Filed Pursuant to Rule 424(b)(5)

Registration No. 333-251359

Prospectus Supplement

(to Prospectus dated December 15, 2020)

76,500,000 American Depositary Shares

Representing 535,500,000 Class A Ordinary Shares

iQIYI, Inc.

This prospectus supplement relates to an offering by us of an aggregate of 76,500,000 American depositary shares, or ADSs, each representing seven Class A ordinary shares, par value US$0.00001 per share, of iQIYI, Inc. Our ADSs are listed on The Nasdaq Global Select Market under the symbol “IQ.” The last reported sale price of our ADSs on The Nasdaq Global Select Market on January 13, 2023 was US$6.69 per ADS.

Investing in the ADSs involves risk. See “Risk Factors” beginning on page S-13 of this prospectus supplement for a discussion of certain risks that you should consider in connection with an investment in the ADSs.

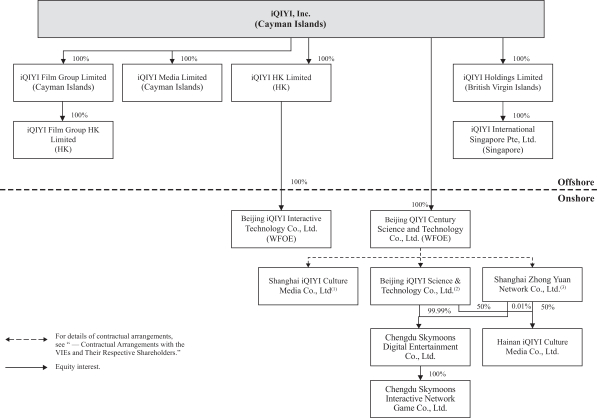

iQIYI, Inc. is not a Chinese operating company, but rather a Cayman Islands holding company with no equity ownership in the variable interest entities, or the VIEs. Our Cayman Islands holding company does not conduct business operations directly. We conduct our operations in China through (i) our PRC subsidiaries and (ii) the VIEs with which we have maintained contractual arrangements and their subsidiaries in China. PRC laws and regulations impose certain restrictions or prohibitions on foreign ownership of companies that engage in certain value-added telecommunication services, internet audio-video program services and certain other businesses. Accordingly, we operate these businesses in China through the VIEs and their subsidiaries, and rely on contractual arrangements among our PRC subsidiaries, the VIEs and their nominee shareholders to control the business operations of the VIEs. The VIEs are consolidated for accounting purposes, but are not entities in which our Cayman Islands holding company, or our investors, own equity. Revenues contributed by the VIEs accounted for 93%, 92%, 94% of our total revenues for the years ended December 31, 2019, 2020 and 2021, respectively. As used in this prospectus supplement, “we,” “us,” “our company,” “our,” or “iQIYI” refers to iQIYI, Inc., its subsidiaries, and, in the context of describing our operations and consolidated financial information, the VIEs in China, including Beijing iQIYI Science and Technology Co., Ltd. (“Beijing iQIYI”), Shanghai iQIYI Culture Media Co., Ltd. (“Shanghai iQIYI”) and Shanghai Zhong Yuan Network Co., Ltd. (“Shanghai Zhong Yuan”), iQIYI Pictures (Beijing) Co., Ltd. (“iQIYI Pictures”) and Beijing iQIYI Intelligent Entertainment Technology Co., Ltd., (“Intelligent Entertainment”). Investors in the ADSs are not purchasing equity interest in the VIEs in China, but instead are purchasing equity interest in a holding company incorporated in the Cayman Islands.

However, the contractual arrangements may not be as effective as direct ownership in providing us with control over the VIEs and we may incur substantial costs to enforce the terms of the arrangements. Uncertainties in the PRC legal system may limit our ability, as a Cayman Islands holding company, to enforce these contractual arrangements. Meanwhile, there are very few precedents as to whether contractual arrangements would be judged to form effective control over the relevant VIEs through the contractual arrangements, or how contractual arrangements in the context of a the VIEs should be interpreted or enforced by the PRC courts. Should legal actions become necessary, we cannot guarantee that the court will rule in favor of the enforceability of the VIEs contractual arrangements. In the event we are unable to enforce these contractual arrangements, or if we suffer significant delay or other obstacles in the process of enforcing these contractual arrangements, we may not be able to exert effective control over the VIEs, and our ability to conduct our business may be materially adversely affected. For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under “Item 3. Key Information — D. Risk Factors — Risks Relating to Our Corporate Structure” in our annual report on Form 20-F for the fiscal year ended December 31, 2021 (the “2021 Form 20-F”), which is incorporated by reference in the accompanying prospectus, and “Risk Factors — Risks Relating to This Offering” in this prospectus supplement.

There are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules regarding the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with the VIEs and their nominee shareholders. It is uncertain whether any new PRC laws or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide. As of the date of this prospectus supplement, to our best knowledge, our directors and management, the contractual arrangements with the VIEs have not been tested in a court of law in the PRC. If we or any of the VIEs is found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. If the PRC government deems that our contractual arrangements with the VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy. Our Cayman Islands holding company, our PRC subsidiaries and the VIEs, and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect the financial performance of the VIEs and our company as a whole. See “Item 3. Key Information — D. Risk Factors — Risks Related to Our Corporate Structure—If the PRC government finds that the agreements that establish the structure for operating certain of our operations in China do not comply with PRC regulations relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations” and “—Uncertainties exist with respect to the interpretation and implementation of the newly enacted PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations” in the 2021 Form 20-F, which is incorporated by reference in the accompanying prospectus.

We face various risks and uncertainties related to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex and evolving PRC laws and regulations. For example, we face risks associated with regulatory approvals on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, which may impact our ability to conduct certain businesses, accept foreign investments or financing, or list on a United States or other foreign exchange. In addition, trading in our securities on U.S. markets, including Nasdaq, may be prohibited under the Holding Foreign Companies Accountable Act (the “HFCAA”) if the Public Company Accounting Oversight Board (the “PCAOB”) determines that it is unable to inspect or investigate completely our auditor for two consecutive years. On December 16, 2021, the PCAOB issued the HFCAA Determination Report to notify the SEC of its determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong (the “2021 Determinations”), including our auditor. On April 21, 2022, we were identified by the SEC under the HFCAA as having filed audit reports issued by a registered public accounting firm that cannot be inspected or investigated completely by the PCAOB in connection with the filing of our 2021 Form 20-F. The inability of the PCAOB to conduct inspections in the past also deprived our investors of the benefits of such inspections. On December 15, 2022, the PCAOB announced that it was able to conduct inspections and investigations completely of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022. The PCAOB vacated its previous 2021 Determinations accordingly. As a result, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCAA for the fiscal year ended December 31, 2022 after we file our annual report on Form 20-F for such fiscal year. However, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume regular inspections in early 2023 and beyond. The PCAOB is required under the HFCAA to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. If the PCAOB determines in the future that it no longer has full access to inspect and investigate accounting firms headquartered in mainland China and Hong Kong and we continue to use such accounting firm to conduct audit work, we would be identified as a “Commission-Identified Issuer” under the HFCAA following the filing of the annual report for the relevant fiscal year, and if we were so identified for two consecutive years, trading in our securities on U.S. markets would be prohibited. For a detailed description of risks related to doing business in China, “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China” in our 2021 Form 20-F, which is incorporated by reference in the accompanying prospectus, and “Risk Factors — Risks Relating to Doing Business in China” in this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the issuance of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

PRICE US$5.90 PER ADS

| | | | | | | | |

| | | Per ADS | | | Total | |

Public offering price | | US$ | 5.90000 | | | US$ | 451,350,000 | |

Underwriting discounts and commissions | | US$ | 0.11800 | | | US$ | 9,027,000 | |

Proceeds to us (before expenses)(1) | | US$ | 5.78200 | | | US$ | 442,323,000 | |

| (1) | See “Underwriting” beginning on page S-64 of this prospectus supplement for a description of the compensation payable to the underwriters. |

The underwriters have an option to purchase up to an aggregate of 11,475,000 additional ADSs from us at the public offering price, less underwriting discounts and commissions, within 30 days of the date of this prospectus supplement.

The underwriters expect to deliver the ADSs against payment in New York, New York on or about January 19, 2023.

| | | | |

| BofA Securities | | Goldman Sachs | | J.P. Morgan |

Prospectus Supplement dated January 17, 2023