Filed Pursuant to Rule 424(b)(5)

Registration No. 333-239131

PROSPECTUS SUPPLEMENT

(To Prospectus dated September 21, 2020)

ATIF HOLDINGS LIMITED

(incorporated in the British Virgin Islands with limited liability)

4,347,826 Ordinary Shares

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering an aggregate of 4,347,826 of our ordinary shares to institutional accredited investors. In a concurrent private placement, we are also selling to such investors warrants to purchase an aggregate of up to 4,347,826 of our ordinary shares (the "Warrants"), which represent 100% of the number of our ordinary shares being issued in this offering. The exercise price of each Warrant is $1.10 per share, and each Warrant will be exercisable immediately upon issuance and will expire five years from the date of issuance. The Warrants and the ordinary shares issuable upon the exercise of the Warrants (the "Warrant Shares") are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the "Securities Act"), and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established trading market for the Warrants, and we do not intend to list the Warrants on any national securities exchange or nationally recognized trading system. Unless otherwise indicate dollar amounts reference herein shall mean United States dollars.

Our ordinary shares are listed on the NASDAQ Capital Market under the symbol “ATIF.”

On October 16, 2020, a date within sixty (60) days of the date of this prospectus supplement, the aggregate market value of our outstanding ordinary shares held by non-affiliates was approximately $17,397,800, based on 47,014,674 ordinary shares outstanding, of which 12,338,868 ordinary shares were held by non-affiliates, and a per ordinary share price of $1.41 based on the closing sale price of our ordinary shares on such date. On November 2, 2020, the closing price for one ordinary share was $1.31. You are urged to obtain current market quotations of our ordinary shares. We have not offered any securities pursuant to General Instruction I.B.5. of Form F-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus supplement.

Investing in our securities involves a high degree of risk. Before investing in our securities, you should carefully consider the risks described under the caption “Risk Factors” beginning on page S-11 of this prospectus supplement, any related free writing prospectus and in the accompanying prospectus and in the documents incorporated by reference in this prospectus supplement and refer to the risk factors that may be included in our reports and other information that we file with the U.S. Securities and Exchange Commission.

We have retained FT Global Capital, Inc. (the “Placement Agent”) to act as our exclusive placement agent in connection with this offering. The Placement Agent has no obligation to buy any of the securities from us in this offering or to arrange for the purchase or sale of any specific number or dollar amount of securities but will assist us in this offering on a “reasonable best efforts basis”. We have also agreed to pay the Placement Agent the fees set forth in the table below in connection with this offering.

| Per Share(1) | Total | |||||||

| Offering Price | $ | 0.92 | $ | 4,000,000 | ||||

| Placement Agent Fees(2) | $ | 0.07 | $ | 300,000 | ||||

| Proceeds, before expenses, to us(3) | $ | 0.85 | $ | 3,700,000 |

| (1) | The public offering price per one ordinary share, less the underwriting discount and commissions. |

| (2) | In addition, we have agreed to reimburse the Placement Agent for certain expenses and to issue to the Placement Agent, or its designees, warrants to purchase up to 391,304 of our ordinary shares (the “Placement Agent Warrants”), which represent 9.0% of the ordinary shares sold in this offering. See “Plan of Distribution” beginning on page S-25 of this prospectus supplement for additional information with respect to the compensation we will pay the Placement Agent. |

| (3) | The amount of offering proceeds to us presented in this table does not give effect to the exercise, if any, of the Warrants being issued in in the concurrent private placement or the Placement Agent Warrants. |

Delivery of the ordinary shares is expected to be made on or about November 5, 2020, subject to the satisfaction of certain closing conditions.

Neither the U.S. Securities and Exchange Commission nor any state securities commission or regulator has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or any related free writing prospectus. Any representation to the contrary is a criminal offense.

Sole Placement Agent

FT Global Capital, Inc.

The date of this prospectus supplement is November 3, 2020.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission (“SEC”) utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to and updates the information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides you with a general description of the securities we may offer from time to time, some of which does not apply to this offering. Generally, when we refer only to the prospectus, we are referring to the combined document consisting of this prospectus supplement and the accompanying prospectus, and, when we refer to the accompanying prospectus, we are referring to the base prospectus. If there is any inconsistency between the information in this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement. You should read the information in this prospectus supplement and the accompanying prospectus together with any related free writing prospectus and the additional information incorporated by reference herein and therein as provided for under the heading “Incorporation of Certain Information by Reference.”

Investing in our securities may subject you to tax consequences in the U.S. This prospectus supplement and the accompanying prospectus may not describe these tax consequences fully. You should read the tax discussion in this prospectus supplement and the accompanying prospectus and consult your own tax adviser with respect to your own particular circumstances.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus. We have not authorized, and the Placement Agent has not authorized, anyone to provide you with different information. We are not making an offer to sell or soliciting an offer to buy these securities in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make the offer or solicitation. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents.

The registration statement of which this prospectus supplement and the accompanying prospectus form a part, including the exhibits to the registration statement, contains additional information about us and the securities offered under this prospectus supplement. You can find the registration statement at the SEC’s website or at the SEC office mentioned under the heading “Where You Can Find More Information.”

Our consolidated financial statements that are incorporated by reference into this prospectus supplement and the accompanying prospectus have been prepared in accordance with U.S. GAAP.

Unless the context otherwise indicates, the terms “us,” “we,” “our,” “ATIF” and the “Company” refer to ATIF Holdings Limited and our subsidiaries.

You should rely only on the information provided or incorporated by reference in this prospectus supplement. We have not authorized anyone to provide you with additional or different information. This document may only be used where it is legal to sell these securities. You should not assume that any information in this prospectus is accurate as of any date other than the date of this prospectus supplement.

In this prospectus supplement, unless otherwise indicated or unless the context otherwise requires:

| l | “Affiliated Entities” refers to our subsidiaries and Qianhai (defined below); |

| l | “ATIF HK” refers to the indirect wholly-owned subsidiary of ATIF, ATIF Limited, a Hong Kong corporation; |

| l | “AT Consulting Center” refers to Asia Era International Financial Consulting Center, which is owned and operated by Qianhai (defined below); |

S-1

| l | “BVI” refers to the “British Virgin Islands”; |

| l | “China” or the “PRC” refers to the People’s Republic of China, excluding, for the purpose of this document only, Taiwan and the special administrative regions of Hong Kong and Macau; |

| l | “Company,” “we,” “us,” and “our” refers to ATIF Holdings Limited (“ATIF”), a British Virgin Islands business company, and its Affiliated Entities (defined above), as the case may be. Neither ATIF nor any of its Affiliated Entities are in any way or manner related to or associated with a digital publishing company incorporated and registered in Hong Kong, Asia Times Holdings Limited; |

| l | “CNNM” refers to www.chinacnnm.com, a news and media platform owned and operated by ATIF HK; |

| l | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| l | “Huaya,” “Huaya Consultant,” or “WFOE” refers to Huaya Consultant (Shenzhen) Co., Ltd., a limited liability company organized under the laws of the PRC, which is wholly-owned by ATIF HK; |

| l | “initial public offering” or “IPO” means our initial public offering of Ordinary Shares at $5.00 per Unit which closed in April 29, 2019; |

| l | “LGC” refers to Leaping Group Co., Ltd. a limited liability organized under the laws of Cayman Islands and a majority-owned subsidiary of the Company; |

| l | “LGC WFOE” refers to Yuezhong (Shenyang) Technology Co., Ltd., a limited liability company organized under the laws of the PRC, which is indirectly wholly-owned by LGC; |

| l | “LMG” refers to Leaping Media Group Co., Ltd., a limited liability company organized under the laws of the PRC, which we control via a serious of contractual arrangements between LGC WFOE (defined below) and LMG; |

| l | “preferred shares,” or “Preferred Shares” refer to the Class A preferred shares of the Company, par value $0.001 per share; |

| l | “Qianhai” is to Qianhai Asia Era (Shenzhen) International Financial Services Co., Ltd., a limited liability company organized under the laws of the PRC, which we control via a series of contractual arrangements between WFOE and Qianhai; |

| l | “RMB” and “Renminbi” refer to the legal currency of the PRC; |

| l | “SEC” refers to the Securities and Exchange Commission; |

| l | “Securities Act” refers to the Securities Act of 1933, as amended; |

| l | “shares,” “Shares,” “Ordinary Shares,” or “ordinary shares” refer to the Ordinary Shares of the Company, par value $0.001 per share; |

| l | “U.S. dollars” and “$” refer to the legal currency of the United States; and |

| l | “VIE” refers to variable interest entity. |

S-2

This summary highlights selected information contained elsewhere in this prospectus supplement, in the accompanying prospectus or in documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment decision. This prospectus supplement and the accompanying prospectus include or incorporate by reference information about this offering, our business and our financial and operating data. You should carefully read the entire prospectus supplement, the accompanying prospectus, including under the sections titled “Risk Factors” included herein and therein, any related free writing prospectus and the documents incorporated by reference into this prospectus supplement the accompanying prospectus, before making an investment decision.

Overview

We are a consulting company providing financial consulting services to small and medium-sized enterprises (“SMEs”). Since our inception in 2015, the main focus of our consulting business has been providing comprehensive going public consulting services designed to help SMEs become public companies on suitable markets and exchanges. Our goal is to become an international financial consulting company with clients and offices throughout Asia. We have to date primarily focused on helping clients going public on the OTC markets and exchanges in the U.S., but we are in the process of expanding our services to listing clients on domestic exchanges in China as well as the Hong Kong Stock Exchange.

Since our inception until July 31, 2019, our revenue was mainly generated from our going public consulting services. We also generated a small portion of our revenue from a one-time registration fee charged to our new clients. We generated total revenue of approximately $3,635,000, $5,308,000, and $3,079,000 for the fiscal years ended July 31, 2017, 2018, and 2019, respectively. The revenues generated from going public consulting services were $3,469,224, $5,236,196, and $3,078,758 for the fiscal years ended July 31, 2017, 2018, and 2019, respectively.

Beginning in August 2018, to complement and facilitate the growth of our going public consulting services, we launched AT Consulting Center to offer financial consulting programs in Shenzhen, and in September 2018, we acquired CNNM, or www.chinacnnm.com, a news and media website focused on distributing financial news and information. In July 2019, we launched an investment and financing analysis reporting business. Although upfront capital and human investments are required in connection with the aforementioned developments, we believe positive synergies can be generated by effectively integrating these three new business ventures with our existing going public consulting services, and we expect these to contribute to our growth in the long run.

In China, a fast-growing economy and a positive market environment have created many entrepreneurial and high-growth enterprises, many of which need assistance in obtaining development funds through financing. China has relatively immature financial systems compared to developed countries. Due to restrictions imposed by China’s foreign exchange regulations, it is difficult for foreign capital to enter China’s capital market. Because of the strict listing policies and a relatively closed financial environment in mainland China, most small to medium sized enterprises in the development stage are unable to list on domestic exchanges in China. Therefore, many Chinese enterprises strive to enter international capital markets through overseas listing for equity financing. However, in China, there is a general lack of understanding of international capital markets, as well as a lack of professional institutions that provide overseas going public consulting services to these companies, and many of them may not be familiar with overseas listing requirements.

We launched our consulting services in 2015. Our aim was to assist these Chinese enterprises by filling the gaps and forming a bridge between PRC companies and overseas markets and exchanges. We have a team of qualified and experienced personnel with legal, regulatory, and language expertise in several overseas jurisdictions. Our services are designed to help SMEs in China achieve their goal of becoming public companies. We create a going public strategy for each client based on many factors, including our assessment of the client’s financial and operational situations, market conditions, and the client’s business and financing requirements. Since our inception and up to July 31, 2019, we have successfully helped seven Chinese enterprises to be quoted on the U.S. OTC markets and are currently assisting our other clients in their respective going public efforts. All of our current and past clients have been Chinese companies, and we plan to expand our operations to other Asian countries, such as Malaysia, Vietnam, and Singapore, by the year of 2020.

S-3

Recent Developments

On April 22, 2020, we completed the acquisition of approximately 51.2% of the issue and outstanding ordinary shares of Leaping Group Co., Ltd. (“LGC”) pursuant to the (i) Debt Conversion and Share Purchase Agreement dated as of April 8, 2020 (the “Debt Conversion SPA”) among the Company and LGC, and (ii) Share Exchange Agreement dated as of April 8, 2020 (the “Share Exchange Agreement”) by and among the Company, LGC, and all of the shareholders of LGC (the “Sellers”). Under the terms of the Debt Conversion SPA, LGC issued 3,934,029 of its ordinary shares to the Company in exchange for (i) the satisfaction of the outstanding debt owed to the Company in the amount of US$1,851,000, and (ii) the issuance of 2,800,000 ordinary shares of the Company to LGC. Concurrent with the closing of the Debt Conversion SPA and under the terms of the Share Exchange Agreement (the “Acquisitions”), the Sellers assigned an aggregate of 6,283,001 ordinary shares of LGC to the Company in exchange for an aggregate of 7,140,002 ordinary shares of the Company. After giving effect to the Acquisitions, LGC will be considered a majority-owned subsidiary of the Company and its financial statements will be consolidated with ours.

LGC currently operates a multi-channel advertising business, event planning and execution business, film production business, and movie theater operating business in China. Currently, LGC’s primary market is Heilongjiang and Liaoning, covering major second-tier cities in the areas such as Harbin and Shenyang. LGC’s services are as follows:

| · | Multi-Channel Advertising Services. LGC provides advertising creation and production, pre-movie advertisements display, and advertising result evaluation. Typically, LGC will sign an advertising service agreement with an advertising client to undertake the advertising campaign of the client. The scope of service varies according to clients’ needs; it could be a full package of all the above services, or the combination of the latter two services. The price of 15-second slots on our pre-movie advertising network currently ranges from US$3,810 to US$5,276 based on the number of movie theaters in which the advertisement is placed, the length of the time slot purchased, and the duration of the advertising campaign. |

| · | Event Planning and Execution Services. LGC provides services related to planning and arrangement of events, and production of related advertising materials. After entering an event planning and execution service agreement with a client, LGC will first decide on the suitable form for a marketing event. If it is an offline event, LGC will choose an event venue based on the target customers and budget, design and order exhibition models, decorate the venue, and hold the event on the designated date. If it is an online event, LGC will develop the concept and discuss them with the client. Upon approval, LGC’s designers will design the website based on the concept, and provide background support to make sure that the website is successfully launched and maintained. Typical marketing events include brand promotion through elevator and in-store LED billboard advertisements and potential customer information collection by offering incentives such as static display, performances, free movie tickets, and VR experiences. LGC’s fees for providing Event Planning and Execution Services for an event is negotiated with the client on a case-by-case basis, depending on the scale and length of the event, the number of employees and independent contractors involved, and the desired effect of the event. |

| · | Film Production Services. LGC Film Production Services include investment in films and TV programs and their distribution in movie theaters or through online platforms. |

| · | Movie Theater Operating Business. LGC invests in and operates movie theaters in China. LGC currently operates three movie theaters in Shenyang with a total of 17 screens. The operating of our own movie theaters will further enhance both our Multi-Channel Advertising Business and Film Production Business. |

S-4

| · | 5G & AI Information Distribution Platform. LGC is investing in and developing a 5G & AI information distribution platform (the “Platform”) to integrate big data of urban cities, enhance effective interaction between consumers and merchants, and boost China’s digital economy. The Platform will feature integration of big platforms, systems, and services, as well as decision making through big data. Once completed, it will be an intelligent information publishing platform that utilizes a unified government network as the channel, a unified cloud data center as the carrier, and a unified information security protection feature as the safeguard. In addition, the Platform will mainly focus on facilitating information sharing, interconnectivity, and business collaboration. |

Corporate Information

On January 5, 2015, we established a holding company, ATIF, under the laws of the British Virgin Islands. ATIF owns 100% of ATIF HK, a Hong Kong company incorporated on January 6, 2015 (formerly known as China Elite International Holdings Limited).

On May 20, 2015, WFOE (Huaya Consultant (Shenzhen) Co., Ltd.) was incorporated pursuant to the PRC law as a wholly foreign owned enterprise. ATIF HK holds 100% of the equity interests in WFOE.

On November 3, 2015, our VIE, Qianhai, was incorporated pursuant to the PRC law as a limited company. We operate our going public financial consulting services through Qianhai.

On December 11, 2015, Qianhai established a wholly-owned subsidiary, Qianhai Asia Era (Shenzhen) International Fund Management Co., Ltd. (“Asia Era Fund”). We disposed of our entire equity ownership in Asia Era Fund on September 19, 2018.

As of the date of this prospectus supplement, Qianhai has two shareholders and both are PRC residents. Ronghua Liu, as trustee, is holding 4,925,000 shares (the “Beneficial Shares”), representing 98.5% of outstanding shares of Qianhai, for their beneficial owner, Qiuli Wang (the “Beneficiary”), pursuant to a trust deed entered into and executed under the PRC law on December 11, 2017. The trust deed stipulates, among other customary provisions, that (1) all dividends and interest accrued on the Beneficial Shares shall be payable as directed by the Beneficiary in writing, and (2) the Beneficiary may transfer the Beneficial Shares to a third-party company or individual as required.

In August 2018, Qianhai launched AT Consulting Center to provide financial consulting services.

On September 20, 2018, ATIF HK acquired and started operating CNNM, a news and media platform based in Hong Kong.

On March 7, 2019, ATIF HK changed its name from ASIA TIMES INTERNATIONAL FINANCE LIMITED to ATIF LIMITED. On March 8, 2019, ATIF changed its name from ASIA TIMES HOLDINGS LIMITED to ATIF HOLDINGS LIMITED.

On April 29, 2019, we completed our IPO of 2,074,672 Ordinary Shares at a public offering price of $5.00 per share. Our Ordinary Shares commenced trading on the NASDAQ Capital Market on May 3, 2019, under the symbol “ATIF.”

Pursuant to PRC law, each entity formed under PRC law shall have a business scope as submitted to the Administration of Industry and Commerce or its local counterpart. Depending on the particular business scope, approval by the relevant competent regulatory agencies may be required prior to commencement of business operations. WFOE’s business scope is to primarily engage in investment consulting, business management consulting, corporate image engineering, and communication product development. Since the sole business of WFOE is to provide Qianhai with technical support, consulting services, and other management services relating to its day-to-day business operations and management in exchange for a service fee approximately equal to Qianhai’s net income after the deduction of the required PRC statutory reserve, such business scope is appropriate under PRC law. Qianhai, on the other hand, is also able to, pursuant to its business scope, provide financial consulting businesses. Qianhai is approved by the competent regulatory body in Shenzhen that regulates financial consulting businesses, to engage in financial consulting business operations.

Mr. Ronghua Liu was the majority shareholder of Qianhai prior to our IPO. However, we control Qianhai through VIE contractual arrangements.

S-5

On April 22, 2020, we acquired approximately 51.2% of the issued and outstanding ordinary shares of LGC. LGC operates through its VIE, LMG, and its subsidiaries. LMG was established in 2013 as a limited company pursuant to PRC laws, and began generating revenue in 2014. Since the inception of LMG, LGC has consolidated its business practice, consistently expanded our business operation beyond Event Planning and Execution Services to include Multi-Channel Advertising Services and more recently in 2017, started to invest in films and TV programs production and distribution. LGC established a wholly owned subsidiary of LMG, Horgos Xinyuezhong Film Media Co., Ltd. in 2017 pursuant to PRC laws, which was subsequently dissolved on April 17, 2019. The related parties of LMG also established companies pursuant to PRC laws, including Shenyang Tianniu Media Co., Ltd. in 2013, Yuezhong Media (Dalian) Co., Ltd. in 2016, Yuezhong (Beijing) Film Co., Ltd. in 2017, and Harbin Yuechuzhong Media Co., Ltd., Shenyang Xiagong Hotel Management Co., Ltd., and Liaoning Leaping International Cinema Management Co., Ltd. in 2018. The ownership of these companies was transferred to LMG, resulting in these companies being wholly owned subsidiaries of LMG.

Pursuant to PRC laws, each entity formed under PRC law shall have a certain business scope as submitted to the Administration of Industry and Commerce or its local counterpart. Pursuant to specific business scopes, approval by the relevant competent regulatory agencies may be required prior to commencement of business operations. As such, LGC WFOE’s business scope is to primarily engage in technology development, provision of technology service, technology consulting; development of computer software and hardware, computer network technology, game software, provision of enterprise management and related consulting service, human resource consulting service and intellectual property consulting service. Since the sole business of LGC WFOE is to provide LMG with technical support, consulting services and other management services relating to its day-to-day business operations and management in exchange for a service fee approximately equal to LMG’s net income after the deduction of the required PRC statutory reserve, such business scope is necessary and appropriate under PRC laws. LMG, on the other hand, is also able to, pursuant to its business scope, provide Multi-Channel Advertising Services, Event Planning and Execution Services, and Film Production Services.

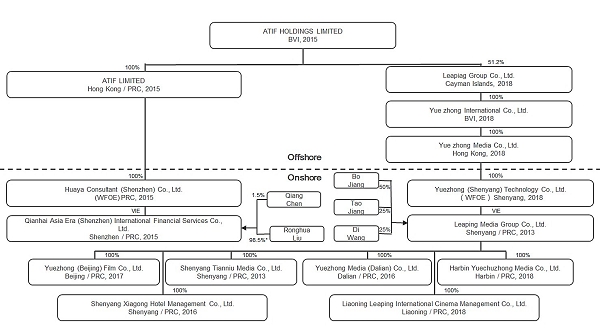

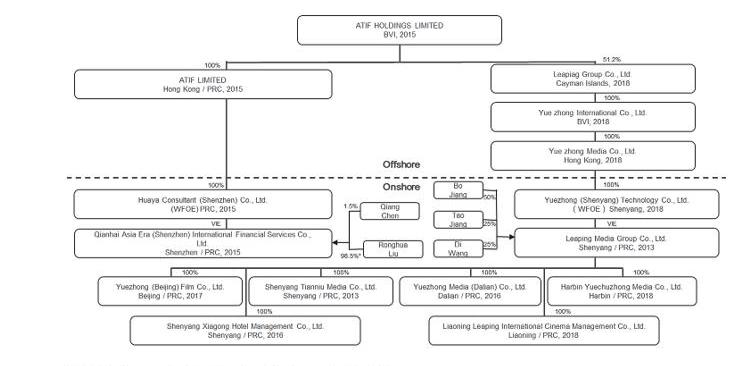

The following diagram illustrates our current corporate structure as of the date of this prospectus supplement

* 98.5% shares are held by Ronghua Liu in trust for Qiuli Wang.

Our principal executive offices are located at Room 2803, Dachong Business Centre, Dachong 1st Road, Nanshan District, Shenzhen, China, and our telephone number is (+86) 0755-8695-0818. We maintain a website at www.atifchina.com. The Company’s registered office in the British Virgin Islands is located at 4th Floor, Ellen Skelton Building, 3076 Sir Francis Drake Highway, Road Town, Tortola, British Virgin Islands VG1110. Our current website is www.atifchina.com. The information contained on our website does not constitute a part of this prospectus supplement.

S-6

| Ordinary shares Offered by Us | 4,347,826 | |

| Offering Price | $0.92 per ordinary share. | |

| Ordinary shares to be Outstanding Immediately After this Offering (1) | 51,362,500 ordinary shares (assuming the sale of all of the ordinary shares offered in this offering and excluding ordinary shares issuable upon the exercise of the Warrants to be issued in the concurrent private placement and the Placement Agent Warrants to be issued to the Placement Agent). | |

| Concurrent Private Placement of Warrants | In a concurrent private placement, we are also selling to investors in this offering Warrants to purchase up to an additional 4,347,826 ordinary shares, representing 100% of the ordinary shares being issued in this offering. The exercise price of each Warrant is $1.10 per share, and each Warrant will be exercisable immediately upon issuance and will have a term of five years from the date of issuance. The Warrants and the ordinary shares are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established trading market for the Warrants, and we do not intend to list the Warrants on any national securities exchange or nationally recognized trading system.

| |

| Use of Proceeds | We expect to use the net proceeds from this offering of $3,468,500 for working capital purposes, expanding existing businesses or acquiring or investing in businesses, debt reduction or debt refinancing, capital expenditures and other general corporate purposes. See “Use of Proceeds” on page S-18 of this prospectus supplement. | |

| Risk Factors | You should read the “Risk Factors” sections beginning on page S-11 of this prospectus supplement, accompanying prospectus and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of factors that you should read and consider before investing in our securities. | |

| Tax Considerations | You are urged to consult your own tax advisers with respect to the U.S. federal tax consequences of purchasing, owning and disposing of our ordinary shares. See “U.S. Federal Income Tax Considerations” on page S-21 of this prospectus supplement. | |

| Listing | Our ordinary shares are listed on the NASDAQ Capital Market under the symbol “ATIF.” The Warrants and the Placement Agent Warrants will not be listed for trading on any national securities exchange or nationally recognized trading system. | |

| Transfer Agent | Our transfer agent and registrar is Transhare Corporation, 2849 Executive Dr, Suite 200, Clearwater FL 33762. |

| (1) | The number of ordinary shares that will be outstanding after this offering as shown above is based on 47,014,674 ordinary shares outstanding as of November 1, 2020 and assumes the sale of all ordinary shares being offered pursuant to this prospectus supplement, and does not give effect to the exercise, if any, of the Warrants being issued in in the concurrent private placement or the Placement Agent Warrants and the following: |

S-7

| · | 260,000 ordinary shares issuable upon the exercise of warrants outstanding at an exercise price of $6.00 per share; |

| · | 4,347,826 ordinary shares issuable upon the exercise of the Warrants to be issued to investors in a private placement concurrent with this offering, at an exercise price of $1.10 per share; and |

| · | 391,304 ordinary shares issuable upon the exercise of the Placement Agent Warrants to be issued as compensation to the Placement Agent in connection with this offering, at an exercise price of $1.10 per share. |

Unless otherwise indicated, all information in this prospectus supplement assumes:

| · | no exercise of the outstanding options or warrants described above; and |

| · | no exercise of the Warrants sold in the concurrent private placement or the Placement Agent Warrants. |

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference the information we file with them. This means that we can disclose important information to you by referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by reference of such documents should not create any implication that there has been no change in our affairs since such date. The information incorporated by reference is considered to be a part of this prospectus supplement and should be read with the same care. When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC, the information incorporated by reference in this prospectus supplement is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus supplement and information incorporated by reference into this prospectus supplement, you should rely on the information contained in the document that was filed later.

We incorporate by reference the documents listed below:

| · | Our annual report on Form 20-F for the fiscal year ended July 31, 2019 filed with the SEC on December 2, 2019, or the 2019 Form 20-F; |

| · | Our current report on Form 6-K furnished with the SEC on December 26, 2019, February 12, 2020, April 8, 2020, April 23, 2020, June 11, 2020, July 20, 2020, August 4, 2020, August 7, 2020, August 27, 2020, and September 9, 2020; |

| · | The description of the securities contained in our registration statement on Form 8-A filed on April 18, 2019 pursuant to Section 12 of the Exchange Act, together with all amendments and reports filed for the purpose of updating that description; and |

| · | With respect to each offering of securities under this prospectus, all of our subsequent annual reports on Form 20-F and any report on Form 6-K that indicates that it is being incorporated by reference, in each case, that we file with the SEC on or after the date on which the registration statement is first filed with the SEC and until the termination or completion of the offering under this prospectus. |

Our 2019 Form 20-F contains a description of our business and audited consolidated financial statements with a report by our independent auditors. These financial statements are prepared in accordance with U.S. GAAP.

Unless expressly incorporated by reference, nothing in this prospectus supplement shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC. We will provide to you, upon your written or oral request, without charge, a copy of any or all of the documents we refer to above which we have incorporated in this prospectus by reference, other than exhibits to those documents unless such exhibits are specifically incorporated by reference in the documents. You should direct your requests to Fang Cheng, our chief financial officer, at Room 2803, Dachong Business Centre, Dachong 1st Road, Nanshan District, Shenzhen, China. Our telephone number at this address is +86-0755-8695-0818.

S-8

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are currently subject to periodic reporting and other informational requirements of the Exchange Act as applicable to foreign private issuers. Accordingly, we are required to file with or furnish to the SEC reports, including annual reports on Form 20-F and other information. All information filed with or furnished to the SEC can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You can request copies of these documents upon payment of a duplicating fee, by writing to the SEC. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference rooms. Additional information may also be obtained over the Internet at the SEC’s website at www.sec.gov.

We also maintain a website at www.atifchina.com, but information contained on our website is not incorporated by reference in this prospectus supplement. You should not regard any information on our website as a part of this prospectus supplement.

As a foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our executive officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we will not be required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

We have filed with the SEC a registration statement on Form F-3 relating to the securities covered by this prospectus. This prospectus supplement and any accompanying prospectus are part of the registration statement and do not contain all the information in the registration statement. You will find additional information about us in the registration statement. Any statement made in this prospectus supplement concerning a contract or other document of ours is not necessarily complete, and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the SEC for a more complete understanding of the document or matter. Each such statement is qualified in all respects by reference to the document to which it refers. You may inspect a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C., as well as through the SEC’s website.

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, any related free writing prospectus and the information incorporated by reference herein and therein may contain “forward-looking statements” within the meaning of, and intended to qualify for the safe harbor from liability established by, the United States Private Securities Litigation Reform Act of 1995. These statements, which are not statements of historical fact, may contain estimates, assumptions, projections and/or expectations regarding future events, which may or may not occur. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. In some cases, you can identify these forward-looking statements by words or phrases such as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will,” “would,” or similar expressions, including their negatives. We have based these forward looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include:

| · | Any changes in the laws of the PRC or local province that may affect our operation; |

| · | Current and future economic and political conditions; |

| · | Inflation and fluctuations in foreign currency exchange rates; |

S-9

| · | Future financial and operating results, including revenues, income, expenditures, cash balances and other financial items; |

| · | Our ability to execute our growth and expansion, including our ability to meet our goals; |

| · | Our on-going ability to obtain all mandatory and voluntary government and other industry certifications, approvals, and/or licenses to conduct our business; |

| · | Our ability to maintain effective internal control over financial reporting; |

| · | Our ability to compete in an industry with low barriers to entry; |

| · | Our ability to continue to operate through our VIE structure; |

| · | Our capital requirements and our ability to raise any additional financing which we may require; |

| · | Our ability to attract new clients, and further enhance our brand recognition; |

| · | Our ability to hire and retain qualified management personnel and key employees in order to enable us to develop our business; and |

| · | Trends and competition in the financial consulting services industry. |

The foregoing list of factors is not exclusive. You should read thoroughly this prospectus supplement, the accompanying prospectus and the documents that we reference in this prospectus supplement with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed in the section titled “Risk Factors.” Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The forward-looking statements and any related statements made in this prospectus supplement, the accompany prospectus, any related free writing prospectus and the documents incorporated by reference are made as of the date of the respective documents. The forward-looking statements obtained from third-party studies or reports are made as of the date of the corresponding study or report. We undertake no obligation, beyond that required by law, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made, even though circumstances may change in the future.

S-10

An investment in our securities is speculative and involves a high degree of risk. Therefore, you should not invest in our securities unless you are able to bear a loss of your entire investment. You should carefully consider the factors set forth under the heading “Item 3. Key Information - D. Risk Factors” in our most recently filed annual report on Form 20-F, which is incorporated in this prospectus supplement by reference, as updated by our subsequent filings under the Exchange Act, and, if applicable, in any related free writing prospectus before investing in any securities that may be offered pursuant to this prospectus supplement. If any of the events described below or in any such other document occur or the risks described herein or therein materialize, our business, financial condition, results of operations, cash flow and prospects could be materially adversely affected. In addition, risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations, our financial results and the value of our securities.

Risks Related to Our Securities and the Offering

Future sales or other dilution of our equity could depress the market price of our ordinary shares.

Sales of our ordinary shares, preferred shares, warrants, debt securities, units consisting of ordinary shares, preferred shares, warrants, or debt securities, or any combination of the foregoing securities in the public market, or the perception that such sales could occur, could negatively impact the price of our ordinary shares. We have a number of shareholders that own significant blocks of our ordinary shares. If one or more of these shareholders were to sell large portions of their holdings in a relatively short time, for liquidity or other reasons, the prevailing market price of our ordinary shares could be negatively affected.

This offering and future capital raising efforts may be dilutive to our shareholders or may depress our share price.

In order to finance our operations, we have raised funds through the issuance of ordinary shares and securities convertible into ordinary shares, we intend to do so pursuant to the offering contemplated by this prospectus supplement and may do so again in the future. This offering may have a dilutive effect on our earnings per share and/or book value per share. The actual amount of dilution, if any, cannot be determined at this time and will be based on numerous factors. In the future, we may issue ordinary shares in connection with investments or acquisitions. The number of ordinary shares issued in future offerings, including those issued in connection with an investment or acquisition, could be material. We cannot predict the size of future issuances of ordinary shares or the size or terms of future issuances of debt instruments or other securities convertible into or exercisable or exchangeable for ordinary shares, or the effect, if any, that future issuances and sales of our securities will have on the market price of our ordinary shares. Sales or issuances of substantial numbers of ordinary shares, or the perception that such sales could occur, whether in this offering or any future offering, may adversely affect the market price of our ordinary shares. With any additional sale or issuance of ordinary shares.

In addition, the issuance of additional shares of our ordinary shares, securities convertible into or exercisable for our ordinary shares, other equity-linked securities, including warrants or any combination of the securities pursuant to this prospectus will dilute the ownership interest of our shareholders and could depress the market price of our ordinary shares and impair our ability to raise capital through the sale of additional equity securities.

We may need to seek additional capital. If this additional financing is obtained through the issuance of equity securities, debt convertible into equity or options or warrants to acquire equity securities, our existing shareholders could experience significant dilution upon the issuance, conversion or exercise of such securities.

An investment in our ordinary shares and warrants to purchase ordinary shares may result in the loss of your entire investment.

An investment in our ordinary shares and warrants is speculative and may result in the loss of your entire investment. Only potential investors who are experienced in high risk investments and who can afford to lose their entire investment should consider an investment in the Company’s ordinary shares and warrants.

S-11

Our management will have broad discretion over the use of the proceeds we receive from the sale our securities pursuant to this prospectus and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion to use the net proceeds from any offerings under this prospectus, and you will be relying on the judgment of our management regarding the application of these proceeds. Except as described in any prospectus supplement or in any related free writing prospectus that we may authorize to be provided to you, the net proceeds received by us from our sale of the securities described in this prospectus will be added to our general funds and will be used for general corporate purposes. Our management might not apply the net proceeds from offerings of our securities in ways that increase the value of your investment and might not be able to yield a significant return, if any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions on how to use such proceeds.

We face business disruption and related risks resulting from the recent outbreak of the novel coronavirus 2019 (COVID-19), which could have a material adverse effect on our business plan.

Our financial consulting services to SMEs and the businesses of the SMEs could be disrupted and materially adversely affected by the recent outbreak of COVID-19. As a result of measures imposed by the China governments in affected regions, businesses and schools have been suspended due to quarantines intended to contain this outbreak. The spread of COVID-19 from China to other countries has resulted in the Director General of the World Health Organization declaring the outbreak of COVID-19 as a Public Health Emergency of International Concern (PHEIC), based on the advice of the Emergency Committee under the International Health Regulations (2005), and the Centers for Disease Control and Prevention in the U.S. issued a warning on February 25, 2020 regarding the likely spread of COVID-19 to the U.S. While the COVID-19 outbreak is still in very early stages, international stock markets have begun to reflect the uncertainty associated with the slow-down in the Chinese economy and the reduced levels of international travel experienced since the beginning of January and the significant declines in the Dow Industrial Average at the end of February and beginning of March 2020 was largely attributed to the effects of COVID-19. We are still assessing our business plans and the impact COVID-19 may have on our ability to provide financial consulting services to SMEs and to the SMEs’ businesses, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally or in our sector in particular.

In addition, COVID-19 has created substantial disruption of LGC’s operations including the suspension of all theatre operations as a result of mandatory quarantine since January 23, 2020, resulting in the cessation of substantially all revenues related to LGC’s theater business during that period. LGC is still assessing the impact of COVID-19 to its theater business and its other operations. In addition, no assurance can be given that there would not be a future outbreak of COVID-19 which may result in additional quarantine and other measures taken to try to prevent the spread of COVID-19, which may materially and adversely affect our financial condition and results of operations.

If we do not continue to satisfy The NASDAQ Stock Market continued listing requirements, our ordinary shares could be delisted.

The listing of our ordinary shares on The NASDAQ Stock Market (“Nasdaq”) is contingent upon our compliance with Nasdaq’s continued listing standards. On August 4, 2020, the Company was notified by Nasdaq that it was not in compliance with the annual meeting requirement for continued listing on Nasdaq as a result of not having held an annual meeting of stockholders within 12 months of the end of the Company’s fiscal year on July 31, 2020. On August 13, 2020, the Company submitted to Nasdaq its intention to follow home country practice in accordance with Listing Rule 5615(a)(3) and in lieu of Nasdaq’s annual meeting requirement. On August 26, 2020, it received a written notice from Nasdaq that the Company has regained compliance with the Nasdaq’s continued listing standards.

If we should fail to continue to maintain compliance with Nasdaq continued listing standards in the future, then our ordinary shares will be subject to delisting. Delisting could have a material adverse effect on our business, liquidity and on the trading of our ordinary shares. If our ordinary shares were to be delisted, then it could be quoted on the OTCQB market or on the “pink sheets” maintained by the OTC Markets Group. However, such alternatives are generally considered to be less efficient markets. Further, delisting from Nasdaq could also have other negative effects, including potential loss of confidence by partners, lenders, suppliers and employees and could also trigger various defaults under outstanding agreements. Finally, delisting of our ordinary shares could make it harder for us to raise capital and sell securities.

S-12

We are subject to litigation which may expose us to liability and require us to incur legal expenses.

On May 14, 2020, Boustead Securities, LLC (“Boustead”) filed a complaint in the United States District Court for the Southern District of New York (CV-03749) against Leaping Group Co., Ltd. and the Company. The case arises from a consulting agreement between the Company and Boustead, wherein Boustead claims that it is entitled to fees in connection with the Company’s cancellation of an $1,851,000 outstanding debt owed by Leaping Group and issuance of 9,940,002 ordinary shares to Leaping Group in exchange for a 51.2% interest in Leaping Group. Boustead claims that the Company breached that consulting agreement and is entitled to fees in connection with the Company acquiring control of Leaping Group. Boustead’s complaint alleges four causes of action against the Company including breach of contract; breach of the implied covenant of good faith and fair dealing; tortious interference with business relationships and quantum meruit. The Boustead litigation is currently in the pleadings stage. The Company has filed a motion to dismiss.

On November 4, 2019, Shenzhen Court of International Arbitration (“Shenzhen Court”) notified Qianhai Asia Era (Shenzhen) International Financial Services Co., Ltd., a limited liability company organized under the laws of the PRC, which we control via a series of contractual arrangements between WFOE and Qianhai (“Qianhai”), regarding the request for arbitration initiated by Huale Group Co., Limited (“Huale”) related to a Going Public Consulting Service Agreement dated March 2, 2017, by and between Qianhai and Huale. Huale claimed that Qianhai failed to refund a deposit of $300,000 after the parties terminated the agreement. Huale asserted its claim at $300,000 (RMB2,073,750), plus any related arbitration fees. On November 14, 2019, Qianhai submitted a counterclaim request, claiming that the $300,000 shall not be refunded since it constituted service fees for consulting services provided to Huale by Qianhai pursuant to the Going Public Consulting Service Agreement. Qianhai asserted its counterclaim for legal fees of RMB88,000, plus any related arbitration fees and travel, translation, and other expenses related to this arbitration proceeding. Qianhai intends to vigorously defend itself and pursue its counterclaim in this proceeding.

On or around September 27, 2020, the Company received an arbitration award dated September 25, 2020 issued by the Shenzhen Court of International Arbitration that Huale won the arbitration case and that Qianhai is obligated to pay back to Huale the $250,000 fee. The Company is currently exploring its options as a result of this arbitration award.

You will incur immediate dilution as a result of this offering.

If you purchase ordinary shares in this offering, you will pay more for your shares than the net tangible book value of your shares. As a result, you will an incur immediate dilution of $0.65 per share, representing the difference between the purchase price of $0.92 per share and our pro forma as adjusted net tangible book value per share after giving effect to this offering as of January 31, 2020 of $0.27. Accordingly, should we be liquidated at our book value, you would not receive the full amount of your investment.

Risks Related to LGC’s Business

LGC’s business is susceptible to fluctuations in the advertising market of China.

We conduct our Multi-Channel Advertising Business primarily in China. Our business depends substantially on the conditions of the PRC advertising market. Demand for pre-movie advertising in China has grown rapidly in the recent decade but such growth is often coupled with volatility in market conditions and fluctuation in pre-movie advertising slot prices. Fluctuations of supply and demand in China’s advertising market are caused by economic, social, political and other factors. Over the years, the Chinese government has announced and implemented various policies and measures aimed to regulate the advertising markets, prohibiting, among other things, misleading content, superlative wording, socially destabilizing content or content involving obscenities, superstition, violence, discrimination or infringement of the public interest. These measures can affect advertising clients’ eligibility to purchase advertising slots. These measures have affected and may continue to affect the conditions of China’s advertising market and cause fluctuations in advertising slot pricing and transaction volume. Furthermore, there may be situations in which advertising clients see a reduced need for marketing initiatives and reduce their spending on such initiatives, which could potentially adversely affect our results of operations. To the extent fluctuations in the advertising market adversely affect advertising transaction volumes or prices, our financial condition and results of operations may be materially and adversely affected.

S-13

Failure to maintain or enhance LGC’s brands or image could have a material and adverse effect on our business and results of operations.

We believe LGC’s “Yuezhong” brand is well-recognized among advertising clients and other film industry players such as cinema operators, film producers and advertising agencies in the local markets we operate in. LGC’s brand is integral to its sales and marketing efforts. LGC’s continued success in maintaining and enhancing its brand and image depends to a large extent on its ability to satisfy customer needs by further developing and maintaining quality of services across LGC’s operations, as well as LGC’s ability to respond to competitive pressures. If we are unable to satisfy customer needs or if LGC’s public image or reputation were otherwise diminished, our business transactions with our customers may decline, which could in turn adversely affect our results of operations.

LGC may not be able to successfully execute its strategy of expanding into new geographical markets in China, which could have a material and adverse effect on our business and results of operations.

LGC plans to expand our business into new geographical areas in China, such as first-tier, second-tier, and third-tier cities in the eastern seaboard area and central China. As China is a large and diverse market, consumer trends and demands may vary significantly by region and LGC’s experience in the markets in which it currently operate may not be applicable in other parts of China. As a result, LGC may not be able to leverage its experience to expand into other parts of China. When LGC enters new markets, it may face intense competition from companies with greater experience or an established presence in the targeted geographical areas or from other companies with similar expansion targets. In addition, LGC’s business model may not be successful in new and untested markets and markets with a different legal and business environment, such as Hong Kong and Macau. Therefore, LGC may not be able to grow its revenues in the new cities it enters into due to the substantial costs involved.

If advertising clients or the viewing public do not accept, or lose interest in, our pre-movie advertising network, we may be unable to generate sufficient cash flow from our operating activities and our prospects and results of operations could be negatively affected.

The market for pre-movie advertising networks in China is relatively new and its potential is uncertain. We compete for advertising spending with many forms of more established advertising media, such as television, print media, Internet and other types of out-of-home advertising. Our success depends on the acceptance of our pre-movie advertising network by advertising clients and agencies and their continuing and increased interest in this medium as a component of their advertising strategies. Our success also depends on the viewing public continuing to be receptive towards our media network. Advertising clients may elect not to use our services if they believe that consumers are not receptive to our network or that our network does not provide sufficient value as an effective advertising medium. Likewise, if consumers find some element of our network to be disruptive or intrusive, movie theaters may decide not to allow us to operate the film screens in movie theaters and advertising clients may view our network as a less attractive advertising medium compared to other alternatives. In that event, advertising clients may determine to reduce their spending on our network and pre-movie advertising.

Pre-Movie advertising is a relatively new concept in China and in the advertising industry generally. If LGC is not able to adequately track filmgoers’ responses to its programs, in particular, tracking the demographics of filmgoers most receptive to pre-movie advertising, LGC will not be able to provide sufficient feedback and data to existing and potential advertising clients to help it to generate demand and determine pricing. Without improved market research, advertising clients may reduce their use of pre-movie advertising and instead turn to more traditional forms of advertising that have more established and proven methods of tracking effectiveness.

If a substantial number of advertising clients lose interest in advertising on LGC’s media network for these or other reasons or become unwilling to purchase advertising time slots on our network, LGC will be unable to generate sufficient revenues and cash flow to operate its business, and our revenues, prospects and results of operations could be negatively affected.

S-14

LGC derives a large portion of its revenues from the provision of Multi-Channel Advertising Services. If there is a downturn in the film industry, LGC may not be able to diversify its revenue sources and our ability to generate revenues and our results of operations could be materially and adversely affected.

A large portion of LGC’s historical revenues and expected future revenues have been and will be generated from the provision of Multi-Channel Advertising Services, in particular through the display of advertisements on film screens before a movie starts. LGC plans to increase its investments in film and TV programs production and distribution is also closely related to the film industry.

LGC does not have any current plans to expand outside of sectors related to the film industry and enter into other sectors to diversify our revenue sources. As a result, if there were a downturn in the film industry for any reason, LGC may not be able to diversify its revenue sources and our ability to generate revenues and our results of operations could be materially and adversely affected.

One or more of our regional distributors could engage in activities that are harmful to LGC’s reputation in the industry and to its business.

As of April 30, 2020, LGC covered 13 out of the 16 cities where we provide our pre-movie advertising network through contractual arrangements with regional distributors. Under these arrangements, LGC provides its business model and operating expertise to local advertising companies in exchange for their acting as regional distributors of our pre-movie advertising services. LGC’s contractual arrangements with its regional distributors, however, do not provide LGC with control or oversight over their everyday business activities, and one or more of LGC’s regional distributors may engage in activities that violate PRC laws and regulations governing the advertising industry and advertising content, or other PRC laws and regulations generally. Some of LGC’s regional distributors may not possess all of the licenses required to operate an advertising business, or may fail to maintain the licenses they currently hold, which could result in local regulators suspending the operations of the network in those cities. In addition, although LGC has the right to review the advertising content that its regional distributors display on the portion of LGC’s pre-movie advertising network that they operate independently, LGC’s regional distributors may include advertising content on their part of the pre-movie advertising network and violate PRC advertising laws or regulations or expose them and LGC to lawsuits or result in the revocation of LGC’s business license. If any of these events occurs, it could harm LGC’s reputation in the industry.

If LGC is unable to attract advertising clients to purchase advertising time slots on its network, LGC will be unable to maintain or increase its advertising fees, which could negatively affect its ability to grow its profits.

The fees LGC charges advertising clients and agencies for time slots on its network depends on the size and quality of LGC’s network and the demand by advertising clients for advertising time on its network. LGC believes advertising clients choose to advertise on its network in part based on the size of its network and the desirability of the locations of the movie theaters LGC operates. If LGC fails to maintain or increase the number of film screens it operates on or solidify its brand name and reputation as a quality pre-movie advertising provider, advertising clients may be unwilling to purchase time on its network or to pay the levels of advertising fees LGC requires to grow its profits.

When LGC’s current pre-movie advertising network of film screens reaches saturation in the major movie theaters where it operates, LGC may be unable to offer additional time slots to satisfy all of its advertising clients’ needs, which could hamper its ability to generate higher levels of revenues and profitability over time.

When LGC’s pre-movie advertising network of film screens reaches saturation in any particular movie theater, LGC may be unable to offer additional advertising time slots to satisfy all of its advertising clients’ needs. LGC would need to increase its advertising rates for advertising in such movie theaters in order to increase its revenues. However, advertising clients may be unwilling to accept rate increases, which could hamper its ability to generate higher levels of revenues over time. In particular, the utilization rates of LGC’s advertising time slots in the movie theaters with best location are higher than those in other movie theaters and saturation of film screens in these movie theaters could have a material adverse effect on its growth prospects.

S-15

If LGC is unable to compete successfully, its financial condition and results of operations may be harmed.

In the pre-movie advertising market inside Heilongjiang and Liaoning, China, LGC believes that it currently does not have any credible competitors because it currently occupies 82% of the market share in the pre-movie advertising market in Heilongjiang and Liaoning. LGC, however, competes for overall advertising spending with other alternative media companies, such as Internet, street furniture, billboard and public transportation advertising companies, and with traditional advertising media, such as newspapers, television, magazines and radio. LGC also competes for advertising dollars spent in the pre-movie advertising industry and faces competition from new entrants into the film multimedia industry in the future. Competition in the advertising industry is primarily based on quality of services or program, brand name recognition, network size and geographic coverage, price, and range of services.

Significant competition could reduce LGC’s operating margins and profitability and result in a loss of market share. Some of LGC’s existing and potential competitors may have competitive advantages, such as significant greater brand recognition, financial, marketing or other resources and may be able to mimic and adopt our business model. Several of LGC’s competitors have significantly larger advertising networks than it does, which gives them an ability to reach a larger number of overall potential consumers and which make them less susceptible to downturns in particular sectors, such as the film industry. Significant competition will provide advertising clients with a wider range of media and advertising service alternatives, which could lead to lower prices and decreased revenues, gross margins and profits.

LGC may be subject to, and may expend significant resources in defending against, government actions and civil suits based on the content LGC provides through its pre-movie advertising network.

Civil claims may be filed against LGC for fraud, defamation, subversion, negligence, copyright or trademark infringement or other violations due to the nature and content of the information displayed on its network. If consumers find the content displayed on LGC’s network to be offensive, movie theaters may seek to hold LGC, and us, responsible for any consumer claims or may terminate their relationships with LGC. Offensive and objectionable content and legal standards for defamation and fraud in China are less defined than in other more developed countries and LGC may not be able to properly screen out unlawful content.

In addition, if the security of the content management system of LGC’s pre-movie advertising network is breached and unauthorized images, text or audio sounds are displayed on its network, viewers or the PRC government may find these images, text or audio sounds to be offensive, which may subject LGC to civil liability or government censure despite LGC’s efforts to ensure the security of its content management system. Any such event may also damage LGC’s reputation. If LGC’s advertising viewers do not believe LGC’s content is reliable or accurate, LGC’s business model may become less appealing to viewers in China and its advertising clients may be less willing to place advertisements on LGC’s network.

LGC has no control over theater chain companies and LGC’s Movie Theater Operating Business may be adversely affected if its access to films is limited or delayed.

In China, film production and distribution entities provide films directly to theater chain companies. Operators of movie theaters lack opportunities to negotiate directly with the film production and distribution entitles for purposes of movie screening. For a movie theater to get the license to screen any movies, it is required to join an existing theater chain or establish its own theater chain. Therefore, we rely on theater chain companies, over whom we have no control, for the films that we exhibit. Although LGC has entered into Theater Chain Agreements with Liaoning North Cinema Line Co., Ltd., according to which the theater chain company will provide LGC with a certain number of films each year. LGC cannot decide which particular films would be provided to it or whether the films provided to it are popular at the moment of exhibition. If the theater chain that LGC has joined could not obtain licenses for first-run exhibition of popular films, LGC’s access to such films would be limited or delayed and LGC’s business may be adversely affected. To the extent that LGC is unable to obtain the license for the exhibition of a popular film in its theaters, LGC’s operating results may be adversely affected.

S-16

LGC’s Movie Theater Operating Business depends on film production and performance.

LGC’s ability to operate successfully depends upon the availability, diversity, and appeal of films, its ability to obtain licensed films, and the performance of such films in our markets. The most attended films are usually released during the summer, the calendar year-end holidays, and other holidays, making LGC’s Movie Theater Operating Business highly seasonal. Poor performance of, or any disruption in the production of these films (including by reason of a strike or lack of adequate financing), or a reduction in the marketing efforts of the major film studios, could hurt LGC’s business and results of operations. Conversely, the successful performance of these films, particularly the sustained success of any one film, or an increase in effective marketing efforts of the major film studios, may generate positive results for LGC’s business and operations in a specific fiscal quarter or year that may not necessarily be indicative of, or comparable to, future results of operations.

LG’s movie theaters are subject, at times, to intense competition.

LGC movie theaters are subject to varying degrees of competition in the geographic areas in which it operates. Competitors may be national circuits, regional circuits, or smaller independent exhibitors. Competition among theater exhibition companies is often intense with respect to the following factors:

| · | Attracting patrons. The competition for patrons is dependent upon factors such as the availability of popular films, the location and number of theaters and screens in a market, the comfort and quality of the theaters, and pricing. Competitors have built or may be planning to build theaters in certain areas where LGC operates, which could result in excess capacity and increased competition for patrons. |

| · | Licensing films. LGC believes that the principal competitive factors with respect to film licensing include licensing terms, number of seats and screens available for a particular picture, revenue potential, and the location and condition of an exhibitor’s theaters. |

| · | New sites and acquisitions. LGC must compete with exhibitors and others in our efforts to locate and acquire attractive new and existing sites for our theaters. There can be no assurance that LGC will be able to acquire such new sites or existing theaters at reasonable prices or on favorable terms. Moreover, some of these competitors may be stronger financially than LGC. As a result of the foregoing, LGC may not succeed in acquiring theaters or may have to pay more than LGC would prefer to make an acquisition. |

The theatrical exhibition industry also faces competition from other forms of out-of-home entertainment, such as concerts, amusement parks, and sporting events and from other distribution channels for filmed entertainment, such as cable television, pay-per-view, and home video systems, and from other forms of in-home entertainment.

An increase in the use of alternative film delivery methods or other forms of entertainment may drive down the attendance of LGC’s theaters and limit its ticket prices.

LGC competes with other film delivery methods, including network, syndicated cable and satellite television, and DVDs, as well as video-on-demand, pay-per-view services, and downloads via the Internet. LGC also competes for the public’s leisure time and disposable income with other forms of entertainment, including sporting events, amusement parks, live music concerts, live theater, and restaurants. An increase in the popularity of these alternative film delivery methods and other forms of entertainment could reduce attendance at LGC’s theaters, limit the prices LGC can charge for admission, and materially adversely affect our business and results of operations.

General political, social, and economic conditions can reduce the attendance of our movie theaters.

LGC’s success depends on general political, social, and economic conditions and the willingness of consumers to spend money at movie theaters. If going to films becomes less popular or consumers spend less on concessions, LGC’s operations could be adversely affected. In addition, LGC’s operations could be adversely affected if consumers’ discretionary income falls as a result of an economic downturn. Geopolitical events, including the threat of domestic terrorism or cyber attacks, could cause people to avoid our theaters or other public places where large crowds are in attendance. In addition, due to LGC’s concentration in certain markets, natural disasters such as hurricanes or earthquakes in those markets could adversely affect our overall results of operations.

S-17

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our cash and capitalization (including indebtedness and stockholders’ equity):

| · | on an actual basis as of January 31, 2020; and | |

| · | on an adjusted basis to give effect to an aggregate of 4,347,826 ordinary shares sold at a public offering price of $0.92 for aggregate gross proceeds of approximately $4,000,000, less commissions and estimated aggregate offering expenses. |

The amounts shown below are unaudited. The information in this table should be read in conjunction with and is qualified by reference to our consolidated financial statements and notes thereto and other financial information incorporated by reference into this prospectus supplement and the accompanying prospectus.

As at January 31, 2020 (Unaudited) | |||||||

| Actual | As Adjusted | ||||||

| Total Liabilities | $ | 2,042,942 | $ | 2,042,942 | |||

| Shareholders’ Equity | |||||||

| Ordinary shares, $0.001 par value, 100,000,000 shares authorized, 37,074,672 shares issued and outstanding as of January 31, 2020; 41,422,498 issued and outstanding pro forma | $ | 37,075 | $ | 41,423 | |||

| Additional paid-in capital | $ | 9,492,893 | $ | 13,488,003 | |||

| Statutory reserve | $ | 355,912 | $ | 355,912 | |||

| Accumulated deficit | $ | (1,655,578 | ) | $ | (1,655,578 | ) | |

| Accumulated other comprehensive loss | $ | (117,024 | ) | $ | (117,024 | ) | |

| Total Stockholders’ Equity | $ | 8,113,278 | $ | 12,112,736 | |||

| Total Capitalization and Indebtedness | $ | 10,156,220 | $ | 14,155,678 | |||

The above table does not include any potential proceeds from the exercise of the Warrants being issued in the concurrent private placement this offering, the Placement Agent Warrants; and any outstanding warrants. In addition, the above table does not reflect 9,940,002 ordinary shares issued by the Company in connection with the acquisition of LGC in April 2020.