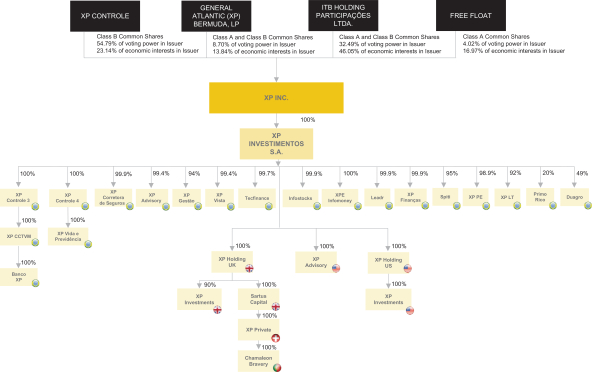

Appointed Representative Agreement to New Europe Advisers Ltd., became effective on September 30, 2019, in order to concentrate our efforts in the private and wealth management business in Switzerland through our Swiss subsidiary, XP Private (Europe) SA.

XP Private (Europe) SA performs activities under the supervision of theAssociation Romande des Intermédiaires Financiers, or the ARIF, a self-regulatory organization (SRO), which is overseen by the Swiss Financial Market Supervisory Authority (FINMA). As required by the applicable regulation, in order to provide securities portfolio management services XP Private (Europe) SA became a member of ARIF on September 5, 2016.

One of our subsidiaries, XP Investments UK LLP, performs activities that are subject to regulation by the Financial Conduct Authority. As required by the applicable regulation, it is authorized and regulated by the FCA and has sufficient permissions to carry out its business, including operating as an Organised Trading Facility (OTF).

One of our subsidiaries, XP Portugal, performs activities that are subject to regulation by the CMVM, including operating as an investment advisory company. As required by the applicable regulation, it has applied to the CMVM for the authorization to operate, which is currently pending.

Two of our subsidiaries, XP Corretora de Seguros Ltda., or XP CS, and XP VP, perform activities that are subject to regulation by SUSEP. As required by the applicable regulation, both have applied for authorizations to operate from SUSEP, which current status is as follows:

| | • | | XP CS, our insurance broker dealer, is authorized to operate as an insurance brokerage; and |

| | • | | XP VP, our insurance company, is authorized to operate life insurance and private pension plans. |

Regulatory Environment in Brazil

Our main subsidiaries in Brazil are subject to extensive regulation, such as those applicable to banks (in the case of Banco XP), securities and foreign exchange brokers (in the case of XP CCTVM), securities portfolio managers (in the case of XP Gestão, XP Advisory, XP PE, XP LT and XP Vista), securities analysts (such as Spiti Análise Ltda.), insurance companies and insurance brokers (in the case of XP VP and XP CS, respectively).

We offer various financial and capital markets services; in particular, we conduct activities related to banking, underwriting, brokerage services, portfolio management and insurance.

Legislation Applicable to Financial Institutions and Portfolio Managers in Brazil

The current Brazilian banking and financial institutional system was established by Law No. 4,595 of December 31, 1964, as amended, or the Banking Law.

The Banking Law laid out the structure of the national financial system, which is made up of the CMN, the Central Bank of Brazil, Banco do Brasil S.A., the National Bank for Economic and Social Development – BNDES, or the BNDES, and other public or private financial institutions. While the following entities do not fall under the purview of the Banking Law, they play key roles in the financial system: the CVM, SUSEP, the National Superintendency of Pension Plans (Superintendência Nacional de Previdência Complementar), or PREVIC; the CNSP, and the National Council for Pension Plans (Conselho Nacional de Previdência Complementar), or CNPC.

Law No. 4,728 of July 14, 1965, as amended, or Law No. 4,728/65, regulates Brazilian capital markets through setting standards and various other mechanisms. Further, pursuant to Law No. 6,385 of December 7, 1976, as amended, or Law No. 6,385/76, the distribution and issuance of securities in the market, trading of

118