Other Related Party Transactions

Before the disposal of discontinued operations, certain subsidiaries in discontinued operations borrowed loans from Mr. Guofu Ye. For the fiscal year ended June 30, 2019, these subsidiaries, before the disposal of discontinued operations, repaid a portion of loan principals amounting to RMB130.4 million and paid loan interests amounting to RMB5.0 million.

For the fiscal years ended June 30, 2019 and 2020, Mr. Guofu Ye made repayment of RMB269.9 million and RMB297.1 million, respectively, in relation to interest-free cash advances made to Mr. Ye in connection with a reorganization in 2018.

For the fiscal year ended June 30, 2019, Mr. Guofu Ye waived the repayment obligation of our subsidiary in the United States in relation to interest-free loans of RMB5.0 million that Mr. Ye previously extended to such subsidiary as working capital.

For the fiscal year ended June 30, 2019, we made cash advances of RMB9.5 million to MINI Investment Holdings Limited, a company controlled by Mr. Guofu Ye for purposes of doing a reorganization. Such amount was fully repaid in July 2020.

For the fiscal year ended June 30, 2020, we made cash advances of RMB101.5 million to Mr. Guofu Ye for purposes of doing a reorganization. Such amount was fully repaid during the fiscal year ended June 30, 2020.

For the fiscal year ended June 30, 2020, we made cash advances of RMB5.2 million to Nome Design Guangzhou Limited, a company controlled by Mr. Guofu Ye, which was subsequently fully repaid in July 2020. During the fiscal years ended June 30, 2020 and 2021, we also purchased goods from Nome Design Guangzhou Limited for a consideration of RMB648.0 thousand and RMB581.0 thousand (US$90.0 thousand), respectively. As of June 30, 2021, the total amount of outstanding receivable from Nome Design Guangzhou Limited was nil.

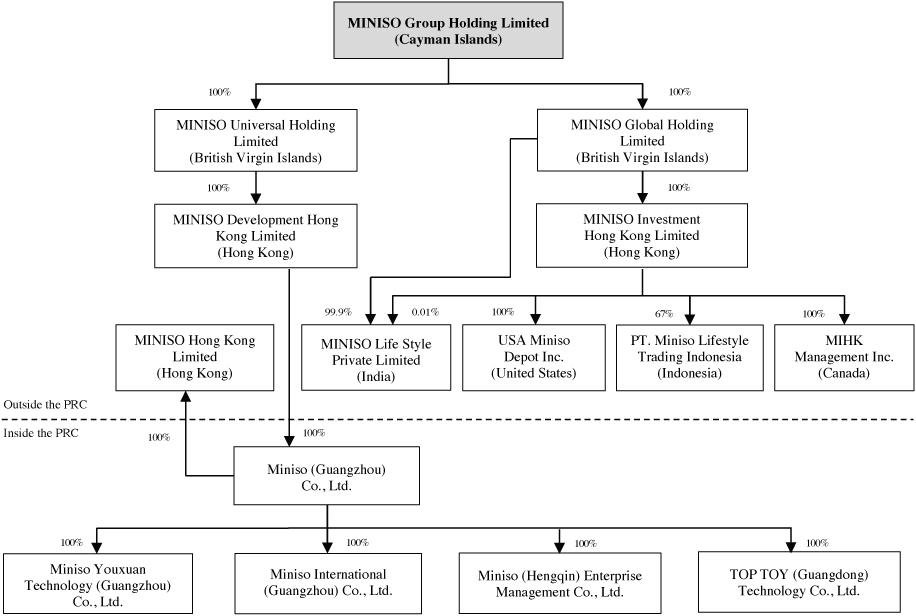

In December 2020, we formed a joint venture in the British Virgin Islands with YGF MC Limited, a company jointly controlled by our controlling shareholders, Mr. Guofu Ye and Ms. Yunyun Yang, to acquire land use right of a parcel of land in Guangzhou and to establish a new headquarters building for MINISO through such joint venture’s subsidiary in Guangzhou, Mingyou Industrial Investment (Guangzhou) Limited, or Mingyou. We hold 20% of the shares of the joint venture company while YGF MC Limited hold the remaining 80% of the shares of the joint venture company. The total investment for the headquarters building project was estimated to be approximately RMB2,885 million, including approximately RMB1,780 million as consideration for acquisition of land use right and the remaining as building costs. On January 25, 2021, MINISO Guangzhou provided a performance guarantee of RMB160.0 million (US$24.8 million) for the benefit of Mingyou and itself to the local government in respect of a certain minimum tax payment commitment resulting from the land use right acquisition.

For the fiscal years ended June 30, 2019, 2020 and 2021, we purchased goods from Shanghai Kerong Network Limited, a company that Mr. Guofu Ye can significantly influence, for a consideration of RMB191.2 million, RMB177.4 million and RMB38.1 million (US$5.9 million), respectively. As of June 30, 2021, our outstanding payable amount to Shanghai Kerong Network Limited was RMB1.4 million (US$222.7 thousand).

For the fiscal years ended June 30, 2019, 2020 and 2021, we purchased goods from Shenzhen Zhizhi Brand Incubation Limited, a company that Mr. Guofu Ye can significantly influence, for a consideration of RMB97.3 million, RMB52.4 million and RMB22.2 million (US$3.4 million), respectively. As of June 30, 2021, the outstanding payable amount was RMB1.1 million (US$175.8 thousand).