Filed by: Sayona Mining Limited

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14d-2(b) and Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Piedmont Lithium Inc.

Commission File Number: 001-38427

The following communication is being filed in connection with the proposed merger of Sayona Mining Limited and Piedmont Lithium Inc.

Additional Information and Where to Find It

In connection with the proposed transaction, Sayona intends to send its shareholders a notice of meeting and explanatory materials ahead of an extraordinary general meeting of Sayona shareholders and Sayona encourages its shareholders to review those materials in full. Sayona will also file with the SEC a registration statement on Form F-4 that also constitutes a prospectus of Sayona. Sayona also plans to file other relevant documents with the SEC regarding the proposed transaction. No offer of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain free copies of these documents (if and when available), and other documents containing important information about Piedmont and Sayona, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Sayona will be available free of charge on Sayona’s website at sayonamining.com.au or by contacting Sayona’s Investor Relations Department by email at ir@sayonamining.com.au or by phone at +61 7 3369 7058. Copies of the documents filed with the SEC by Piedmont will be available free of charge on Piedmont’s website at http://www.piedmontlithium.com/ or by contacting Piedmont’s Investor Relations Department by email at info@piedmontlithium.com or by phone at +1 (704) 461-8000.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to buy any Sayona securities pursuant to the acquisition, nor shall there be any sale of Sayona securities pursuant to the acquisition in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. No offer of Sayona securities pursuant to the acquisition shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

This communication is not a solicitation of proxies in connection with the proposed transaction. However, under SEC rules, Sayona, Piedmont and certain of their respective directors, executive officers and other members of the management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Piedmont’s directors and executive officers may be found in its 2024 Annual Report on Form 10-K filed with the SEC on February 26, 2025, available at www.piedmontlithium.com/ir/ and www.sec.gov. Information about Sayona’s directors and executive officers may be found in its 2024 Annual Report to Shareholders available on its website at https://sayonamining.com.au/investors/financial-reports/ and filed with the ASX on August 29, 2024. The information included on, or accessible through, Sayona’s or Piedmont’s website is not incorporated by reference into this communication. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC and applicable securities regulators in Australia when they become available.

Investor Presentation February / March 2025 ASX:SYA | OTCQB:SYAXF The following is a presentation released by Sayona Mining Limited on the Australian Securities Exchange on March 2, 2025.

Introduction Operational and Financial Performance Merger Update Lithium Market and Guidanc e Agenda 2

Lucas Dow – MD & CEO A highly experienced mining executive, Lucas has a proven track record of outstanding performance across a diverse range of businesses, commodities and geographies, skills which will facilitate Sayona’s next stage of growth as a leading North American lithium producer. Sylvain Collard – President and COO of Canada Sylvain is a specialist in mine project management and continuous process improvement, he has extensive experience in operations management for both open pit and underground mines . Sylvain has worked on several IAMGOLD mining projects and has managed copper and gold mines and projects in Québec, Ontario and the United States . Dougal Elder – CFO Dougal is a chartered accountant with more than 15 years’ experience in large private and publicly owned companies in Australia and the United Kingdom . He has extensive experience in driving budget management, systems implementations, treasury management and strategic initiatives across a range of industries . Strong operational experience 3 Sayona overview Corporate Market Capitalisation (ASX) A$254M 24 February 2025 Shares on Issue 11.5 billion Share consolidation proposed with Piedmont Lithium merger Cash A$110 million A t 31 December 2024 ASX:SYA OTCQB: SYAXF

North America’s leading producer of hard - rock lithium Moblan Lithium Project Sayona’s next flagship project 93.1Mt @ 1.21% 2 • Emerging hard - rock deposit • Close to major infrastructure such as roads, power lines and railroads • Available and trained local workforce • Drilling indicates potential to expand resource • Estimated operating unit cost comparable with most competitive hard - rock lithium mines in production • Sayona 60% : Investissement Quebec 40 % North American Lithium Largest NA lithium producer 87.9Mt @ 1.13% 1 • Only major North American lithium producer • Access to low - cost, renewable power and mature infrastructure • Drilling indicates potential to expand resource • Planned production capacity 190 - 210ktpa Li 2 O for FY25 • Sayona 75% : Piedmont 25% 1. Refer to ASX Announcement on 27 August 2024 (at 0.60% cut - off grade) and slide 21. 2. Refer to ASX Announcement on 27 August 2024 (at 0.55% cut - off grade) and slide 21. NAL (75%) Pilbara Projects Sayona Offices Moblan (60%) 4

5 North American Lithium Focused on resource extension and infill for potential JORC category increase Additional drilling of 53,444m completed in CY24 Supported by utilisation of Flow Through Share funding High - grade lithium mineralisation confirmed beyond existing estimates Supports potential brownfield expansion of NAL Enhances project value amid the Sayona - Piedmont merger New MRE to be completed during 2025

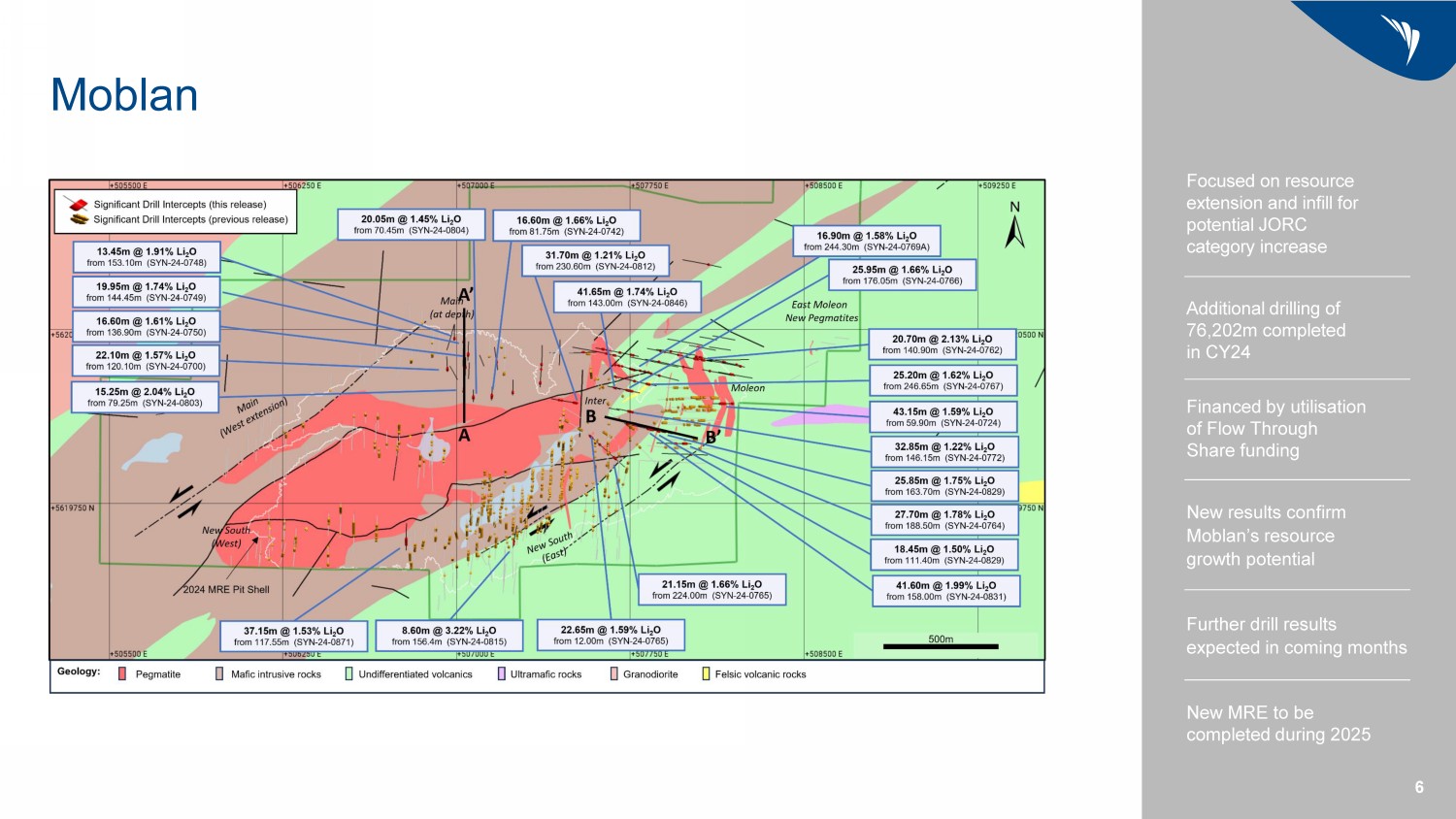

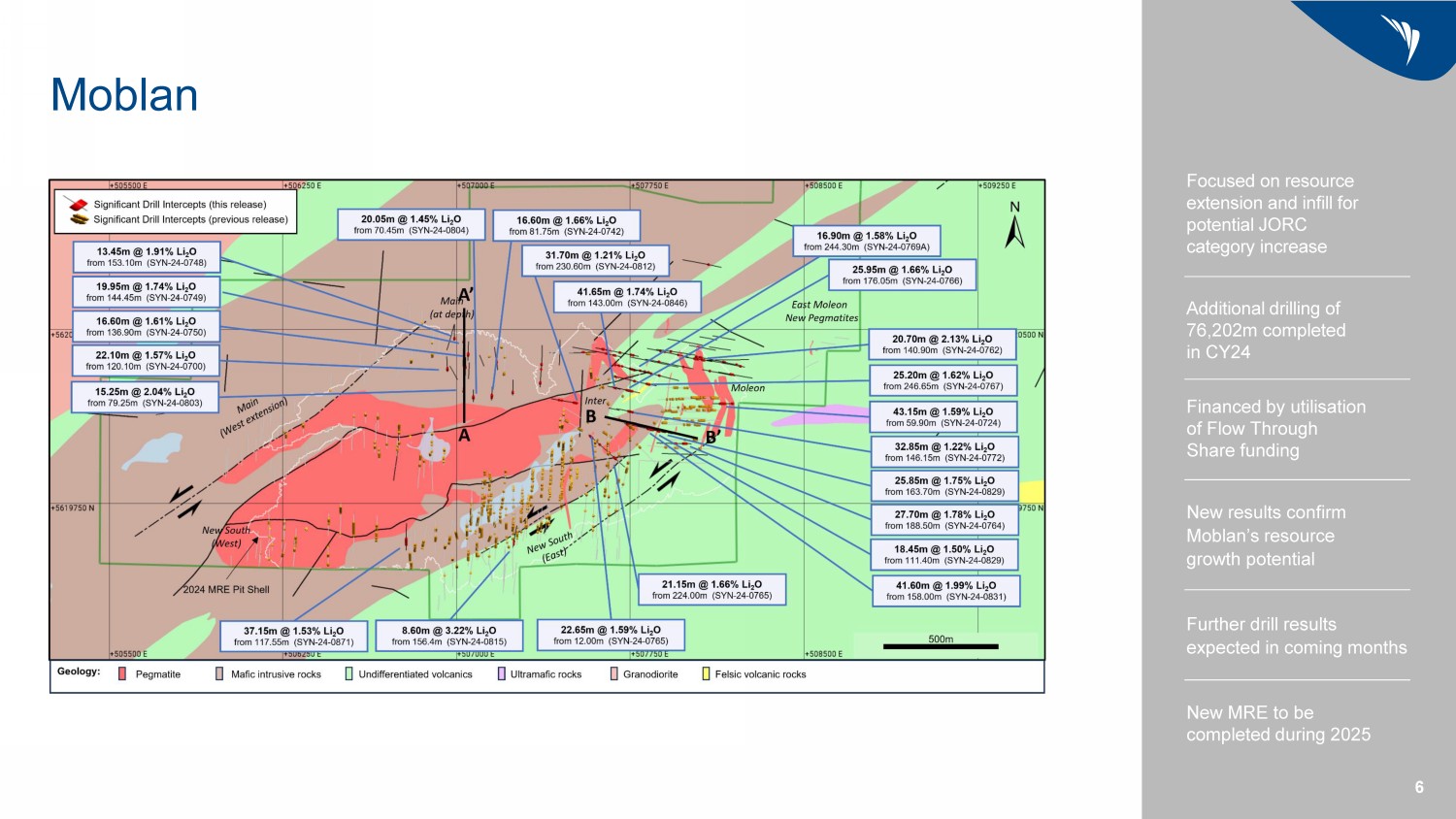

6 Moblan Focused on resource extension and infill for potential JORC category increase Additional drilling of 76,202m completed in CY24 Financed by utilisation of Flow Through Share funding New results confirm Moblan’s resource growth potential Further drill results expected in coming months New MRE to be completed during 2025 6

Operational and Financial Performance 7

FY25 Half Year Highlights 1 North American Lithium achieves consistently strong production $122M REVENUE $110M CASH AT 31 DECEMBER 2024 Production Sales Financial Corporate 53,444 2 METRES DRILLING COMPLETED NAL 76,202 2 METRES DRILLING COMPLETED MOBLAN 90% MILL UTILISATION NAL 67% RECOVERY NAL Conditional A$69 million capital raise at merger completion with RCF Merger with Piedmont Lithium announced DRY METRIC TONNES DRY METRIC TONNES Successful A$38 million capital raise Nov. 2024 Notes 1. All figures are AUD (A$) unless otherwise noted. 2. Funded by Flow Through Share funding as allowed under the Income Tax Act (Canada). 103,063 UP 57% 115,027 UP 59% 8

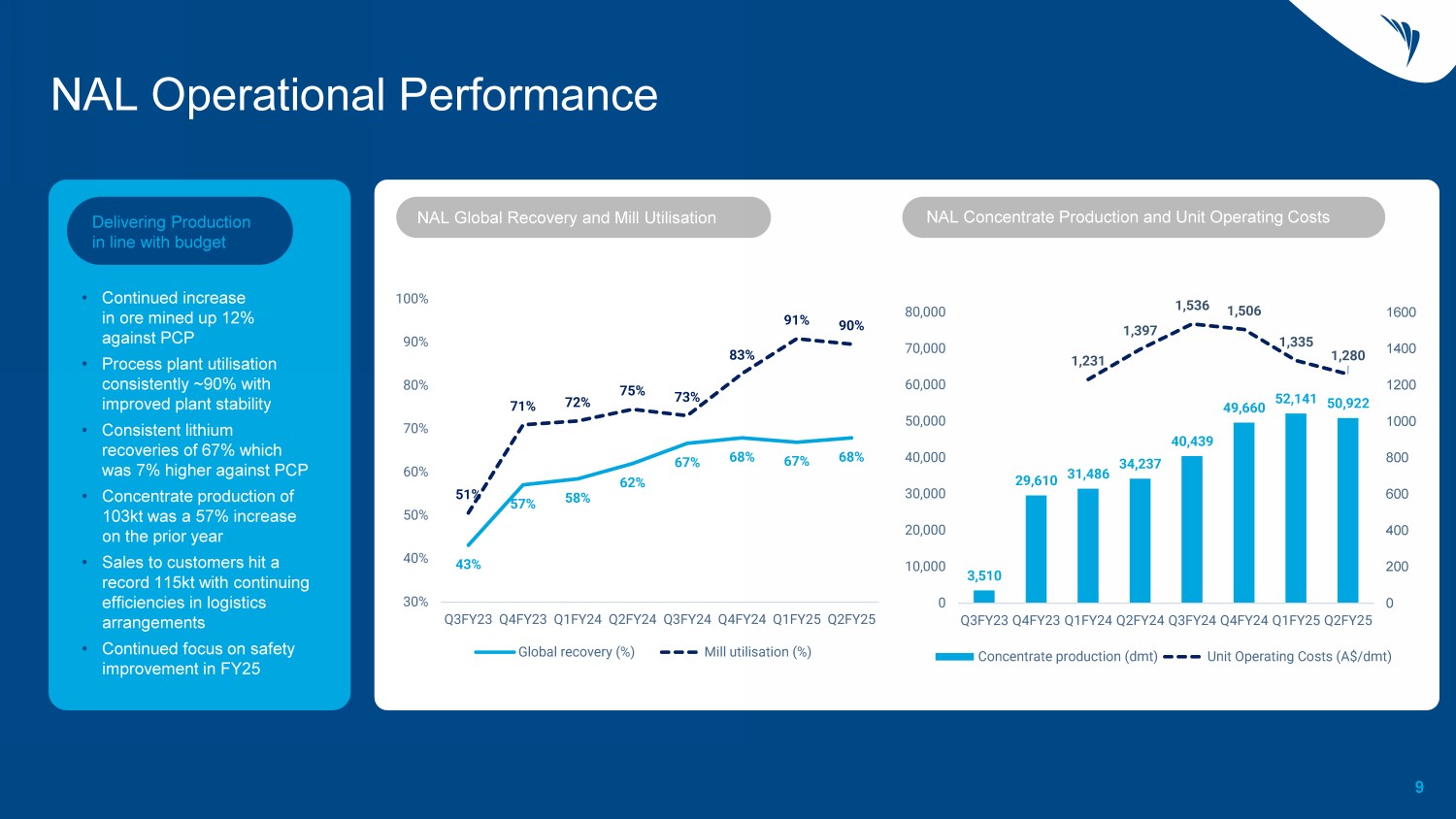

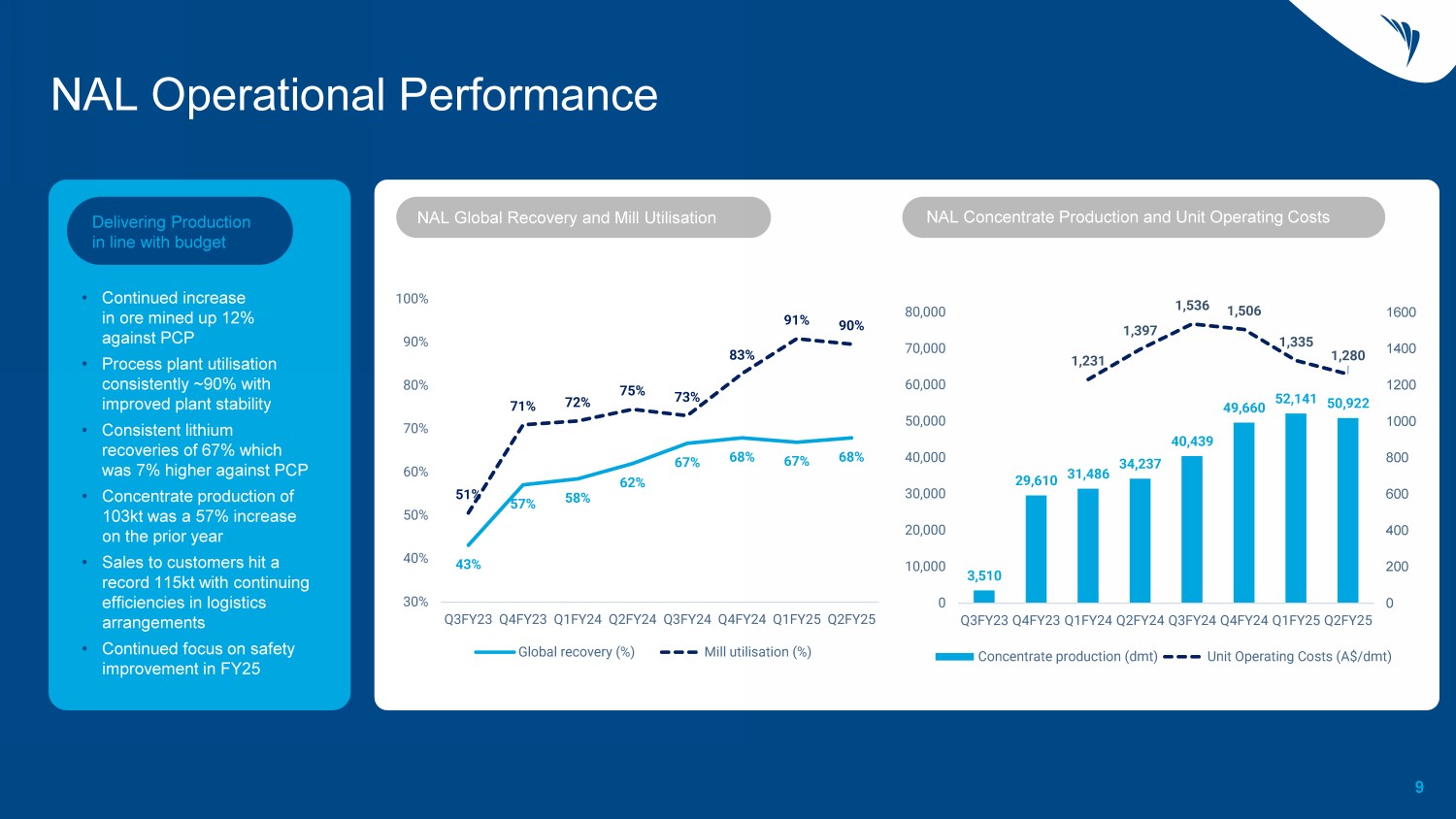

9 NAL Operational Performance • Continued increase in ore mined up 12% against PCP • Process plant utilisation consistently ~90% with improved plant stability • Consistent lithium recoveries of 67% which was 7% higher against PCP • Concentrate production of 103kt was a 57% increase on the prior year • Sales to customers hit a record 115kt with continuing efficiencies in logistics arrangements • Continued focus on safety improvement in FY25 3,510 29,610 31,486 34,237 40,439 49,660 52,141 50,922 1,231 1,397 1,536 1,506 1,335 1,280 0 200 400 600 800 1000 1200 1400 1600 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Concentrate production (dmt) Unit Operating Costs (A$/dmt) 43% 57% 58% 62% 67% 68% 67% 68% 51% 71% 72% 75% 73% 83% 91% 90% 30% 40% 50% 60% 70% 80% 90% 100% Q3FY23 Q4FY23 Q1FY24 Q2FY24 Q3FY24 Q4FY24 Q1FY25 Q2FY25 Global recovery (%) Mill utilisation (%) NAL Global Recovery and Mill Utilisation NAL Concentrate Production and Unit Operating Costs Delivering Production in line with budget

Merger Update 10

11 Merger Transaction Structure Overview of the merger • Newly - formed US subsidiary of Sayona to merge with and into Piedmont, subject to shareholder approvals. • Sayona will be the ultimate parent entity (i.e. “MergeCo”) with Piedmont as a wholly owned subsidiary. • Post transaction ownership split: approximately 50% Sayona shareholders / 50% Piedmont shareholders, on a fully - diluted basis, prior to conditional placement. • MergeCo will be domiciled in Australia – with an ASX primary listing and NASDAQ secondary listing. • Subject to shareholder approval, MergeCo to rebrand under a new name to be announced. Benefits of ASX primary listing and a Nasdaq secondary listing • ASX has demonstrated track record of supporting emerging mining companies, already familiar with MergeCo’s assets. • Nasdaq listing provides enhanced liquidity and potential to broaden equity research coverage and institutional investor interest. Newly Created Delaware Subsidiary MergeCo ASX primary listing Nasdaq secondary listing of ADRs (Renamed from Sayona )

12 Positioned to be a North American Lithium Champion 593 569 397 350 308 285 259 147 141 100 58 Merge Co (NAMR) Patriot Rio Tinto Albemarle (NAMR) Sayona Piedmont (ex-Ewoyaa) Winsome Resources Critical Elements Frontier Lithium Rock Tech Lithium Avalon Advanced North America Hard Rock Lithium Producers North American LOM Avg. Spodumene Concentrate Capacity ( ktpa SC6 equivalent) (1) 1. Capacity based on public company data (see “Important Information and Disclaimer” section for details). Totals may differ due to small rounding. Excludes Chinese companies. Refer to supporting information on page 25 2. LOM average spodumene production for North American Lithium expected to be 190ktpa SC5.4 (171ktpa SC6.0), includes Authier pr oje ct Moblan NAL (2) Carolina Carolina Moblan NAL (2) NAL (2) NAL (2) MergeCo North American pure - play hard rock lithium producer #1 Currently the largest permitted & producing hard - rock lithium mine in North America with potential to develop 3 additional high quality projects

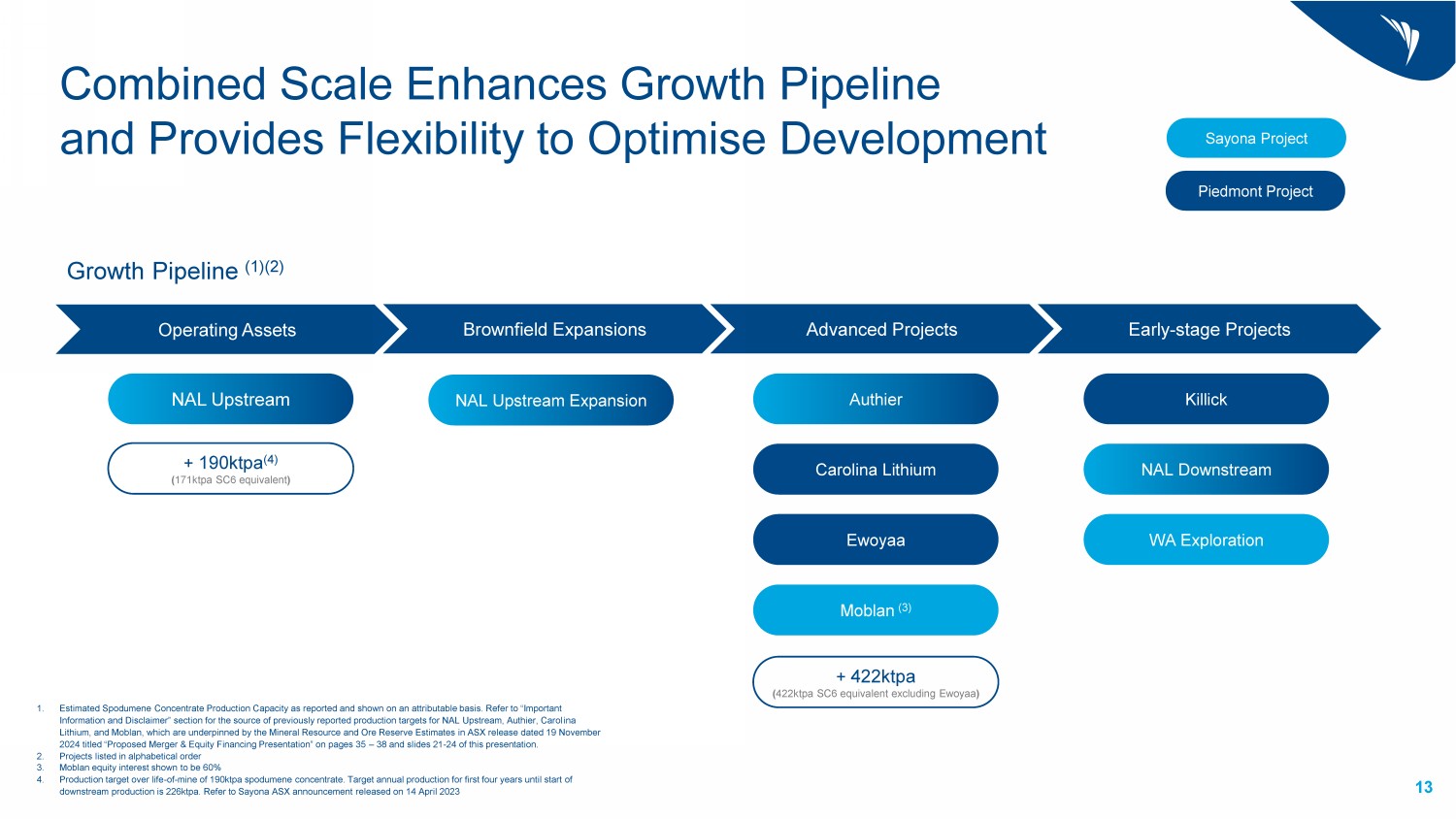

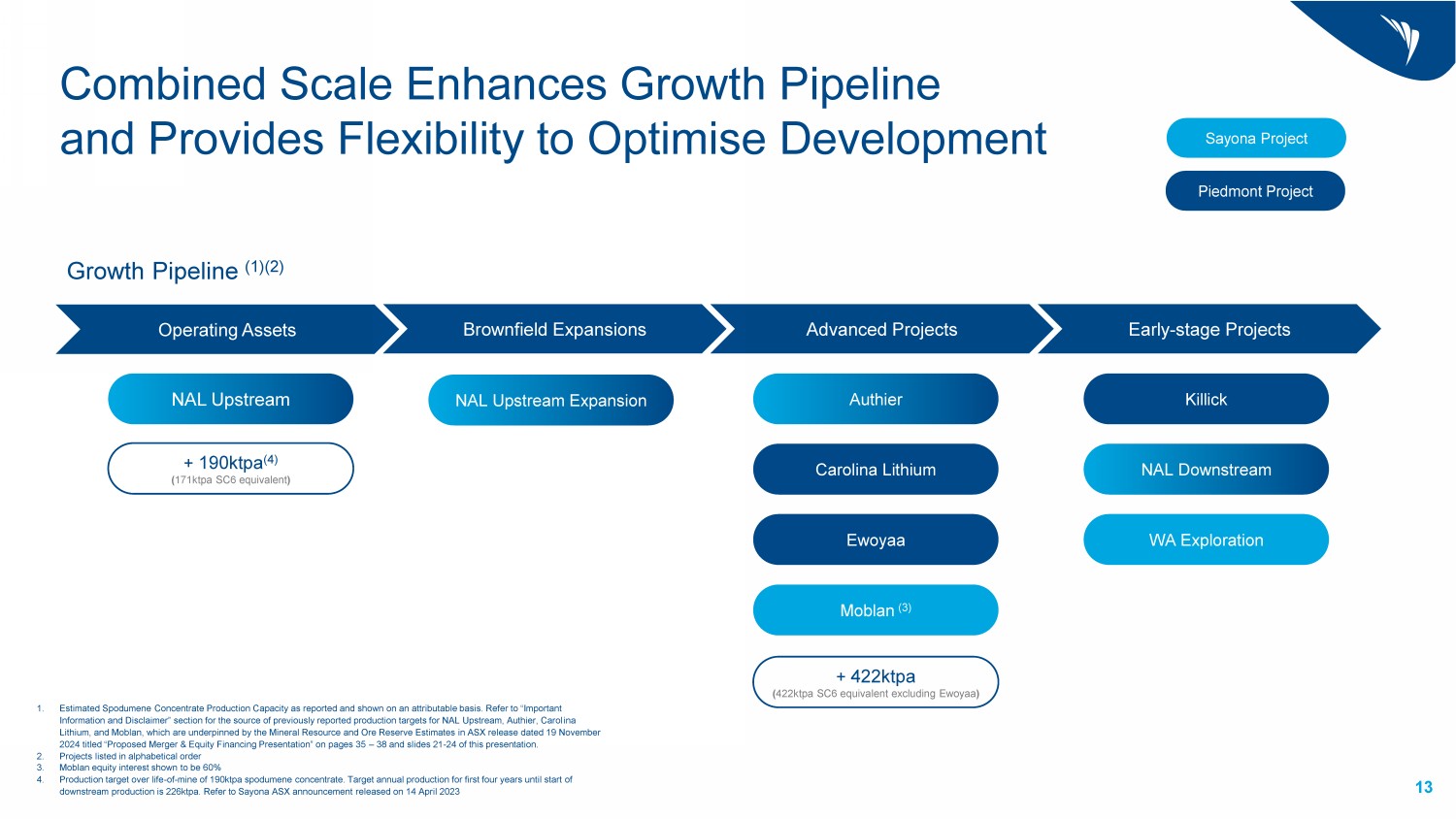

13 Combined Scale Enhances Growth Pipeline and Provides Flexibility to Optimise Development 1. Estimated Spodumene Concentrate Production Capacity as reported and shown on an attributable basis. Refer to “Important Information and Disclaimer” section for the source of previously reported production targets for NAL Upstream, Authier, Carol ina Lithium, and Moblan, which are underpinned by the Mineral Resource and Ore Reserve Estimates in ASX release dated 19 November 2024 titled “Proposed Merger & Equity Financing Presentation” on pages 35 – 38 and slides 21 - 24 of this presentation. 2. Projects listed in alphabetical order 3. Moblan equity interest shown to be 60% 4. Production target over life - of - mine of 190ktpa spodumene concentrate. Target annual production for first four years until start of downstream production is 226ktpa. Refer to Sayona ASX announcement released on 14 April 2023 Early - stage Projects Brownfield Expansions Advanced Projects Sayona Project Piedmont Project NAL Upstream Expansion Operating Assets NAL Upstream Carolina Lithium NAL Downstream Authier WA Exploration Killick Moblan (3) Ewoyaa Growth Pipeline (1)(2) + 422ktpa ( 422ktpa SC6 equivalent excluding Ewoyaa ) + 190ktpa (4) ( 171ktpa SC6 equivalent )

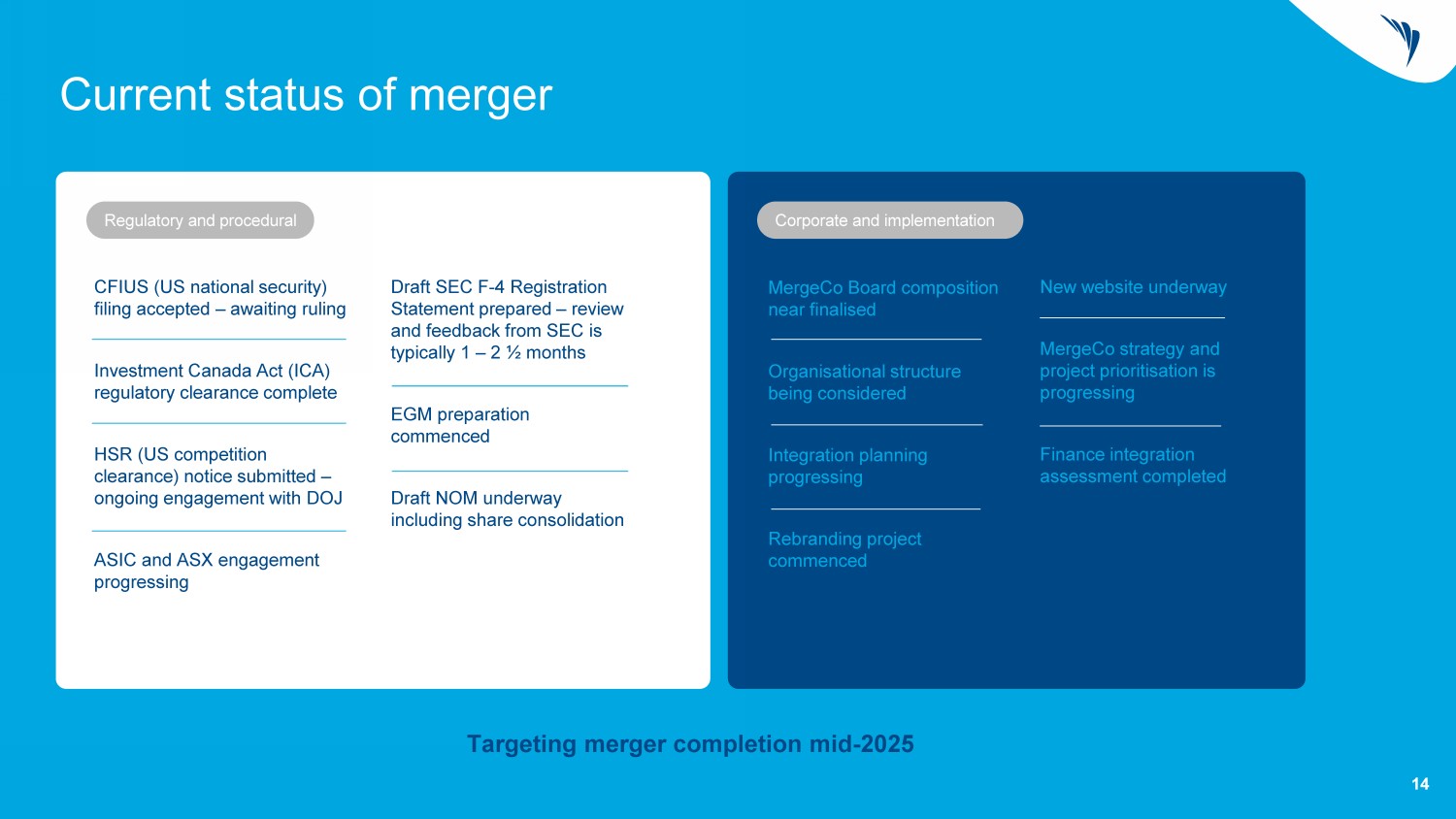

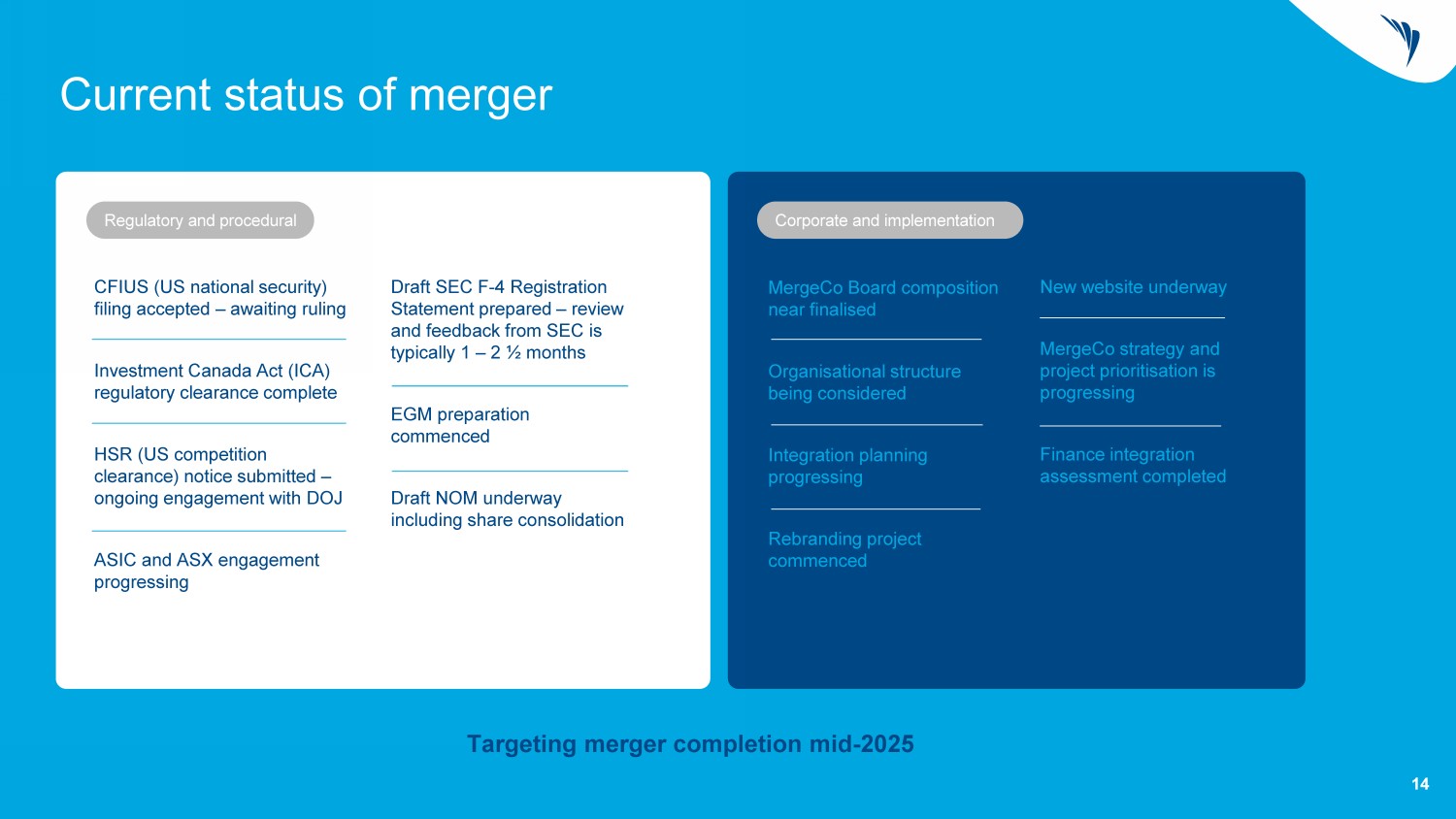

Current status of merger CFIUS (US national security) filing accepted – awaiting ruling Investment Canada Act (ICA) regulatory clearance complete HSR (US competition clearance) notice submitted – ongoing engagement with DOJ ASIC and ASX engagement progressing MergeCo Board composition near finalised Organisational structure being considered Integration planning progressing Rebranding project commenced Targeting merger completion mid - 2025 Draft SEC F - 4 Registration Statement prepared – review and feedback from SEC is typically 1 – 2 ½ months EGM preparation commenced Draft NOM underway including share consolidation Regulatory and procedural Corporate and implementation New website underway MergeCo strategy and project prioritisation is progressing Finance integration assessment completed 14

Lithium Market and Guidance 15

Spodumene Prices Have Continued to Recover; Lithium Hydroxide Futures Remain Strongly in Contango $8,000 $9,000 $10,000 $11,000 $12,000 $13,000 $14,000 $15,000 $16,000 CME Futures ($/t) $725 $745 $765 $785 $805 $825 $845 $865 $885 $905 9/10/2024 10/10/2024 11/10/2024 12/10/2024 1/10/2025 2/10/2025 Spodumene Concentrate 6% CIF China Spot Price 6% Lithium Oxide Spodumene Concentrate Spot Price (US$/t) (1) 1. Fastmarkets pricing as of February 13, 2025 2. Chicago Mercantile Exchange settlements as of February 13, 2025 CME Lithium Hydroxide CIF Futures (US$/t) (2) • Spodumene Concentrate prices have recovered from multi - year lows as industry responds to supply curtailments and project delays • Resilient demand growth from EVs and ESS driving downstream inventory destocking • Lithium Hydroxide futures market remains in contango providing higher prices for future sales volume • MergeCo can forward sell spodumene concentrate deliveries against the futures curve to increase certainty over price realisations and limit downside exposure February13 Spot: US$895/t February 13 Spot: US$9,310/t 16

FY25 Guidance 5 Notes 1 Guidance assumes average annual foreign exchange rates of AUD:CAD 0.91 and AUD:USD 0.667. 2 Capital expenditure guidance excludes movements in capital creditors which amounted to A$3 million as at 30 June 2024. 3 Exploration expenditure guidance excludes movements in exploration creditors which amounted to A$7 million as at 30 June 2024 . 4 Unit operating cost is calculated on an accruals basis and includes mining, processing, transport, port charges, site - based gene ral and administration costs and cash based inventory movements, and excludes depreciation and amortisation charges, freight and royalties. It is reported in A$ / dmt sold, FOB Port of Québec. 5 Guidance published in ASX release 30 August 2024 is based on assumptions, budgets and estimates existing at the time of asses sme nt which may change over time impacting the accuracy of those estimates. These estimates are developed in the context of an u nce rtain operating environment including in respect of inflationary macroeconomic conditions, incomplete engineering and uncertainties surrounding the risks associated with mining and project development including construction, commissioning and ramp up which may delay or impact production and have a flow on e ffect on sales. Actual results may therefore vary significantly depending on these risks and the timing required to address them. The information is provided as an indicative gui de to assist sophisticated investors with modelling of the Company. It should not be relied upon as a predictor of future per for mance. 190,000 - 210,000 DRY METRIC TONNES Spodumene Concentrate Production SC 5.4% product grade 100% NAL production FY25 production guidance assumes NAL achieves steady state production levels in FY25 17 200,000 - 230,000 DRY METRIC TONNES Spodumene Concentrate Sales SC 5.4% product grade 100% NAL sales Approximately two thirds (67%) of concentrate sales will be sold by NAL to Piedmont Lithium under the offtake agreement in FY25 A$1,150 - A$1,300 PER DRY METRIC TONNE Unit Operating Costs (1,4) SC 5.4% product grade 100% NAL unit operating costs A$ / dmt sold, FOB Port of Québec Unit operating costs reflect achievement of steady state production levels ~A$20M Capital Expenditure (1,2) Group capital expenditure relates predominantly to sustaining capital projects at NAL ~A$30M Exploration Expenditure (1,3) Relates to utilisation of Flow Through Share funding which must be spent on Quebec lithium projects by end of 2024 Q3 ~ 30% Q4 ~ 70% H2FY25 Shipment Volumes (Q3vQ4) Shipping volumes have been deliberately weighted to Q4FY25 in order to deliver into higher priced forward sales arrangements that commence in April 2025. Full year sales volume outcomes will not be affected

Connect with us. Sayona Mining Limited ACN 091 951 978 ASX:SYAOTCQB:SYAXF Level 28, 10 Eagle Street Brisbane, Queensland, 4000 Australia info@sayonamining.com.au sayonamining.com.au +61 (7) 3369 7058 @SayonaMining

Appendix

NAL Quarterly Physicals and Operational Metrics 20 FY24 FY23 Variance H1 FY25 H1 FY24 H1 FY25 Q2 Q1 FY24 Q4 Q3 Q2 Q1 UOM Physicals 1 12% 611 547 611 370 240 1,132 234 351 322 224 kwmt Ore Mined 32% 705 535 705 343 362 1,112 312 264 276 259 kwmt Ore Crushed 57% 103 66 103 51 52 156 50 40 34 31 kdmt Spodumene Concentrate Produced 59% 115 72 115 66 49 158 28 58 24 48 kdmt Spodumene Concentrate Sold Unit Metrics (35%) 1,060 1,640 1,060 1,054 1,067 1,272 885 999 946 1,985 A$/t Average Realised Sales Price (FOB) 2 (42%) 1,102 1,884 1,102 1,117 1,088 1,637 1,275 1,681 1,924 1,841 A$/t Unit Operating Cost Produced (FOB) 3 1% 1,303 1,286 1,303 1,280 1,335 1,417 1,506 1,536 1,397 1,231 A$/t Unit Operating Cost Sold (FOB) 4 Production Variables 17% 90 73 90 90 91 75 83 73 75 72 % Mill Utilisation 7% 67 60 67 68 67 64 68 67 62 58 % Global Process Recovery (0.2%) 5.3 5.5 5.3 5.3 5.3 5.4 5.3 5.4 5.5 5.5 % Concentrate Grade Produced FY24 FY25 H1 Notes 1 All figures are reported in 100% terms. Numbers presented may not add up precisely to the totals provided due to rounding. 2 Average realised sales price is calculated on an accruals basis and reported in $/ dmt sold, FOB Port of Québec. 3 Unit operating cost produced is calculated on an accruals basis and includes mining, processing, transport, port charges, si te - based general and administration costs, and excludes inventory movements, depreciation and amortisation charges, freight and royalties. It is reported in $/ dmt Produced, FOB Port of Québec 4 Unit operating cost sold is calculated on an accruals basis and includes mining, processing, transport, port charges, site - base d general and administration costs and cash based inventory movements, and excludes depreciation and amortisation charges, freight and royalties. It is reported in $/ dmt Sold, FOB Port of Québec 20

24 21 Sayona Mineral Resources Notes 1 All resource figures shown on 100% basis. Mineral Resources are reported inclusive of ore reserves. All Mineral Resource esti ma tes are reported in accordance with the JORC Code 2 Updated JORC Mineral Resource Estimate, refer to Sayona’s ASX announcement titled “North American Lithium Resource increases 51% to 88Mt” released on 27 August 2024 3 North American Lithium DFS, refer to Sayona’s ASX announcement titled “DFS Confirms NAL Value With $2.2B NPV” released on 14 April 2023 4 Updated JORC Mineral Resource Estimate, refer to Sayona’s ASX announcement titled “ Moblan Mineral Resource increases 81% to 93Mt” released on 27 August 2024 Contained LCE kt Contained Metal (kt Li 2 O) Grade (% Li 2 O) Tonnage (Mt) 1 Classification Asset 25 10 1.11% 0.9 Measured NAL ( Sayona 75% equity) 2 2,004 811 1.14% 71.1 Indicated 2,029 821 1.14% 72.1 M+I 410 166 1.05% 15.8 Inferred 145 59 0.98% 6.0 Measured Authier ( Sayona 75% equity) 3 206 83 1.03% 8.1 Indicated 351 142 1.01% 14.1 M+I 72 29 1.00% 2.9 Inferred 227 92 1.53% 6.0 Measured Moblan ( Sayona 60% equity) 4 1,783 721 1.22% 59.1 Indicated 2,010 813 1.25% 65.1 M+I 789 319 1.14% 28.0 Inferred

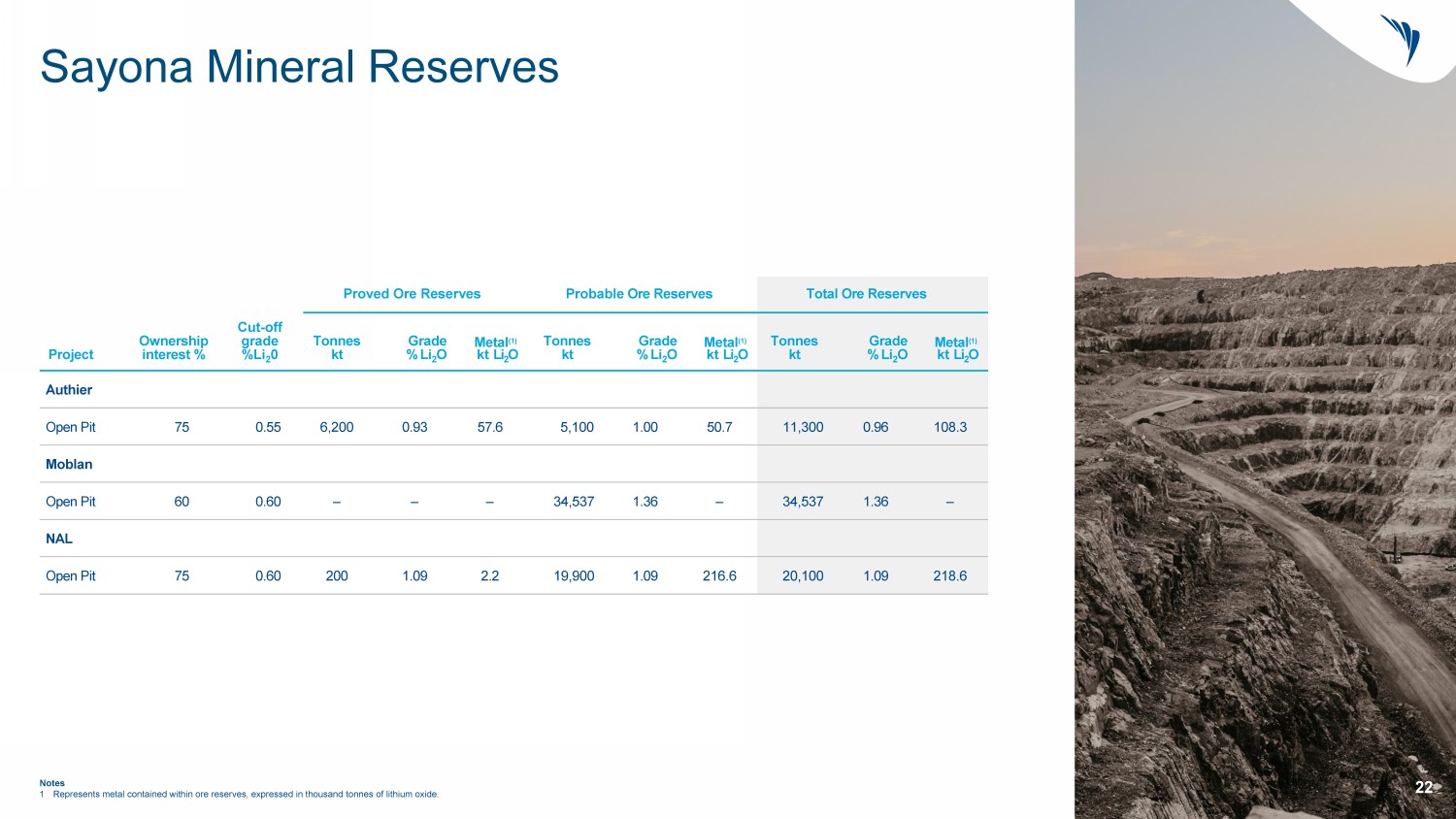

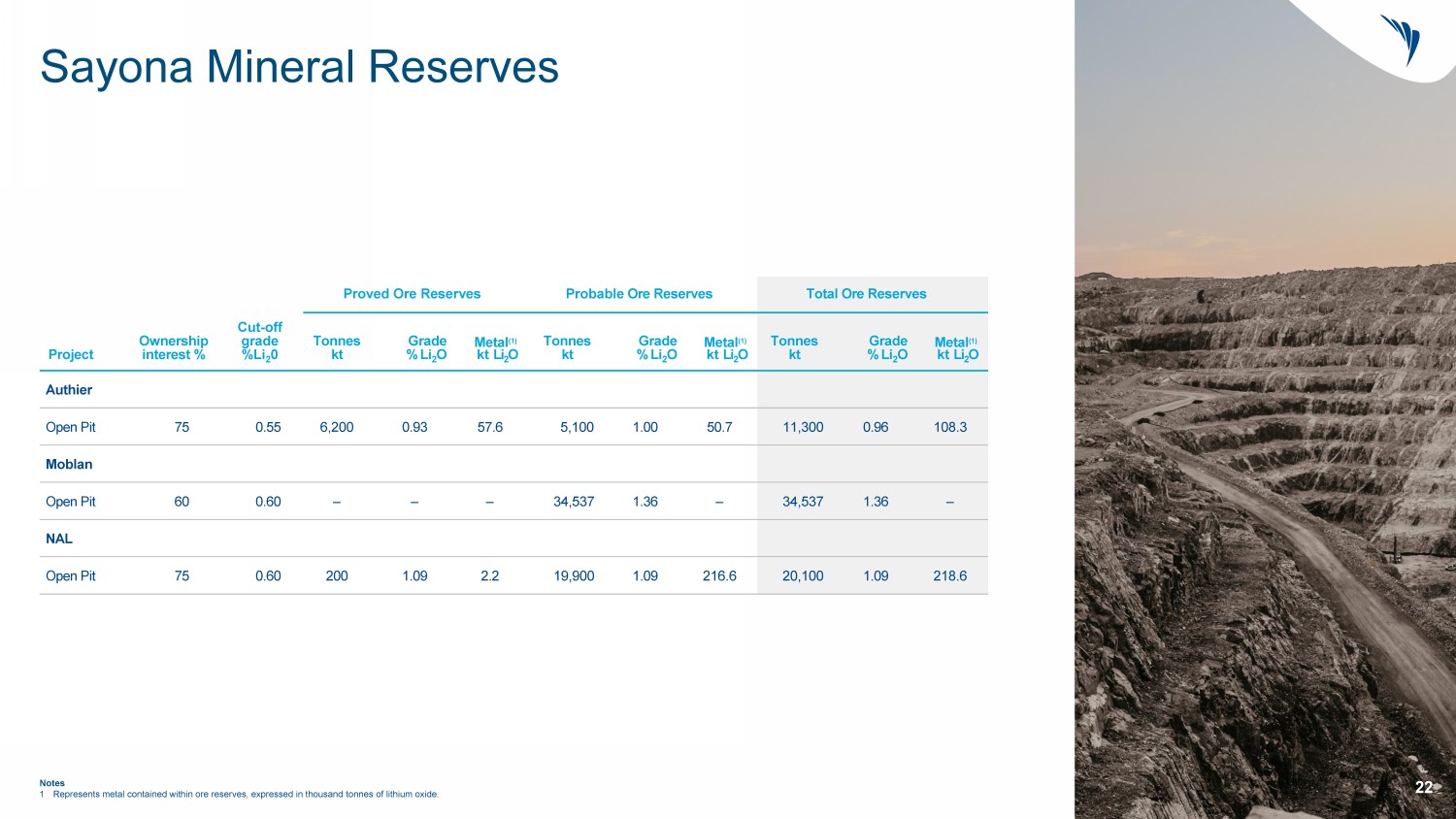

24 22 Sayona Mineral Reserves Notes 1 Represents metal contained within ore reserves, expressed in thousand tonnes of lithium oxide. Total Ore Reserves Probable Ore Reserves Proved Ore Reserves Metal (1) kt Li 2 O Grade % Li 2 O Tonnes kt Metal (1) kt Li 2 O Grade % Li 2 O Tonnes kt Metal (1) kt Li 2 O Grade % Li 2 O Tonnes kt Cut - off grade %Li 2 0 Ownership interest % Project Authier 108.3 0.96 11,300 50.7 1.00 5,100 57.6 0.93 6,200 0.55 75 Open Pi t Moblan – 1.36 34,537 – 1.36 34,537 – – – 0.60 60 Open Pi t NAL 218.6 1.09 20,100 216.6 1.09 19,900 2.2 1.09 200 0.60 75 Open Pit

24 23 Piedmont Mineral Resources (100% basis) Contained LCE kt Contained Metal (kt Li 2 O) Grade (% Li 2 O) Tonnage (1) (Mt) Classification Asset 25 10 1.11% 0.9 Measured NAL (Piedmont 25% equity) (2) 2,004 811 1.14% 71.1 Indicated 2,029 821 1.14% 72.1 M+I 410 166 1.05% 15.8 Inferred 145 59 0.98% 6.0 Measured Authier (Piedmont 25% equity) (3) 206 83 1.03% 8.1 Indicated 351 142 1.01% 14.1 M+I 72 29 1.00% 2.9 Inferred 774 313 1.11% 28.2 Indicated Carolina (Piedmont 100% equity) (4) 774 313 1.11% 28.2 M+I 401 162 1.02% 15.9 Inferred 1. All resource figures shown on 100% basis. Mineral Resources are reported inclusive of ore reserves. All Mineral Resource esti mat es are reported in accordance with the JORC Code 2. Updated JORC Mineral Resource Estimate, refer to Sayona’s ASX announcement titled “ North American Lithium Resource increases 51% to 88Mt” released on 27 August 2024 3. North American Lithium DFS, refer to Sayona’s ASX announcement titled “ DFS Confirms NAL Value With A$2.2B NPV ” released on 14 April 2023 4. Carolina Lithium BFS, refer to Piedmont’s ASX announcement titled “ Piedmont Completes BFS of the Carolina Lithium Project” released on 15 December 2021 23

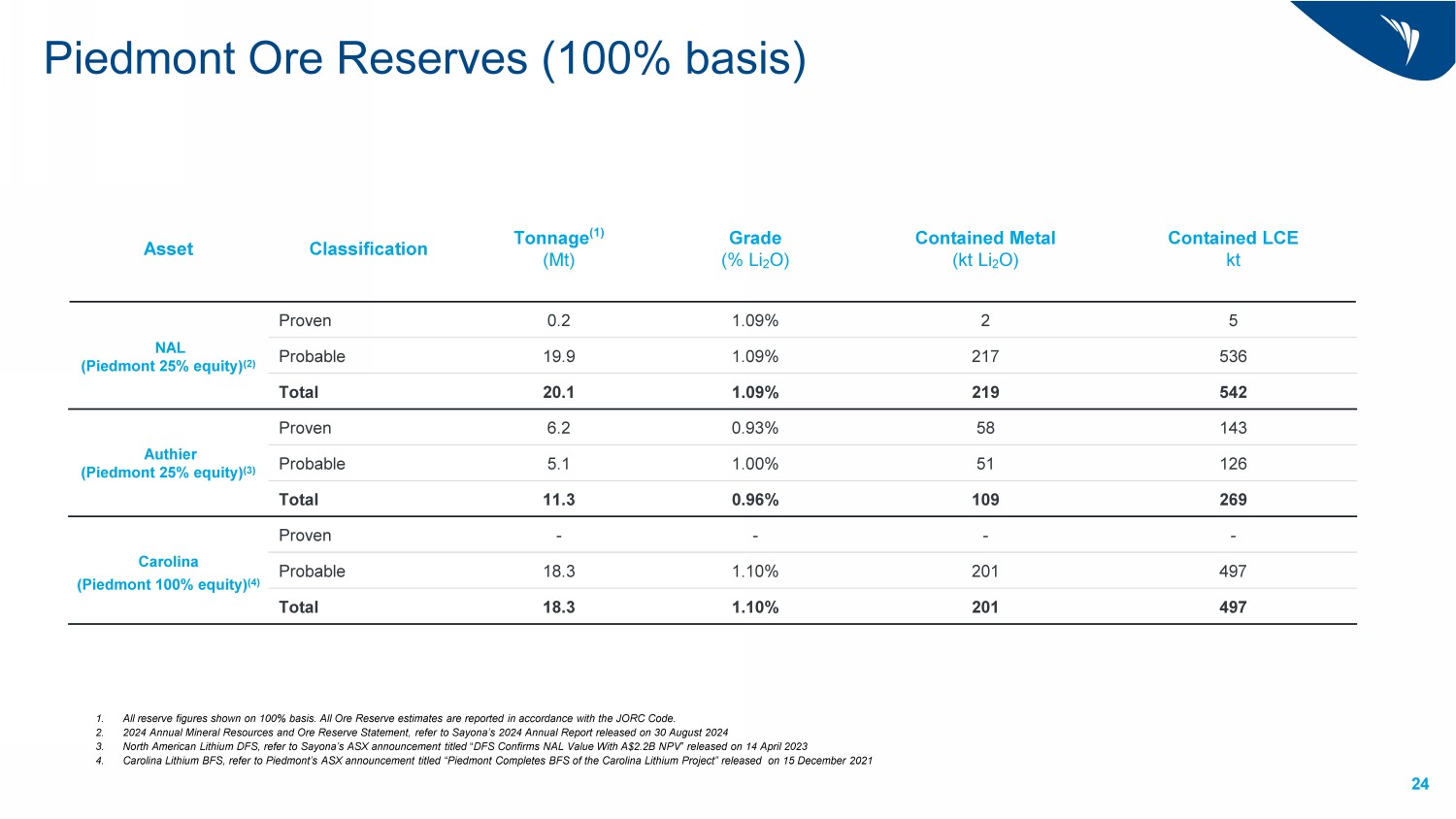

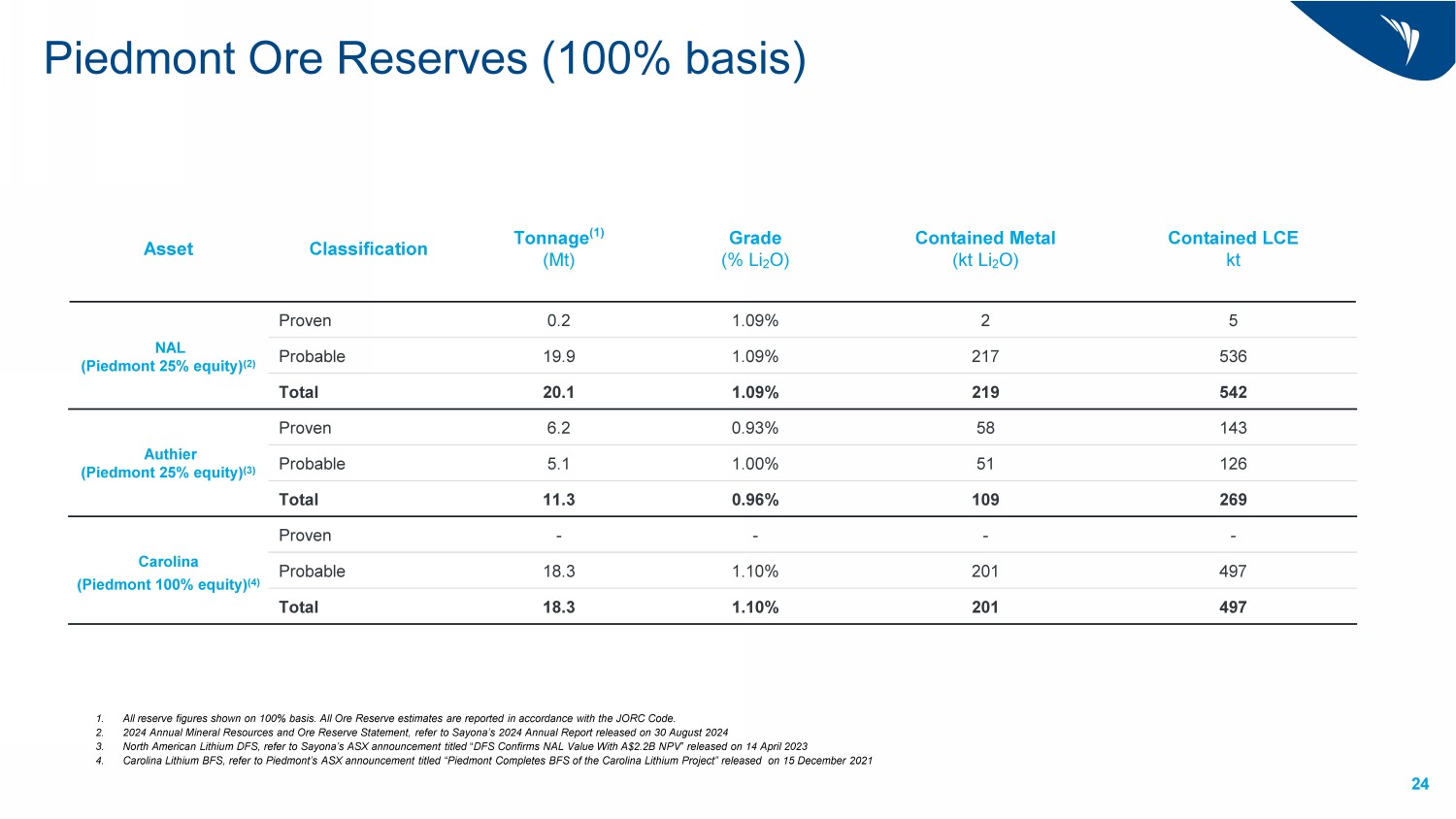

24 24 Piedmont Ore Reserves (100% basis) Contained LCE kt Contained Metal (kt Li 2 O) Grade (% Li 2 O) Tonnage (1) (Mt) Classification Asset 5 2 1.09% 0.2 Proven NAL (Piedmont 25% equity) (2) 536 217 1.09% 19.9 Probable 542 219 1.09% 20.1 Total 143 58 0.93% 6.2 Proven Authier (Piedmont 25% equity) (3) 126 51 1.00% 5.1 Probable 269 109 0.96% 11.3 Total - - - - Proven Carolina (Piedmont 100% equity) (4) 497 201 1.10% 18.3 Probable 497 201 1.10% 18.3 Total 1. All reserve figures shown on 100% basis. All Ore Reserve estimates are reported in accordance with the JORC Code. 2. 2024 Annual Mineral Resources and Ore Reserve Statement, refer to Sayona’s 2024 Annual Report released on 30 August 2024 3. North American Lithium DFS, refer to Sayona’s ASX announcement titled “ DFS Confirms NAL Value With A$2.2B NPV ” released on 14 April 2023 4. Carolina Lithium BFS , refer to Piedmont’s ASX announcement titled “ Piedmont Completes BFS of the Carolina Lithium Project” released on 15 December 2021 24

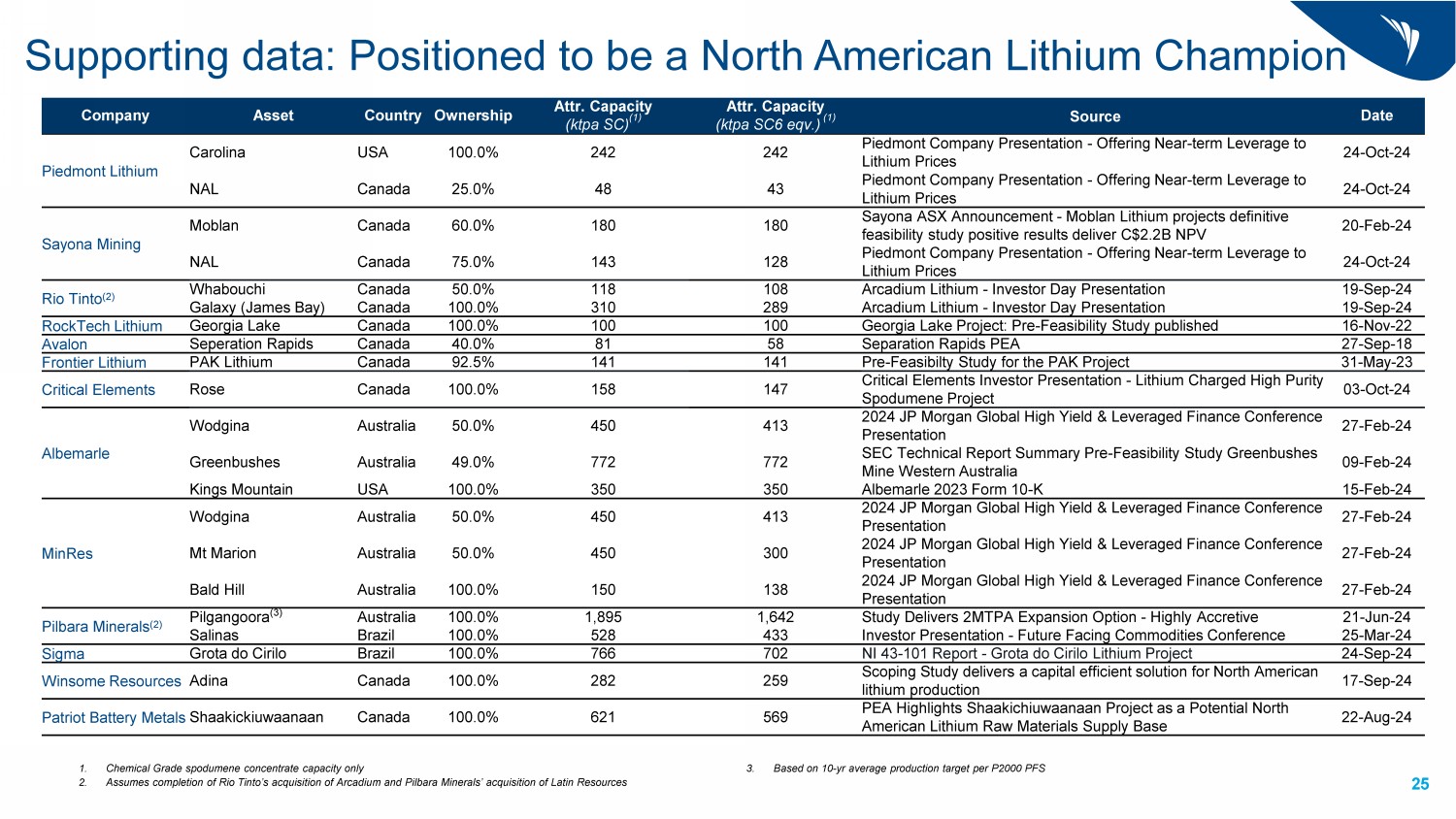

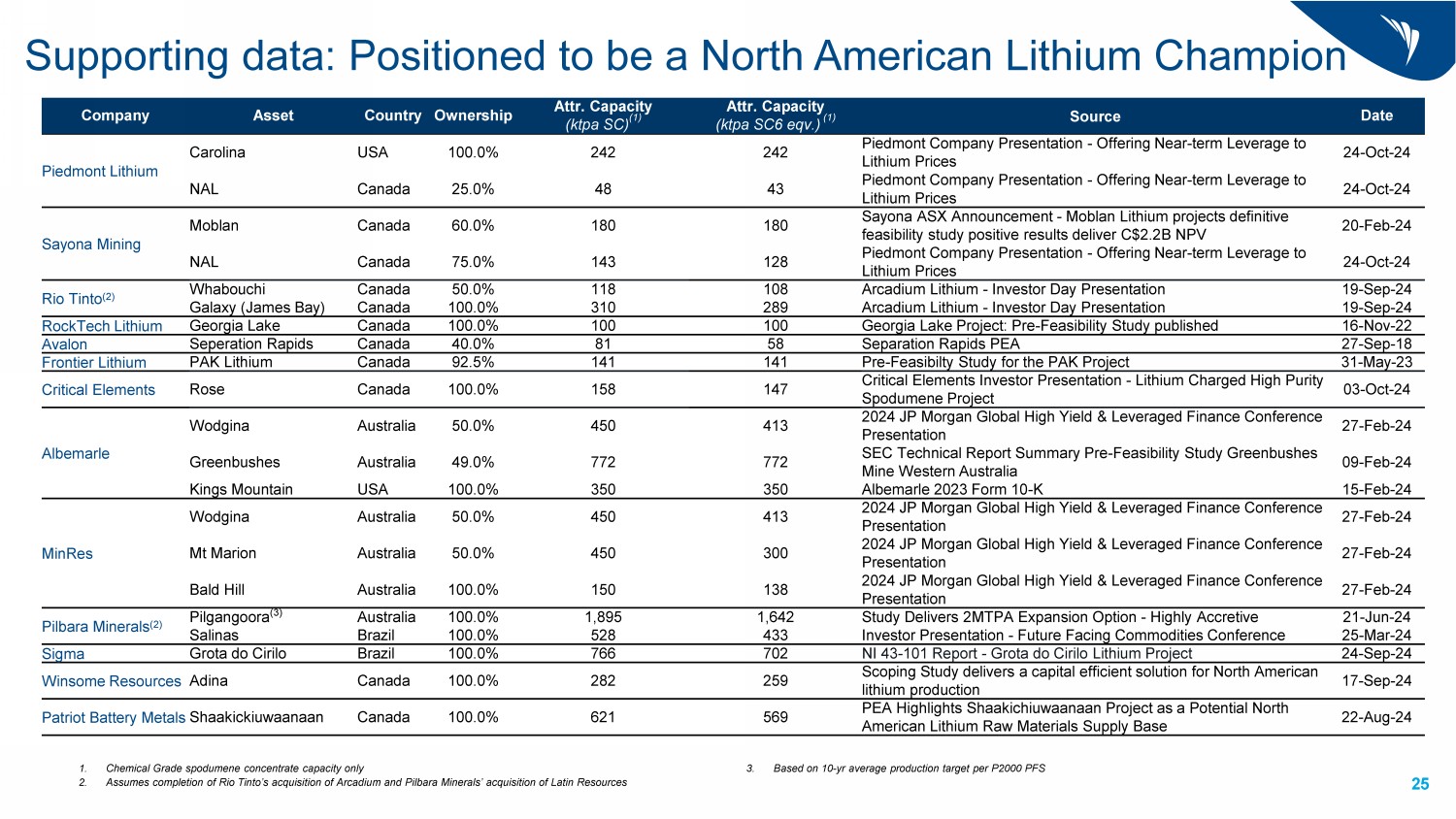

24 25 Supporting data: Positioned to be a North American Lithium Champion Date Source Attr . Capacity ( ktpa SC6 eqv .) (1) Attr . Capacity ( ktpa SC) (1) Ownership Country Asset Company 24 - Oct - 24 Piedmont Company Presentation - Offering Near - term Leverage to Lithium Prices 242 242 100.0% USA Carolina Piedmont Lithium 24 - Oct - 24 Piedmont Company Presentation - Offering Near - term Leverage to Lithium Prices 43 48 25.0% Canada NAL 20 - Feb - 24 Sayona ASX Announcement - Moblan Lithium projects definitive feasibility study positive results deliver C$2.2B NPV 180 180 60.0% Canada Moblan Sayona Mining 24 - Oct - 24 Piedmont Company Presentation - Offering Near - term Leverage to Lithium Prices 128 143 75.0% Canada NAL 19 - Sep - 24 Arcadium Lithium - Investor Day Presentation 108 118 50.0% Canada Whabouchi Rio Tinto (2) 19 - Sep - 24 Arcadium Lithium - Investor Day Presentation 289 310 100.0% Canada Galaxy (James Bay) 16 - Nov - 22 Georgia Lake Project: Pre - Feasibility Study published 100 100 100.0% Canada Georgia Lake RockTech Lithium 27 - Sep - 18 Separation Rapids PEA 58 81 40.0% Canada Seperation Rapids Avalon 31 - May - 23 Pre - Feasibilty Study for the PAK Project 141 141 92.5% Canada PAK Lithium Frontier Lithium 03 - Oct - 24 Critical Elements Investor Presentation - Lithium Charged High Purity Spodumene Project 147 158 100.0% Canada Rose Critical Elements 27 - Feb - 24 2024 JP Morgan Global High Yield & Leveraged Finance Conference Presentation 413 450 50.0% Australia Wodgina Albemarle 09 - Feb - 24 SEC Technical Report Summary Pre - Feasibility Study Greenbushes Mine Western Australia 772 772 49.0% Australia Greenbushes 15 - Feb - 24 Albemarle 2023 Form 10 - K 350 350 100.0% USA Kings Mountain 27 - Feb - 24 2024 JP Morgan Global High Yield & Leveraged Finance Conference Presentation 413 450 50.0% Australia Wodgina MinRes 27 - Feb - 24 2024 JP Morgan Global High Yield & Leveraged Finance Conference Presentation 300 450 50.0% Australia Mt Marion 27 - Feb - 24 2024 JP Morgan Global High Yield & Leveraged Finance Conference Presentation 138 150 100.0% Australia Bald Hill 21 - Jun - 24 Study Delivers 2MTPA Expansion Option - Highly Accretive 1,642 1,895 100.0% Australia Pilgangoora (3) Pilbara Minerals (2) 25 - Mar - 24 Investor Presentation - Future Facing Commodities Conference 433 528 100.0% Brazil Salinas 24 - Sep - 24 NI 43 - 101 Report - Grota do Cirilo Lithium Project 702 766 100.0% Brazil Grota do Cirilo Sigma 17 - Sep - 24 Scoping Study delivers a capital efficient solution for North American lithium production 259 282 100.0% Canada Adina Winsome Resources 22 - Aug - 24 PEA Highlights Shaakichiuwaanaan Project as a Potential North American Lithium Raw Materials Supply Base 569 621 100.0% Canada Shaakickiuwaanaan Patriot Battery Metals 1. Chemical Grade spodumene concentrate capacity only 2. Assumes completion of Rio Tinto’s acquisition of Arcadium and Pilbara Minerals’ acquisition of Latin Resources 3. Based on 10 - yr average production target per P2000 PFS 25

Important Information and Disclaimer Statements in this presentation are made only as of the date of this presentation unless otherwise stated, and the information in this presentation remains subject to change without notice. Presentation for the Purposes of Providing Information Only This presentation is not a prospectus, disclosure document or offering document under Australian law or under the law of any other jurisdiction. It is for informational purposes only. This document does not constitute and should not be construed as, an offer to sell or a solicitation of an offer or invitation to subscribe for, buy, or sell securities in the Company . Any material used in this presentation is only an overview and summary of certain data selected by the management of the Company. The presentation does not purport to contain all the information that a prospective investor may require in evaluating a possible investment in the Company, nor does it contain all the information which would be required in a disclosure document prepared in accordance with the requirements of the Corporations Act and should not be used in isolation as a basis to invest in the Company. Recipients of this presentation must make their own independent investigations, consideration and evaluation of the Company. The distribution of this presentation in other jurisdictions outside of Australia may also be restricted by law and any restrictions should be observed. To avoid doubt, this presentation is not for distribution or dissemination within the US and Canada. Any failure to comply with such restrictions may constitute a violation of applicable securities laws. Disclaimer No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions or conclusions contained in or derived from this presentation or any omission from this presentation or of any other written or oral information or opinions provided now or in the future to any person. To the maximum extent permitted by law, neither the Company nor any of its affiliates , related bodies corporate and their respective officers, directors, employees, advisors and agents, nor any other person, accepts any liability as to or in relation to the accuracy or completeness of the information, statements, opinions, or matters (express or implied) arising out of, contained in or derived from this presentation or any omission from this presentation or of any other written of oral information or opinions provided now or in the future to any person. Forward Looking Statements This presentation may contain certain forward - looking statements. Such statements are only predictions, based on certain assumptions and involve known and unknown risks, uncertainties and other factors, many of which are beyond Sayona Mining Limited’s control. Actual events or results may differ materially from the events or results expected or implied in any forward - looking statement. The inclusion of such statements should not be regarded as a representation, warranty or prediction with respect to the accuracy of the underlying assumptions or that any forward - looking statements will be or are likely to be fulfilled. Sayona Mining Limited undertakes no obligation to update any forward - looking statement or other statement to reflect events or circumstances after the date of this presentation (subject to securities exchange disclosure requirements). The information in this presentation does not take into account the objectives, financial situation or particular needs of any person. Nothing contained in this presentation constitutes investment, legal, tax or other advice. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and all material assumptions and technical parameters continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements. 26 Important Information and Disclaimer