UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______to _______

Commission file number: 001-38147

Core Natural Resources, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 82-1954058 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

275 Technology Drive Suite 101

Canonsburg, PA 15317-9565

(724) 416-8300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CONSOL Energy Inc.

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | CNR | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller Reporting Company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate value of common stock held by non-affiliates of the registrant (treating all executive officers and directors of the registrant, for this purpose, as if they may be affiliates of the registrant) was approximately $2,937,936,190 as of June 30, 2024, the last business day of the registrant's most recently completed second fiscal quarter, based on the reported closing price of the common stock as reported on The New York Stock Exchange on such date.

The number of shares outstanding of the registrant's common stock as of January 31, 2025 was 54,016,722 shares.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of Core Natural Resources, Inc.'s Proxy Statement for the 2025 Annual Meeting of Stockholders to be filed within 120 days of the end of the registrant's fiscal year are incorporated by reference in Items 10, 11, 12, 13 and 14 of Part III.

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

|

| | |

| | |

| | |

| ITEM 1C. | Cybersecurity | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| | |

| | |

| | |

| | |

| | |

| | | |

|

| | |

| |

PART I

Explanatory Note

On January 14, 2025, CONSOL Energy Inc., a Delaware corporation, completed its previously announced all-stock merger of equals transaction (the “Merger”) with Arch Resources, Inc., a Delaware corporation (“Arch”), pursuant to that certain Agreement and Plan of Merger, dated as of August 20, 2024 (the “Merger Agreement”), by and among CONSOL Energy Inc., Mountain Range Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of CONSOL Energy Inc. (“Merger Sub”), and Arch. Pursuant to the terms of the Merger Agreement, Merger Sub merged with and into Arch, with Arch continuing as the surviving corporation and as a wholly-owned subsidiary of the Company. Additionally, pursuant to the Merger Agreement, the Company was renamed “Core Natural Resources, Inc.” and began trading under the ticker symbol “CNR” on January 15, 2025.

Since the Merger occurred subsequent to the end of the reporting period, unless otherwise specifically noted, information set forth herein does not include the information of Arch. Accordingly, unless otherwise specifically noted, references herein to “Core Natural Resources,” “Core,” “we,” “our,” “us,” “our Company” and “the Company” refer only to Core and its subsidiaries prior to the Merger and do not include Arch and its subsidiaries.

Important Definitions Referenced in this Annual Report

•“Core Natural Resources,” “Core,” “we,” “our,” “us,” “our Company” and “the Company” refer to Core Natural Resources, Inc. (formerly known as CONSOL Energy Inc.) and its subsidiaries prior to the Merger (unless otherwise specifically noted herein);

•“Arch” refers to Arch Resources, Inc., a Delaware corporation and a wholly-owned subsidiary of the Company following the Merger;

•“Beckley” refers to the Company's low-vol metallurgical coal mine located in Raleigh County, West Virginia;

•“Black Thunder” refers to the Company's surface mining complex located in Campbell County, Wyoming, consisting of four active pit areas and two active loadout facilities;

•“Btu” refers to one British thermal unit;

•“Coal Creek” refers to the Company's surface mining complex located in Campbell County, Wyoming, consisting of one active pit area and a loadout facility;

•“coal reserves” refer to the Company's proven and probable coal reserves as defined by Section 1300 et. seq. of Regulation S-K that could be economically mineable, after taking into account modifying factors, including mining recovery and preparation plant yield;

•“CONSOL Marine Terminal” refers to the Company's terminal operations located in the Port of Baltimore, Maryland;

•“Dominion Terminal” refers to the ground storage-to-vessel coal transloading facility in Newport News, Virginia operated by Dominion Terminal Associates LLP (“DTA”), a limited liability partnership, in which the Company owns a 35% interest;

•“former parent” refers to CNX Resources Corporation and its consolidated subsidiaries;

•“Greenfield Reserves and Resources” refer to those undeveloped reserves and resources owned by the Company in the Northern Appalachian, Central Appalachian and Illinois basins that are not associated with the Pennsylvania Mining Complex or the Itmann Mining Complex;

•“Itmann Mining Complex” refers to the Company's Itmann No. 5 metallurgical coal mine and coal preparation plant located in Wyoming County, West Virginia, and surrounding reserves to be processed and sold through the Itmann Mining Complex coal preparation plant;

•“Leer” refers to Arch's longwall operation located in Taylor County, West Virginia;

•“Leer South” refers to Arch's longwall operation in the Lower Kittanning seam with a preparation plant and a loadout facility located in Barbour County, West Virginia;

•“Merger” refers to the Company's all-stock merger of equals transaction with Arch that closed on January 14, 2025;

•“Merger Agreement” refers to the Agreement and Plan of Merger, dated as of August 20, 2024, by and among CONSOL Energy Inc., Mountain Range Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of CONSOL Energy Inc., and Arch;

•“mmBtu” refers to one million British thermal units;

•“Mountain Laurel” refers to Arch's underground mining complex located in Logan County and Boone County, West Virginia;

•“Pennsylvania Mining Complex” or “PAMC” refers to the Bailey, Enlow Fork and Harvey coal mines, the Central Preparation Plant, and related coal reserves, assets and operations located in southwestern Pennsylvania and northern West Virginia; and

•“West Elk” refers to Arch's mining complex located in Gunnison County, Colorado.

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K are “forward-looking statements” within the meaning of the federal securities laws. With the exception of historical matters, the matters discussed in this Annual Report on Form 10-K are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) that involve risks and uncertainties that could cause actual results and outcomes to differ materially from results expressed in or implied by our forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenues, income and capital spending. When we use the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “would,” or their negatives, or other similar expressions, the statements which include those words are usually forward-looking statements. When we describe strategy that involves risks or uncertainties, we are making forward-looking statements. The forward-looking statements in this Annual Report on Form 10-K speak only as of the date of this Annual Report on Form 10-K; we disclaim any obligation to update these statements unless required by securities law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties relate to, among other matters, the following:

•deterioration in economic conditions (including continued inflation) or changes in consumption patterns of our customers may decrease demand for our products, impair our ability to collect customer receivables and impair our ability to access capital;

•volatility and wide fluctuation in coal prices based upon a number of factors beyond our control;

•an extended decline in the prices we receive for our coal affecting our operating results and cash flows;

•significant downtime of our equipment or inability to obtain equipment, parts or raw materials;

•decreases in the availability of, or increases in the price of, commodities or capital equipment used in our coal mining operations;

•our reliance on major customers, our ability to collect payment from our customers and uncertainty in connection with our customer contracts;

•our inability to acquire additional coal reserves or resources that are economically recoverable;

•alternative steel production technologies that may reduce demand for our coal;

•the availability and reliability of transportation facilities and other systems that deliver our coal to market and fluctuations in transportation costs;

•a loss of our competitive position;

•foreign currency fluctuations that could adversely affect the competitiveness of our coal abroad;

•the risks related to the fact that a significant portion of our production is sold in international markets (and may grow) and our compliance with export control and anti-corruption laws;

•coal users switching to other fuels in order to comply with various environmental standards related to coal combustion emissions;

•the impact of current and future regulations to address climate change, the discharge, disposal and clean-up of hazardous substances and wastes and employee health and safety on our operating costs as well as on the market for coal;

•the risks inherent in coal operations, including being subject to unexpected disruptions caused by adverse geological conditions, equipment failure, delays in moving out longwall equipment, railroad derailments, security breaches or terroristic acts and other hazards, delays in the completion of significant construction or repair of equipment, fires, explosions, seismic activities, accidents and weather conditions;

•failure to obtain or renew surety bonds or insurance coverages on acceptable terms;

•the effects of coordinating our operations with oil and natural gas drillers and distributors operating on our land;

•our inability to obtain financing for capital expenditures on satisfactory terms;

•the effects of our securities being excluded from certain investment funds as a result of environmental, social and corporate governance (“ESG”) practices;

•the effects of global conflicts on commodity prices and supply chains;

•the effect of new or existing laws or regulations or tariffs and other trade measures;

•our inability to find suitable joint venture partners or acquisition targets or integrating the operations of future acquisitions into our operations;

•obtaining, maintaining and renewing governmental permits and approvals for our coal operations;

•the effects of asset retirement obligations, employee-related long-term liabilities and certain other liabilities;

•uncertainties in estimating our economically recoverable coal reserves;

•defects in our chain of title for our undeveloped reserves or failure to acquire additional property to perfect our title to coal rights;

•the outcomes of various legal proceedings, including those which are more fully described herein;

•the risk of our debt agreements, our debt and changes in interest rates affecting our operating results and cash flows;

•information theft, data corruption, operational disruption and/or financial loss resulting from a terrorist attack or cyber incident;

•the potential failure to retain and attract qualified personnel of the Company;

•failure to maintain effective internal controls over financial reporting;

•uncertainty with respect to the Company’s common stock, potential stock price volatility and future dilution;

•uncertainty regarding the timing and value of any dividends we may declare;

•uncertainty as to whether we will repurchase shares of our common stock;

•inability of stockholders to bring legal action against us in any forum other than the state courts of Delaware;

•the risk that the businesses of the Company and Arch will not be integrated successfully after the closing of the Merger;

•the risk that the anticipated benefits of the Merger may not be realized or may take longer to realize than expected; and

•other unforeseen factors.

The above list of factors is not exhaustive or necessarily in order of importance. Additional information concerning factors that could cause actual results to differ materially from those in forward-looking statements include those discussed under “Risk Factors” elsewhere in this report. The Company disclaims any intention or obligation to update publicly any forward-looking statements, whether in response to new information, future events, or otherwise, except as required by applicable law.

ITEM 1. Business

General

We are a world-class producer and exporter of high-quality, low-cost coals, including metallurgical and thermal coals. With a focus on seaborne markets, we play an essential role in meeting the world's growing need for steel, infrastructure and energy, and have ownership interests in two marine export terminals.

We and our predecessors have been mining coal, primarily in the Appalachian Basin, since 1864. The Company was incorporated in Delaware on June 21, 2017 and became an independent, publicly-traded company on November 28, 2017 when our former parent separated its coal business and natural gas business into two independently traded public companies.

On January 14, 2025, Core Natural Resources, Inc. (formerly known as CONSOL Energy Inc.), a Delaware corporation, completed its previously announced all-stock merger of equals transaction with Arch pursuant to the Merger Agreement. Additionally, pursuant to the Merger Agreement, the Company was renamed “Core Natural Resources, Inc.” and began trading under the ticker symbol “CNR” on January 15, 2025.

The address of our principal executive offices is 275 Technology Drive, Suite 101, Canonsburg, Pennsylvania 15317. We maintain a website at http://www.corenaturalresources.com/. The information contained in or connected to the website will not be deemed to be incorporated in this document, and you should not rely on any such information in making an investment decision.

All dollar amounts discussed in this section are in millions of U.S. dollars, except for per share amounts, and unless otherwise indicated.

Our Mission

The Company's mission is to become the world's leading provider of essential coal-based natural resources in support of human progress. We are committed to providing essential coal-based products necessary for infrastructure development, urbanization, transportation and reliable and affordable power generation. In doing so, we enable global prosperity and enhance the quality of life for people around the world. We are dedicated to the responsible utilization of vital natural resources. In doing so, we are committed to safe and sustainable practices that aim to reduce our environmental footprint, enhance our operations and create opportunities for our business and stakeholders. Our values of safety, sustainability, and continuous improvement are the foundation of the Company’s identity and are the basis for how management defines continued success. We believe the Company’s rich resource base, coupled with these values, will allow management to create value for the long-term. We believe that the use of coal in industrial applications, including but not limited to the steel-making process, and as a fuel source for electricity will continue for many years.

Our Strategy

Following the Merger, the Company’s near-term strategy is focused on promptly and effectively integrating historic Arch with CONSOL Energy's business, assets and employees. The integration is expected to deliver future annual cost savings and synergies to the Company and its stockholders.

At the same time, the Company continues to be focused on driving long-term value for its stakeholders and maximizing cash flow generation through the safe, compliant and efficient operation of our business, while maintaining a strong balance sheet and liquidity, returning capital through share buybacks and/or dividends and, when prudent, allocating capital toward compelling growth and diversification opportunities.

The Merger furthers this vision by combining best-in-sector metallurgical and thermal coal operating platforms anchored by high-quality, low-cost, long-lived longwall coal-mining assets. Following the Merger, the Company has broad and diverse assets that produce coal with qualities and blends capable of serving multiple growth markets and geographies. In addition, the Company has strong North American logistics and export capabilities through ownership interests in two East Coast terminals and longstanding relationships with West Coast and Gulf Coast ports. The Company believes that the Merger will provide ongoing cash generation through a strong contracted thermal coal position from the PAMC coupled with meaningful opportunities through Arch’s metallurgical coal platform. Through this, the Company has the potential to return significant capital to stockholders while simultaneously making strategic investments in innovation and growth.

Opportunistically grow our presence in the industrial and metallurgical markets, while preserving coal sales to rail-served power plants in strategic market areas

We plan to minimize our market risk and maximize realizations by continuing to focus on placing a growing portion of our production in the export markets, where we sell to industrial, metallurgical and power generation end-users. This approach provides us pricing upside when markets are strong and with volume stability when markets are weak.

Prior to the Merger, approximately 57% of the Company’s 2024 sales tons were sold to export markets and 43% were sold to domestic customers. Of the 2024 sales tons, 49% were sold in the electric power generation market, 33% were sold in the industrial market and 18% were sold in the metallurgical market. Through the Merger, we spring-boarded our plan to minimize market risk and maximize realizations via the combination of complementary coal types and increased access to the seaborne markets. Following the Merger, the Company has broad and diverse assets that produce coal with qualities and blends capable of serving multiple growth markets and geographies. In addition, the Company has strong North American logistics and export capabilities through ownership interests in two East Coast terminals and longstanding relationships with West Coast and Gulf Coast ports. The Company believes that the Merger will provide ongoing cash generation through a strong contracted thermal coal position from the PAMC coupled with meaningful opportunities through Arch’s metallurgical coal platform.

Drive operational excellence through safety, compliance, and continuous improvement

We continue to focus on our values of safety, sustainability and continuous improvement. Historically, the PAMC has been one of the most productive, lowest-cost underground mines in the coal industry, while simultaneously setting some of the industry’s highest standards for safety and compliance. Over the past five years, our PAMC Mine Safety and Health Administration (“MSHA”) total reportable incident rate was approximately 53% lower than the national average underground bituminous coal mine incident rate. Furthermore, the PAMC MSHA significant and substantial (“S&S”) citation rate per 100 inspection hours was approximately 79% lower than the industry’s average MSHA S&S citation rate over the twelve-month period ended December 31, 2024. Prior to the Merger, Arch was also viewed as a demonstrated leader in mine safety, with an average lost-time incident rate during the past five years that was more than 2.5 times better than the industry average.

We believe that our focus on safety and compliance promotes greater reliability in our operations, which fosters long-term customer relationships and lower operating costs that support higher margins. Consistent with our core value of continuous improvement, productivity at the PAMC has improved from 6.27 tons per employee hour in 2015 to 7.34 tons per employee hour in 2024. We intend to continue to grow the economic competitiveness of our operations by proactively identifying, pursuing and implementing efficiency improvements and new technologies that can drive down unit costs without compromising safety or compliance.

Preserve and Increase Cash Generation

The Company has generated significant cash from operations since becoming a publicly-traded company. We believe that the Merger further positions the Company to continue to generate significant cash from operations across a range of market environments through the combination of revenue from contracted thermal coal production and sales coupled with a strong metallurgical coal platform.

Maintain Liquidity and Ability to Access Capital Markets

We constantly seek to improve our capital market capacity to provide additional funds, if needed, to grow our business. We believe that our Company can access capital markets to raise debt and equity financing from time to time depending on the market conditions.

The Company and Arch historically have successfully accessed the municipal bond markets, and the Company expects to continue to be able to access these markets following the Merger.

In addition, on January 14, 2025, and in connection with the Merger, the Company entered into an amendment to its existing revolving credit facility. The amendment increases the available revolving commitments from $355 million to $600 million and extends the maturity date of the facility to April 30, 2029. The revolving credit facility now includes participation from 22 banks, including nine new lenders, and 37% of the total commitments come from new lenders, while 63% are from existing lenders. Additionally, the Company reduced the annual interest rate by 75 bps while further enhancing financial flexibility.

Also, on January 14, 2025, and in connection with the Merger, a subsidiary of Arch, Arch Receivable Company, LLC, as seller, and another subsidiary of Arch, Arch Coal Sales Company, Inc., as initial servicer, amended Arch’s receivables purchase agreement, which supports the issuance of letters of credit and requests for cash advances. The amendment permits the receivables purchase agreement to remain outstanding following consummation of the Merger, including by amending the change of control provisions thereunder.

Selectively grow our business to maximize stockholder value by capitalizing on synergies with our assets and expertise

We plan to judiciously direct the cash generated by our operations toward those opportunities that present the greatest potential for value creation to our stockholders, particularly those that take advantage of synergies with our asset base and/or the expertise of our management team. To that end, we intend to regularly and rigorously evaluate opportunities both for organic growth and for acquisitions, joint ventures and other business arrangements that complement our operations. For example, we are actively engaged in continuous improvement or research and development projects to improve the productivity of our mining operations through the use of technology, automation, data visualization and analytics.

Our management team has extensive experience in developing, operating and marketing a wide variety of coal assets and, we believe, is well qualified to evaluate organic and external growth opportunities. We plan to carefully weigh any capital investment decisions against alternate uses of the cash to help ensure we are delivering the most value to our stockholders.

We are also pursuing a variety of alternative and innovative uses of coal to diversify our business. These activities are led by CONSOL Innovations LLC, our wholly-owned subsidiary with operations located in Triadelphia, WV, which is focused on creating long-term growth and diversification opportunities through sustainable innovations in the carbon products and materials and carbon management markets. For example, in 2022, we acquired the remaining equity stake in CFOAM Corp. (“CFOAM”), which manufactures high-performance carbon foam products from coal that can be used in the aerospace, military, industrial and commercial product markets. In 2023, we acquired the assets of Touchstone Advanced Composites (“TAC”), an innovative composite tooling supplier for the aerospace industry that uses our CFOAM product. Also in 2023, we expanded our research and development activities that are focused on using coal and coal mining/preparation plant waste streams for battery applications, including the development of battery electrode materials. In 2024, we installed approximately 2,500 linear feet of our coal plastic composite decking product across several applications and entered aerospace parts manufacturing with the sale of our first TAC-manufactured parts. Additionally, two projects supported by our Innovations team were included on Time Magazine's list of the 200 best inventions of 2024.

We also continue to partner with Ohio University, the U.S. Department of Energy and certain other industry partners on several projects to develop coal-derived materials that can potentially be used in applications such as engineered composite building materials and three-dimensional printing. Another initiative, our 21st Century Power Plant project, is also receiving funding from the Department of Energy to evaluate a next-generation power plant that would be fueled by waste coal and biomass and equipped with carbon dioxide (CO2) capture and storage to achieve net neutral or negative CO2 emissions. In addition, our Department of Energy-sponsored REMEDY project seeks to develop an efficient, safe and cost-effective technology for mitigation of mine ventilation air methane that, if successful, could have broader market applicability.

From time to time, we also evaluate investments in industries and sectors that are not related to coal but may provide long-term business opportunities that develop due to the potential energy transition efforts of various local, federal and international governments.

Our Competitive Strengths

We believe we are well-positioned to successfully execute our business strategies because of the following competitive strengths:

Focus on free cash flow generation supported by strong margins and optimized production levels

We intend to continue our focus on maintaining high margins by optimizing production from our high-quality reserves and leveraging our extensive logistics infrastructure and broad market reach. Following the Merger, the Company has broad and diverse assets that produce coal with qualities and blends capable of serving multiple growth markets and geographies. Following the Merger, the Company has strong North American logistics and export capabilities through ownership interests in two East Coast terminals and longstanding relationships with West Coast and Gulf Coast ports. The Company believes that the Merger will provide ongoing cash generation through a strong contracted thermal coal position from the PAMC coupled with meaningful opportunities through Arch’s metallurgical coal platform.

For example, the PAMC’s low-cost structure, high-quality product, favorable access to rail and port infrastructure and diverse base of end-use customers allow it to move large volumes of coal at positive cash margins throughout a variety of market conditions. Additionally, the Leer franchise consistently ranks among the lowest cost U.S. metallurgical mines and produces a product quality that is recognized and sought-after worldwide. The Leer and Leer South operations are complemented by the Beckley and Mountain Laurel continuous miner mines, which in aggregate provide us with a full suite of high-quality metallurgical products for sale into the global metallurgical market. Additionally, the location of Arch’s mines enables us to ship coal to most of the major coal-fueled power plants in the United States. Furthermore, our ability to enter into multi-year contracts with our longstanding customer base, as well as strategic industrial export customers, will enhance our ability to generate high margins in varied commodity price environments.

Extensive, High-Quality Reserve Base

The PAMC has extensive high-quality reserves of bituminous coal. We mine our reserves from the Pittsburgh No. 8 Coal Seam, which is a large contiguous formation of high-Btu coal that is ideal for high-productivity, low-cost longwall operations. As of December 31, 2024, the PAMC included 557.6 million tons of recoverable coal reserves that are sufficient to support approximately 20 years of full-capacity production. The advantageous qualities of our coal enable us to compete for demand from a broader range of the global industrial and power generation markets. In addition to the substantial reserve base associated with the PAMC, our Itmann Mining Complex includes 27.5 million tons of recoverable coal reserves that are sufficient to support more than 30 years of full-capacity production, and our 1.3 billion tons of Greenfield Reserves and Resources in the Northern Appalachian Basin (“NAPP”), the Central Appalachian Basin (“CAPP”) and the Illinois Basin (“ILB”) feature both thermal and metallurgical reserves and resources and provide additional optionality for organic growth or monetization as market conditions allow.

World-Class, Well-Capitalized, Low-Cost Longwall Mining Complexes

Based on production per employee, the PAMC is a productive and efficient coal mining complex in NAPP, averaging 7.37 tons of coal production per employee hour for the past two years. We believe our substantial capital investment in the PAMC will enable us to maintain high production volumes, low operating costs and a strong safety and environmental compliance record, which we believe are key to supporting stable financial performance and cash flows throughout business and commodity price cycles.

Additionally, the Leer and Leer South longwall mines that we acquired through the Merger anchor our large-scale, first quartile metallurgical franchise. The Leer franchise consistently ranks among the lowest cost U.S. metallurgical mines and produces a product quality that is recognized and sought-after worldwide.

Strategically Located Mining Operations with Advanced Distribution Capabilities and Excellent Access to Key Logistics Infrastructure

Our logistics infrastructure and proximity to coal-fired power plants in the eastern United States provides us with operational and marketing flexibility, reduces the cost to deliver coal to our core markets and allows us to realize higher free-on-board (“FOB”) mine prices. We believe that we have a significant transportation cost advantage compared to many of our competitors, particularly producers in the ILB and the Powder River Basin (“PRB”), for deliveries to customers in our core markets and to East Coast ports for international shipping. For example, based on publicly available data and internal estimates, we believe that the transportation cost advantage from our mines compared to ILB mines (not accounting for Btu differences) is approximately $5 to $8 per ton for coal delivered to foreign consumers in Europe and India, and an even more pronounced cost advantage for coal delivered to domestic customers in the mid-Atlantic states. Our ability to accommodate multiple unit trains from both Norfolk Southern Corporation (“Norfolk Southern”) and CSX Transportation Inc. (“CSX”) at the Central Preparation Plant, which includes a dual-batch loadout facility capable of loading up to 9,000 tons of clean coal per hour and 19.3 miles of track with three sidings, allows for the seamless transition of locomotives from empty inbound trains to fully loaded outbound trains at our facility. Furthermore, the PAMC has exceptional access to export infrastructure in the United States. Through our 100%-owned CONSOL Marine Terminal, served by both the Norfolk Southern and CSX railroads, the PAMC and the Itmann Mining Complex have a competitive advantage in the world’s seaborne coal markets. As a result of the Merger, we now have access to a second East Coast terminal, which provides opportunistic flexibility for all of Core's eastern operations, including the Leer, Leer South, Beckley and Mountain Laurel mines, to further enhance our competitive advantage in the world's seaborne coal markets.

Strong, Well-Established Customer Base Supporting Contractual Volumes

We have a well-established and diverse customer base, comprised of export industrial customers, metallurgical end-users and domestic electric-power-producing companies. We have had success entering into multi-year coal sales agreements with our customers due to our longstanding relationships, reliability of production and delivery, competitive pricing and high coal quality. Approximately 92% of our sales in 2024 were to customer companies that were in our 2023 portfolio, and six of our top domestic power plant customers in 2024 (which are included in the ten plants to which we shipped approximately 500,000 tons or more of PAMC coal in 2024) have been in our portfolio for at least five consecutive years. In addition, to mitigate our exposure to coal-fired power plant retirements, we have strategically developed our customer base to include power plants that are economically positioned to continue operating for the foreseeable future and that are equipped with state-of-the-art environmental controls.

We also have a growing international customer base due to favorable access to seaborne coal markets and our strong relationships with leading coal trading, brokering and international coal end-users. We have grown our exports of coal to the seaborne markets from 8.3 million tons (or approximately 32% of our annual sales volume) in 2017 to 15.9 million tons (or approximately 57% of our annual sales volume) in 2024, including sales from both the PAMC and the Itmann Mining Complex.

Similarly, prior to the Merger, Arch marketed its metallurgical and thermal coal to domestic and foreign steel producers, domestic and foreign power generators, and other industrial facilities. For the year ended December 31, 2024, Arch derived approximately 16% of its total coal revenues from sales to its three largest customers. Additionally, in 2024, Arch sold coal to domestic customers located in 25 different states as the location of its mines enabled it to ship coal to most of the major coal-fueled power plants in the United States and exported coal to Europe, Asia, Central and South America, and Africa.

Highly Experienced Management Team and Operating Team

The Company is being led by a proven and highly experienced management team that reflects the strengths and capabilities of both companies. Our management team is overseen by an experienced, diverse and majority-independent board of directors, comprised of eight directors – four former directors of the Company board immediately prior to the Merger and four former directors of the Arch board immediately prior to the Merger. Our management and operating teams have (i) significant expertise owning, developing and managing complex thermal and metallurgical coal mining operations, (ii) valuable relationships with customers, railroads and other participants across the coal industry, (iii) technical wherewithal and demonstrated success in developing new applications and customers for our coal products in industrial, metallurgical and power generation markets, and (iv) a proven track record of successfully financing, building, enhancing and managing coal assets in a reliable and cost-effective manner throughout all parts of the commodity cycle. We intend to leverage these qualities to continue to successfully develop our coal mining assets while efficiently and flexibly managing our operations to maximize operating cash flow and innovating to create long-term growth and diversification opportunities.

Principal Properties

Prior to the Merger, our most significant tangible assets were the PAMC and the CONSOL Marine Terminal. The PAMC and the CONSOL Marine Terminal have consistently generated strong free cash flows. As of December 31, 2024, the PAMC controlled 557.6 million tons of high-quality Pittsburgh seam reserves, enough to allow for an equivalent of approximately 20 years of full-capacity production. As of December 31, 2024, the Itmann Mining Complex included 27.5 million tons of recoverable coal reserves that are sufficient to support an equivalent of more than 30 years of full-capacity production, based on our current estimates. In addition, as of December 31, 2024, we owned or controlled approximately 1.3 billion tons of Greenfield Reserves and Resources, portions of which are located in the NAPP, CAPP and ILB.

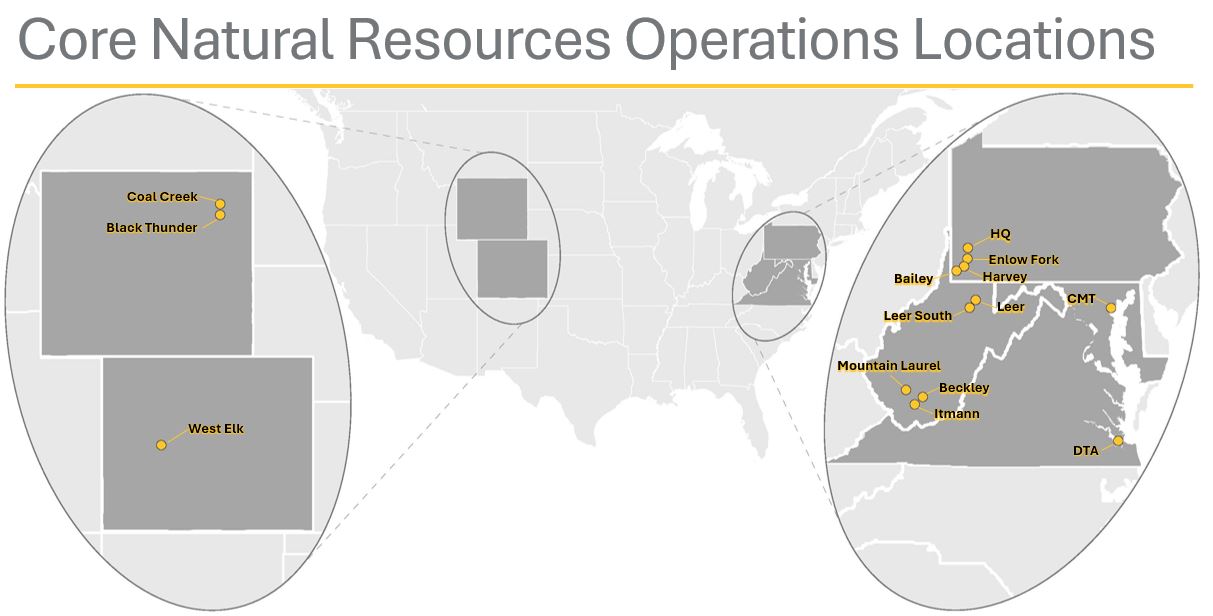

As a result of the Merger, our presence in the metallurgical coal market has expanded with two longwall mines, Leer and Leer South, in West Virginia, and two continuous miner mines, Beckley and Mountain Laurel, in West Virginia. These mines produce a premium metallurgical product used in the global steel industry. Through the Merger, we also gained thermal mines, Black Thunder and Coal Creek, in the PRB, as well as West Elk, in Colorado. The PRB mines produce thermal coal for sale into international and domestic markets. The West Elk mine in Colorado produces a high-quality, high calorific value thermal product that can compete effectively in seaborne markets, where thermal coal demand remains robust. The Merger has also enabled the Company to gain access to a second export terminal, DTA, on the U.S. Eastern seaboard, as well as strategic connectivity to ports on the West Coast and the Gulf of Mexico.

Through the Merger, we have created a global leader exceptionally well-positioned to compete and succeed in two significant, high-potential market segments – the global metallurgical and global high-rank thermal coal markets.

A map showing the location of our material properties is below:

Thermal Mining Properties

Our active thermal mines are described below.

•Pennsylvania Mining Complex: The PAMC includes the Bailey Mine, the Enlow Fork Mine, the Harvey Mine and the Central Preparation Plant. Coal from the PAMC is valued because of its high energy content (as measured in Btu per pound), relatively low levels of sulfur and other impurities, and strong thermoplastic properties that enable it to be used in metallurgical, industrial and power generation applications. We mine our reserves from the Pittsburgh No. 8 Coal Seam, which is a large contiguous formation of high-Btu coal that is ideal for high productivity, low-cost longwall mining operations. The design of the PAMC is optimized to produce large quantities of coal on a cost-efficient basis. We can sustain high production volumes at comparatively low operating costs due to, among other things, our technologically advanced longwall mining systems, logistics infrastructure and safety. All our mines at the PAMC utilize longwall mining, which is a highly automated underground mining technique that produces large volumes of coal at lower costs compared to other underground mining methods. We aggressively market coal from the PAMC to a broad base of diverse and strategically selected industrial and metallurgical end users in the United States and globally. We are able to transport coal from the PAMC to our customers through an extensive logistical network, which is directly served by both the Norfolk Southern and CSX railroads, coupled with the operational synergies afforded by the CONSOL Marine Terminal. We also continue to support power plant customers in the eastern United States and abroad.

•Black Thunder: Black Thunder is a surface mining complex located on approximately 35,300 acres in Campbell County, Wyoming. The Black Thunder complex extracts thermal coal from the Upper Wyodak and Main Wyodak seams. We control a significant portion of the coal reserves through federal and state leases. The Black Thunder mining complex had approximately 378.0 million tons of proven and probable reserves at December 31, 2024. The Black Thunder mining complex currently consists of four active pit areas and two active loadout facilities. We ship all of the coal raw to our customers via the Burlington Northern Santa Fe and Union Pacific railroads. We do not process the coal mined at this complex. Each of the loadout facilities can load a 15,000-ton train in less than two hours.

•Coal Creek: Coal Creek is a surface mining complex located on approximately 7,400 acres in Campbell County, Wyoming. The Coal Creek mining complex extracts thermal coal from the Wyodak-R1 and Wyodak-R3 seams. The Coal Creek complex currently consists of one active pit area and a loadout facility. We ship all of the coal raw to our customers via the Burlington Northern Santa Fe and Union Pacific railroads. We do not process the coal mined at this complex. The loadout facility can load a 15,000-ton train in less than three hours.

•West Elk: The West Elk mining complex is located on approximately 18,400 acres in Gunnison County, Colorado. The West Elk mining complex extracts thermal coal from the E seam. We control a significant portion of the coal reserves through federal and state leases. The West Elk mining complex had approximately 34.5 million tons of

proven and probable reserves at December 31, 2024. The West Elk complex currently consists of a longwall, continuous miner sections, a preparation plant, and a loadout facility. We ship most of the coal raw to our customers via the Union Pacific railroad. When required to improve the quality of some of our coal production, it is processed through the 800 ton-per-hour preparation plant. The loadout facility can load an 11,000-ton train in less than three hours.

Metallurgical Mining Properties

Our active metallurgical mines are described below.

•Leer: The Leer complex is a longwall operation, located in Taylor County, West Virginia, that includes approximately 33.0 million tons of proven and probable coal reserves as of December 31, 2024 that are primarily sold as High-Vol A metallurgical quality coal from the Lower Kittanning seam, and are part of approximately 93,200 acres that is considered our Tygart Valley area. A significant portion of the reserves at Leer are owned rather than leased from third parties. All the production is processed through a 1,400 ton-per-hour preparation plant and loaded on the CSX railroad. A 15,000-ton train can be loaded in less than four hours.

•Leer South: The Leer South mining complex is a longwall operation in the Lower Kittanning seam with a preparation plant and a loadout facility located on approximately 26,500 acres in Barbour County, West Virginia. The 1,600 ton-per-hour preparation plant is located near the mine, and the loadout facility is served by the CSX railroad and connected to the plant by a 4,000 ton-per-hour conveyor system. The loadout facility is capable of loading a 15,000-ton unit train in less than four hours. Coal quality is primarily High-Vol A metallurgical coal similar to our Leer Complex. The Leer South mining complex had approximately 60.6 million tons of proven and probable reserves at December 31, 2024. A significant portion of the reserves at Leer South are owned rather than leased from third parties.

•Beckley: The Beckley mining complex is located on approximately 14,700 acres in Raleigh County, West Virginia. Beckley is extracting high quality, Low-Vol metallurgical coal in the Pocahontas No. 3 seam. The Beckley mining complex had approximately 24.7 million tons of proven and probable reserves at December 31, 2024. Coal is conveyed from the mine to a 600 ton-per-hour preparation plant before shipping the coal via the CSX railroad. The loadout facility can load a 10,000-ton train in less than four hours.

•Mountain Laurel: The Mountain Laurel mining complex is located on approximately 38,200 acres in Logan County and Boone County, West Virginia. Underground mining operations at the Mountain Laurel mining complex extract High-Vol B metallurgical coal from the Alma and No. 2 Gas seams. We process all of the coal through a 1,400 ton-per-hour preparation plant before shipping the coal to our customers via the CSX railroad. The loadout facility can load a 15,000-ton train in less than four hours.

•Itmann Mining Complex: The Itmann No. 5 Mine is located in Wyoming County, West Virginia. The Company controls approximately 20,224 contiguous acres of mining rights, by ownership or lease, to the Pocahontas 3 seam and the Pocahontas 4 seam. The Itmann Mining Complex had approximately 27.5 million tons of proven and probable coal reserves at December 31, 2024. The preparation plant includes a rail loadout located on the Guyandotte Class I rail line, which can be served by both Norfolk Southern and CSX, and has the capability for processing up to an additional 750 thousand to 1 million saleable tons annually from third-parties and mining of our surrounding reserves. This additional processing revenue provides an avenue of growth for the Company.

Terminals

Our ownership interests in two East Coast terminals are described below:

•CONSOL Marine Terminal: Through our wholly-owned subsidiary, CONSOL Marine Terminals LLC, we provide coal export terminal services through the Port of Baltimore. The terminal can either store coal or load coal directly into vessels from rail cars. It is also the only major east coast United States coal terminal served by two Class I railroads, Norfolk Southern and CSX. In 2024, approximately 17.0 million tons of coal were shipped through the CONSOL Marine Terminal. Approximately 84% of the tonnage shipped was produced by the Pennsylvania Mining Complex. The CONSOL Marine Terminal has storage capacity of 1.1 million tons with more than thirty acres of capacity for stockpiles. The facility possesses blending capabilities, and it has transloaded approximately 14.7 million tons of coal per year on average over the past five years, with a throughput capacity of approximately 20 million tons. The facility primarily serves international customers.

•Dominion Terminal: We own a 35% interest in DTA, a limited liability partnership that operates a ground storage-to-vessel coal transloading facility in Newport News, Virginia. The facility has a rated throughput capacity of 20 million tons of coal per year and ground storage capacity of approximately 1.7 million tons. The facility primarily serves international customers, as well as domestic coal users located along the Atlantic coast of the United States. From time to time, we may lease a portion of our port capacity to third parties.

Non-Core Coal Assets and Surface Properties

We own significant coal assets and surface properties that are not in our short or medium-term development plans. We continually explore the monetization of these non-core assets by means of sale, lease, contribution to joint ventures, or a combination of the foregoing in order to bring the value of these assets forward for the benefit of our stockholders.

Mining Properties as of December 31, 2024

Information concerning our mining properties in this Annual Report on Form 10-K has been prepared in accordance with the requirements of subpart 1300 of Regulation S-K. Subpart 1300 of Regulation S-K requires us to disclose our mineral resources and our mineral reserves as of the end of our most recently completed fiscal year both in the aggregate and for each of our individually material mining properties.

As used in this Annual Report on Form 10-K, the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource,” “inferred mineral resource,” “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are defined and used in accordance with subpart 1300 of Regulation S-K. Under subpart 1300 of Regulation S-K, mineral resources may not be classified as “mineral reserves” unless the determination has been made by a qualified person that the mineral resources can be the basis of an economically viable project. As such, you are cautioned that, except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Likewise, you are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted to mineral reserves. We have used the term “coal” as in “coal reserves” and “coal resources” interchangeably with “mineral”.

The Company's estimates of recoverable coal reserves and coal resources are estimated internally by professionals whom we believe to be competent, including engineers and geologists. These estimates are based on geologic data, coal ownership information and current and/or proposed operating plans. The Company’s recoverable coal reserves are proven and probable reserves that could be economically and legally extracted or produced at the time of the reserve determination, considering all material modifying factors. These estimates are periodically updated to reflect past coal production, updated mine plans, new exploration information, and other geologic or mining data. Acquisitions or dispositions of coal properties will also change these estimates. Changes in mining methods or preparation plant processes may increase or decrease the recovery basis for the estimates. The ability to update or modify the estimates of the Company's recoverable coal reserves is restricted to geologists and mining engineers whom we believe to be competent and material modifications recommended by such geologists or engineers are documented by the Company. The Company's estimates of recoverable coal reserves and coal resources, and supporting information, have been assessed by the John T. Boyd Company, a qualified person firm, which conforms to our requirements under subpart 1300 of Regulation S-K for qualified persons.

The information that follows relating to our individually material property – PAMC – is derived, for the most part, from, and in some instances is an extract from, the technical report summary (“TRS”) relating to the property prepared in compliance with Item 601(b)(96) and subpart 1300 of Regulation S-K by the John T. Boyd Company. Portions of the following information are based on assumptions, qualifications and procedures that are not fully described herein. Reference should be made to the full text of the TRS, incorporated herein and made a part of our 2024 Annual Report on Form 10-K.

The Company assigns coal reserves to mining complexes, and the amount of coal we assign to each mine is generally sufficient to support mining through the extent of our current mining permits. These permits were issued on various dates and each are required to be renewed under federal law every five years. All assigned reserves have their required permits or governmental approvals, or there is a high probability that these approvals will be secured. In addition, our mines and mining complexes may have access to additional reserves that have not yet been assigned.

Some reserves may be accessible by more than one mine because of the proximity of many of our mines to one another. In the following tables, the reserves and resources indicated for a mine are based on our review of current mining plans and reflect our best judgment as to which mine is most likely to utilize the reserve. Recoverable coal reserves and coal resources are either owned or leased. The leases generally provide for renewal through the anticipated life of the associated mine. These renewals are exercisable by the payment of minimum royalties. Under current mining plans, reserves and resources reported will be mined out within the period of existing leases or within the time period of probable lease renewal periods.

The following tables provide a summary of all the Company's coal reserves and resources as of the end of the fiscal year ended December 31, 2024:

SUMMARY MATERIAL COAL RESERVES AT END OF THE

FISCAL YEAR ENDED DECEMBER 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Coal Reserves (tons in millions) |

| | Proven | | Probable | | Total | | Realized Coal Price | | Recovery Factor |

| PAMC: | | | | | | | | | |

| Bailey | 53.6 | | 72.3 | | 125.9 | | $ | 61.29 | | | 58 | % |

| Enlow Fork | 206.8 | | 32.4 | | 239.2 | | $ | 61.29 | | | 54 | % |

| Harvey | 101.1 | | 91.4 | | 192.5 | | $ | 61.29 | | | 56 | % |

| Total PAMC | 361.5 | | 196.1 | | 557.6 | | $ | 61.29 | | | 56 | % |

SUMMARY NON-MATERIAL COAL RESERVES AT END OF THE

FISCAL YEAR ENDED DECEMBER 31, 2024

| | | | | | | | | | | | | | | | | |

| | Coal Reserves (tons in millions) |

| | Proven | | Probable | | Total |

| Itmann Mining Complex | 15.2 | | 12.3 | | 27.5 |

| Other NAPP | 3.6 | | 19.7 | | 23.3 |

| Other CAPP | 56.6 | | 20.0 | | 76.6 |

| Total | 75.4 | | 52.0 | | 127.4 |

SUMMARY COAL RESOURCES AT END OF THE

FISCAL YEAR ENDED DECEMBER 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Coal Resources (ton in millions) |

| Non-Material | Measured | | Indicated | | Measured + Indicated | | Inferred | | Total |

| Mason Dixon Mine | 106.6 | | 158.4 | | 265.0 | | 8.9 | | 273.9 |

| River Mine | 46.2 | | 498.3 | | 544.5 | | 66.1 | | 610.6 |

| Other CAPP | 44.3 | | 66.3 | | 110.6 | | 1.9 | | 112.5 |

| Other ILB | 106.6 | | 137.7 | | 244.3 | | 0.6 | | 244.9 |

| Total | 303.7 | | 860.7 | | 1,164.4 | | 77.5 | | 1,241.9 |

Note: All resource tons in the table above are reported as clean recoverable tons.

The following table classifies the Company's coal by type (thermal versus metallurgical). The table also classifies metallurgical coal as high, medium and low volatile, which is based on volatile matter content.

Recoverable Coal Reserves and Coal Resources

by Product (in Millions of Tons) as of December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-Material Metallurgical | | <1.0% Sulfur | | >1.0% <1.5% Sulfur | | >1.5% Sulfur | | Total | | Percent By Product |

| By Rank: | | | | | | | | | | |

| High Vol Bituminous | | 68.0 | | 61.1 | | 23.3 | | 152.4 | | 7.9 | % |

| Med Vol Bituminous | | 14.4 | | 5.6 | | — | | 20.0 | | 1.1 | % |

| Low Vol Bituminous | | 44.4 | | 23.1 | | — | | 67.5 | | 3.5 | % |

| Total Metallurgical | | 126.8 | | 89.8 | | 23.3 | | 239.9 | | 12.5 | % |

| Material Thermal | | < 1.20 lbs. S02/MMBtu | | > 1.20 < 2.50 lbs. S02/MMBtu | | > 2.50 lbs. S02/MMBtu | | Total | | Percent By Product |

| By Region: | | | | | | | | | | |

| NAPP | | — | | — | | 557.6 | | 557.6 | | 28.9 | % |

| | | | | | | | | | |

| Non-Material Thermal | | | | | | | | | | |

| NAPP | | — | | — | | 884.5 | | 884.5 | | 45.9 | % |

| ILB | | — | | 44.2 | | 200.7 | | 244.9 | | 12.7 | % |

| Total Thermal | | — | | 44.2 | | 1,642.8 | | 1,687.0 | | 87.5 | % |

| Total | | 126.8 | | 134.0 | | 1,666.1 | | 1,926.9 | | 100.0 | % |

| Percent of Total | | 6.6 | % | | 6.9 | % | | 86.5 | % | | 100.0 | % | | |

Internal Controls Disclosure

The modeling and analysis of the Company's reserves and resources has been developed by Company engineering and geology personnel and reviewed by several levels of internal management. This section summarizes the internal control considerations for the Company’s development of estimations, including assumptions, used in reserve and resource analysis and modeling.

Records from exploration drilling completed on the mining properties comprise the primary data used in the evaluation of the coal resources for each property. The Company maintains written field and exploration guidelines that cover standard procedures, including site safety, mapping, and how to select proper drilling equipment, record accurate and detailed geological logs, perform coal sampling, supervise geophysical logging, and plug drill holes once work was complete.

The Company maintains all control of coal core samples, up to the point that samples are handed over to the lab performing testing. Once logging and sampling is complete, the sampled coal core intervals are transported to the Company’s headquarters by exploration personnel, at which time they are handed over to quality personnel. The quality personnel arrange pick up by the selected independent lab that will perform the required analyses. All analytical work is conducted to International Organization for Standardization or ASTM International standards.

Management also assesses risks inherent in coal reserve and resource estimates, such as the accuracy of geophysical data that are used to support mine planning, identify hazards and inform operations of the presence of mineable deposits. Also, management is aware of risks associated with potential gaps in assessing the completeness of mineral extraction licenses, entitlements or rights, or changes in laws or regulations that could directly impact the ability to assess coal reserves and resources or could impact production levels. The over- or underestimation of reserves can have certain impacts on financial performance, such as changes in amortizations that are based on life-of-mine estimates.

Pennsylvania Mining Complex - Material Reserves

Pennsylvania Mining Complex. The Pennsylvania Mining Complex is located approximately 26 miles southwest of Pittsburgh, near the city of Washington and the borough of Waynesburg, all in Pennsylvania, and consists of three deep longwall mining operations - the Bailey Mine, the Enlow Fork Mine and the Harvey Mine - as well as a centralized preparation plant located at approximately 39°58’23.7” N latitude and 80°24’43.6” W longitude. The Company controls approximately 179,028 acres of mineral and/or surface rights as a complex collection of owned and/or leased tracts that range from less than an acre to several hundred acres in size covered by various coal deeds and coal lease agreements. Lease terms generally extend until all the coal is removed from the subject tract. Where applicable, royalty rates typically range from 3% to 8% of the gross sales price of the coal. The Company maintains the right to mine and remove almost all of the Pittsburgh Seam within the PAMC boundaries. As part of the PAMC, the Company controls surface rights to approximately 24,092 acres through fee simple ownership. This includes ownership of the property upon which the surface facilities for mine access, processing, storing, and shipping are located, as well as 3,509 permitted acres for coarse and fine refuse disposal facilities. Despite a lengthy ownership history dating back to the 1920s with the acquisition of certain coal leases by the Company’s predecessor, commercial operations at the PAMC did not begin until 1984. The total book value of the PAMC and its associated plant and equipment as of December 31, 2024 is approximately $1.4 billion.

The design of the PAMC is optimized to produce large quantities of coal on a cost-efficient basis. The PAMC is able to sustain high production volumes at comparatively low operating costs due to, among other things, its technologically advanced longwall mining systems, logistics infrastructure and safety. All of the PAMC's mines utilize longwall mining, which is a highly automated underground mining technique that produces large volumes of coal at lower costs compared to other underground mining methods. The PAMC typically operates 4-5 longwalls with 15-17 continuous mining sections. The full annual production capacity of the PAMC is up to 28.5 million tons of coal. The central preparation plant is connected via conveyor belts to each of the PAMC's mines and cleans and processes up to 8,200 raw tons of coal per hour. The PAMC's on-site logistics infrastructure at the central preparation plant includes a dual-batch train loadout facility capable of loading up to 9,000 clean tons of coal per hour and 19.3 miles of track linked to separate Class I rail lines owned by Norfolk Southern and CSX, which significantly increases the PAMC's efficiency in meeting its customers' transportation needs. Sources of electrical power, water, supplies and materials are readily available. Electrical power is provided to the mines and facilities by regional utility companies. Water is supplied by public water services, surface impoundments or water wells.

Numerous permits are required by federal and state law for underground mining, coal preparation and related facilities, and other incidental activities. Permits generally require that the Company post a performance bond in an amount established by the regulatory program to: (1) provide assurance that any disturbance or liability created during mining operation is properly mitigated, and (2) assure that all regulation requirements of the permit are fully satisfied. As of December 31, 2024, the Company held more than $380 million in surety bonds to cover its obligations relating to mining and reclamation, mine subsidence, road repairs, stream restoration, water loss and dam safety with respect to the PAMC.

Bailey Mine. As of December 31, 2024, the Bailey Mine’s assigned and accessible reserve base contained an aggregate of 125.9 million tons of clean recoverable coal with an average as-received gross heat content of approximately 12,938 Btu per pound and an approximate average pounds of sulfur dioxide per mmBtu of 3.76. The Bailey Mine is the first mine developed at the Pennsylvania Mining Complex. Construction of the slope and initial air shaft began in 1982. The slope development reached the coal seam at a depth of approximately 600 feet and, following development of the slope bottom, commercial coal production began in 1984. Longwall mining production commenced in 1985, and the second longwall was placed into operation in 1987. In 2010, a new slope and overland belt system was commissioned, which allowed a large percentage of the Bailey Mine to be sealed off. For the years ended December 31, 2024, 2023 and 2022, the Bailey Mine produced 10.8, 11.2 and 11.6 million tons of coal, respectively.

Enlow Fork Mine. As of December 31, 2024, the Enlow Fork Mine’s assigned and accessible reserve base contained an aggregate of 239.2 million tons of clean recoverable coal with an average as-received gross heat content of approximately 13,011 Btu per pound and an approximate average pounds of sulfur dioxide per mmBtu of 3.06. The Enlow Fork Mine is located directly north of the Bailey Mine. Initial underground development was started from the Bailey Mine while the Enlow Fork slope was being constructed. Once the slope bottom was developed and the slope belt became operational, seals were constructed to separate the two mines. Following development of the slope bottom, commercial coal production began in 1989. Longwall mining production commenced in 1991, and the second longwall came online in 1992. In 2014, a new slope and overland belt system was commissioned and a substantial portion of the Enlow Fork Mine was sealed. For the years ended December 31, 2024, 2023 and 2022, the Enlow Fork Mine produced 9.2, 8.7 and 6.3 million tons of coal, respectively.

Harvey Mine. As of December 31, 2024, the Harvey Mine’s assigned and accessible reserve base contained an aggregate of 192.5 million tons of clean recoverable coal with an average as-received gross heat content of approximately 12,940 Btu per pound and an approximate average pounds of sulfur dioxide per mmBtu of 4.08. The Harvey Mine is located directly east of the Bailey and Enlow Fork Mines. Similar to the Enlow Fork Mine, the Harvey Mine was developed off of the Bailey Mine’s slope bottom. In order to separate the Harvey Mine from the existing Bailey Mine, seals were built around the original Bailey slope bottom, and the original slope was dedicated solely to the Harvey Mine. This transfer of infrastructure eliminated the need to make significant capital expenditures to develop, among other things, a new slope, airshaft and portal facility at the Harvey Mine. Development of the Harvey Mine began in 2009, and construction of the supporting surface facilities commenced in 2011. Longwall mining production commenced in March 2014. For the years ended December 31, 2024, 2023 and 2022, the Harvey Mine produced 5.7, 6.2 and 6.1 million tons of coal, respectively.

The following table sets forth additional information regarding the recoverable coal reserves at the Pennsylvania Mining Complex.

PENNSYLVANIA MINING COMPLEX - MATERIAL RESERVES

Recoverable Coal Reserves as of December 31, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Reserve Class | | As Received Heat Value (Btu/lb) | | Owned | | Leased | | Recoverable Coal Reserves (As-Received) |

| Mine/Reserve | | Range | | (%) | | (%) | | Proven | | Probable | | 12/31/2024 | | 12/31/2023 |

| | | | | | | | | | | | | | | | |

| PA Mining Operations | | | | | | | | | | | | | | |

| Bailey | Permitted | | 12,680 – 13,180 | | 69 | % | | 31 | % | | 44.0 | | 48.1 | | 92.1 | | 69.7 |

| | Unpermitted | | 12,930 – 13,120 | | 100 | % | | — | % | | 9.6 | | 24.2 | | 33.8 | | 67.7 |

| Enlow Fork | Permitted | | 12,680 – 13,670 | | 100 | % | | — | % | | 76.9 | | 8.7 | | 85.6 | | 69.9 |

| | Unpermitted | | 12,670 – 13,240 | | 97 | % | | 3 | % | | 129.9 | | 23.7 | | 153.6 | | 178.1 |

| Harvey | Permitted | | 12,810 – 13,180 | | 98 | % | | 2 | % | | 60.3 | | 39.4 | | 99.7 | | 18.9 |

| | Unpermitted | | 12,710 – 13,120 | | 100 | % | | — | % | | 40.8 | | 52.0 | | 92.8 | | 179.2 |

| Total Recoverable Coal Reserves | | | | | | | | 361.5 | | 196.1 | | 557.6 | | 583.5 |

Itmann Mining Complex - Non-Material Reserves

Itmann No. 5 Mine. The Itmann No. 5 Mine is located in Wyoming County, West Virginia, approximately 2.5 miles northwest of the town of Itmann at approximately 37°35’23.65” N latitude and 81°27’14.43” W longitude. The Company controls approximately 20,224 contiguous acres of mining rights (comprising 270 tracts), by ownership or lease, to the Pocahontas 3 seam (P3) and the Pocahontas 4 seam (P4). The majority (95%) of the acreage is held under coal leases with lengthy terms that are subject to industry standard royalties.

In 2019, the Company commenced development of the new Itmann No. 5 Mine, including excavation of the box cut to access the P3 seam. The mine accesses the P3 and P4 seams using a box cut drift entrance near an outcrop along Still Run Hollow. As of December 31, 2024, the Itmann No. 5 Mine's assigned and accessible reserve base contained an aggregate of 27.5 million tons of clean recoverable coal, enough to allow for more than 30 years of full-capacity production. These reserves contain an approximate average quality on a dry basis of 0.98% sulfur, 7.2% ash, and 19.3% volatile matter. Coal from the Itmann No. 5 Mine is currently extracted by underground methods using 6 continuous miner units in 3 super sections to achieve expected future capacity of approximately 900 thousand clean tons per year. For the years ended December 31, 2024, 2023 and 2022, the Itmann No. 5 Mine produced 393 thousand, 316 thousand and 164 thousand tons of coal, respectively.

General access to the Itmann No. 5 Mine is via a well-developed network of primary and secondary roads serviced by state and local governments. These roads offer direct access to the mine and processing facilities and are typically open year-round. Primary vehicular access to the property is via State Route 10/16, which follows the north bank of the Guyandotte River. The Guyandotte Class I rail line runs along the south bank of the Guyandotte River. Sources of electrical power, water, supplies and materials are readily available. Electrical power is provided to the mines and facilities by a regional utility company. Water is recycled from the abandoned underground Itmann No. 1 and No. 2 Mines or supplied by water wells.

The Itmann Preparation Plant was constructed in 2022 and began processing coal in late September 2022. Coal is shipped from the Itmann No. 5 Mine via tandem trucks to the 600 raw TPH processing facility, which is located approximately 2.5 miles west of the mine along WV State Route 10/16. The plant includes clean coal material handling systems capable of handling up to 3,500 TPH of product along with a 3,500 TPH unit train loadout located on the Guyandotte Class I rail line, which can be served by both Norfolk Southern and CSX. Third-party coal is also trucked into the facility for processing, blending and shipment via rail or truck.

As of December 31, 2024, the Company held less than $1 million in surety bonds to cover its current obligations relating to mining and reclamation, mine subsidence, stream restoration and water loss with respect to the Itmann No. 5 Mine, preparation plant facility and refuse area.

The following table sets forth additional information regarding the recoverable coal reserves at the Itmann Mining Complex.

ITMANN MINING COMPLEX - NON-MATERIAL RESERVES

Recoverable Coal Reserves as of December 31, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Moisture Free

Quality

(%) | | Recoverable

Coal Reserves (As-Received) |

| | | | | | Owned (%) | | Leased%) | | Tons in

Millions |

| Mine/Reserve | | Reserve

Class | | Sulfur | | Ash | | Vol | | | | Proven | | Probable | | 2024 Total | | 2023 Total |

| | | | | | | | | | | | | | | | | | | | | |

| Itmann Mining Complex | | | | | | | | | | | | | | | | | | | | |

| Itmann No. 5 | | Permitted | | 0.97 | | 8.4 | | 18.5 | | — | % | | 100 | % | | 3.0 | | 0.9 | | 3.9 | | 4.3 |

| Itmann No. 5 | | Unpermitted | | 0.98 | | 7.0 | | 19.4 | | 9 | % | | 91 | % | | 12.2 | | 11.4 | | 23.6 | | 23.7 |

| Tug Fork | | N/A | | — | | — | | — | | — | % | | — | % | | — | | — | | — | | 0.4 |

| Total Recoverable Coal Reserves | | | | | | | | | | | | 15.2 | | 12.3 | | 27.5 | | 28.4 |

Other Properties - Non-Material Reserves and Resources as of December 31, 2024

The Company also holds other greenfield recoverable coal reserves and coal resources located in NAPP, CAPP and ILB, which are not deemed individually material and had an estimated 1,341.8 million tons of recoverable coal reserves and coal resources. The Company’s estimate includes recoverable high-vol, mid-vol or low-vol metallurgical coal reserves and resources of 99.9 million tons and 112.5 million tons, respectively. Additionally, worldwide demand for metallurgical coal allows some of our recoverable coal reserves and resources, currently classified as thermal coal but that possess certain qualities, to be sold as metallurgical coal. The extent to which we can sell thermal coal as crossover metallurgical coal depends upon a number of factors, including the quality characteristics of the reserve, the specific quality requirements and constraints of the end-use customer and market conditions (which affect whether customers are compelled to substitute lower-quality crossover coal for higher-quality metallurgical coal in their blends to realize economic benefits).

The following tables set forth our non-operating recoverable coal reserves and coal resources by region.

Non-Material, Non-Operating Recoverable Coal Reserves and Coal Resources

as of December 31, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As Received Heat Value (Btu/lb) | | Owned (%) | | Leased (%) | | Recoverable Coal Reserves (As-Received) |

| Property | | Range | | | | Proven | | Probable | | 12/31/2024 | | 12/31/2023 |

| NAPP | | 11,400 – 13,400 | | 100 | % | | — | % | | 3.6 | | 19.7 | | 23.3 | | 23.3 |

| CAPP | | 12,400 – 14,100 | | 87 | % | | 13 | % | | 56.6 | | 20.0 | | 76.6 | | 76.6 |

| Total Non-Operating Reserves | | | | | | | | 60.2 | | 39.7 | | 99.9 | | 99.9 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As Received Heat Value (Btu/lb) | | Owned (%) | | Leased (%) | | Recoverable Coal Resources (As-Received) |

| Property | | Range | | | | Measured | | Indicated | | Inferred | | 12/31/2024 | | 12/31/2023 |

| Mason Dixon Mine | | 12,250 – 13,060 | | 96 | % | | 4 | % | | 106.6 | | 158.4 | | 8.9 | | 273.9 | | 273.9 |

| River Mine | | 12,790 – 13,100 | | 100 | % | | — | % | | 46.2 | | 498.3 | | 66.1 | | 610.6 | | 610.6 |

| CAPP | | 12,400 – 14,100 | | 67 | % | | 33 | % | | 44.3 | | 66.3 | | 1.9 | | 112.5 | | 112.5 |

| ILB | | 11,600 – 12,000 | | 75 | % | | 25 | % | | 106.6 | | 137.7 | | 0.6 | | 244.9 | | 244.9 |

| Total Non-Operating Resources | | | | | | | | 303.7 | | 860.7 | | 77.5 | | 1,241.9 | | 1,241.9 |

Title to coal properties that we lease or purchase and the boundaries of these properties are verified by law firms retained by us at the time we lease or acquire the properties. Consistent with industry practice, abstracts and title reports are reviewed and updated approximately five years prior to planned development or mining of the property. If defects in title or boundaries of undeveloped reserves are discovered in the future, control of and the right to mine reserves could be adversely affected.

The following table sets forth the total royalty tonnage and the amount of income (net of related expenses) we received from royalty payments for the years ended December 31, 2024, 2023 and 2022.

| | | | | | | | | | | |

| | Total

Royalty Tonnage | | Total

Royalty Income * |

| Year | (in thousands) | | (in thousands) |

| 2024 | 1,985 | | $ | 17,633 | |

| 2023 | 1,179 | | $ | 8,326 | |

| 2022 | 1,030 | | $ | 9,877 | |

* Excludes advanced mining royalty payments received of $746, $529 and $381 during the years ended December 31, 2024, 2023 and 2022, respectively.