The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 29, 2022

UCLOUDLINK GROUP INC.

Class��A Ordinary Shares

Preferred Shares

Warrants

Subscription Rights

Units

We may offer, issue and sell from time to time up to US$150,000,000, or its equivalent in any other currency, currency units, or composite currency or currencies, of our Class A ordinary shares, including in the form of American Depositary Shares, or ADSs, preferred shares, warrants to purchase Class A ordinary shares, including in the form of ADSs, subscription rights and a combination of such securities, separately or as units, in one or more offerings. Each ADS represents 10 Class A ordinary shares. This prospectus provides a general description of offerings of these securities that we may undertake.

We refer to our ADSs, Class A ordinary shares, preferred shares, warrants, subscription rights and units collectively as “securities” in this prospectus.

In addition, this prospectus also relates to the resale from time to time by the shareholder identified in the “Selling Shareholder” section and/or its affiliates in this prospectus supplement, or the selling shareholder, of up to an aggregate of 12,000,000 Class A ordinary shares, which may be represented from time to time by American depositary shares, or ADSs. The Class A ordinary shares offered hereby consist of 1,000,000 Class A ordinary shares as commitment fee and Class A ordinary shares that may be purchased by the selling shareholder from us from time to time at the purchase price and in the purchase amount determined in accordance with the securities purchase agreement dated January 5, 2022 between the us and YA II PN, LTD., or the Securities Purchase Agreement, subject to other terms and conditions therein. We will not receive any of the proceeds from the sale of securities by the selling shareholder.

Each time we sell our securities pursuant to this prospectus, we will provide the specific terms of such offering in a supplement to this prospectus. The prospectus supplement may also add, update, or change information contained in this prospectus. You should read this prospectus, the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information,” before you make your investment decision.

We may, from time to time, sell the securities, and the selling shareholder may, from time to time, sell the Class A ordinary shares, including in the form of ADSs, directly or through underwriters, agents or dealers, on or off the Nasdaq Global Market, at prevailing market prices or at privately negotiated prices. If any underwriters, agents or dealers are involved in the sale of any of these securities, the applicable prospectus supplement will set forth the names of the underwriter, agent or dealer and any applicable fees, commissions or discounts.

Our ADSs are listed on the Nasdaq Global Market under the symbol “UCL.” On June 24, 2022, the closing price of our ADSs on the Nasdaq Global Market was US$1.08 per ADS.

Investing in these securities involves a high degree of risk. Please carefully consider the risks discussed under “Risk Factors” in this prospectus beginning on page 18, in our reports filed with the Securities and Exchange Commission that are incorporated by reference in this prospectus, and in any applicable prospectus supplement.

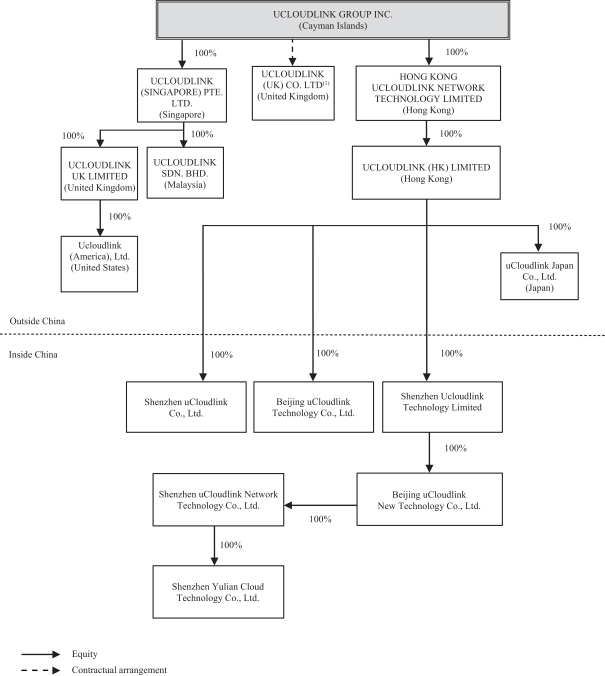

UCLOUDLINK GROUP INC. is not an operating company but a Cayman Islands holding company with operations primarily conducted by its subsidiaries and, historically, through contractual arrangements with the former variable interest entities, or former VIEs, based in China. PRC laws and regulations restrict and impose conditions on foreign investment in telecommunication businesses. Accordingly, we historically operated these businesses in China through the former VIEs, including Beijing uCloudlink New Technology Co., Ltd. and Shenzhen uCloudlink Network Technology Co., Ltd. There were historical contractual arrangements among our PRC subsidiaries, the former VIEs and their nominee shareholders, which were terminated on March 17, 2022 as we continued to adjust our business model in China and proceed the restructuring. We have evaluated the guidance in FASB ASC 810 and concluded that we are the primary beneficiary of the former VIEs for accounting purposes because of these contractual arrangements for the effective period of the contractual arrangements. Accordingly, under U.S. GAAP, the financial statements of the former VIEs are consolidated as part of our financial statements for the years ended December 31, 2019, 2020 and 2021. Revenues contributed by the former VIEs accounted for 25%, 8% and 5% of our total revenues for the years of 2019, 2020 and 2021, respectively. As used in this prospectus, “uCloudlink” refers to UCLOUDLINK GROUP Inc., and “we,” “us,” “our company,” or “our” refers to UCLOUDLINK GROUP INC. and its subsidiaries, and, when describing our operations and consolidated financial information, also includes the former VIEs and their subsidiaries in China. Investors in our ADSs are not purchasing equity interest in the former VIEs in China but instead are purchasing equity interest in a holding company incorporated in the Cayman Islands holding company.

We face various risks and uncertainties related to doing business in China, and we are subject to complex and evolving PRC laws and regulations. For example, we face risks associated with regulatory approvals on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, as well as the lack of inspection by the Public Company Accounting Oversight Board, or the PCAOB, on our auditor as determined by the announcement of the PCAOB issued on December 16, 2021. This may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States or other foreign exchange. These risks could result in a material adverse change in our operations and the value of our ADSs, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline. For a detailed description of risks related to doing business in China, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China” in our 2021 Form 20-F, which is incorporated by reference, and “Risk Factors—Risks Related to Doing Business in China” in this prospectus.

Although our current auditor can be inspected by the PCAOB, if it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors would be deprived of the benefits of such inspection. Our ADSs will be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, if the PCAOB is unable to inspect or fully investigate auditors located in China. On December 2, 2021, the U.S. Securities and Exchange Commission, or the SEC, adopted final amendments implementing the disclosure and submission requirements of the HFCAA, pursuant to which the SEC will identify an issuer as a “Commission Identified Issuer” if the issuer has filed an annual report containing an audit report issued by a registered public accounting firm that the PCAOB has determined it is unable to inspect or investigate completely, and will then impose a trading prohibition on an issuer after it is identified as a Commission-Identified Issuer for three consecutive years. On December 16, 2021, PCAOB issued the HFCAA Determination Report, according to which our previous auditor is subject to the determinations that the PCAOB is unable to inspect or investigate completely. In May 2022, in connection with its implementation of the HFCAA, the SEC conclusively named the company as a “Commission-Identified Issuer” following the filing of the company’s 2021 Form 20-F with the SEC on April 27, 2022. Under the current law, delisting and prohibition from over-the-counter trading in the United States could take place in 2024. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. In addition, the proposed changes to the law would decrease the number of non-inspection years from three years to two, thus reducing the time period before our ADSs may be prohibited from over-the-counter trading or delisted. If the proposed provision is enacted, our ADS could be delisted from the exchange and prohibited from over-the-counter trading in the United States in 2023.

Our historical corporate structure is subject to risks associated with our contractual arrangements with the former VIEs. Our historical contractual arrangements might not be as effective as direct ownership in providing us with control over the former VIEs and the termination of these agreements may incur additional costs. If the PRC government deems that our historical contractual arrangements with the former VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our holding company, our PRC subsidiaries and former VIEs, and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the historical contractual arrangements with the former VIEs and, consequently, significantly affect the historical financial performance of the former VIEs and our company as a whole. See “Risk Factors—Risks Related to Our Corporate Structure—If the PRC government determines that the contractual arrangements with the former VIEs structure did not comply with PRC regulations, or if these regulations change or are interpreted differently in the future, our shares and/or ADSs may decline in value if we are deemed to be unable to assert our contractual control rights over the assets of the former VIEs” in this prospectus.

We conduct our operations in China through our PRC subsidiaries and the former VIEs with which we have maintained contractual arrangements historically. PRC laws and regulations restrict and impose conditions on foreign investment in telecommunication businesses. Accordingly, we operated these businesses in China through the former VIEs. As our Mainland China and Hong Kong subsidiaries and former VIEs have accumulated losses since their incorporation, none of them has declared or paid any dividends or made any distributions to their respective holding companies, including uCloudlink. In return, uCloudlink has not declared a dividend. Our subsidiaries and the former VIEs conduct business transactions that include trading activities, provision of services and intercompany advances. The cash flows occurred between our subsidiaries and the former VIEs included the following: (1) our subsidiaries received cash from the former VIEs amounted to US$35.9 million, US$27.1 million and US$1.9 million for the year ended December 31, 2019, 2020 and 2021, respectively, for the sales of data plans and raw materials; (2) our subsidiaries received cash from the former VIEs amounted to US$6.8 million, US$5.5 million and US$5.4 million for the year ended December 31, 2019, 2020 and 2021, respectively, for the provision of marketing and software licensing services; (3) our subsidiaries paid cash to the former VIE amounted to US$47.8 million, US$55.9 million and US$29.4 million for the year ended December 31, 2019, 2020 and 2021, respectively, for the purchase of WiFi terminals; (4) the former VIEs received inter-company advances of US$7.1 million, US$7.7 million and US$3.1 million for the year ended December 31, 2019, 2020 and 2021, respectively, from our subsidiaries; and (5) the former VIEs repaid inter-company advances of US$3.2 million, nil and nil for the year ended December 31, 2019, 2020 and 2021, respectively, to our subsidiaries. For more detailed discussion of how cash is transferred between our subsidiaries and the former VIEs, see “Our Company—Holding Company Structure and Contractual Arrangements with the former VIEs” and “Certain Financial Information—Financial Information Related to the former VIEs and Parent” in this prospectus.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.