Financial asset impairment

At the end of each fiscal year, we assess if there is objective evidence of impairment of a financial asset or group of financial assets measured at amortized cost. Impairment is recorded only if there is objective evidence of the impairment as a consequence of one or more events occurred after the initial recognition of the asset and said impairment may be reliably measured.

The evidence of impairment includes indications that the debtors or a group of debtors are suffering serious financial difficulties, breaches or arrears in interest or principal payments, the likelihood that they will be declared bankrupt or in reorganization proceedings, and when such observable data indicate that there is a decrease in the estimated future cash flows.

The amount of the impairment is measured as the difference between the book value of the asset and the present value of estimated future cash flows (to the exclusion of future loan losses not incurred) discounted at the original effective interest rate of the financial asset. The book value of the asset is written down and the amount of the loss is recognized in the consolidated statement of profit or loss and other comprehensive income. As a practical measure, we may measure impairment on the basis of the fair value of an instrument, using an observable market price. If, in a subsequent period, the impairment amount decreases and such reduction is related to an event taking place after the original impairment, the reversal of the impairment loss is recognized in the consolidated statement of profit or loss and other comprehensive income.

Offsetting of financial instrument

Financial assets and financial liabilities are offset if there is a currently enforceable legal right to offset the recognized amounts and when there is an intent to settle on a net basis, to realize the asset and settle the liability simultaneously.

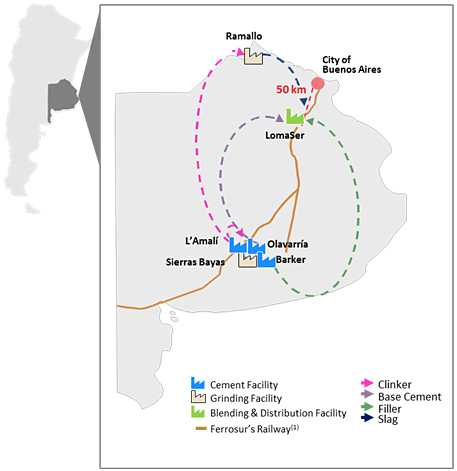

Ferrocarril Roca Management Trust

The 100% ownership interest in the Ferrocarril Roca Management Trust is recorded at cost, which is the amount of the contributions made, net of trust expenses plus net financing profit or loss accrued until the end of the fiscal year. The amounts that may not be recovered or applied against future recoverable capital expenditure have been reduced to their recoverable value by recording an impairment allowance at the end of this fiscal year. See “Note 3.15 of our consolidated financial statements”.

The entity is not controlled by Ferrosur Roca S.A. See “Note 38 of our consolidated financial statements”.

Financial liabilities and equity instruments

Classification as debt or equity

Debt and equity instruments are classified as financial liabilities or as equity in accordance with the substance of the contractual agreement and the definitions of financial liabilities and equity instruments.

Equity instruments

An equity instrument consists in a contract evidencing a residual ownership interest over an entity’s net assets. Equity instruments issued by us at the amount of proceeds receivable, net of direct issuance costs.

The repurchase of our own equity instruments is recognized and deducted directly in equity. No gain or loss is recognized in profit or loss stemming from purchases, sales, issuance or cancellation of our own equity instruments. See “Note 3.16 of our consolidated financial statements”.

Note 3.16 if our consolidated financial statements disclose the valuation and classification criterion for all individual equity accounts, including non-controlling interest.

Financial Liabilities:

Financial liabilities are classified as at fair value through profit or loss or other financial liabilities.

Financial liabilities at fair value through profit or loss:

A financial liability at fair value through profit or loss is a financial liability classified either as held for trading or at fair value through profit or loss. Financial liabilities are classified as held for trading if:

a) It is acquired or incurred principally for the purpose of selling or repurchasing it in the near term; or

b) It is part of a portfolio of identified financial instruments that are managed together and, at a later date, there arises evidence for the first time of a recent actual pattern of short-term profit taking; or

c) It is a derivative, except for a derivative that is a designated and effective hedging instrument.

Financial liabilities at fair value through profit or loss are recorded at fair value, with any gains or losses arising from the remeasurement being recognized in profit or loss. The net gain or loss recognized in profit or loss includes any interest paid on the financial liability and is included in other financial results. Fair value is determined as described in Note 33 of our consolidated financial statements.

Financial liabilities (other than financial liabilities held for trading) or contingent consideration to be paid by an acquirer as a part of a business combination may be designated as a liability at fair value through profit and loss upon initial recognition if:

| | • | | Such designation eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise; or |

| | • | | Financial liabilities are part of a group of financial assets or liabilities or both, which is managed and whose performance is assessed on the basis of fair value, in accordance with the Group’s documented risk management or investment strategy, and information about the Group is provided internally on that basis; or |

| | • | | They are part of a contract containing one or more embedded derivatives, and IFRS 9 allows the entire combined contract to be carried at fair value through profit and loss. |

We has no financial liabilities measured at fair value to be presented in the statement of financial position.

Other financial liabilities:

Other financial liabilities, including borrowings and trade and other payables, are initially recognized at fair value, net of transaction costs.

Subsequent to initial recognition, other financial liabilities are then measured at amortized cost using the effective interest rate method, with interest expenses recognized based on actual return.

Financial liabilities are classified as current liabilities unless the Group has an unconditional right to defer settlement for more than twelve months after the date of the financial statements.

Financial liabilities in foreign currency:

The fair value of financial liabilities in foreign currency is determined in that foreign currency and translated at the exchange rate at the end of each fiscal year. The foreign currency component is part of its profit or loss at fair value. For financial liabilities classified as at fair value through profit or loss, the foreign currency component is recognized in profit or loss.

For debt instruments denominated in foreign currency classified at amortized cost, gains and losses in foreign currency are determined on the basis of the amortized cost of the liability and recognized in “Exchange rate differences” (see Note 10 of our consolidated financial statements) under the “Financial results net” in the statement of profit or loss and other comprehensive income.

Derecognition of financial liabilities:

We derecognize financial liabilities if, and only if, the obligations of the Group expire, are settled or satisfied.

89