Royalty Income Revenues

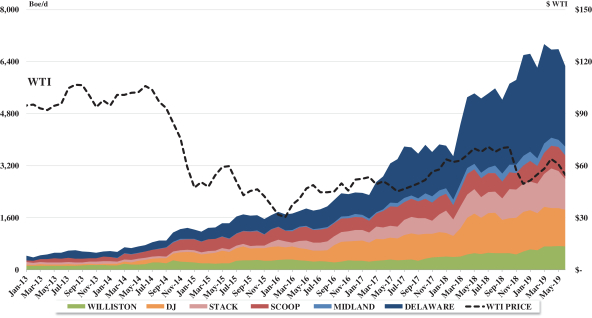

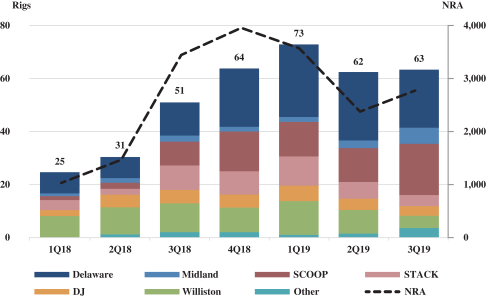

Total revenues for the nine months ended September 30, 2019 increased 37%, or $18.2 million, compared to the nine months ended September 30, 2018. The increase was attributable to a $21.9 million increase in mineral and royalty revenues during the period, partially offset by a $3.7 million decrease in lease bonus revenues. The increase in mineral and royalty revenue was primarily attributable to increased drilling and completion activity on our mineral and royalty interests, which resulted in a 83% increase in production volumes to 6,668 Boe/d and a corresponding increase in revenues of $35.5 million. This was partially offset by a 17% decrease in realized commodity prices, resulting in a decrease in royalty revenues of $13.6 million.

Oil revenues for the nine months ended September 30, 2019 increased 57%, or $19.4 million, compared to the nine months ended September 30, 2018. Oil production volumes increased 84% to 3,668 barrels per day resulting in a $28.8 million increase in oil revenues. The increase in oil production volumes for the period was primarily attributable to increased drilling and completion activity on our properties in the Permian, Anadarko and Williston Basins. In particular, production volumes in the Permian and Anadarko Basins for the nine months ended September 30, 2019 were up 152% and 124%, respectively, compared to the nine months ended September 30, 2018. This was partially offset by a decrease in realized oil prices of 15% to $53.45 per barrel, resulting in a decrease in revenues of $9.4 million.

Natural gas revenues for the nine months ended September 30, 2019 increased 46%, or $2.2 million, compared to the nine months ended September 30, 2018. Natural gas production volumes increased 82% to 11,975 Mcf/d, resulting in a $3.9 million increase in natural gas revenues. The increase in natural gas production volumes for the period was primarily attributable to increased drilling and completion activity on our properties in the Permian and Anadarko Basins. Realized natural gas prices decreased 20% to $2.15 per Mcf, resulting in a decrease in revenue of $1.7 million.

NGL revenues for the nine months ended September 30, 2019 increased 9%, or $0.4 million, compared to the nine months ended September 30, 2018. NGL production volumes increased 80% to 1,005 barrels per day, resulting in an increase in NGL revenues of $3.1 million. The increase in NGL production volumes was largely attributable to the increase in drilling and completion activity on our properties in the Anadarko, Permian, and Williston Basins. This was partially offset by a decrease in realized NGL prices of 39% to $15.43 per barrel, resulting in a decrease of $2.7 million in NGL revenues.

Lease Bonus Revenues

When we lease our minerals, we generally receive an upfront cash payment, or a lease bonus. The decrease in revenues from lease bonus payments for the nine months ended September 30, 2019 is primarily attributable to the highly variable nature of leasing activity from period to period. Other revenues include payments for right-of-way and surface damages and were not a significant portion of the overall amount.

Operating Expenses

Gathering, transportation and marketing expenses. For the nine months ended September 30, 2019, GTM expense increased 30%, or $0.9 million compared to the nine months ended September 30, 2018, primarily due to the higher production volumes.

Severance and ad valorem taxes. For the nine months ended September 30, 2019, severance and ad valorem taxes increased 62%, or $1.6 million, compared to the nine months ended September 30, 2018, primarily due to an increase in well count and royalty revenues.

Depreciation, depletion and amortization. DD&A expense increased 111%, or $10.7 million, for the nine months ended September 30, 2019 as compared to the nine months ended September 30, 2018. Higher production volumes increased our DD&A expense by $7.6 million and a higher depletion rate increased our DD&A expense by $3.1 million. The depletion rate was $10.91 per Boe and $9.18 per Boe for the nine months

73