ECMOHO LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For each reporting period, the Company recorded accretions on the Preferred Shares to the respective redemption value by using the effective interest rate method from the issuance dates to the earliest redemption dates as set forth in the original issuance.

The accretion is recorded against retained earnings, or in the absence of retained earnings, by charges againstadditional paid-in-capital, or in the absence of additionalpaid-in-capital, by charges to accumulated deficit. The accretion of the Preferred Shares was US$ 3,972,281 and US$ 3,038,407 for the years ended December 31, 2017 and 2018.

Extinguishment of preferred shares

The Company assesses whether amendments to the terms of its Preferred Shares is an extinguishment or a modification from both quantitative and qualitative perspectives.

| | i. | Extinguishment of Round A and Round B preferred shares during Reorganization |

As described above, prior to the Reorganization, the equity interests of ECMOHO Shanghai held by the Round A and Round B Investors were with liquidation preference and also were redeemable at the holders’ option any time after a certain date or breach of contract by ECMOHO Shanghai or the Founders.

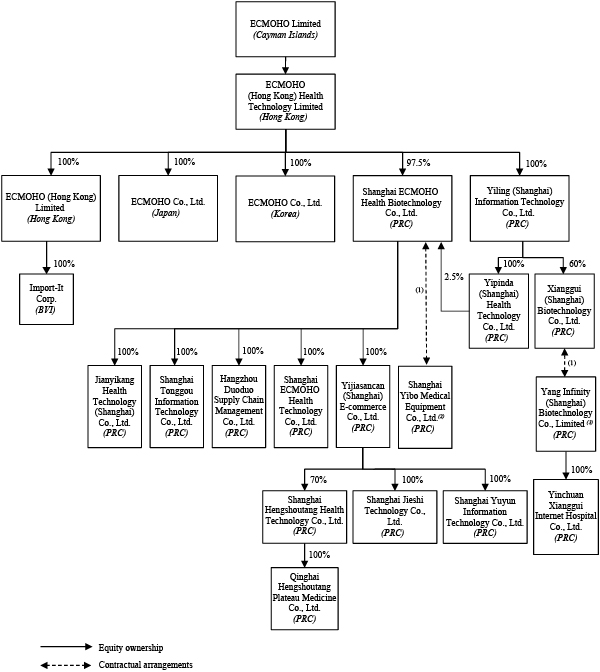

Upon completion of the Reorganization, Round A and Round B Investors’ equity interests with preferential rights, except for the 2.5% held by NCI holder, in ECMOHO Shanghai were exchanged into 9,519,000Class A-1 and 10,817,100Class A-2 Preferred Shares of the Company, respectively.

The most significant changes in the preferential rights of the Round A and Round B Investors are in respect with the redemption right and liquidation preference.

From both quantitative and qualitative perspectives, the Company assessed the impact of the above amendments and concluded that these amendments represent extinguishment rather than modification of Round A and Round B preferred shares. Therefore, at the time of the extinguishment, Round A and Round B preferred shares with the carrying amount of US$ 8,361,109 and US$ 23,284,214 are derecognized, respectively, andClass A-1 andA-2 Preferred Shares are measured at its fair value with the amount of US$ 19,495,152 and 26,172,432, respectively, with the difference of US$ 14,022,261 charged to additionalpaid-in capital and accumulated deficit with the amount of US$ 8,754,073 and US$ 5,268,188, respectively.

The Company concluded that there is no accretion to be recognized forClass A-1 andClass A-2 preferred shares because their initial carrying amount is greater than the redemption value as of December 31, 2018. Therefore, no adjustment will be made to the initial carrying amount of theClass A-1 andClass A-2 preferred shares until the redemption amount exceeds the carrying amount.

As of December 31, 2018, US$ 89,222 of the subscription consideration forClass A-2 preferred shares remained outstanding and such amount was presented as subscriptions receivable, a contra mezzanine equity balance on the consolidated balance sheets.

| | ii. | Extinguishment of 8.36% Round A preferred shares during the Reorganization |

As described above, preferential rights associated with the 8.36% equity interest acquired by the Founders were removed during the Reorganization process and exchanged into 9,519,000 Class A Ordinary Shares of the Company. From accounting perspective, the Founders exchanged their preferred equity interests in ECMOHO Shanghai into the preferred shares of the Company and immediately exercise its conversion right to convert the preferred shares into Class A Ordinary Shares. Changes from the preferred equity interests in ECMOHO Shanghai to preferred shares of the Company were also considered as an extinguishment.

F-38