UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission file number: 333-225927

Riviera Resources, Inc.

(Exact name of registrant as specified in its charter)

| | |

Delaware | | 82-5121920 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

600 Travis Street, Suite 1700 Houston, Texas | | 77002 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code

(281) 840-4000

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ☒ | | Accelerated filer ☐ |

| | |

Non-accelerated filer ☐ | | Smaller reporting company ☐ |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check-mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

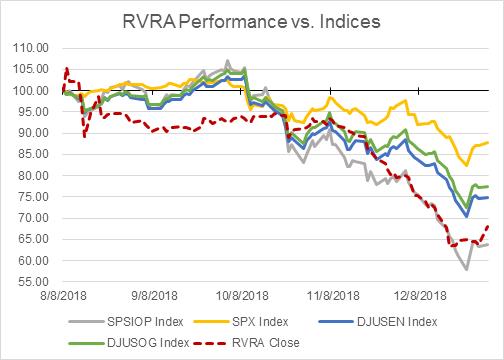

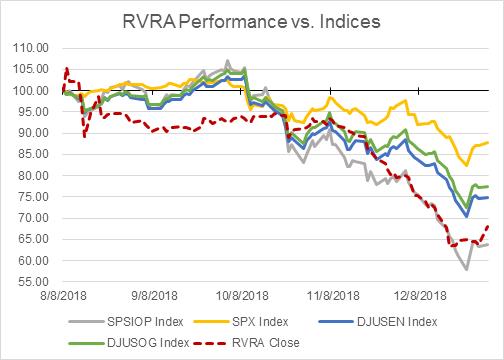

As of June 30, 2018, the last business day of the registrant’s most recently completed second quarter, the registrant’s common stock was not publicly traded. The registrant’s common stock began trading on the OTCQX Market on August 8, 2018.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No ☐

As of January 31, 2019, there were 69,065,373 shares of common stock, par value $0.01 per share, outstanding.

Documents Incorporated By Reference:

Portions of the registrant’s definitive proxy statement relating to its 2019 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days after December 31, 2018, are incorporated by reference to the extent set forth in Part III, Items 10-14 of this Annual Report on Form 10‑K.

TABLE OF CONTENTS

i

Table of Contents

Glossary of Terms

As commonly used in the oil and natural gas industry and as used in this Annual Report on Form 10-K, the following terms have the following meanings:

Basin. A large area with a relatively thick accumulation of sedimentary rocks.

Bbl. One stock tank barrel or 42 United States gallons liquid volume.

Bcf. One billion cubic feet.

Bcfe. One billion cubic feet equivalent, determined using the ratio of six Mcf of natural gas to one Bbl of oil, condensate or natural gas liquids.

Btu. One British thermal unit, which is the heat required to raise the temperature of a one-pound mass of water from 58.5 degrees to 59.5 degrees Fahrenheit.

Development well. A well drilled within the proved area of a reservoir to the depth of a stratigraphic horizon known to be productive.

Dry hole or well. A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production would exceed production expenses and taxes.

Exploratory well. A well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or natural gas in another reservoir.

Field. An area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature and/or stratigraphic condition.

Formation. A stratum of rock that is recognizable from adjacent strata consisting primarily of a certain type of rock or combination of rock types with thickness that may range from less than two feet to hundreds of feet.

Gross acres or gross wells. The total acres or wells, as the case may be, in which a working interest is owned.

MBbls. One thousand barrels of oil or other liquid hydrocarbons.

MBbls/d. MBbls per day.

Mcf. One thousand cubic feet.

Mcfe. One thousand cubic feet equivalent, determined using the ratio of six Mcf of natural gas to one Bbl of oil, condensate or natural gas liquids.

MMBbls. One million barrels of oil or other liquid hydrocarbons.

MMBtu. One million British thermal units.

MMcf. One million cubic feet.

MMcf/d. MMcf per day.

MMcfe. One million cubic feet equivalent, determined using the ratio of six Mcf of natural gas to one Bbl of oil, condensate or natural gas liquids.

MMcfe/d. MMcfe per day.

MMMBtu. One billion British thermal units.

Net acres or net wells. The sum of the fractional working interests owned in gross acres or gross wells, as the case may be.

ii

Table of Contents

Glossary of Terms – Continued

NGL. Natural gas liquids, which are the hydrocarbon liquids contained within natural gas.

Productive well. A well found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceeds production expenses and taxes.

Proved developed reserves. Reserves that can be expected to be recovered through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well.

Proved reserves. Reserves that by analysis of geoscience and engineering data can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

Proved undeveloped drilling location. A site on which a development well can be drilled consistent with spacing rules for purposes of recovering proved undeveloped reserves.

Proved undeveloped reserves or PUDs. Reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. Reserves on undrilled acreage are limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time. Estimates for proved undeveloped reserves are not attributed to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, or by other evidence using reliable technology establishing reasonable certainty.

Recompletion. The completion for production of an existing wellbore in another formation from that which the well has been previously completed.

Reservoir. A porous and permeable underground formation containing a natural accumulation of economically productive natural gas and/or oil that is confined by impermeable rock or water barriers and is individual and separate from other reserves.

Royalty interest. An interest that entitles the owner of such interest to a share of the mineral production from a property or to a share of the proceeds there from. It does not contain the rights and obligations of operating the property and normally does not bear any of the costs of exploration, development and operation of the property.

Spacing. The number of wells which conservation laws allow to be drilled on a given area of land.

Standardized measure of discounted future net cash flows. The after-tax present value of estimated future net cash flows of proved reserves, determined in accordance with the regulations of the Securities and Exchange Commission and discounted using an annual discount rate of 10%.

Undeveloped acreage. Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil, natural gas and NGL regardless of whether such acreage contains proved reserves.

Unproved reserves. Reserves that are considered less certain to be recovered than proved reserves. Unproved reserves may be further sub-classified to denote progressively increasing uncertainty of recoverability and include probable reserves and possible reserves.

Working interest. The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and a share of production.

Workover. Maintenance on a producing well to restore or increase production.

Zone. A stratigraphic interval containing one or more reservoirs.

iii

Table of Contents

Part I

This Annual Report on Form 10-K contains forward-looking statements based on expectations, estimates and assumptions as of the date of this filing. These statements by their nature are subject to a number of risks and uncertainties. Actual results may differ materially from those discussed in the forward-looking statements. For more information, see “Cautionary Statement Regarding Forward-Looking Statements” included at the end of this Item 1. “Business” and see also Item 1A. “Risk Factors.”

References

Unless otherwise indicated or the context otherwise requires, references herein to the “Company,” “we,” “our,” and “us” refer (i) prior to the Spin-off (as defined below) to Linn Energy, Inc. (the “Parent”) and its consolidated subsidiaries, and (ii) after the Spin-off, to Riviera Resources, Inc. (“Riviera”) and its consolidated subsidiaries. Unless otherwise indicated or the context otherwise requires, references herein to “LINN Energy” refer to Linn Energy, Inc. and its consolidated subsidiaries. References to “Successor” relate to the financial position and results of operations of the Company subsequent to LINN Energy’s emergence from bankruptcy on February 28, 2017. References to “Predecessor” relate to the financial position of the Company prior to, and results of operations through and including February 28, 2018. Riviera is a successor issuer of the Parent pursuant to Rule 15d-5 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The reference to a “Note” herein refers to the accompanying Notes to Consolidated and Combined Financial Statements contained in Item 8. “Financial Statements and Supplementary Data.”

Overview

In April 2018, the Parent announced its intention to separate Riviera from LINN Energy.

To effect the separation, the Parent and certain of its then direct and indirect subsidiaries undertook an internal reorganization (including the conversion of Riviera Resources, LLC from a limited liability company to a corporation named Riviera Resources, Inc.), following which Riviera holds, directly or through its subsidiaries, substantially all of the assets of LINN Energy, other than LINN Energy’s 50% equity interest in Roan Resources LLC (“Roan”). A subsidiary of the Company held the equity interest in Roan until the Parent’s internal reorganization on July 25, 2018 (the “Reorganization Date”). Following the internal reorganization, the Parent distributed all of the outstanding shares of Riviera common stock to the Parent’s shareholders on a pro rata basis (the “Spin-off”). The Spin-off was completed on August 7, 2018.

Following the Spin-off, Riviera is an independent reporting company quoted for trading on the OTCQX Market under the ticker “RVRA,” and the Parent did not retain any ownership interest in Riviera.

Prior to the Spin-off, the accompanying consolidated and combined financial statements were prepared on a stand-alone basis and derived from the Parent’s consolidated financial statements and accounting records for the periods presented as the Company was historically managed as a subsidiary of the Parent. After the Spin-off, Riviera is an independent company.

The Company’s upstream reporting segment properties are currently located in six operating regions in the United States (“U.S.”): the Hugoton Basin, East Texas, Michigan/Illinois, the Mid-Continent, North Louisiana and the Uinta Basin. Proved reserves at December 31, 2018, were approximately 1,618 Bcfe, of which approximately 78% were natural gas, 21% were natural gas liquids (“NGL”) and 1% were oil. Approximately 96% were classified as proved developed, with a total standardized measure of discounted future net cash flows of approximately $747 million. In addition, the Company estimates the total discounted future net cash flows of its helium reserves are approximately $110 million, net of income taxes. At December 31, 2018, the Company operated 7,078 or approximately 57% of its 12,354 gross productive wells.

The Blue Mountain reporting segment consists of a state of the art cryogenic natural gas processing facility and a network of gathering pipelines and compressors located in the Merge/SCOOP/STACK play, each of which is owned by Blue Mountain Midstream LLC (“Blue Mountain Midstream”), a wholly owned subsidiary of the Company.

1

Table of Contents

Item 1.Business - Continued

Strategy

Riviera is an independent oil and natural gas company with a strategic focus on efficiently operating its mature low-decline assets, developing its growth-oriented assets, and returning capital to shareholders. Blue Mountain Midstream is an emerging midstream company with assets in central Oklahoma focused on providing its customers with comprehensive natural gas, oil, natural gas liquids, and water solutions in a safe and environmentally sound manner, including gas gathering and processing, water gathering and treatment, and delivery of product to lucrative downstream markets. In the future, Blue Mountain Midstream looks to expand the scale and scope of its service capabilities in the Merge/SCOOP/STACK through organic growth and strategic acquisitions.

Recent Developments

Divestitures

Below are the Company’s completed divestitures in 2018:

On April 10, 2018, the Company completed the sale of its conventional properties located in New Mexico. Cash proceeds received from the sale of these properties were approximately $14 million and the Company recognized a net gain of approximately $12 million.

On April 4, 2018, the Company completed the sale of its interest in properties located in the Altamont Bluebell Field in Utah. Cash proceeds received from the sale of these properties were approximately $129 million, net of costs to sell of approximately $2 million, and the Company recognized a net gain of approximately $83 million.

On March 29, 2018, the Company completed the sale of its interest in conventional properties located in west Texas. Cash proceeds received from the sale of these properties were approximately $105 million, net of costs to sell of approximately $2 million, and the Company recognized a net gain of approximately $54 million.

On February 28, 2018, the Company completed the sale of its Oklahoma waterflood and Texas Panhandle properties. Cash proceeds received from the sale of these properties were approximately $108 million (including a deposit of approximately $12 million received in 2017), net of costs to sell of approximately $1 million, and the Company recognized a net gain of approximately $46 million.

Divestiture – Subsequent Event

On January 17, 2019, the Company completed the sale of its interest in properties located in the Arkoma Basin in Oklahoma and received cash proceeds of approximately $65 million (including a deposit of approximately $5 million received in 2018).

Water Services Agreement

On January 31, 2019, the Company entered into an agreement with Roan to exclusively manage all of Roan’s water needs for its drilling and completion operations in Central Oklahoma. Blue Mountain Midstream will provide comprehensive water management services including pipeline gathering, disposal, treatment and redelivery of recycled water for re-use. The agreement is supported by a 10-year acreage dedication in 67 Townships covering portions of seven Oklahoma Counties.

Construction of Cryogenic Plant

In July 2017, the Company’s subsidiary Blue Mountain Midstream entered into a definitive agreement with BCCK Engineering, Inc. to construct a 225 MMcf/d cryogenic natural gas processing facility with a total capacity of 250 MMcf/d (“Cryo 1”). The facility was successfully commissioned in the second quarter of 2018.

In August 2018, the Company’s Board of Directors (the “Board”) approved Blue Mountain Midstream’s plan to initiate the engineering and design of a second cryogenic natural gas processing plant (“Cryo 2”) servicing the Merge/SCOOP/STACK play in central Oklahoma. Blue Mountain Midstream has completed the conceptual engineering and design for Cryo 2 and has the ability to execute on Cryo 2 quickly if the election is eventually made to proceed.

2

Table of Contents

Item 1.Business - Continued

2018 Oil and Natural Gas and Midstream Capital Expenditures

During the year ended December 31, 2018, the Company had total capital expenditures, excluding acquisitions, of approximately $170 million, including approximately $36 million related to its oil and natural gas capital program and approximately $125 million related to Blue Mountain Midstream.

2019 Oil and Natural Gas Capital Budget

For 2019, the Company estimates its total capital expenditures, excluding acquisitions and Blue Mountain, will be approximately $66 million, including approximately $61 million related to its oil and natural gas capital program. This estimate is under continuous review and subject to ongoing adjustments.

Financing Activities

Blue Mountain Credit Facility

On August 10, 2018, Blue Mountain Midstream entered into a credit agreement with Royal Bank of Canada, as administrative agent, and the lenders and agents party thereto, providing for a new senior secured revolving loan facility (the “Blue Mountain Credit Facility” and together with Riviera Credit Facility, the “Credit Facilities”), providing for an initial borrowing commitment of $200 million.

Before Blue Mountain Midstream completes certain operational milestones (such completion of the operational milestones, the “Covenant Changeover Date”), a condition to any borrowing is that Blue Mountain Midstream’s consolidated total indebtedness to capitalization ratio (the “Debt/Cap Ratio”) be not greater than 0.35 to 1.00 upon giving effect to such borrowing. As such, prior to the Covenant Changeover Date, the available borrowing capacity under the Blue Mountain Credit Facility may be less than the aggregate amount of the lenders’ commitments at such time. On and after the Covenant Changeover Date, Blue Mountain Midstream will no longer have to comply with the Debt/Cap Ratio as a condition to drawing and may borrow up to the total amount of the lenders’ aggregate commitments. The Blue Mountain Credit Facility also provides for the ability to increase the aggregate commitments of the lenders to up to $400 million after the Covenant Changeover Date, subject to obtaining commitments for any such increase, which may result in an increase in Blue Mountain Midstream’s available borrowing capacity. As of December 31, 2018, total borrowings outstanding under the Blue Mountain Credit Facility were $4.5 million and there was approximately $72 million of available borrowing capacity (in addition, there was $12 million of outstanding letters of credit). The Covenant Changeover Date occurred February 8, 2019, which increased the current borrowing commitment to $200 million. At February 28, 2019, total borrowings outstanding under the Blue Mountain Credit Facility were approximately $19 million and there was approximately $169 million of available borrowing capacity (which includes a $12 million reduction for outstanding letters of credit). The Blue Mountain Credit Facility matures on August 10, 2023.

Share Repurchase Program

On August 16, 2018, the Board authorized the repurchase of up to $100 million of the Company’s outstanding shares of common stock. During the period from August 2018 through December 31, 2018, the Company repurchased an aggregate of 945,979 shares of common stock at an average price of $19.21 per share for a total cost of approximately $18 million. For the period from January 1, 2019 through February 22, 2019, the Company repurchased 221,788 shares of common stock at an average price of $15.27 for a total cost of approximately $3 million. At February 22, 2019, approximately $78 million was available for share repurchase under the program.

In accordance with the SEC’s regulations regarding issuer tender offers, the Company’s share repurchase program was suspended concurrent with the September 24, 2018, announcement of the intent to commence a tender offer. The program was resumed in November 2018 following the expiration of the tender offer.

Any share repurchases are subject to restrictions in the Company’s senior secured reserve-based revolving loan facility (the “Riviera Credit Facility”).

Tender Offer

On September 24, 2018, the Company announced the intention to commence a tender offer to purchase $100 million of the Company’s common stock. In October 2018, upon the terms and subject to the conditions described in the Offer to Purchase dated September 25, 2018, as amended, the Company repurchased an aggregate of 6,062,179 shares of common stock at a

3

Table of Contents

Item 1.Business - Continued

price of $22.00 per share for a total cost of approximately $133 million (excluding expenses of approximately $2 million related to the tender offer).

Upstream Segment Operating Regions

The Company’s upstream segment properties are located in six operating regions in the U.S.:

| • | Hugoton Basin, which includes oil and natural gas properties, as well as the Jayhawk natural gas processing plant, located in Kansas; |

| • | East Texas, which includes oil and natural gas properties producing primarily from the Travis Peak, Cotton Valley and Bossier formations; |

| • | Michigan/Illinois, which includes properties producing from the Antrim Shale formation located in northern Michigan and oil properties in southern Illinois; |

| • | Mid-Continent, which includes properties in the Northwest STACK in northwestern Oklahoma and various other oil and natural gas producing properties throughout Oklahoma; |

| • | North Louisiana, which includes oil and natural gas properties producing primarily from the Hosston, Cotton Valley Bossier and Smackover formations; and |

| • | Uinta Basin, which includes non-operated properties located in the Dunkards Wash field in Utah (which was included in the Company’s previous Rockies operating region). |

Historically, a subsidiary of the Company also owned a 50% equity interest in Roan. The Company’s equity earnings (losses), consisting of its share of Roan’s earnings or losses, are included in the consolidated financial statements through the Reorganization Date. However, on the Reorganization Date, the equity interest in Roan was distributed to the Parent and is no longer affiliated with Riviera. As such, the Company has classified the investment and equity earnings (losses) in Roan as discontinued operations on its consolidated financial statements. See Note 4 for additional information.

During 2018, the Company divested all of its properties located in the previous Permian Basin operating region. During 2017, the Company divested all of its properties located in the previous California and South Texas operating regions. As a result of the Company’s strategic exit from California in 2017 (completed by the sale of its interest in properties located in the San Joaquin Basin and the Los Angeles Basin in California), the Company classified the results of operations and cash flows of its California properties as discontinued operations on its consolidated and combined financial statements. See below and Note 4 for details of the Company’s divestitures.

Hugoton Basin

The Hugoton Basin is a large oil and natural gas producing area located in southwest Kansas. The Company’s Hugoton Basin properties primarily produce from the Council Grove and Chase formations at depths ranging from 2,200 feet to 3,100 feet. The Company’s properties in this region are primarily mature, low-decline natural gas wells.

The Company also owns and operates the Jayhawk natural gas processing plant in southwest Kansas with a capacity of approximately 450 MMcf/d, allowing it to receive maximum value from the liquids-rich natural gas produced in the area. The Company’s production in the area is delivered to the plant via a system of approximately 3,120 miles of pipeline and related facilities operated by the Company, of which approximately 1,005 miles of pipeline are owned by the Company.

Hugoton Basin proved reserves represented approximately 50% of total proved reserves at December 31, 2018, all of which were classified as proved developed. This region produced approximately 138 MMcfe/d of the Company’s 2018 average daily production. During 2018, the Company invested approximately $5 million for plant and pipeline construction activities in this region.

East Texas

The East Texas region consists of properties located in east Texas primarily producing natural gas from the Travis Peak, Cotton Valley and Bossier formations at depths ranging from 7,000 feet to 12,500 feet. The Company’s properties in this region are primarily mature, low-decline natural gas wells. To more efficiently transport its natural gas in east Texas to market, the Company owns and operates a network of natural gas gathering systems comprised of approximately 590 miles of pipeline and associated compression and metering facilities that connect to numerous sales outlets in the area.

4

Table of Contents

Item 1.Business - Continued

East Texas proved reserves represented approximately 17% of total proved reserves at December 31, 2018, of which 88% were classified as proved developed. This region produced approximately 50 MMcfe/d of the Company’s 2018 average daily production. During 2018, the Company invested approximately $2 million to develop the properties in this region and approximately $2 million in exploration activity.

Michigan/Illinois

The Michigan/Illinois region consists primarily of natural gas properties in the Antrim Shale formation in north Michigan and oil properties in south Illinois. These wells produce at depths ranging from 500 feet to 4,000 feet. To more efficiently transport its natural gas in Michigan to market, the Company owns and operates a network of natural gas gathering systems comprised of approximately 1,480 miles of pipeline and associated compression and metering facilities that connect to numerous sales outlets in the area.

Michigan/Illinois proved reserves represented approximately 14% of total proved reserves at December 31, 2018, all of which were classified as proved developed. This region produced approximately 28 MMcfe/d of the Company’s 2018 average daily production. During 2018, the Company invested approximately $1 million to develop the properties in this region.

Mid-Continent

The Mid-Continent region consists of properties located in the Northwest STACK, as well as other Oklahoma properties. The Company’s properties in this diverse region produce from both oil and natural gas reservoirs at depths ranging from 3,500 feet to 19,000 feet.

Mid-Continent proved reserves represented approximately 11% of total proved reserves at December 31, 2018, all of which were classified as proved developed. This region produced approximately 53 MMcfe/d of the Company’s 2018 average daily production. During 2018, the Company invested approximately $10 million to develop the properties in this region and approximately $15 million in exploration activity.

North Louisiana

The North Louisiana region consists of properties located in north Louisiana and primarily producing natural gas from the Hosston, Cotton Valley, Bossier and Smackover formations at depths ranging from 7,000 feet to 12,500 feet.

North Louisiana proved reserves represented approximately 5% of total proved reserves at December 31, 2018, of which 64% were classified as proved developed. This region produced approximately 26 MMcfe/d of the Company’s 2018 average daily production. During 2018, the Company invested approximately $2 million to develop the properties in this region.

Uinta Basin

The Uinta Basin region consists of non-operated properties located in the Drunkards Wash field in Utah. The Uinta Basin properties were included in the Company’s previous Rockies operating region. During 2017 and 2018, the Company divested its Rockies region properties located in Wyoming (Green River, Washakie and Powder River basins), North Dakota (Williston Basin) and certain Utah properties (Altamont Bluebell Field in the Uinta Basin).

Uinta Basin proved reserves represented approximately 3% of total proved reserves at December 31, 2018, all of which were classified as proved developed. The Uinta Basin region produced approximately 23 MMcfe/d of the Company’s 2018 average daily production. During 2018, the Company invested approximately $4 million to develop the properties in the Uinta Basin region.

Blue Mountain Segment

Blue Mountain Midstream currently provides natural gas gathering, compression and processing services to producers in the Merge/SCOOP/Stack play in the Mid-Continent Region of Oklahoma. Blue Mountain Midstream’s assets primarily consist of the state of the art 250 MMcf/d design-capacity Cryo 1 natural gas plant as well as a network of natural gas gathering pipelines and compressors (collectively, the “Blue Mountain System”). The Cryo 1 natural gas plant was successfully

5

Table of Contents

Item 1.Business - Continued

commissioned in the second quarter of 2018. As of July 2018, the plant had an initial design capacity of approximately 150 MMcf/d of processing capacity. In the fourth quarter of 2018, Blue Mountain Midstream commissioned 25,000 horsepower compression at its Cryo 1, increasing the processing capacity to the full 250 MMcf/d. Blue Mountain Midstream’s gathering and processing agreements for its gathering and processing system include long-term, fee-based or percent of proceeds contracts. Based on Blue Mountain Midstream’s contracts it gathers natural gas and NGLs from the producers which it then processes and delivers to third party customers.

Blue Mountain Midstream is aggressively pursuing growth to its midstream business primarily in Oklahoma. Additions to the Blue Mountain System are continually underway adding low and high-pressure gathering pipelines and interconnections that will accommodate incremental volume throughput. During 2018, the Blue Mountain Midstream invested approximately $125 million for plant and pipeline construction activities primarily associated with the Blue Mountain System.

Blue Mountain Midstream has completed the conceptual engineering and design for Cryo 2 and has the ability to execute on Cryo 2 quickly if the election is eventually made to proceed.

Drilling and Acreage

The following table sets forth the wells drilled during the years indicated:

| | Year Ended December 31, | |

| | 2018 | | | 2017 | | | 2016 | |

Gross wells: | | | | | | | | | | | | |

Productive | | | 52 | | | | 90 | | | | 211 | |

Dry | | | — | | | | — | | | | 1 | |

| | | 52 | | | | 90 | | | | 212 | |

Net development wells: | | | | | | | | | | | | |

Productive | | | 1 | | | | 12 | | | | 26 | |

Dry | | | — | | | | — | | | | — | |

| | | 1 | | | | 12 | | | | 26 | |

Net exploratory wells: | | | | | | | | | | | | |

Productive | | | 2 | | | | 9 | | | | 7 | |

Dry | | | — | | | | — | | | | — | |

| | | 2 | | | | 9 | | | | 7 | |

There were no lateral segments added to existing vertical wellbores during the years ended December 31, 2018, December 31, 2017, or December 31, 2016. As of December 31, 2018, the Company had 21 gross (4 net) wells in progress, and no wells were temporarily suspended.

This information should not be considered indicative of future performance, nor should it be assumed that there is necessarily any correlation between the number of productive wells drilled and the quantities or economic value of reserves found. Productive wells are those that produce commercial quantities of oil, natural gas or NGL, regardless of whether they generate a reasonable rate of return.

Productive Wells

The following table sets forth information relating to the productive wells in which the Company owned a working interest as of December 31, 2018. Productive wells consist of producing wells and wells capable of production, including wells

6

Table of Contents

Item 1.Business - Continued

awaiting pipeline or other connections to commence deliveries. The number of wells below does not include approximately 2,620 gross productive wells in which the Company owns a royalty interest only.

| | Natural Gas Wells | | | Oil Wells | | | Total Wells (1) | |

| | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operated (2) | | | 6,893 | | | | 6,077 | | | | 185 | | | | 144 | | | | 7,078 | | | | 6,221 | |

Nonoperated (3) | | | 5,141 | | | | 1,838 | | | | 135 | | | | 20 | | | | 5,276 | | | | 1,858 | |

| | | 12,034 | | | | 7,915 | | | | 320 | | | | 164 | | | | 12,354 | | | | 8,079 | |

(1) | Includes 424 gross and 138 net wells divested in 2019. |

(2) | The Company had five operated wells with multiple completions at December 31, 2018. |

(3) | The Company had one nonoperated wells with multiple completions at December 31, 2018. |

Developed and Undeveloped Acreage

The following table sets forth information relating to leasehold acreage as of December 31, 2018:

| | Developed Acreage | | | Undeveloped Acreage | | | Total Acreage (1) | |

| | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | |

| | | | | | | | | | (in thousands) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Leasehold acreage | | | 3,170 | | | | 1,912 | | | | 38 | | | | 13 | | | | 3,208 | | | | 1,925 | |

(1) | Includes approximately 81,000 gross and 39,000 net acres divested in 2019. |

Future Acreage Expirations

The Company’s investment in developed and undeveloped acreage comprises numerous leases. The terms and conditions under which the Company maintains exploration or production rights to the acreage are property-specific, contractually defined and vary significantly from property to property. If production is not established or the Company takes no other action to extend the terms of the related leases, undeveloped acreage will expire. The Company currently has no material undeveloped acreage due to expire during the next three years.

Programs are designed to ensure that the exploration potential of any property is fully evaluated before expiration. In some instances, the Company may elect to relinquish acreage in advance of the contractual expiration date if the evaluation process is complete and there is not a business basis for extension. In cases where additional time may be required to fully evaluate acreage, the Company has generally been successful in obtaining extensions. The Company utilizes various methods to manage the expiration of leases, including drilling the acreage prior to lease expiration or extending lease terms.

Production, Price and Cost History

The Company’s natural gas production is primarily sold under short-term market-sensitive contracts that are typically priced at a differential to the published natural gas index price for the producing area due to the natural gas quality and the proximity to major consuming markets. In certain circumstances, the Company has entered into natural gas processing contracts whereby the residue natural gas is sold under short-term contracts but the related NGL are sold under long-term contracts. In all such cases, the residue natural gas and NGL are sold at market-sensitive index prices. As of December 31, 2018, the Company had no natural gas or NGL delivery commitments under a long-term contracts.

The Company’s natural gas production is sold to purchasers under spot price contracts, percentage-of-index contracts or percentage-of-proceeds contracts. Under percentage-of-index contracts, the Company receives a price for natural gas and NGL based on indexes published for the producing area. Under percentage-of-proceeds contracts, the Company receives a percentage of the resale price received by the purchaser for sales of residue natural gas and NGL recovered after transportation and processing of natural gas. These purchasers sell the residue natural gas and NGL based primarily on spot market prices.

7

Table of Contents

Item 1.Business - Continued

The Company’s natural gas is transported through its own and third-party gathering systems and pipelines. The Company incurs processing, gathering and transportation expenses to move its natural gas from the wellhead to a purchaser specified delivery point. These expenses vary based on the volume, distance shipped and the fee charged by the third-party processor or transporter.

The Company’s oil production is primarily sold under short-term market-sensitive contracts that are typically priced at a differential to the New York Mercantile Exchange (“NYMEX”) price or at purchaser posted prices for the producing area. As of December 31, 2018, the Company had no oil delivery commitments under long-term contracts.

The following table sets forth information regarding total production, average daily production, average prices and average costs for each of the years indicated:

| | Successor | | | Predecessor | |

| | Year Ended December 31, 2018 | | | Ten Months Ended December 31, 2017 | | | Two Months Ended February 28, 2017 | | | Year Ended December 31, 2016 | |

Total production: | | | | | | | | | | | | | | | | |

Natural gas (MMcf) | | | 90,091 | | | | 118,110 | | | | 29,223 | | | | 187,068 | |

Oil (MBbls) | | | 1,186 | | | | 5,442 | | | | 1,191 | | | | 8,088 | |

NGL (MBbls) | | | 3,762 | | | | 6,287 | | | | 1,263 | | | | 9,281 | |

Total (MMcfe) | | | 119,781 | | | | 188,481 | | | | 43,945 | | | | 291,285 | |

| | | | | | | | | | | | | | | | |

Average daily production: | | | | | | | | | | | | | | | | |

Natural gas (MMcf/d) | | | 247 | | | | 386 | | | | 495 | | | | 511 | |

Oil (MBbls/d) | | | 3.2 | | | | 17.8 | | | | 20.2 | | | | 22.1 | |

NGL (MBbls/d) | | | 10.3 | | | | 20.5 | | | | 21.4 | | | | 25.4 | |

Total (MMcfe/d) | | | 328 | | | | 616 | | | | 745 | | | | 796 | |

| | | | | | | | | | | | | | | | |

Weighted average prices: (1) | | | | | | | | | | | | | | | | |

Natural gas (Mcf) | | $ | 2.78 | | | $ | 2.69 | | | $ | 3.41 | | | $ | 2.28 | |

Oil (Bbl) | | $ | 62.99 | | | $ | 47.42 | | | $ | 49.16 | | | $ | 39.00 | |

NGL (Bbl) | | $ | 25.14 | | | $ | 21.28 | | | $ | 24.37 | | | $ | 14.26 | |

| | | | | | | | | | | | | | | | |

Average NYMEX prices: | | | | | | | | | | | | | | | | |

Natural gas (MMBtu) | | $ | 3.09 | | | $ | 3.00 | | | $ | 3.66 | | | $ | 2.46 | |

Oil (Bbl) | | $ | 64.77 | | | $ | 50.53 | | | $ | 53.04 | | | $ | 43.32 | |

| | | | | | | | | | | | | | | | |

Costs per Mcfe of production: | | | | | | | | | | | | | | | | |

Lease operating expenses | | $ | 1.00 | | | $ | 1.11 | | | $ | 1.13 | | | $ | 1.02 | |

Transportation expenses | | $ | 0.70 | | | $ | 0.60 | | | $ | 0.59 | | | $ | 0.55 | |

General and administrative expenses (2) | | $ | 2.05 | | | $ | 0.62 | | | $ | 1.63 | | | $ | 0.82 | |

Depreciation, depletion and amortization | | $ | 0.79 | | | $ | 0.71 | | | $ | 1.07 | | | $ | 1.18 | |

Taxes, other than income taxes | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.34 | | | $ | 0.23 | |

| | | | | | | | | | | | | | | | |

Total production – discontinued operations: | | | | | | | | | | | | | | | | |

Equity method investment – Total (MMcfe) (3) | | | 23,355 | | | | 9,235 | | | | — | | | | — | |

California – Total (MMcfe) (4) | | | — | | | | 4,326 | | | | 1,755 | | | | 11,849 | |

(1) | Does not include the effect of gains (losses) on derivatives. |

(2) | General and administrative expenses for the year ended December 31, 2018, the ten months ended December 31, 2017, the two months ended February 28, 2017, and the year ended December 31, 2016, include approximately $132 million, $41 million, $50 million and $34 million, respectively, of share-based compensation expenses and approximately $27 million, $2 million, $787,000 and $2 million, respectively of severance costs. General and administrative expenses for the year ended December 31, 2018, include |

8

Table of Contents

Item 1.Business - Continued

| approximately $8 million of Spin-off related costs. In addition, general and administrative expenses for the two months ended February 28, 2017, and the year ended December 31, 2016, include expenses incurred by LINN Energy associated with the operations of Berry. On February 28, 2017, LINN Energy and Berry emerged from bankruptcy as stand-alone, unaffiliated entities. |

(3) | Represents the Company’s historical 50% equity interest in Roan. Production of Roan for 2018 is for the period from January 1, 2018 through July 25, 2018. Production of Roan for 2017 is for the period from September 1, 2017 through December 31, 2017. |

(4) | Total production of the Company’s California properties reported as discontinued operations for 2017 is for the period from January 1, 2017 through July 31, 2017. |

The following table sets forth information regarding production volumes for fields with greater than 15% of the Company’s total proved reserves for each of the years indicated:

| | Year Ended December 31, | |

| | 2018 | | | 2017 | | | 2016 | |

Total production: | | | | | | | | | | | | |

Hugoton Basin Field: | | | | | | | | | | | | |

Natural gas (MMcf) | | | 33,510 | | | | 34,363 | | | | 38,501 | |

Oil (MBbls) | | | 24 | | | | 45 | | | | 27 | |

NGL (MBbls) | | | 2,581 | | | | 2,968 | | | | 2,983 | |

Total (MMcfe) | | | 49,137 | | | | 52,437 | | | | 56,566 | |

East Texas Basin: | | | | | | | | | | | | |

Natural gas (MMcf) | | | 17,355 | | | * | | | * | |

Oil (MBbls) | | | 66 | | | * | | | * | |

NGL (MBbls) | | | 113 | | | * | | | * | |

Total (MMcfe) | | | 18,432 | | | * | | | * | |

Green River Basin Field: | | | | | | | | | | | | |

Natural gas (MMcf) | | * | | | * | | | | 44,668 | |

Oil (MBbls) | | * | | | * | | | | 477 | |

NGL (MBbls) | | * | | | * | | | | 1,349 | |

Total (MMcfe) | | * | | | * | | | | 55,625 | |

* | Represented less than 15% of the Company’s total proved reserves for the year indicated. The Company sold its properties in the Green River Basin Field in May 2017. |

Reserve Data

Proved Reserves

The following table sets forth estimated proved oil, natural gas and NGL reserves and the standardized measure of discounted future net cash flows at December 31, 2018, based on reserve reports prepared by independent engineers, DeGolyer and MacNaughton:

| | Proved Reserves | |

| | Natural Gas (Bcf) | | | Oil (MMBbls) | | | NGL (MMBbls) | | | Total (Bcfe) | |

Proved reserves: | | | | | | | | | | | | | | | | |

Proved developed reserves | | | 1,203 | | | | 4 | | | | 55 | | | | 1,553 | |

Proved undeveloped reserves | | | 57 | | | | — | | | | 1 | | | | 65 | |

Total proved reserves | | | 1,260 | | | | 4 | | | | 56 | | | | 1,618 | |

9

Table of Contents

Item 1.Business - Continued

Standardized measure of discounted future net cash flows (in millions) (1) | | $ | 747 | |

| | | | |

Representative NYMEX prices: (2) | | | | |

Natural gas (MMBtu) | | $ | 3.10 | |

Oil (Bbl) | | $ | 65.66 | |

(1) | This measure is not intended to represent the market value of estimated reserves. |

(2) | In accordance with Securities and Exchange Commission (“SEC”) regulations, reserves were estimated using the average price during the 12-month period, determined as an unweighted average of the first-day-of-the-month price for each month, excluding escalations based upon future conditions. The average price used to estimate reserves is held constant over the life of the reserves. |

During the year ended December 31, 2018, the Company’s PUDs increased to 65 Bcfe from 60 Bcfe at December 31, 2017, representing an increase of approximately 5 Bcfe. The increase was primarily due to revisions as a result of additional PUD locations being added. During the year ended December 31, 2018, the Company did not convert any reserves that were classified as PUDs at December 31, 2017, to proved developed reserves.

Based on the December 31, 2018, reserve reports, the amounts of capital expenditures estimated to be incurred in 2019, 2020 and 2021 to develop the Company’s PUDs are approximately $5 million, $5 million and $40 million, respectively. The amount and timing of these expenditures will depend on a number of factors, including actual drilling results, service costs and product prices. None of the 65 Bcfe of PUDs at December 31, 2018, has remained undeveloped for five years or more. All PUD properties are included in the Company’s current five-year development plan.

Reserve engineering is inherently a subjective process of estimating underground accumulations of oil, natural gas and NGL that cannot be measured exactly. The accuracy of any reserve estimate is a function of the quality of available data and engineering and geological interpretation and judgment. Accordingly, reserve estimates may vary from the quantities of oil, natural gas and NGL that are ultimately recovered. Future prices received for production may vary, perhaps significantly, from the prices assumed for the purposes of estimating the standardized measure of discounted future net cash flows. The standardized measure of discounted future net cash flows should not be construed as the market value of the reserves at the dates shown. The 10% discount factor required to be used under the provisions of applicable accounting standards may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with the Company or the oil and natural gas industry. The standardized measure of discounted future net cash flows is materially affected by assumptions regarding the timing of future production, which may prove to be inaccurate.

The reserve estimates reported herein were prepared by independent engineers, DeGolyer and MacNaughton. The process performed by the independent engineers to prepare reserve amounts included their estimation of reserve quantities, future production rates, future net revenue and the present value of such future net revenue, based in part on data provided by the Company. When preparing the reserve estimates, the independent engineering firm did not independently verify the accuracy and completeness of the information and data furnished by the Company with respect to ownership interests, production, well test data, historical costs of operation and development, product prices, or any agreements relating to current and future operations of the properties and sales of production. However, if in the course of their work, something came to their attention that brought into question the validity or sufficiency of any such information or data, they did not rely on such information or data until they had satisfactorily resolved their questions relating thereto. The estimates of reserves conform to the guidelines of the SEC, including the criteria of “reasonable certainty,” as it pertains to expectations about the recoverability of reserves in future years. The independent engineering firm also prepared estimates with respect to reserve categorization, using the definitions of proved reserves set forth in Regulation S-X Rule 4-10(a) and subsequent SEC staff interpretations and guidance.

The Company’s internal control over the preparation of reserve estimates is a process designed to provide reasonable assurance regarding the reliability of the Company’s reserve estimates in accordance with SEC regulations. The preparation of reserve estimates was overseen by the Company’s Director of Reserves and Business Development who has a Master of Petroleum Engineering degree and 10 years of oil and natural gas industry experience. The reserve estimates were reviewed and approved by the Company’s senior engineering staff and management, with final approval by its Executive Vice President and Chief Operating Officer. For additional information regarding estimates of reserves, including the standardized measure of discounted future net cash flows, see “Supplemental Oil and Natural Gas Data (Unaudited)” in Item 8. “Financial Statements and Supplementary Data.” The Company has not filed reserve estimates with any federal authority or agency, with the exception of the SEC.

10

Table of Contents

Item 1.Business - Continued

Operational Overview

General

The Company generally seeks to be the operator of its properties so that it can develop drilling programs and optimization projects intended to not only replace production, but also to add value through reserve and production growth and future operational synergies. Many of the Company’s wells are completed in multiple producing zones with commingled production and long economic lives.

Principal Customers

For the year ended December 31, 2018, sales to ONEOK Hydrocarbon, L.P. accounted for approximately 22% of the Company’s total revenues. If the Company were to lose any one of its major oil and natural gas purchasers, the loss could temporarily cease or delay production and sale of its oil and natural gas in that particular purchaser’s service area. If the Company were to lose a purchaser, it believes it could identify a substitute purchaser. However, if one or more of the large purchasers ceased purchasing oil and natural gas altogether, it could have a detrimental effect on the oil and natural gas market in general and on the prices and volumes of oil, natural gas and NGL that the Company is able to sell.

Competition

The oil and natural gas industry is highly competitive. The Company encounters strong competition from other independent operators in contracting for drilling and other related services, as well as hiring trained personnel. The Company is also affected by competition for drilling rigs and the availability of related equipment. In the past, the oil and natural gas industry has experienced shortages of drilling rigs, equipment, pipe and personnel, which has delayed development drilling and has caused significant price increases. The Company is unable to predict when, or if, such shortages may occur or how they would affect its drilling program.

Operating Hazards and Insurance

The oil and natural gas industry involves a variety of operating hazards and risks that could result in substantial losses from, among other things, injury or loss of life, severe damage to or destruction of property, natural resources and equipment, pollution or other environmental damage, cleanup responsibilities, regulatory investigation and penalties, and suspension of operations. The Company may be liable for environmental damages caused by previous owners of property it purchases and leases. As a result, the Company may incur substantial liabilities to third parties or governmental entities, the payment of which could reduce or eliminate funds otherwise available, or result in the loss of properties. In addition, the Company participates in wells on a non-operated basis, and therefore may be limited in its ability to control the risks associated with the operation of such wells.

In accordance with customary industry practices, the Company maintains insurance against some, but not all, potential losses. The Company cannot provide assurance that any insurance it obtains will be adequate to cover any losses or liabilities. The Company has elected to self-insure for certain items for which it has determined that the cost of available insurance is excessive relative to the risks presented. In addition, pollution and environmental risks generally are not fully insurable. The occurrence of an event not fully covered by insurance could have a material adverse effect on the Company’s financial position, results of operations and cash flows. For more information about potential risks that could affect the Company, see Item 1A. “Risk Factors.”

Title to Properties

Prior to the commencement of drilling operations, the Company conducts a title examination and performs curative work with respect to significant defects. To the extent title opinions or other investigations reflect title defects on those properties, the Company is typically responsible for curing any title defects at its expense prior to commencing drilling operations. Prior to completing an acquisition of producing leases, the Company performs title reviews on the most significant leases and, depending on the materiality of properties, the Company may obtain a title opinion or review previously obtained title opinions. As a result, the Company has obtained title opinions on a significant portion of its properties and believes that it has satisfactory title to its producing properties in accordance with standards generally accepted in the industry.

11

Table of Contents

Item 1.Business - Continued

Seasonality and Cyclicality

Seasonal weather conditions and lease stipulations can limit the drilling and producing activities and other operations in regions of the U.S. in which the Company operates. These seasonal conditions can pose challenges for meeting the well drilling objectives and increase competition for equipment, supplies and personnel, which could lead to shortages and increase costs or delay operations. For example, the Company’s operations may be impacted by ice and snow in the winter and by electrical storms and high temperatures in the spring and summer, as well as by wild fires in the fall.

The demand for natural gas typically decreases during the summer months and increases during the winter months. Seasonal anomalies sometimes lessen this fluctuation. In addition, certain natural gas consumers utilize natural gas storage facilities and purchase some of their anticipated winter requirements during the summer, which can also lessen seasonal demand fluctuations.

Environmental Matters and Regulation

The Company’s operations are subject to stringent federal, state and local laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. The Company’s operations are subject to the same environmental laws and regulations as other companies in the oil and natural gas industry. These laws and regulations may:

| • | require the acquisition of various permits before drilling commences; |

| • | require notice to stakeholders of proposed and ongoing operations; |

| • | require the installation of expensive pollution control equipment; |

| • | restrict the types, quantities and concentration of various substances that can be released into the environment in connection with drilling and production activities; |

| • | limit or prohibit drilling activities on lands located within wilderness, wetlands, areas inhabited by endangered species and other protected areas; |

| • | require remedial measures to prevent pollution from former operations, such as pit closure, reclamation and plugging and abandonment of wells; |

| • | impose substantial liabilities for pollution resulting from operations; and |

| • | require preparation of a Resource Management Plan, an Environmental Assessment, and/or an Environmental Impact Statement with respect to operations affecting federal lands or leases. |

These laws and regulations may also restrict the production rate of oil, natural gas and NGL below the rate that would otherwise be possible. The regulatory burden on the industry increases the cost of doing business and consequently affects profitability. Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary fines or penalties, the imposition of investigatory or remedial requirements, and the issuance of orders enjoining future operations. Moreover, accidental releases or spills may occur in the course of the Company’s operations, which may result in significant costs and liabilities, including third-party claims for damage to property, natural resources or persons. Additionally, Congress and federal and state agencies frequently revise environmental laws and regulations, and any changes that result in more stringent and costly requirements for the oil and natural gas industry could have a significant impact on operating costs.

The environmental laws and regulations applicable to the Company and its operations include, among others, the following U.S. federal laws and regulations:

| • | Clean Air Act, which governs air emissions; |

| • | Clean Water Act (“CWA”), which governs discharges to and excavations within the waters of the U.S.; |

| • | Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), which imposes liability where hazardous releases have occurred or are threatened to occur (commonly known as “Superfund”); |

| • | The Oil Pollution Act of 1990, which amends and augments the CWA and imposes certain duties and liabilities related to the prevention of oil spills and damages resulting from such spills; |

| • | Energy Independence and Security Act of 2007, which prescribes new fuel economy standards and other energy saving measures; |

| • | National Environmental Policy Act, which governs oil and natural gas production activities on federal lands; |

| • | Resource Conservation and Recovery Act (“RCRA”), which governs the management of solid waste; |

12

Table of Contents

Item 1.Business - Continued

| • | Safe Drinking Water Act (“SDWA”), which governs the underground injection and disposal of wastewater; |

| • | Endangered Species Act (“ESA”), which restricts activities that may affect endangered and threatened species or their habitats; and |

| • | U.S. Department of Interior regulations, which impose liability for pollution cleanup and damages. |

Various states regulate the drilling for, and the production, gathering and sale of, oil, natural gas and NGL, including imposing production taxes and requirements for obtaining drilling permits. States also regulate the method of developing new fields, the spacing and operation of wells and the prevention of waste of resources. States may regulate rates of production and may establish maximum daily production allowables from wells based on market demand or resource conservation, or both. States do not regulate wellhead prices or engage in other similar direct economic regulations, but there can be no assurance that they will not do so in the future. The effect of these regulations may be to limit the amounts of oil, natural gas and NGL that may be produced from the Company’s wells and to limit the number of wells or locations it can drill. The oil and natural gas industry is also subject to compliance with various other federal, state and local regulations and laws. Some of those laws relate to occupational safety, resource conservation and equal opportunity employment.

The Company believes that it substantially complies with all current applicable environmental laws and regulations and that continued compliance with existing requirements will not have a material adverse impact on its business, financial condition, results of operations or cash flows. Future regulatory issues that could impact the Company includes new rules or legislation relating to the items discussed below.

Climate Change

In December 2009, the United States Environmental Protection Agency (“EPA”) determined that emissions of carbon dioxide, methane and other “greenhouse gases” (“GHG”) present an endangerment to public health and the environment because emissions of such gases are, according to the EPA, contributing to warming of the earth’s atmosphere and other climatic changes. Based on these findings, the EPA has adopted and implemented regulations to restrict emissions of GHGs under existing provisions of the Clean Air Act. In May 2016, the EPA finalized rules that set additional emissions limits for volatile organic compounds and established new controls for emissions of methane from new, modified or reconstructed sources in the oil and natural gas source category, including production, processing, transmission and storage activities. The rules include first-time standards to address emissions of methane from equipment and processes across the source category, including hydraulically fractured oil and natural gas well completions. However, in September 2018, under a new administration, the EPA proposed amendments that would relax requirements of these rules. In addition, in April 2018, a coalition of states filed a lawsuit in federal district court aiming to force the EPA to establish guidelines for limiting methane emissions from existing sources in the oil and natural gas sector; that lawsuit is pending. The EPA has also adopted rules requiring the monitoring and reporting of GHG emissions from specified sources in the U.S., including certain onshore oil and natural gas production facilities, on an annual basis.

On an international level, the U.S. was one of 175 countries to sign an international climate change agreement in Paris, France that requires member countries to set their own GHG emission reduction goals beginning in 2020 (the “Paris Agreement”). However, on June 1, 2017, President Trump announced that the U.S. would withdraw from the Paris Agreement. It is not clear what steps the Trump Administration plans to take to withdraw from the Paris Agreement, whether a new agreement can be negotiated, or what terms would be included in such an agreement. Certain U.S. city and state governments have announced their intention to satisfy their proportionate obligations under the Paris Agreement. In addition, legislation has from time to time been introduced in Congress that would establish measures restricting GHG emissions in the U.S., and a number of states have begun taking actions to control and/or reduce emissions of GHGs.

Any legislation or regulatory programs to reduce GHG emissions could increase the cost of consuming, and thereby reduce demand for, the oil and natural gas the Company produces. Consequently, legislation and regulatory programs to reduce emissions of GHGs could have an adverse effect on the Company’s business, financial condition and results of operations. Moreover, incentives to conserve energy or use alternative energy sources as a means of addressing climate change could reduce demand for the oil and natural gas the Company produces. In addition, parties concerned about the potential effects of climate change have directed their attention at sources of funding for energy companies, which has resulted in certain financial institutions, funds and other sources of capital, restricting or eliminating their investment in oil and natural gas activities. Finally, most scientists have concluded that increasing concentrations of GHGs in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, floods and

13

Table of Contents

Item 1.Business - Continued

other climatic events. If any such effects were to occur, they could adversely affect or delay demand for the oil or natural gas produced or cause the Company to incur significant costs in preparing for or responding to those effects.

Hydraulic Fracturing

Hydraulic fracturing is an important and common practice that is used to stimulate production of hydrocarbons from tight formations. The process involves the injection of water, sand and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. The Company performs hydraulic fracturing as part of its operations. Hydraulic fracturing operations have historically been overseen by state regulators as part of their oil and natural gas regulatory programs. However, in February 2014, the EPA published permitting guidance under the SDWA addressing the use of diesel in fracturing hydraulic operations, and in May 2014, the EPA issued an advance notice of proposed rulemaking under the Toxic Substances Control Act (“TSCA”) relating to chemical substances and mixtures used in oil and natural gas exploration or production. Further, in March 2015, the Department of the Interior’s Bureau of Land Management (“BLM”) adopted a rule requiring, among other things, public disclosure to the BLM of chemicals used in hydraulic fracturing operations after fracturing operations have been completed and strengthening standards for well-bore integrity and management of fluids that return to the surface during and after fracturing operations on federal and Indian lands. Following years of litigation, the BLM rescinded the rule in December 2017; however that rescission has been challenged by several environmental groups and states in ongoing litigation. In addition, from time to time legislation has been introduced before Congress that would provide for federal regulation of hydraulic fracturing and would require disclosure of the chemicals used in the fracturing process. If enacted, these or similar laws or regulations could result in additional permitting requirements for hydraulic fracturing operations as well as various restrictions on those operations. These permitting requirements and restrictions could result in delays in operations at well sites and also increased costs to make wells productive.

There may be other attempts to further regulate hydraulic fracturing under the SDWA, TSCA and/or other statutory or regulatory mechanisms. In December 2016, the EPA released its final report on the potential impacts of hydraulic fracturing on drinking water resources, concluding that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources under certain circumstances. Moreover, some states and local governments have adopted, and other states and local governments are considering adopting, regulations that could restrict hydraulic fracturing in certain circumstances. For example, many states in which the Company operates have adopted disclosure regulations requiring varying degrees of disclosure of the constituents in hydraulic fracturing fluids. In addition, the regulation or prohibition of hydraulic fracturing is the subject of significant political activity in a number of jurisdictions, some of which have resulted in tighter regulation, bans, and/or recognition of local government authority to implement such restrictions. In many instances, litigation has ensued, some of which remains pending. If new laws or regulations that significantly restrict hydraulic fracturing are adopted, such laws could make it more difficult or costly for the Company to perform fracturing to stimulate production from tight formations. In addition, any such additional regulation could lead to operational delays, increased operating costs and additional regulatory burdens, and reduced production of oil and natural gas, which could adversely affect the Company’s revenues, results of operations and net cash provided by operating activities.

Hydraulic fracturing operations require the use of a significant amount of water. The Company’s inability to locate sufficient amounts of water, or dispose of or recycle water used in its drilling and production operations, could adversely impact its operations. Moreover, new environmental initiatives and regulations could include restrictions on the Company’s ability to conduct certain operations such as hydraulic fracturing or disposal of waste, including, but not limited to, produced water, drilling fluids and other wastes associated with the development or production of natural gas.

The Company disposes of wastewater generated from oil and natural gas production operations, including hydraulic fracturing operations, directly or through the use of third parties. In some instances, the operation of underground injection or large volume disposal wells has been alleged to cause earthquakes in some of the states where the Company operates. Such issues have sometimes led to orders prohibiting continued injection or disposal or the suspension of drilling in certain wells identified as possible sources of seismic activity. Such concerns also have resulted in stricter regulatory requirements in some jurisdictions relating to the location and operation of underground injection wells. For example, Oklahoma issued rules for wastewater disposal wells that imposed certain permitting and operating restrictions, required additional seismicity protocols in certain defined areas, and from time to time, directs certain injection wells in proximity to seismic events to restrict or suspend operations. Future orders or regulations addressing concerns about seismic activity from well injection or water disposal could affect the Company, either directly or indirectly, depending on the wells affected, which materially affect its capital expenditures and operating costs.

14

Table of Contents

Item 1.Business - Continued

Solid and Hazardous Waste

Although oil and natural gas wastes generally are exempt from regulation as hazardous wastes under RCRA and some comparable state statutes, it is possible some wastes the Company generates presently or in the future may be subject to regulation under RCRA or other applicable statutes. The EPA and various state agencies have limited the disposal options for certain wastes, including hazardous wastes, and there is no guarantee that the EPA or the states will not adopt more stringent requirements in the future. For example, in December 2016, the EPA and several environmental groups entered into a consent decree to address the EPA’s alleged failure to timely assess its regulations exempting certain exploration and production related oil and gas wastes from regulation as hazardous wastes under RCRA. The consent decree requires the EPA to propose a rulemaking no later than March 15, 2019, for revision of certain regulations pertaining to oil and gas wastes or to sign a determination that revision of the regulations is not necessary. If the EPA proposes revised oil and gas regulations, the consent decree requires that the EPA take final action following notice and comment rulemaking no later than July 15, 2021. Furthermore, certain wastes generated by the Company’s oil and natural gas operations that are currently exempt from designation as hazardous wastes may in the future be designated as hazardous wastes under RCRA or other applicable statutes, and therefore be subject to more rigorous and costly operating and disposal requirements.

In addition, CERCLA, also known as the Superfund law, imposes cleanup obligations, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the owner or operator of the disposal site or sites where the release occurred and companies that transported or disposed of or arranged for the transport or disposal of the hazardous substances found at the site. Persons who are or were responsible for releases of hazardous substances under CERCLA and any state analogs may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment and for damages to natural resources, and it is not uncommon for neighboring landowners and other third parties to file corresponding common law claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. While petroleum and crude oil fractions are not included in the definition of hazardous substances under CERCLA and some of its state analogs because of the so-called “petroleum exclusion,” adulterated petroleum products containing other hazardous substances have been treated as hazardous substances under CERCLA in the past.

Endangered Species Act

Some of the Company’s operations may be located in areas that are designated as habitats for endangered or threatened species under the ESA. In February 2016, the U.S. Fish and Wildlife Service published a final policy which alters how it identifies critical habitat for endangered and threatened species. A critical habitat designation could result in further material restrictions to federal and private land use and could delay or prohibit land access or development. Moreover, the U.S. Fish and Wildlife Service continues to make listing decisions and critical habitat designations where necessary, including for over 250 species as required under a 2011 settlement approved by the U.S. District Court for the District of Columbia, and many hundreds of additional anticipated listing decisions have already been identified beyond those recognized in the 2011 settlement. The Company believes that it is currently in substantial compliance with the ESA. However, the designation of previously unprotected species as being endangered or threatened, if located in the areas of the Company’s operations, could cause the Company to incur additional costs or become subject to operating restrictions in areas where the species are known to exist.

Air Emissions

The New Source Performance Standards and National Emission Standards for Hazardous Air Pollutants programs under the Clean Air Act impose specific requirements affecting the oil and gas industry under both programs for compressors, controllers, dehydrators, storage tanks, natural gas processing plants, completions, and certain other equipment and processes. Periodic review and revision of these and other rules by federal and state agencies may require changes to the Company’s operations, including possible installation of new equipment to control emissions. For example, as described above, in May 2016, the EPA finalized rules to reduce methane and volatile organic compound emissions from new, modified or reconstructed sources in the oil and natural gas sector; however, in September 2018, under a new administration, the EPA proposed amendments that would relax requirements of the rules. Similarly, in September 2018, the BLM issued a rule that relaxes or rescinds certain requirements of regulations it previously enacted to reduce methane emissions from venting, flaring, and leaks during oil and gas operations on public lands; California and New Mexico have challenged the rule in ongoing litigation. In addition, in April 2018, a coalition of states filed a lawsuit aiming to force the EPA to establish

15

Table of Contents

Item 1.Business - Continued