Filed pursuant to Rule 424(b)(3)

Registration File. No. 333-229782

CIM REAL ASSETS AND CREDIT FUND

Supplement No. 1, dated December 1, 2023,

to the Prospectus dated June 23, 2023

This prospectus supplement (the “Supplement No. 1”) is filed by CIM Real Assets & Credit Fund (the “Fund,” “we,” “us” or “our”) and forms part of the certain prospectus, dated June 23, 2023 (the “Prospectus”). This Supplement No. 1 contains information that amends, supplements or modifies certain information contained in the Prospectus dated June 23, 2023 of the Fund, and is part of, and should be read in conjunction with, the Prospectus. The Prospectus has been filed with the U.S. Securities and Exchange Commission, and are available free of charge at the Fund’s website, https://www.cimgroup.com/public-investment-programs/current-public-programs/racr and at www.sec.gov. Capitalized terms used in this supplement have the same meanings as in the Prospectus, unless otherwise stated herein.

Before investing in our Common Shares, you should read carefully the Prospectus, the statement of additional information (the "SAI") and all supplements thereto and consider carefully our investment objective, risks, fees and expenses. You should also carefully consider the “Risks” beginning on page 32 of the Prospectus before you decide to invest in our Common Shares.

PROSPECTUS

Prospectus Summary

The subsection titled “Incentive Fee” on page 5 under the subheading “Management and Incentive Fees” is hereby deleted and replaced in its entirety, as follows:

Incentive Fee. The Incentive Fee is calculated and payable quarterly in arrears and equals 15.00% of the Fund’s “Pre-Incentive Fee Net Investment Income” for the immediately preceding quarter, subject to a preferred return, or “hurdle,” of 1.50% of the Fund’s NAV and a “catch up” feature. The amount of the Incentive Fee is not affected by any realized or unrealized losses that the Fund may suffer. See “Management and Incentive Fees.”

Summary of the Fund's Expenses

The table and accompanying footnotes on page 9 are hereby deleted and replaced in their entirety, as follows:

The following table is intended to assist you in understanding the costs and expenses that an investor in the Fund’s Common Shares would bear directly or indirectly:

| | | | | | | | | | | | | | | | | | | | | | | |

| Class I Shares | | Class C Shares | | Class A Shares | | Class L Shares |

| Shareholder Transaction Expenses: | | | | | | | |

Maximum Sales Load (as a percentage of the offering price)(1) | None | | None | | 5.75% | | 4.25% |

Maximum Early Withdrawal Charge(2) | None | | 1.00% | | None | | None |

| | | | | | | | | | | | | | | | | | | | | | | |

| Class I Shares | | Class C Shares | | Class A Shares | | Class L Shares |

| Annual Expenses (Percentage of Net Assets Attributable to Common Shares) | | | | | | | |

Management Fee(3) | 1.50 | % | | 1.50 | % | | 1.50 | % | | 1.50 | % |

Incentive fees payable under our investment advisory agreement (15% of Pre-Incentive Fee Net Investment Income subject to hurdle)(4) | | | | | | | |

Servicing Fee(5) | None | | 0.25 | % | | 0.25 | % | | 0.25 | % |

Distribution Fee(6) | None | | 0.75 | % | | None | | 0.25 | % |

Interest Payments on Borrowed Funds(7) | 1.41 | % | | 1.41 | % | | 1.41 | % | | 1.41 | % |

Other Expenses(8) | 2.27 | % | | 1.83 | % | | 1.83 | % | | 1.82 | % |

| Total Annual Fund Operating Expenses | 5.18 | % | | 5.74 | % | | 4.99 | % | | 5.23 | % |

Fees Waived and/or Expenses Reimbursed(9) | (2.93) | % | | (2.49) | % | | (2.49) | % | | (2.48) | % |

| Total Annual Fund Operating Expenses After Waiver and/or Reimbursement | 2.25 | % | | 3.25 | % | | 2.50 | % | | 2.75 | % |

_____________________

(1)As a percentage of the Fund’s public offering price per Share. Northern Lights Distributors, LLC is the Distributor for the Class I Shares, Class C Shares, Class A Shares and Class L Shares. The Distributor is not required to sell any specific number or dollar amount of Shares, but will use its best efforts to distribute the Shares. The Common Shares may be offered through Selling Agents that have entered into selling agreements with the Distributor. Selling Agents typically receive the selling commissions with respect to Class A Shares and Class L Shares purchased by their clients. The Distributor does not retain any portion of the selling commissions. With regard to Class A Shares, an investor will pay a maximum sales load of up to 5.75% of the offering price, which consists of (i) selling commissions of up to 5.00% and (ii) a Dealer Manager Fee of up to 0.75%. With regard to Class L Shares, an investor will pay a maximum sales load of up to 4.25% of the offering price for the purchase of Class L Shares, which consists of (i) selling commissions of up to 3.50% and (ii) a Dealer Manager Fee of up to 0.75%. However, purchases of $250,000 or more of Class A Shares and Class L Shares may be eligible for a sales load discount. See “Purchase of Common Shares—Sales Load.” The Selling Agents may, in their sole discretion, reduce or waive the selling commissions. Investors should direct any questions regarding sales loads to the relevant Selling Agent. No selling commissions or dealer manager fees will be paid in connection with sales under the distribution and reinvestment plan (the “DRP”).

(2)Class C Shares will be subject to an early withdrawal charge of 1.0% of the shareholder’s repurchase proceeds in the event that a shareholder tenders his or her Class C Shares for repurchase by the Fund at any time prior to the one-year anniversary of the purchase of such Class C Shares.

(3)The Adviser receives a Management Fee, which is calculated at an annual rate of 1.50% of the daily value of the Fund’s net assets and is payable quarterly in arrears. Management Fees payable by the Fund will be offset by any advisory fees paid by a REIT Subsidiary. The Adviser has waived its right to receive a Management Fee on the portion of the Fund’s assets invested in an affiliated publicly-traded REIT.

(4)We have agreed to pay the Adviser as compensation under the Investment Advisory Agreement a quarterly incentive fee equal to 15% of our “Pre-Incentive Fee Net Investment Income” for the immediately preceding quarter, subject to a quarterly preferred return, or hurdle, of 1.50% of our NAV (the “Hurdle Rate”) and a catch-up feature. Pre-Incentive Fee Net Investment Income includes accrued income that we have not yet received in cash. No incentive fee is payable to the Adviser on realized capital gains. The incentive fee is paid to the Adviser as follows:

•No Incentive Fee is payable in any calendar quarter in which the Fund’s Pre-Incentive Fee Net Investment Income does not exceed the Hurdle Rate of 1.50%;

•100% of the Fund’s Pre-Incentive Fee Net Investment Income, if any, that exceeds the Hurdle Rate but is less than or equal to 1.765% in any calendar quarter is payable to the Adviser. This portion of the Fund’s Pre-Incentive Fee Net Investment Income which exceeds the Hurdle Rate but is less than or equal to 1.765% is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 15% on all of the Fund’s Pre-Incentive Fee Net Investment Income when the Fund’s Pre-Incentive Fee Net Investment Income reaches 1.765% of our NAV in any calendar quarter; and

•100% of the Fund’s Pre-Incentive Fee Net Investment Income, if any, that exceeds the Hurdle Rate but is less than or equal to 1.765% in any calendar quarter is payable to the Adviser. This portion of the Fund’s Pre-Incentive Fee Net Investment Income which exceeds the Hurdle Rate but is less than or equal to 1.765% is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 15% on all of the Fund’s Pre-Incentive Fee Net Investment Income when the Fund’s Pre-Incentive Fee Net Investment Income reaches 1.765% of our NAV in any calendar quarter; and

For a more detailed discussion of the calculation of this fee, see “Management — Management Fee and Incentive Fee.” We estimate annual incentive fees payable to the Adviser during the twelve months of operations following the date of this prospectus to be approximately 1.0% based on our estimation of the use of the proceeds of this offering and assumed leverage of approximately 12.5% of our total assets (as determined immediately before the leverage is incurred). Incentive fees payable to our Adviser will be offset by any incentive fees payable by our REIT Subsidiaries.

(5)With regard to Class A Shares, Class C Shares, and Class L Shares, the Fund pays the Distributor a Servicing Fee that is calculated monthly and accrued daily at an annualized rate of 0.25% of the net assets of the Fund attributable to Class A Shares, Class C Shares and Class L Shares for services to shareholders. The Servicing Fee is for personal services provided to shareholders and/or the maintenance of shareholder accounts and to reimburse the Distributor for related expenses incurred. The Distributor may pay all or a portion of the Servicing Fee to the Selling Agents that sell Class A Shares, Class C Shares and Class L Shares. The Servicing Fee is governed by the Fund’s Amended and Restated Distribution and Servicing Plan.

(6)With regard to Class C and Class L Shares, the Fund pays the Distributor a Distribution Fee that is calculated monthly and accrued daily at an annualized rate of 0.75% and 0.25% of the net assets of the Fund attributable to Class C Shares and Class L Shares, respectively. The Distribution Fee is for the sale and marketing of the Class C Shares and Class L Shares and to reimburse the Distributor for related expenses incurred. The Distributor may pay all or a portion of the Distribution Fee to the Selling Agents that sell Class C Shares and Class L Shares. Payment of the Distribution Fee is governed by the Fund’s Amended and Restated Distribution and Servicing Plan.

(7)Interest Payments on Borrowed Funds for each class is based on estimated amounts for the current fiscal year and assumes the use of leverage in an amount equal to 12.5% of the Fund’s

total assets, less all liabilities and indebtedness not represented by senior securities (after the leverage is incurred), and the annual weighted average interest rate on borrowings of 9.33%. The actual amount of interest expense borne by the Fund will vary over time in accordance with the level of the Fund’s borrowings and market interest rates. Interest Payments on Borrowed Funds are required to be treated as an expense of the Fund for accounting purposes.

(8)“Other Expenses” are estimated based on Fund average net assets of $303.7 million and anticipated expenses for the Fund’s next twelve months of operations. “Other Expenses” include, without limitation, professional fees, certain offering costs, SEC filing fees, printing fees, administration fees, investor servicing fees, loan origination fees, custody fees, trustee fees, insurance costs and financing costs (including costs incurred in connection with the Fund’s TRS, which represent 0.45% of Fund net assets). The interest expense payable under the TRS is included in “Other Expenses” and has not been included under the “Interest Payments on Borrowed Funds” line item because the amounts subject to the TRS are not treated as our debt obligations for accounting purposes. “Other Expenses” includes all estimated fees and expenses of our subsidiaries.

(9)The Adviser and the Fund have entered into the Expense Limitation Agreement under which the Adviser has agreed contractually to waive its fees and to pay or absorb the ordinary operating expenses of the Fund (including organizational and certain offering expenses, but excluding the incentive fee, the management fee, the shareholder services fee, fees and expenses associated with the Real Estate Services provided by the Affiliated Real Estate Service Providers or by unaffiliated third parties for real properties owned by the REIT Subsidiary, the distribution fee, dividend and interest payments (including any dividend payments, interest expenses, commitment fees, or other expenses related to any leverage incurred by the Fund), brokerage commissions, acquired fund fees and expenses, taxes and extraordinary expenses), to the extent that they exceed 0.75% per annum of the Fund’s average daily net assets (the “Expense Limitation”). In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than thirty-six (36) months from the date which they were incurred and (2) the reimbursement may not be made if it would cause the expense limitation then in effect or in effect at the time the expenses were waived or absorbed to be exceeded, whichever amount is lower (in each case, after the reimbursement is taken into account). On November 16, 2023, the Advisor extended the Expense Limitation Agreement to January 31, 2025, and shall thereafter continue in effect for successive twelve-month periods with the approval of at least annually of a majority of the Board. The Expense Limitation Agreement may be terminated at any time, and without payment of any penalty, by the Board, upon sixty (60) days’ written notice to the Adviser. The Expense Limitation Agreement may not be terminated by the Adviser without the consent of the Board.

Management and Incentive Fees

The first paragraph in the “Incentive Fee” subsection beginning on page 75 is hereby deleted and replaced in its entirety, as follows:

The Incentive Fee is calculated and payable quarterly in arrears and equals 15% of the Fund’s “Pre-Incentive Fee Net Investment Income” for the immediately preceding quarter, subject to a preferred return, or “hurdle,” and a “catch up” feature. For this purpose, “Pre-Incentive Fee Net Investment Income” means interest income, dividend income and any other income (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from an investment, which are deferred and recognized on a straight-line basis) accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the Management Fee, expenses payable under the Administrative Services Agreement, and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee). Pre-Incentive Fee Net Investment Income includes accrued income that the Fund has not yet received in cash, as well as any

such amounts received (or accrued) in kind. Pre-Incentive Fee Net Investment Income does not include any capital gains or losses, and no incentive fees are payable in respect of any capital gains and no incentive fees are reduced in respect of any capital losses. For purposes of calculating Pre-Incentive Fee Net Investment Income, we will look through derivatives or swaps as if the Fund owned the reference assets directly. Therefore, Net Interest, if any, associated with a derivative or swap (which is defined as the difference between (a) the interest income and fees received in respect of the reference assets of the derivative or swap and (b) all interest and other expenses paid by the Fund to the derivative or swap counterparty) is included in the calculation of Pre-Incentive Fee Net Investment Income. We will not include termination payments received related to a derivative or swap position in the calculation of Pre-Incentive Fee Net Investment Income. Incentive fees payable to our Adviser will be offset by any incentive fees payable by our REIT Subsidiaries.

The third paragraph in the “Incentive Fee” subsection beginning on page 75 is hereby deleted and replaced in its entirety, as follows:

The incentive fee is paid to the Adviser as follows:

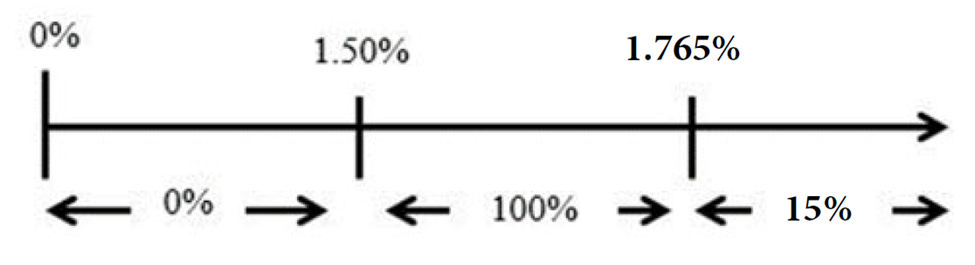

•No Incentive Fee is payable in any calendar quarter in which the Fund’s Pre-Incentive Fee Net Investment Income does not exceed the quarterly hurdle rate of 1.50%;

•100% of the Fund’s Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle rate but is less than or equal to 1.765% in any calendar quarter is payable to the Adviser. This portion of the Fund’s Pre-Incentive Fee Net Investment Income which exceeds the hurdle rate but is less than or equal to 1.765% is referred to as the “catch-up.” The “catch-up” provision is intended to benefit the Adviser and to provide the Adviser with an incentive fee of 15.0% on all of the Fund’s Pre-Incentive Fee Net Investment Income when the Fund’s Pre-Incentive Fee Net Investment Income reaches 1.765% of our NAV in any calendar quarter; and

•15.0% of the Fund’s Pre-Incentive Fee Net Investment Income, if any, that exceeds 1.765% in any calendar quarter is payable to the Adviser once the hurdle rate is reached and the catch-up is achieved (15.0% of all the Fund’s Pre-Incentive Fee Net Investment Income thereafter is allocated to the Adviser).

The sixth paragraph in the “Incentive Fee” subsection beginning on page 75 is hereby deleted and replaced in its entirety, as follows:

The following is a graphical representation of the calculation of the Incentive Fee:

The “Alternative 2” example on page 77 in the “Incentive Fee” subsection beginning on page 75 is hereby deleted and replaced in its entirety, as follows:

Additional Assumptions

•Investment income (including interest, dividends, fees, etc.) = 5.75%

•Pre-Incentive Fee Net Investment Income (investment income - (management fee + other expenses)) = 2.50%

Pre-Incentive Fee Net Investment Income exceeds the hurdle rate, therefore there is an incentive fee.

Incentive Fee Calculation = 0.37525% [0.265% + 0.110250%] or [(100%*(1.765% - 1.50%) + 15%*(2.50% - 1.765%)]