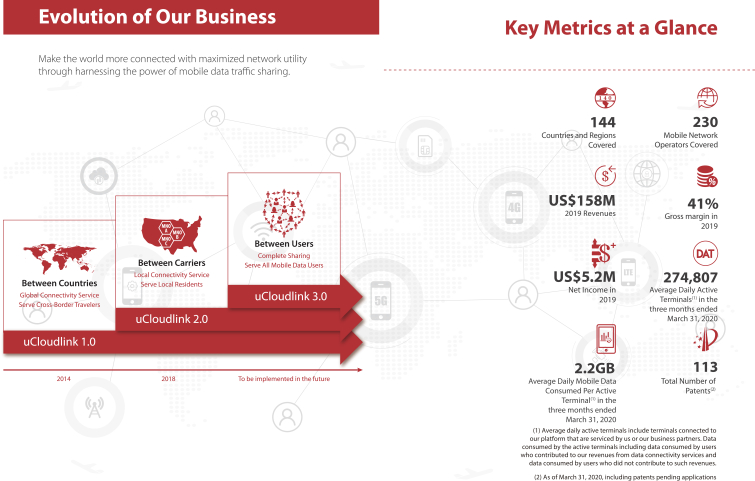

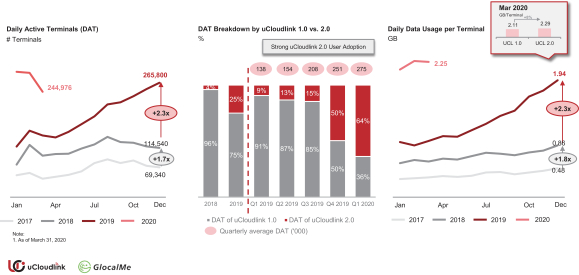

We have grown rapidly in recent years. Average daily active terminals connected to our platform increased from approximately 65,352 in 2017 to 113,033 in 2018, and further to 187,781 in 2019, and increased from approximately 137,934 for the three months ended March 31, 2019 to 274,807 for the same period in 2020. Specifically, in the three months ended March 31, 2020, average daily active terminals using uCloudlink 1.0 model services reached approximately 99,765, as compared to 125,263 in the three months ended March 31, 2019, and average daily active terminals using uCloudlink 2.0 model services reached approximately 175,432, as compared to 12,836 in the three months ended March 31, 2019, including the number of daily active terminals using both categories of services. Daily active terminals using uCloudlink 2.0 model services constituted 64% of daily active terminals connected to our platform in the three months ended March 31, 2020, as compared to 9% in the three months ended March 31, 2019. The average daily data usage per active terminal increased from 395 megabytes in 2017 to 712 megabytes in 2018, and further to 1,386 megabytes in 2019, and increased from approximately 924 megabytes for the three months ended March 31, 2019 to 2,258 megabytes for the three months ended March 31, 2020. Total data consumed through our platform were approximately 9,000, 28,000 and 90,600 terabytes in 2017, 2018 and 2019, respectively, and were approximately 10,900 and 53,800 terabytes in the three months ended March 31, 2019 and 2020, respectively, including data consumed by users who contributed to our revenues from data connectivity services, which we procured, and data consumed by users who did not contribute to our revenues from data connectivity services, which our business partners procured.

We generate revenues primarily from our mobile data connectivity services and hardware terminals that incorporate the services. Our revenues increased from US$85.8 million in 2017 to US$126.4 million in 2018, and further to US$158.4 million in 2019, and increased from US$24.7 million in the three months ended March 31, 2019 to US$33.5 million in the same period in 2020. Our gross margin increased from 34.4% in 2017 to 36.5% in 2018, and further to 41.0% in 2019, and decreased from 48.6% in the three months ended March 31, 2019 to 35.3% in the same period in 2020. We had a net loss of US$19.3 million and US$26.6 million in 2017 and 2018, respectively, and had a net income of US$5.2 million in 2019. We had net loss of US$0.9 million and net income of US$0.2 million in the three months ended March 31, 2019 and 2020, respectively. Our adjusted net (loss)/income, anon-GAAP measure defined as net (loss)/income excluding share-based compensation, was adjusted net loss of US$13.7 million and US$24.3 million in 2017 and 2018, respectively, and was adjusted net income of US$5.4 million in 2019. We had adjusted net income of US$0.2 million in the three months ended March 31, 2020, compared to adjusted net loss of US$0.7 million in the three months ended March 31, 2019. Our adjusted EBITDA, anothernon-GAAP measure defined as net (loss)/income excluding share of loss in equity method investment, net of tax, interest expense, depreciation and amortization, and share-based compensation, was negative US$4.7 million, negative US$15.1 million and US$8.9 million in 2017, 2018 and 2019, respectively. Our adjusted EBITDA was US$0.2 million and US$1.0 million in the three months ended March 31, 2019 and 2020, respectively. See “Summary Consolidated Financial OperatingData—Non-GAAP Financial Measures.” In 2017, 2018, 2019 and the three months ended March 31, 2020, we generated 37.9%, 50.9%, 67.9% and 81.3%, respectively, of our revenues from customers outside of China.

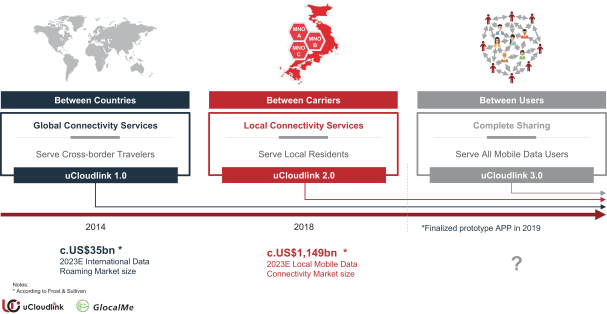

Our Market Opportunity

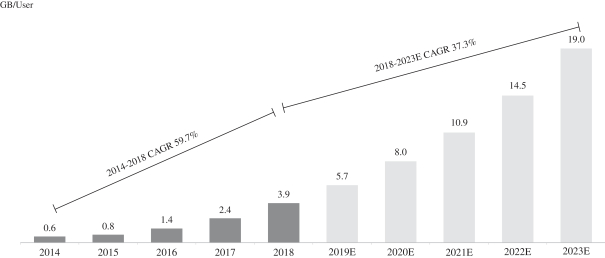

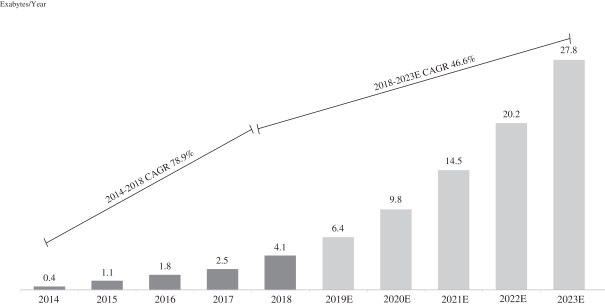

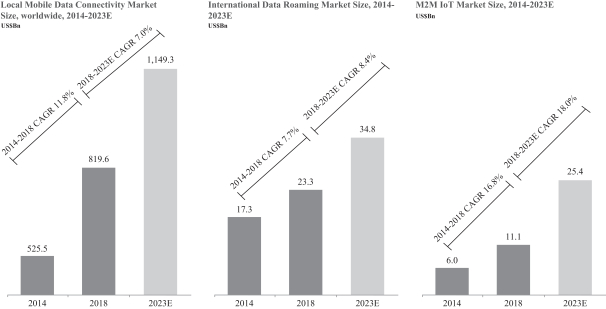

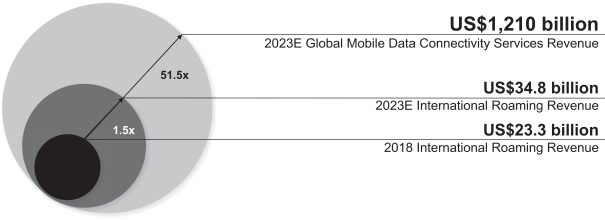

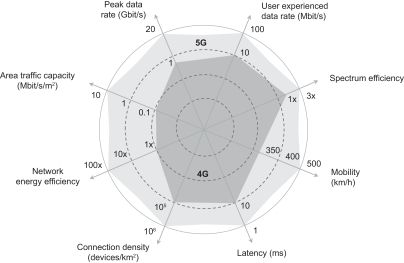

We believe that mobile data traffic has become of utility-like importance for economies and society today. Adoption of mobile technologies has increased significantly across industries and daily life situations in addition to simple internet browsing and basic communications, driven by factors such as massivebuild-out of 3G and 4G telecommunication infrastructure globally, increasingly affordable smartphone and smart-devices, increased adoption of high bandwidth data applications, and increasingly affordable mobile data plans. The mobile data connectivity service industry is a large and stable growing industry globally. According to Frost & Sullivan, the total revenue generated from this industry increased from US$549 billion in 2014 to US$854 billion in 2018, representing a CAGR of 11.7%, which is estimated to grow further at a CAGR of 7.2% to US$1,210 billion in 2023.