21. Ordinary shares (Continued)

| (iv) | 750,000,000 Series C Preferred Shares at par value of US$0.00002 each; |

| (v) | 1,000,000,000 Series D Preferred Shares at par value of US$0.00002 each. |

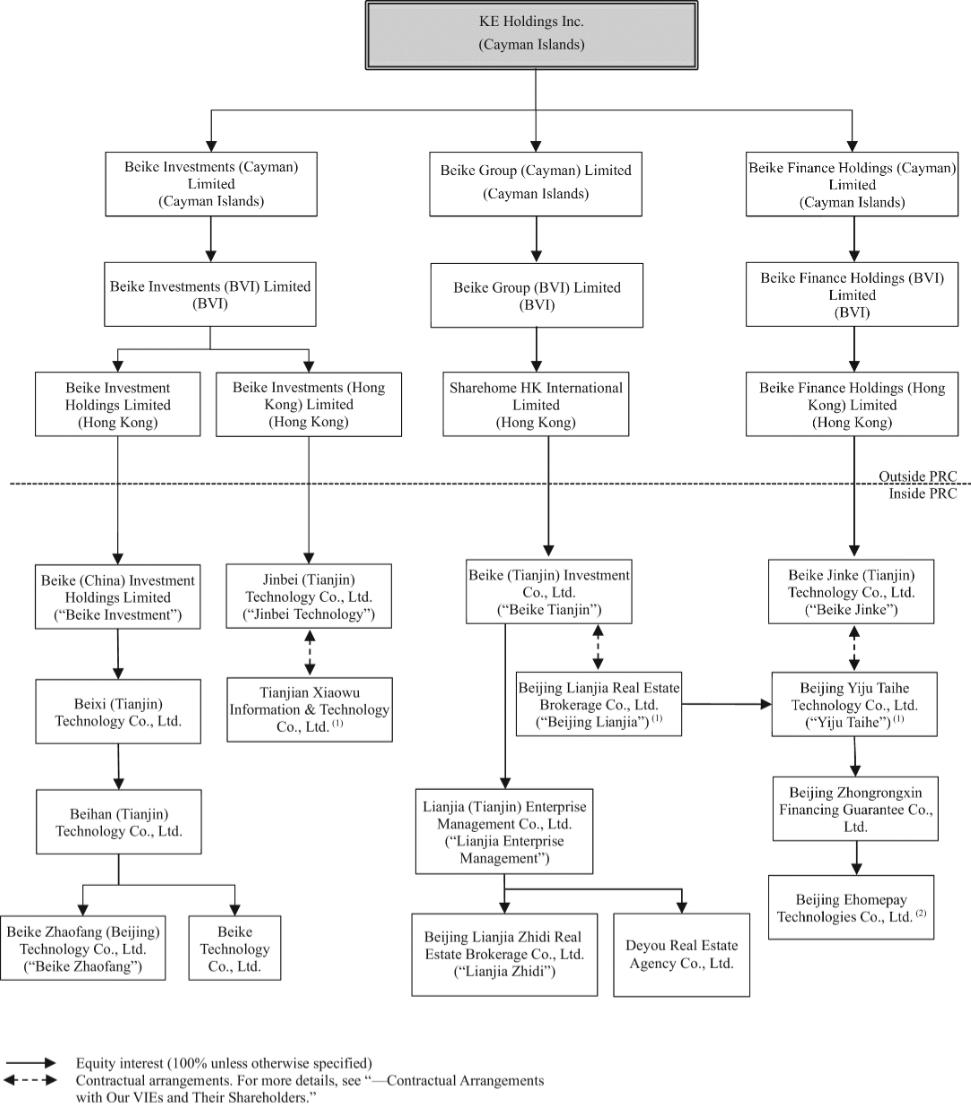

On that same date, ordinary shares held by Mr. Zuo Hui and Shan Yigang were reduced to 933,289,250 Class B Ordinary Shares and 52,649,160 Class A Ordinary Shares, respectively, and other ordinary shares were all re-designated as Class A Ordinary Shares. The Company issued another 289,034,485 Class A Ordinary Shares to other ordinary shareholders as part of the Reorganization to swap their equity interests in Beijing Lianjia and Yiju Taihe with the shareholding interests in the Company.

On June 17, 2019, the Company repurchased 8,806,005 Class A Ordinary Shares held by Golden Fortitude Enterprises Limited, which was controlled by a director of the Company, at a consideration of US$33.5 million (RMB231 million). The difference between the repurchase price and fair value of the ordinary shares at the time of the repurchase amounting to US$6.7 million (RMB46 million) was recorded as compensation expenses. The repurchased ordinary shares were recorded as treasury shares at the fair value of ordinary shares. On November 29, 2019, the treasury shares were reissued as Class A Ordinary Shares to 1 investor at a consideration of US$36.8 million (RMB259 million). The reissuance gain was recorded as additional paid-in capital.

On November 29, 2019, 112,215,315 Class A Ordinary Shares of the Company held by certain directors and employees of the Group were transferred to 2 investors, at a total consideration of US$469.1 million (RMB3,298 million). The Company did not receive any proceeds from this transaction. The Company considered that such transfer, in substance, was the same as a repurchase and cancellation of the ordinary shares and simultaneously an issuance of the ordinary shares. Therefore the difference between the purchase price and fair value of US$46.0 million (RMB323.2 million), was recorded as share based compensation expenses.

On November 29, 2019, certain senior management members of the Company exercised their vested stock options to acquire 95,193,795 Class A Ordinary Shares of the Company.

On November 29, 2019, the Company authorized 750,000,000 Series D+ Preferred Shares at par value of US$0.00002 each, and reduced the authorized number of Class A Ordinary Shares to 20,500,000,000 shares.

On April 10, 2020, the Group entered into share purchase agreements with selling shareholders of Zhonghuan, pursuant to which the Group agreed to issue 22,315,135 Class A Ordinary Shares to the selling shareholders of Zhonghuan to settle the mandatorily redeemable non-controlling interests as a part of consideration for acquisition of Zhonghuan. The shares were issued on April 13, 2020.

On April 16 and 17, 2020, the Company issued 336,915 Class A Ordinary Shares to 2 employees, who were former minority shareholders of certain of the Company's subsidiaries, to settle the RMB9.0 million payable to these employees in connection with the Group's acquisition of their non-controlling interests in November 2018, which approximates the fair value of the shares issued.

During the year ended December 31, 2020, the Company issued 60,852,775 Class A Ordinary Shares to employee trust controlled by the Company upon early exercise of options.

In August 2020, the Company completed its IPO on the New York Stock Exchange ("NYSE"). In the offering, 106,000,000 ADSs, representing 318,000,000 Class A Ordinary Shares, were issued and sold to the public at a price of US$20.00 per ADS. In addition, the Company issued and sold an additional 15,900,000 ADSs, upon the underwriters' exercise of their option to purchase additional ADSs in full, representing 47,700,000 Class A Ordinary Shares. The Company received total net proceeds of approximately US$2,358.8 million after deducting US$79.2 million of underwriter commissions and relevant offering expenses. Upon the completion of the IPO, all of the 1,510,766,620 preferred shares held by the Company's shareholders were converted into an equal number of the Class A ordinary shares.