FINTECH ACQUISITION CORP. IV

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2020

| NOTE | 1. DESCRIPTION OF ORGANIZATION AND BUSINESS OPERATIONS |

FinTech Acquisition Corp. IV (the “Company”) is a blank check company incorporated in Delaware on November 20, 2018. The Company was formed for the purpose of acquiring, through a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business transaction, one or more operating businesses or assets that the Company has not yet identified (a “Business Combination”). The Company has neither engaged in any operations nor generated significant revenue to date.

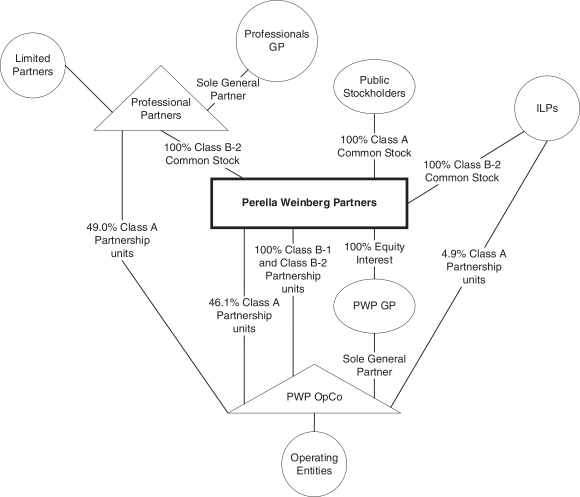

As of December 31, 2020, the Company had not commenced operations. All activity through December 31, 2020 relates to the Company’s formation, the Initial Public Offering (as defined below), and, subsequent to the Initial Public Offering, identifying a target company for a Business Combination, activities in connection with the proposed acquisition of PWP Holdings LP, a Delaware limited partnership (“PWP”) (see Note 7).

The registration statement for the Company’s Initial Public Offering was declared effective on September 24, 2020. On September 29, 2020, the Company consummated the Initial Public Offering of 23,000,000 units (the “Units” and, with respect to the shares of Class A common stock included in the Units sold, the “Public Shares”), which includes the full exercise by the underwriters of their over-allotment option in the amount of 3,000,000 Units, at $10.00 per Unit, generating gross proceeds of $230,000,000 which is described in Note 4.

Simultaneously with the closing of the Initial Public Offering, the Company consummated the sale of 610,000 units (the “Private Placement Units”) at a price of $10.00 per Private Placement Unit in a private placement to FinTech Investor Holdings IV, LLC (collectively with FinTech Masala Advisors IV, LLC, the “Sponsor”), generating gross proceeds of $6,100,000, which is described in Note 5. The manager of each entity of the Sponsor is Cohen Sponsor Interests IV, LLC.

Transaction costs amounted to $14,255,791, consisting of $4,000,000 of underwriting fees, $9,800,000 of deferred underwriting fees and $455,791 of other offering costs. In addition, at December 31, 2020, cash of $1,158,934 was held outside of the Trust Account (as defined below) and is available for working capital purposes.

Following the closing of the Initial Public Offering on September 29, 2020, an amount of $230,000,000 ($10.00 per Unit) from the net proceeds of the sale of the Units in the Initial Public Offering and the sale of the Private Placement Units was placed in a trust account (the “Trust Account”) and invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), with a maturity of 185 days or less, or in money market funds meeting certain conditions under Rule 2a-7 promulgated under the Investment Company Act which invest only in direct U.S. government treasury obligations, until the earlier of: (i) the consummation of a Business Combination; (ii) the redemption of any Public Shares in connection with a stockholder vote to amend the Company’s Amended and Restated Certificate of Incorporation (A) to modify the substance or timing of the Company’s obligation to redeem 100% of its Public Shares if it does not complete an initial Business Combination by September 29, 2022 (the “Combination Period”) or (B) with respect to any other provisions relating to stockholders’ rights or pre-initial Business Combination activity; or (iii) the distribution of the Trust Account, as described below, except that interest earned on the Trust Account can be released to pay

F-7