UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________________________________________________________________________________

FORM 10-K | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2024. | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to .

Commission file number: 001-38900

_______________________________________________________________________________________________________________________________________

THE PENNANT GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter) | | | | | |

| Delaware | 83-3349931 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

1675 East Riverside Drive, Suite 150, Eagle, ID 83616

(Address of Principal Executive Offices and Zip Code)

(208) 506-6100

(Registrant’s Telephone Number, Including Area Code)

__________________________________________________________________________________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | PNTG | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒Yes ☐No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Exchange Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of February 24, 2025, 34,429,989 shares of the registrant’s common stock were outstanding. The aggregate market value of the shares of common stock held by non-affiliates of the registrant on the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2024) was approximately $669,703,000 based upon the closing price of the common stock on such date. For purposes of this calculation, the registrant has excluded the market value of all common stock beneficially owned by all executive officers and directors of the registrant.

Note on Incorporation by Reference

Part III of this Form 10-K incorporates information by reference from the Registrant's definitive proxy statement on Schedule 14A for the Registrant's 2025 Annual Meeting of Stockholders to be filed within 120 days after the close of the fiscal year covered by this annual report.

THE PENNANT GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS | | | | | | | | | | | | |

| | | Part I. | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | Part II. | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | Part III. | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | Part IV. | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | | |

| | | |

Cautionary Note Regarding Forward-Looking Statements

Our reports, filings and other public announcements, including this Annual Report on Form 10-K may from time to time contain statements that do not directly or exclusively relate to historical facts. Such statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and typically include, but are not limited to, our expected future financial position, results of operations, cash flows, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities and plans and objectives of management. Forward-looking statements can often be identified by words such as “anticipate,” “expect,” “intend,” “plan,” “predict,” “believe,” “seek,” “estimate,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. These statements are subject to the safe harbors created under the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors, some of which are listed in Part I, Item 1A., Risk Factors, of this Annual Report on Form 10-K for the year ended December 31, 2024. Accordingly, you should not rely upon forward-looking statements as predictions of future events. These forward-looking statements speak only as of the date of this Annual Report, and are based on our current expectations, estimates and projections about our industry and business, management's beliefs, and certain assumptions made by us, all of which are subject to change. We undertake no obligation to revise or update publicly any forward-looking statement for any reason, except as otherwise required by law.

As used in this Annual Report on Form 10-K, the words, “Pennant,” “Company,” “we,” “our” and “us” refer to The Pennant Group, Inc. and its consolidated subsidiaries. All of our independent operating subsidiaries, and the Service Center (defined below) are operated by separate, wholly-owned, independent subsidiaries that have their own management, employees and assets. References herein to the consolidated “Company” and “its” assets and activities, as well as the use of the terms “we,” “us,” “our” and similar terms in this Annual Report are not meant to imply, nor should they be construed as meaning, that The Pennant Group, Inc. has direct operating assets, employees or revenue, or that any of the subsidiaries are operated by The Pennant Group, Inc.

The Pennant Group, Inc. is a holding company with no direct operating assets, employees or revenues. In addition, certain of our wholly-owned independent subsidiaries, collectively referred to as the “Service Center,” provide centralized accounting, payroll, human resources, information technology, legal, risk management, compliance oversight and other services to the other independent operating subsidiaries through contractual relationships with such subsidiaries.

The address of our headquarters is 1675 East Riverside Drive, Suite 150, Eagle, ID 83616, and our telephone number is (208) 506-6100. Our corporate website is located at www.pennantgroup.com. The information contained in, or that can be accessed through, our website does not constitute a part of this Annual Report on form 10-K.

Part I.

Item 1. Business

Overview

The Pennant Group, Inc. is a leading provider of high-quality healthcare services to patients or residents of all ages, including the growing senior population, in the United States. Through our innovative operating model and unique core values, we strive to be the provider of choice in the communities we serve.

As of December 31, 2024, we operate multiple lines of business, including home health, hospice and senior living, throughout Arizona, California, Colorado, Idaho, Montana, Nevada, Oklahoma, Oregon, Texas, Utah, Washington, Wisconsin and Wyoming. We also provide home health and hospice operational support through a management service agreement in Connecticut. We provide home health and hospice services through 123 agencies, and senior living services at 57 communities with 3,960 total units in our assisted living, independent living and memory care business. We derive revenue from a diversified blend of payors including Medicare and Medicaid programs, private pay patients and residents, and managed care payors.

We believe our key differentiators are our (1) ability to recruit, train, and develop talented local leaders at each of our operations; (2) innovative operating model that empowers those leaders to make decisions that meet the needs of patients and residents, employees, referral sources and the communities they serve with the support of our service center; (3) disciplined growth strategy; and (4) ability to achieve quality care outcomes in cost effective settings. In our experience, healthcare is a local endeavor, largely dependent upon personal and professional relationships, community reputation and an ability to adapt to the changing needs of patients, residents, partners and communities. As our operational leaders build strong relationships with key partners in their local communities, they are empowered to make informed and critical operational decisions that produce quality care outcomes and more effectively meet the needs of our patients and residents.

We believe our home health and hospice businesses achieve quality outcomes—as measured by multiple industry and value-based metrics (such as hospital readmission rates)—in cost-effective settings. We believe our senior living business is able to offer our residents a safe and tailored quality-of-life at an affordable cost, thus appealing to a broad population. With our platform of diversified service offerings, we believe that we are well-positioned to take advantage of favorable demographic shifts as well as industry trends that reward providers offering quality care in lower cost settings.

Our Innovative Operating Model

Our innovative operating model is the foundation of our superior performance and success. Our operating model is founded on two core principles: (1) healthcare is a local business where providers are most successful when key operational decision-making meets local community needs and occurs close to patients or residents and employees, and (2) peer accountability from operational and resource partners is more effective at driving excellent clinical and financial results than traditional hierarchical or “top-down” accountability structures.

Our model is innovative because each operation functions under the direction of local clinical and operational leaders, each of whom is empowered to make decisions based on the unique needs of the patients or residents, partners and communities they serve. This is in contrast to typical models where control and key decision-making is centralized at the corporate level. Moreover, we utilize a “cluster model,” where every operation is part of a defined “cluster,” which is a group of geographically proximate operations working together to allow leaders to communicate and provide support and accountability to each other. Clusters create incentives for leaders to share best practices and real-time data and benchmark clinical and financial performance with their cluster partners. We believe this locally-driven data-sharing and peer accountability model is unique among healthcare and senior living providers and has proven effective in improving clinical care, enhancing patient and resident satisfaction and promoting operational efficiencies. This “cluster” operating model is the same model used by local leaders prior to our spin-off from The Ensign Group, Inc. in 2019 (further discussed below under Company History) and is key to the success of our future operations.

Our organizational structure empowers our highly dedicated leaders and staff at the local level to make key decisions and creates a sense of ownership over operational and clinical results and the overall employee experience. Each operation’s leader and their staff are encouraged to make their operations the “provider of choice” in the communities they serve. To accomplish this goal, our leaders work closely with their clinical staff and our expert resources to identify unique patient and resident needs and priorities in their communities and to create superior service offerings tailored to those needs and priorities. We believe that our localized approach to program development and care leads prospective patients or residents and referral sources to choose or recommend our operations.

Similarly, our emphasis on empowering local decision-makers encourages leaders to strive to become the “employer of choice” in the communities they serve. One of our core values is the principle that the best patient care is provided by employees who experience significant work satisfaction because they are valued as individuals. Our leaders work hard to embody this core value to attract, train, and retain outstanding clinical staff by creating a work environment that fosters critical thinking, measurement, and relevance. Our local teams are motivated and empowered to quickly and proactively meet the needs of those they serve, without waiting for permission to act or being bound to a “one-size-fits-all” corporate strategy. In many markets, we attribute census growth and excellent clinical and financial outcomes to a healthy organizational culture built on these principles. With strong employee satisfaction across the organization, we believe we can continue to attract and retain the best talent in our industries.

Lastly, while our teams are local, they are also supported by cutting-edge systems and our “Service Center”, which is staffed with teams of subject-matter experts who advise regarding their respective fields of expertise, including information technology, compliance oversight, human resources, accounting, payroll, legal, risk management, and other services. The partnership and peer accountability that exists between our local leaders and Service Center resources allows each operation to improve while benefiting from the technical expertise, systems and accountability provided by our Service Center.

Partner of Choice in Local Healthcare Communities

We view healthcare services primarily as a local business, driven by personal relationships, reputation and the ability to identify and address unmet community needs. We believe our success is largely driven by our ability to build strong relationships with key stakeholders within the local healthcare communities, leveraging our reputation for providing superior care.

We believe we are a partner of choice to payors, providers, patients, residents and employees in the healthcare communities we serve. As a partner, we focus on improving care outcomes and the quality of life of our patients and residents in their home. Our local leadership approach facilitates the development of strong professional relationships within communities, which allows us to better understand and meet the needs of our partners. We believe our emphasis on working closely with other providers, payors, residents and patients yields unique, customized solutions and programs that meet local market needs and improve clinical outcomes, which in turn accelerates revenue growth and profitability.

We are a trusted partner to, and work closely with, payors and acute and post-acute providers to deliver innovative healthcare solutions in lower cost settings. In the markets we serve, we have initiated joint venture partnerships, developed formal and informal preferred provider relationships with key referral sources, and implemented transitional care programs that result in better coordination within the care continuum. These solutions have produced significant benefits to patients, residents, payors, and other providers, including reduced hospital readmission rates, appropriate transitions within the care continuum, overall cost savings, increased patient satisfaction and improved quality outcomes. In addition, positive, repeated interactions and data sharing result in strong local relationships and encourage referrals from our acute and post-acute care partners. As we continue to strengthen these formal and informal relationships and expand our referral base, we believe we will continue to drive revenue growth and operational results.

Company History

The Pennant Group, Inc. was incorporated as a Delaware corporation on January 24, 2019, for the purpose of holding the home health and hospice agencies and substantially all of the senior living businesses of The Ensign Group, Inc. (“Ensign”), which was formed in 1999 with the goal of establishing a new level of quality care within the skilled nursing industry. On October 1, 2019, Ensign completed the separation of Pennant (the “Spin-Off”). We believe that, through our innovative operating model, we can foster a new level of patient care and professional competence at our independent operating subsidiaries and set new industry standards for quality home health and hospice and senior living services.

Our independent operating subsidiaries are organized into industry-specific portfolio companies, which we believe has enabled us to maintain a local, field-driven organizational structure, to attract qualified leaders and expert resources, and to effectively identify, acquire, and improve operations. Each of our portfolio companies has its own leader. These experienced and proven leaders are generally taken from the ranks of our operational leaders to serve as resources to independent operating subsidiaries within their own portfolio companies and have the primary responsibility for recruiting qualified talent, finding potential acquisition targets, and identifying other strategic and organic growth opportunities. We believe this decentralized organizational structure will continue to improve the quality of our recruiting and facilitate successful acquisitions.

We have two reportable segments: (1) home health and hospice services, which includes our home health, hospice, home care, and geriatric primary and palliative care businesses; and (2) senior living services, which includes our assisted living, independent living and memory care services. We also report an “all other” category that includes general and administrative expense. Our reporting segments are business units that offer different services and are managed separately to provide greater visibility into those operations. For more information about our operating segments, as well as financial information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 6, Business Segments, to the Consolidated Financial Statements.

Services

Home Health and Hospice. As of December 31, 2024, we provided home health and hospice services through 123 agencies. We also provide home health and hospice operational support through a management service agreement in Connecticut. Our home health services consist of providing a combination of clinical services including nursing, speech, occupational and physical therapy, medical social work and home health aide services within a patient's home. Home health is often a cost-effective solution for patients and can also increase their quality of life by allowing them to receive excellent clinical services in the comfort and convenience of each patient’s home. Our hospice services focus on the physical, spiritual and psychosocial needs of terminally ill patients and their families and consist primarily of clinical care, education and counseling. Our home care services include the provision of case management services, personal care services, and assistance with the activities of daily living. Our geriatric primary and palliative care services include physician and nurse practitioner services provided in the home, facility, or other appropriate setting. We generated approximately 64.7%, 66.9% and 67.7% of our home health and hospice segment revenue from Medicare during the years ended December 31, 2024, 2023 and 2022, respectively.

Senior Living. As of December 31, 2024, we provided assisted living, independent living and memory care services in 57 communities with 3,960 total available units. Our senior living operations provide a variety of services tailored to our residents’ needs, including residential accommodations, activities, meals, housekeeping and assistance in the activities of daily living to seniors who are independent or who require some support, but not at the level of clinical care provided in a skilled nursing facility. We generate revenue in these communities primarily from private pay sources, with a portion earned from Medicaid or other state-specific programs. We derived approximately 69.4%, 68.8% and 71.3% of our senior living revenue from private pay sources during the years ended December 31, 2024, 2023 and 2022, respectively.

Our Growth Strategy

We believe that the following strategies are primarily responsible for our growth to date and will continue to drive the growth of our business:

Grow Talent Base and Develop Future Leaders. We view ourselves as a leadership company. Our growth strategy is focused on expanding our talent base and recruiting and developing future leaders. A key component of our organizational culture is our belief that strong local leadership is a primary ingredient to operational success. We use a multi-faceted strategy to identify and recruit proven business leaders from various industries and backgrounds. To develop these leaders, we have a rigorous “CEO-in-Training Program” that includes significant in-person instruction on leadership, clinical and operational topics, as well as extensive on-the-ground training and active learning with key leaders from across the organization. After placement in a local operation, our leaders continue to receive training and regular feedback and support from operational, clinical and Service Center peers. We also have similar programs for our new and emerging clinical leaders. We believe our model of empowering local leaders and providing them a platform of support, including expert resources and industry-leading systems, will continue to attract and retain highly talented and entrepreneurial leaders.

Focus on Organic Growth. We believe that we have a significant opportunity to drive organic growth within our current portfolio, including recently acquired operations. As we improve clinical outcomes, quality of care and operational results at each of our existing and newly acquired operations, we believe we will become a provider of choice in the communities we serve, which leads to census growth. Through this census growth, and as we continue to expand our service areas and offerings, we believe we will continue to translate revenue growth into bottom line success with rigorous adherence to our core operating principles. By effectively using data systems and analytics and embracing a culture of transparency and accountability, we expect to see our local leaders steadily improving operational results. We believe our unique operating model will continue to cultivate steady and consistent organic growth in the future.

Pursue Disciplined Acquisition Strategy. The disciplined acquisition and integration of strategic and underperforming operations is a key element of our past success and is integral to our future growth plans. Historically, we have successfully transitioned both turnaround and stable target businesses, transforming them into top-quality operations preferred by referral

sources and community partners. We plan to continue to take advantage of the fragmented home health, hospice and senior living industries by being proactive yet disciplined in acquiring strategic and underperforming operations with high upside potential within both existing and new geographic markets. With experienced leaders in place at the local level and demonstrated success in improving operating conditions at acquired businesses, we believe we are well positioned to continue expanding our footprint through strategic and opportunistic acquisitions.

Leverage Our Operational Capabilities to Expand Partnerships. Our local leadership approach enables us to adapt to and efficiently meet the needs of our partners in the communities we serve. Our clinical and data analytics capabilities foster solutions and allow us to optimize clinical outcomes. We use this data to communicate with key partners in an effort to reduce overall cost of care and drive improved clinical outcomes. We also operate joint ventures with leading health systems, which allows us to expand our partnership in the space, and we may undertake additional joint ventures in the future. We will continue to expand formal and informal partnerships across the healthcare continuum by strategically investing in programs and data analytics that help us and our partners improve care transitions, achieve better outcomes and reduce costs.

Growth and Acquisition History

Much of our historical growth can be attributed to our expertise in acquiring strategic and underperforming operations and transforming them into market leaders in clinical quality, staff competency and financial performance. Our local leaders are trained to identify these opportunities for long-term organic growth as we strive to become the provider of choice in our local communities. Accordingly, we plan to continue to drive organic growth and acquire additional operations in existing and new markets in a disciplined manner.

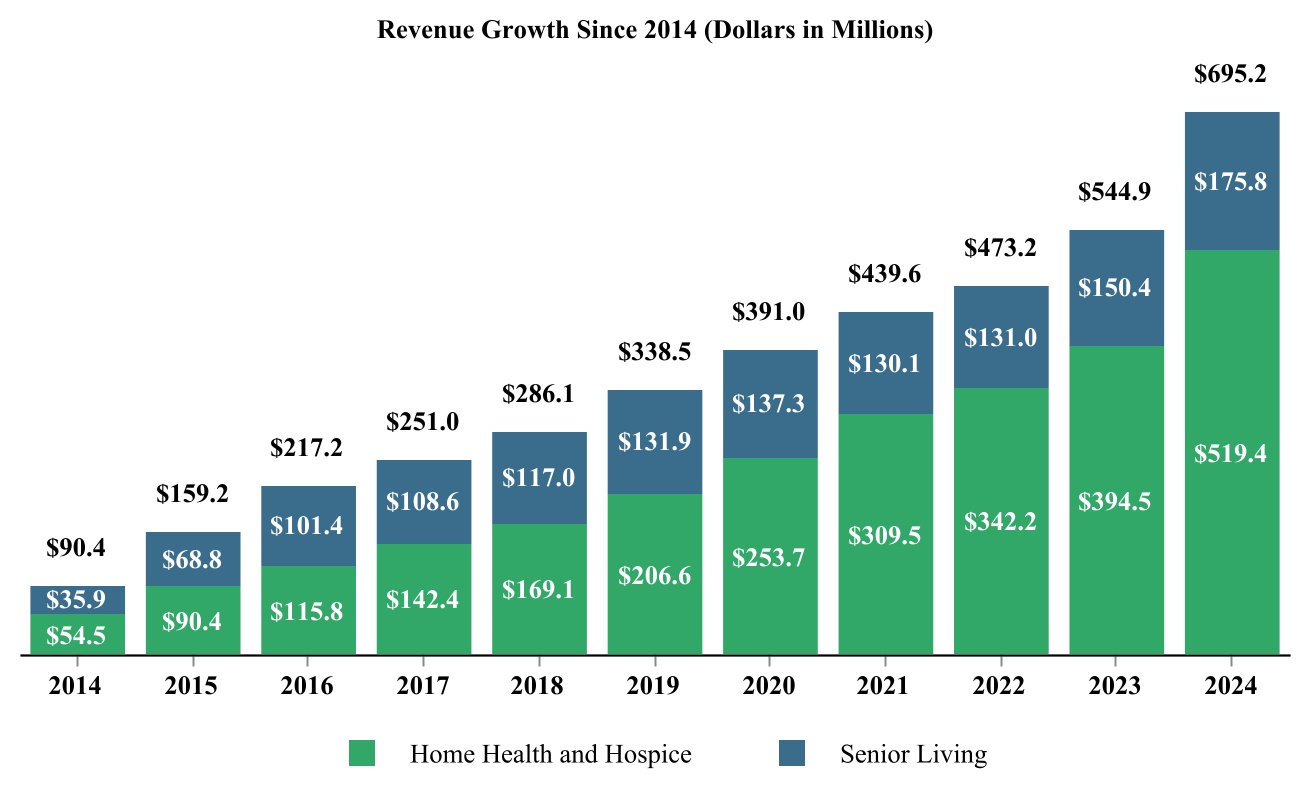

From 2014 to 2024, we grew our home health and hospice services and senior living services revenue by 669.0% or a compounded annual growth rate of 22.6%.

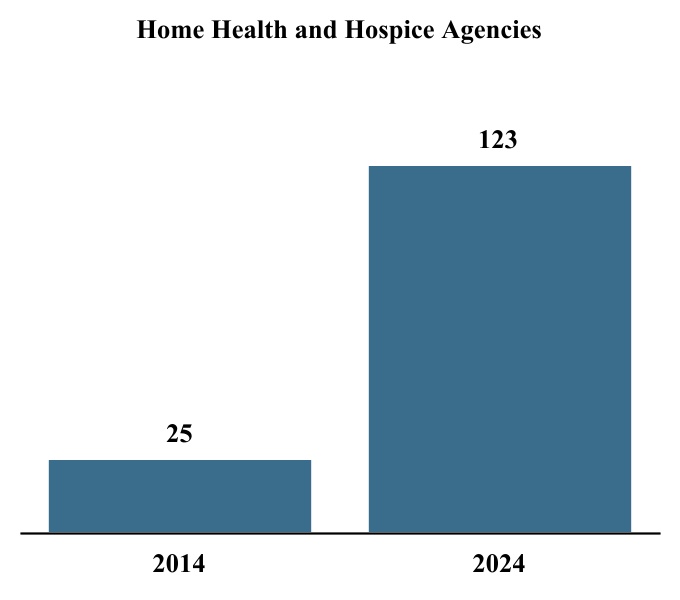

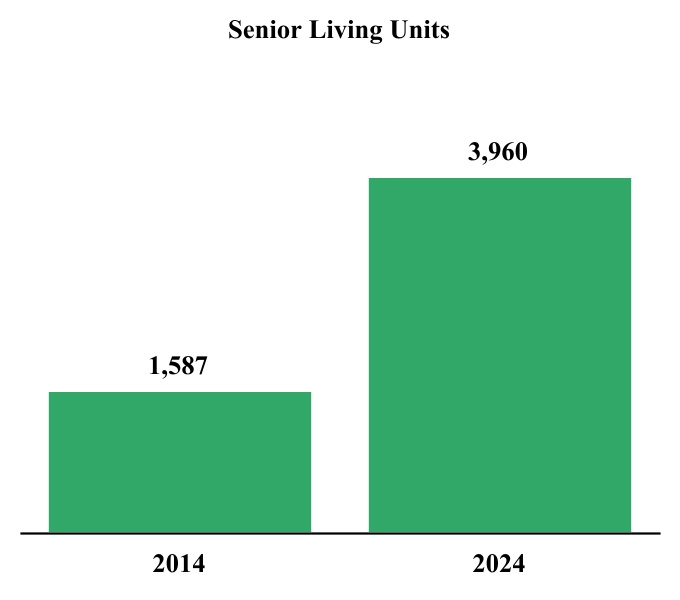

From December 31, 2014 to December 31, 2024, we grew the number of our home health and hospice agencies and senior living units by 392.0% and 149.5%, respectively.

Agency and Unit Growth Since 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | 2024 |

| Home health and hospice agencies | 25 | | | 32 | | | 39 | | | 46 | | | 54 | | | 63 | | | 76 | | | 88 | | | 95 | | | 111 | | | 123 | |

Senior living communities(a) | 15 | | | 36 | | | 36 | | | 43 | | | 50 | | | 52 | | | 54 | | | 54 | | | 49 | | | 51 | | | 57 | |

Senior living units(a) | 1,587 | | | 3,184 | | | 3,184 | | | 3,434 | | | 3,820 | | | 3,963 | | | 4,127 | | | 4,127 | | | 3,500 | | | 3,588 | | | 3,960 | |

| Total number of home health, hospice, and senior living operations | 40 | | | 68 | | | 75 | | | 89 | | | 104 | | | 115 | | | 130 | | | 142 | | | 144 | | | 162 | | | 180 | |

| | | | | | | | |

| (a) | | During January 2022, affiliates of the Company entered into certain operations transfer agreements with affiliates of Ensign, providing for the transfer of the operations of five senior living communities. |

We aim to continue to grow our revenue and earnings by expanding our existing operations and acquiring additional operations in existing and new markets.

Industry Trends

The healthcare sector is one of the largest and fastest-growing sectors of the U.S. economy. According to the Centers for Medicare and Medicaid Services (“CMS”), national healthcare spending increased from 8.9% of U.S. GDP, or $253 billion, in 1980 to an estimated 17.6% of GDP, or $4.8 trillion, in 2023. CMS projects national healthcare spending will grow by an average of 5.6% annually from 2023 through 2032, accounting for approximately 19.7% of U.S. GDP, or approximately $7.7 trillion, in 2032.

The home health and hospice segment is growing within the overall healthcare landscape in the United States. According to Grandview Research, Inc., the home health market is expected to grow at a compounded annual growth rate (“CAGR”) of 8.0% from 2024 to 2030. The hospice industry is estimated at approximately $37.9 billion and is projected to grow at an estimated CAGR of 8.1% from 2024 to 2030. The senior living market is expected to expand at an estimated CAGR of 4.2% between 2024 to 2030. We believe that the industries in which we operate will continue to benefit from several macroeconomic and regulatory trends highlighted below:

Increased Demand Driven by Aging Populations. As seniors account for an increasing percentage of the total U.S. population, we believe demand for home health and hospice will continue to increase and demand for senior living services will improve. According to the U.S. Census Bureau in 2023, between 2022 and 2060, the number of individuals over 65 years old is projected to be one of the fastest growing segments of the United States population, growing from 17% to 24%. The Bureau

identified the year 2030 as the year all baby boomers will be more than 65 years of age. The Bureau expects the over-65 population segment to increase nearly 54% to 89 million by 2060 (from 2022) as compared to the total U.S. population which is projected to increase by 9.3% over that same time period. Furthermore, the generation currently retiring has access to fewer post-retirement benefits and accumulated less savings than in the past, creating demand for more affordable senior housing and in-home care options. As a high-quality provider in lower cost settings, we believe we are well-positioned to benefit from this trend.

Shift of Patient Care to Lower Cost Alternatives. The growth of the senior population in the U.S. continues to increase healthcare costs, often at a rate faster than the available funding from government-sponsored healthcare programs. In response, government payors have adopted measures that encourage the treatment of patients in their homes and other cost-effective settings where the staffing requirements and associated costs are often significantly lower than the alternatives. With our emphasis on the home health, hospice and senior living industries, which are among the lowest cost settings within the post-acute care continuum, we expect this shift to continue to drive our growth.

Transition to Value-Based Payment Models. In response to rising healthcare spending, certain markets’ commercial, government and other payors are shifting away from fee-for-service payment models toward value-based models, including risk-based payment models that tie financial incentives to quality, efficiency and coordination of care. We believe that payors will continue to emphasize reimbursement models driven by value and that our clinical outcomes combined with our services in cost effective settings will be increasingly rewarded. Many of our home health agencies already receive value-based payments, and we are well-positioned to capitalize on this trend as it unfolds across the markets we serve. Please see further discussion of value-based payment models below under Government Regulation.

Significant Acquisition and Consolidation Opportunities. The home health, hospice and senior living industries are highly fragmented markets with thousands of small and regional providers and only a handful of large national players. There were over 11,300 Medicare-certified home health agencies operating in 2022, with the top ten largest operators accounting for approximately 26.6% of the market. There are approximately 6,000 hospice agencies in the U.S. with the top ten largest operators accounting for about 19.1% of the total market share. As with the home health and hospice industries, there is significant fragmentation in the senior housing industry, with the top 25 operators owning approximately 28% of the licensed beds within the US. We believe that our strategy of acquiring strategic and underperforming operations in these highly fragmented markets will be an instrumental to our future growth.

Changing Regulatory Framework. Regulations and reimbursement change frequently in our industries. Our model is designed to successfully navigate these regulatory and reimbursement changes. For example, effective January 1, 2020, CMS enacted additional changes to the Medicare home health prospective payment system (“HH PPS”) with the implementation of the Patient Driven Groupings Model (“PDGM”). As discussed in greater detail below under Government Regulation, and adjusted in subsequent calendar years’ payment rules, this reimbursement structure involved case mix calculation methodology refinements, changes to low-utilization payment adjustment (“LUPA”) thresholds, the elimination of therapy thresholds, a change to the unit of payment from a 60-day episode to a 30-day period of care, and reduction in fiscal year 2020 and full elimination in fiscal year 2021 of requests for anticipated payments (“RAPs”), which were no longer available by January 1, 2022. In fiscal year 2022, CMS replaced the RAP process with the home health Notice of Admission (“NOA”), which requires a single NOA filing that will cover continuous 30-day periods of care until the patient is discharged. We believe our unique operating model has allowed us to effectively transition to PDGM as local operations and clinical leaders, supported by our expert resources, have adapted to the new reimbursement environment.

Payor Sources

We derive revenue primarily from Medicare and Medicaid programs, managed care and private insurance, and private and other payors.

Medicare. Medicare is a federal program that provides healthcare benefits to individuals who are 65 years of age or older or are disabled. The Medicare home health benefit is available both for patients who need care following discharge from an inpatient facility and patients who suffer from chronic conditions that require ongoing but intermittent care. The Medicare hospice benefit is also available to Medicare-eligible patients with terminal illnesses, certified by a physician, where life expectancy is six months or less.

Medicaid. Medicaid is a program financed by state funds and matching federal funds administered by state agencies or managed care organizations on their behalf. Medicaid programs generally provide health benefits for qualifying individuals and may supplement Medicare benefits for the disabled and for persons aged 65 and older meeting financial eligibility

requirements. Medicaid reimbursement formulas are established by each state with the approval of the federal government in accordance with federal guidelines.

Medicaid reimbursement varies from state to state and is based upon a number of different methodologies, including cost-based, prospective payment, case mixed adjusted payments, and negotiated rates. Rates are subject to a state’s annual budgetary requirements and funding, statutory and regulatory changes and interpretations and rulings by individual state agencies and State Plan Amendments approved by CMS.

Managed Care and Private Insurance. Managed care patients consist of individuals who are insured by certain third-party entities, or who are Medicare beneficiaries who have assigned their Medicare benefits to a managed care organization plan. Another type of insurance, long-term care insurance, is also becoming more widely available to consumers and is not expected to contribute significantly to industry revenues in the near term.

Private and Other Payors. Private and other payors consist primarily of individuals, family members or other third parties who directly pay for the services we provide.

The following table sets forth our total revenue by payor source as a percent of revenue generated by each of our reportable segments and as a percentage of total revenue for the year ended December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2024 |

| | Home Health and Hospice Services | | | | |

| | Home Health Services | | Hospice Services | | Senior Living Services | | Total Revenue |

| Medicare | | 45.8 | % | | 86.6 | % | | — | % | | 48.3 | % |

| Medicaid | | 4.3 | | | 10.8 | | | 30.6 | | | 13.2 | |

| Subtotal | | 50.1 | | | 97.4 | | | 30.6 | | | 61.5 | |

| Managed care | | 31.5 | | | 2.0 | | | — | | | 13.3 | |

Private and other(a) | | 18.4 | | | 0.6 | | | 69.4 | | | 25.2 | |

| Total revenue | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | |

| (a) | | Private and other payors in the Company’s home health services includes revenue from all payors generated in the Company’s home care operations and management services agreement. |

Reimbursement for Specific Services

Historically, adjustments to reimbursement under Medicare and Medicaid have had a significant effect on our revenue and results of operations. Recently enacted, pending and proposed legislation and administrative rulemaking at the federal and state levels could have similar effects on our business. Efforts to impose reduced reimbursement rates, greater discounts, cost sequestrations in federal spending bills passed by Congress, and more stringent cost controls by government and other payors are expected to continue for the foreseeable future and could adversely affect our business, financial condition and results of operations. Additionally, any delay or default by the federal or state governments in making Medicare and/or Medicaid reimbursement payments could materially and adversely affect our business, financial condition and results of operations.

Reimbursement for Home Health Services. Our home health business derives substantially all of its revenue from Medicare, managed care, and private pay sources, which may vary in the markets we serve. Our home health services generally consist of providing some combination of the services of registered nurses, speech, occupational and physical therapists, medical social workers and certified home health aides. Home health is often a cost-effective solution for patients and can also increase their quality of life and allow them to receive quality medical care in the comfort and convenience of a familiar setting.

Reimbursement for Hospice Services. Hospice revenues are primarily derived from Medicare. We receive one of four predetermined rate categories based on four different levels of care provided: routine home care, continuous home care, inpatient respite care and general inpatient care. This payment structure is designed to include all of the services needed to manage a beneficiary’s care, consisting primarily of clinical care, education and counseling. These rates are subject to annual adjustments based on inflation and geographic wage considerations.

Reimbursement for Senior Living Services. Assisted living, independent living and memory care community revenue is primarily derived from private pay residents at rates we establish based upon the services we provide and market conditions

in the area of operation. In addition, Medicaid or other state-specific programs in some states where we operate supplement payments for board and care services provided in assisted living and memory care communities.

Competition

The post-acute care industry is highly competitive, and we expect that the industry will become increasingly competitive in the future. The industry is highly fragmented and characterized by numerous local and regional providers, in addition to large national providers that have achieved geographic diversity and economies of scale. Some of our independent operating subsidiaries also compete with skilled nursing facilities, inpatient rehabilitation facilities and long-term acute care hospitals. Competitiveness may vary significantly from location to location, depending upon factors such as the number of competing operations, availability of services, expertise of staff, and the physical appearance and amenities of senior living communities. We believe that the primary competitive factors in the post-acute care industry are:

•ability to attract and to retain qualified leaders and caregivers;

•reputation and achievements of quality healthcare outcomes and patient and resident satisfaction;

•attractiveness and location of senior living communities and other physical assets;

•the expertise and commitment of operational leaders and employees; and

•private equity, payors, and other firms with greater financial resources and/or lower costs of capital with similar asset acquisition objectives.

We seek to compete effectively in each market by establishing a reputation within the local community as the “provider of choice.” This means that the operation leaders are generally free to discern and address the unique needs and priorities of healthcare professionals, customers and other stakeholders in the local community or market, and then create superior service offerings that are calculated to encourage prospective customers and referral sources to choose or recommend the operation.

Increased competition could limit our ability to attract and retain patients and residents, maintain or increase rates of reimbursement or to expand our business. Some of our competitors have greater financial and other resources than we have, may have greater brand recognition and may be more established in their respective communities than we are. Competing companies may also offer newer or more recently renovated communities or different programs or services than we offer and may, therefore, attract individuals who are currently patients of our operations, potential residents of our senior living communities, or who are otherwise receiving our healthcare services. Other competitors may have lower expenses or other competitive advantages than we do and, therefore, provide services at lower prices than we offer.

There are few barriers to entry in the home health and hospice business in jurisdictions that do not require certificates of need or permits of approval. Our primary competition in these jurisdictions comes from local privately and publicly owned providers and hospital-owned healthcare providers. We compete based on the availability of personnel, the quality of services, expertise of visiting staff, and, in certain instances, on the price of our services. In addition, we compete with a number of non-profit organizations that finance acquisitions and capital expenditures on a tax-exempt basis and charity-funded programs that may have strong ties to their local medical communities and receive charitable contributions that are unavailable to us.

Our senior living services also compete with local, regional and national companies. The primary competitive factors in these businesses include reputation, attractiveness and location of physical assets, cost of services, quality of clinical services, responsiveness to patient or resident needs, location and the ability to provide support in other areas such as third-party reimbursement, information management and patient recordkeeping. The market for acquiring and/or operating senior living communities is highly competitive, and some of our present and potential senior living competitors have, or may obtain, greater financial resources than us and may have a lower cost of capital.

Our Competitive Strengths

We believe that we are well positioned to benefit from the ongoing regulatory, reimbursement and demographic changes within the home health, hospice and senior living industries. We believe that we will achieve clinical, financial and cultural success as a direct result of the following key competitive strengths:

Innovative Operating Model. We believe healthcare should be operated primarily as a local business. Our innovative operating model, described in Part 1, Item 1 - “Our Innovative Operating Model”, is one of our key competitive strengths.

Effective Talent Recruitment, Development and Retention. We believe we have an advantage and are successful in attracting, developing, and retaining outstanding business and clinical leaders to lead our independent operating subsidiaries. Our unique operating model, which emphasizes local decision making and team building, supported by our platform of expert resources and best-in-class systems, attracts a highly talented and entrepreneurial group of leaders. Our operational leaders are committed to ongoing training and participate in regular leadership development and educational programs. We believe that our commitment to professional development strengthens the quality of our operational leaders and staff and will continue to differentiate us from our competitors.

Proven Track Record of Successful Acquisitions. We adhere to a disciplined acquisition strategy focused on sourcing and selectively acquiring operations within our target markets. Local leaders are heavily involved in the acquisition process and are recognized and rewarded as these acquired operations become the provider of choice in the communities they serve. Through our innovative operating model and disciplined approach to strategic growth, we have completed and successfully transitioned dozens of value-add operations. Our expertise in acquiring and transforming strategic and underperforming operations allows us to consider a broad range of potential acquisition targets and will be a key element of our future success.

Superior Clinical Outcomes and Quality Care. We will continue to succeed by delivering high quality home health, hospice and senior living services. Using the CMS five-star quality rating criteria, our home health agencies achieved an average of 4.1 out of 5 stars across all agencies for the for the year ended December 31, 2024, compared to the industry average of 3.0 stars (see Government Regulation below for further discussion on the five-star quality rating system). Our locally driven, patient-centered approach to clinical care allows us to meet the unique needs of our patients, resulting in improved clinical outcomes, including reduced hospital readmission rates. These improved outcomes are driven by both our talented local clinicians and our data-driven analytical approach to patient care and risk stratification. We believe that our achievement of high-quality clinical outcomes positions us as a solution for patients, residents and referral sources, leading to census growth and improved profitability.

Diversified Portfolio by Payor and Services. As of December 31, 2024, we operated 123 home health and hospice agencies and 57 senior living communities across 13 states. Because of this diversified portfolio, our blended payor mix was 48.3% Medicare, 13.2% Medicaid, 13.3% managed care and 25.2% private pay and other for the year ended December 31, 2024. Our balanced payor mix can provide greater business stability through economic cycles and mitigates volatility arising from government-driven reimbursement changes. For the year ended December 31, 2024, we generated 74.7% of our revenue from home health and hospice services and 25.3% of our revenue from senior living services. Our diversified service portfolio allows us to opportunistically execute on our acquisition strategy as valuations fluctuate over industry cycles.

Human Capital

The operation of our home health and hospice operations and senior living communities requires a large number of highly skilled healthcare professionals and support staff. As of December 31, 2024, we had approximately 7,000 employees who were employed by our independent operating subsidiaries or our Service Center.

Our ability to attract and retain future leaders is critical to our ongoing success. Therefore, we are dedicated to continuously recruiting and developing a diverse group of capable leaders. As described in Part 1, Item 1., Grow Talent Base and Develop Future Leaders, our CEO-in-Training and Clinical Operations Leadership Training programs provide significant in-person instruction and extensive training with key leaders from across the organization to empower local leaders.

For the year ended December 31, 2024, 67.7% of our total expenses were payroll related. Periodically, market forces, which vary by region, require that we increase wages in excess of general inflation or increases in reimbursement rates we receive. We believe that we staff appropriately, focusing primarily on the acuity level and day-to-day needs of our patients and residents. We seek to manage our labor costs by improving staff retention, improving operating efficiencies, maintaining competitive wage rates and benefits and reducing reliance on overtime compensation and temporary nursing agency services.

The healthcare industry as a whole has been experiencing shortages of qualified professional clinical staff. We believe that our ability to attract and retain qualified professional clinical staff stems from our ability to offer attractive wage and benefits packages, a high level of employee training, a culture that provides incentives for individual efforts and a quality work environment.

Government Regulation

General. The laws and statutes affecting the regulatory landscape of the home health, hospice and senior living industries continue to expand. We expect that these changes will continue. In addition to this changing regulatory environment,

federal, state and local officials are increasingly focusing their efforts on the enforcement of these laws. In order to operate our businesses, we must comply with federal, state and local laws relating to, among other things, licensure, delivery and adequacy of medical care, distribution of pharmaceuticals, equipment, personnel, operating policies, fire prevention, immigration, employment, rate-setting, billing and reimbursement, building codes and environmental protection. Additionally, we must also adhere to federal and state anti-fraud and abuse laws, such as anti-kickback statutes and, physician referral laws, as well as safety and health standards set by the Occupational Safety and Health Administration (“OSHA”). Changes in laws or regulations, or new interpretations of existing laws may have an adverse impact on our methods and costs of doing business.

Our independent operating subsidiaries are also subject to various regulations and licensing requirements promulgated by state and local health and social service agencies and other regulatory authorities. Requirements vary from state to state, and these requirements can affect, among other things, personnel education and training, patient and personnel records, services, staffing levels, monitoring of patient wellness, patient furnishings, housekeeping services, dietary requirements, emergency plans and procedures, certification and licensing of staff prior to beginning employment, and patient rights. These laws and regulations could limit our ability to expand into new markets and to expand our services and facilities in existing markets.

Recent Updates. On July 30, 2024, CMS issued the 2025 Hospice Payment Rate Update Final Rule (the “Hospice Payment Final Rule”). The Hospice Payment Final Rule’s payment update percentage is 2.9%, which is an estimated increase of $790 million in payments from fiscal year 2024. The payment update percentage is based on a 3.4% market basket percentage increase, which is reduced by a 0.5% productivity adjustment. Hospices that fail to meet quality reporting requirements under the Hospice Quality Reporting Program (“HQRP”) will receive a 4% reduction to the annual hospice payment update percentage increase for that year, resulting in a total decrease of 1.1% to those non-compliant hospices’ payments and more than negating the payment update percentage for fiscal year 2025. The Hospice Payment Final Rule also adds two new process measures to HQRP: timely reassessment of pain impact, and timely reassessment of non-pain symptom impact, which are both expected to begin in fiscal year 2028. In addition, the Hospice Payment Final Rule updates the statutory aggregate cap that limits the overall payments per patient that may be made to a hospice annually. The hospice cap amount for the 2025 fiscal year is $34,465.34, increased from the 2024 fiscal year cap of $33,494.01. The Hospice Payment Final Rule also includes clarifying revisions to the hospice conditions of participation; updates statistical area delineations; and makes changes to the Consumer Assessment of Healthcare Providers and Systems (“CAHPS”) Hospice Survey.

On November 1, 2024, CMS issued the 2025 Home Health Prospective Payment System Final Rule (the “Home Health Payment Final Rule”). The Home Health Payment Final Rule’s payment update percentage for calendar year 2025 is 2.7%, an estimated increase of $445 million from calendar year 2024, which is reduced by an estimated 1.8% behavioral adjustment, along with a 0.4% estimated reduction for fixed dollar losses, resulting in an aggregate net increase of 0.5%, or $85 million, for the calendar year 2025 payment rate compared to calendar year 2024. The Home Health Payment Final Rule also recalibrates PDGM case-mix weights, finalizes an update to the home health wage index, updates home health conditions of participation to require patient acceptance policies, and establishes or updates certain LUPA add-on factors.

In June 2024, CMS announced a Period of Enhanced Oversight for newly enrolled hospices in Arizona, California, Nevada, and Texas. The program includes hospices that are newly enrolled, or that undergo a change of ownership, or reactivating after being in a deactivated status after July 13, 2023. Such hospices are subject to enhanced oversight for up to one year and may undergo medical review by CMS contractors to deter fraud, waste and abuse of Medicare funds. This period of enhanced oversight may last up to one year.

On April 22, 2024, CMS published the Ensuring Access to Medicaid Services Final Rule (the “Access Rule”), which creates and, over the course of five years, implements new obligations for providers of home- and community-based services (“HCBS”), including non-skilled personal care services in the home. The Access Rule requires that, beginning in 2030, states must implement data collection and monitoring systems to ensure that, subject to exceptions, Medicaid-funded HCBS providers spend at least 80% of their Medicaid HCBS reimbursement on compensation for direct care workers, as opposed to administrative overhead or profits. The Access Rule further requires states to establish a grievance system for addressing services provided in the fee-for-service context, publish fee-for-service payment rates paid by Medicaid, publish the average hourly rate paid to HCBS care providers, and develop hardship exemptions and separate requirements for small providers, with these requirements to be implemented within one to three years from the Access Rule taking effect. We anticipate potential changes to the Access Rule, or offsetting Medicaid rate increases, before the Access Rule’s ultimate implementation in six years.

Medicare. All providers are subject to compliance with various federal, state and local statutes and regulations in the U.S. and receive periodic inspection by state licensing agencies to review standards of medical care, equipment and safety.

Conditions of Participation. Our home health and hospice operations must comply with regulations promulgated by the United States Department of Health and Human Services (“HHS”) and CMS in order to participate

in the Medicare program and receive Medicare payments. Among other things, these conditions of participation (the “CoPs”), relate to the type of operation, its personnel and its standards of medical care, as well as its compliance with state and local laws and regulations.

Home Health Quality Reporting Requirements. The CoPs require home health agencies to submit quality reporting data through Outcome and Assessment Information Set (“OASIS”) assessments within 30 days of completing the assessment of the Medicare and Medicaid beneficiary as a condition of payment and for quality measurement purposes. If the OASIS assessment is not found in CMS’s quality system upon receipt of a final claim for a home health episode and the receipt date of the claim is more than 30 days after the assessment completion date, CMS will deny the claim. Home health agencies that do not submit quality measure data to CMS incur a 4% reduction in their annual home health payment update. Under this CoP, all home health agencies are required to timely submit both a Start of Care or Resumption of Care OASIS assessment and a Transfer or Discharge OASIS assessment for a minimum of 90% of all episodes.

In addition, CMS requires that all Medicare certified home health and hospice agencies participate in CAHPS surveys. CAHPS surveys are designed to produce comparable data on the perspective of patients and their caregivers that allows meaningful and objective comparisons between agencies. Home health and hospice agencies that do not submit the required data incur a 4% reduction in their annual base rate payment update.

Home Health Star Rating. As a consumer tool for selecting a home health provider, CMS has used a five-star rating model to rate home health agencies since 2015. This Quality of Patient Care Star Rating is a summary measure of a home health agency’s performance based upon how well it provides patient care. CMS uses seven measurements indicating quality to determine its quality of patient care rating, including how often the agency initiated care in a timely manner, how often patients demonstrated improvements in ambulation, bed transferring, bathing, oral medication administration, less shortness of breath, and decreased need for acute care hospitalization. According to CMS, a 3-star rating means the agency provides good quality of care, as a 3-star rating applies to most home health agencies. According to the January 2025 quarterly refresh of CMS Home Health Compare star rating criteria, our home health agencies have achieved an average of 4.1 out of 5 stars across all agencies compared to the industry average of 3.0 stars.

Home Health Reimbursement Under PDGM. To qualify for home health services, Medicare CoPs require that beneficiaries (1) be homebound (meaning that the beneficiary is unable to leave their home without a considerable and taxing effort); (2) require intermittent skilled nursing, physical therapy, or speech therapy services; (3) have a face to face encounter that (a) has occurred no more than 90 days prior to the start of care or within 30 days after the start of care, (b) was related to the primary reason the patient requires home health services, and (c) was performed by a physician or allowed non-physician provider; and (4) receive treatment under a plan of care established and periodically reviewed by a physician.

Under PDGM, Medicare provides agencies with payments for each 30-day payment period provided to beneficiaries. There is no limit to the number of periods of care a beneficiary who remains eligible for the home health benefit can receive. The reimbursement rate is determined by a set of factors intended to account for the cost of providing care to each patient. Payments may be adjusted for certain variables including, but not limited to the number of visits provided, patient transfers, and other factors.

Home Health Value Based Purchasing (“HHVBP”). After introducing HHVBP models in select states from 2016 to 2021, CMS expanded HHVBP to all fifty states beginning on January 1, 2022. Fiscal Year (“FY”) 2022 was the pre-implementation year wherein CMS provided Home Health Agencies (“HHAs”) with resources and training, which allowed HHAs time to prepare and learn about the expectations and requirements of the expanded HHVBP Model without risk to payments. FY 2023 (beginning on January 1, 2023) was the first full performance year for the expanded HHVBP Model. FY 2024 was the second year for the expanded HHVBP model, based on FY 2022 for its baseline, and HHA performance for the FY 2024 applicable measure set determines payment adjustments applicable to FY 2026 Medicare fee-for-service claims by HHAs. FY 2025 is the first year when payment will be adjusted determined on FY 2023 performance. Payment adjustments could be as much as 5% in 2025 based on data obtained in FY 2023 and CMS could increase the payment adjustment percentage in future years.

Review Choice Demonstration for Home Health Services. The Review Choice Demonstration for Home Health Services (“RCD”) is mandatory for our HHAs in Texas and allows them to select from three initial options for payment review:

•Pre-claim review

•Post-payment review

•Minimal post-payment review with a 25% payment reduction

After a 6-month period, HHAs demonstrating compliance with Medicare rules through pre-claim review or post-payment review will have additional choices, including relief from most reviews except for a review of a small sample of claims. (To be eligible, HHAs must meet a 90% target full provisional affirmation rate based on a minimum 10 requests or claims submitted.) This program is designed to reduce the number of Medicare appeals, improve provider compliance with Medicare program requirements, should not delay care to Medicare beneficiaries, and does not alter or reduce the Medicare home health benefit.

Hospice Special Focus Program. In 2024, CMS implemented a Hospice Special Focus Program (“HSFP”). Under this program, 50 hospices will be selected annually for inclusion in the HSFP based on certain quality and survey data. Hospices in the HSFP will be surveyed at least semiannually every 6 months for a period of 18 months. To successfully exit the HSFP, a hospice must have two surveys within 18 months with no uncorrected condition-level deficiencies, and no pending complaint investigations triaged at the immediate jeopardy or condition-level and must otherwise be substantially compliant with all applicable requirements.

Hospice Reimbursement and Cap Amounts. Payments are based on daily rates for each day a beneficiary is enrolled in the hospice benefit and are subject to two annual caps. Rates are set based on specific levels of care, are adjusted by a wage index to reflect healthcare labor costs across the country and are established annually through federal legislation. The following are the four levels of care provided under the hospice benefit:

•Routine Home Care (“RHC”). Care that is not classified under any of the other levels of care, such as the work of nurses, social workers or home health aides.

•General Inpatient Care. Pain control or acute or chronic symptom management that cannot be managed in a setting other than an inpatient Medicare-certified facility, such as a hospital, skilled nursing facility or hospice inpatient facility.

•Continuous Home Care. Care for patients experiencing a medical crisis that requires nursing services to achieve palliation and symptom control, if the agency provides a minimum of eight hours of care within a 24-hour period.

•Inpatient Respite Care. Short-term, inpatient care to give temporary relief to the caregiver who regularly provides care to the patient.

CMS has established a two-tiered payment system for RHC. Hospices are reimbursed at a higher rate for RHC services provided from days of service one through 60 and then a lower rate for all subsequent days of service. CMS also provided for a Service Intensity Add-On, which increases payments for certain RHC services provided by registered nurses and social workers to hospice patients during the final seven days of life.

Medicare payments are subject to two fixed annual caps, which are assessed on a provider-number basis and are broken into an inpatient cap amount and an overall payment cap. These cap amounts are calculated and published by the applicable Medicare fiscal intermediary on an annual basis covering the fiscal year, measured as the period from October 1 through September 30. The inpatient cap limits hospice care provided on an inpatient basis. This cap limits the number of days that are paid at the higher inpatient care rate to 20.0% of the total number of days of hospice care that are provided to all Medicare beneficiaries served by a provider. The daily rate for all days exceeding the cap is the standard RHC daily rate, and the provider must reimburse Medicare for any payments received exceeding that amount. The Medicare fiscal intermediary calculates the overall payment cap at the end of each hospice cap period to determine the maximum allowable payments to a hospice provider during the period. We estimate our potential cap exposure by using available information to compare our actual reimbursement for all hospice services provided during the period to the number of beneficiaries we served multiplied by the statutory per beneficiary cap amount. If payments received by any one of our hospice provider numbers exceeds either of these caps, we are required to reimburse Medicare for payments received in excess of the cap amounts. The hospice cap amount for the 2024 fiscal year was $33,494.01. The hospice cap amount for the 2025 fiscal year is $34,465.34, which is a 2.9% increase over the 2024 fiscal year hospice cap.

Improving Medicare Post-Acute Care Transformation Act of 2014 (“IMPACT Act”). The IMPACT Act requires the submission of standardized assessment data for quality improvement, payment and discharge planning purposes across the spectrum of post-acute care providers (“PACs”), including home health agencies. Failure to report such data when required subjects a PAC to a 2% reduction in market basket prices then in effect.

Hospice Quality Reporting Requirements. HQRP, mandated by the Patient Protection and Affordable Care Act, requires hospice agencies to submit required quality data for inclusion on the public facing Hospice Compare website hosted by CMS. Hospices that fail to meet quality reporting requirements receive a 4.0% reduction to the annual market basket update for the next fiscal year.

Licensure and Certificates of Need (“CON”). Home health, hospice and most senior living communities operate under licenses granted by the health authorities of their respective states. Some states require healthcare providers (including home health, hospice and most senior living providers) to obtain prior state approval for the purchase, construction or expansion of healthcare operations, or changes in services. Certain states, including a number in which we operate, carefully restrict new entrants into the market based on demographic and/or demonstrative usage of additional providers. These states limit the entry of new providers or services and the expansion of existing providers or services in their markets through a CON process, which is periodically evaluated and updated as required by applicable state law. For those states that require a CON, we must also complete a separate application process establishing a location and must receive required approvals. Washington and Montana are the only CON states in which we operate home health or hospice agencies.

Patient Protection and Affordable Care Act (“ACA”). Various healthcare reform provisions became law upon enactment of the ACA in 2010. The reforms contained in the ACA have affected our independent operating subsidiaries in some manner and are directed in large part at increased quality and cost reductions. These reforms include modifications to the conditions of qualification for payment, bundling of payments to cover both acute and post-acute care and the imposition of enrollment limitations on new providers. In 2022 and 2023, HHS engaged in rulemaking under Section 1557 of the ACA that would expand the influence and authority of existing civil rights laws, and prohibitions against discrimination on the bases of race, national origin, sex (or sex stereotype), gender identity or expression, disability, or age, within the healthcare context. On April 27, 2024, HHS finalized and published a final rule containing revised regulations that implemented Section 1557 of the ACA and its anti-discrimination provisions, which contains staggered implementation dates that began taking effect on July 5, 2024. Presidential and congressional elections may result in significant changes in legislation, regulation, and implementation of Medicare, Medicaid, and government policy, along with potential changes to tax rates and other tax treatment of our operations. We continually monitor these developments so we can respond to the changing regulatory environment impacting our business. These rules could be amended by the current administration.

Civil Rights. On January 25, 2024, the HHS Office for Civil Rights (“OCR”) issued guidance to healthcare providers, services, and facilities emphasizing the importance of non-discriminatory visitation policies consistent with CMS regulations and the U.S. National Strategy to Counter Antisemitism, highlighting the prohibition of discrimination based on religion or other protected characteristics during public health emergencies. This guidance also addresses instances of non-compliance, such as unequal treatment based on religious beliefs or dietary restrictions, and outlines the support OCR provides to ensure compliance, encouraging affected individuals to file complaints for potential enforcement actions. This guidance could be amended by the current administration.

Civil and Criminal Fraud and Abuse Laws and Enforcement. Various complex federal and state laws exist which govern a wide array of referrals, relationships and arrangements, and prohibit fraud by healthcare providers. Governmental agencies are devoting increasing attention and resources to such anti-fraud efforts. In connection with our involvement with federal healthcare reimbursement programs, the government or those acting on its behalf may bring an action under the False Claims Act (“FCA”), alleging that a healthcare provider has defrauded the government by submitting a claim for items or services not rendered as claimed, which may include coding errors, billing for services not provided, and submitting false or erroneous cost reports. The FCA is a frequent topic of analysis for the United States Supreme Court. As a result, interpretations of the FCA’s meaning periodically change, and the FCA has been, and may be in the future, amended by Congress as a result of United States Supreme Court decisions. Civil monetary penalties (“CMPs”) under the FCA and other authorities, including the Civil Monetary Penalties Law, 42 U.S.C. § 1320a-7a, are substantial and are adjusted annually for inflation. Under the qui tam or “whistleblower” provisions of the FCA, a private individual with knowledge of fraud may bring a claim on behalf of the federal government and receive a percentage of the federal government’s recovery. Due to these whistleblower incentives, lawsuits have become more frequent. Many states also have a false claim prohibition that mirrors or tracks the federal FCA. Federal law also provides that the Office of the Inspector General for HHS (“OIG”) has the authority to exclude individuals and entities from federally funded healthcare programs on a number of grounds, including, but not limited to, certain types of criminal offenses, licensure revocations or suspensions, and exclusion from state or other federal healthcare programs. In addition, CMS can recover overpayments from healthcare providers up to five years following the year in which payment was made.

We may also face adverse consequences if we violate federal law related to certain Medicare physician referrals. Section 1877 of the Social Security Act, commonly known as the “Stark Law,” provides that a physician may not refer a

Medicare or Medicaid patient for a “designated health service” to an entity with which the physician or an immediate family member has a financial relationship unless the financial arrangement meets an exception under the Stark Law or its regulations. Any funds collected for an item or service resulting from a referral that violates the Stark Law must be repaid to Medicare or Medicaid, any other third-party payor, and the patient. In addition, CMPs, which are adjusted for annual inflation, treble damages, and Medicare exclusion may be imposed for presenting or causing to be presented, a claim for a service rendered in violation of the Stark Law. Many states have enacted healthcare provider referral laws that go beyond physician self-referrals or apply to a greater range of services than just the designated health services under the Stark Law.

Monitoring Compliance in our Operations. As a healthcare provider, we have a compliance program to help us comply with various requirements of federal, state and private healthcare programs. Our compliance program includes, among other things, (1) policies and procedures modeled after applicable laws, regulations, government manuals and industry practices and customs that govern the clinical, reimbursement and operational aspects of our subsidiaries; (2) training about our compliance process for the employees of our independent operating subsidiaries, our directors and officers; (3) training about Medicare and Medicaid laws, fraud and abuse prevention, clinical standards and practices, and claim submission and reimbursement policies and procedures for appropriate employees; and (4) internal controls that monitor, for example, the accuracy of claims, reimbursement submissions, cost reports and source documents, provision of patient care, services, and supplies as required by applicable standards and laws, accuracy of clinical assessment and treatment documentation, and implementation of judicial and regulatory requirements (e.g., background checks, licensing and training). The results of our compliance program are regularly reported to the board of directors.

Additionally, government agencies and other authorities periodically inspect our operations to assess our compliance with various standards, rules and regulations. The robust regulatory and enforcement environment continues to impact healthcare providers, especially in connection with responses to any alleged noncompliance identified in periodic surveys and other inspections by government authorities. Unannounced surveys or inspections generally occur at least annually at our independent operating subsidiaries and may also follow a government agency's receipt of a complaint about an operation. We are also subject to regulatory reviews relating to Medicare services, billings and potential overpayments resulting from the Recovery Audit Contractors, Zone Program Integrity Contractors, Program Safeguard Contractors, Unified Program Integrity Contractors, Supplemental Medical Review Contractors and Medicaid Integrity Contributors programs in which third party firms engaged by CMS conduct extensive reviews of claims data and medical and other records to identify potential improper payments under the Medicare programs. We must pass these inspections to maintain our licensure under state law, to obtain or maintain certification under the Medicare and Medicaid programs, to continue participation in the Veterans Administration (“VA”) program at some operations, and/or to comply with our provider contracts with managed care clients at many operations. From time to time, we, like others in the healthcare industry, may receive notices from federal and state regulatory agencies alleging that we failed to substantially comply with applicable standards, rules or regulations. These notices may require us to take corrective action, may impose CMPs for noncompliance, and may threaten or impose other sanctions and operating restrictions, up through and including the loss of licensure and termination of, or exclusion from, important payor relationships. If our operations fail to comply with these directives or otherwise fail to comply substantially with licensure and certification laws, rules and regulations, we could lose our certification as a Medicare or Medicaid provider, lose our state licenses to operate and be subject to fines and penalties.