| Message from the Chairman | 2 | ||

| Message from the Chief Executive Officer | 4 | ||

| PRESENTATION OF TECHNIP ENERGIES | 7 | |

| Technip Energies at a glance | 8 | ||

| Breaking boundaries to engineer a sustainable future | 10 | ||

| Financial highlights | 12 | ||

| Energy transition | 14 | ||

| A focus on hydrogen | 18 | ||

| A focus on CO2 | 20 | ||

| Key events | 22 | ||

| Our purpose | 28 | ||

| Our values | 29 | ||

| Forward-looking statements | 30 | ||

| VALUE CREATION, BUSINESSES AND FINANCIAL PERFORMANCE | 31 | |

| 2.1. | Long-term value creation | 32 | |

| 2.2. | Business lines to serve traditional and growth markets | 34 | |

| 2.3. | Project Delivery | 44 | |

| 2.4. | Technology, Products and Services | 47 | |

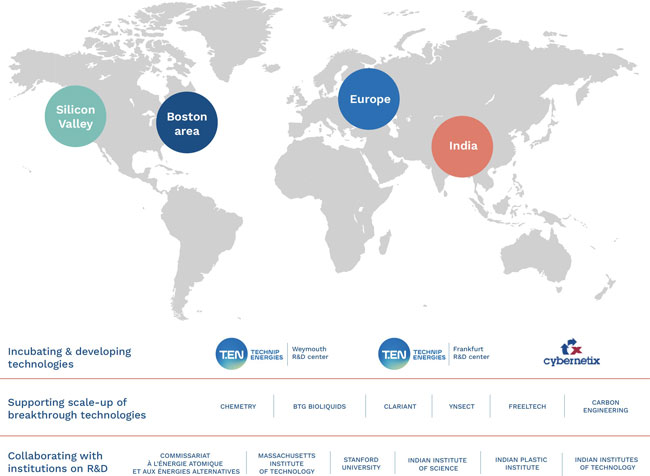

| 2.5. | Research and Technology | 51 | |

| 2.6. | Operating and financial review | 54 | |

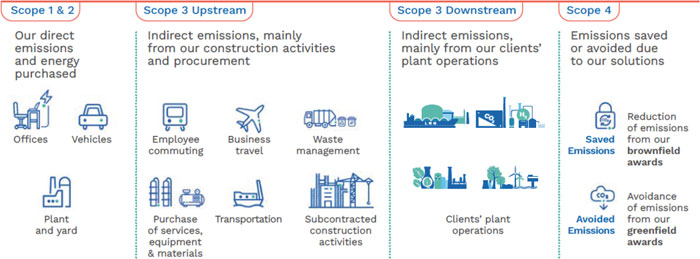

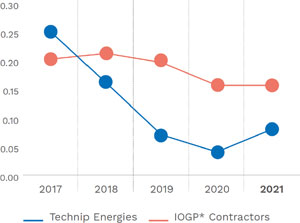

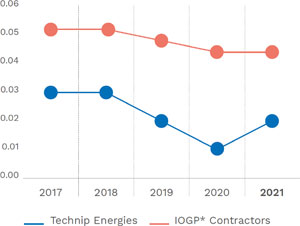

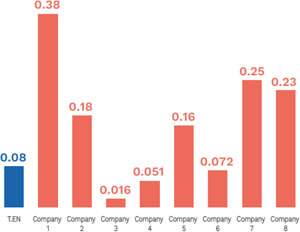

| SUSTAINABILITY | 73 | |

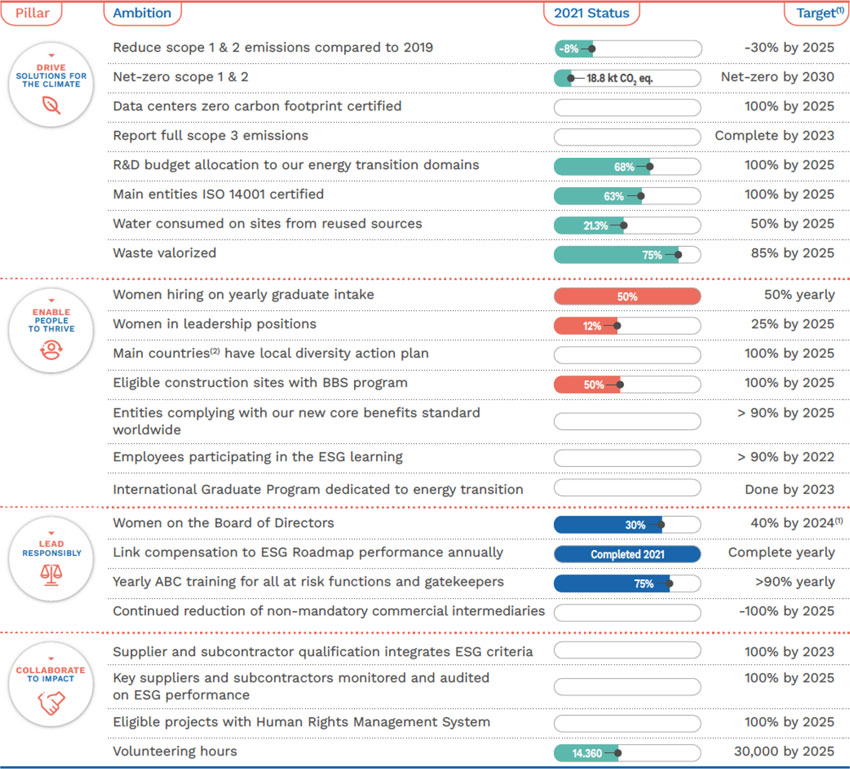

| 3.1. | Our ESG Roadmap | 75 | |

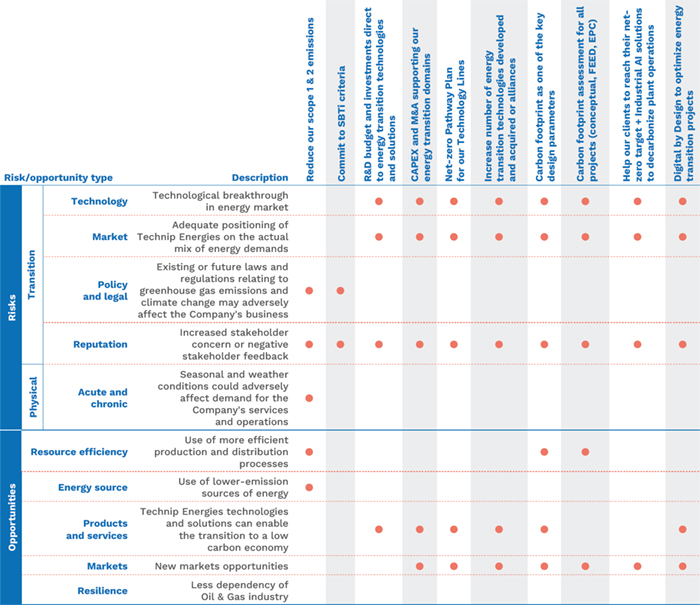

| 3.2. | ESG governance, risk management and certifications | 81 | |

| 3.3. | ESG key indicators | 84 | |

| 3.4. | Business integrity, anti-corruption policies and human rights | 89 | |

| 3.5. | Health, Safety and Environment | 92 | |

| RISK AND RISK MANAGEMENT | 95 | |

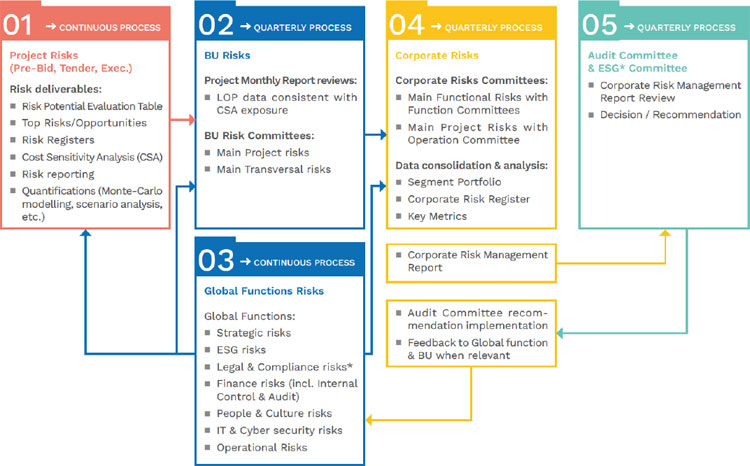

| 4.1 | Risk Management overview | 96 | |

| 4.2 | Enterprise Risk Management framework | 97 | |

| 4.3 | Risks to which we are subject | 99 | |

| CORPORATE GOVERNANCE | 115 | |

| 5.1. | The Technip Energies Board | 116 | |

| 5.2. | Share Capital | 134 | |

| 5.3. | Agreements affecting control of Technip Energies | 137 | |

| 5.4. | Corporate Governance statement | 139 | |

| 5.5. | Board members independence requirements | 141 | |

| 5.6. | Shareholders General Meetings | 141 | |

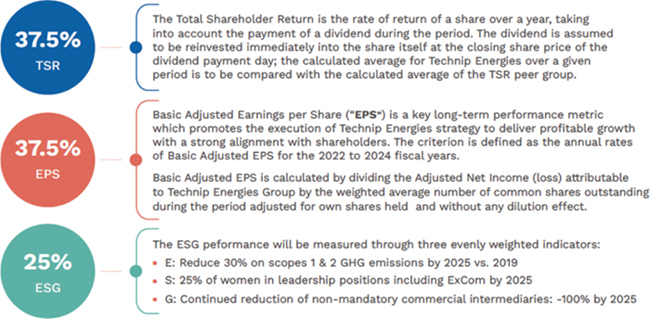

| REMUNERATION REPORT | 143 | |

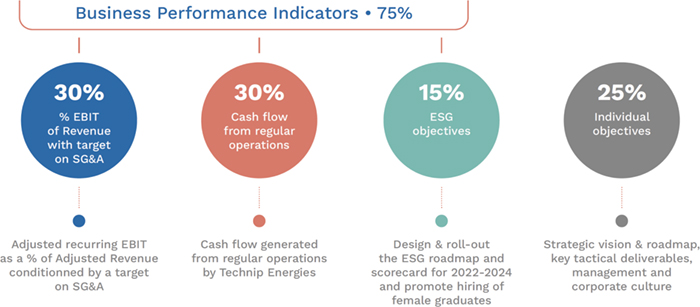

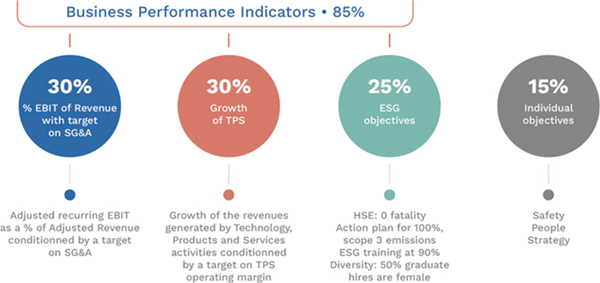

| 6.1. | Remuneration at a glance | 145 | |

| 6.2. | Remuneration policy | 147 | |

| 6.3. | Limitation on Liability and Indemnification Matters | 151 | |

| 6.4. | Other arrangements | 151 | |

| 6.5. | Application of the Remuneration policy in 2021 | 152 | |

| 6.6. | Remuneration policy changes for 2022 | 158 | |

| EMPLOYEES AND OTHER MATTERS | 163 | |

| 7.1. | Employee and social matters | 164 | |

| 7.2. | Compliance Investigations | 168 | |

| BOARD MEMBERS RESPONSIBILITY STATEMENT | 169 | |

| 8.1. | Management report | 170 | |

| 8.2. | CEO statement | 170 | |

| 8.3. | Financial statements | 171 | |

| ANNUAL ACCOUNTS | 173 | |

| 9.1. | Consolidated financial statements for the year ended December 31, 2021 | 174 | |

| 9.2. | Technip Energies Company financial statements | 242 | |

| 9.3. | Independent Auditor’s report | 257 | |

| GLOSSARY | 267 | |

2021 ANNUAL REPORT Breaking boundaries |  |

We are Technip Energies.

We are a leading engineering and technology company for the energy transition.

With more than 60 years of history, we have a clear vision for the future.

We have a passion for excellence and are committed to safety and quality.

Integrity is always at the center of what we do.

We foster a diverse and collaborative environment.

We are a team of 15,000 talented professionals engaged in transforming the energy industry.

Turning our clients’ vision into a reality.

Our reputation is built on our ability to deliver and our limitless drive to enhance our clients’ performance.

Project after project, we have provided innovative solutions, pioneering technologies and mastered processes from concept to delivery, for our clients’ success and our people’s development.

Today, we continue to push the limits and accelerate the journey to a low-carbon world.

| Our success comes from our leading-edge technologies, our unique design and engineering capabilities, our construction expertise and our proprietary equipment.

We unlock added value energy solutions, leveraging innovation and embracing digital.

We lead the natural gas market, a critical transition fuel, and are developing new sustainable energy projects, with hydrogen, sustainable chemistry, biofuels, CO2 management and other solutions.

Supported by a strong Environmental, Social, and Governance roadmap we strive for excellence for our people, our clients, our partners, society, and the coming generations.

We think energies, we think tomorrow.

“We are Technip Energies. Where energies make tomorrow.”

|

Technip Energies is listed on Euronext Paris, headquartered in Paris and registered in the Netherlands. The annual report can be viewed and upleaded at technipenergies.com

|

| ||

| This document is the PDF/printed version of the 2021 Annual Report of Technip Energies and has been prepared for ease of use. The 2021 Annual Report was made publicly available pursuant to section 5:25c of the Dutch Financial Supervision Act (Wet op het financieel toezicht), and was filed with the Netherlands Authority for the Financial Markets in European single electronic reporting format (the ESEF package). The ESEF package is available on the Company’s website at https://investors.technipenergies.com /financial-information/results-center and includes a human readable XHMTL version of the 2021 Annual Report. In any case of discrepancies between this PDF version and the ESEF package, the latter prevails. | ||

References to Technip Energies: references to the Company or company, to Technip Energies or the (Technip Energies) Group or group, or “we”relate to Technip Energies N.V. and its subsidiaries except where the context provides otherwise.

T.EN • 2126 boulevard de La Défense • Immeuble ORIGINE-CS 10266 • 92741 Nanterre cedex • France

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 1 |

• MESSAGE FROM THE CHAIRMAN •

To our stakeholders,

Value Creation

From its beginning as an independent company in February 2021, Technip Energies has focused on the significant opportunities for value creation that exist as the world transitions towards a lower and ultimately zero carbon energy future.

The objective of net-zero has broad support from governments, businesses, consumers and the energy sector and an increasing number of key actors are adopting policies and taking the steps required to achieve this ambition. While timing remains uncertain and detailed pathways continue to be shaped, some important aspects of the energy transition are increasingly apparent.

Liquefied Natural Gas (“LNG”) will continue to play a vital role in the global energy mix for many years to come as renewable sources are unable to scale at a sufficient pace to satisfy growing global energy demand and the world moves away from higher carbon intensity sources such as coal. Technip Energies’ market leading position in LNG - as well as in markets such as hydrogen and ethylene - will therefore continue to provide a strong foundation for the Company’s growth for many years to come.

These traditional markets are themselves evolving to lower carbon content and production. The significant reductions in greenhouse gas emissions projected to be achieved in connection with the Qatar North Field LNG expansion project exemplifies how the Company’s low-carbon design solutions and carbon capture usage and storage (“CCUS”) expertise are helping traditional energy adapt to a lower carbon future.

|

If the net-zero ambition is to be achieved an unprecedented level of global investment in production, transportation, storage and distribution infrastructure and associated technology will be required over the coming decades. The Company’s engineering and technological leadership in the energy sector positions it to become an important player in designing, building and deploying this core infrastructure. The Company’s offerings in markets such as blue and green hydrogen, CO2 management, green chemistry and biofuels are already gaining traction with clients and, over the coming years, the Company also expects to see the development of businesses in offshore wind and plastics recycling where the Company is already starting to leverage its strengths.

Importantly, we believe that the business models. solutions and technologies developed in connection with these net-zero offerings will contribute to the growth of higher margin businesses for the Company, including in the Technology, Products and Services segment.

The Board works closely with management to assess the opportunities and risks that this evolving energy landscape presents. This involves developing and setting the strategic objectives for the business and reviewing and approving the investments (including in people), partnerships and other actions required to execute the Company’s plans. In allocating resources, including between our traditional businesses and the opportunities that we are identifying to build a leading and profitable business for net-zero, the Board’s objective

|

is to grow long-term value for our stakeholders. While we continue to take care of the short term we are building for the long term.

Strong 2021 performance despite global challenges

The past year was marked by the persistence of the COVID-19 pandemic and implementing measures to protect the health and safety of our employees and contractors has been a priority of the Company. I am proud of the manner in which the Technip Energies workforce has responded, including by adapting to new ways of working while maintaining excellence in execution. I am also proud of the support the Technip Energies community has provided to colleagues, and the families and local communities of colleagues, in India and other parts of the world that were particularly hard hit by the pandemic.

Although the pandemic inevitably impacted project execution and timing and generated additional costs. the Company was able to mitigate its impact on the Company’s performance. Indeed the people of Technip Energies delivered excellent 2021 results. Strong project execution resulted in double digit revenue growth alongside adjusted recurring EBIT margin expansion from 5.9% to 6.5% compared to the prior year and the Company has maintained a very strong balance sheet with robust free cash flow growth in 2021 contributing to an adjusted net cash position of €3.1 billion at year end. In line with this strong performance, the Board is delighted to propose an inaugural annual dividend in the amount of €0.45 per share.

|

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 2 |

• MESSAGE FROM THE CHAIRMAN •

Embedding Foundational Values

Throughout 2021, the Board was actively involved with management in the development of our Environmental, Social and Governance (“ESG”) framework and action plan.

Reflecting input from employees and other stakeholders, the ESG framework articulates our company-wide foundational values and the accompanying action roadmap is designed to embed those values in the culture, business practices and strategy of the Company. The roadmap provides for specific and measurable actions and targets that support our commitment to act for the climate and the environment; to ensure a diverse, inclusive and safe work environment that attracts and grows talents; to conduct business with integrity and in an ethical and transparent fashion; and to collaborate with others including by contributing to the development of our local communities and working with suppliers to achieve sustainable supply chains.

The ESG framework and roadmap will guide future Company actions and decisions. For example, a demanding set of ESG criteria will be applied in the Company’s tender selection process going forward.

The Board and its ESG Committee will remain actively involved in monitoring the implementation of the roadmap. To strengthen ESG accountability and transparency, key ESG targets have been incorporated into the incentive components of our 2022 executive compensation program.

We are confident that the values articulated in our ESG framework will generate pride and engagement among the people of Technip Energies, will help attract new skills and talents and will win new business opportunities for the Company.

The Board

The blend of historical company knowledge, industry experience, skills and continuity represented on the Board has been important for the effective operation of the Board this past year. We are nevertheless mindful of the need to continually review Board composition to ensure it reflects the appropriate mix of skills and experience as well as diversity. Accordingly, after having conducted an in depth

| assessment of the Board’s collective skills, experience and background and mindful of the impending retirement of Pascal Colombani, the Board undertook structured searches for individuals with the attributes we believed would complement those of existing members and who would enhance the work of the Board.

I am delighted that two outstanding individuals – Colette Cohen and Francesco Venturini – have agreed, subject to Shareholder approval, to join the Board . Besides being at the forefront of technological developments that are key for the energy transition, Colette is a champion of sustainable and socially responsible practices in the energy industry and a recognized advocate for women in industry. Francesco brings extensive energy industry experience at CEO level with a successful track record of driving transformation towards sustainable products and services and implementing technological and digital change. Francesco’s experience in the utilities field is also particularly relevant for the Company as the movement to electrification accelerates.

Pascal Colombani has decided to retire from the Board at the May 5, 2022, Shareholders’ Annual General Meeting. On behalf of the Board I wish to acknowledge the importance of Pascal’s contributions to the Board and the Company. We have greatly benefited from his wise counsel and his vast industry and governance knowledge and experience. His leadership of the ESG Committee has been particularly important in this critical year. | Moving forward with stakeholder support

I wish to thank our Shareholders for their support. The Board appreciates the trust and responsibility involved in your investment and places great importance on

The global consequences of the COVID-19 pandemic have not entirely disappeared and the devastating war in Ukraine is impacting businesses throughout the world, including the Company’s operations in Russia. The Company has stopped work on future opportunities in Russia and, with our employees, we are helping to provide support for the victims of the war. We continue to monitor the impact of these developments and to take appropriate mitigating actions. The Company is well positioned to weather and contain the impact of these challenges because of its strong, diversified and global businesses and financial strength.

Above all the talent, resilience and commitment of our people give me confidence that the Company will continue to build a strong, sustainable and financially successful future that will drive value creation for all stakeholders. ●

Joseph Rinaldi | ||

“The talent, resilience and commitment of our people give me confidence that the Company will continue to build a strong, sustainable and financially successful future.” | ||||

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 3 |

• MESSAGE FROM THE CEO •

Dear stakeholders,

I feel great pride when looking at our first full year together and am filled with enthusiasm when considering the opportunities ahead. 2021 has been a special and memorable year for Technip Energies, as we embarked on a new journey guided by a strong ambition to accelerate the energy transition. Each of our 15,000 employees actively contributed to the successful opening of this new chapter in February of 2021. I am grateful for the creativity, innovation and engagement they have demonstrated every day, joining forces in our collective effort to build a better future, for us and for society as a whole. 2021 was about building a solid platform from which to deliver future growth and continued success.

Forming

February 16, 2021, marked the beginning of a new chapter in Technip Energies’ history with our stock market listing on the Euronext Paris exchange. In ten months, we have launched Technip Energies and positioned our new company as a prominent player in helping our clients move towards their net -zero goals. We are doing so by leveraging our project delivery track record, which contains some of the world’s most complex energy infrastructure, and our extensive technology portfolio that supports our ability to conceive, build and integrate solutions at scale.

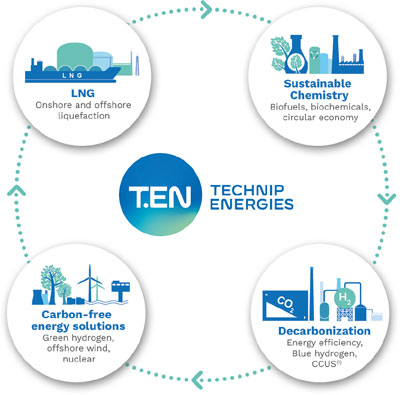

| Our customer engagements throughout the year confirm that the four domains of our energy transition strategy – consisting of LNG, Decarbonization, Sustainable Chemistry and Carbon-free energy solutions - are well aligned with current and future energy market trends.

Strengthening

Despite the pandemic- related challenges of 2021, we continued to execute well across the portfolio. I would like to highlight our solid financial position that results from growing revenues and strong cash flows. Combined with our successful inaugural senior unsecured notes offering, which was more than three times oversubscribed among a large European investor base, and complemented by a robust balance sheet and capital structure, it positions us well to capitalize on future opportunities.

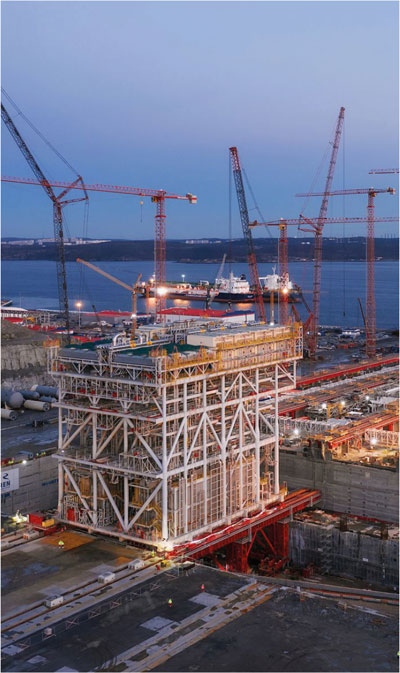

Thanks to the commitment of our teams, our projects achieved key delivery milestones. I cannot mention all of them here, but would like to highlight our Arctic LNG 2 mega-project, where the first modules shipped from China to Russia in record time, and our Coral FLNG project for ENI which has also advanced on schedule and has arrived on location in Mozambique in early January of 2022.

| In Technology, Products and Services many key milestones were met and I want to highlight the business building and business growing mindset driving our teams.

We have also made progress on our decarbonization strategy with a major contract win for the Qatar North Field Expansion project, featuring a large carbon capture and sequestration scope, leading to more than 25% reduction of GHG (greenhouse gas) emissions when compared to similar liquified natural gas (“LNG”) facilities. This is a critical step towards our ambition to decarbonize LNG at scale.

We are also stepping up our efforts in Floating Offshore Wind to play an active role in this long-term growth market. To this end, we have created a dedicated business unit, assembled a team of experts and secured proprietary floater technology through lnocean. Beyond the floater, we have implemented a digital by design model, enabling us to operate across the windfarm’s lifecycle, to offer performance optimization, predictive performance and maintenance.

This approach illustrates how a far-reaching digital strategy can support the energy transition. Digitalize to decarbonize has become an imperative, powered by accurate, objective, and accessible data-turning Technip Energies into a data-centric organization and business.

|

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 4 |

• MESSAGE FROM THE CEO •

Positioning

At Technip Energies, we believe that our role goes far beyond executing. As an energy transition player, we have a responsibility to constantly innovate. This is driving our business strategy, drawing on a long history of successfully developing and commercializing new technologies, to maximize synergies and expertise. In fact, almost 70% of our current R&D spend is via open innovation or development with partners.

I am a firm believer in collaboration, within and among companies, governments, businesses, investors and citizens, within and across industries. 2021 was an especially rich year for us in this regard. We established several partnerships including with Total Energies to advance low-carbon solutions for LNG and offshore facilities, with Shell on the optimization of its Cansolv CO2 capture technology, with IBM and Under Armour on plastics recycling and with Carbios, supporting the launch of its endless PET recycling demonstration plants. These partnerships reinforce our position as a partner of choice and will create business opportunities for years to come.

ESG at the heart of our business and our practices

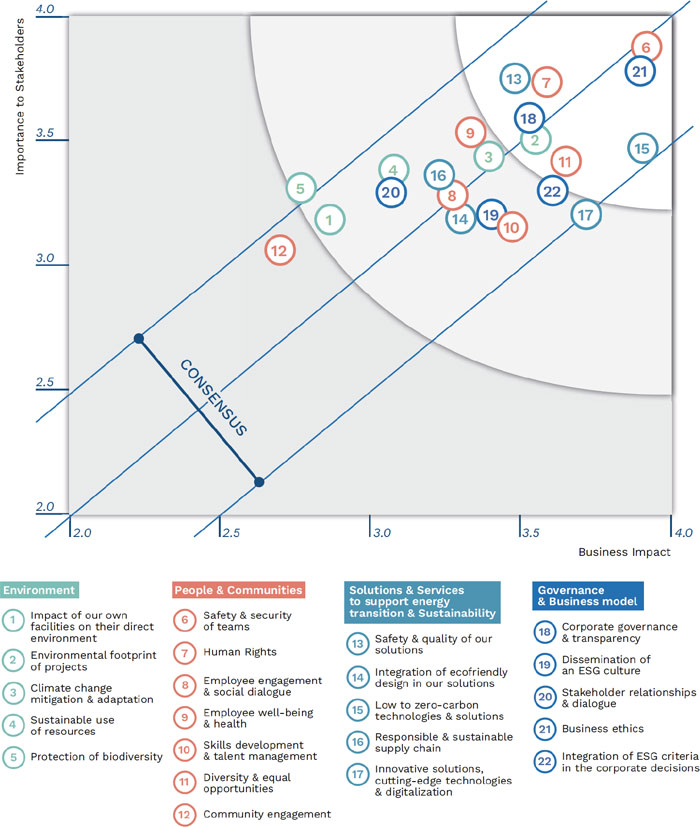

Also looking to the future, there can be no doubt that Environmental, Social, and Governance (“ESG”) and sustainability are and will remain central priorities. In our determination to be recognized as a reference company in this area, we have defined the issues that matter most to our business, to our Shareholders, to our people, and to all our other stakeholders.

Following an extensive and collaborative materiality assessment, we delivered our ESG roadmap as promised within our first year of existence and laid out our ambitions, for both the near-term and the longer-term. This roadmap, which is fully aligned with our Company purpose and corporate values, will

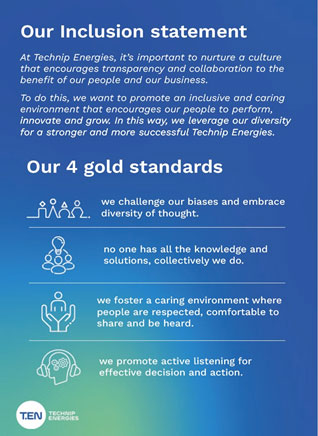

| be fully embedded within our culture and integrated within our business strategy and processes. Our Sustainability Report and ESG scorecard further detail our practical actions and measures undertaken, with a high level of transparency that holds us accountable for our progress. In parallel, we also kicked off our program, “Inclusion in Action”, underpinned by four gold standards, designed to nurture our culture of diversity, transparency and collaboration, where everyone is encouraged to grow, create and thrive.

Unfortunately the end of 2021 was saddened by the accidental death of three employees of our BOMESC subcontractor at the yard where Arctic LNG 2 modules are being built in China. This tragedy is a reminder of how critical it is to never compromise on safety and how fragile our otherwise strong performance can be.

Looking forward with confidence

Overall, we can all be very proud of our collective performance and progress in 2021. The year’s many achievements demonstrate our motivation and strategic momentum to advance the energy transition. Today we are looking towards 2022 with promising growth perspectives, particularly for LNG, carbon capture, hydrogen and sustainable chemistry.

On this solid foundation we will continue to grow Technology, Products and Services and maintain our excellence in Project Delivery. The actions undertaken in 2021 sow the seeds to strengthen our capabilities for the future – extending our reach into a low- to zero-carbon future through technology, innovation and partnerships. We will continue to innovate in our core business while accelerating our other growth engines and significantly increasing our 2022 research and development.

Moreover, as everything starts with our people, we will continue to develop and upskill our internal talents while

| continuing recruitment to enrich our expertise for the opportunities and challenges ahead.

I would like to thank our teams for their commitment, resilience and drive throughout our first year as Technip Energies. I am impressed and humbled by the positive energy and attitude they bring to our transformation.

I also wish to express our solidarity with those suffering as a result of Russia’s invasion of Ukraine. The Company and its employees have taken measures to provide material support to help the Ukrainian people. We are monitoring the situation closely and have taken appropriate measures to safeguard our people and operations. Until further notice, we have decided to suspend working on future business opportunities in Russia and remain confident in the robustness of Technip Energies’ global and diversified business, balance sheet and on our ability to invest and deliver on our strategy.

Finally, I wish to thank our external stakeholders, and in particular our Shareholders, for the confidence you have placed in us. It is an immense privilege to be part of this adventure together.

Thank you. ● Arnaud Pieton

|

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 5 |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 6 |

| TECHNIP ENERGIES AT A GLANCE | 8 |

| BREAKING BOUNDARIES TO ENGINEER A SUSTAINABLE FUTURE | 10 |

| FINANCIAL HIGHLIGHTS | 12 |

| ENERGY TRANSITION | 14 |

| A FOCUS ON HYDROGEN | 18 |

| A FOCUS ON CO2 | 20 |

| KEY EVENTS | 22 |

| OUR PURPOSE | 28 |

| OUR VALUES | 29 |

| FORWARD-LOOKING STATEMENTS | 30 |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 7 |

• PRESENTATION OF TECHNIP ENERGIES •

● | Technip Energies at a glance |

About Technip Energies

Technip Energies is a leading engineering & technology (“E&T”) company for the energy transition, with leadership positions in Liquefied Natural Gas (“LNG”), hydrogen and ethylene as well as growing market positions in blue and green hydrogen, sustainable chemistry and CO2 management. We benefit from our robust project delivery model supported by an extensive technology, products and services offering.

| Operating in 34 countries, our 15,000 people are fully committed to bringing our clients’ innovative projects to life, breaking boundaries to accelerate the energy transition for a better tomorrow.

We are positioned to play a critical role in assisting our clients reach their net-zero targets as they reconcile rising global demand for energy, increasingly stringent environmental and climate targets, rising social and political pressures and the need for affordable and reliable energy supply. We offer solutions to meet these challenges through our emerging clean energy technologies, our array of tools to lower traditional industries emissions, and our decarbonizing solutions for the global energy chain, all of which allow our clients to diversify their offerings without diluting company returns.

Energy transition is our business for which we deploy our core capabilities to meet today’s and tomorrow’s energy challenges, whether in LNG (onshore and offshore liquefaction), in Sustainable Chemistry (biofuels, chemicals, circular economy), for Decarbonization (energy efficiency, blue hydrogen, carbon capture, utilization and storage (“CCUS”)) or for Carbon-free energy solutions (green hydrogen, offshore wind, nuclear).

We have key capabilities which are deployed throughout the energy landscape. We are present in conventional energy chains (oil and natural gas) as well as growing energy chains (CO2, hydrogen, biomass and floating offshore wind) and we are already positioned in electricity, which is the energy chain of the future. We deliver energy infrastructure and molecule transformation for key energy end use markets which include power, heating, agriculture, finished products (e.g., energy derived manufactured goods such as glass or plastics) as well as transportation fuel (such as diesel, kerosene and hydrogen).

|

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 8 |

● PRESENTATION OF TECHNIP ENERGIES ●

| We have | |

| a full range of design and project development services to our clients spanning across the entire downstream value chain, from early engagement technical consulting through final acceptance testing. We have a track record of more than 60 years in managing large Engineering, Procurement, and Construction (“EPC”) projects. |

| We develop |

| a full range of design and project development services to our customers spanning the entire downstream value chain, from early engagement technical consulting through final acceptance testing. We have a track record of more than 60 years in managing large Engineering, Procurement, and Construction projects. |

| We offer |  |

| a comprehensive portfolio of technologies, products, projects, and services with capabilities spanning across early studies, technology licensing, proprietary equipment and project management to full engineering and construction. We support gas monetization, ethylene, hydrogen, refining, petrochemicals and polymers, fertilizers and other activities, such as mining and metals, life sciences, floating offshore wind, renewables and nuclear. |

| We manage |

| an active research and development (“R&D”) program with a large portion of our R&D deployed to improve the efficiency of process technologies in our current portfolio, including by reducing raw material and energy consumption, capital cost reduction, as well as development of add-on technologies to enhance our offering. The balance of the investment is dedicated to portfolio growth through development of new processes or products such as proprietary equipment and catalysts. 56% of our R&D budget is dedicated to energy transition and growing, with our ESG Roadmap providing that 100% of our R&D spend by 2025 will be allocated to energy transition. |

| We partner | |

| with some of the world's most well-known players in oil and gas for technologies, equipment and construction worldwide. Additionally, our Project Management Consulting services ;everage our expertise in the management of complex projects to the benefit of our clients. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 9 |

● PRESENTATION OF TECHNIP ENERGIES ●

| ● | Breaking boundaries to engineer a sustainable future |

| Our values: | |

| We actively listen | |

| We are inclusive and collaborative | |

| We strive for excellence | |

| We drive sustainable change | |

| We don’t compromise on safety and integrity | |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 10 |

● PRESENTATION OF TECHNIP ENERGIES ●

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 11 |

● PRESENTATION OF TECHNIP ENERGIES ●

| ● | Financial highlights |

The strength of Technip Energies’ operating modeL including our asset Light approach and our capacity to deliver projects in a challenging environment, as well as our ability to provide strong visibility of future earnings from our backlog and a rich and diversified opportunity set, is demonstrated throughout our first financial results as an independent company.

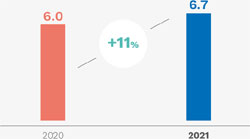

| ADJUSTED REVENUE (In billions of €) | |

| 2021 Adjusted Revenue increased year-on-year by 11% to €6.7 billion buoyed by strong operational execution across the Project Delivery portfolio and significant momentum in Technology, Products & Services. We achieved this thanks to the adaptability and determination of our teams to overcome the challenging external environment relating to the COVID-19 pandemic. The growth of Project Delivery revenues was further supported by the recent growth in backlog with strong business momentum in areas where Technip Energies benefits from differentiated market positioning, including LNG. The double-digit growth of our Technology, Products and Services segment resulted from increased activity in our Loading Systems, Process & Technology and Project Management Consulting activities but more importantly from engineering services for early-phase work in each of our four energy transition domains. |

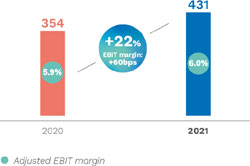

ADJUSTED RECURRING EBIT (In millions of €)

| Adjusted recurring EBIT increased by 22% year-on-year, benefiting from higher revenues and margin expansion to 6.5%, up 60bps versus 2020. Profitability benefited from strong execution on projects heading towards completion phases and growth in higher-margin product lines within Technology, Products & Services, as well as substantially lower corporate costs as the company achieved its SG&A cost reduction target of 20%. Project Delivery profitability had a slight decrease of 20 basis points year-on-year to 6.4% benefiting from good execution on projects in completion phase but not yet capturing the full potential of projects in early stage of execution. This trend also highlights our capacity to weather the challenging backdrop for COVID-19 pandemic, logistics constraints as well as commodities inflation. Technology, Products and Services profitability increased by 110 basis points to 9.2% benefiting from the high value offering of our Process Technology portfolio, our Loading System products and after sales services as well as Project Management Consultancy business. |

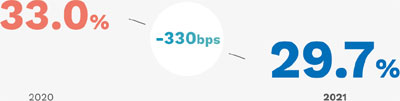

| EFFECTIVE TAX RATE | |

| Effective tax rate is lower year-on-year benefiting from a more favorable mix of earnings. |

Financial information is presented under an adjusted IFRS framework, which records Technip Energies’ proportionate share of equity affiliates and restates the share related to non-controlling interests, and excludes restructuring expenses, merger and integration costs, and litigation costs (see section 2.6. Operating and financial review).

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 12 |

● PRESENTATION OF TECHNIP ENERGIES ●

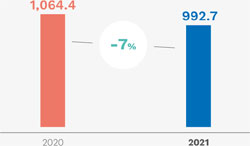

| ADJUSTED OPERATING CASH FLOW (In millions of €) | |

| Adjusted Operating cash flow of €992.7 million, benefited from strong operational performance and working capital inflows associated with new project advances and milestone payments. With capital expenditure, net, of €50.0 million, free cash flow was €942.7 million for the full year of 2021. Excluding the positive impact of working capital in 2021, free cash flow was €315.9 million. |

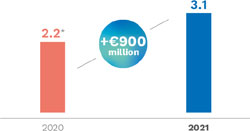

| ADJUSTED NET CASH (In billions of €) | |

| Adjusted net cash at December 31, 2021, was €3.1 billion, benefiting from strong free cash flow throughout 2021. This compares to Adjusted net cash at December 31, 2020, after the impact of the Separation and Distribution Agreement, of €2.2 billion. |

| ADJUSTED ORDER INTAKE | |

| Technip Energies has an extensive and diversified market opportunity set where we can leverage our strengths in natural gas and ethylene, as well as in our emerging market positions in Sustainable Chemistry, carbon capture and Carbon-free energy solutions as the world energy supply pivots to lower carbon intensive sources. Capturing and positioning for these opportunities while remaining intently focused on our selectivity criteria and disciplined bidding principles, Adjusted Order Intake for FY 2021 was €9.8 billion, equating to a book-to-bill of 1.5. Key orders included the major award for the Qatar North Field East, a substantial petrochemical contract awarded by Borouge, a large petrochemical contract with Indian Oil Corporation and two contracts for Neste for development of its Rotterdam Renewables Production Platform. Order intake also benefited from multiple other studies, services contracts and smaller projects. Orders from Russia represented 6% of 2021 total order intake, compared to 8% in 2020. |

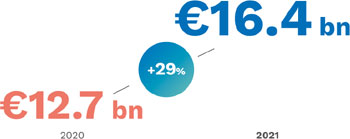

| ADJUSTED BACKLOG | |

| Adjusted Backlog increased by 29%, equivalent to 2.5x 2021 Adjusted Revenue, and benefiting from strong order intake during the year. This provides the Company with strong multi-year visibility. Technip Energies is a global and diversified player with operations carried out in many countries, including Russia. As of December 31, 2021, approximately €3.8 billion or 23% of the Company's backlog relates to Russian projects in execution, which will be impacted by the current crisis. This backlog is scheduled to be executed over the five-year period from 2022 to 2026. |

| 1. | Adjusted recurring EBIT: adjusted profit before net financial expense and income taxes adjusted for items considered as non-recurring. |

| 2. | Net profit attributable to Technip Energies Group. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 13 |

● PRESENTATION OF TECHNIP ENERGIES ●

| ● | Energy transition |

Our four domains

Energy transition is our business. We apply our extensive experience, broad process technology portfolio, project management expertise and Engineering, Procurement, and Construction (“EPC”) capabilities to meet tomorrow’s key energy challenges. Our contribution - which is articulated around our four domain framework - will allow us to accelerate the journey to a low-carbon society.

| Domain 1 LNG |

Natural gas is a critical transition fuel, reducing CO2 emissions from power generation by almost 50% compared to coal. It is the only fossil fuel which will increase in use by 2040 as the world transitions to lower carbon energies. Liquid Natural Gas (“LNG”) is the most dynamic sector of the natural gas market as it dominates growth in international trade.

We have delivered more than 20% of the world’s operating LNG capacity, with world scale liquefaction and export terminals, mid-scale LNG (inland, bunkering) and floating LNG. We are acknowledged for our engineering and project management skills, fast delivery and innovative approaches including of modularization and loading transfer solutions. Over the years we have delivered some of the world’s landmark projects:

| 1. | CCUS: Carbon Capture, Utilization and Storage. |

KEY PROJECTS / REFERENCES

| ● | Qatar NFE |

| ● | Energia Costa Azul LNG |

| ● | Arctic LNG 2 |

| ● | Coral South FLNG |

| ● | Yamal LNG |

| ● | Petronas Satu FLNG |

| ● | Prelude FLNG |

| ● | Ningxia Hanas LNG |

| ● | Yemen LNG |

| ● | Qatargas projects |

We believe that our LNG total market share exceeds 20% when combining recent awards with total awarded liquefaction capability.

The future of LNG is changing – this critical fuel can also be decarbonized. When considering the LNG supply chain from well-head to gas grid in the consumer country, we estimate that as much as 75% of emissions occur during pre-treatment and liquefaction.

The future LNG infrastructure will be low-carbon, including by resorting to electrification the use of which is growing. To achieve a low-to-zero carbon LNG scenario, expertise will be required from multiple domains including hydrogen, CCUS and renewables – all skills that we possess with the result that Technip Energies is uniquely positioned to help the industry succeed in decarbonizing LNG.

For more information on LNG, please see section 2.2.1.1. LNG.

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 14 |

● PRESENTATION OF TECHNIP ENERGIES ●

| Domain 2 Sustainable Chemistry |

We offer a variety of technologies, processes, and services in biofuels, biochemicals and circular economy markets for the generation of sustainable and recyclable products. In these growing markets, we enable the deployment of new technologies from pilot stage to industrial-scale implementation. For more information on Sustainable Chemistry, please see section 2.2.2. Sustainable Fuels, Chemical and Circularity. | |

Biofuels

In biofuels we have proven experience in large refinery and biofuels plant execution. With in-house technologies for bioethanol and ethanol to ethylene and access by way of licensing BtG-BtL pyrolysis oil technology, we have delivered some of the world’s largest biofuels plants:

KEY PROJECTS / REFERENCES

| ● | Neste Biofuels plants based on NexBTL technology, Singapore, and Rotterdam – EPCm services |

| ● | Clariant 2G bioethanol plant based on Sunliquid technology, Poland – Services to develop licensor process design package |

| ● | TotalEnergies La Mède biofuels plant based on Axens Vegan technology, France – EPCm services |

| ● | Btgbioliquids fast pyrolysis bio-oil plants in Sweden and Finland – EPC projects |

| ● | LanzaJet’s Freedom Pines Fuel site using our proprietary Hummingbird technology – License Package and proprietary catalyst supply |

Key technologies and relationships include:

| ● | Fast pyrolysis bio-oil (FPBO) technology where we cooperate with btgbioliquids and which converts biomass residue to pyrolysis oil. This bio-oil is easy to store and transport and can be used in different bio-based economy applications, including for heat, power, transportation fuels and in biorefineries; |

| ● | Hummingbird (for which we hold 18 patent families) which is our proprietary second generation low-cost process for dehydrating ethanol to ethylene; and |

| ● | Our proprietary first generation ethanol technology which is suitable for fuel ethanol applications. |

Biochemicals

We have access to a complete technology portfolio (whether proprietary or from third parties) in our technology centers, with dedicated experts worldwide, and have the ability to develop processes and projects from even very preliminary concepts. Our skills cover the full bio-sourced value chain, including fermentation processes.

KEY PROJECTS / REFERENCES

| ● | Polylactic Acid (PLA) technology integration and licensing (PLAnet® association with Futerro & Sulzer) – Exclusive one-stop shop technology from sugar to biopolymer |

| ● | Meghmani epichlorohydrin (ECH) plant, India – Epicerol® technology services and licensing |

| ● | PBAT/PBS biodegradable polymer plants, China, Taiwan, Korea, Vietnam – Proprietary technology services, equipment sales and licensing |

| ● | UPM biochemical plant, Germany – Services from process consolidation to detailed engineering |

Key technologies and relationships include:

| ● | Epicerol® (for which we hold 36 patents) is our proprietary technology for the production of epichlorohydrin (ECH) from glycerin. The technology uses proprietary enzymes to recycle waste PET (polyethylene terephthalate) plastics into monomers ready for repolymerization into PET with the same technical and physical properties as virgin PET; |

| ● | Biodegradable polybutylene adipate terephtalate (PBAT) and polybutylene succcinate (PBS) polymers (where we hold patents in three families). Polymers are used in applications such as films or foils; and |

| ● | PLAnet” which is a partnership to promote the production of sustainable plastics made of PolyLactic Acid (PLA) combining Futerro’s proprietary technology for the production of lactic acid and raw lactide from sugar or from biomass, Sulzer’s process for the purification of lactide and its polymerization to obtain PLA and our technology integrator capacities. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 15 |

● PRESENTATION OF TECHNIP ENERGIES ●

Circular economy As one of the world’s major providers of proprietary technologies and services in the field of plastics producing plants, ranging from polyesters, polyamides to polyolefins, we are now using our expertise to provide plastic recycling solutions. |  | Domain 3 Decarbonization |

| Decarbonization includes energy efficiency, implementing carbon capture solutions and the production of “blue hydrogen” generated by reforming natural gas associated with carbon capture and storage technologies. For more information on Decarbonization, please see sections 1.2.2. A focus on Hydrogen, 1.2.3. A focus on CO2, 2.2.1.2. Low-carbon LNG and 2.2.1.4. Low-carbon hydrogen and associated derivatives. | ||

KEY PROJECTS / REFERENCES

| ● | Carbios PET demonstration plant, France – EPCm service |

| ● | Pyrolysis-based chemical recycling plants – Feasibility studies, engineering studies, due diligence studies |

| ● | INEOS Infinia technology to recycle PET plastic waste – Alliance Engineering Contractor for Front End Loading services |

| ● | Cooperation agreements to support commercialization of Synova's and Recenso’s pyrolysis technologies |

| ● | Introduction of T.EN pyrolysis gas and pyrolysis oil purification technologies – pure.rGas and pure rOil |

| ● | Polystyrene recycling solution in cooperation with Agilyx – Licensing and collaboration agreement for polystyrene recycling into styrene monomers |

Key technologies and relationships include:

| ● | an agreement with Agilyx to accelerate the implementation of Agilyx’s advanced recycling of post-use polystyrene technology pursuant to which we will market and license Agilyx depolymerization and Technip Energies purification technologies; |

| ● | our proprietary processes to purify pyrolysis products via our pure. rOil and pure.rGas technologies. These technologies, combined with ongoing cooperation with companies owning pyrolysis technology, allow us to supply comprehensive solutions from plastic waste to purified feedstock to re-produce plastics. In France, we have filed two patents related to this technology with an international application to follow and are working on an additional patent application. |

Energy efficiency

Energy efficiency involves continuous improvements in process technologies and plant designs as well as increasing the efficiency of our clients’ facilities, thereby reducing CO2 and other emissions. Our solutions cover ethylene, hydrogen, petrochemical, and other refining processes to which we deploy proprietary technologies (EARTH®, Direct Heating Unit, Low Emission C02 Cracking Furnace). A recent example of innovation relates to the LSV® burner developed by Air Products as to which Technip Energies successfully demonstrated use for the purpose of avoiding direct CO- emissions by substituting 100% hydrogen for methane or other fuel gases.

Carbon Capture Utilization and Storage

With proven experience in CO2 and sulfur components technologies, we are delivering Carbon Capture Utilization and Storage (“CCUS”) solutions and developing the next generation of CCUS technologies through innovative design and technologies to reduce CO2 emissions. We have the ability to call on our technology centers worldwide and have entered into partnerships with leading industry players, including Shell for its Cansolv technology, and Svante for its solid sorbent carbon capture technology. We help define technical and economical carbon management strategies, while accounting for individual client needs and specifications.

“We help define technical and economical carbon management strategies, while accounting for individual client needs.”

KEY PROJECTS / REFERENCES

| ● | 50+ installations delivered – Technologies for removal of carbon dioxide and sulfur components/ CO2 compression and conditioning station |

| ● | HURL Syngas CO2 purification for urea plant, India – EPC Project |

| ● | Peterhead CCS project – FEED Studies, Scotland |

| ● | FOV CCS Oslo project – FEED Studies, Norway |

| ● | Drax Project – Pre-FEED design, UK |

| ● | Bp NZT FEED Project – Leading to EPC bid, UK |

| ● | FEED with ADNOC for its Ghasha mega project including carbon capture integration |

| ● | Qatar NFE LNG, includes capture and sequestration for 2.5 million tons per annum of CO2 |

Blue hydrogen

Low-carbon hydrogen, also referred to as “blue hydrogen” with substantially reduced CO2 emissions, is produced through both minimization of primary footprint and deliberate capture of

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 16 |

● PRESENTATION OF TECHNIP ENERGIES ●

co-produced CO2 and will play a role in the energy transition as an immediate and affordable step to reduce CO2 emissions.

Technip Energies has developed recuperative reforming technologies such as the Technip Energies Parallel Reformer®, and the Enhanced Annular Reforming Tube for Hydrogen “EARTH®”, which are designed to optimize high grade heat utilization (energy efficiency) and reduce primary CO2 footprint by up to 20%. Our in-house combustion and burner technology, the ultra-low NOx advanced Large Scale Vortex “LSV®” burner, was recently successfully tested with 100% hydrogen firing. In May 2021, we launched BlueH2 by T.ENTM, our full suite of deeply decarbonized and cost-competitive solutions for hydrogen production. This suite of solutions comprises flight-proven proprietary technologies and reduces carbon emissions by up to 99% compared with traditional hydrogen. Its flexibility allows BlueH2 to be tailored to individual applications.

KEY PROJECTS / REFERENCES

| ● | 270+ plants using reformer technology worldwide |

| ● | Several of the world’s largest single train hydrogen/ syngas applications |

| ● | Reference fleet rapidly evolving to address the mandate of raising efficiency and reducing carbon emissions |

| ● | 50+ references of CO2 capture in hydrogen plants |

| ● | 30 hydrogen plants with deep CO shift |

| ● | 14 hydrogen plants with recuperative reforming technologies |

For more information on blue hydrogen, please see section 1.2.2 A focus on hydrogen and paragraph 2.2.1.4. Low-carbon hydrogen and associated derivatives.

| Domain 4 Carbon-Free Energy Solutions |

Technip Energies is expanding its technologies and processes portfolio to carbon-free energy chains including “green hydrogen” produced from renewable energy. Carbon-free solutions pose many technical and commercial challenges, requiring the integration of multiple technologies. We apply our solutions and a portfolio of technologies to unlock carbon-free energy chains in green hydrogen, offshore wind and nuclear. For more information on our Carbonfree energy solutions, see section 2.2.3. Carbon-free solutions.

Green hydrogen

Green hydrogen is associated with the “Hydrogen Economy”, a scenario where hydrogen is widely used as a carbon-free energy carrier and an alternative to fossil fuels. We provide designed to scale modular and affordable hydrogen solutions to medium and largescale industrial clients, whether for refining, petrochemicals, power generation, steel manufacturing or ammonia production. We integrate renewable energy production (solar, wind) and energy management systems in our green hydrogen solutions.

KEY PROJECTS / REFERENCES

| ● | More than 20 green hydrogen and green ammonia studies and front end engineering design works/ packages either completed or ongoing. |

| ● | HDF Sara Cleargen – Integration and demonstration of Large Stationary Fuel Cell Systems |

| ● | 19 plants integrating electrolysis (mainly chlorination) |

For more information on green hydrogen, please see section 1.2.2. A focus on hydrogen and section 2.2.3.2. Green hydrogen.

Floating Offshore Wind

We are a pioneer in floating offshore wind and are applying our expertise to full-scale marine energy projects by offering innovative solutions to accompany clients transitioning into the carbon-free energy market. We are working to improve the economics of floating offshore wind which may well become a key component to achieve net-zero emissions.

KEY PROJECTS / REFERENCES

| ● | Havsul Windfarm for Vestavind, Norway – Concept and basic design |

| ● | Iles d’Yeu & Dieppe-Le Treport for Engie/EDPR, France – Feasibility study |

| ● | HVDC/AC platforms – PMC |

| ● | HYWIND floating Offshore Wind platforms for Equinor, Norway |

| ● | Mistral Vertiwind & Inflow in association with EDF Renewables and Nénuphar Development, detailed design & testing of a prototype of the first vertical axis offshore floating wind turbine |

Nuclear, life sciences, mining & metals

Nuclear is a transition energy to low-carbon energy systems. We are present throughout the nuclear industry value chain, which includes mining, chemistry, conversion, reprocessing, underground waste storage and “new build” facilities.

KEY PROJECTS / REFERENCES

| ● | Cigeo project, design contractor for the Industrial Center for Geological Disposal, a deep geological disposal facility for radioactive waste. |

| ● | Somair, Trekkopje and Imouraren projects, Africa PFS to EPCM for open pit mine, uranium ore treatment plants intended to produce “yellow cake” by heap leaching, associated facilities and infrastructures. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 17 |

● PRESENTATION OF TECHNIP ENERGIES ●

● | A focus on Hydrogen |

Hydrogen is the most widely used industrial gas in the refining, chemical and petrochemical industries, and is also expected to become widely used as a clean energy carrier and a decarbonization lever for hard-to-abate sectors in the future.

Carbon neutral hydrogen can be produced either from renewable power and electrolysis (known as “green hydrogen”) or by way of “blue hydrogen”, which is defined as fossil-based hydrogen with a sharply reduced CO2 footprint by resorting to carbon avoidance and capture technologies.

| HYDROGEN CAN CONTRIBUTE 20% OF THE TOTAL ABATEMENT NEEDED IN 2050 |

According to the Hydrogen Council (November 2021) of which Technip Energies is a member

“Hydrogen has a central role in helping the world reach net-zero emissions by 2050 and limit global warming to 1.5 degrees Celsius. Complementing other decarbonization technologies like renewable power, biofuels, or energy efficiency improvements, clean hydrogen (both renewable and low-carbon) offers the only long-term, scalable, and cost-effective option for deep decarbonization in sectors such as steel, maritime, aviation, and ammonia. From now through 2050, hydrogen can avoid 80 gigatons (GT) of cumulative CO2 emissions. With annual abatement potential of 7 GT in 2050, hydrogen can contribute 20% of the total abatement needed in 2050.“

Based on information provided by the Hydrogen Council and the IEA, we estimate that CAPEX for both blue and green hydrogen production will scale up by approximately €90 billion over the next decade and that between 2030 and 2050 investments could amount to US$2 trillion in the aggregate.

| ● | Political decisions, existing infrastructure and levelized cost of hydrogen (LCOH) will drive the choice between blue and green hydrogen, with blue hydrogen being the most competitive scalable option today and in the medium term. |

| ● | Green hydrogen economics are expected to become competitive longer term, with its development being linked to carbon-neutral electricity development through expansion of renewable infrastructure, government funding, with public policy providing the requisite support to accelerate the transition. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 18 |

● PRESENTATION OF TECHNIP ENERGIES ●

●

Green

Hydrogen

Our market survey indicates that green hydrogen prospects are numerous and spread across the world with operators and developers anticipating the future availability of cheap renewable energy power, the reduction in electrolyzer cost, energy efficiency improvements and the emergence of new hydrogen markets. We estimate that between 2030 and 2050 green hydrogen production will increase by circa 15% per year.

We foresee significant development in offshore hydrogen which combines offshore wind and hydrogen transformation. We are actively looking into this emerging market which integrates electricity and hydrogen production and requires the ability to design offshore to onshore field architecture.

●

Blue

Hydrogen

Blue or low-carbon hydrogen is somewhat arbitrarily defined as hydrogen produced with a minimum 70-90% CO2 reduction target with an ever-increasing stretch towards 95% or more and is a necessary stop-gap to enable meaningful greenhouse gas reductions during the period needed to significantly expand renewables infrastructure and decarbonize electricity generation systems.

In the medium term, blue, low-carbon, hydrogen projects are viable when the following three criteria are met:

| ● | Availability of affordable or cheap gas; |

| ● | Existing pipeline infrastructure; and |

| ● | CO2 sequestration potential (i.e. subsurface reservoirs). |

This means that blue hydrogen is likely to be favored in certain geographical areas such as the North Sea, Russia, certain parts of North America, the Middle East and Australia and the creation of concentrated hydrogen hubs in these regions appears highly probable. We estimate that between 2030 and 2050 blue hydrogen production will increase by circa 10% per year.

We are currently seeing a very dynamic pipeline of blue hydrogen prospects and projects developing in countries around the North Sea, driven largely by the UK, Norway and the Netherlands and to a certain extent in Australia and North America. In Russia and the Middle East, we see the emphasis more on developing an export industry through blue ammonia in anticipation of potential markets in Europe and East Asia.

This should in turn lead to a blend of future hydrogen projects, i.e.:

| ● | Blue hydrogen where industrial sites have ready access to CCUS outlets; |

| ● | Electrolysis where CCUS is not possible and/or renewable energy is cheap and readily available. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 19 |

● PRESENTATION OF TECHNIP ENERGIES ●

● | A focus on CO2 |

The key objective of global decarbonization efforts is to rapidly drive global greenhouse gas (“GHG”) emissions down to net-zero by 2050, the prerequisite for containing the impact of climate change to manageable levels by limiting the global temperature increase to 1.5 degrees Celsius above pre-industrial levels.

Within GHG emissions, the biggest volume by far is attributable to CO2 while other GHGs such as NOx or CH4 represent significantly lesser volumes (though they have a higher GHG effect at a molecular level). Accordingly, the most visible effort in the fight against climate change today targets decarbonization, with the objective of achieving a rapid reduction in CO2 emissions globally.

The main driver of global CO emissions is the production and consumption of energy which represented approximately 33 giga tons of the 49.9 giga tons of CO2 equivalent GHGs emitted in 2020. In 2021 the level continued to rise despite COVID-19’s impact on economic activity, leading to a record CO2 concentration in the atmosphere of 421 parts per million in April 2021. In order to meet the challenge of limiting global warming to 1.5 degrees Celsius, the current 33 giga tons annual CO2 emission needs to be driven to a net-zero balance by 2050. Such an ambitious target requires the initiation of all possible CO2 reduction measures immediately and will require a continuing and strong commitment to CO2 reduction over the next 30 years. In its net-zero by 2050

IN ORDER TO MEET THE

CHALLENGE OF LIMITING

GLOBAL WARMING TO

1.5°c

THE CURRENT 33 GIGA

TONS ANNUAL CO2

EMISSION NEEDS TO BE

DRIVEN TO A NET-ZERO

BALANCE BY 2050

BY 2030, THE WORLD WILL

NEED TO REDUCE THE ANNUAL

CO2 EMISSIONS FROM THE

ENERGY INDUSTRY DOWN TO

20.2 Gtpa

report (which was published in May 2021), the International Energy Agency laid out the net-zero by 2050 Scenario which requires a sustained reduction trajectory, achieving a minimum of 12.7 giga tons per annum reduction in annual CO2 emissions by 2030 to maintain the possibility of meeting the Paris Agreement 1.5 degrees Celsius target by 2100. This means the world will need to initiate all efforts to rapidly reduce the annual CO2 emissions from the energy industry down to 20.2 giga tons by 2030.

Achieving such a drastic reduction will entail the rapid and at scale deployment of decarbonization technologies to improve energy efficiency, to change the energy mix and to develop Carbon Capture Utilization and Storage (“CCUS”).

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 20 |

● PRESENTATION OF TECHNIP ENERGIES ●

●

CCUS

Carbon Capture Utilization and Storage

is expected to be a prominent lever and is rapidly growing. In its net-zero by 2050 report, the IEA revised the need for CCUS infrastructure to be created over the next ten years to upwards of 1.67 giga tons, doubling it from the figure previously indicated in its October 2020 report. The net-zero by 2050 report estimates the required CCUS capacity to be installed by 2050 to be 5.7 giga tons per annum which entails doubling the installed CCUS capacity every year.

Considering that the 2020 global operating CCUS capacity is 40 million tons per annum only, this will entail a very significant growth in CCUS investments, which in turn represents a key growth market opportunity for Technip Energies over the next ten years. Whether investments in the requisite volume materialize will depend on factors such as improvements in the affordability of CCUS (which improvements will be driven by technology), favorable evolution in the regulatory environment and government support, increasing global commitment to decarbonization and the continued development of CCUS value chains and business models.

Technip Energies’ current forecast for CCUS investments is of an addressable market of €17 to €28 billion per year until the 2030s. Based on IEA’s NetZero by 2050 report, CCUS investment volume would be split across hydrogen (25%) and fuels (e.g. LNG, refining, biofuels) (17%), power (23%), Direct Air Capture (10%) and general industries (25%).

CCUS investment volume split

●

We observed accelerating client engagement in 2021 during which we were involved in the following projects:

| ● | OGCI/BP – Net-Zero Teesside Power, CO2 Capture and Compression – FEED Competition / UK |

| ● | QP – NFE LNG Project with CCS Section – EPC / Qatar |

| ● | 1Point5 DAC-1 Project – Calciner FEED + OBE / United States |

| ● | Drax BE-CCS Project – Pre-FEED / United Kingdom |

| ● | FOV – CCS Oslo Project Value Engineering & FEED Update / Norway |

| ● | OGCI/BP – Net-Zero Teesside & east Coast Cluster Concept to Define Stages / UK |

| ● | BP – Tangguh Expansion Ph2 – Offshore CCS/ EGR – Pre-FEED / Indonesia |

| ● | ADNOC – Hail & Gahsa Mega Project with Carbon Capture Integration – FEED / UAE |

| ● | SIBUR – Tobolsk Ethylene Plant Carbon Capture Unit – Pre-FEED / Russia |

| ● | SANTOS – Darwin LNG CCS Facility Concept Select and Asses / Australia |

| ● | PTTEP – CO2 to Methanol Pilot Project – PreFS / Thailan |

| ● | Saudi Aramco – Decarbonization Master Plan / Saudi Arabia |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 21 |

● PRESENTATION OF TECHNIP ENERGIES ●

● | Key events |

The Spin-off

2021 is the year we became a standalone Group.

| ||||

Our journey started on August 26, 2019, when TechnipFMC announced that the TechnipFMC Board of Directors had unanimously authorized the preparation to separate Technip Energies’ businesses from TechnipFMC (the “Spin-off”).

March 15, 2020

● TechnipFMC announced that the market environment resulting from the COVID-19 pandemic was not conducive to completing the Spin-off during the first half of 2020.

January 7, 2021

● TechnipFMC announced the resumption of activities towards the Spin-off.

February 15, 2021

● TechnipFMC announced the completion of the Spin-off byway of a special dividend of 50.1% of the Technip Energies N.V. shares (the “Shares”), held by TechnipFMC to the shareholders of TechnipFMC, with TechnipFMC retaining 49.9% of Technip Energies’ shares. Technip Energies shares started trading on the following day on | Euronext Paris. Over-the-Counter trading in Technip Energies American Depositary Receipts started on February 23, 2021.

The Spin-off has allowed us to focus on our strengths, build our strategy and business model whilst providing improved flexibility to pursue growth opportunities with increased focus on energy transition technologies and partnerships.

We entered this next phase of growth with a very strong balance sheet and a tailored capital structure. As an independent company, we have gained the flexibility to adopt a capital allocation policy optimally suited for our business profile and market positioning.

We are able to focus on our core competencies, engineering design and execution for large industrial facilities, which generally have longer investment cycles, and the potential for higher return on invested capital due to the low capital intensity of our businesses.

The Spin-off has also enhanced our ability to attract and retain qualified management and talent by making Technip Energies a more attractive platform for executives and employees with specialized downstream engineering and project execution expertise and experience. Additionally, the Spin-off has allowed us to more clearly align management compensation with the performance of each of our separate businesses.

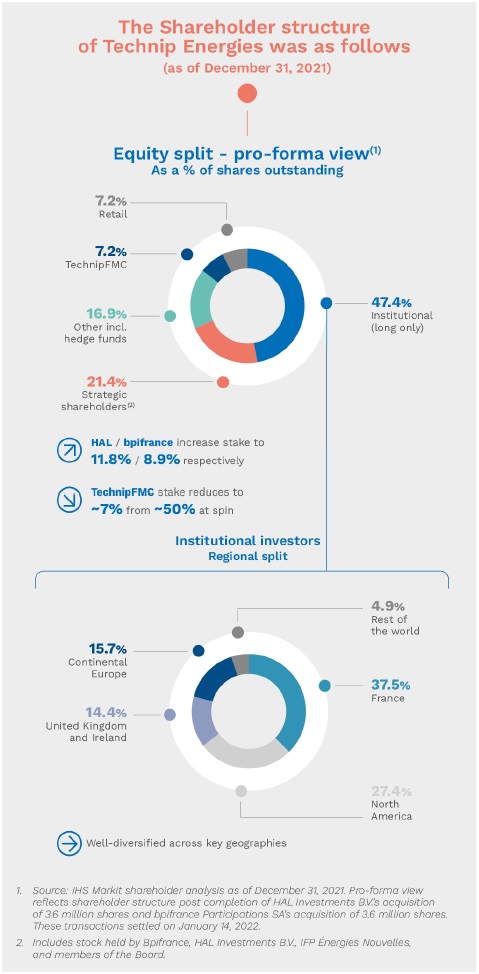

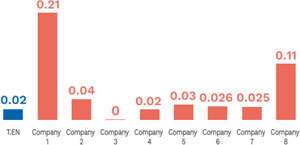

One year on, the rationale for the Spin-off has been upheld by our many developments and achievements – we are applying our collective energies to meet tomorrow’s key energy challenges. | A diversified Shareholder structure

Prior to completion of the Spin-off, Technip Energies was fully owned by TechnipFMC.

February 15, 2021

● TechnipFMC distributed to TechnipFMC shareholders 50.1% of the Technip Energies Shares that were issued and outstanding immediately after completion of the distribution. While initially retaining a 49.9% interest in Technip Energies, TechnipFMC indicated at the time its intent was to significantly reduce its shareholding in Technip Energies over the 18 months following the Spin-off.

TechnipFMC has been able to significantly reduce its stake in Technip Energies over the course of 2021 and into 2022, with many other shareholders having strengthened their initial stake or taken significant first positions, ensuring a diversified shareholder base with anchor shareholders for the years to come.

March 31, 2021

● Bpifrance announced that it would invest $100 million in Technip Energies strengthening its then current stake to approximately 7% of Technip Energies’ share capital, reinforcing Bpifrance’s commitment to being a long-term reference Shareholder and supporting our energy transition focused strategy.

April 26, 2021

● TechnipFMC announced that it would be selling a stake in Technip Energies through a private placement by way of an accelerated book building process thereby further reducing its stake in the Company to approximately 31%. On the same date, Technip Energies announced that it has agreed to acquire €20 million equivalent of its own ordinary shares from TechnipFMC, concurrently with | ||

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 22 |

● PRESENTATION OF TECHNIP ENERGIES ●

TechnipFMC’s announced sell-down, at a price per share equal to the price set in the accelerated book building process.

July 29, 2021

● TechnipFMC announced the further sale of 16 million Technip Energies shares representing approximately 9% of Technip Energies’ issued and outstanding share capital through an accelerated bookbuiLd offering. Upon completion of the transaction, TechnipFMC retained a direct stake of approximately 22% of Technip Energies’ issued and outstanding share capital.

September 3, 2021

● TechnipFMC announced the sale of 17.6 million Technip Energies N.V. shares through a private sale transaction with HAL Investments B.V, the Dutch investment subsidiary of HAL Holding, N.V. Upon completion of the sale, TechnipFMC retained a direct stake of approximately 12.3% of our share capital.

January 11, 2022

● we announced that we would be acquiring 1.8 million of our own ordinary shares from TechnipFMC. This was part of TechnipFMC’s announced further sell-clown of its stake in Technip Energies, through a private sale transaction which also included Bpifrance and HAL Investments B.V each agreeing to purchase 3.6 million of Technip Energies’ Shares from TechnipFMC.

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 23 |

● PRESENTATION OF TECHNIP ENERGIES ●

2021

by month

● February

February 9, 2021

CTJV, a joint venture between Chiyoda Corporation and Technip Energies, was awarded a major(1) Engineering, Procurement, Construction and Commissioning contract by Qatar Energy (formerly Qatar Petroleum) for the onshore facilities of the North Field East Project. See section 2.3.2. Main Project Delivery projects under execution in 2021.

February 16, 2022 The Spin-off from TechnipFMC was completed.

1. A “major’ award for Technip Energies is a contract over €1.0 billion. | March 25, 2021

Technip Energies and NIPIGAS, a Russian leader in engineering, procurement and construction management, announced the creation of NOVA ENERGIES, a joint venture to drive the energy transition journey in Russia. The new joint venture will provide a wide range of expertise, including Engineering and Design, Project Documentation and CAPEX estimates as well as Engineering, Procurement, Construction, Installation, and Commissioning for CO2 removal, carbon capture, clean hydrogen production, bio energies, bio refineries, bio chemistry, ammonia, as well as other energy transition related themes.

March ●

|

● April

April 7, 2021

Technip Energies was awarded a significant(1) Engineering, Procurement, Construction and Commissioning (“EPCC”) contract by Indian Oil Corporation Limited for its BR9 Expansion Project in Barauni, Bihar, in the Eastern part of India. This EPCC contract covers the installation of a new Once-through Hydrocracker Unit of 1 million metric tons per annum capacity, a Fuel Gas Treatment Unit and the associated facilities. The OHCU, in combination with downstream refinery units, will enable production of BS VI Grade fuels - similar to Euro VI Grade fuels - and petrochemicals.

1. A “significant” award for Technip Energies is a contract representing between €50 million and €250 million. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 24 |

● PRESENTATION OF TECHNIP ENERGIES ●

● May

May 6, 2021

Technip Energies announced the launch of BlueH2 by TEN™, its full suite of deeply-decarbonized and affordable solutions for hydrogen production. Technip Energies’ BlueH2 by TEN™ solutions offer many advantages, including: • Up to a 99% reduction in the carbon footprint compared to the traditional hydrogen process - from ~10 down to 0.1 kilogram CO2 per kilogram H2, while maintaining flexibility to be tailored to each individual application; • Maximum hydrogen yield, minimum energy demand (fuel + power), and highly-efficient carbon avoidance and carbon capture utilization and storage techniques, to arrive at the lowest cost of (blue) hydrogen “LCOH”; • Comprised of “flight proven”, company-developed and owned technologies and equipment, available to customers today; • Optional integration of highly efficient, low-carbon cogeneration of power. | May 10, 2021

Technip Energies was awarded a large(1) Engineering, Procurement, Construction and Commissioning contract by Indian Oil Corporation Limited for its Para Xylene and Purified Terephthalic Acid (“PTA”) complex project at Paradip, Orissa, on the East Coast of India. This EPCC contract covers the delivery of a new 1.2 million tons per annum PTA plant and associated facilities. PTA is a major raw material used to manufacture polyester fibers, PET bottles and polyester film used in packaging applications.

May 20, 2021

Technip Energies N.V. announced it had priced its inaugural offering of €600 million aggregate principal amount of 1.125% senior unsecured notes due 2028 (the “Notes”). The offering was more than 3x oversubscribed among a large European investor base. Technip Energies used the net proceeds from the offering of the Notes for general corporate purposes, including the refinancing of the €650 million bridge facility made available to Technip Energies in connection with the Spin-off of Technip Energies from TechnipFMC plc.

May 25, 2021

Technip Energy was awarded two contracts(1) by Neste for work on the development of their renewables production platform in Rotterdam, the Netherlands, as part of the existing Partnership Agreement between Neste and Technip Energies. The first contract covers Engineering, Procurement services and Construction management for the modification of Neste’s existing renewables production refinery in Rotterdam, the Netherlands, to enable production of Sustainable | Aviation Fuel (SAF). The modifications to the refinery, an investment of approximately EUR 190 million, will enable Neste to optionally produce up to 500,000 tons of SAF per annum as part of the existing capacity. The second contract covers the Front-End Engineering and Design for Neste’s possible next world scale renewable products refinery in Rotterdam. The production process is based on Neste’s proprietary NEXBTL state-of-the-art technology, which allows the conversion of waste and residue feedstock into renewable products like renewable diesel, sustainable aviation fuel and renewable solutions for the polymers and chemical industry.

May 27, 2021

Technip Energies through its wholly-owned subsidiary in the UK (Technip E&C Limited) was awarded a significant contract for Project Engineering and Management Services by Kuwait Integrated Petroleum Industries Company (“KIPIC”) for various projects in southern Kuwait. The contract is for six years duration and covers Project Engineering and Management Services for various potential projects in the Al-Zour complex, including the Al-Zour Refinery, Petrochemical Complex, LNG Import Facilities and other facilities belonging to KIPIC.

1. A “large” award for Technip Energies is a contract representing between €250 million and €500 million of revenue.

2. The sum of these two contracts was worth between €50 million and €250 million. |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 25 |

● PRESENTATION OF TECHNIP ENERGIES ●

July 9, 2021

Technip Energies announced the implementation of a liquidity agreement with Kepler Cheuvreux to enhance the liquidity of Technip Energies’ shares admitted to trading on Euronext Paris.

July 21, 2021

TotalEnergies and Technip Energies signed a Technical Cooperation Agreement to jointly develop low-carbon solutions for LNG production and offshore facilities to accelerate the energy transition. As part of this agreement, both parties will explore new concepts and technologies, in order to reduce carbon footprint of existing facilities and greenfield projects in key areas, such as: LNG production, cryogeny, production and use of hydrogen for power generation, or processes for carbon capture, utilization and storage. The qualification of new architectures and equipment that will be developed in these areas is also part of the agreement.

● July

|

● September

September 22, 2021

Technip Energies and National Petroleum Construction Company (“NPCC”), a subsidiary of National Marine Dredging company, signed a Memorandum of Understanding to advance energy transition in the United Arab Emirates and other countries in the MENA region. The aim of this agreement is to explore and capitalize on this evolving opportunity and to provide added value services. Technip Energies and NPCC will create a Joint Venture (JV) to drive the energy transition journey. | October 14, 2021

Technip Energies announced that it had been awarded an Engineering, Procurement, Construction and Commissioning (EPCC) contract by NTPC for its Proton Exchange Membrane (“PEM”) Based Hydrogen Generation Plant project at Vindhyachal, Madhya Pradesh, India. The EPCC contract covers the delivery of a 5 MW Hydrogen Generation Plant using PEM Electrolysis technology at a Super Thermal Power Station. This project is suited for a large scale green hydrogen production facility as power to Electrolyzer can be replaced with renewable electricity in the future.

October 19, 2021

Technip Energies and TÜV Rheinland signed a strategic alliance to offer Project Management Consulting Services to clients in the infrastructure, energy, chemicals and mining & metals industries. The 5-year alliance will leverage the two companies’ strengths as world class players in their respective industries and grow the footprint of both parties to better serve clients globally. This alliance will enable both parties to expand their Project Management Consultancy as well as project controls and supervision capabilities into new market opportunities to create high-value services for clients.

● October

|

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 26 |

● PRESENTATION OF TECHNIP ENERGIES ●

November 15, 2021

Technip Energies and Petronas announced that they had signed a Heads of Agreement establishing a strategic collaboration framework for the further development and commercialization of carbon capture technologies. These include Petronas’ Rotating Pack Bed assisted cryogenic CO2 recovery technology (CryoMin), and membrane based CO2 recovery technology (PN2).

November 22, 2021

Technip Energies and Svante announced that they had entered into a memorandum of understanding to further develop Svante’s solid sorbent carbon capture technology and provide integrated solutions from concept to project delivery. The partnership will explore opportunities in Europe, Middle-East and Africa and Russian Federation markets where Svante’s technology would be selected by end Clients for industrial carbon capture projects.

November ●

|

● December

December 6, 2021

Technip Energies announced that it had been awarded a substantial(1) Engineering, Procurement, and Construction (EPC) contract in consortium with TARGET Engineering by Abu Dhabi Polymers co. Ltd. (Borouge), a joint-venture between ADNOC and Borealis, for the construction of a new Ethane Cracker Unit, to be integrated in the Borouge 4 petrochemical complex in Ruwais, UAE. This EPC contract covers the delivery of a new Ethane Cracker Unit, in excess of 1.5 million tons per annum, based on proprietary Technip Energies technology.

1. A “substantial” award for Technip Energies is a contract representing between €500 million and €1 billion. | December 8, 2021

Technip Energies announced it had been awarded a contract by the Abu Dhabi National Oil Company to update the Front-End Engineering Design (FEED) for the Ghasha mega project including accelerating the integration of carbon capture into the development.

December 15, 2021

Technip Energies announced that, as leader of a consortium with GE Gas Power, it has been selected by BP, on behalf of its partners, to perform a FEED study for the Net-Zero Teesside Power project and the Northern Endurance Partnership’s carbon compression infrastructure in Teesside, UK. Located in the UK’s Teesside region, the Net-Zero Teesside project comprises industrial, power and hydrogen businesses which aim to decarbonize their operations and become UK’s first decarbonized cluster.

2022 |

| ANNUAL REPORT ● 2021 ● TECHNIP ENERGIES | 27 |

● PRESENTATION OF TECHNIP ENERGIES ●

● | Our Purpose |

It is evident that the 21st century challenges us to acknowledge the changes upon us, the industry and the world at large. While change can be unsettling, it is real and necessary, demanding our undivided attention to ever-growing concerns for climate change, inequality and dwindling natural resources across the world.