As filed with the Securities and Exchange Commission on January 28, 2022.

Registration No. 333-253959

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 9

to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ostin Technology Group Co., Ltd.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | | 3679 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification number) |

Building 2, 101/201

1 Kechuang Road

Qixia District, Nanjing

Jiangsu Province, China 210046

Tel: +86 (25) 58595234

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

Tel: (302) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications

sent to agent for service, should be sent to:

| David Selengut, Esq. | Louis Taubman, Esq. |

| Wei Wang, Esq. | Hunter Taubman Fischer & Li LLC |

| Ellenoff Grossman & Schole LLP | 48 Wall Street, Suite 1100 |

| 1345 Avenue of the Americas, 11th Floor | New York, NY 10005 |

| New York, NY 10105 | Tel: 212-530-2206 |

| Tel: (212) 370-1300 | |

| Fax: (212) 370-7889 | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| Title of the Class of Securities to be Registered | | Amount

to Be

Registered | | | Proposed

Offering

Price Per

Share | | | Proposed

Maximum

Aggregate

Offering

Price (1) | | | Amount of

Registration

Fee | |

| Ordinary shares, par value $0.0001(2) | | | 3,881,250 | | | $ | 4.00 | | | $ | 15,525,000 | | | $ | 1,694 | |

| Total | | | 3,881,250 | | | | | | | $ | 15,525,000 | | | $ | 1,694 | (3) |

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional ordinary shares as may be issued after the date hereof as a result of share sub-divisions, share capitalization or similar transactions. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED JANUARY 28, 2022 |

3,375,000 Ordinary Shares

Ostin Technology Group Co., Ltd.

This is the initial public offering of ordinary shares of Ostin Technology Group Co., Ltd., a Cayman Islands exempted company. We are offering 3,375,000 ordinary shares, par value $0.0001 per share. We expect the initial public offering price of the shares to be $4.00 per share. Prior to this offering, there has been no public market for our ordinary shares. We have applied to have our ordinary shares listed on the Nasdaq Capital Market (or Nasdaq) under the symbol “OST.” We cannot guarantee that we will be successful in listing our ordinary shares on the Nasdaq; however, we will not complete this offering unless we are so listed.

We are both an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company” and “Prospectus Summary—Implications of Being a Foreign Private Issuer.”

Investing in our ordinary shares involves a significant degree of risk. We are a holding company incorporated in the Cayman Islands. Our ordinary shares offered in this prospectus are shares of our Cayman Islands holding company. As a holding company with no material operations of our own, we conduct substantially all of our operations through our operating entities established in the People’s Republic of China, or the PRC, primarily Jiangsu Austin Optronics Technology Co., Ltd. (“Jiangsu Austin”), our majority owned subsidiary and its subsidiaries. Jiangsu Austin is also partially controlled through a series of contractual arrangements and therefore is also referred to as our variable interest entity, or VIE. As a result, our investors hold direct equity interest in Jiangsu Austin with respect to 57.88% of its shares and do not hold and may never hold direct equity interest in Jiangsu Austin with respect to 39.97% of its shares which are controlled through the VIE arrangements. The VIE arrangements provide contractual exposure to foreign investment in such companies rather than replicating an investment. There is no limitation or restriction on foreign investment in the industry where Jiangsu Austin operates. We use a VIE structure to control a minority interest in Jiangsu Austin because such minority interest is collectively owned by Jiangsu Austin’s directors, supervisors and senior management members who are subject to timing and volume limitations on the transfer of such interest under the laws of the PRC. We have evaluated the guidance in FASB ASC 810 and determined that we are the primary Beneficiary of the Vie, for Accounting Purposes, based upon such contractual arrangements. Accordingly, under U.S. GAAP, the results of the VIE are consolidated in our financial statements. However, uncertainties exist as to our ability to enforce the VIE arrangements, and the VIE arrangements have not been tested in a court of law. Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and our ordinary shares could decline in value or become worthless. For a description of our corporate structure and the VIE arrangements as well as related risks, see “Corporate Structure – VIE Arrangements” on page 51 and “Risk Factors – Risks Related to Our Corporate Structure” on page 34.

In addition, as we conduct substantially all of our operations in China, we are subject to legal and operational risks associated with having substantially all of our operations in China, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or United States regulations, which risks could result in a material change in our operations and/or cause the value of our ordinary shares to significantly decline or become worthless and affect our ability to offer or continue to offer securities to investors. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We do not believe that we are directly subject to these regulatory actions or statements, as we have not implemented any monopolistic behavior and our business does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. As of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other PRC governmental authorities for our overseas listing plan, nor has our company, any of our subsidiaries or our VIE received any inquiry, notice, warning or sanctions regarding our planned overseas listing from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. exchange. The Standing Committee of the National People’s Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that requires our company, our VIE or its subsidiaries to obtain regulatory approval from Chinese authorities before listing in the U.S. See “Risk Factors” beginning on page 13 for a discussion of these legal and operational risks and other information that should be considered before making a decision to purchase our ordinary shares.

Furthermore, as more stringent criteria have been imposed by the SEC and the Public Company Accounting Oversight Board (the “PCAOB”) recently, our securities may be prohibited from trading if our auditor cannot be fully inspected. On December 16, 2021, the PCAOB issued its determination that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions, and the PCAOB included in the report of its determination a list of the accounting firms that are headquartered in the PRC or Hong Kong. This list does not include our auditor, TPS Thayer, LLC. While our auditor is based in the U.S. and is registered with PCAOB and subject to PCAOB inspection, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause our securities to be delisted from the stock exchange. See “Risk Factors — Risks Related to Doing Business in China — Our ordinary shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors. The delisting of our ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.”

As a holding company, we may rely on dividends and other distributions on equity paid by our PRC subsidiaries for our cash and financing requirements. If any of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. However, neither any of our subsidiary or our VIE has made any dividends or other distributions to our holding company or any U.S. investors as of the date of this prospectus. In the future, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our PRC subsidiaries via capital contribution or shareholder loans, as the case may be.

| | | Per Share | | | Total | |

| Public offering price | | $ | 4.00 | | | $ | 13,500,000 | |

| Underwriting fee and commissions(1)(2) | | $ | 0.28 | | | $ | 945,000 | |

| Proceeds to us, before expenses | | $ | 3.72 | | | $ | 12,555,000 | |

| (1) | Represents underwriting discount and commissions equal to 7.0% per share (or $0.28 per share). |

| (2) | Does not include a non-accountable expense allowance equal to 1.0% of the gross proceeds of this offering, payable to the underwriters, or the reimbursement of certain expenses of the underwriters. For a description of the other terms of compensation to be received by the underwriters, see “Underwriting.” |

We have granted a 45-day option to the representatives of the underwriters to purchase up to an additional 506,250 ordinary shares, solely to cover over-allotments, if any.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to purchasers against payment therefor on [●], 2022.

The date of this prospectus is [●], 2022.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

For investors outside of the United States of America (the “United States” or the “U.S.”): Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our Shares and the distribution of this prospectus outside of the United States.

ABOUT THIS PROSPECTUS

Unless otherwise indicated, in this prospectus, the following terms shall have the meaning set out below:

| “AIO” | | All-in-one computer |

| “AMOLED” | | Active-matrix organic light emitting diode, is an organic light emitting diode display technology |

| “China” or “PRC” | | The People’s Republic of China, excluding Taiwan and the special administrative regions of Hong Kong and Macau |

| “Code” | | The Internal Revenue Code of 1986, as amended |

| “Exchange Act” | | Securities Exchange Act of 1934, as amended |

| “Jiangsu Austin” | | Our majority owned subsidiary which is also partially controlled by us through a series of contractual arrangements, which is a company limited by shares incorporated in China |

| “LED” | | Light emitting diode, a light emitting display technology |

| “Nasdaq” | | Nasdaq Stock Market LLC |

| “Nanjing Aosa” or “WOEF” | | Nanjing Aosa Technology Development Co., Ltd., our wholly owned subsidiary, which is a limited liability company formed in China |

| “OLED” | | Organic light emitting diode, a light emitting display technology |

| “ordinary shares” | | Our ordinary shares, par value $0.0001 per share |

| “Ostin” | | Ostin Technology Group Co., Ltd., a Cayman Islands exempted company |

| “our company,” the “Company,” “us” or “we” | | Ostin Technology Group Co., Ltd. and/or its consolidated subsidiaries, unless the context suggests otherwise |

| “PCAOB” | | Public Company Accounting Oversight Board |

| “polarizer” | | Polarizing film, a composite optical film used in LCD/OLED/AMOLED displays |

| “RMB” or “Renminbi” | | Legal currency of China |

| “PDP” | | Plasma display panel, a type of flat panel display that uses small cells containing plasma |

| “PFIC” | | A passive foreign investment company |

| “SEC” | | The United States Securities and Exchange Commission |

| “Shanghai Inabata” | | Shanghai Inabata Trading Co., Ltd., a wholly owned subsidiary of Inabata & Co., Ltd. |

| “Securities Act” | | The Securities Act of 1933, as amended |

| “TFT-LCD” | | Thin-film transistor liquid crystal display, a display technology |

| “US$,” “U.S. dollars,” “$,” and “dollars” | | Legal currency of the United States |

| “VIE” | | Variable interest entity whose financial statements are included in our consolidated financial statements as a result of a series of agreements based upon which, under U.S. GAAP (as defined below), we are considered the primary beneficiary of Jiangsu Austin for accounting purposes. |

Our reporting and functional currency is the Renminbi. Solely for the convenience of the reader, this prospectus contains translations of some RMB amounts into U.S. dollars, at specified rates. Except as otherwise stated in this prospectus, all translations from RMB to U.S. dollars are made at RMB6.4434 to US$1.00, the rate published by the Federal Reserve Board on December 31, 2021. No representation is made that the RMB amounts referred to in this prospectus could have been or could be converted into U.S. dollars at such rate.

Our fiscal year end is September 30. References to a particular “fiscal year” are to our fiscal year ended September 30 of that calendar year. Our audited consolidated financial statements have been prepared in accordance with the generally accepted accounting principles in the United States (the “U.S. GAAP”).

Except where indicated or where the context otherwise requires, all information in this prospectus assumes no exercise by the underwriters of their over-allotment option.

We obtained the industry, market and competitive position data in this prospectus from our own internal estimates, surveys, and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted by third parties, including, but not limited to, CINNO Research. None of the independent industry publications used in this prospectus were prepared on our behalf. Industry publications, research, surveys, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus, and to risks due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these forecasts and other forward-looking information.

We have proprietary rights to trademarks used in this prospectus that are important to our business, many of which are registered under applicable intellectual property laws. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are without the ®, ™ and other similar symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This prospectus contains additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other person.

PROSPECTUS SUMMARY

Investors are cautioned that you buying shares of a Cayman Islands holding company without no operation of its own that only holds 57.88% of the shares of a China-based operating company while maintains contractual controls over 39.97% of the shares of such entity.

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our financial statements and related notes and the risks described under “Risk Factors.” Our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

Overview

We are a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct substantially all of our operations through our operating entities established in the PRC, primarily Jiangsu Austin Optronics Technology Co., Ltd. (“Jiangsu Austin”), our majority owned subsidiary and its subsidiaries. Jiangsu Austin is also partially controlled through a series of contractual arrangements and therefore is also referred to as our VIE.

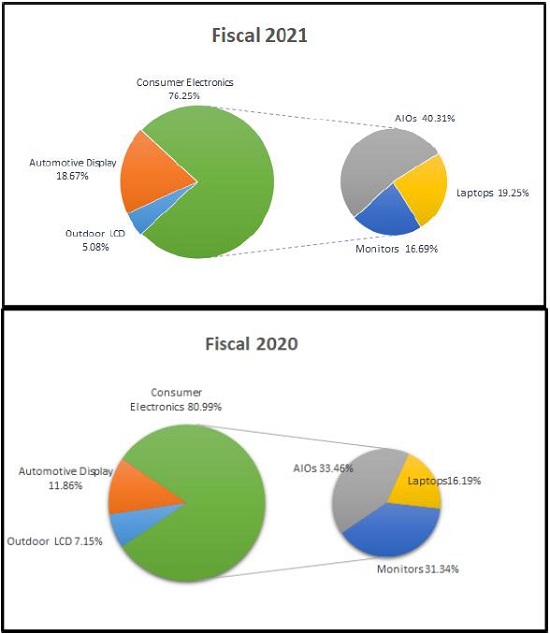

We are a supplier of display modules and polarizers in China. We design, develop and manufacture TFT-LCD modules in a wide range of sizes and customized size according to the specifications of our customers. Our display modules are mainly used in consumer electronics, outdoor LCD displays and automotive displays. We also manufacture polarizers used in the TFT-LCD display modules and are in the process of developing polarizers for the OLED display panel.

We were formed in 2010 by a group of individuals with industry expertise and have been operating our business, primarily through Jiangsu Austin and its subsidiaries. We currently operate four manufacturing facilities in China with an aggregate of 54,665 square meters - two are located in Jiangsu Province for the manufacture of display modules, one in Chengdu, Sichuan Province for the manufacture of TFT-LCD polarizers and one in Luzhou, Sichuan Province, for manufacture of display modules primarily to be used in devices in the education sector.

We seek to build our market position based on our close collaborative customer relationships and a focus on development of high-end display products and new display materials. Our customers include many of the leading manufacturers of computers, automotive electronics and LCD displays in China and worldwide. We have also successfully introduced our polarizers to many companies in China and have witnessed a significant growth in revenue since we commenced the production and sales of polarizers in 2019.

Our dedication to technology and innovation has helped us win the high new-tech enterprise designation in Jiangsu Province, China, which entitles Jiangsu Austin, our main operating entity in China, to a preferential tax rate of 15% and numerous other recognitions, including but not limited to, Jiangsu Provincial Credit Enterprise and Key Optoelectronic Product Laboratory, which are endorsements to our credit and research and development capabilities.

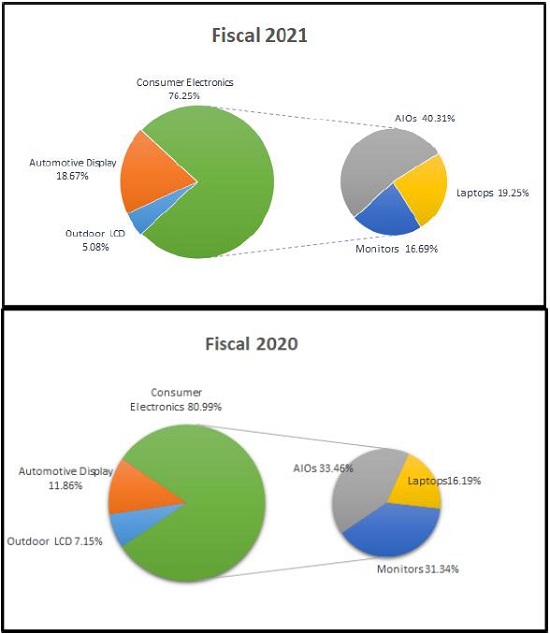

During the fiscal years ended September 30, 2021 and 2020, our revenues were $167,744,801 and $140,073,917, respectively, and net income was $3,295,507 and $2,831,286, respectively.

Our Strengths

We believe that the following strengths contribute to our growth and differentiate us from our competitors:

| ● | Our optimized production capacities; |

| | | |

| ● | Strong research and development capabilities; |

| | | |

| ● | Strengthened market position; |

| | | |

| ● | Long-standing customer relationships; and |

| | | |

| ● | Experienced management team. |

Our Strategies

We intend to grow our business using the following key strategies:

| | ● | Expand our collaboration with our end-brand clients; |

| | | |

| | ● | Increase our research and development efforts for new products; and |

| | | |

| | ● | Upgrade our production lines. |

Our Corporate History and Structure

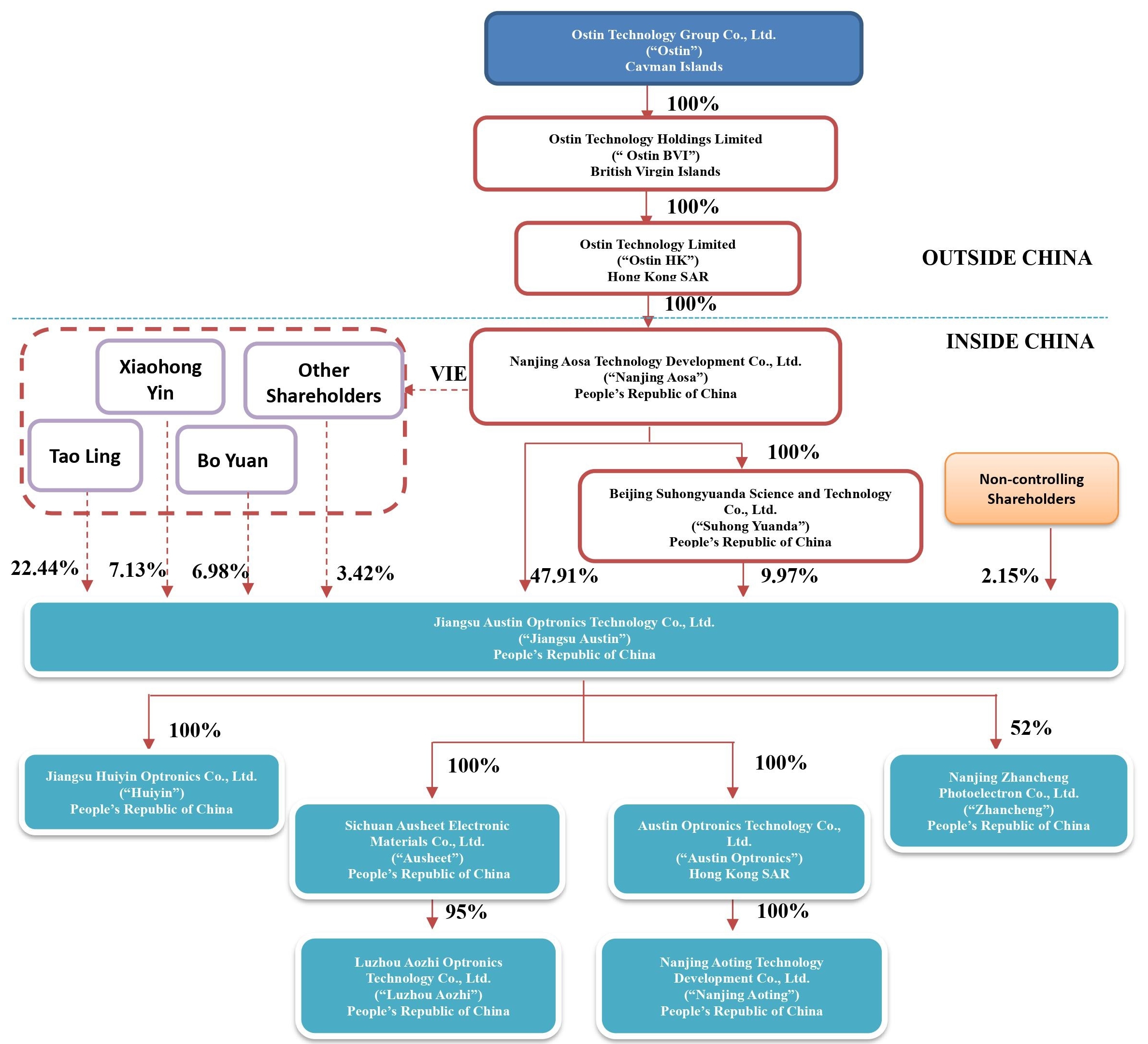

We are a Cayman Islands exempted company structured as a holding company and conduct our operations in China through Jiangsu Austin and its subsidiaries. We first started our business through Jiangsu Austin, which was formed in December 2010.

With the growth of our business and in order to facilitate international capital investment in us, we started a reorganization as described below involving new offshore and onshore entities in the fourth quarter of 2019 and completed it in the first half of 2020.

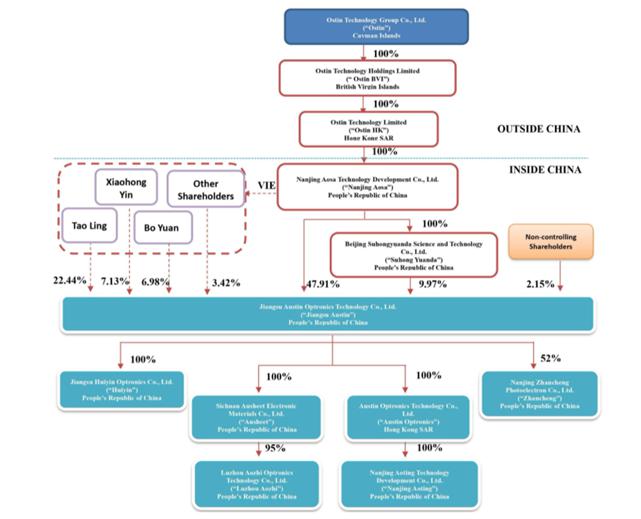

On September 26, 2019, Ostin Technology Group Co., Ltd. was incorporated under the laws of the Cayman Islands as an exempted company. Further, Ostin Technology Holdings Limited and Ostin Technology Limited, were established in the British Virgin Islands in October 2019 and in Hong Kong in October 2019, respectively, as intermediate holding companies.

In March 2020, Nanjing Aosa Technology Development Co., Ltd. (“Nanjing Aosa”) was formed as a limited liability company in China and became a wholly owned subsidiary of Ostin Technology Limited in June 2020. Beijing Suhongyuanda Science and Technology Co., Ltd. (“Suhong Yuanda”) was formed as a limited liability company in September 2019 in China and became a wholly owned subsidiary of Nanjing Aosa in May 2020, holding 9.97% of the shares of Jiangsu Austin.

In June 2020, Nanjing Aosa entered into a series of contractual arrangements (the “VIE Arrangements”) with shareholders of Jiangsu Austin who are directors, supervisors or senior management members of Jiangsu Austin, and other shareholders (excluding Suhong Yuanda and collectively, the “VIE Shareholders”) holding an aggregate of 87.88% of the shares of Jiangsu Austin, which, along with our company’s direct ownership of 9.97% of Jiangsu Austin, enables us to obtain control over Jiangsu Austin through Nanjing Aosa. As a result of the VIE Arrangements, before our VIE became our majority owned subsidiary as described below, we were regarded as the primary beneficiary of our VIE for accounting purposes, and we treated our VIE and its subsidiaries as our consolidated affiliated entities under U.S. GAAP for the fiscal years ended September 30, 2021 and 2020. We consolidated the financial results of our VIE and its subsidiaries in our financial statements in accordance with U.S. GAAP for the same periods.

Our VIE and its subsidiaries contributed to 100% of our consolidated revenue and accounted for 100% of our consolidated total assets and liabilities for the fiscal years ended September 30, 2021 and 2020 and there was no reconciliation performed between the financial position, cash flows and results of operations of our VIE and us. The following financial information of our VIE and its subsidiaries was included in the consolidated financial statements:

| | | As of

September 30, | |

| | | 2021 | | | 2020 | |

| Total Assets | | | 75,966,481 | | | $ | 62,929,137 | |

| Total Liabilities | | | 60,764,626 | | | | 51,666,227 | |

| | | Fiscal Years Ended

September 30, | |

| | | 2021 | | | 2020 | |

| Revenue | | | 167,744,801 | | | $ | 140,073,917 | |

| Net profit | | | 3,295,507 | | | $ | 2,831,286 | |

| | | Fiscal Years Ended

September 30, | |

| | | 2021 | | | 2020 | |

| | | | | | | |

| Net cash provided by (used in) operating activities | | $ | (17,664,259 | ) | | $ | 7,724,681 | |

| Net cash used in investing activities | | | (5,197,913 | ) | | | (5,176,956 | ) |

| Net cash provided by financing activities | | | 18,564,120 | | | | 210,464 | |

| Effect of foreign currency translations | | | (379,135 | ) | | | 133,202 | |

| Net increase (decrease) in cash and cash equivalents | | $ | (4,677,187 | ) | | $ | 2,891,392 | |

VIE Arrangements

Pursuant to the Company Law of the PRC, directors, supervisors and senior management members of a company limited by shares may not transfer more than 25% of his or her shares of the company during the term of his or her services and are prohibited from transfer any of his or her shares of the company within six months after the termination of his or her services. Since Jiangsu Austin is a company limited by shares, it is subject to the forgoing limitations on the transfer of shares by its directors, supervisors and senior management members, who collectively own approximately 39.97% of the shares of Jiangsu Austin. In addition, Jiangsu Austin was listed on the NEEQ and its shareholders were subject to certain limitations on transfer of its shares prior to its voluntary delisting from the National Equities Exchange and Quotations Co., Ltd. (the “NEEQ”), a Chinese over-the-counter system for trading the shares of a company limited by shares that is not listed on either the Shenzhen or Shanghai stock exchanges. As part of the reorganization for our initial public offering, Nanjing Aosa, our WFOE, entered into the VIE Arrangements with the shareholders of Jiangsu Austin who are directors, supervisors or senior management members of Jiangsu Austin. The combination of the VIE Arrangements and Nanjing Aosa’s aggregate direct ownership of 57.88% of the issued and outstanding shares of Jiangsu Austin enable us to (i) exercise effective control over Jiangsu Austin, (ii) receive substantially all of the economic benefits of Jiangsu Austin and (iii) have an exclusive option to purchase substantially all or part of the shares of, and/or assets in, Jiangsu Austin when and to the extent permitted by PRC laws and regulations.

In April 2021, Nanjing Aosa and Jiangsu Austin unwound part of the VIE Arrangements with the minority shareholders of Jiangsu Austin who are not directors, supervisors or senior management members of Austin (the “non-management VIE Shareholders”), whose shares of Jiangsu Austin are no longer subject to the limitations as a result of Jiangsu Austin’s voluntary delisting from the NEEQ, through exercise of an exclusive option to purchase an aggregate of 17,869,615 shares of Jiangsu Austin from the non-management VIE Shareholders as well as certain VIE Shareholders who are directors, supervisors or senior management members of Jiangsu Austin. As a result, our company, through Nanjing Aosa, hold an aggregate of 57.88% of the shares of Jiangsu Austin directly with the remaining 39.97% controlled through the VIE Arrangements. The remaining 2.15% of the shares of Jiangsu Austin are currently owned by two individual shareholders including Tao Ling, our Chief Executive Officer and Chairman of the Board who holds 1.53 % of the shares.

In August 2021, certain directors, supervisors and members of senior management team of Jiangsu Austin, who are also shareholders of Jiangsu Austin holding an aggregate of 39.97% of its outstanding shares, resigned all their positions with Jiangsu Austin and entered into shares transfer agreements, pursuant to which, they have agreed to transfer an aggregate of 39.97% of shares of Jiangsu Austin after six months following the registration of their resignation with relevant government authorities, which would result in Nanjing Aosa, our WFOE, holding an aggregate of 97.85% of the shares of Jiangsu Austin following the completion of the share transfers. We expect to unwind the existing VIE Arrangements by the end of February 2022, as there will be no shares of Jiangsu Austin subject to the VIE Arrangements.

We are not operating in an industry that prohibits or limits foreign investment. As a result, we are not required to obtain any permission from Chinese authorities to operate other than those requisite for a domestic company in China will need to engage in the businesses similar to ours. Such licenses and permissions include Business License, Record Registration Form for Foreign Trade Business Operators and Certificate of the Customs of the People’s Republic of China on Registration of A Customs Declaration Entity. As advised by our PRC counsel, King & Wood Mallesons, neither we nor any of our subsidiaries or our VIE is currently required to obtain regulatory approval from Chinese authorities before listing in the U.S. under any existing PRC law, regulations or rules, including from the CSRC, the Cyberspace Administration of China, or any other relevant Chinese regulatory agencies that is required to approve the VIE’s operations. However, the enforceability of the VIE Arrangements has not been tested in a court of law, and the PRC government may take actions to exert more oversight and control over offerings by China based issuers conducted overseas and/or foreign investment in such companies, or could disallow the VIE Arrangements, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors outside China and cause the value of our securities to significantly decline or become worthless. See “Risk Factors – Risks Related to Doing Business in China –Any requirement to obtain prior approval under the M&A Rules and/or any other regulations promulgated by relevant PRC regulatory agencies in the future could delay this offering and failure to obtain any such approvals, if required, could have a material adverse effect on our business, operating results and reputation as well as the trading price of our ordinary shares, and could also create uncertainties for this offering and affect our ability to offer or continue to offer securities to investors outside China.”

We do not believe we are required to obtain any permission from any PRC governmental authorities to offer securities to foreign investors. We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC or other PRC governmental authorities required for overseas listings, including this offering. As of the date of this prospectus, we have not received any inquiry, notice, warning, sanctions or regulatory objection to this offering from the CSRC or other PRC governmental authorities. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. If it is determined in the future that the approval of the CSRC, The Cyberspace Administration of China or any other regulatory authority is required for this offering, we may face sanctions by the CSRC, the Cyberspace Administration of China or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the repatriation of the proceeds from this offering into China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities. The CSRC, the Cyberspace Administration of China or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt this offering before settlement and delivery of our ordinary shares. Consequently, if you engage in market trading or other activities in anticipation of and prior to settlement and delivery, you do so at the risk that settlement and delivery may not occur. In addition, if the CSRC, the Cyberspace Administration of China or other regulatory PRC agencies later promulgate new rules requiring that we obtain their approvals for this offering, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding such an approval requirement could have a material adverse effect on the trading price of our securities. See “Risk Factors – Risks Related to Doing Business in China – The PRC government exerts substantial influence over the manner in which we conduct our business activities. The PRC government may also intervene or influence our operations and this offering at any time, which could result in a material change in our operations and our ordinary shares could decline in value or become worthless.”

Set forth below is a summary of the material terms of the agreements establish the VIE Arrangements. However, investors are cautioned that the enforceability of such VIE Arrangements has not been tested in a court of law.

Exclusive Option Agreement

Pursuant to the Exclusive Option Agreement between Nanjing Aosa and the VIE Shareholders, such shareholders irrevocably granted Nanjing Aosa or any third party designated by Nanjing Aosa an exclusive option to purchase all or part of their shares of the VIE and/or assist Nanjing Aosa or its designee to purchase all or part of the assets and businesses of the VIE at the higher of RMB1 or the lowest price permitted by applicable PRC laws. Those shareholders further undertake, among other things, that they will neither allow the encumbrance of any security interest in the VIE, nor transfer, mortgage or otherwise dispose of their legal or beneficial interests in the VIE without the prior written consent of Nanjing Aosa. This agreement will remain effective until it is terminated at the discretion of Nanjing Aosa or upon the transfer of all the shares of the VIE owned by the VIE Shareholders to Nanjing Aosa and/or its designee.

Share Pledge Agreement

Pursuant to the Share Pledge Agreement between Nanjing Aosa and the VIE Shareholders, such shareholders agreed to pledge all their shares of the VIE to Nanjing Aosa to guarantee the performance by such shareholders of their obligations under the Exclusive Option Agreement, Power of Attorney and the Share Pledge Agreement. If the shareholders breach their contractual obligations under these agreements, Nanjing Aosa, as pledgee, will have the right to dispose of the pledged shares entirely or partially. The VIE Shareholders also agreed, without Nanjing Aosa’s prior written consent, not to transfer the pledged shares, establish or permit the existence of any security interest or other encumbrance on the pledged shares, or dispose of the pledged shares by any other means, except by the performance of the Exclusive Option Agreement. The VIE Shareholders have completed the registration of the pledge of shares in the VIE with Jiangsu Provincial Administration for Market Regulation as of the date of this prospectus.

Power of Attorney

Pursuant to the Power of Attorney executed by each of the VIE Shareholders, these shareholders irrevocably authorize Nanjing Aosa or its designee to act as his or her authorized representative to exercise all of his or her rights as a shareholder of the VIE, including, but not limited to, the right to call and attend shareholders’ meetings, execute and deliver any and all written resolutions and meeting minutes as a shareholder, vote by itself or by proxy on any matters discussed on shareholders’ meetings, sell, transfer, pledge or dispose of any or all of the shares, nominate, appoint or remove the directors, supervisors and senior management, and other shareholders rights conferred by the articles of association of the VIE and the relevant laws and regulations. The Power of Attorney will remain in force as long as the VIE Shareholders remain as shareholders of the VIE. The VIE Shareholders shall not have the right to terminate the Power of Attorney or revoke the authorization without the prior written consent of Nanjing Aosa.

Spousal Consent

The spouse of each of the individual VIE Shareholders has signed a spousal consent letter. Under the spousal consent letter, the spouse unconditionally and irrevocably waives any rights or entitlements whatsoever to such shares that may be granted to her pursuant to applicable laws and undertakes not to make any assertion of rights to such shares. The spouse agrees and undertakes that he or she will take all necessary actions to ensure the proper performance of the VIE Arrangements, and will be bound by the VIE Arrangements in case she or he obtains any equity of the VIE due to any reason.

The VIE Arrangements are subject to various risks. For example, the VIE Arrangements may not be as effective as direct ownership in providing us with control over Jiangsu Austin. Due to the fact that we only directly hold approximately 57.88% of Jiangsu Austin we expect to rely on the performance by the VIE Shareholders of their respective obligations under the contracts to exercise control over Jiangsu Austin. The VIE Shareholders may not act in the best interests of our company or may not perform their obligations under these contracts. Such risks will exist throughout the period in which we operate our business through the VIE Arrangements. If any dispute relating to these contracts remains unresolved, we will have to enforce our rights under these contracts through the operations of PRC law and arbitration, litigation or other legal proceedings which could be a lengthy process and very costly.

For more details regarding the VIE Arrangements, including risks associated with the VIE structure, see “Corporate History and Structure—VIE Arrangements” and “Risk Factors—Risks Related to Our Corporate Structure.”

The chart below summarizes our corporate structure as of the date of this prospectus:

Dividends and Other Distributions

We are a holding company with no material operations of our own and do not generate any revenue. We currently conduct substantially all of our operations through Jiangsu Austin, our majority owned subsidiary (which is also referred to as our VIE) and its subsidiaries. We are permitted under PRC laws and regulations to provide funding to our WFOE only through loans or capital contributions, and to our VIE only through loans, and only if we satisfy the applicable government registration and approval requirements. See “Risk Factors—Risks Related to Doing Business in China— PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.”

Under our current corporate structure, we rely on dividend payments from our PRC subsidiaries to fund any cash and financing requirements we may have, including the funds necessary to pay dividends and other cash distributions to our shareholders or to service any debt we may incur. Our subsidiaries and VIE in the PRC generate and retain cash generated from operating activities and re-invest it in our business. If any of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. As of the date of this prospectus, there were no cash flows between our PRC subsidiaries and our VIE, and no cash flows between our Cayman Islands holding company and our subsidiaries.

Our PRC subsidiaries are permitted to pay dividends only out of their retained earnings. However, each of our PRC subsidiaries is required to set aside at least 10% of its after-tax profits each year, after making up for previous year’s accumulated losses, if any, to fund certain statutory reserves, until the aggregate amount of such funds reaches 50% of its registered capital. This portion of our PRC subsidiaries’ respective net assets are prohibited from being distributed to their shareholders as dividends. See “Regulation - Regulations on Dividend Distributions”. However, neither any of our subsidiary or our VIE has made any dividends or other distributions to our holding company or any U.S. investors as of the date of this prospectus. See also “Risk Factors – Risks Related to Doing Business in China - We rely to a significant extent on dividends and other distributions on equity paid by our subsidiaries to fund offshore cash and financing requirements and any limitation on the ability of our PRC subsidiaries to make remittance to pay dividends to us could limit our ability to access cash generated by the operations of those entities.”

As of the date of this prospectus, none of our subsidiaries have ever issued any dividends or made other distributions to us or their respective holding companies nor have we or any of our subsidiaries ever paid dividends or made other distributions to U.S. investors. We intend to retain all of our available funds and any future earnings after this offering and cash proceeds from overseas financing activities, including this offering, to fund the development and growth of our business. As a result, we do not expect to pay any cash dividends in the foreseeable future.

In addition, the PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders. See “Risk Factors – Risks Related to Doing Business in China - Restrictions on currency exchange may limit our ability to utilize our revenues effectively.”

A 10% PRC withholding tax is applicable to dividends payable to investors that are non-resident enterprises. Any gain realized on the transfer of ordinary shares by such investors is also subject to PRC tax at a current rate of 10% which in the case of dividends will be withheld at source if such gain is regarded as income derived from sources within the PRC. See also “Risk Factors – Risks Related to Doing Business in China - Dividends payable to our foreign investors and gains on the sale of our ordinary shares by our foreign investors may be subject to PRC tax.”

Summary of Risks Affecting Our Company

Our business is subject to multiple risks and uncertainties, as more fully described in “Risk Factors” and elsewhere in this prospectus. We urge you to read “Risk Factors” and this prospectus in full. Our principal risks may be summarized as follows:

Risks Related to Doing Business in China

We are also subject to risks and uncertainties relating to doing business in China in general, including, but are not limited to, the following:

| | ● | Changes in the political and economic policies of the PRC government or in relations between China and the United States may materially and adversely affect our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies. |

| | ● | There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. |

| | ● | The Chinese government exerts substantial influence over the manner in which we conduct our business activities. The PRC government may also intervene or influence our operations and this offering at any time, which could result in a material change in our operations and our ordinary shares could decline in value or become worthless. |

| | | |

| | ● | On December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures,” collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”). The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets. Among other things, if a domestic enterprise intends to indirectly offer and list securities in an overseas market, the record-filing obligation is with a major operating entity incorporated in the PRC and such filing obligation shall be completed within three working days after the overseas listing application is submitted. The required filing materials for an initial public offering and listing shall include but not limited to: regulatory opinions, record-filing, approval and other documents issued by competent regulatory authorities of relevant industries (if applicable); and security assessment opinion issued by relevant regulatory authorities (if applicable). The Draft Rules Regarding Overseas Listing, if enacted, may subject us to additional compliance requirement in the future. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our ordinary shares to significantly decline in value or become worthless. See “Risk Factors – The CSRC has released for public consultation the draft rules for China-based companies seeking to conduct initial public offerings in foreign markets. While such rules have not yet gone into effect, the Chinese government may exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares to investors and could cause the value of our ordinary shares to significantly decline or become worthless.” |

| | ● | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the prospectus based on foreign laws. |

| | ● | Our business and the ability of our ordinary shares to be listed on Nasdaq may be affected by recently adopted and proposed regulations in China as well as laws and regulations adopted by the United States and any future laws or regulations that may be adopted by the United States and China. |

| | | |

| | ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay us from using the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business |

| | | |

| | ● | We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business. |

| | | |

| | ● | Our ordinary shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors. The delisting of our ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. |

Risks Related to Our Business and Industry:

Risks and uncertainties related to our business and industry include, but are not limited to, the following:

| | ● | We depend on a few major customers with whom we do not enter into long-term contracts, the loss of any of which could cause a significant decline in our revenues. |

| | | |

| | ● | Our industry is cyclical, with recurring periods of capacity increases. As a result, price fluctuations in response to supply and demand imbalances could harm our results of operations. |

| ● | We may experience declines in the selling prices of our products irrespective of cyclical fluctuations in the industry. |

| | | |

| ● | Our debt may restrict our operations, and cash flows and capital resources may be insufficient to make required payments on our substantial indebtedness and future indebtedness. |

| | | |

| ● | We depend on a key equipment supplier for manufacture of polarizers, the loss of which could hurt our business. |

| | | |

| ● | We depend on the supply of raw materials and key component parts, and any adverse changes in such supply or the costs of raw materials may adversely affect our operations. |

| | ● | We may fail to obtain certificates for our new manufacturing facilities in Chengdu, China, which could have a material adverse impact on our operations. |

| ● | We are not in compliance with environmental regulations relating to constructions, which may subject us to fines and other penalties. |

| ● | We operate in a highly competitive environment and we may not be able to sustain our current market position if we fail to compete successfully. |

| | | |

| ● | Other flat panel display technologies or alternative display technologies could render our products uncompetitive or obsolete. |

| | ● | Our financial statements contain an explanatory paragraph regarding uncertainty as our ability to raise capital and therefore cast substantial doubt about our ability to continue as a going concern. |

| | ● | Any negative publicity with respect to us, our employees, the display panel industry in general or our business partners may materially and adversely affect our business and results of operations. |

Risks Related to our Corporate Structure

Risks and uncertainties relating to our corporate structure include, but are not limited to, the following:

| | ● | If the PRC government finds that the VIE Arrangements that establish the structure for operating some of our operations in China do not comply with PRC regulations, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. |

| | | |

| | ● | We rely on a combination of direct ownership of our VIE and contractual arrangements with certain VIE Shareholders to operate our business. The VIE Arrangements may not be as effective as direct ownership in providing operational control which may materially and adversely affect our business. |

| | | |

| | ● | Any failure by the VIE Shareholders to perform their obligations under the VIE Arrangements may have a material and adverse effect on our business. |

| | | |

| | ● | The VIE Shareholders may have actual or potential conflicts of interest with us, which may materially and adversely affect our business and financial condition. |

Risks Related to this Offering and Ownership of our Ordinary Shares

In addition to the risks and uncertainties described above, we are subject to risks relating to ordinary shares and this offering, including, but not limited to, the following:

| ● | An active trading market for our ordinary shares or our ordinary shares may not develop and the trading price for our ordinary shares may fluctuate significantly. |

| ● | Nasdaq may apply additional and more stringent criteria for our initial and continued listing because we plan to have a small public offering and insiders will hold a large portion of our listed securities. |

| ● | The trading price of our ordinary shares may be volatile, which could result in substantial losses to investors. |

| | ● | Because the initial public offering price is substantially higher than the pro forma net tangible book value per share, you will experience immediate and substantial dilution. |

Recent Regulatory Developments in China

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement.

Among other things, the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”) and Anti-Monopoly Law of the People’s Republic of China promulgated by the SCNPC which became effective in 2008 (“Anti-Monopoly Law”), established additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex. Such regulation requires, among other things, that State Administration for Market Regulation (“SAMR”) be notified in advance of any change-of-control transaction in which a foreign investor acquires control of a PRC domestic enterprise or a foreign company with substantial PRC operations, if certain thresholds under the Provisions of the State Council on the Standard for Declaration of Concentration of Business Operators, issued by the State Council in 2008, are triggered. Moreover, the Anti-Monopoly Law requires that transactions which involve the national security, the examination on the national security shall also be conducted according to the relevant provisions of the State. In addition, the PRC Measures for the Security Review of Foreign Investment which became effective in January 2021 require acquisitions by foreign investors of PRC companies engaged in military-related or certain other industries that are crucial to national security be subject to security review before consummation of any such acquisition.

On July 6, 2021, the relevant PRC government authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. Pursuant to the Opinions, Chinese regulators are required to accelerate rulemaking related to the overseas issuance and listing of securities, and update the existing laws and regulations related to data security, cross-border data flow, and management of confidential information. Numerous regulations, guidelines and other measures are expected to be adopted under the umbrella of or in addition to the Cybersecurity Law and Data Security Law. As of the date of this prospectus, no official guidance or related implementation rules have been issued yet and the interpretation of these opinions remains unclear at this stage. See “Risk Factors – Risks Related to Doing Business in China –Any requirement to obtain prior approval under the M&A Rules and/or any other regulations promulgated by relevant PRC regulatory agencies in the future could delay this offering and failure to obtain any such approvals, if required, could have a material adverse effect on our business, operating results and reputation as well as the trading price of our ordinary shares, and could also create uncertainties for this offering and affect our ability to offer or continue to offer securities to investors outside China.”

In addition, on July 10, 2021, the Cyberspace Administration of China issued the Measures for Cybersecurity Review (Revision Draft for Comments), or the Measures, for public comments, which propose to authorize the relevant government authorities to conduct cybersecurity review on a range of activities that affect or may affect national security, including listings in foreign countries by companies that possess the personal data of more than one million users. On December 28, 2021, the Measures for Cybersecurity Review (2021 version) was promulgated and will become effective on February 15, 2022, which iterates that any “online platform operators” controlling personal information of more than one million users which seeks to list in a foreign stock exchange should also be subject to cybersecurity review. The Measures for Cybersecurity Review (2021 version), further elaborates the factors to be considered when assessing the national security risks of the relevant activities, including, among others, (i) the risk of core data, important data or a large amount of personal information being stolen, leaked, destroyed, and illegally used or exited the country; and (ii) the risk of critical information infrastructure, core data, important data or a large amount of personal information being affected, controlled, or maliciously used by foreign governments after listing abroad. The Cyberspace Administration of China has said that under the proposed rules companies holding data on more than 1,000,000 users must now apply for cybersecurity approval when seeking listings in other nations because of the risk that such data and personal information could be “affected, controlled, and maliciously exploited by foreign governments.” The cybersecurity review will also look into the potential national security risks from overseas IPOs.

On December 24, 2021, the CSRC released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (Draft for Comments) (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures,” collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listing”), both of which have a comment period that expires on January 23, 2022. The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets. Among other things, if a domestic enterprise intends to indirectly offer and list securities in an overseas market, the record-filing obligation is with a major operating entity incorporated in the PRC and such filing obligation shall be completed within three working days after the overseas listing application is submitted. The required filing materials for an initial public offering and listing shall include but not limited to: regulatory opinions, record-filing, approval and other documents issued by competent regulatory authorities of relevant industries (if applicable); and security assessment opinion issued by relevant regulatory authorities (if applicable).

The Draft Rules Regarding Overseas Listing, if enacted, may subject us to additional compliance requirement in the future, and we cannot assure you that we will be able to get the clearance of filing procedures under the Draft Rules Regarding Overseas List on a timely basis, or at all. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our ordinary shares to significantly decline in value or become worthless.

As of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require us to seek approval from the CSRC or any other PRC governmental authorities for our overseas listing plan, nor has our company, any of our subsidiaries or our VIE received any inquiry, notice, warning or sanctions regarding our planned overseas listing from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. exchange. The SCNPC or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that requires our company, our VIE or its subsidiaries to obtain regulatory approval from Chinese authorities before listing in the U.S. See “Risk Factors” beginning on page 13 for a discussion of these legal and operational risks and other information that should be considered before making a decision to purchase our ordinary shares.

Implications of Being an Emerging Growth Company

We had less than $1.07 billion in revenue during our last fiscal year. As a result, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and may take advantage of reduced public reporting requirements. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our filings with the SEC; |

| | | |

| ● | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| | | |

| ● | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| | | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our ordinary shares pursuant to this offering. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” if our annual gross revenues exceed $1.07 billion or if we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. We have elected to take advantage of this extended transition period and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

Implications of Being a Foreign Private Issuer

Upon consummation of this offering, we will report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with “foreign private issuer” status. Even after we no longer qualify as an emerging growth company, so long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act and the rules thereunder that are applicable to U.S. domestic public companies, including:

| ● | the rules under the Exchange Act that require U.S. domestic public companies to issue financial statements prepared under U.S. GAAP; |

| ● | the sections of the Exchange Act that regulate the solicitation of proxies, consents or authorizations in respect of any securities registered under the Exchange Act; |

| ● | the sections of the Exchange Act that require insiders to file public reports of their share ownership and trading activities and that impose liability on insiders who profit from trades made in a short period of time; and |

| ● | the rules under the Exchange Act that require the filing with the SEC of quarterly reports on Form 10-Q, containing unaudited financial and other specified information, and current reports on Form 8-K, upon the occurrence of specified significant events. |

We will file with the SEC, within four months after the end of each fiscal year (or such other reports required by the SEC), an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain of the more extensive SEC executive compensation disclosure rules. Therefore, if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from such rules and will continue to be permitted to follow our home country practice as to the disclosure of such matters.

Corporate Information

Our principal executive offices are located at Building 2, 101/201, 1 Kechuang Road, Qixia District, Nanjing, Jiangsu Province, China 210046, and our telephone number is +86 25-58595234. Our website is www.austinelec.com. Information contained on, or available through, our website does not constitute part of, and is not deemed incorporated by reference into, this prospectus. Our registered office in the Cayman Islands is located at the offices of Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, DE 19711.

The Offering

| Securities being offered: | | 3,375,000 ordinary shares on a firm commitment basis. |

| Initial offering price: | | We estimate the initial public offering price for the ordinary shares will be $4.00 per ordinary share. |

| | | |

| Number of ordinary shares outstanding before the offering: | | 10,125,000 ordinary shares. |

| | | |

| Number of ordinary shares outstanding after the offering: | | 13,500,000 ordinary shares, assuming no exercise of the underwriters’ over-allotment option, and 14,006,250 ordinary shares, assuming full exercise of the underwriters’ over-allotment option. |

| Use of proceeds: | | We intend to use the net proceeds of this offering for (i) expanding our manufacturing facilities for production of OLED polarizers, (ii) potential acquisition of, or investment in, business in the new display material field, (iii) research and development of new materials and improvement of manufacturing process; and (iv) working capital and other general corporate purposes. For more information on the use of proceeds, see “Use of Proceeds” on page 45. |

| Lock-up agreements | | All of our directors and officers and certain shareholders have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our ordinary shares or securities convertible into or exercisable or exchangeable for our ordinary shares for a period of six months from the commencement of the Company’s first day of trading on the Nasdaq Capital Market. See “Shares Eligible for Future Sale” and “Underwriting” for more information. |

| | | |

| Proposed Nasdaq symbol: | | We have applied to have our ordinary shares listed on the Nasdaq under the symbol “OST.” |

| Transfer agent and registrar | | VStock Transfer, LLC |

| | | |

| Risk factors: | | Investing in our ordinary shares involves a significant degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 13. |

RISK FACTORS

Investing in our ordinary shares is highly speculative and involves a significant degree of risk. You should carefully consider the following risks, as well as other information contained in this prospectus, before making an investment in our company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our ordinary shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

Risks Related to Doing Business in China

Changes in the political and economic policies of the PRC government or in relations between China and the United States may materially and adversely affect our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies.

Substantially all of our operations are conducted in the PRC and a majority of our revenues is sourced from the PRC. Accordingly, our financial condition and results of operations are affected to a significant extent by economic, political and legal developments in the PRC or changes in government relations between China and the United States or other governments. There is significant uncertainty about the future relationship between the United States and China with respect to trade policies, treaties, government regulations and tariffs.

The PRC economy differs from the economies of most developed countries in many respects, including the extent of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, regulating financial services and institutions and providing preferential treatment to particular industries or companies.

While the PRC economy has experienced significant growth in the past four decades, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall PRC economy, but may also have a negative effect on us. Our financial condition and results of operation could be materially and adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. In addition, the PRC government has implemented in the past certain measures, including interest rate increases, to control the pace of economic growth. These measures may cause decreased economic activity.