Investor Presentation December 2020 Issuer Free Writing Prospectus, Dated December 8, 2020 File Pursuant to Rule 433 Relating to Preliminary Prospectus Dated December 4, 2020 Registration Statement No. 333 - 235426

Safe Harbor Statements This presentation includes statements that are, or may be deemed, "forward - looking statements . " In some cases these forward - looking statements can be identified by the use of forward - looking terminology, including the terms “we believe," "estimates," "anticipates," expects," "plans," “project,” “continuing,” “ongoing,” “expect,” “we intend," "may," "could," "might," "will," "should," "approximately," "potential," or in each case, their negative or other variations thereon or comparable terminology, although not all forward - looking statements contain these words . They appear in several places throughout this presentation and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things the fresh produce market in China and the prospects of our sales and distribution of imported fruits, seafood and dry goods stated herein . By their nature, forward - looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and regulatory developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated . Although we believe that we have a reasonable basis for each forward - looking statement contained in this presentation, we caution you that forward - looking statements are not guarantees of future performance and that our actual results of operation, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward - looking statements contained in this presentation as a result of, among other factors, the factors referenced in the "Risk Factors" section of the prospectus contained in our Registration Statement of Form F - 1 (File No . 333 - 235426 ) initially filed with the Securities and Exchanged Commission (the “SEC”) on December 9 , 2019 , as amended thereafter, for our proposed initial public offering (the "Registration Statement") . In addition, even if our results of operation, financial conditions and liquidity, and the development of the industry in which we operate are consistent with the forward - looking statements contained in this presentation, they may not be predictive of results or developments in future periods . Any forward - looking statement that we make in this presentation speaks only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this presentation except as required by applicable law . This free writing prospectus highlights basic information about us and the offering . Because it is a summary, it does not contain all of the information that you should consider before investing . You should read carefully the factors described in the "Risk Factors" section of the prospectus contained in the Registration Statement to better understand the risks and uncertainties inherent in our business and any forward - looking statements . The trademarks and symbols used herein are the properties of their respective owners . We have filed the Registration Statement (including a prospectus) with the SEC for the offering to which this presentation relates . The Registration Statement has not become effective yet . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC Web site at http : //www . sec . gov . The preliminary prospectus, dated December 4 , 2020 , is available on SEC Website at : https : // www . sec . gov/Archives/edgar/data/ 1785880 / 000121390020041148 / 0001213900 - 20 - 041148 - index . htm Alternatively, we or our underwriter or any dealer participating in the offering will arrange to send you the prospectus if you contact Maxim Group LLC 405 Lexington Ave, New York, NY 10174 , or by calling + 1 800 - 724 - 0761 . In this investor presentation, we rely on and refer to information and statistics regarding the sector in which we compete and other industry data . We obtained this information and statistics from third - party sources, including reports by market survey companies and other sources . We have supplemented this information where necessary with our own internal estimates, taking into account publicly available information about other industry participants and our management's best view as to information that is not publicly available . 2

Table of Contents 1. Offering Summary & Investment Highlights 2. Management Team Overview 3. Business Overview 4. Industry Prospect 5. Financial Highlights 3

NO.1 Offering Summary 4

Offering Summary Issuer LOHA CO. LTD Securities Class A ordinary shares Ticker NasdaqCM : LOHA Pre - Offering Shares Outstanding ~ 27.4 million (including ~ 17.9 million Class A and 9.5 million Class B Shares) Number of Shares Offered 2.5 – 3.1 million Class A shares (excl. over - allotment) Post - Offering Shares Outstanding 29.9 – 30.5 million Class A shares and 9.5 million Class B shares (excl. over - allotment) Offering Per Share Price Range $8.0 - $10.0 Maximum Gross Proceeds $ 25.0 million (excl . over - allotment) Maximum Post - Offering Valuation ~$ 271.6 million (excl . over - allotment) Use of Proceeds (i) 20% developing our information technology and enhancing our traceability system. (ii) 45% expanding our supply chain and distribution channels. (iii) 35% general working capital Book Runners Maxim Group LLC, Valuable Capital, Tiger Brokers , Prime Number Capital, The Benchmark Company 5

We directly source from farms and wholesale in communities, enabling us to deliver fresh produce in an efficient and cost effective way that benefit all parties. We have re - engineered supply chain management to reduce food spoilage, lower operating costs, and provide critical price advantages. Innovative Smart Retail Strategy We developed smart micro mart, which is a self serving vending machine that provides fresh food on demand. We also provide group purchase program via popular social media platform on Wechat . “ Lohas ” stands for Lifestyles of Health and Sustainability. Our products are responsibly sourced from 16 countries under our strict quality control guideline. Investment Highlights 6 Strong Brand Loyalty Amplified by Launching Own Brand Products We developed Lohas branded products that reflect the principles of healthy and sustainable lifestyle to further build consumer loyalty. Robust Supply Chain Management System Ensuring Reliability and Quality of Product Efficient Farm to Business to Consumer (F2B2C) Model Unique Philosophy Emphasizing Health & Sustainability

NO.2 Management Team Overview 7

Management Team Jia hui Shan Director and CCO • D irector and Chief Culture Officer of the Company since 2019 and Chief Culture Officer of Shenzhen Lohas since 2013 • Deputy General Manager of Haina Chuanqiong Culture Communication Co., Ltd. from 2013 to 2015 • Bachelor ’ s degree in marketing from Hubei University of Economics Yanyue Zhang Chairman and CEO Xiaoqin Tan CFO • Founder, Chairman and Chief Executive Officer of the Company since 2019 and Founder and CEO of Lohas Agricultural since 2013 • Bachelor ’ s degree in mobile communication from Beijing University of Posts and Telecommunications ; H onorary Doctor of Humanities by Anaheim University in 2019 • Chief Financial Officer of the Company since 2019 • General Manager Assistant and Chief Investment Officer of Tsinghua Tsingda Innovation Investment Fund from 2016 to 2018 • Accounting degree from Shenzhen University and Centennial College (Canada); MBA from Royal Roads University (Canada) • D irector of the Company since 2019 • Head of Finance Lohas Supply Chain from 2015 to 2019; General Manager of Shenzhen Centennial Health Investment Co.Ltd from 2014 to 2015 • Associate degree in accounting from Guilin University of Aerospace Technology Weijun Huang Director 8

• Partner of Hwang & Associates CPA LLC since 2017 • CFO of Continental Motors, Inc. from 2016 to 2017; CFO of the U.S. branch of the steel tube department of Russian Union Metallurgical Group from 2014 to 2016 • Bachelor ’ s degree in public health from China Medical University; Master ’ s degree in accounting from the University of Houston • CPA in Texas Jengren Michael Hwang Independent Director • Chairman and Chief E conomist at Cypress Leadership Institute since 2007 • Professor of School of Economics and Management at the University of Science and Technology, Beijing • Bachelor ’ s degree in economics from Shandong University; Master ’ s degree in economics from Nankai University; PhD degree in economics from Peking University Xiao Zhao Independent Director • CFO and Treasurer of Aerkomm Inc. (OTCQX AKOM) • VP of IR of Nutrastar International, Inc. (OTCPK: NUIN) from 2016 to 2020; CFO of Success Holding Group International, Inc. from 2015 to 2017; CFO/CIO Partner of Tatum, independent board member of KBS Fashion Group Limited (NASDAQ: KBSF) from 2014 to 2015 • Ma ster ’ s degree in Accounting from The Ohio State University; Bachelor ’ s degree in Economics from Soochow University, Taipei Y. Tristan Kuo Independent Director Independent Directors* 9 * The appointment of independent directors becomes effective upon the SEC ’ s declaration of effectiveness of the Registration Statement.

NO.3 Business Overview 10

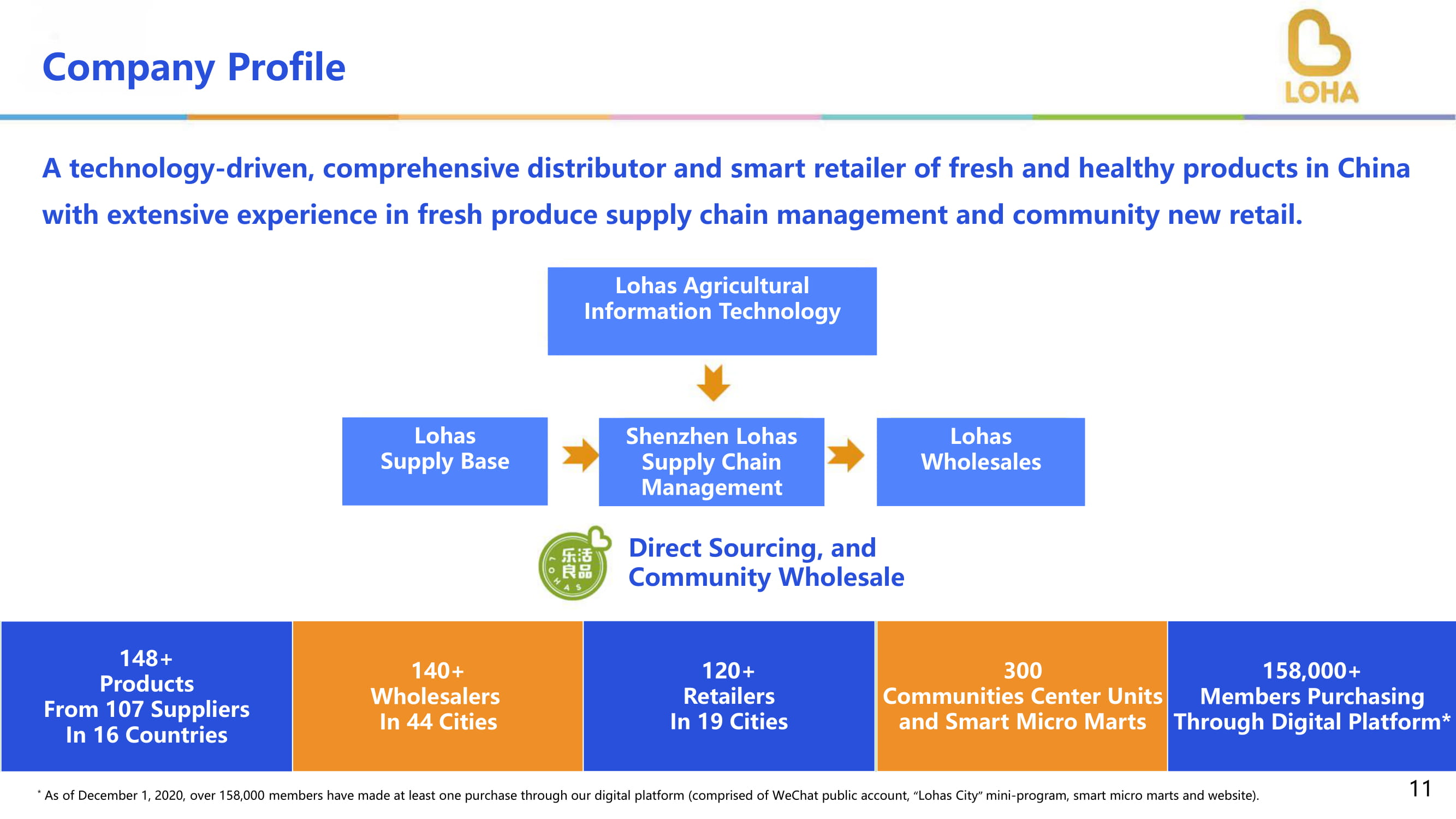

Company Profile A technology - driven, comprehensive distributor and smart retailer of fresh and healthy products in China with extensive experience in fresh produce supply chain management and community new retail. Lohas Agricultural Information Technology Lohas Supply Base Shenzhen Lohas Supply Chain Management Lohas Wholesales Direct Sourcing, and Community Wholesale 148+ Products From 107 Suppliers In 16 Countries 140+ Wholesalers In 44 Cities 120+ Retailers In 19 Cities 300 Communities Center Units and Smart Micro Marts 158,000+ Members Purchasing Through Digital Platform* 11 * As of December 1, 2020, over 158,000 members have made at least one purchase through our digital platform (comprised of WeChat public account, “ Lohas City ” mini - program , smart micro marts and website).

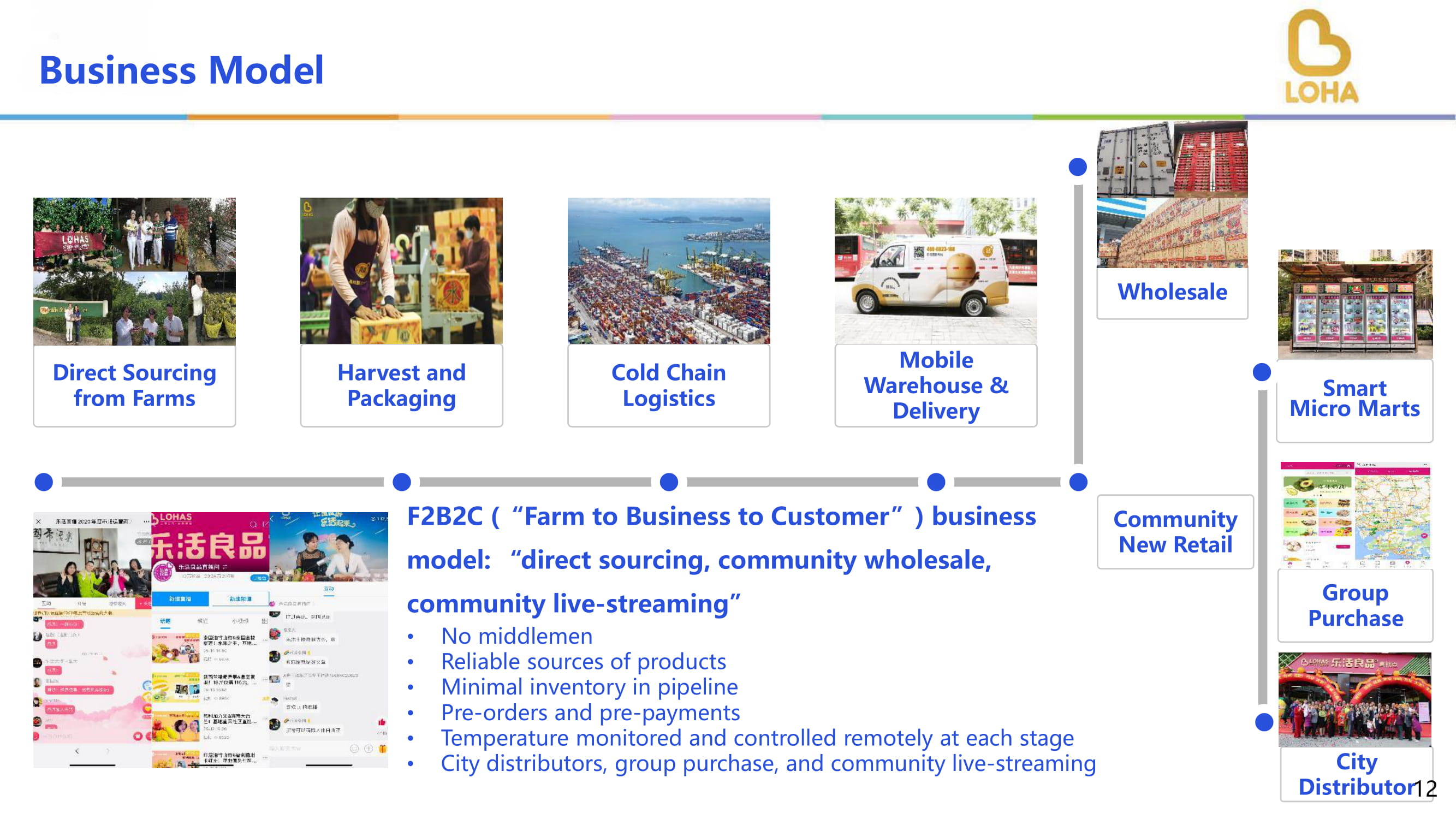

Direct Sourcing from Farms Harvest and Packaging Cold Chain Logistics Mobile Warehouse & Delivery F2B2C ( “Farm to Business to Customer”) business model : “ direct sourcing, community wholesale, community live - streaming ” • No middlemen • Reliable sources of products • Minimal inventory in pipeline • Pre - orders and pre - payments • Temperature monitored and controlled remotely at each stage • City distributors, group purchase, and community live - streaming Wholesale Smart Micro Marts Group Purchase City Distributor Community New Retail Business Model 12

x Offer over 148 fresh, green and healthy products, which mainly consist of imported fruits, wild - harvested seafood, vegetables, eggs, as well as nutritious dry goods. x 107 direct sourcing farm bases in 16 countries, of which 102 are overseas, 5 in China. x Meet the Lohas products standard of low carbon, green, organic, environmentally friendly, and fashion. Longan Kiwi Apple Orange Cherry No.2 in sale Thailand Mexico New Zealand Vietnam Taiwan Australia USA Taiwan Canada Peru Avocado Pitaya Shakya Blueberry Philippines Pineapple Durian No.1 in sale Thailand Grape No.3 in sale Lohas Products 13

• 91.32% of FY19* revenue • 140+ wholesalers located in multiple cities in China • Customers are mainly large fruit wholesale companies Wholesale • 1.71% of FY19* Revenue (Group purchases & smart micro marts) • 120+ city distributors and other retailers • Customers are mainly retail stores located in coastal cities in southeastern China Community New Retail Smart Micro Marts and Group Purchase Deployed 300 units of smart micro marts at residential communities and community centers in Shenzhen and Guangzhou. Group purchase accounted for 1.71% of FY19 revenue. Wholesale and Community New Retail 14 * FY : fiscal year ends September 30

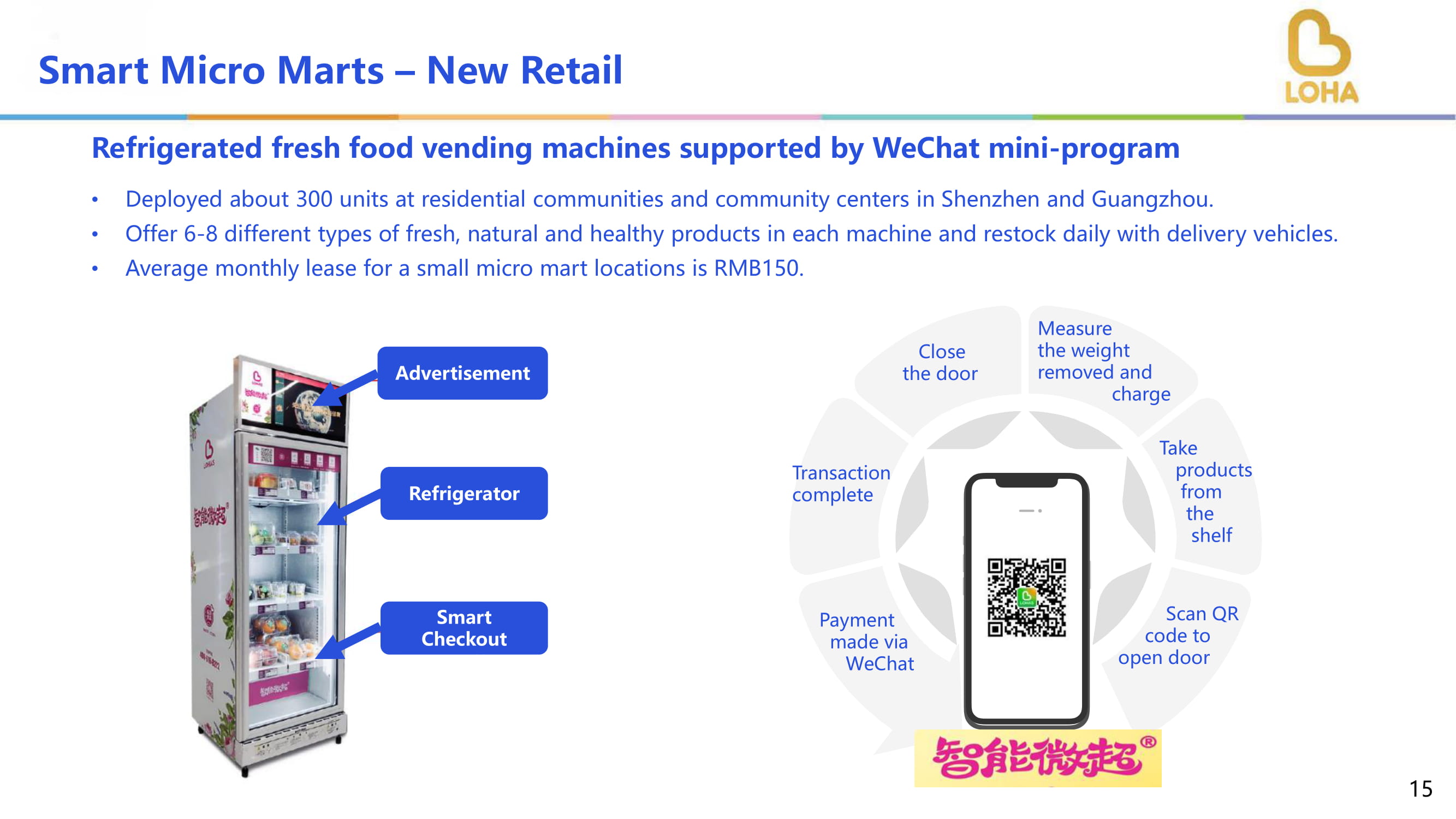

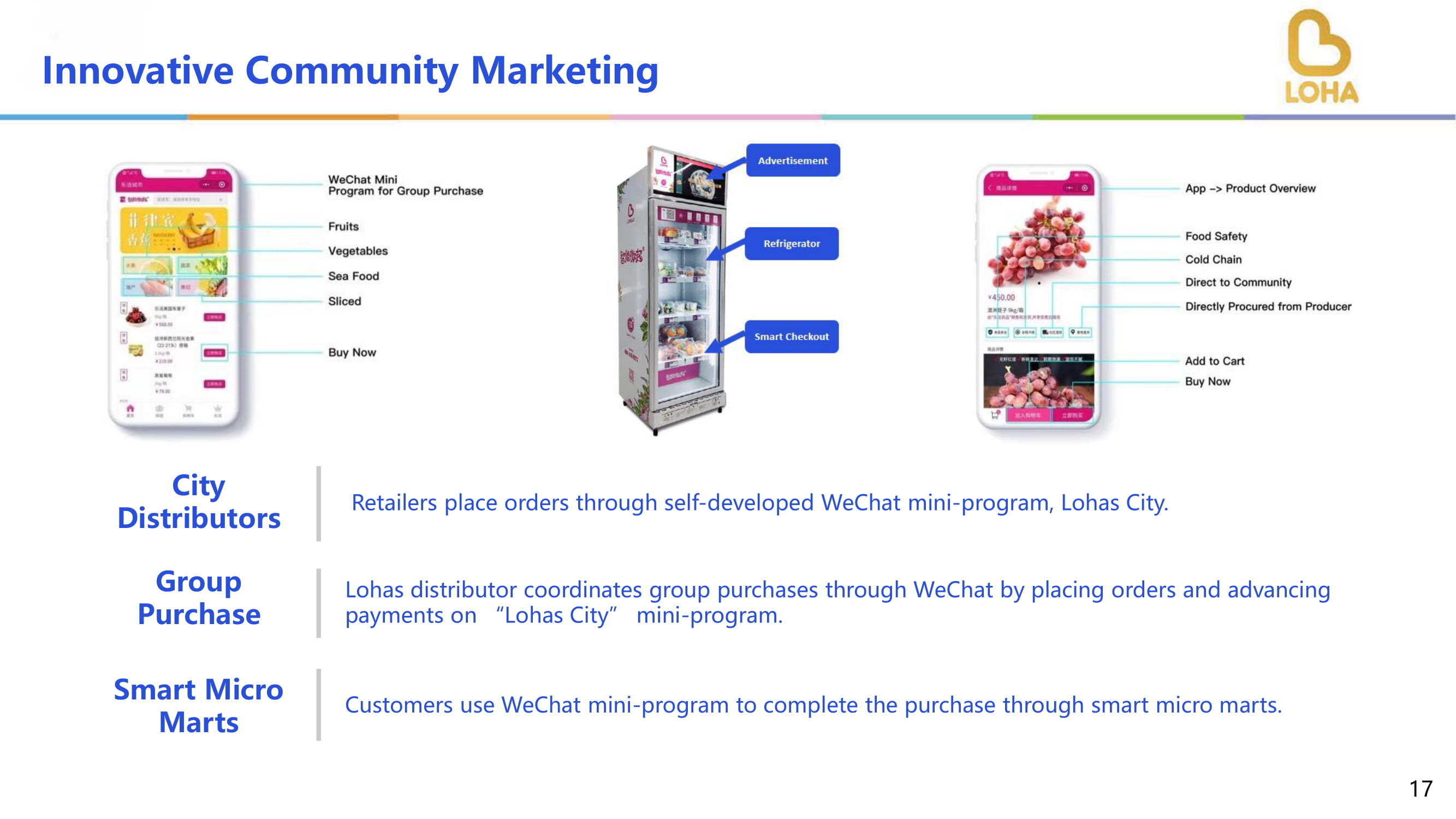

Refrigerated fresh food vending machines supported by WeChat mini - program • Deployed about 300 units at residential communities and community centers in Shenzhen and Guangzhou. • Offer 6 - 8 different types of fresh, natural and healthy products in each machine and restock daily with delivery vehicles. • Average monthly lease for a small micro mart locations is RMB150. Scan QR code to open door Take products from the shelf Measure the weight removed and charge Close the door Transaction complete Payment made via WeChat Advertisement R efrigerator Smart Checkout Smart Micro Marts – New Retail 15

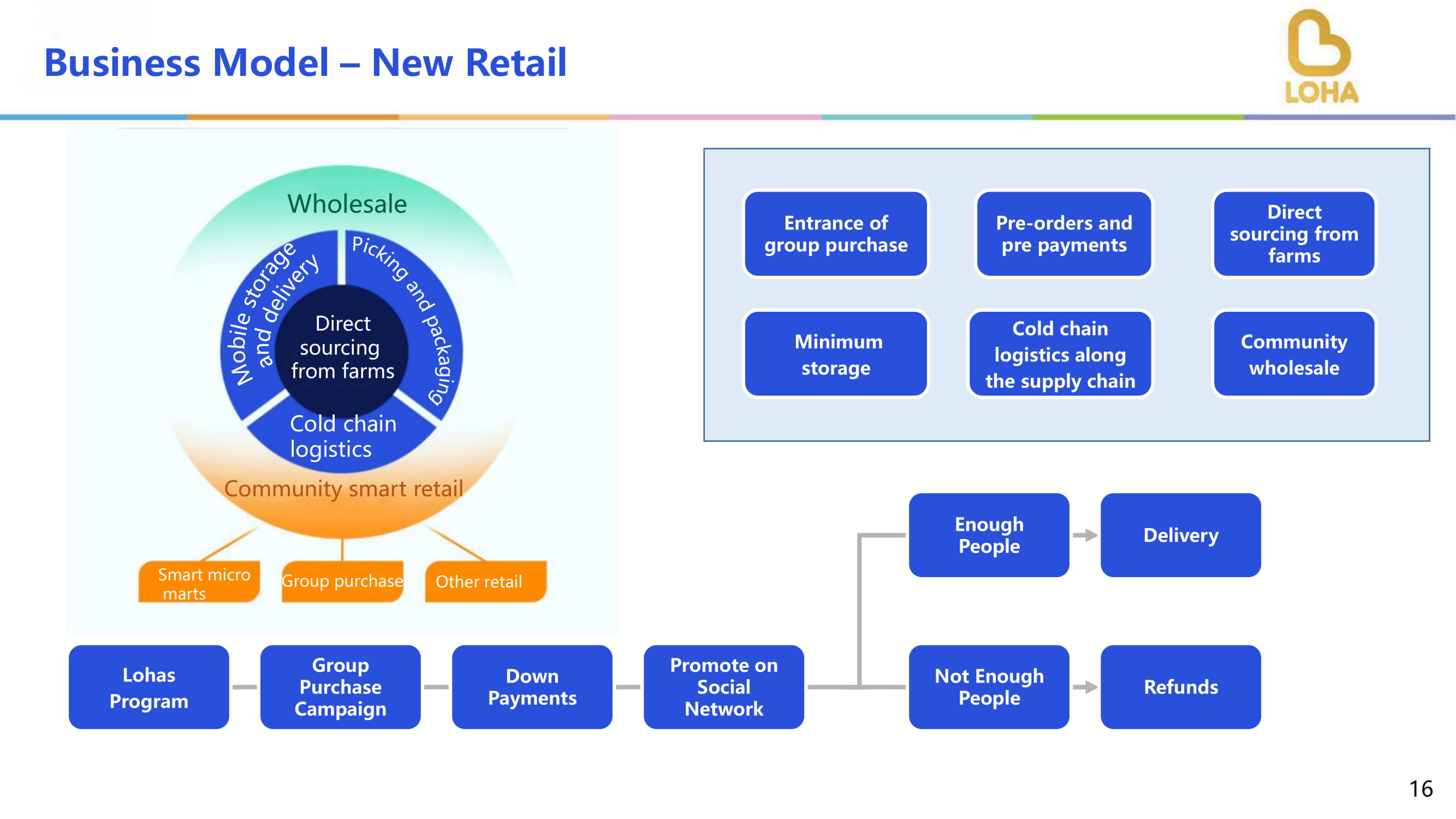

Business Model – New Retail Launched in Late 2018 Refunds Lohas Program Group Purchase Campaign Down Payments Promote on Social Network Not Enough People Delivery Enough People E ntrance of group purchase P re - orders and pre payments D irect sourcing from farms M inimum storage C old chain logistics along the supply chain C ommunit y wholesale W holesale C ommunity smart retail S mart micro marts G roup purchase O ther retail C old chain logistics D irect sourcing from farms 16

Innovative Community Marketing Retailers place orders through self - developed WeChat mini - program, Lohas City. City Distributors Lohas distributor coordinates group purchases through WeChat by placing orders and advancing payments on “Lohas City” mini - program. Group Purchase Customers use WeChat mini - program to complete the purchase through smart micro marts. Smart Micro Marts 17

Supply Chain Management Production Base Air/Sea/Ground Shipping Cold Chain Delivery Wholesale/Retail Stores Smart Micro Marts • Completely controlled • Temperature monitored and adjusted throughout each distribution • Quality control monitoring • Food safety testing • An uninterrupted series of refrigerated production, storage and distribution, along with the associated equipment and logistics • Low - temperature range to preserve product quality and safety • Stable and lucrative traditional wholesale business • Fresh food, an indispensable necessity, is the core focus for many store - based retailers • Retailers pre - order and pre - pay • Deployed in high traffic areas (residential communities and commute centers in large cities) • Combination with online WeChat public account, self - developed WeChat mini - program Lohas City, group purchase, and temperature - controlled vehicles to offer convenient shopping experiences • Sourced from 16 countries • Mainly consist of imported fruits, wild - harvested seafood, pollution - free vegetables and eggs, as well as nutritious dry goods • Strict and transparent product selection process 18

NO.4 Industry Prospect 19

x In 2019, China's fresh food new retail market volume reached 279.62 billion yuan, about 42.82 billion US dollars, an increase of 36.7% over the previous year. x C onsumer's demand for fresh food delivered home has increased in part due to the pandemic in 2020. It is anticipated that he trading scale of the fresh food new retail market will continue to improve. x It is estimated that the trading scale of fresh e - commerce will reach 800 billion yuan by 2023,about 122.51 billion US dollars. Source : iResearch : Fresh Food E - Commerce Industry Research Report, 2020 July (https://www.iresearch.com.cn/Detail/report?id=3652&isfree=0) Market Trade Volume(in Billion Yuan) Industry Prospect 20 Rapid Growth in Community Smart New Retail of Fresh Food 2018 - 2019 China's M arket V olume of Fresh F ood R etail M odel x The comprehensive cost of community group purchase is low, and the market volume has exploded from the second half of 2018. x In 2019, the transaction scale of group purchase is 474.7 billion yuan, about 72.69 billion US dollars, up by 534.8%, showing a positive development momentum. Market Volume of Fresh Produce New Retail( in hundred million yuan ) Growth Rate(%) P enetrate Rate of Fresh Produce New Retail in Online - sh o pping(%) Group P urchase Model Preposition W arehouse Model Platform to Home Model (in hundred million yuan )

NO.5 Financial Highlights 21

85,186 105,429 0 20,000 40,000 60,000 80,000 100,000 120,000 FY18 FY19 Revenues ($’000) YoY Growth Rate: 23.8 % 22 8,781 8,691 0 2,000 4,000 6,000 8,000 10,000 FY18 FY19 Net Income ($’000)

* FY : fiscal year ends September 30 INCOME STATEMENT FY18 1HFY19 1HFY20 ($'000, except share and per share data) FY19 (Unaudited) (Unaudited) Net revenue 85,186 105,429 44,924 26,883 Less: cost of revenue 70,627 89,056 38,982 23,199 Gross profit 14,559 16,373 5,942 3,684 Selling expenses 2,682 2,419 1,160 946 General and administrative expenses 1,638 3,205 1,408 1,798 Total operating expenses 4,320 5,624 2,568 2,744 Income from operations 10,239 10,749 3,374 940 Other income, net 143 109 41 52 Interest expense, net - 18 - 637 - 247 - 359 Total other income 125 - 528 - 206 - 307 Income before income tax expense 10,364 10,221 3,168 633 Income tax expense 1,583 1,530 520 92 Net income 8,781 8,691 2,648 541 Foreign currency translation gain (loss), net of nil income taxes - 1,144 - 1,381 644 308 Total comprehensive income 7,637 7,310 3,292 849 Earnings per ordinary share (basic and diluted) 0.32 0.32 0.1 0.02 23

BALANCE SHEET ($'000) March 31, 2020 (Unaudited) Cash and cash equivalents 6 Accounts receivable, net 11,694 Inventories 17,492 Advance to suppliers, net 19,442 Amounts due from related parties 1,233 Prepaid expenses and other current assets 1,531 Total current assets 51,539 Property and equipment, net 131 Total assets 52,056 Accounts payable 3,808 Total current liabilities 15,400 Total liabilities 15,695 Class A ordinary shares 4 Class B ordinary shares 2 Additional paid - in capital 9,452 Retained earnings 26,719 Accumulated other comprehensive loss - 2,719 Total shareholders' equity 36,361 Total liabilities and shareholders' equity 52,056 STATEMENTS OF CASH FLOWS ($'000) For the six months ended March 31, 2020 (Unaudited) Net income 541 Net cash (used in) provided by operating activities 167 Net cash (used in) provided by investing activities - 2 Net cash (used in) provided by financing activities - 2,379 Net increase (decrease) in cash and cash equivalents - 2,169 Cash and cash equivalents and restricted cash, BoP 2,316 Cash and cash equivalents and restricted cash, EoP 147 24

Summary Strong Brand Loyalty Amplified by Launching Own Brand Products Robust Supply Chain Management System Ensuring Reliability and Quality of Product Efficient Farm to Business to Consumer (F2B2C) Model Unique Philosophy Emphasizing Health & Sustainability Innovative Smart Retail Strategy 25

TEL: 400 - 6823 - 188 E - mail: Joseph@lohas100.com Address : Room 2212A, 22nd Floor, Xiangjiang Financial Center (Industrial Zone), Unit 19, 3rd Street, Xinghai Avenue, Nanshan District, Shenzhen, Guangdong Province 518000, People's Republic of China 26

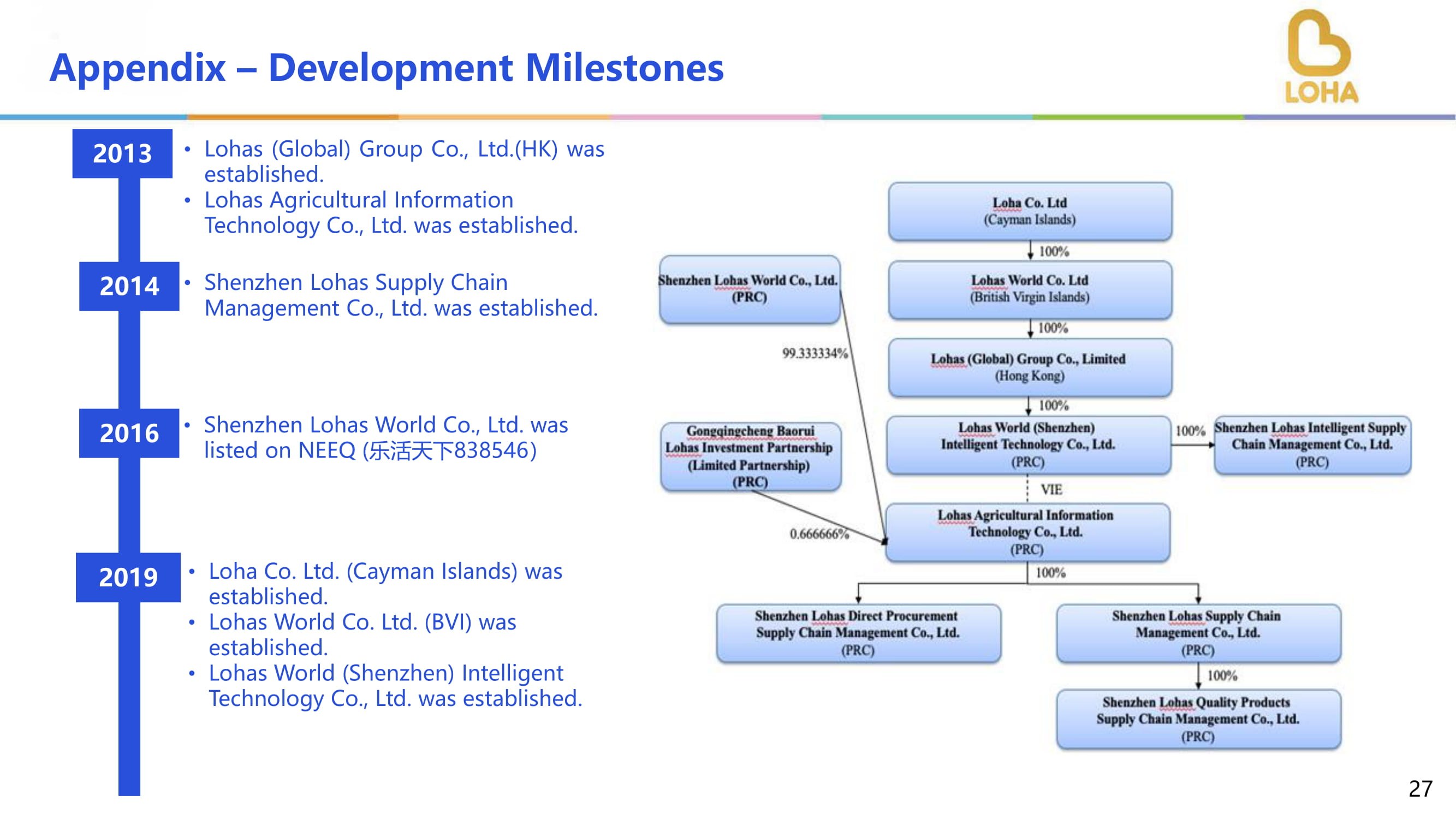

• Lohas (Global) Group Co . , Ltd . ( HK ) was established . • Lohas Agricultural Information Technology Co., Ltd. was established. • Shenzhen Lohas Supply Chain Management Co., Ltd. was established. 2019 • Loha Co. Ltd. (Cayman Islands) was established. • Lohas World Co. Ltd. (BVI) was established. • Lohas World (Shenzhen) Intelligent Technology Co., Ltd. was established. 20 13 2014 2016 • Shenzhen Lohas World Co., Ltd. was listed on NEEQ ( 乐活天下 838546 ) Appendix – Development Milestones 27