As filed with the U.S. Securities and Exchange Commission on March 5, 2021

1933 Act Registration No. 333-[ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| | | | | |

| ¨ | Pre-Effective Amendment No. ____ |

| ¨ | Post-Effective Amendment No. ____ |

| (Check appropriate box or boxes.) |

TIDAL ETF TRUST

(Exact name of registrant as specified in charter)

898 North Broadway, Suite 2

Massapequa, New York 11758

(Address of Principal Executive Offices, Zip Code)

(Registrant’s Telephone Number, including Area Code) (844) 986-7676

The Corporation Trust Company

1209 Orange Street

Corporation Trust Center

Wilmington, DE 19801

(Name and Address of Agent for Service)

Copies to:

Eric W. Falkeis

Tidal ETF Services LLC

898 North Broadway, Suite 2

Massapequa, New York 11758

Christopher M. Cahlamer

Godfrey & Kahn, S.C.

833 East Michigan Street, Suite 1800

Milwaukee, Wisconsin 53202

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under

the Securities Act of 1933, as amended.

It is proposed that this filing will become effective on April 5, 2021 pursuant to Rule 488.

Title of Securities Being Offered: Shares of American Customer Satisfaction ETF

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

TIDAL ETF TRUST

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement is comprised of the following:

Cover Sheet

Contents of Registration Statement

Letter to Shareholders

Notice of Special Meeting of Shareholders

Questions and Answers

Part A – Combined Proxy Statement and Prospectus

Part B – Statement of Additional Information

Part C – Other Information

Signature Page

Exhibit Index

Form of Proxy Card

COMBINED PROXY STATEMENT AND PROSPECTUS

For the Reorganization of

American Customer Satisfaction ETF

a series of ETF Series Solutions

615 East Michigan Street, Milwaukee, Wisconsin 53202

(800) 617-0004

into

American Customer Satisfaction ETF

a series of Tidal ETF Trust

898 North Broadway, Suite 2, Massapequa, New York 11758

(844) 986-7676

[ ], 2021

American Customer Satisfaction ETF

a series of ETF Series Solutions

615 East Michigan Street | Milwaukee, Wisconsin 53202

[ ], 2021

Dear Shareholder:

On behalf of the Board of Trustees of ETF Series Solutions (“ESS”), we are pleased to invite you to a Special Meeting of Shareholders (the “Special Meeting”) of the American Customer Satisfaction ETF (ticker: ACSI) (the “Target Fund”), a series of ESS, on May 12, 2021, at the principal executive offices of ESS, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, at 11:00 a.m. Central Time.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the continuing COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website https://vote.proxyonline.com/etfss/docs/acsetf.pdf, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed below, in advance of the Special Meeting in the event that, as of May 12, 2021, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

As discussed in more detail in the enclosed Combined Proxy Statement and Prospectus, at the Special Meeting, the shareholders of the Target Fund will be asked to consider and vote to approve an Agreement and Plan of Reorganization (the “Plan”) to reorganize the Target Fund into a corresponding new fund (the “Acquiring Fund”), which is a newly created series of Tidal ETF Trust (“Tidal”). The Acquiring Fund was established solely for the purpose of acquiring the assets of the Target Fund and continuing the Target Fund’s business (the “Reorganization”). Upon shareholder approval and effectiveness of the Plan, you will receive shares of the Acquiring Fund equivalent to the value of your Target Fund shares as of the closing date of the Reorganization in complete liquidation and dissolution of the Target Fund, and you will no longer be a shareholder of the Target Fund, but will become a shareholder of the Acquiring Fund. Importantly, approval of the Proposal will not result in any increase in shareholder fees or expenses.

The Acquiring Fund will be managed by Toroso Investments, LLC (“Toroso”), whereas the Target Fund is managed by CSat Investment Advisory, L.P., doing business as Exponential ETFs. Although certain portfolio management team members will change as described in greater detail herein, Toroso will manage the Acquiring Fund in accordance with the same investment objective and materially identical investment strategies, policies, and risks as the Target Fund immediately prior to the Reorganization. Additional information about the Acquiring Fund is included in Appendix D and the Statement of Additional Information related to the Combined Proxy Statement and Prospectus.

YOUR VOTE IS IMPORTANT.

The Board of Trustees of ESS believes that the proposed Reorganization is in the best interests of Target Fund shareholders and recommends that you vote “FOR” the approval of the Plan to authorize the Reorganization with respect to the Target Fund.

You can vote in one of four ways:

•By mail with the enclosed proxy card;

•By internet through the website listed in the proxy voting instructions;

•By automated touchtone using the toll-free number listed in the proxy voting instructions; or

•In person at the special shareholder meeting on May 12, 2021.

Thank you for your consideration of this important Proposal. Your vote is extremely important, so please read the enclosed Combined Proxy Statement and Prospectus carefully and submit your vote.

Your vote is very important to us. Thank you for your response and for your continued investment in the American Customer Satisfaction ETF.

Respectfully,

Michael D. Barolsky

Vice President and Secretary

ETF Series Solutions

American Customer Satisfaction ETF

a series of ETF Series Solutions

615 East Michigan Street | Milwaukee, Wisconsin 53202

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD May 12, 2021

To the Shareholders of the American Customer Satisfaction ETF:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Special Meeting”) of the American Customer Satisfaction ETF (the “Target Fund”), a series of ETF Series Solutions, is to be held on May 12, 2021 at 11:00 a.m. Central Time, at the offices of ETF Series Solutions, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the continuing COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website https://vote.proxyonline.com/etfss/docs/acsetf.pdf, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed below, in advance of the Special Meeting in the event that, as of May 12, 2021, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

At the Special Meeting, you and the other shareholders of the Target Fund will be asked to consider and vote to approve the Agreement and Plan of Reorganization (the “Plan”) approved by the ETF Series Solutions Board of Trustees, which provides for the reorganization (the “Reorganization”) of the Target Fund, a series of ETF Series Solutions, into the American Customer Satisfaction ETF, a newly created series of Tidal ETF Trust. The persons designated as proxies may use their discretionary authority to vote as instructed by management of the Target Fund on any other proposals raised at the Special Meeting to the extent permitted by the proxy rules of the U.S. Securities and Exchange Commission (the “SEC”), including proposals for which timely notice was not received, as set forth in the SEC’s proxy rules.

Those present and the appointed proxies also will transact such other business, if any, as may properly come before the Special Meeting or any adjournments or postponements thereof.

Holders of record of the shares of beneficial interest in the Target Fund as of the close of business on March 1, 2021, are entitled to vote at the Special Meeting or any adjournments or postponements thereof.

If the necessary quorum to transact business or the vote required to approve any proposal is not obtained at the Special Meeting, or if a quorum is obtained but sufficient votes required to approve the Plan are not obtained, the chairman of the Special Meeting may adjourn the Special Meeting one or more times to permit, in accordance with applicable law, further solicitation of proxies with respect to the proposal.

This Notice of Special Meeting of Shareholders and the Combined Proxy Statement and Prospectus are available on the internet at https://vote.proxyonline.com/etfss/docs/acsetf.pdf. On this webpage, you also will be able to access the Target Fund’s Prospectus, the Acquiring Fund’s Prospectus, and any amendments or supplements to the foregoing material that are required to be furnished to shareholders. We encourage you to access and review all of the important information contained in the proxy materials before voting.

By order of the Board of Trustees of ETF Series Solutions,

Michael D. Barolsky

Vice President & Secretary

[ ], 2021

HOW TO VOTE YOUR SHARES

YOUR VOTE IS IMPORTANT

NO MATTER HOW MANY SHARES YOU OWN

We urge you to vote your shares. Your prompt vote may save the Target Fund the necessity of further solicitations to ensure a quorum at the Special Meeting. You may cast your vote by mail, by the internet, and by automated touchtone as set forth below:

•Mail: To vote your proxy by mail, check the appropriate voting box on your proxy card, sign and date the card and return it in the enclosed postage-prepaid envelope. If you sign, date, and return the proxy card but give no voting instructions, the proxies will vote FOR the Proposal.

The options below are available 24 hours a day / 7 days a week.

•Internet: The web address and instructions for voting online can be found on the enclosed proxy card. You will be required to provide your control number found on your proxy card.

•Automated Touchtone: The toll-free number for automated touchtone telephone voting can be found on the enclosed proxy card. You must have the control number found on your proxy card.

If you can attend the Special Meeting and wish to vote your shares in person at that time, you will be able to do so. If you hold your shares in “street name” through a broker, bank or other nominee, you should contact your nominee about voting in person at the Special Meeting. We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the continuing COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website https://vote.proxyonline.com/etfss/docs/acsetf.pdf, and we encourage you to check this website prior to the Special Meeting if you plan to attend.

American Customer Satisfaction ETF

a series of ETF Series Solutions

615 East Michigan Street | Milwaukee, Wisconsin 53202

QUESTIONS AND ANSWERS

Dated: [ ], 2021

Question: What is this document and why did you send it to me?

Answer: The attached Combined Proxy Statement and Prospectus (the “Proxy Statement”) is a proxy statement for the American Customer Satisfaction ETF (the “Target Fund”), a series of ETF Series Solutions (“ESS”), and a prospectus for shares of the American Customer Satisfaction ETF (the “Acquiring Fund”), a newly created series of Tidal ETF Trust (“Tidal”). (The Target Fund and the Acquiring Fund may each be referred to as a “Fund”, or, together, the “Funds”). The purposes of the Proxy Statement are to (1) solicit votes from shareholders of the Target Fund to approve the proposed reorganization of the Target Fund into the Acquiring Fund (the “Reorganization”), as described in the Agreement and Plan of Reorganization between ESS and Tidal (the “Plan”), a form of which is attached to the Proxy Statement as Appendix A, and (2) provide information regarding the shares of the Acquiring Fund. Approval by the shareholders of the Target Fund is required to proceed with the Reorganization. If the shareholders of the Target Fund do not approve the Proposal, then the Reorganization will not be implemented and the Board of Trustees of ESS (the “ESS Board”) will consider what further actions to take.

The Proxy Statement contains information that you should know before voting on the Reorganization, including additional information about the Acquiring Fund in Appendix D and the Statement of Additional Information related to the Proxy Statement. The Proxy Statement should be retained for future reference.

Question: What is the purpose of the Reorganization?

Answer: The primary purpose of the Reorganization is to move the investment portfolio and shareholders presently associated with the Target Fund to the Acquiring Fund. CSat Investment Advisory, L.P., doing business as Exponential ETFs (“Exponential ETFs”), the investment adviser to the Target Fund, recommends that the Target Fund be reorganized with and into the Acquiring Fund. Exponential ETFs’ recommendation was made in light of its plans to wind-down its investment advisory business and its limited resources to market and distribute the Target Fund and to enable the Target Fund to benefit from the experience and resources of Toroso Investments, LLC (“Toroso”) and its affiliates. If the Reorganization is approved by Target Fund shareholders, Toroso will serve as the investment adviser for the Acquiring Fund. The Reorganization will allow Toroso to leverage its resources for, and focus its marketing and distribution efforts on, the Acquiring Fund. Toroso is an investment adviser managing 17 exchange-traded funds (“ETFs”) with over $1.9 billion in assets under management as of February 28, 2021. After careful consideration, upon the recommendation of Exponential ETFs, the Board approved the reorganization of the Target Fund as a new series of Tidal.

Question: How will the Reorganization work?

Answer: To reconstitute the Target Fund as a series of Tidal, an investment company with materially identical investment policies and strategies, referred to as the “Acquiring Fund,” has been created as a new series of Tidal. The Acquiring Fund is newly organized and has no assets or liabilities. If shareholders of the Target Fund approve the Plan, the Target Fund will transfer all of its assets to the Acquiring Fund in return for shares of the Acquiring Fund and the Acquiring Fund’s assumption of the Target Fund’s liabilities. Existing shareholders of the Target Fund will become shareholders of the Acquiring Fund and, immediately after the Reorganization, each shareholder will hold shares of the Acquiring Fund with a value equal to the aggregate net asset value of the Target Fund’s shares that the shareholder held immediately prior to the Reorganization. Subsequently, the Target Fund will be liquidated and terminated.

Please refer to the Proxy Statement for a detailed explanation of the Proposal. If the Plan is approved by shareholders of the Target Fund at the Special Meeting of Shareholders (the “Special Meeting”), the Reorganization is expected to be effective on or about May 24, 2021.

Question: How will the Reorganization affect me as a shareholder?

Answer: You will become a shareholder of the Acquiring Fund. You will receive shares of the Acquiring Fund with a value equal to the aggregate net asset value of your shares of the Target Fund held immediately prior to the Reorganization.

Question: Is the investment focus of the Acquiring Fund different from that of the Target Fund?

Answer: No, the investment objective of the Acquiring Fund will be identical to that of the Target Fund, and the investment strategies of the Acquiring Fund will be materially identical to those of the Target Fund.

Question: Who will manage the Acquiring Fund?

Answer: The Reorganization will shift management responsibility from Exponential ETFs to Toroso, the investment adviser of the Acquiring Fund. Toroso is an SEC-registered investment adviser formed in March 2012 that is dedicated to understanding, researching, and managing assets with the expanding ETF universe. Charles A. Ragauss, CFA, who has been a portfolio manager for the Target Fund since its inception in 2016, will also be a portfolio manager of the Acquiring Fund. ESS and the Target Fund are not affiliated with Toroso, Tidal, or the Acquiring Fund.

Question: Will there be changes to the Board of Trustees and service providers for the Acquiring Fund?

Answer: ESS and Tidal have different Boards of Trustees, legal counsel, and administrators, as set forth in the table below; however, ESS and Tidal have the same fund accountant, transfer agent, distributor, custodian, and independent registered public accounting firm (with respect to the Acquiring Fund). The administrator for the Target Fund serves as the sub-administrator for the Acquiring Fund.

| | | | | | | | |

| Target Fund | Acquiring Fund |

| Administrator | U.S. Bancorp Fund Services, LLC | Tidal ETF Services LLC |

| Sub-Administrator | N/A | U.S. Bancorp Fund Services, LLC |

| Fund Accountant | U.S. Bancorp Fund Services, LLC | U.S. Bancorp Fund Services, LLC |

| Transfer Agent | U.S. Bancorp Fund Services, LLC | U.S. Bancorp Fund Services, LLC |

| Custodian | U.S. Bank National Association | U.S. Bank National Association |

| Distributor and Principal Underwriter | Foreside Fund Services, LLC | Foreside Fund Services, LLC |

| Auditor | Cohen & Company, Ltd. | Cohen & Company, Ltd. |

| Legal Counsel | Morgan, Lewis & Bockius LLP | Godfrey & Kahn, S.C. |

Question: Will the Reorganization affect the fees and expenses I pay as a shareholder of the Target Fund?

Answer: No, the fees and expenses you pay as a shareholder of the Target Fund are expected to stay the same after you become a shareholder of the Acquiring Fund. Each Fund operates under a unitary fee contract structure whereby each Fund pays for its investment advisory and administrative services under what is essentially an “all-in” fee arrangement. The management fee and total annual fund operating expenses for the Target Fund is 0.65% per annum of the Fund’s average daily net assets. The management fee and estimated total annual fund operating expenses for the Acquiring Fund is 0.65% per annum of the Fund’s average daily net assets.

The Funds have each adopted a Rule 12b-1 Distribution and Service Plan under which the applicable Fund may bear a Rule 12b-1 fee not to exceed 0.25% per annum of the Fund’s average daily net assets. However, no such fee is currently expected to be paid by the Acquiring Fund, and the Board of Trustees of Tidal has not approved the commencement of any payments under the plan. Similarly, no such fee is currently being paid by the Target Fund, and the ESS Board has not approved the commencement of any payments under the plan.

Question: Will I own the same number of shares of the Acquiring Fund as I currently own of the Target Fund?

Answer: Although the number of shares of the Acquiring Fund you receive may differ from the number of Target Fund shares you hold, in exchange for your shares of the Target Fund, you will receive shares of the Acquiring Fund equal in value to the net asset value of your Target Fund shares immediately prior to the Reorganization.

Question: Will the Reorganization result in any taxes?

Answer: The Reorganization is expected to qualify as a “reorganization” within the meaning of section 368(a) of the U.S. Internal Revenue Code of 1986, as amended. In general, the Target Fund will not recognize any gain or loss as a direct result of the transfer of all of its assets and its liabilities in exchange for shares of the Acquiring Fund or as a result of its liquidation and termination, and shareholders of the Target Fund will not recognize any gain or loss upon receipt of shares of the Acquiring Fund in connection with the Reorganization. Shareholders of the Target Fund should consult their own tax advisers regarding the federal, state, local, and other tax treatment and implications of the Reorganization in light of their individual circumstances.

Question: Will my basis change as a result of the Reorganization?

Answer: No, your aggregate tax basis for federal income tax purposes of the Acquiring Fund shares you receive in the Reorganization will be the same as the basis of your Target Fund shares you held immediately before the Reorganization.

Question: Will I be charged a commission or other fee as a result of the Reorganization?

Answer: No commission or other transactional fees will be imposed on shareholders in connection with the Reorganization.

Question: Why do I need to vote?

Answer: Your vote is needed to ensure that a quorum and sufficient votes are present at the Special Meeting so that the Proposal can be acted upon. Your immediate response on the enclosed Proxy Card will help prevent the need for any further solicitations for a shareholder vote. Your vote is very important to us regardless of the number of shares you own.

Question: How does the ESS Board recommend that I vote?

Answer: After careful consideration and upon the recommendation of Exponential ETFs, the Board unanimously recommends that shareholders vote “FOR” the Proposal to approve the Plan.

Question: Who is paying for expenses related to the Special Meeting and the Reorganization?

Answer: The Target Fund and the Target Fund shareholders will not pay any expenses related to the Reorganization. Exponential ETFs and Toroso will bear all expenses relating to the Reorganization, including the costs relating to the Special Meeting and Proxy Statement.

Question: Will the Reorganization affect my ability to buy and sell shares?

Answer: No. You may continue to make additional purchases or sales of the Target Fund shares through your financial intermediary up to and including the day of the Reorganization, which is anticipated to be on or about May 24, 2021. Any purchases or sales of Target Fund shares made after the Reorganization will be purchases or sales of the Acquiring Fund. If the Reorganization is approved, your Target Fund shares will automatically be converted to Acquiring Fund shares.

Question: What will happen if the Plan is not approved by shareholders?

Answer: If shareholders of the Target Fund do not approve the Plan, then the Target Fund will not be reorganized into the Acquiring Fund and will continue to operate as a series of ESS. The Board will consider further actions to take in light of Exponential ETFs’ plans to wind-down its investment advisory business.

Question: How do I vote my shares?

Answer: You can vote your shares as indicated under “HOW TO VOTE YOUR SHARES” which immediately precedes this Question and Answers section.

COMBINED PROXY STATEMENT AND PROSPECTUS

[ ], 2021

For the Reorganization of

American Customer Satisfaction ETF

a series of ETF Series Solutions

615 East Michigan Street, Milwaukee, Wisconsin 53202

(800) 617-0004

Into

American Customer Satisfaction ETF

a series of Tidal ETF Trust

898 North Broadway, Suite 2, Massapequa, New York 11758

(844) 986-7676

Listed on Cboe BZX Exchange, Inc.

_________________________________

This Combined Proxy Statement and Prospectus (the “Proxy Statement”) is being sent to you in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of ETF Series Solutions (“ESS”) for use at a Special Meeting of Shareholders (the “Special Meeting”) of the American Customer Satisfaction ETF, a series of ESS (the “Target Fund”), at the principal executive offices of ESS, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, on May 12, 2021 at 11:00 a.m. Central Time. At the Special Meeting, shareholders of the Target Fund will be asked to consider and vote on the following proposal:

| | | | | |

| Proposal: | To approve the Agreement and Plan of Reorganization (the “Plan”) approved by the Board of Trustees of ESS, which provides for the reorganization of the Target Fund into the American Customer Satisfaction ETF (the “Acquiring Fund”), a newly created series of Tidal ETF Trust (“Tidal”) (the “Reorganization”). |

After careful consideration and upon the recommendation of CSat Investment Advisory, L.P., doing business as Exponential ETFs (“Exponential ETFs”), the Target Fund’s investment adviser, the Board unanimously recommends that shareholders vote “FOR” the Proposal.

The Plan provides that all of the assets of the Target Fund will be transferred to the Acquiring Fund in exchange for shares of beneficial interest (“shares”) of the Acquiring Fund and the Acquiring Fund’s assumption of the Target Fund’s liabilities. Shareholders of the Target Fund will receive shares of the Acquiring Fund with a value equal to the aggregate net asset value (“NAV”) of their shares of the Target Fund held immediately prior to the Reorganization in complete liquidation and termination of the Target Fund. After the Reorganization, shareholders will no longer be shareholders of the Target Fund, but would become shareholders of the Acquiring Fund.

Those present and the appointed proxies also will transact such other business, if any, as may properly come before the Special Meeting or any adjournments or postponements thereof.

This Proxy Statement sets forth concisely the information you should know before voting on the Proposal. You should read it and keep it for future reference.

The following documents containing additional information about the Target Fund and the Acquiring Fund, each having been filed with the SEC, are incorporated by reference into (legally considered to be part of) this Proxy Statement:

•the Statement of Additional Information dated [ ], 2021, relating to this Proxy Statement (the “Proxy Statement SAI”);

•the Prospectus of the Target Fund, dated January 31, 2021, as may be amended and supplemented (the “Target Fund Prospectus”) (File Nos. 333-179562 and 811-22668);

•the Statement of Additional Information of the Target Fund, dated January 31, 2021, as may be amended and supplemented (the “Target Fund SAI”) (File Nos. 333-179562 and 811-22668); and •the Annual Report for the Target Fund for the fiscal year ended September 30, 2020 (the “Target Fund Annual Report”) (File No. 811-22668). This Proxy Statement will be mailed on or about [ ], 2021 to shareholders of record of the Fund as of March 1, 2021.

The Target Fund is a registered open-end management investment company. The Target Fund Prospectus and the Target Fund Annual Report have previously been delivered to Target Fund shareholders. Additional information about the Acquiring Fund that will be included in the Acquiring Fund’s Prospectus, when available, is included in Appendix D to this Proxy Statement. The Acquiring Fund is newly-organized and currently has no assets or liabilities. The Acquiring Fund is an open-end management investment company that has been created in connection with the Reorganization for the purpose of acquiring the assets and liabilities of the Target Fund. The Acquiring Fund will not commence operations until the date of the Reorganization.

Copies of this Proxy Statement, the Proxy Statement SAI, and any of the foregoing documents relating to the Target Fund are available upon request and without charge by calling the Target Fund at 1-800-617-0004, visiting www.acsietf.com, or writing to the Target Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701. Copies of documents relating to the Acquiring Fund, when available, may be obtained upon request and without charge by writing to Tidal ETF Trust at the same address or by calling (toll-free) at 1-800-617-0004 or visiting https://exponentialetfs.com/acsi/.

No person has been authorized to give any information or make any representation not contained in this Proxy Statement and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES NOR HAS IT PASSED ON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

An investment in the Target Fund or the Acquiring Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. An investment in any fund involves investment risk, including the possible loss of principal.

TABLE OF CONTENTS

| | | | | |

| PROPOSAL – TO APPROVE THE AGREEMENT AND PLAN OF REORGANIZATION | |

| OVERVIEW OF THE PROPOSED REORGANIZATION | |

| EFFECT OF THE REORGANIZATION | |

| SUMMARY COMPARISON OF THE FUNDS | |

| BOARD CONSIDERATIONS | |

| KEY INFORMATION ABOUT THE PROPOSED REORGANIZATION | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | |

| VOTING INFORMATION | |

| RECORD DATE, VOTING RIGHTS, AND VOTES REQUIRED | |

| HOW TO VOTE | |

| PROXIES | |

| QUORUM AND ADJOURNMENTS | |

| EFFECT OF ABSTENTIONS AND BROKER “NON-VOTES” | |

| SOLICITATION OF PROXIES | |

| OTHER INFORMATION | |

| OTHER BUSINESS | |

| APPRAISAL RIGHTS | |

| NEXT MEETING OF SHAREHOLDERS | |

| LEGAL MATTERS | |

| INFORMATION FILED WITH THE SEC AND CBOE BZX EXCHANGE, INC. | |

| APPENDIX A - FORM OF AGREEMENT AND PLAN OF REORGANIZATION | |

| APPENDIX B - FINANCIAL HIGHLIGHTS OF THE TARGET FUND | |

| APPENDIX C - OWNERSHIP OF SHARES OF THE TARGET FUND | |

| APPENDIX D - SHAREHOLDER INFORMATION FOR THE ACQUIRING FUND | |

PROPOSAL – TO APPROVE THE AGREEMENT AND PLAN OF REORGANIZATION

OVERVIEW OF THE PROPOSED REORGANIZATION

The Board of Trustees of ESS, including all the Trustees who are not “interested persons,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), proposes that shareholders of the Target Fund approve the Plan, pursuant to which the Target Fund will reorganize into the Acquiring Fund and each Target Fund shareholder will become a shareholder of the Acquiring Fund. A form of the Plan is attached to this Proxy Statement as Appendix A. The Board considered the Reorganization at a meeting held on February 25, 2021. Based upon the recommendation of Exponential ETFs, the Board’s evaluation of the terms of the Plan, and other relevant information presented to the Board in advance of the meeting, and in light of its fiduciary duties under federal and state law, the Board, including all of the Trustees who are not “interested persons” of ESS under the 1940 Act, determined that the Reorganization is in the best interests of the Target Fund and its shareholders. See “Board Considerations” for a summary of the factors considered and conclusions drawn by the Board in approving the Plan and authorizing the submission of the Plan to shareholders for approval.

To reorganize the Target Fund into a series of Tidal, a fund with materially identical investment policies and strategies, the Acquiring Fund, which is also named the “American Customer Satisfaction ETF,” has been created as a new series of Tidal. If the shareholders of the Target Fund approve the Plan, the Reorganization will have these primary steps:

•All of the assets of the Target Fund will be transferred to the Acquiring Fund in exchange for shares of the Acquiring Fund and the Acquiring Fund’s assumption of the Target Fund’s liabilities;

•Immediately after the transfer of the Target Fund’s assets as provided for in the Plan, the Target Fund will distribute the Acquiring Fund shares received by the Target Fund pro rata to its shareholders in redemption of the outstanding shares of the Target Fund; and

•The Target Fund will be liquidated and terminated.

Approval of the Plan will constitute approval of the transfer of the Target Fund’s assets to the Acquiring Fund, the assumption of the Target Fund’s liabilities by the Acquiring Fund, the distribution of the Acquiring Fund’s shares to Target Fund shareholders, and the liquidation and termination of the Target Fund. The Acquiring Fund shares issued in connection with the Reorganization will have an aggregate NAV equal to the aggregate value of the assets that the Target Fund transferred to the Acquiring Fund, less the Target Fund’s liabilities that the Acquiring Fund assumes. As a result of the Reorganization, existing shareholders of the Target Fund shares will become shareholders of the Acquiring Fund. Shareholders of the Target Fund will receive shares of the Acquiring Fund with a value equal to the aggregate NAV of their shares of the Target Fund held immediately prior to the Reorganization. No commission or other transaction fees will be charged to the Target Fund’s shareholders in connection with the Reorganization.

The Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes. As a result, in general, the Target Fund will not recognize any gain or loss as a result of the transfer of all of its assets and its liabilities in exchange for shares of the Acquiring Fund or as a result of its liquidation and termination, and shareholders of the Target Fund will not recognize any gain or loss upon receipt of shares of the Acquiring Fund in connection with the Reorganization. Tidal and ESS will receive an opinion from tax counsel to Tidal confirming such tax treatment.

EFFECT OF THE REORGANIZATION

The primary purpose of the Reorganization is to move the investment portfolio and shareholders presently associated with the Target Fund to the Acquiring Fund.

Certain basic information about the Target Fund and Acquiring Fund is provided in the table below. The Target Fund and Acquiring Fund are sometimes referred to together as the “Funds.”

| | | | | | | | |

| Target Fund | Acquiring Fund |

| Identity of Fund | American Customer Satisfaction ETF, a series of ETF Series Solutions (an open-end management investment company registered with the SEC) | American Customer Satisfaction ETF, a series of Tidal ETF Trust (an open-end management investment company registered with the SEC) |

| Listing Exchange | Cboe BZX Exchange, Inc. (the “Exchange”) | Same |

| Ticker Symbol | ACSI | Same following the Reorganization |

| Fiscal Year-End | September 30 | Same |

| Form of Organization | Series of a Delaware statutory trust | Same |

| Diversification Status | Diversified | Same |

The Reorganization will shift management responsibility for the Target Fund from Exponential ETFs to Toroso Investments, LLC (“Toroso”) as investment adviser of the Acquiring Fund. Neither ESS nor Exponential ETFs is affiliated with Tidal or Toroso. The investment objective of the Acquiring Fund will be identical to that of the Target Fund, and the investment strategies of the Acquiring Fund will be materially identical to those of the Target Fund. The Acquiring Fund and the Target Fund are each diversified for purposes of the 1940 Act.

The Reorganization will not result in a change in the management fee currently paid by the Target Fund. The Target Fund pays Exponential ETFs a unitary management fee on a monthly basis at the annual rate of 0.65% of the Target Fund’s average daily net assets. Under the Target Fund’s advisory agreement, Exponential ETFs pays substantially all expenses of the Target Fund, subject to certain exceptions. The Acquiring Fund will pay Toroso a unitary management fee on a monthly basis at the annual rate of 0.65% of the Acquiring Fund’s average daily net assets. Under the Acquiring Fund’s advisory agreement, Toroso pays substantially all expenses of the Acquiring Fund, subject to certain exceptions. Both advisory agreements provide that the applicable adviser will not be responsible for paying for the advisory fee, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and payments under each Fund’s 12b-1 Plan (defined below).

The Target Fund and the Acquiring Fund have each adopted a Rule 12b-1 Distribution and Service Plan (each a “12b-1 Plan”) under which the Target Fund and the Acquiring Fund may bear a Rule 12b-1 fee not to exceed 0.25% per annum of the Fund’s average daily net assets. However, no such fee is currently expected to be paid by the Acquiring Fund, and the Board of Trustees of Tidal has not approved the commencement of any payments under the 12b-1 Plan. Similarly, no such fee is currently being paid by the Target Fund, and the Board of Trustees of ESS has not approved the commencement of any payments under the 12b-1 Plan.

The total expense ratio of the Acquiring Fund’s shares is expected to be the same as that of the Target Fund’s shares. The total annual fund operating expenses for the shares of the Target Fund are 0.65% of the Target Fund’s average daily net assets (excluding acquired fund fees and expenses). The projected total annual fund operating expenses for the shares of the Acquiring Fund are estimated to be 0.65% of the Acquiring Fund’s average daily net assets (excluding acquired fund fees and expenses).

Shareholders will continue to be able to make additional purchases or sales of the Target Fund shares through their financial intermediary up to and including the day of the Reorganization. If the Reorganization is approved, Target Fund shares will automatically be converted to Acquiring Fund shares.

SUMMARY COMPARISON OF THE FUNDS

Fees and Expenses of the Fund

The table below describes the fees and expenses that you pay if you buy, hold, and sell shares of the Target Fund and the pro forma fees and expenses that you may pay if you buy, hold, and sell shares of the Acquiring Fund after giving effect to the Reorganization. This table and the Example below do not include the brokerage commissions and other fees to financial intermediaries that investors may pay on their purchases and sales of Fund shares. Expenses for the Target Fund are based on operating expenses of the Target Fund for the fiscal year ended September 30, 2020. Expenses for the Acquiring Fund are pro forma operating expenses of the Acquiring Fund for the same period, assuming the Reorganization had occurred prior to the start of the period.

| | | | | | | | |

| Fees and Expenses | Target Fund Shares | Acquiring Fund Shares (pro forma) |

| | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | |

| Management Fee | 0.65% | 0.65% |

| Distribution (12b-1) Fees | 0.00% | 0.00% |

| Other Expenses | 0.00% | 0.00% |

| Acquired Fund Fees and Expenses | 0.01% | 0.01% |

Total Annual Fund Operating Expenses(1) | 0.66% | 0.66% |

| | |

| | |

(1) Total Annual Fund Operating Expenses do not correlate to the ratio of expenses to average net assets provided in the Financial Highlights section of the Prospectus, which reflects only the operating expenses of the Fund and does not include acquired fund fees and expenses.

Example

The Example below is intended to help you compare the cost of investing in shares of the Target Fund with the cost of investing in shares of the Acquiring Fund on a pro forma basis. The Example assumes that you invest $10,000 in each Fund and then redeem all of your shares at the end of each period. The Example also assumes that your investment has a 5% annual return and that operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | | | | | | | |

| One Year | Three Years | Five Years | Ten Years |

| Target Fund Shares | $67 | $211 | $368 | $822 |

Acquiring Fund Shares (pro forma) | $67 | $211 | $368 | $822 |

Fund Performance

The following performance information indicates some of the risks of investing in the Funds. The Acquiring Fund will not commence operations until after the closing of the Reorganization. At that time, the Acquiring Fund will adopt the performance history of the Target Fund.

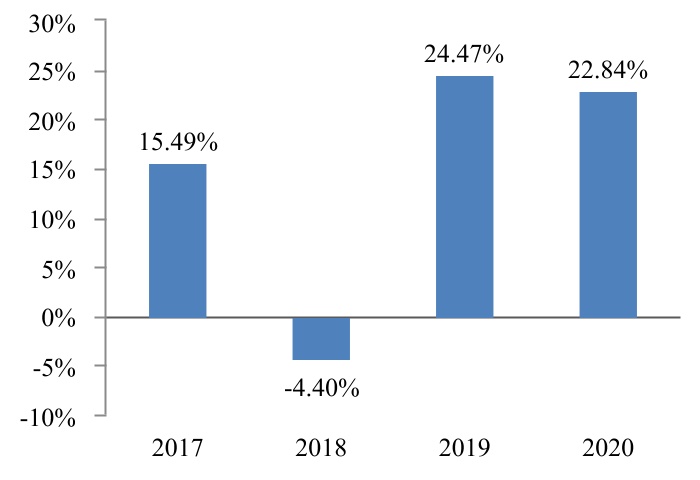

The bar chart shows the Target Fund’s performance for the calendar years ended December 31. The table illustrates how the Target Fund’s average annual returns for the 1-year and since inception periods compared with a broad measure of market performance and the American Customer Satisfaction Investable Index (the “Index”). The Target Fund’s past performance, before and after taxes, does not necessarily indicate how it or the Acquiring Fund will perform in the future. Updated performance information is also available on the Target Fund’s website at www.acsietf.com.

Calendar Year Total Returns

During the period of time shown in the bar chart, the Fund’s highest quarterly return was 20.34% for the quarter ended June 30, 2020, and the lowest quarterly return was -21.62% for the quarter ended March 31, 2020.

| | | | | | | | |

| Average Annual Total Returns for the Periods Ended December 31, 2020 |

|

| Target Fund | 1 Year | Since Inception

(10/31/2016) |

| Return Before Taxes | 22.84% | 15.54% |

| Return After Taxes on Distributions | 22.61% | 15.17% |

| Return After Taxes on Distributions and Sale of Shares | 13.69% | 12.34% |

American Customer Satisfaction Investable Index (reflects no deduction for fees, expenses, or taxes) | 23.60% | 16.40% |

Standard & Poor’s 500 (S&P 500 Index) (reflects no deduction for fees, expenses, or taxes) | 18.40% | 16.91% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect a Fund’s performance. Because the Acquiring Fund is newly organized, no portfolio turnover data is available. For the fiscal year ended September 30, 2020, the Target Fund’s portfolio turnover rate was 67% of the average value of its portfolio.

Principal Investment Objectives, Strategies, and Policies

The Target Fund and the Acquiring Fund have identical investment objectives and materially identical investment strategies, which are presented below.

The Acquiring Fund has been created as a new series of Tidal solely for the purpose of acquiring the Target Fund’s assets and continuing its business and will not conduct any investment operations until after the closing of the Reorganization. Because the Target Fund and the Acquiring Fund have identical investment objectives and materially identical investment strategies, Toroso believes that, if the Reorganization is approved, all of the Target Fund’s assets will be transferred to and held by the Acquiring Fund.

Investment Objectives. Each Fund seeks to track the performance, before fees and expenses, of the Index. Each Fund’s investment objective has been adopted as a non-fundamental investment policy and may therefore be changed without the consent of the Fund’s shareholders, upon written notice to shareholders.

Principal Investment Strategies. Each Fund uses a “passive management” (or indexing) approach to track the performance, before fees and expenses, of the Index. The Index is based on a proprietary methodology developed by Exponential ETFs in partnership with the American Customer Satisfaction Index, LLC, an affiliate of Exponential ETFs and owner/publisher of the leading national cross-industry measure of customer satisfaction (the “Customer Satisfaction Data”). Calculation of the Customer Satisfaction Data incorporates surveys of more than 100,000 household customers each year to identify trends in customer satisfaction and provide benchmarking insights for companies, industry trade associations, and government agencies.

American Customer Satisfaction Investable Index

The Index uses an objective, rules-based methodology to measure the performance of U.S.-listed companies whose customers have been surveyed and who have been assigned a customer satisfaction score as part of the Customer Satisfaction Data (collectively, “ACSI Companies”).

Construction of the Index begins with over 400 ACSI Companies across 46 industries and 10 economic sectors. The initial universe is then screened to eliminate companies whose stock is not principally listed on a U.S. exchange, whose market capitalization is less than $1 billion, or for which the Customer Satisfaction Data is statistically insignificant. The Index is comprised of ACSI Companies in the 25 industries (as classified by the Customer Satisfaction Data) with the highest customer retention, and the company(ies) with the highest ACSI Score (described below) in each such industry will be included in the Index (the “Index Companies”). One to three ACSI Companies from each industry are included in the Index based on the number of ACSI Companies in a given industry. The Index will generally be comprised of 25 to 35 companies at the time of each rebalance of the Index.

A company’s ACSI Score is calculated by utilizing a proprietary model to evaluate customers’ Customer Satisfaction Data based on questions that measure the following facets of satisfaction with a product or service:

| | | | | |

| Customer Expectations | Customer expectations is a measure of the customer’s anticipation of the quality of a company’s products or services. Expectations represent both prior consumption experience, which includes some nonexperiential information like advertising and word-of-mouth, and a forecast of the company’s ability to deliver quality in the future. |

| Perceived Quality | Perceived quality is a measure of the customer’s evaluation via recent consumption experience of the quality of a company’s products or services. Quality is measured in terms of both customization, which is the degree to which a product or service meets the customer’s individual needs, and reliability, which is the frequency with which things go wrong with the product or service. |

| Perceived Value | Perceived value is a measure of quality relative to price paid. Although price (value for money) is often very important to the customer’s first purchase, it usually has a somewhat smaller impact on satisfaction for repeat purchases. |

At the time of each rebalance of the Index, the Index is sector-weighted to reflect the overall U.S. large cap market, industry-weighted based on the highest ACSI Score of any Index Company within an industry, and equal-weighted within each industry, subject to the constraints described below.

Sector Weighting. At the time of each rebalance of the Index, the Index weight is allocated to each economic sector based on the aggregate number of the Index Companies in each sector relative to that of each other sector, provided that such weights will be adjusted upward or downward if necessary to better reflect the weight of such sector in the overall U.S. large cap market. Unallocated Index weight resulting from such downward adjustments is re-allocated first equally to sectors requiring an upward weight adjustment and then equally to all sectors to the extent they stay within the Index’s constraints.

Industry Weighting. At the time of each rebalance of the Index, within each economic sector, the Index weight is allocated to each industry based on the highest ACSI Score of any Index Company within such industry relative to the highest ACSI Score for companies in each other industry within such sector.

Security Weighting. At the time of each rebalance of the Index, Index Companies within an industry are equally weighted, subject to a maximum of 12% for any individual Index Company.

The Index is rebalanced and reconstituted on a quarterly basis after market close on the 10th trading day of each January, April, July, and October. The data used to compute each ACSI Company’s score is updated based on the Customer Satisfaction Data on a rolling basis, no less often than quarterly, with new data replacing earlier data collected in the same period of the previous year.

The Index was developed by Exponential ETFs in 2016 in anticipation of the commencement of operations of the Target Fund.

The Funds’ Investment Strategy

Each Fund will generally use a “replication” strategy to achieve its investment objective, meaning it generally will invest in all of the component securities of the Index. However, a Fund may use a “representative sampling” strategy, meaning it may invest in a sample of the securities in the Index whose risk, return and other characteristics closely resemble the risk, return and other characteristics of the Index as a whole, when the Adviser believes it is in the best interests of the Fund (e.g., when replicating the Index involves practical difficulties or substantial costs, an Index constituent becomes temporarily illiquid, unavailable, or less liquid, or as a result of legal restrictions or limitations that apply to the Fund but not to the Index).

Under normal circumstances, at least 80% of each Fund’s net assets, plus borrowings for investment purposes, will be invested in investments that are tied economically to the United States. Such policy has been adopted as a non-fundamental investment policy and may be changed without shareholder approval upon 60 days’ written notice to shareholders.

Each Fund may invest in securities or other investments not included in the Index, but which its adviser believes will help the Fund track the Index. For example, a Fund may invest in securities that are not components of the Index to reflect various corporate actions and other changes to the Index (such as reconstitutions, additions, and deletions).

To the extent the Index concentrates (i.e., holds more than 25% of its total assets) in the securities of a particular industry or group of related industries, each Fund will concentrate its investments to approximately the same extent as the Index.

Principal Risks

Risk is the chance that you will lose money on your investment or that it will not earn as much as you expect. In general, the greater the risk, the more money your investment can earn for you and the more you can lose. Like other investment companies, the value of each Fund’s shares (the “Shares”) may be affected by its investment objective, principal investment strategies, and particular risk factors. The principal risks of investing in the Funds are discussed below. However, other factors may also affect each Fund’s NAV. There is no guarantee that a Fund will achieve its investment objective or that it will not lose principal value.

The principal risks of investing in the Funds are substantially similar, as their investment objectives are identical and the investment strategies of the Funds are materially identical. The principal risks of investing in the Funds are set forth below. The principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with those of other funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. As with any investment, there is a risk you could lose all or a portion of your investment in the Fund. Some or all of these risks may adversely affect the Fund’s NAV, trading price, yield, total return and/or ability to meet its objectives.

The following risks apply to both the Target Fund and the Acquiring Fund.

•Equity Market Risk. The equity securities held in the Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific issuers, industries, or sectors in which the Fund invests. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from issuers. In addition, local, regional or global events such as war, acts of terrorism, spread of infectious diseases or other public health issues, recessions, or other events could have a significant negative impact on the Fund and its investments. For example, the global pandemic caused by COVID-19, a novel coronavirus, and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, has had negative impacts, and in many cases severe impacts, on markets worldwide. The COVID-19 pandemic has caused prolonged disruptions to the normal business operations of companies around the world and the impact of such disruptions is hard to predict. Such events may affect certain geographic regions, countries, sectors and industries more significantly than others. Such events could adversely affect the prices and liquidity of the Fund’s portfolio securities or other instruments and could result in disruptions in the trading markets.

•ETF Risks. The Fund is an ETF, and, as a result of an ETF’s structure, it is exposed to the following risks:

◦Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

◦Costs of Buying or Selling Shares. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid-ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

◦Shares May Trade at Prices Other Than NAV. As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for Shares in the secondary market, in which case such premiums or discounts may be significant.

◦Trading. Although Shares are listed for trading on Cboe BZX Exchange, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than Shares.

•Models and Data Risk. The composition of the Index is heavily dependent on proprietary quantitative models as well as information and data supplied by third parties (“Models and Data”). When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon may lead to securities being included in or excluded from the Index that would have been excluded or included had the Models and Data been correct and complete. If the composition of the Index reflects such errors, the Fund’s portfolio can be expected to reflect the errors, too.

•Passive Investment Risk. The Fund invests in the securities included in, or representative of, the Index regardless of their investment merit. The Fund does not attempt to outperform the Index or take defensive positions in declining markets. As a result, the Fund’s performance may be adversely affected by a general decline in the market segments relating to the Index.

•Sector Risk. To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors.

◦Consumer Discretionary Sector Risk. The Fund is generally expected to invest significantly in companies in the consumer discretionary sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. The success of consumer product manufacturers and retailers is tied closely to the performance of

domestic and international economies, interest rates, exchange rates, competition, consumer confidence, changes in demographics and consumer preferences. Companies in the consumer discretionary sector depend heavily on disposable household income and consumer spending, and may be strongly affected by social trends and marketing campaigns. These companies may be subject to severe competition, which may have an adverse impact on their profitability.

◦Consumer Staples Sector Risk. The Fund may invest in companies in the consumer staples sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Companies in the consumer staples sector, including those in the food and beverage industries, may be affected by general economic conditions, commodity production and pricing, consumer confidence and spending, consumer preferences, interest rates, product cycles, marketing campaigns, competition, and government regulations.

◦Information Technology Sector Risk. Market or economic factors impacting information technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Stocks of information technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Information technology companies are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect profitability.

•Tracking Error Risk. As with all index funds, the performance of the Fund and the Index may differ from each other for a variety of reasons. For example, the Fund incurs operating expenses and portfolio transaction costs not incurred by the Index. In addition, the Fund may not be fully invested in the securities of the Index at all times or may hold securities not included in the Index.

Portfolio Holdings Information

Information about the Target Fund’s daily portfolio holdings is available at www.ascietf.com. A complete description of the Target Fund’s policies and procedures with respect to the disclosure of the Target Fund’s portfolio holdings is available in the Target Fund’s SAI, which is incorporated by reference into this Proxy Statement. Information about the Acquiring Fund’s daily portfolio holdings will be available at https://exponentialetfs.com/acsi/.

In addition, each Fund discloses its complete portfolio holdings as of the end of its fiscal year and its second fiscal quarter in its reports to shareholders. No later than 30 days after the end of each fiscal quarter, each Fund files with the SEC on Form N-PORT a complete list of its portfolio holdings as of each month-end during the relevant quarter. You can find the SEC filings on the SEC’s website, www.sec.gov. A summarized description of the Acquiring Fund’s policies and procedures with respect to the disclosure of the Acquiring Fund’s portfolio holdings is included in the Proxy Statement SAI.

Funds’ Investment Limitations

The investment restrictions adopted by the Target Fund and the Acquiring Fund as fundamental investment restrictions (i.e., cannot be changed by either Fund’s Board of Trustees without affirmative shareholder approval) are materially identical. The Target Fund’s fundamental investment restrictions, as well as the Target Fund’s interpretations of those restrictions, are summarized under the section entitled “Investment Restrictions” in the Target Fund SAI, which is incorporated by reference into this Proxy Statement. The Acquiring Fund’s fundamental investment restrictions, as well as the Acquiring Fund’s interpretations of those restrictions, are described in the Proxy Statement SAI.

A fundamental restriction cannot be changed without the affirmative vote of the lesser of: (1) 67% or more of the voting securities of the Fund present at the meeting if the holders of more than 50% of the Fund’s outstanding voting securities are present or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund. A non-fundamental limitation may be changed by a Fund’s Board of Trustees without shareholder approval.

Management

Boards of Trustees

Overall responsibility for oversight of ESS rests with its Board. The Board is responsible for overseeing Exponential ETFs and other service providers in the operations of ESS in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and ESS’s governing documents. ESS currently has four Trustees, one of whom is an “interested person,” as that term is defined under the 1940 Act. A list of the Trustees and officers of ESS, and their present positions and principal occupations, is provided under “Management of the Trust” in the Target Fund SAI, which is incorporated by reference into this Proxy Statement.

Overall responsibility for oversight of Tidal rests with its Board of Trustees (the “Tidal Board”). The Tidal Board is responsible for overseeing Toroso and other service providers in the operations of Tidal in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and Tidal’s governing documents. Tidal currently has four Trustees, one of whom is an “interested person,” as that term is defined under the 1940 Act. A list of the Trustees and officers of Tidal, and their present positions and principal occupations, is provided under the section entitled “Management of the Trust” in the Proxy Statement SAI.

Investment Advisers

CSat Investment Advisory, L.P., doing business as Exponential ETFs, located at 1001 Woodward Avenue, Suite 500, Detroit, Michigan 48226, is an investment adviser registered with the SEC and serves as the investment adviser to the Target Fund. Exponential ETFs also arranges for sub-advisory, transfer agency, custody, fund administration, and all other related services necessary for the Fund to operate, subject to the oversight of the ESS Board.

Toroso Investments, LLC, located at 898 North Broadway, Suite 2, Massapequa, New York 11758, is an investment adviser registered with the SEC and will serve as the investment adviser to the Acquiring Fund. Toroso also arranges for sub-advisory, transfer agency, custody, fund administration, and all other related services necessary for the Fund to operate, subject to the oversight of the Tidal Board.

Portfolio Managers

The following portfolio managers are jointly and/or primarily responsible for the day-to-day management of the Funds:

| | | | | | | | |

| Target Fund | | Acquiring Fund |

| Charles A. Ragauss, CFA, Chief Operating Officer of Exponential ETFs | | Michael Venuto, Chief Investment Officer for Toroso |

| | Charles A. Ragauss, CFA, Portfolio Manager for Toroso |

The Target Fund SAI, which is incorporated by reference into this Proxy Statement, and the Proxy Statement SAI provide additional information about the Funds’ portfolio managers’ compensation structure, other accounts managed by the portfolio managers, and the portfolio managers’ ownership of securities of the Fund.

Investment Advisory Fees

Pursuant to an advisory agreement between ESS, on behalf of the Target Fund, and Exponential ETFs (the “Exponential Advisory Agreement”), the Target Fund pays Exponential ETFs a unitary management fee for the services and facilities it provides payable on a monthly basis at an annual rate of 0.65% of the Target Fund’s average daily net assets. Out of the unitary management fee, Exponential ETFs pays all expenses of the Target Fund, except for the advisory fee, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b‑1) fees and expenses.

Pursuant to an investment advisory agreement between Tidal, on behalf of the Acquiring Fund, and Toroso (the “Toroso Advisory Agreement”), the Acquiring Fund will pay Toroso an annual advisory fee based on its average daily net assets for the services and facilities it provides payable at the annual rate of 0.65% of the Acquiring Fund’s average daily net assets. Toroso will pay all the costs of the Acquiring Fund, except for the advisory fee, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions, and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, distribution fees, and expenses paid by the Fund under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act.

A discussion regarding the basis for the ESS Board’s approval of the Exponential Advisory Agreement with respect to the Target Fund is available in the Target Fund’s Annual Report dated September 30, 2020. A discussion regarding the basis for the Tidal Board’s approval of the Tidal Advisory Agreement with respect to the Acquiring Fund will be available in the Acquiring Fund’s first semi-annual or annual report to shareholders following the Reorganization. Other Service Providers

The following table identifies the principal service providers that service the Target Fund and that are expected to service the Acquiring Fund:

| | | | | | | | |

| Target Fund | Acquiring Fund |

| Administrator | U.S. Bancorp Fund Services, LLC | Tidal ETF Services LLC |

| Sub-Administrator | Not applicable | U.S. Bancorp Fund Services, LLC |

| Fund Accounting | U.S. Bancorp Fund Services, LLC | U.S. Bancorp Fund Services, LLC |

| Transfer Agent | U.S. Bancorp Fund Services, LLC | U.S. Bancorp Fund Services, LLC |

| Custodian | U.S. Bank National Association | U.S. Bank National Association |

| Distributor and Principal Underwriter | Foreside Fund Services, LLC | Foreside Fund Services, LLC |

| Auditor | Cohen & Company, Ltd. | Cohen & Company, Ltd. |

| Legal Counsel | Morgan, Lewis & Bockius LLP | Godfrey & Kahn, S.C. |

Purchase and Redemption of Shares in Creation Units

Each Fund issues and redeems shares at NAV only in a large specified number of shares called a “Creation Unit” or multiples thereof. Creation Unit transactions are typically conducted in exchange for the deposit or delivery of in-kind securities and/or cash. It is expected that only a limited number of institutional investors, called Authorized Participants or “APs,” will purchase and redeem shares directly from the Funds.

Individual shares of the Funds may only be purchased and sold in secondary market transactions through brokers. Shares can be bought or sold through an investor’s broker throughout the trading day like shares of any publicly traded issuer. Because shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount). When buying or selling shares through a broker, the investor will incur customary brokerage commissions and charges, and may pay some or all of the spread between the bid and the offered prices (the “bid-ask spread”) in the secondary market for shares. The price at which an investor buys or sells shares (i.e., the market price) may be more or less than the NAV of the shares. Unless imposed by the broker, there is no minimum dollar amount that shareholders must invest in the Funds and no minimum number of shares that shareholders must buy. Shares of the Target Fund are listed, and shares of the Acquiring Fund following the Reorganization will be listed, for trading on Cboe BZX Exchange, Inc. (the “Exchange”) under the ticker symbol ASCI. Recent information about the Target Fund, including its NAV, market price, premiums and discounts, and bid-ask spreads is available on the Target Fund’s website at www.acsietf.com.

For a discussion of how the Target Fund’s shares may be purchased and redeemed, as applicable, see “Purchase and Sale of Shares” and “How to Buy and Sell Shares” in the Target Fund Prospectus incorporated by reference herein. For a discussion of how the Acquiring Fund’s shares may be purchased, exchanged, and redeemed, as applicable, see “How to Buy and Sell Shares” in Appendix D attached to this Proxy Statement.

Tax Information

Distributions shareholders receive from a Fund are generally taxable to them as ordinary income for federal income tax purposes, except that distributions may be taxed to shareholders at long-term capital gain rates to the extent reported by a Fund as “capital gain dividends” or “qualified dividend income,” and may also be subject to state or local taxes. Fund distributions may not be taxable to a shareholder if such shareholder is investing through a tax-advantaged retirement plan account or is a tax-exempt investor, although such shareholder may be taxed on withdrawals from such shareholder’s tax-advantaged account.

BOARD CONSIDERATIONS

The Board considered the Reorganization at a meeting held on February 25, 2021. Based upon the recommendation of Exponential ETFs in light of its plans to wind-down its investment advisory business and its limited resources to market and distribute the Target Fund, and to enable the Target Fund to benefit from the experience and resources of Toroso and its affiliates, the Board evaluated the terms of the Plan, each Fund’s investment objective and strategies, the expenses relating to the Reorganization, each Fund’s fees and expenses (including the total annual fund operating expense ratio and the Rule 12b-1 fee that has been approved by the Tidal Board but has not yet commenced payments), the distribution capabilities of the Acquiring Fund’s distributor, the experience and expertise of the Acquiring Fund’s investment adviser, federal income tax consequences of the Reorganization, and possible alternatives to the Reorganization. The Board, including all of the Trustees who are not “interested persons” of ESS under the 1940 Act, determined that the Reorganization is in the best interests of the Target Fund and its shareholders and approved the Reorganization and the Plan subject to shareholder approval.

The Board considered the following factors, among others, in its evaluation of the Reorganization:

The Terms and Conditions of the Reorganization. The Board considered the terms of the Plan and, in particular, that the transfer of the assets of the Target Fund will be in exchange for shares of the Acquiring Fund and the Acquiring Fund’s assumption of the liabilities of the Target Fund. The Board also took note of the fact that no commission or other transactional fees would be imposed on the Target Fund’s shareholders in connection with the Reorganization. In addition, the Board noted that pursuant to the Plan, each Target Fund shareholder’s account will be credited with the number of Acquiring Fund shares equal to the value of the Target Fund shares that each shareholder holds immediately prior to the Reorganization. The Board also noted that the value of the Target Fund’s assets to be acquired and the amount of its liabilities to be assumed by the Acquiring Fund and the NAV of a share of the Target Fund will be determined in accordance with the valuation methodologies described in the Target Fund Prospectus and SAI, as may be supplemented. As a result, the Board noted that the interests of Target Fund shareholders would not be diluted as a result of the Reorganization. The Board also noted that the Reorganization would be submitted to the Target Fund’s shareholders for approval.

Investment Objectives and Investment Strategies. The Board considered that the investment objective of the Acquiring Fund is identical, and the investment strategies of the Acquiring Fund are materially identical, to those of the Target Fund.

Expenses Relating to Reorganization. The Board considered that the Target Fund shareholders will not incur any expenses in connection with the Reorganization. All expenses relating to the proposed Reorganization, which are estimated to be $70,000, whether or not consummated, will be borne by Exponential ETFs and Toroso, including expenses related to the Special Meeting and solicitation of proxies, preparing and filing the registration statement that includes this Proxy Statement, and the cost of copying, printing, and mailing proxy materials.

Relative Expense Ratios. The Board reviewed information regarding comparative expense ratios (current and pro forma expense ratios are set forth in “Summary Comparison of the Funds—Fees and Expenses” section above), which indicated that the estimated total annual fund operating expense ratio for the shares of the Acquiring Fund are expected to be the same as those of the Target Fund.

Distribution; Distribution and Service Fees. The Board considered the distribution capabilities of Foreside Fund Services, LLC and its commitment to distribute the shares of the Acquiring Fund. The Board further considered that, like the Target Fund, the Acquiring Fund has adopted a 12b-1 Plan under which the Fund may bear a 12b-1 fee up to 0.25% annually of the Fund’s average daily net assets, and the Tidal Board has not currently approved any payments under the 12b-1 Plan. The Board further noted that the Tidal Board will consider the approval of any future commencement of payments under the 12b-1 Plan.

The Experience and Expertise of the Investment Adviser. The Board considered that Toroso is an investment adviser managing 17 ETFs with over $1.9 billion in assets under management as of February 28, 2021, and that its key personnel have significant experience providing investment advisory services to ETFs. The Board also considered that Charles A. Ragauss, who has been a portfolio manager for the Target Fund since its inception in 2016, will serve as one of the Acquiring Fund’s portfolio managers with Toroso after the Reorganization.

Federal Income Tax Consequences. The Board considered that the Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes and that shareholders of the Target Fund are not expected to recognize any gain or loss upon receipt of shares of the Acquiring Fund in the Reorganization.