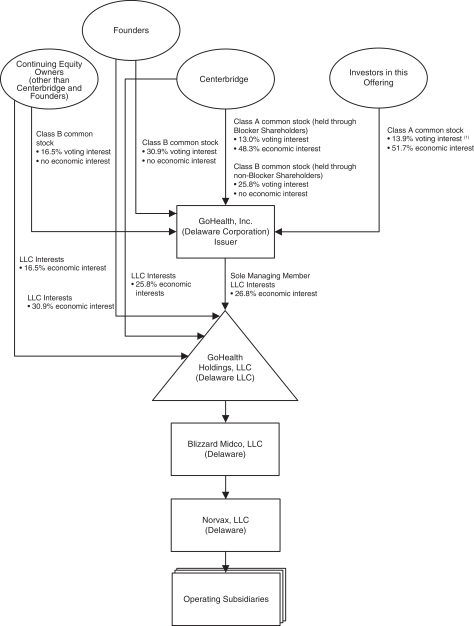

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The following are summaries of certain transactions and relationships with our directors, executive officers and stockholders and certain provisions of our related party agreements and are qualified in their entirety by reference to all of the provisions of such agreements. Because these descriptions are only summaries of the applicable agreements, they do not necessarily contain all of the information that you may find useful. We, therefore, urge you to review the agreements in their entirety. Copies of the forms of the agreements have been filed as exhibits to the registration statement of which this prospectus is a part, and are available electronically on the website of the SEC at www.sec.gov.

Related Party Agreements in Effect Prior to the Transactions

Expense Reimbursement Agreement

On September 13, 2019, in connection with the Centerbridge Acquisition, GoHealth Holdings, LLC, Norvax, LLC and an affiliate of the Sponsor entered into an expense reimbursement and indemnification agreement pursuant to which, GoHealth Holdings, LLC and Norvax, LLC agreed to indemnify and reimburse the Sponsor for up to $500,000 of certain out-of-pocket costs, fees and expenses incurred by or on behalf of the Sponsors in connection with the Centerbridge Acquisition and certain services provided to us by the Sponsor. To date, we have made payments totaling less than $60,000 pursuant to this agreement.

Agreements Involving our Founders

We have entered into various lease agreements (as amended and restated, the “RPT Leases”) with Wilson Tech 5, LLC, 214 W Huron LLC, 220 W Huron Street Holdings LLC and 215 W Superior LLC, each of which are controlled by our Founders, to lease our corporate offices at 214 West Huron Street, Chicago, Illinois, 220 West Huron Street, Chicago, Illinois, 215 West Superior Street, Chicago, Illinois, and a proposed site in Linden, Utah, beginning in 2022. Our lease agreement with Wilson Tech 5, LLC expires on May 11, 2030; our lease agreement with 214 W Huron LLC expires on July 31, 2024; our lease agreements with 220 W Huron Street Holdings LLC expire on May 31, 2024 and July 31, 2024; and our lease agreement with 215 W Superior LLC expires on December 31, 2030. In addition to the lease payments, we are also required to pay operating expenses, maintenance and utilities under the terms of the RPT Leases. For the three months ended March 31, 2020, the Successor 2019 Period, Predecessor 2019 Period and for the year ended December 31, 2018, we made aggregate lease payments of $321,000, $298,000, $758,000 and $1,025,000, respectively under the RPT Leases. Assuming none of the RPT Leases are terminated early, the remaining amounts due under the RPT Leases in aggregate is expected to be $6.9 million.

On January 1, 2020, we entered into a non-exclusive aircraft dry lease agreement with N157BC, LLC, an entity wholly-owned and controlled by our Founders, which we amended and restated on May 29, 2020. The agreement allows us to use an aircraft owned by N157BC, LLC for our business and on an as-needed basis. The agreement has no set term and is terminable without cause by either party upon 30 days’ prior written notice. Under the agreement, we are required to pay $6,036.94 per flight hour for use of the aircraft.

On March 2, 2018, we entered into an agreement with Rank Me Media, LLC, an entity wholly-owned and controlled by Patrick Cruz, brother to each of Brandon M. Cruz, our Chief Strategy Officer and Special Advisor to the Executive Team and a member of our board directors, and Shane E. Cruz, our Chief Operating Officer, to provide search engine optimization consulting services. This agreement had an initial term of 6 months and after the expiration of such period, automatically renews 1 month each month unless terminated by either party with a 30-day prior written notice. Under the agreement, we are required to pay a monthly flat fee retainer of $6,000 per month. For the three months ended March 31, 2020, the Successor 2019 Period, Predecessor 2019 Period and for the year ended December 31, 2018, we made aggregate payments of $18,000, $18,000, $57,000 and $42,000, respectively under this agreement.

178