As filed with the Securities and Exchange Commission on September 14, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________________

RAFAEL HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

________________________________

Delaware | | 6719 | | 82-2296593 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

________________________________

520 Broad Street

Newark, New Jersey 07102

Telephone: (212) 658-1450

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ameet Mallik

Chief Executive Officer

520 Broad Street

Newark, New Jersey 07102

Telephone: (212) 658-1450

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________________________

With copies to:

Dov T. Schwell, Esq.

Schwell Wimpfheimer & Associates LLP

37 W. 39th Street, Suite 505

New York, NY 10018

Telephone: (646) 328-0795 | | Jeffrey Spindler, Esq.

Mitchell Raab, Esq.

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

Telephone: (212) 451-2300 | | Sanjeev Luther

Rafael Pharmaceuticals, Inc.

1 Duncan Drive Cranbury,

NJ 08512 Telephone: (609) 409-7050 | | David E. Schulman, Esq.

Orrick Herrington &

Sutcliffe LLP

1152 15th Street, N.W.

Washington, DC 20005

Telephone: (202) 339-8654 |

________________________________

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and upon completion of the mergers and transactions described in the enclosed proxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | Large accelerated filer | | ☐ | | Accelerated filer | | ☐ | | |

| | | Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ | | |

| | | | | | | Emerging growth company | | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Table of Contents

CALCULATION OF REGISTRATION FEE

Title of Securities to be Registered | | Amount to be

Registered(1) | | Proposed

Maximum

Aggregate

Offering

Price | | Amount of

Registration

Fee(2) |

Class B Common Stock, par value $.01 per share | | 17,145,038 | | $ | 607,191,521 | | $ | 66,244.59 |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such dates as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary proxy statement/prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY, SUBJECT TO COMPLETION, DATED SEPTEMBER 14, 2021

Dear Rafael Holdings, Inc. Stockholders:

On behalf of the board of directors of Rafael Holdings, Inc. (“Parent” or “Holdings”), I am pleased to enclose the proxy statement/prospectus for the business combination of Holdings and Rafael Pharmaceuticals, Inc. (“Pharma”) and the related facilitating transactions.

As previously announced, on June 17, 2021, Holdings entered into an Agreement and Plan of Merger (the “Merger Agreement”) with RH Merger I, Inc., a Delaware corporation and a wholly-owned subsidiary of Holdings (“Merger Sub I”); RH Merger II, LLC, a Delaware limited liability company and a wholly-owned subsidiary of Holdings (“Merger Sub II” and together with Merger Sub I, the “Merger Subs”); and Pharma. The Merger Agreement provides for, among other things, the following shall occur: at the effective time, Merger Sub I will merge with and into Pharma (the “Initial Merger”), and Pharma (as the surviving company of the merger with Merger Sub I) will merge with and into Merger Sub II with Merger Sub II being the surviving entity of the subsequent merger (the “Subsequent Merger” and together with the Initial Merger, the “Mergers”). As a result of the Mergers, Pharma is intended to become a wholly-owned limited liability subsidiary of Holdings. At the Subsequent Merger effective time, the limited liability company agreement of Merger Sub II will be amended and restated to be the certificate of formation and limited liability company agreement of the surviving entity.

As a consequence of the Mergers, at the effective time, each outstanding share of each class of Pharma capital stock will be automatically cancelled and retired and cease to exist and will entitle a holder of shares of a given class of Pharma capital stock to receive 0.12045 shares of Holding’s Class B Common Stock, par value $0.01 per share (the “Parent Class B Common Stock”), per share of Pharma capital stock. This Per Share Merger Consideration ratio for each class of Pharma capital stock is currently anticipated to result in prior holders of Pharma capital stock and contingent interests receiving Parent Class B Common Stock amounting to approximately 44% of the outstanding capitalization of Holdings following the Mergers based on the currently outstanding capitalization, including after giving effect to the issuance of 2,945,986 shares of Parent Class B Common Stock consummated on August 24, 2021 (the “Holdings Financing”). Additional equity in Holdings will be issued pursuant to employment agreements (which will reduce the foregoing percentage proportionately). See “The Merger Agreement — Merger Consideration” beginning on page 66 of the accompanying proxy statement/prospectus.

Pursuant to the Transactions, an aggregate of 17,145,038 shares of Parent Class B Common Stock are expected to be issued to holders of outstanding shares of Pharma capital stock.

The shares of Parent Class B common stock are listed on the New York Stock Exchange (“NYSE”) under the symbol “RFL” and we do not expect that to be impacted by the Mergers. We believe that the Mergers will benefit both Holdings and Pharma stockholders and we ask for your support in voting for the proposals related to the transactions at the special meeting.

In connection with the Mergers, Holdings will grant additional restricted shares of Parent Class B Common Stock to Ameet Mallik, Holdings’ chief executive officer, so that the Mr. Mallik’s equity interest in Holdings represents an indirect, beneficial 5% ownership interest in Pharma after giving effect to the exercise, conversion, or exchange of all outstanding securities that are exercisable or exchangeable for, or convertible into, capital stock of Holdings.

Further, Holdings is in the process of expanding its management team and other personnel and plans to issue incentive awards under the Rafael Holdings, Inc.’s 2018 Equity Incentive Plan, as amended and restated (the “Plan”). Accordingly, we will need to amend the Plan to authorize an additional [•] shares of Parent Class B Common Stock to be issued under the Plan.

Holdings stockholders are cordially invited to attend a special meeting to be held on [•], 2021 at Holdings’ offices at 520 Broad Street, 4th Floor, Newark, New Jersey 07102 at 11:30 a.m., Eastern Time. The matter to be voted on at the special meeting are (i) the approval and adoption of the Merger Agreement, including, but not limited to, the issuance of Parent Class B Common Stock in connection with the Mergers; (ii) the approval of the grant to Ameet Mallik, our chief executive officer, of up to [•] shares of Parent Class B Common Stock as required by his employment agreement upon consummation of the Mergers to be made under the Plan and the necessary amendments to the Plan to provide for such grant; and (iii) to approve an amendment of the Plan to authorize an additional [•] shares of Parent Class B Common Stock to be reserved for issuance thereunder.

Your vote is very important regardless of the number of shares you own. Your proxy is being solicited by the board of directors of Holdings. We cannot consummate the Transactions unless Holdings stockholders adopt the first two proposals listed above. Whether or not you plan to attend the special meeting, please vote as soon as possible by following the instructions in the accompanying proxy statement/prospectus. More information about the Transactions and the proposals are contained in the accompanying proxy statement/prospectus.

Table of Contents

After careful consideration, the board of directors of Holdings and the Special Committee of the board of directors of Holdings have unanimously approved and declared advisable the Merger Agreement and the Transactions, and determined that the terms and provisions of the Merger Agreement are fair to, advisable and in the best interests of Holdings and its stockholders. The board of directors of Holdings unanimously recommends that you vote “FOR” each of the proposals described in the accompanying proxy statement/prospectus, including a proposal to adjourn the special meeting in the event there are not sufficient votes to obtain approval of the three proposals described above. In considering the recommendation of the board of directors of Holdings, you should be aware that certain directors and executive officers of Holdings may have interests in the Transactions that may be different from, or in addition to, the interests of Holdings’ stockholders generally. See “Risk Factors — Risk Factors Relating to the Transaction — Executive officers and directors of Parent may have interests in the Mergers that are different from, or in addition to, the rights of its stockholders.” beginning on page 24 of the accompanying proxy statement/prospectus.

The accompanying proxy statement/prospectus provides important information regarding the special meeting and a detailed description of the Merger Agreement, including, but not limited to, the issuance of shares of Parent Class B Common Stock, and the other proposals related to the Transactions. We urge you to read carefully and in its entirety the accompanying proxy statement/prospectus (including the annexes and any documents incorporated by reference into the accompanying proxy statement/prospectus). Please pay particular attention to the section entitled “Risk Factors” beginning on page 20 of the accompanying proxy statement/prospectus. You can also obtain information about Holdings from documents that Holdings previously has filed with the U.S. Securities and Exchange Commission.

Whether or not you plan to attend the special meeting, please ensure that your shares will be represented and voted at the meeting by submitting a proxy as soon as possible by following the instructions in the accompanying proxy statement/prospectus.

If Holdings stockholders have any questions or require assistance in voting their shares of Parent Class B Common Stock or Class A Common Stock, they should call [•].

We hope to see you at the special meeting and look forward to the successful completion of the Transactions.

On behalf of the board of directors of Holdings, I thank you for your consideration and continued support.

| | Sincerely, |

| | | /s/ Howard S. Jonas |

| | | Howard S. Jonas |

| | | Chairman of the Board of Directors |

Table of Contents

RAFAEL HOLDINGS, INC.

520 Broad Street, Newark, New Jersey 07102

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To the Stockholders of Rafael Holdings, Inc.:

NOTICE IS HEREBY GIVEN that a special meeting (the “Special Meeting”) of stockholders of Rafael Holdings, Inc., a Delaware corporation (“Holdings” or “Parent”), will be held on [•], 2021 at 11:30 a.m. local time, at 520 Broad Street, 4th floor, Newark, New Jersey 07102. Only stockholders who hold shares of Holdings Class A common stock, par value $0.01 per share (“Parent Class A Common Stock”) and Holdings Class B common stock, par value $0.01 per share (“Parent Class B Common Stock,” together with the Parent Class A Common Stock, the “Common Stock”)), at the close of business on [•], 2021, the record date for the Special Meeting, are entitled to vote at the Special Meeting and any adjournments or postponements of the Special Meeting. You are cordially invited to attend the Special Meeting to conduct the following items of business:

• The Merger Agreement — to consider and vote upon a proposal to adopt the Agreement and Plan of Merger (the “Merger Agreement”) with RH Merger I, Inc., a Delaware corporation and a wholly-owned subsidiary of Holdings (“Merger Sub I”); RH Merger II, LLC, a Delaware limited liability company and a wholly-owned subsidiary of Holdings (“Merger Sub II” and together with Merger Sub I, the “Merger Subs”); and Rafael Pharmaceuticals, Inc., a Delaware corporation (“Pharma”), including, but not limited to, the issuances of Parent Class B Common Stock in connection with the Mergers (“Proposal 1”);

• the approval of the grant to Ameet Mallik, our chief executive officer, of up to [•] shares of Parent Class B Common Stock as required by his employment agreement upon consummation of the Mergers to be made under the Plan and the necessary amendments to the Plan to provide for such grant (“Proposal 2”);

• to approve an amendment of the Plan to authorize an additional [•] shares of Parent Class B Common Stock to be reserved for issuance thereunder (“Proposal 3”);

• The Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation of proxies in the event there are insufficient votes present in person or by proxy for, or otherwise in connection with, the approval of each of Proposals 1, 2 and 3 (the “Adjournment Proposal”).

Each of Proposals 1, 2, and 3 is conditioned on the approval of each of the other proposals among Proposals 1, 2 and 3 and will be of no force and effect if any one or more of Proposals 1, 2, and 3 is not approved. Further, the consummation of the transactions, contemplated by the Merger Agreement, is conditioned on, among other things, the approval of the Merger by the Pharma stockholders.

No other business will be conducted at the Special Meeting. These proposals are described more fully in the accompanying proxy statement. We urge you to read the proxy statement/prospectus, including the Annexes and the documents incorporated by reference in the accompanying proxy statement/prospectus carefully and in their entirety. In particular, we urge you to read carefully “Risk Factors” beginning on page 20 of the accompanying proxy statement/prospectus. For specific instructions on how to vote your shares, see “The Special Meeting of Holdings Stockholders — Voting Your Shares” beginning on page 46 of the accompanying proxy statement/prospectus.

Your vote is very important, regardless of the number of shares of Holdings Common Stock that you own. The approval of Proposal 1 requires the approval of the holders of a majority of the outstanding shares of Parent Common Stock, not including shares owned directly or indirectly by any affiliate of Holdings, Merger Subs or any of their respective officers or directors on or after the date of the Merger Agreement, including trusts for the benefit of immediate family members of such parties regardless of whether they are affiliates, outstanding and entitled to vote at the Special Meeting. The approval of Proposals 2 and 3 require the approval of the holders of a majority of

Table of Contents

the outstanding shares of Parent Common Stock. The approval of each of Proposals 1, 2, 3 and the Adjournment Proposal requires the affirmative vote of the holders of a majority of votes cast by the stockholders present in person or represented by proxy and entitled to vote thereon at the meeting.

After careful consideration, our board of directors has unanimously determined that the terms and provisions of the Merger Agreement are fair to, advisable and in the best interests of Holdings and its stockholders, and unanimously recommends you vote “FOR” Proposals 1 through 3, as well as the Adjournment Proposal.

Even if you plan to attend the Special Meeting in person, we request that you complete, sign, date and return the enclosed proxy card in the envelope provided, or submit your proxy by telephone or the Internet prior to the Special Meeting, and thus ensure that your shares will be represented and voted at the Special Meeting if you later become unable to attend. If your shares are held in a stock brokerage account or by a bank or other nominee, please follow the instructions that you receive from your broker, bank or other nominee to vote your shares.

| | By order of the board of directors, |

| | | /s/ Joyce Mason |

| | | Corporate Secretary |

| | | [•], 2021 |

Table of Contents

i

Table of Contents

ii

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION AND THE SPECIAL MEETING

The following questions and answers are intended to address briefly some commonly asked questions regarding the Transactions and the Special Meeting. These questions and answers only highlight some of the information contained in this proxy statement/prospectus. They may not contain all the information that is important to you. You should read carefully this entire proxy statement/prospectus, including the Annexes and the documents incorporated by reference into this proxy statement/prospectus, to understand fully the proposed transactions and the voting procedures for the meeting. See “Where You Can Find More Information” beginning on page 96 of this proxy statement/prospectus. Unless otherwise indicated or the context requires, all references in this proxy statement/prospectus to:

• “Acquired Shares” refers to the Pharma Preferred Stock and Pharma Common Stock not held by Parent, the Merger Subs or any other wholly owned subsidiary of Parent.

• “Altira Acquisition Agreement” refer to the Altira Acquisition Agreement, a copy of which is included as Annex F to this proxy statement/prospectus.

• the “Business Combination” refer to approval by Holdings’ and Pharma’s stockholders, the satisfaction of the other conditions in the Merger Agreement and the Merger transactions contemplated by the Merger Agreement are consummated, resulting in Pharma becoming a wholly-owned subsidiary of Holdings.

• “dollars” or “$” refer to U.S. dollars.

• the “Exchange Act” refer to the Securities Exchange Act of 1934, as amended.

• the “Holdings Bylaws” refer to the Amended and Restated By-laws of Holdings.

• the “Holdings Charter” refer to the Amended and Restated Certificate of Incorporation of Holdings and in effect immediately prior to the Effective Time (as defined below).

• “Initial Merger” refers to Merger Sub I merging with and into Pharma.

• the “Merger Agreement” refer to the Agreement and Plan of Merger, dated as of June 17, 2021, by and among Parent, Merger Subs and Pharma, a copy of which is included as Annex A to this proxy statement/prospectus.

• “our” or “we” refer to Parent.

• “Lock-Up Agreements” refer to the lock-up agreements between certain stockholders of Pharma and Holdings providing for post-closing restrictions on the ability of such individuals with respect to the transfer of shares of Parent Common Stock to be issued to them pursuant to the Merger Agreement and/or otherwise owned, as applicable, in substantially the form included as Annex B to this proxy statement/prospectus.

• “Mergers” refer to, collectively, the Initial Merger and the Subsequent Merger.

• “Merger Sub I” refer to RH Merger I, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent.

• “Merger Sub II” refer to RH Merger II, LLC, a Delaware limited liability company and a wholly-owned subsidiary of Parent.

• “Merger Subs” refer to Merger Sub I, together with Merger Sub II.

• “Parent” or “Holdings” refer to Rafael Holdings, Inc., a Delaware corporation.

• “Parent Class A Common Stock” refer to Parent’s Class A Common Stock, par value $0.01 per share, the holders of which are entitled to three votes per share.

• “Parent Class B Common Stock” refer to Parent’s Class B Common Stock, par value $0.01 per share, the holders of which are entitled to one-tenth of a vote per share.

1

Table of Contents

• “Parent Common Stock” refer to the Parent Class A Common Stock and the Parent Class B Common Stock.

• “Parent Minority Approval” refer to the adoption of the Merger Agreement, and the approval of the transactions contemplated thereby, including the Merger, by the affirmative vote of at least a majority of the issued and outstanding shares of Parent Common Stock, excluding shares owned directly or indirectly by any affiliate of Parent, Merger Subs or any of their respective officers or directors on or after the date of the Merger Agreement, including trusts for the benefit of immediate family members of such parties regardless of whether they are affiliates, outstanding and entitled to vote thereon at the Parent Special Meeting.

• the “Parent Stockholder Approval” refer to the approval of the issuance of the Parent Class B Common Stock issuable pursuant to the Merger and Parent Minority Approval.

• “Pharma” or the “Company” refer to Rafael Pharmaceuticals, Inc., a Delaware corporation.

• “Pharma Charter” refer to the Amended and Restated Certificate of Incorporation and in effect immediately prior to the Effective Time.

• “Pharma Common Stock” refer to Pharma Voting Common Stock and Pharma Non-Voting Common Stock.

• “Pharma Minority Approval” refer to the adoption of the Merger Agreement, and the approval of the transactions contemplated thereby, including the Merger, by the affirmative vote of at least a majority of the issued and outstanding shares of Pharma Capital Stock entitled to vote thereon, excluding shares of Pharma Capital Stock owned directly or indirectly by Parent or any affiliate of Parent.

• “Pharma Non-Voting Common Stock” shall mean Pharma’s Common Stock, par value $0.001 per share, designated as non-voting in the Pharma Charter.

• “Pharma Preferred Stock” refer to collectively the Series A Preferred Stock, Series B-1 Preferred Stock, the Series B-2 Preferred Stock, the Series B-3 Preferred Stock, the Series B-4 Preferred Stock, the Series C Preferred Stock and the Series D Preferred Stock.

• “Pharma Restricted Stock” refer to a share of Pharma Common Stock that is (i) outstanding on the date of the Merger Agreement and (ii) subject to a substantial risk of forfeiture within the meaning of Section 83 of the Code.

• “Pharma Stockholder Approval” refer to the Pharma Minority Approval and approval of the Certificate of Amendment to the Amended and Restated Certificate of Incorporation of Pharma as contemplated by the Merger Agreement.

• “Pharma Voting Common Stock” shall mean Pharma’s Common Stock, par value $0.001 per share, designated as voting in the Pharma Charter.

• “Registration Statement” refer to the Registration Statement of which this proxy statement/prospectus forms a part.

• the “SEC” refer to the U.S. Securities and Exchange Commission.

• the “Securities Act” refer to the Securities Act of 1933, as amended.

• “Subsequent Merger” refer to Pharma merging with and into Merger Sub II with Merger Sub II being the surviving entity of the subsequent merger.

• “Subsequent Merger Effective Time” refer the time when the certificate of merger for Subsequent Merger has been duly filed with the Secretary of State of the State of Delaware or at such later time as is permissible under the DGCL and the Delaware Limited Liability Company Act.

• “Support Agreements” refer to the support agreements entered into by certain directors and executive officers of Pharma and other Pharma Stockholders with Parent and Pharma, a copy of which in substantially the form annexed hereto as Annex C.

2

Table of Contents

• “Transactions” refer to the Merger Agreement, the Mergers and the other transactions contemplated thereunder, including the Voting Agreements, Support Agreements, Lock-Up Agreements and Altira Acquisition Agreement.

• “Voting Agreements” refer to the Voting Agreement among Howard Jonas and certain of his family members and affiliates, in substantially the form included as Annex D to this proxy statement/prospectus.

If you are in any doubt about the transactions described herein, you should consult your own financial advisor.

Q: What is the Merger Agreement and the Transactions?

A: On June 17, 2021, Parent, Merger Subs and Pharma entered into the Merger Agreement, pursuant to which, among other things, the following shall occur: at the Effective Time, Merger Sub I will merge with and into Pharma, and Pharma (as the surviving company of the merger with Merger Sub I) will merge with and into Merger Sub II with Merger Sub II being the surviving entity of the subsequent merger. As a result of the Mergers, Pharma is intended to become a wholly-owned limited liability subsidiary of Holdings. At the Subsequent Merger Effective Time, the limited liability company agreement of Merger Sub II will be amended and restated to be the certificate of formation and limited liability company agreement of the surviving entity.

Concurrently with the execution of the Merger Agreement, certain key affiliates of both Parent and Pharma entered into binding commitments to support the Mergers. The Support Agreements were executed by affiliates and other related parties of Pharma, and the Voting Agreements were executed by affiliates and other related parties of Holdings. In addition, certain key affiliates of both Parent and Pharma entered into lock-up agreements, which contain certain restrictions on transfer of such Parent Common Stock for a period of six months following closing of the Business Combination.

As a result of the Transactions, at the Effective Time, each outstanding share of each class of Pharma capital stock will be automatically cancelled and retired and cease to exist, and will entitle a holder of shares of a given class of Pharma capital stock to receive 0.12045 shares of Parent Class B Common Stock per share of Pharma capital stock. This Per Share Merger Consideration ratio for each class of Pharma capital stock is currently anticipated to result in prior holders of Pharma capital stock and contingent interests receiving Parent Class B Common Stock amounting to approximately 44% of the outstanding capitalization of Holdings following the Mergers based on the currently outstanding capitalization, including after giving effect to the issuance of the Holdings Financing. Additional equity in Parent will be issued pursuant to employment agreements (which will reduce the foregoing percentage proportionately). See “The Merger Agreement” beginning on page 66 of this proxy statement/prospectus.

Q: Why am I receiving this proxy statement/prospectus?

A: This proxy statement/prospectus serves as the proxy statement through which Parent will solicit proxies to obtain the necessary stockholder approval for the Transactions. Parent is holding a special meeting of stockholders (the “Parent Special Meeting”) in order to obtain the Parent Stockholder Approval necessary to approve the Mergers, and to obtain the necessary Parent stockholder approval of (i) the grant to Ameet Mallik, our chief executive officer, of up to [•] shares of Class B Common Stock as required by his employment agreement upon consummation of the Mergers to be made under the Plan and the necessary amendments to the Plan to provide for such grant and (ii) an amendment of the Plan to authorize an additional [•] shares of Class B Common Stock to be reserved for issuance thereunder. Holdings stockholders will also be asked to approve the adjournment of the Parent Special Meeting (if necessary or appropriate to solicit additional proxies if there are not sufficient votes to obtain the Parent Stockholder Approval).

You are receiving this proxy statement/prospectus because you were a holder of record of Parent Common Stock as of the close of business on the record date for the Parent Special Meeting, and are therefore entitled to vote at the Parent Special Meeting.

This proxy statement/prospectus contains important information about the Transactions. Please also review the Annexes to this proxy statement/prospectus. You should read this information carefully and in its entirety. The enclosed voting materials allow you to vote your shares without attending the Parent Special Meeting. Your vote is very important and we encourage you to submit your proxy as soon as possible.

3

Table of Contents

Q: When were the enclosed solicitation materials first made available to Holdings stockholders?

A: The enclosed materials were first made available to Holdings stockholders on or about [•], 2021.

Q: When and where will the Parent Special Meeting be held?

A: The Parent Special Meeting will be held at 520 Broad Street, 4th Floor, Newark, New Jersey 07102, on [•], 2021 at 11:30 a.m., local time.

Q: What will Holdings stockholders receive as consideration in the Mergers?

A: Holdings stockholders will not receive Merger Consideration and, other than issuance of shares of Parent Class B Common Stock, the Business Combination will have no impact on the outstanding capital stock of Parent, and each share of Parent Class A Common Stock or Parent Class B Common Stock of Parent that is issued and outstanding as of immediately prior to the Effective Time of the Mergers, which will continue to remain outstanding. See “The Merger Agreement — Merger Consideration” beginning on page 66 of this proxy statement/prospectus.

Q: What will Pharma Stockholders receive as consideration in the Mergers?

A: As a consequence of the Mergers, at the Effective Time, each outstanding share of each class of Pharma capital stock will be automatically cancelled and retired and cease to exist, and will entitle a holder of shares of a given class of Pharma capital stock to receive 0.12045 shares of Parent Class B Common Stock per share of Pharma capital stock. The Per Share Merger Consideration ratio for each class of Pharma capital stock provides that the prior holders of Pharma capital stock and contingent interests are intended to receive Parent Class B Common Stock. Additional equity in Parent may be issued in connection with one or more financings and pursuant to employment agreements (which will reduce the foregoing percentage proportionately).

See “The Merger Agreement — Merger Consideration” beginning on page 66 of this proxy statement/prospectus.

Q: What will happen to outstanding Pharma equity awards in the Transactions?

A: At the Effective Time, all compensatory options to purchase Pharma Common Stock shall automatically vest in full, and all holders of such options will receive options to purchase Class B common stock of Holdings using the ratios applicable to determine the Holdings stock in the Business Combination. The parties intend that the Company Convertible Notes will not be assumed or continued by Parent or Pharma in connection with the Merger or the other transactions contemplated by the Merger Agreement. All Company Warrants are intended to terminate at the Effective Time as contemplated by and in accordance with the Merger Agreement and the applicable Support Agreement. See “The Merger Agreement — Treatment of Company Warrants, Company Options, Company Convertible Notes and Contingent Rights” beginning on page 69 of this proxy statement/prospectus.

Q: When are the Transactions expected to be completed?

A: Pursuant to the terms of the Merger Agreement, the Transactions are to be completed on or prior to December 15, 2021 (the “End Date”); provided, however, that, in the event that the SEC has not declared effective under the Securities Act the Registration Statement by the date which is 45 calendar days prior to the End Date, then the End Date shall automatically be extended to February 1, 2022. However, no assurance can be provided as to when or if the Transactions will be completed. The Parent Stockholder Approval and the Pharma Stockholder Approval must be obtained, and other conditions specified in the Merger Agreement must be satisfied or, to the extent applicable, waived prior to the consummation of the Transactions.

Q: What conditions must be satisfied to complete the Transactions?

A: The Merger Agreement. The obligations of each of Parent, Merger Subs and Pharma to complete the Mergers are subject to the satisfaction (or waiver to the extent permissible under the Merger Agreement or applicable law) on or prior to the Effective Time of various conditions, including the following:

• The Registration Statement shall have been declared effective by the SEC under the Securities Act and no stop order suspending the effectiveness of the Registration Statement shall have been issued by the SEC and remain in effect, and no proceedings for that purpose shall be pending or threatened in writing by the SEC and not withdrawn or lapsed.

4

Table of Contents

• No temporary restraining order, preliminary or permanent injunction or other order preventing the consummation of any of the Mergers shall have been issued by any court of competent jurisdiction and remain in effect, and no material Law shall have been enacted since the date of the Merger Agreement that makes consummation of any of the Mergers illegal.

• The Merger Agreement shall have been duly adopted by the Required Company Stockholder Vote (as defined in the Merger Agreement) and the Required Parent Stockholder Vote (as defined in the Merger Agreement), and the Required Company Stockholder Vote and the Required Parent Stockholder Vote shall remain in full force and effect and, if the Registration Statement incorporates information by reference as contemplated in General Instruction A.2 of Form S-4 under the Securities Act, at least twenty business days (as defined pursuant to Form S-4) shall have elapsed from the date of the first mailing of the prospectus in the Registration Statement to the Pharma stockholders until the date of the Closing.

• The Merger Agreement shall have been duly adopted by the Parent Minority Approval and the Company Minority Approval, each of the Parent Stockholder Approval and the Company Stockholder Approval have occurred, and all such approvals shall remain in full force and effect.

• The Merger Shares shall have been approved for listing on the NYSE, subject to official notice of issuance.

• The transactions contemplated by the Altira Acquisition Agreement shall have been consummated by all parties thereto in accordance with its terms; provided that such consummation of the Altira Acquisition Agreement shall not be a condition to Parent’s obligations to consummate the Merger if (a) Parent has not funded the payment amount thereunder before the Closing and (b) the Altira Acquisition Agreement has been consummated in all material respects by all parties thereto other than Parent (to the extent that such covenants require performance by such other parties at or before the Closing), including execution and delivery of any and all conveyance documents.

• The Certificate of Amendment to the Amended and Restated Certificate of Incorporation of Pharma in the form of attached to the Merger Agreement, shall have received the required director and stockholder approvals and been filed with the Delaware Secretary of State on a date prior to the Closing Date.

• Parent shall have consummated the Financing (which Financing has since been consummated).

See “The Merger Agreement — Conditions to the Merger” beginning on page 77 of this proxy statement/prospectus.

Q: Who will serve as the management of Parent and the Surviving Company following the Transactions?

A: Following the consummation of the Transactions, the directors and officers of the Initial Surviving Corporation immediately after the Effective Time and the managers and officers of the Surviving Company immediately after the Subsequent Merger Effective Time, shall be the respective individuals listed in a schedule to the Merger Agreement (as may be amended from time to time), each to hold office in accordance with the applicable governing documents and applicable law, until such director’s or officer’s successor is duly elected or appointed and qualified, or until the earlier of their death, resignation or removal. The Surviving Company shall be a wholly owned subsidiary of Parent, to be managed by Parent as its sole member. At the Surviving Company, Patrick Fabbio will serve as Treasurer, Tamara Rhein as Comptroller and Joyce Mason as Secretary. The Merger Agreement does not provide for any changes in the currently existing management of Parent.

Q: Following the Transactions, will Parent Common Stock continue to trade on a stock exchange?

A: Yes. Parent Class B Common Stock is currently listed on the NYSE under the symbol “RFL”. Following the consummation of the Transactions, we expect that Parent Class B Common Stock will continue to be listed on the NYSE.

Q: What vote is required to approve each proposal?

5

Table of Contents

A: Your vote “FOR” each proposal presented at the Special Meeting is very important, and you are encouraged to submit a proxy as soon as possible.

Merger Agreement Proposal. Approval and adoption of the Merger Agreement Proposal requires the affirmative vote of the holders of a majority of the outstanding shares of Holdings Common Stock entitled to vote thereon as of the record date for the special meeting and the approval by Holdings stockholders of at least a majority of the issued and outstanding shares of Holdings Class B Common Stock not owned directly or indirectly by any affiliate of Holdings, the Merger Subs, or any of their respective officers or directors or trusts for the benefit of immediate family members of such parties, outstanding and entitled to vote thereon at the Meeting.

Any abstention by a Holdings stockholder, failure of any Holdings stockholder to submit a vote and broker non-vote will have the same effect as voting against the Merger Agreement Proposal. In connection with the Merger Agreement, it is expected that Holdings’ directors and executive officers who are stockholders of Holdings will vote “FOR” each of the proposals described above, including Holdings’ Chairman and the Board of Directors, Howard Jonas, who along with certain of his family members and affiliates entered into a Voting Agreement, which is attached as Annex D to this proxy statement/prospectus and pursuant to which they have agreed to vote in favor of the consummation of the Mergers and take other actions in furtherance of the consummation of the Merger Agreement.

Ameet Mallik Grant Proposal. Approval and adoption of the Ameet Mallik Grant Proposal requires the affirmative vote of a majority of the issued and outstanding shares of Holdings Common Stock to vote thereon. Abstentions and broker non-votes will not be voted either for or against the Ameet Mallik Proposal and, accordingly, will not affect the outcome of the Ameet Mallik Proposal.

The Plan Amendment Proposal. Approval and adoption of the Plan Amendment Proposal requires the affirmative vote of a majority of the issued and outstanding shares of Holdings Common Stock to vote thereon. Abstentions and broker non-votes will not be voted either for or against the Ameet Mallik Proposal and, accordingly, will not affect the outcome of the Ameet Mallik Proposal.

Q: How does the Holdings board of directors (the “Holdings Board” or “the Board of Directors”) recommend that I vote?

A: The Holdings Board, after considering the recommendation of the Holdings Special Committee and various factors described under “Proposal 1: The Merger Agreement Proposal — Recommendation of the Holdings Board and Reasons for the Transactions,” has unanimously approved the Merger Agreement and determined that the Merger Agreement and the Mergers are fair to, and in the best interests of, Holdings and its stockholders and recommends that Holdings stockholders approve and adopt this Merger Agreement, the Mergers and the other transactions contemplated by this document.

Accordingly, the Holdings Board recommends that Holdings stockholders vote:

• “FOR” the Merger Agreement Proposal,

• “FOR” the Ameet Mallik Grant Proposal and

• “FOR” the Plan Amendment Proposal.

Q: What happens if the Mergers are not completed?

A: If the Merger Agreement is not approved and adopted by Holdings stockholders or the Mergers are not completed for any other reason, Pharma stockholders will not receive any shares of Holdings Class B Common Stock for shares of Pharma’s Common Stock they own. Holdings Class B Common Stock will continue to be listed and traded on the NYSE and registered under the Exchange Act, and Holdings will continue to file periodic reports with the SEC on account of Holdings Class B Common Stock.

Q: Am I entitled to vote at the Special Meeting?

6

Table of Contents

A: Only stockholders of record on [•], 2021, the record date for the Special Meeting, are entitled to receive notice of and to vote at the Special Meeting. As of the close of business on [•], 2021, there were [•] issued and outstanding shares of Holdings Class A Common Stock and [•] issued and outstanding shares of Holdings Class B Common Stock entitled to vote at the Special Meeting, with Stockholders are entitled to three votes for each share of Class A Common Stock held by them and one-tenth of one vote for each share of Class B Common Stock. The holders of Class A Common Stock and Class B Common Stock will vote as a single body on all matters presented to the stockholders.

Q: What constitutes a quorum at the Special Meeting?

A: In order for business to be conducted at the Special Meeting, a quorum must be present. A quorum at the Special Meeting requires the presence, in person or by proxy, of a majority of all the voting power of all shares entitled to vote at the Special Meeting, present in person or by proxy. Abstentions and broker non-votes will be counted towards a quorum. At the close of business on [•], 2021, the record date for the Special Meeting, there were [•] shares of Holdings Class A Common Stock outstanding and [•] shares of Holdings Class B Common Stock outstanding.

Q: What do I need to do now?

A: After you have carefully read and considered the information contained in or incorporated by reference into this proxy statement/prospectus, please submit your proxy via the Internet or by telephone in accordance with the instructions set forth on the enclosed proxy card, or complete, sign, date and return the enclosed proxy card in the postage-prepaid envelope provided as soon as possible so that your shares will be represented and voted at the Special Meeting.

Additional information on voting procedures can be found under the section titled “Special Meeting.”

Q: How will my proxy be voted?

A: If you submit your proxy via the Internet, by telephone or by completing, signing, dating and returning the enclosed proxy card, your proxy will be voted in accordance with your instructions.

If you are a registered stockholder of record and you return your signed proxy card but do not indicate your voting preference, the persons named in the proxy card will vote the shares represented by the proxy as recommended by the Holdings Board. Please note that you may not vote shares held in “street name” by returning a proxy card directly to Holdings, or by voting in person at the Special Meeting, unless you provide a “legal proxy,” which you must obtain from your broker, bank or nominee. If you hold your shares in the name of a broker, bank or other nominee and you do not instruct your broker, bank or nominee how to vote your shares, your broker may not vote your shares of Holdings Common Stock, which will have the same effect as a vote “AGAINST” the Merger Agreement Proposal but will have no effect on the Ameet Mallik Grant and Plan Amendment Proposals.

Additional information on voting procedures can be found under the section titled “Special Meeting.”

Q: Who will count the votes?

A: The votes at the Special Meeting will be counted by an independent inspector of election appointed by the Holdings Board.

Q: May I vote in person?

A: Yes. If you are a stockholder of record of Holdings at the close of business on [•], 2021, you may attend the Special Meeting and vote your shares in person, in lieu of submitting your proxy by Internet or telephone or by completing, signing, dating and returning the enclosed proxy card.

If you are a beneficial holder of Holdings Common Stock, you are also invited to attend the Special Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the Special Meeting unless you request and obtain a valid “legal proxy” from your broker, bank or nominee.

Q: What must I bring to attend the Special Meeting?

7

Table of Contents

A: Only Holdings stockholders of record, as of the close of business on the record date, beneficial owners of Holdings Common Stock as of the record date, holders of valid proxies for the Special Meeting, and invited guests of Holdings may attend the Special Meeting. All attendees should be prepared to present government-issued photo identification (such as a driver’s license or passport) for admittance. The additional items, if any, that attendees must bring depend on whether they are stockholders of record, beneficial owners or proxy holders.

Additional information on attending the Special Meeting can be found under the section titled “Special Meeting.”

Q: What should I do if I receive more than one set of voting materials for the Special Meeting?

A: You may receive more than one set of voting materials for the Special Meeting, including multiple copies of this proxy statement/prospectus and multiple proxy cards or voting instruction forms. For example, if you hold your Holdings Common Stock in more than one brokerage account, you will receive a separate voting instruction form for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please submit each separate proxy or voting instruction form that you receive by following the instructions set forth in each separate proxy or voting instruction form.

Q: What is the difference between holding shares as a “stockholder of record” and holding shares as “beneficial owner” (or in “street name”)?

A: Most stockholders are considered “beneficial owners” of their shares — they hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially or in “street name.”

Stockholder of Record: If your shares are registered directly in your name with Holdings’ transfer agent, you are considered the “stockholder of record” with respect to those shares. As a stockholder of record, you have the right to grant your voting proxy directly to us by submitting your vote by written proxy, telephone or the Internet, or to vote in person at the meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name,” and the proxy materials are being forwarded to you by your broker, bank or nominee. As a beneficial owner, you have the right to direct your broker, bank or nominee as to how to vote your shares if you follow the instructions you receive from your broker, bank, or nominee. You are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you request, complete and deliver the proper documentation provided by your broker, bank or nominee and bring it with you to the Special Meeting.

Q: What is a broker non-vote?

A: If you are a beneficial owner of shares held in “street name” and do not provide your broker, bank or nominee with specific voting instructions, the broker, bank or nominee may generally vote on “routine” matters, but cannot vote on “non-routine” matters. If the broker, bank or nominee does not receive instructions from you on how to vote your shares on a non-routine matter, it will inform the inspector of election that it does not have authority to vote on this matter with respect to your shares. This is referred to as a “broker non-vote.”

You should instruct your broker, bank or other nominee how to vote your shares. Under the rules applicable to broker-dealers, your broker, bank or other nominee does not have discretionary authority to vote your shares on any of the proposals scheduled to be voted on at the Special Meeting. A broker non-vote will have the same effect as a vote “against” the approval and adoption of the Merger Agreement Proposal and will not be voted either for or against the Ameet Mallik Grant Proposal or the Plan Amendment Proposal. Additional information on voting procedures can be found under the section titled “Special Meeting.”

Q: Can I revoke or change my vote?

8

Table of Contents

A: Yes. A stockholder of record may revoke or change a proxy before the proxy is exercised by filing with Holdings’ Secretary a notice of revocation, by delivering to Holdings a new proxy, by attending the meeting and voting in person, or by re-voting by telephone or the Internet. Beneficial owners must follow instructions provided by their broker, bank or other nominee to revoke or change a proxy. A stockholder’s last timely vote, whether via the Internet, by telephone or by mail, is the vote that will be counted.

A beneficial owner of Holdings’ Common Stock may change his, her or its voting instruction by submitting a new voting instruction to the broker, bank or other nominee that holds his, her or its shares of record or by requesting a “legal proxy” from such broker, bank or other nominee and voting in person at the Special Meeting. Additional information can be found under the section titled “Special Meeting.”

Q: What happens if I sell or otherwise transfer my shares of Holdings Common Stock before the Special Meeting?

A: The record date for stockholders entitled to vote at the Special Meeting is [•], 2021, which is earlier than the date of the Special Meeting. If you sell or otherwise transfer your shares after the record date but before the Special Meeting, unless special arrangements (such as provision of a proxy) are made between you and the person to whom you transfer your shares and each of you notifies Holdings in writing of such special arrangements, you will retain your right to vote such shares at the Special Meeting but will otherwise transfer ownership of your shares of Holdings Common Stock.

Q: Where can I find voting results of the Special Meeting?

A: Holdings intends to announce preliminary voting results at the Special Meeting and publish the final results in Current Reports on Form 8-K to be filed with the SEC following the Special Meeting. All reports that Holdings files with the SEC are publicly available when filed. See “Where You Can Find More Information” beginning on page 96 of this proxy statement/prospectus.

Q: Do stockholders have dissenters’ rights or appraisal rights?

A: Holdings stockholders are not entitled to dissenters’ rights or appraisal rights in connection with the Mergers. For further information relating to appraisal and dissenters’ rights, see “The Merger Agreement — Appraisal Rights.” beginning on page 69 of this proxy statement/prospectus.

Q: How can I find more information about Holdings and Pharma?

A: You can find more information about Holdings and Pharma in this proxy statement/prospectus and more information regarding Holdings from various sources described in the section titled “Where You Can Find More Information” beginning on page 96 of this proxy statement/prospectus.

Q: Who can answer my questions about the Special Meeting, the Mergers, the other transactions contemplated by the Merger Agreement, or any other related agreement?

A: If you have any questions about the Special Meeting, the Mergers, the other related agreements, or how to submit your proxy, or if you need additional copies of this proxy statement/prospectus or documents incorporated by reference herein, the enclosed proxy card or voting instructions, you should contact:

Rafael Holdings, Inc.

520 Broad Street

Newark, New Jersey 07102

(212) 658-1450

Attention: Joyce Mason, Corporate Secretary

9

Table of Contents

SUMMARY

This summary highlights selected information contained in this proxy statement/prospectus and may not contain all of the information that may be important to you. Accordingly, you should read carefully this entire proxy statement/prospectus, including the Annexes and the documents referred to or incorporated by reference in this proxy statement/prospectus. The page references have been included in this summary to direct you to a more complete description of the topics presented below. See “Where You Can Find More Information” beginning on page 96 of this proxy statement/prospectus.

Information about the Companies (Page 43)

Rafael Holdings, Inc.

Rafael Holdings, Inc. (“Holdings” or the “Parent”), a Delaware corporation, owns interests in pre-clinical and clinical stage pharmaceutical companies and commercial real estate assets. The assets are operated as two separate lines of business.

The pharmaceutical holdings include preferred and common equity interests and a warrant to purchase additional equity interests in Rafael Pharmaceuticals, Inc., or Rafael Pharmaceuticals, which is a clinical stage, oncology-focused pharmaceutical company committed to the development and commercialization of therapies that exploit the metabolic differences between normal cells and cancer cells; and, a majority equity interest in LipoMedix Pharmaceuticals Ltd., or LipoMedix, a clinical stage oncological pharmaceutical company based in Israel. In addition, in 2019, the Company established the Barer Institute (“Barer”), a wholly-owned early stage venture focused on developing a pipeline of therapeutic compounds, including compounds to regulate cancer metabolism. The venture is pursuing collaborative research agreements with leading scientists from top academic institutions. In addition, the Company has recently initiated efforts to develop other early stage pharmaceutical ventures including Levco Pharmaceuticals Ltd. (“Levco”), an Israeli company, established to partner with Dr. Alberto Gabizon and a top institution in Israel on the development of novel compounds for cancer, and Farber Partners, LLC (“Farber”), formed around an agreement with Princeton University’s Office of Technology Licensing for technology from the laboratory of Professor Joshua Rabinowitz, in the Department of Chemistry, Princeton University, for an exclusive worldwide license to its SHMT (serine hydroxymethyltransferase) inhibitor program. Additionally, in 2021, the Company established Rafael Medical Devices, LLC (“Rafael Medical Devices”), a wholly-owned orthopedic device company developing instruments and implants to advance minimally invasive surgeries in the upper and lower extremities.

The commercial real estate holdings consist of a building at 520 Broad Street in Newark, New Jersey that serves as headquarters for the Company and certain other entities and hosts other tenants and an associated 800-car public garage, and a portion of a building in Israel.

Rafael Pharmaceuticals, Inc.

Pharma is a clinical stage, oncology-focused pharmaceutical company committed to the development and commercialization of therapies that exploit the metabolic differences between normal cells and cancer cells.

Pharma is developing its lead product CPI-613® (devimistat), an investigational new drug for the treatment of solid tumors and hematologic malignancies. This molecule has been developed based on Altered Metabolism Directed (AMD) platform. It is a small molecule and suitable for intravenous (IV) administration.

RH Merger I, Inc.

RH Merger I, Inc., a Delaware corporation, is a wholly-owned subsidiary of Holdings (“Merger Sub I”) formed solely for the purpose of effectuating the Mergers. Merger Sub I has no material assets and does not operate any business. To date, Merger Sub I has not conducted any activities other than those incidental to its formation and the execution of the Merger Agreement. After the consummation of the Mergers, it will cease to exist.

The mailing address of Merger Sub I’s principal executive office is 520 Broad Street, Newark, New Jersey 07102.

10

Table of Contents

RH Merger II, LLC

RH Merger II, LLC, a Delaware limited liability company, is a wholly-owned subsidiary of Holdings (“Merger Sub II”) formed solely for the purpose of effectuating the Mergers. Merger Sub II has no material assets and does not operate any business. To date, Merger Sub II has not conducted any activities other than those incidental to its formation and the execution of the Merger Agreement. After the consummation of the Mergers, Pharma (as the surviving company of the merger with Merger Sub I) will merge with and into Merger Sub II with Merger Sub II being the surviving entity of the subsequent merger and Pharma is intended to become a wholly-owned limited liability subsidiary of Holdings.

The mailing address of Merger Sub II’s principal executive office is 520 Broad Street, Newark, New Jersey 07102.

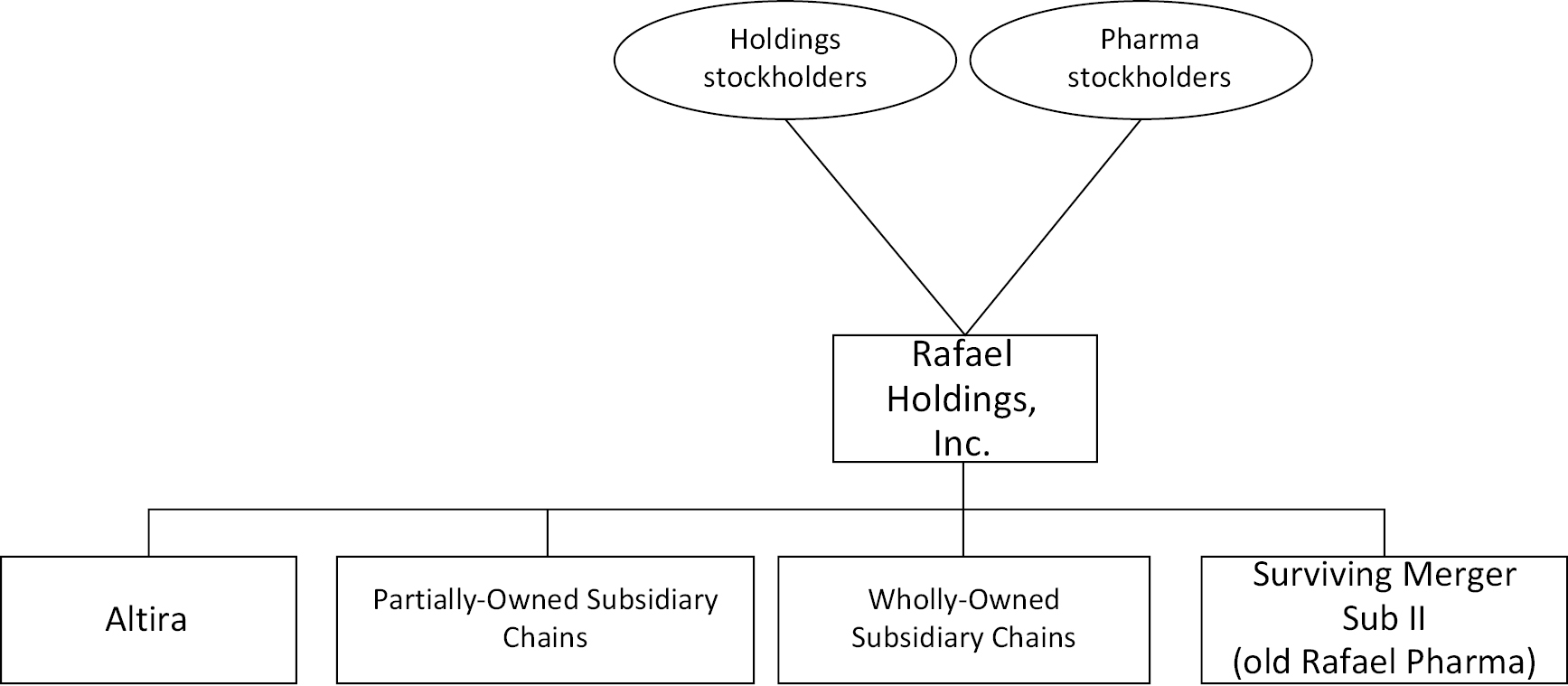

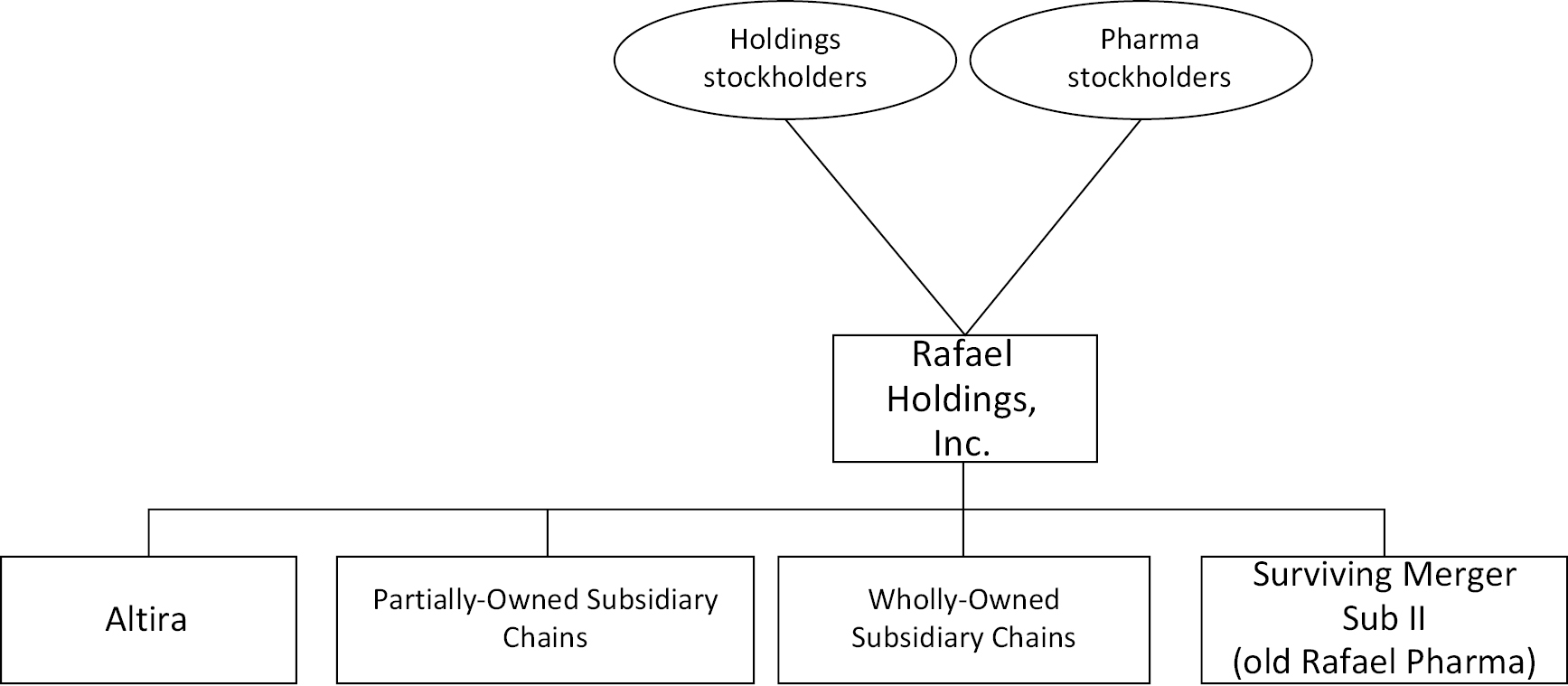

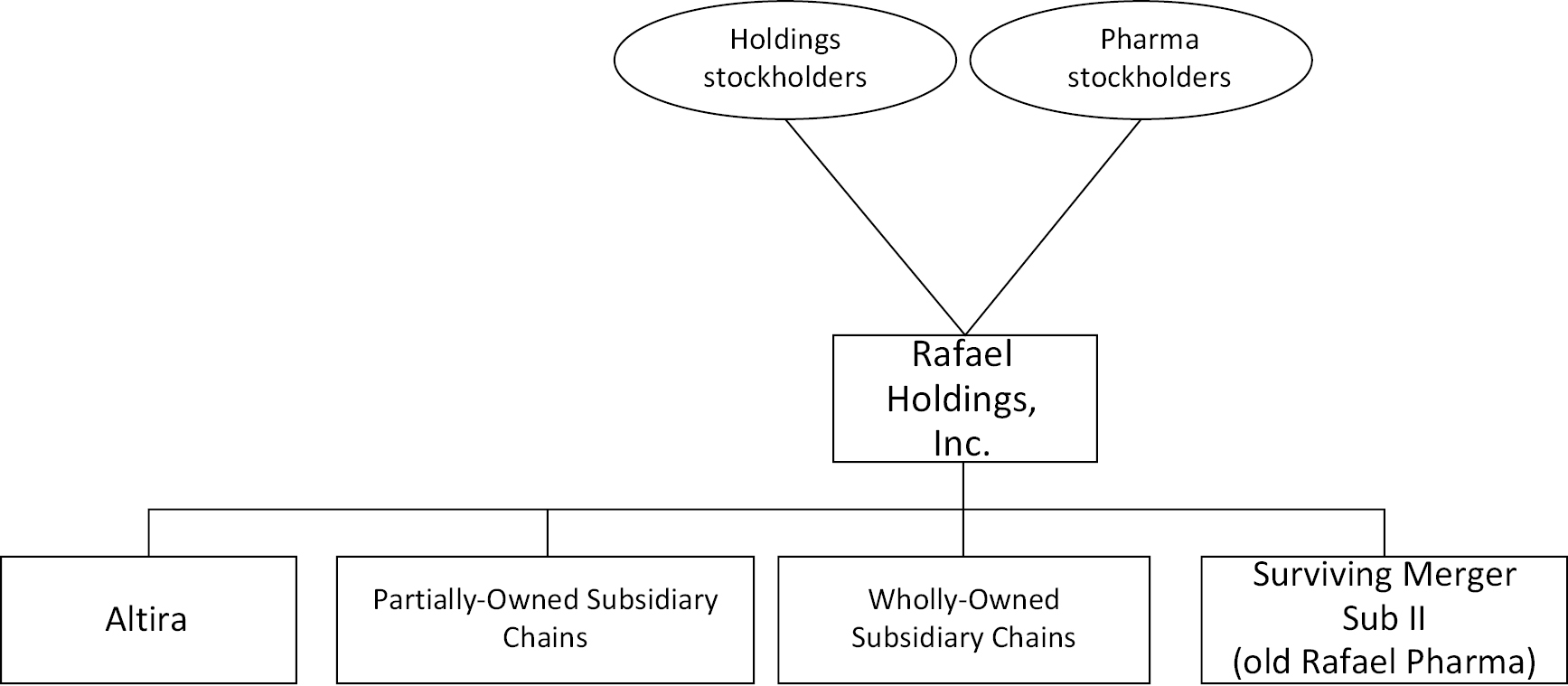

Company Structure — Diagrams (Page 52)

Upon consummation of the Transactions, Pharma is intended to become a direct, wholly-owned subsidiary of Parent. The following diagrams illustrate in simplified terms the current structure of Parent and Pharma and the expected structure of Parent following the consummation of the Transactions.

Current Structure of the Companies

Post-Closing Structure

Holdings Recommendation and Reasons for the Transaction (Page 53)

At a meeting held on June 14, 2021, following receipt of the recommendation of the Holdings Special Committee, the Holdings board of directors met in person and by teleconference to review the Merger. The Holdings board, acting upon the recommendation of the Holdings Special Committee (i) determined that it was fair to and in the best interests of Holdings and its stockholders for Holdings to enter into the Merger Agreement, (ii) declared the Merger Agreement and the transactions contemplated thereby advisable, (iii) adopted the Merger Agreement and approved the

11

Table of Contents

execution, delivery and performance of the Merger Agreement and of certain ancillary agreements thereto agreement, (iv) resolved to recommend adoption of the Merger Agreement and approval of the Mergers and the other transactions contemplated thereby by the holders of shares of Parent Common Stock and (v) directed that the Merger Agreement be submitted to the holders of shares of Parent Common Stock entitled to vote for its adoption.

Pharma Recommendation and Reasons for the Transactions

After consideration, the Pharma board of directors adopted resolutions determining that the Merger Agreement, the Mergers contemplated by the Merger Agreement and the other transactions contemplated by the Merger Agreement were advisable, fair to and in the best interests of Pharma and its stockholders, adopting and approving the Merger Agreement and the transactions contemplated thereby, including the Mergers, and directing that the Merger Agreement be submitted to the Pharma Stockholders for their consideration. Pharma’s board of directors recommends that the Pharma Stockholders adopt and approve the Merger Agreement and the transactions contemplated thereby, including the Mergers.

Opinion of Houlihan Lokey Capital, Inc. (Page 57)

On June 14, 2021, Houlihan Lokey Capital, Inc., which we refer to as Houlihan Lokey, verbally rendered its opinion to the Special Committee (which was subsequently confirmed in writing by delivery of Houlihan Lokey’s written opinion addressed to the Special Committee dated June 14, 2021), as to, as of such date, the fairness, from a financial point of view, to Holdings of the Aggregate Consideration (as defined in the opinion) to be paid by Holdings for the Acquired Shares in the Initial Merger pursuant to the Merger Agreement.

Houlihan Lokey’s opinion was directed to the Special Committee (in its capacity as such) and only addressed the fairness, from a financial point of view, to Holdings of the Aggregate Consideration to be paid by Holdings for the Acquired Shares in the Initial Merger pursuant to the Merger Agreement and did not address any other aspect or implication of the Business Combination or any other agreement, arrangement or understanding. The summary of Houlihan Lokey’s opinion in this prospectus/proxy statement is qualified in its entirety by reference to the full text of its written opinion, which is attached as Annex H to this prospectus and proxy statement and describes the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Houlihan Lokey in connection with the preparation of its opinion. However, neither Houlihan Lokey’s opinion nor the summary of its opinion and the related analyses set forth in this prospectus and proxy statement are intended to be, and do not constitute, advice or a recommendation to the Special Committee, Holdings’s Board of Directors, Holdings, any security holder of Holdings or any other person as to how to act or vote with respect to any matter relating to the Business Combination. See “The Business Combination — Opinion of Houlihan Lokey Capital, Inc.” beginning on page 57 of this proxy statement/prospectus.

Merger Consideration (Page 66)

Merger Agreement

As a consequence of the Mergers, at the Effective Time, each outstanding share of each class of Pharma capital stock will be automatically cancelled and retired and cease to exist, and will entitle a holder of shares of a given class of Pharma capital stock to receive 0.12045 shares of Parent Class B Common Stock per share of Pharma capital stock.

This Per Share Merger Consideration ratio for each class of Pharma capital stock is currently anticipated to result in prior holders of Pharma capital stock and contingent interests receiving Parent Class B Common Stock amounting to approximately 44% of the outstanding capitalization of Holdings following the Mergers based on the currently outstanding capitalization, including after giving effect to the Holdings Financing. Additional equity in Parent may be issued in connection with one or more financings and pursuant to employment agreements (which will reduce the foregoing percentage proportionately).

12

Table of Contents

Treatment of Company Warrants, Company Options, Company Convertible Notes and Contingent Rights (Page 69)

At the Effective Time, all compensatory options to purchase Pharma Common Stock shall automatically vest in full, and all holders of such options will receive options to purchase Class B common stock of Holdings using the ratios applicable to determining the Holdings stock in the Business Combination. The parties intend that the Company Convertible Notes will not be assumed or continued by Parent or Pharma in connection with the Merger or the other transactions contemplated by the Merger Agreement. All Company Warrants are intended to terminate at the Effective Time as contemplated by and in accordance with the Merger Agreement and the applicable Support Agreement.

Conditions to the Merger (Page 77)

Merger Agreement

The obligations of each of Parent, Pharma and Merger Subs to complete the Mergers are subject to the satisfaction (or waiver to the extent permissible under the Merger Agreement or applicable law) on or prior to the Effective Time of various conditions, including the following:

• The Registration Statement shall have been declared effective by the SEC under the Securities Act and no stop order suspending the effectiveness of the Registration Statement shall have been issued by the SEC and remain in effect, and no proceedings for that purpose shall be pending or threatened in writing by the SEC and not withdrawn or lapsed.

• No temporary restraining order, preliminary or permanent injunction or other order preventing the consummation of any of the Mergers shall have been issued by any court of competent jurisdiction and remain in effect, and no material Law shall have been enacted since the date of the Merger Agreement that makes consummation of any of the Mergers illegal.

• The Merger Agreement shall have been duly adopted by the Required Company Stockholder Vote and the Required Parent Stockholder Vote, and the Required Company Stockholder Vote and the Required Parent Stockholder Vote shall remain in full force and effect and, if the Registration Statement incorporates information by reference as contemplated in General Instruction A.2 of Form S-4 under the Securities Act, at least twenty business days (as defined pursuant to Form S-4) shall have elapsed from the date of the first mailing of the prospectus in the Registration Statement to Pharma stockholders until the date of the Closing.

• The Merger Agreement shall have been duly adopted by the Parent Minority Approval and the Company Minority Approval, each of the Parent Stockholder Approval and the Company Stockholder Approval have occurred, and all such approvals shall remain in full force and effect.

• The Merger Shares shall have been approved for listing on the NYSE, subject to official notice of issuance.

• The transactions contemplated by the Altira Acquisition Agreement shall have been consummated by all parties thereto in accordance with its terms; provided that such consummation shall not be a condition to Parent’s obligations to consummate the Merger if (a) Parent has not funded the payment amount thereunder before the Closing and (b) the Altira Acquisition Agreement has been consummated in all material respects by all parties thereto other than Parent (to the extent that such covenants require performance by such other parties at or before the Closing), including execution and delivery of any and all conveyance documents.

• The Certificate of Amendment to the Amended and Restated Certificate of Incorporation of Pharma in the form of attached to the Merger Agreement, shall have received the required director and stockholder approvals and been filed with the Delaware Secretary of State on a date prior to the Closing Date.

• Parent shall have consummated the Financing (which Financing has since been consummated).

13

Table of Contents

Conditions to the Obligations of Parent and the Merger Subs to Complete the Merger

In addition, the obligations of Parent and the Merger Sub to complete the Merger are also subject to the satisfaction (or waiver to the extent permissible under the Merger Agreement or applicable law) at or prior to the Closing of each of the following conditions:

• The Specified Representations (as defined in the Merger Agreement) that are qualified by materiality or Company Material Adverse Effect shall be true and correct in all respects as of the date of the Merger Agreement and as of the Closing Date with the same effect as though made on and as of the Closing (except to the extent expressly made as of an earlier date, in which case such representations and warranties shall be true and correct in all respects as of such earlier date). The Specified Representations that are not qualified by materiality or Company Material Adverse Effect shall be true and correct in all material respects as of the date of the Merger Agreement and as of the Closing Date with the same effect as though made on and as of the Closing (except to the extent expressly made as of an earlier date, in which case such representations and warranties shall be true and correct in all material respects as of such earlier date). The other representations and warranties of Pharma shall be true and correct (without giving effect to any limitation as to materiality or Company Material Adverse Effect set forth therein) as of the date of the Merger Agreement and of the Closing Date with the same effect as though made on and as of the Closing (except to the extent expressly made as of an earlier date, in which case such representations and warranties shall be true and correct as of such earlier date), except where the failure of such representations and warranties to be true and correct would not, individually or in the aggregate, have a Company Material Adverse Effect.

• Pharma shall have performed and complied with, in all material respects, all of its covenants hereunder at or before the Closing (to the extent that such covenants require performance by Pharma at or before the Closing).

• There shall not be pending any lawsuit or other Legal Proceeding challenging the Merger that (a) has been commenced by a Governmental Body of competent jurisdiction and (b) could reasonably be expected to result in an injunction or judgment in favor of such Governmental Body that would prevent consummation of the Merger; Parent shall have received the following agreements and documents, each of which shall be in full force and effect: (a) the D&O Resignations; (b) the Certificate of Merger, executed by Pharma; (c) a good standing certificate of Pharma from the Secretary of State of the State of Delaware dated within seven days prior to the Closing Date; and (d) the Lock-Up Agreements duly executed by each party thereto with respect to shares of Parent Class B Common Stock issued pursuant to the Merger (other than Parent).

• As of the Closing, the Chief Executive Officer or Chief Financial Officer of Pharma shall have delivered to Parent a certificate to the effect that each of the conditions specified in Sections 7.1 (Accuracy of Representations and Warranties), 7.2 (Performance of Covenants) and 7.8 (No Material Adverse Effect) is satisfied in all respects.

• There shall be no obligation to pay any royalties or similar payments on any sales of products incorporating the Company Intellectual Property (as defined in the Merger Agreement) other than as set forth in Pharma’s disclosure schedule and the third-party consents set forth on the Pharma Disclosure Schedules attached to the Merger Agreement shall have been obtained in form and substance reasonably satisfactory to Holdings.

• No Material Adverse Effect. Since the date of the Merger Agreement, no Company Material Adverse Effect shall have occurred that is continuing.

Conditions to the Obligations of Company to Complete the Merger

The obligation of Pharma to complete the Merger is subject to the satisfaction (or waiver to the extent permissible under the Merger Agreement), at or prior to the Closing, of the following conditions:

• The representations and warranties of Parent and the Merger Subs shall be true and correct in all material respects as of the date of the Merger Agreement and as of the Closing Date with the same effect as though made on and as of the Closing (except to the extent expressly made as of an earlier date, in which case such representations and warranties shall be true and correct in all respects as of such earlier date).

14

Table of Contents

• Parent and the Merger Subs shall have performed and complied with, in all material respects, all of their respective covenants hereunder at or before the Closing (to the extent that such covenants require performance by Parent or Merger Subs at or before the Closing).

• There shall not be pending before any court of competent jurisdiction any lawsuit or other Legal Proceeding challenging the Merger that has been commenced by a Governmental Body.

• Since the date of the Merger Agreement, no Parent Material Adverse Effect shall have occurred that is continuing.

• An authorized officer of Parent and the Merger Subs shall have delivered to Company a certificate to the effect that each of the conditions specified in Sections 8.1 (Accuracy of Representations and Warranties), 8.2 (Performance of Covenants) and 8.4 (No Material Adverse Effect) is satisfied in all respects.

• Parent shall have dissolved all of its direct and indirect subsidiaries (other than Merger Sub I and Merger Sub II) holding shares of Company capital stock or securities exercisable for or convertible into Company capital stock, or distributed or otherwise transferred, the shares of Company capital stock or securities exercisable for or convertible into Company capital stock held by such subsidiaries to Parent and the other members of such subsidiaries.

• The Lock-Up Agreements shall have been duly executed by each party thereto with respect to shares of Parent Class A Common Stock and Parent Class B Common Stock.

See “The Merger Agreement — Conditions to the Merger” beginning on page 77 of this proxy statement/prospectus.

Termination of the Agreements (Page 79)

The Merger Agreement may be terminated prior to the Effective Time (whether before or after the adoption of the Merger Agreement by the Required Company Stockholder Vote, except to the extent otherwise provided below) as follows:

• by mutual written consent of Parent and Pharma;

• by either Parent or Pharma, if:

• the Merger shall not have been consummated by the End Date; provided, however, that the right to terminate the Merger Agreement under Section 9.1(b) (Termination) shall not be available to Pharma, on the one hand, or to Parent, on the other hand, if such Party’s action or failure to act has been a principal cause of the failure of the Merger to occur on or before the End Date and such action or failure to act constitutes a breach of the Merger Agreement;

• a court of competent jurisdiction or other Governmental Body of competent jurisdiction shall have issued a final and non-appealable order, decree or ruling, in each case, having the effect of permanently restraining, enjoining or otherwise prohibiting or making illegal the Merger; provided, however, that the right to terminate the Merger Agreement under the foregoing section shall not be available to Pharma, on the one hand, or to Parent, on the other hand, if such Party did not use commercially reasonable efforts to have such order, decree or ruling vacated prior to its becoming final and non-appealable and such failure to use commercially reasonable efforts constitutes a breach of the Merger Agreement;

• each of the following are satisfied: (i) the Parent Stockholder Solicitation Period shall have run and elapsed and either (A) the Required Parent Stockholder Vote or (B) the Parent Minority Approval shall not have been obtained on or prior to the end of the Parent Stockholder Solicitation Period, or (ii) the Company Stockholder Solicitation Period shall have run and elapsed and either (x) the Required Company Stockholder Vote or (y) the Company Minority Approval shall not have been obtained on or prior to the end of the Company Stockholder Solicitation Period; provided however that the right to terminate the Merger Agreement under Section 9.1(f) (Termination) shall not be available to Pharma, on the one hand, or to Parent, on the other hand, if such Party’s action or failure to act has been a principal cause of the failure to obtain the approvals required pursuant to clauses (i) or (ii) hereof, as applicable, and such action or failure to act constitutes a breach of the Merger

15

Table of Contents

Agreement. Notwithstanding any other term in Section 9.1(f) (Termination), once the Required Company Stockholder Vote, the Company Minority Approval, the Required Parent Stockholder Vote and the Parent Minority Approval have been obtained, neither Parent nor Pharma may terminate the Merger Agreement pursuant to Section 9.1(f) (Termination).

• by Parent, if: