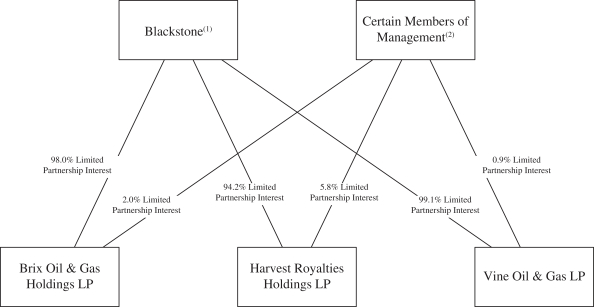

In July 2020, a committee of independent members from Vine’s Board of Managers approved a $30 million

distribution to Vine Oil & Gas Parent LP, a wholly owned subsidiary of Blackstone and certain members of management. The distribution was made immediately following such approval with funds originating from a first lien RBL draw made at the end of June 2020.

In December 2020, we entered into the Second Lien Term Loan and used the proceeds to repay the aggregate principal amount of loans outstanding under the Superpriority in connection with the entry into the amendment to and extension of the RBL. In conjunction with the issuance of the Second Lien Term Loan we paid Blackstone $0.9 million in financing fees.

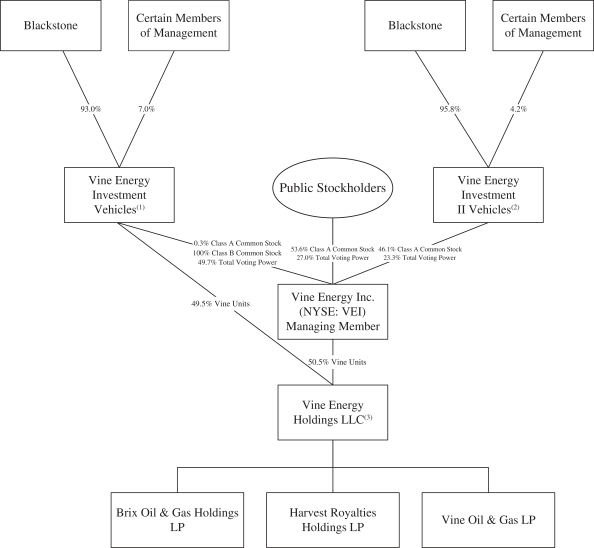

During 2020 and 2019, VMS billed two of our affiliates, Brix Oil & Gas Holdings LP (“Brix”) and Harvest Royalties Holdings LP (“Harvest”), $8.5 million and $9.0 million, respectively, for services rendered and administrative costs incurred. As of December 31, 2020 and 2019, we have a net receivable from these affiliates for such services of $0.9 million and $1.1 million, respectively, which is included in accounts receivable.

Additionally, in 2020 and 2019, Vine issued joint interest bills to Brix totaling $48.2 million and $54.7 million, respectively, for their share of capital expenditures and operating expenses on wells that we have drilled. As of December 31, 2020 and 2019, the total related receivable is $4.4 million and $9.9 million, respectively, which is included in joint interest billing receivables.

In 2020 and 2019, Vine received joint interest bills from one of its affiliates totaling $1.2 million and $0.7 million, respectively, for our share of capital expenditures and operating expenses on a well they operate. As of December 31, 2020 and 2019, the total related payable is $0.3 million and $0.1 million, respectively, which is included in accounts payable.

Vine paid $57.7 million and $67.4 million in 2020 and 2019, respectively, to Brix and Harvest for revenue in wells in which they participate. As of December 31, 2020 and 2019, Vine has $20.4 million and $13.1 million, respectively, included in revenue payable due to these affiliates.

In 2020 and 2019, Vine received $6.1 million and $0.1 million, respectively, in revenue from Brix for revenue in a well in which we participate. As of December 31, 2020, we have a receivable from Brix of $2.9 million which is included in accounts receivable.

During 2020 and 2019, Vine billed Brix $3.5 million and $4.1 million, respectively, in assets used in drilling and operating costs and recognized gains of $0.5 million and $0.3 million, respectively. In 2020 and 2019, Vine purchased $0.4 million and $0.2 million, respectively, in assets from Brix.

| 13. | Supplemental Natural Gas Reserve Information (Unaudited) |

Natural Gas Quantities and Property Summary

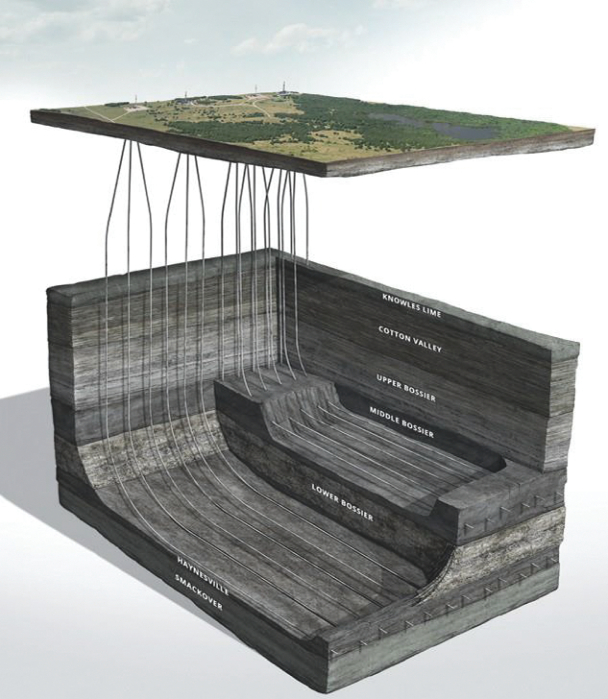

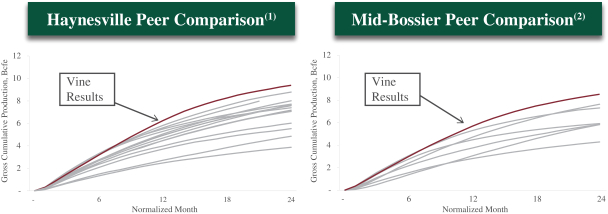

Our reserves were prepared by the independent engineering firm W.D. Von Gonten & Co. All our reserves are located within the stacked Haynesville and Mid-Bossier shale plays in the Haynesville Basin of Northwest Louisiana. Proved natural gas reserves are the estimated quantities of natural gas which geological and engineering data demonstrate, with reasonable certainty, to be recoverable in the future from known reservoirs under existing economic and operating conditions. Proved developed natural gas reserves are proved reserves expected to be recovered through existing wells and equipment in place and under operating methods being utilized at the time the estimates were made. A variety of methodologies are used to determine our proved reserve estimates. The principal methodologies employed, often in combination, are decline curve analysis, advance production type curve matching, petro physics/log analysis and analogy. Reserve estimates are inherently imprecise and estimates of new discoveries and undeveloped locations are more imprecise than estimates of established producing natural gas properties. Accordingly, these estimates are expected to change as future information becomes available.

F-31