Offer to Acquire Inter Pipeline Ltd. Brookfield Infrastructure June 4, 2021 Filed by: Brookfield Infrastructure Corporation (Commission File No. 001-39250) and Brookfield Infrastructure Partners L.P. (Commission File No. 001-33632) Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Inter Pipeline Ltd.

Disclaimer This presentation is for informational purposes only and does not constitute an offer to buy or sell, or a solicitation of an offer to sell or buy, any securities. Any reference to Brookfield Infrastructure Partners L.P. and its institutional partners’ (“Brookfield Infrastructure”) offer to acquire common shares of Inter Pipeline Ltd. (“IPL”) is for information only and is qualified in its entirety by the full terms and conditions of such offer as set forth in the Offer to Purchase and Circular dated February 22, 2021 and the Notice of Variation dated June 4, 2021. This presentation is not intended to form the basis of any investment activity or decision nor should this presentation be considered as a recommendation by Brookfield Infrastructure (nor any person who controls it nor any director, officer, employee nor agent of its or affiliate of any such person), that any recipient should acquire any securities of Brookfield Infrastructure Corporation or other form of interest in Brookfield Infrastructure or any related entity or in any assets of any of the foregoing. This presentation does not constitute or form, nor should it be construed as constituting or forming, any part of any offer, solicitation of any offer or invitation to sell or issue or purchase or subscribe for any securities nor shall it or any part of it, or the fact of its distribution, form the basis of, or be relied on in connection with, any contract or commitment whatsoever with Brookfield Infrastructure. This presentation does not constitute or form, nor should it be construed as an offering circular or memorandum for the purposes of applicable securities law. This presentation is not an offering or solicitation for the sale of securities. This presentation should not be relied upon in making any investment decisions. Under no circumstances shall this presentation constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Forward-Looking Statements and Information This presentation contains certain forward-looking statements within the meaning of applicable Canadian securities laws (“forward-looking statements” or “forward-looking information”) that involve various risks and uncertainties and should be read in conjunction with Brookfield Infrastructure Corporation’s 2020 audited consolidated financial statements and Brookfield Infrastructure Partners L.P.’s 2019 audited consolidated financial statements. Statements other than statements of historical fact contained in this presentation may be forward-looking statements, including, without limitation, management’s expectations, intentions and beliefs concerning anticipated future events, results, circumstances, economic performance or expectations with respect to BIP, including BIP’s business operations, business strategy and financial condition. When used herein, the words “anticipates”, “believes”, “budgets”, “could”, “estimates”, “expects”, “forecasts”, “goal”, “intends”, “may”, “might”, “outlook”, “plans”, “projects”, “schedule”, “should”, “strive”, “target”, “will”, “would” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. The forward-looking statements in this presentation include statements relating to Brookfield Infrastructure’s willingness to further engage with management of IPL; Brookfield Infrastructure’s intentions with respect to the business of IPL; expectations regarding Brookfield Infrastructure’s business; expectations regarding IPL’s dividend; expectations regarding the cost of capital for IPL; expectations regarding IPL’s future if the Alternative Transaction is chosen; expectations regarding IPL’s workforce; and risks and expectations regarding completion and operation of HPC. These forward-looking statements may reflect the internal projections, expectations, future growth, results of operations, performance, business prospects and opportunities and are based on information currently available to Brookfield Infrastructure and/or assumptions that Brookfield Infrastructure believes are reasonable. Many factors could cause actual results to differ materially from the results and developments discussed in the forward- looking information. In developing these forward-looking statements, certain material assumptions were made. These forward-looking statements are subject to certain risks. These risks include, but are not limited to: actual future market conditions being different than anticipated by management; competition and changes in the industry in which IPL and Brookfield Infrastructure operate; changes in the regulatory regime that applies to IPL’s and Brookfield Infrastructure’s business; and the failure to realize on anticipated growth. Material factors or assumptions that were applied to drawing a conclusion or making an estimate set out in forward-looking statements include: IPL’s public disclosure is accurate and that IPL has not failed to publicly disclose any material information respecting IPL, its business, operations, assets, material agreements, or otherwise; there will be no material changes to government and environmental regulations adversely affecting the Brookfield Infrastructure’s or IPL’s operations; management’s views regarding current and anticipated market conditions; industry trends and the regulatory regime remaining unchanged; and assumptions regarding interest rates, foreign exchange rates and commodity prices. Readers are cautioned that the preceding list of material factors or assumptions is not exhaustive. Although forward-looking statements contained in this presentation are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. Accordingly, readers should not place undue reliance on such forward-looking statements and assumptions as management cannot provide assurance that actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Brookfield Infrastructure. All forward-looking information in this presentation is made as of the date of this presentation. These forward-looking statements are subject to change as a result of new information, future events or other circumstances, in which case they will only be updated by Brookfield Infrastructure where required by law.

Notice to Shareholders in the United States In connection with the Offer, BIP and BIPC have filed with the U.S. Securities and Exchange Commission (the “SEC”) a Registration Statement on Form F-4 and Amendment No. 1 thereto, which contains a prospectus relating to the Offer. SHAREHOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ SUCH REGISTRATION STATEMENT AND ANY AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE OFFER, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO ANY SUCH DOCUMENTS, AS EACH BECOMES AVAILABLE, BECAUSE EACH CONTAINS AND WILL CONTAIN IMPORTANT INFORMATION ABOUT BISON ACQUISITION CORP., BIPC, BIP, IPL AND THE OFFER. Materials filed with the SEC will be available electronically without charge at the SEC’s website at www.sec.gov and the materials will be posted on BIP’s website at www.brookfield.com/infrastructure. BIPC is a foreign private issuer and BIP is permitted to prepare the offering documents in accordance with Canadian disclosure requirements, which are different from those of the United States. The financial statements included in the offering documents have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and thus may not be comparable to financial statements of U.S. companies. Shareholders in the United States should be aware that the disposition of their shares and the acquisition of BIPC shares by them as described herein may have tax consequences both in the United States and in Canada. Shareholders should be aware that owning BIPC shares may subject them to tax consequences both in the United States and in Canada. Such consequences for shareholders who are resident in, or citizens of, the United States may not be described fully herein and such shareholders are encouraged to consult their tax advisors. See Section 18 of the Offer to Purchase and Circular dated February 22, 2021, “Certain Canadian Federal Income Tax Considerations” and Section 19 of such Offer to Purchase and Circular, “Certain United States Federal Income Tax Considerations”. The enforcement by shareholders of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that each of Bison Acquisition Corp., BIP, BIPC and IPL is formed under the laws of a non-U.S. jurisdiction, that some or all of their respective officers and directors may reside outside of the United States, that some or all of the experts named herein may reside outside of the United States and that all or a substantial portion of the assets of Bison Acquisition Corp., BIP, BIPC, IPL and such persons may be located outside the United States. Shareholders in the United States may not be able to sue Bison Acquisition Corp., BIP, BIPC or IPL or their respective officers or directors in a non-U.S. court for violation of United States federal securities laws. It may be difficult to compel such parties to subject themselves to the jurisdiction of a court in the United States or to enforce a judgment obtained from a court of the United States. THE SHARE CONSIDERATION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY U.S. STATE SECURITIES COMMISSION NOR HAS THE SEC OR ANY U.S. STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF ANY OFFERING DOCUMENTS, INCLUDING THE OFFER TO PURCHASE AND CIRCULAR OR THE NOTICE OF VARIATION DATED JUNE [•], 2021. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. In accordance with applicable law, rules and regulations of the United States, Canada or its provinces or territories, including Rule 14e-5 under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), Bison Acquisition Corp. or its affiliates and any advisor, broker or other person acting as the agent for, or on behalf of, or in concert with Bison Acquisition Corp. or its affiliates, directly or indirectly, may bid for, make purchases of or make arrangements to purchase common shares or certain related securities outside the Offer, including purchases in the open market at prevailing prices or in private transactions at negotiated prices. Such bids, purchases or arrangements to purchase may be made during the period of the Offer and through the expiration of the Offer. Any such purchases will be made in compliance with applicable laws, rules and regulations. To the extent information about such purchases or arrangements to purchase is made public in Canada, such information will be disclosed by means of a press release or other means reasonably calculated to inform shareholders in the United States of such information. The Offer is being made for the securities of a Canadian company that does not have securities registered under Section 12 of the U.S. Exchange Act. Accordingly, the Offer is not subject to Section 14(d) of the U.S. Exchange Act, or Regulation 14D promulgated by the SEC thereunder, except for any requirements thereunder applicable to exchange offers commenced before the effectiveness of the related registration statement. The Offer is being conducted in accordance with Section 14(e) of the U.S. Exchange Act and Regulation 14E promulgated thereunder.

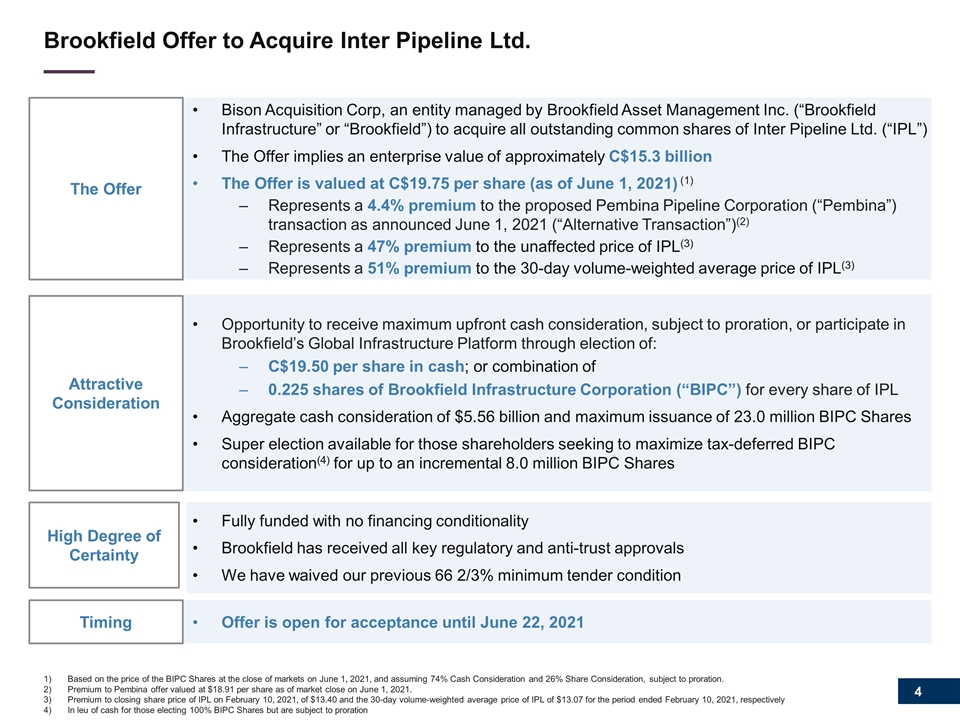

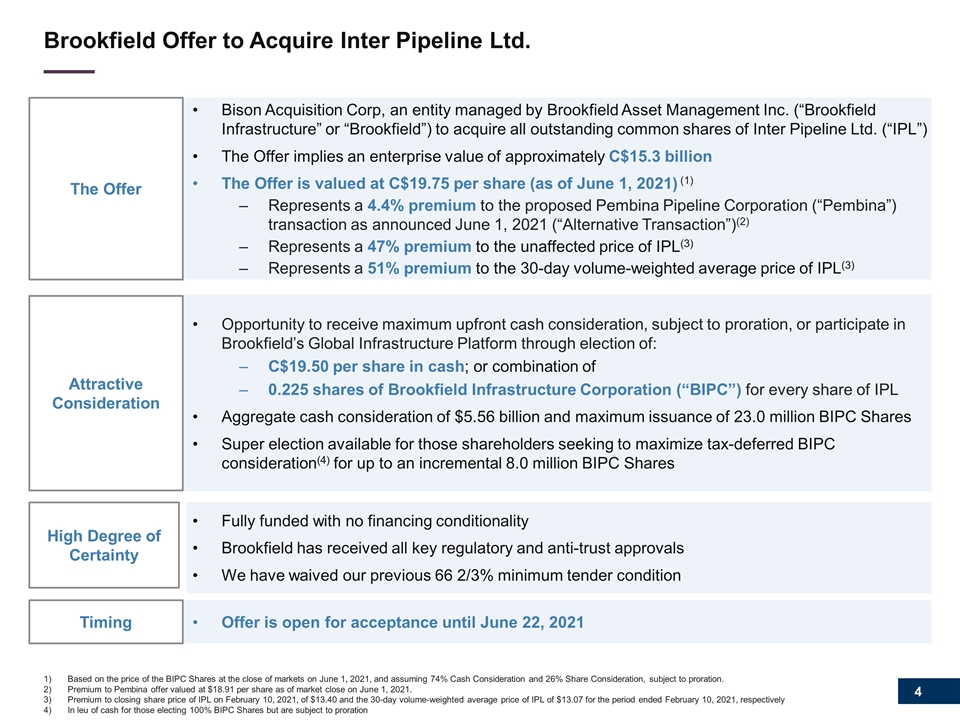

Fully funded with no financing conditionality Brookfield has received all key regulatory and anti-trust approvals We have waived our previous 66 2/3% minimum tender condition High Degree of Certainty Brookfield Offer to Acquire Inter Pipeline Ltd. Bison Acquisition Corp, an entity managed by Brookfield Asset Management Inc. (“Brookfield Infrastructure” or “Brookfield”) to acquire all outstanding common shares of Inter Pipeline Ltd. (“IPL”) The Offer implies an enterprise value of approximately C$15.3 billion The Offer is valued at C$19.75 per share (as of June 1, 2021) (1) Represents a 4.4% premium to the proposed Pembina Pipeline Corporation (“Pembina”) transaction as announced June 1, 2021 (“Alternative Transaction”)(2) Represents a 47% premium to the unaffected price of IPL(3) Represents a 51% premium to the 30-day volume-weighted average price of IPL(3) The Offer Opportunity to receive maximum upfront cash consideration, subject to proration, or participate in Brookfield’s Global Infrastructure Platform through election of: C$19.50 per share in cash; or combination of 0.225 shares of Brookfield Infrastructure Corporation (“BIPC”) for every share of IPL Aggregate cash consideration of $5.56 billion and maximum issuance of 23.0 million BIPC Shares Super election available for those shareholders seeking to maximize tax-deferred BIPC consideration(4) for up to an incremental 8.0 million BIPC Shares Attractive Consideration Offer is open for acceptance until June 22, 2021 Timing Based on the price of the BIPC Shares at the close of markets on June 1, 2021, and assuming 74% Cash Consideration and 26% Share Consideration, subject to proration. Premium to Pembina offer valued at $18.91 per share as of market close on June 1, 2021. Premium to closing share price of IPL on February 10, 2021, of $13.40 and the 30-day volume-weighted average price of IPL of $13.07 for the period ended February 10, 2021, respectively In leu of cash for those electing 100% BIPC Shares but are subject to proration

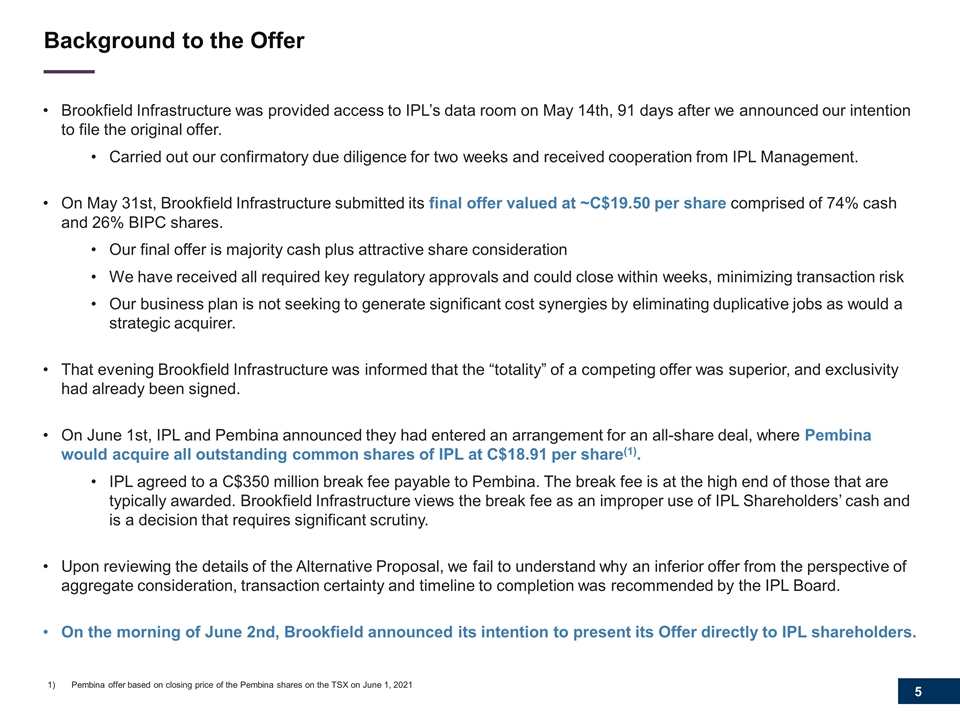

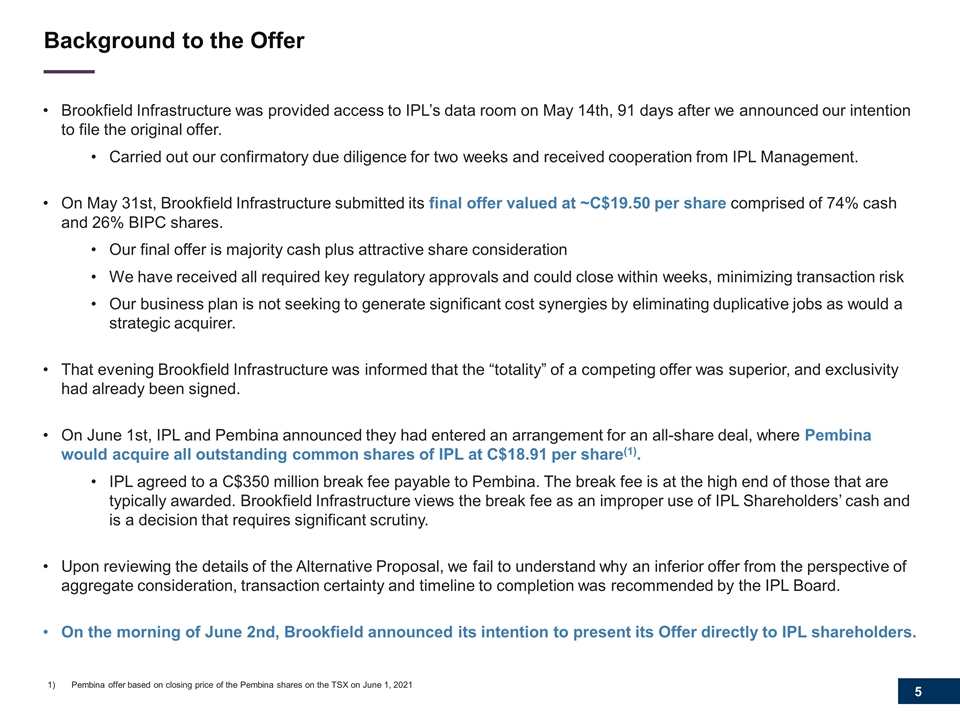

Background to the Offer Brookfield Infrastructure was provided access to IPL’s data room on May 14th, 91 days after we announced our intention to file the original offer. Carried out our confirmatory due diligence for two weeks and received cooperation from IPL Management. On May 31st, Brookfield Infrastructure submitted its final offer valued at ~C$19.50 per share comprised of 74% cash and 26% BIPC shares. Our final offer is majority cash plus attractive share consideration We have received all required key regulatory approvals and could close within weeks, minimizing transaction risk Our business plan is not seeking to generate significant cost synergies by eliminating duplicative jobs as would a strategic acquirer. That evening Brookfield Infrastructure was informed that the “totality” of a competing offer was superior, and exclusivity had already been signed. On June 1st, IPL and Pembina announced they had entered an arrangement for an all-share deal, where Pembina would acquire all outstanding common shares of IPL at C$18.91 per share(1). IPL agreed to a C$350 million break fee payable to Pembina. The break fee is at the high end of those that are typically awarded. Brookfield Infrastructure views the break fee as an improper use of IPL Shareholders’ cash and is a decision that requires significant scrutiny. Upon reviewing the details of the Alternative Proposal, we fail to understand why an inferior offer from the perspective of aggregate consideration, transaction certainty and timeline to completion was recommended by the IPL Board. On the morning of June 2nd, Brookfield announced its intention to present its Offer directly to IPL shareholders. Pembina offer based on closing price of the Pembina shares on the TSX on June 1, 2021

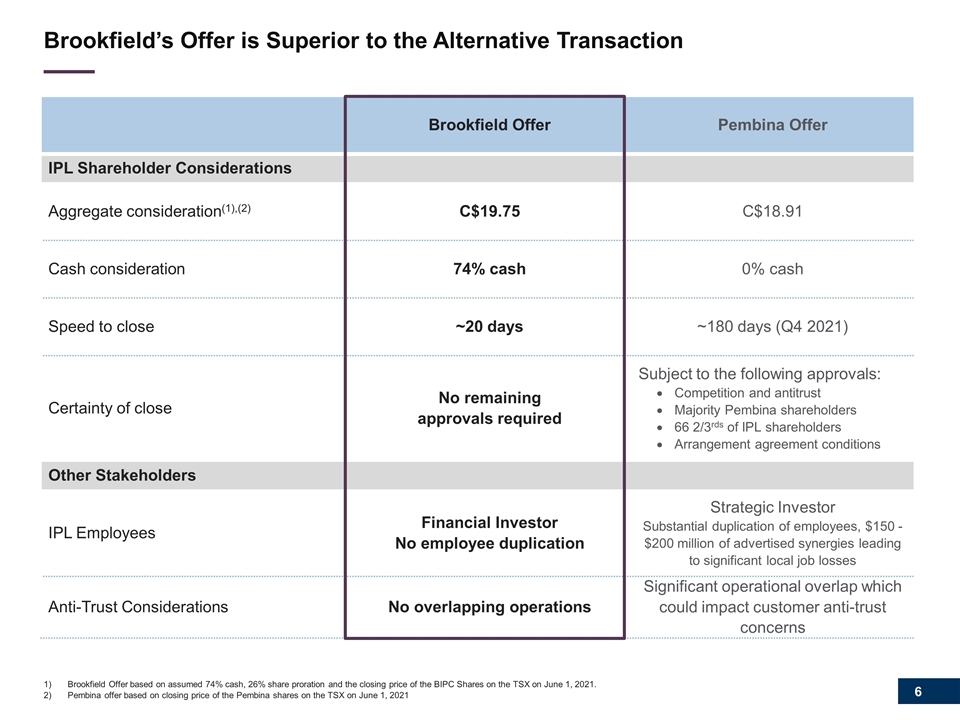

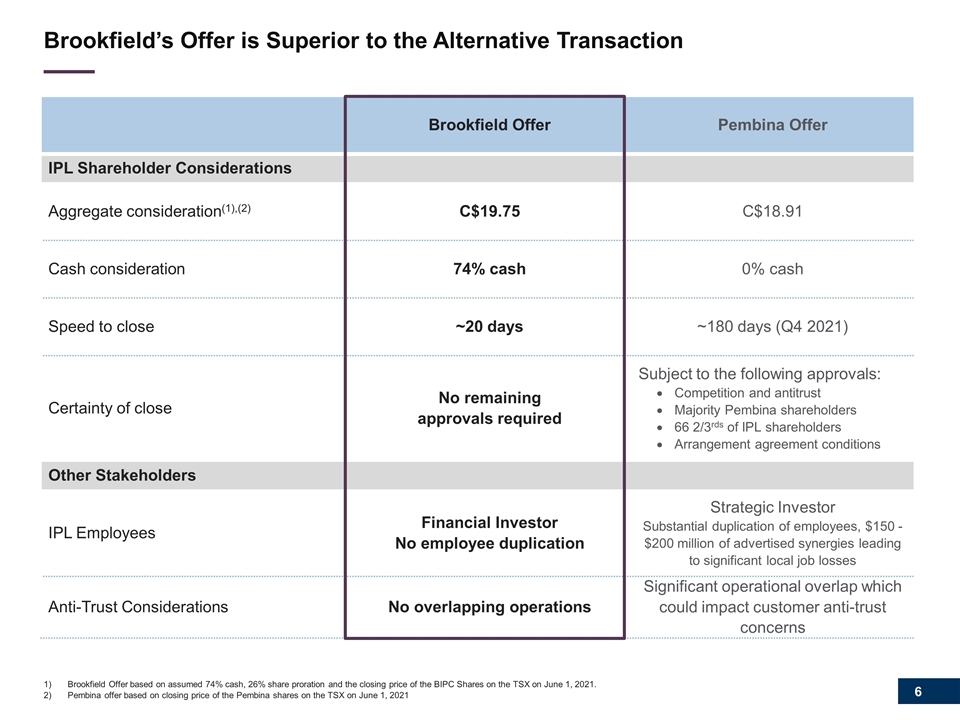

Brookfield’s Offer is Superior to the Alternative Transaction Brookfield Offer Pembina Offer IPL Shareholder Considerations Aggregate consideration(1),(2) C$19.75 C$18.91 Cash consideration 74% cash 0% cash Speed to close ~20 days ~180 days (Q4 2021) Certainty of close No remaining approvals required Subject to the following approvals: Competition and antitrust Majority Pembina shareholders 66 2/3rds of IPL shareholders Arrangement agreement conditions Other Stakeholders IPL Employees Financial Investor No employee duplication Strategic Investor Substantial duplication of employees, $150 - $200 million of advertised synergies leading to significant local job losses Anti-Trust Considerations No overlapping operations Significant operational overlap which could impact customer anti-trust concerns Brookfield Offer based on assumed 74% cash, 26% share proration and the closing price of the BIPC Shares on the TSX on June 1, 2021. Pembina offer based on closing price of the Pembina shares on the TSX on June 1, 2021

Reasons to Accept the Brookfield Offer Highest Upfront Consideration and Certainty of Value to Shareholders Immediate Liquidity for Shareholders Highest Degree of Transaction Certainty versus the Alternative Transaction Opportunity to Participate in Brookfield Infrastructure’s Global Infrastructure Platform Preserves Significant Canadian Jobs in Alberta versus a Cost Reduction-Driven Alternative Transaction

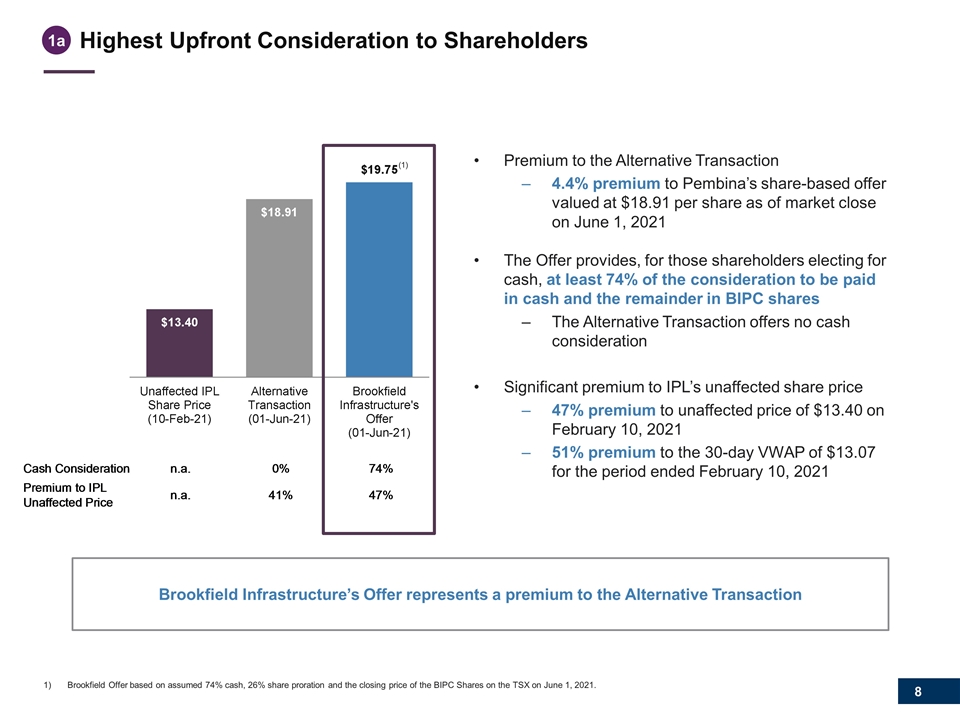

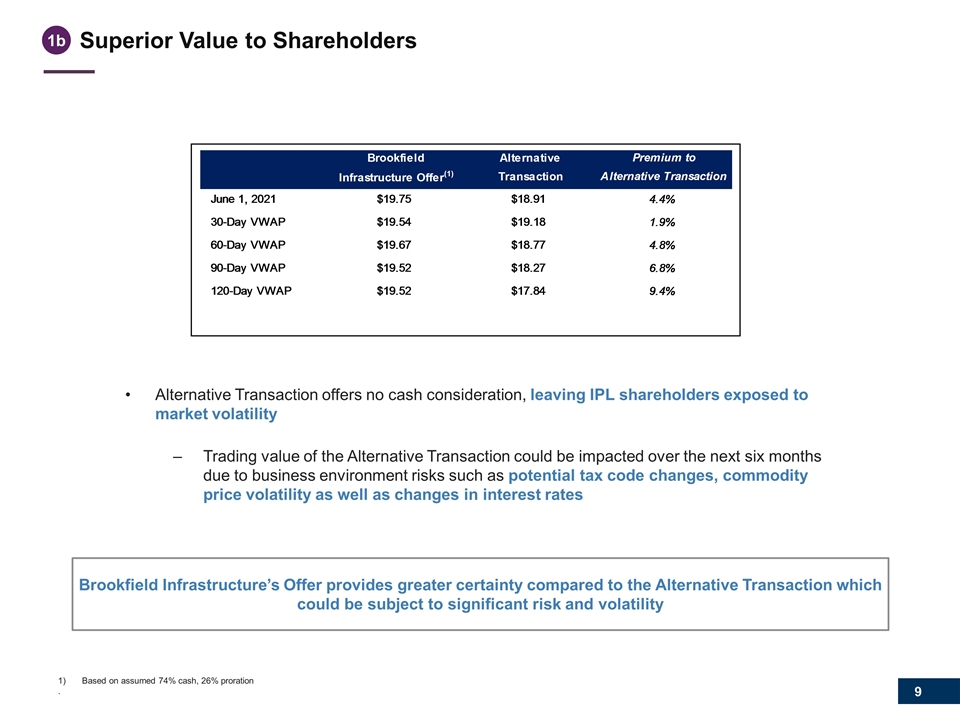

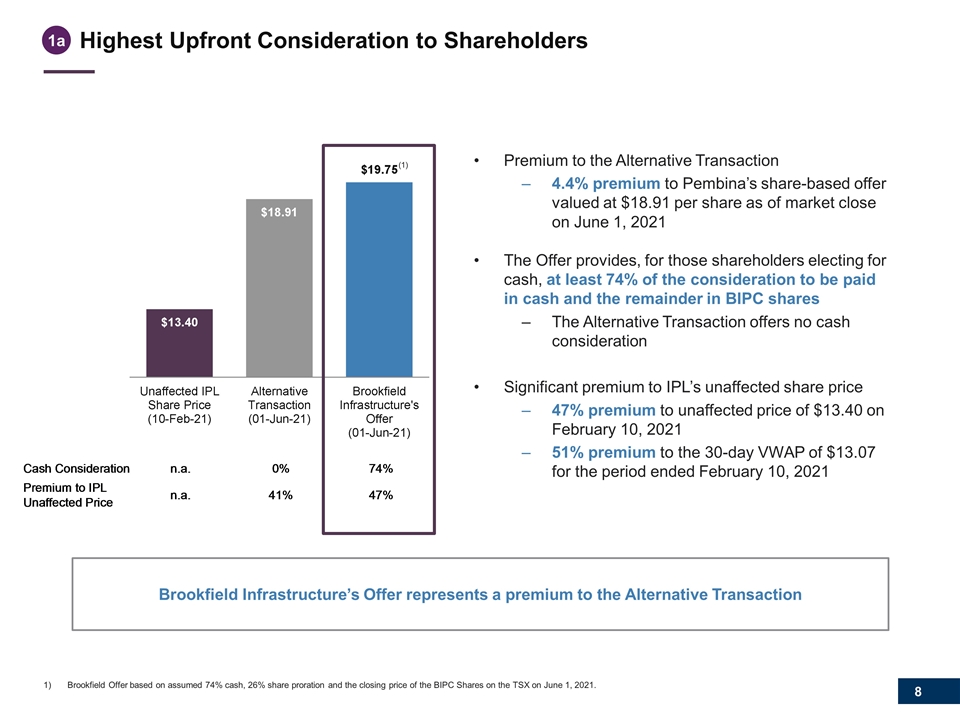

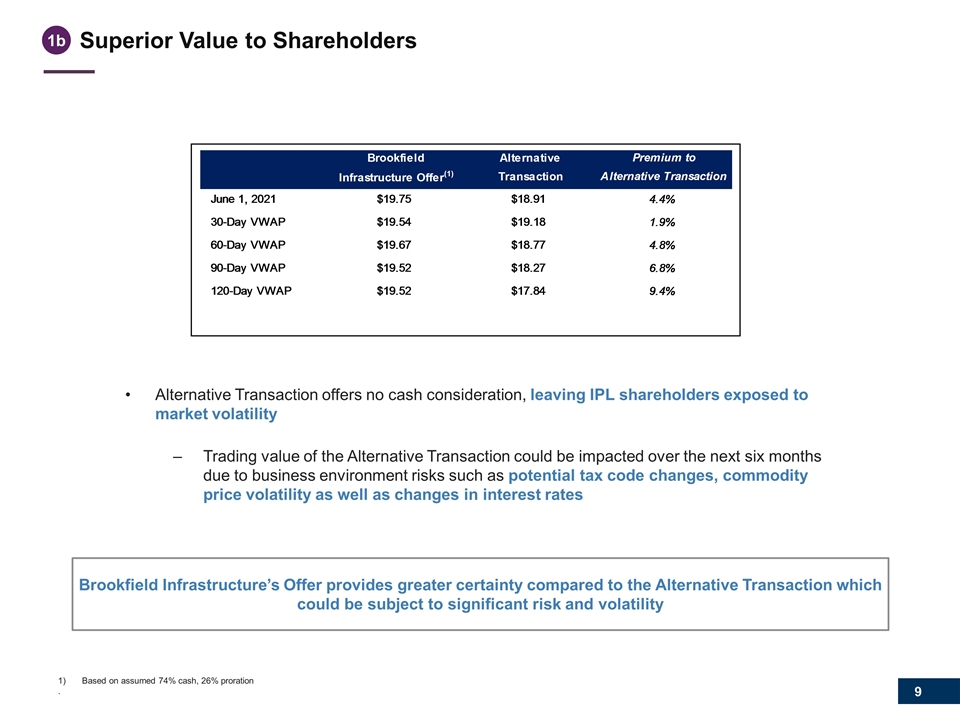

Highest Upfront Consideration to Shareholders Premium to the Alternative Transaction 4.4% premium to Pembina’s share-based offer valued at $18.91 per share as of market close on June 1, 2021 The Offer provides, for those shareholders electing for cash, at least 74% of the consideration to be paid in cash and the remainder in BIPC shares The Alternative Transaction offers no cash consideration Significant premium to IPL’s unaffected share price 47% premium to unaffected price of $13.40 on February 10, 2021 51% premium to the 30-day VWAP of $13.07 for the period ended February 10, 2021 Brookfield Infrastructure’s Offer represents a premium to the Alternative Transaction 1a Brookfield Offer based on assumed 74% cash, 26% share proration and the closing price of the BIPC Shares on the TSX on June 1, 2021. (1)

Superior Value to Shareholders Alternative Transaction offers no cash consideration, leaving IPL shareholders exposed to market volatility Trading value of the Alternative Transaction could be impacted over the next six months due to business environment risks such as potential tax code changes, commodity price volatility as well as changes in interest rates Brookfield Infrastructure’s Offer provides greater certainty compared to the Alternative Transaction which could be subject to significant risk and volatility 1b Based on assumed 74% cash, 26% proration .

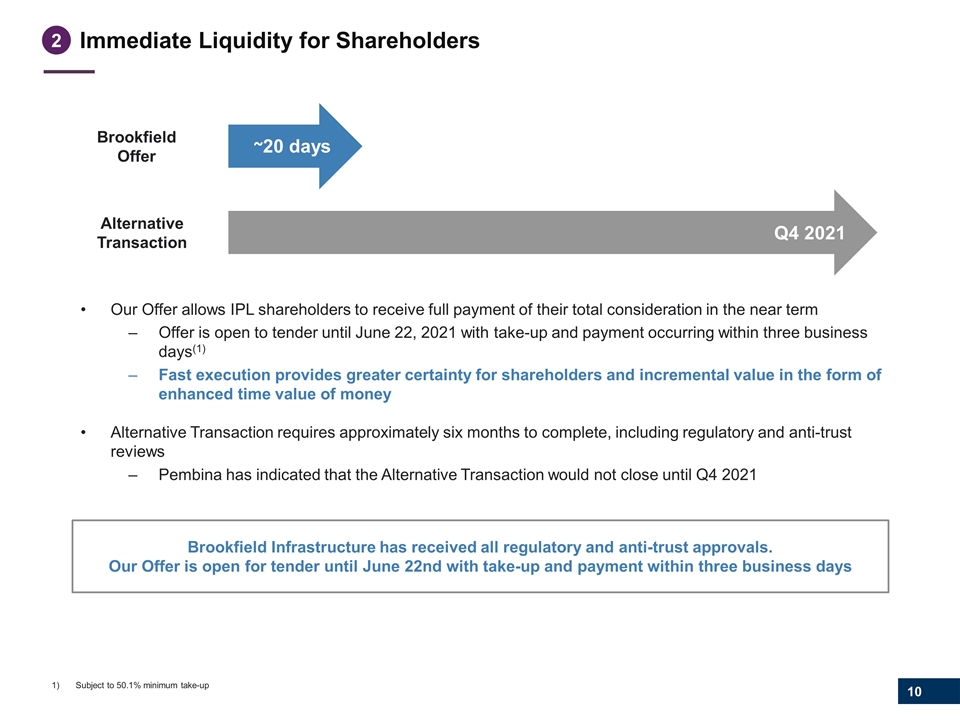

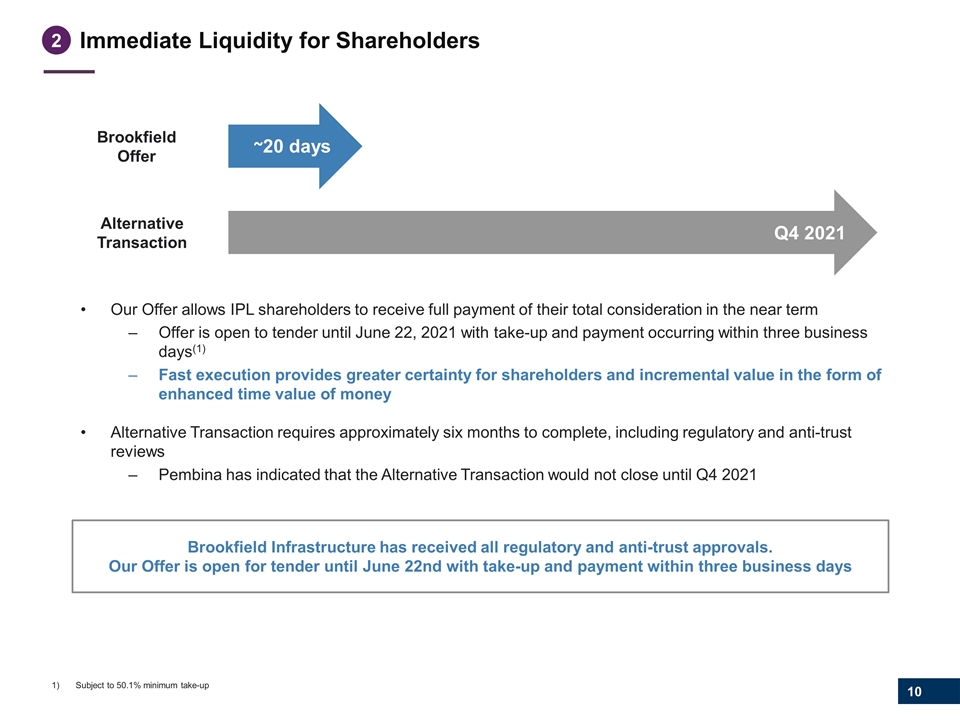

Immediate Liquidity for Shareholders Brookfield Infrastructure has received all regulatory and anti-trust approvals. Our Offer is open for tender until June 22nd with take-up and payment within three business days 2 Our Offer allows IPL shareholders to receive full payment of their total consideration in the near term Offer is open to tender until June 22, 2021 with take-up and payment occurring within three business days(1) Fast execution provides greater certainty for shareholders and incremental value in the form of enhanced time value of money Alternative Transaction requires approximately six months to complete, including regulatory and anti-trust reviews Pembina has indicated that the Alternative Transaction would not close until Q4 2021 ~20 days Brookfield Offer Alternative Transaction Q4 2021 Subject to 50.1% minimum take-up

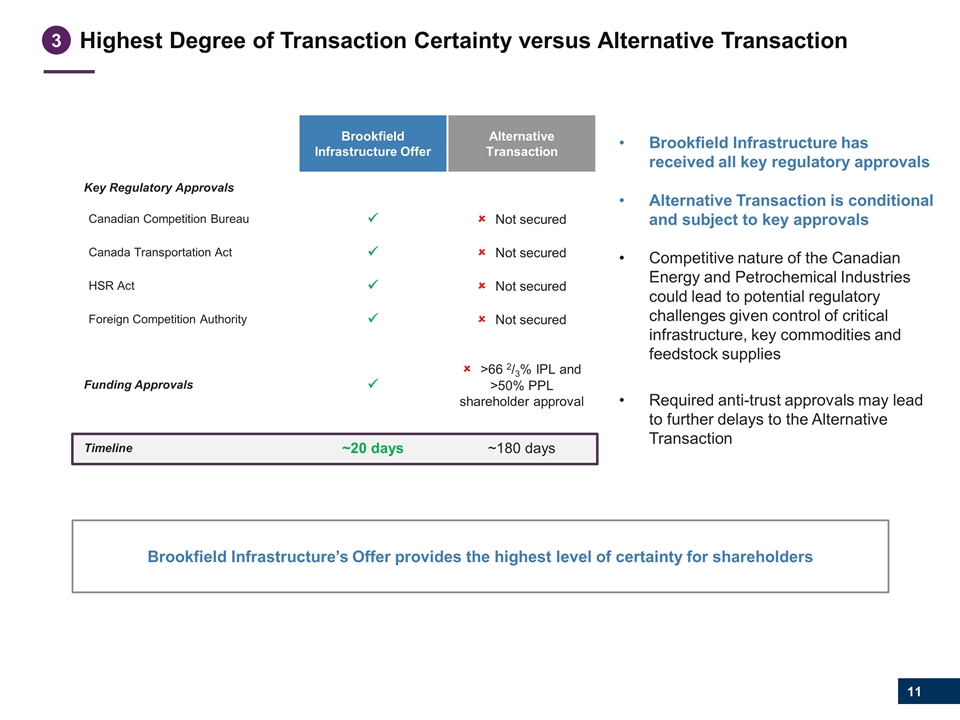

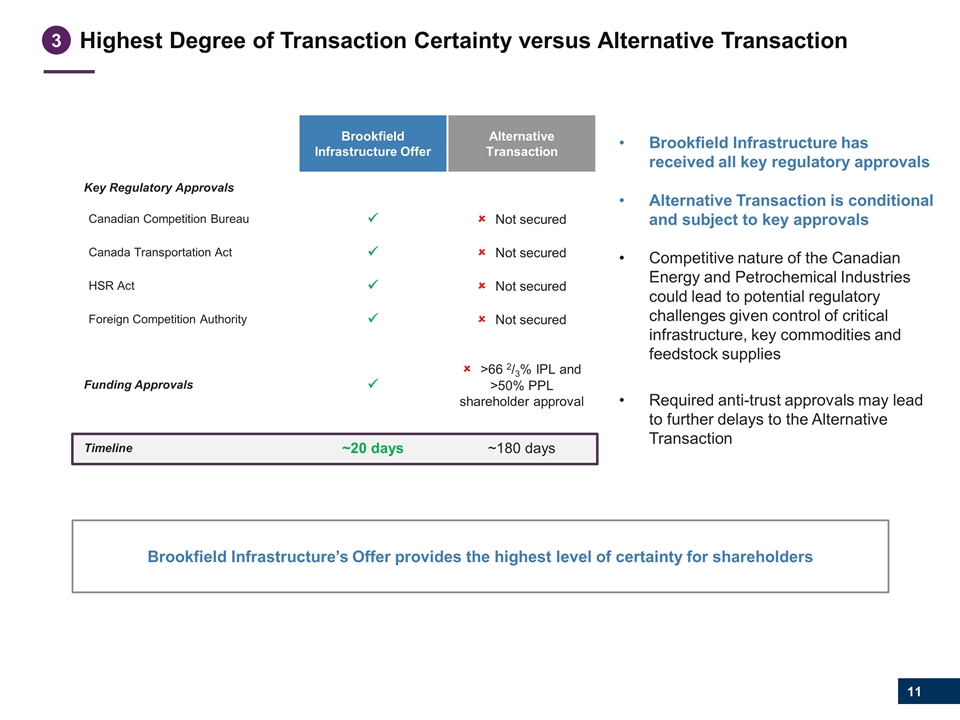

Highest Degree of Transaction Certainty versus Alternative Transaction Brookfield Infrastructure’s Offer provides the highest level of certainty for shareholders 3 Brookfield Infrastructure Offer Alternative Transaction Key Regulatory Approvals Canadian Competition Bureau ü ûNot secured Canada Transportation Act ü ûNot secured HSR Act ü ûNot secured Foreign Competition Authority ü ûNot secured Funding Approvals ü û >66 2/3% IPL and >50% PPL shareholder approval Timeline ~20 days ~180 days Brookfield Infrastructure has received all key regulatory approvals Alternative Transaction is conditional and subject to key approvals Competitive nature of the Canadian Energy and Petrochemical Industries could lead to potential regulatory challenges given control of critical infrastructure, key commodities and feedstock supplies Required anti-trust approvals may lead to further delays to the Alternative Transaction

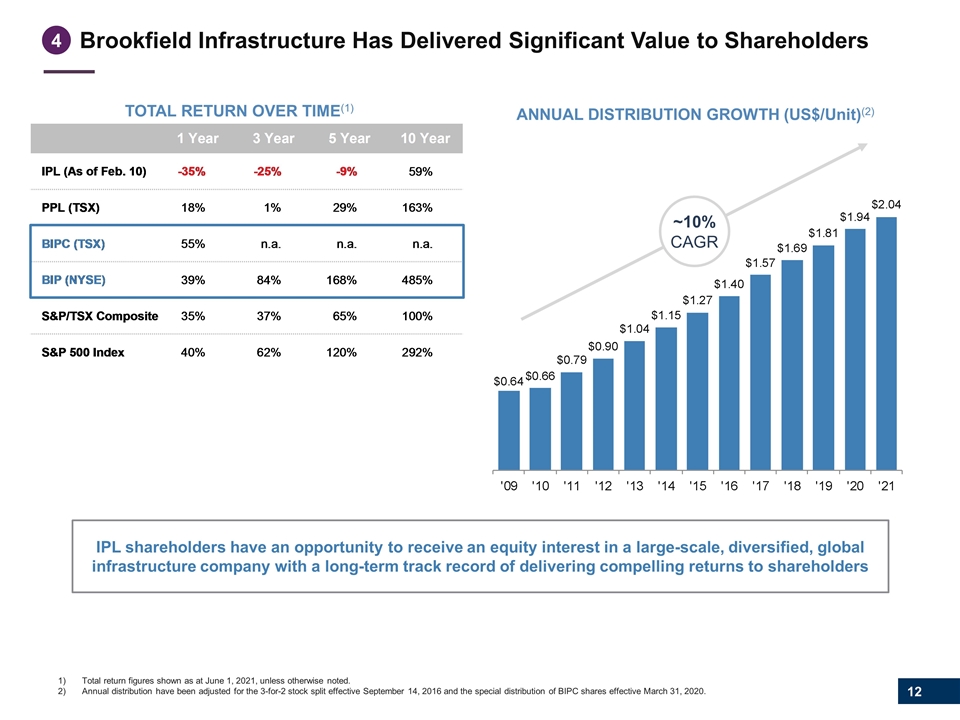

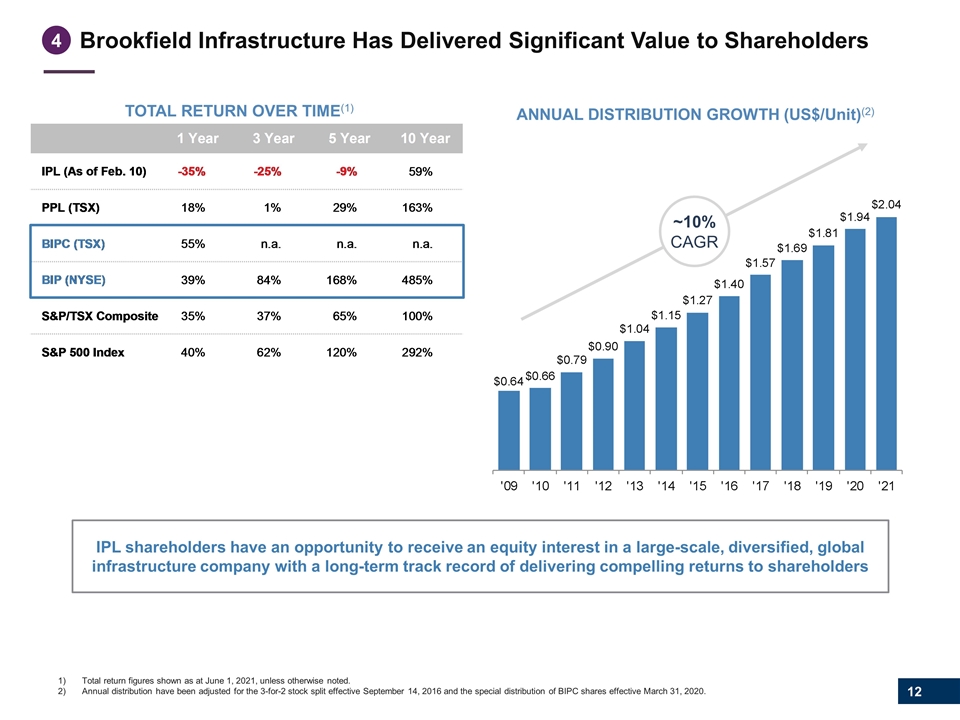

Brookfield Infrastructure Has Delivered Significant Value to Shareholders ANNUAL DISTRIBUTION GROWTH (US$/Unit)(2) ~10% CAGR Total return figures shown as at June 1, 2021, unless otherwise noted. Annual distribution have been adjusted for the 3-for-2 stock split effective September 14, 2016 and the special distribution of BIPC shares effective March 31, 2020. IPL shareholders have an opportunity to receive an equity interest in a large-scale, diversified, global infrastructure company with a long-term track record of delivering compelling returns to shareholders 4 TOTAL RETURN OVER TIME(1)

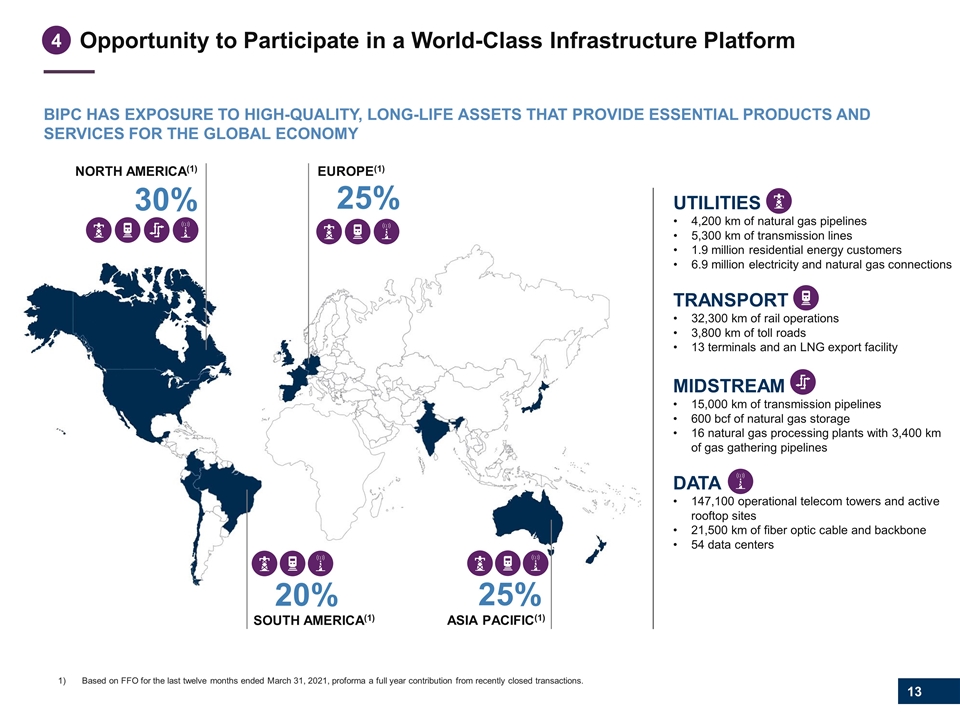

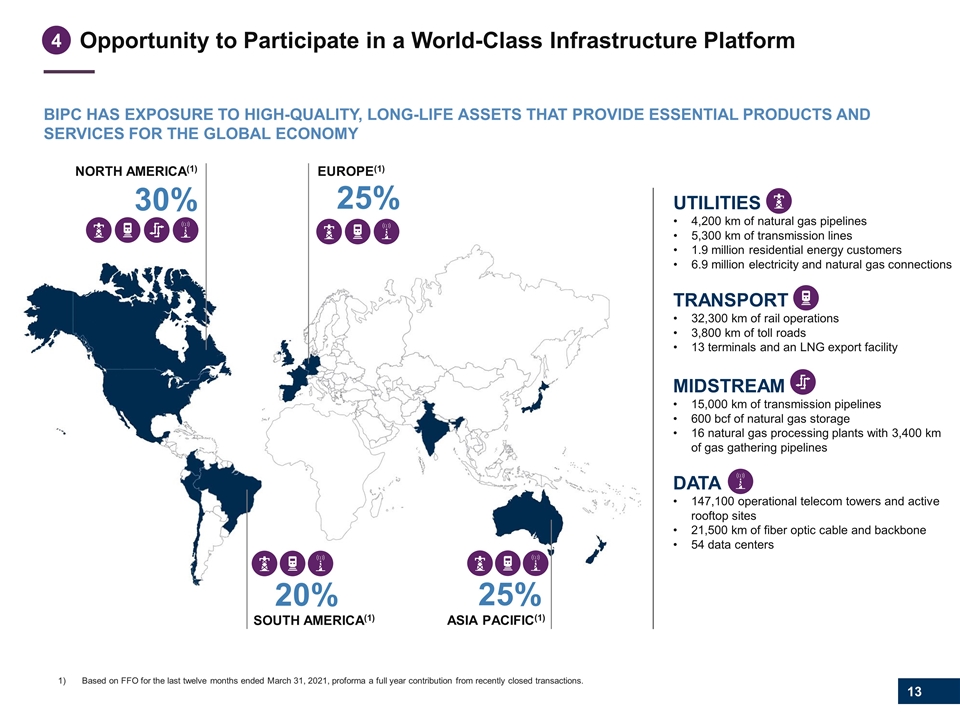

Opportunity to Participate in a World-Class Infrastructure Platform BIPC has exposure to high-quality, long-life assets that provide essential products and services for the global economy Based on FFO for the last twelve months ended March 31, 2021, proforma a full year contribution from recently closed transactions. Asia Pacific(1) EUROPE(1) NORTH AMERICA(1) SOUTH AMERICA(1) DATA 147,100 operational telecom towers and active rooftop sites 21,500 km of fiber optic cable and backbone 54 data centers UTILITIES 4,200 km of natural gas pipelines 5,300 km of transmission lines 1.9 million residential energy customers 6.9 million electricity and natural gas connections TRANSPORT 32,300 km of rail operations 3,800 km of toll roads 13 terminals and an LNG export facility MIDSTREAM 15,000 km of transmission pipelines 600 bcf of natural gas storage 16 natural gas processing plants with 3,400 km of gas gathering pipelines 30% 25% 25% 20% 4

Brookfield Infrastructure Has a Strong Track Record in ESG ESG has always been fully integrated into how we operate our business Ensure the well-being and safety of employees Mitigate the impact of our operations on the environment Conduct business according to the highest ethical and legal standards Be good stewards in the communities in which we operate 4 As part of a larger, more diversified enterprise, IPL will benefit from Brookfield Infrastructure’s proven capabilities and stewardship around ESG transition investing

Preserves Significant Canadian Jobs versus the Alternative Transaction Brookfield Infrastructure’s Offer preserves significant Canadian jobs in Alberta compared to the cost reduction-driven Alternative Transaction 5 ~1,150 Canadian IPL employees(1) As at December 31, 2020, per IPL disclosure. IPL has been one of Alberta’s long-standing, top-tier employers providing rewarding career opportunities and job growth Brookfield is a financial investor and is not seeking to generate significant cost synergies by eliminating duplicative jobs We would seek to support IPL, grow certain segments selectively, and continue to be a large and trusted employer in Alberta The Alternative Transaction, on the other hand, has publicly indicated it is pursuing annual synergies of $150 - $200 million Would lead to significant job losses

Tender Instructions Offer open until 5 p.m. MT on June 22, 2021 (the “Expiry Time”) To accept the Offer properly complete and execute the Letter of Transmittal and deposit it, at or prior to the Expiry Time, together with your certificate(s) or DRS advice(s) representing your Common Shares held in IPL and all other required documents with the Depositary, Laurel Hill Advisory Group, as follows: EMAIL: ipl-offer@laurelhill.com FACSIMILE: 1-416-646-2415 BY MAIL: PO Box 370 STN Adelaide, Toronto, Ontario M5C 2J5 Canada BY REGISTERED MAIL OR COURIER: 70 University Avenue, Suite 1440 Toronto, Ontario M5J 2M4 Canada Beneficial (i.e. non-registered) IPL shareholders must contact their broker, financial institution or other entity that holds their shares to tender to the Offer