Date, as TSHA-102 and any backup products with respect thereto for use in the treatment of Rett syndrome, and (ii) any other gene therapy product for use in the treatment of Rett syndrome that is controlled by us or any of our affiliates or with respect to which the we or any of our affiliates controls intellectual property rights covering the Exploitation thereof, or a Rett Product.

The parties have agreed that, if Astellas exercises an Option, the parties will, for a specified period, negotiate a license agreement in good faith on the terms and conditions outlined in the Option Agreement, including payments by Astellas of a to be determined upfront payment, certain to be determined milestone payments, and certain to be determined royalties on net sales of GAN Products and/or Rett Products, as applicable.

During the Rett Option Period, we have agreed to (A) not solicit or encourage any inquiries, offers or proposals for, or that could reasonably be expected to lead to, a Change of Control (as defined in the Option Agreement), or (B) otherwise initiate a process for a potential Change of Control, in each case, without first notifying Astellas and offering Astellas the opportunity to submit an offer or proposal to us for a transaction that would result in a Change of Control. If Astellas fails or declines to submit any such offer within a specified period after the receipt of such notice, we will have the ability to solicit third party bids for a Change of Control transaction. If Astellas delivers an offer to us for a transaction that would result in a Change of Control, we and Astellas will attempt to negotiate in good faith the potential terms and conditions for such potential transaction that would result in a Change of Control for a specified period, which period may be shortened or extended by mutual agreement.

As partial consideration for the rights granted to Astellas under the Option Agreement, Astellas will pay us a one-time payment in the amount of $20.0 million, or the Upfront Payment, within 30 days after receipt of an invoice for such payment, which invoice will be delivered by us on or after the Effective Date. Astellas or any of its affiliates shall have the right, in its or their discretion and upon written notice to us, to offset the amount of the Upfront Payment (in whole or in part, until the full amount of the Upfront Payment has been offset) against (a) any payment(s) owed to us or any of our affiliates (or to any third party on behalf of us) under or in connection with any license agreement entered into with respect to any GAN Product or Rett Product, including, any upfront payment, milestone payment or royalties owed to us or any of our affiliates (or to any third party on our behalf) under or in connection with any such license agreement or (b) any amount owed to us or any of our affiliates in connection with a Change of Control transaction with Astellas or any of its affiliates. As further consideration for the rights granted to Astellas under the Option Agreement, we and Astellas also entered into the Securities Purchase Agreement (as defined below).

Securities Purchase Agreement

On October 21, 2022, we entered into a securities purchase agreement, or the Securities Purchase Agreement (and together with the Option Agreement, the Astellas Transactions), with Astellas, pursuant to which we agreed to issue and sell to Astellas in a private placement, or the Private Placement, an aggregate of 7,266,342 shares, or the Private Placement Shares, of our common stock, for aggregate gross proceeds of approximately $30.0 million. The Securities Purchase Agreement contains customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company, other obligations of the parties and termination provisions.

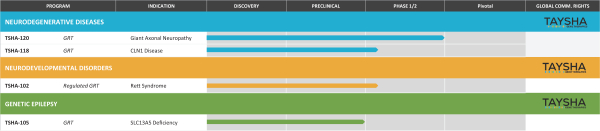

The Private Placement closed on October 24, 2022, or the Closing Date. We expect the net proceeds from the Private Placement to be used to fund the ongoing clinical, regulatory and manufacturing development of TSHA-102 and TSHA-120, pre-commercialization activities for TSHA-120 and for working capital and other general corporate purposes.