The declaration of dividends is within the discretion of our board of directors based upon a review of relevant considerations, and there is no guarantee that we will pay any dividends on our Common Stock in the future or at levels anticipated by our stockholders.

Dividends are authorized and determined by our board of directors in its sole discretion and depend upon a number of factors, including the Company’s financial results, cash requirements and future prospects, as well as such other factors deemed relevant by our board of directors. Any dividends we may declare in the future will be determined by our board of directors in its sole discretion. Any elimination of, or downward revision in, our dividend policy could have an adverse effect on the market price of our Common Stock.

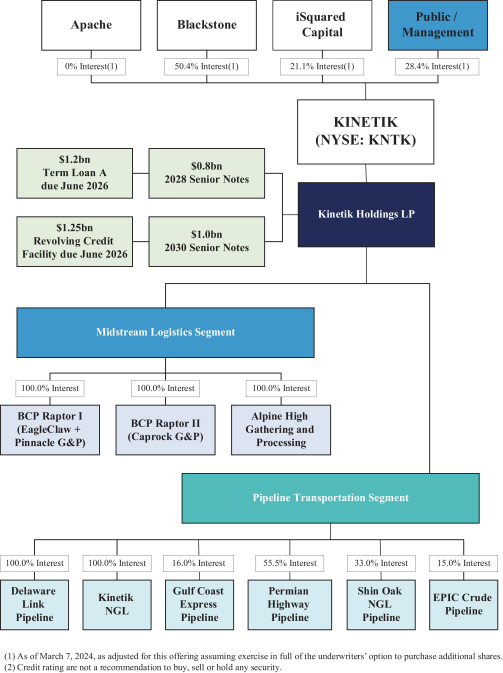

Entities controlled by Blackstone Inc. (“Blackstone”) and ISQ Global Fund II GP, LLC (“I Squared Capital”) are parties to the amended and restated stockholders agreement granting certain director designation rights and own a majority of the Company’s outstanding voting shares and thus strongly influence all of the Company’s corporate actions.

We and each of Blackstone and I Squared Capital are party to the amended and restated stockholders agreement, dated as of October 21, 2021 and effective as of February 22, 2022, which entitles each of Blackstone and I Squared Capital to, among other things, certain director designation rights for so long as each holder continues beneficially own at least 10% of our Common Stock.

As long as Blackstone and I Squared Capital and their respective affiliates own or control a significant percentage of the Company’s outstanding voting power, they will have the ability to strongly influence all corporate actions, including stockholder approval of the election of and removal of directors. The interests of Blackstone or I Squared Capital may not align with the interests of the Company’s other stockholders.

The Company’s ability to return capital to stockholders through dividends and stock repurchases depends on its ability to generate sufficient cash flow, which it may not be able to accomplish.

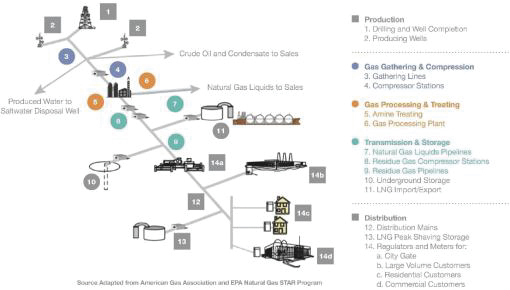

The Company’s ability to return capital to stockholders through dividends and stock repurchases principally depends upon the amount of cash it generates from its operations, which will fluctuate from quarter to quarter based on, among other things, income from the Pipeline Transportation JVs, the volumes of natural gas and NGLs it gathers and processes, commodity prices, and other factors impacting the Company’s financial condition, some of which are beyond its control. In addition, under Delaware law, dividends on the Company’s capital stock may only be paid from “surplus,” which is the amount by which the fair value of the Company’s total assets exceeds the sum of its total liabilities, including contingent liabilities, and the amount of its capital; if there is no surplus, cash dividends on capital stock may only be paid from the Company’s net profits for the then-current and/or the preceding fiscal year.

The Company’s Third Amended and Restated Certificate of Incorporation (our “Charter”) designates the Court of Chancery of the State of Delaware the (“Court of Chancery”) as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by its stockholders, which could limit its stockholders’ ability to obtain a favorable judicial forum for disputes with the Company or its directors, officers, employees, or agents.

The Charter provides that, unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for any derivative action or proceeding brought on the Company’s behalf; any action asserting a claim of breach of a fiduciary duty owed by any of the Company’s directors, officers or other employees to it or its stockholders; any action asserting a claim against the Company or any of its directors, officers or employees arising pursuant to any provision of the Delaware General Corporation Law (“DGCL”), the Charter or the Company’s Amended and Restated Bylaws (the “Bylaws”); or any action asserting a claim against the Company or any of its directors, officers or other employees that is governed by the internal affairs doctrine.

S-14