UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 10-K

___________________________

(Mark One)

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-39511

___________________________

BURFORD CAPITAL LIMITED

(Exact name of registrant as specified in its charter)

___________________________

| | | | | | | | |

| Bailiwick of Guernsey | | N/A |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification no.) |

| Oak House, Hirzel Street, St. Peter Port, Guernsey | | GY1 2NP |

| (Address of principal executive offices) | | (Zip code) |

+44 1481 723 450

(Registrant’s telephone number, including area code)

___________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary shares, no par value | BUR | New York Stock Exchange |

| Ordinary shares, no par value | BUR | London Stock Exchange AIM |

Securities registered pursuant to section 12(g) of the Act: None

___________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | o |

| Non-accelerated filer | o | | Smaller reporting company | o |

| | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2024, the aggregate market value of ordinary shares, no par value (“ordinary shares”), held by non-affiliates of the registrant was $2,601,352,143 based on the closing price of ordinary shares as reported by the New York Stock Exchange on June 30, 2024).

As of February 24, 2025, there were 219,421,904 ordinary shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K for the year ended December 31, 2024 (this “2024 Form 10-K”), to the extent not set forth in this 2024 Form 10-K, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the annual general meeting of shareholders to be held in 2025, which definitive proxy statement shall be filed with the US Securities and Exchange Commission within 120 days of December 31, 2024.

Table of contents

Forward-looking statements

This Annual Report on Form 10-K for the year ended December 31, 2024 (this “2024 Form 10-K”) contains “forward-looking statements” within the meaning of Section 27A of the US Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the US Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are intended to be covered by the safe harbor provided for under these sections. In some cases, words such as “aim”, “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “forecast”, “guidance”, “intend”, “may”, “plan”, “potential”, “predict”, “projected”, “should” or “will”, or the negative of such terms or other comparable terminology, are intended to identify forward-looking statements. Although we believe that the assumptions, expectations, projections, intentions and beliefs about future results and events reflected in forward-looking statements have a reasonable basis and are expressed in good faith, forward-looking statements involve known and unknown risks, uncertainties and other factors, which could cause our actual results and events to differ materially from (and be more negative than) future results and events expressed, projected or implied by these forward-looking statements. Factors that might cause future results and events to differ include, among others, the following:

▪Adverse litigation outcomes and timing of resolution of litigation matters

▪Our ability to identify and select suitable legal finance assets

▪Improper use or disclosure of, or access to, privileged information under our control due to cybersecurity breaches, unauthorized use or theft

▪Inaccuracy or failure of the probabilistic model and decision science tools, including machine learning technology and generative artificial intelligence (collectively, “AI technologies”), we use to predict the returns on our legal finance assets and in our operations

▪Changes and uncertainty in laws, regulations and rules relating to the legal finance industry, including those relating to privileged information and/or disclosure and enforceability of legal finance arrangements

▪Inadequacies in our due diligence process or unforeseen developments

▪Credit risk and concentration risk relating to our legal finance assets

▪Lack of liquidity of our legal finance assets and commitments in excess of our available capital

▪Our ability to obtain attractive external capital, refinance our outstanding indebtedness or raise capital to meet our liquidity needs

▪Competitive factors and demand for our services and capital

▪Failure of lawyers to prosecute and/or defend claims which we have financed with necessary skill and care or misalignment of their clients' interests with ours

▪Poor performance by the commitments we make on behalf of our private funds

▪Negative publicity or public perception of the legal finance industry or us

▪Valuation uncertainty with respect to the fair value of our capital provision assets

▪Current and future legal, political and economic factors, including uncertainty surrounding the effects, severity and duration of public health threats and/or military actions

▪Developments in AI technologies and expectations relating to environmental, social and governance (“ESG”) considerations

▪Potential liability from litigation and legal proceedings against us

▪Our ability to hire and retain key personnel

▪Risks relating to our international operations as a result of differing legal and regulatory requirements, political, social and economic conditions and unforeseeable developments

▪Exposure to foreign currency exchange rate fluctuations

▪Uncertainty relating to the tax treatment of our financing arrangements

▪Cybersecurity risks and improper functioning of our information systems or those of our third-party service providers

▪Failure of our third-party service providers to fulfill their obligations or misconduct by our third-party service providers

▪Failure by us to maintain the privacy and security of personal information and comply with applicable data privacy and protection laws and regulations

▪Failure by us to maintain effective internal control over financial reporting or effective disclosure controls and procedures

▪Failure by us to comply with the requirements of being a US domestic public company and the costs associated therewith

▪Certain risks relating to our incorporation in Guernsey

▪Other factors discussed under “Risk factors”

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements contained in this 2024 Form 10-K and other periodic and current reports that we file with or furnish to the US Securities and Exchange Commission (the "SEC"). Many of these factors are beyond our ability to control or predict, and new factors emerge from time to time. Furthermore, we cannot assess the impact of each such factor on our business or the extent to which any factor or combination of factors may cause actual results and events to be materially different from those contained in any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements.

All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The forward-looking statements speak only as of the date of this 2024 Form 10-K and, except as required by applicable law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Glossary

In this 2024 Form 10-K, references to “Burford”, “we”, “us” or “our” refer to Burford Capital Limited and its subsidiaries, unless the context requires otherwise.

Certain additional terms used in this 2024 Form 10-K are set forth below:

Advantage Fund

Burford Advantage Master Fund LP, a private fund focused on pre-settlement litigation strategies where litigation risk remains, but where the overall risk return profile is generally lower than assets funded directly by our balance sheet. Investors in the Advantage Fund include third parties as well as Burford’s balance sheet. Assets held by the Advantage Fund are recorded as capital provision assets.

Asset management

Includes our activities administering the private funds we manage for third-party investors.

Asset Management and Other Services segment

One of our two reportable segments. Asset Management and Other Services includes the management of legal finance assets on behalf of third-party investors through private funds, and provides other services to the legal industry.

Asset recovery

Pursuit of enforcement of an unpaid legal judgment, which may include our financing of the cost of such pursuit and/or judgment enforcement.

BAIF

Burford Alternative Income Fund LP, a private fund focused on post-settlement matters.

BAIF II

Burford Alternative Income Fund II LP, a private fund focused on post-settlement matters.

BCIM

Burford Capital Investment Management LLC, a wholly owned indirect subsidiary of Burford Capital Limited, serves as the investment adviser to all of our private funds and is registered under the US Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”).

BOF

Burford Opportunity Fund LP, a private fund focused on pre-settlement legal finance matters.

BOF-C

Burford Opportunity Fund C LP, a private fund through which a sovereign wealth fund invests in pre-settlement legal finance matters under the sovereign wealth fund arrangement.

Burford-only (non-GAAP)

A basis of presentation that refers to assets, liabilities and activities that pertain only to Burford on a proprietary basis, excluding any third-party interests and the portions of jointly owned entities owned by others.

Capital provision assets

Financial instruments that relate to the provision of capital in connection with legal finance.

Claimant or plaintiff

The party asserting a right or title in a legal proceeding.

Colorado

Colorado Investments Limited, an exempted company that was established for the secondary sale of some of our entitlement in the YPF-related Petersen matter.

COLP

BCIM Credit Opportunities, LP, a private fund focused on post-settlement matters.

Consolidated funds

Certain of our private funds in which, because of our investment in and/or control of such private funds, we are required under the generally accepted accounting principles in the United States (“US GAAP”) to consolidate the minority limited partner’s interests in such private funds and include the full financial results of such private funds within our consolidated financial statements. As of the date of this 2024 Form 10-K, BOF-C and the Advantage Fund are consolidated funds.

Defendant or respondent

The party against whom a civil action is brought in a legal proceeding.

Deployment

Financing provided for an asset, which adds to our deployed cost in such asset.

Definitive commitments

Commitments where we are contractually obligated to advance incremental capital and failure to do so would typically result in adverse contractual consequences (such as a dilution in our returns or the loss of our deployed capital in a case).

Discretionary commitments

Commitments where we are not contractually obligated to advance capital and generally would not suffer adverse financial consequences from not doing so.

Fair value adjustment

The amount of unrealized gain or loss recognized in our consolidated statements of operations in the relevant period and added to or subtracted from, as applicable, the asset or liability value in our consolidated statements of financial condition.

Group-wide

A basis of presentation which refers to the totality of assets managed by us, which includes assets financed by our balance sheet through our Principal Finance segment and assets financed by third-party capital through our Asset Management and Other Services segment.

Judgment debtor

A party against whom there is a final adverse court award.

Judgment enforcement

The activity of using legal and financial strategies to force a judgment debtor to pay an adverse award made by a court.

Legal finance

The provision of capital against the underlying value of litigation and legal assets.

Legal risk management

Relates to matters where we provide some form of legal risk arrangement, such as an indemnity or insurance for adverse legal costs. These services are typically provided in conjunction with the financing of a legal finance asset.

Litigation

We use the term litigation colloquially to refer to any type of matter involved in the litigation, arbitration or regulatory process and the costs and legal fees associated therewith.

LTIP

The Burford Capital 2016 Long Term Incentive Plan, as amended and renewed from time to time, or any successor plan thereto.

Monetization

The acceleration of a portion of the expected value of a litigation or arbitration matter prior to resolution of such matter, which permits a client to convert an intangible claim or award into tangible cash on a non-recourse basis.

NED Plan

The Burford Capital Limited 2021 Non‐Employee Directors’ Share Plan, as amended from time to time.

Net realized gain or loss

The sum of realized gains and realized losses.

Non-consolidated funds

Certain of our private funds that we are not required to include within our consolidated financial statements but include within group-wide data. As of the date of this 2024 Form 10-K, (i) BCIM Partners II, LP, (ii) BCIM Partners III, LP, (iii) COLP, (iv) BOF, (v) BAIF and (vi) BAIF II and any “sidecar” funds are non-consolidated funds.

NQDC Plan

The Burford Capital Deferred Compensation Plan, as amended from time to time.

Portfolio

The sum of the fair value of capital provision assets and the undrawn commitments.

Post-Settlement

Includes our financing of legal-related assets in situations where litigation has been resolved, such as financing of settlements and law firm receivables. At the date of this annual report, our post settlement activity occurs primarily in COLP, BAIF and BAIF II.

Principal Finance segment

One of our two reportable segments. Principal Finance includes the allocation of capital to legal finance assets from our balance sheet, primarily as capital provision assets, and in limited scope through interests in private funds managed by Burford.

Privileged information

Confidential information that is protected from disclosure due to the application of a legal privilege or other doctrine, including attorney work product, depending on the laws of the relevant jurisdiction.

PSUs

Performance share units awarded to employees under the LTIP.

Realization

A legal finance asset is realized when the asset is concluded (i.e., when litigation risk has been resolved). A realization will result in us receiving cash or, occasionally, non-cash assets, or recognizing a due from settlement receivable, reflecting what we are owed on the asset.

Realized gain or loss

Reflects the total amount of gain or loss, relative to cost, generated by a legal finance asset when it is realized, calculated as realized proceeds less deployed cost, without regard for any previously recognized fair value adjustment.

RSUs

Restricted share units awarded to employees under the LTIP.

Share-based awards

The total of RSUs and PSUs awarded to employees under the LTIP.

Strategic Value Fund

BCIM Strategic Value Master Fund, LP, a private fund that deployed capital in certain complex strategies assets. Investors in the Strategic Value Fund included third parties as well as Burford’s balance sheet. Assets held by the Strategic Value Fund were recorded as capital provision assets, and the Strategic Value Fund was a consolidated fund. As of December 31, 2023, all assets held at the Strategic Value Fund have concluded, and the Strategic Value Fund was liquidated.

Sovereign wealth fund arrangement

The agreement we have entered into with a sovereign wealth fund pursuant to which it provides financing for a portion of our legal finance assets through BOF-C. Under this agreement, we (in our capacity as the appointed investment adviser) receive reimbursement of expenses from BOF-C up to a certain level before we or the sovereign wealth fund, as applicable, receive a return of capital. After the repayment of capital, we then receive a portion of the return generated from the assets held by BOF-C, which is reported as profit sharing income from private funds.

Total segments

Refers to the sum of our two reportable segments, (i) Principal Finance and (ii) Asset Management and Other Services, and is presented on a Burford-only basis.

Unrealized gain or loss

Represents the fair value of our legal finance assets over or under their deployed cost, as determined in accordance with the requirements of the applicable US GAAP standards, for the relevant financial reporting period (consolidated statements of operations) or cumulatively (consolidated statements of financial condition).

Vintage

Refers to the calendar year in which a legal finance commitment is initially made.

YPF-related assets

Refers to our Petersen and Eton Park legal finance assets, which are two claims relating to the Republic of Argentina’s nationalization of YPF S.A., the Argentine energy company.

Notes on changes to reporting framework

Burford has always focused on providing disclosure that represents what shareholders actually own, which is reflected in the “Burford-only” basis of financial reporting. “Burford-only” reporting removes the impact of private fund entities that must be consolidated under accounting standards, even though economic ownership resides with a third party.

Beginning with our reporting for the year ended December 31, 2024, the Burford-only disclosure is enhanced with a more prominent use of segment reporting through two reportable segments: (i) “Principal Finance” (which captures the financial impact of the legal finance portfolio funded by Burford’s balance sheet) and (ii) “Asset Management and Other Services” (which captures fee income from Burford’s private funds funded by third-party capital and income earned from other service-related operations). Under US reporting standards, the use of segment reporting allows for more efficient and helpful disclosure on the key metrics that illuminate how Burford generates shareholder value in each segment.

The sum of Burford’s two reportable segments is referenced as “Total segments” in certain disclosure schedules, which is consistent and identical to reporting on an aggregate “Burford-only” basis.

The Principal Finance segment reporting is further simplified by discontinuing the use of the labels “capital provision-direct” or “core portfolio” (which described direct funding of legal finance assets by Burford’s balance sheet) and “capital provision-indirect” (which described indirect funding of legal finance assets through commitments made by Burford’s balance sheet to private funds). Performance track record measures such as return on invested capital (ROIC) and internal rate of return (IRR) is entirely consistent with prior reporting and reflect direct funding by the balance sheet (formerly referred to as “capital provision-direct” or “core portfolio”), excluding the impact of any balance sheet commitments to private funds.

Part I

Item 1. Business

Introduction

Burford is the world’s largest dedicated provider of capital, based on portfolio size, against the underlying value of litigation and legal assets, which we colloquially call legal finance.

We are a global firm that serves the industry of law by providing an array of financial products and services. Our largest business is providing capital to clients engaged in ongoing legal disputes, which they can use to pay the legal fees and expenses associated with disputes, to monetize the expected future value of disputes or to do both. Our focus is on large, complex disputes, not on small-scale litigation typically pursued by consumers or small businesses. We rarely engage in transactions in which we are providing less than $5.0 million in capital, and we frequently provide multiples of that amount up to hundreds of millions of dollars. Since our inception in 2009, we made commitments of more than $11.2 billion into legal finance assets on a group-wide basis.

Our clients are a wide range of litigants including a number of the world’s largest law firms and businesses. Legal finance allows law firm clients to obtain cash to operate their businesses and pay the salaries of their lawyers even when they have taken a case on a contingent fee or alternative fee basis. It also allows law firms that prefer to operate on an hourly basis to compete for contingency or alternative fee work. We have received financing inquiries from 94 of the 100 largest US law firms by revenue according to the 2024 rankings by The American Lawyer and 92 of the 100 largest global law firms by revenue according to the 2024 rankings by The American Lawyer as well as large regional firms and litigation boutiques. Legal finance allows litigants to hire law firms that generally work on an hourly fee basis without incurring those fees, and potentially to accelerate a portion of an expected recovery on the business's preferred schedule. Further, legal finance may enable clients to avoid incurring legal fees as an operating expense, and thus improve net income metrics, as well as boost liquidity by obtaining cash through upfront monetization of legal assets that otherwise would not be reflected in their financial statements.

We fund our legal finance portfolio primarily from our balance sheet using modest leverage, with the aim of re-investing proceeds to grow and compound returns. Our principal financing activities are supplemented by the use of third-party capital through private funds, from which we earn asset management income.

Today, we manage a group-wide legal finance portfolio of $7.4 billion. Our portfolio is diversified by geography and type of legal claim and is, we believe, the largest of its kind globally. Over the last 15 years, it has grown by a multiple of more than 50x when compared to $130 million raised at our inception.

In an industry that continues to grow and evolve, we believe we enjoy a substantial competitive advantage, given our lifetime track record of generating strong returns, our growing proprietary data set drawn from thousands of cases that guides optimal underwriting decisions, our balance sheet scale, our diversity of funding, our quality of team and our brand recognition.

In addition to legal finance, we see opportunity and potential growth for our company in providing certain additional service offerings within the business of law.

History and development

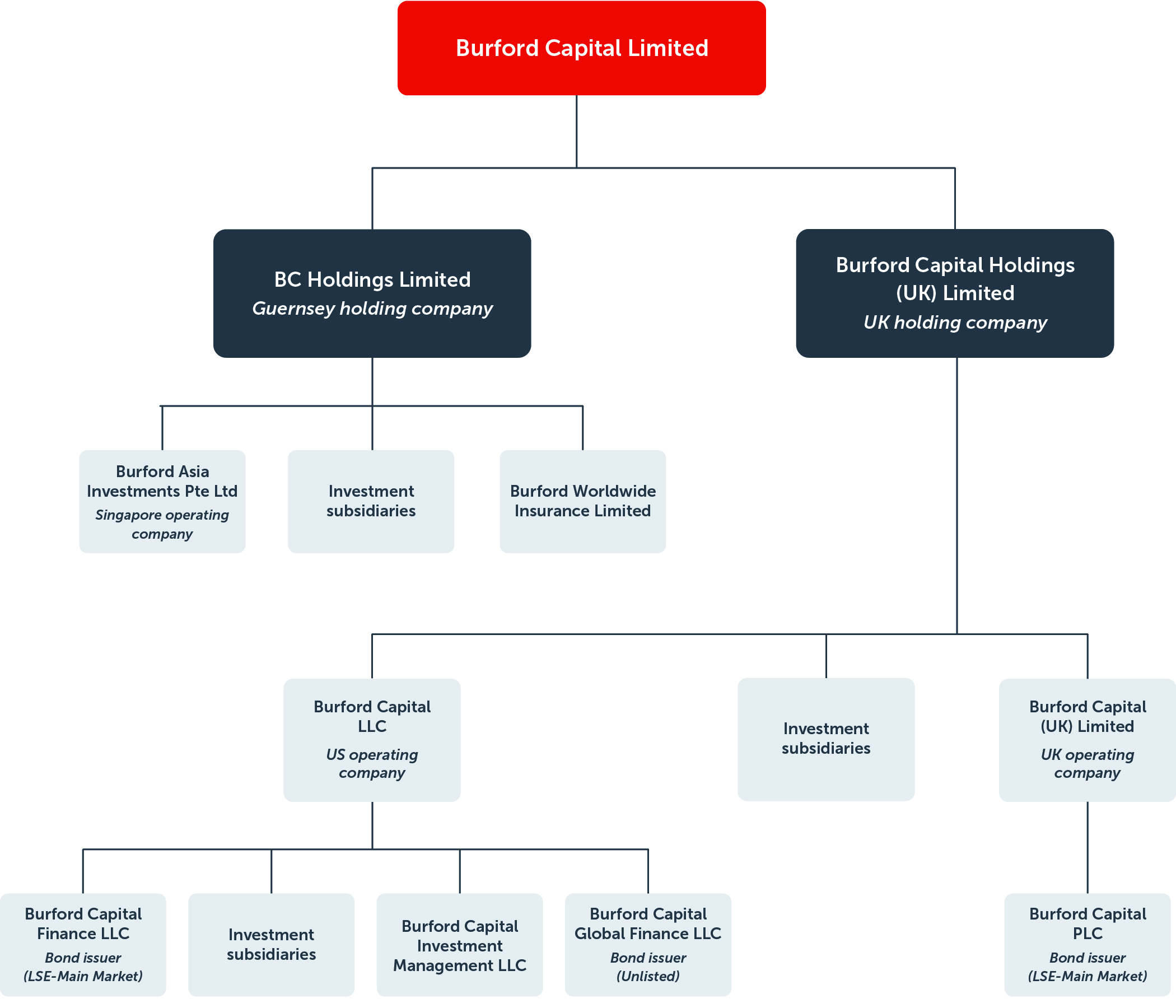

We are composed of our parent company, Burford Capital Limited, and numerous wholly owned subsidiaries in various jurisdictions through which our operations are conducted and our capital is deployed. Burford Capital LLC is a wholly owned indirect subsidiary of Burford Capital Limited and our primary operating company in the United States, and Burford Capital (UK) Limited is a wholly owned indirect subsidiary of Burford Capital Limited and our primary operating company in the United Kingdom. These two entities provide various corporate and investment advisory services to other group companies. Our parent company, Burford Capital Limited, does not have any operations or employees. See “—Organizational structure” for additional information with respect to our organizational structure.

In 2009, our founders launched Burford with a shared vision of an entity supported by permanent capital that could provide bespoke financing to help businesses and law firms address the significant economic challenges they faced in managing legal costs. At the time, the few capital providers addressing this investment proposition were generally domiciled in the United Kingdom, where prior judicial system reforms had permitted the entry of third-party capital into the delivery of a range of legal services. Thus, despite the investment adviser’s team being based in the United States, Burford Capital Limited was incorporated in the Bailiwick of Guernsey (“Guernsey”) as a closed-end fund company limited by shares on September 11, 2009 with a view to list the vehicle on the London Stock Exchange through an offering of new shares. Following

that initial public offering, Burford’s ordinary shares, under the symbol “BUR”, were admitted to trading on AIM, a market operated by the London Stock Exchange (“AIM”), on October 21, 2009.

Increased demand for our capital proposition soon meant the closed-end fund structure was insufficient to address the market opportunity. In 2012, our shareholders voted in support of a proposal to reconstitute Burford as a unitary, specialty finance operating company. The reconstitution permitted more debt capital to be raised to fund growth than was possible under the closed-end fund vehicle and, between 2014 and 2018, we raised $693.0 million through the sale of bonds listed on the Main Market of the London Stock Exchange, and the fair value of our capital provision assets grew by more than 6x. Outgrowing the UK bond market’s capacity to provide the US dollar funding needed to match the principal currency denomination of our legal finance assets, we sought credit ratings to facilitate access to the US private debt market and we duly obtained a maiden corporate family rating from Moody’s in October 2019 and a long-term debt rating from Standard & Poor’s in November 2019.

We have also made a few strategic acquisitions to support inorganic growth. Our acquisition in 2011 of Firstassist Legal Expenses Insurance, a leading provider of litigation expenses insurance in the United Kingdom, provided footprint in London and was the basis of our legacy adverse cost insurance business. Our acquisition in 2015 of a business intelligence firm Focus Intelligence Ltd enabled us to provide clients judgment enforcement services for their funded disputes. Our acquisition in 2016 of GKC Holdings, LLC, a law-focused asset manager registered as an investment adviser with the SEC, formed the initial core of our asset management business as well as expanded our US footprint and our ability to finance patent disputes.

To support further development of our standing in US capital markets, in 2020, Burford Capital Limited registered with the SEC as a “foreign private issuer”, which, among other things, allowed us to issue annual consolidated financial statements on Form 20-F and interim condensed consolidated financial statements on Form 6-K and exempted us from certain provisions applicable to US domestic public companies. We secured the admission of our ordinary shares on the New York Stock Exchange (the “NYSE”) on October 19, 2020, also under the symbol “BUR”. Subsequently, our subsidiaries issued $1.4 billion of debt securities through private placement transactions under Rule 144A and Regulation S under the Securities Act. See note 12 (Debt) to our consolidated financial statements contained in this 2024 Form 10-K for additional information with respect to our debt securities. Upon determining that the majority of our ordinary shares were held in the United States as of June 30, 2024, we no longer qualified as a “foreign private issuer” effective as of January 1, 2025. We are now subject to the same disclosure and financial reporting requirements as most US domestic public companies listed on the NYSE.

We maintain our registered address at Oak House, Hirzel Street, St. Peter Port, Guernsey GY1 2NP. Our telephone number at our registered address is +44 1481 723 450.

Our industry

Since our launch, the legal finance industry has experienced significant growth due to factors including increased visibility and normalization, greatly expanded use cases and regulatory and other developments that have fueled its practice in more jurisdictions. In our early days, our clients were often businesses that were unable or unwilling to pay their law firms’ hourly fees, and our financing served to bridge the gap between the needs of legal departments for risk-sharing and the reality that as cash partnerships many law firms have limited capacity to take on the substantial multi-year risk of working on a contingent fee basis. But the legal finance industry has grown considerably beyond this initial emphasis on simple cost and risk management for single claims. Law firms now use legal finance, in particular multi-case portfolios, to pursue new business and build books of high-value contingent claims. Equally if not more important, businesses including very large companies now use legal finance as a form of corporate finance for the legal department that allows them to accelerate high-value recoveries and preserve their working capital for revenue-generating activities. Increasingly, both law firms and businesses embrace legal finance as a tool for growth.

We believe our addressable market in legal finance to be focused on three areas of legal activity: (i) the underlying asset value of litigation claims and the enforcement of settlements, judgments and awards; (ii) the amount paid to law firms as legal fees and expenses; and (iii) the value of assets affected by litigation. We believe that each of these areas is of significant size, that their size is much greater than the supply of capital available and that we remain at an early stage of market development. In 2023, for instance, the most recent year of available industry data, the value of the largest 100 US verdicts was $23 billion1 and the value of pending arbitration cases before the International Chamber of Commerce's International Court of Arbitrati

1 ALM VerdictSearch, "The Top 100 Verdicts of 2023"

on was $255 billion2. Alternatively, annualized global legal fees were $819 billion3, of which $404 billion was in the United States, while estimated revenue of the largest 200 US law firms was $165 billion4. We continuously look for new opportunities to capitalize on deploying capital into, or otherwise generating returns from, the legal finance sector.

In addition to the legal finance market, the market for legal services, including not only legal fees but all of the other costs and expenses associated with litigation (including, among others, the costs of expert witnesses, jury consultants, court reporters, trial graphics, settlement administrators and electronic discovery vendors), is substantial and growing.

Segments

We provide a variety of legal finance services to our clients through our two segments: (i) Principal Finance and (ii) Asset Management and Other Services.

Principal Finance

Our Principal Finance segment allocates capital to legal finance assets from our balance sheet, primarily as capital provision assets and in limited scope through interests in private funds managed by us. These balance sheet capital provision assets and private fund interests generate capital provision income, which is the most significant driver of our total revenues.

Funding our legal finance portfolio predominantly using our own capital allows us, we believe, to maximize earnings and cash flow capacity for shareholders, compound our book value per share at a higher rate and achieve the most efficient financing strategy for the higher risk/return profile of this asset class. We utilize access to debt capital markets to modestly leverage the Principal Finance segment portfolio at an attractive cost of capital relative to our target returns and maintain a laddered debt maturity structure with an average maturity in excess of the expected average life of our portfolio assets.

We predominantly provide capital to clients, and in that capacity we remain passive investors without control of litigation. In limited instances we may purchase a claim and have greater rights over litigation decision-making but remain a third party to the litigation. In other instances, we may make an investment in which an asset's value is impacted by litigation but we are the principal and have no client.

The scope of our Principal Finance portfolio is broad and encompasses a wide variety of structures, risk levels and anticipated returns. We provide capital against the underlying value of high-value single or multiple litigation and arbitration matters at any stage of the process, from before filing to after a final judgment has been entered. In some instances, we provide capital to a law firm that has agreed to take a case on a contingent fee or alternative fee basis. In other instances, we provide capital directly to the client. Our provision of capital may finance the costs of the fees and/or expenses needed to take the matter forward, or it may monetize some of the potential future value of a claim by providing an upfront cash payment to the client. In return, we receive our contractually agreed entitlement from the ultimate settlement, judgment or award on the claim and, if the claim does not produce any cash proceeds or other value, we generally lose our capital. At times we provide capital for multiple cases for the same client in cross-collateralized portfolios with terms that recognize the lower risk of loss generally associated with such diversified portfolios. Portfolios allow us to originate larger volumes of assets with greater efficiency, as well as to provide clients financing for cases that could otherwise be difficult to finance. We also deploy capital in other ways to express a view about litigation outcomes, such as by purchasing securities whose future value may be affected by litigation outcomes or by acquiring assets that are or can be the basis for legal claims.

We also provide legal risk management services to help protect clients against certain adverse litigation outcomes, including the risk of being held liable for adverse costs. In many legal jurisdictions (although generally not in the United States), the loser in a litigation must pay the winner’s legal expenses, creating adverse legal cost risk. Adverse legal cost risk can be a significant obstacle for clients, especially in the kind of larger complex litigation that is the focus of our core legal finance business. Burford Worldwide Insurance Limited, our wholly owned Guernsey licensed insurer, offers adverse legal cost insurance globally in litigation and arbitration cases that we are financing as part of our Principal Finance business, providing a further impetus for clients to work with us.

2 International Chamber of Commerce Dispute Resolution 2023 Statistics

3 The Business Research Company, "Legal Services Global Market report 2025"

4 Burford analysis of AmLaw 100 and AmLaw 200 data rankings 2023

Asset Management and Other Services

Our Asset Management and Other Services segment manages legal finance assets on behalf of third-party investors and provides other services to the legal industry. We receive fees for both of these types of activities. As of December 31, 2024, we operated eight private funds and three “sidecar” funds as an investment adviser registered with and regulated by the SEC. As of December 31, 2024 and 2023, our total assets under management (“AUM”) were $3.5 billion and $3.4 billion, respectively. We believe that we are the largest investment manager focused solely on the legal finance sector by a considerable margin.

Over the course of our history, we have used private fund capital to finance our portfolio across the risk / return spectrum and acquired in 2016 a fund management business to enhance our access to third-party capital. While currently we expect to prioritize the favorable economics of allocating capital from our balance sheet, we maintain a sizable asset management portfolio. Our most recently raised private funds focused on allocating to assets with a lower overall risk/return profile compared to our balance sheet, and our strategic sovereign wealth fund partner has invested alongside the balance sheet.

See “Management's discussion and analysis of financial condition and results of operations—Segments—Asset Management and Other Services segment—Private funds” for additional information with respect to the key statistics for each of our private funds.

Legal finance capital allocation

We allocate legal finance assets to different pools of capital based on their overall risk / return profile, which encompasses a range of characteristics, including, among others:

▪Expected yield and range of potential yield outcomes

▪Risk of capital loss and ability to contractually protect principal

▪Expected duration, including duration risk

▪Currency risk

▪Stage of legal process (merits risk and appeal risk)

▪Collection risk (counterparty creditworthiness and enforcement)

There are generally three pools of capital from which we currently or have historically funded legal finance assets:

▪Our balance sheet

▪Our sovereign wealth fund arrangement (BOF-C)

▪Various private funds managed by us (in some cases, including allocations from our balance sheet as a limited partner)

Our capital allocation policy for the legal finance portfolio, at any given point in time, has set clear parameters to determine allocation of capital to new legal finance assets based on a combination of the risk / return characteristics noted above. We have always maintained a disciplined policy framework that avoids conflicts of interest between our balance sheet and our third-party capital providers. When our balance sheet and third-party capital providers co-invest in a deal, we typically apportion the new legal finance asset based on a formulaic allocation policy to each capital provider. Over time, the composition and investment objectives of our third-party capital providers have evolved alongside broader market dynamics. We continually seek to maximize the operational efficiency of our platform to deliver attractive economics to our shareholders and, as a result, our capital allocation framework for the legal finance portfolio has evolved over time as well.

In general terms, our balance sheet has historically allocated to legal finance assets with a higher overall risk / return profile, supplemented at varying levels over time by BOF-C, our sovereign wealth fund arrangement, and certain private funds for which the investment period has now concluded. These private funds include BCIM Partners II, LP, BCIM Partners III, LP and BOF.

BOF-C’s fund commitment was fully utilized by September 2024 and thus BOF-C did not participate in further new commitments following that date through December 31, 2024, the end date of the BOF-C investment period. Burford and BOF-C are in active discussions about extending the investment period and expanding BOF-C’s commitment.

Our other private funds have generally allocated to legal finance assets with a lower overall risk / return profile, which can be generally addressed in two categories:

▪First, we offer our clients the ability to monetize post-settlement and other legal receivables, where little or no litigation risk remains. These assets are underwritten to target returns more similar to fixed income investments, and we have historically funded them with third-party capital through

COLP and its successor private funds BAIF and BAIF II. While the investment periods for COLP and BAIF concluded in 2019 and 2022, respectively, the investment period for BAIF II extends to September 2025.

▪Second, driven by an era of sustained low interest rates, we launched the Advantage Fund in 2022 to allocate capital to legal finance assets that (i) were pre-judgment or pre-settlement and (ii) presented an overall risk / return profile that was generally lower than those allocated to our balance sheet, but generally higher than our post-settlement strategies. The investment period for the Advantage Fund concluded in December 2024, and our balance sheet holds a 17% stake in the Advantage Fund.

Currently, we are pursuing a deliberate strategy to prioritize the allocation of capital from our balance sheet, as we believe capital provision income offers more attractive return economics for our shareholders compared to asset management fees. At the same time, a higher interest rate environment has altered the market appeal of private fund products like the Advantage Fund, and we believe it would be challenging to raise a successor private fund at this time at pricing terms that we would find attractive.

Consistent with this strategic evolution, our Principal Finance segment will selectively evaluate a wider range of legal finance opportunities with a diversified mix of risk / return characteristics. Our market opportunity is not static as this emerging alternative asset class continues to evolve and grow.

Operating processes

Origination and underwriting

Our origination and underwriting teams generate new opportunities to commit capital to legal finance assets, to be deployed over a period of time and/or upfront against those assets, both from our balance sheet and our private funds.

We engage in extensive marketing and origination activities. Upon receipt of inbound inquiries, we undertake an initial screening process that is intended to filter investable opportunities into our pipeline. Once a potential opportunity progresses into our pipeline, it is assigned to individual underwriters to conduct extensive in-house due diligence with input from our global team, including comprehensive legal and factual analysis. In addition, we undertake quantitative probabilistic modeling using proprietary analytical tools that rely on third-party data as well as a significant proprietary dataset we have developed since our inception in 2009.

Opportunities that satisfy the requirements of our in-house due diligence are then presented for review by our dedicated Commitments Committee, which is comprised of certain members of the management committee (the “Management Committee”) and senior members of the underwriting team (the “Commitments Committee”). All commitments of capital must be approved by the Commitments Committee, which considers legal and factual merits and risks, reasonably recoverable damages, proposed budget, proposed terms, collection issues and enforceability. If the Commitments Committee approves the opportunity, our underwriters negotiate terms with the goal of closing a transaction to provide the committed capital against the asset.

The manner in which we provide financing on a commitment varies widely. Some financing agreements require us to provide financing over a period of time, whereas other financing agreements require us to finance the total commitment upfront. In addition, our undrawn commitments are either discretionary or definitive. Discretionary commitments provide a framework and partnership through which to finance a client portfolio, but with funding ultimately subject to further case-level underwriting. Definitive commitments are those in which we are contractually obligated to advance incremental capital and where failure to do so would typically result in adverse contractual consequences (such as a dilution in our returns or the loss of our deployed capital in a case).

While the use of true artificial generative intelligence such that it could replace the human legal judgment required in our business remains in its infancy, we expect that ongoing development could continue to grow in benefit for our business, including by augmenting and enhancing our origination and underwriting. The legal industry in general and our business in particular have made increasing use of technological innovations over the past decade. We believe that we are well positioned relative to current market players or potential market entrants in the use of AI technologies in legal finance given our extensive database of dispute economics and outcomes.

Pricing and returns

We use a wide range of economic structures for our assets, and our returns can have several components. The terms of each asset are bespoke, which we believe offers an attractive degree of flexibility to serve our

clients. In a basic single-case financing transaction, we pay some or all of the claimant’s costs in bringing a litigation matter. In such transactions, we typically use an economic structure that provides that, upon conclusion of a successful claim, we would receive the return of our deployed capital, plus one or a combination of the following: (i) a time-based return, such as an interest rate; (ii) a multiple of our deployed capital that may increase over time; and (iii) an entitlement to some percentage of the net realization that may increase or decrease over time or may depend on the size of the total resolution amount. Moreover, the larger or more complex a matter, the more likely we will be to use an individually designed transactional structure that aligns interests, incentivizes rational economic behavior and accommodates the needs of the client and potentially multiple parties with different economic interests.

We also engage in transactions in which we seek to reduce the risk of loss, typically by using a portfolio or multi-case structure, but occasionally through a variety of other structures, such as interest-bearing recourse debt (sometimes with a premium based on net realizations) or the purchase of equity or debt assets that underlie the relevant litigation or arbitration claims.

We price our assets commensurate with the risks we identify and quantify as part of our in-house due diligence process, which relies on, among other things, our probabilistic modeling to evaluate each potential asset considered by the Commitments Committee.

Asset monitoring and realizations

Although most legal jurisdictions and our capital provision agreements generally stipulate that as a passive investor in legal finance assets we may not directly control or litigate cases, we invest substantial time and resources to actively advising our clients in the management of our legal finance assets. We maintain a team devoted to the oversight of those assets with a dedicated in-house legal professional assigned to monitor developments in each asset and its relevant underlying cases. In addition to receiving reports from counsel, we proactively monitor case developments, including receiving docket alerts and reviewing court documents filed. Our engagement varies depending on the circumstances of each individual matter, including not only the individual matter’s litigation dynamics, but also the experience and sophistication of our counterparties. We routinely consult on litigation strategy, participate in choosing arbitrators and expert witnesses, comment on draft pleadings, assist in the creation of the damages theory and consult on potential settlement, management of spending and performance against budget.

We devote meaningful resources to managing our legal finance assets and working collaboratively with clients to maximize their value. While our clients are generally not obliged to follow our advice, our clear alignment of interests makes our advice valuable and worthy of serious consideration, and we believe that many clients not only welcome our perspective but welcome our expertise as a reason to work with us. Thus, although we generally lack decision making authority in a contractual sense such that we could veto a decision by a counterparty, our active engagement and case management make us a valued and influential advisor to our clients and their respective litigation teams. On occasion, there are certain exceptions when we have specifically contracted to assume some control of a litigation matter or the underlying asset. In those instances, we have control over the conduct of the litigation matter subject to whatever contractual terms have been agreed.

We also conduct risk reviews on a regular basis and provide monthly and quarterly reporting on the portfolio and its risk profile to senior management and our board of directors (the “Board of Directors”). Further, we conduct an extensive review of every asset for valuation purposes following the occurrence of certain qualifying events in accordance with our valuation policy.

The matters underlying our assets resolve in various ways consistent with the typical course of litigation. Most matters reach a negotiated resolution (i.e., a settlement) between the litigants either before or after going to trial. Others do not resolve through settlement and proceed through the formal dispute resolution process, including trial and appeal(s). The timing of their outcomes varies widely depending on the complexity of the matter and the schedule of the relevant court or tribunal. In a small number of matters where we are permitted to do so, we have made a secondary sale of all or a portion of an asset prior to its conclusion.

In many instances, our clients receive their entire cash payment at the time of resolution of the legal dispute against which we have deployed our capital. However, in other instances, payments are delayed by agreement (i.e., when a settlement is paid in installments over time) or because the parties agree on an entitlement that includes non-cash value that must be monetized over time. Because our clients give up valuable leverage through the pendency of the litigation process by agreeing to a resolution, clients tend not to do so unless payment is reasonably certain. In our experience, defaults in connection with such payments

are rare, but in instances where the adverse party loses and refuses to pay, enforcement efforts may be needed.

Privileged information

Our underwriting and ongoing asset monitoring require that we receive privileged information from our clients. Such privileged information can lose its protection and become accessible to a litigation opponent if it is disclosed (a concept called “waiver” in the United States), which could have detrimental consequences for the litigant. We are entitled to receive such privileged information but are under a strict obligation to protect it to minimize the risk of waiver. Among other things, this obligation requires us to tightly restrict access to the privileged information itself and conclusions drawn from it. As a result, we do not release asset valuations of ongoing matters underlying our assets, including partially concluded matters, and we are similarly unable to provide other asset-specific information about our portfolio unless such information becomes publicly available through other means.

Competition

The legal finance industry is highly competitive and evolving as new competitors enter the market, which has affected and could affect our competitiveness in the future. We compete both globally and on the basis of region, industry and type of dispute based on factors including performance of our legal finance assets, transaction execution, access to capital, access to and retention of qualified personnel, reputation, range of products and services, innovation and pricing. Furthermore, we compete to finance assets primarily with pure-play legal finance companies and multi-strategy firms that engage in legal finance as one of many investment strategies.

Information concerning our competitors is limited as most participants in the legal finance industry either do not publish information publicly or, in the case of multi-strategy firms that engage in legal finance, do not publish information specific to their legal finance strategies. However, despite limited available information regarding our competitors, we believe that we are well-positioned competitively in the legal finance industry. We believe that we are more visible than our competitive set in legal and business publications. For example, according to “share of voice” calculations using Muck Rack, a provider of public relations tracking software, we were featured in over half of the total articles that discussed the legal finance industry and that mentioned other pure play legal finance providers during the year ended December 31, 2024. In addition, according to the interviews conducted in the second quarter of 2023 by an independent researcher commissioned by us, Burford is the most recognized brand in the legal finance industry and is the first or only legal finance provider to be named by the overwhelming majority of law firm and in-house lawyers able to name any legal finance provider in response to the question “With which legal finance providers are you most familiar?”.

Seasonality

While the litigation process is not driven by seasonality by nature, we have historically closed and financed a disproportionate amount of our new business in the fourth quarter, primarily driven by the behavior of our corporate and law firm clients. While realizations have also historically been higher in the fourth quarter, there can be meaningful variation in the timing of the resolution of our legal finance assets, so the timing of realizations may be different in the future, especially if a single large legal finance asset resolves in the first, second or third quarter of a year.

Regulatory and compliance matters

Our operations are subject to regulation and supervision in a number of jurisdictions. The level of regulation and supervision to which we are subject varies from jurisdiction to jurisdiction and is based on the type of activity involved. We, in conjunction with our outside advisors and counsel, seek to manage our operations in compliance with such regulation and supervision. There are a number of legislative and regulatory initiatives in the United States, the United Kingdom and the other jurisdictions in which we operate. The regulatory frameworks applicable to us and our operations are very detailed and technical. Accordingly, the discussion below is general in nature, does not purport to be complete and is current only as of the date of this 2024 Form 10-K.

United States

As a public company in the United States, we are subject to the rules and regulations of the SEC and the listing requirements of the NYSE. As of June 30, 2024, we determined that we no longer qualify as a “foreign private issuer” as defined under the Exchange Act and, as a result, effective as of January 1, 2025, we were no longer eligible to use the rules designed for foreign private issuers and are required to comply with the

reporting regime that applies to most US domestic public companies listed on the NYSE. Furthermore, our disclosure controls and procedures and internal control over financial reporting are documented, tested and assessed for design and operating effectiveness in accordance with the US Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”).

BCIM, a wholly owned indirect subsidiary of Burford, serves as the investment adviser to all our private funds and is registered as an investment adviser with the SEC under the Investment Advisers Act. BCIM, as an investment adviser, is subject to the anti-fraud provisions of the Investment Advisers Act and to fiduciary duties derived from these provisions, which apply to our relationships with our advisory clients globally, including the private funds that we manage. These provisions and duties impose restrictions and obligations on us with respect to our dealings with our private fund investors and our legal finance assets, including for example limitations on agency cross and principal transactions between an adviser or its affiliates and advisory clients. BCIM is subject to periodic examinations by the SEC and other requirements under the Investment Advisers Act and related regulations primarily intended to benefit advisory clients. These additional requirements relate, among other things, to maintaining an effective and comprehensive compliance program and code of ethics, conflicts of interests, record-keeping and reporting requirements, advertising and custody requirements, political contributions and disclosure requirements. The Investment Advisers Act generally grants the SEC broad administrative powers, including the power to limit or restrict an investment adviser from conducting advisory activities in the event it fails to comply with federal securities laws. Additional sanctions that may be imposed for failure to comply with applicable requirements include the prohibition of individuals from associating with an investment adviser, the revocation of registrations and other censures and fines.

United Kingdom

The UK Financial Conduct Authority (the “FCA”) and the London Stock Exchange regulate the trading of our ordinary shares on AIM in the United Kingdom. Deutsche Numis (the trading name used by Deutsche Bank AG, Numis Securities Limited and Numis Europe Limited for the combined UK and Ireland corporate finance business) is our nominated adviser under the AIM rules, in which capacity it advises and guides us with respect to our responsibilities and continuing obligations under the rules and regulations of the London Stock Exchange. The FCA also reviews debt prospectuses for our retail bonds traded on the Main Market of the London Stock Exchange. In addition, the FCA regulates our legacy UK insurance business and our UK insurance intermediation business with respect to Burford Worldwide Insurance Limited.

Guernsey

The Guernsey Financial Services Commission regulates our insurance business conducted through Burford Worldwide Insurance Limited, our wholly owned Guernsey insurer. Burford Worldwide Insurance Limited is licensed to carry on international, domestic and general insurance business under the Insurance Business (Bailiwick of Guernsey) Law, 2002 (as amended).

Other laws, rules and regulations

We are also subject to various other laws, rules and regulations, ranging from the UK Bribery Act 2010, as amended, and the US Foreign Corrupt Practices Act of 1977, as amended, to anti-money laundering and know-your-customer regulations in numerous jurisdictions. In addition, we are subject to a range of US and international laws, rules and regulations relating to data privacy and protection, including the California Consumer Privacy Act, the California Privacy Rights Act, the UK General Data Protection Regulation, the UK Data Protection Act 2018, the EU General Data Protection Regulation and the DIFC Data Protection Law No. 5 of 2020.

Legal finance industry

We engage in a constant level of activity around monitoring of, and engagement with, regulatory initiatives relating to the legal finance industry. In the United States, some individual states and individual judicial districts have promulgated rules and regulations concerning matters such as disclosure of legal finance arrangements, and the US Government Accountability Office released a report on the legal finance industry in 2023 and a subsequent report on the patent legal finance industry in 2024. In general, we have not seen any indication that there is any groundswell of support for broad regulation of the legal finance industry, and ongoing discussion tends to focus on subsidiary issues, such as disclosure of the presence of litigation financing. As of the date of this 2024 Form 10-K, there are no new US state or federal regulations aimed at

the commercial legal finance industry, although various US state and federal legislative proposals have been introduced and considered that, if passed, could potentially affect the legal finance industry.

In the United Kingdom, in July 2023, the Supreme Court held in R (PACCAR Inc) v. Competition Appeal Tribunal that litigation funding agreements that entitle funders to payments based on the amount of damages recovered should be classified as damages-based agreements which need to comply with the Damages-Based Agreements Regulations 2013 or risk being deemed unenforceable. In March 2024, the government proposed legislation to restore the law as it existed prior to the decision, however, the legislation failed to pass ahead of the dissolution of Parliament in May 2024. While the new government has expressed support for a legislative fix, there is no legislation pending as of the date of this 2024 Form 10-K. In spring 2024, the then-Lord Chancellor called upon the Civil Justice Council to conduct a review of the litigation funding market, and its final report is due by summer 2025. In the European Union, following the passage of a European Parliamentary resolution in 2022, the European Commission has been conducting a “mapping study” to collect information on the litigation funding market and current practices in member states of the European Union. The results of the study could have an impact on potential future regulation by the European Union.

We are a founding member of the Association of Litigation Funders of England and Wales (“ALF”), an independent organization charged by the UK Ministry of Justice with self-regulation of litigation financing in England and Wales. The ALF’s Code of Conduct sets forth the standards by which all members must abide. We are also a founding member of the International Legal Finance Association (“ILFA”), a non-profit trade association and the only global organization that represents the commercial legal finance sector. ILFA promotes the highest standards of operation and service for the sector, including respecting duties to the courts, avoiding conflicts of interest and preserving confidentiality and legal privilege.

In newer markets, such as Singapore and Hong Kong, authorities have also enacted regulations largely focused on capital adequacy and constraining abusive behavior.

Compliance

Rigorous legal and compliance analysis of our businesses and legal finance arrangements is endemic to our culture and risk management. Our General Counsel supervises our legal and compliance personnel, who are responsible for addressing the regulatory and compliance matters that affect our operations. We strive to maintain a culture of compliance through the use of policies and procedures, including a code of ethics, electronic compliance systems, testing and monitoring, communication of compliance guidance and employee education and training. Our compliance policies and procedures address regulatory and compliance matters, such as the handling of material non-public information, personal securities trading, marketing practices, gifts and entertainment, anti-money laundering, anti-bribery and sanctions, privacy and data security, recordkeeping and potential conflicts of interest. Moreover, we are fundamentally a business run by experienced lawyers, including some who have functioned in senior legal roles in major global businesses. The challenge in many businesses is reining in individuals who take on unacceptable or ill-considered risks, and it is the function of the lawyers to hold those reins. At Burford, we have a business run by people accustomed to that role.

In addition, disclosure controls and procedures and internal control over financial reporting are documented, tested and assessed for design and operating effectiveness in accordance with the Sarbanes-Oxley Act. The internal audit group, which reports directly to the audit committee of the Board of Directors (the “Audit Committee”), operates with a global mandate and is responsible for providing independent assessments whether our network of risk management, control and governance processes is adequate and effective.

Corporate responsibility

We believe that legal finance has a positive social impact and delivers two primary benefits. First, our financing increases access to justice and reinforces and strengthens the rule of law, both fundamental social goods. The global economy and modern society need strong, clear and efficient legal systems in order to function. Our legal finance solutions support these systems and improve them by creating a more level economic playing field in disputes, allocating capital to meritorious legal matters and facilitating access to justice for litigants, including those with meritorious claims for whom the expense of litigating a claim would be unaffordable without the use of third-party financing.

Second, our legal finance helps to increase the efficient allocation of scarce economic resources, another social good. When companies and law firms finance litigation and arbitration with our capital, they preserve their own capital to invest in their businesses where and when doing so will have the greatest benefit, whether that means hiring employees, spending on research and development or simply easing liquidity

pressures that would otherwise harm the enterprise. This benefits our clients, their stakeholders and the broader economy.

We have led the institutionalization of our industry and have adopted corporate responsibility and best practices. The nominating and corporate governance committee of the Board of Directors assists the Board of Directors in its oversight of our management in defining and implementing our strategy relating to ESG matters.

Human capital management

We expend considerable effort towards human capital management, including recruitment of talented individuals, creating an appealing environment and continuing their development once employed. Competitive compensation is certainly an important part of that dynamic, but so too is a collaborative environment and mutual respect. The Management Committee regularly assesses our human capital strategy across each of our global offices, reviews our existing capabilities and performance and identifies any gaps to ensure that resources are appropriately allocated to realize our strategic and operational objectives as well as to support and develop our talent at each employee level.

We are a global company with a highly diverse footprint. As of December 31, 2024, we had a total of 160 full-time employees across our offices in the United States, the United Kingdom, United Arab Emirates, Singapore and other jurisdictions around the world where we do not have formal offices. As of December 31, 2024, our employees included 47 lawyers qualified to practice in the United States, the United Kingdom, Argentina, Australia, Germany, India and Switzerland, as applicable.

The table below sets forth our full-time employees by office location based on the respective office affiliation of such full-time employees as of December 31, 2024.

| | | | | |

| Office location | Number of employees |

| United States | 107 |

| United Kingdom | 41 |

| Rest of the world | 12 |

| Total | 160 |

Compensation and benefits

Our compensation structure is designed to attract and retain qualified employees as well as to incentivize and reward employee performance, and our goal is to provide competitive compensation in the markets where we compete for talent. Our basic compensation principles include, among others:

•Paying market levels of total cash compensation for individual functions that is tied to our overall performance and the performance of our portfolio

•Enabling long-term employees to build equity in our company over time by providing each employee an award of our ordinary shares to align their overall compensation with our long-term performance and growth

•Weighting a more significant proportion of senior- and executive-level employee compensation toward performance-based compensation

In addition, we offer a range of competitive benefits to our eligible employees, including matching contributions to a defined contribution 401(k) retirement plan, contributions to health savings accounts and payments of premiums for life insurance and long-term disability insurance.

Talent development

We are committed to investing in employee learning and development. Our flagship training initiative, Burford University, provides instruction to all employees on topics including client services, company policies, technical tools and industry know-how. We also provide mandatory compliance and data security training and assessment for all employees. Furthermore, we encourage and support our employees in receiving external training to maintain their professional credentials and in seeking opportunities for professional development, including courses and professional certifications, and regularly pay for such training and opportunities.

Health and safety

We are committed to ensuring the health, safety and well-being of our employees in each of our offices worldwide by complying with relevant laws and preventing health and occupational risks. In some of the jurisdictions where we have offices, the health and safety standards we operate may exceed local requirements.

Organizational structure

The chart below sets forth our organizational structure as of December 31, 2024. The chart does not depict all our subsidiaries, including intermediate holding companies through which certain of the subsidiaries depicted are held.

Available information, website and social media disclosure

We are subject to the reporting requirements under the Exchange Act and, accordingly, file certain reports with, and furnish other information to, the SEC. Such reports and other information may be inspected free of charge at a website maintained by the SEC at www.sec.gov.

We maintain a website at www.burfordcapital.com and make available free of charge, on or through the Investor Relations section of our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC.

In addition, we use our website (investors.burfordcapital.com) and social media platforms including LinkedIn (www.linkedin.com/company/burford-capital), X (www.x.com/burfordcapital), Instagram (www.instagram.com/burford_capital) and YouTube (www.youtube.com/c/burfordcapital) as channels of distribution for documents and other information about our company. The documents and other information we make available through these channels may be deemed material. Accordingly, investors should monitor these channels in addition to following our press releases, SEC filings and public conference calls and webcasts. Furthermore, investors may automatically receive email alerts and other information about our company upon submitting a request at the “Investor Email Alerts” section of our website at investors.burfordcapital.com.

The information on, or that can be accessed through, our website, social media and any alerts is not incorporated by reference into, and does not form a part of, this 2024 Form 10-K.

Item 1A. Risk factors

Investing in our securities involves risk. Persons investing in our securities should carefully consider the risks set forth below and the other information contained in this 2024 Form 10-K and our other reports that we file with, or furnish to, the SEC from time to time, including our consolidated financial statements and accompanying notes. Any of the following risks could materially and adversely affect our business, financial condition, results of operations and/or liquidity. Our business, financial condition, results of operations and/or liquidity could also be materially and adversely affected by additional factors that apply to all companies generally as well as other risks that are not currently known to us or that we currently view to be immaterial. In any such case, the trading price of our securities could decline, and you may lose all or part of your investment in our securities. While we may attempt to mitigate known risks to the extent we believe to be practicable and reasonable, we can provide no assurance, and we make no representation, that our mitigation efforts, if any, will be successful. See “Forward-looking statements”, “Business" and "Management's discussion and analysis of financial condition and results of operations" for additional information with respect to certain business, competitive, regulatory, market, economic and other conditions that may materially and adversely affect our business, financial condition, results of operations and/or liquidity.

Summary of risk factors

Risks relating to our business and industry

▪Litigation outcomes are risky and difficult to predict, and a loss in a litigation matter may result in the total loss of our capital associated with that matter.

▪Our revenues, earnings and cash flows can vary materially between periods as both the timing of resolution and the outcome of litigation matters are difficult to predict.

▪Our success depends on our ability to identify and select suitable legal finance assets to finance, and our failure to do so could have a material adverse effect on our business, financial condition, results of operations and/or liquidity.

▪Our business and operations could suffer if we are not able to prevent improper use or disclosure of, or access to, privileged information under our control due to cybersecurity breaches, unauthorized use or theft.

▪The inaccuracy or failure of the probabilistic model and decision science tools, including AI technologies, we use to predict the returns on our legal finance assets and in our operations could have a material adverse effect on our business.

▪The laws relating to privileged information are complex and continue to evolve, and any adverse court rulings, changes in law or other developments could impair our ability to conduct effective due diligence on potential legal finance assets.

▪The due diligence process that we undertake in connection with financing legal finance assets may not reveal all facts that may be relevant in connection with such financing.

▪Investors will not have an opportunity to independently evaluate our legal finance assets.

▪We are subject to credit risk relating to our various legal finance assets that could adversely affect our business, financial condition, results of operations and/or liquidity.

▪Our portfolio may be concentrated in cases likely to have correlated results, and we have a number of assets involving the same counterparty.

▪The lack of liquidity of our legal finance assets may adversely affect our business, financial condition, results of operations and/or liquidity.

▪We have commitments in excess of our available capital.

▪Changes in market conditions may negatively impact our ability to obtain attractive external capital or to refinance our outstanding indebtedness and may increase the cost of such financing or refinancing if it is obtained.

▪We face substantial competition for opportunities with respect to legal finance assets, which could delay commitment and/or deployment of our capital, reduce returns and result in losses.

▪If lawyers who prosecute and/or defend claims which we have financed fail to exercise due skill and care, or the interests of their clients do not align with ours, there may be a material adverse effect on the value of our legal finance assets.