Filed by LINKBANCORP, Inc. Pursuant to Rule 425 under the Securities Act of 1933 LINKBANCORP Inc. Investor Presentation February 24, 2021 Positively Impacting LivesFiled by LINKBANCORP, Inc. Pursuant to Rule 425 under the Securities Act of 1933 LINKBANCORP Inc. Investor Presentation February 24, 2021 Positively Impacting Lives

Important Information Forward-Looking Statements -- This communication contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about LINKBANCORP (together with its bank subsidiary unless the context otherwise requires, “LINK”) involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding LINK’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to LINK, are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: (1) the businesses of LINK and GNB Financial Services, Inc. (“GNB Financial”) may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of LINK or GNB Financial may fail to approve the merger; (6) changes to interest rates; (7) the ability to control costs and expenses; (8) general economic conditions; (9) adverse developments in borrower industries and, in particular, declines in real estate values; (10) LINK’s ability to maintain compliance with federal and state laws that regulate its business and capital levels; (11) LINK’s ability to raise capital as needed by its business; (12) the duration and scope of the coronavirus disease 2019 (“COVID-19”) pandemic and its impact on levels of consumer confidence; (13) actions governments, businesses and individuals take in response to the COVID-19 pandemic; (14) the impact of the COVID-19 pandemic and actions taken in response to the pandemic on global and regional economies and economic activity, and (15) the pace of recovery when the COVID-19 pandemic subsides. LINK does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward- looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements. Additional Information and Where to Find it -- In connection with the proposed transaction, LINK expects to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a joint proxy statement of LINK and GNB Financial that also constitutes a prospectus of LINK. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) at the SEC’s website at www.sec.gov. Copies of the documents filed by LINK with the SEC will be available free of charge on LINK’s website at ir.linkbancorp.com or by directing a request to LINKBANCORP, Inc., 3045 Market Street, Camp Hill, PA 17011, attention: Secretary. Participants in Solicitation -- LINK and GNB Financial and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and officers of LINK and GNB Financial and their ownership of LINK and GNB Financial common stock, and the interests of such potential participants will be included in the joint proxy statement/prospectus if and when it becomes available. 2Important Information Forward-Looking Statements -- This communication contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about LINKBANCORP (together with its bank subsidiary unless the context otherwise requires, “LINK”) involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding LINK’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to LINK, are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: (1) the businesses of LINK and GNB Financial Services, Inc. (“GNB Financial”) may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of LINK or GNB Financial may fail to approve the merger; (6) changes to interest rates; (7) the ability to control costs and expenses; (8) general economic conditions; (9) adverse developments in borrower industries and, in particular, declines in real estate values; (10) LINK’s ability to maintain compliance with federal and state laws that regulate its business and capital levels; (11) LINK’s ability to raise capital as needed by its business; (12) the duration and scope of the coronavirus disease 2019 (“COVID-19”) pandemic and its impact on levels of consumer confidence; (13) actions governments, businesses and individuals take in response to the COVID-19 pandemic; (14) the impact of the COVID-19 pandemic and actions taken in response to the pandemic on global and regional economies and economic activity, and (15) the pace of recovery when the COVID-19 pandemic subsides. LINK does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward- looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements. Additional Information and Where to Find it -- In connection with the proposed transaction, LINK expects to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a joint proxy statement of LINK and GNB Financial that also constitutes a prospectus of LINK. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) at the SEC’s website at www.sec.gov. Copies of the documents filed by LINK with the SEC will be available free of charge on LINK’s website at ir.linkbancorp.com or by directing a request to LINKBANCORP, Inc., 3045 Market Street, Camp Hill, PA 17011, attention: Secretary. Participants in Solicitation -- LINK and GNB Financial and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and officers of LINK and GNB Financial and their ownership of LINK and GNB Financial common stock, and the interests of such potential participants will be included in the joint proxy statement/prospectus if and when it becomes available. 2

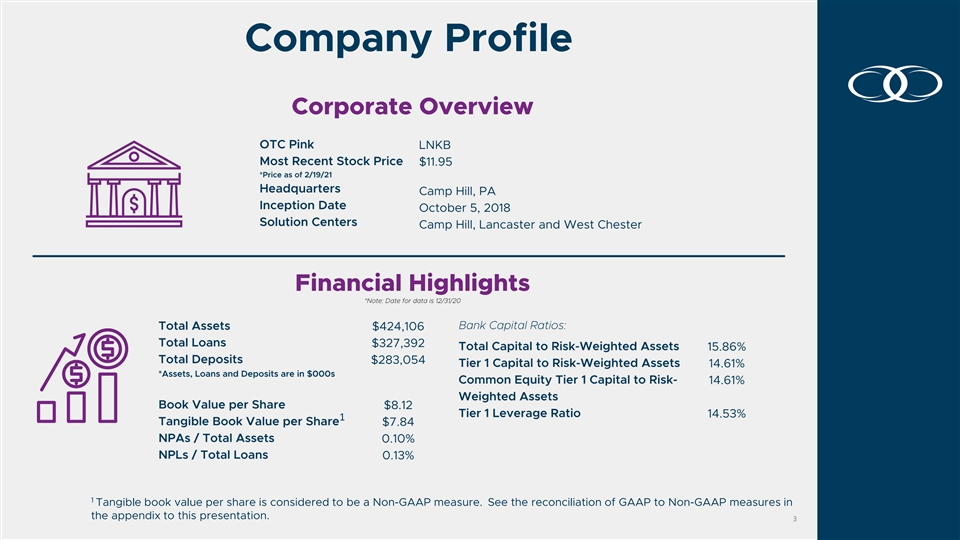

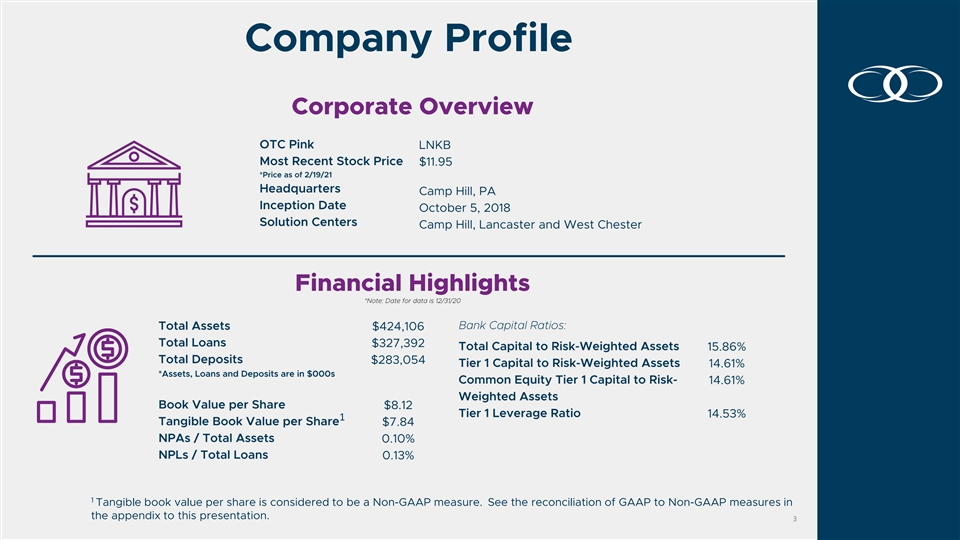

Company Profile 1 1 Tangible book value per share is considered to be a Non-GAAP measure. See the reconciliation of GAAP to Non-GAAP measures in the appendix to this presentation. 3Company Profile 1 1 Tangible book value per share is considered to be a Non-GAAP measure. See the reconciliation of GAAP to Non-GAAP measures in the appendix to this presentation. 3

Why LINKBANCORP? 4Why LINKBANCORP? 4

OUR MISSION POSITIVELY IMPACT LIVES OUR VALUES 5OUR MISSION POSITIVELY IMPACT LIVES OUR VALUES 5

Our Board of Directors 6Our Board of Directors 6

Our Management Team Carl Lundblad Brent Smith Andrew Samuel President, President, Chairman LINKBANCORP LINKBANK Chief Executive Chief Risk Officer 15 years in-market Officer 25 years in-market experience 33 years in-market experience experience Kris Paul Tiffanie Horton Melissa Hoffman Finance Credit Operations 18 years in-market 17 years in-market 37 years in-market experience experience experience 7Our Management Team Carl Lundblad Brent Smith Andrew Samuel President, President, Chairman LINKBANCORP LINKBANK Chief Executive Chief Risk Officer 15 years in-market Officer 25 years in-market experience 33 years in-market experience experience Kris Paul Tiffanie Horton Melissa Hoffman Finance Credit Operations 18 years in-market 17 years in-market 37 years in-market experience experience experience 7

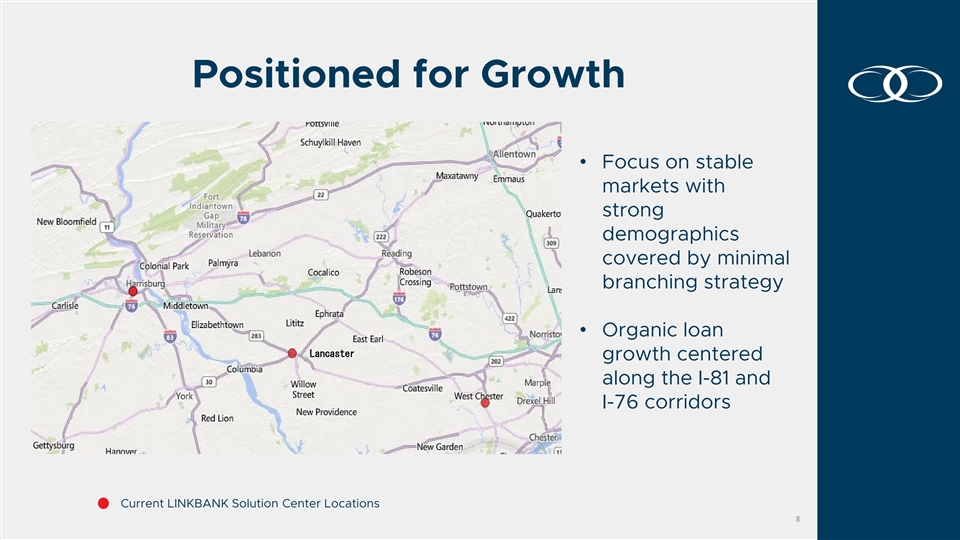

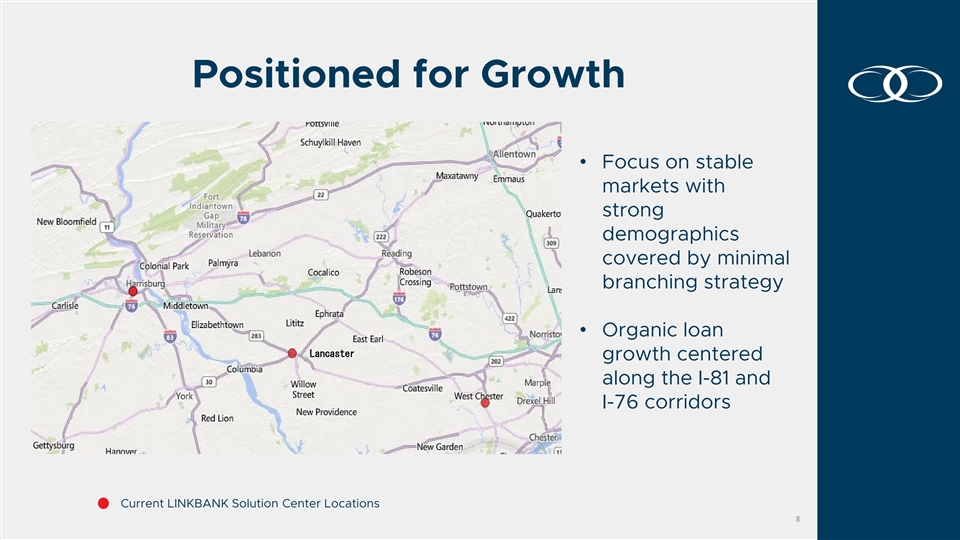

Positioned for Growth • Focus on stable markets with strong demographics covered by minimal branching strategy • Organic loan Lancaster growth centered along the I-81 and I-76 corridors Current LINKBANK Solution Center Locations 8Positioned for Growth • Focus on stable markets with strong demographics covered by minimal branching strategy • Organic loan Lancaster growth centered along the I-81 and I-76 corridors Current LINKBANK Solution Center Locations 8

Market Demographics Projected Projected HH Median Population Deposits Population Households Unemployment Population Income County Household Change (%) ($ 000) (actual) (actual) Rate (%) ** Change (%) Change (%) Income ($) 2010-2021 2021-2026 2021-2026 106,431 528,806 193,940 4.2 6.00 1.86 9.21 17,076,964 Chester 8,906,268 75,275 256,308 104,098 4.5 8.88 2.70 10.19 Cumberland 8,286,869 65,792 280,026 116,167 6.1 4.45 1.54 8.36 Dauphin 14,102,995 72,498 549,185 206,420 4.7 5.73 1.72 12.81 Lancaster LINKBANK * 48,373,096 79,999 1,614,325 620,625 4.9 6.10 1.89 10.08 Pennsylvania 492,968,532 65,958 12,804,019 5,105,423 6.4 0.80 0.24 8.41 * Represents the counties compromising LINKBANK's current primary market areas ** Unemployment data is as of December 2020 Source: S&P Global Market Intelligence demographic data provided by Claritas based primarily on US Census data. 9Market Demographics Projected Projected HH Median Population Deposits Population Households Unemployment Population Income County Household Change (%) ($ 000) (actual) (actual) Rate (%) ** Change (%) Change (%) Income ($) 2010-2021 2021-2026 2021-2026 106,431 528,806 193,940 4.2 6.00 1.86 9.21 17,076,964 Chester 8,906,268 75,275 256,308 104,098 4.5 8.88 2.70 10.19 Cumberland 8,286,869 65,792 280,026 116,167 6.1 4.45 1.54 8.36 Dauphin 14,102,995 72,498 549,185 206,420 4.7 5.73 1.72 12.81 Lancaster LINKBANK * 48,373,096 79,999 1,614,325 620,625 4.9 6.10 1.89 10.08 Pennsylvania 492,968,532 65,958 12,804,019 5,105,423 6.4 0.80 0.24 8.41 * Represents the counties compromising LINKBANK's current primary market areas ** Unemployment data is as of December 2020 Source: S&P Global Market Intelligence demographic data provided by Claritas based primarily on US Census data. 9

Key Accomplishments December 2020 – Achieved $400 million in assets September-October 2020 - Issued January 2019 - $20 million in Completed initial sub debt and private placement, $5 million in common April – July 2020 - raising $45.5 million equity (at $12 per originated in common equity share) over 500 PPP loans for $86 million October 2019 – Achieved $200 million in assets December 10, 2020 - Announced strategic partnership with GNB May/June 2019 – Financial Services, opened Client Inc/The Gratz Bank Solution Centers in Camp Hill and Lancaster October 2018 – Purchased charter with $50 million in assets and initial office 10 in West ChesterKey Accomplishments December 2020 – Achieved $400 million in assets September-October 2020 - Issued January 2019 - $20 million in Completed initial sub debt and private placement, $5 million in common April – July 2020 - raising $45.5 million equity (at $12 per originated in common equity share) over 500 PPP loans for $86 million October 2019 – Achieved $200 million in assets December 10, 2020 - Announced strategic partnership with GNB May/June 2019 – Financial Services, opened Client Inc/The Gratz Bank Solution Centers in Camp Hill and Lancaster October 2018 – Purchased charter with $50 million in assets and initial office 10 in West Chester

Our Community Banking Strategy 11Our Community Banking Strategy 11

Building Franchise Value Strategic Acquisitions Organic Growth Branch Strategic Acquisitions Partnerships 12Building Franchise Value Strategic Acquisitions Organic Growth Branch Strategic Acquisitions Partnerships 12

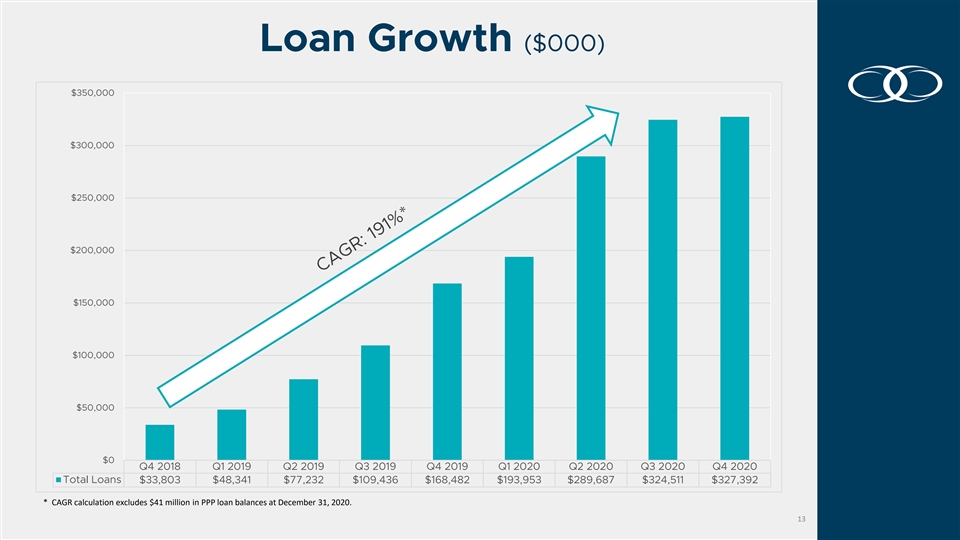

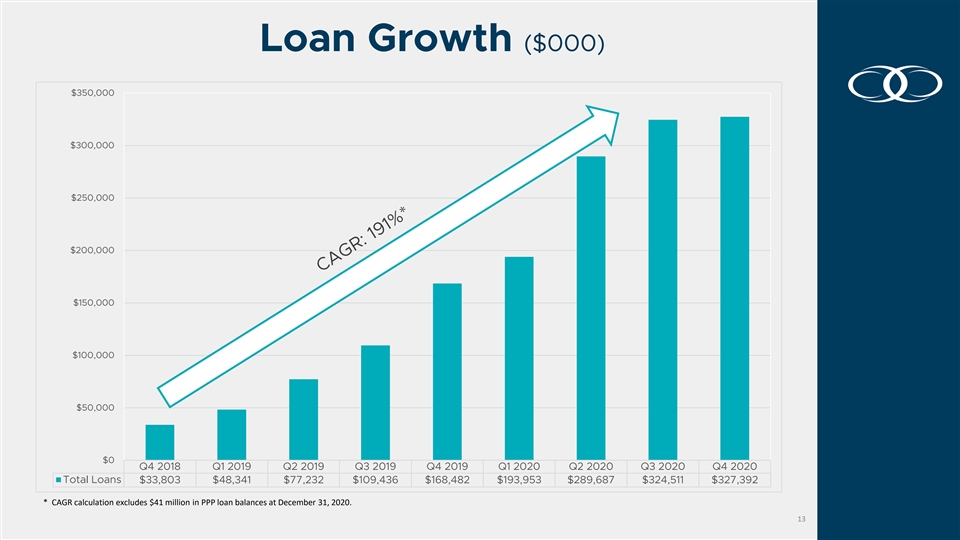

Loan Growth ($000) $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Total Loans $33,803 $48,341 $77,232 $109,436 $168,482 $193,953 $289,687 $324,511 $327,392 * CAGR calculation excludes $41 million in PPP loan balances at December 31, 2020. 13Loan Growth ($000) $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Total Loans $33,803 $48,341 $77,232 $109,436 $168,482 $193,953 $289,687 $324,511 $327,392 * CAGR calculation excludes $41 million in PPP loan balances at December 31, 2020. 13

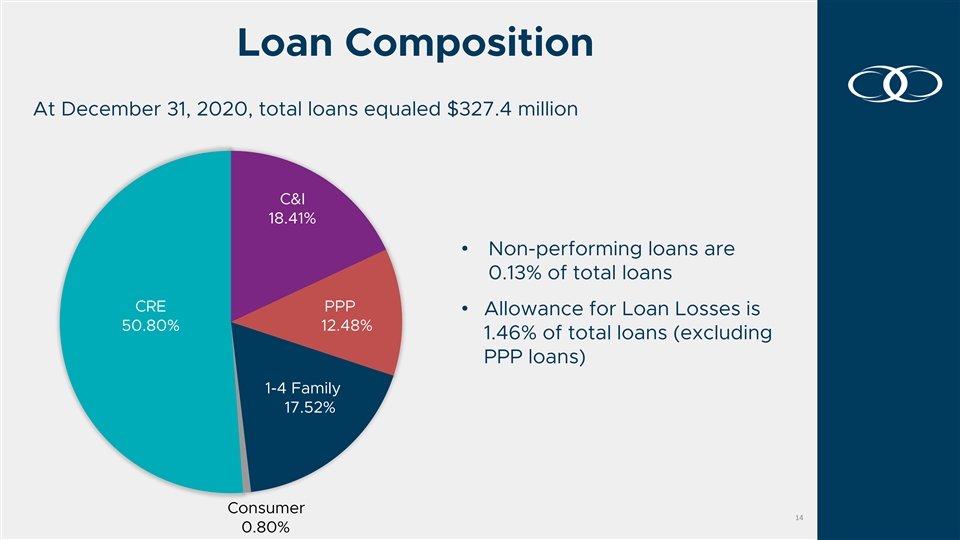

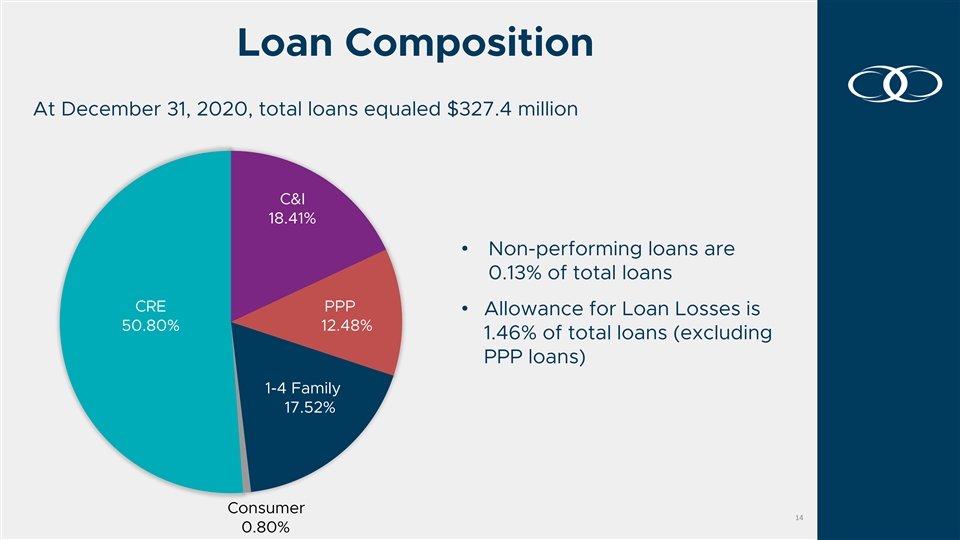

Loan Composition At December 31, 2020, total loans equaled $327.4 million C&I 18.41% • Non-performing loans are 0.13% of total loans CRE PPP • Allowance for Loan Losses is 50.80% 12.48% 1.46% of total loans (excluding PPP loans) 1-4 Family 17.52% Consumer 14 0.80%Loan Composition At December 31, 2020, total loans equaled $327.4 million C&I 18.41% • Non-performing loans are 0.13% of total loans CRE PPP • Allowance for Loan Losses is 50.80% 12.48% 1.46% of total loans (excluding PPP loans) 1-4 Family 17.52% Consumer 14 0.80%

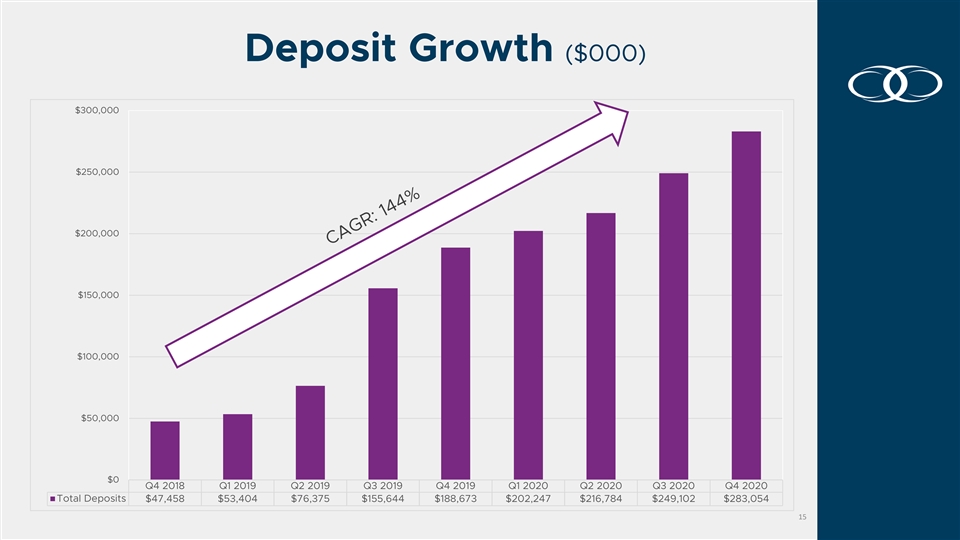

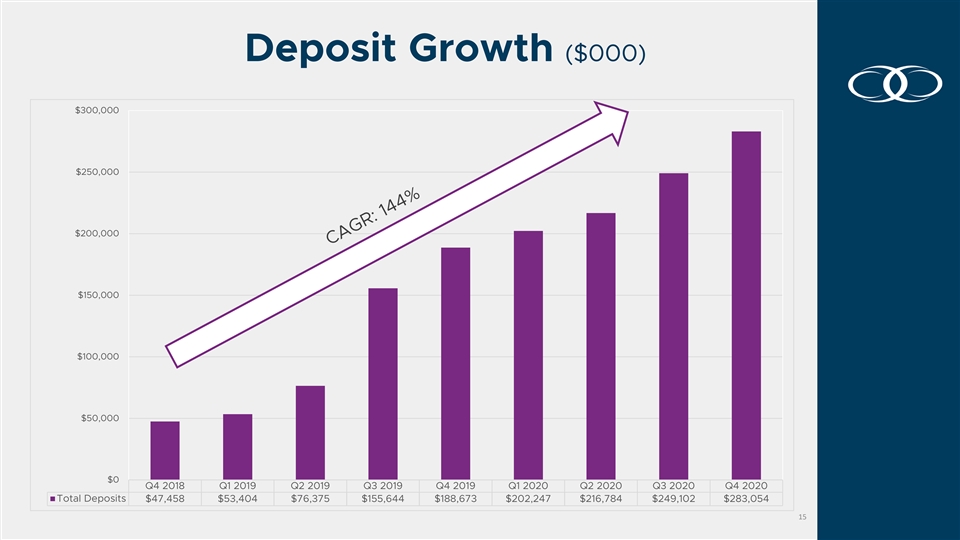

Deposit Growth ($000) $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Total Deposits $47,458 $53,404 $76,375 $155,644 $188,673 $202,247 $216,784 $249,102 $283,054 15Deposit Growth ($000) $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Total Deposits $47,458 $53,404 $76,375 $155,644 $188,673 $202,247 $216,784 $249,102 $283,054 15

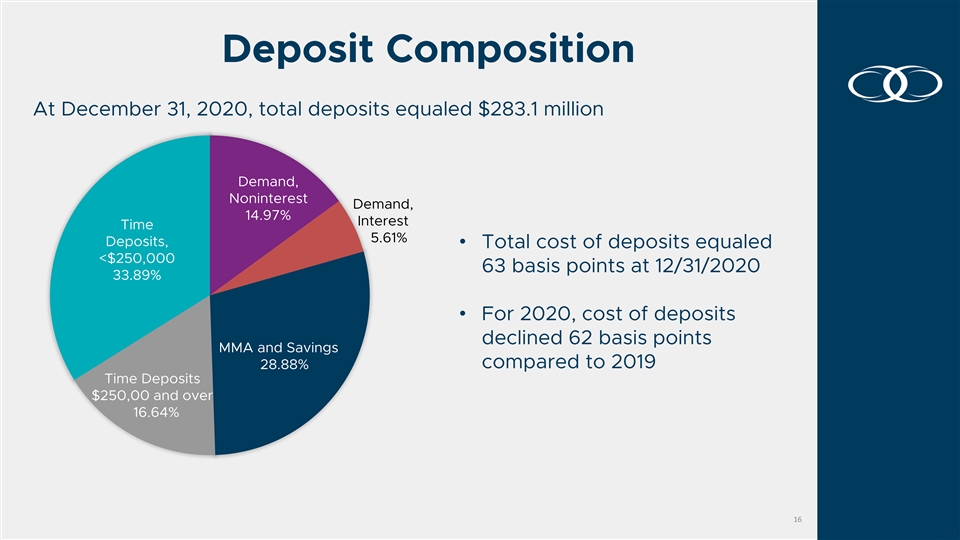

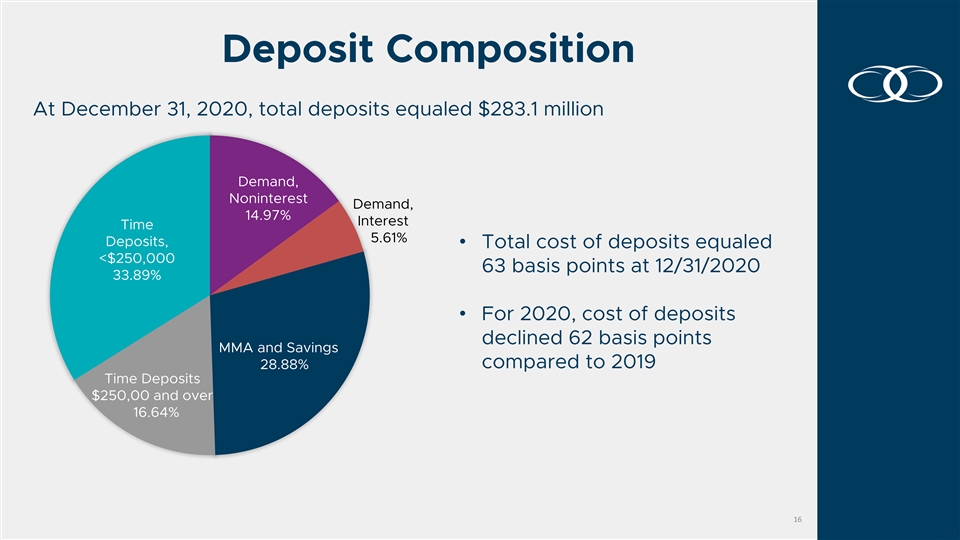

Deposit Composition At December 31, 2020, total deposits equaled $283.1 million Demand, Noninterest Demand, 14.97% Interest Time 5.61% Deposits, • Total cost of deposits equaled <$250,000 63 basis points at 12/31/2020 33.89% • For 2020, cost of deposits declined 62 basis points MMA and Savings compared to 2019 28.88% Time Deposits $250,00 and over 16.64% 16Deposit Composition At December 31, 2020, total deposits equaled $283.1 million Demand, Noninterest Demand, 14.97% Interest Time 5.61% Deposits, • Total cost of deposits equaled <$250,000 63 basis points at 12/31/2020 33.89% • For 2020, cost of deposits declined 62 basis points MMA and Savings compared to 2019 28.88% Time Deposits $250,00 and over 16.64% 16

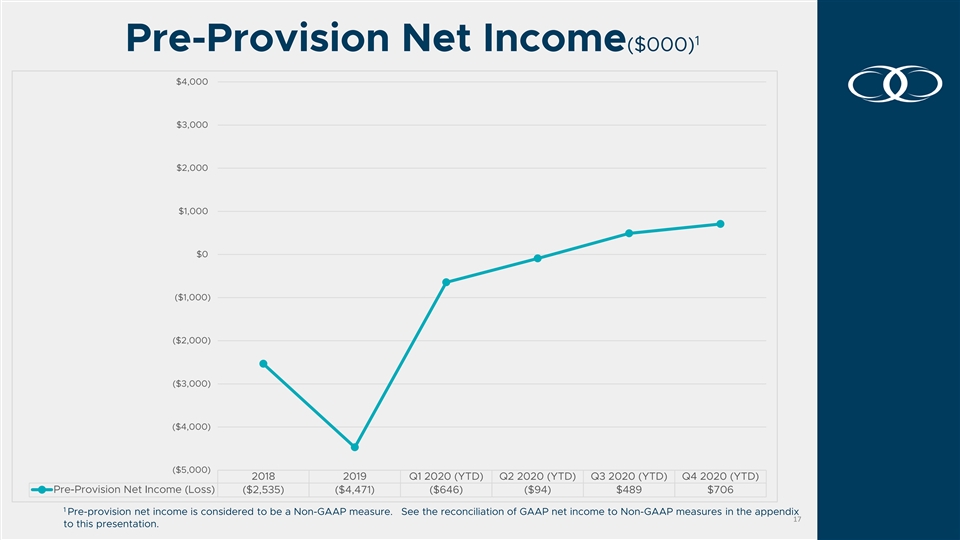

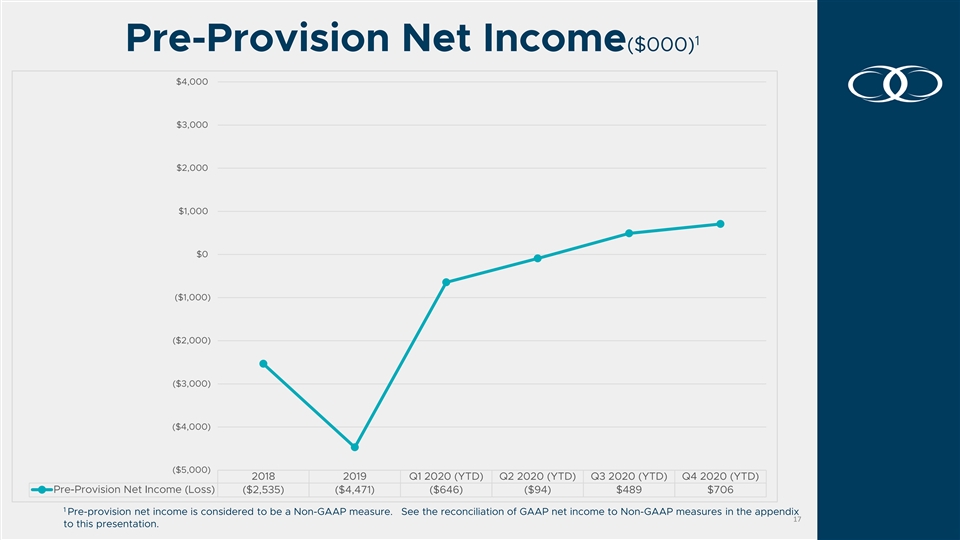

1 Pre-Provision Net Income($000) $4,000 $3,000 $2,000 $1,000 $0 ($1,000) ($2,000) ($3,000) ($4,000) ($5,000) 2018 2019 Q1 2020 (YTD) Q2 2020 (YTD) Q3 2020 (YTD) Q4 2020 (YTD) Pre-Provision Net Income (Loss) ($2,535) ($4,471) ($646) ($94) $489 $706 1 Pre-provision net income is considered to be a Non-GAAP measure. See the reconciliation of GAAP net income to Non-GAAP measures in the appendix 17 to this presentation.1 Pre-Provision Net Income($000) $4,000 $3,000 $2,000 $1,000 $0 ($1,000) ($2,000) ($3,000) ($4,000) ($5,000) 2018 2019 Q1 2020 (YTD) Q2 2020 (YTD) Q3 2020 (YTD) Q4 2020 (YTD) Pre-Provision Net Income (Loss) ($2,535) ($4,471) ($646) ($94) $489 $706 1 Pre-provision net income is considered to be a Non-GAAP measure. See the reconciliation of GAAP net income to Non-GAAP measures in the appendix 17 to this presentation.

Strategic Partnership with GNB Financial Service, Inc. and The Gratz Bank 18Strategic Partnership with GNB Financial Service, Inc. and The Gratz Bank 18

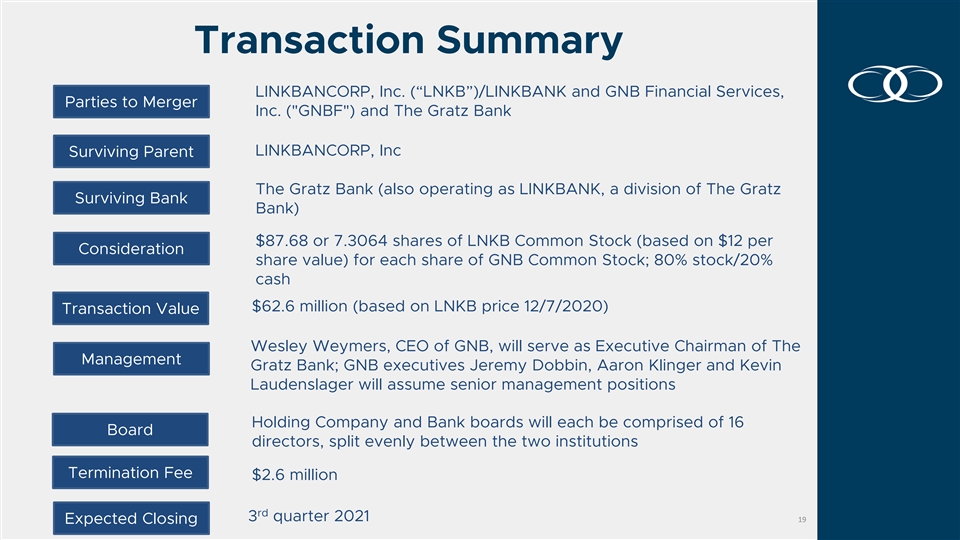

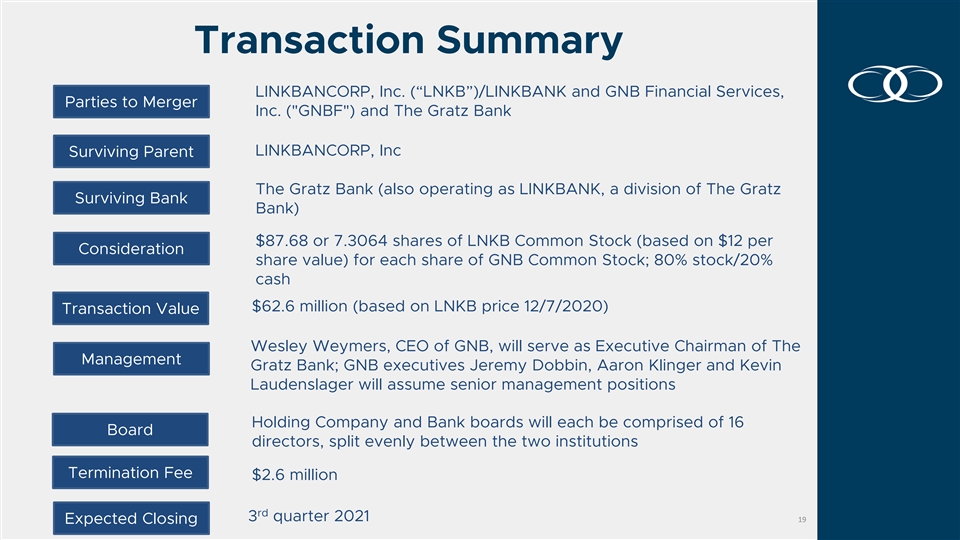

Transaction Summary LINKBANCORP, Inc. (“LNKB”)/LINKBANK and GNB Financial Services, Parties to Merger Inc. ( GNBF ) and The Gratz Bank LINKBANCORP, Inc Surviving Parent The Gratz Bank (also operating as LINKBANK, a division of The Gratz Surviving Bank Bank) $87.68 or 7.3064 shares of LNKB Common Stock (based on $12 per Consideration share value) for each share of GNB Common Stock; 80% stock/20% cash $62.6 million (based on LNKB price 12/7/2020) Transaction Value Wesley Weymers, CEO of GNB, will serve as Executive Chairman of The Management Gratz Bank; GNB executives Jeremy Dobbin, Aaron Klinger and Kevin Laudenslager will assume senior management positions Holding Company and Bank boards will each be comprised of 16 Board directors, split evenly between the two institutions Termination Fee $2.6 million rd 3 quarter 2021 19 Expected ClosingTransaction Summary LINKBANCORP, Inc. (“LNKB”)/LINKBANK and GNB Financial Services, Parties to Merger Inc. ( GNBF ) and The Gratz Bank LINKBANCORP, Inc Surviving Parent The Gratz Bank (also operating as LINKBANK, a division of The Gratz Surviving Bank Bank) $87.68 or 7.3064 shares of LNKB Common Stock (based on $12 per Consideration share value) for each share of GNB Common Stock; 80% stock/20% cash $62.6 million (based on LNKB price 12/7/2020) Transaction Value Wesley Weymers, CEO of GNB, will serve as Executive Chairman of The Management Gratz Bank; GNB executives Jeremy Dobbin, Aaron Klinger and Kevin Laudenslager will assume senior management positions Holding Company and Bank boards will each be comprised of 16 Board directors, split evenly between the two institutions Termination Fee $2.6 million rd 3 quarter 2021 19 Expected Closing

Pro Forma Highlights as of 12/31/2020 Balance Sheet LNKB GNBF Pro Forma ($000s) Assets $383,152 $430,455 $813,607 Loans $286,438 $236,584 $523,022 Deposits $283,054 $375,124 $658,178 *LINKBANK Assets & Loans are Net of $41 million in PPP loans 20 The Gratz Bank LINKBANK 20Pro Forma Highlights as of 12/31/2020 Balance Sheet LNKB GNBF Pro Forma ($000s) Assets $383,152 $430,455 $813,607 Loans $286,438 $236,584 $523,022 Deposits $283,054 $375,124 $658,178 *LINKBANK Assets & Loans are Net of $41 million in PPP loans 20 The Gratz Bank LINKBANK 20

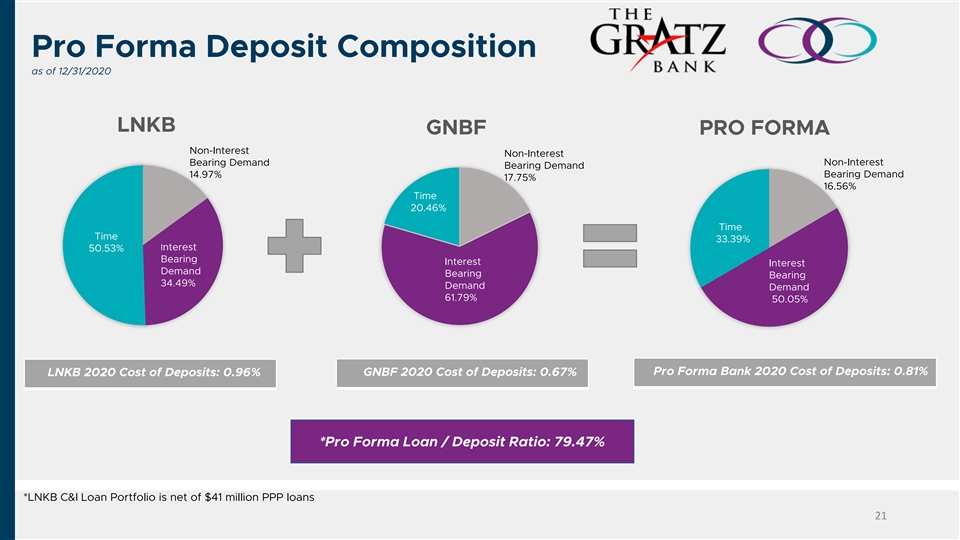

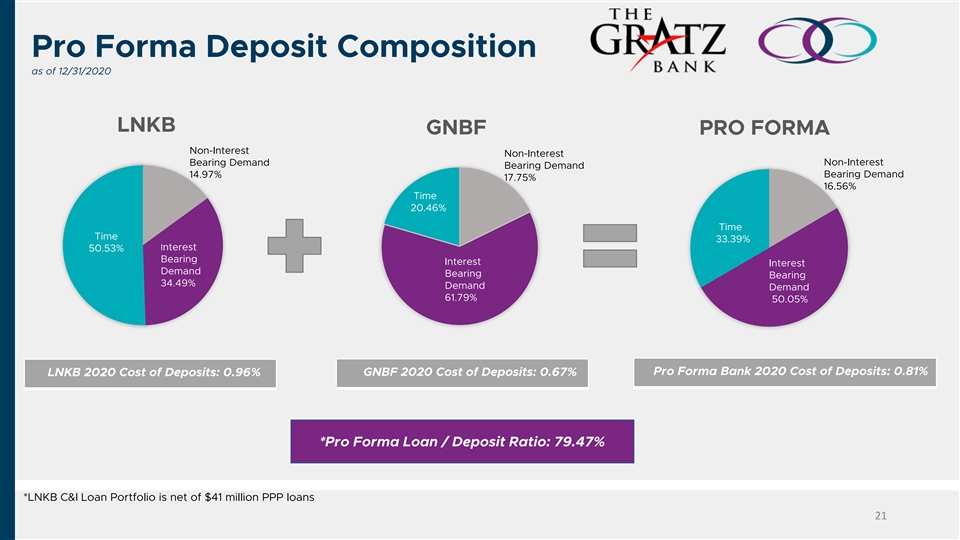

Pro Forma Deposit Composition as of 12/31/2020 LNKB GNBF PRO FORMA Non-Interest Non-Interest Bearing Demand Non-Interest Bearing Demand 14.97% Bearing Demand 17.75% 16.56% Time 20.46% Time Time 33.39% Interest 50.53% Bearing Interest Interest Demand Bearing Bearing 34.49% Demand Demand 61.79% 50.05% Pro Forma Bank 2020 Cost of Deposits: 0.81% LNKB 2020 Cost of Deposits: 0.96% GNBF 2020 Cost of Deposits: 0.67% *Pro Forma Loan / Deposit Ratio: 79.47% *LNKB C&I Loan Portfolio is net of $41 million PPP loans 21Pro Forma Deposit Composition as of 12/31/2020 LNKB GNBF PRO FORMA Non-Interest Non-Interest Bearing Demand Non-Interest Bearing Demand 14.97% Bearing Demand 17.75% 16.56% Time 20.46% Time Time 33.39% Interest 50.53% Bearing Interest Interest Demand Bearing Bearing 34.49% Demand Demand 61.79% 50.05% Pro Forma Bank 2020 Cost of Deposits: 0.81% LNKB 2020 Cost of Deposits: 0.96% GNBF 2020 Cost of Deposits: 0.67% *Pro Forma Loan / Deposit Ratio: 79.47% *LNKB C&I Loan Portfolio is net of $41 million PPP loans 21

Pro Forma Loan Composition as of 12/31/2020 LNKB PRO FORMA GNBF C&I CRE C&I 13.93% 19.00% 17.81% C&I Consumer & 21.03% Other CRE 3.76% 40.35% CRE 1-4 Family 58.04% 20.02% 1-4 Family 1-4 Family 39.63% 63.31% Consumer Consumer & Other 0.91% 2.20% GNBF Yield on Loans: 4.9% LNKB Yield on Loans: 3.96% Pro Forma Bank Yield on Loans: 4.46% *LNKB C&I Loan Portfolio is net of $41 million PPP loans 22Pro Forma Loan Composition as of 12/31/2020 LNKB PRO FORMA GNBF C&I CRE C&I 13.93% 19.00% 17.81% C&I Consumer & 21.03% Other CRE 3.76% 40.35% CRE 1-4 Family 58.04% 20.02% 1-4 Family 1-4 Family 39.63% 63.31% Consumer Consumer & Other 0.91% 2.20% GNBF Yield on Loans: 4.9% LNKB Yield on Loans: 3.96% Pro Forma Bank Yield on Loans: 4.46% *LNKB C&I Loan Portfolio is net of $41 million PPP loans 22

Transaction Structure and Modeling 1 Assumptions q LNKB will be the surviving holding company; The Gratz Bank will be the surviving bank q GNBF expected to be the accounting acquirer, requiring reverse merger accounting q Assumed cost savings of 25% of GNBF’s expense base q Merger costs estimated at approximately 7% of transaction value q Purchase accounting loan mark of approximately 2% of LNKB gross loan portfolio 23 q Expected earnings accretion supports commitment to maintain an annual dividend of $0.30 per LNKB share, subject to applicable regulatory guidance q LNKB expected recognition of estimated $3 million deferred tax asset (DTA) valuation allowance q Pro forma capital ratios remain “well capitalized” 1 Reflects preliminary assumptions utilized by management for initial merger modeling. Updated assumptions and pro forma financials will 23 be disclosed in the registration statement on Form S-4 to be filed with the SEC.Transaction Structure and Modeling 1 Assumptions q LNKB will be the surviving holding company; The Gratz Bank will be the surviving bank q GNBF expected to be the accounting acquirer, requiring reverse merger accounting q Assumed cost savings of 25% of GNBF’s expense base q Merger costs estimated at approximately 7% of transaction value q Purchase accounting loan mark of approximately 2% of LNKB gross loan portfolio 23 q Expected earnings accretion supports commitment to maintain an annual dividend of $0.30 per LNKB share, subject to applicable regulatory guidance q LNKB expected recognition of estimated $3 million deferred tax asset (DTA) valuation allowance q Pro forma capital ratios remain “well capitalized” 1 Reflects preliminary assumptions utilized by management for initial merger modeling. Updated assumptions and pro forma financials will 23 be disclosed in the registration statement on Form S-4 to be filed with the SEC.

Strategic Rationale 24Strategic Rationale 24

QUESTIONS Thank you! 25QUESTIONS Thank you! 25

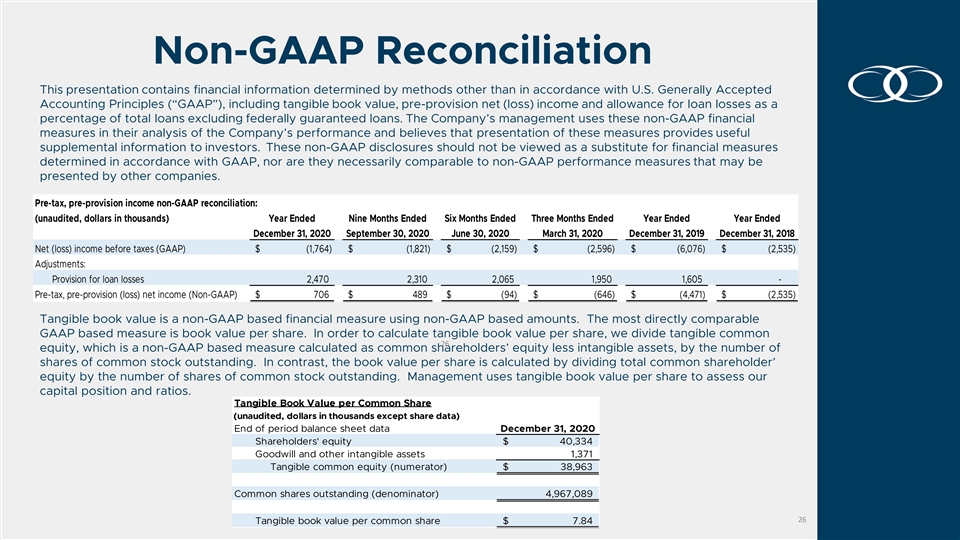

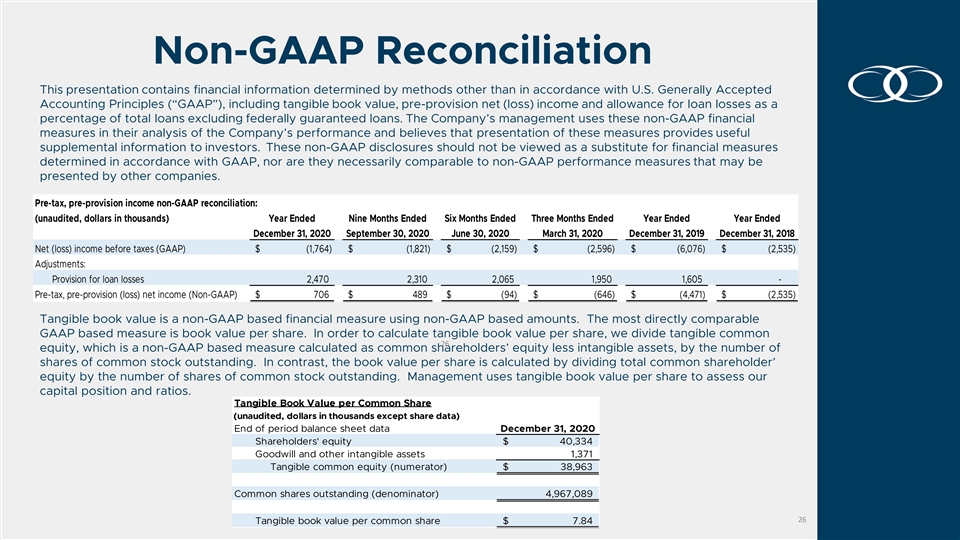

Non-GAAP Reconciliation This presentation contains financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), including tangible book value, pre-provision net (loss) income and allowance for loan losses as a percentage of total loans excluding federally guaranteed loans. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance and believes that presentation of these measures provides useful supplemental information to investors. These non-GAAP disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Pre-tax, pre-provision income non-GAAP reconciliation: (unaudited, dollars in thousands) Year Ended Nine Months Ended Six Months Ended Three Months Ended Year Ended Year Ended December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 December 31, 2019 December 31, 2018 Net (loss) income before taxes (GAAP) $ (1,764) $ (1,821) $ (2,159) $ ( 2,596) $ (6,076) $ ( 2,535) Adjustments: Provision for loan losses 2 ,470 2 ,310 2,065 1,950 1,605 - Pre-tax, pre-provision (loss) net income (Non-GAAP) $ 706 $ 489 $ (94) $ (646) $ (4,471) $ ( 2,535) Tangible book value is a non-GAAP based financial measure using non-GAAP based amounts. The most directly comparable GAAP based measure is book value per share. In order to calculate tangible book value per share, we divide tangible common 26 equity, which is a non-GAAP based measure calculated as common shareholders’ equity less intangible assets, by the number of shares of common stock outstanding. In contrast, the book value per share is calculated by dividing total common shareholder’ equity by the number of shares of common stock outstanding. Management uses tangible book value per share to assess our capital position and ratios. Tangible Book Value per Common Share (unaudited, dollars in thousands except share data) End of period balance sheet data December 31, 2020 Shareholders' equity $ 4 0,334 Goodwill and other intangible assets 1,371 Tangible common equity (numerator) $ 38,963 Common shares outstanding (denominator) 4,967,089 26 Tangible book value per common share $ 7.84Non-GAAP Reconciliation This presentation contains financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), including tangible book value, pre-provision net (loss) income and allowance for loan losses as a percentage of total loans excluding federally guaranteed loans. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance and believes that presentation of these measures provides useful supplemental information to investors. These non-GAAP disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Pre-tax, pre-provision income non-GAAP reconciliation: (unaudited, dollars in thousands) Year Ended Nine Months Ended Six Months Ended Three Months Ended Year Ended Year Ended December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 December 31, 2019 December 31, 2018 Net (loss) income before taxes (GAAP) $ (1,764) $ (1,821) $ (2,159) $ ( 2,596) $ (6,076) $ ( 2,535) Adjustments: Provision for loan losses 2 ,470 2 ,310 2,065 1,950 1,605 - Pre-tax, pre-provision (loss) net income (Non-GAAP) $ 706 $ 489 $ (94) $ (646) $ (4,471) $ ( 2,535) Tangible book value is a non-GAAP based financial measure using non-GAAP based amounts. The most directly comparable GAAP based measure is book value per share. In order to calculate tangible book value per share, we divide tangible common 26 equity, which is a non-GAAP based measure calculated as common shareholders’ equity less intangible assets, by the number of shares of common stock outstanding. In contrast, the book value per share is calculated by dividing total common shareholder’ equity by the number of shares of common stock outstanding. Management uses tangible book value per share to assess our capital position and ratios. Tangible Book Value per Common Share (unaudited, dollars in thousands except share data) End of period balance sheet data December 31, 2020 Shareholders' equity $ 4 0,334 Goodwill and other intangible assets 1,371 Tangible common equity (numerator) $ 38,963 Common shares outstanding (denominator) 4,967,089 26 Tangible book value per common share $ 7.84