UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

_________________________

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended December 31, 2023

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from ________ to ________

Commission file number: 001-39160

_________________________

FISKER INC.

(Exact name of registrant as specified in its charter)

_________________________

| Delaware | 82-3100340 | ||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| 1888 Rosecrans Avenue, Manhattan Beach, CA | 90266 | ||||

| (Address of principal executive offices) | (ZIP Code) | ||||

Registrant’s telephone number, including area code: (833) 434-7537

_________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A Common Stock, par value of $0.00001 per share | FSRN | OTC Pink Current Information | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

_________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | o | ||||||||

| Non-accelerated filer | Smaller reporting company | ☐ | |||||||||

| Emerging growth company | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. x (See Note 6. Property and Equipment, net)

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $1.2 billion as of June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter) based upon the closing sale price on The New York Stock Exchange reported for such date. Shares of Class A Common Stock held by each officer and director and by each person who may be deemed to be an affiliate have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of April 15, 2024, the registrant had 1,385,486,856 shares of Class A Common Stock, par value $0.00001 per share and 132,354,128 shares of Class B Common Stock, par value $0.00001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates by reference certain information from the registrant’s definitive proxy statement (the “Proxy Statement”) relating to its 2024 Annual Meeting of Stockholders. The Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

FISKER INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

TABLE OF CONTENTS

| Page | ||||||||

| Item 1. | 3 | |||||||

| Item 1C. | 52 | |||||||

| Item 9C. | ||||||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are forward-looking and as such are not historical facts. These forward-looking statements include, without limitation, statements regarding future financial performance, business strategies, expansion plans, future results of operations, estimated revenues, losses, projected costs, prospects, plans and objectives of management. These forward-looking statements are based on our management’s current expectations, estimates, projections and beliefs, as well as a number of assumptions concerning future events, and are not guarantees of performance or future events. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this report, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would” and variations thereof and similar words and expressions are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report may include, for example, statements about:

•our ability to continue as a going concern;

•our ability to grow and manage growth profitably;

•our ability to enter into additional manufacturing and other contracts with Magna, OEMs or tier-one suppliers in order to execute on our business plan;

•our ability to execute our business model, including market acceptance of our planned products (e.g., Alaska, PEAR and Ronin) and services;

•our expansion plans and opportunities;

•our expectations regarding future expenditures;

•our ability to raise capital in the future;

•our ability to attract and retain qualified employees and key personnel;

•the possibility that we may be adversely affected by other economic, business or competitive factors;

•changes in applicable laws or regulations;

•the outcome of any known and unknown litigation and regulatory proceedings;

•our transition to a Dealer Partnership model; and

•other factors described in this report, including those described in the section entitled “Risk Factors” under Part I, Item 1A of this report.

The forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments and their potential effects on our business. There can be no assurance that future developments affecting our business will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” under Part I, Item 1A of this report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the effect of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

The forward-looking statements made by us in this report speak only as of the date of this report. Except to the extent required under the federal securities laws and rules and regulations of the U.S. Securities and Exchange Commission

1

(“SEC”), we disclaim any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

WEBSITE AND SOCIAL MEDIA DISCLOSURE

We use our website (www.fiskerinc.com) and various social media channels as a means of disclosing information about the company and its products to its customers, investors and the public (e.g., @fiskerinc, @fiskerofficial, #fiskerinc, #henrikfisker and #fisker on Twitter, Facebook, Instagram, YouTube, TikTok and LinkedIn). The information posted on social media channels is not incorporated by reference in this report or in any other report or document we file with the SEC. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about the Company when you enroll your e-mail address by visiting the “Investor Email Alerts” section of our website at https://investors.fiskerinc.com.

ADDITIONAL INFORMATION

Unless the context indicates otherwise, references in this Annual Report on Form 10-K to the “Company,” “Fisker,” “we,” “us,” “our” and similar terms refer to Fisker Inc. (f/k/a Spartan Energy Acquisition Corp.) and its consolidated subsidiaries (including Fisker Group Inc. or Legacy Fisker). References to “Spartan” refer to our predecessor company prior to the consummation of the Business Combination (as defined below).

2

PART I

Item 1. Business.

The following discussion contains forward-looking statements that reflect future plans, estimates, beliefs and expected performance. The forward-looking statements are dependent upon events, risks and uncertainties that may be outside of our control. Our actual results could differ materially from those discussed in these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below and those discussed elsewhere in this Form 10-K, particularly in Part I, Item 1A, Risk Factors. We do not undertake, and expressly disclaim, any obligation to publicly update any forward-looking statements, whether as a result of new information, new developments or otherwise, except to the extent that such disclosure is required by applicable law.

Our Vision

A clean future for all.

Our Mission

Create the world’s most emotional and sustainable vehicles.

Overview

We have built a technology-enabled, capital-light automotive business model that we believe is among the first of its kind and aligned with the future state of the automotive industry. This involves innovations in vehicle development, customer experience, and sales and service that improve the personal mobility experience through technological innovation, ease of use and flexibility. Fisker brings the legendary design and product development expertise of Henrik Fisker – the visionary behind such iconic vehicles as the BMW Z8 sports car and the famed Aston Martin DB9 and V8 Vantage – to deliver high quality, sustainable, affordable electric vehicles that create a strong emotional connection with customers. Central to our business model is the development of platforms designed with engineering flexibility for high content carryover to reduce development time and lower cost to bring multiple derivatives to the market. Our Ocean SUV and Alaska mid-size EV pick up are derived from the same F platform. Fisker also designed the world’s first, low-cost EV platform with 35% fewer parts versus comparable EV’s in the market for lower weight and cost. This, combined with rapid decision-making, focused supply chain management and outsourced manufacturing, reduces development cost and time to market, creating a new business model for the industry and one that gives Fisker an advantage in bringing vehicles to market faster, more efficiently, and with more modern and advanced technology than many competitors.

3

Our first model, the all-electric Fisker Ocean, has already garnered numerous awards for its design. As of April 16, 2024, the Company has delivered over 6,400 Oceans.

The Fisker Ocean is an all-electric SUV and targets the large and rapidly expanding “premium with volume” segment (meaning a premium automaker producing more than 100,000 units of a single model, such as the BMW X3 Series or Tesla Model 3) of the SUV market. The Fisker Ocean is a five-passenger vehicle with a certified range, depending on specification, of between 231 and a class-leading 360-miles (depending on the customer’s chosen battery pack, driving conditions, wheel size and testing procedures).

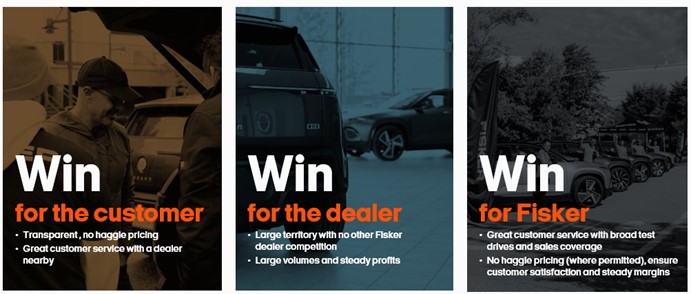

Our goal is to revolutionize how customers view personal mobility and vehicle ownership by employing an innovative customer-focused Dealer Partnership model offering a seamless haggle-free (where permitted) buying experience with an efficient easy-to-access vehicle service network. Fisker’s transformative strategic efforts will offer outstanding customer service with easy to access test drives to meet customers’ demand for the Fisker Ocean and to prepare for the launch of additional future models.

Through our design and engineering process combined with rapid product development decision-making and an intense focus on supply chain management, our goal is to significantly reduce the capital intensity and investments typically associated with a new car manufacturing business, accelerate the development cycle of new products, and expedite the adoption of advanced technology in several ways, including:

•Launching with a highly respected brand name in the automotive and EV categories. The Fisker name is a recognized part of automotive industry history and has established premium EV brand value in the global EV marketplace. Henrik Fisker, Fisker’s co-founder, Chairman, President and Chief Executive Officer, is a pioneer in the EV industry, having launched the world’s first luxury plug-in hybrid EV, and has a track record of successful designs as the former Chief Executive Officer and President of BMW Designworks USA and the former Design Director for Aston Martin. We enter the market with an established brand name that is associated with automotive innovation and superior design.

4

•Magna collaboration. We entered into a cooperation agreement with Magna International Inc. (“Magna”), an industry-leading supplier, and manufacturer of premium high-quality vehicles. The cooperation agreement sets out the main terms and conditions for certain operational agreements related to manufacturing engineering, component sourcing and manufacturing for the Fisker Ocean. By working with an established contract manufacturer such as Magna Steyr, we accelerated our time to market, reduced risk for quality vehicle assembly, and gained access to an established global supply chain. We previously entered into a Non-Exclusive Car Platform Sharing Agreement with a Magna subsidiary and while that agreement remains in place, we have substantially re-engineered an original platform proposal with the Fisker owned FM29 platform, which we have the right to commercialize accordingly.

•Fisker EV Platforms. We created FM29, a unique EV platform, that has unique Fisker intellectual property. Our proprietary FF-PAD process is hardware agnostic which will enable us to collaborate with multiple suppliers for development of new, advanced EV platforms. Fisker FM29 Platform is a premium, cross-over SUV platform developed for global markets that we are exploring to adapt into other derivatives, such as a pickup truck FT32 (Project Alaska/Kayak). SLV1 (Project PEAR) is a brand new cost-efficient platform which we plan to adapt into other potential derivatives. A third platform is conceptualized (Project Ronin) for high-end luxury vehicles at low volumes.

•Using an existing manufacturing facility. We are leveraging contract manufacturers with existing modern manufacturing facilities and trained workforce, which positions us well to meet timing, cost, and quality expectations while optimally matching our cost structure with our projected production ramp. Partnering with Magna on manufacturing is intended to position us to meet our projected production and delivery targets and will enable us to focus on what we believe will be the key differentiators for a new car company: delivering truly innovative design features, a superior customer experience, and a leading user interface that leverages sophisticated software and other technology advancements.

•New Dealer Partnership model. As a high-growth startup, Fisker is transforming its strategic efforts by offering customers a no haggle (where permitted), transparent sales experience and improved access to vehicle test drive, delivery and service. As a company, Fisker intends to improve customer satisfaction, increase sales for the Fisker Ocean and prepare the foundation for successful new product launches. In keeping with our asset light strategy, the Dealer Partnership model should enable Fisker to expand its sales and delivery network at a faster pace.

Manufacturing Approach

We decided to seek out partnerships with existing manufacturers rather than constructing new production capacity. On June 12, 2021, we executed a binding Contract Manufacturing Agreement with Magna Steyr Fahrzeugtechnik AG & Co KG (“Magna Steyr”) for the manufacture of the Fisker Ocean. This contract manufacturing approach is intended to lower our upfront costs, while also supporting our ESG mission by reducing the carbon footprint of our operations.

A significant advantage of working with established manufacturing partners is that such enterprises are already connected to the existing automotive supply chain. The maturity of supply chain relationships is critical and is reflected in the connectivity of business systems and IT infrastructure. A typical vehicle consists of over 5,000 individual parts and assemblies, each of which is sourced from an extended supply chain consisting of thousands of suppliers. Compounding this further is the fact that there is complexity in the vehicle build specifications to suit customer choice. These parts must be delivered to the final point of assembly at a rate and in a sequence that matches planned vehicle production. Considering that a typical automotive facility will assemble more than 5,000 parts into a complete vehicle at a rate of one vehicle every 45-120 seconds, the smooth running of that logistics effort becomes critical to the running of the operation. Such organizational efficiency is the result of decades of experience and cannot be easily replicated. These critical relationships extend beyond the simple supply of parts and into areas such as local government, where support and cooperation are vital to ensure that local infrastructure updates are considered at a strategic local government level. Such partnerships are also decades in the making and are critical to the ongoing success of the enterprise.

Growth Strategy

We intend to implement the following strategies to drive stakeholder value from the following actions:

5

•Re-imagine the customer experience for personal transportation and car ownership. We believe immense opportunities exist to re-imagine the customer experience for personal transportation and car ownership. We plan to continue to design EVs that will be differentiated in the marketplace by proprietary design innovation and a customer experience delivered through a state-of-the-art, software-based user interface and experience. We plan to also continue to develop our proprietary Fisker App to improve the customer experience throughout the entire personal transportation lifecycle. In addition, we are designing our EVs to be compliant with the CCS standard and adaption of the NACS standard in North America, where we have already signed an agreement with Tesla that will allow all Fisker Ocean owners in North America to use the Tesla charging network by January 1, 2025. This will allow our vehicles to charge with existing public charging infrastructure in North America. We have executed charging network agreements with ChargePoint in North America and Deftpower in Europe. We've entered into an agreement with ChargePoint and their roaming partners, who are committed to utilizing renewable energy for their charging stations.

•Develop additional high value, sustainable EV models. We believe the combination of our superior design expertise, along with the power and versatility of platforms engineered with industry-leading OEMs and tier-one automotive suppliers, will enable us to efficiently achieve our goal of providing the world with a range of high value, sustainable EVs. We intend to utilize one or more platforms over time to develop a lifestyle pickup truck and a sport crossover to complement the Fisker Ocean. In addition, we also plan to explore additional EV platform opportunities that will facilitate the company’s mission to revolutionize the personal transportation industry.

Fisker Vehicles

6

Our first vehicle is the Fisker Ocean, an all-electric premium SUV that we launched with one of the lowest entry price points in the EV SUV segment. The Fisker Ocean offers an electric range of 231 to 360 miles per U.S. EPA standard or 288 to 435 miles per WLTP standard (used in Europe), depending on the battery pack in the customer’s chosen trim, driving conditions, wheel size and testing procedures.

The Fisker Ocean has many selling points that set Fisker apart from its competitors, including:

•California Mode. Patented California Mode delivers an open-air experience with the push of “one button”. With California Mode, customers can drop the front door windows, both rear-seat door windows, both rear Doggie windows next to the D-pillar, and the Rear Lift Gate Window while opening the SolarSky roof at the same time. The rear liftgate window opening is particularly appealing for an EV SUV as there are no exhaust fumes from the vehicle that could enter the cabin. The rear liftgate window opening allows for long items to be transported without having to drive with an open hatch.

•Extra wide track. For the size of the vehicle and category, we believe the Ocean’s extra wide track, among other technical features, gives the Ocean best-in-class ride and handling while maintaining the same tire aspect ratios. The wide track on sports cars contribute to a visually powerful “stance,” and we believe this further distinguishes the Ocean’s design. It has also allowed for a more dramatically sculptured body side design and, combined with the dynamic silhouette, we believe it has achieved a class-leading aesthetically arresting and emotional design.

•User Interface. The Ocean features a revolve screen with integrated physical buttons. We have done extensive design development on the highest quality user interface (“UI”) to enhance the driving experience. We believe combining Ocean’s large 17.1” touch screen with several physical buttons provides drivers a user-friendly interface that allows drivers to access the most-often-used functions while maintaining their eyes on the road.

•Autonomy. The Ocean is engineered with hardware to support future upgrades delivered through post-production software-based updates. Fisker and Magna are working together to develop an industry-unique feature set and a suite of software packages powered by a scalable domain controller architecture. We intend to equip Fisker Ocean

7

with a class-competitive suite of Advanced Driving Assistance System (ADAS) features supported by a sensor suite that includes state-of-the-art computer vision technology and digital imaging radar.

•SolarSky roof. The Fisker brand is a pioneer and leader in full length curved photo voltaic roof design and integration into a passenger vehicle. The photo voltaic roof makes a strong personal statement for those customers that want to fully optimize for zero emissions and sustainability. Fisker Ocean’s SolarSky roof produces up to 1,500 clean, emissions-free miles per year. Under ideal conditions may increase to beyond 2,000 miles, all powered by pure sunshine.

•Vegan interior. We offer a full vegan interior in the Fisker Ocean without any leather or animal sourced materials.

•Recycled materials throughout the vehicle. Sustainability is represented throughout the Fisker Ocean. Specifically, the interior has carpeting and acoustical backing made from recycled polyester and recycled nylon, seating made from recycled plastic bottles, and coatings derived from plant-based materials. Like our carbon neutral manufacturing, some of our key suppliers also produce materials through full carbon neutral processes.

•Sustainability. We designed the Fisker Ocean to be the world’s most sustainable vehicle, measured through the entire life cycle, from upstream sourcing of low carbon and recycled materials, through logistics, manufacturing, use phase and re-use and recycling when the vehicles finally come off the road. Use of recycled materials is enhanced by other features, such as offering a full-length photo-voltaic roof, and the fact that we are using existing manufacturing rather than building new plants as part of our asset-light strategy. In addition, we work with our suppliers to source and produce through highly sustainable methods. The sustainability features extend to the full vehicle, where Fisker utilizes innovative materials. Our available SolarSky roof can add over 1,500 miles of clean, free charging from the sun and materials that reinforce our focus on recycling and reuse. For example, through the reuse of tire manufacturing by-products, recycled and bio-based materials, we significantly reduce the amount of process waste that would otherwise go to landfill and reduce the overall CO2 footprint of the Fisker Ocean. In the Fisker Ocean, this deliberate effort delivered the lowest published carbon footprint of any electric SUV, using over 110 lbs. of recycled and bio-based materials. We are also working with suppliers who recover and repurpose materials such as plastics and carbon fiber. These suppliers recover materials that are landfill and ocean-bound, such as plastic bottles and fishing nets, and reprocess them into automotive grade feedstock which can then be used to produce new interior trim, fabrics, acoustic backing, and moldings. In doing so, we reinforce our requirement to minimize ‘new’ hydrocarbon-based feedstock, while simultaneously providing an outlet for, and supporting, those suppliers who are investing in ocean clean up and potentially landfill commodities as an alternate source of raw material.

Fisker has plans to introduce new vehicles in the next three years. For these vehicles, we plan to use our own platforms and in-house design and engineering processes with one or more industry-leading OEMs and suppliers.

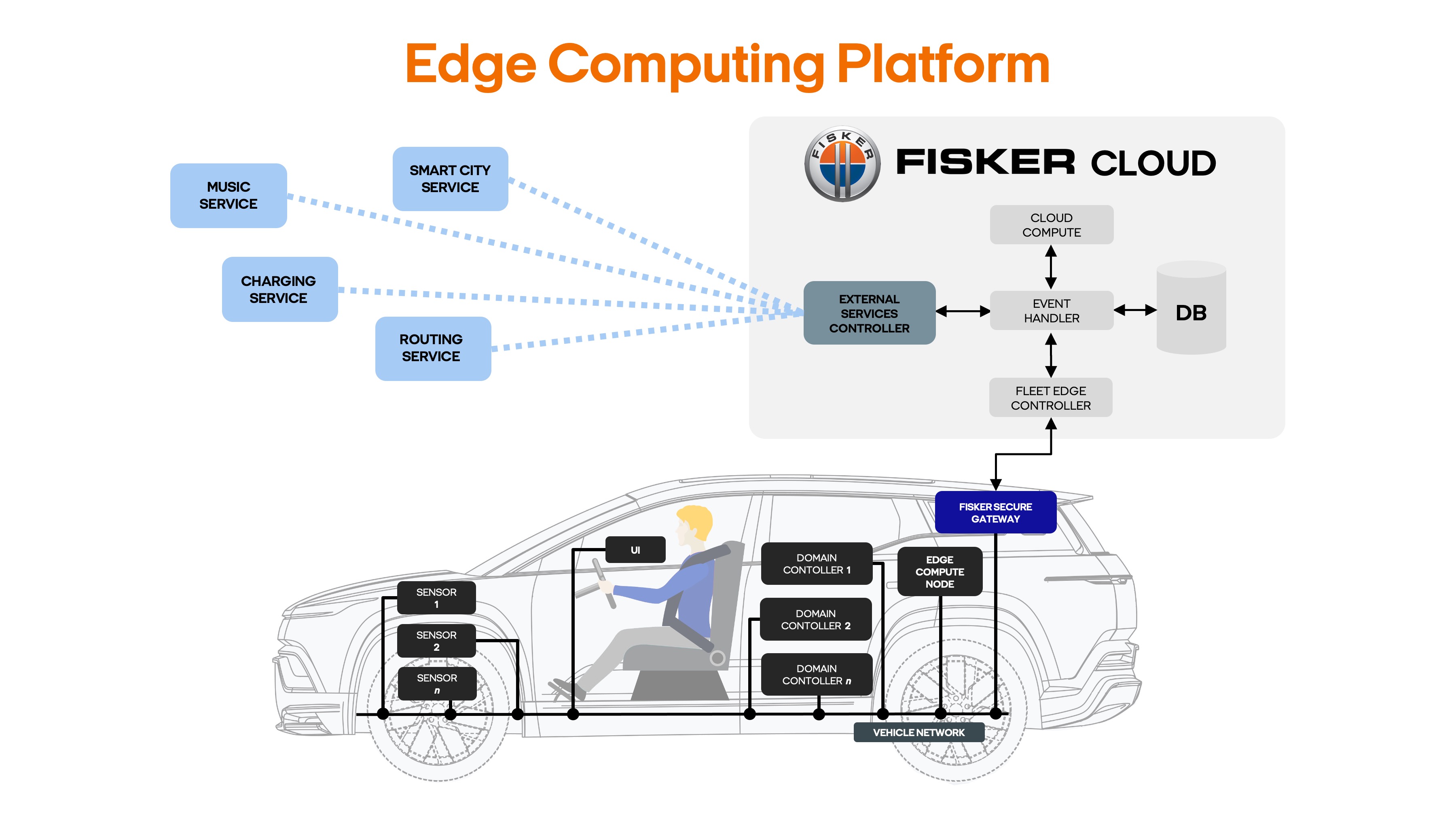

New Electronics Architecture

The Fisker Ocean electronics architecture is based around a small number of key domain controllers, for advanced driver assistance functions, drivetrain and battery management, and infotainment. A traditional vehicle electronics architecture typically contains a high number of independent and self-contained modules, each a black box to the rest of the car. This architecture, based on domain computers, opens new avenues for integration, sensor fusion, and an adaptive and evolving user experience. A connectivity module enables full communication with the Fisker cloud and the possibility for edge computing, while over-the-air (“OTA”) software updates ensure the in-car experience can stay ahead of market expectations.

We anticipate that future generations of Fisker architecture will integrate automotive requirements into customized electronic boards, with hardware accelerators for AI, machine-learning, and computer-vision. This further reduction in electronics component counts is designed to lower power consumption, increase computational power, and allow for even greater scope for feature integration and optimization.

8

Digital Car of the Future: Delivered Over the Air

The new electric, digital car is more technologically sophisticated than its predecessors. Many immediate benefits to the customer of this always-online car will be evident in the infotainment system. Entertainment and productivity apps, mobility services, and navigation aids can keep pace with the latest regional trends. The integrated and fully connected nature of the digital car opens new opportunities for innovation, and enables functions previously impossible, such as predictive maintenance and remote fault diagnosis.

Through edge computing and 4G, later ultra-low latency 4G connectivity, it also becomes possible for cloud computing resources to be used as a seamless extension of the computing power in the car. Continuous software updates, both for embedded systems in the car and functions hosted in the cloud, let the digital car grow and become smarter over its lifetime. Fisker automotive design is meeting all functional safety requirements as outlined by ISO 26262 and SO/SAE 21434, which covers security management, and cybersecurity within the Fisker product development lifecycle.

We intend to fully utilize software to improve the powertrain performance, making the cars more efficient, allowing more instantaneous power output, and improving the charging experience. In the future, the powertrain parameters could be tailored to each driver in real time, optimal characteristics of the motors could be constantly measured and altered, and the level of the recuperation system could be adjusted. On-board diagnostics, combined with predictive models and anomaly detection could guide the customer to schedule a service appointment before they even perceive any symptoms, possibly averting a costly repair.

We are designing our EVs to always be “connected” Our next-generation connectivity platform is already heavy at work seamlessly integrating online services and functions, Fisker-unique as well as third party services. Features that are visualized on the large 17.1” high-definition center touchscreen or digital instrument cluster meet strict driver-distraction guidelines with Fisker’s custom UI framework. The My Fisker app seamlessly connects to the car, ensuring the customer’s digital life and driving experience meet in the car.

With data analysis, cloud computing, and the ability to push OTA updates to the vehicle, we expect the in-car experience will evolve over time for the driver and passengers and not the other way around as has traditionally been the case.

9

Sales - Go To Market Strategy

We believe over the next several years, the EV markets in the U.S. and EU will be broken down into three fundamental segments: the white space segment, the value segment and the conservative premium segment. All three segments will attract customers from traditional ICE vehicles, but the largest growth, by volume, will be the white space segment and the value segment.

| EV Segment | Attributes of Segment | Fisker Plan within Segment | ||||||||||||

| White space segment | Currently occupied by Tesla globally and by a few Chinese EV independent start-ups operating in China only. Appeals to customers who want to be part of the new EV movement, who value sustainability and ESG. Can only be occupied by pure EV brands that only produce EVs with a clear commitment towards zero emission vehicles. | We believe we will be the primary alternative to Tesla in this segment with the Fisker Ocean priced around the base price of the Tesla Model 3 and Model Y. We believe other EV startups will move into the higher premium priced segments due to the lack of volume pricing of components. We expect to sell approximately 50% of our vehicles into this segment. | ||||||||||||

| Value segment | Focus on price and value proposition—customers will buy vehicles in this segment when the purchase price and cost of maintaining/running fits the budget and is better than an ICE vehicle. Yet to be dominated by any auto maker. | We believe we will penetrate the upper end of this segment by offering a compelling and differentiated price/ performance vehicle, compared to other traditional car makers struggling to compete due to lack of volume pricing. We expect to sell approximately 10% of our vehicles into this segment. | ||||||||||||

| Conservative premium segment | Emerging segment currently occupied by several traditional auto makers that are trying to keep their own customers from defecting to EV makers like Tesla. Vehicles in this segment, produced by the traditional premium automakers, are struggling with a clear EV identity as they try to bridge the traditional ICE attributes with new EV attributes. | We believe our vehicles will be very attractive to customers sitting “on the fence” in this segment, ready to leave their ICE brand, but needing assurance of quality and reliability. This is a segment where we believe we can attract new customers that will come from traditional ICE brands. We believe we will sell approximately 40% of our vehicles into this segment, but it will grow rapidly, as we will be able to offer a more emotional design, an exclusive EV brand, a larger battery and better equipment for the price due to our volume pricing versus the lower volume traditional brands | ||||||||||||

Service, Marketing and Insurance

Media coverage, digital and non-traditional marketing, and word-of-mouth have been the primary drivers of Fisker’s sales leads, helping us achieve a high volume of reservations without traditional marketing efforts and with a relatively low marketing budget. In 2024, we plan to increase our marketing budget as we roll out our new Dealer Partnership model, while decreasing our internal spending through the elimination of costs associated with the direct-to-consumer business model. We plan to continue to expand our social media presence as a key part of our marketing efforts. We plan to attend and participate in global events and to activate pop-up show rooms to give customers the opportunity to experience Fisker vehicles. We support our customers by providing reference to reputable third-party automotive insurance options.

10

Direct Sales, Service, and Vehicle Financing

We historically marketed and sold our vehicles directly to customers using our proprietary digital platforms, including the “My Fisker App” and website. During 2024, we will be transitioning to a dealer model from a direct-to-consumer model but expect to operate under both models during 2024. Europe will operate under both models.

New Dealer Partnership

Fisker is making this move to scale for significant acceleration of Fisker Ocean deliveries and higher volume production of additional future models. The Dealer Partnership model also aligns with its asset light business strategy.

The Fisker dealer strategy is multi-faceted, designed to benefit customers and dealers, as well as Fisker. Fisker dealers will provide retail, service, test drive and delivery functions for Fisker vehicles. Fisker dealers will be able to open at a faster pace due to the lower amounts of upfront capital investment versus traditional dealer strategies employed by other OEMs. The reduced facilities related capital investment is consistent with Fisker’s commitment to sustainability principles: use-less, and re-use. Fisker will offer dealers large market areas and no cost sales and service training programs for early dealer partners for a period of time. Dealers may have service area, back-of-house, and administrative functions for a period of time until the dealer’s operation requires dedicated non-customer facing functions. However, customer facing dealership personnel will be dedicated to Fisker.

Fisker is selecting its dealers based upon multiple criteria, including a dealer’s ability to deliver a high level of customer satisfaction. Customer satisfaction will be a key performance metric that dealers will be expected to achieve.

Vehicle Maintenance

Our vehicles are designed to have no “first mandatory service”. We expect service will be needed for mainly two reasons: (1) a fault shows up in the on-board diagnostics/request to go to service, or (2) the customer notices something needs to be “fixed” and service is needed. In each case, we will be alerted by either the vehicle’s on-board diagnostics or the customer and we will then refer the customer to their nearest Fisker dealership.

Fisker Added Value

Fisker's Platform Strategy supports its growth plan objectives, firstly by intelligent re-use of the Ocean platform to define a new EV market segment with the Alaska mid-size EV pick up (labelled the Kayak in the EU); followed by the introduction of an all new, lower cost, higher volume, global platform for the PEAR and future derivatives. This new platform features Fisker's novel 'Steel++' body structure which has 35% less parts than the industry norm due to an intensive focus on component integration and advanced tooling methods. Finally, the ultra low volume, bonded aluminum

11

Ronin platform concept will be a technology test bed for future Fisker products, and features a novel, structurally integrated battery amongst many other innovations.

Key among the attributes defining Fisker-brand design and engineering is exterior and interior design language. The Fisker Ocean is establishing the look and feel of Fisker products going forward—an evolution of the design language Henrik Fisker developed over his career and with which he has become synonymous. A key element of this design language is the broad shouldered, “muscular” stance of the vehicle. In creating an exterior design with these proportions, our team has taken some key decisions intended to move typical autobody engineering solutions, such as a fixed hood, to a position more relevant to EVs. Not only does this give our vehicles a distinctive, unique look, it also simplifies an otherwise complex manufacturing build tolerance issue. This approach provides greater control of the front-end package and removes certain hardware, ultimately facilitating our desire to design a vehicle with class-leading frontal high-speed impact and pedestrian impact safety.

12

Fisker-brand design and engineering also encompasses our goal to build the world’s most sustainable vehicles. Fisker Ocean offers SolarSky, a large photo-voltaic glass roof. Our internal testing indicates that this feature has the capability to deliver annually the equivalent of up to 1,500 miles of completely carbon free miles in optimum conditions.

Our design language extends further into the interior of the vehicle with the deployment of our unique UI. In addition to seamless integration of user devices, such as mobile phones and tablets, Fisker has developed a central screen display that is the largest in its class. This screen is the centerpiece of the Fisker UI and will integrate all main vehicle electrical functions and settings into a single, simple interface. The ergonomics of the central screen are further enhanced by combining user programmable “soft keys” on the touch screen surface, with five fixed switches that control the five most frequently used functions. In this way we expect to deliver a futuristic EV “glass cockpit” without the annoyance of searching through several menus to find that critical function, which has been a criticism of similar systems. The combination of this unique central screen and the digital driver’s display will ensure a class-leading user experience.

Research and Development

Our research and development activities primarily take place at our facilities located in La Palma, San Francisco, and Culver City, California. The majority of our current activities are primarily focused on the research and development of our EVs and software technology platforms. We undertake significant testing and validation of our products in order to ensure that we will meet the demands of our future customers. We are working with various strategic partners to improve the Ocean and to bring other future EV models into commercialization.

13

Sustainability Actions

As demonstrated in our vision and mission, we are committed to sustainability, which includes our dedication not only to the environment, but also our communities and other stakeholders. ESG is foundational to Fisker and, as a purpose driven company, it is embedded in everything we do. We engage with our community through direct actions such as beach clean-ups and employee food drives. We are currently evaluating incentives and other programs to support sustainability and social accountability throughout our corporate activities.

Fisker’s Commitment to Building a Leading ESG, Digital Mobility Company

Our commitment is to build the world’s leading, digital-first, next generation mobility company. We are building towards that vision with a commitment to a broad foundation of environmental, sustainability and ethical governance policies. Through this approach, we believe we will create a company that can better serve the needs of all our stakeholders and ultimately deliver greater returns.

We are committed to leading the automotive industry in alignment with our mission, from the thorough analysis of the full life-cycle impact of our vehicles to creating solutions that minimize our carbon footprint and ensuring we responsibly source all of our materials. Our focus is on the total environmental and social impacts of our business throughout our supply chain. We seek to optimize our internal practices and build mutually beneficial relationships with the communities in which we operate.

We have set strong performance standards through our policies, such as our Human Rights and Labor Policy and our Responsible Supplier Policy, including conflict materials chain of custody, of which we will validate. We have aligned with the United Nations Sustainable Development Goals (UNSDG’s), as a guidance framework for our internal targets and are using Sustainability Accounting Standards Board (SASB) requirements for measurement and reporting of our vehicles and related metrics. Through dedicated work streams and detailed research with investors, we are focused on providing best-in-class metrics and public ESG disclosures. We published our first ESG Impact Report in 2022.

In June 2023 we released our 2023 Fisker Ocean Life Cycle Assessment (LCA) detailing the progress we've made toward our mission of creating the world's most emotional and sustainable electric vehicles.

Our diverse management team and board of directors is a testament to our commitment to diversity and inclusion. We will continue to evaluate our governance structure, hiring practices and pay equity, in accordance with our company policies, industry benchmarks and reporting agencies. We have also created an ESG Advisory Council, comprised of non-company ESG leaders, who will help shape our strategy, our commitments and, work with us to engage in dialogue with NGO’s and other stakeholders on important civic issues. In addition to the ESG Advisory Board, we have an internal ESG governance structure, led by the head of ESG, with a leadership planning team that meets weekly, a monthly executive management strategy review team and review of critical material by the Board of Directors.

Intellectual Property

Our success depends in part upon our ability to protect its core technology and intellectual property. We attempt to protect our intellectual property rights, both in the U.S. and abroad, through a combination of patent, trademark, copyright and trade secret laws, as well as nondisclosure and invention assignment agreements with our consultants and employees, and we seek to control access to and distribution of our proprietary information through non-disclosure agreements with our vendors and business partners. Unpatented research, development and engineering skills make an important contribution to our business, but we pursue patent protection when we believe it is possible and consistent with our overall strategy for safeguarding intellectual property.

As of March 6, 2024, we owned 16 issued U.S. patents, have 56 pending or allowed U.S. patent applications, 51 issued foreign designs and 16 pending foreign design applications. In addition, we have 162 registered trademarks, and 13 pending trademark applications. Our patents and patent applications are directed to, among other things, vehicle design, engineering and battery technology.

Government Regulation and Credits

We operate in an industry that is subject to extensive environmental regulation, which has become more stringent over time. The laws and regulations to which we are subject govern, among others, water use; air emissions; use of recycled materials; energy sources; the storage, handling, treatment, transportation and disposal of hazardous materials; the

14

protection of the environment, natural resources and endangered species; and the remediation of environmental contamination. Compliance with such laws and regulations at an international, regional, national, provincial and local level is an important aspect of our ability to continue our operations.

Environmental standards applicable to us are established by the laws and regulations of the countries in which we operate, standards adopted by regulatory agencies and the permits and licenses granted. Each of these sources is subject to periodic modifications and what we anticipate will be increasingly stringent requirements. Violations of these laws, regulations or permits and licenses may result in substantial civil and criminal fines, penalties, and possibly orders to cease the violating operations or to conduct or pay for corrective works. In some instances, violations may also result in the suspension or revocation of permits and licenses.

Emissions

In the U.S., EU and China, there are vehicle emissions performance standards that will provide an opportunity for us to sell emissions credits.

United States

In the U.S., the U.S. Environmental Protection Agency (“EPA”) promulgates and enforces emissions standards for motor vehicles under the Clean Air Act. The EPA requires that Fisker obtain a Certificate of Conformity concerning emissions for its vehicles before offering them for sale. California also regulated motor vehicle emissions even before the Clean Air Act’s passage. Therefore, California is permitted to issue its own emissions standards, and other states may adopt California’s standards instead of the EPA’s standards. The California Air Resources Board (“CARB”) is responsible for setting California’s emissions standards. CARB requires Fisker to obtain an Executive Order, confirming that its vehicles conform to California’s emissions standards.

Greenhouse Gases

Both the EPA and California have greenhouse gas emissions standards for motor vehicles. These regulations restrict the amount of carbon dioxide (CO2) and non-methane organic gases and nitrous oxide gas (NMOG+NOx) that a vehicle is permitted to emit. California’s greenhouse gas emissions standards were established in 2012 under California’s “Advanced Clean Cars I” program; Advanced Clean Cars II (“ACCII”) was adopted in 2022. California continues to consider potential amendments to ACCII to further scale down emissions of new motor vehicles sold in California (and the states which have adopted California’s standards). Both the EPA and CARB enforce their greenhouse gas standards by issuing credits for over-compliance with the given standard and penalizing a manufacturer’s failure to meet the standard. Manufacturers who have an excess of these credits may transfer or sell them to a manufacturer which is deficient in the credits. Because Fisker vehicles are all-electric, Fisker vehicles will necessarily comply (and over-comply) with these standards, offering Fisker significant opportunity to sell these credits to other manufacturers. Fisker already has one such agreement in place. Finally, because these standards become more stringent over time, Fisker’s opportunity to sell these credits will also increase over time.

Zero Emission Vehicles

California also requires manufacturers to maintain a certain percentage of zero-emission vehicles (“ZEVs”) as part of their overall number of new vehicles sold in that state. The ZEV program assigns ZEV credits to each vehicle sold in California. The number of credits is based on the drivetrain type and the all-electric range (“AER”) of the vehicle under the Urban Dynamometer Driving Schedule Test Cycle. Plug-in hybrid vehicles (“PHEVs”) receive between 0.4 and 1.3 credits per vehicle. Battery electric and fuel cell vehicles receive between 1 and 4 credits per vehicle, based on range. The Fisker Ocean receives 3.4 credits or 4.0 credits, depending on trim and wheel options.

Vehicle manufacturers are then required to maintain ZEV credits equal to a set percentage of non-electric vehicles sold in California. By 2035, all new passenger vehicles sold in California must be a ZEV. Similar to the greenhouse gas standards, CARB permits manufacturers who over-comply with the ZEV standard of a given model year to sell those credits to a manufacturer who is not in compliance. CARB has established a $5,000 penalty for each credit that a manufacturer is short of the standard for that year.

Other states have adopted California’s ZEV sales requirements including Colorado, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island and Vermont (the “ZEV states”). Additionally, some states

15

have legislation to adopt California’s ZEV standard beginning in 2025 including Minnesota, Nevada, Virginia, and Washington. New Mexico will adopt these standards in 2026.

Because of the increasingly stringent ZEV sales requirements and the increasing number of states adopting these standards, we believe Fisker has significant opportunity to sell its ZEV credits to manufacturers who do not meet their quotas.

European Union

Regulation (EU) No. 443/2009 setting emissions performance standards for new passenger cars in the EU (as amended) provides that if the average CO2 emissions of a manufacturer’s fleet exceed its limit value in any Calendar Year from Calendar Year 2019 onwards, the manufacturer will have to pay to the European Commission an excess emissions premium of €95 for each subsequent CO2 g/km of exceedance per vehicle registered in the EU.

In the EU, manufacturers of passenger cars may act jointly through a pooling arrangement to collectively meet their CO2 emissions targets.

The indicative average EU fleet-wide emissions target for new passenger cars for the calendar year 2019 was 130 CO2 g/km. From 1 January 2020 this target has been reduced to 95 CO2 g/km. From 1 January 2020 until 31 December 2024 this target will be complemented by additional measures corresponding to a reduction of 10 CO2 g/km. Between 2025 and 2029 the target will be 15% stricter compared to 2021. From 1 January 2030, the target will be equal to a 37.5% reduction of the target in 2021.

The European Commission adjusts the Specific Emissions Target each year for each manufacturer on the basis of the average mass of the relevant passenger cars using a limit value curve. This is laid down in Implementing Decisions.

Manufacturers of passenger cars are given additional incentives to put on the European market zero and low-emission passenger cars emitting less than 50 CO2 g/km through a “super-credits” system. These are taken into account for the calculation of a manufacturer’s specific average emissions. Such passenger cars are to be counted as 2 vehicles in 2020, 1.67 vehicles in 2021, 1.33 vehicles in 2022, and 1 vehicle from 2023 onwards (subject to a cap of 7.5 CO2 g /km over the 2020-2022 period for each manufacturer).

Given that the specific average emissions of CO2 of Fisker’s electric passenger cars will be 0.000 CO2 g/km per vehicle registered in the EU, this will provide an opportunity for other manufacturers, which may not otherwise meet their specific CO2 emissions targets, to pay Fisker to consolidate their fleets with those of Fisker via a pooling arrangement for CO2 emissions compliance purposes.

Fuel Economy

The United States Department of Transportation, through its agency the National Highway Transportation Safety Administration (“NHTSA”), sets fuel economy standards for new vehicles sold in the U.S. NHTSA does so by setting standards for Corporate Average Fuel Economy (“CAFE”). The CAFE program assesses a manufacturer’s fleet of vehicles for its fuel economy, expressed in miles per gallon.

Manufacturers who over-comply with NHTSA’s CAFE standards are given a credit for every one-tenth of a mile per gallon by which they exceed the standard. For manufacturers whose fleet fails to meet the year’s standard, NHTSA set a penalty of $14 per credit deficiency. This penalty increased to $15 per credit in model year 2022.

Because Fisker vehicles are all electric, they not only comply with NHTSA standards but also generate CAFE credits. Fisker continues to engage manufacturers on selling these credits.

Vehicle Safety and Testing

Our vehicles are subject to, and will be required to comply with, numerous regulatory requirements established by the National Highway Traffic Safety Administration (“NHTSA”), including applicable U.S. federal motor vehicle safety standards (“FMVSS”). We intend for the Fisker Ocean to fully comply with all applicable FMVSSs without the need for

16

any exemptions, and expect future Fisker vehicles to either fully comply or comply with limited exemptions related to new technologies. Additionally, there are regulatory changes being considered for several FMVSSs, and while we anticipate compliance, there is no assurance until final regulation changes are enacted.

On January 11, 2024, NHTSA opened a Preliminary Evaluation regarding the Ocean’s braking performance. On February 14, 2024, NHTSA opened a Preliminary Evaluation regarding alleged unintended movement. And on April 1, 2024, NHTSA opened a Preliminary Evaluation regarding alleged failure of the Ocean’s latch and handle that prevents doors from opening. The Company is fully cooperating with NHTSA with respect to these matters.

As a manufacturer, Fisker must self-certify that its vehicles meet all applicable FMVSSs, as well as the NHTSA bumper standard, or otherwise are exempt, before the vehicles can be imported or sold in the U.S. Numerous FMVSSs will apply to Fisker’s vehicles, such as crash-worthiness requirements, crash avoidance requirements and EV requirements. We will also be required to comply with other federal laws administered by NHTSA, including the CAFE standards, Theft Prevention Act requirements, consumer information labeling requirements, Early Warning Reporting requirements regarding warranty claims, field reports, death and injury reports and foreign recalls and owner’s manual requirements.

The Automobile Information and Disclosure Act requires manufacturers of motor vehicles to disclose certain information regarding the manufacturer’s suggested retail price, optional equipment and pricing. In addition, this law allows inclusion of city and highway fuel economy ratings, as determined by EPA, as well as crash test ratings as determined by NHTSA if such tests are conducted.

Fisker vehicles sold outside of the U.S. are subject to similar foreign safety, environmental and other regulations. Many of those regulations are different from those applicable in the U.S. and may require redesign and/or retesting. The EU established new rules regarding additional compliance oversight, and there is also regulatory uncertainty related to the United Kingdom’s withdrawal from the EU. These changes could impact the rollout of new vehicle features in the EU. Fisker has completed the homologation testing process in the EU and U.S. during 2023. The Company has received regulatory approvals including the European Whole Vehicle Type Approval Certificate, EPA Certificate of Conformity, and CARB Executive Order, after which we commenced retail customer deliveries in both the U.S. and EU in 2023.

In addition to the various territorial legal requirements we are obligated to meet, the Fisker Ocean is engineered to deliver 5-star performance in the two main voluntary vehicle safety performance assessment programs, U.S. New Car Assessment Program (“NCAP”) and Euro NCAP. Five-star is the maximum attainable score. These independent organizations have introduced a number of additional safety related tests aimed at improving the safety of passenger vehicles, both for occupants and pedestrians involved in collisions with vehicles. Some of these tests are derived from the legal tests, such as side impact, but have higher performance requirements. Others are unique to the program. Areas covered by these tests in 2020 include:

•Mobile Progressive Deformable Barrier

•Full Width Rigid Barrier

•Mobile Side Impact Barrier

•Side Pole

•Far Side Impact

•Whiplash

•Vulnerable Road Users (Pedestrians and Cyclists)

•Safety Assist

•Rescue and Extrication

17

Strategic Collaborations

Magna

On October 14, 2020, Legacy Fisker and Spartan entered into a cooperation agreement with Magna setting forth certain terms for the development of a full electric vehicle (the “Cooperation Agreement”). The Cooperation Agreement sets out the main terms and conditions of the operational phase agreements (the “Operational Phase Agreements”) that will extend from the Cooperation Agreement and other agreements with Magna that are expected to be entered into by and between us and Magna (or its affiliates). The upcoming Operational Phase Agreements referenced in the Cooperation Agreement relate to various platform and manufacturing agreements. The Cooperation Agreement provides that we would issue to Magna warrants to purchase Class A Common Stock in an amount equal to six percent (6%) of our capital stock on a fully diluted basis (which means for these purposes, after giving effect to the deemed conversion or exercise of all of our options, warrants and other convertible securities outstanding on the issuance date; provided, however, that the “public warrants” sold as part of the units issued by Spartan in its initial public offering which closed on August 14, 2018 shall not be deemed to be exercised for these purposes) after giving effect to the Business Combination and issuance of the warrants to purchase such shares to Magna, with an exercise price of $0.01 per share of (the “Magna Warrants”). On October 29, 2020, we issued to Magna 19,474,454 Magna Warrants. The Magna Warrants were subject to the satisfaction of certain vesting criteria related to the development and start of production of the Fisker Ocean, all of which have been satisfied as of December 31, 2023.

The shares of Class A Common Stock underlying the Magna Warrants are entitled to registration rights pursuant to the Amended and Restated Registration Rights Agreement dated as of October 29, 2020, among us, Spartan Energy Acquisition Sponsor LLC, Magna, Henrik Fisker, Dr. Geeta Gupta-Fisker and certain former stockholders of Legacy Fisker.

On December 17, 2020, we announced that our wholly-owned operating subsidiary, Fisker Group Inc., entered into (i) a non-exclusive car platform sharing agreement with Steyr USA LLC (an affiliate of Magna), and (ii) an initial contract manufacturing agreement with Magna, which were originally contemplated by the Cooperation Agreement. On April 27, 2021 we entered into a Supplement No 1 to Development Services Agreement with Magna Steyr which provides for the completion of the development and launch of Fisker Ocean. On June 12, 2021 Fisker entered into the Detailed Manufacturing Agreement with Magna Steyr which provides for the contract manufacturing of the Fisker Ocean by Magna Steyr.

Human Capital Resources

We pride ourselves on the quality of our diverse team by seeking to hire only employees that are dedicated and aligned with our strategic mission. We work to leverage partnerships and modulate hiring based on our product roadmap. We employed approximately 1,560 full-time employees as of December 31, 2023, 760 as of December 31, 2022 and 327 as of December 31, 2021 based primarily in our California, Munich and Hyderabad facilities. The majority of our employees are engaged in marketing, sales and service with research and development and related functions close behind. To date, we have not experienced any work stoppages and consider our relationships with our employees to be in good standing. None of our employees are either represented by a labor union or subject to a collective bargaining agreement.

As of April 19, 2024, we employed approximately 1,135 employees. The decrease since December 31, 2023 primarily reflects actions taken to reduce our headcount.

We strive to attract a pool of diverse and exceptional candidates and support their career growth once they become employees. In addition, we seek to hire based on talent rather than solely on educational pedigree. We also emphasize in our evaluation and career development efforts internal mobility opportunities for employees to drive professional development.

We also believe that our ability to retain our workforce is dependent on our ability to foster an environment that is sustainably safe, respectful, fair and inclusive of everyone and promotes diversity, equity and inclusion inside and outside of our business. We engage diverse networks as key business resources and sources of actionable feedback. We are also working on diversity efforts in our supply chain to expand our outreach and support to small- and large-scale suppliers from underrepresented communities to emphasize this culture with our own employees.

18

Corporate Information

We were originally incorporated in Delaware in October 2017 as a special purpose acquisition company f/k/a Spartan Energy Acquisition Corp. In October 2020, we consummated our business combination with Fisker Group Inc. (f/k/a Fisker Inc.) through a reverse merger (the “Business Combination”). In connection with the closing of the Business Combination, we changed our name to Fisker Inc.

Our principal executive offices are located at 1888 Rosecrans Avenue, Manhattan Beach, California 90266. Our telephone number at that location is (833) 434-7537. Our corporate website address is www.fiskerinc.com. Information contained on, or that may be accessed through, our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered a part of this Annual Report on Form 10-K.

Fisker is a registered trademark of Fisker Inc. All other brand names or trademarks appearing in this Annual Report on Form 10-K are the property of their respective holders. Solely for convenience, the trademarks and trade names in this Annual Report on Form 10-K are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Available Information

We make available, free of charge through our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Sections 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after they have been electronically filed with, or furnished to, the SEC.

The SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors.

Our operations and financial results are subject to various risks and uncertainties, including those described below that could adversely affect our business, financial condition, results of operations, cash flows and the trading price of our Class A Common Stock. You should carefully consider the following risks, together with all of the other information in this Annual Report on Form 10-K, including our financial statements and the related notes included elsewhere in this Annual Report on Form 10-K.

RISK FACTORS SUMMARY

Investing in our securities involves a high degree of risk. Below please find a summary of the principal risks we face. These risks are discussed more fully below:

Operational Risks

•There is substantial doubt about our ability to continue as a going concern.

•Our ability to develop, manufacture and obtain required regulatory approvals for a car of sufficient quality and appeal to customers on schedule and on a large scale is unproven.

•We are substantially reliant on our relationships with suppliers and service providers for the parts and components in our vehicles, as well as for the manufacture of our initial vehicles. If any of these suppliers or service partners choose to not do business with us, then we would have significant difficulty in procuring and producing our vehicles and our business prospects would be significantly harmed.

•Our relationship with automotive suppliers is integral to our platform procurement and manufacturing plan, and we may not be able to obtain such commitments in the future. We therefore may seek alternative arrangements with a number of component suppliers, and contract manufacturers, which we may not be successful in obtaining.

•If we are unable to continue to contract with OEMs or suppliers on manufacturing of our future vehicles, we would need to develop our own platform and manufacturing facilities, which may not be feasible and, if feasible at all, would significantly increase our capital expenditure and would significantly delay production of our vehicles.

19

•There are complex software and technology systems that need to be developed in coordination with vendors and suppliers in order to reach production for our electric vehicles, and there can be no assurance such systems will be successfully developed.

•We may experience significant delays in the design, manufacture, regulatory approval, launch and financing of our vehicles, which could harm our business and prospects.

•We are dependent on our suppliers, a significant number of which are single or limited source suppliers, and the inability of our suppliers to deliver necessary components for our vehicles in a timely manner and at prices and volumes acceptable to us could have a material adverse effect on our business, prospects and operating results.

•Our vehicles make use of lithium-ion battery cells, which have been observed to catch fire or vent smoke and flame.

•We have a limited operating history and face significant challenges as a new entrant into the automotive industry.

•We are an early-stage company with a history of losses, and we expect to incur significant expenses and continuing losses in the future.

•Our limited operating history makes evaluating our business and future prospects difficult and will increase the risk of investing in us.

•If our vehicles fail to perform as expected, our ability to develop, market, and sell or lease our electric vehicles could be harmed.

•We may not succeed in establishing, maintaining and strengthening our brand, which would materially and adversely affect customer acceptance of its vehicles and components and its business, revenues and prospects.

•Our direct-to-consumer distribution model which we historically deployed has been different from the predominant current distribution model for automobile manufacturers. We are transitioning to a dealer sales model, which makes evaluating our business, operating results and future prospects difficult.

•We depend on revenue generated from a single model and in the foreseeable future will be significantly dependent on a limited number of models.

Macroeconomic, Market, and Strategic Risks

•Our asset-light business model is unique in the automotive industry and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business, harm our reputation and could result in substantial liabilities that exceed our resources.

•We could experience cost increases or disruptions in supply of raw materials or other components used in our vehicles. The automotive market is highly competitive, and we may not be successful in competing in this industry.

•Our future growth is dependent on the demand for, and upon consumers’ willingness to adopt, electric vehicles.

•Doing business internationally creates operational and financial risks for our business.

•We have identified material weaknesses in our internal control over financial reporting. If our remediation of such material weaknesses is not effective, or if we experience additional material weaknesses in the future or otherwise fail to develop and maintain effective internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable laws and regulations could be impaired, which could adversely affect investor confidence in the accuracy and completeness of our financial statements and adversely affect our business and operating results and the market price for our Class A common stock.

•The issuance of shares of our Class A Common Stock upon the conversion of the 2025 Notes or the exercise of the outstanding Magna Warrants would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders.

Financial Risks

•Our operating and financial results forecast relies in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our forecasted results.

•Retail vehicle sales depend significantly on affordable interest rates and availability of credit for vehicle financing and a substantial increase in interest rates could adversely affect our business, prospects, financial condition, results of operations, and cash flows.

•Our business plans require a significant amount of capital. In addition, our future capital needs are likely to require us to sell additional equity or debt securities that may dilute our stockholders or introduce covenants that may restrict our operations or our ability to pay dividends.

20

•Absent relief, as a result of our failure to timely file a periodic report with the SEC, we are currently ineligible to file a registration statement on Form S-3, which is likely to impair our ability to raise capital on terms favorable to us, in a timely manner or at all.

•Our Class A Common Stock is currently traded on the OTC Market Pink Sheets, which may have an unfavorable impact on our stock price and liquidity.

Legal and Regulatory Risks

•Compliance with and changes to state dealer franchise laws could adversely impact our ability to successfully move to a dealership sales model.

•We retain certain information about our users and may be subject to various privacy and consumer protection laws.

•We may not be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive position.

•Our patent applications may not issue as patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

•Our vehicles are subject to motor vehicle standards and the failure to satisfy such mandated safety standards would have a material adverse effect on our business and operating results.

•We will face risks associated with potential international operations, including unfavorable regulatory, political, tax and labor conditions, which could harm our business.

•The dual class structure of our Common Stock has the effect of concentrating voting with Henrik Fisker and Dr. Geeta Gupta-Fisker, our co-founders, members of our Board of Directors and Chief Executive Officer and Chief Financial Officer, respectively. This may limit or preclude other stockholders' ability to influence corporate matters, including the outcome of important transactions, including a change in control.

Risks Related to Our Convertible Senior Notes

•The 2026 Notes are effectively subordinated to our existing and future secured indebtedness and structurally subordinated to the liabilities of our subsidiaries.

•We did not make a required interest payment of approximately $8.4 million payable in cash on March 15, 2024 with respect to the 2026 Notes. Under the indenture governing the 2026 Notes, such non-payment is a default and we had a 30-day grace period to make the interest payment which now has elapsed. Such non-payment constitutes an Event of Default with respect to the 2026 Notes. For the quarter ended March 31, 2024, the 2026 Notes (in addition to the 2025 Notes) are expected to be classified as a current liability.

•We may be unable to raise the funds necessary to repurchase the 2026 Notes for cash following a fundamental change (as defined in the Indenture) or to pay any cash amounts due upon conversion, and our other indebtedness limits our ability to repurchase the 2026 Notes or pay cash upon their conversion.

•Our indebtedness and liabilities could limit the cash flow available for our operations, expose us to risks that could adversely affect our business, financial condition, and results of operations and impair our ability to satisfy our obligations under the Notes.

•Our obligations to the Investor pursuant to the 2025 Notes are secured by a first priority security interest in all of the existing and future assets of the Company and certain of our subsidiaries, and because of a default, the Investor could foreclose on, liquidate and/or take possession of such assets. If that were to happen, we could be forced to curtail, or even to cease, our operations.

21

We have listed below the material risk factors applicable to us grouped into the following categories: Operational Risks; Macroeconomic, Market, and Strategic Risks; Financial Risks; Legal and Regulatory Risks; and Risks Related to Our Convertible Notes.

Operational Risks

There is substantial doubt about our ability to continue as a going concern.

We used $904.9 million in cash in operating and investing activities in 2023, and our cash balance reduced from $736.5 million at December 31, 2022 to $325.5 million at December 31, 2023. Our cash and cash equivalents balance further reduced to $53.9 million of unrestricted and $11.2 million of restricted at April 16, 2024, reflecting significant payments to certain suppliers. We expect to require additional cash in 2024 for debt service and investment needs, and our ability to generate cash from operating activities will depend on our ability to transition to a dealer model and sell vehicles. Accordingly, we have concluded there is substantial doubt as to our ability to continue as a going concern.

Our ability to continue as a going concern is dependent upon our ability to raise additional debt or equity financings, enter into a strategic partnership with an OEM, and generate cash from the sale of vehicles. We need significant additional funding in the near term to execute our business plan and to continue our operations. We continue to seek and evaluate opportunities to raise additional funds through the issuance of our securities, through one or more potential strategic partnerships, and from the sale of vehicles. If capital is not available to us when, and in the amounts needed, we could be required to further curtail our operations. Moreover, if we do not raise capital in the near term or receive a forbearance agreement and/or waivers from our debt holders (for relief from current defaults), we will be unable to satisfy our debt service obligations and expect to seek protection under applicable bankruptcy laws.

Our ability to develop, manufacture and obtain required regulatory approvals for a car of sufficient quality and appeal to customers on schedule and on a large scale is unproven.

Our business depends in large part on our ability to develop, manufacture, market and sell or lease our electric vehicles. Initially, we plan to manufacture vehicles in collaboration with contract manufacturers such as Magna Steyr, automotive component and large tier-one automotive suppliers.