- ZBAI Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-3 Filing

ATIF (ZBAI) S-3Shelf registration

Filed: 21 Dec 22, 1:09pm

As filed with the Securities and Exchange Commission on December 21, 2022

Registration No. 333-[ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ATIF HOLDINGS LIMITED

(Exact name of registrant as specified in its charter)

| British Virgin Islands | Not Applicable | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

25391 Commercentre Dr., Ste 200,

Lake Forest, CA 92630

308-888-8888

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jun Liu

Chief Executive Officer

ATIF Holdings Limited

25391 Commercentre Dr., Ste 200,

Lake Forest, CA 92630

308-888-8888

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

Huan Lou, Esq.

David Manno, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

(212) 930-9700

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plants, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ Large accelerated filer | ☒ Non-accelerated filer |

| ☐ Accelerated filer | ☒ Smaller reporting company |

| ☒ Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement relating to these securities that has been filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated December 21, 2022

PROSPECTUS

$100,000,000

ATIF Holdings Limited

Ordinary Shares

Preferred shares

Warrants

Rights

Units

ATIF Holdings Limited, a British Virgin Islands corporation (“ATIF BVI”), may from time to time, in one or more offerings at prices and on terms that ATIF BVI may determine at the time of each offering, sell ordinary shares, preferred shares, warrants to purchase ordinary shares, rights to purchase ordinary shares, or a combination of these securities, or units composed of any combination of our ordinary shares, preferred shares, rights and warrants, for an aggregate initial offering price of up to $100,000,000. This prospectus describes the general manner in which our securities may be offered using this prospectus. Each time ATIF BVI offers and sells securities, ATIF BVI will provide you with a prospectus supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

ATIF BVI’s ordinary shares, par value US$0.001 per share (“ordinary shares”) are listed on the Nasdaq Capital Market under the symbol “ATIF.” On December 19, 2022, the closing price of ATIF BVI’s ordinary shares was $1.84 per share. As of the date of this prospectus, none of the other securities that ATIF BVI may offer by this prospectus is listed on any national securities exchange or automated quotation system.

As of December 5, 2022, the aggregate market value of ATIF BVI’s outstanding ordinary shares held by non-affiliates is approximately $6,246,622, based on 9,627,452 ordinary shares issued and outstanding as of December 5, 2022, of which 4,359,122 shares were held by non-affiliates, and based on the closing price of our ordinary shares of $1.433 per share on December 5, 2022. ATIF BVI has not sold any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million.

The securities offered by this prospectus involve a high degree of risks. ATIF BVI is a holding company incorporated in British Virgin Islands. As a holding company with no material operations of its own, ATIF BVI conducts a substantial amount of its operations through its subsidiaries in U.S. We conduct our operations in the U.S. through our 100% ownership interest in ATIF USA, a California corporation and 76.6% limited partnership interest in ATIF-1, L.P., a Delaware limited partnership. ATIF USA also holds a 100% membership interest in ATIF-1 GP, LLC, a Delaware Limited Liability Company.

Since our inception in 2015, no transfers, dividends, or distributions to U.S. investors have been made to date.

Our ordinary shares may be prohibited from trading on a national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable Act (the “HFCAA”) if the Public Company Accounting Oversight Board (“PCAOB”) determines that it is unable to inspect or fully investigate our auditor and as a result the exchange where our securities are traded may delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which, if signed into law, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to inspect or investigate completely certain named registered public accounting firms headquartered in mainland China and Hong Kong. Our independent registered public accounting firm is headquartered in Denver, Colorado and has been inspected by the PCAOB on a regular basis and as such, it is not affected by or subject to the PCAOB’s Determination Report.

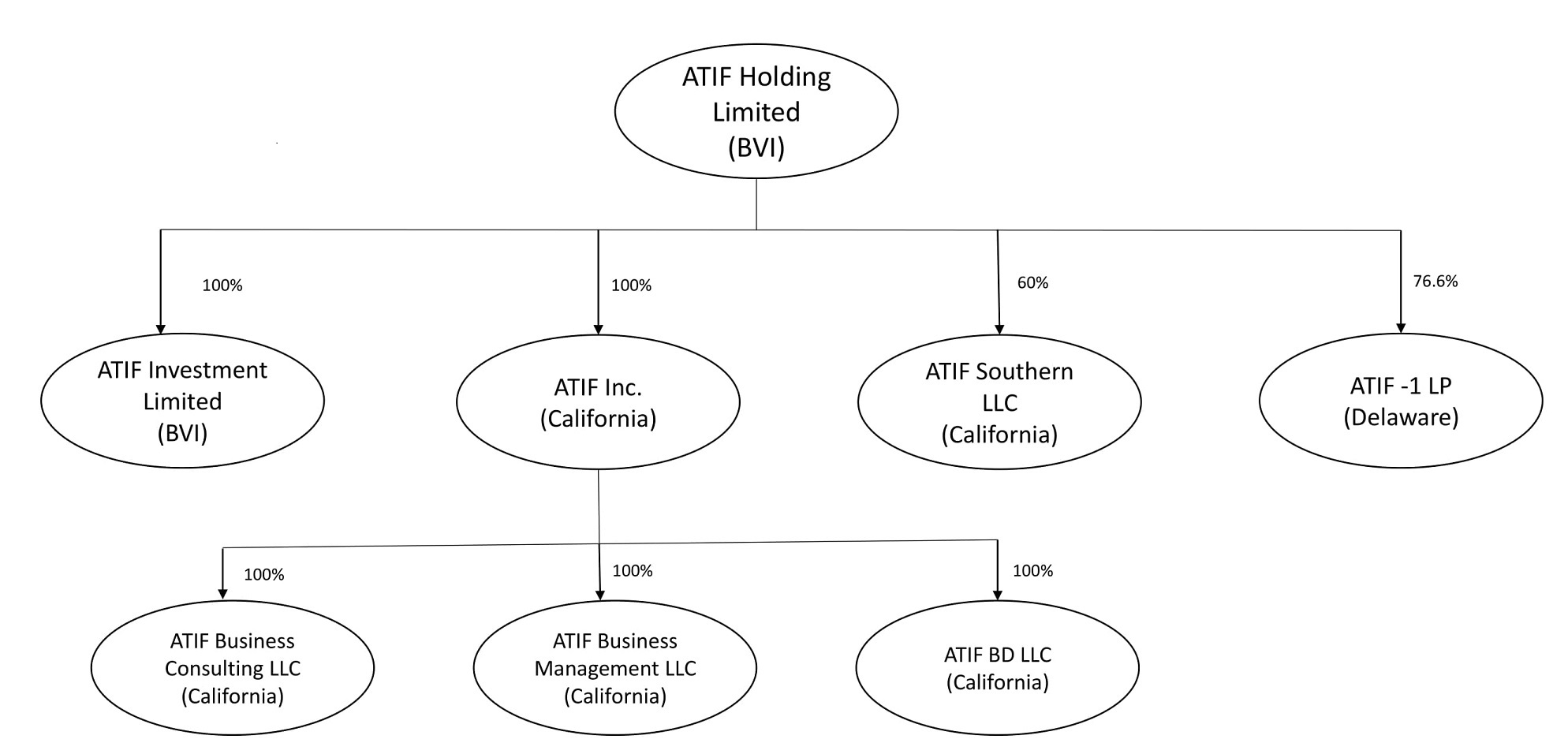

ATIF BVI is a holding company incorporated in British Virgin Islands. You will be purchasing the ordinary shares of ATIF BVI, the holding company with U.S. and offshore subsidiaries and affiliates pursuant to this registration statement. You are not directly investing in any of our Affiliated Entities. “ATIF USA” means ATIF Inc., a California corporation and a wholly-owned subsidiary of ATIF BVI. “ATIF Investment” shall hereinafter refer to ATIF Investment Limited, a BVI company and wholly-owned subsidiary of ATIF BVI. “ATIF LP” shall hereinafter refer to ATIF -1, L.P., a Delaware limited partnership and majority-owned subsidiary of ATIF BVI. “ATIF BD” shall hereinafter refer to ATIF BD LLC, a California limited liability company and wholly-owned subsidiary of ATIF USA. ATIF Southern US, LLC (“ATIF Southern”), a California limited liability company is a majority-owned subsidiary of ATIF BVI. ATIF Business Consulting LLC, a California limited liability company (“ATIF Consulting”) is a wholly-owned subsidiary of ATIF USA. ATIF Business Management LLC, a California limited liability company (“ATIF Management”), is a wholly-owned subsidiary of ATIF USA. All references to the “we,” “us,” “our,” “Company,” “Group,” “registrant” or similar terms used in this registration statement refer to ATIF BVI, ATIF USA, ATIF Investment, ATIF LP, ATIF Southern, ATIF Consulting, ATIF Management, and ATIF BD, unless the context otherwise indicates. “Affiliated Entities” shall refer to the ATIF USA, ATIF Southern, ATIF Consulting, ATIF Management, ATIF Investment, ATIF LP, and ATIF BD.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

ATIF BVI may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are involved in the sale of the securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus supplement. ATIF BVI can sell the securities through agents, underwriters, or dealers only with the delivery of a prospectus supplement describing the method and terms of the offering of such securities. See “Plan of Distribution.”

This prospectus is dated , 2022

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson, or other person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities by anyone in any jurisdiction in which such offer or solicitation is not authorized, or in which the person is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

i

This prospectus is part of a registration statement that ATIF BVI filed with the Securities and Exchange Commission, or the “SEC,” using a “shelf” registration process. Under this shelf registration process, ATIF BVI may sell any combination of the securities described in this prospectus in one of more offerings up to a total dollar amount of $100,000,000. This prospectus describes the general manner in which our securities may be offered by this prospectus. Each time ATIF BVI sells securities, ATIF BVI will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update, or change information contained in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement that contains specific information about the terms of the securities being offered may also include a discussion of certain U.S. federal income tax consequences and any risk factors or other special considerations applicable to those securities. To the extent that any statement that ATIF BVI make in a prospectus supplement is inconsistent with statements made in this prospectus or in documents incorporated by reference in this prospectus, you should rely on the information in the prospectus supplement. You should carefully read both this prospectus and any prospectus supplement together with the additional information described under “Where You Can Find Additional Information” before buying any securities in this offering.

Other Pertinent Information

ATIF BVI is a holding company incorporated in British Virgin Islands. You will be purchasing the ordinary shares of ATIF BVI, the holding company with U.S. and offshore subsidiaries and affiliates pursuant to this registration statement. You are not directly investing in any of our Affiliated Entities.

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| ● | “ATIF BVI” shall hereinafter refer to ATIF Holdings Limited, a British Virgin Islands corporation. | |

| ● | “ATIF USA” shall hereinafter refer to ATIF Inc., a California corporation and a wholly-owned subsidiary of ATIF BVI. | |

| ● | “ATIF Investment” shall hereinafter refer to ATIF Investment Limited, a BVI company and a wholly-owned subsidiary of ATIF BVI. | |

| ● | “ATIF LP” shall hereinafter refer to ATIF -1, L.P., a Delaware limited partnership and a majority-owned subsidiary of ATIF BVI. | |

| ● | “ATIF BD” shall hereinafter refer to ATIF BD LLC, a California limited liability company and a wholly-owned subsidiary of ATIF USA. | |

| ● | “ATIF Southern” shall hereinafter refer to ATIF Southern US, LLC, a California LLC and a majority-owned subsidiary of ATIF BVI. | |

| ● | “ATIF Consulting” shall hereinafter refer to ATIF Business Consulting LLC, a California LLC and a wholly-owned subsidiary of ATIF USA. | |

| ● | “ATIF Management” shall hereinafter refer to ATIF Business Management LLC, a California LLC and wholly-owned subsidiary of ATIF USA. | |

| ● | “we,” “us,” “Company,” “Group,” or the “registrant” or similar terms used in this registration statement refer to ATIF BVI, ATIF USA, ATIF Investment, ATIF LP, ATIF Southern, ATIF Consulting, ATIF Management, and ATIF BD, unless the context otherwise indicates. | |

| ● | “Affiliated Entities” shall refer to the ATIF USA, ATIF Southern, ATIF Consulting, ATIF Management, ATIF Investment, ATIF LP, and ATIF BD. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” These statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets, or future development and/or otherwise are not statements of historical fact.

All statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” or similar expressions or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements are made based on management’s beliefs, estimates, and opinions on the date the statements are made and ATIF BVI undertakes no obligation to update forward-looking statements if these beliefs, estimates, and opinions or other circumstances should change, except as may be required by applicable law. Although ATIF BVI believes that the expectations reflected in the forward-looking statements are reasonable, ATIF BVI cannot guarantee future results, levels of activity, performance, or achievements.

1

Overview

We are a British Virgin Islands business company. We are a business consulting company providing financial consulting services to small and medium-sized enterprises (“SMEs”) and prior to August 1, 2022, our Affiliated Entity ATIF USA, managed a private equity fund with approximately $1.3 million assets under management (“AUM”). Since our inception in 2015, the main focus of our consulting business has been providing comprehensive going public consulting services designed to help SMEs become public companies on suitable stock markets and exchanges. Our goal is to become an international financial consulting company with clients and offices throughout North America and Asia. In order to expand our business with a flexible business concept and reach our goal of high growth revenue and strong profit growth, on January 4, 2021, we opened an office in California, USA, through our wholly owned subsidiary ATIF USA. Our clients located within United States are serviced by ATIF USA. ATIF BVI relies on a professional service team, who is rich in business consulting experiences, extensive social relations, and international integrated services, to make the IPO process as easy as possible for its clients. We operate with competitive fee schedules and in the cases of clients with attractive financial performance and/or great growth potential, we would offer the option of paying no fees upfront.

To mitigate the potential risks arising from the PRC government provision of new guidance to and restrictions on China-based companies raising capital offshore, we decided to divest our PRC subsidiaries. As of May 31, 2022, we completed the transfer of our equity interest in ATIF Limited, a Hong Kong corporation (“ATIF HK”) and Huaya Consulting (Shenzhen) Co., Ltd., corporation formed under the laws of the PRC (“Huaya”) to Mr. Pishan Chi, our former director and CEO, for no consideration.

We have primarily focused on helping clients going public on the OTC markets and national stock exchanges in the U.S.

Recent Developments

On January 4, 2021, we announced the relocation of our operating headquarter to California, USA, through our wholly owned subsidiary ATIF USA. As part of this relocation, we transitioned our services from the variable interest entity (“VIE”), Qianhai Asia Times (Shenzhen) International Financial Services Co., Ltd. (“Qianhai”), to ATIF USA and Huaya by terminating the VIE agreements between the Company and Qianhai on February 3, 2021. We did this to simplify the management chain and improve management control, with the goal of lowering costs. We believe that this streamlined management model and strategic partnership strategy is in line with the current fast-changing and competitive business environment and will provide us with strong growth capability. The termination of the VIE agreement with Qianhai did not adversely affect Huaya, our business, financial condition, and results of operations.

On January 14, 2021, the Company entered into the sales and purchase agreement (the “Sales and Purchase Agreement”) with the majority shareholders of Leaping Group Co., Ltd. (“LGC”) consisting of Jiang Bo, Jiang Tao and Wang Di (collectively the “LGC Buyers”) to sell our 51.2% equity interest in LGC. Pursuant to the Sales and Purchase Agreement, the Company sold 10,217,230 ordinary shares of LGC in exchange for (i) 5,555,548 ordinary shares of the Company owned by the LGC Buyers, and (ii) a cash payment of US$2,300,000 payable by January 14, 2023 at an interest rate of 10% per annum. As of the date of this prospectus, the 5,555,548 ordinary shares owned by the LGC Buyers have been returned to the Company and the $2.3 million cash payment has not yet been received from the LGC Buyers. The Company recognized an estimated loss of approximately $6.1 million from this transaction, which were reflected in the pro forma financial information as included in the Company’s form 6-K as filed with SEC on February 4, 2021, and was recognized in the audited financial statements and included in our annual report for the year ended July 3, 2022.

As a result of termination of the VIE agreements and sale of all our equity interests in LGC, we currently do not have a VIE structure.

2

On February 16, 2021, we established ATIF-1, LP (“ATIF LP”) as a private equity fund, with ATIF USA as the investment manager and ATIF-1 GP, LLC (“ATIF GP”), a Delaware limited liability company, as the general partner of ATIF LP. As of July 31, 2022, we own a 76.6% interest in ATIF LP as a limited partner. As of July 31, 2022, ATIF LP had approximately $1.3 million assets under management (“AUM”). ATIF LP’s investment strategy involves directional long and short investments in equity securities, primarily issued by large cap U.S. companies, and American Depositary Receipts (“ADRs”) related to Chinese companies of various sizes, including private companies. Due to significant volatility in stock market, the private equity fund lost $1.5 million in fiscal year 2022 as compared to gain $0.2 million in fiscal year 2021. On August 1, 2022, ATIF USA entered into and closed a sales and purchase agreement (the “ATIF GP Agreement”) with Asia Time (HK) International Finance Service Limited (the “Buyer”) pursuant to which ATIF USA sold all of its membership interests in ATIF GP to the Buyer for cash consideration of US$50,000. Upon the closing of the Agreement on August 1, 2022, ATIF GP is no longer our subsidiary and ATIF USA ceased to be the investment manager of ATIF LP.

On August 23, 2021, we completed a five (5) for one (1) reverse stock split of our issued and outstanding ordinary shares.

On December 22, 2021, we established ATIF BD which is engaged in consultancy and information technology support services.

On April 25, 2022, we established ATIF Investment which is engaged in consultancy and information technology support services.

On May 31, 2022, we completed the transfer of our equity interest in ATIF HK and Huaya to Mr. Pishan Chi, our former director and CEO, for $nil consideration. The transfer of equity interest was to mitigate the potential risks arising from the PRC government provision of new guidance to and restrictions on China-based companies raising capital offshore.

On October 3, 2022, we established ATIF Southern which is engaged in equity investment business in Texas.

On October 6, 2022, we established ATIF Consulting which is engaged in IPO consulting services in North America.

On October 7, 2022, we established ATIF Management which plans to provide comprehensive services, such as investors’ relationships and secretarial services in North America in future.

Corporate Structure

The following diagram illustrates our current corporate structure:

3

Competitive Strengths

We believe that the following strengths enable us to stand out in the financial service industry and differentiate us from our competitors:

Experienced and Highly Qualified Team

We have a highly qualified professional service team with extensive experience in going public consulting services. Our professional team members have an average of five years of experience in their respective fields of international finance, capital market, cross-border and domestic listing services, and marketing. The majority of the members of our team previously worked in the technology or finance industries. We highly value members of our qualified professional team and are on the constant lookout for new talents to join our team.

Recognition and Reputation Achieved from Our Previous Success

Since our inception in 2015, we have successfully helped eight clients to be quoted on the U.S. OTC markets and one client listed on the U.S Nasdaq market, respectively. We believe we are one of the few going public consulting service providers that possess the necessary resources and expertise to provide comprehensive personalized one-stop going public consulting services to clients.

Long-Term Cooperation Relationship with Third-Party Professional Providers

We have established long-term professional relationships with a group of well-known third-party professional providers both domestically and in the U.S., such as investment banks, certified public accounting firms, law firms, and investor relations agencies, whose services and support are necessary for us to provide high-quality one-stop going public consulting service to our clients. It took us years of hard work to demonstrate to these professional organizations that we are a worthy partner capable of providing high-quality professional services that conforms to their high standards. As a result, our clients are able to gain direct access to and obtain high-quality professional services from our third-party professional providers.

COVID-19 Impact

The COVID-19 pandemic has resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines, and travel bans, intended to control the spread of the virus. Even though the COVID-19 situation is now normalizing internationally, we are continuing to assess our business plans and the impact COVID-19 may have on our ability to provide financial consulting services to SMEs and to the SMEs’ businesses, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from the spread of COVID-19 or its consequences, including downturns in business sentiment generally or in our sector in particular. In addition, no assurance can be given that there would not be a future outbreak of COVID-19 which may result in additional quarantine and other measures taken to try to prevent the spread of COVID-19, which may materially and adversely affect our financial condition and results of operations.

Recent Regulatory Development

We are subject to a wide variety of complex laws and regulations in the United States and other jurisdictions in which we operate. The laws and regulations govern many issues related to our business practices, including those regarding consumer protection, worker classification, wage and hour, sick pay and leaves of absence, anti-discrimination and harassment, whistleblower protections, background checks, privacy, data security, intellectual property, health and safety, environmental, competition, fees and payments, pricing, product liability and disclosures, property damage, communications, employee benefits, taxation, unionization and collective bargaining, contracts, arbitration agreements, class action waivers, terms of service, and accessibility of our website.

These laws and regulations are constantly evolving and may be interpreted, applied, created, superseded, or amended in a manner that could harm our business. These changes may occur immediately or develop over time through judicial decisions or as new guidance or interpretations are provided by regulatory and governing bodies, such as federal, state and local administrative agencies. As we expand our business into new markets or introduce new features or offerings into existing markets, regulatory bodies or courts may claim that we are subject to additional requirements, or that we are prohibited from conducting business in certain jurisdictions. This section summarizes the principal regulations applicable to our business.

4

Regulation on Intellectual Property Rights

Regulations on trademarks

The Trademark Law of the People’s Republic of China was adopted at the 24th meeting of the Standing Committee of the Fifth National People’s Congress on August 23, 1982. Three amendments were made on February 22, 1993, October 27, 2001, and August 30, 2013, respectively. The last amendment was implemented on May 1, 2014. The regulations on the implementation of the trademark law of the People’s Republic of China were promulgated by the State Council of the People’s Republic of China on August 3, 2002, and took effect on September 15, 2002. It was revised on April 29, 2014 and April 23, 2019. The PRC Trademark Office under the State Administration of Market Regulation handles trademark registrations and grants a term of 10 years to registered trademarks and another 10 years if requested upon expiration of the first or any renewed 10-year term. Trademark license agreements must be filed with the PRC Trademark Office for record. The PRC Trademark Law has adopted a “first-to-file” principle with respect to trademark registration. Where a trademark to be registered is identical or similar to another trademark which has already been registered or been subject to a preliminary examination and approval for use on the same kind of or similar goods or services, the application for registration of such trademark may be rejected. Any person applying for the registration of a trademark may not prejudice the existing right first obtained by others, nor may any person register in advance a trademark that has already been used by another party and has already gained a “sufficient degree of reputation” through such party’s use. After receiving an application, the PRC Trademark Office will make a public announcement if the relevant trademark passes the preliminary examination. During the three months after this public announcement, any person entitled to prior rights and any interested party may file an objection against the trademark. The PRC Trademark Office’s decisions on rejection, objection, or cancellation of an application may be appealed to the PRC Trademark Review and Adjudication Board, whose decision may be further appealed through judicial proceedings. If no objection is filed within three months after the public announcement or if the objection has been overruled, the PRC Trademark Office will approve the registration and issue a registration certificate, at which point the trademark is deemed to be registered and will be effective for a renewable 10-year period, unless otherwise revoked. For licensed use of a registered trademark, the licensor shall file record of the licensing with the PRC Trademark Office, and the licensing shall be published by the PRC Trademark Office. Failure of the licensing of a registered trademark shall not be contested against a good faith third party. For a detailed description of our trademark registrations, please refer to “—Intellectual Property.”

Regulations on domain names

In accordance with the Measures for the Administration of Internet Domain Names, which was promulgated by the Ministry of Industry and Information Technology (the “MIIT”) on August 24, 2017 and came into effect on November 1, 2017, the Implementing Rules of China Internet Network Information Center on Domain Name Registration, which was promulgated by China Internet Network Information Center (the “CNNIC”) on May 28, 2012 and came into effect on May 29, 2012, and the Measures of the China Internet Network Information Center on Domain Name Dispute Resolution, which was promulgated by CNNIC on September 1, 2014 and came into effect on the same date, domain name registrations are handled through domain name service agencies established under relevant regulations, and an applicant becomes a domain name holder upon successful registration, and domain name disputes shall be submitted to an organization authorized by CNNIC for resolution. Besides, the MIIT is in charge of the administration of PRC internet domain names. The domain name registration follows a first-to-file principle. Applicants for registration of domain names shall provide true, accurate, and complete information of their identities to domain name registration service institutions. In accordance with the Notice from the Ministry of Industry and Information Technology on Regulating the Use of Domain Names in Internet Information Services, which was promulgated by the MIIT on November 27, 2017 and came into effect on January 1, 2018, Internet access service providers shall verify the identity of each Internet information service provider, and shall not provide services to any Internet information service provider which fails to provide real identity information. The applicant will become the holder of such domain names upon completion of the registration procedure. As of July 31, 2020, we had completed registration of five domain names, “ipoex.com,” “chinacnnm.com,” “atifchina.com,” “atifus.com,” and “dpoex.com,” in the PRC and became the legal holder of such domain names.

PRC Laws and Regulations Relating to Foreign Exchange

General administration of foreign exchange

The principal regulation governing foreign currency exchange in the PRC is the Administrative Regulations of the PRC on Foreign Exchange (the “Foreign Exchange Regulations”), which were promulgated on January 29, 1996, became effective on April 1, 1996, and were amended on January 14, 1997, and August 1, 2008. Under these rules, RMB is generally freely convertible for payments of current account items, such as trade- and service-related foreign exchange transactions and dividend payments, but not freely convertible for capital account items, such as capital transfer, direct investment, investment in securities, derivative products, or loans unless prior approval and prior registration by competent authorities for the administration of foreign exchange is obtained and made. Under the Foreign Exchange Regulations, foreign-invested enterprises in the PRC may purchase foreign exchange under the current accounts without the approval of SAFE to pay dividends by providing certain evidentiary documents, including board resolutions, tax certificates, or for trade- and services-related foreign exchange transactions, by providing commercial documents evidencing such transactions.

5

Circular No. 75, Circular No. 37, and Circular No. 13

Circular 37 was released by SAFE on July 4, 2014, and abolished Circular 75 which had been in effect since November 1, 2005. Pursuant to Circular 37, a PRC resident should apply to SAFE for foreign exchange registration of overseas investments prior to the establishment or control of an offshore special purpose vehicle, or SPV, using his or her legitimate domestic or offshore assets or interests. SPVs are offshore enterprises directly established or indirectly controlled by domestic residents for the purpose of investment and financing by utilizing domestic or offshore assets or interests they legally hold. Following any significant change in a registered offshore SPV, such as capital increase, reduction, equity transfer or swap, consolidation or division involving domestic resident individuals, the domestic individuals shall amend the registration with SAFE. Where an SPV intends to repatriate funds raised after completion of offshore financing to the PRC, it shall comply with relevant PRC regulations on foreign investment and foreign debt management. A foreign-invested enterprise established through return investment shall complete relevant foreign exchange registration formalities in accordance with the prevailing foreign exchange administration regulations on foreign direct investment and truthfully disclose information on the actual controller of its shareholders.

If any shareholder who is a PRC resident (as determined by Circular 37) holds any interest in an offshore SPV and fails to fulfil the required foreign exchange registration with the local SAFE branches, the PRC subsidiaries of that offshore SPV may be prohibited from distributing their profits and dividends to their offshore parent company or from carrying out other subsequent cross-border foreign exchange activities. The offshore SPV may also be restricted in its ability to contribute additional capital to its PRC subsidiaries. Where a domestic resident fails to complete relevant foreign exchange registration as required, fails to truthfully disclose information on the actual controller of the enterprise involved in the return investment or otherwise makes false statements, the foreign exchange control authority may order them to take remedial actions, issue a warning, and impose a fine of less than RMB300,000 (approximately $43,000) on an institution or less than RMB50,000 (approximately $7,300) on an individual.

Circular 13 was issued by SAFE on February 13, 2015, and became effective on June 1, 2015. Pursuant to Circular 13, a domestic resident who makes a capital contribution to an SPV using his or her legitimate domestic or offshore assets or interests is no longer required to apply to SAFE for foreign exchange registration of his or her overseas investments. Instead, he or she shall register with a bank in the place where the assets or interests of the domestic enterprise in which he or she has interests are located if the domestic resident individually seeks to make a capital contribution to the SPV using his or her legitimate domestic assets or interests; or he or she shall register with a local bank at his or her permanent residence if the domestic resident individually seeks to make a capital contribution to the SPV using his or her legitimate offshore assets or interests. The qualified bank will directly examine the applications and accept registrations under the supervision of SAFE.

As of the date of this prospectus, our shareholders have not completed registrations in accordance with Circular 37, they are currently working on their registrations in the local Administration of Exchange Control. The failure of our shareholders to comply with the registration procedures may subject each of our shareholders to warnings and fines. If the registration formalities cannot be processed retrospectively, then the repatriation of the financing funds, profits, or any other interests of our shareholders obtained through special purpose vehicles, for use in China, would be prohibited. As a result, any cross-border capital flows between our PRC subsidiary and its offshore parent company, including dividend distributions and capital contributions, would be illegal

Circular 19 and Circular 16

Circular 19 was promulgated by SAFE on March 30, 2015, and became effective on June 1, 2015. According to Circular 19, foreign exchange capital of foreign-invested enterprises shall be granted the benefits of Discretional Foreign Exchange Settlement (“Discretional Foreign Exchange Settlement”). With Discretional Foreign Exchange Settlement, foreign exchange capital in the capital account of a foreign-invested enterprise for which the rights and interests of monetary contribution has been confirmed by the local foreign exchange bureau, or for which book-entry registration of monetary contribution has been completed by the bank, can be settled at the bank based on the actual operational needs of the foreign-invested enterprise. The allowed Discretional Foreign Exchange Settlement percentage of the foreign exchange capital of a foreign-invested enterprise has been temporarily set to be 100%. The RMB converted from the foreign exchange capital will be kept in a designated account and if a foreign-invested enterprise needs to make any further payment from such account, it will still need to provide supporting documents and to complete the review process with its bank.

6

Furthermore, Circular 19 stipulates that foreign-invested enterprises shall make bona fide use of their capital for their own needs within their business scopes. The capital of a foreign-invested enterprise and the RMB if obtained from foreign exchange settlement shall not be used for the following purposes

| ● | directly or indirectly used for expenses beyond its business scope or prohibited by relevant laws or regulations; |

| ● | directly or indirectly used for investment in securities unless otherwise provided by relevant laws or regulations; |

| ● | directly or indirectly used for entrusted loan in RMB (unless within its permitted scope of business), repayment of inter-company loans (including advances by a third party) or repayment of bank loans in RMB that have been sub-lent to a third party; and |

| ● | directly or indirectly used for expenses related to the purchase of real estate that is not for self-use (except for foreign-invested real estate enterprises). |

Circular 16 was issued by SAFE on June 9, 2016. Pursuant to Circular 16, enterprises registered in the PRC may also convert their foreign debts from foreign currency to RMB on a self-discretionary basis. Circular 16 provides an integrated standard for conversion of foreign exchange capital items (including but not limited to foreign currency capital and foreign debts) on a self-discretionary basis applicable to all enterprises registered in the PRC. Circular 16 reiterates the principle that an enterprise’s RMB converted from foreign currency-denominated capital may not be directly or indirectly used for purposes beyond its business scope or purposes prohibited by PRC laws or regulations, and such converted RMB shall not be provided as loans to non-affiliated entities.

Circulars 16 and 19 address foreign direct investments into the PRC, and stipulate the procedures applicable to foreign exchange settlement. As we do not plan to transfer any proceeds raised to our subsidiaries in the PRC, such proceeds would not be subject to Circular 19 or Circular 16. However, if and when circumstances require funds to be transferred to our subsidiaries in the PRC from our offshore entities, then any such transfer would be subject to Circulars 16 and 19.

Laws and Regulations Relating to Employment and Social Welfare in the U.S. and PRC

U.S. Labor and Employment Laws

Various federal and state labor laws govern our relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime pay, unemployment tax rates, workers’ compensation rates, citizenship requirements and sales taxes. Additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits such as those to be imposed by recently enacted legislation in California, increased tax reporting and tax payment requirements for employees who receive gratuities, or a reduction in the number of states that allow tips to be credited toward minimum wage requirements could harm our operating results.

The Federal Americans with Disabilities Act prohibits discrimination on the basis of disability in public accommodations and employment. Although our office is designed to be accessible to the disabled, we could be required to make modifications to our office to provide service to, or make reasonable accommodations for, disabled persons.

Labor Law of the PRC

Pursuant to the Labor Law of the PRC, which was promulgated by the Standing Committee of the NPC on July 5, 1994, with an effective date of January 1, 1995, and was last amended on December 29, 2018, and the Labor Contract Law of the PRC, which was promulgated on June 29, 2007, became effective on January 1, 2008, and was last amended on December 28, 2012, with the amendments coming into effect on July 1, 2013, enterprises and institutions shall ensure the safety and hygiene of a workplace, strictly comply with applicable rules and standards on workplace safety and hygiene in China, and educate employees on such rules and standards. Furthermore, employers and employees shall enter into written employment contracts to establish their employment relationships. Employers are required to inform their employees about their job responsibilities, working conditions, occupational hazards, remuneration, and other matters with which the employees may be concerned. Employers shall pay remuneration to employees on time and in full accordance with the commitments set forth in their employment contracts and with the relevant PRC laws and regulations. Until May 31, 2022, before we transfer all our equity interest in Huaya, Huaya has entered into written employment contracts with all its employees and performed its obligations required under the relevant PRC laws and regulations.

7

PRC Social Insurance and Housing Fund

As required under the Regulation of Insurance for Labor Injury implemented on January 1, 2004, and amended in 2010, the Provisional Measures for Maternity Insurance of Employees of Corporations implemented on January 1, 1995, the Decisions on the Establishment of a Unified Program for Pension Insurance of the State Council issued on July 16, 1997, the Decisions on the Establishment of the Medical Insurance Program for Urban Workers of the State Council promulgated on December 14, 1998, the Unemployment Insurance Measures promulgated on January 22, 1999, the Interim Regulations Concerning the Collection and Payment of Social Insurance Premiums implemented on January 22, 1999, and the Social Insurance Law of the PRC, which was promulgated by the Standing Committee of the NPC on October 28, 2010, became effective on July 1, 2011, and last amended on December 29, 2018, employers in the PRC shall provide their employees with welfare schemes covering basic pension insurance, basic medical insurance, unemployment insurance, maternity insurance, and occupational injury insurance. Huaya has deposited the social insurance fees in full for all the employees in compliance with the relevant regulations since June 2019 to May 31,2022.

In accordance with the Regulations on Management of Housing Provident Fund, which were promulgated by the State Council on April 3, 1999, and last amended on March 24, 2019, employers must register at the designated administrative centers and open bank accounts for depositing employees’ housing funds. Employer and employee are also required to pay and deposit housing funds, with an amount no less than 5% of the monthly average salary of the employee in the preceding year in full and on time.

U.S. Data Protection and Privacy Laws

California has several laws protecting the literary works read by California residents. The California Reader Privacy Act protects information about the books California residents read from electronic services. Such information cannot be disclosed except pursuant to an individual’s affirmative consent, a warrant or court order with limited exceptions, such as imminent danger of serious injury. California Education Code Section 99122 requires for-profit postsecondary educational institutions to post a social media privacy policy on their website.

The Digital Millennium Copyright Act (DMCA) provides relief for claims of circumvention of copyright protected technologies and includes a safe harbor intended to reduce the liability of online service providers for hosting, listing, or linking to third-party content that infringes copyrights of others.

The Communications Decency Act provides that online service providers will not be considered the publisher or speaker of content provided by others, such as individuals who post content on an online service provider’s website.

8

The California Consumer Privacy Act (CCPA), which went into effect on January 1, 2020, provides consumers the right to know what personal data companies collect, how it is used, and the right to access, delete, and opt out of the sale of their personal information to third parties. It also expands the definition of personal information and gives consumers increased privacy rights and protections for that information. The CCPA also includes special requirements for California consumers under the age of 16.

The California Privacy Rights Act (CPRA), Virginia Consumer Data Protection Act (CDPA) and Colorado Privacy Act (CPA) all will come into effect on January 1, 2023. These laws provide consumers with the right to know what personal data companies collect, how it is used, and the right to access, delete, and opt out of the sale of their personal information to third parties. The CPRA also includes special requirements for California consumers under the age of 16.

The Holding Foreign Companies Accountable Act

On May 20, 2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act (“HFCAA”) requiring a foreign company to certify it is not owned or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. On December 18, 2020, the Holding Foreign Companies Accountable Act or HFCAA was signed into law. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which became law in December 2020 and prohibits foreign companies from listing their securities on U.S. exchanges if the company has been unavailable for PCAOB inspection or investigation for three consecutive years. As a result of the HFCAA, trading in ATIF BVI’s securities may be prohibited if the PCAOB determines that it cannot inspect or fully investigate ATIF BVI’s auditor. Furthermore, in June 2021, the Senate passed the AHFCAA, which, if signed into law, would reduce the time period for the delisting of foreign companies under the HFCAA to two consecutive years, instead of three years.

Our independent registered public accounting firm has been inspected by the PCAOB on a regular basis and as such, it is not subject to the PCAOB Determination Report.

The recent developments would add uncertainties to our offering and we cannot assure you whether Nasdaq would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach, or experience as it relates to our audit.

9

Investing in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this prospectus. Additionally you should also consider the risks set forth below.

We depend heavily on a limited number of clients.

We have derived, and believe that we will continue to derive, a significant portion of our revenue from a limited number of clients for which we perform large projects. In addition, revenue from a large client may constitute a significant portion of our total revenue in any particular quarter. The loss of any of our large clients for any reason, including as a result of the acquisition of that client by another entity, our failure to meet that client’s expectations, the client’s decision to reduce spending on projects, or failure to collect amounts owed to us from our client could have a material adverse effect on our business, financial condition and results of operations.

We rely on information management systems and any damage, interruption or compromise of our information management systems or data could disrupt and harm our business.

We rely upon information technology systems and networks, some of which are managed by third parties, to process, transmit, and store electronic information in connection with the operation of our business. Additionally, we collect and store data that is sensitive to our company. Operating these information technology systems and networks and processing and maintaining this data, in a secure manner, are critical to our business operations and strategy. Our information management systems and the data contained therein may be vulnerable to damage, including interruption due to power loss, system and network failures, operator negligence and similar causes.

The techniques used to obtain unauthorized access, disable or degrade service or sabotage systems are constantly evolving and often are not recognized until launched against a target, or even some time after. We may be unable to anticipate these techniques, implement adequate preventative measures or remediate any intrusion on a timely or effective basis even if our security measures are appropriate, reasonable, and/or comply with applicable legal requirements. Certain efforts may be state-sponsored and supported by significant financial and technological resources, making them even more sophisticated and difficult to detect. Insider or employee cyber and security threats are also a significant concern for all companies, including ours. Given the unpredictability of the timing, nature and scope of such disruptions, we could potentially be subject to production downtimes, operational delays, other detrimental impacts on our operations or ability to provide products and services to our customers, the compromising, misappropriation, destruction or corruption of data, security breaches, other manipulation or improper use of our systems or networks, financial losses from remedial actions, loss of business or potential liability, and/or damage to our reputation, any of which could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition. Any significant compromise of our information management systems or data could impede or interrupt our business operations and may result in negative consequences including loss of revenue, fines, penalties, litigation, reputational damage, inability to accurately and/or timely complete required filings with government entities including the SEC and the Internal Revenue Service, unavailability or disclosure of confidential information (including personal information) and negative impact on our stock price.

We may not be successful in the implementation of our business strategy or our business strategy may not be successful, either of which will impede our development and growth.

We do not know whether we will be able to continue successfully implementing our business strategy or whether our business strategy will ultimately be successful. In assessing our ability to meet these challenges, a potential investor should take into account our lack of operating history, our management’s relative inexperience, the competitive conditions existing in our industry and general economic conditions. Our growth is largely dependent on our ability to successfully implement our business strategy. Our revenues may be adversely affected if we fail to implement our business strategy or if we divert resources to a business strategy that ultimately proves unsuccessful.

Our service offerings may not be accepted.

We constantly seek to modify our service offerings to the marketplace. As is typically the case evolving service offerings, anticipation of demand and market acceptance are subject to a high level of uncertainty. The success of our service offerings primarily depends on the interest of our customers. In general, achieving market acceptance for our services will require substantial marketing efforts and the expenditure of significant funds, which we may not have available, to create awareness and demand among customers.

These risks could materially affect our business, results of operation or financial condition and affect the value of our securities. Additional risks and uncertainties that are not yet identified may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment. You could lose all or part of your investment. For more information, see “Where You Can Find More Information.”

10

Unless otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus for general corporate purposes, which may include, among other things, repayment of debt, repurchases of ordinary shares, capital expenditures, the financing of possible acquisitions or business expansions, increasing our working capital and the financing of ongoing operating expenses and overhead.

DESCRIPTION OF SECURITIES TO BE REGISTERED

We may offer, from time to time, our ordinary shares, preferred shares, warrants to purchase ordinary shares, rights to purchase ordinary shares or a combination of these securities, or units consisting of a combination of any or all of these securities, in amounts we will determine from time to time, under this prospectus at prices and on terms to be determined by market conditions at the time of offering. This prospectus provides you with a general description of the securities we may offer. See “Description of Shares ,” “Description of Warrants,” “Description of Rights,” and “Description of Units,” below. Each time we offer a type or series of securities, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

| ● | Designation or classification; |

| ● | Aggregate principal amount or aggregate offering price; |

| ● | Rates and times of payment of interest or dividends, if any; |

| ● | Redemption, conversion or sinking fund terms, if any; |

| ● | Voting or other rights, if any; |

| ● | Conversion prices, if any; and |

| ● | Important federal income tax considerations. |

The prospectus supplement and any related free writing prospectus also may supplement, or, as applicable, add, update or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

The terms of any particular offering, the offering price and the net proceeds to us will be contained in the prospectus supplement, information incorporated by reference or free writing prospectus relating to such offering.

DESCRIPTION OF SHARES

We are a British Virgin Islands company with limited liability and our affairs are governed by our amended and restated memorandum and articles of association, as amended and restated from time to time, and the BVI Business Companies Act of 2004, as amended, which is referred to as the BVI Act below, and the common law of the British Virgin Islands.

We are authorized to issue up to 100,000,000,000 ordinary shares and Class A preferred shares, with a par value of $0.001 each. As of the date of this prospectus, there are 9,627,452 ordinary shares issued and outstanding. There are no Class A preferred shares outstanding. The following are summaries of material provisions of our current amended and restated memorandum and articles of association which are currently effective and the BVI Act insofar as they relate to the material terms of our ordinary shares. You should read the forms of our current memorandum and articles of association, which was filed as an exhibit to our current report on Form 6-K filed with the commission on September 8, 2021. For information on how to obtain copies of our current memorandum and articles of association, see “Where You Can Find Additional Information.”

11

Ordinary Shares

General

All of our issued ordinary shares are fully paid and non-assessable. There are no limitations imposed by our memorandum and articles of association on the rights of non-resident or foreign shareholders to hold or exercise voting rights on our ordinary shares. In addition, there are no provisions in our memorandum and articles of association governing the ownership threshold above which shareholder ownership must be disclosed.

Under the BVI Act, the ordinary shares are deemed to be issued when the name of the shareholder is entered in our register of members. If (a) information that is required to be entered in the register of members is omitted from the register or is inaccurately entered in the register, or (b) there is unreasonable delay in entering information in the register, a shareholder of the company, or any person who is aggrieved by the omission, inaccuracy or delay, may apply to the British Virgin Islands Courts for an order that the register be rectified, and the court may either refuse the application or order the rectification of the register, and may direct the company to pay all costs of the application and any damages the applicant may have sustained.

Distributions

Shareholders holding ordinary shares in the Company are entitled to receive a pro rata share of such dividends as may be declared by our board of directors subject to the BVI Act and the memorandum and articles of association.

Voting rights

Any action required or permitted to be taken by the shareholders must be effected at a duly called meeting of the shareholders entitled to vote on such action or may be effected by a resolution of members in writing, each in accordance with the memorandum and articles of association. At each meeting of shareholders, each shareholder who is present in person or by proxy (or, in the case of a shareholder being a corporation, by its duly authorized representative) will have one vote for each share that such shareholder holds.

Election of directors

BVI law permits cumulative voting for the election of directors only if expressly authorized in the memorandum and articles of association. There is nothing under BVI law which specifically prohibits or restricts the creation of cumulative voting rights for the election of our directors. Our memorandum and articles of association do not provide for cumulative voting for elections of directors.

Meetings

Under our memorandum and articles of association, a copy of the notice of any meeting of shareholders shall be given in writing not less than seven (7) days before the date of the proposed meeting to those persons whose names appear as shareholders in the register of members on the date of the notice and are entitled to vote at the meeting. Our board of directors shall call a meeting of shareholders upon the written request of shareholders holding at least 30% of our outstanding voting shares. In addition, our board of directors may call a meeting of shareholders on its own motion. A meeting of shareholders may be called on short notice if at least 90% of the shares entitled to vote on the matters to be considered at the meeting have agreed to short notice of the meeting, or if all members holding shares entitled to vote on all or any matters to be considered at the meeting have waived notice and presence at the meeting shall be deemed to constitute waiver for this purpose.

At any meeting of shareholders, a quorum will be present if there are shareholders present in person or by proxy representing not less than one-third of the issued shares entitled to vote on the resolutions to be considered at the meeting. Such quorum may be represented by only a single shareholder or proxy. If no quorum is present within two hours of the start time of the meeting, the meeting shall be dissolved if it was requested by shareholders. In any other case, the meeting shall be adjourned to the next business day, and if shareholders representing not less than one-third of the votes of the common shares or each class of shares entitled to vote on the matters to be considered at the meeting are present within one (1) hour of the start time of the adjourned meeting, a quorum will be present. If not, the meeting will be dissolved. No business may be transacted at any meeting of shareholders unless a quorum is present at the commencement of business. If present, the chair of our board of directors shall be the chair presiding at any meeting of the shareholders. If the chair of our board is not present then the members present shall choose a shareholder to act to chair the meeting of the shareholders. If the shareholders are unable to choose a chairman for any reason, then the person representing the greatest number of voting shares present in person or by proxy shall preside as chairman, failing which the oldest individual member or member representative shall take the chair.

12

A corporation that is a shareholder shall be deemed for the purpose of our memorandum and articles of association to be present in person if represented by its duly authorized representative. This duly authorized representative shall be entitled to exercise the same powers on behalf of the corporation which he represents as that corporation could exercise if it were our individual shareholder.

Protection of minority shareholders

British Virgin Islands law permits a minority shareholder to commence a derivative action in our name, or an unfair prejudice claim, or seek a restraining or compliance order, as appropriate, to challenge, for example (1) an act which is ultra vires or illegal, (2) an act which is likely to be oppressive, unfairly discriminatory or unfairly prejudicial to a shareholder, (3) an act which constitutes an infringement of individual rights of shareholders, such as the right to vote, (4) conduct of the Company or a director which contravenes the BVI Act or our memorandum and articles of association or (5) an irregularity in the passing of a resolution which requires a majority of the shareholders.

Pre-emptive rights

Our memorandum and articles of association dis-apply the pre-emptive rights provisions of the BVI Act and do not provide for any other pre-emptive rights. Accordingly, there are no pre-emptive rights applicable to the issue by us of new shares.

Transfer of shares

Subject to the restrictions in our memorandum and articles of association, and applicable securities laws, any of our shareholders may transfer all or any of his or her shares by an instrument of transfer in the usual or common form, or in any other form which our directors may approve, or, in the case of listed shares, in any manner permitted by and in accordance with the rules of the relevant exchange.

Liquidation

As permitted by the BVI Act and our memorandum and articles of association, we may be voluntarily liquidated under Part XII of the BVI Act by resolution of directors or resolution of shareholders if our assets exceed our liabilities and we are able to pay our debts as they fall due. We also may be wound up in circumstances where we are insolvent in accordance with the terms of the BVI Insolvency Act, 2003 (as amended).

If we are wound up and the assets available for distribution among our shareholders are more than sufficient to repay all amounts paid to us on account of the issue of shares immediately prior to the winding up, the excess shall be distributable pari passu among the shareholders.

Calls on ordinary shares and forfeiture of ordinary shares

Our board of directors may, on the terms established at the time of the issuance of such ordinary shares or as otherwise agreed, make calls upon shareholders for any amounts unpaid on their ordinary shares in a notice served to such shareholders at least fourteen (14) days prior to the specified time of payment. The ordinary shares that have been called upon and remain unpaid are subject to forfeiture.

13

Redemption of shares

Subject to the provisions of the BVI Act, we may issue ordinary shares on terms that are subject to redemption, at our option or at the option of the holders, on such terms and in such manner as may be determined by our memorandum and articles of association and subject to any applicable requirements imposed from time to time by, the BVI Act, the SEC, the NASDAQ Capital Market, or by any recognized stock exchange on which our securities may be listed.

Modifications of class rights

If at any time, the Company is authorized to issue more than one (1) class of ordinary shares, all or any of the rights attached to any class of ordinary shares may be amended only with the consent in writing of or by a resolution passed at a meeting of not less than fifty percent (50%) of the shares of the class to be affected.

Changes in the number of ordinary shares we are authorized to issue and those in issue

We may from time to time by resolution of our board of directors, subject to our memorandum and articles of association:

| ● | amend our memorandum and articles of association to increase or decrease the maximum number of ordinary shares we are authorized to issue; |

| ● | divide our authorized and issued ordinary shares into a larger number of shares; |

| ● | combine our authorized and issued ordinary shares into a smaller number of shares; and |

| ● | create new classes of shares with preferences to be determined by resolution of the board of directors to amend the memorandum and articles of association to create new classes of shares with such preferences at the time of authorization. |

Inspection of books and records

Under the BVI Act, members of the general public, on payment of a nominal fee, can obtain copies of the public records of a company available at the office of the Registrar of Corporate Affairs which will include the company’s certificate of incorporation, its memorandum and articles of association (with any amendments) and records of license fees paid to date and will also disclose any articles of dissolution, articles of merger and a register of charges if the company has elected to file such a register.

A member of the Company is also entitled, upon giving written notice to us, to inspect (i) our memorandum and articles of association, (ii) the register of members, (iii) the register of directors, and (iv) minutes of meetings and resolutions of members and of those classes of members of which that member is a member, and to make copies and take extracts from the documents and records referred to in (i) to (iv) above. However, our directors may, if they are satisfied that it would be contrary to the company’s interests to allow a member to inspect any document, or part of a document specified in (ii) to (iv) above, refuse to permit the member to inspect the document or limit the inspection of the document, including limiting the making of copies or the taking of extracts or records. See “Where You Can Find More Information.” Where a company fails or refuses to permit a member to inspect a document or permits a member to inspect a document subject to limitations, that member may apply to the BVI court for an order that he should be permitted to inspect the document or to inspect the document without limitation.

Rights of non-resident or foreign shareholders

There are no limitations imposed by our memorandum and articles of association on the rights of non-resident or foreign shareholders to hold or exercise voting rights on our shares. In addition, there are no provisions in our memorandum and articles of association governing the ownership threshold above which shareholder ownership must be disclosed.

14

Issuance of additional shares

Our memorandum and articles of association authorizes our board of directors to issue additional shares from authorized but unissued shares, to the extent available, from time to time as our board of directors shall determine.

Preferred Shares

Our memorandum and articles of association authorizes the creation and issuance without shareholder approval preferred shares up to the maximum number of authorized but unissued shares, divided into a single class, Class A preferred shares, with such designation, rights and preferences as may be determined by a resolution of our board of directors to amend the memorandum and articles of association to create such designations, rights and preferences. Under BVI law, all shares of a single class must be issued with the same rights and obligations. No preferred shares are currently issued or outstanding. Accordingly, our board of directors is empowered, without shareholder approval, to issue preferred shares with dividend, liquidation, redemption, voting or other rights, which could adversely affect the voting power or other rights of the holders of ordinary shares. The preferred shares could be utilized as a method of discouraging, delaying or preventing a change in control of us. Although we do not currently intend to issue any preferred shares, we may do so in the future.

The rights of preferred shareholders, once the preferred shares are in issue, may only be amended by a resolution to amend our memorandum and articles of association provided such amendment is also approved by a separate resolution of a majority of the votes of preferred shareholders who being so entitled attend and vote at the class meeting of the relevant preferred class. If our preferred shareholders want us to hold a meeting of preferred shareholders (or of a class of preferred shareholders), they may requisition the directors to hold one upon the written request of preferred shareholders entitled to exercise at least thirty percent (30%) of the voting rights in respect of the matter (or class) for which the meeting is requested. Under British Virgin Islands law, we may not increase the required percentage to call a meeting above thirty percent (30%).

Differences in Corporate Law

The BVI Act and the laws of the British Virgin Islands affecting British Virgin Islands companies like us and our shareholders differ from laws applicable to U.S. corporations and their shareholders. Set forth below is a summary of the significant differences between the provisions of the laws of the British Virgin Islands applicable to us and the laws applicable to companies incorporated in the United States and their shareholders.

Mergers and similar arrangements