Filed by Vector Acquisition Corp. pursuant to

Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Vector Acquisition Corp. and Rocket Lab USA, Inc.

(Commission File No. 333-257440-01)

Rocket Lab USA SPACE IS OPEN FOR BUSINESS Investor Presentation August 2021 rocketlabusa.comRocket Lab USA SPACE IS OPEN FOR BUSINESS Investor Presentation August 2021 rocketlabusa.com

FROM THE FOUNDER Space has defined some of humanity’s greatest achievements, and it continues to shape our future. I’m motivated by the enormous impact we can have on Earth by making it easier to get to space and to use it as a platform for innovation, exploration, and infrastructure. We go to space to improve life on Earth.” Peter J. Beck Founder, CEO, Chief Engineer, Adjunct Professor 2 Rocket Lab USA FROM THE FOUNDER Space has defined some of humanity’s greatest achievements, and it continues to shape our future. I’m motivated by the enormous impact we can have on Earth by making it easier to get to space and to use it as a platform for innovation, exploration, and infrastructure. We go to space to improve life on Earth.” Peter J. Beck Founder, CEO, Chief Engineer, Adjunct Professor 2 Rocket Lab USA

DISCLAIMER AND FORWARD LOOKING STATEMENTS This presentation (this “Presentation”) was from the forward-looking statements in the owners of such trademarks, copyrights, represents Rocket Lab’s future operations Non-GAAP Financial Measures. The financial relevant documents filed or that will be filed prepared for informational purposes only this presentation, including but not limited logos and other intellectual property. Solely or financial conditions. Such information information and data contained in this with the SEC in connection with the proposed to assist interested parties in making their to: (i) the risk that the Transaction may not for convenience, trademarks and trade is subject to a wide variety of significant Presentation is unaudited and does not transaction as they become available because own evaluation of the proposed transaction be completed in a timely manner or at all, names referred to in this Presentation may business, economic and competitive risks conform to Regulation S-X promulgated they will contain important information about (the “Transaction”) between Vector which may adversely affect the price of appear with the ® or ™ symbols, but such and uncertainties, including but not limited under the Securities Act of 1933, as the proposed transaction. Investors and security Acquisition Corporation Inc. (“Vector”, “we”, Vector’s securities, (ii) the failure to satisfy references are not intended to indicate, to those set forth in the second paragraph amended. This Presentation also includes holders will be able to obtain free copies of the or “our”) and Rocket Lab USA, Inc. (“Rocket the conditions to the consummation of the in any way, that such names and logos above that could cause actual results to non-GAAP financial measures. Vector and registration statement, the proxy statement/ Lab”). This Presentation is for discussion Transaction, (iii) the occurrence aretrademarks or registered trademarks differ materially from those contained in the Rocket Lab believe that these non-GAAP prospectus and all other relevant documents purposes only and does not constitute an offer of any event, change or other circumstance of Vector. prospective financial information. measures of financial results provide useful filed or that will be filed with the SEC by Rocket to purchase nor a solicitation of an offer to sell that could give rise to the termination of the Accordingly, there can be no assurance information to management and investors Lab and Vector through the website maintained shares of Vector, Rocket Lab or any successor Agreement and Plan of Merger, (iv) the Use of Projections. Rocket Lab does not as a that the prospective results are indicative regarding certain financial and business by the SEC at www.sec.gov. entity of the Transaction, nor shall there be any effect of the announcement or pendency matter of course make public projections as to of the future performance of Vector or trends relating to Rocket Lab’s financial sale of securities in any jurisdiction in which of the Transaction on Rocket Lab’s business future results. Rocket Lab provided its internally- Rocket Lab or that actual results will not condition and results of operations. Rocket The documents filed by Vector with the SEC also such offer, solicitation, or sale would be unlawful relationships, operating results and business derived forecasts, prepared in the first quarter differ materially from those presented in the Lab’s management uses certain of these may be obtained free of charge upon written prior to registration or qualification under the generally, (v) risks that the Transaction of 2021, for each of the years in the seven-year prospective financial information. Some of non-GAAP measures to compare Rocket request to Vector Acquisition Corporation, One securities laws of any such jurisdiction. This disrupts current plans and operations of period ending December 31, 2027 to Vector for the assumptions upon which the projections Lab’s performance to that of prior periods Market Street, Steuart Tower, 23rd Floor, San Presentation is not intended to form the basis Rocket Lab, (vi) changes in the competitive use as a component of its overall evaluation of are based inevitably will not materialize for trend analyses and for budgeting and Francisco, CA 94105. The documents filed by of any investment decision by the recipient and highly regulated industries in which Rocket Lab. Such projected financial information and unanticipated events may occur that planning purposes. Not all of the information Rocket Lab with the SEC also may be obtained and does not constitute investment, tax or legal Rocket Lab plans to operate, variations in is included in this Presentation because it was could affect results. Therefore, actual results necessary for a quantitative reconciliation free of charge upon written request to Rocket advice. No representation, express or implied, operating performance across competitors, provided to Vector for its evaluation of the achieved during the periods covered by the of these forward-looking non-GAAP Lab USA, Inc., 3881 McGowen Street, Long Beach, is or will be given by Vector, Rocket Lab or their changes in laws and regulations affecting Transaction. Rocket Lab has not updated or projections may vary and may vary materially financial measures to the most directly CA 90808. respective affiliates and advisors as to the Rocket Lab’s business and changes in the reaffirmed any of these projections since the from the projected results. Inclusion of the comparable GAAP financial measures is accuracy or completeness of the combined capital structure, (vii) the ability date of they were provided to Vector and is not prospective financial information in this available without unreasonable efforts at Participants in the Solicitation. Rocket Lab, information contained herein, or any to implement business plans, forecasts and doing so by restating them in this Presentation. presentation should not be regarded as this time. Specifically, Rocket Lab does not Vector and their respective directors and other written or oral information made available other expectations after the completion Rocket Lab has not made any representations a representation by any person that the provide such quantitative reconciliation executive officers may be deemed to be in the course of an evaluation of the Transaction, and identify and realize or warranties regarding the accuracy, reliability, results contained in the prospective financial due to the inherent difficulty in forecasting participants in the solicitation of proxies from of the Transaction. additional opportunities, (viii) the risk appropriateness or completeness of the information are indicative of future results or and quantifying certain amounts that are Vector’s shareholders in connection with the of downturns in the commercial launch projections to anyone, including Vector. Neither will be achieved. necessary for such reconciliations, including proposed transaction. A list of the names of such This Presentation provided by Vector and Rocket services, satellite and spacecraft industry Rocket Lab’s board, officers, management nor net income (loss), accelerated depreciation directors, executive officers, other members of Lab may contain certain “forward-looking and (ix) other risk factors, including those any other representative of Rocket Lab has made This Presentation contains statistical data, and variations in effective tax rate. management, and employees, and information statements” within the meaning of the Private detailed in the section of the Form S-4 filed or makes any representation to any person estimates and forecasts that are based This Presentation relates to a proposed regarding their interests in the business Securities Litigation Reform Act of 1995, Section by Vector and Rocket Lab with the SEC in regarding Rocket Lab’s ultimate performance on independent industry publications or transaction between Rocket Lab and Vector This combination will be contained in Vector’s filings 27A of the Securities Act 1933, as amended, and connection with the Transaction titled Risk compared to the information contained in the other publicly available information. This Presentation does not constitute an offer to sell with the SEC, including Vector’s Quarterly Report Section 21E of the Securities Exchange Act of Factors . There can be no assurance that the projections, and none of them intends to or information involves many assumptions or exchange, or the solicitation of an offer to buy on Form 10-Q for the fiscal quarter ended March 1934, as amended, including statements future developments affecting Vector, Rocket undertakes any obligation to update or otherwise and limitations and you are cautioned not or exchange, any securities, nor shall there be 31, 2021, which was filed with the SEC on May regarding Vector’s, Rocket Lab’s on their Lab or any successor entity of the Transaction revise the projections to reflect circumstances to give undue weight to these estimates. any sale of securities in any jurisdiction in which 24, 2021, and such information and names of management teams’ expectations, hopes, will be those that we have anticipated. These existing after the date when made or to reflect We have not independently verified the such offer, sale or exchange would be unlawful Rocket Lab’s directors and executive officers beliefs, intentions or strategies regarding forward-looking statements involve a number of the occurrence of future events if any or all of accuracy or completeness of the data prior to registration or qualification under the is in the Registration Statement on Form S-4 the future. The words “anticipate”, “believe”, risks, uncertainties (some of which are beyond the assumptions underlying the projections are that has been contained in these industry securities laws of any such jurisdiction. Vector filed with the SEC by Rocket Lab and Vector on “continue”, “could”, “estimate”, “expect”, Vector’s or Rocket Lab’s control) or other shown to be in error. Accordingly, the projections publications and other publicly available and Rocket Lab filed a registration statement on July 13, 2021. Additional information regarding “intends”, “may”, “might”, “plan”, “possible”, assumptions that may cause actual should not be looked upon as “guidance” of any information. Accordingly, none of Vector, Form S-4 with the U.S. Securities and Exchange the interests of such potential participants “potential”, “predict”, “project”, “should”, results or performance to be materially sort. Rocket Lab does not intend to refer back to Rocket Lab nor their respective affiliates Commission (the “SEC”), which includes a in the solicitation process are included in the “would” and similar expressions may different from those expressed or implied by these projections in its future periodic reports and advisors makes any representations as document that serves as a joint prospectus registration statement (and included in the identify forward-looking statements, but these forward-looking statements. Except filed under the Exchange Act. Neither to the accuracy or completeness of these and proxy statement, referred to as a proxy definitive proxy statement/prospectus) and the absence of these words does not mean as required by law, Vector and Rocket Lab Vector’s nor Rocket Lab’s independent public data. This Presentation contains references statement/prospectus. A proxy statement/ other relevant documents when they are filed that a statement is not forward-looking. are not undertaking any obligation to update accountants have examined, reviewed or to Rocket Lab’s achievements compared to prospectus will be sent to all Rocket Lab and with the SEC. These forward-looking statements are or revise any forward-looking statements compiled the forecasts or projections and, other companies, including being the first Vector shareholders. Rocket Lab and Vector based on Vector’s and Rocket Lab’s current whether as a result of new information, future accordingly, neither expresses an opinion to achieve certain milestones. All of such will also file other documents regarding the expectations and beliefs concerning future events or otherwise. All rights to the trademarks, or other form of assurance with respect references are based on the belief of Rocket proposed transaction with the SEC. Before developments and their potential effects on copyrights, logos and other intellectual property thereto. Furthermore none of Vector, Rocket Lab’s management based on publicly making any voting decision, investors and Vector, Rocket Lab or any successor entity listed herein belong to their respective owners Lab nor their respective management teams availableinformation known to Rocket Lab’s security holders of Rocket Lab and Vector of the Transaction. Many factors could cause and Vector’s or Rocket Lab’s use thereof does can give any assurance that the forecasts management. are urged to read the registration statement, actual future events to differ materially not imply an affiliation with, or endorsement by or projections contained herein accurately the proxy statement/prospectus and all other 3 Rocket Lab USA Proxy Statement: https://www.sec.gov/Archives/edgar/data/1819994/000119312521220660/d169841d424b3.htmDISCLAIMER AND FORWARD LOOKING STATEMENTS This presentation (this “Presentation”) was from the forward-looking statements in the owners of such trademarks, copyrights, represents Rocket Lab’s future operations Non-GAAP Financial Measures. The financial relevant documents filed or that will be filed prepared for informational purposes only this presentation, including but not limited logos and other intellectual property. Solely or financial conditions. Such information information and data contained in this with the SEC in connection with the proposed to assist interested parties in making their to: (i) the risk that the Transaction may not for convenience, trademarks and trade is subject to a wide variety of significant Presentation is unaudited and does not transaction as they become available because own evaluation of the proposed transaction be completed in a timely manner or at all, names referred to in this Presentation may business, economic and competitive risks conform to Regulation S-X promulgated they will contain important information about (the “Transaction”) between Vector which may adversely affect the price of appear with the ® or ™ symbols, but such and uncertainties, including but not limited under the Securities Act of 1933, as the proposed transaction. Investors and security Acquisition Corporation Inc. (“Vector”, “we”, Vector’s securities, (ii) the failure to satisfy references are not intended to indicate, to those set forth in the second paragraph amended. This Presentation also includes holders will be able to obtain free copies of the or “our”) and Rocket Lab USA, Inc. (“Rocket the conditions to the consummation of the in any way, that such names and logos above that could cause actual results to non-GAAP financial measures. Vector and registration statement, the proxy statement/ Lab”). This Presentation is for discussion Transaction, (iii) the occurrence aretrademarks or registered trademarks differ materially from those contained in the Rocket Lab believe that these non-GAAP prospectus and all other relevant documents purposes only and does not constitute an offer of any event, change or other circumstance of Vector. prospective financial information. measures of financial results provide useful filed or that will be filed with the SEC by Rocket to purchase nor a solicitation of an offer to sell that could give rise to the termination of the Accordingly, there can be no assurance information to management and investors Lab and Vector through the website maintained shares of Vector, Rocket Lab or any successor Agreement and Plan of Merger, (iv) the Use of Projections. Rocket Lab does not as a that the prospective results are indicative regarding certain financial and business by the SEC at www.sec.gov. entity of the Transaction, nor shall there be any effect of the announcement or pendency matter of course make public projections as to of the future performance of Vector or trends relating to Rocket Lab’s financial sale of securities in any jurisdiction in which of the Transaction on Rocket Lab’s business future results. Rocket Lab provided its internally- Rocket Lab or that actual results will not condition and results of operations. Rocket The documents filed by Vector with the SEC also such offer, solicitation, or sale would be unlawful relationships, operating results and business derived forecasts, prepared in the first quarter differ materially from those presented in the Lab’s management uses certain of these may be obtained free of charge upon written prior to registration or qualification under the generally, (v) risks that the Transaction of 2021, for each of the years in the seven-year prospective financial information. Some of non-GAAP measures to compare Rocket request to Vector Acquisition Corporation, One securities laws of any such jurisdiction. This disrupts current plans and operations of period ending December 31, 2027 to Vector for the assumptions upon which the projections Lab’s performance to that of prior periods Market Street, Steuart Tower, 23rd Floor, San Presentation is not intended to form the basis Rocket Lab, (vi) changes in the competitive use as a component of its overall evaluation of are based inevitably will not materialize for trend analyses and for budgeting and Francisco, CA 94105. The documents filed by of any investment decision by the recipient and highly regulated industries in which Rocket Lab. Such projected financial information and unanticipated events may occur that planning purposes. Not all of the information Rocket Lab with the SEC also may be obtained and does not constitute investment, tax or legal Rocket Lab plans to operate, variations in is included in this Presentation because it was could affect results. Therefore, actual results necessary for a quantitative reconciliation free of charge upon written request to Rocket advice. No representation, express or implied, operating performance across competitors, provided to Vector for its evaluation of the achieved during the periods covered by the of these forward-looking non-GAAP Lab USA, Inc., 3881 McGowen Street, Long Beach, is or will be given by Vector, Rocket Lab or their changes in laws and regulations affecting Transaction. Rocket Lab has not updated or projections may vary and may vary materially financial measures to the most directly CA 90808. respective affiliates and advisors as to the Rocket Lab’s business and changes in the reaffirmed any of these projections since the from the projected results. Inclusion of the comparable GAAP financial measures is accuracy or completeness of the combined capital structure, (vii) the ability date of they were provided to Vector and is not prospective financial information in this available without unreasonable efforts at Participants in the Solicitation. Rocket Lab, information contained herein, or any to implement business plans, forecasts and doing so by restating them in this Presentation. presentation should not be regarded as this time. Specifically, Rocket Lab does not Vector and their respective directors and other written or oral information made available other expectations after the completion Rocket Lab has not made any representations a representation by any person that the provide such quantitative reconciliation executive officers may be deemed to be in the course of an evaluation of the Transaction, and identify and realize or warranties regarding the accuracy, reliability, results contained in the prospective financial due to the inherent difficulty in forecasting participants in the solicitation of proxies from of the Transaction. additional opportunities, (viii) the risk appropriateness or completeness of the information are indicative of future results or and quantifying certain amounts that are Vector’s shareholders in connection with the of downturns in the commercial launch projections to anyone, including Vector. Neither will be achieved. necessary for such reconciliations, including proposed transaction. A list of the names of such This Presentation provided by Vector and Rocket services, satellite and spacecraft industry Rocket Lab’s board, officers, management nor net income (loss), accelerated depreciation directors, executive officers, other members of Lab may contain certain “forward-looking and (ix) other risk factors, including those any other representative of Rocket Lab has made This Presentation contains statistical data, and variations in effective tax rate. management, and employees, and information statements” within the meaning of the Private detailed in the section of the Form S-4 filed or makes any representation to any person estimates and forecasts that are based This Presentation relates to a proposed regarding their interests in the business Securities Litigation Reform Act of 1995, Section by Vector and Rocket Lab with the SEC in regarding Rocket Lab’s ultimate performance on independent industry publications or transaction between Rocket Lab and Vector This combination will be contained in Vector’s filings 27A of the Securities Act 1933, as amended, and connection with the Transaction titled Risk compared to the information contained in the other publicly available information. This Presentation does not constitute an offer to sell with the SEC, including Vector’s Quarterly Report Section 21E of the Securities Exchange Act of Factors . There can be no assurance that the projections, and none of them intends to or information involves many assumptions or exchange, or the solicitation of an offer to buy on Form 10-Q for the fiscal quarter ended March 1934, as amended, including statements future developments affecting Vector, Rocket undertakes any obligation to update or otherwise and limitations and you are cautioned not or exchange, any securities, nor shall there be 31, 2021, which was filed with the SEC on May regarding Vector’s, Rocket Lab’s on their Lab or any successor entity of the Transaction revise the projections to reflect circumstances to give undue weight to these estimates. any sale of securities in any jurisdiction in which 24, 2021, and such information and names of management teams’ expectations, hopes, will be those that we have anticipated. These existing after the date when made or to reflect We have not independently verified the such offer, sale or exchange would be unlawful Rocket Lab’s directors and executive officers beliefs, intentions or strategies regarding forward-looking statements involve a number of the occurrence of future events if any or all of accuracy or completeness of the data prior to registration or qualification under the is in the Registration Statement on Form S-4 the future. The words “anticipate”, “believe”, risks, uncertainties (some of which are beyond the assumptions underlying the projections are that has been contained in these industry securities laws of any such jurisdiction. Vector filed with the SEC by Rocket Lab and Vector on “continue”, “could”, “estimate”, “expect”, Vector’s or Rocket Lab’s control) or other shown to be in error. Accordingly, the projections publications and other publicly available and Rocket Lab filed a registration statement on July 13, 2021. Additional information regarding “intends”, “may”, “might”, “plan”, “possible”, assumptions that may cause actual should not be looked upon as “guidance” of any information. Accordingly, none of Vector, Form S-4 with the U.S. Securities and Exchange the interests of such potential participants “potential”, “predict”, “project”, “should”, results or performance to be materially sort. Rocket Lab does not intend to refer back to Rocket Lab nor their respective affiliates Commission (the “SEC”), which includes a in the solicitation process are included in the “would” and similar expressions may different from those expressed or implied by these projections in its future periodic reports and advisors makes any representations as document that serves as a joint prospectus registration statement (and included in the identify forward-looking statements, but these forward-looking statements. Except filed under the Exchange Act. Neither to the accuracy or completeness of these and proxy statement, referred to as a proxy definitive proxy statement/prospectus) and the absence of these words does not mean as required by law, Vector and Rocket Lab Vector’s nor Rocket Lab’s independent public data. This Presentation contains references statement/prospectus. A proxy statement/ other relevant documents when they are filed that a statement is not forward-looking. are not undertaking any obligation to update accountants have examined, reviewed or to Rocket Lab’s achievements compared to prospectus will be sent to all Rocket Lab and with the SEC. These forward-looking statements are or revise any forward-looking statements compiled the forecasts or projections and, other companies, including being the first Vector shareholders. Rocket Lab and Vector based on Vector’s and Rocket Lab’s current whether as a result of new information, future accordingly, neither expresses an opinion to achieve certain milestones. All of such will also file other documents regarding the expectations and beliefs concerning future events or otherwise. All rights to the trademarks, or other form of assurance with respect references are based on the belief of Rocket proposed transaction with the SEC. Before developments and their potential effects on copyrights, logos and other intellectual property thereto. Furthermore none of Vector, Rocket Lab’s management based on publicly making any voting decision, investors and Vector, Rocket Lab or any successor entity listed herein belong to their respective owners Lab nor their respective management teams availableinformation known to Rocket Lab’s security holders of Rocket Lab and Vector of the Transaction. Many factors could cause and Vector’s or Rocket Lab’s use thereof does can give any assurance that the forecasts management. are urged to read the registration statement, actual future events to differ materially not imply an affiliation with, or endorsement by or projections contained herein accurately the proxy statement/prospectus and all other 3 Rocket Lab USA Proxy Statement: https://www.sec.gov/Archives/edgar/data/1819994/000119312521220660/d169841d424b3.htm

Today’s Presenters Peter Beck Adam Spice Shaun O'Donnell Lars Hoffman Founder, CEO, Chief Engineer Chief Financial Officer EVP – Global Operations SVP – Global Launch Services Shaun D'Mello Ehson Mosleh Richard French David Ramazetti Director – Business Development and VP - Launch Chief Engineer – Space Systems Managing Director – Vector Capital Strategy Space Systems 4 Rocket Lab USA Today’s Presenters Peter Beck Adam Spice Shaun O'Donnell Lars Hoffman Founder, CEO, Chief Engineer Chief Financial Officer EVP – Global Operations SVP – Global Launch Services Shaun D'Mello Ehson Mosleh Richard French David Ramazetti Director – Business Development and VP - Launch Chief Engineer – Space Systems Managing Director – Vector Capital Strategy Space Systems 4 Rocket Lab USA

Vector Capital Overview OUR PEDIGREE Our Value Add for Rocket Lab Tech-only Investment Fund Executing Accretive Acquisitions $320M SPAC 25-Year Track Record Sales, Operations, Strategy HIGHLIGHTS $3B+ 40+ 100+ 39% Capital Under Investing and Operating Tech Companies Gross IRR Since Management Professionals Acquired Since 1997 Inception 5 Rocket Lab USA Vector Capital Overview OUR PEDIGREE Our Value Add for Rocket Lab Tech-only Investment Fund Executing Accretive Acquisitions $320M SPAC 25-Year Track Record Sales, Operations, Strategy HIGHLIGHTS $3B+ 40+ 100+ 39% Capital Under Investing and Operating Tech Companies Gross IRR Since Management Professionals Acquired Since 1997 Inception 5 Rocket Lab USA

CONTENTS SECTION SECTION SECTION SECTION SECTION 01 02 03 04 05 Rocket Lab Overview Launch Space Systems Vertical Integration Transaction Overview & Introduction & Financials 6 Rocket Lab USA CONTENTS SECTION SECTION SECTION SECTION SECTION 01 02 03 04 05 Rocket Lab Overview Launch Space Systems Vertical Integration Transaction Overview & Introduction & Financials 6 Rocket Lab USA

SECTION 01 ROCKET LAB OVERVIEW & Introduction 7 Rocket Lab USA Section 1

In the history of spaceflight, only two private companies have delivered regular and reliable access to orbit & 8 Rocket Lab USA Section 1In the history of spaceflight, only two private companies have delivered regular and reliable access to orbit & 8 Rocket Lab USA Section 1

Rocket lab at a glance A vertically integrated provider of small launch services, satellites and spacecraft components Delivering end-to-end IN UNDER 6 YEARS space solutions Launch: Proven rocket delivering dedicated access to orbit for 3+ years ND 20 3 2 2 8 104 Space Systems: Manufacturing satellites and Satellites Most frequently Launches Launch Mission Successful best-in-class heritage spacecraft components 1 to space deployed pads launched control missions to orbit U.S. rocket centers for USG customers Space Applications: Uniquely positioned to leverage launch and satellite capabilities and infrastructure to build and operate our own constellations 2 2 3 1 1 2 of our own Recovered Interplanetary Awarded Strategic Factories acquisition built satellites on rockets missions contract for orbit (+ more scheduled Photon demo to come) (Moon, Mars, of propellant Venus) depot in orbit 9 Rocket Lab USA Section 1 1 Includes Pad B at Launch Complex-1 that is under construction and Wallops Island that may be used upon certification of our flight termination system software by NASARocket lab at a glance A vertically integrated provider of small launch services, satellites and spacecraft components Delivering end-to-end IN UNDER 6 YEARS space solutions Launch: Proven rocket delivering dedicated access to orbit for 3+ years ND 20 3 2 2 8 104 Space Systems: Manufacturing satellites and Satellites Most frequently Launches Launch Mission Successful best-in-class heritage spacecraft components 1 to space deployed pads launched control missions to orbit U.S. rocket centers for USG customers Space Applications: Uniquely positioned to leverage launch and satellite capabilities and infrastructure to build and operate our own constellations 2 2 3 1 1 2 of our own Recovered Interplanetary Awarded Strategic Factories acquisition built satellites on rockets missions contract for orbit (+ more scheduled Photon demo to come) (Moon, Mars, of propellant Venus) depot in orbit 9 Rocket Lab USA Section 1 1 Includes Pad B at Launch Complex-1 that is under construction and Wallops Island that may be used upon certification of our flight termination system software by NASA

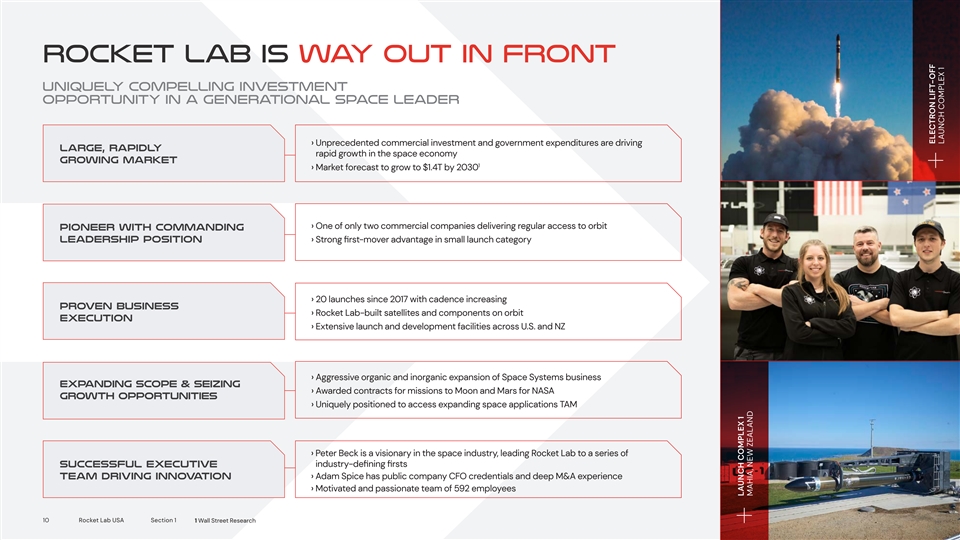

Rocket Lab is way out in front Uniquely compelling investment opportunity in a generational space leader › Unprecedented commercial investment and government expenditures are driving Large, Rapidly rapid growth in the space economy Growing Market 1 › M arket forecast to grow to $1.4T by 2030 › One of only two commercial companies delivering regular access to orbit Pioneer with Commanding Leadership Position › Strong first-mover advantage in small launch category › 20 launches since 2017 with cadence increasing Proven Business › Rocket Lab-built satellites and components on orbit Execution › Extensive launch and development facilities across U.S. and NZ › A ggressive organic and inorganic expansion of Space Systems business Expanding Scope & Seizing › Awarded contracts for missions to Moon and Mars for NASA Growth Opportunities › Uniquely positioned to access expanding space applications TAM › Peter Beck is a visionary in the space industry, leading Rocket Lab to a series of industry-deni fi ng r fi sts Successful Executive › Adam Spice has public company CFO credentials and deep M&A experience Team Driving Innovation › Motivated and passionate team of 592 employees 10 Rocket Lab USA Section 1 1 Wall Street Research LAUNCH COMPLEX 1 MAHIA, NEW ZEALAND ELECTRON LIFT-OFF LAUNCH COMPLEX 1 Rocket Lab is way out in front Uniquely compelling investment opportunity in a generational space leader › Unprecedented commercial investment and government expenditures are driving Large, Rapidly rapid growth in the space economy Growing Market 1 › M arket forecast to grow to $1.4T by 2030 › One of only two commercial companies delivering regular access to orbit Pioneer with Commanding Leadership Position › Strong first-mover advantage in small launch category › 20 launches since 2017 with cadence increasing Proven Business › Rocket Lab-built satellites and components on orbit Execution › Extensive launch and development facilities across U.S. and NZ › A ggressive organic and inorganic expansion of Space Systems business Expanding Scope & Seizing › Awarded contracts for missions to Moon and Mars for NASA Growth Opportunities › Uniquely positioned to access expanding space applications TAM › Peter Beck is a visionary in the space industry, leading Rocket Lab to a series of industry-deni fi ng r fi sts Successful Executive › Adam Spice has public company CFO credentials and deep M&A experience Team Driving Innovation › Motivated and passionate team of 592 employees 10 Rocket Lab USA Section 1 1 Wall Street Research LAUNCH COMPLEX 1 MAHIA, NEW ZEALAND ELECTRON LIFT-OFF LAUNCH COMPLEX 1

$350B+ TAM forecast to grow 1 to $1.4T by 2030 Uniquely positioned to exploit a growing market 1 2 3 Launch SPACE SYSTEMS SPACE APPLICATIONS 1 Electron & Neutron Photon TAM ~$320B 2 2 TAM ~$10B TAM ~$20B › TAM growth driven › S ignic fi ant growth in › Market growth driven by historic levels small satellite mega by demand for space- of demand for constellations driven by based connectivity, Earth responsive small demand for commercial observation (including satellite launch Earth observation and synthetic aperture radar, and constellation telecom applications electro-optical and RF) deployments and other services › DoD focused on resiliency › Small satellite of space infrastructure › S ignic fi ant untapped constellations will and satellite constellation potential for value-added account for ~83% deployment and services including data of all satellites replenishment management & analytics 3 launched by 2028 to support end › I ncreased focus from customer insights multiple governments on high value deep space planetary exploration and discovery missions 11 Rocket Lab USA Section 1 1 Wall Street Research 2 Allied Market Research 3 Bryce Reports PHOTON ROCKET LAB PRODUCTION COMPLEX ELECTRON LIFT OFF LAUNCH COMPLEX 1$350B+ TAM forecast to grow 1 to $1.4T by 2030 Uniquely positioned to exploit a growing market 1 2 3 Launch SPACE SYSTEMS SPACE APPLICATIONS 1 Electron & Neutron Photon TAM ~$320B 2 2 TAM ~$10B TAM ~$20B › TAM growth driven › S ignic fi ant growth in › Market growth driven by historic levels small satellite mega by demand for space- of demand for constellations driven by based connectivity, Earth responsive small demand for commercial observation (including satellite launch Earth observation and synthetic aperture radar, and constellation telecom applications electro-optical and RF) deployments and other services › DoD focused on resiliency › Small satellite of space infrastructure › S ignic fi ant untapped constellations will and satellite constellation potential for value-added account for ~83% deployment and services including data of all satellites replenishment management & analytics 3 launched by 2028 to support end › I ncreased focus from customer insights multiple governments on high value deep space planetary exploration and discovery missions 11 Rocket Lab USA Section 1 1 Wall Street Research 2 Allied Market Research 3 Bryce Reports PHOTON ROCKET LAB PRODUCTION COMPLEX ELECTRON LIFT OFF LAUNCH COMPLEX 1

WORLD LEADING TECHNOLOGY Large technology moat st st st st 1 1 1 1 3D printed Electric-pump Fully carbon And private rocket engine -fed rocket composite orbital engine launch vehicle launch site ROCKET Unique Only FIRST that converts Kick Stage Reusable Private to a satellite enabling small launch interplanetary on orbit in-space vehicle mission transportation 12 Rocket Lab USA Section 1 PRODUCTION COMPLEX AUCKLAND, NEW ZEALAND ELECTRON LIFT-OFF LAUNCH COMPLEX 1, 2020 PHOTON ENCAPSULATION LAUNCH COMPLEX 1, 2020WORLD LEADING TECHNOLOGY Large technology moat st st st st 1 1 1 1 3D printed Electric-pump Fully carbon And private rocket engine -fed rocket composite orbital engine launch vehicle launch site ROCKET Unique Only FIRST that converts Kick Stage Reusable Private to a satellite enabling small launch interplanetary on orbit in-space vehicle mission transportation 12 Rocket Lab USA Section 1 PRODUCTION COMPLEX AUCKLAND, NEW ZEALAND ELECTRON LIFT-OFF LAUNCH COMPLEX 1, 2020 PHOTON ENCAPSULATION LAUNCH COMPLEX 1, 2020

PROVEN TEAM led by industry veterans EXECUTIVE LEADERSHIP Peter Beck Adam Spice Shaun O’Donnell Lachlan Matchett Founder, CEO, Chief Engineer Chief Financial Officer EVP – Global Operations VP – Propulsion Shaun D’Mello Lars Hoffman Estelle Curd Jennifer Jeffries Director of People & Culture (US) VP – Launch SVP – Global Launch Services Head of People & Culture (NZ) Ehson Mosleh Richard French, Director – Business Morgan Bailey Shane Fleming, VP – Global Development & Strategy Space Systems Space Systems Chief Engineer Director of Communications Commercial Launch Services 13 Rocket Lab USA Section 1PROVEN TEAM led by industry veterans EXECUTIVE LEADERSHIP Peter Beck Adam Spice Shaun O’Donnell Lachlan Matchett Founder, CEO, Chief Engineer Chief Financial Officer EVP – Global Operations VP – Propulsion Shaun D’Mello Lars Hoffman Estelle Curd Jennifer Jeffries Director of People & Culture (US) VP – Launch SVP – Global Launch Services Head of People & Culture (NZ) Ehson Mosleh Richard French, Director – Business Morgan Bailey Shane Fleming, VP – Global Development & Strategy Space Systems Space Systems Chief Engineer Director of Communications Commercial Launch Services 13 Rocket Lab USA Section 1

Our execution history We do what we say we will do Launch 6 YEARS 2014 2018 2020 1st venture NZ launch 1st flight Factory built First NRO U.S. launch Successful 4th most Monthly launch capital site built to orbit to support 1 launch site built reuse mission frequent cadence into raised rocket per week launcher in 2021 production the world in ‘19 & ‘20 Space Systems 1 YEAR 2019 2020 Photon program Acquired Sinclair Awarded Awarded NASA Developed KSAT First Awarded announced Interplanetary NASA CAPSTONE propellant multiple partnership Photon missions to mission depot mission Rocket Lab launched Moon and Mars. to the Moon in LEO satellite Private mission components to Venus scheduled Space Applications 0.5 YEARS 2020 First Rocket Lab Positioned to provide satellite on orbit space data to the market 14 Rocket Lab USA Section 1 PHOTON FIRST LIGHT ELECTRON LIFT-OFF NOVEMBER 2020 MAHIA, NEW ZEALAND FIRST NASA MISSION 2018Our execution history We do what we say we will do Launch 6 YEARS 2014 2018 2020 1st venture NZ launch 1st flight Factory built First NRO U.S. launch Successful 4th most Monthly launch capital site built to orbit to support 1 launch site built reuse mission frequent cadence into raised rocket per week launcher in 2021 production the world in ‘19 & ‘20 Space Systems 1 YEAR 2019 2020 Photon program Acquired Sinclair Awarded Awarded NASA Developed KSAT First Awarded announced Interplanetary NASA CAPSTONE propellant multiple partnership Photon missions to mission depot mission Rocket Lab launched Moon and Mars. to the Moon in LEO satellite Private mission components to Venus scheduled Space Applications 0.5 YEARS 2020 First Rocket Lab Positioned to provide satellite on orbit space data to the market 14 Rocket Lab USA Section 1 PHOTON FIRST LIGHT ELECTRON LIFT-OFF NOVEMBER 2020 MAHIA, NEW ZEALAND FIRST NASA MISSION 2018

SECTION 02 LAUNCH 15 Rocket Lab USA Section 2SECTION 02 LAUNCH 15 Rocket Lab USA Section 2

dedicated small launch is critical Not all space access is the same Rocket Lab delivers the first dedicated ride to orbit for small satellites, providing customers control over launch schedule and enabling tailored orbits that cannot be matched by large rocket rideshare Frequent Launch launch On demand Strategically critical for Potential for 132 launch slots Large rockets do not Small satellites More than 50% military space resilience and every year (more than all U.S. provide adequate 1 face costly delays of small satellites commercial constellation launch sites combined) when flying launched in control for many replenishment rideshare on large the past 5 years small satellite orbital rockets due to low were delayed from destinations launch frequency 4 months to 2 years SCHEDULE Tailored CONTROL orbits Small satellite customers in control Ability to control launch time of exact orbits. Wide range of down to the second launch azimuths 16 Rocket Lab USA Section 2 1 Includes expected capacity when Pad B at Launch Complex-1 and Wallops Island launch complex are operationaldedicated small launch is critical Not all space access is the same Rocket Lab delivers the first dedicated ride to orbit for small satellites, providing customers control over launch schedule and enabling tailored orbits that cannot be matched by large rocket rideshare Frequent Launch launch On demand Strategically critical for Potential for 132 launch slots Large rockets do not Small satellites More than 50% military space resilience and every year (more than all U.S. provide adequate 1 face costly delays of small satellites commercial constellation launch sites combined) when flying launched in control for many replenishment rideshare on large the past 5 years small satellite orbital rockets due to low were delayed from destinations launch frequency 4 months to 2 years SCHEDULE Tailored CONTROL orbits Small satellite customers in control Ability to control launch time of exact orbits. Wide range of down to the second launch azimuths 16 Rocket Lab USA Section 2 1 Includes expected capacity when Pad B at Launch Complex-1 and Wallops Island launch complex are operational

Meet Fairing electron Payload plate SIGNIFICANT technology Kick stage moats SECOND stage RUTHERFORD VACUUM ENGINE INTERSTAGE st 104 1 132 200 Satellites Carbon Launch slots 3D printed deployed to composite possible engines FIRST STAGE orbit to date orbital launch every year delivered vehicle in across 3 to space 1 the world launch pads Powered by the Unique Kick Stage Designed for Tailored for world’s first 3D standard on every manufacturability satellites up printed and electric- mission to provide and reliability to 300 kg pump-fed rocket precise orbit (660 pounds) engine technology, insertion and on-orbit payload class Power Pack backed by a growing maneuvering IP portfolio and 9x Rutherford patent filings Sea Level Engines 17 Rocket Lab USA Section 2 1 Includes expected capacity when Pad B at Launch Complex-1 and Wallops Island launch complex are operational ELECTRON ELECTRON PRODUCTION COMPLEX LAUNCH COMPLEX 1 ELECTRON ON LAUNCH PAD LAUNCH COMPLEX 1Meet Fairing electron Payload plate SIGNIFICANT technology Kick stage moats SECOND stage RUTHERFORD VACUUM ENGINE INTERSTAGE st 104 1 132 200 Satellites Carbon Launch slots 3D printed deployed to composite possible engines FIRST STAGE orbit to date orbital launch every year delivered vehicle in across 3 to space 1 the world launch pads Powered by the Unique Kick Stage Designed for Tailored for world’s first 3D standard on every manufacturability satellites up printed and electric- mission to provide and reliability to 300 kg pump-fed rocket precise orbit (660 pounds) engine technology, insertion and on-orbit payload class Power Pack backed by a growing maneuvering IP portfolio and 9x Rutherford patent filings Sea Level Engines 17 Rocket Lab USA Section 2 1 Includes expected capacity when Pad B at Launch Complex-1 and Wallops Island launch complex are operational ELECTRON ELECTRON PRODUCTION COMPLEX LAUNCH COMPLEX 1 ELECTRON ON LAUNCH PAD LAUNCH COMPLEX 1

Kicking The Space Junk Habit Responsible orbital deployment with the Kick Stage After deploying customer satellites, the Kick Stage can lower its orbit and speed up its own deorbiting With more Rocket stage Enables: Standard satellites debris is a large on every › Plane changes and mega contributor to mission › Custom orbits constellations, orbital debris › In-space safe and transportation sustainable › Orbit raising management and lowering space must be priority 18 Rocket Lab USA Section 2Kicking The Space Junk Habit Responsible orbital deployment with the Kick Stage After deploying customer satellites, the Kick Stage can lower its orbit and speed up its own deorbiting With more Rocket stage Enables: Standard satellites debris is a large on every › Plane changes and mega contributor to mission › Custom orbits constellations, orbital debris › In-space safe and transportation sustainable › Orbit raising management and lowering space must be priority 18 Rocket Lab USA Section 2

α - X i r t S | e v i t c e p s n y S r o c k 2nd most frequently launched rocket in the U.S. 5 1 SPACEX 2 ROCKET LAB MAY JANUARY NOVEMBER DECEMBER MARCH MAY 2017 2018 2018 2018 2019 2019 4th most frequent launcher globally JUNE AUGUST OCTOBER DECEMBER JANUARY JUNE JULY 2019 2019 2019 2019 2020 2020 2020 1 CHINA 4 ROCKET LAB 2 RUSSIA 5 EUROPE 3 SPACEX 6 JAPAN 19 Rocket Lab USA Section 2 AUGUST OCTOBER NOVEMBER DECEMBER JANUARY MARCH MAY 2020 2020 2020 2020 2021 2021 2021 e t l a b s n i g e b t h g i n s ' l w o e h T α - X i r t S | e v i t c e p s n y S r o c k 2nd most frequently launched rocket in the U.S. 5 1 SPACEX 2 ROCKET LAB MAY JANUARY NOVEMBER DECEMBER MARCH MAY 2017 2018 2018 2018 2019 2019 4th most frequent launcher globally JUNE AUGUST OCTOBER DECEMBER JANUARY JUNE JULY 2019 2019 2019 2019 2020 2020 2020 1 CHINA 4 ROCKET LAB 2 RUSSIA 5 EUROPE 3 SPACEX 6 JAPAN 19 Rocket Lab USA Section 2 AUGUST OCTOBER NOVEMBER DECEMBER JANUARY MARCH MAY 2020 2020 2020 2020 2021 2021 2021 e t l a b s n i g e b t h g i n s ' l w o e h T

Our customers ~50% 20 missions, 104 satellites deployed C O M M E R C IAL for more than 20 organizations 2 Missions 1 Mission 1 Mission 2 Missions 1 Mission (upcoming) 1 Mission 3 Missions 1 Mission 4 Missions 2 Missions 3 Missions 1 Mission 1 Mission 1 Mission 1 Mission 2 Missions ~20% ~30% C I VI L NAT I O NAL S E C U R I T Y 2 Missions 1 Mission 2 Missions 2 Missions 20 Rocket Lab USA Section 2Our customers ~50% 20 missions, 104 satellites deployed C O M M E R C IAL for more than 20 organizations 2 Missions 1 Mission 1 Mission 2 Missions 1 Mission (upcoming) 1 Mission 3 Missions 1 Mission 4 Missions 2 Missions 3 Missions 1 Mission 1 Mission 1 Mission 1 Mission 2 Missions ~20% ~30% C I VI L NAT I O NAL S E C U R I T Y 2 Missions 1 Mission 2 Missions 2 Missions 20 Rocket Lab USA Section 2

Unrivaled launch infrastructure 3 launch pads across 2 countries Launch Complex 1 New Zealand Launch Complex 2 Virginia, U.S. Potential for 132 slots Critical national Dedicated annually (more than infrastructure asset integration and all U.S. ranges for U.S. government control facilities 1 combined) customers World’s first 24-hr rapid call-up A bilateral private, FAA- launch for defense treaty that allows licensed orbital needs and constellation U.S. launch vehicles launch site replenishment to launch outside of the U.S. 21 Rocket Lab USA Section 2 1 Includes P ad B at Launch Complex-1 that is under construction and Wallops Island that may be used upon certification of our flight termination system software by NASA LAUNCH COMPLEX 1 MAHIA, NEW ZEALAND LAUNCH COMPLEX 2 VIRGINIA, U.S.

Strong growth strategy Launch Qualie fi d to compete for USG multi year launch programs › D epartment of Defense (DoD) ($968M* opportunity over 10 years) › National Reconnaissance Ofc fi e (NRO) ($700M* opportunity over 10 years) › NASA ($300M* opportunity over 5 years) Capabilities address Space Development Agency constellation launch requirements G rowth opportunities with existing and emerging customers › Secure facility to be completed this year to support classified DoD and Intelligence Community business › O pportunities in progress with other major USG customers Missile Defense Agency (MDA), United States Special Operations Command (USSOCOM), Army, Navy, National Oceanic and Atmospheric Administration ( NOAA) › A ctive engagements and partnerships with major aerospace and defense primes › C apturing early launches for startup commercial satellite companies leading to long term recurring business FLIGHT 17, INTEGRATION MAHIA, NEW ZEALAND, DEC 2020 22 Rocket Lab USA Section 2 *Source: Publicly available NASA, DoD and NASA RFPsStrong growth strategy Launch Qualie fi d to compete for USG multi year launch programs › D epartment of Defense (DoD) ($968M* opportunity over 10 years) › National Reconnaissance Ofc fi e (NRO) ($700M* opportunity over 10 years) › NASA ($300M* opportunity over 5 years) Capabilities address Space Development Agency constellation launch requirements G rowth opportunities with existing and emerging customers › Secure facility to be completed this year to support classified DoD and Intelligence Community business › O pportunities in progress with other major USG customers Missile Defense Agency (MDA), United States Special Operations Command (USSOCOM), Army, Navy, National Oceanic and Atmospheric Administration ( NOAA) › A ctive engagements and partnerships with major aerospace and defense primes › C apturing early launches for startup commercial satellite companies leading to long term recurring business FLIGHT 17, INTEGRATION MAHIA, NEW ZEALAND, DEC 2020 22 Rocket Lab USA Section 2 *Source: Publicly available NASA, DoD and NASA RFPs

Pipeline – future launch opportunities Sum: $2.4B Prospecting 1.5B Qualica fi tion 624M 244M Proposal Negotiation Review 50M 23 Rocket Lab USA Section 2 FLIGHT 18 'ANOTHER ONE LEAVES THE CRUST' MAHIA, NEW ZEALAND LAUNCH COMPLEX 2 VIRGINIA, U.S.

REUSABILITY Boosting profitability Electron is the only reusable orbital-class small rocket One of only two Components Enables First re-flight companies to from first higher launch of a full booster successfully bring recovered frequency scheduled back an orbital- booster already without for 2022 class booster scheduled for expanding from space re-flight production 24 Rocket Lab USA Section 2 ELECTRON RECOVERY TESTING NOVEMBER 2020 MID-AIR CAPTURE MARCH 2020REUSABILITY Boosting profitability Electron is the only reusable orbital-class small rocket One of only two Components Enables First re-flight companies to from first higher launch of a full booster successfully bring recovered frequency scheduled back an orbital- booster already without for 2022 class booster scheduled for expanding from space re-flight production 24 Rocket Lab USA Section 2 ELECTRON RECOVERY TESTING NOVEMBER 2020 MID-AIR CAPTURE MARCH 2020

Investing in our people and communities Creating career and education opportunities Supporting local causes Championing regional development LOCAL SCHOOL VISIT AT LAUNCH COMPLEX 1 MAHIA, NEW ZEALAND $80K 100+ $20k $200k awarded in volunteer hours annual sponsorships raised for scholarships for community across community Starship initiatives groups, schools, Children’s environmental programs Hospital 150+ 60+ FORMAL school visits internships apprenticeship through our Space completed program Ambassador Program 25 Rocket Lab USA Section 1Investing in our people and communities Creating career and education opportunities Supporting local causes Championing regional development LOCAL SCHOOL VISIT AT LAUNCH COMPLEX 1 MAHIA, NEW ZEALAND $80K 100+ $20k $200k awarded in volunteer hours annual sponsorships raised for scholarships for community across community Starship initiatives groups, schools, Children’s environmental programs Hospital 150+ 60+ FORMAL school visits internships apprenticeship through our Space completed program Ambassador Program 25 Rocket Lab USA Section 1

Small Launch was the beginning The market needs a constellation LAUNCHER of the small satellites launched by 2028 will be 1 83% constellation missions 2 Example: Commercial Broadband Constellation 1 2 3 4 8t There is currently Constellation An analysis of large 220 20 11 7.7 no commercial satellites need to be constellations medium lift class launched in batches points to an 8-ton Satellites Different SATELLITES TONS launch vehicle to to different orbital class rocket as the need launch orbital planes per plane per launch meet this demand planes. Large rockets ideal lift capacity (700kg each) required don’t solve this 26 Rocket Lab USA Section 2 1 Euroconsult 2 Space NewsSmall Launch was the beginning The market needs a constellation LAUNCHER of the small satellites launched by 2028 will be 1 83% constellation missions 2 Example: Commercial Broadband Constellation 1 2 3 4 8t There is currently Constellation An analysis of large 220 20 11 7.7 no commercial satellites need to be constellations medium lift class launched in batches points to an 8-ton Satellites Different SATELLITES TONS launch vehicle to to different orbital class rocket as the need launch orbital planes per plane per launch meet this demand planes. Large rockets ideal lift capacity (700kg each) required don’t solve this 26 Rocket Lab USA Section 2 1 Euroconsult 2 Space News

Next Step Rocket Lab solved small launch with Electron Neutron solves medium launch 27 Rocket Lab USA Section 2Next Step Rocket Lab solved small launch with Electron Neutron solves medium launch 27 Rocket Lab USA Section 2

63M Next Step 98% E LECT RO N & NEW ROCKET DEVELOPMENT N E UT RO N C L AS S 8-Ton PAYLOAD CAPACITY › Rocket Lab solved small launch with Electron 40M Rocket Lab › Neutr on solves medium launch can lift 98% of all satellites forecast to launch through 1 2029 Tailored for Anticipated highly Direct commercial and disruptive lower costs alternative DoD constellation by leveraging Electron’s to SpaceX launches heritage, launch sites Falcon 9 and architecture 18M 2% OT H E R C L AS S Capable of human Reusable-ready ~$200M development space flight and platform after program. First crew resupply test program launch 2024 to the ISS completion ELECTRON NEUTRON SPaceX, FALCon 9 (SMALL LIFT) (MEDIUM LIFT) (LARGE LIFT) 28 Rocket Lab USA Section 2 1 Euroconsult, Northern Sky Research63M Next Step 98% E LECT RO N & NEW ROCKET DEVELOPMENT N E UT RO N C L AS S 8-Ton PAYLOAD CAPACITY › Rocket Lab solved small launch with Electron 40M Rocket Lab › Neutr on solves medium launch can lift 98% of all satellites forecast to launch through 1 2029 Tailored for Anticipated highly Direct commercial and disruptive lower costs alternative DoD constellation by leveraging Electron’s to SpaceX launches heritage, launch sites Falcon 9 and architecture 18M 2% OT H E R C L AS S Capable of human Reusable-ready ~$200M development space flight and platform after program. First crew resupply test program launch 2024 to the ISS completion ELECTRON NEUTRON SPaceX, FALCon 9 (SMALL LIFT) (MEDIUM LIFT) (LARGE LIFT) 28 Rocket Lab USA Section 2 1 Euroconsult, Northern Sky Research

Cost-effective launch for mega-constellations and human spaceflight Highly re-usable Low-cost Leveraging platform with materials and proven low ongoing manufacturing technology. OPEX methods for Low risk expendable development elements roadmap 29 Rocket Lab USA Section 2Cost-effective launch for mega-constellations and human spaceflight Highly re-usable Low-cost Leveraging platform with materials and proven low ongoing manufacturing technology. OPEX methods for Low risk expendable development elements roadmap 29 Rocket Lab USA Section 2

Leveraging existing technology and experience Hardware rich Agile systems Test like you fly, program – engineering, safety fly like you test – concurrent and mission barrage of testing design, build assurance approach early and often and test for foresight on end-customer requirements from day 1 30 Rocket Lab USA Section 2 FLIGHT 19 'THEY GO UP SO FAST' MAHIA, NEW ZEALAND ELECTRON RECOVERY ROCKET APC, NEW ZEALANDLeveraging existing technology and experience Hardware rich Agile systems Test like you fly, program – engineering, safety fly like you test – concurrent and mission barrage of testing design, build assurance approach early and often and test for foresight on end-customer requirements from day 1 30 Rocket Lab USA Section 2 FLIGHT 19 'THEY GO UP SO FAST' MAHIA, NEW ZEALAND ELECTRON RECOVERY ROCKET APC, NEW ZEALAND

Program Development Development Progressing Breakdown at Pace Large Infrastructure (Test & Launch) Avionics (HW, GNC, SW) Test & Launch Ops. Several critical technologies New developments leverage and capability scale well rich flight proven heritage with size of launch vehicle + Propulsion Telemetry, Avionics Command + Structures & Mechanisms & Control GNC + Fluid Systems Software + Certic fi ation & licensing Communications Command & Control Certic fi ation New entrants start all of the & Licensing Integrated Testing & Operations above from scratch Fluid Existing launch site suited Systems to Neutron available Propulsion + Test and launch infrastructure at Pad 0A, Virginia Structures & Mechanisms 31 Rocket Lab USA Section 2Program Development Development Progressing Breakdown at Pace Large Infrastructure (Test & Launch) Avionics (HW, GNC, SW) Test & Launch Ops. Several critical technologies New developments leverage and capability scale well rich flight proven heritage with size of launch vehicle + Propulsion Telemetry, Avionics Command + Structures & Mechanisms & Control GNC + Fluid Systems Software + Certic fi ation & licensing Communications Command & Control Certic fi ation New entrants start all of the & Licensing Integrated Testing & Operations above from scratch Fluid Existing launch site suited Systems to Neutron available Propulsion + Test and launch infrastructure at Pad 0A, Virginia Structures & Mechanisms 31 Rocket Lab USA Section 2

Proven execution history at Wallops Demonstrated track record of securing funds and delivering on large infrastructure projects Launch pad constructed in less than 11 months Integration & control facillity designed and built in 8 months Rocket Lab is well integrated with State of Virginia, Virginia Space and NASA Wallops Flight Facility 32 Rocket Lab USA Section 2

US PRODUCTION, Assembly, Integration and Test FACILITY Aggressive and Expect to Facility competitive break ground expected site selection in Q4 2021 to be ready process nearing to support completion operations by Q4 2022 33 Rocket Lab USA Section 2US PRODUCTION, Assembly, Integration and Test FACILITY Aggressive and Expect to Facility competitive break ground expected site selection in Q4 2021 to be ready process nearing to support completion operations by Q4 2022 33 Rocket Lab USA Section 2

S I G N I F I C ANT N E U TR O N R E V E AL C O M I N G S O O N 34 Rocket Lab USA Section 2S I G N I F I C ANT N E U TR O N R E V E AL C O M I N G S O O N 34 Rocket Lab USA Section 2

SECTION 03 SPACE SYsTEMS 35 Rocket Lab USA Section 3SECTION 03 SPACE SYsTEMS 35 Rocket Lab USA Section 3

Space Systems MANDATE Satellites 1 as a Service From LEO constellations to high-complexity deep space and interplanetary missions Satellite 2 COMPONENTS Anything that goes to space should have a Rocket Lab logo on it SPACE 3 APPLICATIONS Uniquely positioned to access expanding space applications TAM 36 Rocket Lab USA Section 3 PHOTON PATHFINDER 1 AUGUST 2020 PHOTON - CAPSTONE AUGUST 2020Space Systems MANDATE Satellites 1 as a Service From LEO constellations to high-complexity deep space and interplanetary missions Satellite 2 COMPONENTS Anything that goes to space should have a Rocket Lab logo on it SPACE 3 APPLICATIONS Uniquely positioned to access expanding space applications TAM 36 Rocket Lab USA Section 3 PHOTON PATHFINDER 1 AUGUST 2020 PHOTON - CAPSTONE AUGUST 2020

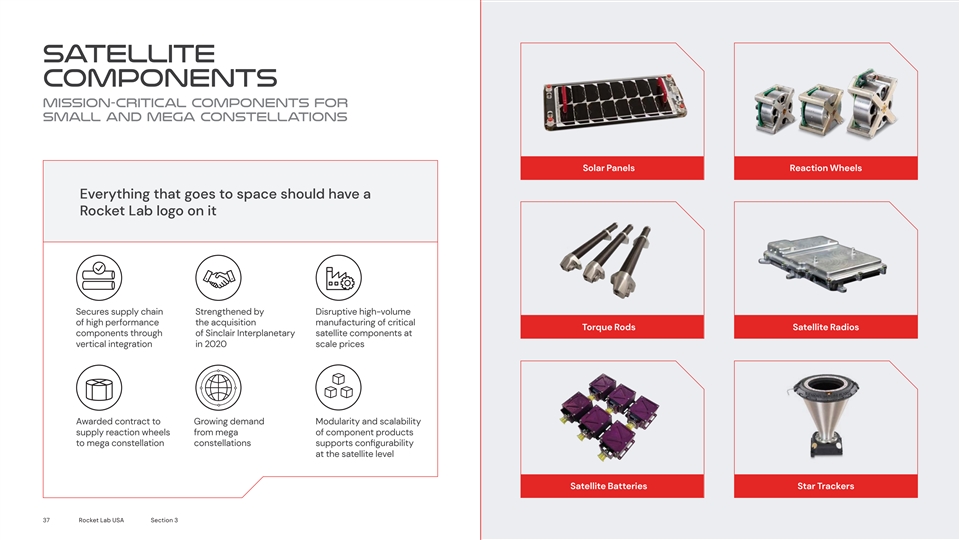

Satellite Components Mission-critical components for small and mega constellations Solar Panels Reaction Wheels Everything that goes to space should have a Rocket Lab logo on it Secures supply chain Strengthened by Disruptive high-volume of high performance the acquisition manufacturing of critical Torque Rods Satellite Radios components through of Sinclair Interplanetary satellite components at vertical integration in 2020 scale prices Awarded contract to Growing demand Modularity and scalability supply reaction wheels from mega of component products to mega constellation constellations supports configurability at the satellite level Satellite Batteries Star Trackers 37 Rocket Lab USA Section 3Satellite Components Mission-critical components for small and mega constellations Solar Panels Reaction Wheels Everything that goes to space should have a Rocket Lab logo on it Secures supply chain Strengthened by Disruptive high-volume of high performance the acquisition manufacturing of critical Torque Rods Satellite Radios components through of Sinclair Interplanetary satellite components at vertical integration in 2020 scale prices Awarded contract to Growing demand Modularity and scalability supply reaction wheels from mega of component products to mega constellation constellations supports configurability at the satellite level Satellite Batteries Star Trackers 37 Rocket Lab USA Section 3

PHOTON Launch, satellite, ground services, and on-orbit mission operations in a turn-key package Cong fi urable spacecraft for Evolved from Electron’s Kick Stage, missions in LEO, MEO, GEO, lunar building on signic fi ant flight history. PHOTON PATHSTONE and planetary Primary propulsion, reaction control FEBRUARY 2021 system, flight computer, GPS receiver, Vertically integrated with in-house sensors, communications, structures subsystems/components based and mechanisms on constellation-scale assembly manufacturing capabilities Adds high power generation, upgraded attitude determination Operates as Electron’s Kick and control, more radiation-tolerant Stage during launch, eliminates avionics, and high-speed downlink the duplicative subsystems of deployed spacecraft and allows Key subsystems like power, full use of the fairing for sensors propulsion, thermal, and attitude and payload control are scaled to meet individual mission requirements Can fly on Neutron or on other rockets in a constellation High heritage, precision attitude cong fi uration or as a determination and control sensors secondary payload and actuators from Sinclair Interplanetary PHOTON ENCAPSULATION PHOTON FIRST LIGHT MISSION 38 Rocket Lab USA Section 3 ELECTRON FAIRING, MARCH 2021 AUGUST 2020

Space Systems Growth Strategy C ong fi urable, high performance › Focus on large quantity space systems to discriminate constellation opportunities against commodity satellites › Leverage launch relationships › Vertically integrated, end to and secure facility plans to end mission solutions including expand on existing business launch, ground, and operations › Regularize hosted payload › Technology advancement offering to monetize launch through rapid tech demo rideshare missions launches Continue vertical integration, Mission services, satellite grow the space components manufacturing, and component portfolio through new product sales growth opportunities launches, and scale component manufacturing › A ggressive business development, rapid proposal/bid Inorganic growth opportunities, generation, and broad customer like Sinclair Interplanetary, to engagement further support vertical › Strong pipeline of commercial, integration and enhance national security, and civil space competitiveness opportunities › Study contracts driving targeted sales SOLAR PANELS IN PRODUCTION MISSION CONTROL 39 Rocket Lab USA Section 3 DECEMBER 2020 AUCKLAND, NEW ZEALANDSpace Systems Growth Strategy C ong fi urable, high performance › Focus on large quantity space systems to discriminate constellation opportunities against commodity satellites › Leverage launch relationships › Vertically integrated, end to and secure facility plans to end mission solutions including expand on existing business launch, ground, and operations › Regularize hosted payload › Technology advancement offering to monetize launch through rapid tech demo rideshare missions launches Continue vertical integration, Mission services, satellite grow the space components manufacturing, and component portfolio through new product sales growth opportunities launches, and scale component manufacturing › A ggressive business development, rapid proposal/bid Inorganic growth opportunities, generation, and broad customer like Sinclair Interplanetary, to engagement further support vertical › Strong pipeline of commercial, integration and enhance national security, and civil space competitiveness opportunities › Study contracts driving targeted sales SOLAR PANELS IN PRODUCTION MISSION CONTROL 39 Rocket Lab USA Section 3 DECEMBER 2020 AUCKLAND, NEW ZEALAND

PHOTON ‘FIRST LIGHT’ Successfully deployed to orbit in August 2020 Exploiting high launch rate to rapidly mature Photon capabilities with hosted payload missions Successfully Operating on orbit High flight rate is demonstrated as a testbed for supporting rapid tech solar arrays, power flight and ground demo of increased management, software validation, Photon capabilities thermal demonstrating lights and increasing management, and out operations demonstrated lifetime attitude control 40 Rocket Lab USA Section 3 PHOTON FIRST LIGHT MISSION AUGUST 2020

PHOTON ‘PATHSTONE’ Successfully deployed to orbit in March 2021 Pathstone mission is de-risking Rocket Lab's deep space mission approach for PHOTON F19, MARCH 2021 upcoming mission to the Moon for NASA Risk reduction Demonstrated rapid Demonstrating mission for the integration of Photon upgraded avionics, radios, CAPSTONE NASA CAPSTONE core systems with concept of operations lunar mission existing Kick Stage (flight dynamics production flow required for supporting hosted system, ground payload missions and systems, etc.) other low-cost tech demonstrations PATHSTONE 41 Rocket Lab USA Section 3 F19, MARCH 2021PHOTON ‘PATHSTONE’ Successfully deployed to orbit in March 2021 Pathstone mission is de-risking Rocket Lab's deep space mission approach for PHOTON F19, MARCH 2021 upcoming mission to the Moon for NASA Risk reduction Demonstrated rapid Demonstrating mission for the integration of Photon upgraded avionics, radios, CAPSTONE NASA CAPSTONE core systems with concept of operations lunar mission existing Kick Stage (flight dynamics production flow required for supporting hosted system, ground payload missions and systems, etc.) other low-cost tech demonstrations PATHSTONE 41 Rocket Lab USA Section 3 F19, MARCH 2021

Upcoming Mission: LOXSAT-1 Photon to be used for an in-orbit propellant depot mission for NASA Demonstrates the value of integrated launch + satellite solutions to affordably meet challenging mission requirements Rocket Lab Electron Dedicated 9-month 125 kg payload launch vehicle and mission to test CFM integrated with Photon spacecraft technologies in orbit Photon spacecraft selected by launching in 2024 on › Active and passive Eta Space to Electron to a 500 km thermal control demonstrate sunsynchronous orbit › Liquid acquisition advanced › Pressure control cryogenic fluid management (CFM) › T ransfer in orbit for NASA › Quick Disconnects › Slosh dynamics 42 Rocket Lab USA Section 3 Credit: Eta SpaceUpcoming Mission: LOXSAT-1 Photon to be used for an in-orbit propellant depot mission for NASA Demonstrates the value of integrated launch + satellite solutions to affordably meet challenging mission requirements Rocket Lab Electron Dedicated 9-month 125 kg payload launch vehicle and mission to test CFM integrated with Photon spacecraft technologies in orbit Photon spacecraft selected by launching in 2024 on › Active and passive Eta Space to Electron to a 500 km thermal control demonstrate sunsynchronous orbit › Liquid acquisition advanced › Pressure control cryogenic fluid management (CFM) › T ransfer in orbit for NASA › Quick Disconnects › Slosh dynamics 42 Rocket Lab USA Section 3 Credit: Eta Space

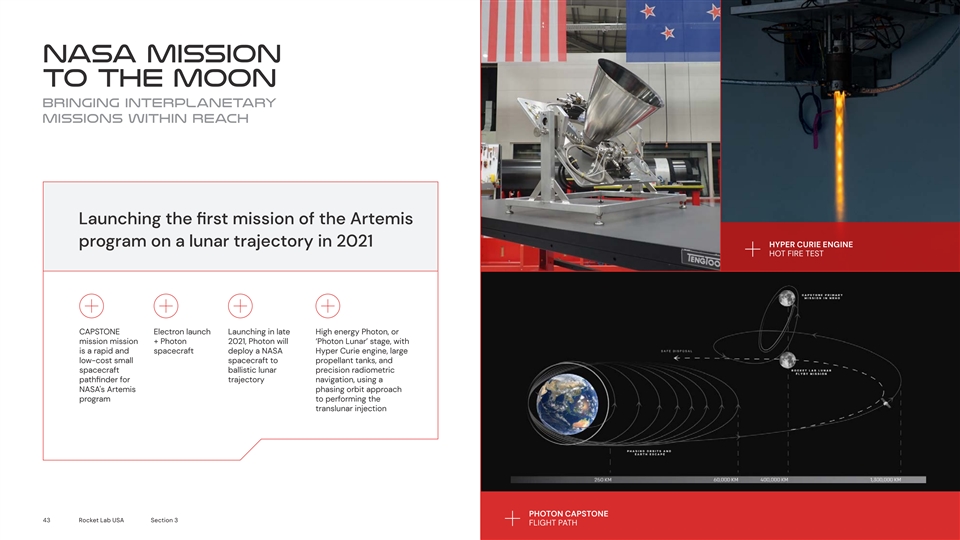

NASA Mission to the Moon Bringing interplanetary missions within reach Launching the first mission of the Artemis program on a lunar trajectory in 2021 HYPER CURIE ENGINE HOT FIRE TEST CAPSTONE Electron launch Launching in late High energy Photon, or mission mission + Photon 2021, Photon will ‘Photon Lunar’ stage, with is a rapid and spacecraft deploy a NASA Hyper Curie engine, large low-cost small spacecraft to propellant tanks, and spacecraft ballistic lunar precision radiometric pathfinder for trajectory navigation, using a NASA's Artemis phasing orbit approach program to performing the translunar injection PHOTON CAPSTONE 43 Rocket Lab USA Section 3 FLIGHT PATHNASA Mission to the Moon Bringing interplanetary missions within reach Launching the first mission of the Artemis program on a lunar trajectory in 2021 HYPER CURIE ENGINE HOT FIRE TEST CAPSTONE Electron launch Launching in late High energy Photon, or mission mission + Photon 2021, Photon will ‘Photon Lunar’ stage, with is a rapid and spacecraft deploy a NASA Hyper Curie engine, large low-cost small spacecraft to propellant tanks, and spacecraft ballistic lunar precision radiometric pathfinder for trajectory navigation, using a NASA's Artemis phasing orbit approach program to performing the translunar injection PHOTON CAPSTONE 43 Rocket Lab USA Section 3 FLIGHT PATH

NASA Mission to Mars First NASA-funded Rocket Lab planetary science mission Awarded contract to design twin Photons to orbit at Mars and study the atmosphere Two Photon spacecraft in Launching as a rideshare Mars orbit to understand mission for NASA Science the structure, composition, Mission Directorate's variability, and dynamics SIMPLEx program in of Mars' unique hybrid partnership with University magnetosphere of California, Berkeley Credit: UB Berkeley UC Berkeley ESCAPADE mission to Mars 44 Rocket Lab USA Section 3NASA Mission to Mars First NASA-funded Rocket Lab planetary science mission Awarded contract to design twin Photons to orbit at Mars and study the atmosphere Two Photon spacecraft in Launching as a rideshare Mars orbit to understand mission for NASA Science the structure, composition, Mission Directorate's variability, and dynamics SIMPLEx program in of Mars' unique hybrid partnership with University magnetosphere of California, Berkeley Credit: UB Berkeley UC Berkeley ESCAPADE mission to Mars 44 Rocket Lab USA Section 3

Mission to Venus Decadal-class Science with Small Spacecraft and Dedicated Launch Rocket Lab is leading the first privately funded mission to Venus to explore habitability of the cloud layer Photon spacecraft Hyperbolic Collaborating with launched by trajectory with leading university Electron rocket high energy Photon scientists for operating as instrumentation the cruise and expanding stage and as a partnerships communications with NASA relay PRIVATELY-FUNDED MISSION TO VENUS 45 Rocket Lab USA Section 3Mission to Venus Decadal-class Science with Small Spacecraft and Dedicated Launch Rocket Lab is leading the first privately funded mission to Venus to explore habitability of the cloud layer Photon spacecraft Hyperbolic Collaborating with launched by trajectory with leading university Electron rocket high energy Photon scientists for operating as instrumentation the cruise and expanding stage and as a partnerships communications with NASA relay PRIVATELY-FUNDED MISSION TO VENUS 45 Rocket Lab USA Section 3

New Mission: Methanesat Monitoring methane emissions from space, Mission Operations by Rocket Lab Rocket Lab is providing payload operations, satellite operations management, tracking and collision avoidance services, orbit determination, flight dynamics, and ground Credit: Ball/BCT/MLLC station operations management. Mission funded by Responsive daily Cloud-based mission the Environmental planning/tasking operations control, Defense Fund, based on weather, allowing operations from Spacecraft by coverage, changes anywhere on the globe; BCT, instrument/ in anthropogenic automated low-thrust flight system by methane emission, and maneuver planning Ball Aerospace, other external data and deconfliction with science and target sources; automated collection planning planning at Harvard/ collection planning Smithsonian and optimization 46 Rocket Lab USA Section 3New Mission: Methanesat Monitoring methane emissions from space, Mission Operations by Rocket Lab Rocket Lab is providing payload operations, satellite operations management, tracking and collision avoidance services, orbit determination, flight dynamics, and ground Credit: Ball/BCT/MLLC station operations management. Mission funded by Responsive daily Cloud-based mission the Environmental planning/tasking operations control, Defense Fund, based on weather, allowing operations from Spacecraft by coverage, changes anywhere on the globe; BCT, instrument/ in anthropogenic automated low-thrust flight system by methane emission, and maneuver planning Ball Aerospace, other external data and deconfliction with science and target sources; automated collection planning planning at Harvard/ collection planning Smithsonian and optimization 46 Rocket Lab USA Section 3

Uniquely positioned to create a new multi-billion-dollar business vertical Rocket Lab is in a unique position to complete the final move up the value chain to provide data and services to the market by leveraging Electron, Neutron, and Photon, 1 further unlocking the ~$1.4T TAM by 2030 Rocket Lab’s in-house launch and space systems capabilities provide signic fi ant competitive advantages in the space applications market 47 Rocket Lab USA Section 3 1 Wall Street ResearchUniquely positioned to create a new multi-billion-dollar business vertical Rocket Lab is in a unique position to complete the final move up the value chain to provide data and services to the market by leveraging Electron, Neutron, and Photon, 1 further unlocking the ~$1.4T TAM by 2030 Rocket Lab’s in-house launch and space systems capabilities provide signic fi ant competitive advantages in the space applications market 47 Rocket Lab USA Section 3 1 Wall Street Research

SECTION 04 Vertical integration From raw material to orbit Vertical integration 48 Rocket Lab USA Section 4

vertically integrated space company From raw material to orbit 1 2 1 2 5 6 Rocket Lab HQ Si nclair Auckland Mission Control Space Systems Interplanetary Production New Zealand Mission Control U.S. by Rocket Lab Complex 3 4 5 6 3 4 7 8 Global Tracking La unch Pr opulsion Test La unch Systems Complex 2 Complex Complex 1 49 Rocket Lab USA Section 4 7 8vertically integrated space company From raw material to orbit 1 2 1 2 5 6 Rocket Lab HQ Si nclair Auckland Mission Control Space Systems Interplanetary Production New Zealand Mission Control U.S. by Rocket Lab Complex 3 4 5 6 3 4 7 8 Global Tracking La unch Pr opulsion Test La unch Systems Complex 2 Complex Complex 1 49 Rocket Lab USA Section 4 7 8

AUCKLAND PRODUCTION COMPLEX (APC) 6.6 ACRES Greenfield Site Mission Operations Team, Warehousing Neutron and Engineering Development Composites, Avionics, Electron Assembly, R&D, Design, Engineering, Test, Mission Engineering Control, and Admin Development, Spacecraft Machine Shop 50 Rocket Lab USA Section 4AUCKLAND PRODUCTION COMPLEX (APC) 6.6 ACRES Greenfield Site Mission Operations Team, Warehousing Neutron and Engineering Development Composites, Avionics, Electron Assembly, R&D, Design, Engineering, Test, Mission Engineering Control, and Admin Development, Spacecraft Machine Shop 50 Rocket Lab USA Section 4

Rocket Lab Headquarters 2.1 acres Avionics Production Engine Production Mission Management Business Development Mission Control Space Systems Development 51 Rocket Lab USA Section 4Rocket Lab Headquarters 2.1 acres Avionics Production Engine Production Mission Management Business Development Mission Control Space Systems Development 51 Rocket Lab USA Section 4

PROPULSION TEST COMPLEXES PROPULSION TEST COMPLEX 1 NEW ZEALAND 250 acres of licensed land dedicated to test activity 12 acres of test stands and ancillary support buildings Dedicated test stands for cryogenic oxygen component testing: – T win Rutherford engine test bays for higher volume engine testing – Altitude test facility for in space propulsion – Multiple contr ol rooms and clearance between test stands allows for simultaneous testing 52 Rocket Lab USA Section 4

STATE OF THE ART MANUFACTURING Production facilities capable of producing a rocket every week R&D and Extensive All production ~90% vertically manufacturing automation incl. scaling integrated. Engines, facilities across 3D printing and investments and vehicle structures, the U.S., NZ custom robotic infrastructure avionics, guidance and Canada processing. complete sets and flight Largest robotic termination machining center hardware in the Southern produced Hemisphere in-house PRODUCTION COMPLEX 53 Rocket Lab USA Section 4 AUCKLAND, NEW ZEALAND PRODUCTION HQ LONG BEACH, U.S. PRODUCTION HQ LONG BEACH, U.S. PRODUCTION COMPLEX AUCKLAND, NEW ZEALANDSTATE OF THE ART MANUFACTURING Production facilities capable of producing a rocket every week R&D and Extensive All production ~90% vertically manufacturing automation incl. scaling integrated. Engines, facilities across 3D printing and investments and vehicle structures, the U.S., NZ custom robotic infrastructure avionics, guidance and Canada processing. complete sets and flight Largest robotic termination machining center hardware in the Southern produced Hemisphere in-house PRODUCTION COMPLEX 53 Rocket Lab USA Section 4 AUCKLAND, NEW ZEALAND PRODUCTION HQ LONG BEACH, U.S. PRODUCTION HQ LONG BEACH, U.S. PRODUCTION COMPLEX AUCKLAND, NEW ZEALAND