UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38329

NEWMARK GROUP, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 6531 | | 81-4467492 |

(State or other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

125 Park Avenue

New York, New York 10017

(212) 372-2000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.01 par value | | NMRK | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting common equity held by non-affiliates of the registrant, based upon the closing price of the Class A common stock on June 30, 2023 as reported on Nasdaq, was approximately $814.4 million.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at February 26, 2024 |

| Class A Common Stock, par value $0.01 per share | | 151,384,467 shares |

| Class B Common Stock, par value $0.01 per share | | 21,285,533 shares |

DOCUMENTS INCORPORATED BY REFERENCE.

Portions of the registrant’s definitive proxy statement for its 2024 annual meeting of stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

We anticipate that we will file such proxy statement with the SEC on or before April 29, 2024.

NEWMARK GROUP, INC.

2023 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| | |

| GLOSSARY OF TERMS, ABBREVIATIONS AND ACRONYMS | |

| | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION | |

| | |

| RISK FACTOR SUMMARY | |

| | |

| PART I |

| ITEM 1. | BUSINESS | |

| ITEM 1A. | RISK FACTORS | |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | |

| ITEM 1C. | CYBERSECURITY | |

| ITEM 2. | PROPERTIES | |

| ITEM 3. | LEGAL PROCEEDINGS | |

| ITEM 4. | MINE SAFETY DISCLOSURES | |

| | |

| PART II |

| | |

| ITEM 5. | | |

| ITEM 6. | [RESERVED] | |

| ITEM 7. | | |

| ITEM 7A. | | |

| ITEM 8. | | |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| ITEM 9A. | CONTROLS AND PROCEDURES | |

| ITEM 9B. | OTHER INFORMATION | |

| ITEM 9C. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | |

| | |

| PART III |

| | |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| ITEM 11. | EXECUTIVE COMPENSATION | |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| | |

| PART IV |

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

| ITEM 16. | FORM 10-K SUMMARY | |

Industry and Market Data

In this Annual Report on Form 10-K, we rely on and refer to information and statistics regarding the commercial real estate services industry. We obtained this data from independent publications or other publicly available information. Independent publications generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Although we believe these sources are reliable, we have not independently verified this information, and we cannot guarantee the accuracy and completeness of this information.

GLOSSARY OF TERMS, ABBREVIATIONS AND ACRONYMS

The following terms, abbreviations and acronyms are used to identify frequently used terms and phrases that may be used in this report:

| | | | | | | | | | | |

| TERM | | DEFINITION | |

| 2021 Equity Event | | In connection with the acceleration of the Nasdaq Earn-out, on June 28, 2021, the Compensation Committee approved a plan to expedite the tax deductible exchange and redemption of a substantial number of limited partnership units held by partners of the Company | |

| | | |

| 6.125% Senior Notes | | The Company’s 6.125% Senior Notes which were issued on November 6, 2018, in an original principal amount of $550.0 million and matured on November 15, 2023 | |

| | | |

| 7.500% Senior Notes | | The Company’s 7.500% Senior Notes due on January 12, 2029, issued on January 12, 2024, in an original principal amount of $600.0 million | |

| | | |

| AI | | Artificial intelligence, including machine learning and generative artificial intelligence | |

| | | |

| Audit Committee | | Audit Committee of the Board | |

| | | |

| Berkeley Point | | Berkeley Point Financial LLC, a wholly owned subsidiary of the Company acquired on September 8, 2017, which does business as part of the Newmark Multifamily Capital Markets business | |

| | | |

| BGC | | (i) Following the closing of the Corporate Conversion, BGC Group and, where applicable, its consolidated subsidiaries and (ii) prior to the closing of the Corporate Conversion, BGC Partners and, where applicable, its consolidated subsidiaries

| |

| | | |

| BGC Class A common stock | | BGC Class A common stock, par value $0.01 per share | |

| | | |

| BGC Class B common stock | | BGC Class B common stock, par value $0.01 per share | |

| | | |

| BGC common stock | | BGC Class A common stock and BGC Class B common stock, collectively | |

| | | |

| BGC Entity Group | | BGC Partners, BGC Holdings, BGC U.S. OpCo and their respective subsidiaries (other than, prior to the Spin-Off, the Newmark Entity Group), collectively, and in each case as such entities existed prior to the Corporate Conversion | |

| | | |

| BGC Group | | BGC Group, Inc. (Nasdaq: BGC) and, where applicable, its consolidated subsidiaries | |

| | | |

| BGC Holdings | | BGC Holdings, L.P., an entity which, prior to the Corporate Conversion, was owned by Cantor, Founding Partners, BGC employee partners and, after the Separation, Newmark employee partners | |

| | | |

| BGC Holdings Distribution | | Pro rata distribution, pursuant to the Separation and Distribution Agreement, by BGC Holdings to its partners of all of the exchangeable limited partnership interests in Newmark Holdings owned by BGC Holdings immediately prior to the distribution | |

| | | |

| BGC Partners | | BGC Partners, Inc., which acquired us on October 14, 2011, facilitated the Newmark IPO on December 14, 2017 and completed the Spin-Off that led to us becoming a separate publicly traded company on November 30, 2018 and, where applicable, its consolidated subsidiaries. On July 1, 2023, BGC Partners, Inc. completed its Corporate Conversion and became a wholly owned subsidiary of its public holding company successor, BGC Group, Inc. | |

| | | |

| BGC U.S. Opco | | Prior to the Separation, BGC Partners, L.P., an operating partnership which held the U.S. businesses of BGC, including Newmark Entity Group, and which is owned jointly, following the closing of the Corporate Conversion, by BGC Partners and the successor to BGC Holdings | |

| | | |

| BH2 | | Newmark BH2 LLP, a London-based real estate advisory firm | |

| | | |

| Board or Board of Directors | | Board of Directors of the Company | |

| | | |

| | | |

| | | |

| Bylaws | | Amended and Restated Bylaws of Newmark Group, Inc. | |

| | | |

| CAGR | | Compound annual growth rate | |

| | | |

| Cantor | | Cantor Fitzgerald, L.P. and, where applicable, its consolidated subsidiaries | |

| | | |

| | | | | | | | | | | |

| Cantor Credit Agreement | | Unsecured credit agreement entered into with Cantor on November 30, 2018, as amended by the First Cantor Credit Agreement Amendment on December 20, 2023 | |

| | | |

| Cantor Entity Group | | Cantor and its consolidated subsidiaries (other than any member of the BGC Entity Group or the Newmark Entity Group), Howard W. Lutnick and/or any of his immediate family members as so designated by Howard W. Lutnick and any trusts or other entities controlled by Howard W. Lutnick | |

| | | |

| Cantor Units | | Limited partnership interests of Newmark Holdings or, prior to the Corporate Conversion, Newmark Holdings or BGC Holdings, held by the Cantor Entity Group, which Newmark Holdings units are exchangeable into shares of Newmark Class A common stock or Newmark Class B common stock and which BGC Holdings units were exchangeable into shares of BGC Class A common stock or BGC Class B common stock, as applicable | |

| | | |

| CARES Act | | The Coronavirus Aid, Relief, and Economic Security Act | |

| | | |

| CCRE | | Cantor Commercial Real Estate Company, L.P. | |

| | | |

| CCRE Lending | | Cantor Commercial Real Estate Lending, L.P., a wholly owned subsidiary of Real Estate LP | |

| | | |

| CECL | | Current Expected Credit Losses | |

| | | |

| Certificate of Incorporation | | Amended and Restated Certificate of Incorporation of Newmark | |

| | | |

| CF Secured | | CF Secured, LLC | |

| | | |

| CF&Co | | Cantor Fitzgerald & Co., a wholly owned broker-dealer subsidiary of Cantor | |

| | | |

| CFE | | Cantor Fitzgerald Europe | |

| | | |

| CFGM | | CF Group Management, Inc., the managing general partner of Cantor | |

| | | |

| CFS11 | | CFS11 Holdings, LLC, a subsidiary of Cantor | |

| | | |

| CIO | | Chief Information Officer | |

| | | |

| CISO | | Chief Information Security Officer | |

| | | |

| Commission-based revenue | | Revenues including Leasing and other commissions, Investment sales, fees from commercial mortgage origination, net, and V&A. In these businesses, producers earn a substantial portion or all their compensation based on their production. Commission-based revenues exclude OMSR revenues because Newmark does not compensate its producers based on this non-cash item | |

| | | |

| Company | | Newmark Group, Inc. and, where applicable, its consolidated subsidiaries | |

| | | |

| Company debt securities | | The 6.125% Senior Notes, 7.500% Senior Notes, and any future debt securities issued by the Company | |

| | | |

| Compensation Committee | | Compensation Committee of the Board | |

| | | |

| Contractual revenues, contractual services or contractual business | | Includes business for which the Company has a contract with a client that is generally for a year or longer. Contractual business, when quantified, includes all revenues related to landlord (or agency) representation leasing, loan servicing (including escrow interest income), outsourcing (including property management, facilities management, and asset management), and lease administration. It also includes certain fees under contract produced by the Company’s flexible workspace and tenant representation service lines | |

| | | |

| Contribution Ratio | | Ratio of shares of Newmark Common Stock that were outstanding compared to the shares of BGC common stock outstanding as of immediately prior to the Newmark IPO (not including any shares of our common stock sold in the Newmark IPO); this ratio was set initially at a fraction equal to one divided by 2.2 | |

| | | |

| Corporate Conversion | | A series of mergers and related transactions pursuant to which, effective at 12:02 AM Eastern Time on July 1, 2023, BGC Partners and BGC Holdings became wholly owned subsidiaries of BGC Group, transforming the organizational structure of the BGC businesses from an “Up-C” structure to a simplified “Full C-Corporation” structure | |

| | | |

| CoStar | | CoStar Group Inc. | |

| | | |

| | | | | | | | | | | |

| COVID-19 | | Coronavirus Disease 2019 | |

| | | |

| Credit Agreement | | The Company’s unsecured senior revolving credit agreement with Bank of America, N.A., as administrative agent, and a syndicate of lenders, most recently amended and restated on March 10, 2022 | |

| | | |

| Credit Facility | | The credit facility pursuant to the Credit Agreement, with a current maximum revolving loan balance of $600.0 million and maturity date of March 10, 2025, bearing interest at either SOFR or a defined base rate plus additional margin | |

| | | |

| Delayed Draw Term Loan | | The credit facility pursuant to the Delayed Draw Term Loan Credit Agreement, with an aggregate principal amount of $420.0 million (which may be increased, subject to certain terms and conditions, to up to $550.0 million) and a maturity date of November 14, 2026, bearing interest at SOFR or a defined base rate plus additional margin | |

| | | |

| Delayed Draw Term Loan Credit Agreement | | The Company’s credit agreement with Bank of America, N.A., as administrative agent, and a syndicate of lenders, dated as of August 10, 2023 | |

| | | |

| Deskeo | | Space Management (d/b/a “Deskeo”) | |

| | | |

| DGCL | | Delaware General Corporation Law | |

| | | |

| Employees | | Includes both employees and those real estate brokers who qualify as statutory non-employees under Internal Revenue Code Section 3508 | |

| | | |

| EPS | | Earnings Per Share | |

| | | |

| EPUs | | Exchangeable preferred partnership units, which related to the Nasdaq Forwards | |

| | | |

| Equity Plan | | Newmark Group, Inc. Long Term Incentive Plan | |

| | | |

| ESG | | Environmental, social and governance, including sustainability or similar items | |

| | | |

| eSpeed | | eSpeed, Inc. | |

| | | |

| EU | | European Union | |

| | | |

| Exchange Act | | Securities Exchange Act of 1934, as amended | |

| | | |

| Exchange Agreement | | Exchange agreement which provides (i) BGC Partners, (ii) Cantor, (iii) any entity controlled by either of them or by Howard W. Lutnick, and (iv) Howard W. Lutnick, his spouse, his estate, any of his descendants, any of his relatives, or any trust established for his benefit or for the benefit of his spouse, any of his descendants or any of his relatives, the right to exchange shares of Newmark Class A common stock into Newmark Class B common stock on a one-to-one basis up to the number then authorized but unissued | |

| | | |

| | | |

| | | |

| Exchange Ratio | | The ratio by which a Newmark Holdings limited partnership interest can be exchanged for a number of shares of Newmark Class A common stock | |

| | | |

| FASB | | Financial Accounting Standards Board | |

| | | |

| Fannie Mae | | The Federal National Mortgage Association | |

| | | |

| Fannie Mae DUS | | The Fannie Mae Delegated Underwriting and Servicing Program | |

| | | |

| First Cantor Credit Agreement Amendment | | First Amendment to the Cantor Credit Agreement entered into on December 20, 2023 | |

| | | |

| FHA | | The Federal Housing Administration | |

| | | |

| FHFA | | The Federal Housing Finance Agency | |

| | | |

| FOMC | | Federal Open Market Committee | |

| | | |

| Forward Sales Contract | | An agreement to deliver mortgages to third-party investors at a fixed price | |

| | | |

| Founding Partners | | Individuals who became limited partners of Newmark Holdings in connection with the Separation who held BGC Holdings founding partner interests immediately prior to the Separation (provided that members of the Cantor Entity Group and the BGC Entity Group are not Founding Partners) | |

| | | |

| | | | | | | | | | | |

| Founding Partner interests, Founding Partner units or FPUs | | Founding/Working Partners units in Newmark Holdings or, prior to the closing of the Corporate Conversion, Newmark Holdings or BGC Holdings, that are generally redeemed upon termination of employment | |

| | | |

| Freddie Mac | | The Federal Home Loan Mortgage Corporation | |

| | | |

| Freddie Mac Strip | | A three-basis point servicing fee and/or up to a one-basis point surveillance fee on certain Freddie Mac loans after the loan is securitized in a Freddie Mac pool | |

| | | |

| Freddie Mac TAH | | The Freddie Mac Targeted Affordable Housing Program | |

| | | |

| | | |

| | | |

| | | |

| | | |

| GCS | | Global corporate services | |

| | | |

| GDP | | Gross domestic product | |

| | | |

| GDPR | | General Data Protection Regulation | |

| | | |

| Gerald Eve | | Gerald Eve LLP, a London-based real estate advisory firm acquired on March 10, 2023 | |

| | | |

| Ginnie Mae | | The Government National Mortgage Association | |

| | | |

| GSE or GSEs | | Fannie Mae and Freddie Mac | |

| | | |

| H-Rights | | Rights to exchange PSUs into HDUs | |

| | | |

| HDUs | | LPUs with capital accounts, which are liability awards recorded in “Accrued compensation” in the Company’s consolidated balance sheets | |

| | | |

| HUD | | The U.S. Department of Housing and Urban Development | |

| | | |

| HUD LEAN | | HUD’s mortgage insurance program for senior housing | |

| | | |

| HUD MAP | | HUD’s Multifamily Accelerated Processing | |

| | | |

| Investment Company Act of 1940, as amended | | Investment Company Act | |

| | | |

| Knotel | | Knotel, Inc. | |

| | | |

| Kastle Barometer | | Security provider Kastle Systems tracks the number of employees in ten of the largest U.S. metropolitan areas that were physically in offices and reports every work week as a percentage of the typical number physically present during the first three weeks of February 2020 | |

| | | |

| LIBOR | | London Inter-Bank Offered Rate | |

| | | |

| Limited Partnership Unit Holders | | The individuals who became limited partners of Newmark Holdings in connection with the Separation and who held BGC Holdings limited partnership units immediately prior to the Separation and certain individuals who became or become limited partners of Newmark Holdings from time to time after the Separation and who provide services to the Newmark Entity Group | |

| | | |

| LPA Amendment | | An amendment, dated as of March 10, 2023, to the Newmark Holdings limited partnership agreement | |

| | | |

| LPUs, limited partnership units, or limited partnership interests | | Certain limited partnership units in Newmark Holdings or, prior to the closing of the Corporate Conversion, Newmark Holdings or BGC Holdings, held by certain employees of BGC or Newmark and other persons who have provided services to BGC or Newmark, which units may include APSIs, APSUs, AREUs, ARPSUs, HDUs, U.K. LPUs, N Units, PLPUs, PPSIs, PPSUs, PSEs, PSIs, PSUs, REUs, and RPUs, along with future types of limited partnership units in Newmark Holdings | |

| | | |

| Master Repurchase Agreement | | Master Repurchase Agreement, dated August 2, 2021, by and between Newmark OpCo and CF Secured | |

| | | |

| MBA | | Mortgage Bankers’ Association | |

| | | |

| McCall & Almy | | McCall & Almy, Inc. | |

| | | |

| MPC | | Monetary Policy Committee of the Bank of England | |

| | | |

| MSCI | | MSCI Real Assets (formerly known Real Capital Analytics, or “RCA”) | |

| | | |

| MSRs | | Mortgage servicing rights | |

| | | |

| | | | | | | | | | | |

| Nasdaq | | Nasdaq, Inc., formerly known as NASDAQ OMX Group, Inc. | |

| | | |

| Nasdaq Earn-out | | Total consideration received from the sale of eSpeed by BGC Partners to Nasdaq, including $750.0 million in cash paid upon closing and an earn-out of up to 14,883,705 shares of shares which was paid ratably over 15 years, provided that Nasdaq, as a whole, produced at least $25.0 million in consolidated gross revenues each year | |

| | | |

| Nasdaq Forwards | | Variable postpaid forward contracts with RBC entered into using an SPV that is a consolidated subsidiary of Newmark | |

| | | |

| Nasdaq shares or Nasdaq payment | | The shares of common stock of Nasdaq which remained payable by Nasdaq in connection with the Nasdaq Monetization Transactions, the right to which BGC Partners transferred to Newmark in connection with the Separation | |

| | | |

| Nasdaq Monetization Transactions | | The sale on June 28, 2013, of eSpeed by BGC Partners to Nasdaq, in which the total consideration paid or payable by Nasdaq included the Nasdaq Earn-out | |

| | | |

| Newmark | | Newmark Group, Inc., and where applicable, its consolidated subsidiaries. Also referred to as the “Company,” “we,” “us,” or “our.” | |

| | | |

| Newmark & Co. | | Newmark & Company Real Estate, Inc., which for the purposes of this document is defined as all of the companies acquired by BGC Partners on October 14, 2011. Comparisons in this document to our 2011 revenues are based on unaudited full year 2011 revenues for Newmark & Co. | |

| | | |

| Newmark Common Stock | | Newmark Class A common stock and Newmark Class B common stock, collectively | |

| | | |

| Newmark Class A common stock | | Newmark Class A common stock, par value $0.01 per share | |

| | | |

| Newmark Class B common stock | | Newmark Class B common stock, par value $0.01 per share | |

| | | |

| Newmark Entity Group | | Newmark, Newmark Holdings, Newmark OpCo and their respective consolidated subsidiaries, collectively | |

| | | |

| Newmark Holdings | | Newmark Holdings, L.P., which is owned jointly by Newmark, Cantor, Newmark’s employee partners and other partners | |

| | | |

| NHL | | Newmark Holdings Limited | |

| | | |

| Newmark Holdings limited partnership agreement | | Amended and Restated Agreement of Limited Partnership of Newmark Holdings, dated as of December 13, 2017 | |

| | | |

| Newmark IPO | | The initial public offering of 23 million shares of Newmark Class A common stock at a price of $14.00 per share in December 2017 | |

| | | |

| Newmark OpCo | | Newmark Partners, L.P., an operating partnership, which is owned jointly by Newmark and Newmark Holdings and holds the businesses of Newmark | |

| | | |

| Newmark OpCo Preferred Investment | | On June 18, 2018 and September 26, 2018, Newmark OpCo issued approximately $175.0 million and $150.0 million of EPUs, respectively, in private transactions to RBC | |

| | | |

| Newmark Research | | A Newmark service providing insightful real estate market reports and analysis to our professionals and clients | |

| | | |

| Newmark Revolving Loans | | Certain loans that Cantor has agreed to make from time to time to Newmark pursuant to the First Cantor Credit Agreement Amendment in an aggregate outstanding principal amount of up to $150.0 million, on substantially the same terms as other loans under such agreement, except that until April 15, 2024, the Newmark Revolving Loans will bear interest at a rate equal to 25 basis points less than the interest rate borne by the revolving loans made pursuant to the Credit Facility | |

| | | |

| Newmark S11 | | Newmark S11 Holdings, LLC | |

| | | |

| NOL | | Net operating loss | |

| | | |

| | | |

| | | |

| N Units | | Non-distributing partnership units of Newmark Holdings that may not be allocated any item of profit or loss, and may not be made exchangeable into shares of Class A common stock, including NREUs and NPSUs | |

| | | | | | | | | | | |

| | | |

| | | |

| | | |

| OECD | | Organisation for Economic Co-operation and Development | |

| | | |

| Official Bank Rate | | The rate the Bank of England charges banks and financial institutions for loans with a maturity of one day | |

| | | |

| OMSRs | | Originated mortgage servicing rights | |

| | | |

| Open Realty | | Open Realty Advisors, LLC and Open Realty Properties, LLC, which operate together as a retail real estate advisory firm | |

| | | |

| Preferred Distribution | | Allocation of net profits of BGC Holdings or Newmark Holdings to holders of Preferred Units, at a rate of either 0.6875% (i.e., 2.75% per calendar year) or such other amount as set forth in the award documentation | |

| | | |

| Preferred Units | | Preferred partnership units in Newmark Holdings or, prior to the closing of the Corporate Conversion, BGC Holdings, such as PPSUs, which are settled for cash, rather than made exchangeable into shares of Class A common stock, are only entitled to a Preferred Distribution, and are not included in BGC’s or Newmark’s fully diluted share count | |

| | | |

| Preqin | | Preqin Ltd | |

| | | |

| Producers | | Customer-facing, revenue-generating professionals, including brokers, salespersons, front-office personnel, and originators, who are directly compensated based wholly or in part on the revenues they contribute to generating, revenue-generating professionals, including brokers, salespersons, front-office personnel, and originators | |

| | | |

| RBC | | Royal Bank of Canada | |

| | | |

| Real Estate LP | | CF Real Estate Finance Holdings, L.P. | |

| | | |

| Recurring revenues | | Includes all pass through revenues, as well as fees from Newmark’s servicing business, GCS, Property Management, its flexible workspace platform, and V&A, as well as Spring11 | |

| | | |

| REIT | | Real estate investment trust | |

| | | |

| RSUs | | BGC or Newmark restricted stock units, paid or payable in shares of BGC Class A common stock or Newmark Class A common stock, respectively, held by certain employees of BGC or Newmark and other persons who have provided services to BGC or Newmark, or issued in connection with certain acquisitions | |

| | | |

| SEC | | U.S. Securities and Exchange Commission | |

| | | |

| Securities Act | | Securities Act of 1933, as amended | |

| | | |

| Separation | | Principal corporate transactions pursuant to the Separation and Distribution Agreement, by which the BGC Entity Group transferred to the Newmark Entity Group the assets and liabilities of the BGC Entity Group relating to BGC’s real estate services business, and related transactions, including the distribution of Newmark Holdings units to holders of units in BGC Holdings and the assumption and repayment of certain BGC indebtedness by Newmark | |

| | | |

| Separation and Distribution Agreement | | The Separation and Distribution Agreement entered into prior to the completion of the Newmark IPO by Cantor, Newmark, Newmark Holdings, Newmark OpCo, BGC Partners, BGC Holdings, BGC U.S. Opco and, for certain limited purposes described therein, BGC Global Holdings, L.P., dated December 13, 2017, as amended from time to time, and as amended on November 8, 2018 and amended and restated on November 23, 2018 | |

| | | |

| Signature | | Signature Bridge Bank, N.A. | |

| | | |

| Signature transactions | | On October 2, 2023, the FDIC, in its capacity as receiver for Signature closed on the sale of approximately $16.6 billion of capital commitment facilities made by Signature to private equity funds, which represented Signature’s banking loan portfolio. On December 15, 2023, the FDIC announced the completion of the sale of approximately $33 billion of the Signature commercial real estate loan portfolio, representing the final transaction for the Signature loan portfolio. Newmark served as the exclusive advisor to the FDIC for the sale of the Signature loan portfolio | |

| | | |

| SOFR | | Secured Overnight Financing Rate | |

| | | |

| SPAC | | Special purpose acquisition company | |

| | | |

| | | | | | | | | | | |

| Spin-Off | | The pro rata distribution, pursuant to the Separation and Distribution Agreement, by BGC Partners to its stockholders of all of the shares of Newmark Common Stock owned by BGC Partners immediately prior to the effective time of the Spin-Off, completed on November 30, 2018 | |

| | | |

| Spring11 | | Spring11 Holdings, LP | |

| | | |

| SPV | | Special purpose vehicle | |

| | | |

| Standing Policy | | In March 2018, Newmark’s Compensation Committee and Audit Committee approved Mr. Lutnick’s right, subject to certain conditions, to accept or waive opportunities offered to other executive officers to monetize or otherwise provide liquidity with respect to some or all of their limited partnership units of Newmark Holdings or to accelerate the lapse of or eliminate any restrictions on equity awards | |

| | | |

| TAM | | Total addressable market | |

| | | |

| TDRs | | Troubled debt restructurings | |

| | | |

| Total debt | | Newmark’s quarterly volumes from mortgage brokerage and GSE/FHA originations together | |

| | | |

| Tradeweb | | Tradeweb Markets, Inc. | |

| | | |

| U-3 | | The number of unemployed individuals as a percentage of the entire labor force; considered the official unemployment rate by the U.S. Department of Labor | |

| | | |

| U.K. | | United Kingdom | |

| | | |

| U.S. GAAP or GAAP | | Generally Accepted Accounting Principles in the United States of America | |

| | | |

| UBT | | Unincorporated Business Tax | |

| | | |

| V&A | | Valuation and Advisory | |

| | | |

| Working Partners or Newmark Holdings Working Partners | | The individuals who became limited partners of Newmark Holdings in connection with the Separation and who held BGC Holdings working partner interests immediately prior to the Separation, and certain individuals who became or become limited partners of Newmark Holdings from time to time from and after the Separation and who provide services to the Newmark Entity Group | |

| | | |

| | | |

| | | |

| | | |

| | | |

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “possible,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements. The information included herein is given as of the filing date of this Annual Report on Form 10-K with the SEC, and future results or events could differ significantly from these forward-looking statements. Such statements are based upon current expectations that involve risks and uncertainties. Factors that could cause future results or events to differ from those expressed in these forward-looking statements include, but are not limited to, the risks and uncertainties described or referenced in this Form 10-K in Part I, Item 1A, Risk Factors, in Part II, Item 7A, Quantitative and Qualitative Disclosures About Market Risk. Except to the extent required by applicable law or regulation, the Company does not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

RISK FACTOR SUMMARY

The following is a summary of material risks that could affect our business, each of which may have a material adverse effect on our business, financial condition, results of operations and prospects. This summary may not contain all of our material risks, and it is qualified in its entirety by reference to the more detailed risk factors set forth in Part I, Item 1A, Risk Factors.

•General conditions in the economy, commercial real estate market and the banking sector (including perceptions of such conditions) can have a material adverse effect on our business, financial condition, results of operations and prospects.

•Interest rate increases in response to inflation rates may have a material negative impact on our businesses.

•We operate in a highly competitive industry with numerous competitors, some of which may have greater financial and operational resources than we do.

•We may pursue opportunities including strategic alliances, acquisitions, dispositions, joint ventures or other growth opportunities (including hiring new brokers and other professionals), which could present unforeseen integration obstacles or costs and could dilute our stockholders. We may also face competition in our acquisition strategy, and such competition may limit such opportunities.

•We are and we will continue to be exposed to political, economic, legal, regulatory, operational and other risks, including with respect to the outbreak of hostilities or other instability, inherent in operating in foreign countries.

•The long-term effects of the COVID-19 pandemic continue to significantly disrupt and adversely affect the environment in which we and our clients and competitors operate, including ongoing changes in demand in the commercial real estate services industry.

•If we fail to comply with laws, rules and regulations applicable to commercial real estate brokerage, valuation and advisory, mortgage transactions and our other business lines, then we may incur significant financial penalties.

•Changes in relationships with the GSEs and HUD could adversely affect our ability to originate commercial real estate loans through such programs, although we also provide debt and equity to our clients through other third-party capital sources. Compliance with the minimum collateral and risk-sharing requirements of such programs, as well as applicable state and local licensing agencies, could reduce our liquidity.

•We may not be able to protect our intellectual property rights or may be prevented from using intellectual property used in our business.

•Malicious cyber-attacks and other adverse events affecting our operational systems or infrastructure, or those of third parties, could disrupt our business, result in the disclosure of confidential information, damage our reputation and cause losses or regulatory penalties.

•We may use AI in our business, and challenges with properly managing its use could result in competitive harm, regulatory action, legal liability and brand or reputational harm.

•The loss of one or more of our key executives, the development of future talent, and the ability of certain key employees to devote adequate time and attention to us are a key part of the success of our business, and failure to continue to employ and have the benefit of these executives may adversely affect our businesses and prospects.

•Declines in or terminations of servicing engagements or breaches of servicing agreements could have a material adverse effect on our business, financial condition, results of operations and prospects.

•We have debt, which could adversely affect our ability to raise additional capital to fund our operations and activities, limit our ability to react to changes in the economy or the commercial real estate services industry, expose us to interest rate risk, impact our ability to obtain favorable credit ratings and prevent us from meeting or refinancing our obligations under our indebtedness, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

•We may be required to pay Cantor for a significant portion of the tax benefit relating to any additional tax depreciation or amortization deductions we claim as a result of any step up in the tax basis of the assets of Newmark OpCo resulting from exchanges of interests held by Cantor in by Newmark Holdings for our common stock.

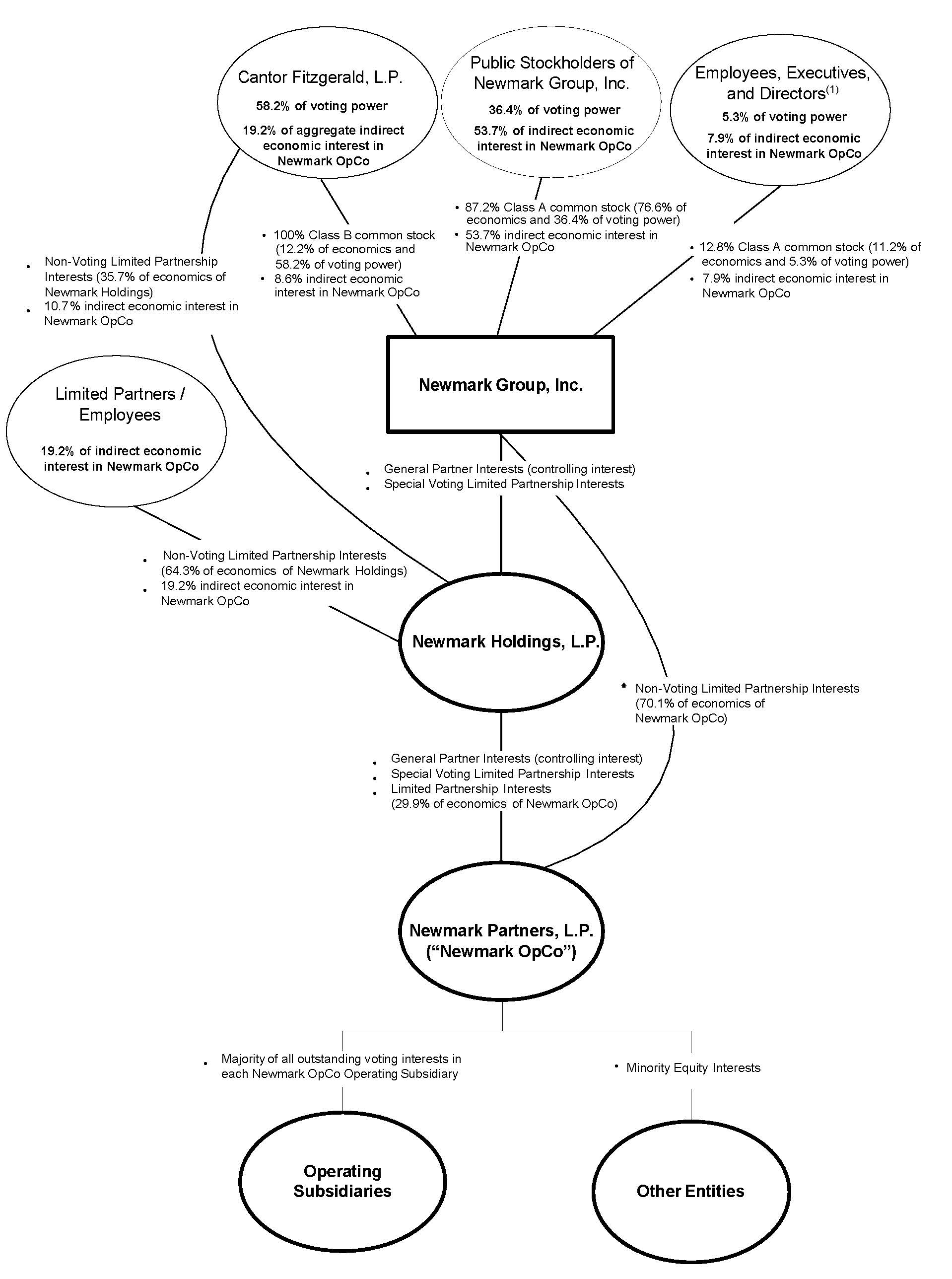

•We are a holding company, and accordingly we are dependent upon distributions from Newmark OpCo to pay dividends, taxes and indebtedness and other expenses and to make repurchases.

•Reductions in our quarterly cash dividend and corresponding reductions in distributions by Newmark Holdings to its partners may reduce the value of our common stock and the attractiveness of our equity-based compensation and limit the ability of our partners to repay employee loans.

•We are controlled by Cantor. Cantor’s interests may conflict with our interests, and Cantor may exercise its control in a way that favors its interests to our detriment, including in competition with us for acquisitions or other business opportunities.

•Purchasers of our Class A common stock, as well as existing stockholders, may experience significant dilution as a result of sales of shares of our Class A common stock by us, and the perception that such sales could occur, may adversely affect prevailing market prices for our stock.

•Ongoing scrutiny and changing expectations from stockholders with respect to the Company’s corporate responsibility or ESG practices may result in additional costs or risks.

•We face increasing financial, regulatory, and transitional risks associated with the effects of climate change.

PART I

ITEM 1. BUSINESS

Throughout this document Newmark Group, Inc. is referred to as “Newmark” and, together with its subsidiaries, as the “Company,” “we,” “us,” or “our.”

Our Business

Newmark is a leading commercial real estate advisor and service provider to large institutional investors, global corporations, and other owners and occupiers. We offer a diverse array of integrated services and products designed to meet the full needs of our clients.

Our investor/owner services and products include:

•capital markets, which consists of investment sales and commercial mortgage brokerage (including the placement of debt, equity raising, structured finance, and loan sales on behalf of third parties);

•landlord (or agency) leasing;

•valuation and advisory;

•property management;

•our leading commercial real estate technology platform and capabilities;

•business rates for U.K. property owners;

•due diligence, consulting and other advisory services;

•GSEs and FHA lending, including multifamily lending and loan servicing;

•limited loan servicing and asset management; and

•flexible workspace solutions for owners.

Our corporate or occupier services and products include:

•tenant representation leasing;

•GCS, which includes real estate, workplace and occupancy strategy, corporate consulting services, project management, lease administration and facilities management;

•business rates for U.K. occupiers; and

•flexible workspace solutions for occupiers.

Our goal is to lead with extraordinary talent, data, and analytics, which together allow us to provide strategic and specialized advice. This combination enables our revenue-generating employees, including brokers, originators, and other customer-facing professionals to be highly productive and to help clients increase their efficiency and profits while optimizing their real estate portfolios. Our goal is also to continue recruiting and retaining the greatest talent in the industry and to be recognized as the leading advisor in commercial real estate services.

We have relationships with many of the world’s largest commercial property owners, real estate developers and investors, as well as Fortune 500 and Forbes Global 2000 companies. For the year ended December 31, 2023, we generated revenues of approximately $2.5 billion, primarily from commissions on leasing and capital markets transactions, consulting and technology user fees, property and facility management fees, and mortgage origination and loan servicing fees. Our revenues are widely diversified across service lines, geographic regions and clients, with our top 10 clients accounting for approximately 11.1% of our total revenue on a consolidated basis for the year ended December 31, 2023.

As of December 31, 2023, we had nearly 7,000 employees in approximately 140 offices in 120 cities. The expenses of approximately 1,150 of those employees are partially or fully reimbursed by clients, mainly in our property management and GCS businesses. In addition, and as of this same date, Newmark has licensed its name to certain independently owned commercial real estate providers that we consider business partners, with more than 430 employees of such business partners operating out of 25 offices in various locations where Newmark does not operate.

Newmark’s History

Newmark was founded in New York City in 1929, with an emphasis on local investor/owner and occupier services and products and became known for having dedicated, knowledgeable, and client-focused advisors/intermediaries. Our acquisition

by Cantor Fitzgerald’s subsidiary BGC in 2011 and its subsequent investments in our business contributed to Newmark’s strong growth. From that time until we spun off from BGC in November 2018, we embarked on a rapid expansion throughout North America encompassing nearly all key business lines in the commercial real estate services sector, which included the acquisition of Berkeley Point Financial LLC in 2017. We believe our long-term growth has been a result of our management team’s strong understanding of commercial real estate as an asset class, long-term vision and deep relationships with users and owners, our strong culture of innovation and collaboration, our ability to adapt to the evolving market and to shifts in the demand for our services, and our proven track record of attracting and retaining the industry’s best talent.

Between 2011 and 2023, we increased our total revenues by a CAGR of 22%. Based on reported results, we believe that our improvement was greater than the average for our publicly traded commercial real estate services peers listed in the U.S. that have reported revenues over this period, as of February 27, 2024.

Due to this long-term record of growth, we are now a top commercial real estate services platform in the United States with a rapidly expanding international footprint.

During 2021, we ended our affiliation with Knight Frank LLP and accelerated our global growth plans. In 2022, we acquired BH2, a leading London-based real estate advisory firm and in 2023, we acquired Gerald Eve, a U.K. based full service advisory firm. Furthermore, over the past three years, we announced the addition of industry-leading international professionals in GCS, leasing, capital markets, and V&A. As a result, nearly 13% of our revenues were generated outside of the U.S. in 2023, compared with 7% in 2022 and less than 1% in 2017. Our global strategy involves adding to or growing our presence in certain key international markets in Europe, Asia, and the Americas, while partnering with local companies in other markets. We also expect to continue bolstering our presence in the U.S.

Our Services

Newmark offers a diverse array of integrated services designed to meet the full needs of both real estate investors/owners and occupiers. We believe our technological advantages, industry-leading talent, deep and diverse client relationships and suite of complementary services allow us to actively cross-sell our services and drive margins.

Real Estate Investor/Owner Services and Products

Capital Markets. We offer a broad range of capital markets services, including investment sales and mortgage brokerage (which includes debt and equity placement, fundraising, and recapitalization) of individual assets, portfolios and operating companies. We match capital providers with capital users. Our capital markets professionals have deep relationships with investors and capital sources of various composition, including government sponsored agencies, insurance companies, pension funds, real estate investment trusts, private funds, private investors, developers and construction firms.

Landlord (or “Agency”) Representation Leasing. We understand the nuanced needs of corporate, institutional, family and entrepreneurial property owners, and develop customized leasing strategies to help them attract and maintain the right tenants. Armed with both on-the-ground intelligence and comprehensive data, we help landlords find opportunities and make sound decisions. From strategic planning to property and asset management, we believe that our seamless services deliver increased revenue and enhanced value for our clients.

V&A. Our V&A professionals execute projects of nearly every size and type, from single properties to large portfolios, existing and proposed facilities, and mixed-use developments across the spectrum of asset classes. Clients include banks, pension funds, equity funds, REITs, insurance companies, developers, corporations, and institutional capital sources. These institutions utilize the advisory services we provide in their loan underwriting, construction financing, portfolio analytics, feasibility determination, acquisition structures, litigation support, property tax, and financial reporting.

Property Management. We provide property management services on a contractual basis to owners and investors in office (including medical and life sciences offices), industrial and retail properties. Property management services include building operations and maintenance, vendor and contract negotiation, project oversight and value engineering, labor relations, property inspection/quality control, property accounting and financial reporting, cash flow analysis, financial modeling, lease administration, due diligence and exit strategies. We have an opportunity to grow our property management contracts in connection with our other businesses, including higher-margin leasing or capital markets. These businesses also give us better insight into our clients’ overall real estate needs.

U.K. Business Rates Services. Gerald Eve has a strong foundation of expertise in business rates, which is a property tax that is payable with respect to all commercial properties in the U.K. This tax is based on government valuations that are reassessed every three years. The owner of each property has a right to challenge the level of value assessed on their premises. Gerald Eve has delivered a significant amount of savings for its investor and owner clients since 2017. As part of this service, we manage rate payments and process a significant amount of liabilities annually. Our success is underpinned by the deep knowledge our business rates team has of property sectors, property cases, market movements, and complex legislative procedures. We currently advise over 40 of the companies listed on the FTSE 100 and are an established market leader in the U.K. with over 2,000 corporate clients. This business provides valuable connectivity to many of our other service lines and generates a solid stream of recurring and predictable revenues.

Leading Commercial Real Estate Technology Platform and Capabilities. Investing in digital solutions has become imperative and we remain dedicated to creating customer-centric technology that optimizes our business methods while keeping our workforce and clients safe. Our multi-faceted real estate database continues to grow, as does our commitment to providing innovative, value-added technological solutions across our service lines, which enables our professionals to provide clients with data-driven advice and analytics with expediency. Our solutions are designed to increase operational efficiency, realize additional income, and/or generate cost savings for our professionals and clients.

Due Diligence, Consulting, Advisory Services and Other Services. We provide commercial real estate due diligence consulting and advisory services to a variety of clients, including lenders, investment banks and investors. Our core competencies include underwriting, modeling, structuring, due diligence, and asset management. We also offer clients cost-effective and flexible staffing solutions through both on-site and off-site teams. We believe this business line and other non-brokerage services we offer give us additional ways to cross-sell services and add value to our clients.

GSE/FHA Services

Lending. We operate a leading commercial real estate finance company focused on the origination and sale of multifamily and other related commercial real estate loans through government-sponsored and government-funded loan programs, as well as the servicing of loans originated by it and third parties. We participate in loan origination, sale, and servicing programs operated by two GSEs, Fannie Mae and Freddie Mac. We also originate, sell and service loans under HUD FHA programs, and are an approved MAP and HUD LEAN lender, as well as an approved Ginnie Mae issuer.

Through HUD’s MAP and LEAN Programs, we provide construction and permanent loans to developers and owners of multifamily housing, affordable housing, senior housing and healthcare facilities. We are one of 25 approved lenders that participate in the DUS program and one of 22 lenders approved as a Freddie Mac seller/servicer. As a low-risk intermediary, we originate loans guaranteed by government agencies or entities and pre-sell such loans prior to transaction closing. We have established a strong credit culture over decades of originating loans and remain committed to disciplined risk management from the initial underwriting stage through loan payoff.

Loan Servicing and Asset Management. In conjunction with our origination services, we sell the loans that we originate under GSE and FHA programs and retain the servicing of those loans. Our GSE/FHA loan servicing portfolio provides a stable, predictable recurring stream of revenue to us over the life of each loan. The typical multifamily loan that we originate and service under these programs is either fixed or variable rate and includes significant prepayment penalties. These structural features generally offer prepayment protection and provide more stable, recurring fees. In addition to our GSE/FHA portfolio, we also offer limited and special servicing as well as asset management for a wide range of commercial and multifamily loans.

Our servicing operations are rated by Fitch, S&P, and Kroll for commercial loan primary and special servicing and consist of a team of professionals dedicated to primary, limited, and special servicing and to asset management. These professionals focus on financial performance and risk management to anticipate potential property, borrower, or market issues. Portfolio management conducted by these professionals is not only a risk management tool, but also leads to deeper relationships with borrowers, resulting in continued interaction with borrowers over the term of the loan, and potential additional financing opportunities.

Additional information regarding our key GSE/FHA lending channels:

•Fannie Mae. As one of 25 lenders under the Fannie Mae DUS program, we are a multifamily approved seller/servicer for conventional, affordable and senior loans that satisfy Fannie Mae’s underwriting and other eligibility requirements. Fannie Mae has delegated to us responsibility for ensuring the loans originated under the Fannie Mae DUS program satisfy the underwriting and other eligibility requirements established from time to time by

Fannie Mae. In exchange for this delegation of authority, we share up to one-third of the losses that may result from a borrower’s default. All of the Fannie Mae loans we originate are sold, prior to loan funding, in the form of a Fannie Mae-insured security to third-party investors. We service all loans we originate under the Fannie Mae DUS program.

•Freddie Mac. We are one of 22 Freddie Mac multifamily approved seller/servicer for conventional, affordable and senior loans that satisfy Freddie Mac’s underwriting and other eligibility requirements. Under the program, we submit the completed loan underwriting package to Freddie Mac and obtain Freddie Mac’s commitment to purchase the loan at a specified price after closing. Freddie Mac ultimately performs its own underwriting of loans we sell to Freddie Mac. Freddie Mac may choose to hold, sell or, as it does in most cases, later securitize such loans. We do not have any material risk-sharing arrangements on loans sold to Freddie Mac under the program. We also generally service loans we originate under this Freddie Mac program.

•HUD/Ginnie Mae/FHA. As an approved HUD MAP and HUD LEAN lender and Ginnie Mae issuer, we provide construction and permanent loans to developers and owners of multifamily housing, affordable housing, senior housing and healthcare facilities. We submit a completed loan underwriting package to FHA and obtain FHA’s firm commitment to insure the loan. The loans are typically securitized into Ginnie Mae securities that are sold, prior to loan funding, to third-party investors. Ginnie Mae is a United States government corporation in HUD. Ginnie Mae securities are backed by the full faith and credit of the United States. In the event of a default on a HUD insured loan, HUD will reimburse approximately 99% of any losses of principal and interest on the loan and Ginnie Mae will reimburse the majority of remaining losses of principal and interest. The lender typically is obligated to continue to advance principal and interest payments and tax and insurance escrow amounts on Ginnie Mae securities until the HUD mortgage insurance claim has been paid and the Ginnie Mae security is fully paid. We also generally service all loans we originate under these programs.

•Warehouse Loan Agreements. We finance our loan originations under GSE programs through collateralized financing agreements in the form of warehouse loan agreements with multiple lenders with an aggregate commitment as of December 31, 2023 of $1.5 billion, an aggregate of $1.1 billion of uncommitted warehouse lines with two lenders, and an uncommitted $400 million Fannie Mae loan repurchase facility. As of December 31, 2023 and December 31, 2022, we had collateralized financing outstanding of approximately $498.6 million and $137.4 million, respectively. Collateral includes the underlying originated loans and related collateral, the commitment to purchase the loans, and credit enhancements from the applicable GSE or HUD. We typically complete the distribution of the loans we originate within 30 to 60 days of closing. Proceeds from the distribution are applied to reduce borrowings under the warehouse loan agreements, thus restoring borrowing capacity for further loan originations under GSE programs.

•Flexible Workspace Provider. We offer amenity-rich and flexible work environments across a network of offices located primarily in Europe and North America, including through Knotel and Deskeo. We make smart, city-dependent choices with buildings that serve investors and owners of real estate by providing a bespoke solution with world-class amenities.

Real Estate Corporate or Occupier Services and Products

Tenant Representation Leasing. We represent commercial tenants in virtually all aspects of the leasing process (often in conjunction with GCS), including space acquisition and disposition, strategic planning, site selection, financial and market analysis, economic incentives analysis, lease negotiations, lease auditing and project management. We assist clients by defining space requirements, identifying suitable alternatives, recommending appropriate occupancy solutions, negotiating lease and ownership terms with landlords and minimizing real estate costs and associated risks for clients through analyzing, structuring and negotiating business and economic incentives, as well as advising on relevant sustainability and environmental issues. Fees are typically based on a percentage of the total financial consideration of the lease commitment for executed leases and are generally earned when a lease is signed. In many cases, landlords are responsible for paying the fees. We use innovative technology and data to provide tenants with an advantage in negotiating leases, which has contributed to our market share gains.

Global Corporate Services. GCS is our consulting and outsourcing services business that focuses on reducing occupancy expenses and improving efficiency for corporate real estate occupiers, with significant, often multi-national presences. We provide beginning-to-end corporate real estate solutions for clients. GCS strives to make its clients more effective by optimizing real estate usage, managing overall corporate footprint expenses, and improving workflow and human capital efficiency through large scale data analysis and our industry-leading technology.

We provide real estate strategic consulting services to our clients, including Fortune 500 and Forbes Global 2000 companies, owner-occupiers, government agencies, as well as organizations in healthcare and higher education. We also provide enterprise asset management information consulting and technology solutions which can yield cost-savings for our GCS business’s client base. Our consulting services include financial integration, asset and portfolio strategy, location strategy and optimization, workplace strategies, energy and sustainability, workflow and business process improvement, merger and acquisition integration and industrial consulting. Fees for these services are on a negotiated basis and are often part of a multi-year services agreement. Fees may be contingent on meeting certain financial or savings objectives with incentives for exceeding agreed upon targets.

We believe that GCS provides us with a unique lens into commercial real estate and offers ways to win business across multiple business lines. Whether a client currently manages its real estate function in-house (insource) or has engaged an external provider (outsource), GCS aims to create value by securing accounts that are first generation outsourced or by gaining outsourced market share. GCS often provides us with recurring and/or contractual revenue streams when it enters into multi-year contracts for ongoing services, such as project and facilities management and real estate and lease administration over the course of the contract.

For the past 15 years, the International Association of Outsourcing Professionals has named Newmark to The Best of The Global Outsourcing 100®, which identifies the world’s best outsourcing providers across all industries.

Additional information about our GCS platform:

•Workplace and Occupancy Strategy. Our workplace strategy and human experience team includes real estate strategists, architects, financial analysts, change managers, and subject matter experts with experience in the components of a successful workplace. We focus on the people, place and process aspects that drive performance. We work with clients to make the experience of going to work more engaging, supportive, and productive by inspiring people through meaningful placemaking. Our clients include leading corporations who are increasingly rethinking their approach to the workplace. They are motivated by a variety of factors — including making their people happier, safer and healthier, driving organizational change and re-alignment, and being more effective with their real estate and technology investments. Our team leverages workplace strategies to tailor environments where employees want to come to work, participate and perform.

•Energy and Sustainability Services. Our Energy and Sustainability Services team aims to help management services clients lower energy costs, increase net operating income and support responsible corporate stewardship, and include: calibration of outside air/demand control ventilation, energy procurement, Energy Star management, enhanced air filtration and indoor air quality upgrades, electrical demand lightning, electrical load curtailment (demand response), EV charging stations, LED lighting upgrades, Leadership in Energy and Environmental Design certification, renewable energy and utility data management and benchmarking.

•Technology. GCS has upgraded and improved upon various technologies offered in the real estate industry, combining our technological specialties and our creative core of development within our GCS platform.

•Project Management. We provide a variety of services to tenants and owners of self-occupied spaces. These include conversion management, move management, construction management and strategic occupancy planning services. These services may be provided in connection with a tenant representation lease or on a contractual basis across a corporate client’s portfolio. Fees are generally determined on a negotiated basis and earned when the project is complete.

•Real Estate and Lease Administration. We manage leases for our clients for a fee, which is generally on a per lease basis. We also perform lease audits and certain accounting functions related to the leases. Our lease administration services include critical data management, rent processing and rent payments. These services provide additional insight into a client’s real estate portfolio, which allows us to deliver significant value back to the client through the provision of additional services, such as tenant representation, project management and consulting assignments, to minimize leasing and occupancy costs. For large occupier clients, our real estate technology enables them to access and manage their complete portfolio of real estate assets. We offer clients a fully integrated user-focused technology product designed to help them efficiently manage their real estate costs and assets.

•Facilities Management. We manage a broad range of properties on behalf of users of commercial real estate, including headquarters, facilities and office space, for a broad cross section of companies including Fortune 500 and Forbes Global 2000 companies. We can manage the day-to-day operations and maintenance for urban and suburban

commercial properties of most types, including office, industrial, data centers, healthcare, life sciences, retail, call centers, urban towers, suburban campuses, and landmark buildings. Facilities management services may also include facility audits and reviews, energy management services, janitorial services, mechanical services, bill payment, maintenance, project management, and moving management. While facility management contracts are typically three to five years in duration, they may be terminated on relatively short notice periods.

U.K. Business Rates Services. Gerald Eve has a strong foundation of expertise in business rates, which is a property tax that is payable with respect to all commercial properties in the U.K. This tax is based on government valuations that are reassessed every three years. The occupier of each property has a right to challenge the level of value assessed on their premises. Gerald Eve has delivered a significant amount of savings for its occupier clients since 2017. As part of this service, we manage rate payments and process a significant amount of liabilities annually. Our success is underpinned by the deep knowledge our business rates team has of property sectors, property cases, market movements, and complex legislative procedures. We currently advise over 40 of the companies listed on the FTSE 100 and are an established market leader in the U.K. with over 2,000 corporate clients. This business provides valuable connectivity to many of our other service lines and generates a solid stream of recurring and predictable revenues.

Flex Workspace Provider. We offer amenity-rich and flexible work environments across a network of offices located primarily in Europe and North America including through Knotel and Deskeo. We make smart, city-dependent choices with buildings that serve occupiers of real estate by providing a bespoke solution with world-class amenities.

Business Partners

In certain smaller U.S. and international markets in which we do not maintain Newmark-owned offices, we have agreements in place to operate on a collaborative and cross-referral basis with certain independently owned offices in return for contractual and referral fees paid to us and/or certain mutually beneficial co-branding and other business arrangements. These independent offices are referred to as business partners. We believe these partnerships allow us to provide the best service to our clients and higher returns to our shareholders, without diluting our focus. These business partners may use some variation of our branding in their names and marketing materials. These agreements typically take the form of multi-year contracts, and provide for mutual referrals in their respective markets, generating additional contract and brokerage fees. While we do not derive a significant portion of our revenue from these relationships, they do enable us to seamlessly provide service to our mutual clients. These business partners give our clients access to additional brokerage professionals with local market research capabilities as well as other commercial real estate services in locations where the Company does not have a physical presence. The discussion of our financial results and other metrics reflects only the business owned by us and does not include the results for business partners using some variation of the Newmark name in their branding or marketing. See “Risks Related to Our Business—Risks Related to Our Commercial Contracts and Arrangements—We may not be able to replace partner offices when affiliation agreements are terminated, which may decrease our scope of services and geographic reach,” under Part I, Item 1A, Risk Factors.

Industry Trends and Opportunity

We expect the following industry and macroeconomic trends to impact our market opportunity:

Large and Highly Fragmented Market. We estimate that the commercial real estate services industry is a more than $400 billion global revenue market opportunity. This TAM represents the actual and/or potential revenues that are or could be generated annually by public and private commercial real estate services firms. We believe that a significant portion of the TAM currently resides with smaller and regional companies offering services like ours. We also believe that a large percentage consists of real estate services that are performed in-house by owners and occupiers but that could be partially or entirely outsourced. The estimated TAM also includes businesses in which our public commercial real estate services competitors operate but where Newmark currently does not, such as real estate investment management. We estimate that less than 20% of the potential revenue in the global commercial real estate services market is currently serviced by the top 10 global firms (by total revenues), leaving a large opportunity for us to reach clients through superior experience and high-quality service, relative to both our larger competitors and the significant number of fragmented smaller and regional companies. We believe that clients increasingly value full service real estate service providers with comprehensive capabilities and multi-jurisdictional reach. We believe this will provide a competitive advantage for us as we have full-service capabilities to service both real estate owners and occupiers.

Institutional Investor Demand for Commercial Real Estate. Institutions investing in real estate often compare their returns on investments in real estate to those of alternative asset classes, benchmark sovereign bonds, and investment-grade

corporate bonds. Even with their recent rise, benchmark interest rates have remained below long-term average historical rates around the world over the past several years. For example, ten-year U.S. Treasuries averaged just under 6% over the fifty years ended December 31, 2023, compared with approximately 2.3% over the past five and ten calendar years, 2.9% in 2022, and 4.0% in 2023. From the end of the Great Recession through the first half of 2022, this generally offered investors appealing spreads between those rates and risk-adjusted total returns for commercial real estate, which attracted significant investment from the portfolios of sovereign wealth funds, insurance companies, pension and mutual funds, high net worth investors and family offices, and other institutional investors, leading to an increased percentage of direct and indirect ownership of real estate related assets over time.

Beginning in the second half of 2022 and continuing through 2023, investment and origination volumes in commercial and multifamily real estate declined significantly from the record levels recorded a year earlier. This was largely due to both the relatively rapid rise in both the absolute level of interest rates and the increase in overall interest rate volatility as measured by ICE BofA MOVE Index and similar indices as well as widening credit spreads. A large percentage of commercial real estate investment is financed with debt, and these recent macroeconomic conditions made the financing of deals more challenging. Despite this recent slowdown in industry-wide activity, over the long term, institutions continue to expect to invest in global real estate. For context, the weighted average target allocation for all global institutional investors to real estate increased from 5.6% of their overall portfolios in 2010 to 9.6% in 2015 and 10.8% in 2023, according to figures from an annual survey by Cornell University’s Baker Program in Real Estate and Hodes Weill & Associates. The Cornell survey estimates that the global target allocations will remain at 10.8% in 2024, which would be consistent with the levels reported for 2022 and 2023 but be nearly double the percentage in 2010. We expect these relatively high investor allocations to benefit our owner-focused businesses as interest rates and transaction activity normalize. According to recent data from Bloomberg, economists and futures market participants widely expect major central banks, including the Federal Reserve, to begin lowering short term rates over the summer of this year. We would expect such a pivot to lead to real estate capital markets activity beginning to accelerate in the second half of 2024 and into 2025.

One indication that investors remain ready to deploy capital toward real estate is the uninvested amounts held by global real estate focused institutions in closed-end funds. Preqin estimated that there was approximately $405 billion of investible funds held by such institutions as of December 31, 2023, versus $235 billion in 2015 and $157 billion in 2010. These figures exclude the significant amount of real estate assets held by other types of investors and owners, such as publicly traded REITs, non-traded REITs, and open-ended core property funds. According to the most recent data from MSCI, total global funds under management by real-estate focused institutional investors was $13.3 trillion in 2022, while the total size of overall investible real estate market was $19.5 trillion.

We expect industry volumes to bounce back relatively quickly once interest rates stabilize. While the rise in interest rates may be challenging in the short term, we remain excited about our market position and our future.

Significant Levels of Commercial Mortgage Debt Outstanding and Upcoming Maturities. As of the most recently available data from the MBA, there is approximately $4.7 trillion in U.S. commercial and multifamily mortgage debt outstanding (excluding loans for acquisitions, development, and construction, as well as loans collateralized by owner-occupied commercial properties). Of this amount, approximately $2.6 trillion is expected to mature between 2024 and 2028. Refinancing typically makes up a significant portion of overall industry originations. For context, the MBA states that total U.S. commercial and multifamily originations were $713 billion in 2019, $614 billion in 2020, $891 billion in 2021, and $816 billion in 2022. U.S. origination volumes declined in 2023 to $444 billion, but the MBA projects that they will resume their long-term growth trend over the following two years. In the intermediate term, we expect the increase in interest rates and generally rising capitalization rates, as well as the pullback in commercial real estate lending by banks and other traditional lenders, will lead a large and growing percentage of investors and owners to find alternative solutions, including via the growing share of loans we expect to be originated by alternative lenders such as private credit funds. We anticipate a significant portion of debt maturities to be resolved not only through refinancing, which should help our mortgage brokerage and origination businesses, but also through the kinds of more complex and sophisticated restructurings, loan sales, and recapitalizations in which Newmark specializes. Our capital markets clients have sought, and we believe will continue to seek, our counsel with respect to addressing their related investing and financing needs. We expect our professionals to not only provide our clients with innovative capital markets solutions, but to offer integrated services from our experts across leasing, V&A, property management, and other areas of Newmark. By using a collaborative and multidisciplinary approach, we can provide our clients with extensive industry and product expertise along regional, national, and increasingly global reach across a wide variety of property types.

Steady interest rate environments typically stimulate our capital markets business, where demand is often dependent on attractive all-in borrowing rates versus expected asset yields. Demand also depends on credit accessibility and general

macroeconomic trends. As interest rates stabilize, we expect this to increase demand for our origination, investment sales, and mortgage brokerage businesses.

Favorable Multifamily Demographics Driving Growth in Multifamily Originations and Sales. Increasing sales prices for single-family homes relative to wages, the rise in mortgage rates, relatively low home construction rates over the past decade, an aging population, and immigration to the United States are among the factors increasing demand for new apartment living in the U.S., as well as for single-family rental housing. We expect these factors to support continued growth for our multifamily capital markets business, which provides integrated investment sales, mortgage brokerage, GSE/FHA lending, and loan servicing capabilities. We believe that the combination of these businesses has provided and will continue to have a multiplier effect that drives growth across the Company.