commercialization, we will increase capacity with our current suppliers and evaluate other options to secure commercial-scale capacity.

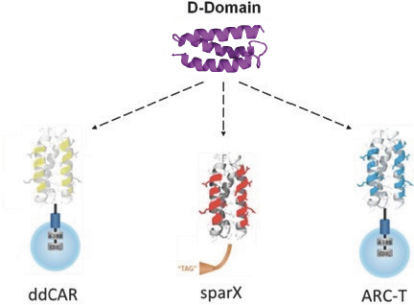

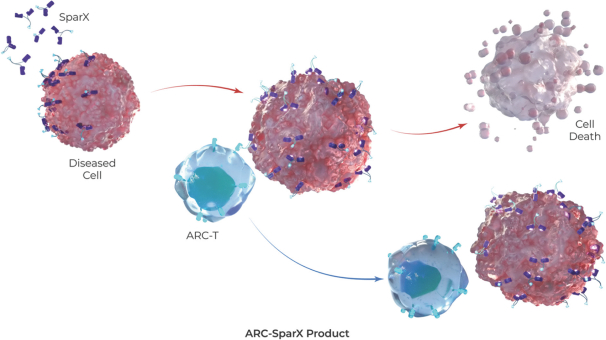

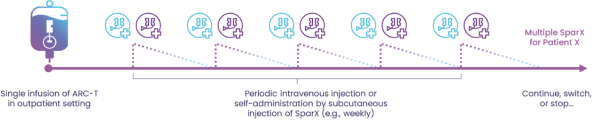

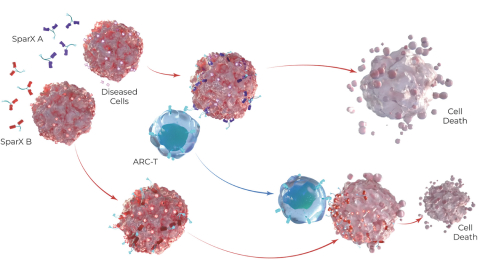

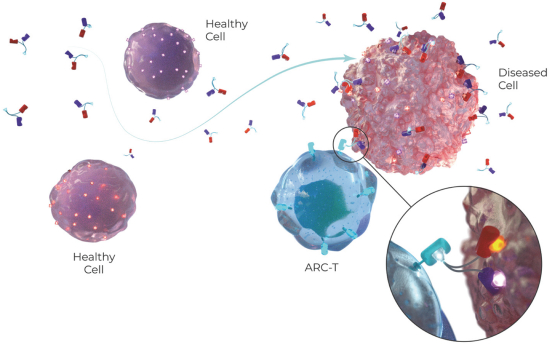

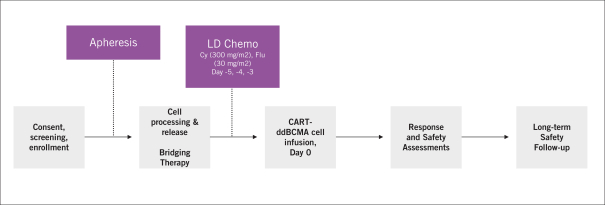

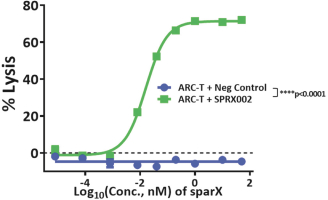

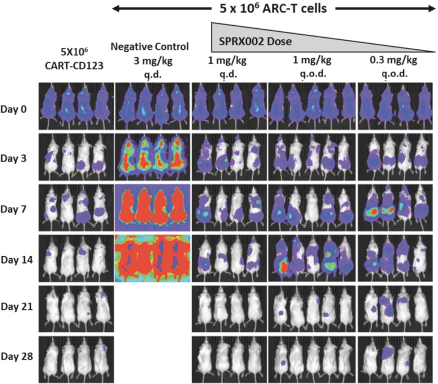

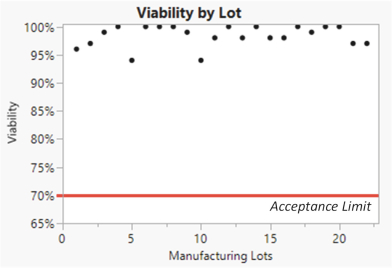

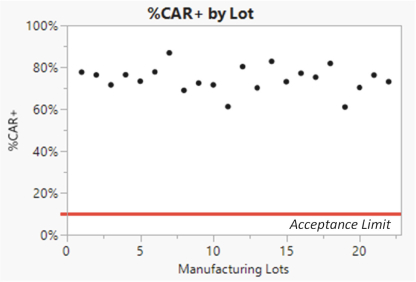

The manufacturing process for our ARC-T cells is consistent with the CART-ddBCMA process. However, cells are transduced with a lentiviral vector encoding our universal ARC, which is a CAR with an anti-TAG binding domain, in lieu of a lentiviral vector encoding the CAR construct with a ddBCMA binding domain. Because our ARC-T cells are designed to express the same TAG-specific binding domain rather than a cell surface antigen-specific binding domain, the same lentiviral vector encoding the universal ARC can be used for every patient regardless of disease or target antigen.

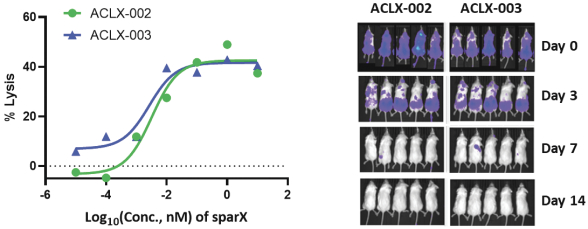

SparX Protein

We manufacture SparX proteins in-house for most research activities, but we use a third-party CMO for most preclinical studies, and all clinical trials. We produce research SparX proteins in mammalian and microbial systems using fermentation and protein purification strategies that we believe can be scaled for commercial purposes. The purified SparX protein is formulated to the desired concentration and then put into the desired formulation buffer. Every SparX protein is monitored throughout the purification process and afterwards using an array of analytical tests that assess SparX protein size, binding activity and potential biophysical changes in the SparX protein. We anticipate the process will evolve over time to improve yields, quality and quantity of recovered SparX protein.

Competition

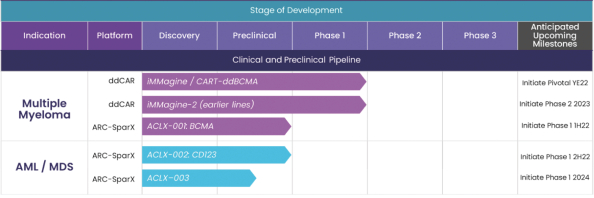

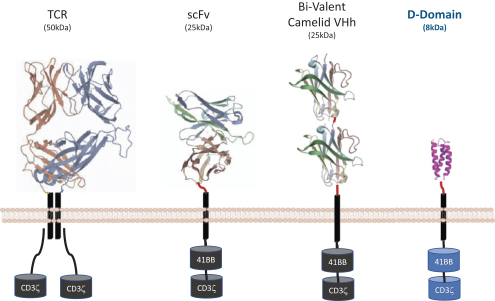

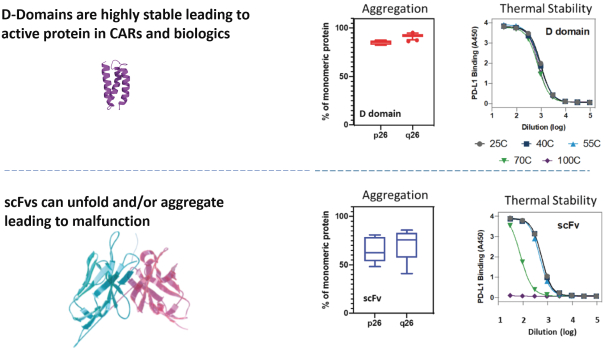

The biotechnology and pharmaceutical industries, including the oncology subsector, are characterized by rapidly advancing technologies, intense competition and a strong emphasis on intellectual property. Any candidate that we successfully develop and commercialize will have to compete with existing therapies as well as therapies that may be developed in the future. While we believe our D-Domain, ddCAR and ARC-SparX platforms and scientific expertise provide us with a number of key advantages, we face substantial competition from many different sources, including large pharmaceutical companies and biotechnology companies, academic research institutions and governmental agencies, and public and private research institutions.

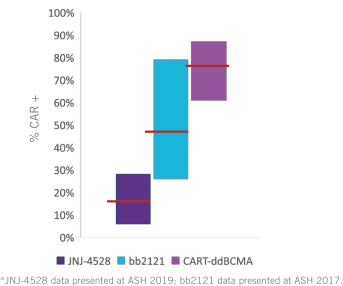

We anticipate substantial direct competition from other organizations developing advanced CAR-Ts, other types of genetically modified cell therapies, or other anti-BCMA biologics due to their promising clinical therapeutic effect in clinical trials including: 2seventy, Abbvie, Allogene, Amgen, Autolus, Bristol-Myers Squibb, CARSgen, Cartesian, Cellular Biomedicine Group, Gracell, GSK, Innovent, Johnson & Johnson, Legend, Novartis, Pfizer, Poseida Therapeutics, Precision BioSciences, Pregene, and Regeneron. In addition, some companies, such as Allogene, Caribou Biosciences, Cellectis, Celyad, and Crispr, are developing allogeneic cell therapies that could compete with our product candidate.

We cannot predict whether other types of CAR-T or other genetically modified cell therapies may be developed and demonstrate greater efficacy, and we may have direct and substantial competition from such therapies in the future. Further, despite the unique approach that we have developed to address the limitations of CAR-T and other types of genetically modified cell therapies, we expect to face increasing competition as new, more effective treatments for cancer enter the market and further advancements in technologies are made. We expect market adoption of any treatments that we develop and commercialize to be dependent on, among other things, efficacy, safety, delivery, price and the availability of reimbursement from government and other third-party payors.

Many of our current or potential competitors, either alone or with their collaboration partners, have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical, biotechnology, gene therapy and cell therapy industries may result in even more resources being

146