Table of Contents

As filed with the Securities and Exchange Commission on January 27, 2020

RegistrationNos. 333-233934 and 333-233934-01

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 3 to

FORMF-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| BROOKFIELD INFRASTRUCTURE CORPORATION | BROOKFIELD INFRASTRUCTURE PARTNERS L.P. | |

| (Exact name of Registrant as specified in their charters) | (Exact name of Registrant as specified in their charters) | |

| Not Applicable | Not Applicable | |

| (Translation of Registrant’s name into English) | (Translation of Registrant’s name into English) | |

| British Columbia, Canada | Bermuda | |

| (State or other jurisdiction of incorporation or organization) | (State or other jurisdiction of incorporation or organization) | |

| 4923 | 4400 | |

| (Primary Standard Industrial Classification Code Numbers) | (Primary Standard Industrial Classification Code Numbers) | |

| Not Applicable | Not Applicable | |

| (IRS Employer Identification Numbers) | (IRS Employer Identification Numbers) | |

| Brookfield Infrastructure Corporation | Brookfield Infrastructure Partners L.P. | |

| 250 Vesey Street, 15th Floor | 73 Front Street, 5th Floor | |

| New York, New York 10281 | Hamilton, HM 12, Bermuda | |

| (212)417-7000 | +1 (441)294-3309 | |

| (Address, including zip code, and telephone number, including area code, of Registrants’ principal executive offices) | (Address, including zip code, and telephone number, including area code, of Registrants’ principal executive offices) | |

Ralph Klatzkin

Brookfield Infrastructure US Holdings I Corporation

Brookfield Place

250 Vesey Street, 15th Floor

New York, New York 10281

(212)417-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service of the Registrants)

Copies to:

Mile T. Kurta, Esq.

Torys LLP

1114 Avenue of the Americas, 23rd Floor

New York, New York 10036

(212)880-6000

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

Table of Contents

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrants are emerging growth companies as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP (as defined below), indicate by check mark if the registrants have elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be Registered | Proposed Maximum Offering Price Per Share/Unit | Proposed maximum aggregate offering price | Amount of registration fee | ||||

Class A Subordinate Voting Shares of Brookfield Infrastructure Corporation | (1) | N/A | $1,966,000,000(2) | $255,186.80(2) | ||||

Limited Partnership Units of Brookfield Infrastructure Partners L.P. | (3) | N/A | $— (5) | $— (5) | ||||

Limited Partnership Units of Brookfield Infrastructure Partners L.P. | (4) | N/A | $— (5) | $— (5) | ||||

| ||||||||

| ||||||||

| (1) | This registration statement relates to an aggregate of 47,000,000 class A subordinate voting shares, no par value (“class A shares”), of Brookfield Infrastructure Corporation (the “company”), consisting of approximately 33,000,000 class A shares that will be distributed (the “special distribution”) to the holders of limited partnership units of Brookfield Infrastructure Partners L.P. (“units”), and an additional approximate 14,000,000 class A shares to be issued to Brookfield Asset Management Inc. and its subsidiaries (other than entities within our group), as more fully described in the prospectus contained herein. |

| (2) | There is currently no market for the class A shares. Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(f) under the Securities Act of 1933. The amount of the registration fee is $255,186.80, of which $77,083.20 was paid in connection with the initial filing of the registration statement on Form F-1 on September 25, 2019 and the remaining amount of $178,103.60 was paid in connection with the filing of Amendment No. 1 to Form F-1 on November 13, 2019. |

| (3) | Represents 47,000,000 units of Brookfield Infrastructure Partners L.P. to be issued from time to time upon exchange, redemption or purchase of class A shares (including upon liquidation, dissolution, or winding up of the company) following the special distribution as described in the prospectus filed as part of this registration statement. The number of units represents a good-faith estimate of the maximum number of units to be issued upon exchange, redemption or purchase of class A shares (including upon liquidation, dissolution, or winding up of the company). Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional units as may be issuable as a result of stock splits, stock dividends or similar transactions. |

| (4) | Represents 47,000,000 units of Brookfield Infrastructure Partners L.P. to be delivered by the selling unitholder upon exchange, redemption or purchase of class A shares (including upon liquidation, dissolution, or winding up of the company) following the special distribution as described in the prospectus filed as part of this registration statement. The number of units represents a good-faith estimate of the maximum number of units to be delivered upon exchange, redemption or purchase of class A shares (including upon liquidation, dissolution, or winding up of the company). Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional units as may be deliverable as a result of stock splits, stock dividends or similar transactions. |

| (5) | No separate registration fee is payable pursuant to Rule 457(i) under the Securities Act. |

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JANUARY 27, 2020

BROOKFIELD INFRASTRUCTURE CORPORATION

Class A Subordinate Voting Shares of Brookfield Infrastructure Corporation

Limited Partnership Units of Brookfield Infrastructure Partners L.P.

(issuable or deliverable upon exchange, redemption or purchase of Class A Subordinate Voting Shares)

This prospectus is being furnished to you as a unitholder of Brookfield Infrastructure Partners L.P., or the partnership, in connection with the planned special distribution, or the special distribution, by the partnership to the holders of itsnon-voting limited partnership units, or units, of approximately 32.6 million class A subordinate voting shares, or class A shares, of Brookfield Infrastructure Corporation, or our company, a corporation incorporated under, and governed by, the laws of British Columbia. Each class A share will be structured with the intention of providing an economic return equivalent to one unit (subject to adjustment to reflect certain capital events). Each class A share will be exchangeable at the option of the holder for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our company). The partnership may elect to satisfy our exchange obligation by acquiring such tendered class A shares for an equivalent number of units (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of the partnership). See “Description of Our Share Capital — Exchange by Holder — Adjustments to Reflect Certain Capital Events.” Our company and the partnership currently intend to satisfy any exchange requests on the class A shares through the delivery of units rather than cash. It is expected that following completion of the special distribution each class A share will receive identical dividends to the distributions paid on each unit, as more fully described in this prospectus. We therefore expect that the market price of our class A shares will be significantly impacted by the market price of the units and the combined business performance of the partnership, our company and our respective subsidiaries as a whole, which we refer to throughout this prospectus as our group.Prior to the special distribution, our company will acquire our operating subsidiaries from certain of the partnership’s subsidiaries. Following completion of the special distribution, our company will own and operate high-quality, long-life infrastructure assets that generate stable cash flows, require relatively minimal maintenance capital expenditures and, by virtue of barriers to entry and other characteristics, tend to appreciate in value over time. Our initial operations will consist of utilities businesses in Europe and South America.

This prospectus also relates to (i) the delivery of up to approximately 46.3 million units to holders of class A shares if our company or the partnership elects to satisfy any exchange, redemption or purchase of class A shares by delivering units pursuant to this prospectus (including in connection with any liquidation, dissolution or winding up of our company) and (ii) the delivery by Brookfield Asset Management Inc., as selling unitholder, of up to approximately 46.3 million units to holders of class A shares, pursuant to the rights agreement between Brookfield Asset Management Inc. and Wilmington Trust, National Association. Brookfield has agreed that, until the fifth anniversary of the distribution date, in the event that our company or the partnership has not satisfied an exchange, redemption or purchase of class A shares in cash or by delivering units, then Brookfield, as selling unitholder, will satisfy or cause to be satisfied such exchange, redemption or purchase by paying such cash amount or delivering such units pursuant to this prospectus. The partnership and Brookfield currently intend to satisfy any exchange, redemption or purchase of class A shares through the delivery of units rather than cash.

The partnership is a holding entity and its sole material asset is its managing general partnership interest and preferred limited partnership interest in Brookfield Infrastructure L.P., or Holding LP. Prior to the special distribution, the partnership will receive our class A shares through a special distribution by Holding LP of the class A shares to all the holders of its equity units (which does not include preferred partnership units). Brookfield Asset Management Inc. and its subsidiaries (other than entities within our group), or Brookfield, who has a current approximate 29.6% economic interest in the partnership on a fully-exchanged basis, as holder of redeemable partnership units of Holding LP, the special general partner interest that it holds in Infrastructure Special LP and the general partner interest in the partnership, will receive an additional approximate 13.7 million class A shares. Immediately following the special distribution, our company’s sole direct investment will be an interest in the common equity of BIPC Holdings Inc., or Canada SubCo. It is currently anticipated that immediately following the special distribution, (i) holders of units will hold approximately 70.4% of the issued and outstanding class A shares of our company, (ii) Brookfield and its affiliates will hold approximately 29.6% of the issued and outstanding class A shares, and (iii) a subsidiary of the partnership will own all of the issued and outstanding class B multiple voting shares, or class B shares, and all of the issued and outstanding class C non-voting shares, or class C shares, of our company, which represent a 75% voting interest and an approximate 20% economic interest, respectively. Holders of class A shares are expected to hold an aggregate 25% voting interest in our company. Brookfield, through its ownership of class A shares, will initially hold an approximate 7.4% voting interest in our company. Holders of class A shares, excluding Brookfield, will initially hold an approximate 17.6% aggregate voting interest in our company. Together, Brookfield and Brookfield Infrastructure will hold an approximate 82% voting interest in our company. The holders of the class A shares will be entitled to one vote for each class A share held at all meetings of our shareholders, except for meetings at which only holders of another specified class or series of shares of our company are entitled to vote separately as a class or series. The holders of the class B shares will be entitled to cast, in the aggregate, a number of votes equal to three times the number of votes attached to the class A shares. Except as otherwise expressly provided in the articles or as required by law, the holders of class A shares and class B shares will vote together and not as separate classes. Holders of class C shares will have no voting rights.

Pursuant to the special distribution, holders of units as of , the record date for the special distribution, or the record date, will be entitled to receive one (1) class A share for every nine (9) units held as of the record date, provided that the special distribution will be subject to any applicable withholding tax and no holder will be entitled to receive any fractional interests in the class A shares. The distribution date for the special distribution is expected to be on or about , or the distribution date. Holders of units who would otherwise be entitled to a fractional class A share will receive a cash payment.

Holders of units will not be required to pay for the class A shares to be received upon completion of the special distribution or tender or surrender units or take any other action in connection with the special distribution. Holders of units are not being asked for a proxy and are requested not to send a proxy. See “Questions and Answers Regarding the Special Distribution” for further details.

Our company may, at any time and in our sole discretion, upon sixty (60) days’ prior written notice to holders of class A shares, redeem all of the outstanding class A shares for one unit per class A share held (subject to adjustment to reflect certain capital events as described in more detail in this prospectus) or its cash equivalent. See “Description of Our Share Capital”.

In addition, wholly-owned subsidiaries of Brookfield will provide management services to us pursuant to the partnership’s existing master services agreement, or the Master Services Agreement, which will be amended in connection with the completion of the special distribution. There will be no increase to the base management fee and incentive distribution fees currently paid by the partnership to the Service Providers, though following completion of the special distribution, our company will be responsible for reimbursing the partnership or its subsidiaries, as the case may be, for our proportionate share of the base management fee. See also “Relationship with Brookfield – Incentive Distributions”.

There is currently no public market for our class A shares. We have applied to have our class A shares listed on the New York Stock Exchange, or the NYSE, and the Toronto Stock Exchange, or the TSX, under the symbol “BIPC” and we anticipate that trading in our class A shares will begin on a “when-issued” basis as early as trading days prior to the record date and will continue up to and including the distribution date. “When-issued” trades generally settle within trading days after the distribution date. On the first trading day following the distribution date, any “when-issued” trading of our class A shares will end and “regular-way” trading will begin. Listing is subject to the approval of the NYSE and the TSX in accordance with their respective original listing requirements. The NYSE and the TSX have not conditionally approved our listing application and there is no assurance that the NYSE or the TSX will approve the listing application.

In reviewing this prospectus, you should carefully consider the matters described in the section entitled “Risk Factors” beginning on page 30.

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS INFORMATION IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Table of Contents

| Page | ||||

| 1 | ||||

| 3 | ||||

| 9 | ||||

| 19 | ||||

| 30 | ||||

| 57 | ||||

| 59 | ||||

| 63 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

| 64 | ||||

| 65 | ||||

| 70 | ||||

| 77 | ||||

| 78 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 84 | |||

| 117 | ||||

| 128 | ||||

| 135 | ||||

| 142 | ||||

| 162 | ||||

| 165 | ||||

COMPARISON OF RIGHTS OF HOLDERS OF OUR CLASS A SHARES AND THE PARTNERSHIP’S UNITS | 173 | |||

| 188 | ||||

| 194 | ||||

| 196 | ||||

| 197 | ||||

| 198 | ||||

| 204 | ||||

| 215 | ||||

| 216 | ||||

- i -

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||||

| 216 | ||||

| 216 | ||||

| 217 | ||||

| 217 | ||||

| 218 | ||||

| 219 | ||||

| 220 | ||||

| 222 | ||||

| 223 | ||||

| A-1 | ||||

| B-1 | ||||

| F-1 | ||||

- ii -

Table of Contents

About this Prospectus

This prospectus, which forms part of a registration statement on FormF-1 filed by our company and the partnership with the SEC, constitutes a prospectus of our company and the partnership for purposes of the Securities Act with respect to the class A shares to be distributed in the special distribution and the units to be issued or delivered in connection with the exchange, redemption or purchase, if any, of class A shares (including in connection with any liquidation, dissolution or winding up of our company).

You should rely only on the information contained in or incorporated by reference into this prospectus. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus. Our business, financial condition, results of operations and prospects could have changed since that date. We expressly disclaim any duty to update this prospectus, except as required by applicable law.

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in any jurisdiction in which, or from any person with respect to whom, it is unlawful to make any such offer in such jurisdiction.

Meaning of Certain References

Unless otherwise noted or the context otherwise requires, when used in this prospectus, the terms “we”, “us”, “our” and “our company” mean Brookfield Infrastructure Corporation together with all of its subsidiaries. References to “Brookfield Infrastructure” mean the partnership collectively with Holding LP, the Brookfield Infrastructure Holding Entities and the Brookfield Infrastructure Operating Entities (but excluding our company). References to “our group” mean, collectively, our company and Brookfield Infrastructure. Unless otherwise noted or the context otherwise requires, the disclosure in this prospectus assumes that the special distribution has been completed and we have acquired our operating subsidiaries from Brookfield Infrastructure, although we will not acquire such subsidiaries until prior to the special distribution. Certain capitalized terms and phrases used in this prospectus are defined in the “Glossary”. Words importing the singular number include the plural, andvice versa, and words importing any gender include all genders.

Historical Performance and Market Data

This prospectus contains information relating to our Business as well as historical performance and market data for Brookfield Infrastructure and certain of its operating subsidiaries. When considering this data, you should bear in mind that historical results and market data may not be indicative of the future results that you should expect from us or the partnership.

Financial Information

The financial information contained in this prospectus is presented in United States dollars and, unless otherwise indicated, has been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. All figures are unaudited unless otherwise indicated. In this prospectus, all references to “$” are to United States dollars, references to “C$” are to Canadian dollars and references to “R$” are to Brazilian real.

Use of Non-IFRS Measures

To measure performance, we focus on net income, an IFRS measure, as well as certainnon-IFRS measures, including Funds from Operations, or FFO, Adjusted Funds from Operations, or AFFO, proportionate debt and proportionate net debt.

- 1 -

Table of Contents

We define FFO as net income excluding the impact of depreciation and amortization, deferred income taxes, breakage and transaction costs, andnon-cash valuation gains or losses. FFO is a measure of operating performance that is not calculated in accordance with, and does not have any standardized meaning prescribed by IFRS or the IASB. FFO is therefore unlikely to be comparable to similar measures presented by other issuers. FFO has limitations as an analytical tool. Specifically, our definition of FFO may differ from the definition used by other organizations, as well as the definition of Funds from Operations used by the Real Property Association of Canada and the National Association of Real Estate Investment Trusts, Inc., or NAREIT, in part because the NAREIT definition is based on U.S. GAAP, as opposed to IFRS.

We define AFFO as FFO less capital expenditures required to maintain the current performance of our operations (maintenance capital expenditures). AFFO is a measure of operating performance that is not calculated in accordance with, and does not have any standardized meaning prescribed by, IFRS. AFFO is therefore unlikely to be comparable to similar measures presented by other issuers and has limitations as an analytical tool.

Proportionate debt is presented based on our proportionate share of borrowings obligations relatingto our investments in various portfolio businesses. Proportionate net debt is proportionate debt net of our proportionate share of cash.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for reconciliations ofnon-IFRS measures to the nearest IFRS measures.

Market Data and Industry Data

Market and industry data presented throughout, or incorporated by reference in, this prospectus was obtained from third party sources, industry publications, and publicly available information, as well as industry and other data prepared by us and the partnership on the basis of our collective knowledge of the Canadian, U.S. and international markets and economies (including estimates and assumptions relating to these markets and economies based on that knowledge). Our group believes that the market and economic data is accurate and that the estimates and assumptions are reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and economic data used throughout this prospectus, or incorporated by reference herein, are not guaranteed and our group does not make any representation as to the accuracy of such information. Although our group believes it to be reliable, our group has not independently verified any of the data from third party sources referred to or incorporated by reference in this prospectus, analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying economic and other assumptions relied upon by such sources.

- 2 -

Table of Contents

“AFFO” means Adjusted Funds from Operations;

“Annual Report” means the partnership’s annual report on Form20-F for the fiscal year ended December 31, 2018 (filed in Canada with the Canadian securities regulatory authorities in lieu of an annual information form), which includes the partnership’s audited consolidated statements of financial position as of December 31, 2018 and December 31, 2017, together with the report thereon of the independent registered public accounting firm and management’s discussion and analysis of the partnership as of December 31, 2018 and 2017 and for each of the three years in the period ended December 31, 2018;

“ANP” means Agência Nacional do Petróleo;

“articles” means the notice of articles and articles of our company;

“audit committee” means the audit committee of our board, as further described under “Governance — Corporate Governance Disclosure — Committees of the Board of Directors — Audit Committee”;

“BCBCA” means theBusiness Corporations Act (British Columbia);

“Bermuda Holdco” means BUUK Bermuda Holdco Limited;

“BIPIC” means BIP Investment Corporation;

“board” means the board of directors of our company;

“Brookfield” has the meaning ascribed thereto on the cover page of this prospectus;

“Brookfield Accounts” means Brookfield and/or other Brookfield-sponsored vehicles, consortiums and/or partnerships (including private funds, joint ventures and similar arrangements);

“Brookfield Class A Shares” has the meaning ascribed thereto under “Executive Compensation — Compensation Elements Paid by Brookfield”;

“Brookfield Infrastructure” means the partnership collectively with Holding LP, the Brookfield Infrastructure Holding Entities and the Brookfield Infrastructure Operating Entities (but excluding our company);

“Brookfield Infrastructure Debt Issuers” means Brookfield Infrastructure Finance ULC, Brookfield Infrastructure Finance LLC, Brookfield Infrastructure Finance Limited and Brookfield Infrastructure Finance Pty Ltd., collectively;

“Brookfield Infrastructure Holding Entities” means certain subsidiaries of Holding LP, including Canada HoldCo, through which the partnership holds all of its interest in the Brookfield Infrastructure Operating Entities;

“Brookfield Infrastructure Operating Entities” means the entities which directly or indirectly hold the partnership’s current operations and assets that the partnership may acquire in the future, including any assets held through joint ventures, partnerships and consortium arrangements;

“Brookfield Personnel” means the partners, members, shareholders, directors, officers and employees of Brookfield;

“Brookfield’s compensation committee” has the meaning ascribed thereto under “Executive Compensation — Compensation Elements Paid by Brookfield”;

“Brookfield Trading Policy” has the meaning ascribed thereto under “Governance — Corporate Governance Disclosure — Personal Trading Policy”;

- 3 -

Table of Contents

“Business” means the initial infrastructure business to be acquired by our company immediately prior to the special distribution;

“BUUK” means BUUK Infrastructure No 1 Limited;

“Canada HoldCo” means Brookfield Infrastructure Holdings (Canada) Inc.;

“Canada SubCo” has the meaning ascribed thereto on the cover page of this prospectus;

“CDS” means CDS Clearing and Depository Services Inc.;

“chair” means the chairperson of the board;

“class A shares” means the class A subordinate voting shares in the capital of our company, as further described under “Description of Our Share Capital — Class A Shares”, and “class A share” means any one of them;

“class B shares”means the class B multiple voting shares in the capital of our company, as further described under “Description of Our Share Capital — Class B Shares”, and “class B share” means any one of them;

“class C shares”means the class Cnon-voting shares in the capital of our company, as further described under “Description of Our Share Capital — Class C Shares”, and “class C share” means any one of them;

“code” means the Code of Business Conduct and Ethics;

“collateral account” means thenon-interest bearing trust account established by Brookfield or its affiliates to be administered by the rights agent;

“committees” means the audit committee and the nominating and governance committee;

“company” has the meaning ascribed thereto on the cover page of this prospectus;

“company notice” has the meaning ascribed thereto under “Relationship with Brookfield — Rights Agreement — Satisfaction of Secondary Exchange Rights”;

“conflicts management policy” has the meaning ascribed thereto under “Relationship with Brookfield — Conflicts of Interest and Fiduciary Duties”;

“CRA” means the Canada Revenue Agency;

“customary rates” means the same or substantially similar services provided by Brookfield to one or more third parties;

“distribution date” has the meaning ascribed thereto on the cover page of this prospectus;

“DSU allotment price” has the meaning ascribed thereto under “Executive Compensation — Cash Bonus and Long-Term Incentive Plans”;

“DSUP” means the Deferred Share Unit Plan;

“DSUs” has the meaning ascribed thereto under “Executive Compensation — Cash Bonus and Long-Term Incentive Plans”;

- 4 -

Table of Contents

“DTC” means the Depository Trust Company;

“EDGAR” means the Electronic Data Gathering, Analysis, and Retrieval system atwww.sec.gov;

“Enercare” means Enercare Inc.;

“escrow company” has the meaning ascribed thereto under “Executive Compensation — Cash Bonus and Long-Term Incentive Plans”;

“escrowed shares” has the meaning ascribed thereto under “Executive Compensation — Cash Bonus and Long-Term Incentive Plans”;

“ESG” means environmental, social and governance;

“Exchange LP” means Brookfield Infrastructure Partners Exchange LP;

“FFO” means Funds from Operations;

“forward-looking information” has the meaning ascribed thereto under “Special Note RegardingForward-Looking Information”;

“group” means collectively, our company and Brookfield Infrastructure;

“GTAs” means inflation-adjusted gas transportation agreements;

“Holding LP” means Brookfield Infrastructure L.P.;

“IFRS” means International Financial Reporting Standards as issued by the International Accounting Standards Board;

“Infrastructure Special LP” means Brookfield Infrastructure Special L.P.;

“investing affiliate” has the meaning ascribed thereto under “Relationship with Brookfield — Conflicts of Interest and Fiduciary Duties — Investments by the Investing Affiliate”;

“IRS” means the Internal Revenue Service;

“LIBOR” means the London Inter-bank Offered Rate;

“Licensing Agreement” has the meaning ascribed thereto under “Relationship with Brookfield — Licensing Agreement”;

“Master Services Agreement” means the amended and restated master services agreement dated as of March 13, 2015, among the Service Recipients, Brookfield, the Service Providers and others, as amended;

“MSOP” means the Management Share Option Plan;

“NAREIT” means the National Association of Real Estate Investment Trusts, Inc.;

- 5 -

Table of Contents

“NEOs” means the named executive officers of our company;

“nominating and governance committee” means the nominating and governance committee of the board, as further described under “Governance — Corporate Governance Disclosure — Committees of the Board of Directors — Nominating and Governance Committee”;

“non-resident holder” has the meaning ascribed thereto under “Material Canadian Federal Income Tax Considerations — Taxation of Holders Not Resident in Canada”;

“non-U.S. unitholder” has the meaning ascribed thereto under “Material United States Federal Income Tax Considerations”;

“NTS” means Nova Tranportadora do Sudeste S.A.;

“NTS entities” means collectively, the entities through which our company holds our interest in NTS;

“NYSE” means the New York Stock Exchange;

“OFGEM” means the Office of Gas and Electricity Markets Authority;

“operating performance compensation” means performance-based compensation;

“partnership” means Brookfield Infrastructure Partners L.P.;

“PFIC” has the meaning ascribed thereto under “Material United States Federal Income Tax Considerations”;

“pre-approval policy” means the written policy on auditor independence that our board of directors has adopted;

“preferred shares” has the meaning ascribed thereto under “Description of Our Share Capital”;

“preferred units” means the preferred limited partnership units of the partnership;

“proposed amendments” has the meaning ascribed thereto under “Material Canadian Federal Income Tax Considerations”;

“prospectus” means this prospectus dated as of ;

“PSG” means Brookfield’s Public Securities Group;

“RDSP” means registered disability savings plan;

“record date” has the meaning ascribed thereto on the cover page of this prospectus;

“Registration Rights Agreement” has the meaning ascribed thereto under “Relationship with Brookfield — Registration Rights Agreement”;

“Relationship Agreement” means the amended and restated relationship agreement dated as of March 28, 2014, as amended from time to time, by, among others, Brookfield Asset Management Inc., the partnership and Holding LP;

- 6 -

Table of Contents

“resident holder” has the meaning ascribed thereto under “Material Canadian Federal Income Tax Considerations — Taxation of Holders Resident in Canada”;

“RESP” means registered education savings plan;

“restricted shares” has the meaning ascribed thereto under “Executive Compensation — Compensation Elements Paid by Brookfield”;

“restricted stock plan” has the meaning ascribed thereto under “Executive Compensation — Compensation Elements Paid by Brookfield”;

“rights agent” means Wilmington Trust, National Association;

“Rights Agreement” has the meaning ascribed thereto under “Relationship with Brookfield — Rights Agreement”;

“RRIF” means registered retirement income fund;

“RRSP” means registered retirement savings plan;

“RSU allotment price” has the meaning ascribed thereto under “Executive Compensation — Cash Bonus and Long-Term Incentive Plans”;

“RSUP” means the Restricted Share Unit Plan;

“RSUs” has the meaning ascribed thereto under “Executive Compensation — Cash Bonus and Long-Term Incentive Plans”;

“Sarbanes-Oxley Act” means theSarbanes-Oxley Act of 2002 (United States);

“SEC” means the United States Securities and Exchange Commission;

“SEDAR” means the System for Electronic Document Analysis and Retrieval at www.sedar.com;

“Service Providers” has the meaning ascribed thereto in the Master Services Agreement;

“Service Recipients” has the meaning ascribed thereto in the Master Services Agreement;

“special distribution” has the meaning ascribed thereto on the cover page of this prospectus;

“Tax Act” means theIncomeTax Act (Canada);

“TFSA” meanstax-free savings account;

“Transactions” has the meaning ascribed thereto under “Unaudited Pro Forma Financial Information of Our Company”;

“Treasury Regulations” means the U.S. Treasury Regulations promulgated under the U.S. Internal Revenue Code;

- 7 -

Table of Contents

“TSX” means the Toronto Stock Exchange;

“U.K.” means United Kingdom;

“Unaudited Pro Forma Financial Statements” means our unaudited condensed combined pro forma financial statements;

“units” has the meaning ascribed thereto on the cover page of this prospectus;

“U.S. Internal Revenue Code” means the U.S. Internal Revenue Code of 1986, as amended;

“U.S. Securities Act” means the United StatesSecurities Act of 1933, as amended, and the rules and regulations promulgated from time to time thereunder;

“U.S. unitholder” has the meaning ascribed thereto under “Material United States Federal Income Tax Considerations”; and

“Voting Agreement” has the meaning ascribed thereto under “Relationship with Brookfield Infrastructure — Voting Agreements”.

- 8 -

Table of Contents

QUESTIONS AND ANSWERS REGARDING THE SPECIAL DISTRIBUTION

The following questions and answers address briefly some questions you may have regarding the special distribution. These questions and answers may not address all questions that may be important to you as a holder of units and these questions and answers should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus. See “Glossary” for the definitions of the various defined terms used throughout this prospectus.

Questions | Answers About the Special Distribution | |

Why is the partnership distributing our class A shares to its unitholders? | The partnership believes that certain investors in certain jurisdictions may be dissuaded from investing in the partnership because of the tax reporting framework that results from investing in units of a Bermuda-exempted limited partnership. Creating our company, a corporation, and distributing our class A shares, which have been structured with the intention of providing an economic return equivalent to the units, is intended to achieve the following objectives:

• Provide investors that would not otherwise invest in the partnership with an opportunity to gain access to the partnership’s globally diversified portfolio of high-quality infrastructure assets.

• Provide investors with the flexibility to own, through the ownership of a class A share of our company, the economic equivalent of a unit because of the ability to exchange into a unit or its cash equivalent and the identical distributions that are expected to be paid on each class A share.

• Provide investors with a tax reporting framework that may be favored by investors in some jurisdictions over the tax reporting framework provided by an investment in the partnership, which we believe will attract new investors who will benefit from investing in our business.

• Provide non-corporate U.S. investors in the maximum U.S. federal tax bracket with a higher after-tax yield.

• Create a company that we expect to be eligible for inclusion in several indices, which may be attractive to certain investors.

• Provide our group with a greater securityholder base, thereby creating enhanced liquidity for our group’s securityholders.

• Create a company that will provide our group with the ability to access new capital pools.

The special distribution is being effected in a manner that we expect will not result in any adverse impact on Brookfield Infrastructure’s credit rating or its preferred unitholders or debtholders.

See “The Special Distribution — Background to and Purpose of the Special Distribution” and “Relationship with Brookfield |

- 9 -

Table of Contents

Questions | Answers About the Special Distribution | |

Infrastructure — Credit Support”. For additional information regarding Brookfield Infrastructure, see “Brookfield Infrastructure Partners L.P.”. | ||

How will our company’s performance track to the partnership’s performance? | Each class A shares has been structured with the intention of providing an economic return equivalent to one unit. We therefore expect that the market price of our class A shares will be significantly impacted by the combined business performance of our group as a whole and the market price of the units in a manner that should result in the market price of the class A shares tracking the market price of the units. Following the special distribution, it is expected that dividends on our class A shares will be declared and paid at the same time as distributions are declared and paid on the units and that dividends on each class A share will be declared and paid in the same amount as distributions are declared and paid on each unit to provide holders of our class A shares with an economic return equivalent to holders of units. We expect to commence paying dividends on our class A shares on the first distribution payment date for the units occurring after the distribution date for the special distribution.

Each class A share will be exchangeable at the option of the holder for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our company). The partnership may elect to satisfy our exchange obligation by acquiring such tendered class A shares for an equivalent number of units (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of the partnership). See “Description of Our Share Capital — Exchange by Holder — Adjustments to Reflect Certain Capital Events” for a description of such capital events. Our company and the partnership currently intend to satisfy any exchange requests on the class A shares through the delivery of units rather than cash. However, factors that the partnership and our company may consider when determining whether to satisfy any exchange request for cash rather than units include, without limitation, compliance with applicable securities laws, changes in law (including the Bermuda limited partnership laws), the partnership’s and our company’s respective available consolidated liquidity, and any tax consequences to the partnership or our company or to a holder as a result of delivery of units. | |

Do you intend to pay dividends on the class A shares? | Yes. The board of directors of our company, or our board, may declare dividends at its discretion. However, each class A share has been structured with the intention of providing an economic return equivalent to one unit and it is expected that dividends on the class A shares will be declared and paid at the same time as distributions are declared and paid on units and that dividends on each class A share will be declared and paid in the same amount as distributions are declared and paid on each unit. We expect to commence paying dividends on our class A shares on the first distribution payment | |

- 10 -

Table of Contents

Questions | Answers About the Special Distribution | |

date for the units occurring after the distribution date for the special distribution. The partnership’s distributions are underpinned by stable, highly regulated and contracted cash flows generated from operations. The partnership’s objective is to pay a distribution that is sustainable on a long-term basis and it has set its target payout ratio at60-70% of Brookfield Infrastructure’s FFO.

Immediately following completion of the special distribution, the aggregate distribution received by a holder on its units and class A shares (assuming such holder did not dispose of its units or class A shares) will be the same as it would have received if the special distribution had not been made, with distributions on each unit representing nine-tenths (9/10ths) of such aggregate amount as a result of the one (1) for nine (9) special distribution, and the dividends on each class A share being identical to the distributions on each unit after the special distribution. See also “Dividend Policy”.

For example, assuming a partnership unitholder owns 90 units prior to the special distribution, it would be entitled to receive an aggregate of $45.225 in distributions (based on a quarterly distribution amount per unit of $0.5025) for the distribution period immediately prior to the special distribution. Based on the distribution ratio of one class A share for nine units, the unitholder is expected to receive 10 class A shares and therefore immediately after the special distribution the holder would own 100 securities (90 units and 10 class A shares). The holder will still receive an aggregate distribution of $45.225 (assuming the holder continues to own the 90 units and 10 class A shares), but that $45.225 would be divided among the 90 units it owns and the 10 class A shares it owns immediately after the special distribution. Therefore, while the aggregate distributions to be received by the holder for the distribution period immediately after the special distribution would remain the same (i.e., $45.225), the per unit/per share distribution amount would no longer be $0.5025 but rather $0.45225 per unit and $0.45225 per class A share. Therefore, the distribution amount per unit/class A share will be identical (i.e., $0.45225), but on a per unit/class A share basis it will be reduced from the pre-closing level to take into account that there are more securities outstanding (100 rather than 90, in the above example) that will be entitled to receive distributions. This effect on the quarterly distribution level mirrors what would happen in the event of a stock split.

| ||

What will our relationship with Brookfield be after the special distribution? | Our relationship with Brookfield will be substantially the same as Brookfield Infrastructure’s existing relationship with Brookfield. After the special distribution:

• Brookfield will be our largest investor and will hold approximately 29.6% of our class A shares.

• The Service Providers, being wholly-owned subsidiaries of Brookfield, will provide management and | |

- 11 -

Table of Contents

Questions | Answers About the Special Distribution | |

administrative services to us pursuant to the Master Services Agreement in exchange for a base management fee and incentive distributions. The Master Services Agreement will continue in perpetuity until terminated in accordance with its terms.

• Until the fifth anniversary of the distribution date, if our company or the partnership has not satisfied its obligation under our notice of articles and articles, or our articles, to deliver the unit amount or its cash equivalent amount upon an exchange request, Brookfield will satisfy or cause to be satisfied the obligation to deliver units or cash on an exchange of the class A shares.

For additional information, see “Management and the Master Services Agreement — The Master Services Agreement” and “Relationship with Brookfield”. | ||

What will our company’s relationship with Brookfield Infrastructure be after the special distribution? | Brookfield Infrastructure, together with our company, comprise our group, which will serve as a primary vehicle through which Brookfield will make future infrastructure-related acquisitions. After the special distribution:

• Each class A share has been structured with the intention of providing an economic return equivalent to one unit. We therefore expect that the market price of our class A shares will be significantly impacted by the combined business performance of our group as a whole and the market price of the units in a manner that should result in the market price of the class A shares tracking the market price of the units.

• Following the special distribution, it is expected that dividends on our class A shares will be declared and paid at the same time as distributions are declared and paid on the units and that dividends on each class A share will be declared and paid in the same amount as distributions are declared and paid on each unit to provide holders of our class A shares with an economic return equivalent to holders of units. We expect to commence paying dividends on our class A shares on the first distribution payment date for the units occurring after the distribution date for the special distribution. Immediately following completion of the special distribution, the aggregate distribution received by a holder on its units and class A shares (assuming such holder did not dispose of its units or class A shares) will be the same as it would have received if the special distribution had not been made, with distributions on each unit representing nine-tenths (9/10ths) of such aggregate amount as a result of the one (1) for nine (9) special distribution, and the dividends on each class A share being identical to the distributions on each unit after the special distribution. | |

- 12 -

Table of Contents

Questions | Answers About the Special Distribution | |

• Each class A share will be exchangeable at the option of the holder for one unit (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our company). The partnership may elect to satisfy our exchange obligation by acquiring such tendered class A shares for an equivalent number of units (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of the partnership). | ||

• Brookfield Infrastructure will hold a 75% voting interest and an approximate 20% economic interest in our company through its holding of our class B shares and class C shares, respectively. Brookfield Infrastructure’s ownership of class C shares will entitle it to receive dividends as and when declared by our board, subject to the holders of the class A shares receiving the dividends to which they are entitled.

• Brookfield Infrastructure will provide our company with an equity commitment in the amount of $1 billion. In addition, we expect to enter into two credit agreements with Brookfield Infrastructure, one as borrower and one as lender, each providing for a ten-year revolving credit facility to facilitate the movement of cash within our group. Each credit facility will contemplate potential deposit arrangements pursuant to which the lender thereunder would, with the consent of the borrower, deposit funds on a demand basis to such borrower’s account at a reduced rate of interest.

• We expect that our board will mirror the board of the general partner of the partnership, except that there will be one additional non-overlapping board member to assist us with, among other things, resolving any conflicts of interest that may arise from our relationship with Brookfield Infrastructure.

This prospectus, which forms a part of a registration statement on Form F-1, constitutes a prospectus of the partnership with respect to the delivery of units to holders of class A shares upon exchange, redemption or purchase of the class A shares as contemplated by our articles and the Rights Agreement (including in connection with any liquidation, dissolution or winding up of our company); however, the partnership has filed a registration statement on Form F-3 in order to register the delivery of units in connection with any such redemption, exchange or purchase from and after the effective date of the special distribution.

For additional information, see “Description of Our Share Capital — Class A Shares”, “Description of Our Share Capital — Exchange |

- 13 -

Table of Contents

Questions | Answers About the Special Distribution | |

by Holder — Adjustments to Reflect Certain Capital Events,” and “Relationship with Brookfield Infrastructure”. | ||

Will there be any significant shareholders of our company after the special distribution? | Yes. Brookfield Infrastructure will hold all of our class B shares and class C shares, thereby giving Brookfield Infrastructure a 75% voting interest and an approximate 20% economic interest in our company. In addition, Brookfield will, directly and indirectly, hold approximately 29.6% of our class A shares immediately upon completion of the special distribution as a result of class A shares distributed to Brookfield on the redeemable partnership units that it holds in Holding LP, the units that it holds in the partnership and the special general partner interest that it holds in Infrastructure Special LP. See “The Special Distribution — Background to and Purpose of the Special Distribution”. | |

How will the special distribution work? | The partnership and Holding LP intend to make a special distribution to holders of its equity units of all of the class A shares. As a result of the special distribution, holders of units will be entitled to receive one (1) class A share for every nine (9) units held as of the record date, provided that the special distribution will be subject to any applicable withholding tax and no holder will be entitled to receive any fractional interests in the class A shares. Holders who would otherwise be entitled to a fractional class A share will receive a cash payment. For additional information, see “The Special Distribution — Mechanics of the Special Distribution”.

The distribution ratio is intended to cause a proportionate split of the market capitalization of the partnership between the units and the class A shares based on the value of the businesses to be transferred to our company relative to the partnership’s market capitalization. The final distribution ratio has been determined using the fair market value of the businesses to be transferred by the partnership to our company, the number of the units outstanding (assuming exchange of the redeemable partnership units of Holding LP), and the market capitalization of the partnership. The fair market value of the businesses to be transferred by the partnership has been determined by the management of the partnership using commonly accepted valuation methodologies and the value of the class A shares and the partnership’s market capitalization has been determined using the market price for the units, each as of the most recent practicable date.

Holders of the partnership’s preferred limited partnership units, or the preferred units, will not participate in this special distribution.

On October 16, 2018, Brookfield Infrastructure, alongside institutional partners, acquired an effective 30% interest in Enercare, a North American residential energy infrastructure business. As part of the transaction, certain qualified Canadian Enercare shareholders elected to receive, in lieu of cash consideration, exchangeable units of Brookfield Infrastructure | |

- 14 -

Table of Contents

Questions | Answers About the Special Distribution | |

Partners Exchange LP, or Exchange LP, a subsidiary of the partnership, for each share of Enercare. The exchangeable units of Exchange LP provide holders with economic terms that are substantially equivalent to those of units and are exchangeable, on a one-for-one basis, for units. Holders of exchangeable units of Exchange LP will, without taking any action, receive one (1) additional exchangeable unit of Exchange LP for every nine (9) exchangeable units held as of the record date in connection with a unit split by way of a subdivision that Exchange LP will complete concurrently with the special distribution pursuant to the governing documents of Exchange LP. In order to participate in the special distribution instead of receiving an additional exchangeable unit, holders of exchangeable units are required to exchange their exchangeable units for units prior to the record date. Because such an exchange may have tax consequences, we urge such holders of exchangeable units to consult with their own tax, legal or financial advisors. | ||

If I am a holder of units, what do I have to do to participate in the distribution? | Nothing. You are not required to pay for the class A shares that you will receive upon the special distribution or tender or surrender your units or take any other action in connection with the special distribution. No vote of the partnership’s unitholders will be required for the special distribution. If you own units as of the close of business on the record date, a book-entry account statement reflecting your ownership of the class A shares will be mailed to you, or your brokerage account will be credited for the class A shares, on or about , 2020. | |

Are there risks associated with owning the class A shares or units? | Yes, our Business and the ownership of class A shares are subject to both general and specific risks and uncertainties. Owning units of the partnership also is subject to risks. For a discussion of factors you should consider, please see “Risk Factors”. | |

How will owning a class A share be different from owning a unit? | Each class A share will be structured with the intention of providing an economic return equivalent to one unit (subject to adjustment to reflect certain capital events), including identical dividends on a per share basis as are paid on each unit. See “Description of Our Share Capital — Exchange by Holder — Adjustments to Reflect Certain Capital Events.” Our company and the partnership currently intend to satisfy any exchange requests on the class A shares through the delivery of units rather than cash. However, there are certain material differences between the rights of holders of class A shares and holders of the units under the governing documents of our company and the partnership and applicable law, such as the right of holders of class A shares to request an exchange of their class A shares for an equivalent number of units or its cash equivalent (the form of payment to be determined at the election of our group) and the redemption right of our company. These material differences are described in the section entitled “Comparison of Rights of Holders of Our Class A Shares and the Partnership’s Units”. | |

- 15 -

Table of Contents

Questions | Answers About the Special Distribution | |

When will the special distribution be completed? | The partnership expects to complete the special distribution on or about , 2020. | |

What is the record date for the distribution? | On or about , 2020. | |

How many class A shares will I receive? | You will be entitled to receiveone (1) class A share for every nine (9) units you hold as of the record date of the special distribution. Based on the number of units expected to be outstanding on the record date for the special distribution, the partnership expects to distribute approximately 32.6 million class A shares. An additional approximate 13.7 millionclass A shares will be distributed to Brookfield as holder of redeemable partnership units of Holding LP and the special general partner interest that it holds in Infrastructure Special LP. No holder will be entitled to receive any fractional interests in the class A shares. Holders who would otherwise be entitled to a fractional class A share will receive a cash payment. For additional information on the distribution, see “The Special Distribution — Mechanics of the Special Distribution”.

Holders of the preferred units of the partnership will not receive any class A shares pursuant to the special distribution. | |

Can units be exchanged for class A shares of our company? | No, units are not exchangeable. A unitholder who would like to acquire additional class A shares of our company would be required to acquire them in the market. However, our company or one of its affiliates may in the future consider, subject to market and other conditions, making an offer to unitholders to permit them to exchange their units for class A shares. | |

Is the special distribution taxable for Canadian federal income tax purposes? | In general, subject to the conditions and limitations set forth below under the heading “Material Canadian Federal Income Tax Considerations”, the special distribution will reduce the adjusted cost base of a resident holder’s interest in the partnership and the special distribution should not be taxable to anon-resident holder for Canadian federal income tax purposes.

Unitholders who receive class A shares pursuant to the special distribution should consult their own tax advisors having regard to their particular circumstances. | |

Is the special distribution taxable for United States federal income tax purposes? | In general, subject to the conditions and limitations set forth below under the heading “Material United States Federal Income Tax Considerations”, the general partner of the partnership intends to take the position and believes that each of the partnership and Holding LP qualifies as an “investment partnership” within the meaning of the U.S. Internal Revenue Code. If the partnership and Holding LP so qualify, then the special distribution of class A shares to a U.S. unitholder that is an “eligible partner” (as defined below) will qualify as anon-taxable distribution of property. However, the treatment of the partnership and Holding LP as | |

- 16 -

Table of Contents

Questions | Answers About the Special Distribution | |

investment partnerships is not free from doubt, as it depends on the highly factual determination that, for such U.S. federal income tax purposes, neither the partnership nor Holding LP has ever been engaged in a trade or business since the date of formation. Accordingly, no assurance can be given that the IRS will not assert, or that a court would not sustain, a position contrary to any of the positions described herein. U.S. unitholders should consult their own tax advisors regarding the U.S. federal income tax consequences of the special distribution in light of their particular circumstances. | ||

Where will I be able to trade the class A shares? | There is no public trading market for our class A shares. However, we have applied to have our class A shares listed on the NYSE and the TSX under the symbol “BIPC”. Listing is subject to the approval of the NYSE and the TSX in accordance with their respective original listing requirements. The NYSE and the TSX have not conditionally approved our listing application and there is no assurance that the NYSE or the TSX will approve the listing application.

We anticipate that trading in our class A shares will begin on a “when-issued” basis as early as trading days prior to the record date and will continue up to and including the distribution date. “When-issued” trading in the context of a special distribution refers to a sale or purchase made conditionally on or before the distribution date because the securities of the entity have not yet been distributed. | |

How do I exchange the class A shares I will receive into units? | As a class A shareholder, you will be entitled to exchange your class A shares for an equivalent number of units (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of our company) at any time. The partnership may elect to satisfy our exchange obligation by acquiring such tendered class A shares for an equivalent number of units (subject to adjustment to reflect certain capital events) or its cash equivalent (the form of payment to be determined at the election of the partnership). Our company and the partnership currently intend to satisfy any exchange requests through the delivery of units rather than cash. For additional information, see “Description of Our Share Capital — Class A Shares” and “— Exchange by Holder — Adjustments to Reflect Certain Capital Events.” However, factors that the partnership and our company may consider when determining whether to satisfy any exchange request for cash rather than units include, without limitation, compliance with applicable securities laws, changes in law (including the Bermuda limited partnership laws), the partnership’s and our company’s respective available consolidated liquidity, and any tax consequences to the partnership or our company or to a holder as a result of delivery of units.

If you hold your units and class A shares through a broker, please contact your broker to request an exchange. If you are a registered | |

- 17 -

Table of Contents

Questions | Answers About the Special Distribution | |

holder and hold your units and class A shares in certificated form or in an account directly with the transfer agent, Computershare Inc., please contact the transfer agent to request an exchange.

An exchange of class A shares for an equivalent number of units or its cash equivalent may have tax consequences. See “Material Canadian Federal Income Tax Considerations” and “Material United States Federal Income Tax Considerations”. | ||

Will the number of units I own or the distributions I receive change as a result of the special distribution? | No. The number of units that you own will not change as a result of the special distribution. Immediately following completion of the special distribution, the aggregate distribution received by a holder on its units and class A shares (assuming such holder did not dispose of its units or class A shares) will be the same as it would have received if the special distribution had not been made, with distributions on each unit representing nine-tenths (9/10ths) of such aggregate amount as a result of the one (1) for nine (9) special distribution, and the dividends on each class A share being identical to the distributions on each unit after the special distribution. | |

What will happen to the listing of the partnership’s units? | Nothing. The units will continue to trade on the TSX under the symbol “BIP.UN” and on the NYSE under the symbol “BIP”. | |

Whom do I contact for information regarding our company and the special distribution? | Before the special distribution, you should direct inquiries relating to the special distribution to:

Brookfield Infrastructure Partners L.P. 73 Front Street, 5th Floor Hamilton HM12, Bermuda Attention: Company Secretary

After the special distribution, you should direct inquiries relating to the class A shares to:

Brookfield Infrastructure Corporation 250 Vesey Street, 15th Floor New York NY 10281 Attention: Investor Relations Phone: (416)956-5129 Email: bip.enquiries@brookfield.com

After the special distribution, the transfer agent and registrar for the class A shares will be:

Computershare Inc. 150 Royall Street Canton, MA 02021 | |

- 18 -

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus and in the documents incorporated herein by reference and does not contain all of the information you should know about our group, the class A shares and the units. You should read this entire prospectus carefully, especially the “Risk Factors” section and the more detailed information and financial data and statements contained elsewhere in this prospectus and incorporated herein by reference. Some of the statements in this prospectus constituteforward-looking statements that involve risks and uncertainties. See “Special Note RegardingForward-Looking Information” for more information. Unless otherwise indicated or the context otherwise requires, the disclosure in this prospectus assumes that the special distribution has been completed and we have acquired our operating subsidiaries from Brookfield Infrastructure, although we will not acquire such subsidiaries until prior to the special distribution. See “Glossary” for the definitions of the various defined terms used throughout this prospectus.

Our Business

Our company was established by Brookfield Infrastructure as a vehicle to own and operate certain infrastructure assets on a global basis. Prior to the special distribution, we will acquire our operating subsidiaries from Brookfield Infrastructure. Following completion of the special distribution, through these operating subsidiaries, we will own and operate high-quality, long-life assets that generate stable cash flows, require relatively minimal maintenance capital expenditures and, by virtue of barriers to entry or other characteristics, tend to appreciate in value over time. Specifically, our initial operations will consist principally of the ownership and operation of regulated gas transmission systems in Brazil and of regulated distribution operations in the United Kingdom, but upon Brookfield’s recommendation and allocation of opportunities to our company, we intend to seek acquisition opportunities in other sectors with similar attributes and in which we can deploy our operations-oriented approach to create value. See “Our Business — Current Operations” for further details.

Current Operations

United Kingdom

Our company, through BUUK Infrastructure No 1 Limited, or BUUK, is the leader among independent providers of last-mile utility networks, constructing and operating essential utility assets in the United Kingdom. Our businesses design, construct and operate utility infrastructure networks throughout England, Wales and Scotland. We have over 35,000 discrete networks serving over 1 million homes. We support thenew-build residential and commercial markets by providing both traditional and next generation utility solutions. Our customers include a majority of the largest U.K. home builders and construction firms as well as hundreds of smaller regional builders in a fully competitive market process.

Our business is currently a market leader in terms of new gas and electricity connection sales on thenew-build housing market and in terms of total installed connections among independent utilities. We compete with other connection providers to secure contracts to construct, own and operate connections to the home for six product lines which include: natural gas, electricity, fiber, water, wastewater and district heating.

Brazil

Our company’s regulated gas transmission operation in Brazil was acquired by Brookfield Infrastructure in April 2017 through its acquisition, alongside institutional investors and a Brookfield-sponsored infrastructure fund, of a 90% interest in Nova Tranportadora do Sudeste S.A., or NTS. Following completion of the special distribution, we will hold a 28% economic interest in NTS. NTS owns the backbone natural gas

- 19 -

Table of Contents

transmission system that serves the core economic regions in the highly populated states of São Paulo, Rio de Janeiro and Minas Gerais in South Central Brazil. These long-life assets earn revenues that are indexed to inflation and have no volume risk.

NTS is a critical, strategic infrastructure asset with a robust and long-term cash generation profile with over 2,000 km of natural gas transportation pipelines in the states of Rio de Janeiro, Sao Paulo and Minas Gerais. These pipelines operate under regulatory authorizations, overseen by the Brazilian gas regulator Agência Nacional do Petróleo, or ANP. The authorizations have an average remaining life of 21 years and expire between 2039 and 2041.

Growth Strategy

Our group’s vision is to be a leading owner and operator of high-quality infrastructure assets. We will seek to grow by deploying our group’s operations-oriented approach to enhance value and by leveraging our group’s relationship with Brookfield to pursue acquisitions. To execute our group’s strategy, we seek to:

| • | incorporate our group’s technical insight into the evaluation and execution of acquisitions; |

| • | maintain a disciplined approach to acquisitions; |

| • | actively manage our group’s assets to improve operating performance; and |

| • | employ ahands-on approach to key value drivers such as capital investments, development projects,follow-on acquisitions and financings. |

We believe that our group’s relationship with Brookfield will provide us with competitive advantages in comparison with a stand-alone infrastructure company in the following respects:

| • | ability to leverage Brookfield’s transaction structuring expertise; |

| • | ability to pursue acquisitions of businesses that own infrastructure assets together with other assets that have a riskier cash flow profile; |

| • | ability to acquire assets developed by Brookfield through its operating platforms; and |

| • | ability to participate alongside Brookfield and in or alongside Brookfield-sponsored orco-sponsored consortiums, partnerships and companies. |

Management

Similar to Brookfield Infrastructure, the Service Providers, being wholly-owned subsidiaries of Brookfield, will provide management services to us pursuant to the Master Services Agreement of Brookfield Infrastructure. Many of the members of the senior management team that is principally responsible for providing services to Brookfield Infrastructure have been doing so since the formation of Brookfield Infrastructure in 2008, including Sam Pollock, who will serve as our Chief Executive Officer, and Bahir Manios, who will serve as our Chief Financial Officer. See “Management and the Master Services Agreement” for further details.

Stock Exchange Listing

We have applied to have our class A shares listed on the NYSE and the TSX under the symbol “BIPC”. Listing is subject to the approval of the NYSE and the TSX in accordance with their respective original listing requirements. The NYSE and the TSX have not conditionally approved our listing application and there is no assurance that the NYSE or the TSX will approve the listing application.

- 20 -

Table of Contents

The Special Distribution

The partnership believes that certain investors in certain jurisdictions may be dissuaded from investing in the partnership because of the tax reporting framework that results from investing in units of a Bermuda-exempted limited partnership. Creating our company, a corporation, and distributing our class A shares, with each share structured with the intention of providing an economic return equivalent to one unit, is intended to achieve the following objectives:

| • | Provide investors that would not otherwise invest in the partnership with an opportunity to gain access to the partnership’s globally diversified portfolio of high-quality infrastructure assets. |

| • | Provide investors with the flexibility to own, through the ownership of a class A share of our company, the economic equivalent of a unit because of the ability to exchange into a unit or its cash equivalent and the identical distributions that are expected to be paid on each class A share. |

| • | Provide investors with a tax reporting framework that may be favored by investors in some jurisdictions over the tax reporting framework provided by an investment in the partnership, which we believe will attract new investors who will benefit from investing in our business. |

| • | Provide non-corporate U.S. investors in the maximum U.S. federal tax bracket with a higher after-tax yield. |

| • | Create a company that we expect to be eligible for inclusion in several indices, which may be attractive to certain investors. |

| • | Provide our group with a greater securityholder base, thereby creating enhanced liquidity for our group’s securityholders. |

| • | Create a company that will provide our group with the ability to access new capital pools. |

The special distribution is being effected in a manner that we expect will not result in any adverse impact on Brookfield Infrastructure’s credit rating or its preferred unitholders or debtholders. See “The Special Distribution — Background to and Purpose of the Special Distribution” and “Relationship with Brookfield Infrastructure — Credit Support” for further details. For additional information regarding Brookfield Infrastructure, see “Brookfield Infrastructure Partners L.P.”.

- 21 -

Table of Contents

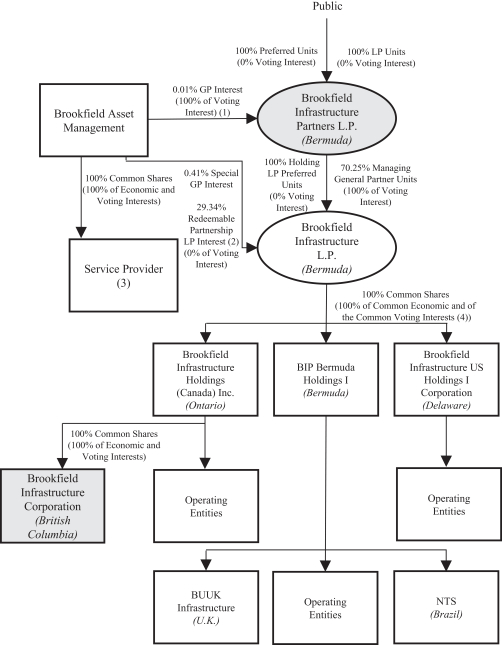

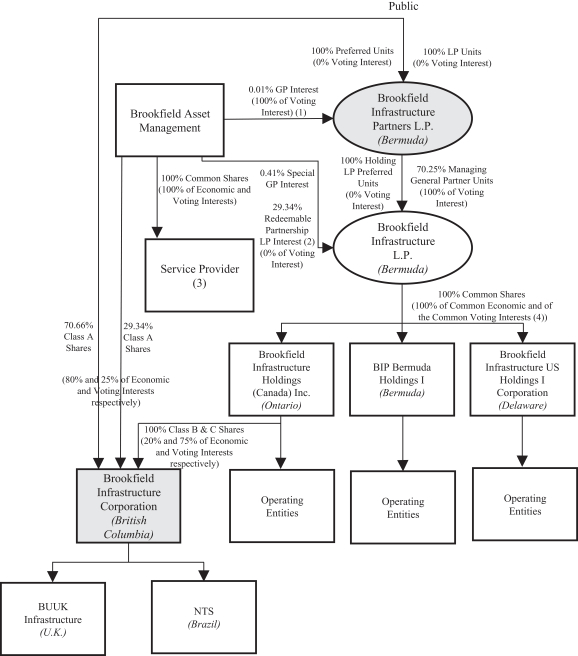

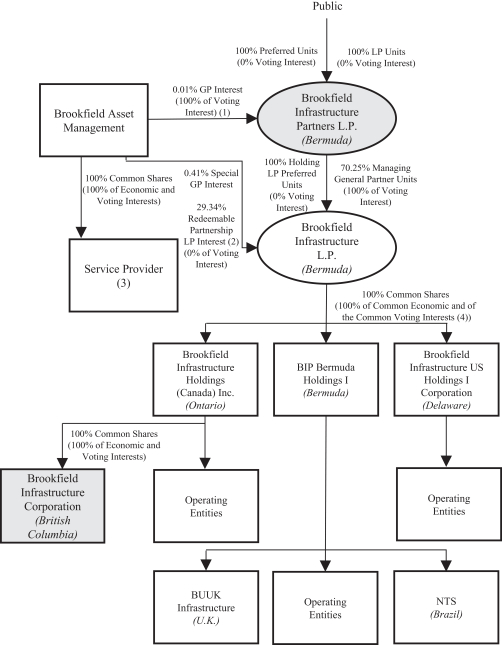

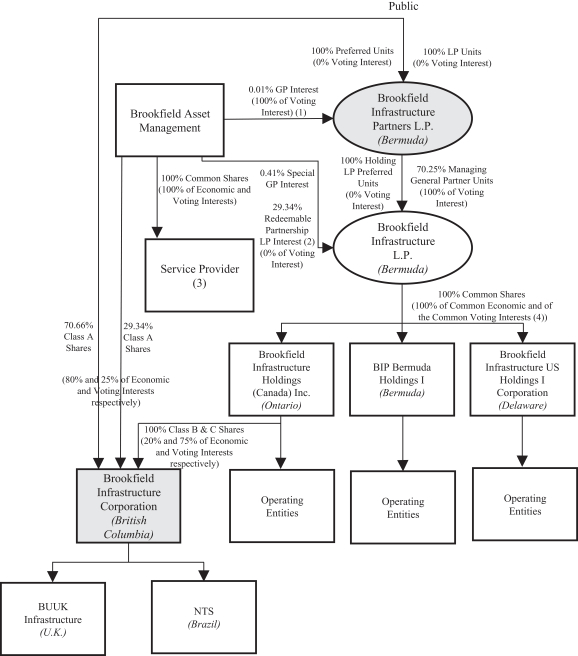

Ownership and Organizational Structure

Prior to the completion of the special distribution, our company was an indirect subsidiary of the partnership. The following diagram provides an illustration of the simplified corporate structure of our group immediately prior to completion of the special distribution.

| (1) | Brookfield’s general partner interest is held through Brookfield Infrastructure Partners Limited, a Bermuda company that is indirectly wholly-owned by Brookfield. |

- 22 -

Table of Contents