark OpCo or others; |

| • | our ability to enter new markets or develop new products or services and to induce customers to use these products or services and to secure and maintain market share; |

4

| • | the impact of the Spin-Off and related transactions, our ability to enter into marketing and strategic alliances, and business combinations or other transactions, including acquisitions, dispositions, reorganizations, partnering opportunities and joint ventures, the anticipated benefits of any such transactions, relationships or growth and the future impact of any such transactions, relationships or growth on our other businesses and our financial results for current or future periods, the integration of any completed acquisitions and the use of proceeds of any completed dispositions, and the value of any hedging entered into in connection with consideration received or to be received in connection with such dispositions and any transfers thereof; |

| • | our estimates or determinations of potential value with respect to various assets or portions of our business, including with respect to the accuracy of the assumptions or the valuation models or multiples used; |

| • | our ability to hire and retain personnel, including brokers, salespeople, managers, and other professionals; |

| • | our ability to effectively manage any growth that may be achieved, while ensuring compliance with all applicable financial reporting, internal control, legal compliance, and regulatory requirements; |

| • | our ability to identify and remediate any material weaknesses in our internal controls that could affect our ability to properly maintain books and records, prepare financial statements and reports in a timely manner, control our policies, practices and procedures, operations and assets, assess and manage our operational, regulatory and financial risks, and integrate our acquired businesses and brokers, salespeople, managers and other professionals; |

| • | the effectiveness of our risk management policies and procedures, and the impact of unexpected market moves and similar events; |

| • | information technology risks, including capacity constraints, failures, or disruptions in our systems or those of clients, counterparties, or other parties with which we interact, including cyber-security risks and incidents, compliance with regulations requiring data minimization and protection and preservation of records of access and transfers of data, privacy risk and exposure to potential liability and regulatory focus; |

| • | our ability to meet expectations with respect to payment of dividends and repurchases of our common stock or purchases of Newmark Holdings limited partnership interests or other equity interests in our subsidiaries, including Newmark OpCo, including from Cantor or our executive officers, other employees, partners and others and the effect on the market for and trading price of our Class A common stock as a result of any such transactions; |

| • | the fact that the prices at which shares of our Class A common stock are sold in offerings or other transactions may vary significantly, and purchasers of shares in such offerings or other transactions, as well as existing stockholders, may suffer significant dilution if the price they paid for their shares is higher than the price paid by other purchasers in such offerings or transactions; |

| • | the effect on the market for and trading price of our Class A common stock of various offerings and other transactions, including offerings of our Class A common stock and convertible or exchangeable securities, our repurchases of shares of our Class A common stock and purchases of Newmark Holdings limited partnership interests or other equity interests in us or in our subsidiaries, any exchanges by Cantor of shares of our Class A common stock for shares of our Class B common stock, any exchanges or redemptions of limited partnership units and issuances of shares of Class A common stock in connection therewith, including in corporate or partnership restructurings, our payment of dividends on our Class A common stock and distributions on limited partnership interests of Newmark Holdings and Newmark OpCo, convertible arbitrage, hedging, and other transactions engaged in by holders of our outstanding debt or other securities, share sales and stock pledge, stock loan, and other financing transactions by holders of our shares or units (including by Cantor executive officers, partners, employees or others), including of shares acquired pursuant to our employee benefit plans, unit exchanges and redemptions, corporate or partnership restructurings, acquisitions, conversions of our Class B common stock and our other convertible securities, stock pledge, stock loan, or other financing transactions, and distributions from Cantor pursuant to Cantor’s distribution rights obligations and other distributions to Cantor partners, including deferred distribution rights shares; and |

5

| • | other factors, including those that are discussed under “Risk Factors,” to the extent applicable. |

The foregoing risks and uncertainties, as well as those risks and uncertainties set forth in this Quarterly Report on Form 10-Q, may cause actual results and events to differ materially from the forward-looking statements. The information included herein is given as of the filing date of this Form 10-Q with the Securities and Exchange Commission (the “SEC”), and future results or events could differ significantly from these forward-looking statements. We do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

6

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. These filings are also available to the public from the SEC’s website at www.sec.gov.

Our website address is www.ngkf.com. Through our website, we make available, free of charge, the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC: our Annual Reports on Form 10-K; our proxy statements for our annual and special stockholder meetings; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; Forms 3, 4 and 5 and Schedules 13G filed on behalf of Cantor Fitzgerald, L.P., CF Group Management, Inc., our directors and our executive officers; and amendments to those documents. Our website also contains additional information with respect to our industry and business. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this Quarterly Report on Form 10-Q.

7

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(unaudited)

| | March 31, 2019 | | | December 31, 2018 | |

Assets: | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 72,527 | | | $ | 122,475 | |

Restricted cash and cash equivalents | | | 65,306 | | | | 64,931 | |

Marketable securities | | | 43,745 | | | | 48,942 | |

Loans held for sale, at fair value | | | 873,021 | | | | 990,864 | |

Receivables, net | | | 445,941 | | | | 451,605 | |

Receivables from related parties | | | — | | | | 20,498 | |

Other current assets (see Note 19) | | | 51,527 | | | | 57,739 | |

Total current assets | | | 1,552,067 | | | | 1,757,054 | |

Goodwill | | | 515,326 | | | | 515,321 | |

Mortgage servicing rights, net | | | 406,960 | | | | 411,809 | |

Loans, forgivable loans and other receivables from employees and partners, net | | | 312,985 | | | | 285,532 | |

Fixed assets, net | | | 81,845 | | | | 78,805 | |

Other intangible assets, net | | | 34,485 | | | | 35,769 | |

Other assets (see Note 19) | | | 549,530 | | | | 369,867 | |

Total assets | | $ | 3,453,198 | | | $ | 3,454,157 | |

Liabilities, Redeemable Partnership Interests, and Equity: | | | | | | | | |

Current liabilities: | | | | | | | | |

Warehouse facilities collateralized by U.S. Government Sponsored Enterprises | | $ | 859,746 | | | $ | 972,387 | |

Accrued compensation | | | 288,804 | | | | 366,506 | |

Current portion of accounts payable, accrued expenses and other liabilities (see Note 29) | | | 302,191 | | | | 312,239 | |

Securities loaned | | | 43,745 | | | | — | |

Current portion of payables to related parties | | | 29,273 | | | | 13,507 | |

Total current liabilities | | | 1,523,759 | | | | 1,664,639 | |

Long-term debt | | | 538,626 | | | | 537,926 | |

Other long-term liabilities (see Note 29) | | | 343,431 | | | | 168,623 | |

Total liabilities | | | 2,405,816 | | | | 2,371,188 | |

Commitments and contingencies (see Note 31) | | | | | | | | |

Redeemable partnership interests | | | 26,584 | | | | 26,170 | |

Equity: | | | | | | | | |

Class A common stock, par value of $0.01 per share: 1,000,000 shares authorized; 157,473 and 156,966 shares issued at March 31, 2019 and December 31, 2018, respectively, and 157,423 and 156,916 shares outstanding at March 31, 2019 and December 31, 2018, respectively | | | 1,574 | | | | 1,570 | |

Class B common stock, par value of $0.01 per share: 500,000 shares authorized; 21,285 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | | | 212 | | | | 212 | |

Additional paid-in capital | | | 284,054 | | | | 285,071 | |

Retained earnings | | | 275,589 | | | | 277,952 | |

Contingent Class A common stock | | | 3,141 | | | | 3,250 | |

Treasury stock at cost: 50 shares of Class A common stock at March 31, 2019 and December 31, 2018 | | | (486 | ) | | | (486 | ) |

Total stockholders’ equity | | | 564,084 | | | | 567,569 | |

Noncontrolling interests | | | 456,714 | | | | 489,230 | |

Total equity | | | 1,020,798 | | | | 1,056,799 | |

Total liabilities, redeemable partnership interest, and equity | | $ | 3,453,198 | | | $ | 3,454,157 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these financial statements.

8

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(unaudited)

| | Three Months Ended March 31, | |

| | 2019 | | | 2018 | |

Revenues: | | | | | | | | |

Commissions | | $ | 275,268 | | | $ | 260,735 | |

Gains from mortgage banking activities/originations, net | | | 31,346 | | | | 38,914 | |

Management services, servicing fees and other | | | 141,042 | | | | 130,811 | |

Total revenues | | | 447,656 | | | | 430,460 | |

Expenses: | | | | | | | | |

Compensation and employee benefits | | | 263,353 | | | | 261,088 | |

Equity-based compensation and allocations of net income to limited partnership units and FPUs | | | 13,871 | | | | 17,416 | |

Total compensation and employee benefits | | | 277,224 | | | | 278,504 | |

Operating, administrative and other | | | 87,893 | | | | 75,427 | |

Fees to related parties | | | 6,725 | | | | 6,894 | |

Depreciation and amortization | | | 28,304 | | | | 22,513 | |

Total operating expenses | | | 400,146 | | | | 383,338 | |

Other income, net: | | | | | | | | |

Other income (loss) | | | (9,718 | ) | | | 5,707 | |

Total other income (loss), net | | | (9,718 | ) | | | 5,707 | |

Income from operations | | | 37,792 | | | | 52,829 | |

Interest expense, net | | | (7,699 | ) | | | (13,409 | ) |

Income before income taxes and noncontrolling interests | | | 30,093 | | | | 39,420 | |

Provision for income taxes | | | 6,687 | | | | 6,933 | |

Consolidated net income | | | 23,406 | | | | 32,487 | |

Less: Net income attributable to noncontrolling interests | | | 6,502 | | | | 12,490 | |

Net income available to common stockholders | | $ | 16,904 | | | $ | 19,997 | |

Per share data: | | | | | | | | |

Basic earnings per share | | | | | | | | |

Net income available to common stockholders (1) | | $ | 13,680 | | | $ | 19,997 | |

Basic earnings per share | | $ | 0.08 | | | $ | 0.13 | |

Basic weighted-average shares of common stock outstanding | | | 178,611 | | | | 155,694 | |

Fully diluted earnings per share | | | | | | | | |

Net income for fully diluted shares | | $ | 21,968 | | | $ | 30,286 | |

Fully diluted earnings per share | | $ | 0.08 | | | $ | 0.12 | |

Fully diluted weighted-average shares of common stock outstanding | | | 269,057 | | | | 246,834 | |

| | | | | | | | |

(1) In accordance with ASC 260, includes a reduction for dividends on preferred stock or units in the amount of $3.2 million for the three months ended March 31, 2019. | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these financial statements.

9

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

(unaudited)

| | Three Months Ended March 31, | |

| | 2019 | | | 2018 | |

Consolidated net income | | $ | 23,406 | | | $ | 32,487 | |

Comprehensive income, net of tax | | | 23,406 | | | | 32,487 | |

Less: Comprehensive income attributable to noncontrolling interests, net of tax | | | 6,502 | | | | 12,490 | |

Comprehensive income available to common stockholders | | $ | 16,904 | | | $ | 19,997 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these financial statements.

10

NEWMARK GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(In thousands, except share and per share amounts)

(unaudited)

| | Class A Common Stock | | | Class B Common Stock | | | Additional Paid-in Capital | | | Contingent Class A Common Stock | | | Treasury Stock | | | Retained Earnings | | | Noncontrolling Interests | | | Total | |

Balance, January 1, 2018 | | $ | 1,386 | | | $ | 158 | | | $ | 59,374 | | | $ | — | | | $ | — | | | $ | 199,492 | | | $ | (38,092 | ) | | $ | 222,318 | |

Consolidated net income | | | — | | | | — | | | | — | | | | — | | | | — | | | | 19,997 | | | | 12,490 | | | | 32,487 | |

Cumulative effect of revenue standard adoption | | | — | | | | — | | | | — | | | | — | | | | — | | | | 16,463 | | | | 2,342 | | | | 18,805 | |

Distributions | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (100 | ) | | | (100 | ) |

BGC's purchase of 16,606,726 exchangeable limited partnership units in Newmark Holdings | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 241,960 | | | | 241,960 | |

Grant of exchangeability and redemption of limited partnership interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 19,869 | | | | 19,869 | |

Allocation of net income to redeemable partnership interests | | | — | | | | ��� | | | | — | | | | — | | | | — | | | | — | | | | (1,009 | ) | | | (1,009 | ) |

Equity-based compensation and related issuance of (Class A common stock 327,746 shares) | | | 3 | | | | — | | | | (4,900 | ) | | | — | | | | — | | | | — | | | | — | | | | (4,897 | ) |

Other | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,144 | | | | — | | | | 2,144 | |

Balance, March 31, 2018 | | $ | 1,389 | | | $ | 158 | | | $ | 54,474 | | | $ | — | | | $ | — | | | $ | 238,096 | | | $ | 237,460 | | | $ | 531,577 | |

| | Class A Common Stock | | | Class B Common Stock | | | Additional Paid-in Capital | | | Contingent Class A Common Stock | | | Treasury Stock | | | Retained Earnings | | | Noncontrolling Interests | | | Total | |

Balance, January 1, 2019 | | $ | 1,570 | | | $ | 212 | | | $ | 285,071 | | | $ | 3,250 | | | $ | (486 | ) | | $ | 277,952 | | | $ | 489,230 | | | $ | 1,056,799 | |

Consolidated net income | | | — | | | | — | | | | — | | | | — | | | | — | | | | 16,904 | | | | 6,502 | | | | 23,406 | |

Dividends to common stockholders | | | — | | | | — | | | | — | | | | — | | | | — | | | | (16,043 | ) | | | — | | | | (16,043 | ) |

Preferred dividend on exchangeable preferred partnership units | | | — | | | | — | | | | — | | | | — | | | | — | | | | (3,224 | ) | | | 3,224 | | | | — | |

Earnings distributions to limited partnership interests and other noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (27,280 | ) | | | (27,280 | ) |

Grant of exchangeability, redemption and issuance of 498,129 shares | | | 4 | | | | — | | | | (572 | ) | | | — | | | | — | | | | — | | | | (14,962 | ) | | | (15,530 | ) |

Issuance of Class A common stock, 8,451 shares | | | — | | | | — | | | | 109 | | | | (109 | ) | | | — | | | | — | | | | — | | | | — | |

Other | | | — | | | | — | | | | (554 | ) | | | — | | | | — | | | | — | | | | — | | | | (554 | ) |

Balance, March 31, 2019 | | $ | 1,574 | | | $ | 212 | | | $ | 284,054 | | | $ | 3,141 | | | $ | (486 | ) | | $ | 275,589 | | | $ | 456,714 | | | $ | 1,020,798 | |

| | For the Three Months Ended March 31, | |

| | 2019 | | | 2018 | |

Dividends declared per share of common stock | | $ | 0.10 | | | $ | 0.09 | |

Dividends paid per share of common stock | | $ | 0.09 | | | N/A | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these financial statements.

11

NEWMARK GROUP INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(unaudited)

| | Three Months Ended March 31, | |

| | 2019 | | | 2018 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

Consolidated net income | | $ | 23,406 | | | $ | 32,487 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Gain on originated mortgage servicing rights | | | (17,254 | ) | | | (6,389 | ) |

Depreciation and amortization | | | 28,304 | | | | 22,513 | |

Equity-based compensation and allocation of net income to limited partnership units and FPUs | | | 13,871 | | | | 17,416 | |

Employee loan amortization | | | 7,437 | | | | 6,009 | |

Change in fair value of contingent consideration | | | 193 | | | | 134 | |

Unrealized gains on loans held for sale | | | (13,276 | ) | | | (15,126 | ) |

Income from an equity method investment | | — | | | | (3,176 | ) |

Provision for uncollectible accounts | | | 956 | | | | 1,140 | |

Realized (gain) loss on marketable securities | | | 51 | | | | (2,400 | ) |

Unrealized gains on marketable securities | | | (3,960 | ) | | | (796 | ) |

Valuation of derivative asset | | | 13,329 | | | | — | |

Loan originations—loans held for sale | | | (1,554,443 | ) | | | (1,410,690 | ) |

Loan sales—loans held for sale | | | 1,685,561 | | | | 822,811 | |

Other | | | 1,167 | | | | 255 | |

Consolidated net income (loss), adjusted for non-cash and non-operating items | | | 185,342 | | | | (535,812 | ) |

Changes in operating assets and liabilities: | | | | | | | | |

Receivables, net | | | 4,709 | | | | (19,374 | ) |

Loans, forgivable loans and other receivables from employees and partners | | | (39,995 | ) | | | (24,583 | ) |

Other assets | | | (18,602 | ) | | | (14,063 | ) |

Accrued compensation | | | (62,051 | ) | | | (26,676 | ) |

Accounts payable, accrued expenses and other liabilities | | | (29,970 | ) | | | 30,114 | |

Net cash provided by (used in) operating activities | | | 39,433 | | | | (590,394 | ) |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

Proceeds from the sale of marketable securities | | | 9,106 | | | | 52,196 | |

Investment in cost method investments | | — | | | | (7,500 | ) |

Purchases of fixed assets | | | (5,936 | ) | | | (1,714 | ) |

Purchase of mortgage servicing rights | | | (298 | ) | | | (509 | ) |

Net cash provided by investing activities | | | 2,872 | | | | 42,473 | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

Proceeds from warehouse facilities | | | 1,554,443 | | | | 1,410,690 | |

Principal payments on warehouse facilities | | | (1,667,084 | ) | | | (820,651 | ) |

Proceeds from BGC's purchase of exchangeable limited partnership units in Newmark Holdings | | — | | | | 241,960 | |

Payments to related parties | | — | | | | (13,000 | ) |

Borrowings from related parties | | — | | | | 177,016 | |

Settlement of pre-Spin-Off related party receivables | | | 27,044 | | | — | |

Fees relating to the IPO | | — | | | | (8,870 | ) |

Repayment of debt | | | (50,000 | ) | | | (270,710 | ) |

Borrowings of debt | | | 50,000 | | | — | |

Securities loaned | | | 43,745 | | | | (49,001 | ) |

Earnings distributions to limited partnership interests and noncontrolling interests | | | (33,951 | ) | | | (100 | ) |

Distributions to stockholders | | | (16,043 | ) | | | — | |

Payments on acquisition earn-outs | | — | | | | (758 | ) |

Payment of deferred financing costs | | | (32 | ) | | | (16 | ) |

Net cash (used in) provided by financing activities | | | (91,878 | ) | | | 666,560 | |

Net increase (decrease) in cash and cash equivalents and restricted cash | | | (49,573 | ) | | | 118,639 | |

Cash and cash equivalents and restricted cash at beginning of period | | | 187,406 | | | | 173,374 | |

Cash and cash equivalents and restricted cash at end of period | | $ | 137,833 | | | $ | 292,013 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these financial statements.

12

NEWMARK GROUP INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS – (Continued)

(In thousands)

(unaudited)

| | Three Months Ended March 31, | |

| | 2019 | | | 2018 | |

Supplemental disclosures of cash flow information: | | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Interest | | $ | 288 | | | $ | 12,922 | |

Taxes | | $ | 59,279 | | | $ | 19 | |

The accompanying notes to the unaudited condensed consolidated financial statements are an integral part of these financial statements.

13

NEWMARK GROUP, INC.

Notes to Condensed Consolidated Financial Statements

(unaudited)

(1) | Organization and Basis of Presentation |

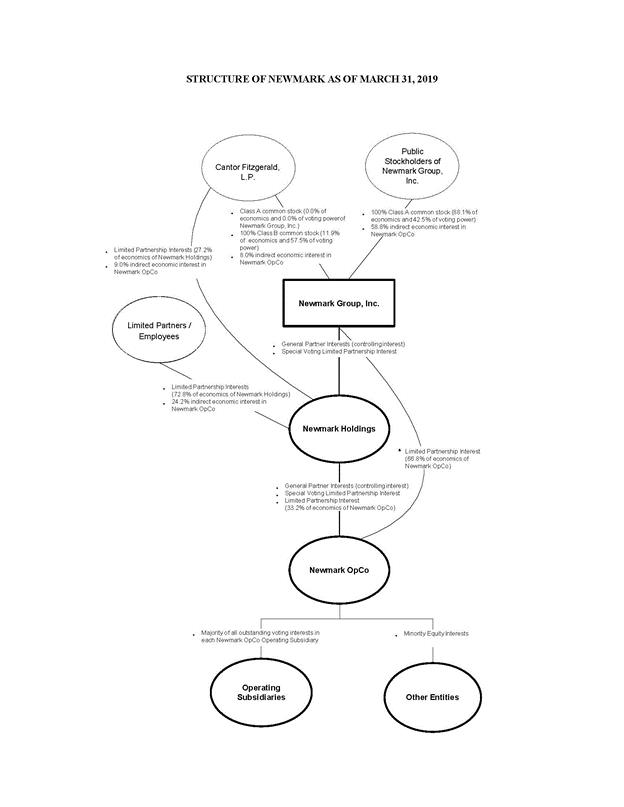

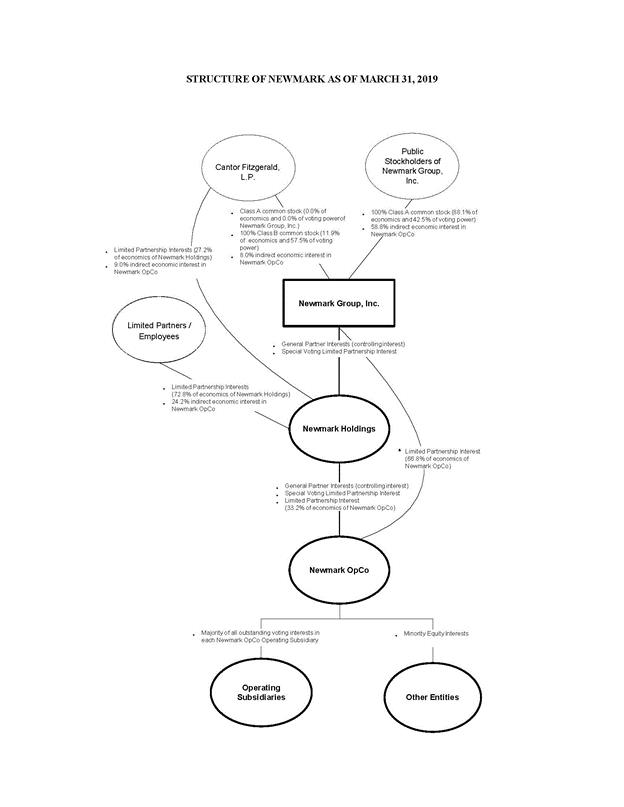

Newmark Group, Inc., formerly known as Newmark Knight Frank (together with its subsidiaries, “Newmark” or the “Company”), a Delaware corporation, was formed as NRE Delaware, Inc. on November 18, 2016. Newmark changed its name to Newmark Group, Inc. on October 18, 2017. Newmark Holdings, L.P. (“Newmark Holdings”) is a consolidated subsidiary of Newmark for which Newmark is the general partner. Newmark and Newmark Holdings jointly own Newmark Partners, L.P. (“Newmark OpCo”), the operating partnership. Newmark is a leading commercial real estate services firm. Newmark offers a diverse array of integrated services and products designed to meet the full needs of both real estate investors/owners and occupiers. Newmark’s investor/owner services and products include capital markets, which consists of investment sales, debt and structured finance and loan sales, agency leasing, property management, valuation and advisory, commercial real estate due diligence consulting and advisory services and GSE lending and loan servicing, mortgage broking and equity-raising. Our occupier services and products include tenant representation, real estate management technology systems, workplace and occupancy strategy, global corporate consulting services, project management, lease administration and facilities management. Newmark enhances these services and products through innovative real estate technology solutions and data analytics that enable our clients to increase their efficiency and profits by optimizing their real estate portfolio. Newmark has relationships with many of the world’s largest commercial property owners, real estate developers and investors, as well as Fortune 500 and Forbes Global 2000 companies.

Newmark was formed through BGC Partners, Inc.’s (“BGC Partners” or “BGC”) purchase of Newmark & Company Real Estate, Inc. and certain of its affiliates in 2011. A majority of the voting power of BGC Partners is held by Cantor Fitzgerald, L.P. (“CFLP” or “Cantor”), including Cantor Fitzgerald & Co (“CF&Co”). Subsequent to the Spin-Off, as defined below, the majority of the voting power of Newmark is held by Cantor.

On November 30, 2018 (the “Distribution Date”), BGC completed its previously announced pro-rata distribution (the “Spin-Off”) to its stockholders of all of the shares of common stock of Newmark owned by BGC as of immediately prior to the effective time of the Spin-Off, with shares of Newmark Class A common stock distributed to the holders of shares of BGC Class A common stock (including directors and executive officers of BGC Partners) of record as of the close of business on November 23, 2018 (the “Record Date”), and shares of Newmark Class B common stock distributed to the holders of shares of BGC Partners Class B common stock (consisting of Cantor and CF Group Management, Inc. (“CFGM”)) of record as of the close of business on the Record Date. The Spin-Off was effective as of 12:01 a.m., New York City time, on the Distribution Date.

See Note 1 – Organization and Basis of Presentation to our consolidated financial statements included in Part II, Item 8 of our Annual Report on Form 10-K as of December 31, 2018, for further information regarding the transactions related to the IPO and Spin-Off of Newmark. A summary of the key transactions is provided below.

Acquisition of Berkeley Point and Investment in Real Estate LP

On September 8, 2017, BGC acquired, from Cantor Commercial Real Estate Company, LP (“CCRE”), 100% of the equity of Berkeley Point Financial LLC (the “Berkeley Point Acquisition”). Berkeley Point Financial LLC (“Berkeley Point” or “BPF”) is a leading commercial real estate finance company focused on the origination and sale of multifamily and other commercial real estate loans through government-sponsored and government-funded loan programs, as well as the servicing of commercial real estate loans. On December 13, 2017, in connection with the Separation from BGC, the assets and liabilities of Berkeley Point were transferred to Newmark (See Note 27 – Related Party Transactions).

Concurrently with the Berkeley Point Acquisition, on September 8, 2017 Newmark invested $100.0 million in a newly formed commercial real estate-related financial and investment business, CF Real Estate Finance Holdings, L.P. (“Real Estate LP”), which is controlled and managed by Cantor. Real Estate LP may conduct activities in any real estate-related business or asset backed securities-related business or any extensions thereof and ancillary activities thereto. In addition, Real Estate LP may provide short-term loans to related parties from time to time when funds in excess of amounts needed for investment are available. As of March 31, 2019, Newmark’s investment in Real Estate LP was accounted for under the equity method.

14

Separation and Distribution Agreement and IPO

On December 13, 2017, prior to the closing of Newmark’s initial public offering (“IPO”), BGC, BGC Holdings, BGC Partners, L.P. (“BGC U.S. OpCo”), Newmark, Newmark Holdings, Newmark OpCo and, solely for the provisions listed therein, Cantor and BGC Global Holdings, L.P. (“BGC Global OpCo”) entered into a Separation and Distribution Agreement (the “Original Separation and Distribution Agreement”). The Original Separation and Distribution Agreement set forth the agreements among BGC, Cantor, Newmark and their respective subsidiaries regarding, among other things:

•the principal corporate transactions pursuant to which BGC, BGC Holdings and BGC U.S. OpCo and their respective subsidiaries (other than the Newmark Group (defined below), the “BGC Group”) transferred to Newmark, Newmark Holdings and Newmark OpCo and their respective subsidiaries (the “Newmark Group”) the assets and liabilities of the BGC Group relating to BGC’s Real Estate Services business, including BGC’s interests in both BPF and Real Estate LP (the “Separation”);

•the proportional distribution of interests in Newmark Holdings to holders of interests in BGC Holdings;

•the IPO;

•the assumption and repayment of indebtedness by the BGC Group and the Newmark Group, as further described below; and

•the pro rata distribution of the shares of Newmark Class A common stock and the shares of Newmark Class B common stock held by BGC, pursuant to which shares of Newmark Class A common stock held by BGC would be distributed to the holders of shares of BGC Class A common stock and shares of Newmark Class B common stock held by BGC would be distributed to the holders of shares of BGC Class B common stock, which distribution is intended to qualify as generally tax-free for U.S. federal income tax purposes.

Initial Public Offering

On December 15, 2017, Newmark announced the pricing of the IPO of 20 million shares of Newmark’s Class A common stock at a price to the public of $14.00 per share, which was completed on December 19, 2017. Newmark Class A shares began trading on December 15, 2017 on the NASDAQ Global Select Market under the symbol “NMRK” (See Note 27 – Related Party Transactions for additional information). In addition, Newmark granted the underwriters a 30-day option to purchase up to an additional 3 million shares of Newmark Class A common stock at the IPO price, less underwriting discounts and commissions. On December 26, 2017, the underwriters of the IPO exercised in full their overallotment option to purchase an additional 3 million shares of Newmark Class A common stock from Newmark at the IPO price, less underwriting discounts and commission.

Debt

In connection with the Separation, on December 13, 2017, Newmark OpCo assumed all of BGC U.S. OpCo’s rights and obligations under the 2042 Promissory Note in relation to the 8.125% Senior Notes and the 2019 Promissory Note in relation to the 5.375% Senior Notes. Newmark repaid the $112.5 million outstanding principal amount under the 2042 Promissory Note on September 5, 2018, and repaid the $300.0 million outstanding principal amount under the 2019 Promissory Note on November 23, 2018. In addition, as part of the Separation, Newmark assumed the obligations of BGC as borrower under the Term Loan and Converted Term Loan. Newmark repaid the outstanding balance of the Term Loan as of March 31, 2018, and repaid the outstanding balance of the Converted Term Loan as of November 6, 2018. In addition, on March 19, 2018, BGC loaned Newmark $150.0 million under the “Intercompany Credit Agreement” on the same day. All borrowings outstanding under the Intercompany Credit Agreement were repaid as of November 7, 2018 (See Note 22 — Long-term Debt for defined terms and more information on Newmark’s long-term debt).

15

BGC’s Investment in Newmark Holdings

On March 7, 2018, BGC Partners and its operating subsidiaries purchased 16.6 million newly issued exchangeable limited partnership units (the “Newmark Units”) of Newmark Holdings L.P. for approximately $242.0 million (the “Investment in Newmark in Newmark Holdings”) (See Note 27 – Related Party Transactions for additional information).

Nasdaq Monetization Transactions

On June 28, 2013, BGC sold certain assets of its on-the-run, electronic benchmark U.S. Treasury platform (“eSpeed”) to Nasdaq. The total consideration received in the transaction included $750.0 million in cash paid upon closing and an earn-out of up to 14,883,705 shares of Nasdaq common stock to be paid ratably over 15 years, provided that Nasdaq, as a whole, produces at least $25.0 million in consolidated gross revenues each year. The remaining rights under the Nasdaq Earn-out were transferred to Newmark on September 28, 2017 (See Note 7 – Marketable Securities for additional information).

Exchangeable Preferred Partnership Units and Forward Contracts

On June 18, 2018 and September 26, 2018, Newmark’s principal operating subsidiary, Newmark OpCo, issued approximately $175.0 million and $150.0 million of exchangeable partnership units (“EPUs”), respectively, in private transactions to the Royal Bank of Canada (“RBC”) (the “Newmark OpCo Preferred Investment”). Newmark received $152.9 million and $113.2 million of cash in the second and third quarter, respectively, of 2018 with respect to these transactions. The EPUs were issued in four tranches and are separately convertible by either RBC or Newmark into a fixed number of Newmark’s Class A common stock, subject to a revenue hurdle for Newmark in each of the fourth quarters of 2019 through 2022 for each of the respective four tranches. As the EPUs represent equity ownership of a consolidated subsidiary of Newmark, they have been included in Noncontrolling interests on the unaudited condensed consolidated statements of changes in equity. The EPUs are entitled to a preferred payable-in-kind dividend, which is recorded as accretion to the carrying amount of the EPUs through Retained Earnings on the unaudited condensed consolidated statements of changes in equity and are reductions to Net income (loss) available to common stockholders for the purpose of calculating earnings per share.

Contemporaneously with the issuance of the EPUs, the newly formed special purpose vehicle entities (the “SPVs”) that are consolidated subsidiaries of Newmark, entered into four variable postpaid forward contracts with RBC (together, the "RBC Forwards"). The SPVs are indirect subsidiaries of Newmark whose sole asset is the Nasdaq share Earn-Outs for 2019 through 2022.The RBC Forwards provide the option to both Newmark and RBC for RBC to receive up to 992,247 shares of Nasdaq common stock, received by Newmark pursuant to the Nasdaq earn-out (See Note 7 — Marketable Securities), in each of the fourth quarters of 2019 through 2022 in exchange for either cash or redemption of the EPUs, solely at Newmark’s option.

The Spin-Off

On November 30, 2018, BGC completed the Spin-Off to its stockholders of all of the shares of Newmark’s common stock owned by BGC as of immediately prior to the effective time of the Spin-Off, with shares of Newmark’s Class A common stock distributed to the holders of shares of BGC’s Class A common stock (including directors and executive officers of BGC Partners) of record as of the close of business on (the Record Date, and shares of Newmark’s Class B common stock distributed to the holders of shares of BGC’s Class B common stock (consisting of Cantor and CFGM) of record as of the close of business on the Record Date. Based on the number of shares of BGC common stock outstanding as of the close of business on the Record Date, BGC’s stockholders as of the Record Date received in the Distribution 0.463895 of a share of Newmark Class A common stock for each share of BGC Class A common stock held as of the Record Date, and 0.463895 of a share of Newmark Class B common stock for each share of BGC Class B common stock held as of the Record Date. BGC Partners stockholders received cash in lieu of any fraction of a share of Newmark common stock that they otherwise would have received in the Distribution.

Prior to and in connection with the Spin-Off, 14.8 million Newmark Holdings Units held by BGC were exchanged into 9.4 million shares of Newmark Class A common stock and 5.4 million shares of Newmark Class B

16

common stock, and 7.0 million Newmark OpCo Units held by BGC were exchanged into 6.9 million shares of Newmark Class A common stock. These Newmark Class A and Class B shares of common stock were included in the Spin-Off to BGC’s stockholders.

In the aggregate, BGC distributed 131,886,409 shares of Newmark’s Class A common stock and 21,285,537 shares of our Newmark’s Class B common stock to BGC’s stockholders in the Distribution. These shares of our Newmark’s common stock collectively represented approximately 94% of the total voting power of our outstanding common stock and approximately 87% of the total economics of Newmark outstanding common stock in each case as of the Distribution Date.

On November 30, 2018, BGC Partners also caused its subsidiary, BGC Holdings, L.P. (“BGC Holdings”), to distribute pro rata (the “BGC Holdings distribution”) all of the 1,458,931 exchangeable limited partnership units of Newmark Holdings held by BGC Holdings immediately prior to the effective time of the BGC Holdings distribution to its limited partners entitled to receive distributions on their BGC Holdings units (including Cantor and executive officers of BGC) who were holders of record of such units as of the Record Date. The Newmark Holdings units distributed to BGC Holdings partners in the BGC Holdings distribution are exchangeable for shares of Newmark Class A common stock, and in the case of the 449,917 Newmark Holdings units received by Cantor also into shares of Newmark Class B common stock, at the applicable exchange ratio (subject to adjustment). As of March 31, 2019, the exchange ratio was 0.9558 shares of Newmark common stock per Newmark Holdings unit.

Following the Spin-Off and the BGC Holdings distribution, BGC Partners ceased to be Newmark’s controlling stockholder, and BGC and its subsidiaries no longer held any shares of Newmark common stock or other equity interests in it or its subsidiaries. Cantor continues to control Newmark and its subsidiaries following the Distribution and the BGC Holdings distribution.

(a)Basis of Presentation

Newmark’s unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission and in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”). The Newmark unaudited condensed consolidated financial statements were prepared on a stand-alone basis derived from the financial statements and accounting records of BGC. During the year ended December 31, 2018, Newmark changed the line item formerly known as “Allocations of net income and grant of exchangeability to limited partnership units and FPUs” to “Allocations of net income and grant of exchangeability to limited partnership units and FPUs and issuance of common stock” in Newmark’s consolidated statement of operations. For the three months ended March 31, 2019 Newmark changed the line item formerly known as “Allocations of net income and grant of exchangeability to limited partnership units and FPUs and issuance of common stock” to “Equity-based compensation and allocations of net income to limited partnership units and FPUs” in Newmark’s condensed consolidated statements of operations. The change resulted in the reclassification of amortization charges related to equity-based awards such as REUs and RSUs from “Compensation and employee benefits” to “Equity-based compensation and allocations of net income to limited partnership units and FPUs”.

“Equity-based compensation and allocations of net income to limited partnership units and FPUs” reflect the following items:

| • | Charges with respect to grants of exchangeability, which reflect the right of holders of limited partnership units with no capital accounts, such as LPUs and PSUs, to exchange these units into shares of common stock, or into partnership units with capital accounts, such as HDUs, as well as cash paid with respect to taxes withheld or expected to be owed by the unit holder upon such exchange. The withholding taxes related to the exchange of certain non-exchangeable units without a capital account into either common shares or units with a capital account may be funded by the redemption of preferred units such as PPSUs. |

17

| • | Charges with respect to preferred unit redemption. Any preferred units would not be included in Newmark’s fully diluted share count because they cannot be made exchangeable into shares of common stock and are entitled only to a fixed distribution. Preferred units are granted in connection with the grant of certain limited partnership units that may be granted exchangeability at ratios designed to cover any withholding taxes expected to be paid by the unit holder upon exchange. This is an alternative to the common practice among public companies of issuing the gross amount of shares to employees, subject to cashless withholding of shares, to pay applicable withholding taxes. |

| • | Equity-based compensation charges with respect to the grant of an offsetting amount of common stock or partnership units with capital accounts in connection with the redemption of non-exchangeable units, including PSUs and LPUs. |

| • | Charges related to amortization of RSUs and limited partnership units. |

| • | Charges related to grants of equity awards, including common stock and partnership units with capital accounts. |

| • | Allocations of net income to limited partnership units and FPUs. Such allocations represent the pro-rata portion of post-tax GAAP earnings available to such unit holders. |

Newmark also changed “Gains from mortgage banking activities, net” to “Gains from mortgage banking activities/orginations, net” during the year ended December 31, 2018. The line item “Warehouse notes payable” was changed to “Warehouse facilities collateralized by U.S. Government Sponsored Enterprises” during the year ended December 31, 2018. Reclassifications have been made to previously reported amounts to conform to the current presentation.

Intercompany balances and transactions within Newmark have been eliminated. Transactions between Cantor or BGC and Newmark pursuant to service agreements between Cantor and BGC (See Note 27 — Related Party Transactions), representing valid receivables and liabilities of Newmark, which are periodically cash settled, have been included in the unaudited condensed consolidated financial statements as either receivables to or payables from related parties.

Newmark receives administrative services to support its operations, and in return, Cantor and/or BGC allocate certain of their expenses to Newmark. Such expenses represent costs related, but not limited to, treasury, legal, accounting, information technology, payroll administration, human resources, incentive compensation plans and other services. These costs, together with an allocation of Cantor and/or BGC overhead costs, are included as expenses in the unaudited condensed consolidated statements of operations. Where it is possible to specifically attribute such expenses to activities of Newmark, these amounts have been expensed directly to Newmark. Allocation of all other such expenses is based on a services agreement between Cantor and/or BGC which reflects the utilization of service provided or benefits received by Newmark during the periods presented on a consistent basis, such as headcount, square footage, revenue, etc. Management believes the assumptions underlying the stand-alone financial statements, including the assumptions regarding allocated expenses, reasonably reflect the utilization of services provided to or the benefit received by Newmark during the periods presented. However, these shared expenses may not represent the amounts that would have been incurred had Newmark operated independently from Cantor and/or BGC. Actual costs that would have been incurred if Newmark had been a stand-alone company would depend on multiple factors, including organizational structure and strategic decisions in various areas, including information technology and infrastructure (See Note 27 — Related Party Transactions for an additional discussion of expense allocations).

Transfers of cash, both to and from Cantor and/or BGC, are included in “Current portion of payables to related parties” on the unaudited condensed consolidated balance sheets and as part of the change in payments to and borrowings from related parties in the financing section within the accompanying unaudited condensed consolidated statements of cash flows.

18

The income tax provision in the unaudited condensed consolidated statements of operations and comprehensive income has been calculated as if Newmark was operating on a stand-alone basis and filed separate tax returns in the jurisdictions in which it operates. Newmark’s operations have historically been included in the BGC U.S. federal and state tax returns or separate non-U.S. jurisdictions tax returns. As Newmark operations in many jurisdictions were unincorporated commercial units of BGC and its subsidiaries, stand-alone tax returns have not been filed for the operations in these jurisdictions.

Newmark’s unaudited condensed consolidated financial statements contain all normal and recurring adjustments that, in the opinion of management, are necessary for a fair presentation of the unaudited condensed consolidated balance sheets, the unaudited condensed consolidated statements of operations, the unaudited condensed consolidated statements of comprehensive income, the unaudited condensed consolidated statements of cash flows and the unaudited condensed consolidated statements of changes in equity of Newmark for the periods presented.

| (b) | Recently Adopted Accounting Pronouncements |

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers, which relates to how an entity recognizes the revenue it expects to be entitled to for the transfer of promised goods and services to customers. Newmark adopted the standard as of its effective date of January 1, 2018 and recognized an increase in assets, liabilities, beginning retained earnings and noncontrolling interests of $64.4 million, $45.6 million, $16.5 million and $2.3 million, respectively, as the cumulative effect of adoption of this accounting change. The impact of adoption is primarily related to Newmark’s brokerage revenues from leasing commissions where revenue recognition was previously deferred when future contingencies exist under the previous revenue recognition guidance. The adoption of the new revenue recognition guidance accelerated these commission revenues that were based, in part, on future contingent events. For example, a portion of certain brokerage revenues from leasing commissions were deferred until a future contingency was resolved (e.g., tenant move-in or payment of first month’s rent). Under the new revenue recognition model, Newmark’s performance obligation will be typically satisfied at lease signing, and, therefore, the portion of the commission that is contingent on a future event will likely be recognized earlier, if it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur.

Further, Newmark previously presented expenses incurred on behalf of customers for certain management services subject to reimbursement on a net basis within expenses. Under the new revenue recognition model, Newmark concluded that it controls the services provided by a third-party on behalf of customers and, therefore, acts as a principal under those contracts. As a result, for these service contracts Newmark will present expenses incurred on behalf of customers along with corresponding reimbursement revenue on a gross basis in Newmark’s unaudited condensed consolidated statements of operations, with no impact on net income available to common stockholders.

Newmark elected to adopt the new guidance using a modified retrospective approach applied to contracts that were not completed as of January 1, 2018. Accordingly, the new revenue standard is applied prospectively in Newmark’s financial statements from January 1, 2018 onward.

The new revenue recognition guidance does not apply to revenue associated with financial instruments, including loans and securities that are accounted for under other U.S. GAAP, and as a result did not have an impact on the elements of Newmark’s unaudited condensed consolidated statements of operations most closely associated with financial instruments, including Gains from mortgage banking activities/origination, net, and Servicing fees.

There was no significant impact as a result of applying the new revenue standard to Newmark’s unaudited condensed consolidated financial statements for the three months ended March 31, 2018, except as it relates to the revenue recognition of certain brokerage revenues from leasing commissions that were based, in part, on future contingent events and the presentation of expenses incurred on behalf of customers for certain management services subject to reimbursement (See Note 3 — Summary of Significant Accounting Policies and Note 13 — Revenues from Contracts with Customers).

19

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. This ASU requires entities to measure equity investments that do not result in consolidation and are not accounted for under the equity method at fair value and recognize any changes in fair value in net income unless the investments qualify for the new measurement alternative. The guidance also requires entities to record changes in instrument-specific credit risk for financial liabilities measured under the fair value option in other comprehensive income. In February 2018, the FASB issued ASU No. 2018-03, Technical Corrections and Improvements to Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, to clarify transition and subsequent accounting for equity investments without a readily determinable fair value, among other aspects of the guidance issued in ASU 2016-01. The amendments in ASU 2018-03 were effective for fiscal years beginning January 1, 2018 and interim periods beginning July 1, 2018. The amendments and technical corrections provided in ASU 2018-03 could be adopted concurrently with ASU 2016-01, which was effective for Newmark on January 1, 2018. Newmark adopted both ASUs on January 1, 2018 using the modified retrospective approach for equity securities with a readily determinable fair value and the prospective method for equity investments without a readily determinable fair value. The adoption of this guidance did not have a material impact on Newmark’s unaudited condensed consolidated financial statements.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230)—Classification of Certain Cash Receipts and Cash Payments, which makes changes to how cash receipts and cash payments are presented and classified in the statements of cash flows. The new standard became effective beginning with the first quarter of 2018 and required adoption on a retrospective basis. The adoption of this guidance did not have a material impact on Newmark’s unaudited condensed consolidated statements of cash flows.

In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230)—Restricted Cash, which requires that the statements of cash flows explain the change during the period in the total of cash, cash equivalents and amounts generally described as restricted cash or restricted cash equivalents. The new standard became effective beginning January 1, 2018 and required adoption on a retrospective basis. The effect of this guidance resulted in the inclusion of restricted cash in the cash and cash equivalents balance on Newmark’s unaudited condensed consolidated statements of cash flows.

In January 2017, the FASB issued ASU No. 2017-01, Business Combinations (Topic 805)—Clarifying the definition of Business, which clarifies the definition of a business with the objective of providing additional guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The new standard became effective beginning January 1, 2018 on a prospective basis. The adoption of this U.S. GAAP guidance did not have a material impact on Newmark’s unaudited condensed consolidated financial statements.

In May 2017, the FASB issued ASU No. 2017-09, Compensation—Stock Compensation (Topic 718)—Scope of Modification Accounting, which amends the scope of modification accounting for share-based payment arrangements and provides guidance on the types of changes to the terms or conditions of share-based payment awards to which an entity would be required to apply modification accounting. Under this guidance, an entity would not apply modification accounting if the fair value, the vesting conditions, and the classification of the awards (as equity or liability) are the same immediately before and after the modification. The new standard became effective beginning January 1, 2018, on a prospective basis for awards modified on or after the adoption date. The adoption of this guidance did not have a material impact on Newmark’s unaudited condensed consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). This standard requires lessees to recognize a right-of-use (“ROU”) asset and lease liability for all leases with terms of more than 12 months. Recognition, measurement and presentation of expenses will depend on classification as a finance or operating lease. The amendments also require certain quantitative and qualitative disclosures. Accounting guidance for lessors is mostly unchanged. In July 2018, the FASB issued ASU 2018-10, Codification Improvements to Topic 842, Leases, to clarify how to apply certain aspects of the new leases standard. The amendments address the rate implicit in the lease, impairment of the net investment in the lease, lessee reassessment of lease classification, lessor reassessment of lease term and purchase options, variable payments that depend on an index or rate and certain transition adjustments, among other issues. In addition, in July 2018, the FASB issued ASU 2018-11, Leases (Topic 842), Targeted Improvements, which provided an additional (and optional) transition method to adopt the new leases

20

standard. Under the new transition method, a reporting entity would initially apply the new lease requirements at the effective date and recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption; continue to report comparative periods presented in the financial statements in the period of adoption in accordance with current U.S. GAAP (i.e., ASC 840, Leases); and provide the required disclosures under ASC 840 for all periods presented under current U.S. GAAP. Further, ASU 2018-11 contains a practical expedient that allows lessors to avoid separating lease and associated non-lease components within a contract if certain criteria are met. In December 2018, the FASB issued ASU 2018-20, Leases (Topic 842), Narrow-Scope Improvements for Lessors, to clarify guidance for lessors on sales taxes and other similar taxes collected from lessees, certain lessor costs and recognition of variable payments for contracts with lease and non-lease components. In March 2019, the FASB issued ASU 2019-01, Leases (Topic 842), Codification Improvements, to clarify certain application and transitional disclosure aspects of the new leases standard. The amendments address determination of the fair value of the underlying asset by lessors that are not manufacturers or dealers and clarify interim period transition disclosure requirements, among other issues. The guidance in ASUs 2016-02, 2018-10, 2018-11 and 2018-20 was effective beginning January 1, 2019, with early adoption permitted; whereas the guidance in ASU 2019-01 is effective beginning January 1, 2020, with early adoption permitted. Newmark adopted the standards on January 1, 2019 using the effective date as the date of initial application. Therefore, pursuant to this transition method, financial information was not updated and the disclosures required under the new leases standards were not provided for dates and periods before January 1, 2019. The new guidance provides a number of optional practical expedients to be utilized by lessees upon transition. Accordingly, Newmark elected the “package of practical expedients,” which permitted Newmark not to reassess under the new standard its prior conclusions about lease identification, lease classification and initial direct costs. Newmark did not elect the use-of-hindsight or the practical expedient pertaining to land easements, with the latter not being applicable to Newmark. The new standard also provides practical expedients for an entity’s ongoing accounting as a lessee. Newmark elected the short-term lease recognition exemption for all leases that qualify. This means, for those leases that qualify, Newmark will not recognize ROU assets and lease liabilities, and this includes not recognizing ROU assets and lease liabilities for existing short-term leases of those assets upon transition. Newmark also elected the practical expedient to not separate lease and non-lease components for all leases other than leases of real estate. As a result upon adoption, acting primarily as a lessee, Newmark recognized an approximately $178.8 million ROU asset and an approximately $226.7 million ROU liability on its unaudited condensed consolidated balance sheets for its real estate operating leases. The adoption of the new guidance did not have a significant impact on Newmark’s unaudited condensed consolidated statements of operations, unaudited condensed consolidated statements of changes in equity and unaudited condensed consolidated statements of cash flows (See Note 18 — Leases for additional information on Newmark’s leasing arrangements).

In August 2017, the FASB issued ASU No. 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities. The guidance intends to better align an entity’s risk management activities and financial reporting for hedging relationships through changes to both the designation and measurement guidance for qualifying hedging relationships and the presentation of hedge results. To meet that objective, the amendments expand and refine hedge accounting for both nonfinancial and financial risk components and align the recognition and presentation of the effects of the hedging instrument and the hedged item in the financial statements. The new standard became effective beginning January 1, 2019 on a prospective basis and modified retrospective basis. In October 2018, the FASB issued ASU No. 2018-16, Derivatives and Hedging (Topic 815): Inclusion of the Secured Overnight Financing Rate (SOFR) Overnight Index Swap (OIS) Rate as a Benchmark Interest Rate for Hedge Accounting Purposes. Based on concerns about the sustainability of LIBOR, in 2017, a committee convened by the Federal Reserve Board and the Federal Reserve Bank of New York identified a broad Treasury repurchase agreement (repo) financing rate referred to as the SOFR as its preferred alternative reference rate. The guidance in ASU No. 2018-16 adds the OIS rate based on SOFR as a U.S. benchmark interest rate to facilitate the LIBOR to SOFR transition and provide sufficient lead time for entities to prepare for changes to interest rate risk hedging strategies for both risk management and hedge accounting purposes. The amendments in this ASU are required to be adopted concurrently with the guidance in ASU No. 2017-12. As Newmark currently does not designate any derivative contracts as hedges for accounting purposes, the adoption of this new guidance did not have an impact on Newmark’s unaudited condensed consolidated financial statements.

21

In February 2018, the FASB issued ASU No. 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. The guidance helps organizations address certain stranded income tax effects in accumulated other comprehensive income resulting from the Tax Cuts and Jobs Act of 2017 by providing an option to reclassify these stranded tax effects to retained earnings in each period in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act (or portion thereof) is recorded. The new standard will become effective beginning January 1, 2019, with early adoption permitted. Newmark adopted the new standard on its required effective date and elected to reclassify the stranded income tax effects of the Tax Cuts and Jobs Act from accumulated other comprehensive income to retained earnings. However, the adoption of the new guidance did not have a material effect on Newmark’s unaudited condensed consolidated financial statements.

In June 2018, the FASB issued ASU 2018-07, Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. The guidance largely aligns the accounting for share-based payment awards issued to employees and nonemployees, whereby the existing employee guidance will apply to non-employee share-based transactions (as long as the transaction is not effectively a form of financing), with the exception of specific guidance relate to the attribution of compensation cost. The cost of nonemployee awards will continue to be recorded as if the grantor had paid cash for the goods or services. In addition, the contractual term will be able to be used in lieu of an expected term in the option-pricing model for non-employee awards. The new standard became effective beginning January 1, 2019. The ASU is required to be applied on a prospective basis to all new awards granted after the date of adoption. In addition, any liability-classified awards that have not been settled and equity-classified awards for which a measurement date has not been established by the adoption date should be remeasured at fair value as of the adoption date with cumulative effect adjustment to opening retained earnings in the year of adoption. Management adopted this standard on its effective date. The adoption of this guidance did not have a material impact on Newmark’s unaudited condensed consolidated financial statements.

| (c) | New Accounting Pronouncements |

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which requires financial assets that are measured at amortized cost to be presented, net of an allowance for credit losses, at the amount expected to be collected over their estimated life. Expected credit losses for newly recognized financial assets, as well as changes to credit losses during the period, are recognized in earnings. For certain purchased financial assets with deterioration in credit quality since origination, the initial allowance for expected credit losses will be recorded as an increase to the purchase price. Expected credit losses, including losses on off-balance-sheet exposures such as lending commitments, will be measured based on historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amount. The new standard will become effective for Newmark beginning January 1, 2020, under a modified retrospective approach, and early adoption is permitted. Management is currently evaluating the impact of the new guidance on Newmark’s unaudited condensed consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment, which eliminates the requirement to determine the fair value of individual assets and liabilities of a reporting unit to measure goodwill impairment. Under the amendments in the new ASU, goodwill impairment testing will be performed by comparing the fair value of the reporting unit with its carrying amount and recognizing an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. The new standard will become effective beginning January 1, 2020 and will be applied on a prospective basis, and early adoption is permitted. However, the adoption of the new guidance is not expected to have a material effect on Newmark’s unaudited condensed consolidated financial statements.

22

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement. The guidance is part of the FASB’s disclosure framework project, whose objective and primary focus are to improve the effectiveness of disclosures in the notes to financial statements. The ASU eliminates, amends and adds certain disclosure requirements for fair value measurements. The FASB concluded that these changes improve the overall usefulness of the footnote disclosures for financial statement users and reduce costs for preparers. The new standard will become effective for Newmark beginning January 1, 2020 and early adoption is permitted for eliminated and modified fair value measurement disclosures. Certain disclosures are required to be applied prospectively and other disclosures need to be adopted retrospectively in the period of adoption. As permitted by the transition guidance in the ASU, Newmark’s early adoption eliminated and modified disclosure requirements as of December 31, 2018 and Newmark plans to adopt the remaining disclosure requirements effective January 1, 2020. The adoption of this standard did not impact Newmark’s unaudited condensed consolidated financial statements (See Note 26 — Fair Value of Financial Assets and Liabilities for additional information).

In August 2018, the FASB issued ASU 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract (a consensus of the FASB Emerging Issues Task Force). The guidance on the accounting for implementation, setup, and other upfront costs (collectively referred to as implementation costs) applies to entities that are a customer in a hosting arrangement that is a service contract. The amendments align the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software (and hosting arrangements that include an internal-use software license). The accounting for the service element of a hosting arrangement that is a service contract is not affected by the guidance in this ASU. The new standard will become effective for Newmark beginning January 1, 2020, should be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption, and early adoption is permitted. Management is currently evaluating the impact of the new guidance on Newmark’s unaudited condensed consolidated financial statements.