internal approvals or delays associated with technology or system implementations, thereby further delaying the implementation process. Our current and future clients may not be willing or able to invest the time and resources necessary to implement our services, and we may fail to enter into arrangements for our services with potential clients to which we have devoted significant time and resources, which could have an adverse effect on our business, financial condition and results of operations.

While managing our growth, we may have difficulty updating our internal operational and financial systems as well as our existing internal accounting, financial and cost control systems.

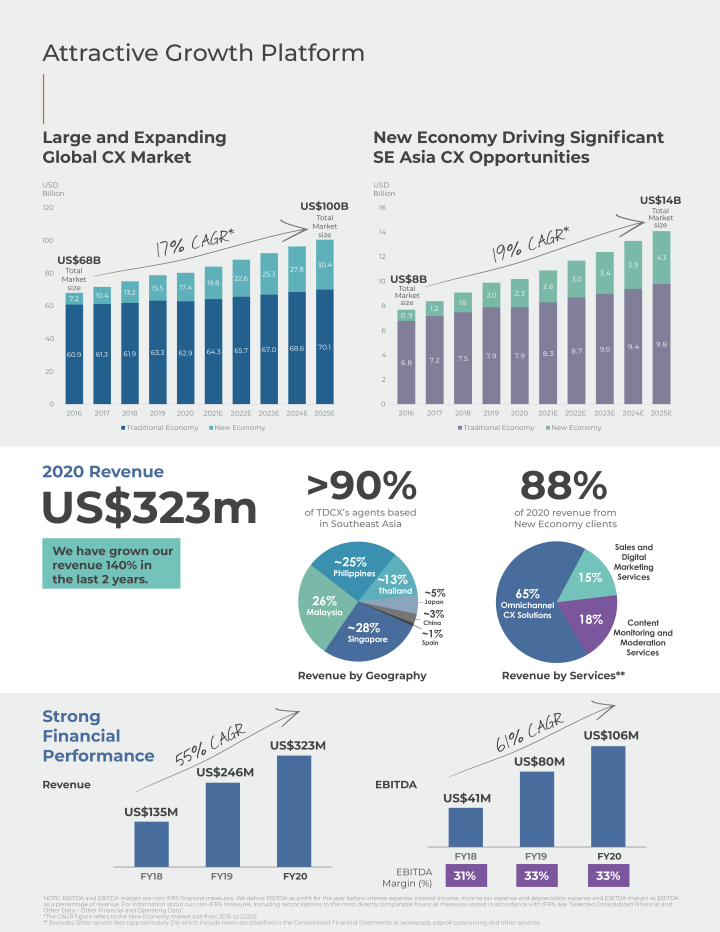

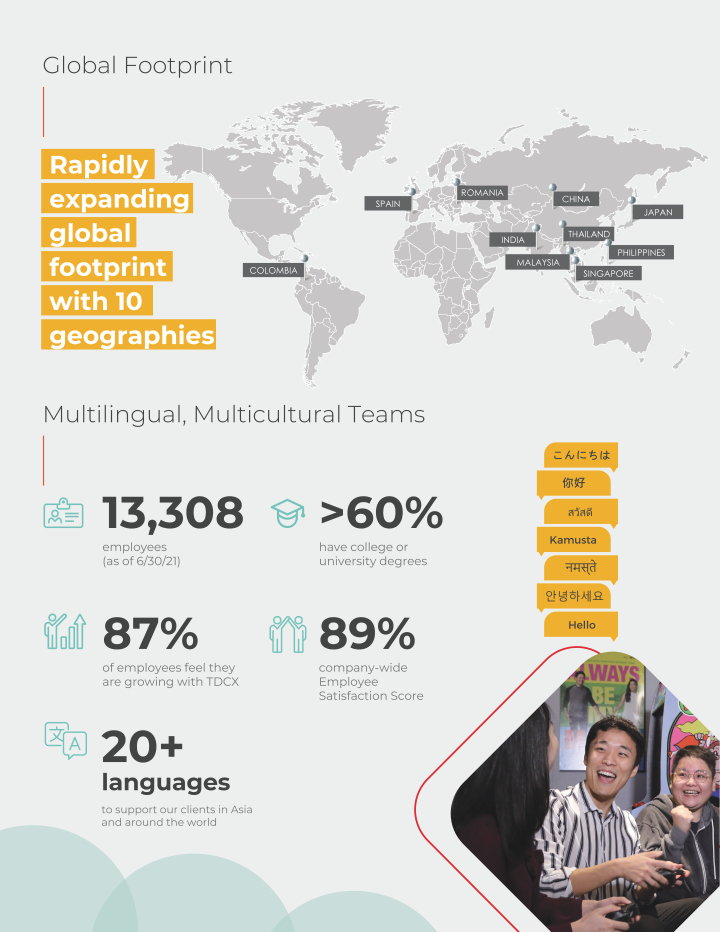

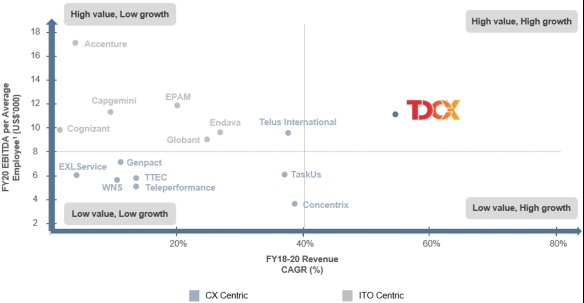

Since our founding in 1995, and particularly from 2012, we have experienced rapid growth and significantly expanded our operations in key regions and client industries, especially with our clients involved in innovative businesses engaged in the new economy. For years ended December 31, 2018, 2019 and 2020 and the six months ended June 30, 2020 and 2021, our number of agents was 4,608, 7,213, 9,128, 7,473 and 10,020, respectively. In the years ended December 31, 2018, 2019 and 2020 and in the six months ended June 30, 2020 and 2021, we generated revenue of S$181.2 million, S$330.3 million, S$434.7 million, S$209.3 million and S$251.6 million, respectively.

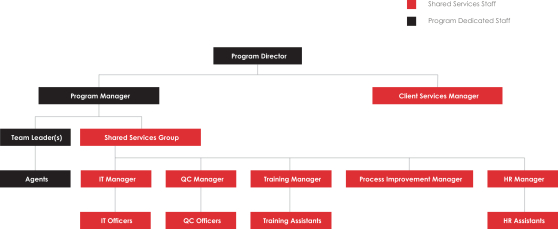

The rapid growth which we have experienced requires us to constantly monitor, evaluate and, if appropriate, reallocate our management and financial and operational resources. In order to manage growth effectively, we must recruit new employees, including employees in middle-management positions such as team leader roles, and implement and improve operational systems, procedures and internal controls on a timely basis.

In addition, we need to update our existing internal accounting, financial and cost control systems to ensure that we can access all necessary financial information in line with the increasing demands of our business. Any internal and disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, but not absolute, assurance that the objectives of the control system are met. The design of a control system must consider the benefits of controls relative to their costs. Inherent limitations within a control system include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple errors or mistakes. Additionally, controls can be circumvented by individuals acting alone or in collusion with others to override controls, which may also include controls implemented by our clients. If we are unable to assert that our internal controls over financial reporting are effective now or in the future, or if our auditors are unable to express an opinion on the effectiveness of our internal controls, we could lose investor confidence in the accuracy and completeness of our financial reports.

If we fail to implement these systems, procedures and controls or update these systems on a timely basis, we may not be able to service our clients’ needs, hire and retain new employees, pursue new business, complete future acquisitions or operate our business effectively. Failure to effectively transfer new client business to our delivery centers, properly budget transfer costs, accurately estimate operational costs associated with new contracts or access financial, accounting or cost control information in a timely fashion could result in delays in executing client contracts, trigger service level penalties or cause our profit margins not to meet our expectations. Any of the foregoing factors could adversely affect our business, financial condition and results of operations.

If we fail to implement and maintain an effective system of internal controls, we may be unable to accurately or timely report our results of operations or prevent fraud, and investor confidence and the market price of our ADSs may be materially and adversely affected.

Prior to this offering, we were a private company with limited accounting personnel resources. Furthermore, prior to this offering, our management has not performed an assessment of the effectiveness of our internal control over financial reporting, and our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud.

40