The information in this preliminary proxy statement / prospectus / consent solicitation statement is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement / prospectus / consent solicitation statement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY — SUBJECT TO COMPLETION, DATED JANUARY 27, 2021

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

OF

BIG ROCK PARTNERS ACQUISITION CORP.

PROSPECTUS FOR UP TO 75,200,000 SHARES OF COMMON STOCK

Big Rock Partners Acquisition Corp., a Delaware corporation (“BRPA”), entered into an Agreement and Plan of Merger (as it may be amended and/or restated from time to time, the “Merger Agreement”) on December 13, 2020, with NeuroRx, Inc., a Delaware corporation (“NeuroRx”), and Big Rock Merger Corp., a Delaware corporation and wholly-owned, direct subsidiary of BRPA (“Merger Sub”), pursuant to which Merger Sub will merge with and into NeuroRx, with NeuroRx surviving the merger (“Merger”). As a result of the Merger, and upon consummation of the Merger and the other transactions contemplated by the Merger Agreement (together with the Merger, the “Transactions”), NeuroRx will become a wholly-owned subsidiary of BRPA. In connection with the Merger, BRPA will change its name to NRX Pharmaceuticals, Inc., a Delaware corporation (“NRX Pharmaceuticals”), with stockholders of NeuroRx becoming stockholders of NRX Pharmaceuticals.

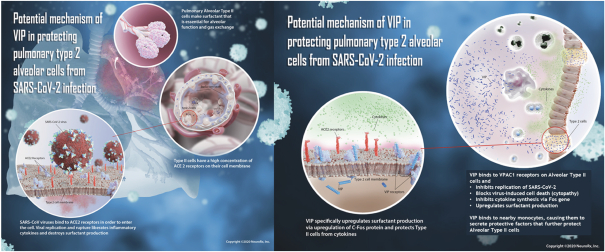

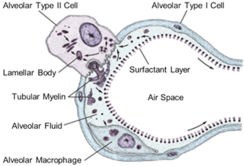

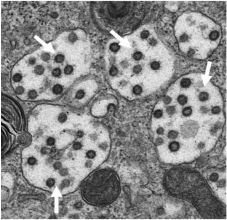

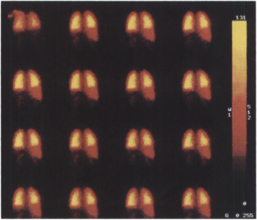

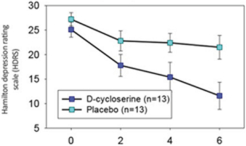

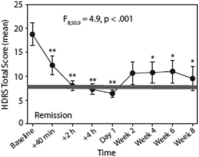

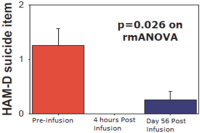

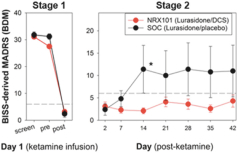

NeuroRx is a clinical-stage small molecule pharmaceutical company which develops novel therapeutics for the treatment of central nervous system disorders and life-threatening pulmonary diseases. NeuroRx recently announced a commercial partnership with Relief Therapeutics Holding AG for global commercialization of RLF-100, or “ZYESAMI”, an application for COVID-related respiratory failure (the “NeuroRx COVID-19 Drug”). NeuroRx is also developing NRX-100/101, the first sequential drug regimen for bipolar depression in patients with acute suicidal ideation and behavior (the “NeuroRx Antidepressant Drug Regimen”).

Pursuant to the Merger Agreement, the aggregate consideration payable to stockholders of NeuroRx at the effective time of the Merger (the “Effective Time”) consists of 50,000,000 shares (“Closing Consideration”) of BRPA common stock, par value $0.001 per share (“Common Stock”). In addition, the securityholders of NeuroRx (including option holders and warrant holders) who own NeuroRx securities immediately prior to the Closing will receive the contingent right to receive the Earnout Shares and Earnout Cash (each as defined below). At the Effective Time, each outstanding share of NeuroRx common stock, par value $0.001 (“NeuroRx Common Stock”), including shares of NeuroRx Common Stock resulting from the conversion of outstanding shares of NeuroRx preferred stock, par value $0.001 (each, a share of “NeuroRx Preferred Stock”) (as calculated pursuant to the NeuroRx certificate of incorporation), immediately prior to the Effective Time, will be converted into the right to receive a pro rata portion of the Closing Consideration and the contingent right to receive a pro rata portion of the Earnout Shares and Earnout Cash. Each option and warrant of NeuroRx that is outstanding and unexercised immediately prior to the Effective Time will be assumed by NRX Pharmaceuticals and will represent the right to acquire an adjusted number of shares of Common Stock at an adjusted exercise price, in each case, pursuant to the terms of the Merger Agreement.

Pursuant to the terms of the Merger Agreement, NeuroRx’s securityholders (including option holders and warrant holders) who own NeuroRx securities immediately prior to the closing of the Transactions (“Closing”) will have the contingent right to receive their pro rata portion of (i) an aggregate of 25,000,000 shares of Common Stock (“Earnout Shares”) if, prior to December 31, 2022, the NeuroRx COVID-19 Drug receives emergency use authorization by the Food and Drug Administration (“FDA”) and NeuroRx submits and the FDA files for review a new drug application for the NeuroRx COVID-19 Drug (the occurrence of the foregoing, the “Earnout Shares Milestone”), and (ii) an aggregate of $100,000,000 in cash (“Earnout Cash”) upon the earlier to occur of (x) FDA approval of the NeuroRx COVID-19 Drug and the listing of the NeuroRx COVID-19 Drug in the FDA’s “Orange Book” and (y) FDA approval of the NeuroRx Antidepressant Drug Regimen and the listing of the NeuroRx Antidepressant Drug Regimen in the FDA’s “Orange Book,” in each case prior to December 31, 2022 (the occurrence of either of clauses (x) or (y), the “Earnout Cash Milestone”).

Additionally, pursuant to the Merger Agreement, BRPA and EarlyBirdCapital, Inc., the representative of the underwriters of BRPA’s initial public offering (“EBC”), will enter into an amendment (“BCMA Amendment Agreement”) to the Business Combination Marketing Agreement, dated as of November 20, 2017 (“BCMA”), by and between BRPA and EBC. The BCMA Amendment Agreement will provide that, in lieu of the cash fee payable to EBC pursuant to the BCMA, BRPA will issue to EBC at the Effective Time an aggregate of 200,000 shares of Common Stock and the BCMA (as amended by the BCMA Amendment Agreement) will terminate immediately following the Effective Time.

Accordingly, this proxy statement / prospectus / consent solicitation statement covers an aggregate of 75,200,000 shares of Common Stock issuable to the securityholders of NeuroRx and to EBC as a result of the Transactions.

Proposals to approve the Merger Agreement and the other matters discussed in this proxy statement / prospectus / consent solicitation statement will be presented at the annual meeting of BRPA stockholders scheduled to be held on , 2021.

BRPA’s units, Common Stock, rights, and warrants are currently listed on the Capital Market of The Nasdaq Stock Market LLC (“Nasdaq”) under the symbols “BRPAU,” “BRPA,” “BRPAR,” and “BRPAW,” respectively. BRPA intends to apply for listing, to be effective at the consummation of the Transactions, of the Closing Consideration and Earnout Shares, together with the Common Stock previously issued to BRPA stockholders (including the Common Stock underlying the units, warrants, and rights issued in BRPA’s initial public offering and simultaneous private placement) and the warrants issued in BRPA’s initial public offering and simultaneous private placement, on Nasdaq under the proposed symbols NRXP and NRXPW, respectively. BRPA will not have units or rights traded on Nasdaq following consummation of the Transactions. It is a condition of the consummation of the Transactions that the Common Stock is approved for listing on Nasdaq (subject only to official notice of issuance thereof and round lot holder requirements), but there can be no assurance such listing condition will be met. If such listing condition is not met, the Merger will not be consummated unless the listing condition set forth in the Merger Agreement is waived by the parties to the Merger Agreement.

BRPA is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and is therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

This proxy statement / prospectus / consent solicitation statement provides you with detailed information about the Merger Agreement, the Transactions, and other matters to be considered at the annual meeting of BRPA’s stockholders. We encourage you to carefully read this entire document. You should also carefully consider the risk factors described in the section of this proxy statement / prospectus / consent solicitation statement titled “Risk Factors.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this proxy statement / prospectus / consent solicitation statement. Any representation to the contrary is a criminal offense.

This proxy statement / prospectus / consent solicitation statement is dated , 2021 and is first being mailed to BRPA’s stockholders on or about , 2021.