AP WIP INVESTMENTS, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2019 and 2018

(Dollar amounts in thousands, unless otherwise disclosed)

used to repay the loans. The full amount of the new loans of $893 and $5,241, respectively, have been expensed in the consolidated statement of operations because they are nonrecourse loans.

During the year ended December 31, 2019, AP WIP Investments issued no units under the DWIP Plan. As of December 31, 2019, the DWIP Plan has 145,000,000 authorized units, of which 121,580,001 were issued.

There were no employee loans issued pursuant to the IWIP Plan for the periods ended December 31, 2019 and 2018, respectively.

During the year ended December 31, 2019, AP WIP Investments issued no units under the IWIP Plan. As of December 31, 2019, the IWIP Plan has 145,000,000 authorized units, of which 116,775,001 were issued.

As payment to employees is contingent upon a change of control, no compensation expense has been recognized in connection with the DWIP and/or IWIP Plan other than the expense associated with the nonrecourse loans.

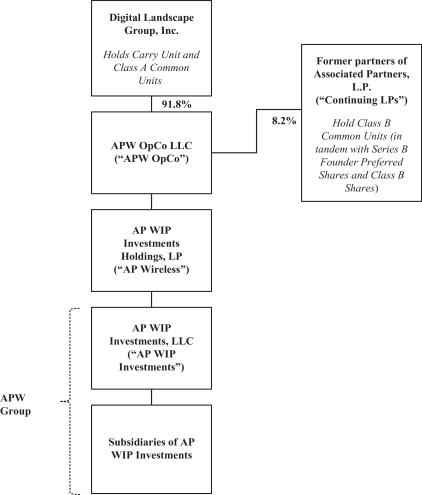

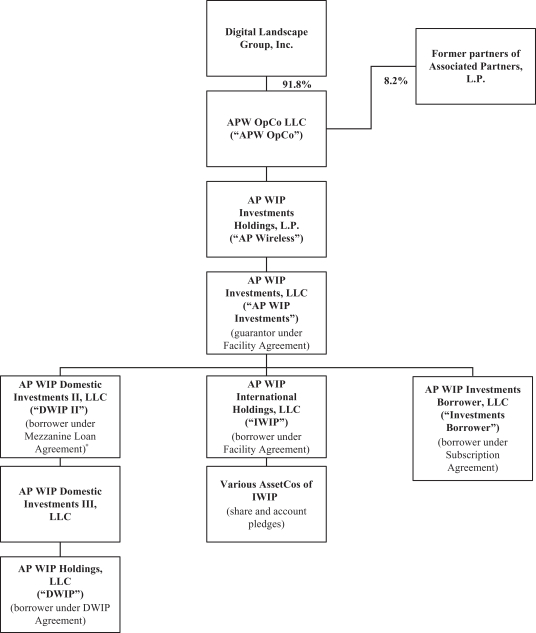

Landscape Transaction

On November 19, 2019, Landscape Acquisition Holdings Limited entered into a definitive agreement to acquire AP WIP Investments Holdings, LP, and the parent company of AP WIP Investments, for consideration of approximately $859,500 consisting of cash, shares and assumption of debt (the “Landscape Transaction”). The Landscape Transaction closed on February 10, 2020. Landscape Acquisition Holdings Limited now has been renamed as Digital Landscape Group, Inc. (“Digital Landscape”). In connection with the Landscape Transaction, the minority interest in AP WIP Investments, LLC, held by KKR Investors, LP, was redeemed in its entirety.

As a result of the entrance of the agreement, trading of Digital Landscape’s ordinary shares and warrants on the London Stock Exchange was suspended on November 20, 2019. The Landscape Transaction was treated as a reverse takeover, and in connection with the closing of the Landscape Transaction, Digital Landscape was granted readmission that was effective on April 1, 2020. Pursuant to readmission, 58,425,000 ordinary shares of no par value and 50,025,000 warrants were added to the Official List and to trading on the London Stock Exchange’s main market for listed securities. the As soon as practicable, Digital Landscape expects to pursue a change in its jurisdiction of incorporation to Delaware, U.S. and that, in conjunction with such change, it will file a registration statement with the Securities and Exchange Commission and a listing application with a U.S.-based stock exchange that is subject to regulatory approval.

TowerCom B, LLC Working Capital Bridge

On January 2, 2020, AP Working Capital, LLC, entered into a Secured Promissory Note and Security Agreement (the “Promissory Note Agreement”) with TowerCom B, LLC, a Delaware limited liability company, as the borrower (“TowerCom B”), and TowerCom, LLC, a Florida limited liability company and owner of 100% of the equity interests in TowerCom B, as the guarantor (“TowerCom”). Under the terms of the Promissory Note Agreement, AP Working Capital agreed to lend to TowerCom B up to $20,000 in three installments. The first two installments totaling $17,500 were advanced by AP Working Capital, LLC in January 2020. On March 18, 2020, AP Working Capital, LLC assigned all of its rights and obligations as lender under the Promissory Note Agreement to APW OpCo LLC, a newly formed subsidiary of Digital Landscape as part of the Landscape Transaction, in exchange for the principal and interest amounts then due under the Promissory Note Agreement.

F-63