UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38329

NEWMARK GROUP, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 6531 | | 81-4467492 |

(State or other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

125 Park Avenue

New York, New York 10017

(212) 372-2000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.01 par value | | NMRK | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting common equity held by non-affiliates of the registrant, based upon the closing price of the Class A common stock on June 30, 2022 as reported on NASDAQ, was approximately $1.3 billion.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at March 13, 2023 |

| Class A Common Stock, par value $0.01 per share | | 152,435,926 shares |

| Class B Common Stock, par value $0.01 per share | | 21,285,533 shares |

DOCUMENTS INCORPORATED BY REFERENCE.

Portions of the registrant’s definitive proxy statement for its 2023 annual meeting of stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

We anticipate that we will file the 2023 Proxy Statement with the SEC on or before May 1, 2023.

NEWMARK GROUP, INC.

2022 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION | |

| | |

| RISK FACTOR SUMMARY | |

| | |

| PART I |

| ITEM 1. | BUSINESS | |

| ITEM 1A. | RISK FACTORS | |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | |

| ITEM 2. | PROPERTIES | |

| ITEM 3. | LEGAL PROCEEDINGS | |

| ITEM 4. | MINE SAFETY DISCLOSURES | |

| | |

| PART II |

| | |

| ITEM 5. | | |

| ITEM 6. | [RESERVED] | |

| ITEM 7. | | |

| ITEM 7A. | | |

| ITEM 8. | | |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| ITEM 9A. | CONTROLS AND PROCEDURES | |

| ITEM 9B. | OTHER INFORMATION | |

| ITEM 9C. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | |

| | |

| PART III |

| | |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| ITEM 11. | EXECUTIVE COMPENSATION | |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| | |

| PART IV |

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

| ITEM 16. | FORM 10-K SUMMARY | |

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (this “Form 10-K”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “possible,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements. The information included herein is given as of the filing date of this Form 10-K with the Securities and Exchange Commission (the “SEC”), and future results or events could differ significantly from these forward-looking statements. We do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

RISK FACTOR SUMMARY

The following is a summary of material risks that could affect our business, each of which may have a material adverse effect on our business, financial condition, results of operations and prospects. This summary may not contain all of our material risks, and it is qualified in its entirety by the more detailed risk factors set forth in Item 1A- “Risk Factors.”

•General conditions in the economy, commercial real estate market and the banking sector (including perceptions of such conditions) can have a material adverse effect on our business, financial condition, results of operations and prospects.

•Interest rate increases in response to rising inflation rates may have a material negative impact on our businesses.

•The effects of the COVID-19 pandemic continue to significantly disrupt and adversely affect the environment in which we and our clients and competitors operate, including the global economy, the U.S. economy, the global financial markets, and the commercial real estate services industry.

•The loss of one or more of our key executives, the development of future talent, and the ability of certain key employees to devote adequate time and attention to us are a key part of the success of our business, and failure to continue to employ and have the benefit of these executives may adversely affect our businesses and prospects.

•We have debt, which could adversely affect our ability to raise additional capital to fund our operations and activities, limit our ability to react to changes in the economy or the commercial real estate services industry, expose us to interest rate risk, impact our ability to obtain favorable credit ratings and prevent us from meeting or refinancing our obligations under our indebtedness, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

•As we grow our business internationally, we are and we will continue to be exposed to political, economic, legal, regulatory, operational and other risks, including with respect to the outbreak of hostilities or other instability, inherent in operating in foreign countries.

•We operate in a highly competitive industry with numerous competitors, some of which may have greater financial and operational resources than we do.

•We may pursue opportunities including strategic alliances, acquisitions, dispositions, joint ventures or other growth opportunities (including hiring new brokers and other professionals), which could present unforeseen integration obstacles or costs and could dilute our stockholders. We may also face competition in our acquisition strategy, and such competition may limit such opportunities.

•We may have liabilities in connection with our business, including appraisal and valuation, sales and leasing and property and facilities management activities that exceed our insurance coverage.

•If we fail to comply with laws, rules and regulations applicable to commercial real estate brokerage, valuation and advisory and mortgage transactions and our other business lines, then we may incur significant financial penalties.

•The changes in relationships with the GSEs and HUD could adversely affect our ability to originate commercial real estate loans through such programs, although we also provide debt and equity to our clients through other third-party capital sources. Compliance with the minimum collateral and risk-sharing requirements of such programs, as well as applicable state and local licensing agencies, could reduce our liquidity.

•We may not be able to protect our intellectual property rights or may be prevented from using intellectual property used in our business.

•Malicious cyber-attacks and other adverse events affecting our operational systems or infrastructure, or those of third parties, could disrupt our business, result in the disclosure of confidential information, damage our reputation and cause losses or regulatory penalties.

•Declines in or terminations of servicing engagements or breaches of servicing agreements could have a material adverse effect on our business, financial condition, results of operations and prospects.

•We may be required to pay Cantor Fitzgerald, L.P. (“Cantor”) for a significant portion of the tax benefit relating to any additional tax depreciation or amortization deductions we claim as a result of any step up in the tax basis of the assets of Newmark OpCo resulting from exchanges of interests held by Cantor in by Newmark Holdings, L.P. (“Newmark Holdings”) for our common stock.

•Increased scrutiny and changing expectations from stockholders with respect to the Company's ESG practices or demographic disclosure may result in additional costs or risks.

•We are a holding company, and accordingly we are dependent upon distributions from Newmark OpCo to pay dividends, taxes and indebtedness and other expenses and to make repurchases.

•Reductions in our quarterly cash dividend and corresponding reductions in distributions by Newmark Holdings to its partners may reduce the value of our common stock and the attractiveness of our equity-based compensation and limit the ability of our partners to repay employee loans.

•We are controlled by Cantor. Cantor’s interests may conflict with our interests, and Cantor may exercise its control in a way that favors its interests to our detriment, including in competition with us for acquisitions or other business opportunities.

•Purchasers of our Class A common stock, as well as existing stockholders, may experience significant dilution as a result of sales of shares of our Class A common stock by us or by our partners and employees. Our management will have broad discretion as to the timing and amount of sales of our Class A common stock in any offering by us, as well as the application of the net proceeds of any such sales. In addition, sales of substantial amounts of our Class A common stock, or the perception that such sales could occur, may adversely affect prevailing market prices for our stock.

PART I

ITEM 1. BUSINESS

Throughout this document Newmark Group, Inc. is referred to as “Newmark” and, together with its subsidiaries, as the “Company,” “we,” “us,” or “our.”

Our Business

Newmark is a leading full-service commercial real estate services business. We offer a diverse array of integrated services and products designed to meet the full needs of both real estate investors/owners and occupiers. Our investor/owner services and products include:

•capital markets, which consists of investment sales and commercial mortgage brokerage (including the placement of debt, equity and structured finance and loan sales on behalf of third parties);

•agency leasing;

•valuation and advisory (“V&A”);

•property management;

•due diligence consulting and other advisory services;

•services related to government-sponsored enterprises (“GSE”) and the Federal Housing Administration (“FHA”), including multifamily lending and loan servicing, mortgage brokering and equity-raising; and

•flexible workspace solutions for owners.

Our occupier services and products include:

•tenant representation leasing;

•global corporate services ("GCS"), which includes real estate, workplace and occupancy strategy, corporate consulting services, project management, lease administration and facilities management; and

•flexible workspace solutions for occupiers.

We enhance these services and products through innovative real estate technology solutions and data analytics, enabling our clients to increase their efficiency and profits by optimizing their real estate portfolio. For the past decade, we have aimed to become the company with the greatest talent in the industry. We believe that we have made great progress towards achieving this goal, having assembled an incredible combination of the top strategists and advisors together with extraordinary expertise. This has led to a strong record of revenue growth for Newmark, and our becoming a top commercial real estate services platform in the United States. We have relationships with many of the world’s largest commercial property owners, real estate developers and investors, as well as Fortune 500 and Forbes Global 2000 companies. For the year ended December 31, 2022, we generated revenues of over $2.7 billion primarily from commissions on leasing and capital markets transactions, consulting and technology user fees, property and facility management fees, and mortgage origination and loan servicing fees.

As discussed in greater detail in “—Industry Trends and Opportunity,” transaction and investment volumes in the commercial real estate industry declined significantly from record levels a year earlier due to the rapid rise in interest rates. We expect industry volumes to bounce back relatively quickly once interest rates have stabilized. Our near-term objectives include becoming number one in capital markets in the United States. This is partly because our investment sales and debt businesses have historically had a multiplier effect that drives outsized growth across many of our other businesses. When overall capital markets activity rebounds, we believe that our market share, revenues, and earnings can therefore outperform the industry. While the macroeconomic environment may be challenging in the short term, we remain excited about our market position and our future. We are also focused on increasing the percentage of our total revenues from our recurring and/or predictable businesses, such as V&A, mortgage servicing, GCS, and property management. Our goals also include increasing cross-selling opportunities with and between many of these businesses and our capital markets and leasing businesses. A portion of the revenues that we derive from providing property management services and from our GCS business are “pass-through” revenues that represent fully reimbursable compensation and non-compensation costs.

Our growth has historically been focused on North America; however, over the last few years, we have expanded our services and product offerings internationally. During 2021, we ended our affiliation with Knight Frank LLP and accelerated our global growth plans by acquiring Space Management (DBA “Deskeo”) and Knotel, Inc. (“Knotel”), both of which are European leaders in flexible and serviced workspace. We continued our non-U.S. expansion during 2022 when we acquired BH2, a leading London-based real estate advisory firm. Furthermore, over the past two years, we announced the addition of industry-leading international professionals in GCS, leasing, real estate capital markets, and V&A.

As of December 31, 2022, we have nearly 6,300 employees in over 150 offices in more than 110 cities. Over 1,100 of those employees are partially or fully reimbursed by clients, mainly in our property management and GCS businesses. In addition, as of December 31, 2022, Newmark has licensed its name to 13 commercial real estate providers with more than 400 employees operating out of 27 offices in various locations where Newmark does not have its own offices.

We are a leading real estate capital markets business in the United States. We have access to many of the world’s largest owners of commercial real estate, which we expect to drive growth throughout the life cycle of each real estate asset by allowing us to provide best-in-class agency leasing and property management during the ownership period. Our deep bench of talented professionals provides investment sales and arrange debt and equity financing to assist owners in maximizing the return on investment in each of their real estate assets. We are a leading GSE lender by loan origination volume and servicer with a $70.7 billion servicing portfolio as of December 31, 2022 (of which 79.5% is higher margin primary servicing, 18.1% is limited servicing, and 2.4% is special servicing). Servicing companies generally earn considerably higher fees from primary servicing (GSE and FHA loans) compared with limited and special servicing.

We generate strong cash flows from our business and use those proceeds to invest by adding high profile revenue-generating professionals, including brokers and originators (together, “producers”) and other client-facing individuals. Historically, our newly hired producers tend to achieve dramatically higher productivity in their second and third years with the Company, although we generally incur related expenses immediately. As newly hired producers increase their production, our commission revenue and earnings growth accelerate, thus reflecting our operating leverage.

Our long-term track record of strong revenue and earnings growth resulted from the execution of our unique combination of corporate strategies, in which we aim to:

•build the leading capital markets platform in the U.S., while expanding our investment sales and debt businesses internationally, which we expect to have multiplier effects on our revenue streams across the Company, including in GSE/FHA origination and servicing, V&A, property management, and agency leasing,

•add and retain the industry’s most talented professionals and encourage their innovative and entrepreneurial natures, while providing them the benefits of our partnership and equity-based compensation structure, which drives talent to our platform, encourages an ownership mindset, and promotes cross-selling and collaboration with respect to servicing our clients,

•empower our professionals through technology, data analytics, and infrastructure, to make them better at what they do and to enable them to provide higher returns for our clients while enhancing the depth of their relationships with them, and

•expand our global footprint by entering new geographies and new and complementary business lines, as well as by acquiring companies with attractive expected returns and hiring talented professionals.

Our History

Newmark was founded in 1929 with an emphasis on New York-based investor/owner and occupier services, and developed a reputation for having talented, knowledgeable, and motivated advisors/intermediaries. BGC acquired us in October 2011. From that time until we spun off from BGC in December 2018, we embarked on a rapid expansion throughout North America encompassing nearly all key business lines in the real estate services sector, which included the acquisition of Berkeley Point Financial LLC in 2017. We believe our rapid growth is a result of our management team’s strong understanding of commercial real estate as an asset class, deep relationships with users and owners and long-term vision, our strong culture of innovation and collaboration, our ability to adapt to the evolving market and to shifts in the demand for our services, and our proven track record of attracting and retaining the industry’s best talent.

Beginning in 2006, our servicing of clients in the Asia-Pacific region, in Europe, the Middle East and Africa was facilitated through our relationship with Knight Frank. In the third quarter of 2021, we ended our affiliation with Knight Frank. We have accelerated our own global growth plans, including through the acquisitions of Knotel and Deskeo. Furthermore, we have announced the addition of industry-leading international professionals in our GSC, V&A, leasing, and capital markets businesses in locations including Singapore, Hong Kong and London, as we establish footholds in economic centers outside of the Americas. On February 15, 2023, we announced the hiring of the leading capital markets team in New York. On March 10, 2023, we announced the acquisition of London-based advisory firm Gerald Eve LLP ("Gerald Eve"), further expanding our operations in the U.K. with the addition of nine offices. During 2022, we acquired BH2, a leading London-based real estate advisory firm. We expect to continue to acquire and hire outside of North America as we execute on our plans to expand globally.

In certain smaller U.S. and international markets in which we do not maintain Newmark-owned offices, we have agreements in place to operate on a collaborative and cross-referral basis with certain independently-owned offices in return for

contractual and referral fees paid to us and/or certain mutually beneficial co-branding and other business arrangements (“business partners”). These business partners may use some variation of our branding in their names and marketing materials. These agreements typically take the form of multi-year contracts, and provide for mutual referrals in their respective markets, generating additional contract and brokerage fees. While we do not derive a significant portion of our revenue from these relationships, they do enable us to seamlessly provide service to our mutual clients. These business partners give our clients access to additional brokerage professionals with local market research capabilities as well as other commercial real estate services in locations where the Company does not have a physical presence. The discussion of our financial results and other metrics reflects only the business owned by us and does not include the results for business partners using some variation of the Newmark name in their branding or marketing.

We intend to continue to opportunistically expand into markets, where we believe we can profitably execute our full service and integrated business model, with a particular focus on growing our presence in key markets in Europe, the Middle East, and Asia, while continuing to opportunistically augment our presence in the Americas.

In summary, we generate revenues from commissions on leasing and capital markets transactions, mortgage origination and loan servicing fees, V&A, property and facility management fees, as well as fees related to consulting and other real estate services. Our revenues are widely diversified across service lines, geographic regions and clients, with our top 10 clients accounting for approximately 7.4% of our total revenue on a consolidated basis, and our largest client accounting for less than 2.3% of our total revenue on a consolidated basis in 2022.

Our Services

Newmark offers a diverse array of integrated services designed to meet the full needs of both real estate investors/owners and occupiers. Our technological advantages, industry-leading talent, deep and diverse client relationships and suite of complementary services allow us to actively cross-sell our services and drive margins.

Real Estate Investor/Owner Services and Products

Capital Markets. We offer a broad range of capital markets services, including investment sales and mortgage brokerage (which includes debt and equity placement, fundraising and recapitalization) of individual assets, portfolios and operating companies. We match capital providers with capital users. Our capital markets professionals have deep relationships with investors and capital sources of various composition, including government sponsored agencies, insurance companies, pension funds, real estate investment trusts, private funds, private investors, developers and construction firms. On February 15, 2023, we announced the hiring of the leading capital markets team in New York.

Landlord Representation. We understand the nuanced needs of corporate, institutional, family and entrepreneurial property owners, and develop customized leasing strategies to help them attract and maintain the right tenants. Armed with both on-the-ground intelligence and comprehensive data, we help landlords find opportunities and make sound decisions. From strategic planning to property and asset management, we believe that our seamless services deliver increased revenue and enhanced value for our clients.

Valuation and Advisory (“V&A”). We operate a V&A business, which has grown over the past seven years from fewer than 40 professionals to over 630 as of December 31, 2022. Our V&A professionals execute projects of nearly every size and type, from single properties to large portfolios, existing and proposed facilities, and mixed-use developments across the spectrum of asset classes. Clients include banks, pension funds, equity funds, REITs, insurance companies, developers, corporations, and institutional capital sources. These institutions utilize the advisory services we provide in their loan underwriting, construction financing, portfolio analytics, feasibility determination, acquisition structures, litigation support, property tax, and financial reporting.

Property Management. We provide property management services on a contractual basis to owners and investors in office (including medical and life science offices), industrial and retail properties. Property management services include building operations and maintenance, vendor and contract negotiation, project oversight and value engineering, labor relations, property inspection/quality control, property accounting and financial reporting, cash flow analysis, financial modeling, lease administration, due diligence and exit strategies. We have an opportunity to grow our property management contracts in connection with our other businesses, including higher-margin leasing or capital markets. These businesses also give us better insight into our clients’ overall real estate needs.

Leading Commercial Real Estate Technology Platform and Capabilities. Investing in digital solutions has become imperative and we remain dedicated to creating customer-centric technology that optimizes our business methods while keeping our workforce and clients safe. Our multi-faceted real estate database continues to grow, as does our commitment to providing

innovative, value-added technological solutions across our service lines, which enables our professionals to provide clients with data-driven advice and analytics with expediency. Our solutions are designed to increase operational efficiency, realize additional income, and/or generate cost savings for our professionals and clients.

Due Diligence, Consulting and Advisory Services and Other Services. We provide commercial real estate due diligence consulting and advisory services to a variety of clients, including lenders, investment banks and investors. Our core competencies include underwriting, modeling, structuring, due diligence and asset management. We also offer clients cost-effective and flexible staffing solutions through both on-site and off-site teams. We believe this business line and other non-brokerage services we offer give us additional ways to cross-sell services and add value to our clients.

Government Sponsored Enterprise (“GSE”)

Lending and Loan Servicing. We operate a leading commercial real estate finance company focused on the origination and sale of multifamily and other related commercial real estate loans through government-sponsored and government-funded loan programs, as well as the servicing of loans originated by it and third parties, including our affiliates. We participate in loan origination, sale, and servicing programs operated by two GSEs, Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”). We also originate, sell and service loans under Housing and Urban Development's (“HUD”) Federal Housing Administration (“FHA”) programs, and are an approved HUD Multifamily Accelerated Processing (“MAP”) and HUD LEAN lender, as well as an approved Government National Mortgage Association (“Ginnie Mae”) issuer.

Origination for GSEs. We originate multifamily loans distributed through the GSE programs of Fannie Mae and Freddie Mac, as well as through HUD programs. Through HUD’s MAP and LEAN Programs, we provide construction and permanent loans to developers and owners of multifamily housing, affordable housing, senior housing and healthcare facilities. We are one of 25 approved lenders that participate in the Fannie Mae Delegated Underwriting and Servicing (“DUS”) program and one of 22 lenders approved as a Freddie Mac seller/servicer. As a low-risk intermediary, we originate loans guaranteed by government agencies or entities and pre-sell such loans prior to transaction closing. We have established a strong credit culture over decades of originating loans and remain committed to disciplined risk management from the initial underwriting stage through loan payoff.

Servicing. In conjunction with our origination services, we sell the loans that we originate under GSE and FHA programs and retain the servicing of those loans. The servicing portfolio (which includes certain other non-agency loans) provides a stable, predictable recurring stream of revenue to us over the life of each loan. The typical multifamily loan that we originate and service under these programs is either fixed or variable rate and includes significant prepayment penalties. These structural features generally offer prepayment protection and provide more stable, recurring fees. Our servicing operations are rated by Fitch, S&P, and Kroll for commercial loan primary and special servicing and consist of a team of approximately 70 professionals dedicated to primary and special servicing and asset management. These professionals focus on financial performance and risk management to anticipate potential property, borrower or market issues. Portfolio management conducted by these professionals is not only a risk management tool, but also leads to deeper relationships with borrowers, resulting in continued interaction with borrowers over the term of the loan, and potential additional financing opportunities.

We believe that the combination of our leading multifamily investment sales, mortgage brokerage, and agency lending businesses has provided and will have a multiplier effect that drives outsized growth across the Company.

Key Lending Channels

•Fannie Mae. As one of 25 lenders under the Fannie Mae DUS program, we are a multifamily approved seller/servicer for conventional, affordable and senior loans that satisfy Fannie Mae’s underwriting and other eligibility requirements. Fannie Mae has delegated to us responsibility for ensuring the loans originated under the Fannie Mae DUS program satisfy the underwriting and other eligibility requirements established from time to time by Fannie Mae. In exchange for this delegation of authority, we share up to one-third of the losses that may result from a borrower’s default. All of the Fannie Mae loans we originate are sold, prior to loan funding, in the form of a Fannie Mae-insured security to third-party investors. We service all loans we originate under the Fannie Mae DUS program.

•Freddie Mac. We are one of 22 Freddie Mac multifamily approved seller/servicer for conventional, affordable and senior loans that satisfy Freddie Mac’s underwriting and other eligibility requirements. Under the program, we submit the completed loan underwriting package to Freddie Mac and obtain Freddie Mac’s commitment to purchase the loan at a specified price after closing. Freddie Mac ultimately performs its own underwriting of loans we sell to Freddie Mac. Freddie Mac may choose to hold, sell or, as it does in most cases, later securitize such

loans. We do not have any material risk-sharing arrangements on loans sold to Freddie Mac under the program. We also generally service loans we originate under this Freddie Mac program.

•HUD/Ginnie Mae/FHA. As an approved HUD MAP and HUD LEAN lender and Ginnie Mae issuer, we provide construction and permanent loans to developers and owners of multifamily housing, affordable housing, senior housing and healthcare facilities. We submit a completed loan underwriting package to FHA and obtain FHA’s firm commitment to insure the loan. The loans are typically securitized into Ginnie Mae securities that are sold, prior to loan funding, to third-party investors. Ginnie Mae is a United States government corporation in HUD. Ginnie Mae securities are backed by the full faith and credit of the United States. In the event of a default on a HUD insured loan, HUD will reimburse approximately 99% of any losses of principal and interest on the loan and Ginnie Mae will reimburse the majority of remaining losses of principal and interest. The lender typically is obligated to continue to advance principal and interest payments and tax and insurance escrow amounts on Ginnie Mae securities until the HUD mortgage insurance claim has been paid and the Ginnie Mae security is fully paid. We also generally service all loans we originate under these programs.

•As described under “Real Estate Investor/Owner Services - Capital Markets,” we also offer our clients access to third party banks, insurance companies and other capital providers through our mortgage brokerage platform.

Lending Transaction Process. Our value driven, credit focused approach to underwriting and credit processes provides for clearly defined roles for senior management and carefully designed checks and balances to ensure appropriate quality control. We are subject to both our own and the GSEs’ and HUD’s rigorous underwriting requirements related to property, borrower, and market due diligence to identify risks associated with each loan and to ensure credit quality, satisfactory risk assessment and appropriate risk diversification for our portfolio. We believe thorough underwriting is essential to generating and sustaining attractive risk adjusted returns for our investors.

We source lending opportunities by leveraging a deep network of direct borrower and brokerage professional relationships in the real estate industry from our national origination platform. We benefit from offices located throughout the United States and our $70.7 billion servicing portfolio as of December 31, 2022 (of which 79.5% is higher margin primary servicing, 18.1% is limited servicing, and 2.4% is special servicing), providing real time information on market performance and comparable data points. Servicing companies generally earn considerably higher fees from primary servicing (GSE and FHA loans) compared with limited and special servicing. Our primary servicing book has grown at an approximately 9% CAGR since 2015.

Financing. We finance our loan originations under GSE programs through collateralized financing agreements in the form of warehouse loan agreements (“WHAs”) with multiple lenders with an aggregate commitment as of December 31, 2022 of $1.6 billion, an aggregate of $400.0 million of uncommitted warehouse lines with two lenders, and an uncommitted $400 million Fannie Mae loan repurchase facility. As of December 31, 2022 and December 31, 2021, we had collateralized financing outstanding of approximately $137.4 million and $1,050.7 million, respectively. Collateral includes the underlying originated loans and related collateral, the commitment to purchase the loans, and credit enhancements from the applicable GSE or HUD. We typically complete the distribution of the loans we originate within 30 to 60 days of closing. Proceeds from the distribution are applied to reduce borrowings under the WHAs, thus restoring borrowing capacity for further loan originations under GSE programs.

Intercompany Referrals. Certain of our affiliates, including subsidiaries of Cantor, have entered into arrangements in respect of intercompany referrals. Pursuant to these arrangements, the parties refer to each other for customary fees, opportunities for commercial real estate loan originations to our affiliates, opportunities for real estate investment sales, broker or leasing services to us, and opportunities for GSE/FHA loan originations to us.

Real Estate Occupier Services

Tenant Representation Leasing. We represent commercial tenants in virtually all aspects of the leasing process, including space acquisition and disposition (often in conjunction with our GCS business), strategic planning, site selection, financial and market analysis, economic incentives analysis, lease negotiations, lease auditing and project management. We assist clients by defining space requirements, identifying suitable alternatives, recommending appropriate occupancy solutions, negotiating lease and ownership terms with landlords and minimizing real estate costs and associated risks for clients through analyzing, structuring and negotiating business and economic incentives, as well as advising on relevant sustainability and environmental issues. Fees are typically based on a percentage of the total financial consideration of the lease commitment for executed leases and are generally earned when a lease is signed. In many cases, landlords are responsible for paying the fees. We use innovative technology and data to provide tenants with an advantage in negotiating leases, which has contributed to our market share gains.

Global Corporate Services (“GCS”). GCS is our consulting and outsourcing services business that focuses on reducing occupancy expenses and improving efficiency for corporate real estate occupiers, with significant, often multi-national presences. We provide beginning-to-end corporate real estate solutions for clients. GCS strives to make its clients more effective by optimizing real estate usage, managing overall corporate footprint expenses, and improving workflow and human capital efficiency through large scale data analysis and our industry-leading technology.

We provide real estate strategic consulting services to our clients, including Fortune 500 and Forbes Global 2000 companies, owner-occupiers, government agencies, as well as organizations in healthcare and higher education. We also provide enterprise asset management information consulting and technology solutions which can yield cost-savings for our GCS business’s client base. Our consulting services include financial integration, asset and portfolio strategy, location strategy and optimization, workplace strategies, energy and sustainability, workflow and business process improvement, merger and acquisition integration and industrial consulting. Fees for these services are on a negotiated basis and are often part of a multi-year services agreement. Fees may be contingent on meeting certain financial or savings objectives with incentives for exceeding agreed upon targets.

We believe that GCS provides us with a unique lens into commercial real estate and offers ways to win business across multiple business lines. Whether a client currently manages its real estate function in-house (insource) or has engaged an external provider (outsource), GCS aims to create value by securing accounts that are first generation outsource or by gaining outsourced market share. GCS often provides us a recurring revenue stream when it enters into multi-year contracts for ongoing services, such as project and facilities management and real estate and lease administration over the course of the contract.

For the past 13 years, the International Association of Outsourcing Professionals (“IAOP”) has named Newmark to The Best of The Global Outsourcing 100®, which identifies the world’s best outsourcing providers across all industries.

Our GCS platform offers the following services:

•Workplace and Occupancy Strategy. Our workplace strategy and human experience team includes real estate strategists, architects, financial analysts, change managers, and subject matter experts with experience in the components of a successful workplace. We focus on the people, place and process aspects that drive performance. We work with clients to make the experience of going to work more engaging, supportive, and productive by inspiring people through meaningful placemaking. Our clients include leading corporations who are increasingly rethinking their approach to the workplace as a result of the pandemic. They are motivated by a variety of factors - including making their people happier, safer and healthier, driving organizational change and re-alignment, and being more effective with their real estate and technology investments. Our team leverages workplace strategies to tailor environments where employees want to come to work, participate and perform.

•Energy and Sustainability Services. Our Energy and Sustainability Services team aims to help management services clients lower energy costs, increase net operating income and support responsible corporate stewardship, and include: calibration of outside air/demand control ventilation, energy procurement, EnergyStar management, enhanced air filtration & IAQ Upgrades, Electrical Demand Lightning, electrical load curtailment (demand response), EV charging stations, LED lighting upgrades, LEED certification, renewable energy and utility data management and benchmarking.

•Technology. GCS has upgraded and improved upon various technologies offered in the real estate industry, combining our technological specialties and our creative core of development within our GCS platform.

•Project Management. We provide a variety of services to tenants and owners of self-occupied spaces. These include conversion management, move management, construction management and strategic occupancy planning services. These services may be provided in connection with a tenant representation lease or on a contractual basis across a corporate client’s portfolio. Fees are generally determined on a negotiated basis and earned when the project is complete.

•Real Estate and Lease Administration. We manage leases for our clients for a fee, which is generally on a per lease basis. We also perform lease audits and certain accounting functions related to the leases. Our lease administration services include critical data management, rent processing and rent payments. These services provide additional insight into a client’s real estate portfolio, which allows us to deliver significant value back to the client through the provision of additional services, such as tenant representation, project management and consulting assignments, to minimize leasing and occupancy costs. For large occupier clients, our real estate technology enables them to access and manage their complete portfolio of real estate assets. We offer clients a fully integrated user-focused technology product designed to help them efficiently manage their real estate costs and assets.

•Facilities Management. We manage a broad range of properties on behalf of users of commercial real estate, including headquarters, facilities and office space, for a broad cross section of companies including Fortune 500 and Forbes Global 2000 companies. We can manage the day-to-day operations and maintenance for urban and suburban commercial properties of most types, including office, industrial, data centers, healthcare, life sciences, retail, call centers, urban towers, suburban campuses, and landmark buildings. Facilities management services may also include facility audits and reviews, energy management services, janitorial services, mechanical services, bill payment, maintenance, project management, and moving management. While facility management contracts are typically three to five years in duration, they may be terminated on relatively short notice periods.

Flex Workspace Provider. We offer amenity-rich and flexible work environments across a network of offices located primarily in Europe and North America and which operate under the names Knotel and Deskeo. We make smart, city-dependent choices with buildings that serve occupiers of real estate by providing a bespoke solution with world-class amenities.

Industry and Market Data

In this Annual Report on Form 10-K, we rely on and refer to information and statistics regarding the commercial real estate services industry. We obtained this data from independent publications or other publicly available information. Independent publications generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Although we believe these sources are reliable, we have not independently verified this information, and we cannot guarantee the accuracy and completeness of this information.

Industry Trends and Opportunity

We expect the following industry and macroeconomic trends to impact our market opportunity:

Large and Highly Fragmented Market. We estimate that the commercial real estate services industry is a more than $400 billion global revenue market opportunity. This total addressable market (“TAM”) represents the actual and/or potential revenues that are or could be generated annually by public and private commercial real estate services firms. We believe that a significant portion of the TAM currently resides with smaller and regional companies offering services like ours. We also believe that a large percentage consists of real estate services that are performed in-house by owners and occupiers but that could be partially or entirely outsourced. The estimated TAM also includes businesses in which our public CRE services competitors operate but where Newmark currently does not, such as real estate investment management. We estimate that less than 20% of the potential revenue in the global commercial real estate services market is currently serviced by the top 10 global firms (by total revenue), leaving a large opportunity for us to reach clients through superior experience and high-quality service, relative to both our larger competitors and the significant number of fragmented smaller and regional companies. We believe that clients increasingly value full service real estate service providers with comprehensive capabilities and multi-jurisdictional reach. We believe this will provide a competitive advantage for us as we have full-service capabilities to service both real estate owners and occupiers.

Institutional Investor Demand for Commercial Real Estate. Institutions investing in real estate often compare their returns on investments in real estate to those of alternative asset classes, benchmark sovereign bonds, and investment-grade corporate bonds. Even with their recent rise, benchmark interest rates have remained relatively low compared with long-term average historical rates around the world over the past several years. For example, ten-year U.S. Treasuries averaged just over 6% over the fifty years ended December 31, 2022, compared with approximately 2.1% over the past five and ten years, 2.9% in 2022, and 3.8% in the fourth quarter of 2022. From the end of the Great Recession through the second half of 2022, this generally offered investors appealing spreads between those rates and risk-adjusted total returns for commercial real estate, which attracted significant investment from the portfolios of sovereign wealth funds, insurance companies, pension and mutual funds, high net worth investors and family offices, and other institutional investors, leading to an increased percentage of direct and indirect ownership of real estate related assets over time.

For example, Preqin estimated that there was approximately $436 billion of investable funds held by global real estate focused institutions in closed-end funds as of December 31, 2022, versus $235 billion in 2015 and $157 billion in 2010. These amounts exclude the significant amount of real estate assets held by other types of investors and owners, such as publicly-traded REITs, non-traded REITs, and open-ended core property funds.

In the second half of 2022, investment volumes in commercial real estate declined significantly from the record levels recorded a year earlier. This was largely due to both the relatively rapid rise in both the absolute level of interest rates and the increase in overall interest rate volatility as measured by ICE BofA MOVE Index and similar indices as well as widening credit spreads. A large percentage of commercial real estate investment is financed with debt, and these recent macroeconomic

conditions made the financing of deals more challenging. Despite this recent slowdown in industry-wide activity, over the long term, we expect institutions to continue increasing investments in global real estate. For context, the weighted average target allocation for all global institutional investors to real estate increased from 5.6% of their overall portfolios in 2010 to 9.6% in 2015 and 10.8% in 2022, according to figures from Cornell University’s Baker Program in Real Estate and Hodes Weill & Associates. This same source estimates that the global target allocations will increase to 11.1% in 2023, which would be nearly double the percentage in 2010, and which they say implies the potential for an additional $80 to $120 billion of capital allocations to real estate over the coming years. We expect this positive allocation trend to continue to benefit our owner-focused businesses.

Significant Levels of Commercial Mortgage Debt Outstanding and Upcoming Maturities. As of the most recently available data, there is approximately $4.5 trillion in U.S. commercial and multifamily mortgage debt outstanding according to the Mortgage Bankers Association (“MBA”) and over $2.5 trillion of related maturities expected from 2023 to 2027 according to Trepp, LLC. Refinancing typically makes up a significant portion of overall industry originations. For context, the MBA states that total U.S. commercial and multifamily originations were $713 billion in 2019, $614 billion in 2020, $891 billion in 2021, and $904 billion in 2022. The MBA projects that U.S. origination volumes will decline in 2023, but they are expected to resume their long-term growth trend over the following two years. We therefore continue to see long-term opportunities for our commercial mortgage brokerage and GSE/FHA origination businesses to benefit from this trend. Steady interest rate environments typically stimulate our capital markets business, where demand is often dependent on attractive all-in borrowing rates versus expected asset yields. Demand also depends on credit accessibility and general macroeconomic trends.

Favorable Multifamily Demographics Driving Growth in GSE Lending and Multifamily Sales. Increasing sales prices for single-family homes relative to wages, delayed marriages, an aging population, and immigration to the United States are among the factors increasing demand for new apartment living, as well as for single-family rental housing. We expect these factors to support continued growth for our capital markets business, which provides integrated investment sales, mortgage brokerage, GSE/FHA lending, and loan servicing capabilities.

Trend Toward Outsourcing of Commercial Real Estate Services. We estimate that the outsourcing of real estate-related services has reduced both property owner and tenant costs, which has increased the profitability for those who utilize commercial real estate and spurred additional demand for property. We believe that the more than $400 billion global revenue opportunity includes a large percentage of companies and landlords that have not yet outsourced their commercial real estate functions, including many functions offered by our management services businesses. Large corporations are focused on consistency in service delivery and centralization of the real estate function and procurement to maximize cost savings and efficiencies in their real estate portfolios. This focus tends to lead them to choose full-service providers like Newmark, where customers can centralize service delivery and maximize cost savings. We expect our GCS and property management businesses to benefit from the continued growth of outsourcing. For those companies and landlords who do not outsource, we consult with them and offer technology solutions to facilitate self-management more efficiently. In addition, the recent global pandemic has increased demand among owners and occupiers of commercial real estate for ways to best manage their property portfolios and maximize both the safety and productivity of their workforce. Our GCS business has seen increased demand for services relevant to these client needs. We believe that our outsourcing, consulting, and technology offerings allow us to engage further with clients and position us for opportunities to provide additional services to fulfill their needs.

Changing Nature of Office Usage. Since the onset of the global pandemic, a large percentage of our occupier clients have begun to examine the best ways to utilize office space as they seek to attract and retain talent. This has led to occupiers reducing the amount of office space they lease or will lease, particularly in the technology sector. At the same time, across most industries and regions, older office buildings in less desirable locations (often referred to as "class B” or “class C" space) have seen reduced demand and lease or sell at significant discount to “class A” space, which are newer, renovated, LEED certified, and have more amenities. Class A properties not only command historically high prices relative to class B and C office space, but often at higher absolute prices per square foot than before the pandemic. This flight to quality has negatively impacted industry capital markets and leasing activity related to class B and C space. The changing nature of office usage creates opportunities for the Company to (i) assist corporate clients with workplace strategy, site selection, and other ways to maximize the efficiency of their operations and workforce, (ii) the trend towards hybrid work includes an increasing percentage of flexible work as a percentage of corporate portfolios, which will benefit our leasing business and flexible workspace business and (iii) class B and class C building obsolescence will create opportunities to assist owners with debt and equity recapitalizations, and repositioning obsolete office inventory into multi-family, industrial, life science and other uses.

While it remains to be seen how long these recent trends with respect to office utilization continue, there are indications that they have recently been moving in a positive direction. For example, security provider Kastle Systems tracks the number of employees in ten of the largest U.S. metropolitan areas that were physically in the offices. They report every work week as a percentage of the typical number physically present during the first three weeks of February 2020 (the "Kastle

Barometer"). The Kastle Barometer remained below 35 for most of 2021, climbed from the low 40s in early 2022 to the high 40s towards the end of 2022, and climbed above 50 for the first time since early 2020 at the end of January 2023.

It remains unclear if or when office usage will return to pre-pandemic levels. To the extent occupiers continue to further increase the percentage of employees working in offices, we expect to have additional opportunities for our professionals in tenant restructuring and portfolio optimization. Our teams are also actively collaborating with clients to differentiate or repurpose underutilized spaces, including with respect to converting office space into multifamily, life science, industrial, or other uses. We also expect the need for flexibility and hybrid workforces to create significant opportunities for both our Company-owned flexible workspace business and for our Company to broker leasing transactions involving external flexible workspace platforms.

Our Competitive Strengths

We believe the following competitive strengths differentiate us from competitors and will help us enhance our position as a leading commercial real estate services provider:

Full-Service Capabilities. We provide a fully integrated real estate services platform to meet the needs of our clients and seek to provide beginning-to-end services to each client. These services include leasing, investment sales, mortgage brokerage, property management, facility management, multifamily GSE/FHA lending, loan servicing, advisory and consulting, appraisal, property and development services, and technology solutions. Today’s clients are focused on consistency of service delivery and centralization of the real estate function and procurement, resulting in savings and efficiencies, and allowing them to focus on their core competencies. Our target clients increasingly award business to full-service commercial real estate services firms, a trend which benefits our business over many of our competitors. Additionally, our full-service capabilities afford us an advantage when competing for business from clients who are outsourcing real estate services for the first time, as well as clients seeking best in class data, industry knowledge, and technology solutions. We believe our comprehensive and collaborative approach to commercial real estate services has allowed our revenue sources to become well-diversified across services and key markets throughout North America. Going forward, we expect to replicate our growth strategies as we continue our global expansion, with an initial focus on entering or further growing in 8-10 key non-U.S. markets.

Proven Ability to Attract High-Quality Talent and Grow Market Share. Over the past decade, Newmark has been able to provide full-service capabilities while maintaining a manageable scale and has gained market share and risen in relevant league table standings across many business lines. We have accomplished this in part by investing in leadership and recruiting the top performers across our diverse business lines and geographies to our platform. We believe that we will duplicate this success over time as we further expand our presence outside the U.S.

Alignment to Investor Sentiment & Diverse Revenue Mix. We have added companies and talent to our platform that provide services in business lines, property types and geographies that align with the objectives of our clients and with the changing market for commercial real estate services. We have grown our revenues in property types such as multifamily, industrial and life sciences, driven by our clients’ desires to expand their investments and operations. Additionally, we have expanded our services through geographic diversification, growing service offerings in many markets in North America, and more recently, in other markets globally.

Industry-Leading Technology. Our technology is designed to create customer-centric digital solutions to transform processes and effectively increase the revenue, productivity and/or efficiency of our professionals and clients. As we further improve these solutions based on our professionals’ feedback, we continue to empower them with data and technology intended to give them a competitive advantage. By digitizing and automating the way we conduct business across our service lines, we aim to increase efficiency through data-driven insights, empowering Newmark professionals to make well-informed decisions delivered with speed and precision.

Below are some examples of our technology solutions:

•Ngage and Nform meaningfully increase the productivity of our V&A business. Together, these comprise our proprietary value-modeling database containing expansive records of sales, comparable leases, and building operating expenses. We have dramatically reduced appraisal modeling time by automating a large percentage of the report creation process, reducing the possibility of formula errors through the use of our proprietary technology and reliable data.

•Spaceful is our proprietary digital tourbook platform, which allows brokerage teams to collaborate and make real-time adjustments through its drag-and-drop interface, assembling elegant tourbooks with auto-generated maps within minutes, thereby improving the tour experience and strengthening our client relationships. Spaceful is designed to eliminate the need for paper and circulating multiple physical versions by providing an in-app experience and digital downloads when sharing with a client or internally, furthering our commitment to sustainability.

•Pegasus is Newmark’s 3D mapping software that assists with location strategies based on demographics and proprietary data. With features such as fly-over technology and 360-degree angles, submarket color overlays, property layers and details, heat maps, and generated animated market views with stacking plan details, Pegasus leverages the art of storytelling and transforms the visual aspect of geography into a presentation in and of itself.

•Ideal is Newmark's proprietary customer relationship management (CRM) platform that allows brokers and brokerage team members to share, update, maintain, and forecast the information and data relevant to their transactions and client relationships. Through its intuitive design and reliable data, Ideal is enhancing our collaborative culture by fostering valuable insights for pursuit tracking, lead-to-sale conversions, as well as cross-selling and upselling opportunities.

•Newlitic is an innovative technology solution that integrates enterprises' real estate portfolio information into a single platform. A flexible and intuitive tool for corporate real estate professionals, Newlitic offers capabilities for multiple management reporting needs, including occupancy utilization, portfolio and lease administration, transaction management, capital projects and facilities management through customizable web dashboards. Newlitic, in combination with our GCS team’s expertise in real estate management, further empowers our enterprise clients across the world, enabling leaders to advance data-driven strategies and leverage real estate information to the fullest.

We believe our technology solutions encourage customers to use Newmark to execute capital markets and leasing transactions, as well as to use our other services. We believe that the customer experience through use of our data and technology is a key competitive advantage as companies look to transform how they do business. Through product innovation and engineering excellence, we expect to continue developing and investing in cutting-edge technology tailored to accommodate Newmark’s full-service platform. We are committed to empowering our professionals with customized data and digital solutions intended to improve and optimize the client experience and help drive growth.

Strong and Diversified Client Relationships. We have long-standing relationships with many of the world’s largest commercial property owners, real estate developers and investors, and Fortune 500 and Forbes Global 2000 companies. We can provide beginning-to-end solutions for our clients through our management services offerings. This allows us to generate more recurring and predictable revenues. We generally have multi-year contracts to provide services, including repeatable transaction work, lease administration, project management, facilities management and consulting. In capital markets, we provide real estate investors and owners with property management and landlord representation during their ownership and assist them with maximizing their return on real estate investments through investment sales, debt and equity financing, lending and V&A services and real estate technology solutions. We believe that the many touch points we have with our clients gives us a competitive advantage in client-specific and overall industry knowledge, and that this has a multiplier effect that drives growth across the Company.

Strong Financial Position to Support High Growth. We generate significant earnings and strong and consistent cash flow. We have $233.8 million of cash and cash equivalents and a $600 million revolving credit facility as of December 31, 2022. We expect to use our strong balance sheet and future cash flow generation to fuel our future growth.

Employee Ownership and Equity-Based Compensation Yields Multiple Benefits. Unlike many of our peers, virtually all of our key executives and revenue-generating employees have partnership and/or equity stakes in our company. This strong emphasis on ownership promotes an entrepreneurial culture that enables us to attract and retain top producers in key markets and service lines. See “-Human Capital Management.”

Strong and Experienced Management Team. Our management team possesses deep leadership experience and subject matter expertise, benefiting both us and our clients. Our executive officers comprise a diverse set of individuals with an average of more than 30 years of industry experience. Additionally, our geographic and business line leadership teams also average more than 30 years of industry experience. Together, these leadership teams represent our flat leadership structure and robust capabilities in both corporate strategy and production expertise.

Opportunity to Grow Domestic and Global Footprint. In 2022, more than 7% of our revenues were from international sources, while our largest, full-service, U.S.-listed competitors generated approximately 28-45% of their revenues outside the U.S. for the most recent fiscal years reported. We believe that our successful history of acquiring over 55 businesses since 2011 and making profitable hires across our business lines and existing geographies demonstrate our ability to continue to grow substantially around the globe.

Industry Recognition

As a result of our experienced management team’s ability to skillfully grow the Company, we have become a nationally recognized brand. Over the past several years, we have consistently won a number of U.S. industry awards and accolades, been ranked highly by third-party sources and significantly increased our rankings, which we believe reflects recognition of our performance and achievements. For example:

•Ranked #2 Top Apartment Brokers, Real Capital Analytics, 2022;

•Ranked #2 Top Office Brokers, Real Capital Analytics, 2022;

•Ranked #2 Top Cross-Border Brokers, Real Capital Analytics, 2022;

•Ranked #2 Top Brokers of Self-Storage Properties, Real Estate Alert, 2022;

•Ranked #3 Top CRE Brokerage Firms and #3 Top Sales Firms, Commercial Property Executive, 2022;

•Ranked #3 Top Mortgage Banking & Brokerage Firms, Commercial Property Executive, 2023;

•Ranked #3 Top Brokers of Multi-Family Properties, Real Estate Alert, 2022;

•Ranked #4 Top Office Brokers, Real Estate Alert, 2022;

•Ranked #4 Top Overall Brokers, Real Estate Alert, 2022;

•Ranked #4 Top Retail Brokers, Real Estate Alert, 2022;

•Ranked #5 Fannie Mae Delegated Underwriting and Servicing (DUS) lender by volume for 2022 by the agency; including #3 DUS Producers for Structured Transactions; and

•Ranked among The Global Outsourcing 100® by the International Association of Outsourcing Professionals, 2023, for the 14th consecutive year.

Clients

Our clients include a full range of real estate owners, occupiers, tenants, investors, lenders, small and medium sizes businesses, as well as multi-national corporations and some of the largest institutional owners of real estate in the world in numerous markets and across multiple property types, including office, retail, industrial, multifamily, student housing, hotel/lodging, data centers, healthcare, self-storage, land, condominium conversions, subdivisions and special use. Our clients vary greatly in size and complexity, and include for-profit and non-profit entities, governmental entities and public and private companies.

Sales and Marketing

We seek to develop our brand and highlight its expansive platform while reinforcing our position as a leading commercial real estate services firm in the United States through national brand and corporate marketing, local marketing of specific business lines and targeted brokerage professional marketing efforts.

National Brand and Corporate Marketing. At a national level, we utilize media relations, industry sponsorships, social media, sales collateral and targeted advertising in trade and business publications to develop and market our brand. We believe that our emphasis on our unique capabilities enables us to demonstrate our strengths and differentiate ourselves from our competitors. Our multi-market business groups provide customized collateral, website and technology solutions designed to address specific client needs.

Local Market Expertise and Targeted Brokerage Professional Efforts. On a local level, our offices (including those owned by us and those independently owned business partners) have access to tools and templates that provide our revenue-generating professionals with the market knowledge we believe is necessary to educate and advise clients, and also to bring properties to market quickly and effectively. These tools and templates include proprietary research and analyses, web-based marketing systems and ongoing communications and training about our depth and breadth of services. Our professionals use these local and national resources to participate directly in selling to, advising and servicing clients. We provide marketing services and materials to certain business partners as part of an overall agreement allowing them to use our branding. We also benefit from shared referrals and materials from local offices.

Additionally, we invest in and rely on comprehensive research to support and guide the development of real estate and investment strategy for our clients. Research plays a key role in keeping colleagues attuned to important trends and changing conditions in world markets. We disseminate this information internally and externally directly to prospective clients and the marketplace through the company website, direct email, and social media. We believe that our investments in research and

technology are critical to establishing our brand as a thought leader and expert in real estate-related matters and provide a key sales and marketing differentiator.

Globally, we believe that the combination of (i) our having assembled a group that includes some of the industry’s most talented professionals, (ii) encouraged their innovative and entrepreneurial natures, and (iii) provided them the benefits of our partnership and equity-based compensation structure together encourage an ownership mindset while promoting cross-selling and collaboration with respect to servicing our clients across our platform.

Intellectual Property

We hold various trademarks, trade dress and trade names and rely on a combination of patent, copyright, trademark, service mark and trade secret laws, as well as contractual restrictions, to establish and protect our intellectual property rights. We own numerous domain names and have registered numerous trademarks and/or service marks in the United States and foreign countries. We will continue to file additional patent applications on new inventions, as appropriate, demonstrating our commitment to technology and innovation. Although we believe our intellectual property rights play a role in maintaining our competitive position in a number of the markets that we serve, we do not believe we would be materially adversely affected by the expiration or termination of our trademarks or trade names or the loss of any of our other intellectual property rights. Our trademark registrations must be renewed periodically, and, in most jurisdictions, every 10 years.

Competition

We compete across a variety of business disciplines within the commercial real estate industry, including commercial property and corporate facilities management, owner-occupier, property and landlord representation, property sales, valuation, capital markets (equity and debt) solutions, GSE lending and loan servicing and development services. Each business discipline is highly competitive on a local, regional, national and global level. We also compete with other large multi-national firms that have similar service competencies to ours, including CBRE Group, Inc., Jones Lang LaSalle Incorporated, Cushman & Wakefield plc, Savills plc, and Colliers International Group, Inc. In addition, more specialized firms like Marcus & Millichap Inc., Eastdil Secured LLC and Walker & Dunlop, Inc. compete with us in certain service lines or property types. Depending on the geography, property type or service, we compete with other commercial real estate service providers, including outsourcing companies that traditionally competed in limited portions of our real estate management services business and have recently expanded their offerings. These competitors include companies such as Aramark, ISS A/S and ABM Industries. From time to time, we also compete with in-house corporate real estate departments, institutional lenders, insurance companies, investment banking firms, and accounting and consulting firms in various parts of our business. Despite recent consolidation, the commercial real estate services industry remains highly fragmented and competitive. Although many of our competitors are local or regional firms that are smaller than us, some of these competitors are more entrenched than us on a local or regional basis.

Seasonality

Due to the strong desire of many market participants to close real estate transactions prior to the end of a calendar year, our business exhibits certain seasonality, with our revenue tending to be lowest in the first quarter and strongest in the fourth quarter. For the five years ended 2018 through 2022, we generated an average of approximately 22% of our revenues in the first quarter and 29% of our revenues in the fourth quarter.

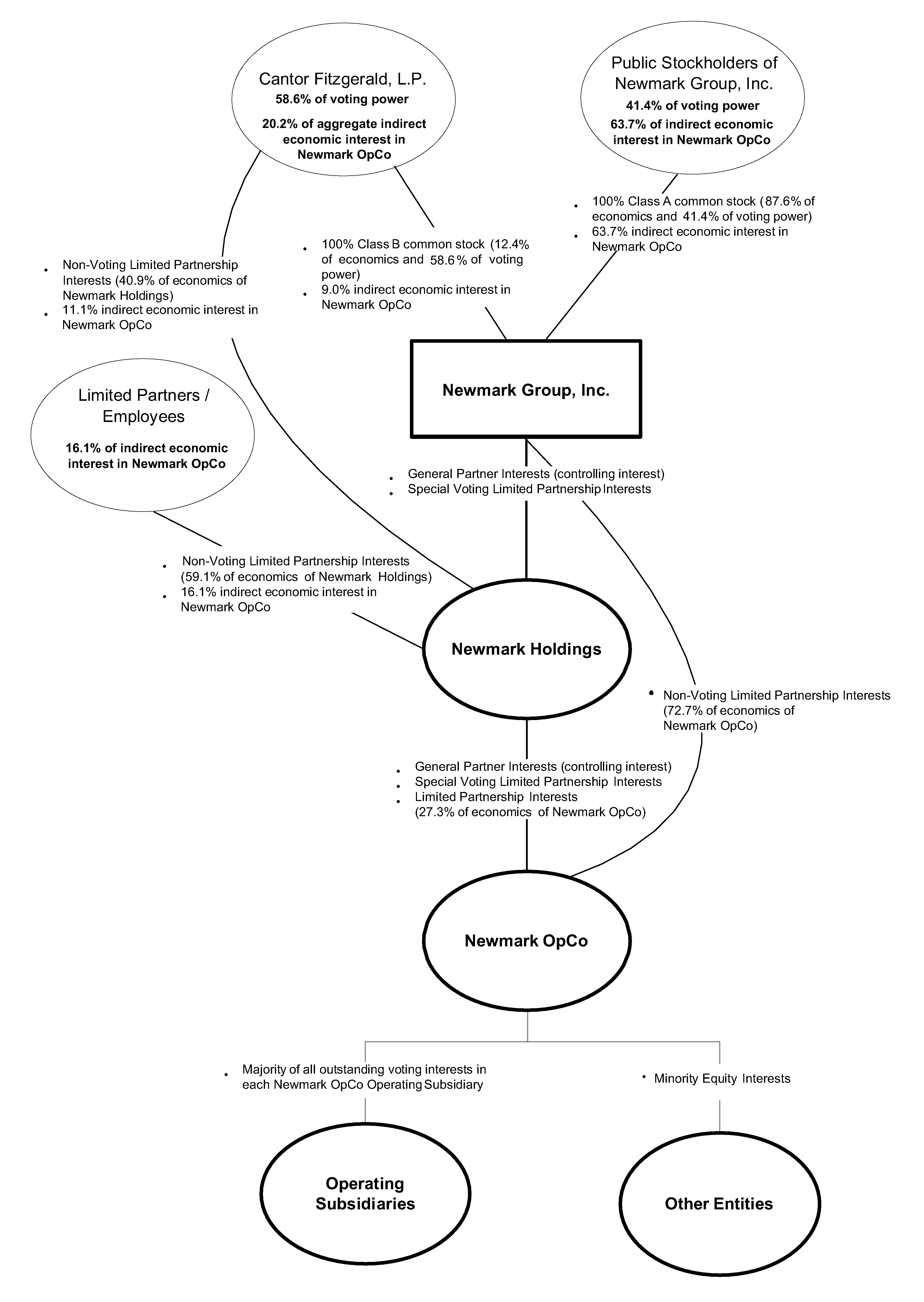

Partnership and Equity Overview

We expect many of our key brokerage professionals, salespeople and other professionals to have a substantial amount of their own capital invested in our business, aligning their interests with those of our stockholders. We control the general partner of Newmark Holdings. The limited partnership interests in Newmark Holdings consist of: (i) a special voting limited partnership interest held by us; (ii) exchangeable limited partnership interests held by Cantor; (iii) founding/working partner interests held by founding/working partners; (iv) limited partnership units, which consist of a variety of units that are generally held by employees such as REUs, RPUs, PSUs, PSIs, PSEs, LPUs, APSUs, APSIs, AREUs, ARPUs and NPSUs; and (v) Preferred Units, which are working partner interests that may be awarded to holders of, or contemporaneous with, the grant of certain limited partnership units. See “Our Organizational Structure.”

While Newmark Holdings limited partnership interests generally entitle our partners to participate in distributions of income from the operations of our business, upon leaving Newmark Holdings (or upon any other purchase of such limited partnership interests), any such partners will only be entitled to receive over time, and provided such partner does not violate certain partner obligations, an amount for their Newmark Holdings limited partnership interests that reflects such partner’s capital account or compensatory grant awards, excluding any goodwill or going concern value of our business unless Cantor, in