The information in this preliminary proxy statement/prospectus is not complete and may be changed. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. These securities may not be issued until the registration statement filed with the Securities and Exchange Commission is effective.

PRELIMINARY PROXY STATEMENT AND PROSPECTUS

SUBJECT TO COMPLETION, DATED APRIL 1, 2021

APEX TECHNOLOGY

ACQUISITION CORPORATION

533 Airport Blvd

Suite 400

Burlingame, CA 94010

Dear Apex Technology Acquisition Corporation Stockholders:

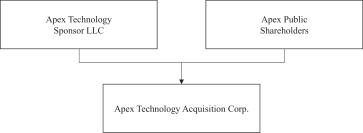

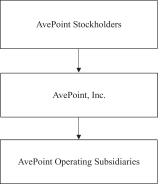

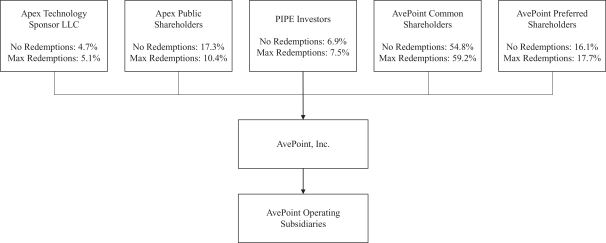

Apex Technology Acquisition Corporation, a Delaware corporation (“Apex”), Athena Technology Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Apex (“Merger Sub 1”), Athena Technology Merger Sub 2, LLC, a Delaware limited liability company and a wholly-owned subsidiary of Apex (“Merger Sub 2” and, together with Merger Sub 1, “Merger Subs” and each, a “Merger Sub”), and AvePoint, Inc., a Delaware corporation (“AvePoint”), have entered into a Business Combination Agreement and Plan of Reorganization, dated as of November 23, 2020, as amended on December 30, 2020 and March 8, 2021 (the “Business Combination Agreement”) pursuant to which Merger Sub 1 will be merged with and into AvePoint (the “First Merger”), with AvePoint surviving the First Merger as a wholly-owned subsidiary of Apex, and promptly following the First Merger, AvePoint will be merged with and into Merger Sub 2 (the “Second Merger,” together with the First Merger, the “Mergers” and, collectively with the other transactions described in the Business Combination Agreement, the “Business Combination”), with Merger Sub 2 surviving the Second Merger as a wholly owned subsidiary of Apex (the “Combined Company”). At the closing of the Business Combination, based on AvePoint’s capitalization table as of February 23, 2021, the aggregate consideration to be paid to AvePoint’s equityholders will be (i) an amount in cash of approximately $262 million, assuming AvePoint stockholders elect to receive the maximum cash consideration, subject to a deduction for fees and (ii) 143,261,093 shares of Apex’s common stock, which includes shares of Apex common stock that may be issuable pursuant to the exercise of exchanged AvePoint stock options (calculated using the treasury stock method, subject to an adjustment for an additional number of shares of Apex common stock if AvePoint’s stockholders elect to receive less than the maximum cash consideration of approximately $262 million or if there is not sufficient available cash to pay such maximum cash consideration). Apex determined the composition and structure of the aggregate consideration to be paid to AvePoint’s equityholders after due and careful consideration of AvePoint’s liquidity needs, transaction fees, and liquidation preferences for existing AvePoint equityholders.

The maximum cash consideration payable will remain consistent even in a scenario in which Apex’s Public Stockholders exercise their maximum redemption rights with respect to their Apex shares. Pro forma for the transaction, the Combined Company will have sufficient balance sheet cash if Apex’s Public Stockholders redeem up to the maximum amount possible while still satisfying the $300 million minimum cash proceeds condition in the Business Combination Agreement, Apex will have sufficient remaining funds to be able to satisfy the maximum amount of cash consideration payable to AvePoint equityholders of approximately $262 million. See the section titled “Questions and Answers about the Business Combination — What consideration will AvePoint equityholders receive upon consummation of the Business Combination?” on page xviii of the attached proxy statement/prospectus for examples of the indicative quantum of cash and Apex common stock shares an AvePoint equityholder could receive per share based on such equityholder’s cash election percentage (up to approximately 12.678% of total consideration).

Upon consummation of the Business Combination, each share of AvePoint’s common stock, convertible preferred stock, and preferred stock will be converted into approximately 8.6851 shares of Apex common stock based on the determined exchange ratio described in the Business Combination Agreement. See pages 2 and 3 of the section titled “Summary of the Proxy Statement/Prospectus —The Business Combination – The Business Combination Agreement” of the attached proxy statement/prospectus for further information on the amount of cash and Apex shares an AvePoint stockholder could receive.

On November 23, 2020, Apex executed subscription agreements with certain investors for the sale of an aggregate of 14,000,000 shares of Apex’s common stock in a private placement transaction at a purchase price of $10.00 per share for gross aggregate proceeds of $140 million. The closing of the sale of these shares will occur concurrently with the consummation of the Business Combination. See the section titled “The Business Combination” on page 96 of the attached proxy statement/prospectus for further information on the consideration being paid to the stockholders of AvePoint and the private placement transaction.

Apex’s units, Class A common stock and warrants are currently listed on the Nasdaq Capital Market under the symbols “APXTU,” “APXT,” and “APXTW,” respectively. Apex has applied to list the shares of common stock and the warrants of the Combined Company on the Nasdaq Capital Market under the symbols “AVPT” and “AVPTW,” respectively, upon the closing of the Business Combination. At the closing of the Business Combination, each Apex Unit will be separated into its components, which consists of one share of Class A common stock and one-half of one warrant, and such units will no longer exist. Upon closing, Apex intends to change its name from “Apex Technology Acquisition Corporation” to “AvePoint, Inc.”.

Apex is holding a special meeting of its stockholders in order to obtain the stockholder approvals necessary to complete the Business Combination. At the Apex special meeting of stockholders, which will be held on , 2021, at 10:00 a.m., Eastern time, via live webcast at the following address: , unless postponed or adjourned to a later date, Apex will ask its stockholders to adopt the Business Combination Agreement, thereby approving the Business Combination, and approve the other proposals described in this proxy statement/prospectus.

After careful consideration, Apex’s board of directors has unanimously approved the Business Combination Agreement and the other proposals described in this proxy statement/prospectus, and Apex’s board of directors has determined that it is advisable to consummate the Business Combination. The board of directors of Apex recommends that its stockholders vote “FOR” the proposals described in this proxy statement/prospectus.

More information about Apex, AvePoint and the Business Combination is contained in this proxy statement/prospectus. Apex and AvePoint urge you to read the accompanying proxy statement/prospectus, including the financial statements and annexes and other documents referred to herein, carefully and in their entirety. IN PARTICULAR, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DISCUSSED UNDER “RISK FACTORS” BEGINNING ON PAGE 24 OF THIS PROXY STATEMENT/ PROSPECTUS.

On behalf of our board of directors, I thank you for your support and look forward to the successful completion of the Business Combination.

|

| Sincerely, |

|

| Jeff Epstein |

| Co-Chief Executive Officer |

, 2021

The accompanying proxy statement/prospectus is dated , 2021 and is first being mailed to the stockholders of Apex on or about that date.

Your vote is very important. Whether or not you plan to attend the special meeting of Apex stockholders online, please submit your proxy by completing, signing, dating, and mailing the enclosed proxy card in the pre-addressed postage paid envelope or by using the telephone or Internet procedures provided to you by your broker or bank. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares or, if you wish to attend the special meeting of Apex stockholders and vote online, you must obtain a proxy from your broker or bank.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE BUSINESS COMBINATION DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE BUSINESS COMBINATION, OR PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION.