Filed by Blue Owl Technology Finance Corp.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed under Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Blue Owl Technology Finance Corp. II

Commission File No. 000-56371

File No. of Related Registration Statement: 333-28341

Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLYTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. V60221-S04033 For Against Abstain BLUE OWL TECHNOLOGY FINANCE CORP. 1. To approve the Second Articles of Amendment and Restatement of Blue Owl Technology Finance Corp. (the "Company"), which includes proposed changes to the Articles of Amendment and Restatement of the Company as described in the Company's joint proxy statement/prospectus. The Board of Directors recommends you vote FOR the following proposal: IF THE PROXY IS SIGNED, SUBMITTED, AND NO SPECIFICATION IS MADE, THE PROXY SHALL BE VOTED FOR THE PROPOSAL. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. ! !! BLUE OWL TECHNOLOGY FINANCE CORP. 399 PARK AVE, 37TH FLOOR NEW YORK, NEW YORK 10022 SCAN TO VIEW MATERIALS & VOTEw VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on March 19, 2025. Follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/OTF2025SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on March 19, 2025. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return before 5:00 p.m. Eastern Time on March 19, 2025 to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

V60222-S04033 BLUE OWL TECHNOLOGY FINANCE CORP. Special Meeting of Shareholders March 20, 2025 at 9:00 A.M. Eastern Time This proxy is solicited by the Board of Directors The undersigned shareholder of Blue Owl Technology Finance Corp., hereby appoints Karin Kringen and Jonathan Lamm, and each of them, as proxies for the undersigned with full power of substitution in each of them, to attend the Special Meeting of Shareholders of Blue Owl Technology Finance Corp. to be held on March 20, 2025 at 9:00 A.M. Eastern Time, virtually at www.virtualshareholdermeeting.com/OTF2025SM, and any and all adjournments and postponements thereof, with all power possessed by the undersigned as if personally present and to vote in their discretion on such other matters as may properly come before the meeting. The undersigned hereby acknowledges receipt of the Notice of Special Meeting of Shareholders and the accompanying Joint Prospectus/Proxy Statement and revokes any proxy heretofore given with respect to such meeting. This proxy is solicited on behalf of the Blue Owl Technology Finance Corp. board of directors. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Special Meeting of Shareholders or any adjournments or postponements thereof in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion, including, but not limited to, matters incident to the conduct of the meeting or a motion to adjourn or postpone the meeting to another time and/or place for the purpose of soliciting additional proxies for the proposal referenced herein. If you sign, date and return this proxy, it will be voted as directed, or if no direction is indicated, will be voted in accordance with the Board of Directors' recommendations. Continued and to be signed on reverse side Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Notice and Joint Prospectus/Proxy Statement are available at www.proxyvote.com. NOTICE IS HEREBY GIVEN THAT the special meeting of shareholders (the “Special Meeting”) of Blue Owl Technology Finance Corp., a Maryland corporation (the “Company”), will be held on March 20, 2025 at 9:00 a.m. Eastern Time. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/OTF2025SM. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting Shareholder votes.

The Board of Directors has unanimously approved the agreement to merge with OTF II and the Amended OTF Charter. The Board of Directors unanimously recommends that OTF shareholders vote FOR the Charter Amendment Proposal described in the enclosed joint prospectus / proxy statement. Shareholders are urged to vote promptly “FOR” the proposal. Your vote is important, no matter how many shares you own. If you have additional questions about how to vote your shares or need assistance voting your shares, please call OTF’s proxy solicitor: Broadridge at 1-855-200-8019 Transaction Rationale • Acquisition of a Known, High-Quality Portfolio of Assets – OTF and OTF II employ the same investment strategy, and Blue Owl Capital Inc. (“Blue Owl”) has been allocating substantially the same investments to both funds since OTF II’s inception. As a result, as of September 30, 2024, approximately 84% of the investments in OTF II overlap with those of OTF. The combination of two known, complementary portfolios, constructed and managed by the same centralized team, should facilitate portfolio consolidation and meaningfully mitigate potential integration risk. • Strong Combined Portfolio Company Metrics – The combined portfolio would have an asset mix on a combined basis with 77% first lien investments and 81% senior secured investments as of September 30, 2024. Based on financial data as of September 30, 2024, the combined portfolio would also maintain excellent credit quality, with less than 0.1% of total investments at fair value on non-accrual and 93% of investments in our highest two internal ratings categories based on fair value1. • Increased Scale and Diversification – The proposed merger would increase OTF’s total investments by greater than 100% at its target leverage range of 0.90x – 1.25x, meaningfully increasing the combined company’s scale. OTF’s total assets on a pro forma basis are expected to increase to approximately $15.8 billion based on financial data as of September 30, 2024, which would make the combined company a top five BDC and the largest dedicated software-focused BDC by total assets with all capital called and the fund at target leverage2. The proposed combination would also increase the number of portfolio companies to 180 and reduce the average position size within the portfolio to less than 0.6% at fair value as of September 30, 2024. Diversification is critical to risk mitigation, reducing reliance on the success of any one investment, and this proposed merger strengthens that effort. • Enhanced Positioning for a Possible Future Liquidity Event – Subsequent to the transaction, should the combined company pursue a possible future liquidity event, OTF is expected to have a more attractive profile than either BDC on a standalone basis in the public markets. The larger scale of the combined company is expected to increase possible trading liquidity, broaden investor appeal and expand prospective research coverage. Additionally, the elimination of a second private-to-public software-focused BDC should reduce potential arbitrage opportunities while streamlining the organizational structure of Blue Owl’s BDCs. Finally, the combined company would have nearly $300 million in undistributed net investment income and undistributed net capital gains as of September 30, 2024, which should support a strong and predictable potential future public company dividend. • Greater Access to Debt Markets and Financing Cost Savings – Greater scale and structural simplification could improve the cost of debt and allow for more favorable financing terms over time. Additionally, the increased scale of the combined company may lead to more diverse funding sources while consolidating existing facilities. • Accretive to Net Investment Income (“NII”) – Shareholders of the combined company should benefit from operational savings through the elimination of duplicative expenses, which are estimated to be more than $4 million in the first year, a lower cost of financing, which is estimated to save $15 million annually in the long-term, and improved portfolio-level asset yields. For additional information, please visit www.blueowlproducts.com/otf-otf-ii- merger. Please refer to the press release, presentation, and the joint prospectus / proxy statement for the special meeting. 1 As part of its portfolio monitoring process, Blue Owl Technology Credit Advisors LLC employs an investment rating system to categorize our investments. 2 Based on latest publicly available filings as of November 8, 2024. Combined company assets are as of September 30, 2024 and assumes $1.6 billion of remaining OTF II uncalled capital commit- ments are funded. Also assumes combined company leverage of 1.0x debt-to

Go to proxyvote.com S04033-EPB Merger Proposed Materials requiring your prompt action enclosed. Voting is quick and easy, please cast your vote today on any device you prefer. Your vote is urgently needed. Technology Finance Corp.

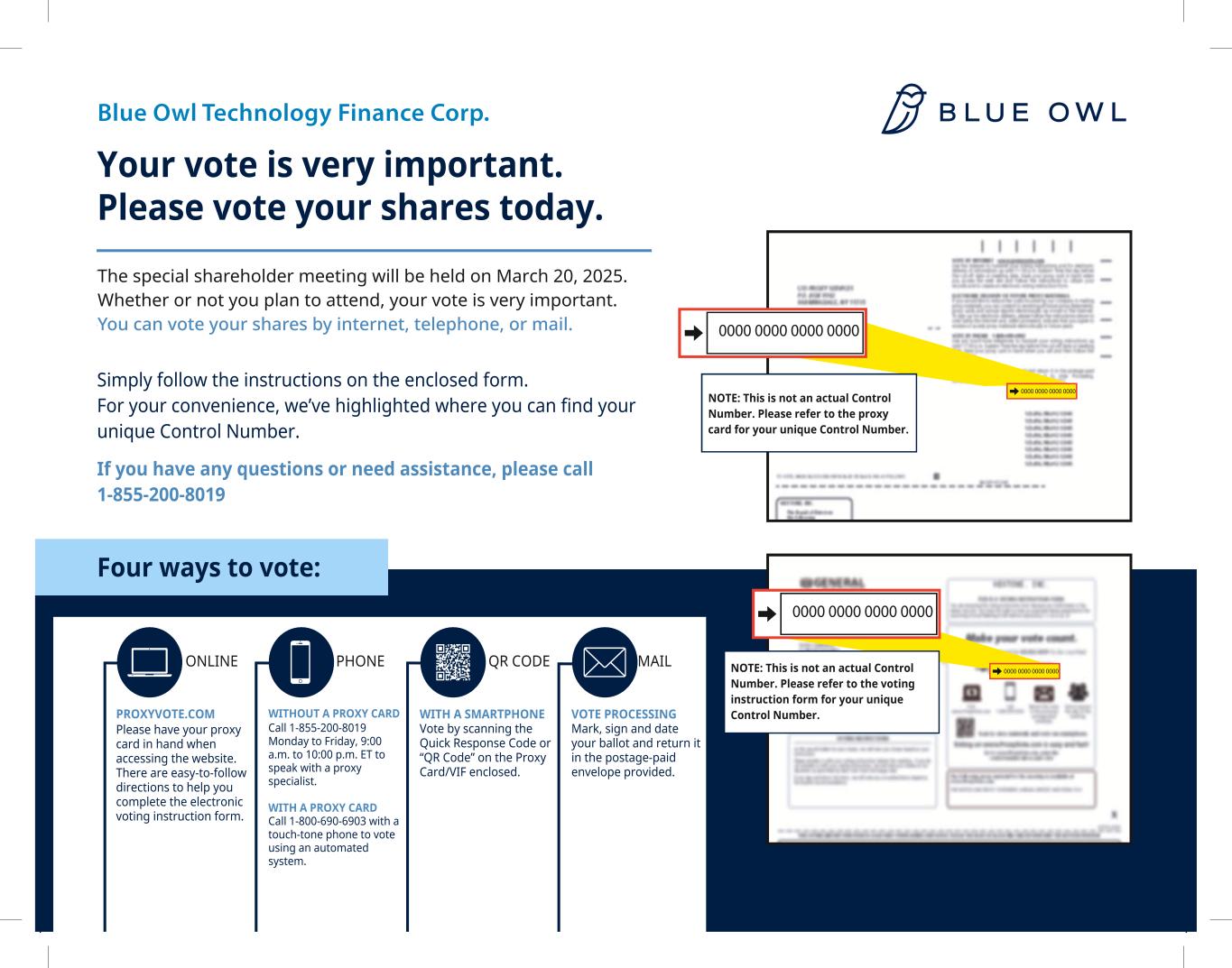

0000 0000 0000 0000 NOTE: This is not an actual Control Number. Please refer to the proxy card for your unique Control Number. PROXYVOTE.COM Please have your proxy card in hand when accessing the website. There are easy-to-follow directions to help you complete the electronic voting instruction form. VOTE PROCESSING Mark, sign and date your ballot and return it in the postage-paid envelope provided. 0000 0000 0000 0000 NOTE: This is not an actual Control Number. Please refer to the voting instruction form for your unique Control Number. Your vote is very important. Please vote your shares today. The special shareholder meeting will be held on . Whether or not you plan to attend, your vote is very important. You can vote your shares by internet, telephone, or mail. Simply follow the instructions on the enclosed form. For your convenience, we’ve highlighted where you can find your unique Control Number. If you have any questions or need assistance, please call 1-855-200-8019 Four ways to vote: ONLINE PHONE QR CODE MAIL WITHOUT A PROXY CARD Call 1-855-200-8019 Monday to Friday, 9:00 a.m. to 10:00 p.m. ET to speak with a proxy specialist. WITH A PROXY CARD Call 1-800-690-6903 with a touch-tone phone to vote using an automated system. WITH A SMARTPHONE Vote by scanning the Quick Response Code or “QR Code” on the Proxy Card/VIF enclosed. 0000 0000 0000 0000 0000 0000 0000 0000 i l l i ill l March 20, 2025. Whether or not y u plan to attend, your vote is very important. You can vote your shares by internet, telephone, or mail. Blue Owl Technology Finance Corp.

1 Be the vote that counts. - Re: Merger Proposed - Vote Now! OTF Special Meeting - Re: Merger Proposed - Please Vote! OTF Special Meeting - Re: REMINDER: Your OTF shares still need to be voted for the Special Meeting - Re: VOTE NOW! OTF is still seeking investor votes on important proposal - Re: Merger Proposed - OTF - We Need Your Vote - One Week Left! - Re: OTF - Last Day to Vote Your Shares! We Need Your Vote!

2 BLUE OWL TECHNOLOGY FINANCE CORP. 2025 Special Meeting March 20, 2025 VOTE NOW Why Should I Vote? Your support provides OTF shareholders such as yourself with multiple critical benefits, described in more detail in the letter below. More information on the proposal on the ballot can be found in the joint prospectus/proxy statement also below. Thank you for supporting this important transaction. Ways to Vote ProxyVote 800.690.6903 Virtual Meeting Important Information For holders as of January 16, 2025 Vote Common Shares by: March 19, 2025 Control Number: 0123456789012345

3 This email represents the following share(s): *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 *** PRINT OPTIONS NOT SET FOR SUMMARY!!! 123,456,789,012.00000 View documents: Proxy Statement | Shareholder Letter | © 2025 Broadridge Financial Solutions Inc. P.O. Box 1310, Brentwood, NY 11717 ProxyVote and Broadridge are trademarks of Broadridge Financial Solutions Inc. CUSIP is a registered trademark of the American Bankers Association. All other registered marks belong to their respective owners. Email Settings | Terms and Conditions | Privacy Statement

Your vote is very important Dear shareholder, According to our latest records, we have not yet received your vote for the Special Meeting of Shareholders of Blue Owl Technology Finance Corporation (“OTF”) to be to be held March 20th, 2025, in connection with OTF’s proposed merger with Blue Owl Technology Finance Corporation II (“OTF II”). Your vote is extremely important, no matter how many shares you hold. I believe the proposed merger between OTF and OTF II is a compelling combination that will provide multiple benefits to OTF shareholders. In short, I believe this transaction will: Streamline the Blue Owl direct lending platform; Combine two complementary, high-quality portfolios of assets, each with a significant share of senior secured investments and excellent credit quality; Meaningfully increase our scale and diversification; Enhance our positioning for a possible future liquidity event; Increase our access to debt markets and generate financing cost savings; and Create net investment income accretion. By voting FOR the proposal listed in the joint prospectus / proxy statement you previously received, you are providing OTF with these critical benefits, which we describe in more detail on the following page. The OTF Board of Directors unanimously recommends that shareholders vote FOR the proposal. If you have any questions about voting or need additional information, please call our proxy solicitor, Broadridge, at 1-855-200-8019. Thank you for your continued support. Sincerely, Craig W. Packer | Chief Executive Officer ONLINE WWW.PROXYVOTE.COM Please have your proxy card in hand when accessing the website. There are easy-to-follow directions to help you complete the electronic voting instruction form. PHONE WITHOUT A PROXY CARD Call 1-855-200-8019 Monday to Friday, 9:00 a.m to 10:00 p.m. ET to speak with a proxy specialist. WITH A PROXY CARD Call 1-800-690-6903 with a touch-tone phone to vote using an automated system. QR CODE WITH A SMARTPHONE Vote by scanning the Quick Response Code or “QR Code” on the Proxy Card/VIF enclosed. MAIL VOTE PROCESSING Mark, sign and date your ballot and return it in the postage-paid envelope provided. PROXY QUESTIONS ? Call 1-855-200-8019 Please respond by voting FOR the proposal at any of the avenues below. Voting now will allow us to complete the Special Meeting without delay.

The Board of Directors has unanimously approved the agreement to merge with OTF II and the Amended OTF Charter. The Board of Directors unanimously recommends that OTF shareholders vote FOR the Charter Amendment Proposal described in the enclosed joint prospectus / proxy statement. Shareholders are urged to vote promptly “FOR” the proposal. Your vote is important, no matter how many shares you own. If you have additional questions about how to vote your shares or need assistance voting your shares, please call OTF’s proxy solicitor: Broadridge at 1-855-200-8019 Transaction Rationale • Acquisition of a Known, High-Quality Portfolio of Assets – OTF and OTF II employ the same investment strategy, and Blue Owl Capital Inc. (“Blue Owl”) has been allocating substantially the same investments to both funds since OTF II’s inception. As a result, as of September 30, 2024, approximately 84% of the investments in OTF II overlap with those of OTF. The combination of two known, complementary portfolios, constructed and managed by the same centralized team, should facilitate portfolio consolidation and meaningfully mitigate potential integration risk. • Strong Combined Portfolio Company Metrics – The combined portfolio would have an asset mix on a combined basis with 77% first lien investments and 81% senior secured investments as of September 30, 2024. Based on financial data as of September 30, 2024, the combined portfolio would also maintain excellent credit quality, with less than 0.1% of total investments at fair value on non-accrual and 93% of investments in our highest two internal ratings categories based on fair value1. • Increased Scale and Diversification – The proposed merger would increase OTF’s total investments by greater than 100% at its target leverage range of 0.90x – 1.25x, meaningfully increasing the combined company’s scale. OTF’s total assets on a pro forma basis are expected to increase to approximately $15.8 billion based on financial data as of September 30, 2024, which would make the combined company a top five BDC and the largest dedicated software-focused BDC by total assets with all capital called and the fund at target leverage2. The proposed combination would also increase the number of portfolio companies to 180 and reduce the average position size within the portfolio to less than 0.6% at fair value as of September 30, 2024. Diversification is critical to risk mitigation, reducing reliance on the success of any one investment, and this proposed merger strengthens that effort. • Enhanced Positioning for a Possible Future Liquidity Event – Subsequent to the transaction, should the combined company pursue a possible future liquidity event, OTF is expected to have a more attractive profile than either BDC on a standalone basis in the public markets. The larger scale of the combined company is expected to increase possible trading liquidity, broaden investor appeal and expand prospective research coverage. Additionally, the elimination of a second private-to-public software-focused BDC should reduce potential arbitrage opportunities while streamlining the organizational structure of Blue Owl’s BDCs. Finally, the combined company would have nearly $300 million in undistributed net investment income and undistributed net capital gains as of September 30, 2024, which should support a strong and predictable potential future public company dividend. • Greater Access to Debt Markets and Financing Cost Savings – Greater scale and structural simplification could improve the cost of debt and allow for more favorable financing terms over time. Additionally, the increased scale of the combined company may lead to more diverse funding sources while consolidating existing facilities. • Accretive to Net Investment Income (“NII”) – Shareholders of the combined company should benefit from operational savings through the elimination of duplicative expenses, which are estimated to be more than $4 million in the first year, a lower cost of financing, which is estimated to save $15 million annually in the long-term, and improved portfolio-level asset yields. For additional information, please visit www.blueowlproducts.com/otf-otf-ii- merger. Please refer to the press release, presentation, and the joint prospectus / proxy statement for the special meeting. 1 As part of its portfolio monitoring process, Blue Owl Technology Credit Advisors LLC employs an investment rating system to categorize our investments. 2 Based on latest publicly available filings as of November 8, 2024. Combined company assets are as of September 30, 2024 and assumes $1.6 billion of remaining OTF II uncalled capital commit- ments are funded. Also assumes combined company leverage of 1.0x debt-to-equity.

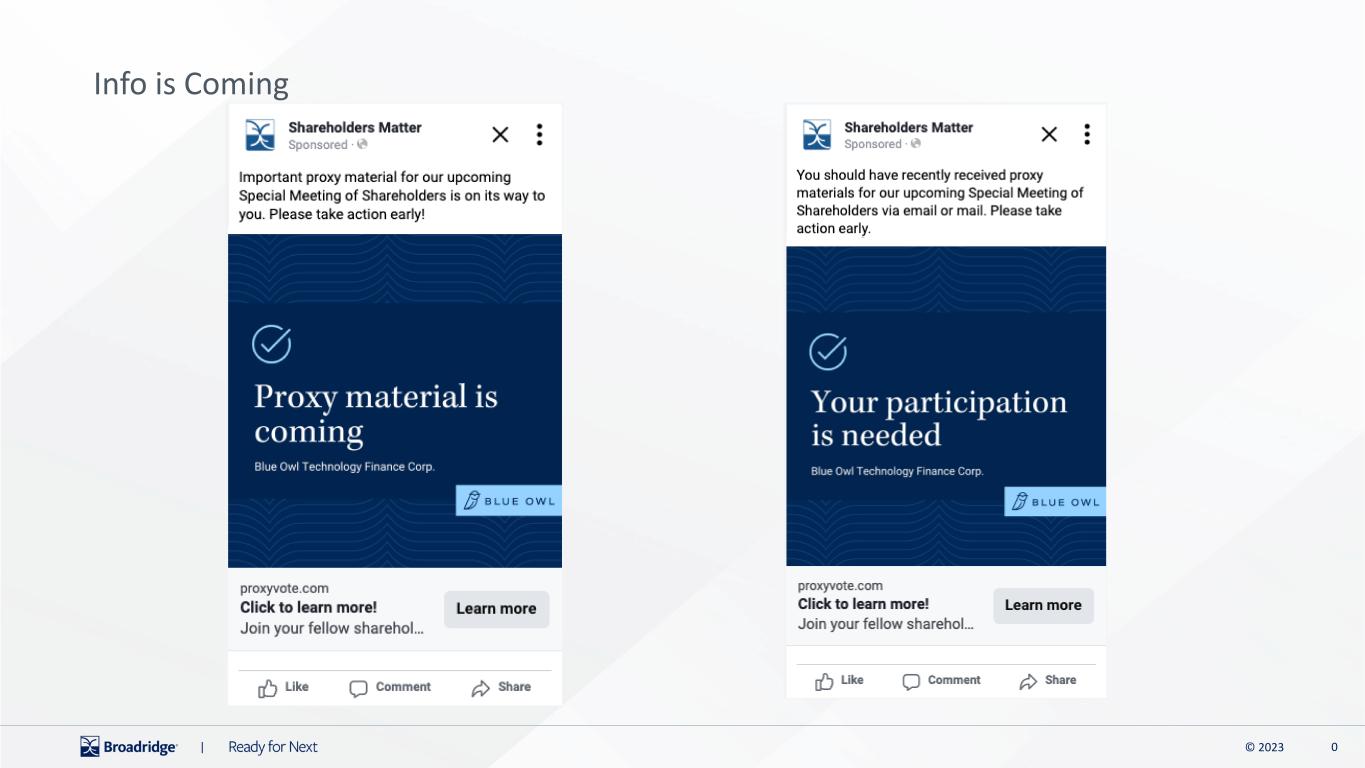

0© 2023 | Info is Coming

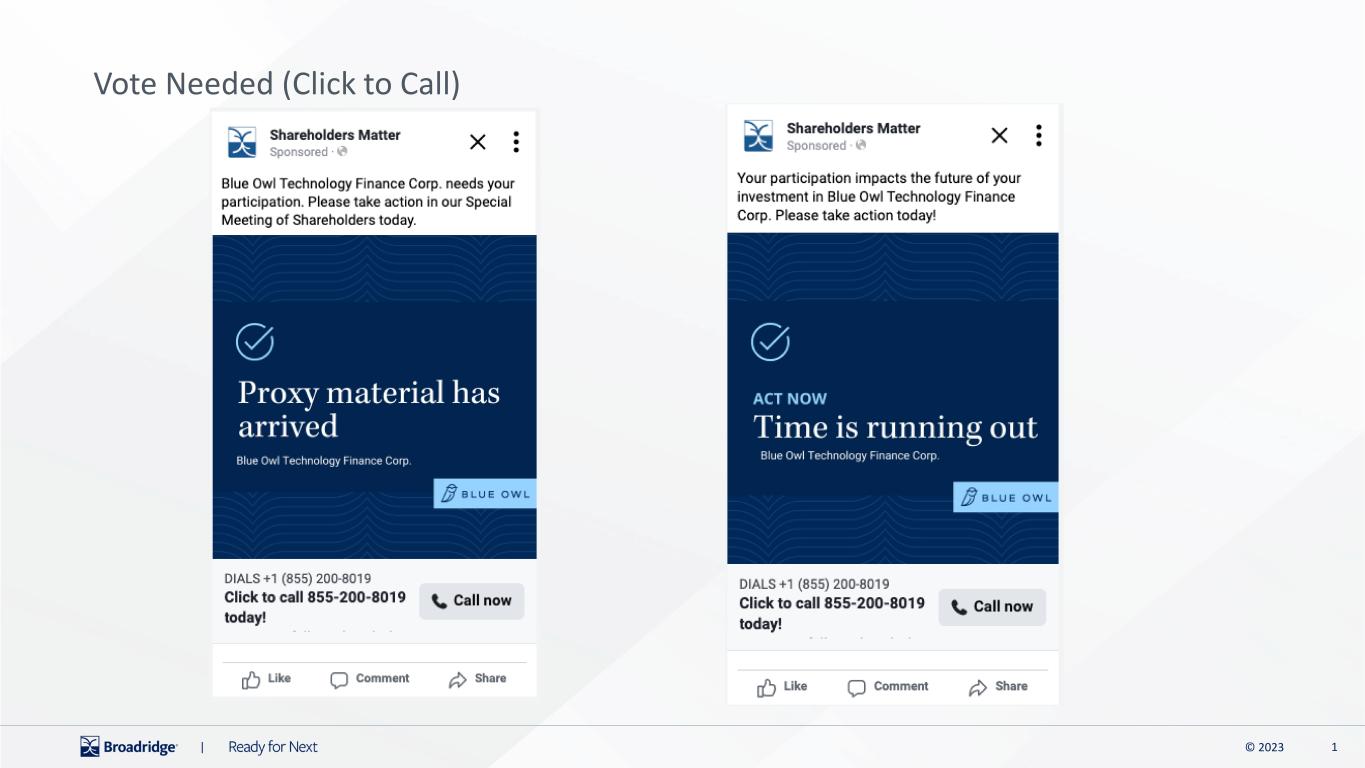

1© 2023 | Vote Needed (Click to Call)

2© 2023 | Thank You

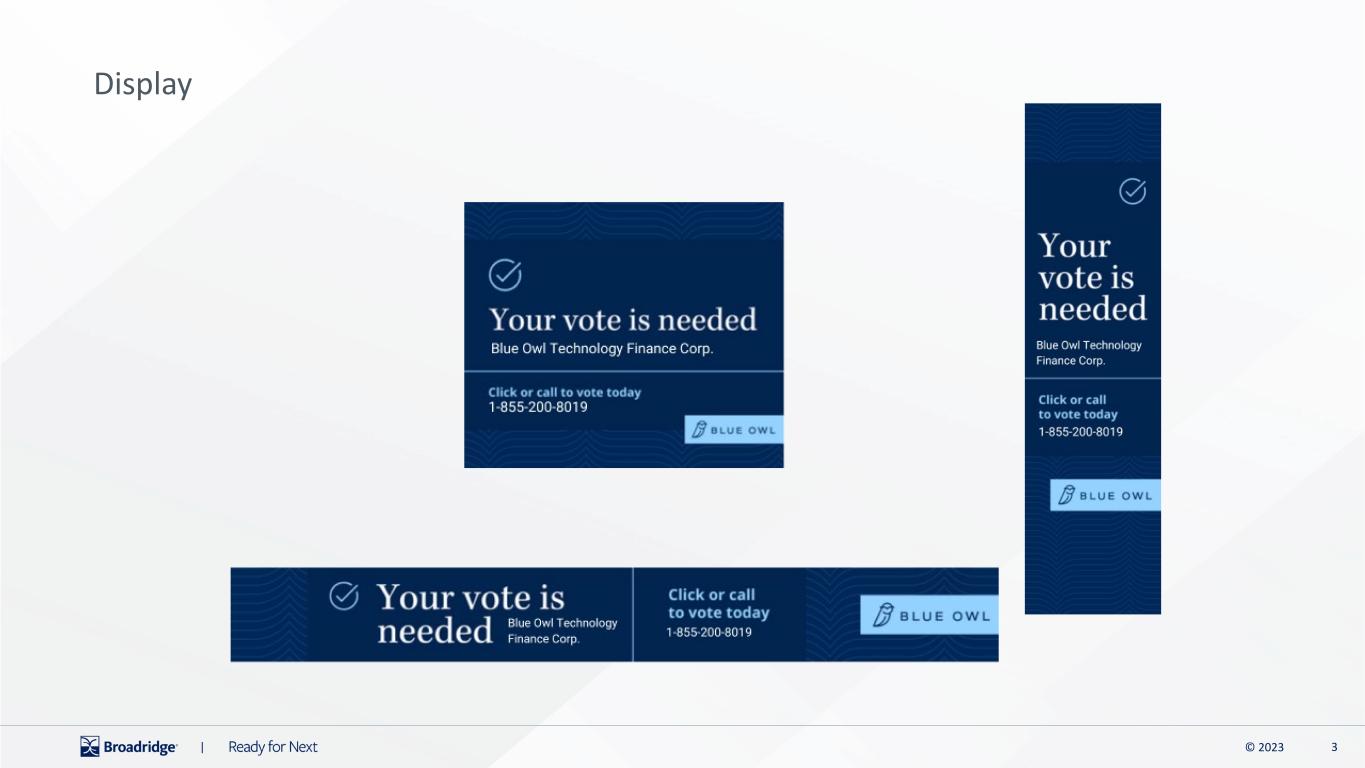

3© 2023 | Display

Solicitation Script (Inbound and Outbound) BLUE OWL TECHNOLOGY FINANCE CORP. Meeting Date: 3/20/2025 Toll Free Number: 855-200-8019 INBOUND GREETING: Thank you for calling the Broadridge Proxy Services Center for BLUE OWL TECHNOLOGY FINANCE CORP. . My name is <Agent Name>. How may I assist you today? GENERAL OUTBOUND GREETING: Good day, may I please speak with Mr./Ms. <full name as it appears on registration>? Hello Mr./Ms. <Shareholder’s Last Name>. My name is <agent name> and I am a proxy voting specialist calling on a recorded line on behalf of BLUE OWL TECHNOLOGY FINANCE CORP. to confirm you have received the proxy materials for the special meeting of shareholders scheduled for March 20th 2025. Have you received proxy materials? NEAR MEETING DATE OUTBOUND GREETING: Good day, may I please speak with Mr./Ms. <full name as it appears on registration>? Hello Mr./Ms. <Shareholder’s Last Name>. My name is <agent name> and I am a proxy voting specialist calling on a recorded line on behalf of BLUE OWL TECHNOLOGY FINANCE CORP. to confirm you have received the proxy materials for the special meeting of shareholders scheduled in just a few days on March 20th 2025. Have you received proxy materials? VOTING: Your board has recommended a vote IN FAVOR of the proposal. Would you like to vote along with the recommendations of the board for all of your accounts? Thank you, I am recording your <for, against, abstain> vote. For confirmation purposes, please state your full name. And according to our records, you currently reside in <read street address, city, and state > is that correct? For confirmation purposes, please state your zip code. Thank you. You will receive a confirmation of your voting instructions within 5 days. If you have any questions, please contact us at this toll-free number 855-200-8019. Mr./Ms. <Shareholder’s Last Name>, your vote is important, and your time is appreciated. Thank you and have a good <day, evening, night>. IF UNSURE OF VOTING OR DOES NOT WANT TO VOTE ALONG WITH THE RECOMMENDATION OF THE BOARD: © 2023 Broadridge Financial Solutions, Inc., Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc. broadridge.com CONFIDENTIAL INFORMATION

CONFIDENTIAL INFORMATION | © 2023 2 Would you like me to review the proposal with you? <After review, ask them if they would like to vote now over the phone>. IF NOT RECEIVED/REQUESTING MATERIAL TO BE RE-MAILED: I can resend the proxy materials to you, or I can review the proposal with you and record your vote immediately by phone. <Pause for response> AFTER REVIEW, ASK THEM IF THEY WOULD LIKE TO VOTE NOW OVER THE PHONE: Your Board recommends that you vote “FOR” the proposal. Would you like to vote along with the recommendations of the Board for all your accounts? IF THEY DON’T WANT THE PROPOSAL REVIEWED: Do you have an email address this can be sent to? <If yes, enter the email address in the notes and read it back phonetically to the shareholder.> Thank you. You should receive the proxy materials shortly and the materials will inform you of the methods available to cast your vote, one of which is to call us back at 855-200-8019. IF NOT INTERESTED: I am sorry for the inconvenience. Please be aware that as a shareholder, your vote is very important. Please fill out and return your proxy card at your earliest convenience. If you would rather not do that, you can always vote via the other methods outlined in the proxy materials. Thank you again for your time today and have a wonderful day/evening. VOTING (ANY VOTE NEEDED): Your board has recommended a vote “FOR” the proposal, or you may choose to vote Against or Abstain and help the company reach quorum. How would you like to vote on your accounts today? And this (for/against/abstain) vote will be for all of your accounts accordingly? REGISTERED HOLDER WANTS A NEW PROXY CARD/OR THEIR CONTROL NUMBER: <send complete contact information name, address, control #, & shares to Broadridge>: Your control number can be found on your proxy card. I can arrange to have a new proxy card sent to you. However, I can record your voting instructions right now so that it will be represented at the upcoming meeting. Your board is recommending you vote FOR the proposal. Would you like to vote along with the recommendations of the Board for all your accounts? BENEFICIAL HOLDER WANTS A NEW VIF/OR THEIR CONTROL NUMBER: Your control number can be found on your Vote Instruction Form. You can contact your broker/financial advisor and they can arrange to have a new voting instruction form sent to you. However, I can record your voting instructions right now so that it will be represented at the upcoming meeting. Your board is recommending you vote FOR the proposal. Would you like to vote along with the recommendations of the Board for all your accounts? ANSWERING MACHINE MESSAGE: Hello, my name is <Agent Name> and I am a proxy voting specialist calling on behalf of BLUE OWL TECHNOLOGY FINANCE CORP. You should have received proxy material electronically or in the mail concerning the special Meeting of Shareholders to be held on March 20th 2025. Your vote is very important. Please sign, date and promptly mail your proxy card in the postage-paid envelope provided. Internet and telephone voting are also available. To vote over the Internet please follow the instructions provided in the proxy materials. If you have any questions, would like to vote over the telephone or need new proxy materials, call toll-free at 855-200-8019 and a proxy voting specialist

CONFIDENTIAL INFORMATION | © 2023 3 will assist you. Specialists are available Monday through Friday, 9AM to 10PM Eastern Time. Voting takes just a few moments and will benefit all shareholders. Thank you for your prompt attention to this matter. AUTOMATED ANSWERING MACHINE MESSAGE (ONLY ON LANDLINES): Hello, this is the Broadridge Proxy Services Center calling with an important message on behalf of BLUE OWL TECHNOLOGY FINANCE CORP. . You should have received proxy material electronically or in the mail concerning the special Meeting of Shareholders to be held on March 20th 2025. Your vote is very important. Please sign, date, and promptly mail your proxy card in the postage-paid envelope provided. Internet and telephone voting are also available. To vote over the Internet please follow the instructions provided in the proxy materials. If you have any questions, would like to vote over the telephone or need new proxy materials, call toll-free at 855-200-8019 and a proxy voting specialist will assist you. Specialists are available Monday through Friday, 9AM to 10PM Eastern Time. Voting takes just a few moments and will benefit all shareholders. Thank you for your prompt attention to this matter. PRE-RECORDED MESSAGES – CANNOT BE UPDATED INBOUND - CLOSED RECORDING: Thank you for calling the Broadridge Proxy Services Center. Our offices are now closed. Please call us back during our normal business hours which are, Monday through Friday, 9AM to 10PM Eastern Time. Thank you. INBOUND - CALL IN QUEUE MESSAGE: Thank you for calling the Broadridge Proxy Services Center. Our proxy specialists are currently assisting other callers. Your call is important to us. Please continue to hold and your call will be answered in the order it was received. END OF CAMPAIGN MESSAGE: Thank you for calling the Broadridge Proxy Services Center. The meeting has been held and as a result, this toll-free number is no longer in service for proxy related calls. If you have questions regarding your investment, please contact your investment professional. Thank you. CC HOURS (EASTERN TIME): Monday through Friday, 9AM to 10PM

1FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR FURTHER DISTRIBUTION. OTF & OTF II Special Meetings Merger Proposed Get in touch Dear valued partner, We wanted to make you aware that the joint prospectus / proxy statement for the special meetings associated with the proposed merger of OTF and OTF II were sent to all shareholders over the past few days. The agendas for the special meetings include the following proposals: Blue Owl Technology Finance Corp: • To approve the Second Articles of Amendment and Restatement, which includes proposed changes as described in the Company's joint proxy statement/prospectus Blue Owl Technology Finance Corp II: • To adopt the Agreement and Plan of Merger The Boards of Directors of both BDCs unanimously recommend investors vote FOR each of the proposals. Both proposals must pass in order for the proposed merger to close. Please encourage shareholders of record as of January 16, 2025 to vote as soon as possible by going to www.proxyvote.com or by calling 1-800-690-6903 and providing the control number which is listed in the email or proxy card they received. Proxy solicitation costs are borne by us and our shareholders, and these costs can be substantial. Voting as soon as possible helps us manage these costs and avoid unnecessary outreach. Our proxy solicitation firms will be sending email reminders and making outbound calls to unvoted shareholders based on participation. We want to highlight for your clients that once a shareholder’s vote is recorded, there will be no further solicitation. The joint prospectus / proxy statement associated with the proposed merger can be found [here]. Please reach out to your Blue Owl representative with any questions. Copyright© Blue Owl Capital Inc. 2025. All rights reserved. salesdesk@blueowl.com Blue Owl Capital 399 Park Ave 38th Floor New York, New York 10022

Subject: 2025 Special Meetings: OTF/OTF II Merger – Please Vote All – We wanted to make you aware that proxy materials for the merger of OTF and OTF II were sent to all shareholders over the past week. If you were a shareholder of record as of January 16, 2025 we would encourage you to vote as soon as possible by going to www.proxyvote.com or by calling 1-800- 690-6903 and providing the control number which is listed in the email or proxy card you received. The agendas include the following proposals: Blue Owl Technology Finance Corp: • To approve the Second Articles of Amendment and Restatement, which includes proposed changes as described in the Company's joint proxy statement/prospectus Blue Owl Technology Finance Corp. II: • To adopt the Agreement and Plan of Merger More information about these proposals can be found within the joint prospectus / proxy statement here. The Boards of Directors of both BDCs unanimously recommend investors vote FOR each of the proposals. Both proposals must pass in order for the proposed merger to close. The voting deadline is March 19, 2025 at 11:59 PM EST. Please let us know if you have any questions. Thanks, XX

Subject: Upcoming OTF Special Meeting Hi XX, I hope you’re well. I wanted to make sure you received the joint proxy statement / prospectus for our upcoming special meeting associated with the proposed merger of OTF and OTF II and check in on whether you had any questions on the proposal on the ballot. We distributed materials a few weeks ago and we have not received your vote. I’ve included a copy of the materials [here] for your convenience. There is one proposal on the ballot: • To approve the Second Articles of Amendment and Restatement, which includes proposed changes as described in the Company's joint proxy statement/prospectus The Board of Directors unanimously recommends that OTF shareholders vote “FOR” this proposal and we’d very much appreciate your vote in line with our Board’s recommendations. The proposal must pass in order for the proposed merger to close. Your shares can be voted by visiting www.proxyvote.com and entering your control number below. If you have any questions about the proposal or how to vote, please let us know and we would be happy to help. Thank you for your support, XX Subject: RE: Upcoming OTF Special Meeting Hi XX, I wanted to follow up on my earlier note since I noticed we haven’t received your vote yet. You can view the materials [here] and there is one item on the ballot: • To approve the Second Articles of Amendment and Restatement, which includes proposed changes as described in the Company's joint proxy statement/prospectus The Board of Directors unanimously recommends that OTF shareholders vote “FOR” this proposal. The proposal must pass in order for the proposed merger to close. You can vote by going to www.proxyvote.com or by calling 1-800-690-6903 and providing your control number below. We very much appreciate your support! XX

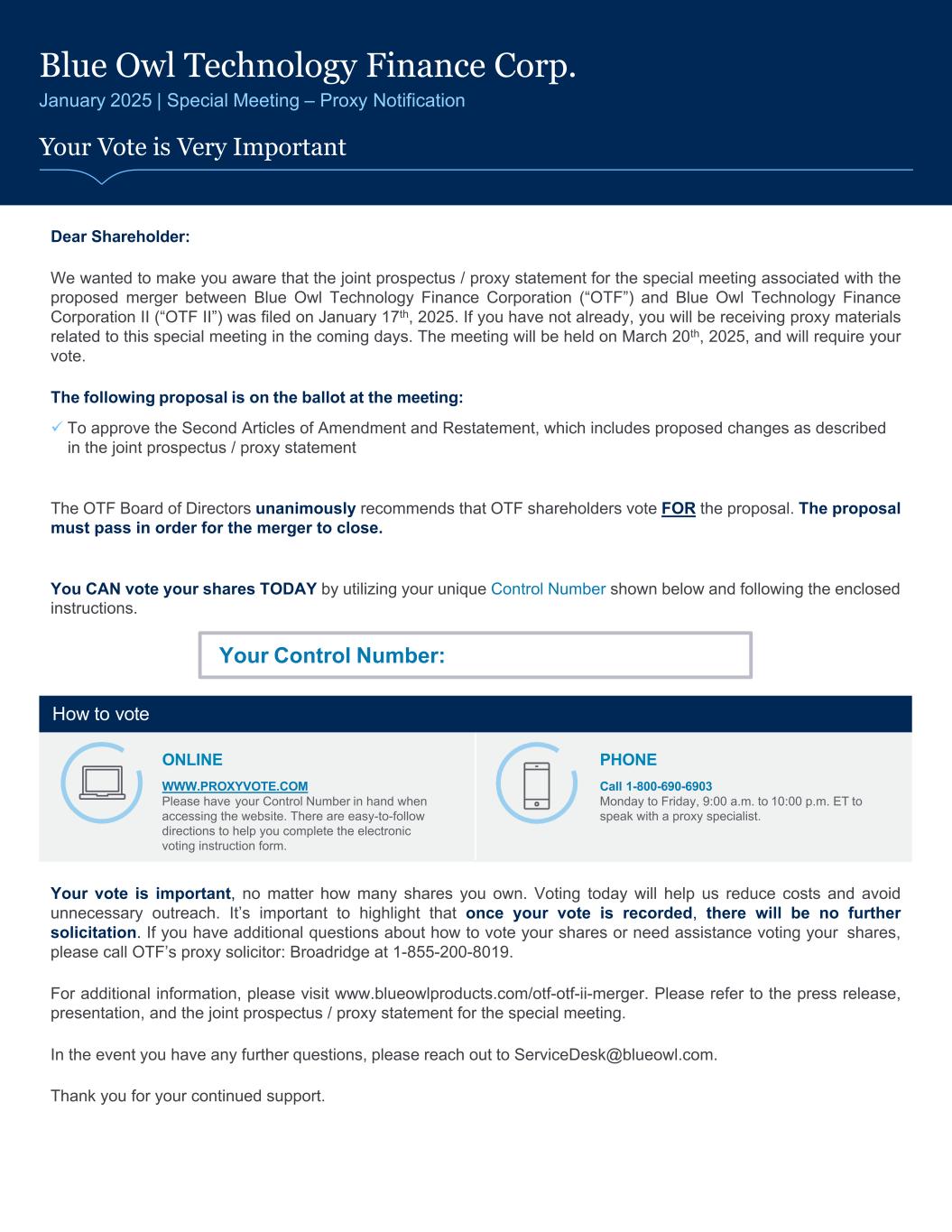

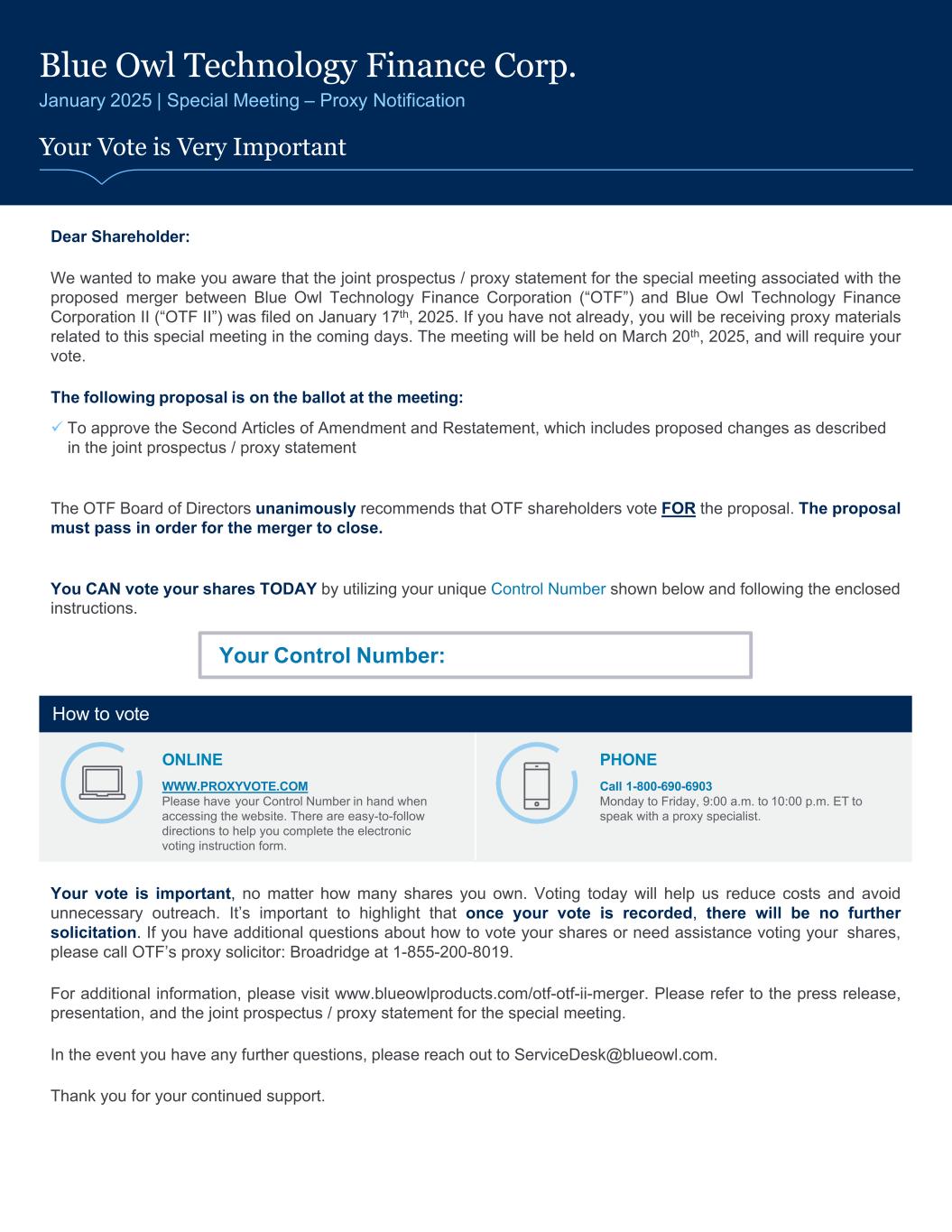

1 PHONE Call 1-800-690-6903 Monday to Friday, 9:00 a.m. to 10:00 p.m. ET to speak with a proxy specialist. How to vote Dear Shareholder: We wanted to make you aware that the joint prospectus / proxy statement for the special meeting associated with the proposed merger between Blue Owl Technology Finance Corporation (“OTF”) and Blue Owl Technology Finance Corporation II (“OTF II”) was filed on January 17th, 2025. If you have not already, you will be receiving proxy materials related to this special meeting in the coming days. The meeting will be held on March 20th, 2025, and will require your vote. The following proposal is on the ballot at the meeting: To approve the Second Articles of Amendment and Restatement, which includes proposed changes as described in the joint prospectus / proxy statement The OTF Board of Directors unanimously recommends that OTF shareholders vote FOR the proposal. The proposal must pass in order for the merger to close. You CAN vote your shares TODAY by utilizing your unique Control Number shown below and following the enclosed instructions. ONLINE WWW.PROXYVOTE.COM Please have your Control Number in hand when accessing the website. There are easy-to-follow directions to help you complete the electronic voting instruction form. Your vote is important, no matter how many shares you own. Voting today will help us reduce costs and avoid unnecessary outreach. It’s important to highlight that once your vote is recorded, there will be no further solicitation. If you have additional questions about how to vote your shares or need assistance voting your shares, please call OTF’s proxy solicitor: Broadridge at 1-855-200-8019. For additional information, please visit www.blueowlproducts.com/otf-otf-ii-merger. Please refer to the press release, presentation, and the joint prospectus / proxy statement for the special meeting. In the event you have any further questions, please reach out to ServiceDesk@blueowl.com. Thank you for your continued support. Your Control Number: Blue Owl Technology Finance Corp. January 2025 | Special Meeting – Proxy Notification Your Vote is Very Important

Forward-Looking Statements

Some of the statements in this press release constitute forward-looking statements because they relate to future events, future performance or financial condition of OTF or OTF II or the two-step merger (collectively, the “Mergers”) of OTF II with and into OTF. The forward-looking statements may include statements as to: future operating results of OTF and OTF II and distribution projections; business prospects of OTF and OTF II and the prospects of their portfolio companies; and the impact of the investments that OTF and OTF II expect to make. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this press release involve risks and uncertainties. Certain factors could cause actual results and conditions to differ materially from those projected, including the uncertainties associated with (i) the timing or likelihood of the Mergers closing; (ii) the expected synergies and savings associated with the Mergers; (iii) the ability to realize the anticipated benefits of the Mergers, including the expected accretion to net investment income and the elimination or reduction of certain expenses and costs due to the Mergers; (iv) the percentage of OTF and OTF II shareholders voting in favor of the proposals submitted for their approval; (v) the possibility that competing offers or acquisition proposals will be made; (vi) the possibility that any or all of the various conditions to the consummation of the Mergers may not be satisfied or waived; (vii) risks related to diverting management’s attention from ongoing business operations; (viii) the risk that shareholder litigation in connection with the Mergers may result in significant costs of defense and liability; (ix) changes in the economy, financial markets and political environment; (x) the impact of geo-political conditions, including revolution, insurgency, terrorism or war, including those arising out of the ongoing war between Russia and Ukraine and the escalated conflict in the Middle-East, including the Israel-Hamas conflict, and general uncertainty surrounding the financial and political stability of the United States (including uncertainties related to the incoming administration), the United Kingdom, the European Union and China, on financial market volatility, global economic markets, and various markets for commodities globally such as oil and natural gas; (xi) future changes in law or regulations; (xii) conditions to OTF’s and OTF II’s operating areas, particularly with respect to business development companies or regulated investment companies; (xiii) an economic downturn, elevated interest and inflation rates, ongoing supply chain and labor market disruptions, including those as a result of strikes, work stoppages or accidents, instability in the U.S. and international banking systems, and the risk of recession or a shutdown of government services could impact business prospects of OTF and OTF II and their portfolio companies or following the closing of the Mergers, the combined company; (xiv) the ability of Blue Owl Technology Credit Advisors LLC to locate suitable investments for the combined company and to monitor and administer its investments; (xv) the ability of Blue Owl Technology Credit Advisors LLC to attract and retain highly talented professionals; and (xvi) other considerations

that may be disclosed from time to time in OTF’s and OTF II’s publicly disseminated documents and filings with the Securities and Exchange Commission (“SEC”). OTF and OTF II have based the forward-looking statements included in this press release on information available to them on the date hereof, and they assume no obligation to update any such forward-looking statements. Although OTF and OTF II undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that they may make directly to you or through reports that OTF and OTF II in the future may file with the SEC, including the Joint Proxy Statement and the Registration Statement (each as defined below), annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

Additional Information and Where to Find It

In connection with the Mergers, OTF and OTF II have filed with the SEC and intend mail to their respective shareholders a joint proxy statement/prospectus (the “Joint Proxy Statement”) and OTF has filed with the SEC a registration statement on Form N-14 (the “Registration Statement”) that includes the Joint Proxy Statement and a prospectus of OTF. The Joint Proxy Statement and Registration Statement each contain important information about OTF, OTF II, the Mergers and related matters. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. SHAREHOLDERS OF OTF AND OTF II ARE URGED TO READ THE JOINT PROXY STATEMENT AND THE REGISTRATION STATEMENT AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT OTF, OTF II, THE MERGERS AND RELATED MATTERS. Investors and security holders will be able to obtain the documentation filed with the SEC free of charge at the SEC’s website, http://www.sec.gov and for documents filed by OTF and OTF II at https://www.blueowlproducts.com/otf-otf-ii-merger.

Participation in the Solicitation

OTF, its directors, certain of its executive officers and certain employees and officers of Blue Owl Technology Credit Advisors LLC and its affiliates may be deemed to be participants in the solicitation of proxies in connection with the Merger. Information about directors and executive officers of OTF is set forth in its proxy statement for its 2024 Annual Meeting of Shareholders, which was filed with the SEC on March 28, 2024. OTF II, its directors, certain of its executive officers and certain employees and officers of Blue Owl Technology Credit Advisors II LLC and its affiliates may be deemed to be participants in the solicitation of proxies in connection with the Merger. Information about directors and executive officers of OTF II is set forth in its proxy statement for its 2024 Annual Meeting of Shareholders, which was filed with the SEC on March 28, 2024. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the OTF and OTF II shareholders in connection with the Merger will be contained in the Joint Proxy Statement when such document becomes available. These documents may be obtained free of charge from the sources indicated above.